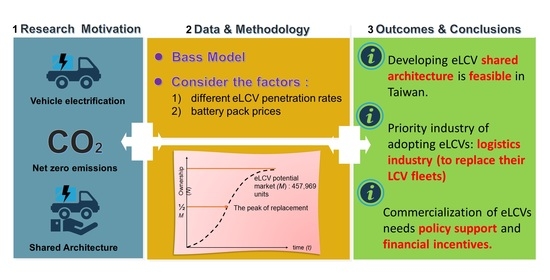

A Feasibility Study of Developing eLCV Shared Architecture in Taiwan

Abstract

:1. Introduction

2. The Development of eLCVs in Taiwan

2.1. Current Progress of eLCVs

2.2. An Estimation of the Potential eLCV Market in Taiwan

3. Model Description

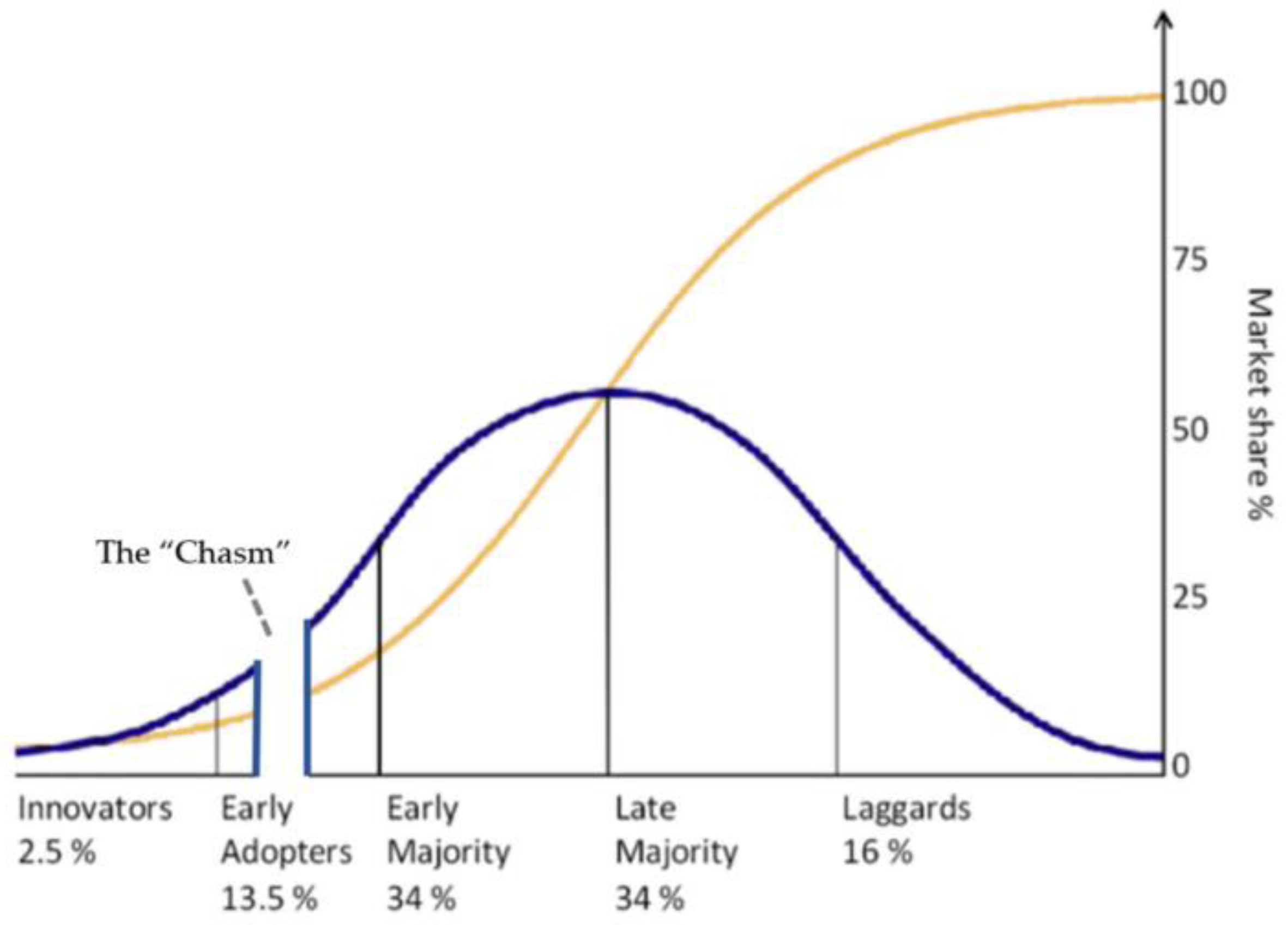

3.1. Diffusion Model

3.2. Parameters of the Diffusion Rate

4. Positive Analysis

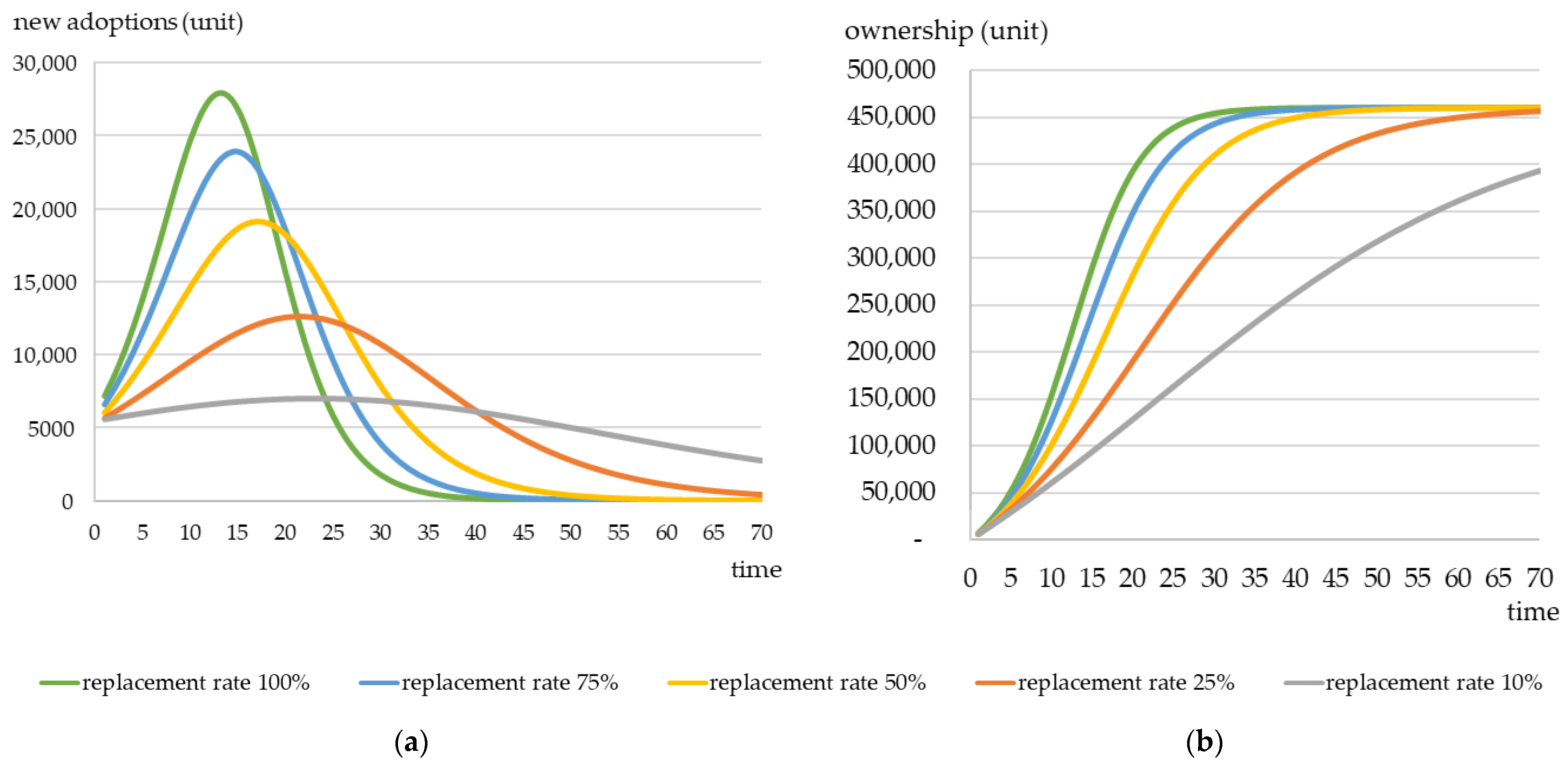

4.1. Analytical Model

4.2. Results of the Analysis

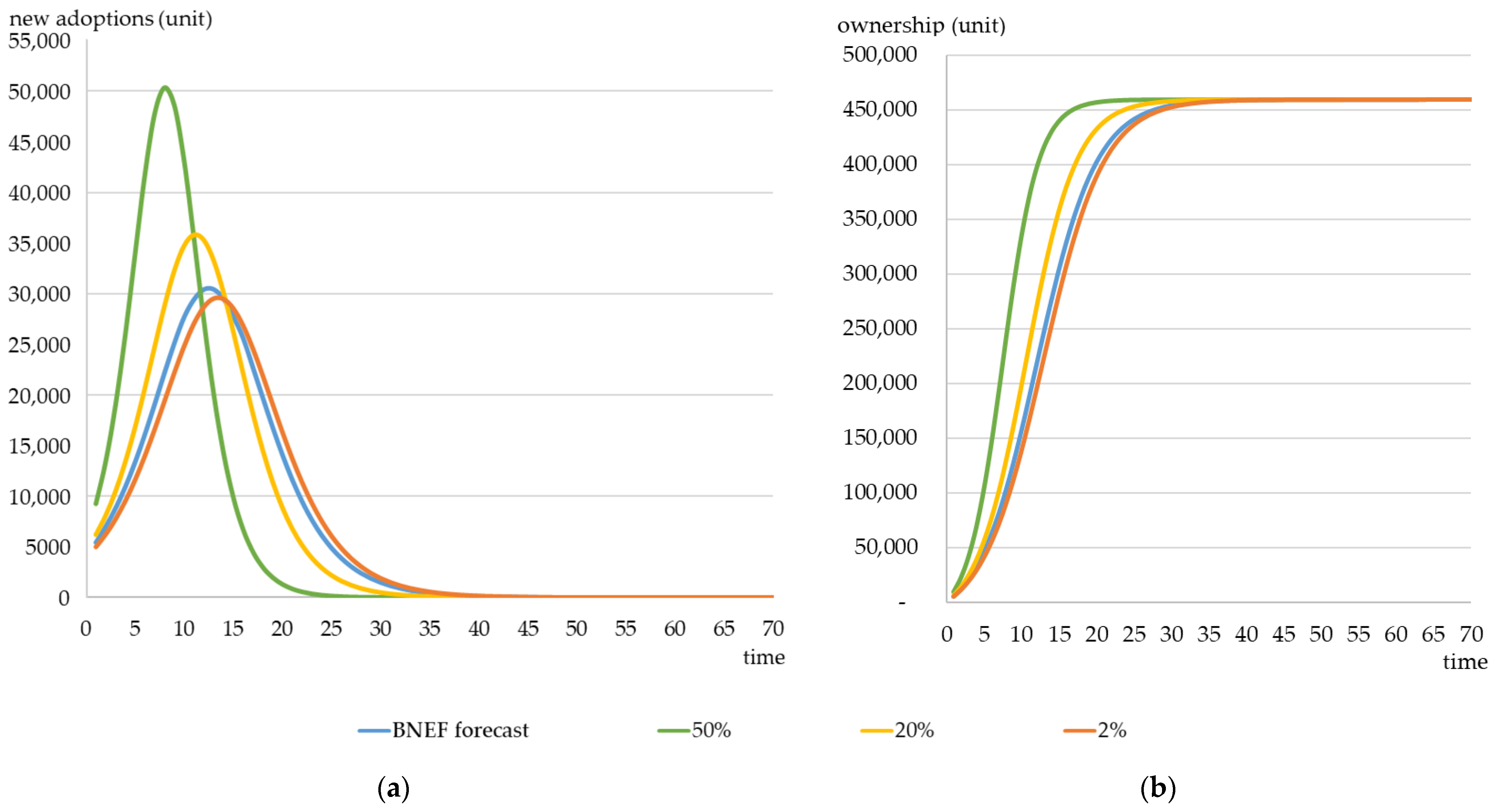

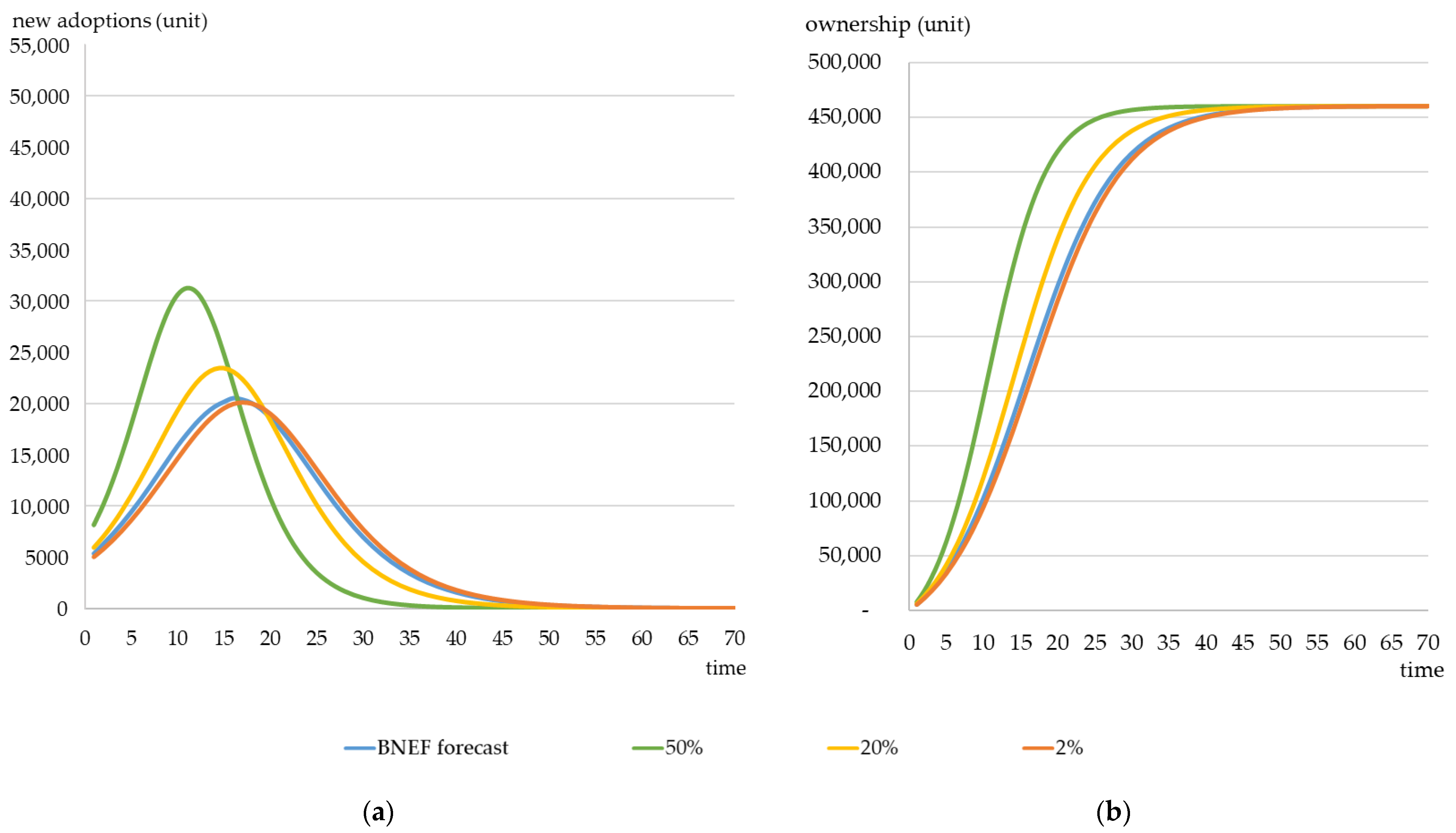

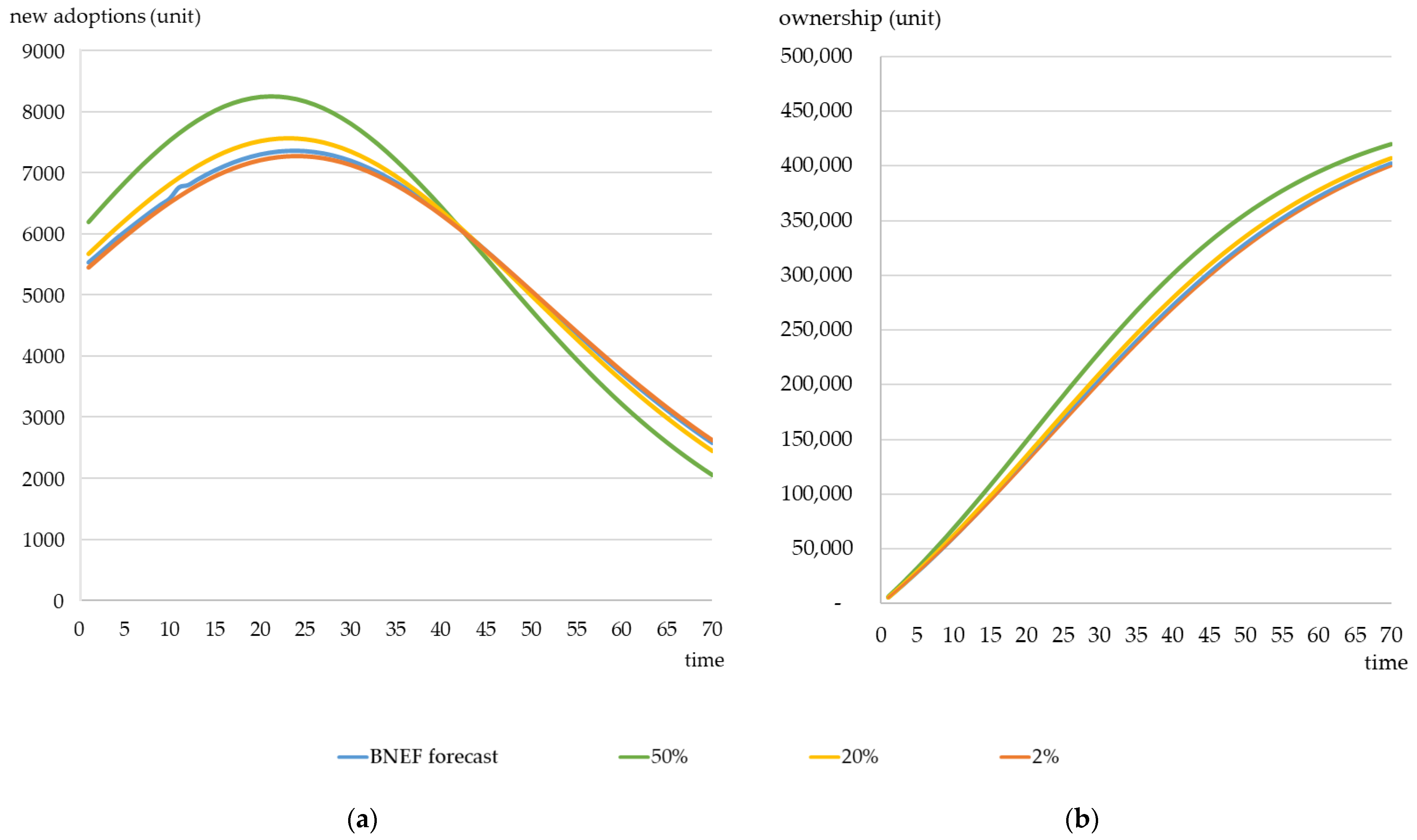

4.2.1. Simulation Results of Full Penetration in the Different Scenarios

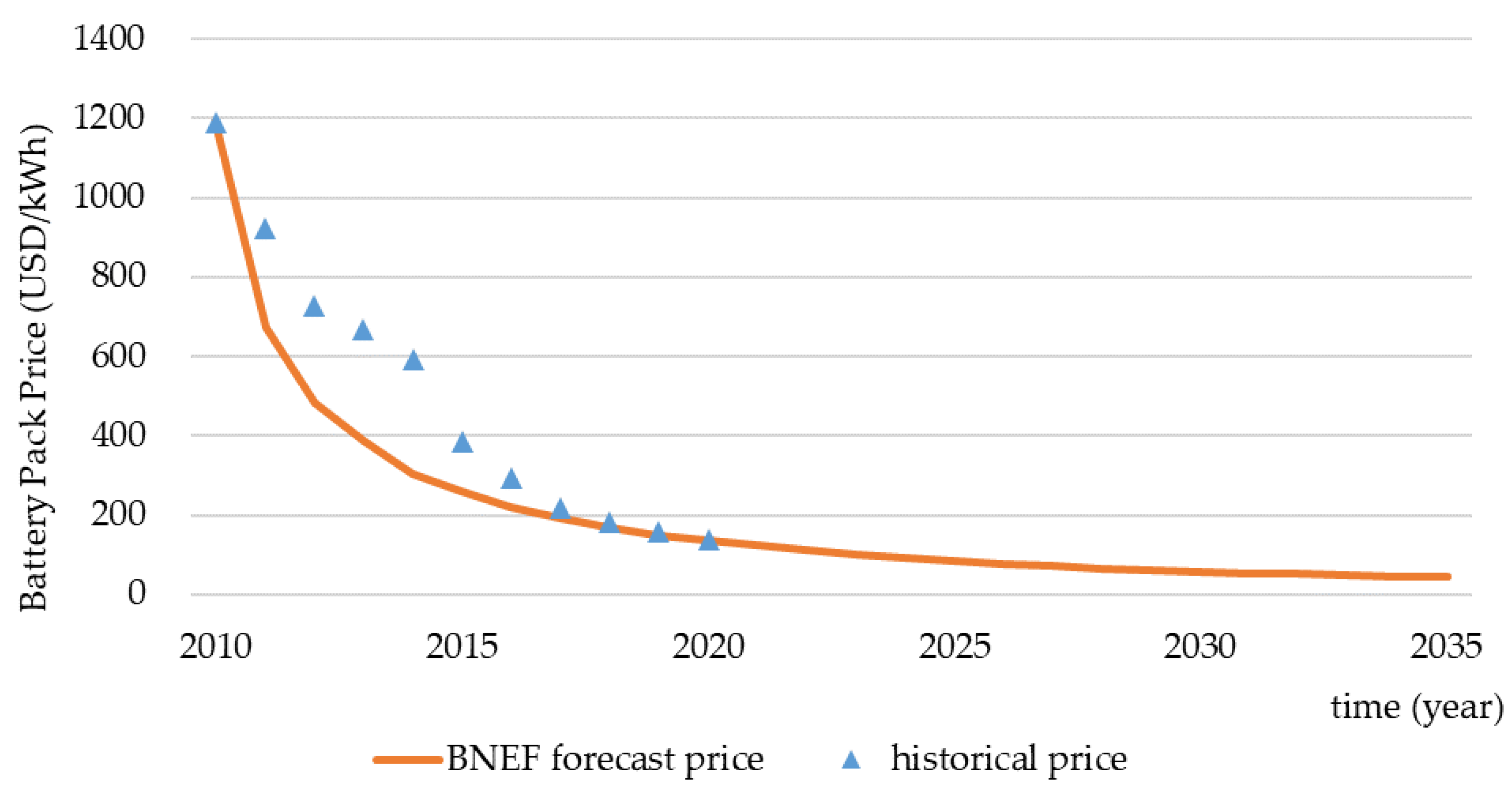

