Abstract

The emergence of new transformational technology, known as the fourth industrial revolution, has crucially opened a new window to green economic growth. The transition to low carbon, green economy, and green sustainability has gained momentum simultaneously in developed and developing countries. The greening policy echoes the pending climate change and its entrenching disruptions. Financial technology, or FinTech seems to be a promising direction in unlocking the green dilemma; to be concrete, FinTech and the green economy are separately documented in the literature. Against this background, the current study investigates the intersection between green economic growth and FinTech by conducting a systematic-cum-bibliometric analysis of published papers in the Scopus database with the goal of first examining the role and opportunities of implementing green FinTech as a stimulus for transition towards green economic growth in African countries and, second, identifying knowledge gaps and future policy and research directions by developing an integrated framework to help African countries in the transition to green economic growth and green FinTech. The results illustrate an increasing trend in research attention towards the green FinTech concept and its relationship with green economic growth, climate change, and greening rules and standards. A deep inspection of the mined papers indicates that future research trajectories are oriented into five different mainstreams: technology and instruments in digital finance; regulation, policies, and green FinTech; climate risk mitigation through FinTech; FinTech and environmental quality; green finance and climate change mitigation. Based on these research directions, an integrated framework was conceptualised that aims to deliver green economic growth using FinTech as a vehicle of transition for African countries.

1. Introduction

The recent worldwide disjuncture, moving from COVID-19 to the current global warming, has exacerbated the socioeconomic structure of many developing countries, even developed nations, and efforts to transition to a green economy have now become a socioeconomic imperative. The world is facing the risk of increasing temperatures and environmental degradation. This necessitates a united global front in mitigating global risks. One such collaborative effort was the Paris Agreement of December 2015 that aims to keep the increase in global temperatures under 2 °C and to fix it to 1.5 °C [1]. However, a key question arises and points to whether economic growth can be sustained while dealing with adverse climate change. This question has raised an ongoing contentious debate that has not resulted in any consensus. Whilst some scholars, such as [2,3], argue that environmental limitations do not bind economic growth, other scholars have posited that economic growth is simply not compatible with environmental limitations (see, for example, [4,5]).

A key challenge for the African continent is that its economy is closely tied to climate-related activities. It has a higher exposure to climate risks such as flooding, droughts, and low-adaptive capacity, further exacerbated by financial and technological limitations. Despite Africa’s relatively low contribution to carbon dioxide emissions on a global scale, African countries remain vulnerable to climate risks. The Germanwatch institute presented the Global Climate Risk Index [6], which showed that Africa, Madagascar, Kenya, and Rwanda are among the top 10 most climate-vulnerable countries in the world, positioned at 4, 7, and 8, respectively.

The economic consequences of adverse climate risks affect the already fragile economies of African countries, making them vulnerable to shocks such as food security, rising crude oil prices, and social turmoil. This climate-change problem in Africa compounds the structural economic fragilities exposed by the COVID-19 outbreak. Achieving the Sustainable Development Goals (SDGs) alongside the goals of the Paris Agreement on Climate Change requires capital to fund measures that aim at alleviating climate risks and reducing carbon emissions so that green economic growth can be attainable in Africa. Unfortunately, there is a huge funding gap for climate investments in Africa since the demand exceeds the current investment inflows. This is despite the pledge made by developing countries to invest USD 100 billion in emerging economies to deal with climate risks [7]. Part of the challenge is the low-credit-risk scores and high indebtedness of the African countries alongside alarming poverty and unemployment rates and recent post-COVID-19 disruptions. Various options can be considered in attaining low-carbon investments that alleviate climate change effects. The usual approach is government spending, which relies on shifting the burden to taxpayers. Private capital is an alternative to government spending in low-carbon investments. Another viable strategy is to consider blended finance, which involves private and public funding. Under blended finance, government spending budgets or grants are used to finance the initial stages of implementing carbon-financed projects, and private funding can be used to finance the remaining project lags after project risks associated with inception stages have been significantly reduced.

The Paris Agreement on Climate Change is also dedicated to “making finance flows consistent with a pathway toward low greenhouse gas emissions and climate-resilient development” [1]. FinTech is a channel that can potentially stem the increasing climate effects and can be a tool to which policymakers have not given much attention for mitigating climate change effects, especially in developing countries. In the pursuit of minimising those effects, the opportunities provided by green FinTech can potentially be part of the levers that help developing countries implement the Paris Agreement on Climate Change of December 2015 [1] and promote the implementation of Sustainable Development Goals. As such, we ask, “As Africa is on a collision path with the devastating consequences of climate change, could fintech be part of the solution that transitions Africa to a green economy?” The authors in [8] asserted that green FinTech might promote the progress of innovations and models that can support SDGs.

A key player in this domain is the United Nations Task Force on Digital Financing of the Sustainable Development Goals [9]. In this regard, green FinTech, which is part of the advancements in digital and smart technologies, provides opportunities for firms and countries to minimise the gap between short-term and long-term climate risk goals, permitting green FinTech to be an enabler of transition towards green economies.

Green FinTech can assist firms and countries to decrease their climate impacts at different levels of the value chain through its technologies such as blockchain, smart contracts, and artificial intelligence. One important aspect to explore is the role that FinTech can play in evaluating the alignment of low-carbon emissions’ goals along the value chain, including consumers, tech companies and start-ups, service providers, banks, and insurance companies, as well as the providers of the regulatory environment. Moreover, the FinTech industry renders services to other crucial sectors of the economy, such as agriculture, energy, retailing, and manufacturing, which are at different stages of digitalisation; some already use digital payment processes, such as Mpesa in Kenya. FinTech offers an opportunity to enhance the technological infrastructure that contributes to defining different value chain players.

The primary goal of this study is to explore the role and the opportunities of implementing green FinTech as a stimulus of transition towards green economic growth in African countries. The contribution of this study is threefold: (1) The study explores the intersection of green economic growth and FinTech by employing a systematic-cum-bibliometric method of network-based bibliometric coupling, co-citation and co-occurrence analyses of published journal papers in FinTech and green growth. (2) The second contribution of this study is to recognise the important contributions of the published articles in the field of green FinTech and to group them into clusters/categories of the main themes. This approach enables us to establish the knowledge gaps and to determine future policy and research directions. (3) The third contribution of this study is the development of an integrated green FinTech and green growth framework.

The main results of the performed research, which are characterised by scientific novelty, are as follows: We found out that there is a growing trend in research interest in the green FinTech and green economic growth nexus. Moreover, there is a continuous growing body of literature on green rules and standards. A thorough examination of the mined papers revealed that future research trajectories will be focused on five distinct areas: digital finance technology and instruments, regulation and policies, green FinTech, climate risk mitigation through FinTech, FinTech and environmental quality, green finance, and climate change mitigation. Based on these research directions, an integrated framework was developed with the goal of delivering green economic growth through the use of FinTech as a vehicle of transition for African countries.

The remainder of the paper is structured as follows: Section 2 is an exposition of the literature review of FinTech and green growth nexus. Section 3 specifies the methodology of bibliometric analysis employed in this study. The results obtained from the systematic-cum-bibliometric review are analysed in Section 4. Section 5 provides a discussion of the results contextualised within accepted knowledge. Finally, the conclusion and policy recommendations are documented in Section 6.

2. Literature Review

The current study backs two fast-growing schools of literature. For the first stream connected to FinTech, see, for instance, [10]. The other domain is associated with the interaction between financial technology and climate risk/climate change. Hence, the term “green FinTech”, according to [9] is defined as the range of digital financing technologies, including mobile payment platforms, artificial intelligence, big data, IoT, blockchain, and cryptocurrencies, while the Financial Stability Board [11] describes financial technology as a technologically supported novelty in the financial sector that might affect outcomes in novel business schema, requests, procedures, or products with related impact on the financial sector and organisations and the delivery of financial results. Furthermore, Ref. [12] asserted that FinTech leverages on inter-machine communication, and the Internet of Things and applies them to finance. Green FinTech is premised on financial technology that has the potential to reduce carbon emissions that leads to environmental sustainability. Moreover, green FinTech is enabled by modern technologies such as blockchain technology, cryptocurrency, artificial intelligence, data analytics, the Internet of Things (IoT), and smart contracts.

2.1. Financial Technologies and Their Integrated Ecosystem

The FinTech business model is recognised as one of the great breakthroughs in the financial industry and is growing rapidly. It is partially motivated by the sharing economy, favourable government rule, and digital information technology. The authors in [13] highlighted that the FinTech industry holds the promise to revolutionise the financial industry by reducing costs, enhancing the financial service quality, and building a resilient financial system that absorbs a range of shocks of different types.

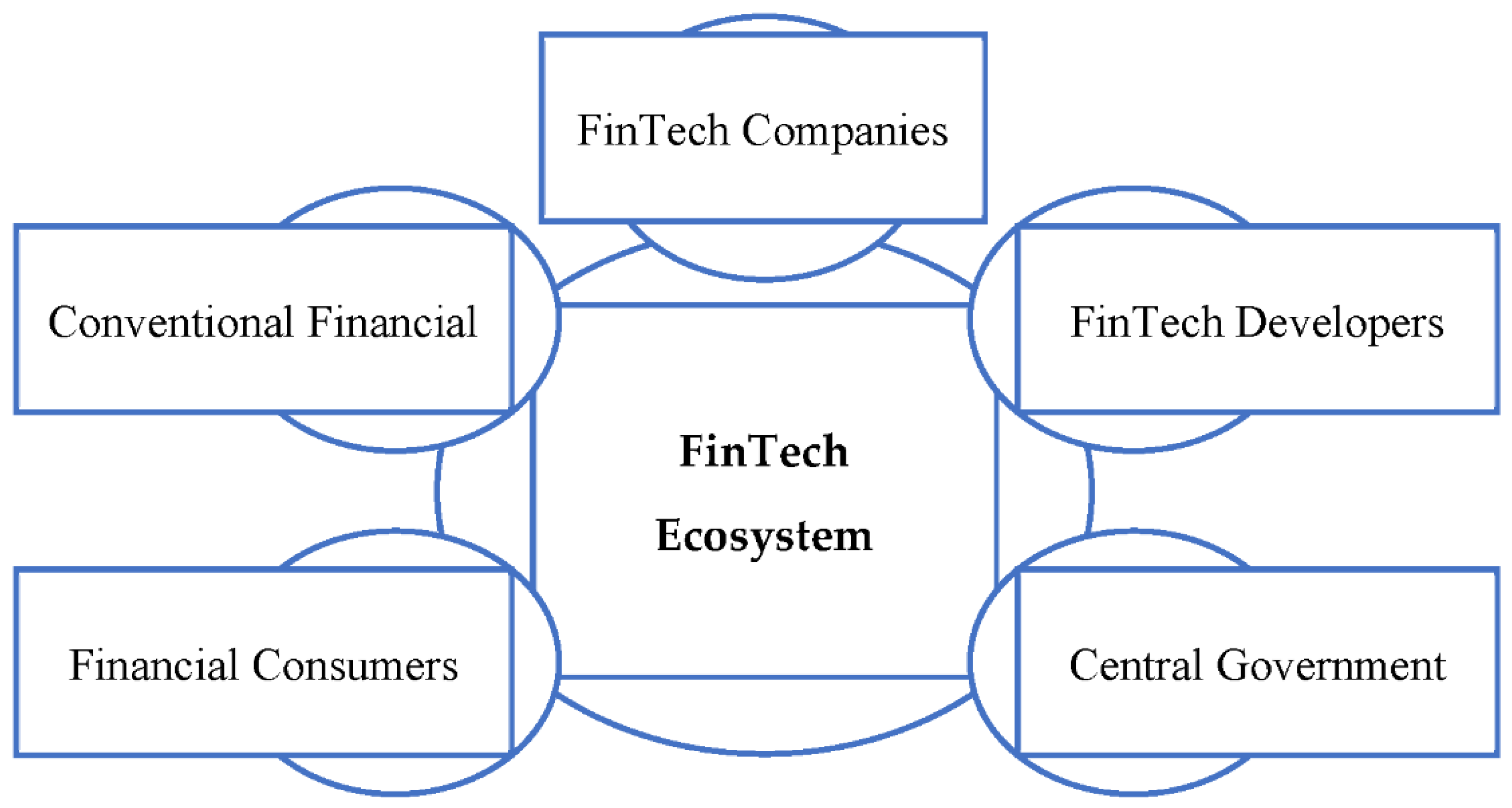

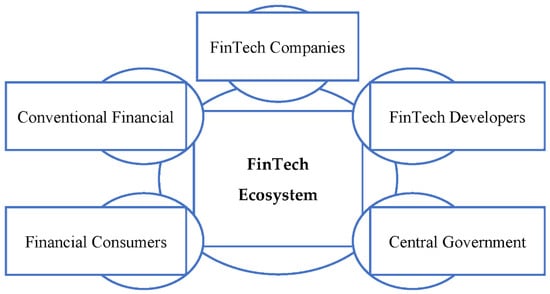

A study by the authors in [14] stated that the structure of financial technologies enables growth opportunities in many related sectors, including software development, data-driven analytics, online payment platforms (e.g., peer-to-peer trading and lending), and asset management systems based on blockchain technology. Mapping a stable FinTech ecosystem will help to understand the competitive and collaborative dynamics in the FinTech industry. As suggested by the authors in [15], there are five essential elements of the inter-correlated FinTech ecosystem:

- FinTech Companies, including digital payment, asset management, trading, InsurTech, and crowdfunding.

- FinTech Developers, including data-driven analytics, big data management, cloud computing, cryptocurrency, blockchain technology.

- Central Government, including entities that create the financial rules and standards.

- Financial Consumers, including individuals and institutions.

- Conventional Financial entities, including banks, insurance, and trading companies.

These five interconnected elements cohesively stimulate innovation and promote economic growth in the long run. Figure 1 shows the integrated ecosystem of the financial technologies industry based on the publications of the authors in [13,15]:

Figure 1.

The core contributors in the financial technology ecosystem.

The core element of the ecosystem is the FinTech companies. Most FinTech start-ups are innovating in areas such as digital payment, asset management, trading, InsurTech, and crowdfunding. They offer reduced costs compared with traditional operators and focus on all types of markets. In addition, they address global issues such as climate change and environmental degradation.

While consumers have the option of choosing different sets of services from a variety of FinTech firms, a consumer may use his bank to transfer money ((PayPal, San Jose, CA, USA), (Skrill, London, UK), ( Payoneer, New York, NY, USA)), hold a cryptocurrency wallet (Coinbase Wallet (version 10.42.9), MetaMask (version 5.9.1), TrustWallet (version 7.21), Electrum (version 4.3.2)), or buy any digital currency from an online trading platform (e.g., Binance (version 2.56.0), Etoro (version 482.0.0), Coinbase (version 10.42.9)).

