Abstract

The study was conducted on a sample of 60 of the world’s biggest banks financing the largest fossil fuel entities. The aim is to identify the determinants of ESG ratings of these banks and to determine how relevant their actual credit and investment exposure is to this assessment. The indirect objective is also an examination of whether coal power financing affects ESG ratings. Two logistic regression models have been explored: one dedicated to the identification of high ESG risk banks and the second to predict low ESG risk, which thereafter were combined into one final model. The results indicate that an increase in the Sustainable Development Index (SDI) translates into a decline in the odds of being assigned to the high-risk ESG group relative to the probability of being qualified to the low- or medium-risk ESG group. This study is the first to analyse the impact of actual exposures of the world’s largest banks to the fossil fuels sector on their ESG ratings. The value added is the use of a unique database, the focus on actual rather than declared effects of banks’ policies, and the use of a two-stage logistic regression model construction. The proved relationships are important and of practical relevance to bank managers, regulators, and ESG rating providers. Since the research is conducted on the basis of ESG provided only by one rating agency verification of conclusions with the use of ratings of other agencies, confronting benefits from financing the fossil fuels sector with losses resulting from an increase in the cost of obtaining financing are only selected directions for further research.

1. Introduction

The European Union, in its ‘2030 Climate Target Plan’ announced on 17 September 2020, set a new goal of climate neutrality, understood as the decarbonisation of national economies and the reduction of oil and gas consumption, to be achieved in 2050. Moreover, it was assumed that already in 2030 there will be a 55% reduction in greenhouse gas emissions compared to 1990. It is assumed that in 2030 the share of energy from renewable sources will be about 40%, while—compared to 2015—there will be a decrease in the consumption of hard coal and lignite in total by 70%, natural gas by 25%, and crude oil by 30%. The initiatives of international organisations in the area of climate agreements, and in particular the measures taken by the European Union in the context of the need to prioritise environmental and climate protection issues in economic activities, have also been reflected in the functioning of commercial banks. The consideration of environmental, social, and governance factors, referred to as ESG factors, in banking activities dates back to the 1990s [1], well before the coinage of the ESG acronym that has been in place since 2004. The acronym ESG reflects the Environment (E), Social responsibility (S) and Corporate governance (G) spheres. The E factor refers to the evaluation of criteria related to the implementation of environmental strategy and policy, environmental management, fulfilment of the principles of responsibility and care for the environment. The S component takes into account factors such as relationships with stakeholders in the market, in detail compliance with employee rights, and health and safety rules. The company’s information policy and transparency are also evaluated. The C factor refers to the assessment of governance and management. The following are analysed inter alia: structure of the board of directors, respect for shareholder rights, respect for disclosure obligations, decision-making independence, and management skills. Banks’ policies and strategies in this regard can be divided into three areas. First, it is to minimise environmental impact through rational management of electricity, water, heat, natural gas, fuels, consumption of office supplies, and reduction of municipal waste and air pollution. Secondly, there are the indirect actions of offering credit and investment products, the proceeds from which are used to mitigate environmental risks, as well as providing infrastructure for the distribution of public funds for the implementation of the low-carbon economy. Third, it is to conduct responsible business by taking into account the needs of the bank’s stakeholders in implemented business models. These are all kinds of sponsorships, where banks (through their activities in culture, arts, sports, education, or community outreach) support values protecting the well-being of the local community. This group includes educating current and potential customers about ESG. There is indeed no consensus in the academic literature when it comes to defining ESG activities, and very often terms such as sustainable bank, socially responsible bank, ethical bank, green bank, etc. are mixed up and treated as synonymous, despite the different meanings of these concepts [2]. This nevertheless does not change the fact that ESG factors are an increasingly important element in the assessment of bank performance since ESG risk affects the quality of assets, valuation, investors’ interest in securities issued by a bank, and probably capital adequacy in the near future. Poor bank’s ESG assessment results from either high exposure to ESG risk (e.g., violation of human rights in the bank or financed entities, high carbon footprint generated by the bank or its customers, bribery or corruption, violation of business ethics) and level of ESG risk management. It should be noted, however, that quite often it is very difficult to separate the actual ESG activity of banks from a carefully thought-out and consistently applied marketing and promotional strategy that takes advantage of the growing interest of stakeholders in these issues and consistently implemented rationalisation of operating costs, including those arising from the consumption of media and consumables. Many activities of this type are aimed only at exposing the bank’s brand and building its specific image, or only at minimising the costs of bank operations. During the COVID-19 escalation period, the focus of research on the banking sector was primarily on the resilience of banks to the crisis [3,4,5,6] and the capital market response in the context of considering the banking sector as one of the most affected by the pandemic [7,8]. Focusing on the recent pandemic years, one can confirm the increased importance of ESG in banks’ operations. It refers mainly to the E factor, which is considered to be the most important in ESG scorings [9]. In the case of banks in which ESG issues are not among the priorities, there are expected negative investor reactions, loss of customers, as well as negative appraisals from rating agencies, and an increase in the cost of capital [10]. Given the aforementioned growing importance of ESG risk in the activities of commercial banks and its increasing influence on the decisions of various stakeholder groups, the aim of this article is to determine the relationship between commercial banks’ involvement in fossil fuel sector financing (lending and investing) and the ESG scores of these banks. The ESG risk ratings analysed in this paper reflect the magnitude to which a bank is exposed to ESG risk and how well it manages this risk. ESG ratings are categorised across five risk levels: negligible, low, medium, high, and severe. In other words, the research question is whether banks that contribute the most to carbon emissions suffer a related penalty in the form of poor ESG ratings, which in turn affects the cost of funding, the maximum period for which external financing is available, or finally the market valuation of these institutions, since the results of the study confirm that commercial banks with good performance on material ESG issues outperform banks with bad performance on the same issues [11]. The motivation is also to explore the usefulness of ESG ratings from the perspective of various bank stakeholder groups, including sustainability-minded investors. A possible link between a bank’s impact on the environment and its ESG assessment would also be important for regulators looking to indirectly limit bank financing of the fossil fuels sector. This study was conducted on a sample of 60 world’s largest banks, which between 2016 and 2020 collectively provided USD 3.8 trillion worth of financing to 2300 largest fossil fuels sector entities [12]. These banks come from 17 countries around the world. Data on their exposure to the coal sector comes from the Fossil Fuel Finance Report 2021. The report aggregates bank lending and underwriting data using Bloomberg’s league credit methodology and uses data from Bloomberg Finance L. P. and the Global Coal Exit List [13]. Data on ESG ratings were taken from the Sustainalytics database [14].

This is the first study on the direct impact of fossil fuel financing exposure on lenders’ ESG ratings. Its conclusions are significant in that they apply to banks collectively representing more than 70% of global banking sector assets (in an environment of steadily increasing global banking sector concentration, at the end of 2017, the 50 largest banks accounted for about 70% of sector assets and 100 institutions for about 90% of assets—see [15]). This article fills a research gap in the area of determinants of ESG ratings. The obtained results also answer the question of how sufficient the use of ratings by the bank’s stakeholders is to be oriented towards sustainability goals. Another problem addressed in this paper, so far rather poorly penetrated in research, is the question of the extent to which the indirect adverse environmental impact of the bank’s operations translates into an assessment that should prioritise this issue.

The remainder of this article is structured as follows. Section 2 reviews the most significant literature. The next section describes the data and methodology employed in the empirical research. Section 4 presents results that are discussed in Section 5. The last part of the manuscript summarises and presents the main conclusions.