4.2.2. Simulation Results of Full Penetration in the Scenarios with Different Battery Pack Prices

- where the following notations used denote:

- X(t) is the coefficient of the battery pack price,

- Pr(t) is the unit price of the battery pack at time t.

- βp is the price elasticity.

- The definition of others refers to Table 3.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- White House FACT SHEET: President Biden Announces Support for the Bipartisan Infrastructure Framework. Available online: https://www.whitehouse.gov/briefing-room/statements-releases/2021/06/24/fact-sheet-president-biden-announces-support-for-the-bipartisan-infrastructure-framework/ (accessed on 26 August 2021).

- A Clean Planet for All: A European Strategic Long-Term Vision for a Prosperous, Modern, Competitive and Climate Neutral Economy COM/2018/773 Final. Brussels. Available online: https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX%3A52018DC0773 (accessed on 26 August 2021).

- International Energy Agency: CO2 Emissions from Fuel Combustion: Overview. Available online: https://www.iea.org/reports/co2-emissions-from-fuel-combustion-overview#data-service (accessed on 18 April 2021).

- Wolfram, P.; Lutsey, N. Electric Vehicles: Literature Review of Technology Costs and Carbon Emissions (Working Paper); International Council on Clean Transportation: Washington, DC, USA, 2016; Available online: https://theicct.org/publication/electric-vehicles-literature-review-of-technology-costs-and-carbon-emissions/ (accessed on 2 April 2021).

