Research on the Blue Carbon Trading Market System under Blockchain Technology

Abstract

:1. Introduction

2. Literature Review

3. Design of Blue Carbon Cycle and Transaction Circulation System

3.1. Selection of Method

3.2. Introduction to Participants

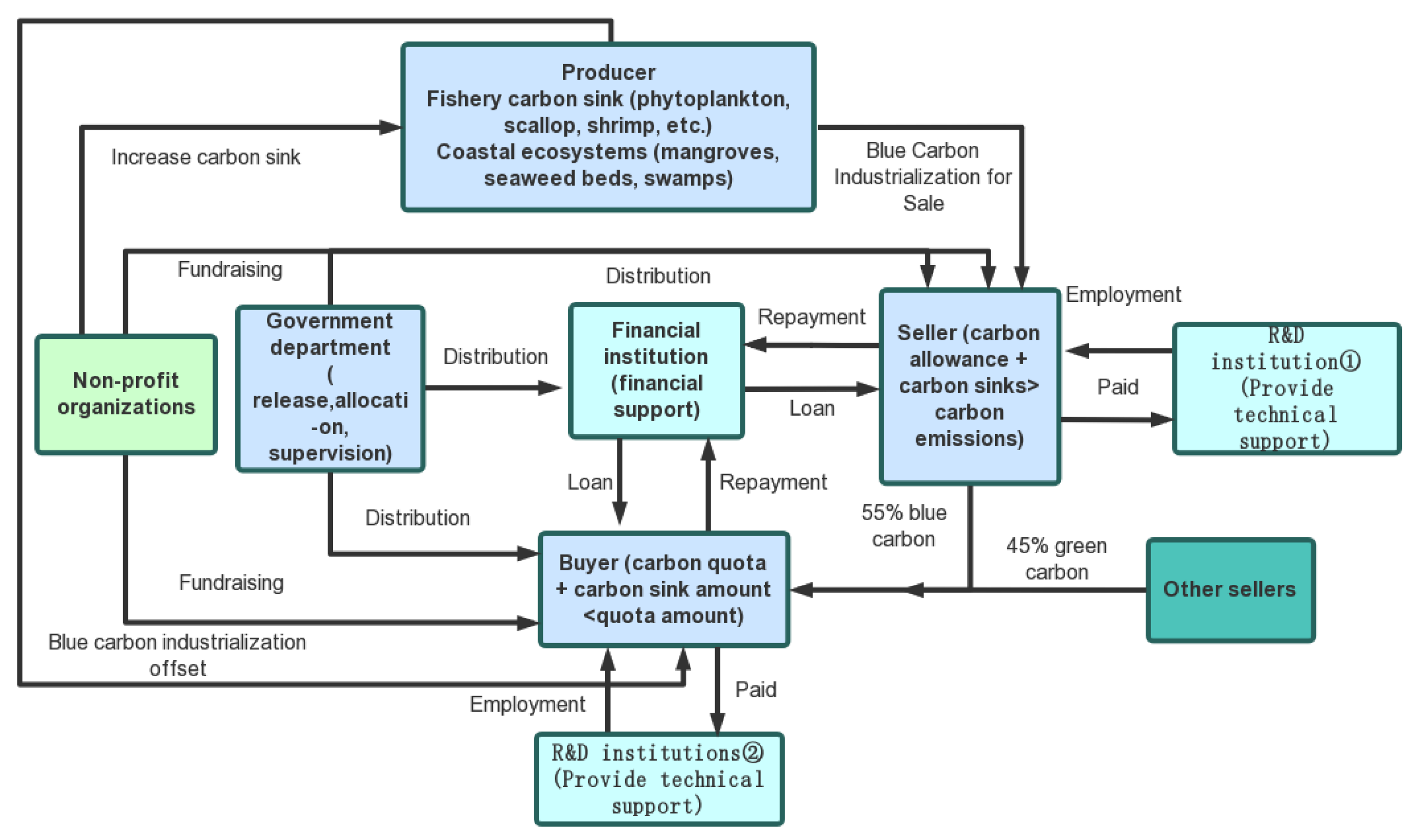

3.3. Analysis of the Specific Behavior of the Participants

- (1)

- Producers: The blue carbon sinks that can be considered for inclusion in the carbon market are divided into two main parts: fishery carbon sinks and coastal ecosystem carbon sinks [46]. The former mainly revolves around the processes and mechanisms that promote the absorption of carbon dioxide by marine organisms through fishery production activities, and remove stored carbon through marine product capture. Specific activities can include algae farming, shellfish farming, filter-feeding fish farming, etc. [47]. The carbon sinks of the latter coastal ecosystems have very similar mechanisms to forest carbon sinks. The coastal ecosystems include mangroves, seaweed beds, salt marshes, seaweed beds, coral reefs, etc., which have significant carbon sinks [48]. Protecting these ecosystems or expanding their scope can increase carbon sinks. These two carbon fixation methods reflect the ecological and economic value of blue carbon, making it one of the objects of carbon sink trading in the carbon market.

- (2)