Rather than rely on a single financial institution for their needs, consumers are beginning to pick and choose services they would like from a variety of FinTech companies.

FinTech developers are the IT professionals who build the hardware and the software environment for FinTech firms to start their innovative projects. The government, as the neutral agent in this ecosystem, should provide a regulatory system for FinTech to evolve, but should keep it under observation to not repeat the financial crisis of 2007-08. Financial consumers are the main source of income for FinTech firms. Most traditional financial institutions start to re-evaluate their business models toward the FinTech industry after realising its competitiveness and future growth opportunities.

Recently FinTech businesses started to address global issues and to become the main actor in the green FinTech ecosystems. They enable economies to transition to green economic growth characterised by reduced climate risks and vulnerabilities for African countries. The publication by the authors in [16] stated that green economic growth “promotes economic growth and development by balancing environmental hazards with long-term economic growth”. In the same frame of mind, the authors in [17] asserted that “Blockchain, Big Data, the Internet of Things (IoT), smart contracts and other cutting-edge technologies hold out the promise of addressing the needs of new generation climate markets post-2020”. The author of [18] noted that FinTech technologies can be used in the attainment of sustainable development: “the applications included: pay-as-you-go resource utilities; flexible energy supply and demand, peer-to-peer renewable energy, and community distributed generation”. Furthermore, the authors in [18] posited that financial technologies that can be tapped into for green economic growth include blockchain for renewable energy, decentralization of electricity markets, and climate finance, as well as innovation of financial products such as green bonds.

The discussed FinTech’s businesses have been widely adopted in many vital sectors. FinTech still faces crucial challenges, since it has the potential to disrupt global financial stability. Consequently, the FinTech industry must handle challenging issues, such as regulatory restrictions, because the traditional financial systems have been under great regulatory restrictions since the financial crisis of 2007-08 [18]. Moreover, investors tend to leverage and shift to FinTech investments to overcome the traditional regulatory burden. Another challenging issue is data security, since FinTech carries sensitive data of its actors. In this regard, the authors in [19] suggest a policy framework to secure FinTech services.

2.2. The Role of Financial Technologies in Ensuring Green Economic Growth

Recently, green economic growth has received great attention and is considered the new economic model (see, for example, the study by the authors in [20]). Technology is the main driving force of green growth via CleanTech products. The nexus between green economy and technology in the financial sector has recently become a prevalent topic for policy making, as noted by the authors in [21]. Accordingly, financial technologies become essential in stimulating the green economy through strengthened green finance products, which in fact has a higher significance for many countries (see, for example, the study by the authors in [22]).

The authors in [23] stated that the key to quality economic development and balancing green economic transformation is financial support for green economic development. The FinTech industry is well positioned to serve as an enabler of the new green economic model through the introduction of a set of new technologies such as artificial intelligence and big data mining in small and medium-sized businesses (SMEs) [24]. The authors in [23] noted that FinTech is the key for ensuring and balancing the process of transition. The FinTech business model is still in the early stages of development and suffers from many structural obstacles such as regulatory restrictions and personal data security. However, FinTech businesses play a major role in supporting green development projects by providing the necessary finance, ensuring global trust, and narrowing asymmetric information [25].

While the current business model, including the traditional financial instruments, contributes to the environmental degradation and climate change, the authors in [26] affirm that financial technologies are more inclusive and provide the necessary opportunities and can handle the constraints posed by the financial crisis of 2007-08.

FinTech plays a major role in developed countries compared with developing countries. The authors in [27] noted that financial technologies can support start-ups and entrepreneurs in launching high-market-value firms and in creating significant job opportunities in developing countries, which helps in improving the socioeconomic development of certain marginalised populations. An empirical study by [21] found a significant causality between green economy and financial technologies and CleanTech. Small businesses are also known to be a key part in developing countries and to contribute to economic growth and employment of less-skilled people [28,29].

3. Methodology of Bibliometric Analysis

A systematic-cum-bibliometric review of the literature was carried out to explore the literature that covers green FinTech and subsequently describes the challenges and opportunities for green growth as well as policy recommendations and future research directions. The authors in [30] noted that a systematic review is a technique that identifies and critically examines previously published studies related to a well-defined research question. The aim is to make evidence available and accessible to research.

A systematic-cum-bibliometric review was based on journal articles extracted from the Scopus database due to its reliability in covering peer-reviewed and trusted journals. Moreover, the data obtained from the Scopus database is in a format compatible with the VOSviewer software (version 1.6.18) used for bibliometric network analysis in this study; the software was developed by [31].

For instance, the co-occurrence analysis uses the keywords from Table 1 as items (inputs) in creating the network map with a 0 as the default value; the co-occurrence is the only analysis that uses the keywords as items. While the co-citation can use three different items (references, sources, authors), the software can substitute each item with another to create a complete co-citation map without dropping any element (document). The bibliographic coupling uses five different items (documents, sources, authors, organisations, and countries), meaning that the analysis can be explored based on the number of publications by country or organisation.

The co-citation is processed under three rules: (1) It matches the name of the first author, the year of publication, the page number, and the volume number. (2) This rule should pop up automatically if the first rule does not find any match, which uses the following items as match criteria: the name of the first author, the year of publication, the page number, and the title. (3) A final option is used when both the first and the second steps fail to capture the link by using the DOI as a matching item. Two papers will be connected if a paper contains a cited reference with a matching key that matches one of the two match keys used to represent the other paper. The bibliographic coupling network uses the same three rules and the same structure described for co-citation analysis, except another fourth rule (4) is included when no results are obtained using rule (1), (2), or (3), and the software uses the raw references’ string as the match criteria.

Table 1.

Inclusion and exclusion criteria for the systematic-cum-bibliometric review.

Table 1.

Inclusion and exclusion criteria for the systematic-cum-bibliometric review.

| Criteria | |

|---|---|

| Logical Statement | TITLE-ABS-KEY ((Green Or “Zero Carbon” OR “Low Carbon”) AND “Fintech”) And (Limit-To (Pubstage, “Final”)) AND (Limit-To (Doctype, “Ar”)) And (Limit-To (Exactkeyword, “Fintech”) Or Limit-To (Exactkeyword, “Green Finance”) Or Limit-To (Exactkeyword, “Fintech”) Or Limit-To (Exactkeyword, “Sustainable Development”) Or Limit-To (Exactkeyword, “Finance”) Or Limit-To (Exactkeyword, “Sustainability”) Or Limit-To (Exactkeyword, “Green Digital Finance”) Or Limit-To (Exactkeyword, “Blockchain”) Or Limit-To (Exactkeyword, “Commerce”) Or Limit-To (Exactkeyword, “Artificial Intelligence”) Or Limit-To (Exactkeyword, “Climate Change”) Or Limit-To (Exactkeyword, “Digitization”) Or Limit-To (Exactkeyword, “Green Economy”) Or Limit-To (Exactkeyword, “Big Data”) Or Limit-To (Exactkeyword, “Digital Transformation”) Or Limit-To (Exactkeyword, “Financial Technology”) Or Limit-To (Exactkeyword, “Green Bonds”) Or Limit-To (Exactkeyword, “Investments”) Or Limit-To (Exactkeyword, “Sustainable Finance”) Or Limit-To (Exactkeyword, “Technology Adoption”) Or Limit-To (Exactkeyword, “Carbon”) Or Limit-To (Exactkeyword, “Carbon Emissions”) Or Limit-To (Exactkeyword, “Energy Conservation”) Or Limit-To (Exactkeyword, “Energy Utilization”)) And (Limit-To (Language, “English”)) |

| Inclusion |

|

| Exclusion |

|

Source: Author’s elaboration.

The bibliometric coupling analysis in VOSviewer typically uses only one type of item (author’s first name, title, DOI) and it is not possible to have more than one item (the literature sometimes uses the node or vertex as the main terminology) in the same map; only one link can be set between two items. The link is considered a connection or relation between the two items, takes many forms, and can be a co-authorship between authors or a bibliographic coupling between documents. The link has a positive numerical value representing the strength (also known as edge weight in the literature), the more the strength the higher the relation. In some cases, the strength can be equal to 1. In this scenario, VOSviewer shows no strength of the link.

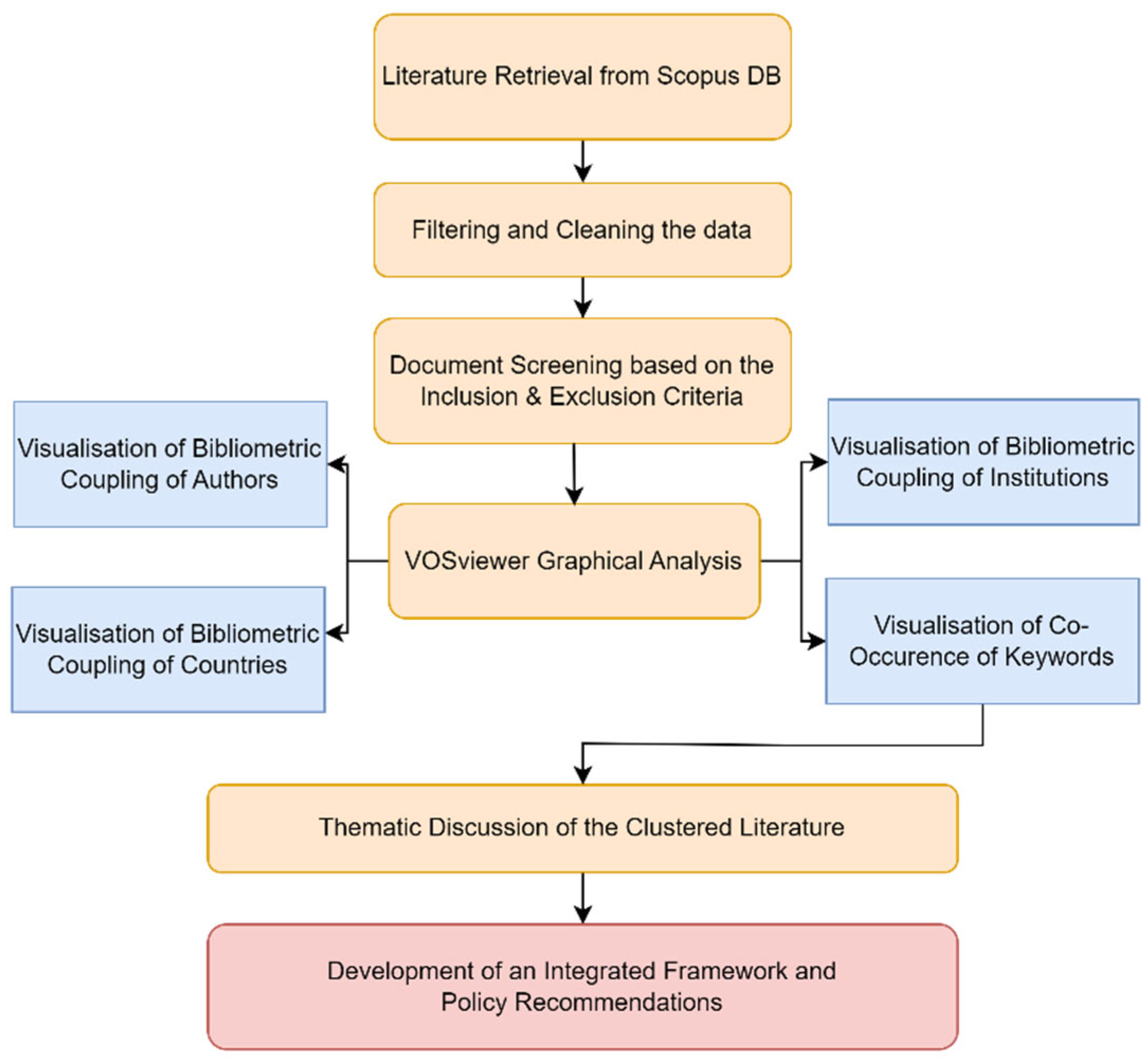

The concept of network (the literature sometimes uses the graph concept) is the constitution of the link and the items. The term cluster (the literature refers to it as a community) emerges when the items are grouped into a specific group that has the same identified characteristics, each item belongs to one cluster and it is not possible to find an item in another cluster (known as the non-overlapping of clusters), and clusters do not include all available items (DOI, publication) but plot only the mined results. Each cluster is displayed in a different colour. Finally, the constructed network is represented by a label and a coloured circle and its size is determined by the weight of the item. This study followed 6 steps in arriving at the review results:

- (1)

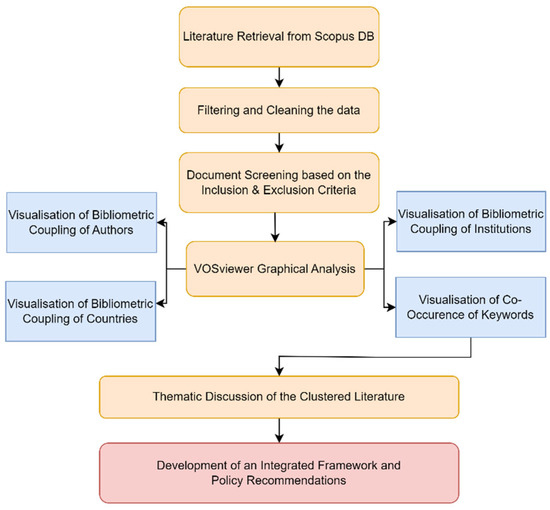

- The literature was retrieved from the SCOPUS database based on a selection of keywords used following the inclusion and exclusion criteria for the systematic-cum-bibliometric review. Using criteria from Table 1, specifying four inclusion criteria for the article to be considered in the analysis, each paper needed to satisfy the four conditions at the same time: it should be in the SCOPUS database, be in the final state of an article form, and include some of the following keywords: FinTech, green FinTech, low carbon, zero carbon, or low-carbon emissions. Moreover, three exclusion criteria were used and any paper that included one of those conditions was removed automatically, all papers need to satisfy the three criteria in order to be regarded, and the articles necessarily need to be in the English language and include related keywords mentioned in the inclusion criteria. Therefore, the inclusion and exclusion criteria were programmed into a logical statement to be implemented in the SCOPUS database. Then, the steps mentioned in Figure 2 would start consecutively.

Figure 2. Flow chart of the systematic-cum-bibliometric review process.

Figure 2. Flow chart of the systematic-cum-bibliometric review process. - (2)

- The records were retrieved in a CSV-structured format and checked for duplicates. The duplication issue may crucially bias the analysis. In the presence of a small number of retrieved publications, the checking can be done manually; however, in the presence of a high number of publications the research study should move to create a script for cleaning the data.