2. Literature Review

2.1. Rationale to Shift Financing from Fossil Fuels to the Renewable Energy Sector

The shift away from fossil energy financing, resulting from commitments already made by leading global banks, and the intensification of Renewable Energy Sources (RES) financing should contribute to higher GDP growth and redistribution of capital (from capital owners to wage earners). Green finance shall result in the reduction of coal consumption to 2.5% below BAU (Business As Usual) in 2030, which, from the aforementioned perspective, will be accompanied by a global increase in the share of non-fossil energy sources from 42% to 46%. Green finance will enable CO2 emission reductions equivalent to the combined 2017 emissions of the European Union and Japan [16]. At the same time, there are reasons to prefer green investments by private equity investors, as the performance of portfolios free of fossil fuel production assets does not differ in terms of risk and return from unrestricted ones. Divesting from the fossil fuel sector does not result in the worsening of key investment measures [17]. In turn, in view of the introduction of the restrictions for fossil fuel companies, the affected firms (predominantly private) face shorter loan maturities, lower access to permanent forms of bank financing, higher interest rates, and higher participation of shadow banks in their lending syndicates [18]. This reduction in financing opportunities and deteriorated terms and conditions emanate from the growing credit risk associated with fossil fuel’s loan portfolio. These risks are in turn derived from climate risks. That is why climate-related risks, i.e., physical and transitional risks, gain growing importance for financial and credit institutions, mainly for insurers and banks. To mitigate the negative impact of these risks, central banks, supervisors, and policymakers introduce green banking initiatives (e.g., the idea to combine capital adequacy with exposure of banks’ clients to climate risks). At the same time, both private and public financial institutions focus on these issues mainly from a risk management perspective, as well as try to link climate strategies with new business opportunities [19]. However, empirical studies do not confirm that energy efficiency has an effect on a company’s ability to obtain external financing. This, in fact, reveals some potential for the enhancement of the energy efficiency policy [20].

2.2. Involvement of the Banking Sector in Energy Transition and Its Determinants

It is crucial to note that globally, investment in renewables does not show a stable upward trend. This was evidenced in 2017 when investment in renewables and energy efficiency was down by 3% from the previous period. Fossil fuels continue to be a dominant area of investment in power generation. In some developed and developing countries, CO2 reduction efforts are offset by emissions from new coal-fired power plants. Financial and credit institutions still show relatively high interest in fossil fuel-based projects compared to green projects, mainly due to the relationship between risk and expected return of these projects [21]. Based on data from 137 countries obtained in the period from 1998 to 2013, for high-income countries, financial capital facilitates the transition from fossil fuels to modern renewable energy sources, especially wind energy. In lower-income countries, financial capital (especially private debt) supports the shift from biomass to fossil sources, most notably coal [22]. The subject of contemporary research involves, among others, the process of replacing exposures related to fossil fuels with the financing of renewable energy sources, their premises and conditions. The banking sector is considered to be relatively slow in introducing climate protection policies. The integration of climate policy into a bank’s strategy depends, among other things, on the initial interpretation of the climate change issue, the importance given to the issue in lending and investment policies, as well as internal and external communication [23]. Key reasons for the low involvement of financial and credit institutions, including banks, in tackling climate change include the lack of tangible incentives, reluctance of for-profit companies to internalise environmental externalities, and the perception of high risk associated with low-carbon technologies by commercial banks. The mismatch between long-term investment return periods and the short-term horizons of most private investors should also be pointed out [24]. The Paris Agreement and its far-reaching consequences proved to be an exception in this regard. Following the Paris Agreement, European banks reallocated credit away from polluting firms. After the withdrawal of the United States from the aforementioned agreement in 2017, European banks limited lending to polluting entities in the United States even further in relative terms [25]. At the same time, it should be added that the Paris Agreement has only become an incentive to slow down the pace of lending in the coal sector. In 2019, financial institutions from the United States accounted for 58% of new investments by institutional players in the global coal sector. Limiting the discussion to commercial banks, banks from the United States, the United Kingdom, and Japan together accounted for 52% of the financing of the 934 coal companies on the Global Coal Exit List. In total, the balance of banks’ exposures to the 934 entities on the Global Coal Exit List increased by 11% to reach USD 543 billion at the end of 2019. New funding between October 2018 and October 2020 exceeded USD 315 billion and was provided by 381 commercial banks, mainly from Japan and the United States. At the same time, in the two-year period under review, 427 banks provided underwriting services worth USD 808 billion to companies on the list. These were mainly Chinese banks [26].

One of the most important issues is the influence of overseas finance on power generation development and long-term CO2 emissions beyond the borders of the jurisdiction of institutions providing such financing. It has been proven that overseas financing granted by institutions from China, Japan, and the United States was allocated in fossil fuel power technologies over the period from 2000 to 2018. China accounted for 64% of total exposure, Japan for 87%, and the United States for 66% of credit exposure. These projects with a total capacity of about 243 GW between 2018 and 2060 will generate about 24 GT of CO2 emissions. It is also worth mentioning that each of the aforementioned countries’ contribution to renewable power generation (other than hydro) was less than 15% of capacity additions [27]. In general, the U.S. and European multilateral development banks and export credit banks expose and apply strict rules for financing newly built coal-fired power plants, but this applies mainly to investments in their own regions. At the same time, there is a significant group of Asian commercial banks and public sector financial institutions that are willing to support cleaner and more efficient high efficiency low emission (HELE) coal technologies. Leading institutions in this regard include the Japan Bank for International Cooperation and the China Development Bank. The financing provided to coal companies by Asian financial institutions reduces the impact of the new policies of Western public agencies and is aimed at supporting new coal technologies and their eventual export [28]. As already mentioned, although most coal-fired power plants are being built in Asia, their financing comes from financial institutions from all over the world, mainly from the United States, Europe, China, and Japan. That is why there has been a proposition of a methodology to calculate ‘finance-based emissions’ which aims at revealing countries responsible for coal emissions analysed not from territorial but finance-based perspective [29]. Inter alia, for this reason European and American banks decided to cut off funding for new coal-fuelled power plants in poorer Asian countries. Nowadays, Asian financiers provide the bulk of funding for new coal projects in countries, such as Vietnam and Bangladesh. However, most key banks in Japan and South Korea, as well as some in China, announced stopping or slowing the flow of money for projects carried out abroad due to the statements of their governments signalling increased risk of such investments [30]. Kim and Lee [31] examined the evolution of energy financing of the World Bank and found that the share of fossil fuels diminished from 51.8% (1985–1990) to 15.2% (2011–2019); however, financing for fossil fuels has remained stable, whereas for NHRE in low-income countries it was too low to meet the demand. To finance the transition to low-carbon economies, countries apply carbon pricing and green bonds. This raises the question of the effectiveness of different combinations of these solutions. From the perspective of the criterion of optimising intergenerational burden sharing and energy transition benefits, it appears that green bonds perform better when they are combined with carbon pricing [32].

2.3. Coal Pricing in Bank Practices and Greenwashing

Before 2015, banks did not price climate policy exposures. Thereafter, on the basis of syndicated loans’ sample, it was proved that the cost for fossil fuel companies was higher by approx. 16 basis points. At the same time, “green banks” charge marginally higher loan rates to fossil fuel firms [33]. Additionally, financing entities that experience tougher environmental regulations involve higher risks for banks. This risk should be identified with a higher probability of borrower failure and thus a poorer quality of the bank’s loan portfolio. For this reason, fossil fuel exposures carry higher interest rates [34]. The increase in lending rates, reflecting the increase in credit risk, is particularly pronounced for the mining sector. Loan spreads for these exposures were subject to dramatic growth of 54% comparing 2007–2010 and 2017–2020 [35]. After the Paris Agreement, carbon risks in syndicated loans were priced consistently both across and within industry sectors. This allows the conclusion that banks have started to internalise possible risks from the transition to a low-carbon economy; however, it takes place only for Scope 1 carbon emissions (i.e., direct greenhouse emissions that occur from sources that are controlled or owned by an entity), and this pricing is relatively low if compared to possible profitability erosion due to the introduction of carbon prices. This means that the overall carbon footprint of companies has not been priced [36]. The pricing of risk (including carbon footprint risk) associated with the financing of fossil fuel entities is also influenced by the financing structure [37]. A survey conducted among the world’s 56 largest commercial banks and mapping their coal policies led to the conclusion that these institutions finance coal industry entities more through corporate finance than project finance.