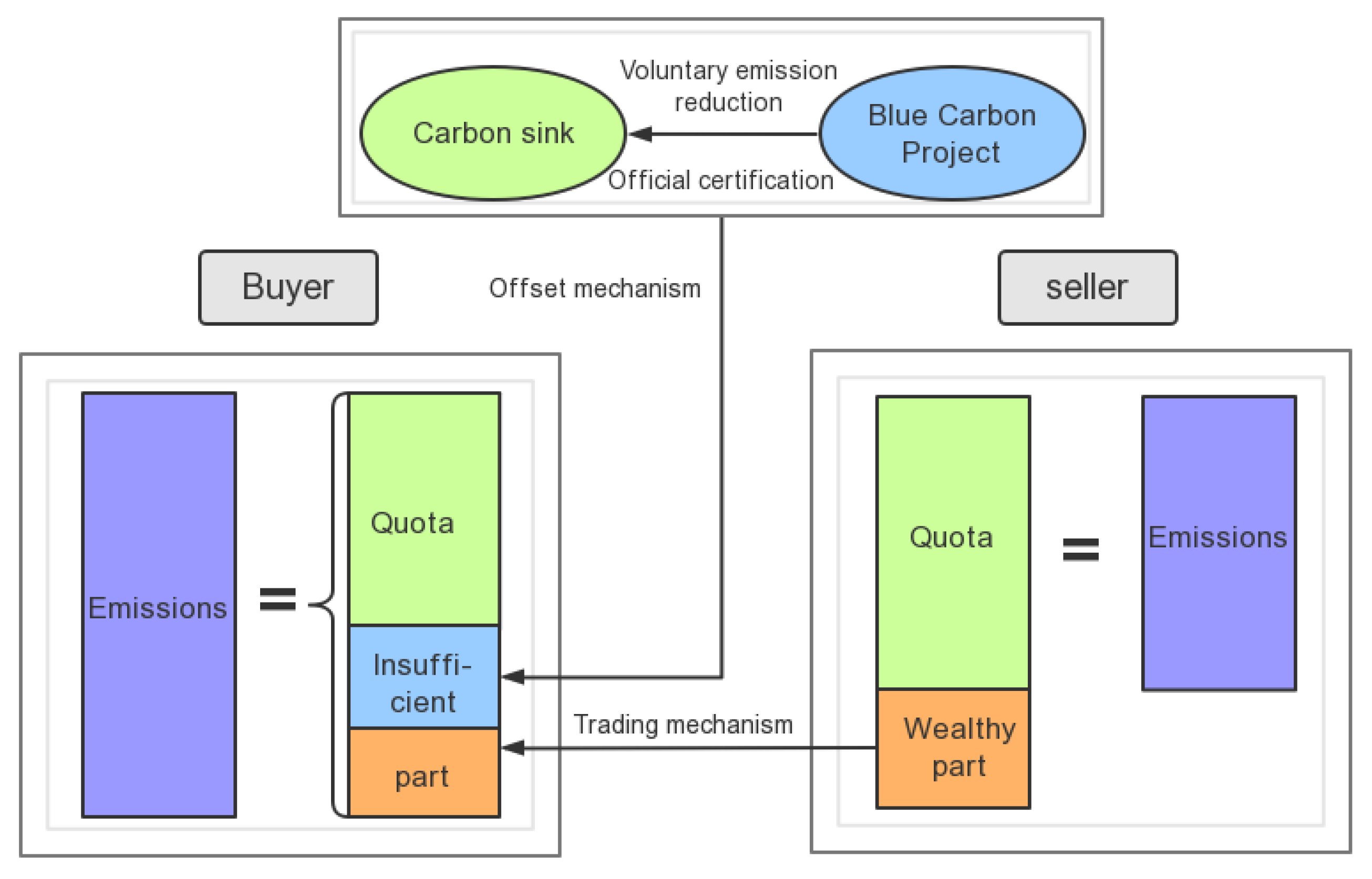

- Sellers and buyers: The definition of buyers and sellers in the blue carbon transaction flow mainly depends on the difference between the total carbon emissions of the controlling company and the total carbon ownership (the sum of the initial allowances and carbon sinks). When carbon emissions > initial allowance + carbon sinks, the company acts as a buyer; otherwise, it is a seller. Among them, the choices of emissions control companies are concentrated in industries such as electricity, cement, steel, petrochemical, papermaking, and civil aviation with high carbon emissions. The flow of transactions between the two parties is shown in Figure 2. The buyer’s insufficient part can be offset by the carbon sinks of its own emission reduction certification, or purchasing the seller’s wealthy part, which comes from the seller’s remaining allowances and the carbon sinks obtained from the development of blue carbon projects.

- (3)