- (3)

- An analysis and screening of papers based on titles, abstracts, and keywords was carried out. This step verifies the two mentioned criteria, the inclusion, the exclusion, and each paper needs to either include or exclude criteria from Table 1.

- (4)

- VOSviewer was used for bibliometric coupling. In this step, a set of bibliometric analyses was conducted based on many criteria such as country, institution, and authors. Results should illustrate the keyword occurrence links between the keywords from Table 1.

- (5)

- A thematic discussion of identified clusters was carried out. The identified clusters should be discussed in line with the previous research results and be contextualised among the current literature.

- (6)

- The development of the integrated framework and policy implications was discussed and, considering this driving structure, should be set as a catalyst for African countries in implementing green FinTech in the transition towards green economic growth.

The study certainly did not bind the search strategy to a specific time period, because defining a specific time period might tie the search trajectories and consequently bias the future research trend, as done in a similar study [26]. Additionally, the mentioned paper considered only the Q1 and Q2 from the Scopus database; a choice that is always under debate [27], including criteria as the JIF quartile concept may open a window of rethinking and requisitioning the optimal method of evaluation in the research community and its impact in diverging the future research trajectories.

4. Results and Analysis

4.1. Digital FinTech Ecosystem and Energy Consumption Trends in African Countries

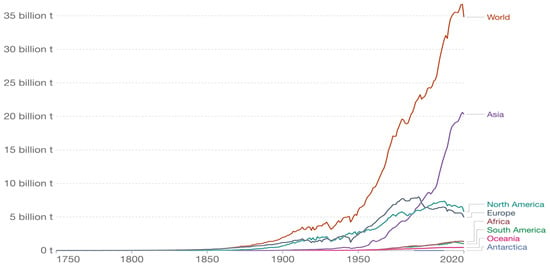

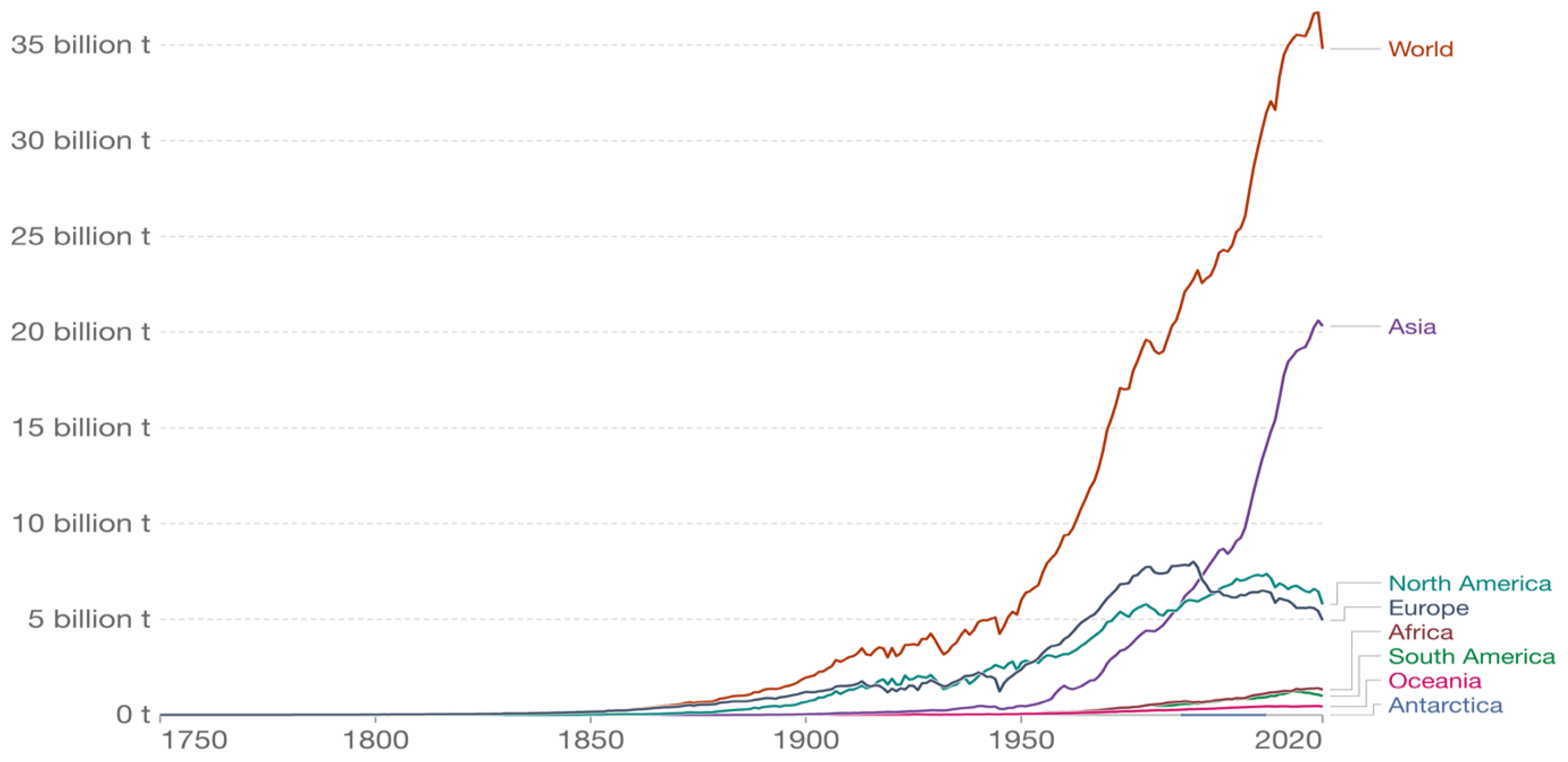

The pending climate change is considered one of the serious global issues that needs attention as it affects the entire planet. As shown in Table 2, the largest contributor of carbon dioxide emissions is Asia, which accounts for about 58.37% of global emissions, followed by North America, which accounts for about 16.60% of global emissions. Africa contributes 1.33 billion tonnes of annual carbon dioxide emissions, about 3.8% of the global carbon dioxide emissions. Antarctica and Oceania contribute the least emissions at 0% and 1.28%, respectively.

Figure 3 illustrates an increasing trend in the carbon dioxide emissions (in billion tonnes) from fossil fuels and industry, without including land use change. Asia is considered the biggest contributor to carbon dioxide emissions, whereas Africa, South America, Oceania, and Antarctica are the least polluting.

Figure 3.

CO2 emissions for different regions of the world. Source: An online database developed originally by [28], https://ourworldindata.org/co2-emissions (accessed on the 20 August 2022).

Figure 3.

CO2 emissions for different regions of the world. Source: An online database developed originally by [28], https://ourworldindata.org/co2-emissions (accessed on the 20 August 2022).

Table 2.

Proportions of CO2 emissions (in tonnes) across regions of the world.

Table 2.

Proportions of CO2 emissions (in tonnes) across regions of the world.

| Regions | Annual Carbon Dioxide Emissions (In Tonnes) | Percentage Contribution |

|---|---|---|

| Asia | 20.32 billion | 58.37% |

| North America | 5.78 billion | 16.60% |

| Europe | 4.95 billion | 14.22% |

| Africa | 1.33 billion | 3.82% |

| South America | 994.16 million | 2.86% |

| Oceania | 444.57 million | 1.28% |

| World | 34.81 billion |

Source: According to the global climate risk index report 2020 [6].

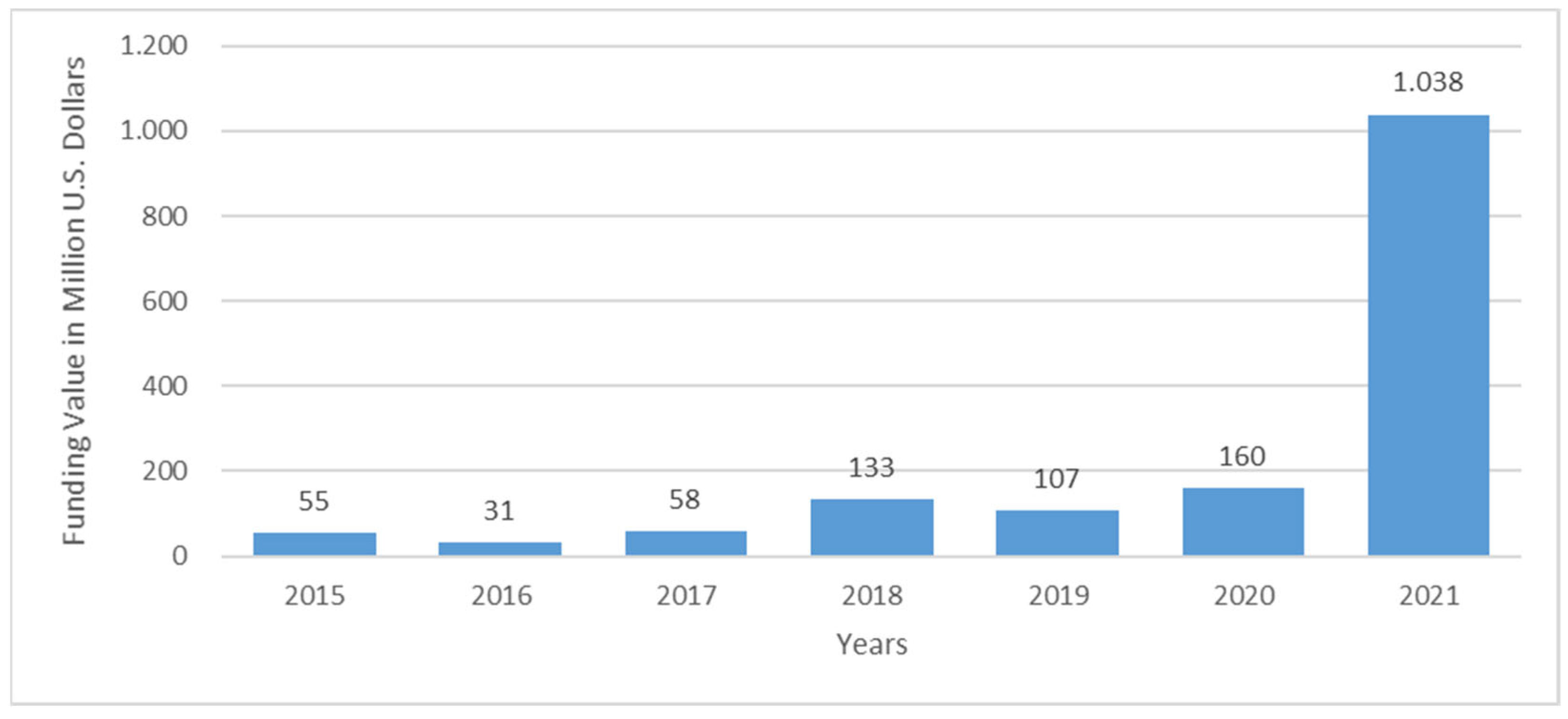

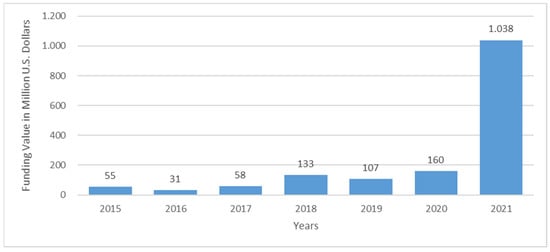

Figure 4 illustrates that, as of 2021, funding to the tune of USD 1038 billion was secured by African FinTech start-ups. This was an exponential increase from 55 million in funding secured in 2015. In comparison, the total venture capital funding for all African tech start-ups was USD 2.1 billion in 2021 (https://www.statista.com/statistics/1278939/funding-value-secured-by-startups-in-africa/, accessed on 30 September 2022). As part of the increased FinTech funding trend, green FinTech emerged at the nexus of FinTech and green economic growth that reduces climate risk impacts. Figure 4 depicts the increasing trend in the financing provided by FinTech start-ups in Africa for the period 2015–2021.

Figure 4.

Funding secured by FinTech start-ups in Africa from 2015 to 2021. Source: Statista, https://www.statista.com/statistics/1249965/african-fintech-startups-funding/ (accessed on 10 August 2022).

