1. Introduction

Unconventional shale gas extraction techniques make it possible to extract large quantities of shale oil and gas that were once unprofitable. New technologies in hydraulic fracturing, or fracking are the primary reason of the dramatic increase in the U.S. oil and natural gas production in the last decade. In hydraulic fracturing process high-pressure fracking fluid that contains water mixed with sand and other compounds is injected into the layers of rock formation to crack and release trapped oil and gas. Unconventional tight oil and gas developments in rural agricultural communities across the U.S. caused economic, social, and environmental changes in these regions (e.g., [

1,

2,

3]). The energy extraction boom of the mid-2000s had a particular impact on local economies in areas with substantial shale oil and gas reserves.

This study aims to analyze wages and employment trends in shale gas regions in the Northeast US. Most studies in this research area focus on wages and employment, but less is known about the effect of new wells opening in mostly rural areas on population dynamics like migration inflows and outflows as a result of new job opportunities. This paper establishes a methodology to determine the direction and magnitude of population changes, wages, and employment for thirteen counties in Ohio and Pennsylvania that have and thirteen counties that do not have shale gas and tight oil production. A control group of thirteen counties similar in employment by industry and geographic location that did not begin drilling wells for shale around 2011 are compared in terms of employment, population, and wage trends to thirteen counties in a treatment group that did. The research question concerns whether producing oil and gas via shale has an economically significant effect on the job market in terms of the number of employed individuals, number of establishments, average annual payroll per person and total wages in these counties. The analysis incorporates migration inflow and outflow between counties in the control and treatment groups and is based on county-level data.

The significant growth in the U.S. oil and natural gas industry in shale gas production potentially had economic impacts on labor market outcomes. Many papers in the literature have left out migration flows, making it difficult to measure labor market differences between counties. Whether a shale boom has created net migration into a county is an important socioeconomic question. Many researchers argue that impacts on regional labor markets have been significant, as average wages and employment have risen and individuals and families have migrated to these areas in search of work and higher wages [

4,

5,

6].

This paper investigates two hypotheses. The first hypothesis is that the impact of shale production on labor market is positive. The methodology is designed to measure the potential impacts on several labor market outcomes. The second hypothesis is that the shale energy boom had an impact on population dynamics in terms of migration. This paper does not have a priori anticipation about the direction of migration. The net effect can be a migration inflow because development of a gas extraction industry may attract new workers to these areas. However, the net effect can be a migration outflow as well because such developments may put a significant strain on the area’s infrastructure, such as public school systems, area hospitals, law enforcement, and administrative services, until the economic gains allow expansion of these services. These factors may encourage some people to move to other counties permanently. In this paper, we investigate the direction of migration that is due to shale production in the long run.

The second section of this paper summarizes the related literature. The third section introduces the data, fourth section discusses the methodology that is used to test the hypotheses, the fifth section analyzes the estimation results, and the last section offers some concluding remarks, discusses about limitations and potential for future research.

2. Literature Review

The literature on shale boom can be summarized in three broad categories. The first category is the studies that focus on direct impact of shale on labor market. Many studies that focused on shale energy boom document positive impacts on labor market outcomes. For instance, Komarek [

7] examines the impact of the energy boom on the labor market in the Marcellus region by comparing counties with fracking activity in Pennsylvania, Ohio, and West Virginia to a control group of counties in New York, which imposed a ban on fracking, and finds that total employment and wages per job increased by 7 percent and 11 percent, respectively, above preshale levels in the first three years after the boom, but declined in the following years. Komarek also finds no response to the energy boom in terms of total population, suggesting little permanent migration as a result of energy extraction. Similarly, Cosgrove et al. [

8] and Weber [

9,

10] find some evidence of positive employment effects in the US labor market in resource extraction.