Greenwashing, on the other hand, is a phenomenon that can threaten the achievement of the goals of the Paris Agreement. It consists of presenting to the bank’s stakeholders (investors, customers, and supervisory institutions) a wide spectrum of pro-environmental initiatives in which the bank is involved while continuing to finance the fossil fuels economy. The Bank publicises efforts to implement the Paris Agreement, introduces directional climate policies, and does not withdraw from direct or indirect financing of coal power [38].

2.4. ESG Risk and Its Impact on Bank Activity and Performance

The issues related to finance, sustainability, and sustainable adaptation are closely interrelated [39]. ESG risk is currently reflected both in ESG and credit ratings; however, in the case of the BIG Three (i.e., Standard & Poor’s; Moody’s and Fitch Ratings), competencies needed to assess ESG risk assessment are acquired through takeovers of small specialised entities, which in turn poses the question of intensifying oligopolisation of both the ESG and credit rating market [40,41]. Among ESG components, the environmental factor is the most important [42]. At the same time, one has to note material differences as regards the definition of ESG, as well as its decomposition into E, S, and G factors [43]. For this reason, among others, there exists some criticism with regard to ESG ratings. It stems from the incomparability of criteria, quantification methods, variation in weights and ratings given by different actors, as well as low transparency of the process and the high variability and diversity of ratings given by different actors [44]. Another criticism is that ESG ratings fail to include useful information, such as the dollar value of various risks. The diversity of ratings reflects a variety of approaches represented by raters. For instance, Sustainalytics focuses on ESG risk, others on the impact, while the rest look only at reputation or market sentiment [45]. The study described in this paper focuses on the determinants of ESG assessment among banks with the largest absolute exposure to the fossil fuel sector. The identification of factors affecting the value of ESG ratings and the impact of ESG on the performance of business entities and the price behaviour of their issued securities has already been the subject of previous research. Regarding the relation between ESG ratings and performance indicators, a significant positive correlation between the company’s size, resources dedicated to the process, and scope of data provided for the assessment and ESG rating was proved [46]. As far as the banking sector is concerned, it was confirmed that ESG scoring is positively correlated with bank standing [47]. At the same time, relatively higher ESG scoring features banks with stable and good financial conditions [48]. U.S. banks with policies aimed at the mitigation of environmental risks were less affected during the subprime crisis [49]. Companies owned by the same owners as the raters receive relatively higher ESG ratings. This means that the quality of ESG ratings may be undermined by conflicts of interest [50]. The ESG performance of financial institutions increases linearly over time, a trend that is reinforced by their size and profitability, along with the economic and social development of the country in which they operate. Research also shows that the environmental, social, and governance pillars follow independent patterns [51]. A significant proportion of research studies and reports prepared by consulting firms focus on the impact of ESG risks on bank operations. The relationship of ESG risks with other risk factors is recognised, as well as the need to integrate ESG into the bank’s strategy, risk management policies, loan, investment, and pricing policies [52]. At the same time, the question arises about the importance of ESG assessments for different stakeholder groups. The results confirm a positive and statistically significant relationship between ESG and Value Based Management (VBM) and no relationship with accounting-based performance. It should also be noted that the adoption of a short-term management perspective in banks means that managers do not have sufficient incentives (in terms of additional profitability) to engage in ESG projects (ESG-based financing). The incentive for bank managers is solely ESG risk and its potential consequences [53].

On the sample of 251 banks from 44 emerging markets, a non-linear relationship between ESG activity and bank value was proved over the period 2011–2017. Low levels of ESG activity positively impact bank value, and environmentally friendly actions have the most important positive impact on bank value. ESG performance negatively affects the cost of equity but has no impact on the cost of debt funding [54]. The study conducted for the Malaysian and Singapore markets between 2010 and 2014 found that social and governance practices influence the economic standing of companies [55]. A good governance score positively affects a portfolio’s performance in Europe and North America, whereas in the Asia-Pacific market E/S/G/ESG scores do not have an impact on risk and return ratios [56]. In the case of banks in emerging markets (a study conducted on a sample of 93 banks between 2015 and 2018), a positive relation of banks’ environmental and social scores with their financial performance was proved. However, the respective association between governance performance and financial standing was not identified [57]. Roughly 90% of more than 2200 studies dedicated to ESG issues and verified by Deutsche Bank prove a nonnegative ESG–CFP (corporate financial performance) relation. A large majority of studies confirm a positive and stable ESG impact on CFP over time. At the same time, the relationship varies when decomposition is performed. The G component shows the strongest relationship (62.3% of studies confirm a positive correlation between G and CFP scores). For E it is 58.7%, while for S it is 55.1%, respectively. Interestingly, a much weaker relationship is found when linking total ESG scores to CFP, with just over 35% of studies proving a positive correlation and over 7% proving a negative correlation. In terms of the analysed world regions, a positive relation between ESG and CFP was noted in the case of over 65% of studies devoted to entities representing Emerging Markets. The same relationship was confirmed by only 26% of studies on Developed Europe [58]. Finally, it should be mentioned that the change in energy financing policy applied by banks has an impact on financial stability. A growing share of renewable energy in the energy production mix initially led to an increase in electricity prices. This improved the creditworthiness of incumbent power plants. However, when the process turned out to be too fast, it negatively influenced financial stability since the CAPEX on the RES projects offset the increased incomes of existing power plants [59].

As outlined above, studies that address the issue of banking sector involvement in the energy transformation focus mainly on regulatory incentives for financing customers with positive environmental impact (e.g., [19]), the question of determinants of changes in the structures of banks’ loan and investment portfolios towards replacing fossil fuel exposures with financing renewable energy sources, climate risk pricing in banking products and services [60], the impact of climate policy on the risk of banks’ loan and investment portfolios, determinants of ESG ratings [61] and the relationship between ESG and VBM [53] or the entity’s financial standing (e.g., [62]). However, there have been no studies dedicated to analysing the impact of commercial banks’ involvement in the fossil fuel sector on their ESG ratings. Given the crucial importance of the banking sector to the real economy and to the structure of sources of energy generation in the economy, it seems reasonable to ask whether banks financing the coal sector suffer to some extent from the tangible consequences of this (e.g., in the form of a poorer ESG assessment). In this context and in view of the potential establishment of a new determinant of ESG rating, this study fills an important research gap. This is because the research so far focuses mainly on equity investments. In this case, the move away from fossil fuel financing has no negative effect from the perspective of financial investors. Changing the portfolio structure to exclude fossil fuel production companies does not materially change the investment profile, i.e., the relationship between risk and return [17].

3. Materials and Methods

The 60 largest banks worldwide were chosen for the analysis (Table 1).

Table 1.

Characteristics of selected banks.