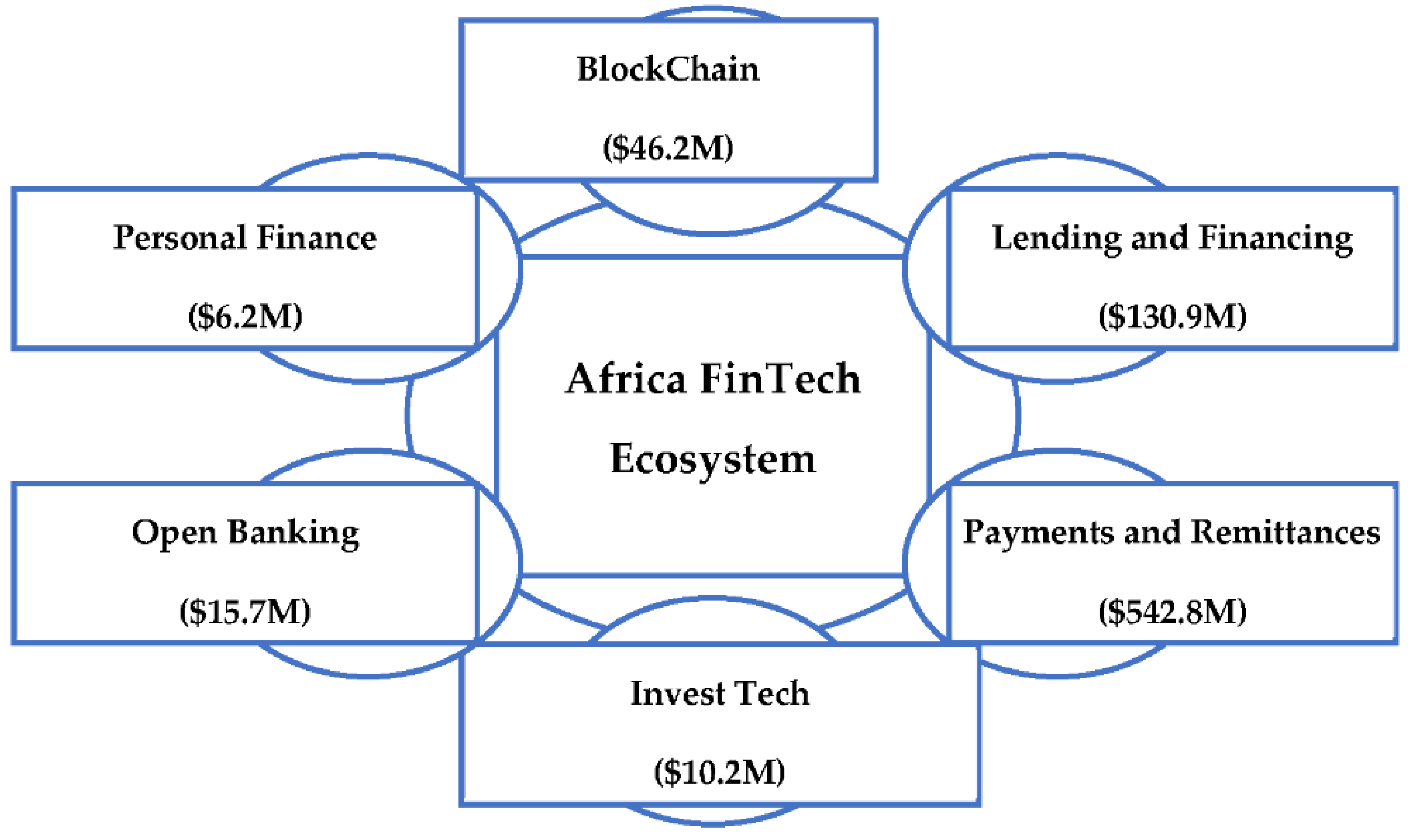

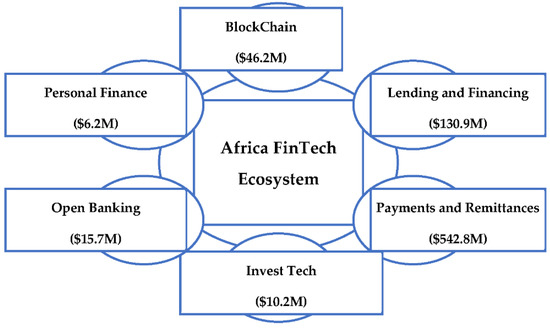

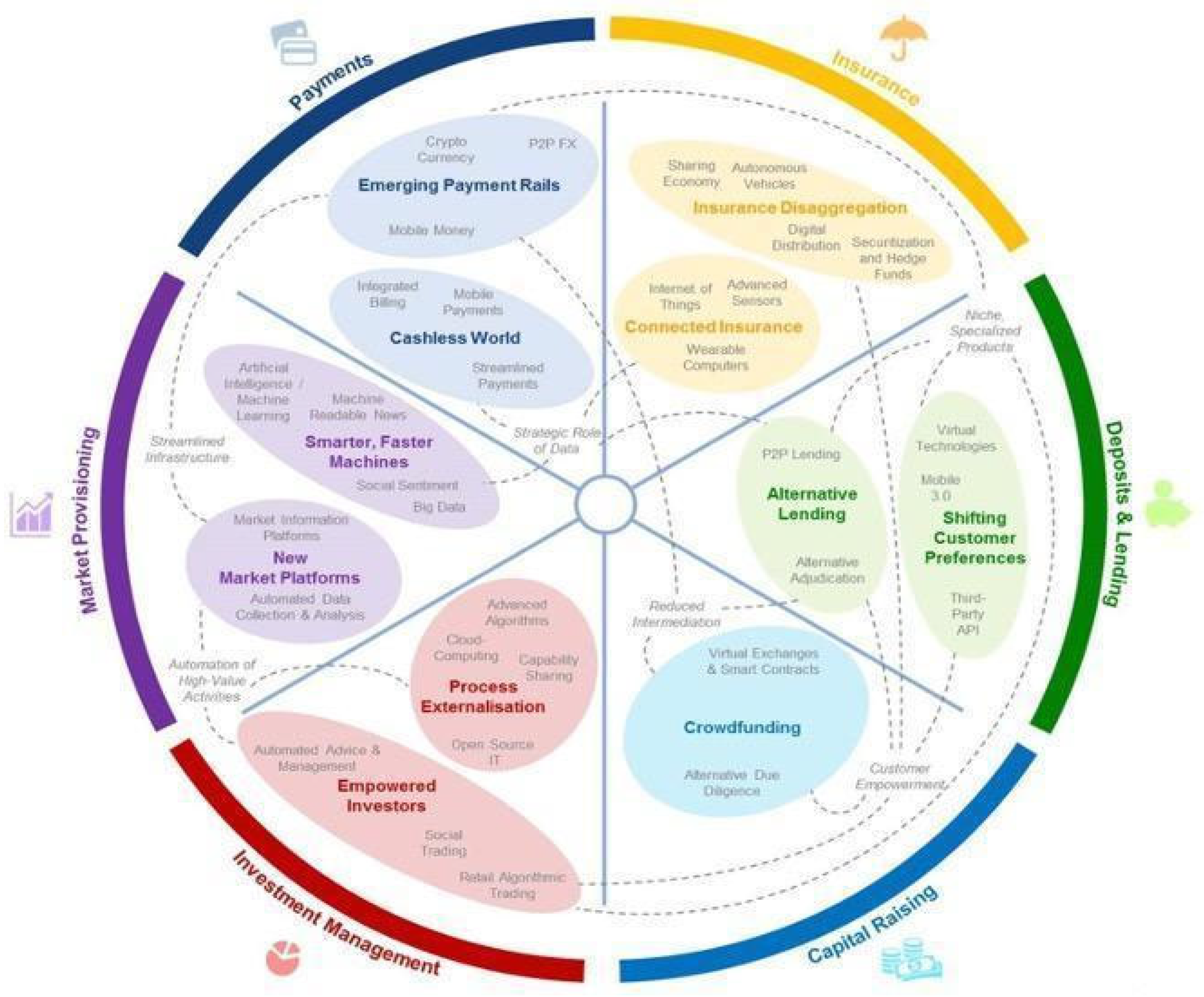

While the world moves toward reducing carbon dioxide emissions, the African countries show some promising direction regarding their FinTech ecosystems that includes payments and remittances, lending and financing, insurance, InvesTec, personal finance, blockchain, and open banking. The magnitude of the opportunity and the impact of FinTech is large. For example, the unbanked masses in many African countries have easily adopted the money channels, thus increasing financial inclusion and access. Figure 5 illustrates the key segments of the FinTech industry in Africa, which is a derivative of the fully-fledged global digital ecosystem illustrated in Figure A1 (see Appendix A.1).

Figure 5.

Digital finance ecosystem in Africa. Source: See [29].

The financial system ensures the interconnection between lenders and borrowers and this economic cycle stimulates economic growth toward the process of investing and saving [30]. However, this exchange masks great issues, for instance, asymmetric information between financial agents due to the uneven distribution of information [30]. The conventional system covers these asymmetric information risks by increasing the costs, leading to low efficiency and making the business fail, as seen in the financial crisis of 2007-08. Green FinTech offers promising solutions such as blockchain and cryptocurrencies to reduce or even eliminate this information failure [31]. To achieve this, blockchain uses a data-driven model that connects internal and external data from both sides of the contract to increase transparency. It can also be used at the macroeconomic level in addressing global issues such as reducing the production of energy [32], allocation, utilisation, or even agri-food chains [31] that crucially harm economic growth and socioeconomic stability.

As found in much recent research, FinTech innovation can promote green finance and increase green credit and green investment [33]. The use of a green cycle of instruments and projects in a country leads to enduring green sustainability for future generations. The discussed ecosystem elements mentioned in Figure 5 can be used as instruments for a transition toward green economic growth. One of the objectives of this study is to design an integrated framework of FinTech as an enabler of the transition to green sustainability for African countries, which should be used as a cornerstone in designing and implementing FinTech projects.

4.2. Bibliometric Review Results and Analysis

Table A1 in Appendix A.2 summarises the results of the 35 research articles retrieved in the systematic-cum-bibliometric review of the research connected to green financial technology and green economic growth and states the title of the journal article, the title of the journal, the year of publication, and the main focus of the paper.

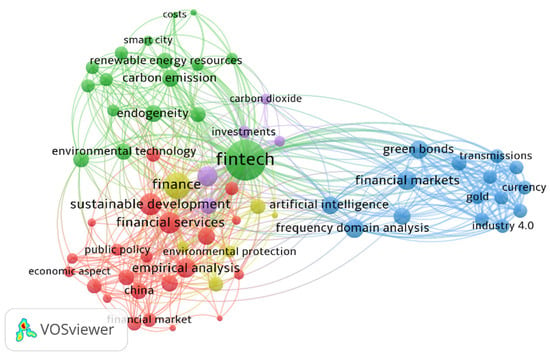

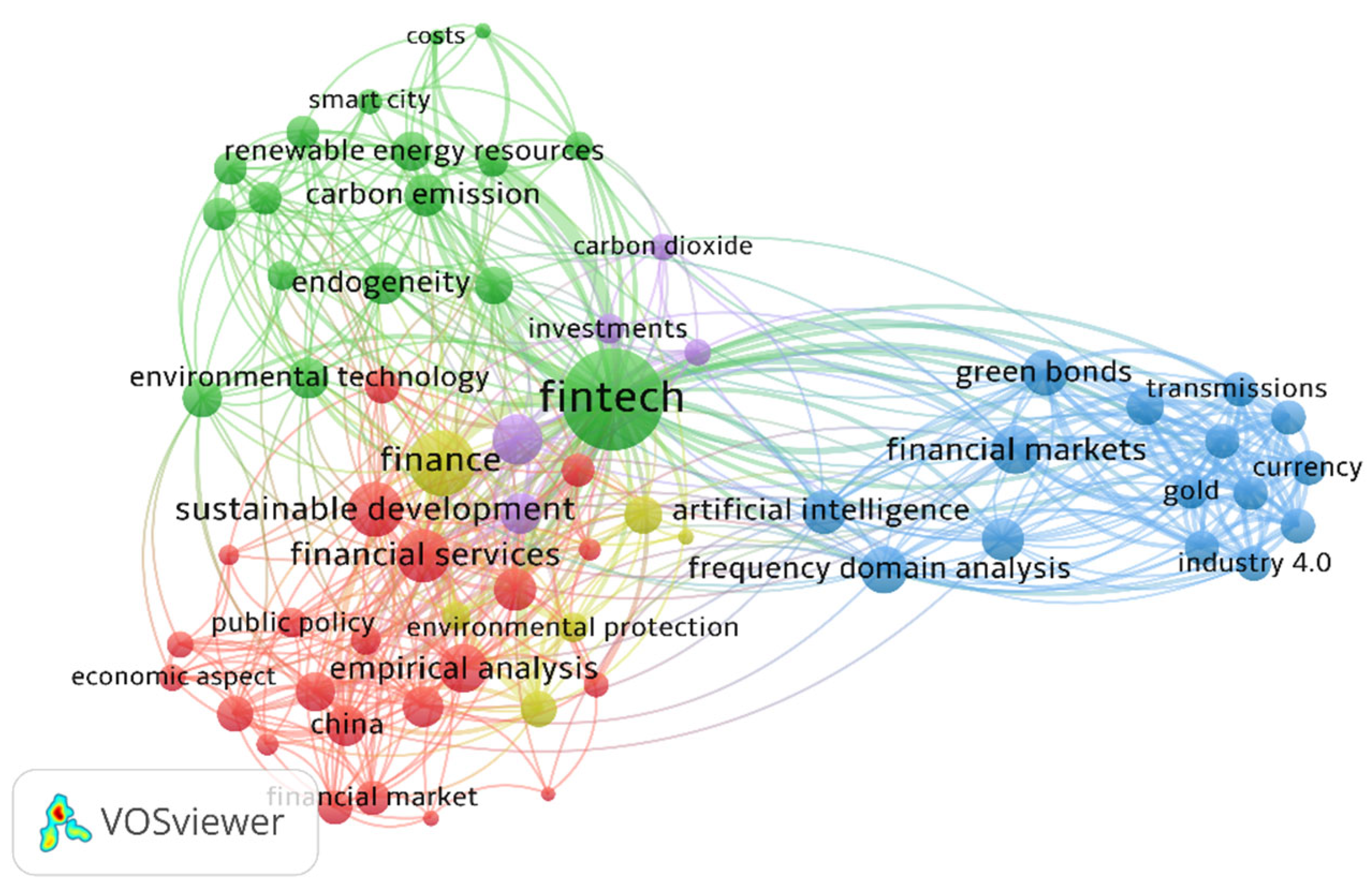

Figure 6 illustrates the keywords that most frequently appear in the 35 articles encountered in the systematic-cum-bibliometric review.

The first bibliometric analysis was conducted using the co-occurrence networks that used the occurrence of keywords as units of analysis (keywords are the items of this analysis). VOSviewer has three possible units of analysis as an option (all keywords, author keywords, index keywords) and, by choosing the first option, the best results are mined in terms of quantity of all possible texts in the dataset. The next step to generate Figure 6 is to choose the threshold, which is the minimum number of occurrences of a word. The number of results declines with an increase in the threshold. Consequently, the most connected keyword according to the co-occurrence network is the FinTech keyword determined by the size of the circle; the FinTech keyword has a link with all other keywords. Figure 6 also determines five clusters based on link weight.

Figure 6.

Co-occurrence analysis of keywords using all keywords as units of analysis.

Figure 6.

Co-occurrence analysis of keywords using all keywords as units of analysis.

The five generated clusters are all connected with the FinTech keywords. The first identified cluster (red colour) contains 22 items (in the co-occurrence analysis, the items are keywords) such as (China, climate change, financial regulation, public policy, etc.). Retrieving a word such as “China” in a cluster means that China is one of the countries interested in the FinTech concept and this may be due to many factors such as the level of environmental degradation in China. A word such as “financial regulation” in the same cluster illustrates the connection between China as a country and the regulation concept. The second cluster (green colour) has 17 items, followed by cluster number three (blue colour) with the most mined keywords considered to be instruments and products used in the FinTech industry. The fourth cluster (yellow colour) contains six items and the final cluster (violet colour) has the lowest number of items (five items).