Munasib and Rickman [

11] study the impacts of oil and gas production in the Bakken, Fayetteville, and Marcellus shales using a synthetic control group approach and find employment gains in state economies. Agerton et al. [

12] confirm that increased drilling for oil and gas creates jobs. Wrenn et al. [

13] compare employment increases among residents and nonresidents in Pennsylvania counties where wells were drilled and find modest employment increases among both residents and nonresidents. Gittings and Roach [

14] find not only that increases in the value of new oil and gas production significantly increase local jobs and average earnings in the county but also that a large portion of new jobs are filled by workers who reside outside of the county. Wilson [

15] documents an increase in in-migration rates in North Dakota because of the resource boom but that effect was more muted in other parts of the country. Similarly, Cai et al.’s [

16] results suggest that benefits to the labor market benefits are widespread and economically meaningful, as many workers appear to benefit economically from increased oil and gas employment in their local areas.

Maniloff and Mastromonaco [

17] examine changes in county-level employment and incomes and calculate elasticities and show that doubling the number of wells drilled in a county raises employment by approximately 10 percent. A study by Hausman and Kellogg [

18] examines economywide effects and finds that the shale boom increased producer and consumer surplus by about a third of 1 percent of GDP. Similarly, Winters et al. [

19,

20] find that oil and gas boom had positive net effects on employment and incomes of individuals by using instrumental variables approach. On the contrary, Jacobsen et al. [

21] argue that the cumulative net effect of the U.S. oil boom and bust of the 1980s on lifetime earnings was negative.

The second category is the studies that investigate spillovers to other sectors of the economy, outside of resource extraction, and focus on long-run effects [

3,

5,

10,

22,

23,

24,

25,

26,

27]. Using various geographic locations, the authors of these studies find positive spillover effects on total employment and wages. However, Paredes et al. [

4] argue that the income spillover effects in the Marcellus region appear to be minimal, and like Paredes et al. [

4], some studies suggest that the positive effects of a shale boom decrease over time [

23,

27], and even that resource boom–bust cycles can leave communities worse off in aggregate [

28]. Other studies have provided evidence that the effects vary across regions [

11].

Third category is the line of research that studies the potential negative impacts of shale developments. Blanco and Grier [

29] show that educational attainment and human capital development may be lower in areas that are resource-dependent, and Rickman et al. [

30] show that such is the case in shale-rich regions. Betz et al. [

31] and Tsvetkova and Partridge [

27] show that long-run growth may be hindered by resource dependence and a move away from entrepreneurial ventures outside of the mining sector. Murshed and Serino [

32] consider poor industry diversification and export structures to be a causal mechanism for lower growth. Local concerns that are associated with oil and gas development include road noise and congestion, earthquakes, and air and water pollution [

33,

34,

35,

36]. Some studies focus on possible social problems resulting from rural communities’ being overwhelmed by significant changes to the population, which may magnify such social problems as drug and alcohol abuse, domestic violence, mental health problems, and crime [

37,

38].

Clearly, the academic literature finds mixed results in terms of the local economic benefits of the post-2000 oil and gas boom. However, less is known about the population dynamics between neighboring and other geographically proximate counties in which some of them experience a resource boom and some do not.

3. The Data

This paper tests two hypotheses. The labor market impacts of shale energy and the impacts of shale developments on population migration. The empirical strategy uses a difference-in-differences approach to identify the effect of an oil and gas boom on the labor market. The data set used for this analysis is panel data covering a group of twelve rural Ohio counties and fourteen Pennsylvania counties over the fourteen years from 2005 to 2018, collected quarterly. The quarterly data for shale well locations and gas production were procured from the Ohio Department of Natural Resources, while the data on employment were collected from the Bureau of Labor Statistics, Pennsylvania Center for Workforce Information & Analysis and the United States Census Bureau. County-to-county migration data were obtained from the US Census Bureau, and the number of establishments, employment, and annual payroll data were obtained from the United States Census Bureau, County Business Patterns. County-to-county migration data (Authors calculations from:

https://www.census.gov/topics/population/migration/guidance/county-to-county-migration-flows.html (accessed on 21 February 2022)) are available only as aggregate data over several years, so the migration data were compiled between 2005 and 2011 and between 2012 and 2018 as two groups and a uniform distribution is assumed within each group. Migration inflows and outflows in this analysis refer to any migration within the U.S., not only to migration between the selected groups of counties because several papers in the literature argue that shale developments attract migration/commuting from long distances. In addition, this analysis is based on the amount of shale gas production, not on the number of wells spudded. It is clear from the gas production data that 2011 is the best candidate for a cut year, as significant shale gas production began only after 2011.

