Abstract

Worldwide, there has been an exponential growth in the production and application of lithium-ion batteries (LIBs), driven by the energy transition and the electric vehicle market. The scarcity of raw materials and the circular economy strategy of LIBs encourage the need to reuse components, recycle, and give second life to used batteries. However, one of the obstacles is the insufficient volume of LIBs for recycling, which prevents the economic viability of this industrial process. Thus, this article mainly focuses on the economic aspects of the recycling of LIBs, presenting and analyzing: (i) the advantages and disadvantages of recycling and (ii) a survey of factors that influence the cost and economic feasibility of disposing of batteries. The importance of regulations, the market, and business models regarding the recycling of LIBs in a few countries are also discussed. Finally, a business model is created for recycling LIBs in Brazil. The main factors that influence the economic feasibility of this process are indicated, such as government incentives through regulation, exemption from fees and taxes, and the adequacy of battery technology. Encouraging recycling through tax exemptions or reductions can make the process more economically viable, in addition to contributing to the circular economy. Another essential factor to be considered is the creation of joint ventures, which can facilitate the entire chain of the circular economy, including logistics, transport, and disposal of batteries.

1. Introduction

Batteries are the primary energy storage source [1], and the lithium-ion battery (LIB) market is growing at a rapid pace. The trend is that it will continue to grow significantly in the coming years [2], with light electric vehicles (LEVs) as the main driver of this revolution. By 2030, it is estimated that a total of 10.5 TWh of LIBs will be placed on the market, and electric vehicles (EVs) will represent 77% of the total installed LIBs globally, equivalent to approximately 8.1 TWh [3].

In 2013, the electric vehicle market grew in the most prominent LIB markets (China, Europe, and the United States). In 2018, light-duty electric vehicles were already the largest segment of LIBs [3]. For that same year, it was estimated that 1.5 million all-electric or plug-in hybrid electric vehicles (PHEVs) would be sold, corresponding to cumulative sales of more than 3 million EVs worldwide [4,5].

In 2019, LEVs reached 93 GWh of LIBs installed in all battery electric vehicles (BEVs) and PHEVs. One of the main reasons for the significant growth in the use of EVs is government incentives aimed at reducing greenhouse gases and public policies. Such incentives include both original equipment manufacturers (OEMs) and EV consumers [3].

One of the significant contributions of EVs is that they can help mitigate climate problems by assisting in decarbonization and being a sustainable vehicle [6]. Most BEVs use LIBs because they have a longer life cycle and higher loading and unloading efficiency [7,8,9]. Compared to lead–acid and nickel–cadmium batteries, for example, LIBs offer greater energy density and power level, combined with the lower weight of the batteries [9].

In addition to LEVs, heavy electric vehicles can be electric buses and light, medium, and heavy electric trucks. Small collection vehicles, microvans, and vans can also be considered as part of this category because they are, in most cases, used for commercial purposes or as heavy vehicles. This is the third-largest segment for LIBs [3]. In 2020, about 90% of heavy EVs were manufactured in China [10,11].

LIBs are composed of several chemical components. The main one is lithium, which is used as a cathode [12]. The first commercial LIB was LCO battery. Based on carbon, nonaqueous electrolyte, and lithium cobalt (LiCoO2), it pioneered rechargeable battery technology for portable applications [13]. Over time, other types of LIBs emerged based on the chemistry of the cathode used in the battery.

Regarding the safety of LIBs, there is some concern with the use of liquid electrolytes. The organic solvents used in producing these electrolytes are highly flammable. When used with lithium anodes, they can result in the formation of lithium dendrites, which can cause a short circuit [14]. To avoid this, the use of solid electrolytes is recommended. Cathode and anode account for almost half of the total battery weight (approximately 40%), followed by the current collector, which is usually copper or aluminum and accounts for about 15% of the battery weight [15]. For this reason, aluminum is also a material worth recycling.

Table 1 presents the most common lithium-ion chemistries on the market, along with some of their applications from power tools to energy storage systems (ESS). The most used LIB applications are highlighted below.

Table 1.

Most common lithium-ion chemistries and their applications. Adapted from [5].

The popularity of LIBs has resulted in lower prices. In 2021, the cost of LIBs was $132/kWh, equivalent to an 89% price drop compared to 2010 ($1200/kWh) and 6% compared to 2019 ($140/kWh). Based on the historical trend of falling prices, Bloomberg has stated the projection that the average price will be less than $100/kWh by 2024 [16]. The accelerated growth in the use of LIBs has made developed countries worried about the disposal of these batteries, culminating in the development of regulations to achieve this goal [17].

This article is the result of a research and development project focused on studying the factors that impact the economic viability of recycling EV LIBs in Brazil with the aim of guiding CPFL and its partners through the presentation of business possibilities for recycling LIBs. For this, a study on the state of the art of LIB recycling worldwide, a survey of Brazilian companies involved in recycling or second life, and examination of the international regulatory and normative benchmarking on this topic were carried out. The project resulted in the development of a business model for disposal of LIBs in this country. This business model consists of defining a Brazilian recycling route for LIBs based on the study above, addressing costs and revenues of the recycling process, and surveying Brazilian taxes so that one of the 27 states in the country can be chosen for the implementation of a recycling factory.

2. Recycling

Due to many LIBs being in use, it is essential to be concerned about the fate of these batteries when they reach the end of their useful life in the application in which they are found. Significant environmental impacts are caused during the manufacture of new batteries. These impacts are even more important than the choice of battery chemistry [18]. In addition, there is some concern about the scarcity of raw materials and the possibility of reducing the value of batteries through recycling. Faced with such situations, there are two alternatives to the simple disposal of LIBs: second life and recycling.

2.1. Second Life

In the case of LIBs, some applications require high capacity, such as light-duty electric vehicles. When batteries reach between 70 and 80% of their ability, depending on the manufacturer, they are usually no longer suitable for such an application [19].

However, LIBs can be reused in applications that require less capacity. This reuse is called second life [19]. The ESS for renewable sources is a growing segment and is an excellent example of the second life use of LIBs from EVs. However, there are also other applications for used LIBs, such as forklifts, agricultural machines, e-bikes, etc. [20].

