Short-Term Electricity Price Forecasting Based on the Two-Layer VMD Decomposition Technique and SSA-LSTM

Abstract

1. Introduction

2. Methodology

2.1. Variational Mode Decomposition(VMD)

2.2. Sparrow Search Algorithm (SSA)

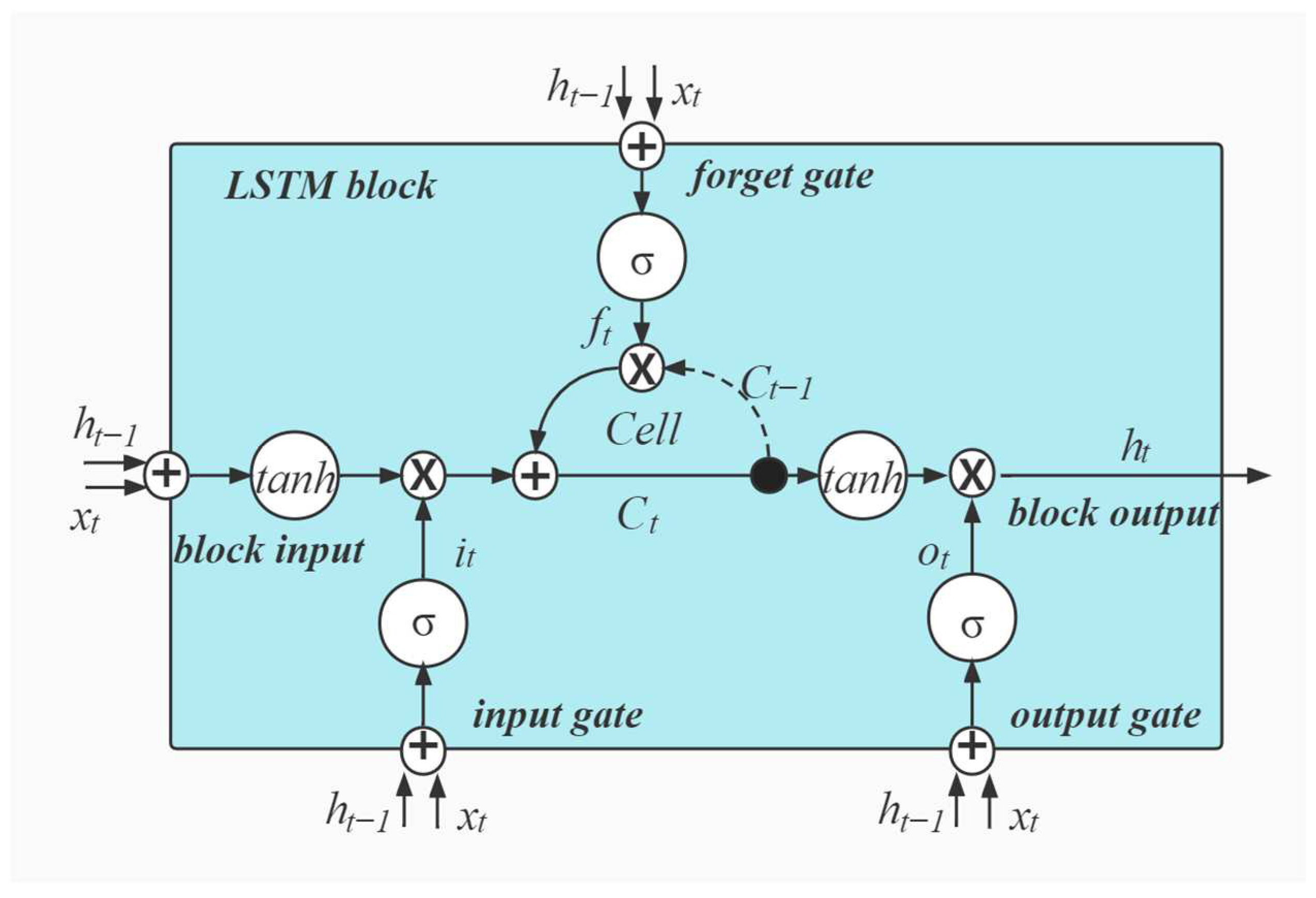

2.3. Long Short-Term Memory Neural Network (LSTM)

2.4. Normalization and Denormalization

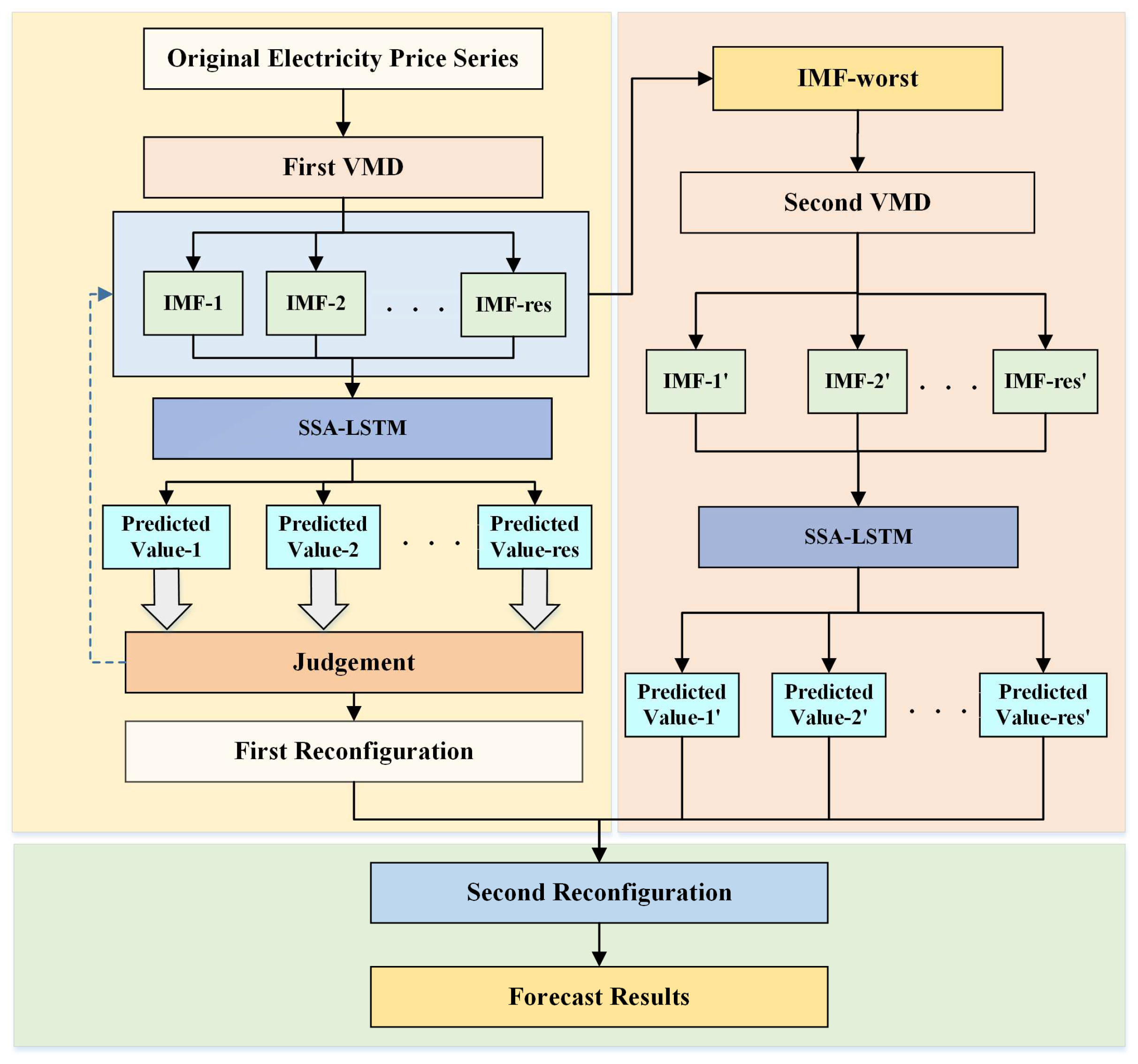

3. Construction of VMD-SSA-LSTM Model

3.1. Input and Output of the Model

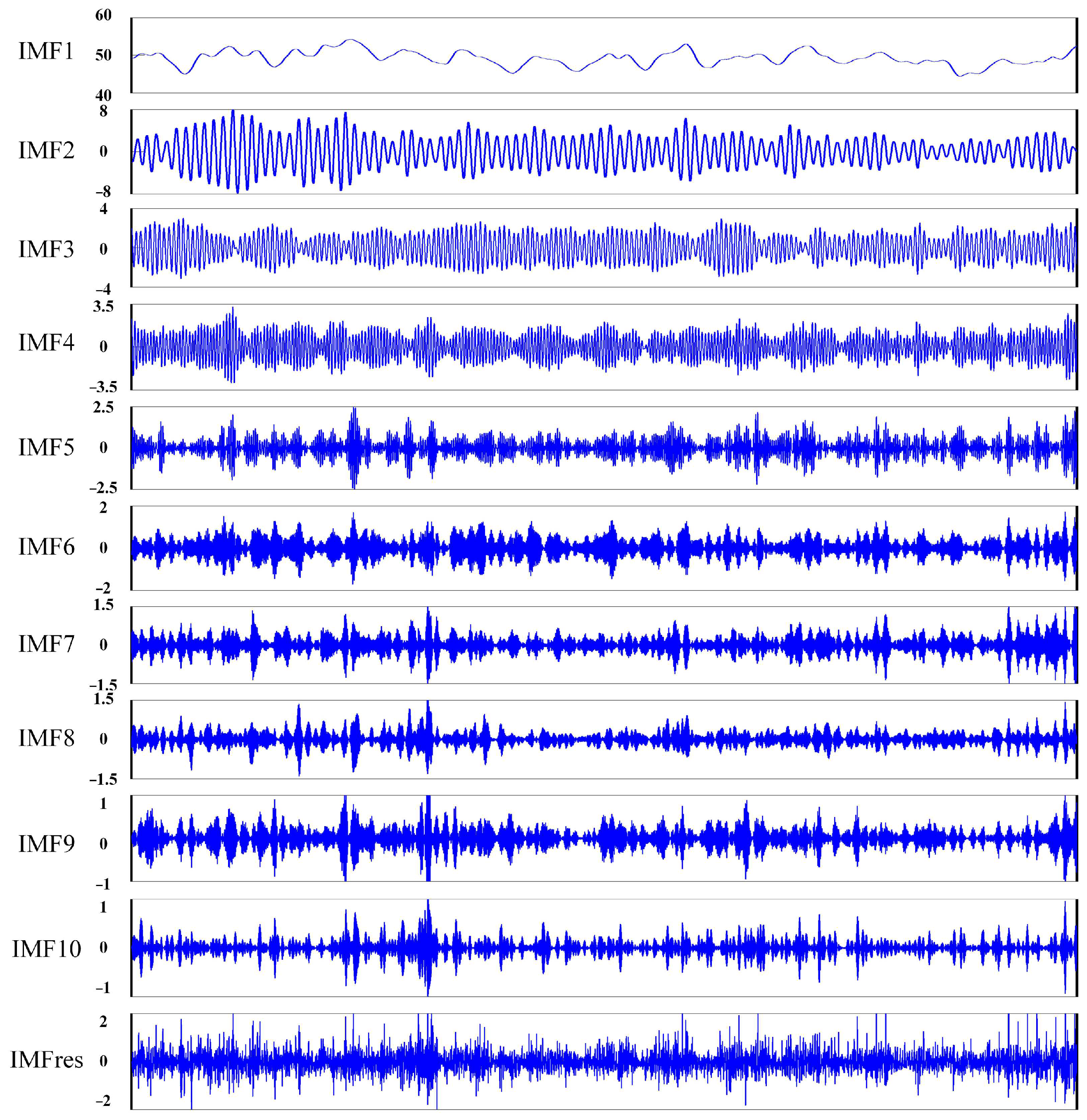