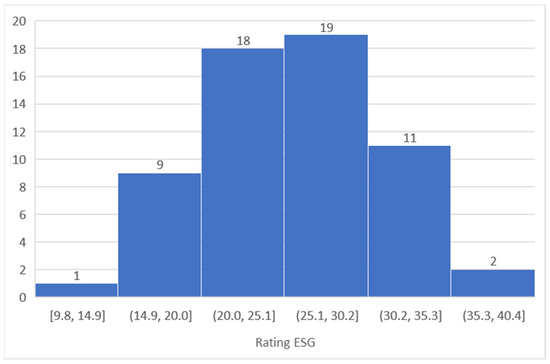

Data on ESG ratings were taken from the Sustainalytics database. The distribution of ESG risk ratings among the input data is shown in Figure 1. The ratings cover the whole spectrum of the scale—the lowest rating is 9.8, while the greatest is 35.6. These ratings are categorised across three levels: low (<20 points), medium (20; 30) points), and high (≥30 points). After categorisation, 10 banks were classified in the lowest ESG risk category, 33 to medium ESG risk, and 17 are considered as high ESG risk.

Figure 1.

Distribution of the ESG ratings of analysed banks.

The theoretical concept of the study follows the idea of climate indices [63] and centres on the question of how ESG ratings can be used in low carbon and fossil fuel-free strategies. For this reason, the list of potential determinants of financial ESG ratings was expanded to include variables reflecting the scale of a bank’s involvement in financing the fossil fuels sector. Based on a review of the literature focused on establishing the determinants of ESG scoring (among others: [51,57,64,65,66,67,68]), candidate explanatory variables were selected. These, as well as additional variables, referring to the scale of coal power industry financing by the world’s largest banks, are presented in Table 2.

Table 2.

Description of explanatory variables used in the study.

The basic descriptive statistics for the explanatory variables are presented in Table 3.

Table 3.

Basic descriptive statistics for explanatory variables.

Most of the variables describing the scale of coal power industry financing by the banks (CAGR and AVR variables) have a mean much greater than the median. Usually, this indicates that the data is right skewed, but in the considered cases the reason is outliers. This is why for CAGR_U and all the AVRs, the mean is even greater or equal to the third quartile. At least one-fourth (and for CAGR_U even more than a half) of the banks have the negative compound annual growth rate of fossil fuels enterprises, coal mines’, or coal power plants’ financing. Out of the 60 banks under consideration, there are only 17 countries of a banks’ registration. Therefore, it is more difficult to draw conclusions about general regularities based on the variables related to the countries (SDI and ARC). However, it can be observed that the minimum values are much further from the first quartile than the maximum values from the third quartile. For both variables, the minimum is reached for India, while the maximum SDI is reached for Finland. The average credit rating distribution is quite polarised—maximum value and values close to a minimum are assigned to many countries, while the set of countries with medium ratings is almost empty.

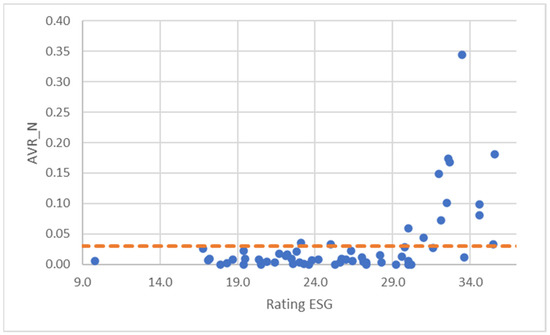

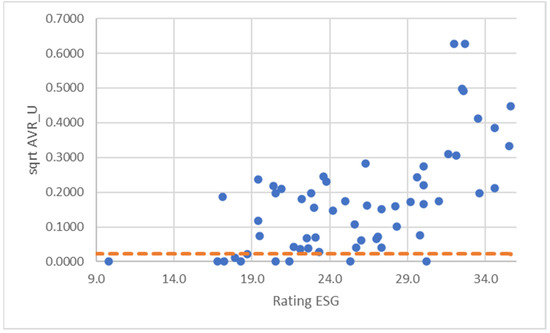

To find the good determinants of the ESG risk, variables that capture the differences between the specific categories were identified. Of special concern were the variables that differentiate high ESG risk from banks with lower risk and low ESG risk from greater (medium and high) ESG risk. Examples of such variables are presented in Figure 2 and Figure 3. In both graphs, the horizontal lines were drawn, which separates banks in the high ESG risk group from the less risky banks (Figure 2, cut-off point equal 0.03) or banks in low ESG risk from the riskier banks (Figure 3, cut-off point equal 0.0005; for the clarity of visualisation, the square roots instead of the original values were used). Based on the observed dependencies, two dummy variables were defined:

Figure 2.

Relation between ESG ratings (X-axis) and AVR_N (Y-axis). The horizontal line represents the cut-off value translated into dummy variable AVR_N_cut-off.

Figure 3.

Relation between ESG ratings (X-axis) and the square root of AVR_U (Y-axis). The horizontal line represents the cut-off value translated into dummy variable AVR_U_cut-off.

AVR_N_cut-off = 1 if an average share of the bank’s total financing of the 30 largest coal mines in the bank’s portfolio (2016–2020), that is, if AVR_N ≥ 0.03; 0 otherwise;

AVR_U_cut-off = 1 if an average share of the bank’s total financing of the 30 largest coal-fired power plants in the bank’s portfolio (2016–2020), that is, if AVR_U < 0.0005; 0 otherwise.

Variable AVR_N_cut-off classifies 12 banks from the high ESG risk group and 2 from the medium group, whereas AVR_U_cut-off takes the value 1 for 10 banks: 1 from the high ESG risk group, 3 from the medium, and 6 from the low group.

It is worth emphasising that more variables in the considered dataset have similar properties to the two identified dummy variables, but firstly, none of the variables is a perfect classifier, and secondly, possible alternatives are redundant in the sense of multicollinearity of the explanatory variables in an econometric model. Therefore, the dummy variables were created based only on two selected variables, and only these two with the rest variables described in Table 2 were used in econometric modelling.

There are a few possible methods to model the qualitative variables. In the case of three levels of the explained variable, e.g., the ordered logistic regression could be used. This approach, however, requires the fulfilment of additional assumptions, and the obtained results are sometimes difficult to interpret. It has been decided to explore another approach that can be treated as an example of a popular machine learning ensemble technique. The ensemble method combines several sub-models into one model, whose predictive power is superior to each of the sub-models (see e.g., [70]). An ensemble idea has been adopted for classical econometric models. Two separate logistic regression models for binary outcomes were constructed: one dedicated to the identification of high ESG risk banks (high vs. rest model), and the second to predict low ESG risk (low vs. rest model). These two models were combined into one final model, where to the high ESG risk group the banks identified by the first—high vs. rest—model were included, and to the low ESG risk group the banks pointed by the second—low vs. rest—model. The remaining banks are treated as the medium ESG risk category. The approach used makes it possible to interpret the obtained results easily and quantify them.

The calculations were performed in the R programme using the mlogit package. The parameters of the logistic regression models were estimated using the stepwise elimination of variables with the AIC selection criterion. Together with the standard errors, z-values, p-values, and odds ratios, values of the estimated coefficients of the final models are given in Table 4 and Table 5. All explanatory variables used in these models turned out to be statistically significant (at the significance level of 0.05).

Table 4.

Estimation results for the high vs. rest model.

Table 5.

Estimation results for the low vs. rest model.

4. Results

The results of the study indicate that an increase in SDI by a unit translates, on average, ceteris paribus, into the decline of the odds of being assigned to the high-risk ESG group by 0.68 relative to the probability of being qualified to the low- or medium-risk ESG group. The odds of getting into the group of high ESG risk for the banks with AVR_N over the chosen cut-off value are, ceteris paribus, about 2372% higher than the odds for the banks with lower than the cut-off value AVR_N. Analogously, a rise in AVR_G by unit, ceteris paribus, results in an approximately 500% increase in the chance of a bank being classified in the least ESG risk group relative to the chance of being considered moderately or very risky according to the ESG classification. Odds of getting into the group of low ESG risk for the banks with AVR_U over the chosen cut-off value are, ceteris paribus, greater by about 35.79 relative to the probability of being qualified to the medium or high risk ESG group.