For every 10 EV batteries, nine are ready to be reused in other applications in China. Therefore, instead of recycling, 90% of the LIBs used in vehicles can be given a second life [3]. This is also a cheaper way of disposing of used batteries as it eliminates recycling costs. These LIBs can be used between 7 and 10 years longer when removed from their initial application and destined for another [19]. Besides understanding the advantages of reusing batteries, it is necessary to know that there are also some disadvantages, such as the risk of explosion when it comes to the second life use of LIBs.

According to article 14 of the China National Energy Administration’s 22 June 2021 document “Management Specifications for New Energy Storage Projects”: “In principle, no new large-scale energy storage projects using lithium ions in second life must be built” [21,22]. The document was made available to the population for consultation and suggestions. After the consultation period, article 15 of the official document determines the following: “Constructed and newly constructed second life battery energy storage projects must establish a platform monitoring system to monitor battery performance parameters in real-time, perform regular maintenance, and make emergency plans” [23]. In addition, there must be a battery safety assessment report issued by the corresponding qualification agency. This change will result in changes to the previously made predictions of LIBs.

In this way, it can be understood that the business model used will direct that batteries must go to recycling or second life. By 2030, it is estimated that a capacity of 145 GWh will be available for second life in the world, while 170 GWh could be recycled [3]. In general, if second life is not chosen, it can be said that 315 GWh of LIBs will reach the end of life (EOL) worldwide. This is the reason the main focus of this article is the recycling of LIBs rather than second life.

2.2. Recycling Processes

The price of metals, saving natural resources and raw materials, safety, reducing environmental toxicity, minimizing CO2 emissions, moderating energy consumption, and reducing waste are factors that drive the recycling of LIBs [24]. In addition to lithium, other components can also be recovered in recycling LIBs, for example, aluminum, cobalt, iron, manganese, and nickel [17].

One of the challenges of recycling LIBs, in general, is the diversity of components, including different properties [4] and varied physical configurations and cell types. For example, cylindrical cells present more significant challenges for electrode separation compared to prismatic or pouch cells [24]. The variety of LIB chemistries can also create difficulties in the material recovery process.

Usually, the LIB recycling chain starts with the pretreatment phase. The battery is discharged first, separated by components such as BMS (battery management system), pack, and electrode elements [25]. After the recycling steps, various materials can be recovered. These materials can serve as raw materials for batteries again or go to other destinations. Table 2 shows the market value of some of these recycled elements.

Table 2.

Market values of the main elements of vehicle lithium-ion batteries [26].

Next, comments are made on the main categories of recycling processes.

2.2.1. Pyrometallurgy

The pyrometallurgical process is used for recycling other types of batteries. It involves high temperatures, generally above 1400 °C [21], to melt the batteries so that the metal oxides are transformed into an alloy of Co, Cu, Fe, and Ni [24], which can be separated mainly through leaching [4,25,27].

The main disadvantages of this type of process are generation of toxic gases, loss of material, and high energy consumption [19]. Some advantages are flexibility as different packs of used LIBs can be mixed, cost and time savings, accelerated process, and ability to reach high volumes more efficiently [4]. Furthermore, it is impossible to recover lithium from black mass (alloyed with precious metals) [25].

2.2.2. Hydrometallurgy

Aqueous solutions are used to leach metals from the cathode [24]. Water and different acids are used for the separation of active materials to occur, most often producing compounds of cobalt, lithium, and nickel [4]. Some of the advantages of this method include ability to recover metals more efficiently and with a high degree of purity, recovery of Li in the form of lithium carbonate, and less energy usage [19]. In addition, the emission of gases in this process is minimal [28].

The most common hydrometallurgical processes used to recover black mass elements are leaching, electrochemical deposition, solvent extraction, and chemical precipitation [25]. Pretreatment steps are necessary before starting this process due to the presence of impurities that hinder leaching, including agents with high selectivity [19].

2.2.3. Mechanical/Physical

The physical processing step aims to reduce the volume of scrap by separating valuable materials and removing the battery’s outer casing [19]. Recovered materials can undergo physical separation processes, including, for example, crushing, screening, filtration, and magnetic stirring [24]. There are cases where flotation separates the casings and plastics [4]. Physical separation is classified into four types: (i) size separation, (ii) magnetic separation, (iii) density separation, and (iv) flotation separation [17].

Mechanical treatment is a process necessary for each element to be separated from the other [29]. Considering the volume of material in the recovery process, mechanical treatment is more recommended than manual treatment [27].

2.3. Disadvantages and Advantages of the Recycling Process

Recycling LIBs have many benefits in several areas. Socially, there is a reduction in local impacts of mining and refinery. Economically, there is a profitable recovery of metals from batteries. Environmentally, recycling reduces greenhouse gas (GHG) emissions because used batteries can be toxic and harmful to the environment when disposed of incorrectly [29]. In the supply chain, the advantages include the recovery of raw materials in scarcity, reduction in the demand for these products, and reduction in the dependence on imported materials.

Among the disadvantages currently existing in the recycling process, a few can be mentioned, including the absence or insufficiency of governmental laws and regulations, safety problems in the transport and storage of batteries due to the risk of explosion, and logistical challenges, such as insufficient collection and disposal points. In addition, the recycling process still has a high operating cost, and the technology can cause damage to the environment through discharge of acids into rivers during leaching, toxicity of solvents from the process extraction, air pollution, and high energy consumption of molten metals and oxides used in the battery melting process [29].

3. Regulations

Countries should be interested in recycling LIBs given the continuous growth in various technologies, the value of the components (raw materials), concerns about the impact of battery waste being deposited in the wrong place, and damage to the environment. Thus, governments should focus on creating and implementing regulations as a matter of great importance given their direct influence on the application of recycling targets. Manufacturers and users of batteries must follow these measures to minimize the negative impact of their waste in the future.

The United States is starting to move in this direction [30], in addition to the European Union [31]. Both follow pioneer China’s footsteps, with the highest production, use, and recycling of LIBs globally. The challenges lie mainly in the recycling processes, the regulatory barriers of each country, and the race against time for these laws, restrictions, and regulations to come into force as soon as possible, thus minimizing the environmental risk that could be caused by improper disposal. In addition to recycling, second life can recover battery elements that can be reused in other applications, so each country must check its LIB supply chain to understand the need for each component and each application.