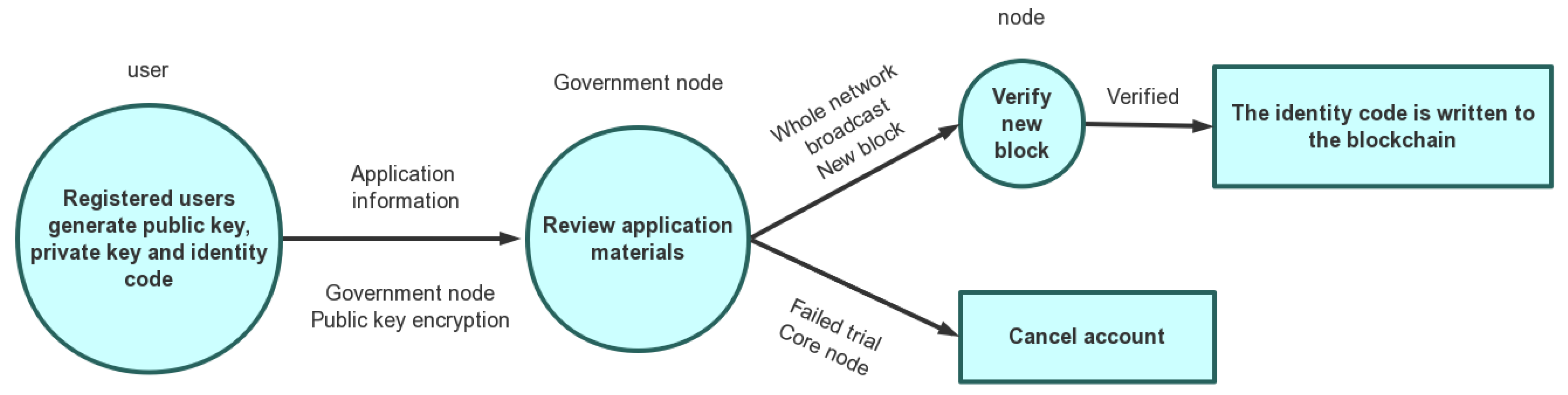

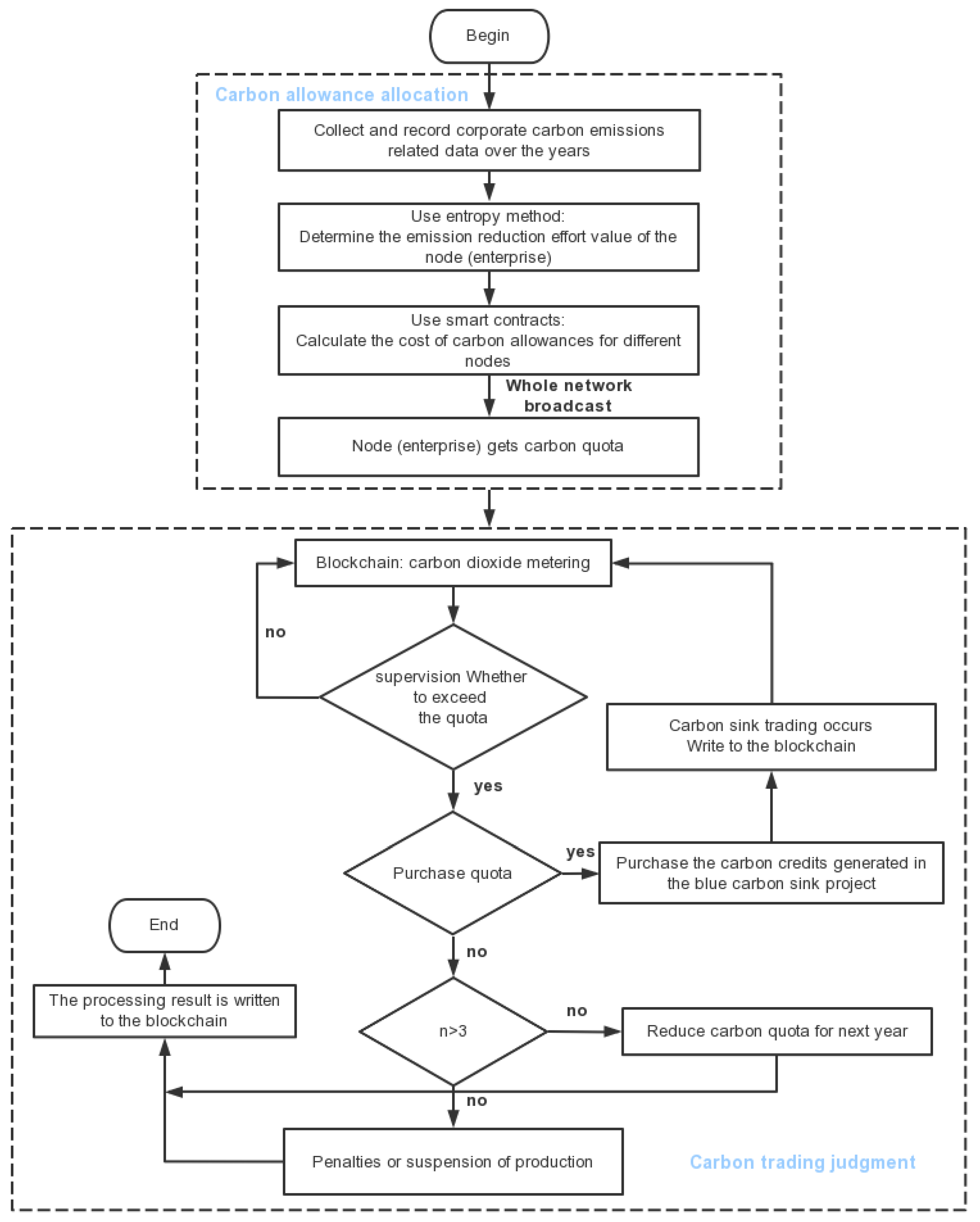

- Relevant government departments: Blockchain technology has huge potential in realizing smart government services [50]. It is an important means to optimize government management, improve decision-making capabilities, and promote public services [51]. Therefore, the application of blockchain in the field of government affairs is becoming more and more extensive. In terms of environmental management, relevant government departments that can be chained can be designed as the Ministry of Environment or Climate Bureau of the country where the chain enterprise is located. In the traditional carbon trading market, government departments mainly provide the issuance, distribution and registration of carbon emission allowances for domestic enterprises. Based on the underlying technology of the blockchain, the carbon emission allowance for the year can be calculated based on the company’s emissions over the years by designing smart contract algorithms; then, the data are broadcast on the whole network so that all users on the chain can make inquiries, and it also plays a supervising role for the enterprises. This greatly reduces costs and improves efficiency. If the company defaults, the relevant government departments can allocate part of the company’s carbon allowance rights for the next year to international financial institutions, and then auction it.

- (4)

- Financial institutions: In the practice and prospects of the application of blockchain, the banking industry has become the most popular application field of blockchain [52]. For example, Indian commercial banks introduced blockchain technology to overcome high debt and capital risks; the Brazilian Development Bank used blockchain technology to lend and monitor development projects [53]; Italian banks used blockchain to solve practical business problems, in order to provide greater data transparency and visibility, faster execution, and the possibility of transferring checks and money directly within the application [54]. Among them, the most influential R3 blockchain alliance brings together more than 40 world-leading financial institutions, including Bank of America, Citigroup, Morgan Stanley, Deutsche Bank, and Barclays Bank [55]. Therefore, the financial institutions that apply for chaining in this article can provide loans or financing for blue carbon suppliers, and only need to register an electronic account on the financial institution chain platform to provide financial support for their projects’ development. Financial institutions can also provide loan services for high-energy-consuming buyers, so that they have sufficient capital circulation capacity, balance their own emission reduction tasks, and improve corporate emission reduction technologies.

- (5)

- Non-profit organizations: First of all, non-profit organizations themselves are an important force in environmental governance, and they are dedicated to the public. Secondly, non-profit organizations can use blockchain to build trust between donors, thereby improving the transparency of donation management, and meeting demand with lower costs and higher efficiency [56]. A blue carbon trading application system under blockchain technology can be built and designed for non-profit organizations to register on the chain; donors can choose the goal of donations; all details of donations can be recorded on the blockchain; once the donation reaches the beneficiary’s account, relevant information about transfers and withdrawals will also be recorded. Non-profit organizations can raise funds for high emitting companies to improve production technology and replace energy-saving equipment. Education and publicity can also be carried out in maintaining the ecosystem, and more environmental maintenance volunteers can be provided. The design of this node on the chain can refer to the international non-governmental organizations in the international blue carbon partners, such as the World Conservation Union (IUCN), the Pacific Regional Environmental Program Secretariat, and the Nature Conservancy (TNC) [27]. These kinds of public welfare participants have made their own contribution to global climate governance, and can also enhance the image of the organizations and attract more volunteers to strengthen the organizations.