- Hall, D.; Lutsey, N. Emerging Best Practices for Electric Vehicle Charging Infrastructure; International Council on Clean Transportation: Washington, DC, USA, 2017; Available online: https://theicct.org/publication/emerging-best-practices-for-electric-vehicle-charging-infrastructure/ (accessed on 30 July 2021).

- International Energy Agency (IEA). Net Zero by 2050: A Roadmap for the Global Energy Sector; IEA: Paris, France, 2021. Available online: https://www.iea.org/reports/net-zero-by-2050 (accessed on 28 August 2021).

- Bloomberg New Energy Finance (BNEF). Electric Vehicle Outlook 2021; BNEF: New York, NY, USA, 2021; Available online: https://about.bnef.com/electric-vehicle-outlook/ (accessed on 21 October 2021).

- European Union. Directive (EU) 2019/1161 of the European Parliament and of the Council of 20 June 2019 amending Directive 2009/33/EC on the promotion of clean and energy-efficient road transport vehicles (Text with EEA relevance). PE/57/2019/REV/2 OJ L 2019, 188, 116–130. [Google Scholar]

- Foltyński, M. Electric fleets in urban logistics. Procedia Soc. Behav. Sci. 2014, 151, 48–59. [Google Scholar] [CrossRef] [Green Version]

- Baroody, L.; Eckerle, T.; Bevan, A. California’s Zero Emission Vehicle Action Plan. In Proceedings of the 33rd Electric Vehicle Symposium (EVS33), Portland, OR, USA, 14–17 June 2020; Zenodo: Geneva, Switzerland, 2020. [Google Scholar] [CrossRef]

- National Highway Traffic Safety Administration: Corporate Average Fuel Economy. Available online: https://www.nhtsa.gov/laws-regulations/corporate-average-fuel-economy (accessed on 26 August 2021).