4. Market

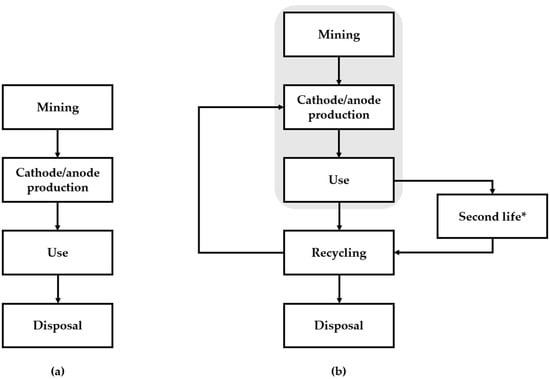

The current lithium-ion battery life cycle starts with mining, followed by cathode/anode production, use, and then disposal (Figure 1a). However, to create a circular economy of these batteries, improvements in technology, second life applications (reuse and remanufacture), and recycling are needed (Figure 1b).

Figure 1.

LIB life cycle: (a) actual (b) proposed. Adapted from [29]. * Second life depends on the cathode’s chemistry and the recycling industry’s location. For example, in some places in China, the second life of NMC batteries will be banned.

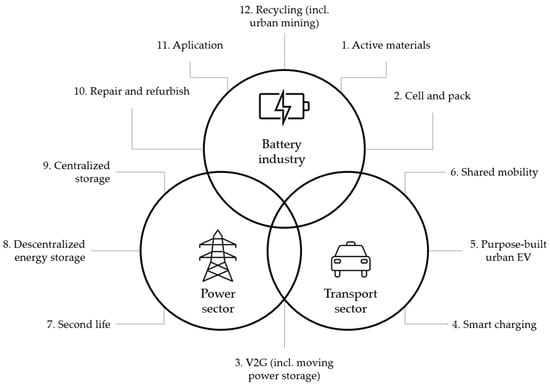

The World Economic Forum has produced an estimate for the battery value chain in 2030, in which batteries are produced at lower costs and have lower raw material requirements, fewer emissions, and better social outcomes (Figure 2). For this goal to be achieved, investments in recycling and second life as well as greater consumer and government incentives are necessary.

Figure 2.

Circular value chain of a battery engaging the energy and transport sectors. Adapted from [32].

In addition to environmental and economic benefits, implementing this battery value chain will also bring social benefits, secure jobs, higher industry revenues, more sustainable profits, and better outcomes for workers and communities [33].

The products of disassembling and recycling LFP lithium-ion batteries are iron phosphate, lithium carbonate, and aluminum materials. Therefore, the economic benefits of dismantling and recycling are not great. Hence, for LFP batteries, the priority is second life due to EOL battery capacity (between 70 and 80%).

4.1. Recycling Routes

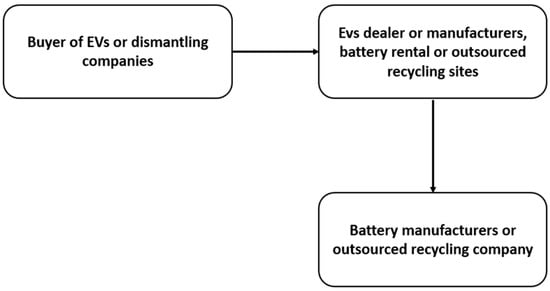

The battery goes through different paths depending on the participation of consumers and manufacturers according to recycling routes and reverse logistics [33]. In European countries and the United States, battery manufacturers usually assume responsibility for recycling, coordinated by electric vehicle manufacturers.

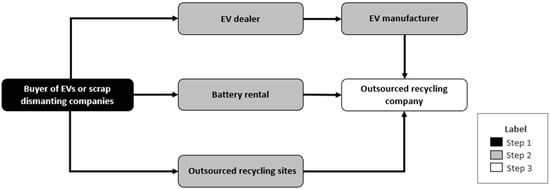

In Figure 3, the EV user initially sends the used LIB to a buyer of EVs or a dismantling company, which sends the LIB directly to the battery rental location, recycling facilities, or EV factories through an EV distributor. Finally, the LIB manufacturers receive the battery from EV manufacturers and battery rental companies. Another option is that outsourced recycling companies get the battery from outsourced recycling sites (collection points, for example).

Figure 3.

Recycling routes for reverse logistics. Adapted from [33].

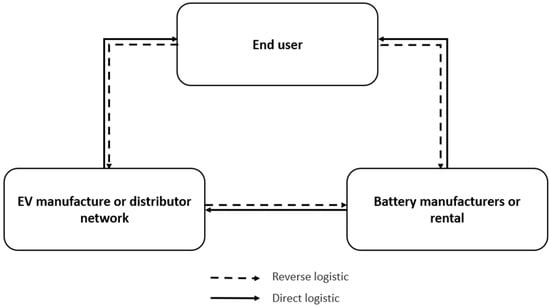

In Figure 4, some ways to dispose of used LIB batteries are shown. It is important to note that reverse and direct logistics are possible. Consumer have some disposal options. The first option is to exchange the used battery for a new one in the EV distribution network. The second option is to exchange the battery in the EV battery market. The third option is to deposit the battery with a battery rental company. It should be noted that disposal that starts with the EV distribution network then goes through EV and battery manufacturers, finally reaching the battery rental company, closing the reverse logistics with battery rental to the consumer [33].

Figure 4.

Lithium-ion battery reverse chain in Japan. Adapted from [33].

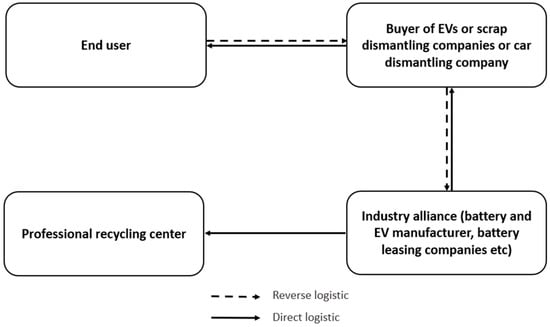

In European countries and North America, battery manufacturers form a recycling alliance. The consumer’s first option is to send the battery for disposal to a vehicle dismantling company, vehicle buyer company, or scrap dismantling company. Then, the next step is to send these disposed batteries to a member company of the recycling industry alliance, which can be battery manufacturers, battery leasing companies, etc. The last step is to send the batteries to the professional recycling center (Figure 5) [33].