Table A1 and

Table A2 show population dynamics in Ohio and Pennsylvania, respectively. These tables present total migration inflow, total migration outflow, net migration, average population, and average number of people employed (all industries) between 2005 and 2011 and between 2012 and 2018.

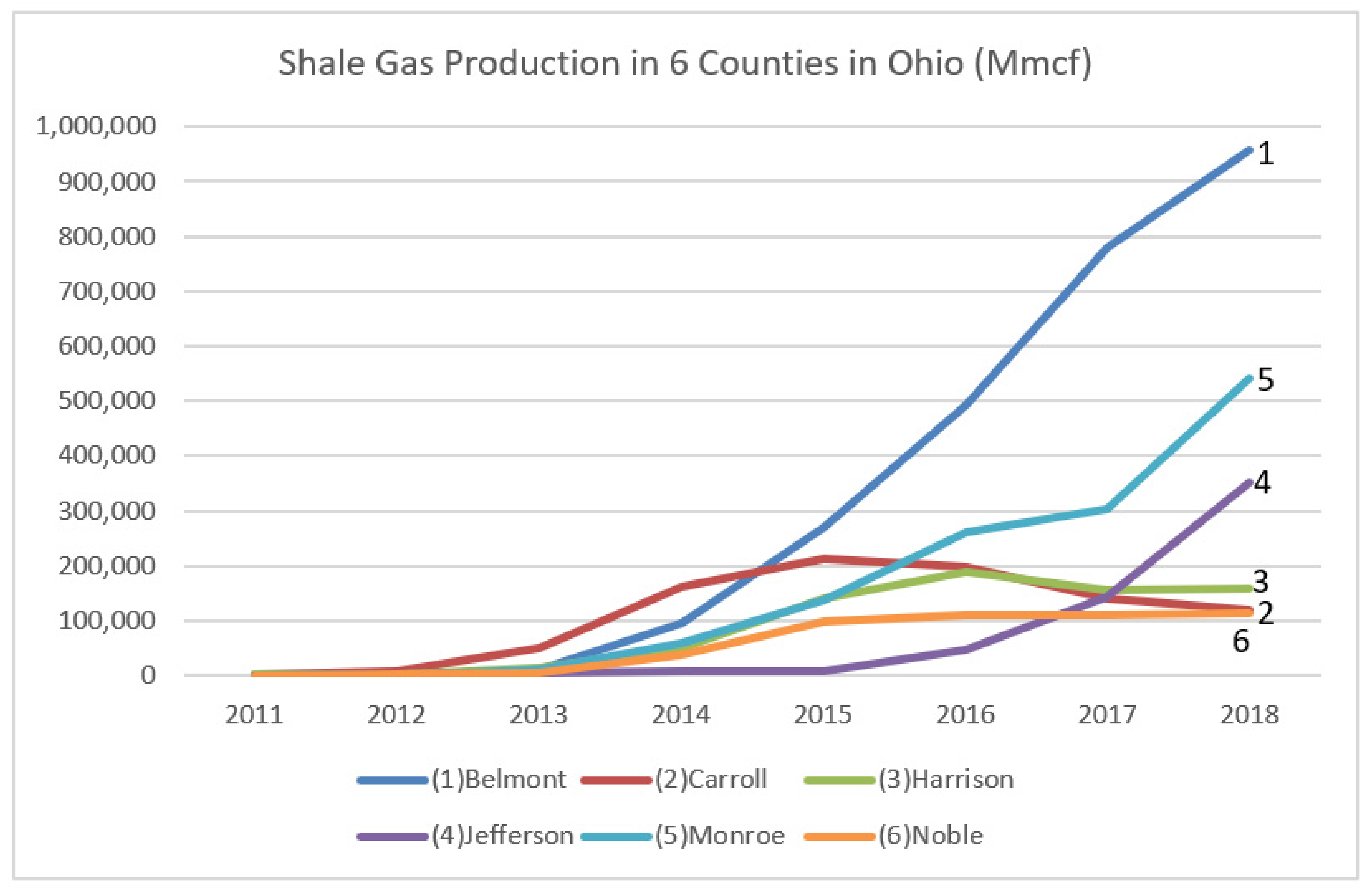

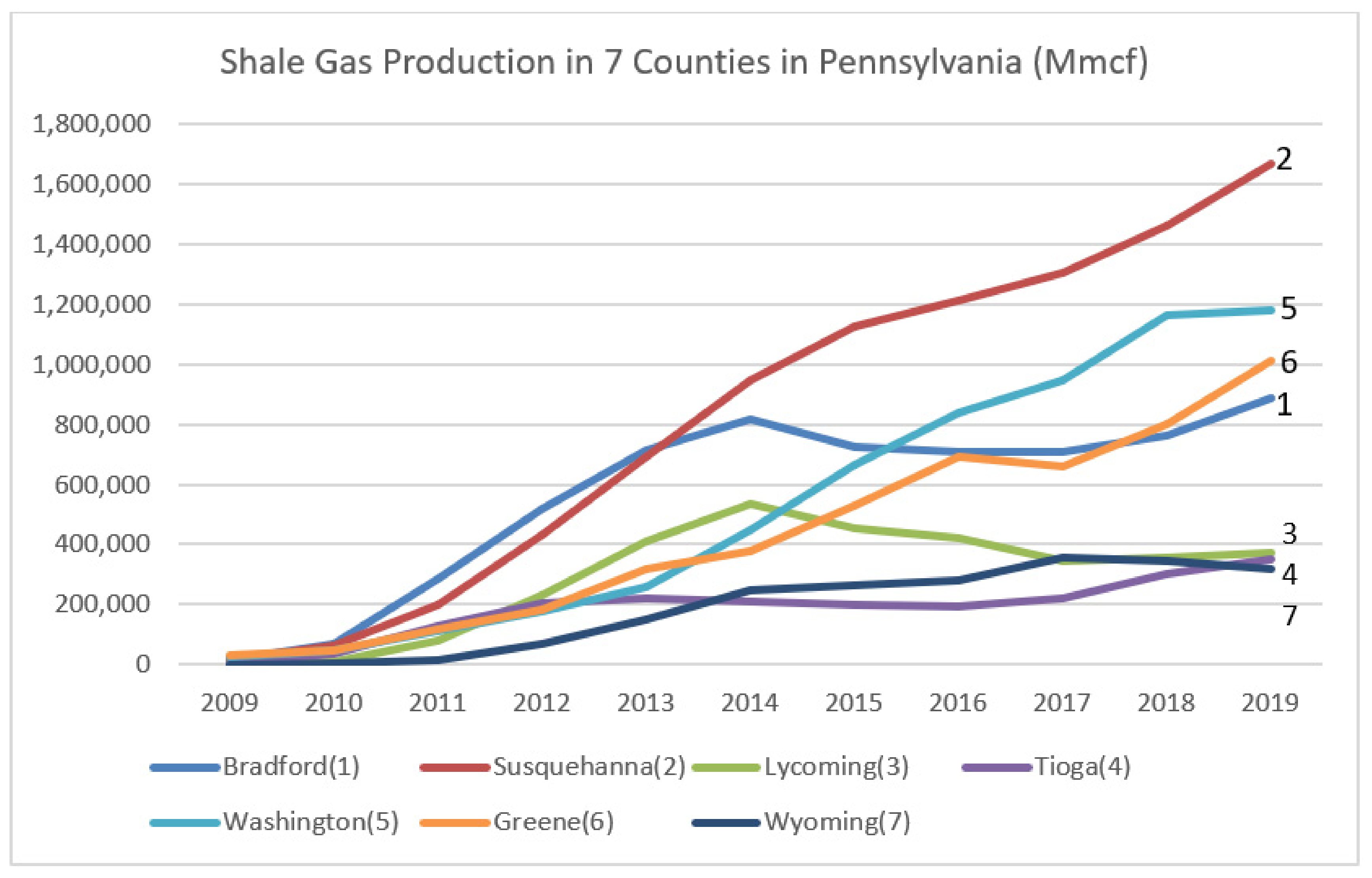

Table A3 and

Table A4 show gas production from shale in Ohio and Pennsylvania, respectively. The six producing counties in Ohio are Belmont, Monroe, Carroll, Harrison, Noble, and Jefferson, and the seven producing counties in Pennsylvania are Bradford, Susquehanna, Lycoming, Tioga, Washington, Greene, and Wyoming. As boom counties, these thirteen counties make up the treatment group. The six nonproducing counties in Ohio—Fairfield, Perry, Pike, Ross, Vinton and Morgan—and the seven nonproducing counties in Pennsylvania—Snyder, Clinton, Columbia, Potter, Union, Beaver, and Fayette—were chosen because they are comparable in terms of location and economic and demographic characteristics to the counties in the group of producers. The counties are rural eastern/southeastern Ohio counties and southwestern/northern Pennsylvania counties that either border one another or are in close proximity and are expected to act as a reasonable control group for the treated observations.

Figure A1 presents a map of the Ohio counties, and

Figure A2 presents a map of the Pennsylvania counties. The producing counties in Ohio and Pennsylvania lie above the Marcellus and Utica shales.

A map of the Marcellus and Utica shales is presented in

Figure A3, and

Figure 1 and

Figure 2 show the gas production trends in Ohio and Pennsylvania from

Table A3 and

Table A4, respectively, in a graph. The next section presents the empirical models.

4. Methodology and Empirical Models

This section presents the methodology to obtain estimations of the changes in migration dynamics, wages, establishments, and employment for the counties with and without shale gas and tight oil production.