The optimum cut-off point for each model was chosen based on the minimisation of the misclassification error. Both models turn out to be quite accurate, considering the percentage of correctly predicted values, known as count R2. Detailed information, including contingency tables, is presented in Table 6 and Table 7.

Table 6.

The contingency table for the high vs. rest model.

Table 7.

The contingency table for the low vs. rest model.

The composite model, which combines the results of the high vs. rest model with the low vs. rest model, can be written as follows:

The accuracy of this model, measured by the count R2, should be considered as very satisfactory (83.33%). Furthermore, the off-diagonal elements corresponding to the Low-High and High-Low relations (see contingency table in Table 8) are equal to 0. This means that the model predicts in every case at most one, not two, category lower or higher. A similar accuracy could be reached with a single ordered logistic regression model, but the classical logistic regression for binary outcomes has the advantage of clarity of description and interpretability.

Table 8.

The contingency table for the composite model.

5. Discussion

The assessment of banks from the point of view of the degree of financing of high-emission sectors: hard and lignite coal mining, electricity generation excluding renewable energy sources, and the level of exclusion of financing new projects related to these sectors is pejorative. According to the report ‘Banking on Climate Chaos: Fossil Fuel Finance Report 2021’, within 5 years since the adoption of the Paris Agreement, the 60 world’s largest banks have financed fossil fuels in a total of USD 3.8 trillion. Despite existing commitments from individual signatory countries and statements from the banks themselves, fossil fuel funding levels are higher than they were in 2016, and this is true even taking into account the recession caused by the pandemic, which resulted in an overall reduction in fossil fuel funding by around 9% [12]. It should also be added that some of the analysed banks have not yet officially announced the date on which they will achieve the ‘coal free’ status, while others give very distant dates. For example, some French banks have specified that they will not finance such projects in the European Union and OECD countries from 2030, in China from 2040, and in the rest of the countries from 2050. It can therefore be concluded that the level of actual exit from fossil fuel financing is determined primarily by the portfolio of loans currently held in the sector and the existing cooperation with strategic customers, which undoubtedly include companies from the energy sector. This type of trend can also be seen in the rules introduced by some banks to cooperate with their clients in terms of criteria for granting loans for new projects, e.g., very diversified financing of companies with a share of revenues deriving from coal—from banks excluding such projects to banks financing companies that generate more than 30% of sales from thermal coal mining. It is worth noting that, in fact, in most cases banks do not withdraw from financing projects if they believe that they can bring in the measurable income at the expense of the bank’s image, stakeholders’ pressure, and environmental organisations. This goes some way to showing the decline of their ethos as institutions of public trust. The ESG rating received by banks is consistent with the extent of funding in extreme cases—funding constraints or overfunding—which have been classified into groups defined as ‘low’ or ‘high’. This is in line with the conclusion that high ESG scores are associated with a modest reduction in risk-taking for banks that are high or low risk-takers [71]. However, in the case of the largest group, labelled ‘medium’, there is no noticeable relationship between these variables. While ESG rating institutions do not state their methodology for developing ratings, it seems that the important role of banks in managing environmental risk in such a way as to eliminate companies that do not meet environmental standards from access to finance should be prioritised [72].

The lack of existing correlations in the ‘medium’ group may therefore suggest that the ratings do not fully reflect the banks’ actual activities in this area. A different element is pointed out by Doyle [73]. According to him, companies with higher market capitalisation—and therefore with better visibility—tend to receive better ESG scores than similar companies with lower market capitalisation. Weber [74] also adds that ESG rating agencies face the same challenges that have affected Credit Rating Agencies (CRAs), e.g., cooperation in advising clients receiving ratings. Other studies, on the other hand, reach the opposite conclusion [51]. According to them, in this case, the relationship between corporate social responsibility and common equity is negative. This can be explained by the fact that, especially during hard financial times, bank managers put special emphasis on meeting sustainability goals to improve the bank’s reputation. This thesis is also supported by the results of other studies [75]. The lack of an unequivocal relationship between fossil fuel sector funding exposure by banks in the “medium” category (these are the largest banks) and ESG rating thus corresponds with the different results of the cited studies.

Another issue is that most of the analysed banks do not publish quantified information on the actions they take in financing fossil fuels. There is also a lack of a standardised and unified reporting scheme. In fact, it seems that banks provide this kind of information in favourable situations and are silent about such actions when they turn out to be unfavourable. These results confirm an earlier study by Christensen et al. [76]. Paradoxically, they even note that greater ESG disclosure leads to greater ESG disagreement across ESG rating agencies. Meanwhile, the basis of market discipline is for market participants to have up-to-date and reliable information about a particular bank that enables them to make a proper assessment of the company, its activities, and its risk profile [77]. Transparency of banks is a factor that builds trust and the reputation of the entire banking sector.

6. Conclusions

The aim of the study in question was to examine whether coal power financing affects ESG ratings. The study focused on 60 world’s largest banks, representing more than 70% of the assets of the global banking system and therefore being critical to the availability of finance and thus the potential for coal power development. In 2020, as many as 33 of these 60 banks saw an increase in their exposure to fossil fuel financing. The volume of new funding per year in 2020 was higher than in 2016 [12]. Thus, the entry into force of the Paris Agreement left de facto no impact on the banking sector, whose lending and investment policies are critical to the success of the energy transition. This raises the question of whether there are market-based mechanisms that may influence banks to reduce their financing of the fossil fuels sector. One of them is the ESG rating, the level of which determines, among other things, the price of financing obtained by the bank, attractiveness, and possibility of placement of bank share issues, and is an important determinant of all stakeholders’ decisions. The study proved that the odds of getting into the group of high ESG risk for the banks with AVR_N over the chosen cut-off value are higher than the odds for the banks with lower than the cut-off value AVR_N. Analogously, a rise in AVR_G results in an increase in the chance of a bank being classified in the least ESG risk group relative to the chance of being considered moderately or very risky according to the ESG classification. The odds of getting into the group of low ESG risk for the banks with AVR_U over the chosen cut-off value are greater relative to the probability of being qualified to the medium- or high-risk ESG group. Of the selected explanatory variables based on the literature review, only the SDI found that an increase in this index translates into the decline of the odds of being assigned to the high-risk ESG group relative to the probability of being qualified to the low- or medium-risk ESG group. Interestingly, for the world’s largest banks, none of the areas of their financial standing assessment (profitability, liquidity, asset quality, and solvency) have a statistically significant impact on ESG ratings. As the ESG risk has not yet been reflected in the calculation of capital requirements or in the eco-financial performance of financed entities (a dynamic increase in the price of carbon emission allowances did not occur until H2 2020), financing coal power generation has a positive impact on banks’ results (assuming that an increase in loan margins is not accompanied by an augmentation of provisions). ESG rating thus turns out to be the only potential instrument, besides reputational risk and the regulatory tool, for limiting banks’ exposure to the fossil fuels sector. As shown in this paper, low and high ESG ratings are affected by actual exposure to companies representing the coal economy. Hence, the obtained research results are important, especially from the point of view of bank owners and their managers. Indeed, the ad hoc revenues (arguably high due to rising climate risk) from fossil fuel financing must be adjusted to the costs resulting from ESG downgrades, and these apply to the entire loan or investment portfolio. Then, in all likelihood, fossil fuel financing will be found to be uneconomic, to which the risk adjustment of profitability, as reflected in the RAROC index, provides some analogy. At the same time, the survey results may provide guidance to entities assigning ESG ratings on how to more fully incorporate actual involvement in the fossil fuel sector into their methodologies, rather than relying on often only declarative credit and investment policies, membership in climate organisations, or the quality of reporting on the achievement of ESG goals. The credit risk assessment methodology is currently moving towards an approach based on mixed data clustering techniques [78]; hence, the findings of this study, in terms of the content of ESG ratings and the linkage of ESG scores with other assessment tools, can be used by risk managers in banks.