Figure 5.

Lithium-ion battery reverse-chain in Europe and North America. Adapted from [33].

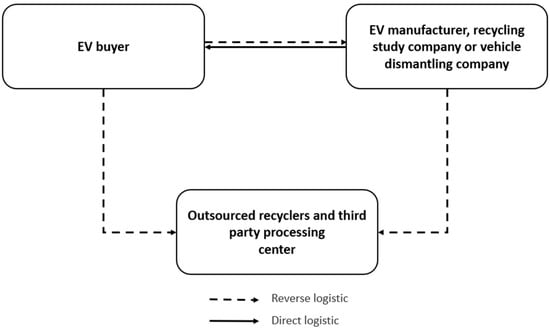

Another possible route is through outsourced recyclers, where the battery is sent for recycling after the consumer sends the EV to the dismantling (scrap) company, which will send the battery for recycling, or the consumer directly delivers the battery to the third-party recycler (Figure 6) [33].

Figure 6.

Another lithium-ion battery recycling route option. Adapted from [33].

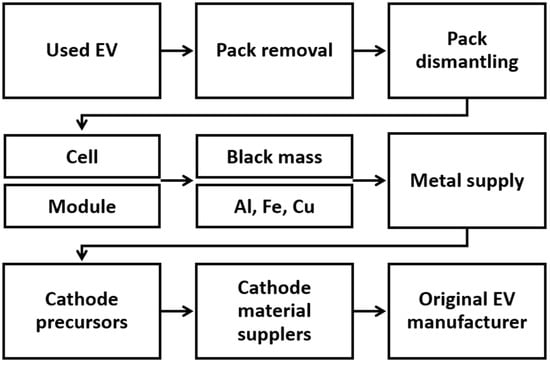

Each type of business must choose the recycling route to maximize its benefits. Lithium-ion battery recycling generally follows the value chain exemplified in Figure 7 and, in some cases, may follow a different way depending on the country and regulations in force.

Figure 7.

Lithium-ion battery recycling chain. Adapted from [34].

4.2. Costs

Lithium-ion battery recycling costs can be divided into eight items as follows:

- Depreciation;

- New battery;

- Waste treatment (environmental treatment);

- Auxiliary materials (machinery and equipment);

- Electricity;

- Labor;

- Maintenance;

- Taxes.

Thus, the recycling value can be obtained through the sum of these variables. It is worth noting that the costs and weighting of these variables in the final cost of recycling may vary according to the place where recycling is carried out. Today, the total cost to recycle lithium batteries is approximately US$26/kWh [35], with a recycling fee of US$10/kWh. However, several recycling plants aim to streamline operations to pay for their batteries in the next 10 years [36].

American Manganese, a US lithium recycler, cites that NMC batteries, which weigh about 7.3 kg/kWh, have materials worth US$13/kg or US$96/kWh [35]. In the future, as the extraction process is improved, up to 20% of the value of the material could be paid, amounting to approximately US$20/kWh.

For battery recycling, cost parameters include the battery chemistry to be recycled, the yield (tons of cells per year) of the recycling plant, industry location, whether manufacturing scrap and rejected cells will be reused, materials and energy flows associated with the recycling process, equipment used for the procedure, unit prices for chemicals and utilities consumed, unit prices for materials recovered, and information about plant operation.

By default, a recycling plant must operate 320 days a year, 20 h a day, regardless of the technology chosen. The assumed useful life for the plant is 10 years. These factors are used to determine the investment required for the plant as part of the recycling cost calculation [35].

Depending on the battery chemistry technology, the type of recycling process can be influenced. For example, in the North American market, NMC-type lithium-ion batteries are more popular, mainly because of the high cobalt value and the existence of more NMC-type battery recycling companies. For this reason, recyclers are generally paid for recycling LFP-type batteries. In contrast, NMC-type batteries are high-value and purchased to be recycled and generate a higher profit. Usually, companies have to pay extra to obtain products with a higher cobalt content [35]. Recycling values LIBs in the North American market in US$/kg are shown in Table 3.

Table 3.

Recycling values for different types of lithium-ion battery chemistries. Source: [35].

CAPEX (capital expenditure) and OPEX (operational expenditure) are included within the recycling costs of LIBs, and the return on investment (ROI) rate of the recycling process must also be considered for the calculation.

4.2.1. CAPEX

CAPEX is the money spent to buy, repair, update, or improve a business property, such as machinery, equipment, construction materials, and industry investments. The costs will help the sector expand its processing capacity [37]. As an example, Table 4, Table 5 and Table 6 show some estimated values of capital costs of a recycling plant in Germany for the company Neometals’ joint venture with Primobius based on studies and tests of pilot plant trials of Neometals’ proprietary hydrometallurgical flowsheet [35].

Table 4.

CAPEX values (direct capital) of the company Neometals. Source: [35].

Table 5.

CAPEX values (indirect capital) of the company Neometals. Source: [35].

Table 6.

Total CAPEX values of the company Neometals. Source: [35].

Table 7 shows the estimated CAPEX values in the coming years for lithium-ion battery recycling for the Canadian company Li-Cycle.

Table 7.

CAPEX values of the company Li-Cycle. Source: [38].

In 2018, it was estimated that the value obtained from recycling LIBs would be US$20/kWh in 10 to 20 years. For an energy storage system (ESS), recycling covers the decommissioning costs, which are approximately US$16/kWh [39]. Recycling and decommissioning values for a 1000 kWh storage system are shown in Table 8 and Table 9.

Table 8.

Costs of lithium-ion battery decommissioning in 2018. Source: [39].

Table 9.

Costs of lithium-ion battery decommissioning in 2038. Source: [39].