Table 1 presents the descriptive statistics of the main variables. Shale gas production in the region started around 2011, but the pretreatment period includes the housing bust and U.S. recession that began in late 2007 and continued through 2008 and 2009, so the time of the analysis spans the years of the Great Recession.

The Great Recession clearly had an adverse effect on the job market in the U.S., so the estimation should control for possible differences between counties in how they experienced the recession. When we compare the difference in the means of growth rates in the labor market variables between the control and treatment groups from 2005 to 2011, there is no statistically significant difference at the 10% level (

Table 2), so the job market dynamics in the counties were similar during the recession and they experienced the recession in a similar fashion.

However, it is possible to employ additional strategies to control for the exogenous shock produced by the recession. First, the recession years can be included as control variables. Alternatively, from the main years of the recession (2008 and 2009) can be dropped in the estimations. Finally, yearly dummy variables can be included in the estimates with time fixed effects. The impact of the Great Recession on each estimation result is discussed on the results section.

The first analysis addresses the impact of the shale boom on net migration. Equation (1) states:

where

dummy1 is zero if the observation is from a nonproducing county and 1 if the observation is from a producing county;

dummy2 is zero if the observation is from 2005–2011, when the unconventional gas production had not yet started (The exact production start time is also used as a robustness check later in this section) (or when it was negligible) and 1 if the observation is from 2012–2018; and the interaction variable equals

dummy1 ×