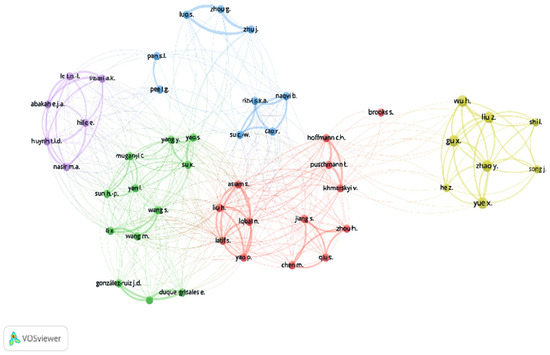

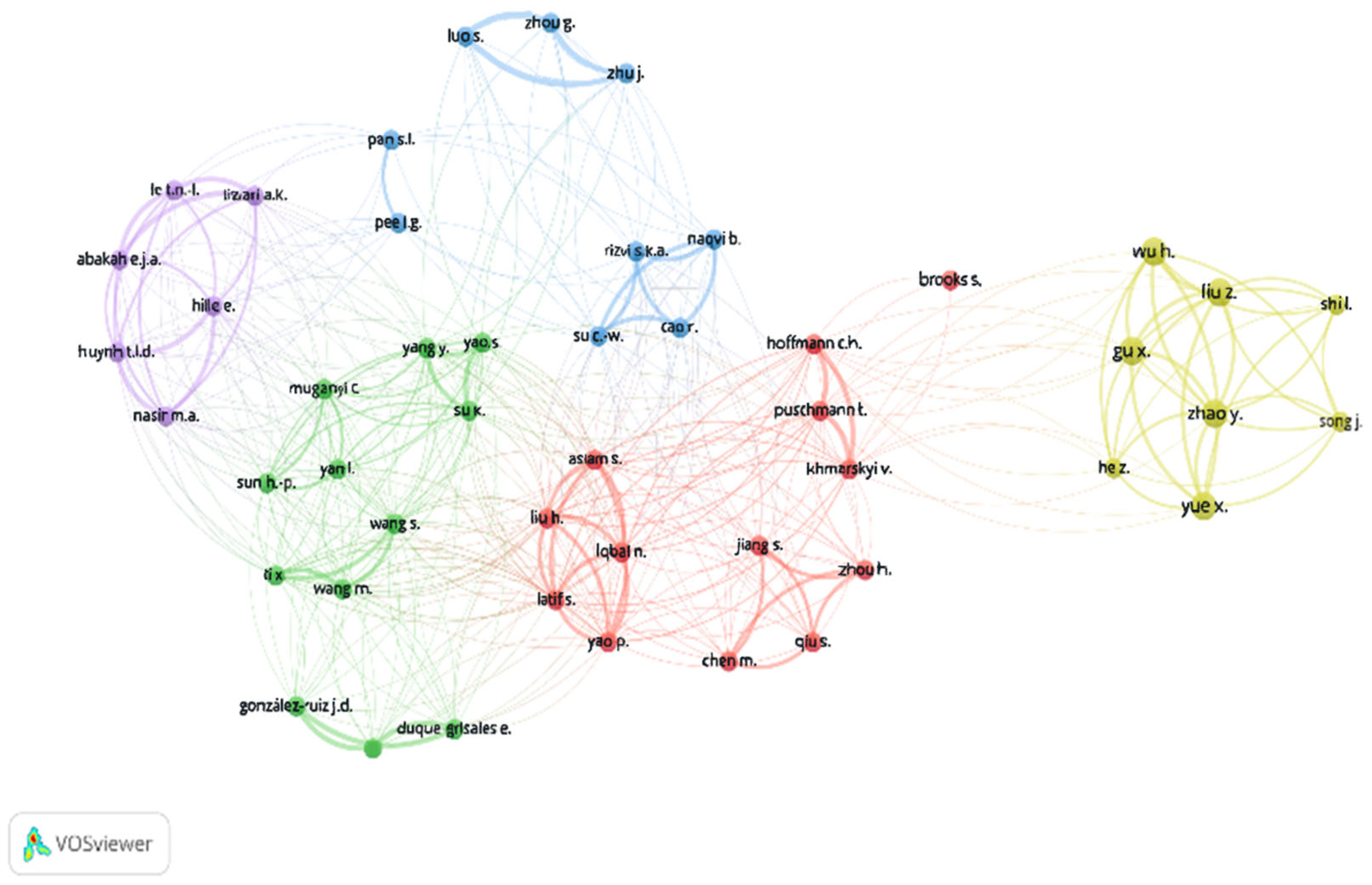

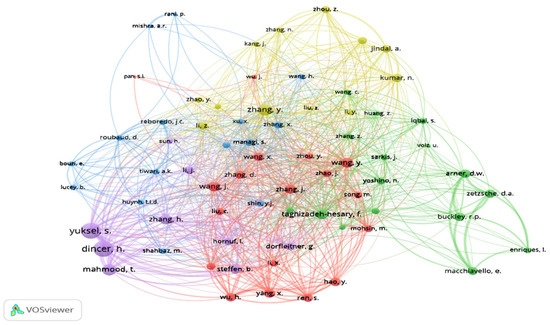

The co-citation analysis network depicted in Figure 7 illustrates the item similarity between the 35 encountered documents during the systematic-cum-bibliometric review related to green FinTech and green economic growth; five clusters were identified. The co-citation analysis has three units of analysis (cited references, citer source, cited author). Figure 7 displays the cited author option; five clusters were identified.

The first and largest cluster has 13 items (red colour), the second largest cluster has 12 items (green colour), the third cluster has 9 items (blue colour), the fourth cluster has 8 items (yellow colour), and the fifth but smallest cluster has 6 items (violet colour).

Figure 7.

Co-citation analysis of authors using cited author as unit of analysis.

Figure 7.

Co-citation analysis of authors using cited author as unit of analysis.

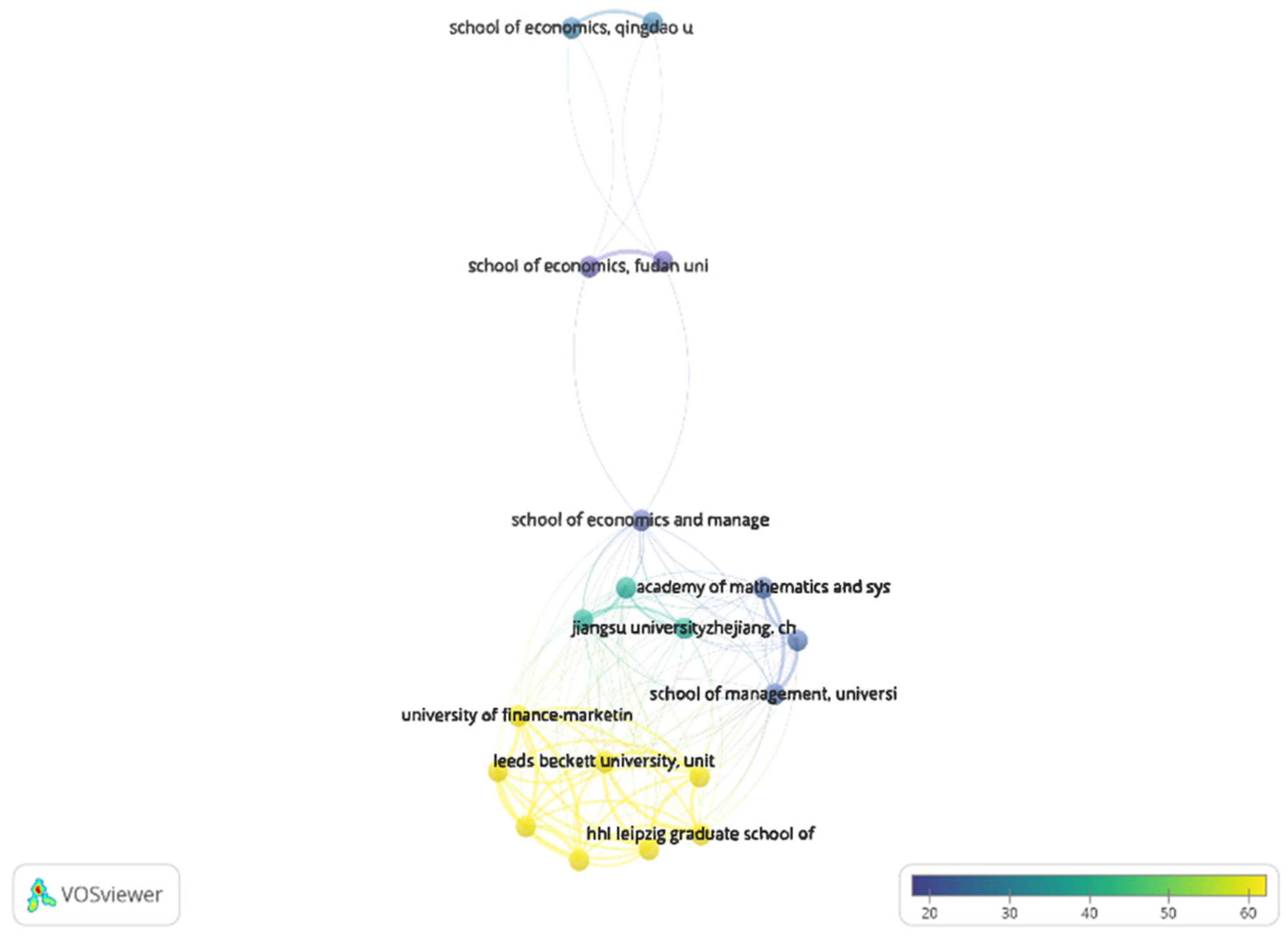

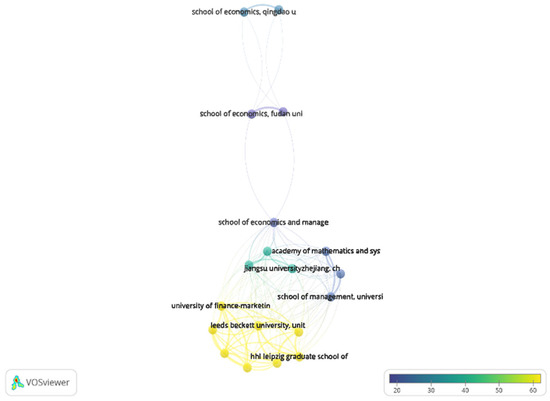

Figure 8 illustrates the bibliometric coupling of institutions that occurs when journal articles from a minimum of two institutions cite a journal article from a third institution. We identified four clusters; Jiangsu University in China is considered to be one of the most highly ranked and prestigious institutions in China. According to the bibliometric coupling network, Jiangsu University is amongst the most influential research actors in the space of FinTech and green economic growth.

Figure 8.

Bibliometric coupling of institutions using institution names as units of analysis.

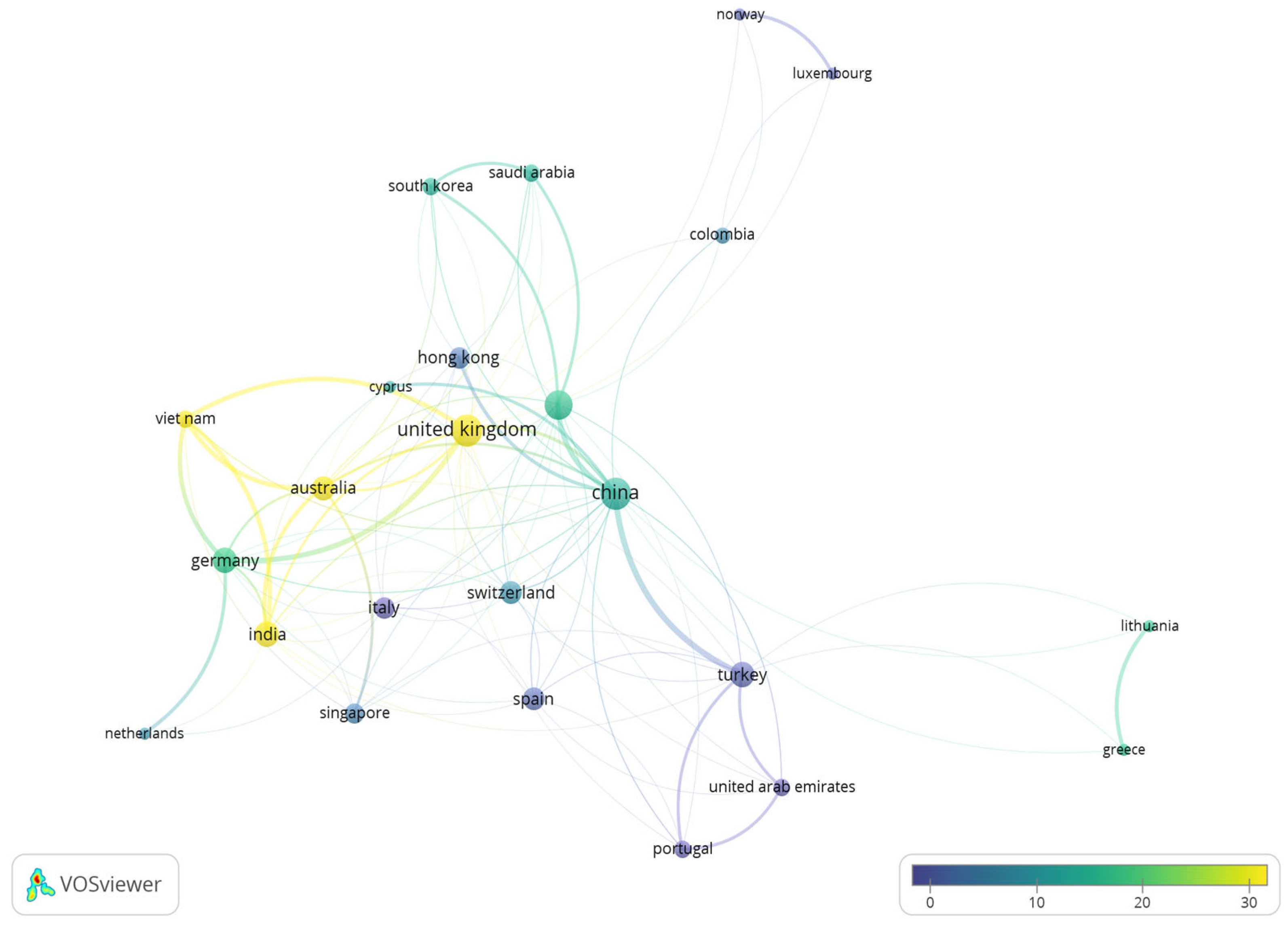

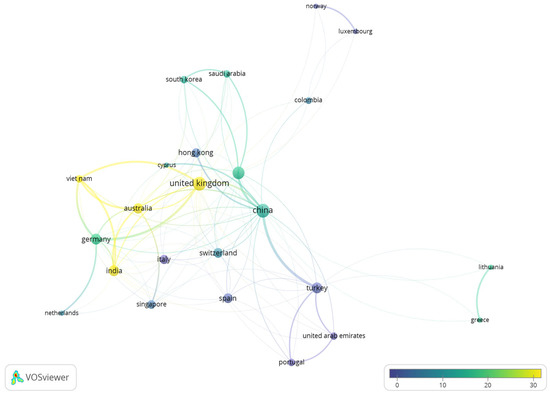

Correspondingly, the results of the bibliometric coupling by countries show that the most dominant country in the FinTech research field is China (see Figure 9), which confirms the results found in Figure 6, where the keyword “China” figures as one of the most occurred words in cluster one (red colour), as it contributes more to the FinTech-related research.