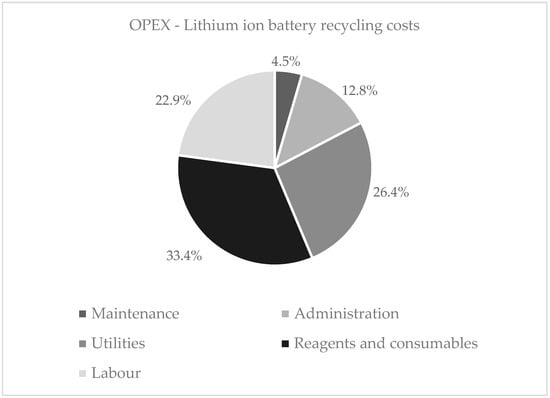

4.2.2. OPEX

OPEX includes operating expenses related to payroll, maintenance, and labor hiring costs. For the joint venture between NeoMetals and Primobius, the OPEX cost of processing batteries in its lithium-ion battery recycling operation in Germany is US$1560 per ton [39]. A breakdown of these costs is shown in Figure 8.

Figure 8.

OPEX lithium-ion battery recycling costs. Adapted from [39].

For the Li-Cycle company, the OPEX values estimated are outlined in Table 10.

Table 10.

OPEX values estimated for the company Li-Cycle. Source: [38].

5. Return on Investment (ROI)

ROI is a performance measure used to assess the efficiency or profitability of an investment or to compare the efficiency of several different investments. It measures the return on a given asset with regard to the applied cost [40]. The calculation method is given by Equation (1).

China Everbright Securities calculated the return on investment of disused LFP batteries for second life relative to new batteries. The values are given in Table 11.

Table 11.

ROI on LFP lithium-ion batteries. Source: [33].

Revenues

Besides expenditures, the cost calculation for battery recycling also needs to take revenues into consideration [34], which can be calculated according to Equation (2):

where is the mass of the material “i” recovered from spent batteries, and is the price of material “i”, as shown in Table 2.

The net recycling cost (NRC) is given by Equation (3) [35]:

where Recycling costs = CAPEX + OPEX.

NRC = Transportation cost + Recycling costs − Revenue

6. Business Model

The term business model refers to a company’s plan to profit by identifying the products or services it intends to sell, its identified target market, and anticipated expenses [41]. For lithium-ion battery recycling companies, the business model is proposed to eliminate obstacles in the value chain, such as high initial investments, negative values at the end of battery life, and low efficiency in the final product [3].

Some tools to help build a business model include the following [42]:

- Business Model Canvas;

- SWOT Analysis;

- Value Proposition Canvas;

- Pyramid Business Plan;

- 360° Value Analysis.

Among these tools, the Business Model Canvas was chosen to assemble the lithium-ion battery recycling business model by simple, practical, and visual means. While using this device, it is possible to understand and visualize the relationships between business segments and promote discussions that stimulate innovation.

Business Model Canvas

The Business Model Canvas is a strategic management template for developing new models or documenting existing models. It is a visual tool with elements that describe its value proposition, infrastructure, customers, and finances. This business model can best be described through nine basic building blocks that show the logic of how a company intends to add value and make money by covering the three main areas of a business: convenience, feasibility, and practicality [43].

Thus, the Business Model Canvas is an organized way to establish the main features and critical activities, value proposition, customer relationships, channels, customer segments, cost structures, and revenue streams. The following is a brief explanation of the nine parts of the Business Model Canvas:

- Customer segments: This will be the focus of the business.

- Value proposition: Describes the products and services that create value for a specific customer segment. The value proposition solves a problem or satisfies a customer’s need.

- Channels: Describes how a company communicates with and reaches its customer segments. Channels are customer touchpoints that play an essential role in the customer experience.

- Customer relationships: In this segment, the company must clarify the type of relationship it wants to establish with each customer segment. Relationships can range from personal to automated. Customer relationships can be driven by the following motivations: customer acquisition, customer loyalty, and increased sales.

- Revenue streams: Represents the money a company generates from each customer segment (costs must be subtracted from revenues to generate profit). Each revenue stream can have different pricing mechanisms, such as fixed list prices, trading, auction, market dependent, volume dependent, or yield management.

- Key resources: Describes the essential features needed to make a business model work. These capabilities allow a company to create and deliver a value proposition, reach markets, maintain relationships with customer segments, and earn revenue.

- Key activities: Describes a company’s activities to make its business model work. They must create and deliver a value proposition, reach markets, maintain customer relationships, and earn revenue, similar to key resources.

- Key partners: Describes the network of suppliers and partners that makes the business model work. Alliances are created to optimize, reduce risks, or acquire resources.

- Cost: These are all costs incurred to operate a business model. Creating and delivering value, maintaining customer relationships, and generating revenue will generate costs. These costs can be calculated after defining key resources, key activities, and key partnerships.

For better understanding, the nine segments can be grouped into four pillars:

- What: value proposition;

- Who: channels, customer segment, and customer relationship;

- How: key resources, key partners, and key activities;

- How much: cost and revenue streams.

A business model canvas for the lithium-ion battery recycling industry was developed. The results for the market segment and value proposition pillars are shown in Table 12 and Table 13.

Table 12.

Market segment for LIB recycling business model.

Table 13.

Value proposition for LIB recycling business model.

Furthermore, the indispensable costs for the business model were analyzed to determine the relevant variables to be considered in the income equation (income = revenue − profit), keeping it positive and within the limits that the company will establish. The results are shown in Table 14.

Table 14.

Cost structure for LIB recycling business model.

7. Lithium-Ion Battery Recycling in Brazil

According to NeoCharge, in August 2021, there were 65,644 EVs in Brazil, with 47,122 hybrid vehicles, 15,128 plug-in hybrids, and only 3394 fully electric vehicles. The hybrid Corolla model is the most popular in Brazil, with 18,567 vehicles in use, representing 28.28% of the Brazilian EV fleet. In addition to Corolla, Toyota has four other EV models in Brazil, making it the leader in the EV segment in Brazil with 59.90% of the total EVs in the country [44].

In Brazil, laws that support and encourage increased use of EVs are still lacking, both for companies and users. At the corporate level, granting tax incentives allows governments to promote economic or social development, stimulating business activity in their territories [45].