- (6)

- Research and development institutions: These mainly provide technical support for emission control companies, such as mangrove area estimation, restoration technology, project carbon sink accounting and reasonable pricing for the development of blue carbon projects.

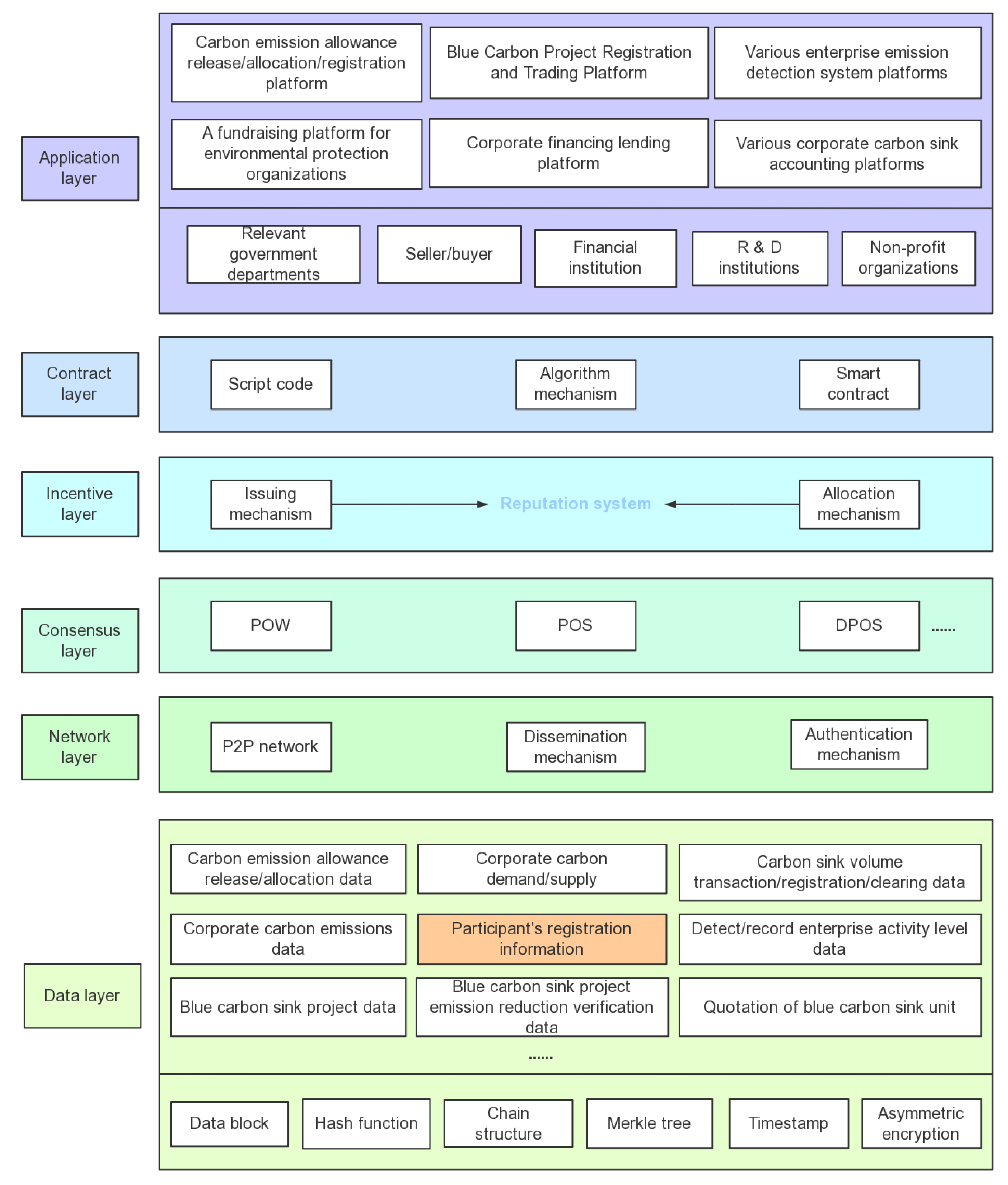

4. Blockchain-Based Blue Carbon Governance Cooperation System

4.1. Construction of the System Architecture

4.2. Advantages of Blockchain as a Blue Carbon Trading System

5. Discussion

- (1)

- Providing research ideas for the integration of blockchain and the virtual economy industry in environmental governance: At present, government governance projects based on blockchain are also concentrated in applications such as digital identity authentication, electronic medical care, and electronic election voting. Moreover, the current blockchain is mainly used in the field of industrial finance for commodity transactions to provide financing for small and medium-sized enterprises. This article combines the two in ecological product (carbon sink) trading and expands its application range to blue carbon.

- (2)

- Enriching the carbon market and promote “emission reduction without reducing production”: The current mainstream framework believes that to solve the huge and hyper-spatial externality of “carbon emissions”, it is necessary to realize the internalization of this negative externality through carbon pricing (carbon tax and carbon trading). However, some scholars have gradually questioned carbon pricing as the main policy tool to deal with climate change [64] and reviewed the post-mortem quantitative assessment of global carbon pricing policies since 1990, showing that carbon pricing has a limited impact on emissions and only maintains between 0−2% [65]. Carbon rights and forest carbon sinks are often mainly discussed in carbon trading, and ocean carbon sinks are not included. Moreover, the ocean is the world’s largest carbon reservoir, and its high carbon sequestration efficiency is conducive to achieving “emission reduction without reducing production”. Therefore, this research discusses carbon sink trading under the blockchain, enriches the carbon trading market, and increases the contribution of carbon trading in the path to carbon neutrality.