dummy2 and is the difference in difference coefficient, which shows the average impact of a shale boom on a county’s net immigration. The next set of estimations are designed to measure the impact of shale gas on several labor market outcomes. The results from these equations can be used to test the main hypothesis of this paper.

The dependent variable is the number of paid employees in Equation (2), the number of establishments in Equation (3), average annual payroll per person in Equation (4) and total wages in Equation (5). Dummy1 is zero if the observation is from a nonproducing county and 1 if the observation is from a producing county. Dummy2 is zero if the observation is before 2012 (2005–2011), when the unconventional gas and oil production had not yet fully started and 1 if the observation is 2012 or later (2012–2018). Dummy3 is the difference in difference coefficient, which shows the employment difference of a producing county after the shale production began. Migration variables are included as control variables because labor market outcomes (dependent variables on Equations (2)–(5)) might be affected by this time-varying factor. is the error term.

The interaction coefficient is the main variable of interest. The inflow variable is the migration inflow (outflow) to (from) each county from (to) all other places within the U.S. during the analysis period. The migration data account for relocations.

The models were estimated with several variations, including county fixed effects and time fixed effects. The models are used to obtain the marginal effect of shale production on employment, payrolls, and the number of establishments by taking migration dynamics into account. Population and migration differences play a role in determining labor market outcomes; it is reasonable to think that there is a direct correlation between population and employment, so controlling for population differences among counties may reduce some omitted variable bias.