Figure 9.

Bibliometric coupling of countries using countries as units of analysis.

According to Table 3 and Figure 9, China has the highest citations, standing at 213, with 16 documents having 213, as shown in Table 3. This means that the research output from China has the most influence in this study within the field of the green FinTech industry. If we take the number of documents as the attribute of analysis, the United Kingdom ranked in second class with six documents in total, followed by Germany with four documents.

Table 3.

Top 10 countries’ bibliometric coupling results based on total link strength.

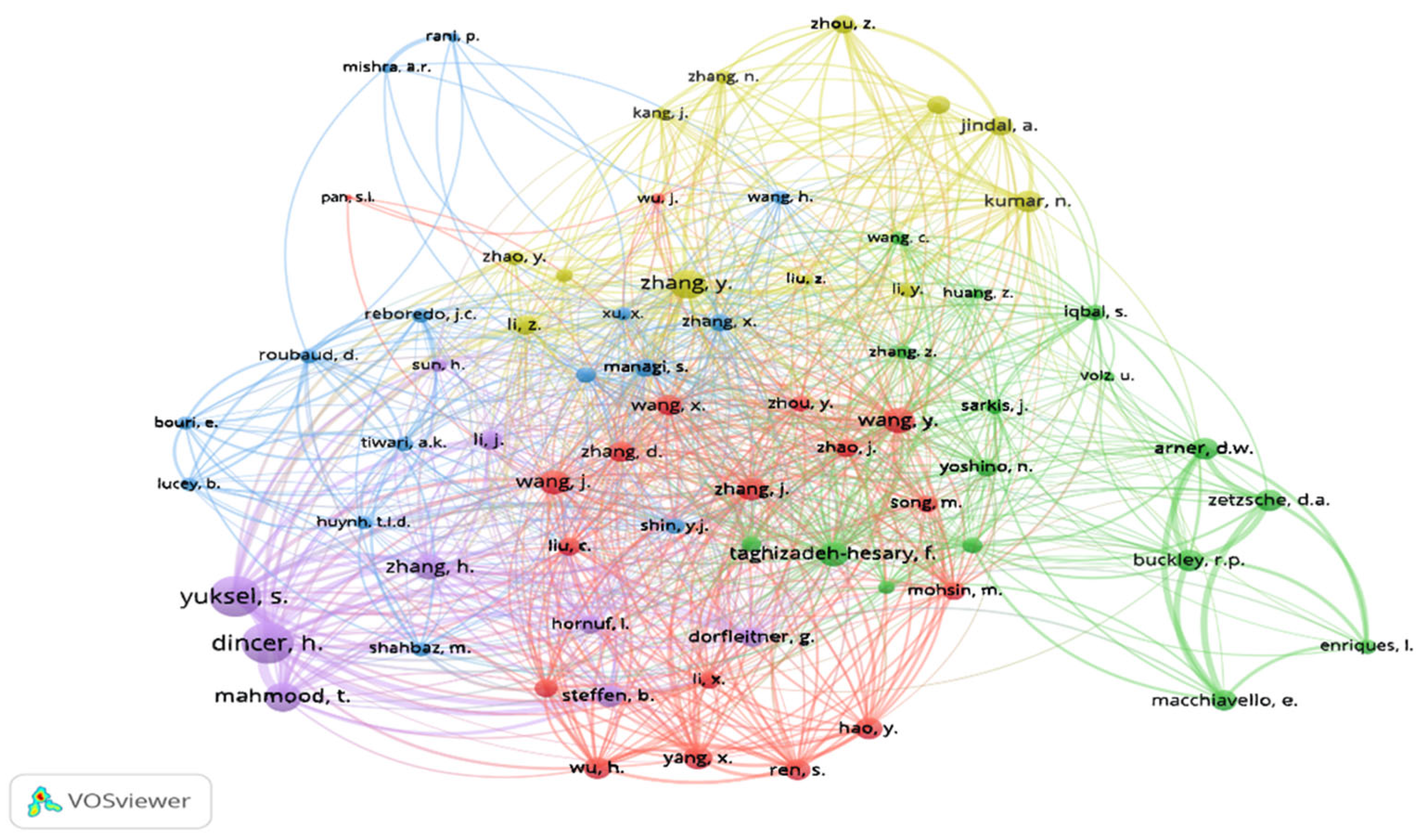

Figure 10 illustrates the bibliometric coupling of the authors. In principle, a bibliometric coupling uses citations to establish the extent of similarity between documents. The author (Dincer, 2021) (as displayed in Figure 10) has the highest total link strength alongside (Yuksel, 2021) of 1299; this means they are the two most influential authors in terms of bibliometric coupling in the field of green FinTech research.

Figure 10.

Bibliometric coupling of author analysis.

Moreover, the analysis identified five clusters based on the bibliometric coupling of authors (the author’s name as a unit of analysis). The above-retrieved results and findings will be used as a cornerstone for creating the integrated framework that links the FinTech concept with green economic growth.

4.3. An Integrated Framework of FinTech to Ensure the Green Sustainable Economic Growth of African Countries

Based on the list of articles described in Table A1, we identified the key clusters of the systematic-cum-bibliometric review shown in Table A2 in Appendix A.3. Based on these clusters, we are able to identify policy and research gaps and opportunities and challenges which can inform governments to engage and explore digital finance as a tool to achieve green economic growth for African countries.

Cluster one, represented by the blue colour (see Figure 6), illustrates the technology and instruments in digital finance. Cluster two, represented by the red colour, represents studies under the themes of regulation, policies, and green FinTech. Cluster three, represented by the purple colour, includes studies covered by the climate risk mitigation theme through FinTech. Cluster four, shown as the green circles, covers studies that fall under the theme of FinTech and environmental quality. Cluster five, in the lemon colour, represents the literature under the themes of green finance and climate change mitigation.

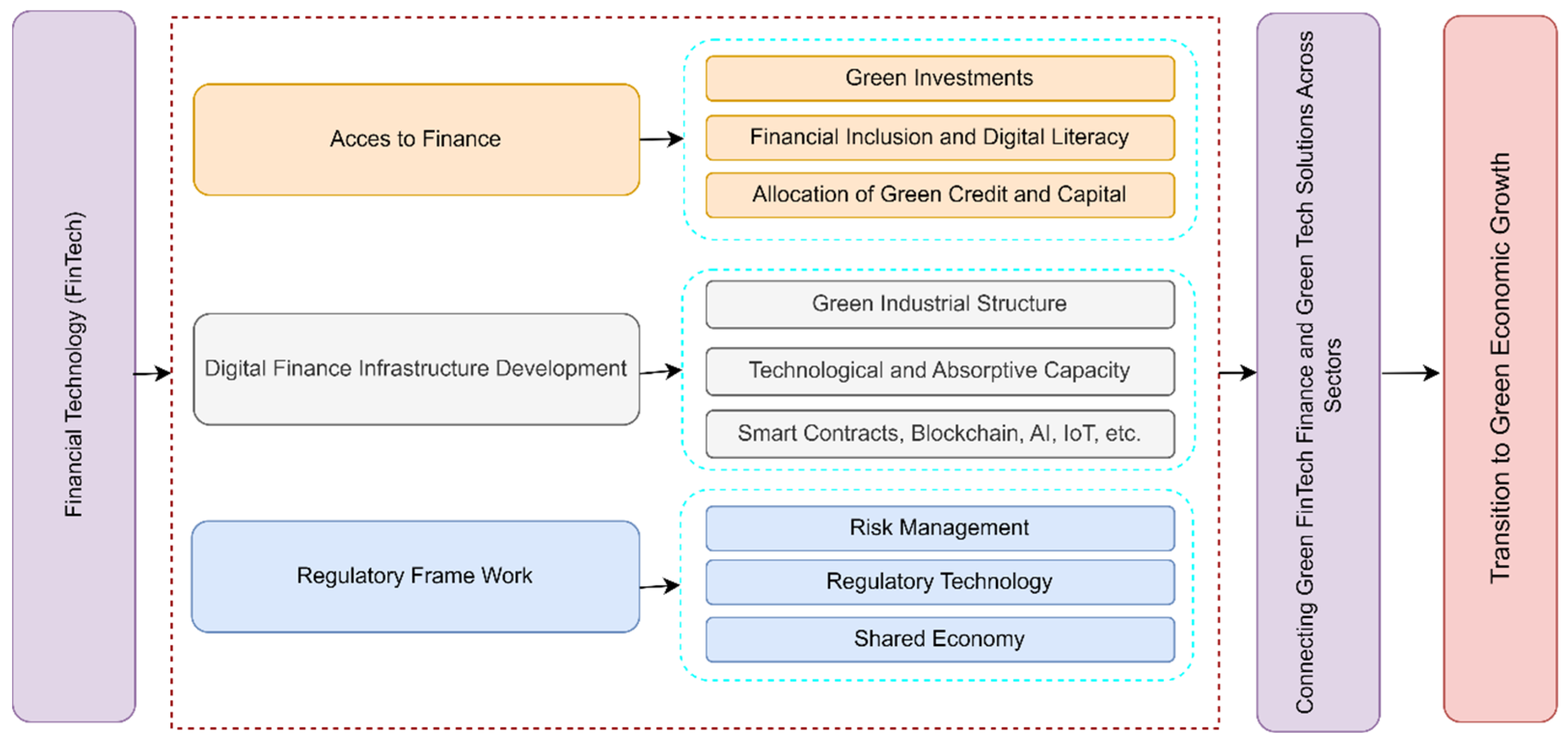

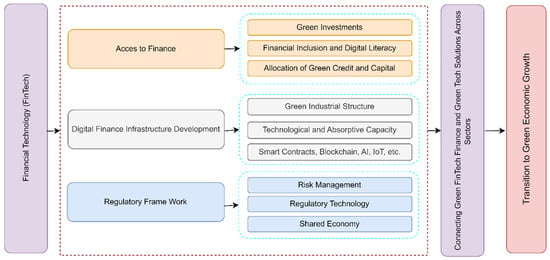

Based on the five-identified clusters, an integrated framework was conceptualised that aims to deliver green economic growth using FinTech as a vehicle of transition for African countries; see Figure 11.

Figure 11.

Integrated framework of FinTech as an enabler of sustainability in Africa. Source: Authors’ elaboration.

The integrated framework is composed of three primary pillars: (1) access to finance, which covers green investments and highlights the importance of financial inclusion and digital literacy in accessing finance for green projects; (2) digital finance infrastructure development, which is premised on developing a green industrial structure in developing countries and underscores the importance of both technological and absorptive capacity as well as the peculiar digital technology such as smart contracts, artificial intelligence, and blockchain; (3) regulatory framework that takes cognisance of principles of shared economy, efficient regulatory technology, and risk management. Once these elements are in place, green FinTech finance can be connected to green tech solutions across all industries contributing to green economic growth. Since green FinTech is found to be in great harmony with the environment, has a great advantage in reducing climate risks and environmental degradation costs compared with traditional instruments, and is easily accessible, green FinTech holds the hope for African countries to acquire the necessary conditions for sustainability and to avoid the long faltering expectation by its population.

5. Discussion

This systematic-cum-bibliometric review aimed to address the following question: what are the roles and opportunities of implementing FinTech as an incentive for African countries in the transitional process to green economic growth?

The analysis extracted 35 research papers using criteria from Table 1. The results illustrate an increasing trend in research attention towards the green FinTech concept and its relationship with economic growth, climate change, and greening rules and policy.

This research topic started to receive attention earlier in 2019, as also found by [31]. According to Table A1, only 1 paper was published in 2019; 9 papers in 2020; 14 papers in 2021; 11 papers in 2022. The evolution of numbers shows an increasing trend (by the end of year 2022 the number will surely be superior to 2021). Therefore, this topic of green FinTech and economic growth is receiving attention.

However, a close inspection of the 35 article shows no frequently appearing research directions, since the publications are spread across different topics. The authors in [31] noted that research is scattered in terms of techniques used to verify certain hypotheses surrounding green FinTech. They also argue that research is significantly limited by the availability of certain FinTech statistics. On the other hand, some scholars attempted to construct robust composite indicators [33], e.g., Ref. [34], to capture green FinTech policies at the macro- and microeconomic levels. Interestingly, new research attempts to introduce artificial intelligence-based methods [35,36,37] to overcome the limitations of the conventional techniques and to reduce the error term.

In an era of big data, many traditional models show shortages in computational capability and convergence issues. Additionally, most econometric models were incapable of solving models in the presence of multiple sets of variables. At this point, artificial intelligence-based models gained renewed respect and became the new pathway among the retrieved papers [35,36,37,38,39,40].

Most papers use the data-driven scientometric analysis [31,41,42,43,44,45,46,47,48,49,50], basically aimed to investigate the progress and the possible trajectories bordering the FinTech knowledge area. Other research publications use different panel data models, owing to the lack of long time series data related to FinTech indicators and the greening policy [44]. Panel data were the suitable solution proposed by many scholars; methods go from linear regression modelling [33,51] to complex models such as GMM and 2SLS models [38,52,53,54,55]. However, other papers scattered between ranking techniques such as the fuzzy methods in the decision-making process [32,35,37,38] and time series modelling techniques [12,34,56,57].

Finally, only a few studies use microeconomic models such as the Cournot competition mechanism and mechanism design approach [58] and the Bayesian game with incomplete information [59]. These results shows that there is a diversification in methods used to approach the nexus between green FinTech and economic growth.

By inspecting all papers from Table A1 using co-occurrence analysis, five key clusters were identified, as illustrated in Figure 6.

5.1. Cluster One: Technology and Instruments in Digital Finance

The first cluster illustrates the technology and instruments used in green FinTech. These instruments include: green credit and green investment [33], green bonds [34,38], the equity sharing model for FinTech-based financing alternatives [38], equity financing, and four different FinTech-based financing alternatives mentioned in [36]. Other instruments include: blockchain technology, cryptocurrencies [34], green InsurTech solutions in the insurance sector [31], as well as the use of P2P trading models to trade energy-related carbon emissions’ quota [60].