- English.gov.cn (The State Council of the People’s Republic of China): Notice by the Ministry of Finance, the Ministry of Industry and Information Technology, the Ministry of Science and Technology, and the National Development and Reform Commission of Improving the Policies on Government Subsidies for Promotion and Application of New Energy Vehicles. Available online: http://www.gov.cn/zhengce/zhengceku/2020-04/23/content_5505502.htm (accessed on 16 August 2021).

- English.gov.cn (The State Council of the People’s Republic of China): Notice by the Ministry of Finance, the Ministry of Industry and Information Technology, the Ministry of Science and Technology, and the National Development and Reform Commission of Financial Dupport Policies for the Promotion of New Energy Vehicles in 2016–2020. Available online: http://www.gov.cn/xinwen/2015-04/29/content_2855040.htm (accessed on 7 August 2021).

- Department of Statistics, Ministry of Transportation and Communications (MOTC). Private Sedan Usage Survey; MOTC: Taipei, Taiwan, 2019. Available online: https://www.motc.gov.tw/uploaddowndoc?file=survey/202110281340320.pdf&filedisplay=109%E5%B9%B4%E8%87%AA%E7%94%A8%E5%B0%8F%E5%AE%A2%E8%BB%8A%E4%BD%BF%E7%94%A8%E7%8B%80%E6%B3%81%E8%AA%BF%E6%9F%A5%E5%A0%B1%E5%91%8A.pdf&flag=doc (accessed on 2 April 2021).

- Estimated CO2 Emissions from the Transportation Sector Over the Years (Institute of Transportation, Ministry of Transportation and Communications). Available online: https://data.gov.tw/dataset/8331 (accessed on 26 August 2021).

- [Industry Map Illustration] A Picture to Understand Taiwan’s “E-Commerce Logistics” Industry (MIRAI Business). Available online: https://www.mirai.com.tw/2021-taiwan-ec-logistics-industry-map-analysis/ (accessed on 2 April 2021).

- Liu, M.Y.; Chang, C.N.; Chang, T.Y. A Study on the Performance-Based Logistics Model for the Electric Small Truck in the Trucking Industry in Taiwan; Institute of Transportation; Ministry of Transportation and Communications (MOTC): Taipei, Taiwan, 2018. Available online: https://www.iot.gov.tw/cp-78-8143-8e957-1.html (accessed on 24 August 2021).

- Business Next: To Manufacture an EV within the Shortest Time Possible! MIH Has Cross-Field Alliances with 1500 Manufacturers to Muscle into Market in the EV Frenzy. Available online: https://www.bnext.com.tw/article/62633/mih-2021-ecosystem (accessed on 6 June 2021).

- Taipei Times: Formosa Automobile to Launch Own E-Truck in 2022. Available online: https://www.taipeitimes.com/News/biz/archives/2020/11/12/2003746750 (accessed on 7 April 2021).

- Christensen, L.; Klauenberg, J.; Kveiborg, O.; Rudolph, C. Suitability of commercial transport for a shift to electric mobility with Denmark and Germany as use cases. Res. Transp. Econ. 2017, 64, 48–60. [Google Scholar] [CrossRef] [Green Version]

- Figenbaum, E. Can battery electric light commercial vehicles work for craftsmen and service enterprises? Energy Policy 2018, 120, 58–72. [Google Scholar] [CrossRef]

- Klauenberg, J.; Rudolph, C.; Zajicek, J. Potential users of electric mobility in commercial transport—Identification and recommendations. Transp. Res. Procedia 2016, 16, 202–216. [Google Scholar] [CrossRef] [Green Version]

- Tsakalidis, A.; Krause, J.; Julea, A.; Peduzzi, E.; Pisoni, E.; Thiel, C. Electric light commercial vehicles: Are they the sleeping giant of electromobility? Transp. Res. Part D Transp. Environ. 2020, 86, 102421. [Google Scholar] [CrossRef]

- Feng, W.; Figliozzi, M. An economic and technological analysis of the key factors affecting the competitiveness of electric commercial vehicles: A case study from the USA market. Transp. Res. Part C Emerg. Technol. 2013, 26, 135–145. [Google Scholar] [CrossRef]

- Quak, H.; Nesterova, N.; Van Rooijen, T.; Dong, Y. Zero emission city logistics: Current practices in freight electromobility and feasibility in the near future. Transp. Res. Procedia 2016, 14, 1506–1515. [Google Scholar] [CrossRef] [Green Version]

- Frenzel, I. Who are the early adopters of electric vehicles in commercial transport—A description of their trip patterns. In Commercial Transport; Clausen, U., Friedrich, H., Thaller, C., Geiger, C., Eds.; Springer: New York, USA, 2015; pp. 115–128. [Google Scholar] [CrossRef]

- Tsakalidis, A.; Julea, A.; Thiel, C. The role of infrastructure for electric passenger car uptake in Europe. Energies 2019, 12, 4348. [Google Scholar] [CrossRef] [Green Version]

- Camilleri, P.; Dablanc, L. An assessment of present and future competitiveness of electric commercial vans. J. Earth Sci. Geotech. Eng. 2017, 7, 337–364. Available online: https://hal.archives-ouvertes.fr/hal-01539105 (accessed on 23 March 2021).