- (3)

- Making the world pay more attention to the development and utilization of marine resources: The establishment of the blue carbon market has been blocked due to various factors such as the lack of blue carbon measurement standards and monitoring mechanisms. With the maturity of blue carbon sink quantitative research methods [66], and the establishment of a well-functioning blue carbon trading mechanism, a fair market environment and effective regulatory framework can be established [67]. From a forward-looking perspective, this article assumes that under the conditions of mature blue carbon sink data collection and accounting methods, the programming language of smart contracts under blockchain technology can be used to measure blue carbon sinks and improve transaction efficiency.

6. Conclusions

Limitations and Future Research Directions

- (1)

- In this study, a framework for blockchain application in blue carbon trading was assumed to be established in an ideal state. Among them, the coordination of interests among various subjects, the selection of carbon quota indicators and the setting of benchmarks for emission reduction rewards and penalties have not yet been specified and are at a preliminary stage. Therefore, the literature needs to gradually refine and improve the setting of relevant indicators and benchmarks as the blue carbon market develops.

- (2)

- This paper adopted a qualitative research approach to summarize the conceptual framework for the participation of emissions control enterprises in blue carbon trading under blockchain in the context of the trend of research related to the application of blockchain in carbon trading. There was a certain lack of rigidity in the data. In the future, based on the independent quantification of blue carbon-related emission factors, the gradual maturity of blue carbon measurement methods and the increase of practical application cases, modeling and simulation methods can be used to further study what factors affect blue carbon trading under blockchain.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Nomenclature

| Nomenclature | Definition |

| Nature-based solutions (NbS) | It emphasizes respecting the laws of nature, and through afforestation, strengthening farmland management, protecting wetlands, oceans and other ecological protection and ecological restoration, improving ecological management and other implementation paths, controlling greenhouse gas emissions, improving the ability to deal with climate risks, and at the same time increase carbon sinks. It is a comprehensive means of mitigating and adapting to climate change and improving climate resilience. |

| peer-to-peer (P2P) | A P2P network is the networking method of blockchain. Each node in the P2P network has the characteristics of equality, autonomy and distribution, and so on. All nodes are connected to each other in a flat topology, without any centralized authority node and hierarchical structure. |

| Clean Development Mechanism (CDM) | One of the mechanisms for flexible compliance introduced in the Kyoto Protocol. It allows Parties to undertake joint projects with non-Parties to reduce emissions of greenhouse gases such as carbon dioxide. The amount of emission reductions generated by these projects can be used by Parties to meet the emission limits or reductions to which they are committed. |

| Joint Implementation (JI) | It is one of the flexible compliance mechanisms introduced in the Kyoto Protocol. It is the certification and transfer or acquisition of emission reduction units (ERUs) between Annex I countries under the supervision of a “supervisory committee”, using ERUs. As tradable commodities, ERUs can help Annex I countries meet their Kyoto Protocol emission reduction commitments. |

| Proof of Work (POW) | A consensus mechanism, which is simply understood as “work-based distribution”, that is, how much one gets paid for the work one puts in, and labor in blockchain refers to the computing services provided to the network. |

| Proof of Stake (POS) | A consensus mechanism, simply understood as “assignment by capital”, where interest is paid based on the amount and duration of money held by users. |

| Delegated Proof of Stake (DPOS) | It is a consensus mechanism in which a trusted account elected by the community, i.e., the one with the highest number of votes, creates the block. Similar to a shareholding company, ordinary shareholders do not have access to the board of directors and need to elect representatives to make decisions in their place. |

References

- Zhang, Y.; Zhao, M.X.; Cui, Q.; Fan, W.; Qi, J.G.; Chen, Y.; Zhang, Y.Y.; Gao, K.S.; Fan, J.F.; Wang, G.Y.; et al. Processes of coastal ecosystem carbon sequestration and approaches for increasing carbon sink. Sci. China Earth Sci. 2017, 60, 809–820. [Google Scholar] [CrossRef]

- Contributing Editor. Promote Ocean Carbon Sinks to Become New Force in Achieving Carbon Neutrality. Bull. Chin. Acad. Sci. 2021, 36, 239–240. [Google Scholar] [CrossRef]

- Khatiwala, S.; Primeau, F.; Hall, T. Reconstruction of the history of anthropogenic CO2 concentrations in the ocean. Nature 2009, 462, 346–349. [Google Scholar] [CrossRef] [PubMed]

- Pan, X. Theoretical Isomorphism and Legal Path of China’s Blue Carbon Market Construction. Hunan Univ. (Social Sci. Ed.) 2018, 32, 155–160. (In Chinese) [Google Scholar] [CrossRef]

- Howson, P. Tackling climate change with blockchain. Nat. Clim. Chang. 2019, 9, 644–645. [Google Scholar] [CrossRef]

- Pan, Y.; Zhang, X.; Wang, Y.; Yan, J.; Zhou, S.; Li, G.; Bao, J. Application of blockchain in carbon trading. Energy Procedia 2019, 158, 4286–4291. [Google Scholar] [CrossRef]

- Barreca, A. Carbon Market and Carbon Contracts for CERs Transactions. In Developing CDM Projects in the Western Balkans: Legal and Technical Issues Compared; Montini, M., Ed.; Springer Netherlands: Dordrecht, The Netherlands, 2010; pp. 43–58. ISBN 978-90-481-3392-5. [Google Scholar]

- Dimos, S.; Evangelatou, E.; Fotakis, D.; Mantis, A.; Mathioudaki, A. On the impacts of allowance banking and the financial sector on the EU Emissions Trading System. Euro-Mediterr. J. Environ. Integr. 2020, 5, 34. [Google Scholar] [CrossRef]

- Xiong, L.; Shen, B.; Qi, S.; Price, L.; Ye, B. The allowance mechanism of China’s carbon trading pilots: A comparative analysis with schemes in EU and California. Appl. Energy 2017, 185, 1849–1859. [Google Scholar] [CrossRef] [Green Version]

- Hastig, G.M.; Sodhi, M.S. Blockchain for supply chain traceability: Business requirements and critical success factors. Prod. Oper. Manag. 2020, 29, 935–954. [Google Scholar] [CrossRef]