3.2. Two-Layer VMD Decomposition Technique

3.3. SSA Optimize LSTM’s Hyperparameters

3.4. Forecasting Process of VMD-SSA-LSTM Model

4. Case Study and Result

4.1. Data Collection

4.2. Evaluation Metrics

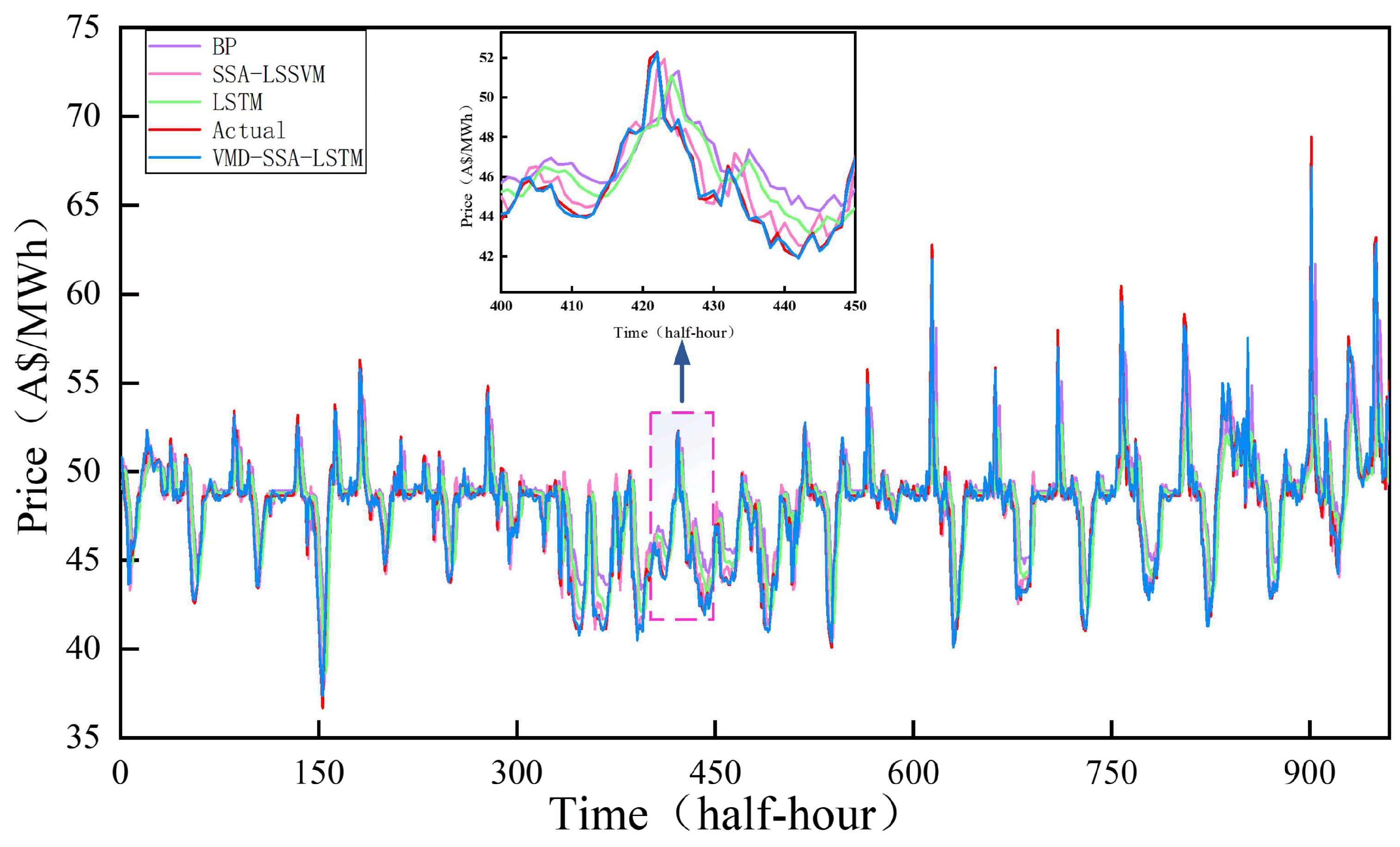

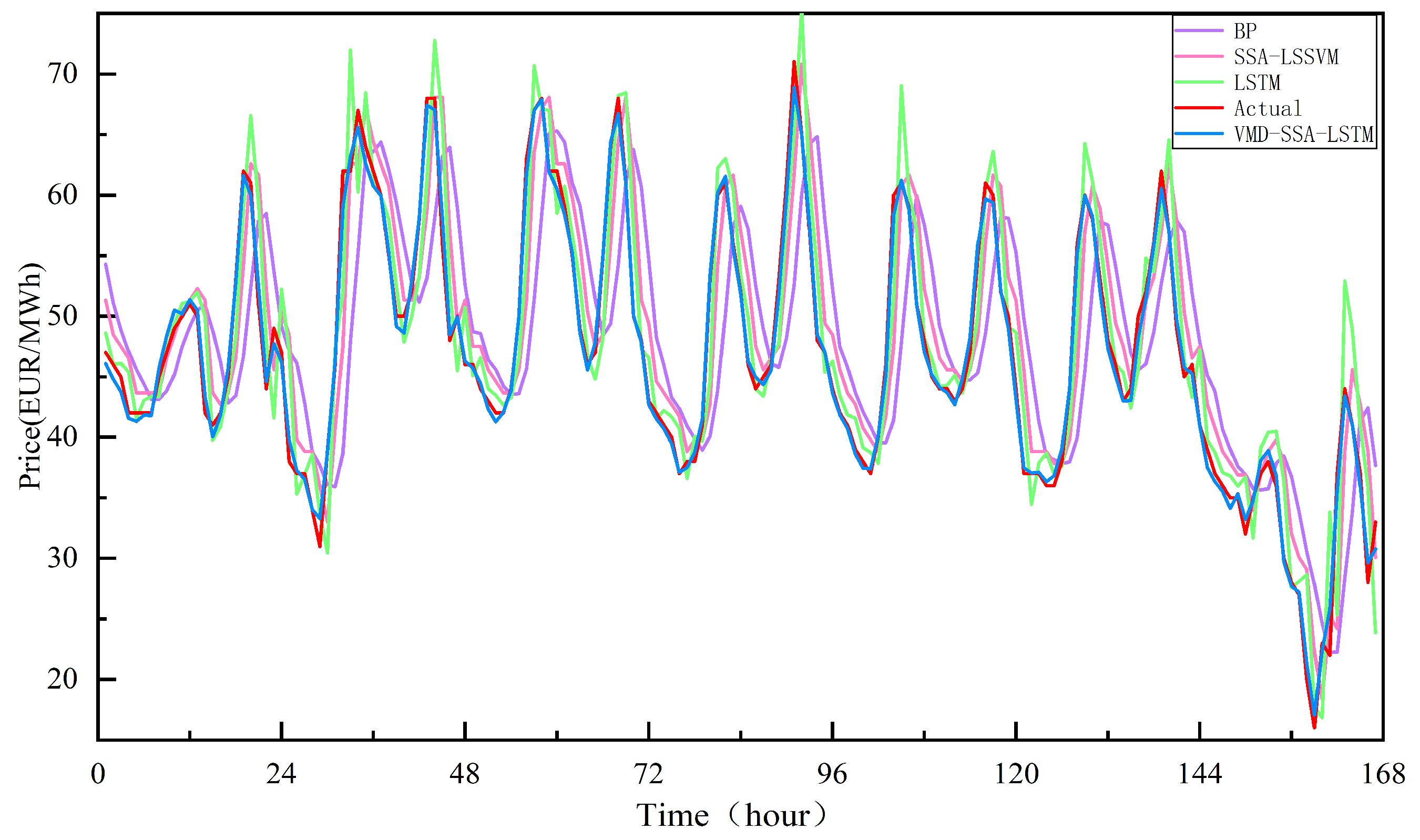

4.3. The Case of the Australian Electricity Market

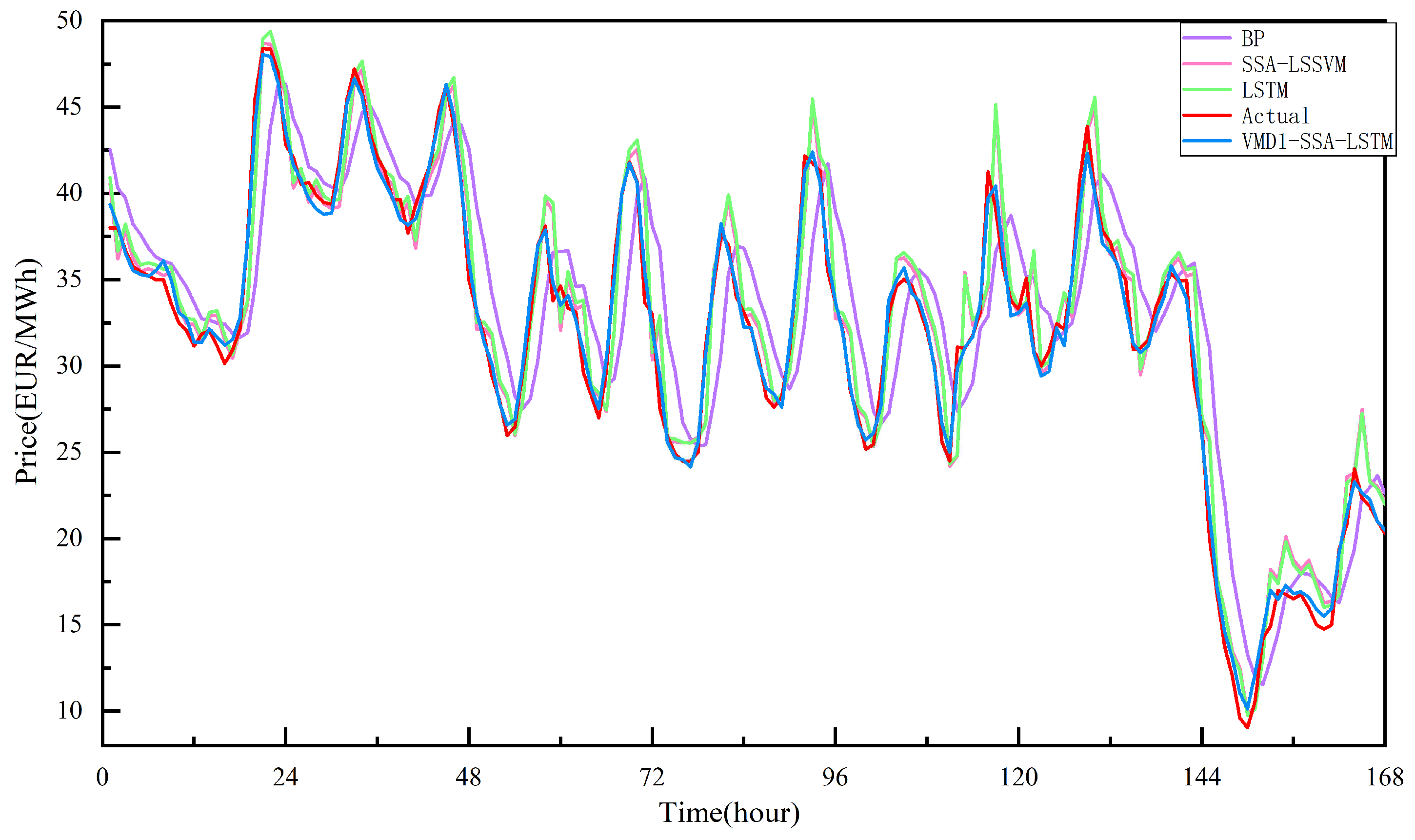

4.4. The Case of the French Electricity Market

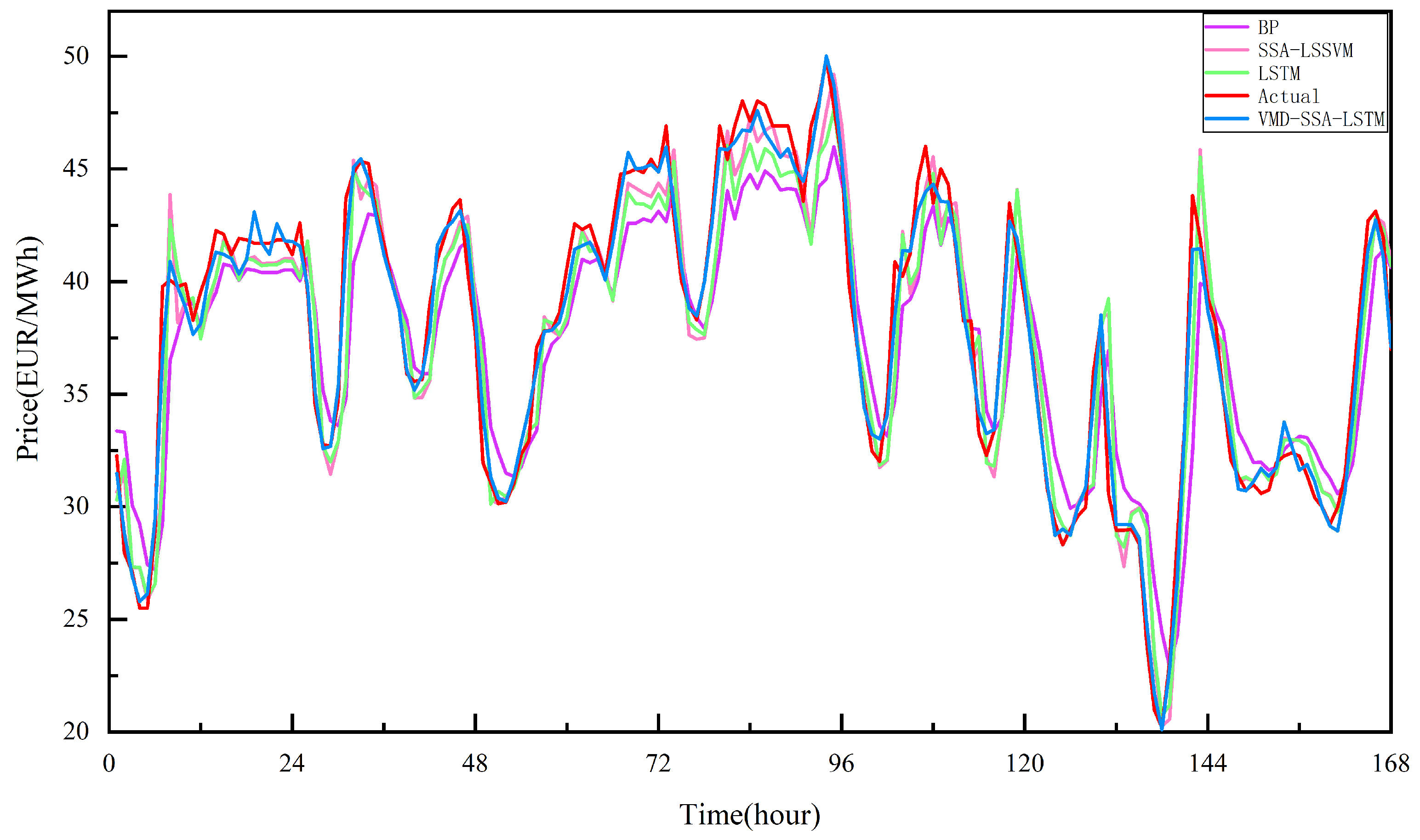

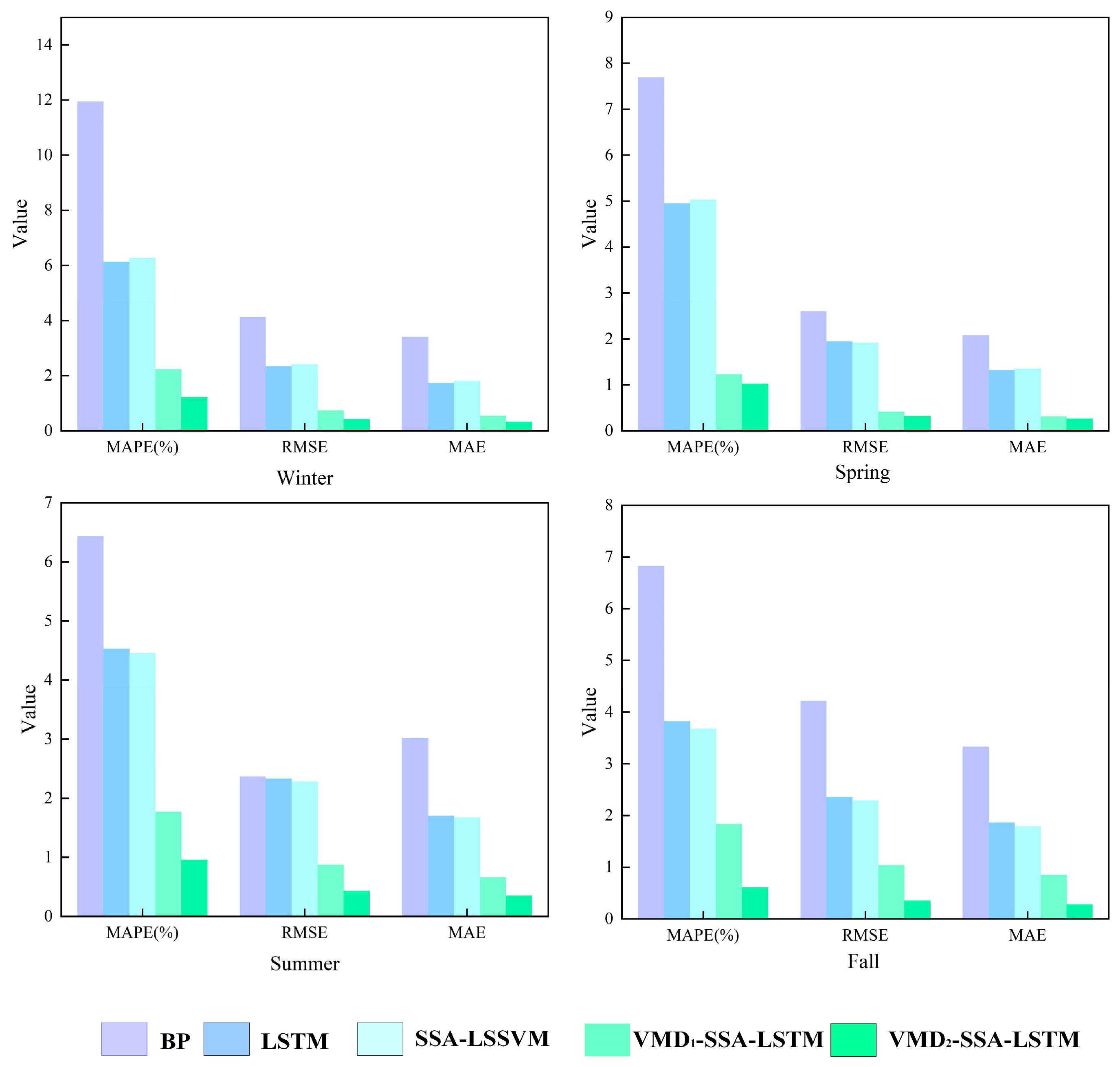

4.5. The Case of the Spanish Electricity Market