- Dablanc, L.; Morganti, E.; Arvidsson, N.; Woxenius, J.; Browne, M.; Saidi, N. The rise of on-demand ‘Instant Deliveries’ in European cities. Supply Chain. Forum Int. J. 2017, 18, 203–217. [Google Scholar] [CrossRef] [Green Version]

- Kaplan, S.; Gruber, J.; Reinthaler, M.; Klauenberg, J. Intentions to introduce electric vehicles in the commercial sector: A model based on the theory of planned behaviour. Res. Transp. Econ. 2016, 55, 12–19. [Google Scholar] [CrossRef]

- Niese, N.; Pieper, C.; Arora, A.; Xie, A. The Case for a Circular Economy in Electric Vehicle Batteries; Boston Consulting Group Analysis: Boston, MA, USA, 2020; Available online: https://www.bcg.com/publications/2020/case-for-circular-economy-in-electric-vehicle-batteries (accessed on 14 July 2021).

- Rogers, E.M. Diffusion of Innovations, 1st ed.; The Free Press of Glencoe: New York, NY, USA, 1962. [Google Scholar]

- Brdulak, A.; Chaberek, G.; Jagodziński, J. BASS Model Analysis in “Crossing the Chasm” in E-Cars Innovation Diffusion Scenarios. Energies 2021, 14, 3216. [Google Scholar] [CrossRef]

- Lekvall, P.; Wahlbin, C. A study of some assumptions underlying innovation diffusion functions. Swed. J. Econ. 1973, 75, 362–377. [Google Scholar] [CrossRef]

- Geroski, P.A. Models of technology diffusion. Res. Policy 2000, 29, 603–625. [Google Scholar] [CrossRef]

- Mahajan, V.; Peterson, R.A. Models for Innovation Diffusion, 1st ed.; Sage: Palm Springs, CA, USA, 1985. [Google Scholar]

- Soumia, A.; Maaroufi, M. Diffusion models for predicting electric vehicles market in Morocco. In Proceedings of the 2018 International Conference and Exposition on Electrical and Power Engineering (EPE), Iasi, Romania, 18–19 October 2018; Institute of Electrical and Electronics Engineers (IEEE): Piscataway, NJ, USA, 2018. [Google Scholar] [CrossRef]

- Ensslen, A.; Will, C.; Jochem, P. Simulating electric vehicle diffusion and charging activities in France and Germany. World Electr. Veh. J. 2019, 10, 73. [Google Scholar] [CrossRef] [Green Version]

- Ahmadi, L.; Croiset, E.; Elkamel, A.; Douglas, P.L.; Entchev, E.; Abdul-Wahab, S.A.; Yazdanpanah, P. Effect of socio-economic factors on EV/HEV/PHEV adoption rate in Ontario. Technol. Forecast. Soc. Change 2015, 98, 93–104. [Google Scholar] [CrossRef]

- Hagman, J.; Ritzén, S.; Stier, J.J.; Susilo, Y. Total cost of ownership and its potential implications for battery electric vehicle diffusion. Res. Transp. Bus. Manag. 2016, 18, 11–17. [Google Scholar] [CrossRef] [Green Version]

- Li, J.; Jiao, J.; Tang, Y. An evolutionary analysis on the effect of government policies on electric vehicle diffusion in complex network. Energy Policy 2019, 129, 1–12. [Google Scholar] [CrossRef]

- Li, Y.; Ma, G.; Li, L. Development of a generalization bass diffusion model for Chinese electric vehicles considering charging stations. In Proceedings of the 2017 5th International Conference on Enterprise Systems (ES), Beijing, China, 22–24 September 2017; Institute of Electrical and Electronics Engineers (IEEE): Piscataway, NJ, USA, 2017; pp. 148–156. [Google Scholar] [CrossRef]

- Bass, F.M. A new product growth model for consumer durables. Manag. Sci. 1969, 15, 215–227. [Google Scholar] [CrossRef]

- Rao, K.U.; Kishore, V.V.N. A review of technology diffusion models with special reference to renewable energy technologies. Renew. Sustain. Energy Rev. 2010, 14, 1070–1078. [Google Scholar] [CrossRef]

- Massiani, J.; Gohs, A. The choice of Bass model coefficients to forecast diffusion for innovative products: An empirical investigation for new automotive technologies. Res. Transp. Econ. 2015, 50, 17–28. [Google Scholar] [CrossRef] [Green Version]

- Saisirirat, P.; Chollacoop, N.; Tongroon, M.; Laoonual, Y.; Pongthanaisawan, J. Scenario Analysis of Electric Vehicle Technology Penetration in Thailand: Comparisons of Required Electricity with Power Development Plan and Projections of Fossil Fuel and Greenhouse Gas Reduction. Energy Procedia 2013, 34, 459–470. [Google Scholar] [CrossRef] [Green Version]

- Egbue, O.; Long, S.; Samaranayake, V.A. Mass deployment of sustainable transportation: Evaluation of factors that influence electric vehicle adoption. Clean Tech. Environ. Policy 2017, 19, 1927–1939. [Google Scholar] [CrossRef]

- Scorrano, M.; Danielis, R.; Giansoldati, M. Electric light commercial vehicles for a cleaner urban goods distribution. Are they cost competitive? Res. Transp. Econ. 2021, 85, 101022. [Google Scholar] [CrossRef]