Industrial costs vary depending on the state the industry is located in. Brazil is a territorially large country, and this can lead to high transport and logistical costs for LIBs depending on where the recycling factory area is installed. In addition to transport and logistical costs, another relevant issue for choosing the location of a LIB recycling company is tax incentives. There are three classes of taxes levied on Brazilian industry: municipal, state, and federal. The state tax (tax on the circulation of goods and services (ICMS)) is the one that has the most significant impact on the final value of the product and should therefore be studied more carefully to define the best location for the recycling factory.

Brazilian Taxes

Brazil is divided into five regions (North, Northeast, Midwest, Southeast, and South) and comprises 26 states and the Federal District (equivalent to 27 federative units). Each federative unit has its ICMS defined, making the study of taxes a little more complex. Therefore, the state tax was evaluated in a more in-depth way as follows: (i) the rates established for the ICMS of each state were listed, and (ii) the survey was divided by the five Brazilian regions and the state with better performance (lower ICMS).

Another critical point is that this value, which corresponds to each state’s tax, changes according to the industry. In addition, the company’s size, the number of jobs that will be generated, the capital that will be invested, among others, are some of the variables that define how much tax reduction will be granted for each industry. For this reason, surveys of ICMS reduction ranges practiced in the states were carried out. After obtaining an average, this value was called the encouraged ICMS. It is worth mentioning that a margin of error for such data should be considered.

The five selected states, one from each region, are shown in Table 15. It should be noted that the cost of transport combined with the cost of taxes (mainly ICMS) is what will indicate the best place to install a lithium-ion battery recycling factory.

Table 15.

Encouraged ICMS for five states in Brazil.

8. Results

Suggested Model for Brazil

For Brazil, a model similar to the Chinese model was proposed, in which the battery of the consumer or the vehicle dismantling company can follow three paths: (i) EV dealer, (ii) battery rental company, and (iii) outsourced recycling points. It is worth noting that this proposal is not yet in force and has not been implemented. Of the three possible paths, only path (i) delivers the battery to the EV manufacturer to deliver it to the recycling company, while paths (ii) and (iii) have direct access to the recycler. In step 3 for recycling LIBs, the company responsible for recycling places itself on the recycling route as an accessible company to receive the batteries from all other participants in the flow. The proposed recycling route is given in Figure 9.

Figure 9.

Proposed route for recycling lithium-ion batteries in Brazil. Adapted from [33].

Regarding the choice of state for implementing the recycling factory, two variables must be evaluated with more care as mentioned earlier in the document: ICMS and distance. This is because ICMS varies between states and bring more benefits to the industry. The recycler must be located in a focal point to ensure better use of the routes between states with the used batteries.

Among the five states chosen with the lowest ICMS in each region, the following stood out: Bahia, Pará, and Minas Gerais with ICMS of 2.4, 2.6, and 3.0%, respectively. They have similar tax percentages, so the best choice will be determined by the distance factor. Pará was excluded from possible states for installing the recycling plant as it only has 869 EVs. The country’s northern region does not favor such investment as it only has 2274 EVs, equivalent to less than 3.5% of the Brazilian EV fleet. The expenses with transport and logistics of LIBs would also be unfeasible. As LIBs are flammable material, the cost of transport and the degree of danger posed would be very high.

The two remaining states are therefore Bahia and Minas Gerais. In terms of ICMS, Bahia has an advantage. This state is located in the Northeast Region bordering the Southeast and Midwest Regions. Installing the recycler in the south of Bahia would prove to be a good option. However, Minas Gerais is the Brazilian state with the second-most extensive hybrid/electric vehicles fleet of 5009 EVs [44]. In addition, it borders other Brazilian states with the largest fleet of EVs, such as São Paulo (21,897 EVs) and Rio de Janeiro (4491 EVs) [44]. In this case, the volume may indicate that Bahia will be a bolder choice compared to Minas Gerais. However, knowing that EVs have grown and will grow more and more in Brazil, it is also known that the volume of batteries used will also increase. Therefore, the state of Minas Gerais is the best choice for the installation of the recycling factory.

9. Conclusions

This study analyzed the economic feasibility of implementing a recycling factory for LIBs in Brazil and examined the main factors that will enable the feasibility of this process through examples of worldwide cases that have been successfully implemented or are under development.

Worldwide, there is growing concern for the environment. In the near future, when the volume of lithium-ion batteries available for disposal will be more significant due to increased use of these batteries in electric vehicles and other applications, the recycling process will become more financially attractive. Many countries have concerns about the correct disposal of lithium-ion batteries, including economic, political, and environmental factors. The price of LIBs and EVs has been decreasing annually, demonstrating a growth in demand for these items and the competition created among companies in the sector. We have emphasized the importance of recycling LIBs in countries that still do not have a solid business in this sector, such as Brazil.

However, it is a challenge to profit from recycling batteries at the existing volumes as these processes are only profitable with scaled quantities. Another current difficulty, especially in underdeveloped and undeveloped countries, is exporting LIBs to other countries. Due to lack of local recyclers, many batteries can be disposed of in the wrong way in landfills, causing severe damage to the environment and the health and integrity of neighborhoods.

Another factor to note is that the transport of used LIBs is dangerous. For this reason, it incurs a high cost, making it impossible to export batteries to other countries in most cases. With the growing number of EVs on the streets, it will be increasingly urgent to have recyclers in as many countries as possible. This can happen with the development of recycling facilities in different locations or with branches of prominent recyclers in places where this enterprise is lacking.

A circular economy aims to manage waste by encouraging reuse, recycling, and responsible manufacturing. It also aims to reduce emissions and increase efficiency in the use of natural resources. By understanding the value chain and routes of LIBs, it is possible to achieve the recycling goals and correctly dispose of batteries.

Encouraging recycling through tax exemptions or reductions can make the process more economically viable, in addition to contributing to the circular economy. Locations with more significant tax incentives encourage the construction of recycling plants, generate jobs, and promote economic and social development at the plant’s installation site.

Another essential factor to be considered is the creation of joint ventures, which stimulate and encourage companies to join together to achieve the same objective, further allowing recycling goals to be achieved. Joint ventures can facilitate the entire chain of the circular economy, including logistics, transport, and disposal of batteries, to help reduce barriers to recycling batteries in Brazil.