5.2. Cluster Two: Regulation and Policies in Green FinTech

The second cluster discusses regulations and policies used to stimulate the transition to green FinTech. Some of the regulations need the support of governments. The authors in [53] noted that governments should support R&D that promotes FinTechs to dynamically contribute to green finance and eco-friendly initiatives that endorse greening concepts whilst also reducing the systemic risk that FinTech poses. The publication by the authors in [48,61], noted that, at the macroeconomic level, several policies can be employed such as a carbon tax policy, a government subsidy policy, a green bond policy, and an investment policy.

5.3. Cluster Three: Climate Risk Mitigation through FinTech

With the pending climate emergency, green FinTech has shown to be a promising solution for the world to minimise certain impacts of climate change. Researchers reacted to the climate-changing risks and have suggested many possible solutions using financial products; for instance, using DLT frameworks can reduce risks between the green finance actors [62]. The authors in [32] posit that, whilst the energy sector holds the responsibility for the climate change, FinTech provides an opportunity for the use of clean energy. Furthermore, the authors in [36] noted that FinTech provides an additional avenue through which equity-based financing can be used in green energy investment projects.

5.4. Cluster Four: FinTech and Environmental Quality

Many researchers suggest that FinTech has the potential to reduce environmental degradation. Moreover, the authors in [51,53] posited that green financial policies have been found to decrease CO2 emissions in China. In the same frame, the authors in [61] argued that overall green FinTech-based rules and standards produce a positive environmental effect.

5.5. Cluster Five: Green Finance and Climate Change Mitigation

One of the most challenging matters regarding the mitigation of climate change is financing. How can governments, NGOs, and policymakers supply funding for start-ups and firms active in green FinTech? The study by the authors in [33] highlighted that green economic growth requires green credit, distribution of green loans, and financing green investments. The authors in [53] noted that the greater a country’s level of green financial innovation the lower its carbon emissions will be, resulting in reduced climate risks. Some researchers, such as [36], suggest that equity financing is the most suitable alternative for clean energy investments in the future. Moreover, the publication by [48] stated that international public policies related to green finance are of significance for global sustainable development.

Generally, the findings suggest the need for further exploration of the intersection of green growth and FinTech in the context of African countries. This paper synthesised the publications and presented five clusters that link green FinTech with climate change and economic growth. Classifying the retrieved papers into clusters shows us the trajectories of research, as most scholars were interested in developing FinTech instruments to address the climate change risks and environmental degradation. Moreover, we found out that there is a dearth of research that investigates the rules and standards to promote green FinTech policy in developing countries. As we think, those results can significantly uncover the advantage of green FinTech that has already been proven in developed countries and started to be used recently in Africa. The integrated framework developed should be used as a tool of transition to green economic growth for African countries. The adoption of the integrated framework can leverage from the mentioned technologies such as AI, IoT, and machine learning, as well as financial instruments such as green bonds and hedging instruments developed to address global risks.

Compared with the previous studies addressing the same question, the authors in [63] obtained 1002 publications. This large number is due to the less stringent inclusion and exclusion criteria. The authors in [63] also used four different databases; this can result in duplications of papers, since some journals can be indexed in more than one database. The current study managed to capture the same technologies and green financial instruments found by the authors in [63,64], with some novel products introduced between 2020 and 2022, such as the blockchain-backed P2P platform that enables green financing using smart contracts as documented in [58].

6. Conclusions

This paper aims to explore the nexus between green growth and FinTech by employing a systematic-cum-bibliometric analysis related to published papers in the Scopus database. Firstly, the study examined the role and the opportunities of implementing green FinTech as a stimulus of transition towards green economic growth in African countries. Secondly, the study explored a set of knowledge gaps and determined future policy and research directions. The third purpose of the study was to develop an integrated framework that can be used to facilitate the transition process to green economic growth using green FinTech for African countries. Against this background, the analysis extracted 35 research papers. The results illustrated an increasing trend in research focus given to green FinTech and economic growth. The research on the topic started gaining momentum in 2019, which implies that the question of green FinTech and economic growth is starting to receive considerable attention. A deep inspection of the mined papers shows that the research trajectories can be clustered into five different themes: the technology and instruments in digital finance, regulation and policies and green fintech, climate risk mitigation theme through FinTech, FinTech and environmental quality, green finance and climate change mitigation. Based on these clusters, an integrated framework was conceptualised to deliver green economic growth using FinTech as a vehicle of transition for African countries.

Whilst most African countries show a lack of funding to support the adoption of green FinTech as an enabler of the transition to sustainability, the publications in this study have indicated that FinTech can indeed be a pathway to reducing climate change risks and to attaining green economic growth. The study also indicated that there is a dearth of research on the nexus of green FinTech and economic growth in African countries. As such, we suggest that an eminent future research direction is a time series/panel data analysis that evaluates the impact of green FinTech on economic growth in African countries.

Author Contributions

Conceptualization, P.T., H.O. and E.h.O.; methodology, P.T.; software, P.T.; validation, E.h.O., P.T. and H.O.; formal analysis, E.h.O.; investigation, E.h.O.; resources, H.O.; data curation, P.T.; writing—original draft preparation, P.T. and E.h.O.; writing—review and editing, H.O.; visualization, P.T.; supervision, H.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Appendix A.1. Global Digital Ecosystems

Figure A1.

Global digital ecosystems. Source: See [65].

Figure A1.

Global digital ecosystems. Source: See [65].

Appendix A.2. Tabulated Results of the Systematic-Cum-Bibliometric Analysis

Table A1.

Results of the systematic-cum-bibliometric analysis.

Table A1.

Results of the systematic-cum-bibliometric analysis.

| Article | Title | Year | Journal | Focus | Methodology |

|---|---|---|---|---|---|

| [56] | “Analyzing the relationship between energy efficiency and environmental and financial variables: A way towards sustainable development” | 2022 | Energy | Investigating the association of the energy effectiveness, energy research, pollution mitigation, and FinTech. The study discusses the need to integrate financial technologies that will provide funding for energy efficiency and climate risk mitigation. | Granger causality test |

| [51] | “Impact of fintech and green finance on environmental quality protection in India: By applying the semi-parametric difference-in-differences (SDID)” | 2022 | Renewable Energy | Discusses whether India’s green finance associated with policies have directed a substantial decrease in industrial CO2 emissions during the period 2010–2020. | Text analysis approach and panel data |

| [41] | “Scaling up sustainable investment through blockchain-based project bonds” | 2022 | Development Policy Review | Discussion of opportunities of organising domestic savings using FinTech instruments to obtain sustainable green investment. | Literature review |

| [43] | “Climate-intelligent cities and resilient urbanisation: Challenges and opportunities for information research” | 2022 | International Journal of Information Management | Highlighting four future research directions (intelligent governance, energy and resource optimisation, digital citizen engagement, and climate-neutral digital economy). | Literature review |

| [44] | “Regulating Sustainable Finance in the Dark” | 2022 | European Business Organization Law Review | Analysing the revised EU Sustainable Finance Strategy disclosed. | Document analysis method |

| [33] | “The impact of fintech innovation on green growth in China: Mediating effect of green finance” | 2022 | Ecological Economics | Constructing a composite indicator to assess the effect of green growth using panel data modelling. | Panel data from 2011 to 2018 using mixed regression, fixed effect, and random effect |

| [32] | “Impact of Green financing, FinTech, and financial inclusion on energy efficiency” | 2022 | Environmental Science and Pollution Research | Evalutating the consequence of green investment, financial inclusion, and financial technology on the energy effectivness. | Non-parametric mathematical technique in which decision-making unit (DMU) is quantified |

| [45] | “Sustainable Finance and Fintech: Can Technology Contribute to Achieving Environmental Goals? A Preliminary Assessment of Green Fintech’ and ‘Sustainable Digital Finance” | 2022 | European Company and Financial Law Review | Discussing the Digital Finance/Fintech Action Plan and the Sustainable Finance Strategy, both representing important pillars of the current EU policy agenda. | Literature review |

| [46] | “Digital Finance and Beyond in the Third Decade of the 21st CenturyObservations with a Focus on the EU Policy and Legal Perspective” | 2022 | European Business Law Review | Explores critically digital finance in the third decenium of the twenty-first century. Focus lies on the more general policy and legal approach to digital finance at the EU level. | Literature review |

| [52] | “Is the sustainability profile of FinTech companies a key driver of their value?” | 2022 | Technological Forecasting and Social Change | Assessing the impact of FinTech companies on their future value. | Dynamic GMM system and Panel Corrected Standard Errors (PCSE) static |

| [53] | “Can Fintech development pave the way for a transition towards low-carbon economy: A global perspective” | 2022 | Technological Forecasting and Social Change | Questioning the effect of FinTech progress on the transition toward lowering of carbon emissions and greenhouse gases. | 2SLS and GMM estimations |

| [38] | “Consensus-based multidimensional due diligence of fintech-enhanced green energy investment projects” | 2021 | Financial Innovation | Evaluation of the multidimensional due diligence of FinTech alternative products in the context of financing green energy projects. | The spherical fuzzy DEMATEL methodology |

| [54] | “Nexus between green finance, fintech, and high-quality economic development: Empirical evidence from China” | 2021 | Resources Policy | Assessing the effect of green FinTech and green projects on the long-run economic growth using empirical methods. | Two-step generalised method of moments (GMM) |

| [35] | “Fermatean fuzzy critic-copras method for evaluating the challenges to industry 4.0 adoption for a sustainable digital transformation” | 2021 | Sustainability (Switzerland) | A ranking method to explore the challenges of adopting the industry 4.0 by the FinTech firms. | Fuzzy CRITIC COPRAS method for ranking |

| [47] | “The role of green finance in community renewable energy projects of main region and taiwan” | 2021 | Lex Localis | This paper adopted a document analysis method to seek more diversified financing channels compared with traditional ways of financing and lending from financial institutions. The combination of FinTech and the power of the masses, such as crowdfunding, has become one of the emerging financial instruments for the development of the green energy industry. | Document analysis method |

| [61] | “Green finance, fintech and environmental protection: Evidence from China” | 2021 | Environmental Science and Ecotechnology | Assessing the impact of green FinTech standards on China’s economy. | Semi-parametric Difference-in-Differences (SDID) in panel data context |

| [48] | “Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis” | 2021 | Energy Policy | Plotting the future research trends of the green FinTech and energy rules and standards. | Data-driven scientometric analysis |

| [58] | “Poverty mitigation via solar panel adoption: Smart contracts and targeted subsidy design” | 2021 | Omega (United Kingdom) | This paper evaluates the instrumental value of smart contracts towards poverty mitigation in developing economies. | Cournot competition mechanism and mechanism design approach |

| [62] | “Leveraging blockchain technology for innovative climate finance under the Green Climate Fund” | 2021 | Earth System Governance | The case of the Green Climate Fund to explore how distributed ledger technologies can be used for innovative climate finance. | Distributed Ledger Technology (DLT) system models |

| [55] | “Impacts of financial technology on urban-rural income gap in the context of green sustainable development” | 2021 | Journal of Environmental Protection and Ecology | Exploring impact degrees of FinTech on the URIG is of great practical significance to China for solving the problem of excessive URIG and even realising the GSD strategy. | Panel data using instrumental variables |

| [36] | “Pattern Recognition of Green Energy Innovation Investments Using a Modified Decision Support System” | 2021 | IEEE Access | Uncovering the life cycle of green energy innovation. | Geometrical recognition methodology, Pythagorean fuzzy decision-making trial and evaluation laboratory (DEMATEL) |

| [37] | “Impact of financial technology on regional green finance” | 2021 | Computer Systems Science and Engineering | The effect of green FinTech on the regional growth of three provinces and cities in the Yangtze River Delta in China. | Fuzzy principal component analysis to build a green finance index and the Quadratic Assignment Procedure (QAP) to test its reliability. |

| [49] | “Development of Internet Supply Chain Finance Based on Artificial Intelligence under the Enterprise Green Business Model” | 2021 | Mathematical Problems in Engineering | This article is to solve the problems between the development of corporate GDP and green protection and explores the effect of green business development rules and standards on China’s corporate GDP. | Survey method |

| [50] | “Configuring the digital farmer: A nudge world in the making?” | 2021 | Economy and Society | This paper explores the ‘digital farmer’ assemblage as an illuminating case of the behavioural turn in international development, in which smallholder farmers are digitally steered towards behaviours deemed necessary for market inclusion. | Literature review |

| [34] | “Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution” | 2021 | Technological Forecasting and Social Change | Technical examinatin of green bonds, cryptocurrency, and FinTech. | Time domain spillover index model and frequency domain spillover method |

| [31] | “How green fintech can alleviate the impact of climate change—The case of Switzerland” | 2020 | Sustainability (Switzerland) | Exploring the effect of financial technology in relation to climate change. | Comprehensive literature analysis |

| [60] | “A blockchain based peer-to-peer trading framework integrating energy and carbon markets” | 2020 | Applied Energy | Trading energy and carbon emissions’ allowance can be improved using blockchain. | The modified IEEE 37-bus test feeder |

| [39] | “Blockchain for energy sharing and trading in distributed prosumer communities” | 2020 | Computers in Industry | Using smart contacts improves energy efficency and secure trading between financial agents. | Implemented an Ethereum-based subscriber/supplier energy model with associated purpose, consent, payment, and attestation functions |

| [12] | “Diversification in the age of the 4th industrial revolution: The role of artificial intelligence, green bonds and cryptocurrencies” | 2020 | Technological Forecasting and Social Change | The artificial intelligence-based model and green bonds can improve the efficency of the portfolio. | The GFEVD estimation model |

| [66] | “Blockchain Based Trading Platform of Green Power Certificate: Concept and Practice” | 2020 | Automation of Electric Power Systems (AEPS) | Blockchain-based platform for trading green energy licence. | Bilateral trading mechanism of Green Power Certificate (GPC) and the full life cycle of GPC circulation design |

| [42] | “Sustainable financial products in the Latin America banking industry: Current status and insights” | 2020 | Sustainability | The research trends regarding green financial sustainability in the banking sector localised in Latin America. | Data-driven scientometric analysis |

| [59] | “A Bayesian Game Based Vehicle-to-Vehicle Electricity Trading Scheme for Blockchain-Enabled Internet of Vehicles” | 2020 | IEEE Transactions on Vehicular Technology | Electricity trading model using vehicle-to-vehicle schema. | Bayesian game with incomplete information |

| [57] | “Research on the Impact of Green Finance and Fintech in Smart City” | 2020 | Complexity | Building smart cities is significantly impacted by green FinTech. | Distributed Lag (DL) model |

| [40] | “Blockchain-Based Energy Trading and Load Balancing Using Contract Theory and Reputation in a Smart Community” | 2020 | IEEE Access | Energy entities achieve a higher degree of social welfare and utility when information asymmetry is used compared with no information asymmetry. | System of blockchain-based secure DRM model for ET |

| [67] | “Can fintech development curb agricultural nonpoint source pollution?” | 2019 | International Journal of Environmental Research and Public Health | The effect of FinTech progress on agricultural non-point source degradation. | The Weighted Least Squares (WLS) and threshold regression methods of transversal data |

Appendix A.3. Tabulated Clusters of Systematic-Cum-Bibliometric Analysis

Table A2.