- Zhang, X.; Xie, J.; Rao, R.; Liang, Y. Policy incentives for the adoption of electric vehicles across countries. Sustainability 2014, 6, 8056–8078. [Google Scholar] [CrossRef] [Green Version]

- Safari, M. Battery electric vehicles: Looking behind to move forward. Energy Policy 2018, 115, 54–65. [Google Scholar] [CrossRef]

- Hsu, C.I.; Li, H.C.; Lu, S.M. A dynamic marketing model for hybrid electric vehicles: A case study of Taiwan. Transp. Res. Part D 2013, 20, 21–29. [Google Scholar] [CrossRef]

- Tian, Y.; Govindan, K.; Zhu, Q. A system dynamics model based on evolutionary game theory for green supply chain management diffusion among Chinese manufacturers. J. Clean. Prod. 2014, 80, 96–105. [Google Scholar] [CrossRef]

- Foggia, G.D. Drivers and challenges of electric vehicles integration in corporate fleet: An empirical survey. Res. Transp. Bus. Manag. 2021, 41, 100627. [Google Scholar] [CrossRef]

| Category | Purpose | LCVs’ Ownership | Service Life | Annual Replacement Demand for eLCVs |

|---|---|---|---|---|

| 1 | Children’s minibus | 3943 | 10 years | 300 |

| 2 | Rehabilitation microbus | 2147 | 8 years | 163 |

| 3 | Wheelchair accessible taxi | 1358 | 7 years | 41 |

| 4 | Small wheelchair accessible passenger car | 966 | 8 years | 341 |

| 5 | Microbus serving in remote areas (aka Happiness Bus) | 20 | 8~12 years | 0 |

| 6 | Light truck of 2.5 to 3.5 tons | 449,535 | No | 19,376 |

| Total number | 457,969 | 20,221 | ||

| Category | Diffusion Behavior | Formula | Parameters |

|---|---|---|---|

| External | Innovation | β | |

| Internal | Imitation | β | |

| Mixed | Innovation and imitation | p (Coefficient of innovation) q (Coefficient of imitation) |

| Terms & Parameters | Definitions |

|---|---|

| Ownership (N) | The total number of registered eLCVs in the market |

| Number of new adoptions (n) | The net increase in ownership, which indicates the net increase in registered eLCVs |

| Number of potential market adoptions (M) | The total number of potential eLCVs in the market |

| Market penetration (F) | The proportion of ownership in the potential market adoption, the value of which rises as the replacement number increases, and the maximum is 100% under full penetration |

| Parameter p | The parameter that influences the numbers of eLCVs adopted when introduced to the market. It indicates the consumers’ willingness to buy. |

| Parameter q | The number of eLCVs adopted is influenced by the interaction among customers after their introduction to the market. The parameter denotes these influences. |

| Replacement Rate of LCVs | Parameter | R2 | Peak of Replacement (t) | The Highest Number of New Adoptions (nt) | |

|---|---|---|---|---|---|

| p | q | ||||

| 100% | 1.56% | 21.07% | 0.9927 | 13 | 27,926 |

| 75% | 1.43% | 17.83% | 0.9941 | 15 | 23,913 |

| 50% | 1.31% | 13.89% | 0.9962 | 17 | 19,139 |

| 25% | 1.23% | 8.31% | 0.9987 | 21 | 12,572 |

| 10% | 1.21% | 3.21% | 0.9997 | 23 | 7005 |

| Scenario | p | q | R2 | Replacement Peak (t) | Highest Number of New Adoptions | ||

|---|---|---|---|---|---|---|---|

| Replacement Rate of LCVs | Battery Pack Price Tendency | ||||||

| 100% | BNEF estimation | 0.95% | 23.28% | −107.22% | 0.9268 | 13 | 30,408 |

| 50% price drop | - | 8 | 50,344 | ||||

| 20% price drop | - | 11 | 35,844 | ||||

| 2% price drop | - | 13 | 29,501 | ||||

| 50% | BNEF estimation | 1.00% | 15.13% | −83.97% | 0.9732 | 16 | 20,535 |

| 50% price drop | - | 11 | 31,226 | ||||

| 20% price drop | - | 15 | 23,439 | ||||

| 2% price drop | - | 17 | 20,096 | ||||

| 10% | BNEF estimation | 1.17% | 3.59% | −20.07% | 0.9141 | 24 | 7363 |

| 50% price drop | - | 21 | 8253 | ||||

| 20% price drop | - | 23 | 7570 | ||||

| 2% price drop | - | 24 | 7275 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wei, I.-H.; Wang, F.-M.; Chang, C.-H. A Feasibility Study of Developing eLCV Shared Architecture in Taiwan. Energies 2022, 15, 3283. https://doi.org/10.3390/en15093283

Wei I-H, Wang F-M, Chang C-H. A Feasibility Study of Developing eLCV Shared Architecture in Taiwan. Energies. 2022; 15(9):3283. https://doi.org/10.3390/en15093283

Chicago/Turabian StyleWei, I-Hua, Fu-Ming Wang, and Chung-Hao Chang. 2022. "A Feasibility Study of Developing eLCV Shared Architecture in Taiwan" Energies 15, no. 9: 3283. https://doi.org/10.3390/en15093283

APA StyleWei, I.-H., Wang, F.-M., & Chang, C.-H. (2022). A Feasibility Study of Developing eLCV Shared Architecture in Taiwan. Energies, 15(9), 3283. https://doi.org/10.3390/en15093283