Author Contributions

Conceptualization, M.C.C.L., L.P.P. and A.S.M.V.; methodology, M.C.C.L., L.P.P. and A.S.M.V.; software, M.C.C.L. and L.P.P.; validation, A.S.M.V., W.d.A.S.J. and K.W.; formal analysis, A.S.M.V.; investigation, M.C.C.L., L.P.P. and A.S.M.V.; resources, M.C.C.L., L.P.P. and A.S.M.V.; data curation, M.C.C.L., L.P.P. and A.S.M.V.; writing—original draft preparation, M.C.C.L. and L.P.P.; writing—review and editing, M.C.C.L., L.P.P. and A.S.M.V.; visualization, W.d.A.S.J. and K.W.; supervision, A.S.M.V., W.d.A.S.J. and K.W.; project administration, A.S.M.V., W.d.A.S.J. and K.W.; funding acquisition, K.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Acknowledgments

This article is the result of a project linked to Companhia Paulista de Força e Luz (CPFL). The authors thank the support of CPFL and Agência Nacional de Energia Elétrica (ANEEL) of Brazil for the investments necessary to carry out this study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Dai, H.; Jiang, B.; Hu, X.; Lin, X.; Wei, X.; Pechte, M. Advanced battery management strategies for a sustainable energy future: Multilayer design concepts and research trends. Renew. Sustain. Energy Rev. 2020, 138, 110480. [Google Scholar] [CrossRef]

- Rietmann, N.; Hügler, B.; Lieven, T. Forecasting the trajectory of electric vehicle sales and the consequences for worldwide CO2 emissions. J. Clean. Prod. 2020, 261, 121038. [Google Scholar] [CrossRef]

- Melin, H.E. The Lithium-Ion Battery Life Cycle Report; Circular Energy Storage: London, UK, 2021. [Google Scholar]

- Kotak, Y.; Fernández, C.M.; Casals, L.C.; Kotak, B.S.; Koch, D.; Geisbauer, C.; Trilla, L.A.G.; Schweiger, H.-G. End of Electric Vehicle Batteries: Reuse vs. Recycle. Energies 2021, 14, 2217. [Google Scholar] [CrossRef]

- Melin, H.E. The Lithium-Ion Battery End-of-Life Market 2018–2025; Circular Energy Storage: London, UK, 2018. [Google Scholar]

- NeoMetals. Primobius Recycling JV-Operating and Cost Estimates. 7 May 2021. Available online: https://www.criticalmetals.eu/reports/132-210507-NMT-LiB-Recycling—Outstanding-Cost-Estimates.pdf (accessed on 16 September 2021).

- Knauf Industries Automotive. 22 September 2020. Available online: https://knaufautomotive.com/pt-br/tipos-de-baterias-de-carros-eletricos (accessed on 8 November 2021).

- Institute for Energy Research. 9 September 2020. Available online: https://www.instituteforenergyresearch.org/renewable/china-dominates-the-global-lithium-battery-market (accessed on 18 November 2021).

- Bermúdez-Rodríguez, T.; Consoni, F.L. Uma abordagem da dinâmica do desenvolvimento. Rev. Bras. Inovação 2020, 19, 1–33. [Google Scholar]

- BloombergNEF. 30 November 2021. Available online: https://about.bnef.com/blog/battery-pack-prices-fall-to-an-average-of-132-kwh-but-rising-commodity-prices-start-to-bite (accessed on 12 January 2022).

- He, H.; Jin, L. How China Put Nearly 5 Million New Energy Vehicles on the Road in One Decade. The International Council on Clean Transportation. 28 January 2021. Available online: https://theicct.org/blog/staff/china-new-energy-vehicles-jan2021. (accessed on 15 November 2021).

- Steward, D.; Mayyas, A.; Mann, M. Economics and Challenges of Li-Ion Battery Recycling from End-of-Life Vehicles. Procedia Manuf. 2019, 33, 272–279. [Google Scholar] [CrossRef]

- Julien, C.M.; Mauger, A.; Zaghib, K.; Groult, H. Comparative Issues of Cathode Materials for Li-Ion Batteries. Inorganics 2014, 2, 132–154. [Google Scholar] [CrossRef] [Green Version]

- Verdier, N.; Foran, G.; Lepage, D.; Prébé, A.; Aymé-Perrot, D.; Dollé, M. Challenges in Solvent-Free Methods for Manufacturing Electrodes And Electrolytes for Lithium-Based Batteries. Polymers 2021, 13, 323. [Google Scholar] [CrossRef] [PubMed]

- Zhu, P.; Gastol, D.; Marshall, J.; Sommerville, R.; Goodship, V.; Kendrick, E. A review of current collectors for lithium-ion batteries. J. Power Sources 2021, 485, 1–21. [Google Scholar] [CrossRef]

- Ali, H.; Khan, H.A.; Pecht, M.G. Circular economy of Li Batteries: Technologies and trends. J. Energy Storage 2021, 40, 102690. [Google Scholar] [CrossRef]

- Peters, J.F.; Baumann, M.; Zimmermann, B.; Braun, J.; Weil, M. The environmental impact of Li-Ion batteries and the role of key parameters-A review. Renew. Sustain. Energy Rev. 2017, 67, 491–506. [Google Scholar] [CrossRef]

- Haram, M.H.S.M.; Lee, J.W.; Ramasamy, G.; Ngu, E.E.; Thiagaraja, S.P.; Lee, Y.H. Feasibility of utilising second life EV batteries: Applications, lifespan, economics, environmental impact, assessment, and challenges. Alex. Eng. J. 2021, 60, 4517–4536. [Google Scholar] [CrossRef]

- Mossali, E.; Picone, N.; Gentilini, L.; Rodrìgues, O.; Pérez, J.M.; Colledani, M. Lithium-ion batteries towards circular economy: A literature review of opportunities and issues of recycling treatments. J. Environ. Manag. 2020, 264, 110500. [Google Scholar] [CrossRef] [PubMed]

- Sparton Resources Inc. Announces Possible China Ban on Lithium Based Large Scale Energy Storage Systems. GlobeNewswire by Notified. 30 June 2021. Available online: https://www.globenewswire.com/news-release/2021/06/30/2255545/0/en/Sparton-Resources-Inc-Announces-Possible-China-Ban-on-Lithium-Based-Large-Scale-Energy-Storage-Systems.html (accessed on 19 November 2021).