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zugno, M.; Morales, J.M.; Pinson, P.; Madsen, H. A Bilevel Model for Electricity Retailers’ Participation in a Demand Response Market Environment. Energy Econ. 2013, 36, 182–197. [Google Scholar] [CrossRef]

- Singh, N.; Mohanty, S.R.; Dev Shukla, R. Short Term Electricity Price Forecast Based on Environmentally Adapted Generalized Neuron. Energy 2017, 125, 127–139. [Google Scholar] [CrossRef]

- Lago, J.; De Ridder, F.; Vrancx, P.; De Schutter, B. Forecasting Day-Ahead Electricity Prices in Europe: The Importance of Considering Market Integration. Appl. Energy 2018, 211, 890–903. [Google Scholar] [CrossRef]

- Shah, I.; Bibi, H.; Ali, S.; Wang, L.; Yue, Z. Forecasting One-Day-Ahead Electricity Prices for Italian Electricity Market Using Parametric and Nonparametric Approaches. IEEE Access 2020, 8, 123104–123113. [Google Scholar] [CrossRef]

- Shao, Z.; Zheng, Q.; Liu, C.; Gao, S.; Wang, G.; Chu, Y. A Feature Extraction- and Ranking-Based Framework for Electricity Spot Price Forecasting Using a Hybrid Deep Neural Network. Electr. Power Syst. Res. 2021, 200, 107453. [Google Scholar] [CrossRef]

- Shah, I.; Akbar, S.; Saba, T.; Ali, S.; Rehman, A. Short-Term Forecasting for the Electricity Spot Prices With Extreme Values Treatment. IEEE Access 2021, 9, 105451–105462. [Google Scholar] [CrossRef]

- Li, W.; Becker, D.M. Day-Ahead Electricity Price Prediction Applying Hybrid Models of LSTM-Based Deep Learning Methods and Feature Selection Algorithms under Consideration of Market Coupling. Energy 2021, 237, 121543. [Google Scholar] [CrossRef]