5. Results

Table 3 presents the estimation results from Equation (1). A Wald test was used to see if the time fixed effects are needed when running a fixed effect model; the test did not reject the null hypothesis that the coefficients for all years are jointly equal to zero, so no time fixed effects are needed in this case. The Hausman test favored the random effects model, so the estimations from the random effects model with no time fixed effects are presented in Models 6–10. Recession year dummies (2008 and 2009) were insignificant, as were all other year dummies. There is no observable significant impact of recession on migration dynamics.

As shown in

Table 3, the fracking boom had a negative impact on net migration, as about thirty-seven more people moved out of the fracking counties compared to the nonproducing counties. The migration trend in boom and nonboom counties differed, significant at the 1% level. Furthermore, the negative impact on net migration was greater in Ohio (−55 at the 1% significance level) than it was in Pennsylvania (−19 at the 5% significance level). Even though this result is statistically significant, such a small number compared to these counties’ populations cannot be considered to have an economically significant impact on the socio-demographics of these counties. This result suggests that the shale boom did not create permanent labor migration and was responsible for only a small migration outflow. (Recall that the net migration variable refers to all migration within the U.S., not just migration in the selected group).

The estimation results from Equations (2)–(5) are shown in

Table 4. This table shows that the shale production had both economically and statistically significant impacts on labor market outcomes. In producing counties after the shale boom, the number of employed people increased by 722 compared to nonproducing counties, the number of establishments is increased by 35, total wages are increased by

$103,507,000, and the average annual pay per person increased by

$2443. All these impacts are statistically significant at the 1% level. To present these numbers in percentages, semi elasticities are calculated, and they show that the number of jobs in producing counties was 2.4 percent higher than it was in nonproducing counties, the number of establishments was 1.1 percent higher, total wages were 3 higher, and the average annual pay was 1.5 percent higher. The same percentages were obtained when the regressions were run with logs of the dependent variables. The large increase in total wages suggests possible spillover impacts to other sectors, but this aspect of study is beyond the scope of this paper.

In summary, the negative impact of fracking on net migration was greater in Ohio’s producing counties than it was in Pennsylvania’s producing counties: Migration outflow was higher than migration inflow, so there was negative net migration in producing counties. Ohio is a smaller shale gas producer than Pennsylvania is, with about a third of Pennsylvania’s production capacity, so the increases in the number of employed and total wages were much larger in Pennsylvania counties than they were in Ohio counties. The increase in the number of establishments and average annual pay were similar in the two states. To show this situation more clearly,

Table A5 presents labor market results for Pennsylvania alone. In

Table A5, the number of jobs increased by 1403, the number of establishments increased by 35, the average annual pay per person increased by

$2444, and total wages increased by

$210,525,000 in Pennsylvania after the fracking boom.

These results show that migration inflow and outflow in these counties had some effect; even though small in the estimation results, they increased the models’ goodness of fit and should be accounted for. Even though the recession did not have an effect on net migration results (

Table 3), it did affect the labor market variables. Year dummies for 2008 and 2009 were significant in the estimations in

Table 4, while all other years were insignificant, so time fixed effects are required for estimations in

Table 4. However, several scenarios are presented for a robustness check.

Counties have different gas production amounts, as shown in

Table A3 and

Table A4. To see how many additional jobs were created by the amount of gas produced in the shale sector, the amount of gas production is interacted with the before/after shale boom dummy variable, as in Equation (6):

where

is a dummy variable that equals zero before a county started producing (exact quarter) and 1 after shale production began in that county, so it is always zero for nonproducing counties. That every county started producing at a different time has been accounted for, as production is the amount of shale gas production in MMcf (=1000 mcf or one million cubic feet), and the interaction variable is the multiplication of the gas production variable with the before/after dummy. This variable measures the increase in employment from each additional MMcf of shale gas. As

Table 5 shows, every 100 MMcf of gas production creates 1.3 jobs. (Every 77 MMcf of gas production creates an additional job.).