Clusters of systematic-cum-bibliometric analysis.

Table A2.

Clusters of systematic-cum-bibliometric analysis.

| Cluster Themes | Description | Key Results |

|---|---|---|

| Technology and instruments in digital finance | This theme covers the application of technologies such as AI, IoT, and machine learning, as well as financial instruments such as green bonds and hedging instruments in minimising climate risk. |

|

| Environmental quality and FinTech | The literature under this theme illustrated how FinTech has the potential of reducing environmental degradation |

|

| Climate risk mitigation through FinTech | This theme incorporates the literature that addresses the consequences of financial innovation of climate and the reverse. It captures the transitioning to zero carbon emissions alongside the digital finance value chain. |

|

| Green finance and climate change mitigation | The literature explores opportunities in finance that can be used to finance climate mitigation. |

|

| Regulatory environment policies and green FinTech | FinTech is proving to be an alternative that can help in achieving sustainability, hencethis theme gives an exposition of the regulatory and legal framework that facilitates the transition to green growth. |

|

References

- Agreement, P. United Nations Framework Convention on Climate Change (UNFCCC). Clim. Change Secr. Bonn. Ger. 2015. [Google Scholar]

- Beckerman, W. Economic growth and the environment: Whose growth? Whose environment? World Dev. 1992, 20, 481–796. [Google Scholar] [CrossRef]

- Bhagwati, J. The case for free trade. Sci. Am. 1993, 269, 42–49. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar]

- Gene, M.G.; Krueger, A.B. Environment Impacts of a North American Free Trade Agreement. In U. S. Mexico Free Trade Agreement; National Bureau of Economic Research: Cambridge, MA, USA, 1993. [Google Scholar]

- Eckstein, D.; Künzel, V.; Schäfer, L. Global climate risk index 2021. In Who Suffers Most from Extreme Weather Events; GermanWatch: Bonn, Germany, 2021; pp. 2000–2019. [Google Scholar]

- UNFCCC. Report of the Conference of the Parties on Its Fifteenth Session, Held in Copenhagen from 7 to 19 December 2009; UNFCCC: New York, NY, USA, 2010. [Google Scholar]

- Blakstad, S.; Allen, R. SME microfinance, fractional ownership and crowdfunding. In FinTech Revolution; Palgrave Macmillan: Cham, Switzerland, 2018; pp. 201–213. [Google Scholar]

- United Nations. Harnessing Digitalization in Financing of the Sustainable Development Goals Co-Chairs’ Progress Report to the Secretary-General of the Task Force on Digital Financing of the Sustainable Development Goals. 2019. Available online: https://digitalfinancingtaskforce.org/wp-content/uploads/2020/08/TFDF-2019-Interim-Report-Summary.pdf (accessed on 25 September 2022).

- Arner, D.W.; Buckley, R.P.; Zetzsche, D.A.; Veidt, R. Sustainability, FinTech and Financial Inclusion. Eur. Bus. Organ. Law Rev. 2020, 21, 7–35. [Google Scholar] [CrossRef]

- Financial Stability Board. Financial Stability Implications from Fintech: Supervisory and Regulatory Issues That Merit Authorities’ Attention; Financial Stability Board: Basel, Switzerland, 2017; pp. 2–32. [Google Scholar]

- Huynh, T.L.D.; Hille, E.; Nasir, M.A. Diversification in the age of the 4th industrial revolution: The role of artificial intelligence, green bonds and cryptocurrencies. Technol. Forecast. Soc. Change 2020, 159, 120188. [Google Scholar] [CrossRef]

- OECD. Declaration on Green Growth. 2009. Available online: https://legalinstruments.oecd.org/en/instruments?mode=advanced&typeIds=3 (accessed on 25 September 2022).

- World Bank Group. Blockchain and Emerging Digital Technologies for Enhancing Post-2020 Climate Markets; World Bank: Washington, DC, USA, 2018; Available online: https://openknowledge.worldbank.org/handle/10986/29499 (accessed on 25 September 2022).

- United Nations Environment Programme. Green Finance for Developing Countries: Needs, Concerns and Innovations. 2016. Available online: https://www.unep.org/resources/report/green-finance-developing-countries-needs-concerns-and-innovations-0 (accessed on 25 September 2022).

- Mustafa, M. The technology of mobile banking and its impact on the financial growth during the COVID-19 pandemic in the gulf region. Turk. J. Comput. Math. Educ. 2021, 12, 389–398. [Google Scholar]

- Rabbani, M.R.; Abdulla, Y.; Basahr, A.; Khan, S.; Ali, M.A.M. Embracing of Fintech in Islamic Finance in the post COVID era. In Proceedings of the 2020 International Conference on Decision Aid Sciences and Application (DASA), Online, 9 November 2020; pp. 1230–1234. [Google Scholar]

- Buchak, G.; Matvos, G.; Piskorski, T.; Seru, A. Fintech, regulatory arbitrage, and the rise of shadow banks. J. Financ. Econ. 2018, 130, 453–483. [Google Scholar] [CrossRef]

- Hussain, M.; Nadeem, M.W.; Iqbal, S.; Mehrban, S.; Fatima, S.N.; Hakeem, O.; Mustafa, G. Security and Privacy in FinTech: A Policy Enforcement Framework. In Research Anthology on Concepts, Applications, and Challenges of FinTech; IGI Global: Hershey, PA, USA, 2021; pp. 372–384. [Google Scholar]

- Haddad, C.; Hornuf, L. The emergence of the global fintech market: Economic and technological determinants. Small Bus. Econ. 2019, 53, 81–105. [Google Scholar] [CrossRef]

- Fu, J.; Mishra, M. Fintech in the time of COVID-19: Technological adoption during crises. J. Financ. Intermed. 2022, 50, 100945. [Google Scholar] [CrossRef]

- Ziegler, T.; Zhang, B.Z.; Carvajal, A.; Barton, M.E.; Smit, H.; Wenzlaff, K.; Natarajan, H.; Paes, F.F.D.C.; Suresh, K.; Forbes, H.; et al. The Global COVID-19 FinTech Market Rapid Assessment Study; World Bank Group: Washington, DC, USA, 2020. [Google Scholar]

- Tidjani, C. COVID-19 and Challenges of the Fintech Industry: A State of the Art and Outlooks on the North African Region. Abaad Iktissadia Rev. 2021, 11, 696–721. [Google Scholar]

- Khan, K.S.; Riet, G.T.; Glanville, J.; Sowden, A.J.; Kleijnen, J. Undertaking Systematic Reviews of Research on Effectiveness: CRD’s Guidance for Carrying out or Commissioning Reviews; NHS Centre for Reviews and Dissemination: York, UK, 2001. [Google Scholar]

- Van Eck, N.; Waltman, L. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef] [PubMed]

- Elghaish, F.; Matarneh, S.T.; Edwards, D.J.; Rahimian, F.P.; El-Gohary, H.; Ejohwomu, O. Applications of Industry 4.0 digital technologies towards a construction circular economy: Gap analysis and conceptual framework. Constr. Innov. 2022, 22, 647–670. [Google Scholar] [CrossRef]

- Orbay, K.; Miranda, R.; Orbay, M. Invited article: Building journal impact factor quartile into the assessment of academic performance: A case study. Particip. Educ. Res. 2020, 7, 1–13. [Google Scholar] [CrossRef]

- Friedlingstein, P.; Jones, M.W.; O’Sullivan, M.; Andrew, R.M.; Bakker, D.C.; Hauck, J.; Quéré, C.L.; Peters, G.P.; Peters, W.; Pongratz, J.; et al. Global carbon budget 2021. Earth Syst. Sci. Data 2022, 14, 1917–2005. [Google Scholar] [CrossRef]

- McWaters, R.J. Financial Technologies and the Disruption of Financial Services. In The Technological Revolution in Financial Services: How Banks, FinTechs, and Customers Win Together; University of Toronto Press: Toronto, ON, Canada, 2020; p. 39. [Google Scholar]

- Song, N.; Appiah-Otoo, I. The Impact of Fintech on Economic Growth: Evidence from China. Sustainability 2022, 14, 6211. [Google Scholar] [CrossRef]

- Puschmann, T.; Hoffmann, C.H.; Khmarskyi, V. How green FinTech can alleviate the impact of climate change—The case of Switzerland. Sustainability 2020, 12, 10691. [Google Scholar] [CrossRef]

- Liu, H.; Yao, P.; Latif, S.; Aslam, S.; Iqbal, N. Impact of Green financing, FinTech, and financial inclusion on energy efficiency. Environ. Sci. Pollut. Res. 2022, 29, 18955–18966. [Google Scholar] [CrossRef]

- Zhou, G.; Zhu, J.; Luo, S. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecol. Econ. 2022, 193, 107308. [Google Scholar] [CrossRef]

- Le, T.-L.; Abakah, E.J.A.; Tiwari, A.K. Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technol. Forecast. Soc. Change 2021, 162, 120380. [Google Scholar] [CrossRef]

- Saraji, M.K.; Streimikiene, D.; Kyriakopoulos, G.L. Fermatean fuzzy CRITIC-COPRAS method for evaluating the challenges to industry 4.0 adoption for a sustainable digital transformation. Sustainability 2021, 13, 9577. [Google Scholar] [CrossRef]

- Wei, J.; Dinçer, H.; Yüksel, S. Pattern recognition of green energy innovation investments using a modified decision support system. IEEE Access 2021, 9, 162006–162017. [Google Scholar] [CrossRef]

- Liu, Z.; Song, J.; Wu, H.; Gu, X.; Zhao, Y.; Yue, X.; Shi, L. Impact of financial technology on regional green finance. Comput. Syst. Sci. Eng. 2021, 39, 391–401. [Google Scholar] [CrossRef]

- Liu, W.; Sun, Y.; Yüksel, S.; Dinçer, H. Consensus-based multidimensional due diligence of fintech-enhanced green energy investment projects. Financ. Innov. 2021, 7, 72. [Google Scholar] [CrossRef]

- Petri, I.; Barati, M.; Rezgui, Y.; Rana, O.F. Blockchain for energy sharing and trading in distributed prosumer communities. Comput. Ind. 2020, 123, 103282. [Google Scholar] [CrossRef]

- Yahaya, A.S.; Javaid, N.; Javed, M.U.; Shafiq, M.; Khan, W.Z.; Aalsalem, M.Y. Blockchain-based energy trading and load balancing using contract theory and reputation in a smart community. IEEE Access 2020, 8, 222168–222186. [Google Scholar] [CrossRef]

- Chen, Y.; Volz, U. Scaling up sustainable investment through blockchain-based project bonds. In ADB-IGF Special Working Paper Series Fintech to Enable Development, Investment, Financial Inclusion, and Sustainability; ADB: Mandaluyong, Philippines, 2021. [Google Scholar]

- Mejia-Escobar, J.C.; González-Ruiz, J.D.; Duque-Grisales, E. Sustainable financial products in the Latin America banking industry: Current status and insights. Sustainability 2020, 12, 5648. [Google Scholar] [CrossRef]

- Pee, L.G.; Pan, S.L. Climate-intelligent cities and resilient urbanisation: Challenges and opportunities for information research. Int. J. Inf. Manag. 2022, 63, 102446. [Google Scholar] [CrossRef]

- Zetzsche, D.A.; Anker-Sørensen, L. Regulating sustainable finance in the dark. Eur. Bus. Organ. Law Rev. 2022, 23, 47–85. [Google Scholar] [CrossRef]

- Macchiavello, E.; Siri, M. Sustainable Finance and Fintech: Can Technology Contribute to Achieving Environmental Goals? A Preliminary Assessment of ‘Green Fintech’and ‘Sustainable Digital Finance’. Eur. Co. Financ. Law Rev. 2022, 19, 128–174. [Google Scholar] [CrossRef]

- Deipenbrock, G. Digital Finance and Beyond in the Third Decade of the 21st Century-Observations with a Focus on the EU Policy and Legal Perspective. Eur. Bus. Law Rev. 2022, 33, 309–330. [Google Scholar] [CrossRef]

- Chiu, W.-H.; Lin, W.-C.; Liang, C.-J. The Role of Green Finance in Community Renewable Energy Projects of main Region and Taiwan. Lex Localis J. Local Self-Gov. 2021, 19, 503–519. [Google Scholar] [CrossRef]

- Wang, M.; Li, X.; Wang, S. Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis. Energy Policy 2021, 154, 112295. [Google Scholar] [CrossRef]

- Zhang, J. Development of internet supply chain finance based on artificial intelligence under the enterprise green business model. Math. Probl. Eng. 2021, 2021, 9947811. [Google Scholar] [CrossRef]

- Brooks, S. Configuring the digital farmer: A nudge world in the making? Econ. Soc. 2021, 50, 374–396. [Google Scholar] [CrossRef]

- Nenavath, S. Impact of fintech and green finance on environmental quality protection in India: By applying the semi-parametric difference-in-differences (SDID). Renew. Energy 2022, 193, 913–919. [Google Scholar] [CrossRef]

- Merello, P.; Barberá, A.; De la Poza, E. Is the sustainability profile of FinTech companies a key driver of their value? Technol. Forecast. Soc. Change 2022, 174, 121290. [Google Scholar] [CrossRef]

- Tao, R.; Su, C.-W.; Naqvi, B.; Rizvi, S.K.A. Can Fintech development pave the way for a transition towards low-carbon economy: A global perspective. Technol. Forecast. Soc. Change 2022, 174, 121278. [Google Scholar] [CrossRef]

- Yang, Y.; Su, X.; Yao, S. Nexus between green finance, fintech, and high-quality economic development: Empirical evidence from China. Resour. Policy 2021, 74, 102445. [Google Scholar] [CrossRef]

- Jin, C. Impacts of Financial Technology on Urban-Rural Income Gap in the Context of Green Sustainable Development. J. Environ. Prot. Ecol. 2021, 22, 2438–2446. [Google Scholar]

- Taskin, D.; Dogan, E.; Madaleno, M. Analyzing the relationship between energy efficiency and environmental and financial variables: A way towards sustainable development. Energy 2022, 252, 124045. [Google Scholar] [CrossRef]