- Shah, I.; Iftikhar, H.; Ali, S.; Wang, D. Short-Term Electricity Demand Forecasting Using Components Estimation Technique. Energies 2019, 12, 2532. [Google Scholar] [CrossRef]

- Lago, J.; Marcjasz, G.; De Schutter, B.; Weron, R. Forecasting Day-Ahead Electricity Prices: A Review of State-of-the-Art Algorithms, Best Practices and an Open-Access Benchmark. Appl. Energy 2021, 293, 116983. [Google Scholar] [CrossRef]

- Narajewski, M.; Ziel, F. Econometric Modelling and Forecasting of Intraday Electricity Prices. J. Commod. Mark. 2020, 19, 100107. [Google Scholar] [CrossRef]

- Girish, G.P. Spot Electricity Price Forecasting in Indian Electricity Market Using Autoregressive-GARCH Models. Energy Strategy Rev. 2016, 11–12, 52–57. [Google Scholar] [CrossRef]

- Liu, H.; Shi, J. Applying ARMA–GARCH Approaches to Forecasting Short-Term Electricity Prices. Energy Econ. 2013, 37, 152–166. [Google Scholar] [CrossRef]

- Chang, Z.; Zhang, Y.; Chen, W. Electricity Price Prediction Based on Hybrid Model of Adam Optimized LSTM Neural Network and Wavelet Transform. Energy 2019, 187, 115804. [Google Scholar] [CrossRef]

- Tan, Z.; Zhang, J.; Wang, J.; Xu, J. Day-Ahead Electricity Price Forecasting Using Wavelet Transform Combined with ARIMA and GARCH Models. Appl. Energy 2010, 87, 3606–3610. [Google Scholar] [CrossRef]

- Yang, Z.; Ce, L.; Lian, L. Electricity Price Forecasting by a Hybrid Model, Combining Wavelet Transform, ARMA and Kernel-Based Extreme Learning Machine Methods. Appl. Energy 2017, 190, 291–305. [Google Scholar] [CrossRef]

- Zhang, J.-L.; Zhang, Y.-J.; Li, D.-Z.; Tan, Z.-F.; Ji, J.-F. Forecasting Day-Ahead Electricity Prices Using a New Integrated Model. Int. J. Electr. Power Energy Syst. 2019, 105, 541–548. [Google Scholar] [CrossRef]

- Panapakidis, I.P.; Dagoumas, A.S. Day-Ahead Electricity Price Forecasting via the Application of Artificial Neural Network Based Models. Appl. Energy 2016, 172, 132–151. [Google Scholar] [CrossRef]

- Mosbah, H.; El-hawary, M. Hourly Electricity Price Forecasting for the Next Month Using Multilayer Neural Network. Can. J. Electr. Comput. Eng. 2016, 39, 283–291. [Google Scholar] [CrossRef]

- Keles, D.; Scelle, J.; Paraschiv, F.; Fichtner, W. Extended Forecast Methods for Day-Ahead Electricity Spot Prices Applying Artificial Neural Networks. Appl. Energy 2016, 162, 218–230. [Google Scholar] [CrossRef]

- Zhang, C.; Li, R.; Shi, H.; Li, F. Deep Learning for Day-Ahead Electricity Price Forecasting. IET Smart Grid 2020, 3, 462–469. [Google Scholar] [CrossRef]

- Shiri, A.; Afshar, M.; Rahimi-Kian, A.; Maham, B. Electricity Price Forecasting Using Support Vector Machines by Considering Oil and Natural Gas Price Impacts. In Proceedings of the 2015 IEEE International Conference on Smart Energy Grid Engineering, Oshawa, ON, Canada, 17–19 August 2015; pp. 1–5. [Google Scholar]

- Che, J.; Wang, J. Short-Term Electricity Prices Forecasting Based on Support Vector Regression and Auto-Regressive Integrated Moving Average Modeling. Energy Convers. Manag. 2010, 51, 1911–1917. [Google Scholar] [CrossRef]

- Imani, M.H.; Bompard, E.; Colella, P.; Huang, T. Forecasting Electricity Price in Different Time Horizons: An Application to the Italian Electricity Market. IEEE Trans. Ind. Appl. 2021, 57, 5726–5736. [Google Scholar] [CrossRef]

- Najafi, A.; Homaee, O.; Jasinski, M.; Golshan, M.; Leonowicz, Z. Application of Extreme Learning Machine-Autoencoder to Medium Term Electricity Price Forecasting. In Proceedings of the 2022 IEEE International Conference on Environment and Electrical Engineering and 2022 IEEE Industrial and Commercial Power Systems Europe, Prague, Czech Republic, 28 June–1 July 2022; pp. 1–4. [Google Scholar]

- Wang, L.; Zhang, Z.; Chen, J. Short-Term Electricity Price Forecasting With Stacked Denoising Autoencoders. IEEE Trans. Power Syst. 2017, 32, 2673–2681. [Google Scholar] [CrossRef]

- Wang, D.; Luo, H.; Grunder, O.; Lin, Y.; Guo, H. Multi-Step Ahead Electricity Price Forecasting Using a Hybrid Model Based on Two-Layer Decomposition Technique and BP Neural Network Optimized by Firefly Algorithm. Appl. Energy 2017, 190, 390–407. [Google Scholar] [CrossRef]

- Yi, M.; Xie, W.; Mo, L. Short-Term Electricity Price Forecasting Based on BP Neural Network Optimized by SAPSO. Energies 2021, 14, 6514. [Google Scholar] [CrossRef]

- Anbazhagan, S.; Kumarappan, N. Day-Ahead Deregulated Electricity Market Price Forecasting Using Recurrent Neural Network. IEEE Syst. J. 2013, 7, 866–872. [Google Scholar] [CrossRef]

- Khan, Z.A.; Fareed, S.; Anwar, M.; Naeem, A.; Gul, H.; Arif, A.; Javaid, N. Short Term Electricity Price Forecasting Through Convolutional Neural Network (CNN). In Proceedings of the Web, Artificial Intelligence and Network Applications, Caserta, Italy, 15–17 April 2020; Springer: Cham, Switzerland, 2020; pp. 1181–1188. [Google Scholar]

- Abedinia, O.; Amjady, N.; Shafie-khah, M.; Catalão, J.P.S. Electricity Price Forecast Using Combinatorial Neural Network Trained by a New Stochastic Search Method. Energy Convers. Manag. 2015, 105, 642–654. [Google Scholar] [CrossRef]

- Yang, Y.; Tan, Z.; Yang, H.; Ruan, G.; Zhong, H.; Liu, F. Short-Term Electricity Price Forecasting Based on Graph Convolution Network and Attention Mechanism. IET Renew. Power Gener. 2022, 16, 2481–2492. [Google Scholar] [CrossRef]