This study is the first to analyse the impact of the industry composition of bank loans and investment portfolios on ESG ratings. The findings fill a research gap in the area of determinants of ESG ratings. Previous research on ESG ratings has primarily focused on aspects such as financial performance, credit rating, size, and country. This study is the first to examine the relationship between a bank’s exposure to fossil fuel sectors (and thus the bank’s actual environmental impact) and its ESG rating. In other words, the crux of the research problem was made the question of the possible “penalty” that coal power financing banks incur in the form of worse ESG ratings. The mentioned research gap as a direction for further research was at the same time pointed out in one article on determinants of ESG rating [51].

The theoretical implications include the widening of the spectrum of determinants of ESG ratings assigned to banks, while the applied implications should be associated, on the one hand, with the expected pressure of supervisory institutions on agencies assigning ESG ratings so that these ratings are more strongly linked to banks’ exposure to the fossil fuels sector. At the same time, this study demonstrates the limitation of the exclusive use by investors and other sustainability-minded stakeholders of the ESG ratings assigned to the largest banks.

At the same time, the study has some limitations, which include relying solely on a database of ESG ratings assigned by Sustainalytics. However, such an action has to be explained by the inconsistent ratings given by different agencies, as indicated repeatedly in the literature [44]. The second limitation is the lack of decomposition of ESG ratings into components E, S, and G. This is due to the lack of rating agency disclosures in this area.

Verification of conclusions with the use of ratings of other agencies, confronting benefits from financing the fossil fuels sector with losses resulting from an increase in the cost of obtaining financing are only selected directions for further research. In addition, with the increase in ESG rating decomposition disclosures and disclosures related to the SFDR Regulation, it is planned to investigate the impact of a bank’s involvement in the fossil fuel sector on E scoring in further studies.

Author Contributions

Conceptualisation, M.B., Z.K., and P.N.; methodology, M.B., Z.K., and P.N.; software, M.B., Z.K., and P.N.; validation, M.B., Z.K., and P.N.; formal analysis, M.B., Z.K., and P.N.; investigation, M.B., Z.K., and P.N.; resources, M.B., Z.K., and P.N.; data curation, M.B., Z.K., and P.N.; writing—original draft preparation, M.B., Z.K., and P.N.; writing—review and editing, M.B., Z.K., and P.N.; visualisation, M.B., Z.K., and P.N.; supervision, M.B., Z.K., and P.N.; project administration, M.B., Z.K., and P.N.; funding acquisition, M.B., Z.K., and P.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

We wish to thank anonymous referees for valuable comments and suggestions.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Jeucken, M. Sustainable Finance and Banking: The Financial Sector and the Future of the Planet; Routledge: London, UK, 2010. [Google Scholar]

- da Silva Inácio, L.; Delai, I. Sustainable banking: A systematic review of concepts and measurements. Environ. Dev. Sustain. 2021, 24, 1–39. [Google Scholar] [CrossRef]

- Danisman, G.O.; Demir, E.; Zaremba, A. Financial Resilience to the COVID-19 Pandemic: The Role of Banking Market Structure. Appl. Econ. 2021, 53, 1–24. [Google Scholar] [CrossRef]

- Başarir, C.; Darici, B. Financial Systems, Central Banking and Monetary Policy During COVID-19 Pandemic and After; Lexington Books: Lanham, MD, USA, 2021. [Google Scholar]

- Foglia, M.; Addi, A.; Angelini, E. The Eurozone banking sector in the time of COVID-19: Measuring volatility connectedness. Glob. Financ. J. 2021, 51, 100677. [Google Scholar] [CrossRef]

- Korzeb, Z.; Niedziółka, P. Resistance of commercial banks to the crisis caused by the COVID-19 pandemic: The case of Poland. Equilib. Q. J. Econ. Econ. Policy 2020, 15, 205–234. [Google Scholar] [CrossRef]

- Demirguc-Kunt, A.; Pedraza, A.; Ruiz, C. Banking sector performance during the COVID-19 Crisis. J. Bank Financ. 2021, 133, 106305. [Google Scholar] [CrossRef]

- Bernardelli, M.; Korzeb, Z.; Niedziółka, P. The banking sector as the absorber of the COVID-19 crisis? economic consequences: Perception of WSE investors. Oecon. Copernic. 2021, 12, 335–374. [Google Scholar] [CrossRef]

- Park, S.R.; Jang, J.Y. The Impact of ESG Management on Investment Decision: Institutional Investors’ Perceptions of Country-Specific ESG Criteria. Int. J. Financ. Stud. 2021, 9, 48. [Google Scholar] [CrossRef]

- KPMG. Purpose and Value Take Center Stage. Available online: https://home.kpmg/xx/en/home/insights/2020/07/banks-put-esg-at-the-heart-of-their-operations.html (accessed on 10 January 2022).

- Kotsantonis, S.; Bufalari, V. Do Sustainable Banks Outperform. Driving Value Creation Through ESG Practices. KKS Advisors, Deloitte, EIB, GABV. Available online: https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-services/Banking/lu-do-sustainable-banks-outperform-driving-value-creation-through-ESG-practices-report-digital.pdf (accessed on 12 January 2022).

- Reclaim Finance. Banking on Climate Chaos: Fossil Fuel Finance Report. 2021. Available online: https://reclaimfinance.org/site/en/2021/03/24/baking-climate-chaos-fossil-fuel-finance-report-2021/ (accessed on 10 January 2022).

- Clifford, C. 60 Largest Banks in the World Have Invested $3.8 Trillion in Fossil Fuels Since the Paris Agreement. Available online: https://www.cnbc.com/2021/03/24/how-much-the-largest-banks-have-invested-in-fossil-fuel-report.html (accessed on 10 January 2022).

- Sustainalytics. Available online: https://www.sustainalytics.com (accessed on 6 December 2021).

- World Bank Group. Bank Regulation and Supervision a Decade After the Global Financial Crisis. Global Financial Development Report 2019/2020. Available online: https://issuu.com/world.bank.publications/docs/9781464814471 (accessed on 10 January 2022).

- Glomsrød, S.; Wei, T. Business as unusual: The implications of fossil divestment and green bonds for financial flows, economic growth and energy market. Energy Sustain. Dev. 2018, 44, 1–10. [Google Scholar] [CrossRef]

- Plantinga, A.; Scholtens, B. The financial impact of fossil fuel divestment. Clim. Policy. 2021, 21, 107–119. [Google Scholar] [CrossRef]

- Ivanov, I.; Kruttli, M.S.; Watugala, S.W. Banking on Carbon: Corporate Lending and Cap-and-Trade Policy. Available online: https://ssrn.com/abstract=3650447 (accessed on 12 January 2022).

- Park, H.; Kim, J.D. Transition towards green banking: Role of financial regulators and financial institutions. Asian J. Sustain. Soc. Responsib. 2020, 5, 5. [Google Scholar] [CrossRef]

- Brutscher, P.-B.; Ravillard, P.; Semeniuk, G. Do Energy Efficient Firms Have Better Access to Finance? Energy J. 2021, 42, 6. [Google Scholar] [CrossRef]

- Sachs, J.D.; Woo, W.T.; Yoshino, N.; Taghizadeh-Hesary, F. Why Is Green Finance Important? ADBI Working Paper 917; Asian Development Bank Institute: Tokyo, Japan, 2019; Available online: https://www.adb.org/publications/why-green-finance-important (accessed on 10 January 2022).