- National Energy Administration. Announcement of the General Department of the National Energy Administration on Publicly Soliciting Opinions on the Management Specifications for New Energy Storage Projects (Interim) (Draft for Comment). 22 June 2021. Available online: http://www.nea.gov.cn/2021-06/22/c_1310021541.htm (accessed on 7 July 2021).

- National Energy Administration. Management Specifications for New Energy Storage Projects. 22 June 2021. Available online: http://www.nea.gov.cn/1310021541_16243514280981n.pdf (accessed on 7 July 2021).

- MINNEWS, National Energy Administration Issued. New Energy Storage Project Management Regulations (Interim). Available online: https://min.news/en/economy/c1d71974226e1d60a006970d2fa03df9.html (accessed on 10 January 2022).

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S.; et al. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Windisch-Kern, S.; Holzer, A.; Ponak, C.; Raupenstrauch, H. Pyrometallurgical Lithium-Ion-Battery Recycling: Approach to Limiting Lithium Slagging with the InduRed Reactor Concept. Processes 2021, 9, 84. [Google Scholar] [CrossRef]

- Trading Economics. Available online: https://tradingeconomics.com/commodities (accessed on 22 November 2021).

- He, Y.; Yuan, X.; Zhang, G.; Wang, H.; Zhang, T.; Xie, W.; Li, L. A critical Review of current technologies for the liberation of electrode materials from foils in the recycling process of spent lithium-ion batteries. Sci. Total Environ. 2021, 766, 142382. [Google Scholar] [CrossRef] [PubMed]

- Zhu, M.; Zhao, Z.; Tong, B.; Fan, Y.; Yao, Y.; Hua, Z. Hydrometallurgical Processes for Recycling Spent Lithium-ion Batteries: A critical Review. ACS Sustain. Chem. Eng. 2018, 6, 13611–13627. [Google Scholar]

- XProEM. Lithium-Ion Battery Recycling: Current Challenges and Future Recycling. 10 May 2021. Available online: https://bit.ly/3wjPRou (accessed on 14 May 2021).

- Federal Consortium for Advanced Batteries. Executive Summary: National Blueprint for Lithium Batteries 2021–2030. June 2021. Available online: https://www.energy.gov/sites/default/files/2021-06/FCAB%20National%20Blueprint%20Lithium%20Batteries%200621_0.pdf (accessed on 12 July 2021).

- Comissão Europeia. Proposta de Regulamento do Parlamento Europeu e do Conselho Relativo às Baterias e Respetivos resÍduos, que Revoga a Diretiva 2006/66/CE e Altera o Regulamento (UE) 2019/1020. Bruxelas, 2020. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:4b5d88a6-3ad8-11eb-b27b-01aa75ed71a1.0003.02/DOC_1&format=PDF (accessed on 4 August 2021). (In Portuguese).

- World Economic Forum. A Vision for a Sustainable Battery Value Chain in 2030. September 2019. Available online: https://www3.weforum.org/docs/WEF_A_Vision_for_a_Sustainable_Battery_Value_Chain_in_2030_Report.pdf (accessed on 22 October 2021).

- China Everbright Securities. Energy Battery Recycling: Cost Reduction and Discovery of Lithium Restrictions, Forming a Closed Lithium Battery Cycle; Everbright Securities: Shanghai, China, 2021. (In Chinese) [Google Scholar]

- Pillot, C.; Sanders, M. Avicenne Energy, Battery Recycling: How Are Business Models Developing? 6 May 2021. Available online: https://www.forgenano.com/wp-content/uploads/2021/05/Avicenne-Energy-LIB-Recycling-MPSC-May-2021.pdf (accessed on 14 March 2022).

- Argonne National Laboratory. EverBatt: A Closed-loop Battery Recycling. April 2019. Available online: https://publications.anl.gov/anlpubs/2019/07/153050.pdf (accessed on 13 August 2021).

- Reuters, Metal Recyclers Prepare for Electric Car Revolution. Available online: https://www.reuters.com/article/us-batteries-recycling-analysis/metal-recyclers-prepare-for-electric-car-revolution (accessed on 22 May 2021).

- Proost, J. State-of-the-art CAPEX data for water electrolysers, and their impact on renewable hydrogen price settings. Int. J. Hydrogen Energy 2018, 44, 4406–4413. [Google Scholar] [CrossRef]

- Li-Cycle. Li-Cycle Investor Presentation. February 2021. Available online: https://li-cycle.com/wp-content/uploads/2021/02/Li-Cycle-Investor-Presentation-February-2021.pdf (accessed on 10 March 2022).

- Fractal Energy Storage Consultants. Lithium-Ion and Lead Acid Battery Recycling Report; Fractal Energy Storage Consultants: Austin, TX, USA, 2020. [Google Scholar]

- Zhu, D.; Wang, Y.; Yue, S.; Xie, Q.; Pedram, M.; Chang, N. Maximizing Return on Investment of a Grid-Connected Hybrid Electrical Energy Storage System. In Proceedings of the 2013 18th Asia and South Pacific Design Automation Conference (ASP-DAC), Yokohama, Japan, 22–25 January 2013; pp. 638–643. [Google Scholar]

- Zott, C.; Amit, R.; Massa, L. The Business Model: Recent Developments and Future Research. J. Manag. 2011, 3, 1019–1042. [Google Scholar]

- Federal Invest. 6 Ferramentas para Definir seu Modelo de Negócio. 9 April 2018. Available online: https://blog.federalinvest.com.br/6-ferramentas-para-definir-seu-modelo-de-negocio/ (accessed on 17 November 2021).

- Strategyzer, Business Models. Available online: https://www.strategyzer.com/expertise/business-models (accessed on 17 November 2021).

- NeoCharge. Available online: https://www.neocharge.com.br/carroseletricos-brasil#localizacao. (accessed on 4 January 2022).

- Firjan. Available online: https://www.firjan.com.br/firjan/empresas/competitividade-empresarial/temas-em-destaque/incentivos-ao-rio/entenda/default-13.htm (accessed on 5 January 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).