- Afrasiabi, M.; Mohammadi, M.; Rastegar, M.; Kargarian, A. Probabilistic Deep Neural Network Price Forecasting Based on Residential Load and Wind Speed Predictions. IET Renew. Power Gener. 2019, 13, 1840–1848. [Google Scholar] [CrossRef]

- Peng, L.; Liu, S.; Liu, R.; Wang, L. Effective Long Short-Term Memory with Differential Evolution Algorithm for Electricity Price Prediction. Energy 2018, 162, 1301–1314. [Google Scholar] [CrossRef]

- Gundu, V.; Simon, S.P. PSO–LSTM for Short Term Forecast of Heterogeneous Time Series Electricity Price Signals. J. Ambient. Intell. Hum. Comput 2021, 12, 2375–2385. [Google Scholar] [CrossRef]

- Lahmiri, S. Comparing Variational and Empirical Mode Decomposition in Forecasting Day-Ahead Energy Prices. IEEE Syst. J. 2017, 11, 1907–1910. [Google Scholar] [CrossRef]

- Naz, A.; Javed, M.U.; Javaid, N.; Saba, T.; Alhussein, M.; Aurangzeb, K. Short-Term Electric Load and Price Forecasting Using Enhanced Extreme Learning Machine Optimization in Smart Grids. Energies 2019, 12, 866. [Google Scholar] [CrossRef]

- Gholipour Khajeh, M.; Maleki, A.; Rosen, M.A.; Ahmadi, M.H. Electricity Price Forecasting Using Neural Networks with an Improved Iterative Training Algorithm. Int. J. Ambient Energy 2018, 39, 147–158. [Google Scholar] [CrossRef]

- Victoire, T.A.A.; Gobu, B.; Jaikumar, S.; Arulmozhi, N.; Kanimozhi, P.; Victoire, T.A. Two-Stage Machine Learning Framework for Simultaneous Forecasting of Price-Load in the Smart Grid. In Proceedings of the 2018 17th IEEE International Conference on Machine Learning and Applications, Orlando, FL, USA, 17–20 December 2018; pp. 1081–1086. [Google Scholar]

- Darudi, A.; Bashari, M.; Javidi, M.H. Electricity Price Forecasting Using a New Data Fusion Algorithm. IET Gener. Transm. Distrib. 2015, 9, 1382–1390. [Google Scholar] [CrossRef]

- Gao, W.; Darvishan, A.; Toghani, M.; Mohammadi, M.; Abedinia, O.; Ghadimi, N. Different States of Multi-Block Based Forecast Engine for Price and Load Prediction. Int. J. Electr. Power Energy Syst. 2019, 104, 423–435. [Google Scholar] [CrossRef]

- Pourdaryaei, A.; Mokhlis, H.; Illias, H.A.; Kaboli, S.H.A.; Ahmad, S. Short-Term Electricity Price Forecasting via Hybrid Backtracking Search Algorithm and ANFIS Approach. IEEE Access 2019, 7, 77674–77691. [Google Scholar] [CrossRef]

- Yang, W.; Sun, S.; Hao, Y.; Wang, S. A Novel Machine Learning-Based Electricity Price Forecasting Model Based on Optimal Model Selection Strategy. Energy 2022, 238, 121989. [Google Scholar] [CrossRef]

- Zhang, F.; Fleyeh, H.; Bales, C. A Hybrid Model Based on Bidirectional Long Short-Term Memory Neural Network and Catboost for Short-Term Electricity Spot Price Forecasting. J. Oper. Res. Soc. 2022, 73, 301–325. [Google Scholar] [CrossRef]

- Chen, Y.; Li, M.; Yang, Y.; Li, C.; Li, Y.; Li, L. A Hybrid Model for Electricity Price Forecasting Based on Least Square Support Vector Machines with Combined Kernel. J. Renew. Sustain. Energy 2018, 10, 055502. [Google Scholar] [CrossRef]

- Hong, Y.-Y.; Liu, C.-Y.; Chen, S.-J.; Huang, W.-C.; Yu, T.-H. Short-Term LMP Forecasting Using an Artificial Neural Network Incorporating Empirical Mode Decomposition. Int. Trans. Electr. Energy Syst. 2015, 25, 1952–1964. [Google Scholar] [CrossRef]

- He, K.; Yu, L.; Tang, L. Electricity Price Forecasting with a BED (Bivariate EMD Denoising) Methodology. Energy 2015, 91, 601–609. [Google Scholar] [CrossRef]

- Qiu, X.; Suganthan, P.N.; Amaratunga, G.A.J. Short-Term Electricity Price Forecasting with Empirical Mode Decomposition Based Ensemble Kernel Machines. Procedia Comput. Sci. 2017, 108, 1308–1317. [Google Scholar] [CrossRef]

- Zhang, J.; Tan, Z.; Wei, Y. An Adaptive Hybrid Model for Short Term Electricity Price Forecasting. Appl. Energy 2020, 258, 114087. [Google Scholar] [CrossRef]

- Jiang, P.; Ma, X. A Hybrid Forecasting Approach Applied in the Electrical Power System Based on Data Preprocessing, Optimization and Artificial Intelligence Algorithms. Appl. Math. Model. 2016, 40, 10631–10649. [Google Scholar] [CrossRef]

- Huang, C.-J.; Shen, Y.; Chen, Y.-H.; Chen, H.-C. A Novel Hybrid Deep Neural Network Model for Short-Term Electricity Price Forecasting. Int. J. Energy Res. 2021, 45, 2511–2532. [Google Scholar] [CrossRef]

- Zhang, T.; Tang, Z.; Wu, J.; Du, X.; Chen, K. Short Term Electricity Price Forecasting Using a New Hybrid Model Based on Two-Layer Decomposition Technique and Ensemble Learning. Electr. Power Syst. Res. 2022, 205, 107762. [Google Scholar] [CrossRef]

- Heydari, A.; Majidi Nezhad, M.; Pirshayan, E.; Astiaso Garcia, D.; Keynia, F.; De Santoli, L. Short-Term Electricity Price and Load Forecasting in Isolated Power Grids Based on Composite Neural Network and Gravitational Search Optimization Algorithm. Appl. Energy 2020, 277, 115503. [Google Scholar] [CrossRef]

- Dragomiretskiy, K.; Zosso, D. Variational Mode Decomposition. IEEE Trans. Signal Process. 2014, 62, 531–544. [Google Scholar] [CrossRef]

- Xue, J.; Shen, B. A Novel Swarm Intelligence Optimization Approach: Sparrow Search Algorithm. Syst. Sci. Control Eng. 2020, 8, 22–34. [Google Scholar] [CrossRef]

- Hochreiter, S.; Schmidhuber, J. Long Short-Term Memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef] [PubMed]