Lastly, this section discusses if the two hypotheses are validated or rejected. The first hypothesis is that the impact of shale production on labor market is positive. The second hypothesis is that the shale energy boom had an impact on population dynamics in terms of migration. The analysis shows that shale development did not create a positive net migration into producing counties but had a negative impact on net migration, although the difference is small compared to the population. Wilson [

15] study also suggests the net migration is negative and the findings of this paper is consistent with that study. The fracking counties experienced more people moving out of the county in the long run compared to the nonproducing counties. On the other hand, the number of jobs is higher by 2.4%, the number of establishments is higher by 1.1%, total wages are 3% more and the average annual pay is 1.5% more in producing counties than after shale. The second hypothesis is validated but these positive labor market impacts are smaller than some previous studies that are discussed in the literature review section.

6. Conclusions and Policy Implications

This paper shows that counties that engage in shale oil extraction saw economically significant positive impacts on all job market variables because of the new technology. The counties that use shale technology for oil and gas production experienced an approximately 2.4 percent increase in the number of paid employees. The estimation results also show the positive effect of shale extraction technology on the number of establishments, average annual payroll per person, and total wages in counties in the Marcellus and Utica shale regions. Based on this analysis, counties that adopt these shale production methods experienced a statistically and economically significant positive marginal effect on labor market outcomes, significant at the 1% level, that is robust across various specifications.

This paper also documents the importance of population variables in labor market estimations. The extant literature tends to ignore population reallocation or uses synthetic control groups to measure the economic impact of shale gas, while this paper incorporates actual migration flows to account for people who may have moved to a neighboring county with shale development in pursuit of new job openings. However, the labor allocation may also be affected by others moving away from production sites permanently because of concerns about environmental and social impacts. The analysis reveals a small but statistically significant negative impact on migration, as shale regions have experienced some migration outflows, as discussed in some sociology literature. The labor market results are significantly larger than the negative net migration effect, but they are smaller than those in many earlier papers.

This paper contributes to the discussion in the literature that shale development may attract workers from neighboring regions. The influx of people may place a burden on an area’s established infrastructure and may bring socioeconomic changes to the county. Despite the significant labor market impact with hydrofracking, this paper found no significant migration into the producing areas that could be attributed to shale development. On the contrary, there was a net negative migration from these sites that could be attributable to negative social impacts and people’s other concerns, although shale businesses may attract commuters and temporary workers from outside. Despite the significant economic increases from hydrofracking across the country, concern about the environmental and social costs when considering further development of the process remain, and regulation of the natural gas industry remains an important issue for economists, politicians, and communities to address.

Consequently, this paper does a partial cost–benefit analysis of shale energy. While this paper documents positive labor market outcomes, shale developments may have other costs especially when regulations are not met. These costs include chemical spills, gas leaks, or uncontrolled erosion and sedimentation. The production of natural gas through hydrofracking requires a mixture of chemicals (The amount of chemicals and the proportion they make up in fracking mixtures are largely considered to be trade secrets and it is not required that they be disclosed to the public in most places), and naturally occurring toxicants like heavy metals, volatile organics, and radioactive compounds are also mobilized in the hydrofracking process. Public and private water contamination is likely when these chemicals are not handled properly. Other potential negative effects besides water contamination are lowering of the water table, increased seismic activity, harm to animals, deterioration of roads, increased strain on social services, and neighbor conflict. Opponents of such unconventional drilling techniques site a lack of controlled research on these negative impacts as a reason to slow development until the short- and long-term environmental and social costs of production are better understood. On the other hand, shale energy may have further benefits besides employment and wage gains. Other benefits of hydrofracking include a cleaner source of energy for household consumption, electricity, and production in other industries, and reduced dependence on foreign sources of energy. A full-scale cost–benefit analysis is still required in the literature on shale energy that quantifies all potential costs and benefits.

Finally, this paper does have certain limitations and caveats. Migration data are obtained from census records, similar migration statistics are also measured by the IRS (Internal Revenue Service). A reproduction with another data source would contribute to the robustness of the results. The analysis is based on natural gas production, future research can base the selection on the number of wells spudded or the number of wells completed as the variable of interest for the analysis. Overall, future research is still needed to understand full scale economic, demographic, and sociological impacts of shale energy.