- Yoo, S. Blockchain based financial case analysis and its implications. Asia Pac. J. Innov. Entrep. 2017, 11, 312–321. [Google Scholar] [CrossRef]

- Hersh, W.R.; Totten, A.M.; Eden, K.B.; Devine, B.; Kassakian, S.Z.; Woods, S.S.; Daeges, M.; Pappas, M.; Mcdonagh, S.; Hersh, W.R.; et al. Health Information Dissemination from Hospital To Community Care: Current State And Next Steps in Ontario. J. Med. Syst. 2016, 63, 425–432. [Google Scholar]

- Khatoon, A. A blockchain-based smart contract system for healthcare management. Electronics 2020, 9, 94. [Google Scholar] [CrossRef] [Green Version]

- Pop, C.; Cioara, T.; Antal, M.; Anghel, I.; Salomie, I.; Bertoncini, M. Blockchain based decentralized management of demand response programs in smart energy grids. Sensors 2018, 18, 162. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Yuan, Y.; Wang, F.-Y. IEEE towards Blockchain-Based Intelligent Transportation Systems; IEEE: New York, NY, USA, 2016; ISBN 978-1-5090-1889-5. [Google Scholar]

- Astarita, V.; Giofrè, V.P.; Mirabelli, G.; Solina, V. A Review of Blockchain-Based Systems in Transportation. Information 2019, 11, 21. [Google Scholar] [CrossRef] [Green Version]

- Wang, J.; Wang, S.; Guo, J.; Du, Y.; Cheng, S.; Li, X. A Summary of Research on Blockchain in the Field of Intellectual Property. Procedia Comput. Sci. 2019, 147, 191–197. [Google Scholar] [CrossRef]

- Howson, P. Building trust and equity in marine conservation and fisheries supply chain management with blockchain. Mar. Policy 2020, 115, 103873. [Google Scholar] [CrossRef]

- Franke, L.; Schletz, M.; Salomo, S. Designing a blockchain model for the paris agreement’s carbon market mechanism. Sustainability 2020, 12, 1068. [Google Scholar] [CrossRef] [Green Version]

- Zhao, F.; Chan, W.K. When is blockchain worth it? A case study of carbon trading. Energies 2020, 13, 1980. [Google Scholar] [CrossRef] [Green Version]

- Hu, Z.; Du, Y.; Rao, C.; Goh, M. Delegated Proof of Reputation Consensus Mechanism for Blockchain-Enabled Distributed Carbon Emission Trading System. IEEE Access 2020, 8, 214932–214944. [Google Scholar] [CrossRef]

- Mar, J.; Quevedo, D.; Uchiyama, Y.; Kohsaka, R. A blue carbon ecosystems qualitative assessment applying the DPSIR framework: Local perspective of global benefits and contributions. Mar. Policy 2021, 128, 104462. [Google Scholar]

- Wan, X.; Li, Q.; Qiu, L.; Du, Y. How do carbon trading platform participation and government subsidy motivate blue carbon trading of marine ranching? A study based on evolutionary equilibrium strategy method. Mar. Policy 2021, 130, 104567. [Google Scholar] [CrossRef]

- Li, J.; Liu, Y.; Sun, H.; Huang, J.; Lu, J. Analysis of Blue Carbon in China’s Coastal Zone. Environ. Sci. Technol. 2019, 42, 207–216. [Google Scholar]

- Shen, J.; Liang, R. Study on the blue carbon sink pricing of marine ranch. Resour. Sci. 2018, 40, 1812–1821. [Google Scholar]

- Zhang, C.; Wang, M. Study on the Blue Carbon Cooperation Mechanism of the Countries along the Maritime Silk Road. Econ. Geogr. 2018, 38, 25–31+59. (In Chinese) [Google Scholar]

- Zhao Peng, H.X. International blue carbon cooperation and China’s choice. Mar. Sci. Bull. 2019, 38, 613–619. (In Chinese) [Google Scholar]

- Zhao, C.; Fang, C.; Gong, Y.; Lu, Z. The economic feasibility of Blue Carbon cooperation in the South China Sea region. Mar. Policy 2020, 113, 103788. [Google Scholar] [CrossRef]

- Chen, G.; Xu, B.; Lu, M.; Chen, N.-S. Exploring blockchain technology and its potential applications for education. Smart Learn. Environ. 2018, 5, 1. [Google Scholar] [CrossRef] [Green Version]

- Kim, S.-K.; Kim, U.-M.; Huh, J.-H. A Study on Improvement of Blockchain Application to Overcome Vulnerability of IoT Multiplatform Security. Energies 2019, 12, 402. [Google Scholar] [CrossRef] [Green Version]

- Al Kawasmi, E.; Arnautovic, E.; Svetinovic, D. Bitcoin-Based Decentralized Carbon Emissions Trading Infrastructure Model. Syst. Eng. 2015, 18, 115–130. [Google Scholar] [CrossRef]

- Hartmann, S.; Thomas, S. Applying Blockchain to the Australian Carbon Market. Econ. Pap. J. Appl. Econ. Policy 2020, 39, 133–151. [Google Scholar] [CrossRef]

- Jiang, T.; Song, J.; Yu, Y. The influencing factors of carbon trading companies applying blockchain technology: Evidence from eight carbon trading pilots in China. Environ. Sci. Pollut. Res. 2022, 29, 28624–28636. [Google Scholar] [CrossRef] [PubMed]

- Khaqqi, K.N.; Sikorski, J.J.; Hadinoto, K.; Kraft, M. Incorporating seller/buyer reputation-based system in blockchain-enabled emission trading application. Appl. Energy 2018, 209, 8–19. [Google Scholar] [CrossRef]

- Kim, S.K.; Huh, J.H. Blockchain of carbon trading for UN sustainable development goals. Sustainability 2020, 12, 4021. [Google Scholar] [CrossRef]

- Schletz, M.; Franke, L.A.; Salomo, S. Blockchain application for the paris agreement carbon market mechanism-a decision framework and architecture. Sustainability 2020, 12, 5069. [Google Scholar] [CrossRef]