- Best, R. Switching towards coal or renewable energy? The effects of financial capital on energy transitions. . Energy Econ. 2017, 63, 75–83. [Google Scholar] [CrossRef] [Green Version]

- Eckardt, A.; Mazutis, D. Banking for a Low Carbon Future: Explaining Climate Change Responses in a Low-Salience Industry. In Academy of Management Proceedings; Academy of Management: New York, NY, USA, 2020; Volume 2020. [Google Scholar] [CrossRef]

- Bhandary, R.R.; Gallagher, K.S.; Zhang, F. Climate finance policy in practice: A review of the evidence. Clim. Policy 2021, 21, 529–545. [Google Scholar] [CrossRef]

- Marques-Ibanez, D.; Reghezza, A.; Altunbas, Y.; d’Acri, C.R.; Spaggiar, M. Do Banks Fuel Climate Change? ECB Working Papers 2550; European Central Bank: Frankfurt, Germany, 2021. [Google Scholar]

- Kuykendall, T. S&P Global: Banks Provided 11% More Money to Coal-Related Companies Since 2016—Report. Available online: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/banks-provided-11-more-money-to-coal-related-companies-since-2016-8211-report-62849285 (accessed on 11 January 2022).

- Chen, X.; Li, Z.; Gallagher, K.P.; Mauzerall, D.L. Financing carbon lock-in in developing countries: Bilateral financing for power generation technologies from China, Japan, and the United States. Appl. Energy 2021, 300, 117318. [Google Scholar] [CrossRef]

- Baruya, P. International Finance for Coal-Fired Power Plants; CCC/277; EA Clean Coal Centre: London, UK, 2017; Available online: https://usea.org/sites/default/files/International%20finance%20for%20coal%20fired%20power%20plants%20-%20ccc277.pdf (accessed on 10 January 2022).

- Manych, N.; Steckel, J.C.; Jakob, M. Finance-based accounting of coal emissions. Environ. Res. Lett. 2021, 16, 044028. [Google Scholar] [CrossRef]

- Dvorak, P.; Hua, S.; Yoon, F. Coal Projects in Asia Face Dwindling Financing as Climate Pressure Mounts. The Wall Street Journal. Available online: https://www.wsj.com/articles/coal-projects-in-asia-face-dwindling-financing-as-climate-pressure-mounts-11627896602 (accessed on 4 January 2022).

- Kim, J.W.; Lee, J.-S. Greening Energy Finance of Multilateral Development Banks: Review of the World Bank’s Energy Project Investment (1985–2019). Energies 2021, 14, 2648. [Google Scholar] [CrossRef]

- Heine, D.; Semmler, W.; Mazzucato, M.; Braga, J.P.; Flaherty, M.; Gevorkyan, A.; Hayde, E.; Radpour, S. Financing Low-Carbon Transitions Through Carbon Pricing and Green Bonds; Policy Research Working Paper 8991; World Bank: Washington, DC, USA, 2019; Available online: https://openknowledge.worldbank.org/handle/10986/32316 (accessed on 10 January 2022).

- Delis, M.D.; de Greiff, K.; Ongena, S. Being Stranded with Fossil Fuel Reserves? Climate Policy Risk and the Pricing of Bank Loans; EBRD Working Paper 231; European Central Bank: Frankfurt, Germany, 2019; Available online: https://www.ebrd.com/publications/working-papers/fossil-fuel-reserves (accessed on 10 January 2022).

- Fard, A.; Javadi, S.; Kim, I. Environmental Regulation and the Cost of Bank Loans: International Evidence. J. Financ. Stab. 2020, 51, 956. [Google Scholar] [CrossRef]

- Zhou, X.; Wilson, C.; Caldecott, B. The Energy Transition and Changing Financing Costs. Oxford Sustainable Finance Programme. 2021. Available online: https://www.smithschool.ox.ac.uk/research/sustainable-finance/publications/The-energy-transition-and-changing-financing-costs.pdf (accessed on 11 February 2022).

- Ehlers, T.; Packer, F.; de Greiff, K. The Pricing of Carbon Risk in Syndicated Loans: Which Risks are Priced and Why? BIS Working Papers 946; Bank for International Settlements: Basel, Switzerland, 2021; Available online: https://www.bis.org/publ/work946.htm (accessed on 10 January 2022).

- Chan, H.-Y.; Merdekawati, M.; Suryadi, B. Bank climate actions and their implications for the coal power sector. Energy Strategy Rev. 2022, 39, 100799. [Google Scholar] [CrossRef]

- Kustra, A.; Pawłowski, S.; Kozieł, D. Trendy zmian finansowania górnictwa węgla przez międzynarodowe instytucje finansowe. Przegląd Górniczy 2019, 75, 34–40. Available online: http://yadda.icm.edu.pl/yadda/element/bwmeta1.element.baztech-1ed551a0-181a-49b2-a7c8-192d2310cd62 (accessed on 10 January 2022).

- Zioło, M. Finanse Zrównoważone. Rozwój, Ryzyko, Rynek; Polskie Wydawnictwo Ekonomiczne: Warsaw/Szczecin, Poland, 2020. [Google Scholar]

- Korzeb, Z.; Kulpaka, P.; Niedziółka, P. Deoligopolizacja Rynku Agencji Ratingowych Oraz Inne Inicjatywy na Rzecz Poprawy Jakości Ratingów Zewnętrznych w Kontekście Oddziaływania Agencji Ratingowych na Stabilność Finansową; Materiały i Studia No. 333; Narodowy Bank Polski: Warsaw, Poland, 2019; Available online: https://www.nbp.pl/publikacje/materialy_i_studia/ms333.pdf (accessed on 10 January 2022).

- Niedziółka, P. Expected effects of the opening of the on-shore credit ratings’ market in China for the Big Three and its rationale. Bank Kredyt 2020, 51, 189–210. Available online: https://bankikredyt.nbp.pl/content/2020/02/BIK_02_2020_04.pdf (accessed on 10 January 2022).

- Kosiński, K. Ratingi ESG Wdzierają się do Polskich Spółek. Available online: https://www.pb.pl/ratingi-esg-wdzieraja-sie-do-polskich-spolek-981928 (accessed on 11 January 2022).

- Billio, M.; Costola, M.; Hristova, I.; Latino, C.; Pelizzon, L. Inside the ESG Ratings: (Dis)Agreement and Performance; SAFE Working Paper 284; Ca’ Foscari University of Venice: Venice, Italy, 2020; Available online: https://www.unive.it/pag/fileadmin/user_upload/dipartimenti/economia/doc/Pubblicazioni_scientifiche/working_papers/2020/WP_DSE_billio_costola_histova_latino_pelizzon_17_20.pdf (accessed on 11 January 2022).

- Walter, I. Sense and Nonsense in ESG Scoring. J. Law Financ. Account. 2020, 5, 307–336. [Google Scholar] [CrossRef]

- Norton, L. Market Wants ESG Data. Morningstar. Available online: https://www.morningstar.ca/ca/news/215859/market-wants-esg-data.aspx (accessed on 10 December 2021).