- Diebold, F.X.; Mariano, R.S. Comparing Predictive Accuracy. J. Bus. Econ. Stat. 2002, 20, 134–144. [Google Scholar] [CrossRef]

| BP | LSTM | SSA-LSSVM | VMD1-SSA-LSTM | VMD2-SSA-LSTM | |

|---|---|---|---|---|---|

| MAPE (%) | 3.67 | 2.41 | 1.91 | 0.63 | 0.39 |

| RMSE | 2.54 | 1.84 | 1.58 | 0.43 | 0.25 |

| MAE | 1.74 | 1.17 | 0.94 | 0.31 | 0.19 |

| BP | LSTM | SSA-LSSVM | VMD1-SSA-LSTM | VMD2-SSA-LSTM | |

|---|---|---|---|---|---|

| MAPE (%) | 15.4 | 9.89 | 8.08 | 3.12 | 1.58 |

| RMSE | 8.39 | 5.34 | 4.51 | 1.70 | 0.90 |

| MAE | 6.99 | 4.32 | 3.48 | 1.35 | 0.68 |

| Season | Error Metrics | Model | ||||

|---|---|---|---|---|---|---|

| BP | SSA-LSSVM | LSTM | VMD1-SSA-LSTM | VMD2-SSA-LSTM | ||

| Winter | MAPE (%) | 11.94 | 6.13 | 6.28 | 2.23 | 1.22 |

| RMSE | 4.13 | 2.34 | 2.41 | 0.74 | 0.42 | |

| MAE | 3.41 | 1.74 | 1.81 | 0.61 | 0.33 | |

| Spring | MAPE (%) | 7.69 | 5.03 | 4.95 | 1.23 | 1.02 |

| RMSE | 2.60 | 1.92 | 1.95 | 0.42 | 0.32 | |

| MAE | 2.08 | 1.35 | 1.32 | 0.31 | 0.26 | |

| Summer | MAPE (%) | 6.43 | 4.46 | 4.53 | 1.77 | 0.96 |

| RMSE | 2.37 | 2.28 | 2.33 | 0.87 | 0.43 | |

| MAE | 3.02 | 1.67 | 1.70 | 0.67 | 0.35 | |

| Fall | MAPE (%) | 6.83 | 3.68 | 3.83 | 1.83 | 0.61 |

| RMSE | 4.22 | 2.29 | 2.36 | 1.04 | 0.35 | |

| MAE | 3.33 | 1.79 | 1.86 | 0.85 | 0.28 | |

| Average | MAPE (%) | 8.22 | 4.83 | 4.90 | 1.77 | 0.95 |

| RMSE | 3.33 | 2.21 | 2.26 | 0.77 | 0.38 | |

| MAE | 2.96 | 1.64 | 1.67 | 0.61 | 0.31 | |

| Market | Models | BP | LSTM | SSA-LSSVM | VMD1 | VMD2 |

|---|---|---|---|---|---|---|

| Australia | BP | – | <0.01 | <0.01 | <0.01 | <0.01 |

| LSTM | 0.99 | – | <0.01 | <0.01 | <0.01 | |

| SSA-LSSVM | 0.99 | 0.99 | – | <0.01 | <0.01 | |

| VMD1 | 0.99 | 0.99 | 0.99 | – | <0.01 | |

| VMD2 | 0.99 | 0.99 | 0.99 | 0.99 | – | |

| France | BP | – | <0.01 | <0.01 | <0.01 | <0.01 |

| LSTM | 0.99 | – | <0.01 | <0.01 | <0.01 | |

| SSA-LSSVM | 0.99 | 0.99 | – | <0.01 | <0.01 | |

| VMD1 | 0.99 | 0.99 | 0.99 | – | <0.01 | |

| VMD2 | 0.99 | 0.99 | 0.99 | 0.99 | – | |

| Spain—Spring | BP | – | <0.01 | <0.01 | <0.01 | <0.01 |

| LSTM | 0.99 | – | <0.01 | <0.01 | <0.01 | |

| SSA-LSSVM | 0.99 | 0.99 | – | <0.01 | <0.01 | |

| VMD1 | 0.99 | 0.99 | 0.99 | – | <0.01 | |

| VMD2 | 0.99 | 0.99 | 0.99 | 0.99 | – | |

| Spain—Summer | BP | – | <0.01 | <0.01 | <0.01 | <0.01 |

| LSTM | 0.99 | – | 0.05 | <0.01 | <0.01 | |

| SSA-LSSVM | 0.99 | 0.95 | – | <0.01 | <0.01 | |

| VMD1 | 0.99 | 0.99 | 0.99 | – | <0.01 | |

| VMD2 | 0.99 | 0.99 | 0.99 | 0.99 | – | |

| Spain—Fall | BP | – | <0.01 | <0.01 | <0.01 | <0.01 |

| LSTM | 0.99 | – | 0.02 | <0.01 | <0.01 | |

| SSA-LSSVM | 0.99 | 0.98 | – | <0.01 | <0.01 | |

| VMD1 | 0.99 | 0.99 | 0.99 | – | <0.01 | |

| VMD2 | 0.99 | 0.99 | 0.99 | 0.99 | – | |

| Spain—Winter | BP | – | <0.01 | <0.01 | <0.01 | <0.01 |

| LSTM | 0.99 | – | <0.01 | <0.01 | <0.01 | |

| SSA-LSSVM | 0.99 | 0.99 | – | <0.01 | <0.01 | |

| VMD1 | 0.99 | 0.99 | 0.99 | – | <0.01 | |

| VMD2 | 0.99 | 0.99 | 0.99 | 0.99 | – |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, F.; Deng, S.; Zheng, W.; Wen, A.; Du, J.; Huang, G.; Wang, R. Short-Term Electricity Price Forecasting Based on the Two-Layer VMD Decomposition Technique and SSA-LSTM. Energies 2022, 15, 8445. https://doi.org/10.3390/en15228445

Guo F, Deng S, Zheng W, Wen A, Du J, Huang G, Wang R. Short-Term Electricity Price Forecasting Based on the Two-Layer VMD Decomposition Technique and SSA-LSTM. Energies. 2022; 15(22):8445. https://doi.org/10.3390/en15228445

Chicago/Turabian StyleGuo, Fang, Shangyun Deng, Weijia Zheng, An Wen, Jinfeng Du, Guangshan Huang, and Ruiyang Wang. 2022. "Short-Term Electricity Price Forecasting Based on the Two-Layer VMD Decomposition Technique and SSA-LSTM" Energies 15, no. 22: 8445. https://doi.org/10.3390/en15228445

APA StyleGuo, F., Deng, S., Zheng, W., Wen, A., Du, J., Huang, G., & Wang, R. (2022). Short-Term Electricity Price Forecasting Based on the Two-Layer VMD Decomposition Technique and SSA-LSTM. Energies, 15(22), 8445. https://doi.org/10.3390/en15228445