- Zhang, N.; Wang, Y.; Kang, C.; Cheng, J.; He, D. Blockchain Technique in the Energy Internet: Preliminary Research Framework and Typical Applications. Proc. Chin. Soc. Electr. Eng. 2016, 36, 4011–4022. [Google Scholar]

- Baumann, T. Blockchain for Planetary Stewardship: Using the Disruptive Force of Distributed Ledger to Fight Climate Disruption; Blockchain Research Institute: Toronto, ON, Canada, 2018; Volume 1, p. 34. [Google Scholar]

- Alongi, D.M. Global Significance of Mangrove Blue Carbon in Climate Change Mitigation. Sci 2020, 2, 67. [Google Scholar] [CrossRef]

- Wedding, L.M.; Moritsch, M.; Verutes, G.; Arkema, K.; Hartge, E.; Reiblich, J.; Douglass, J.; Taylor, S.; Strong, A.L. Incorporating blue carbon sequestration benefits into sub-national climate policies. Glob. Environ. Chang. 2021, 69, 102206. [Google Scholar] [CrossRef]

- Delcambre, L.M.L.; Liddle, S.W.; Pastor, O.; Storey, V.C. Characterizing Conceptual Modeling Research BT—On the Move to Meaningful Internet Systems: OTM 2019 Conferences; Panetto, H., Debruyne, C., Hepp, M., Lewis, D., Ardagna, C.A., Meersman, R., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 40–57. [Google Scholar]

- Zou, Y.; Yao, Y.; Jiang, Z.; Tang, W. An Overview of Conceptual Model for Simulation BT—Theory, Methodology, Tools and Applications for Modeling and Simulation of Complex Systems; Zhang, L., Song, X., Wu, Y., Eds.; Springer Singapore: Singapore, 2016; pp. 96–100. [Google Scholar]

- Pace, D.K. Ideas about simulation conceptual model development. Johns Hopkins APL Tech. Dig. (Appl. Phys. Lab.) 2000, 21, 327–336. [Google Scholar]

- Thalheim, B. Conceptual Models and Their Foundations BT—Model and Data Engineering; Schewe, K.-D., Singh, N.K., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 123–139. [Google Scholar]

- Hua, Y. China’ s Carbon Market Development and Carbon Market Connection: A Literature Review. Energies 2019, 12, 1663. [Google Scholar] [CrossRef] [Green Version]

- Bai, Y.; Hu, F. Research on my country’s Ocean Blue Carbon Trading Mechanism and Institutional Innovation. Technol. Manag. Res. 2021, 41, 187–193. (In Chinese) [Google Scholar] [CrossRef]

- Gao, Y.; Yu, G.; Yang, T.; Jia, Y.; He, N.; Zhuang, J. Earth-Science Reviews New insight into global blue carbon estimation under human activity in land-sea interaction area: A case study of China. Earth Sci. Rev. 2016, 159, 36–46. [Google Scholar] [CrossRef]

- Howard, J.; Sutton-Grier, A.; Herr, D.; Kleypas, J.; Landis, E.; McLeod, E.; Pidgeon, E.; Simpson, S. Clarifying the role of coastal and marine systems in climate mitigation. Front. Ecol. Environ. 2017, 15, 42–50. [Google Scholar] [CrossRef]

- Research, H.S. Carbon Neutral Policy Support: Carbon Trading and Green Finance. Available online: https://huanbao.bjx.com.cn/news/20210317/1142331.shtml (accessed on 5 September 2021).

- Alketbi, A.; Nasir, Q.; Abu Talib, M. IEEE Blockchain for Government Services—Use Cases, Security Benefits and Challenges; IEEE: New York, NY, USA, 2018; ISBN 978-1-5386-4817-9. [Google Scholar]

- Shan, S.; Duan, X.; Zhang, Y.; Zhang, T.T.; Li, H. Research on Collaborative Governance of Smart Government Based on Blockchain Technology: An Evolutionary Approach. Discret. Dyn. Nat. Soc. 2021, 2021, 6634386. [Google Scholar] [CrossRef]

- Bauer, V.P.; Smirnov, V.V.; Бayэp, B.П.; Cмиpнов, B.B. Prospects for the introduction of blockchain technology in the banking sector. Inf. Soc. 2020, 139, 23–37. [Google Scholar]

- Arantes Junior, G.M.; D’Almeida, J.N., Jr.; Onodera, M.T.; de Borba Maranhao Moreno, S.M.; Santos Almeida, V.d.R. IEEE Improving the Process of Lending, Monitoring and Evaluating through Blockchain Technologies an Application of Blockchain in the Brazilian Development Bank (BNDES); IEEE: New York, NY, USA, 2018; ISBN 978-1-5386-7975-3. [Google Scholar]

- Cucari, N.; Lagasio, V.; Lia, G.; Torriero, C. The impact of blockchain in banking processes: The Interbank Spunta case study. Technol. Anal. Strat. Manag. 2021, 34, 138–150. [Google Scholar] [CrossRef]

- Guo, Y.; Liang, C. Blockchain application and outlook in the banking industry. Financ. Innov. 2016, 2, 24. [Google Scholar] [CrossRef] [Green Version]

- Shin, E.J.; Kang, H.G.; Bae, K. A study on the sustainable development of NPOs with blockchain technology. Sustainability 2020, 12, 6158. [Google Scholar] [CrossRef]

- Intelligence, E.O. 2018 Blockchain Industry Research Report (Part 1). Available online: https://www.iyiou.com/research/20181122588 (accessed on 5 September 2021). (In Chinese).

- Jøsang, A.; Ismail, R.; Boyd, C. A survey of trust and reputation systems for online service provision. Decis. Support Syst. 2007, 43, 618–644. [Google Scholar] [CrossRef] [Green Version]

- Fu, B.; Shu, Z.; Liu, X. Blockchain Enhanced Emission Trading Framework in Fashion Apparel Manufacturing Industry. Sustainability 2018, 10, 1105. [Google Scholar] [CrossRef] [Green Version]

- Lu, Q.; Xu, X. Adaptable Blockchain-Based Systems: A Case Study for Product Traceability. IEEE Softw. 2017, 34, 21–27. [Google Scholar] [CrossRef]

- Du, X.; Liang, K.; Li, D. Blockchain technology-based carbon emission reduction rewards and punishments and carbon trading matching model in the power industry. Autom. Electr. Power Syst. 2020, 44, 29–37. (In Chinese) [Google Scholar] [CrossRef]

- The “Blue Solution” for Carbon Neutrality. Available online: https://xw.qq.com/cmsid/20210420A04P2200 (accessed on 5 September 2021).