- Drempetic, S.; Klein, C.; Zwergel, B. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings Under Review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Chih, H.L.; Chih, H.H.; Chen, T.H. On the determinants of corporate social responsibility: International evidence on the financial industry. J. Bus. Ethics 2010, 93, 115–135. [Google Scholar] [CrossRef]

- Ciciretti, R.; Kobeissi, N.; Zhu, Y. Corporate social responsibility and financial performance: An analysis of bank community responsibility. Int. J. Bank. Account. Financ. 2014, 5, 342–373. [Google Scholar] [CrossRef]

- Cornett, M.M.; Erhemjamts, O.; Tehranian, H. Greed or good greeds: An examination of the relation between corporate social responsibility and the financial performance of U.S. commercial banks around the financial crisis. J. Bank Financ. 2016, 70, 137–159. [Google Scholar] [CrossRef]

- Tang, D.Y.; Yan, J.; Yao, Y. The Determinants of ESG Ratings: Rater Ownership Matters. Available online: https://ssrn.com/abstract=3889395 (accessed on 7 October 2021).

- Crespi, F.; Migliavacca, M. The Determinants of ESG Rating in the Financial Industry: The Same Old Story or a Different Tale? Sustainability 2020, 12, 6398. [Google Scholar] [CrossRef]

- KPMG, ESG Risks in Banks. Available online: https://assets.kpmg/content/dam/kpmg/xx/pdf/2021/05/esg-risks-in-banks.pdf (accessed on 11 October 2021).

- La Torre, M.; Leo, S.; Panetta, I.C. Banks and Environmental, Social and Governance Drivers: Follow the Market or the Authorities? Available online: https://onlinelibrary.wiley.com/doi/epdf/10.1002/csr.2132 (accessed on 23 October 2021).

- Azmi, W.; Hassan, M.K.; Houston, R.; Karim, M.S. ESG activities and banking performance: International evidence from emerging economies. J. Int. Financ. Mark. Inst. Money 2021, 70, 101277. [Google Scholar] [CrossRef]

- Tarmuji, I.; Maelah, R.; Tarmuji, N.H. The Impact of Environmental, Social and Governance Practices (ESG) on Economic Performance: Evidence from ESG Score. Int. J. Trade Econ. Financ. 2016, 7, 67–74. [Google Scholar] [CrossRef] [Green Version]

- Bruder, B.; Cheikh, Y.; Deixonne, F.; Zheng, B. Integration of ESG in Asset Allocation. Available online: https://ssrn.com/abstract=3473874 (accessed on 10 December 2021).

- Shakil, M.H.; Mahmood, N.; Tasnia, M.; Munim, Z.H. Do environmental, social and governance performance affect the financial performance of banks? A cross-country study of emerging market banks. Manag. Environ. Qual. 2019, 30, 1331–1344. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef] [Green Version]

- Safarzynska, K.; van den Bergh, J. Financial stability at risk due to investing rapidly in renewable energy. Energy Policy 2017, 108, 12–20. [Google Scholar] [CrossRef]

- Eceiza, J.; Harreis, H.; Härtl, D.; Viscardi, S. Banking Imperatives for Managing Climate Risk. McKinsey & Company. Available online: https://www.mckinsey.com/~/media/mckinsey/business%20functions/risk/our%20insights/banking%20imperatives%20for%20managing%20climate%20risk/banking-imperatives-for-managing-climate-risk.pdf?shouldIndex=false (accessed on 10 December 2021).

- EBA—European Banking Authority. EBA Report on Management and Supervision of ESG Risks for Credit Institutions and Investment Firms. EBA/REP/2021.18. Available online: https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Reports/2021/1015656/EBA%20Report%20on%20ESG%20risks%20management%20and%20supervision.pdf (accessed on 10 January 2022).

- Whelan, T.; Atz, U.; van Holt, T.; Clark, C. ESG and Financial Performance. Uncovering the Relationship by Aggregating Evidence from 1,000 Plus Studies Published Between 2015–2020. Studies Published Between 2015–2020. NYU Stern. Available online: https://www.stern.nyu.edu/sites/default/files/assets/documents/NYU-RAM_ESG-Paper_2021%20Rev_0.pdf (accessed on 14 December 2021).

- MSCI. MSCI World ESG Select Impact ex Fossil Fuels Index. 2019. Available online: https://www.msci.com/eqb/methodology/meth_docs/MSCI_World_ESG_Select_Impact_ex_Fossil_Fuels_Index_Aug2019.pdf (accessed on 12 February 2022).

- Haniffa, R.M.; Cooke, T.E. The impact of culture and corporate governance on corporate social reporting. J. Account. Public Policy 2005, 24, 391–430. [Google Scholar] [CrossRef]

- Buallay, A. Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Manag. Environ. Qual. 2019, 30, 98–115. [Google Scholar] [CrossRef]

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Redondo Hernández, J. ESG Performance and shareholder value creation in the banking industry: International differences. Sustainability 2019, 11, 1404. [Google Scholar] [CrossRef] [Green Version]

- Devalle, A.; Fiandrino, S.; Cantino, A. The Linkage between ESG Performance and Credit Ratings: A Firm-Level Perspective Analysis. Int. J. Bus. Manag. Sci. 2017, 12, 53–65. [Google Scholar] [CrossRef] [Green Version]

- Bouyé, E.; Menville, D. The Convergence of Sovereign Environmental, Social and Governance Ratings; Policy Research Working Paper 9583; World Bank: Washington, DC, USA, 2021; Available online: https://openknowledge.worldbank.org/handle/10986/35291 (accessed on 10 January 2022).

- Hickel, J. The sustainable development index: Measuring the ecological efficiency of human development in the Anthropocene. Ecol. Econ. 2020, 167, 106331. [Google Scholar] [CrossRef]

- Zhou, Z. Ensemble Methods. Foundations and Algorithms; Chapman and Hall/CRC: Boca Raton, FL, USA, 2012. [Google Scholar]

- Di Tommaso, C.; Thornton, J. Do ESG scores effect bank risk taking and value? Evidence from European banks. Corp. Soc. Responsib. Environ. 2020, 27, 2286–2298. [Google Scholar] [CrossRef]

- Douglas, E.; Van Holt, T.; Whelan, T. Responsible Investing: Guide to ESG Data Providers and Relevant Trends. J. Environ. Invest. 2017, 8, 92–114. Available online: https://cbey.yale.edu/sites/default/files/Responsible%20Investing%20-%20Guide%20to%20ESG%20Data%20Providers%20and%20Relevant%20Trends.pdf (accessed on 10 January 2022).

- Doyle, T.M. Ratings That Don’t Rate: The Subjective World of ESG Rating Agencies. American Council for Capital Formation. Available online: https://accfcorpgov.org/wp-content/uploads/2018/07/ACCF_RatingsESGReport.pdf (accessed on 12 January 2022).

- Weber, I. Sense and Nonsense in ESG Ratings. Harvard Law School Forum on Corporate Governance. Available online: https://corpgov.law.harvard.edu/2020/12/02/sense-and-nonsense-in-esg-ratings/ (accessed on 12 January 2022).

- Hemingway, C.A.; Maclagan, P.W. Managers’ Personal Values as Drivers of Corporate Social Responsibility. J. Bus. Ethics 2004, 50, 33–44. [Google Scholar] [CrossRef]

- Christensen, D.M.; Serafeim, G.; Sikochi, A. Why is Corporate Virtue in the Eye of the Beholder? The Case of ESG Ratings. Account. Rev. 2021, 97, 147–175. [Google Scholar] [CrossRef]

- Amel-Zadeh, A.; Serafeim, G. Why and How Investors Use ESG Information: Evidence from a Global Survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef] [Green Version]

- Caruso, G.; Gattone, S.A.; Fortuna, F.; Di Battista, T. Cluster Analysis for mixed data: An application to credit risk evaluation. Socio Econ. Plan. Sci. 2021, 73, 100850. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).