- Huobi Research Institute. Global Blockchain Industry Panorama and Trend 2020–2021 Annual Report. Available online: http://www.cbdio.com/BigData/2021-02/09/content_6162885.htm (accessed on 5 September 2021). (In Chinese).

- Rosenbloom, D.; Markard, J.; Geels, F.W.; Fuenfschilling, L. Why carbon pricing is not sufficient to mitigate climate change—And how “sustainability transition policy” can help. Proc. Natl. Acad. Sci. USA 2020, 117, 8664–8668. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Green, J.F. Does carbon pricing reduce emissions? A review of ex-post analyses OPEN ACCESS Does carbon pricing reduce emissions? A review of ex-post analyses. Environ. Res. Lett. 2021, 16, 043004. [Google Scholar] [CrossRef]

- Tang, J.; Ye, S.; Chen, X.; Yang, H.; Sun, X.; Wang, F.; Wen, Q.; Chen, S. Coastal blue carbon: Concept, study method, and the application to ecological restoration. Sci. China Earth Sci. 2018, 61, 637–646. [Google Scholar] [CrossRef]

- Wan, X.; Xiao, S.; Li, Q.; Du, Y. Evolutionary policy of trading of blue carbon produced by marine ranching with media participation and government supervision. Mar. Policy 2021, 124, 104302. [Google Scholar] [CrossRef]

| Author (Year) | Aim/Main Topic |

|---|---|

| Al Kawasmi E et al. (2015) [31] | Established a distributed carbon emissions trading platform based on the Bitcoin system to improve user privacy and system security, and to achieve P2P trading of carbon emissions allowances. |

| Hartmann S and Thomas S. (2020) [32] | Used an established design process to develop the blockchain design of the Australian carbon market to improve the efficiency, fairness and effectiveness of the Australian carbon market, and solve the important research gap of how blockchain technology can be applied to the existing carbon market. |

| Jiang T et al. (2022) [33] | Data from eight carbon trading pilots in China were collected to demonstrate the factors that influence the adoption of blockchain technology by carbon trading companies. Among them, the willingness to use blockchain technology is inversely proportional to the time it takes for companies to learn to master it. Moreover, the higher the number of companies involved in carbon trading, the earlier the companies use the technology. |

| Khaqqi KN et al. (2018) [34] | Proposed a carbon trading management mechanism based on blockchain technology, combined with a reputation system, and introduced a market segmentation mechanism and a priority value order mechanism to solve carbon trading management and fraud problems. |

| Kim SK and Huh JH. (2019) [35] | A reliable blockchain algorithm was designed to verify the carbon emission rights in the 17 tasks of the United Nations Sustainable Development Goals (UN-SDGs’), which provides a reference for the design of smart contracts in the decentralized carbon trading system. |

| Schletz M et al. (2020) [36] | Evaluated the applicability of blockchain technology to Article 6.2 of the Paris Agreement’s carbon market mechanism. The results showed that the technology can improve the transparency and automation of the transaction process and blockchain applications are promising. |

| Zhao F and Chan WK. (2020) [20] | Used the advantages of blockchain technology and integrated the institutional risk control framework to propose a new hybrid blockchain system architecture that provides for the adoption of blockchain in carbon trading and other industries through integrated analysis. |

| Zhang N et al. (2016) [37] | It is believed that blockchain technology can realize the automatic measurement and certification of carbon emission rights through smart contracts, and use a distributed structure to ensure the traceability and non-tampering of all transaction information, and to solve the problems of large workload of carbon certification in traditional carbon markets and the traceability of transaction records. |

| Process | Elaboration | Key Technologies |

|---|---|---|

| Information release and matching | High-energy-consuming enterprise users with transaction qualifications and carbon sink project development companies register through websites or applications and submit requests for purchase and sale of carbon sinks. Users and suppliers reach transaction intentions, that is, the matching of buyers and sellers has been completed at this stage. | Consensus mechanism, P2P network transmission technology |

| Transaction information on the chain | The blockchain client developed based on the application framework and blockchain standards writes the data information obtained in the previous stage to the blockchain, including initial information such as quotations and matching information. | Consensus mechanism, smart contract, cryptography |

| Transaction settlement | After the block link receives the matching information from the buyer and the seller, it settles the transaction and realizes the automatic transfer of funds from the buyer to the seller. | Consensus mechanism, smart contract, cryptography |

| Transaction storage | Records the transaction content and provides a reference for the next round of transactions. When storing transaction information, it is necessary to ensure that the information is true and checkable, but also to ensure that the information will not be tampered with. Finally, the transaction results will be announced on the entire network. | Consensus mechanism, cryptography, distributed storage technology, P2P |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, C.; Sun, J.; Gong, Y.; Li, Z.; Zhou, P. Research on the Blue Carbon Trading Market System under Blockchain Technology. Energies 2022, 15, 3134. https://doi.org/10.3390/en15093134

Zhao C, Sun J, Gong Y, Li Z, Zhou P. Research on the Blue Carbon Trading Market System under Blockchain Technology. Energies. 2022; 15(9):3134. https://doi.org/10.3390/en15093134

Chicago/Turabian StyleZhao, Changping, Juanjuan Sun, Yu Gong, Zhi Li, and Peter Zhou. 2022. "Research on the Blue Carbon Trading Market System under Blockchain Technology" Energies 15, no. 9: 3134. https://doi.org/10.3390/en15093134

APA StyleZhao, C., Sun, J., Gong, Y., Li, Z., & Zhou, P. (2022). Research on the Blue Carbon Trading Market System under Blockchain Technology. Energies, 15(9), 3134. https://doi.org/10.3390/en15093134