Abstract

Integrated reporting (IR) contains a lot of important information for firms, such as income, cash flows, risks, uncertainties, intellectual capital, social capital and environmental capital. Based on the relevant literature it is found that the adoption of integrated reporting affects the firms’ value in the short, medium and long term and, at the same time affects its environmental, social and governance performances. The aim of this paper is to analyze the impact of integrated reporting in European energy firms’ value relevance. To do so, the panel data concerning 38 European energy distribution listed firms are analyzed, using statistical and econometrical methods including OLS, WLS, fixed effects and random effects models. The paper’s main novelty is that it concerns a sector that plays a key role in the economic development of countries and, at the same time only a few studies are carried out concerning the examined subject in this sector. The research results have revealed that integrated reporting, book value and earnings per share have a statistically significantly effect on energy firms’ market value. Thus, it is proposed that energy firms adopt IR.

1. Introduction

The environmental context of firms has changed since the financial crisis of 2008, due to the fact that its effects established new circumstances that led them to focus on sustainability [1,2,3]. The challenging and complex business environment created for stakeholders, the need for high quality, value relevant and timely information. For this reason, the annual report, based on historical earnings and cash flow information, cannot be used to predict the future value of a firm and its performance [4,5,6]. Investors and creditors need additional information that can provide future orientation [7]. Forward-looking information affects actual results and decisions [8]. Several firms, in order to improve their competitive position in the market, focus on their sustainability performance, expressed in sustainability reports that incorporate a set of information concerning their environmental, social and governance goals. Non-financial information is highly complex and difficult to handle but simultaneously affects the value creation of the firms.

At the same time, the threat of climate change and its effects is increasing [9,10,11]. Both countries and firms are in the need of taking measures to mitigate the negative implications of climate change, in order to ensure a sustainable future. In this sense, the international community is looking for solutions, in order to achieve climate neutrality. Ambitious climate and energy policies have been adopted in recent years, since the energy sector exerts substantial social and environmental impacts and has a key role in the transition to a climate neutral economy [12,13].

Furthermore, it is important for the long-term success of both firms and society, to ingrate in firms’ strategies climate change prevention, depletion of natural resources mitigation, working conditions and human rights [14]. The new circular economy action plan (CEAP), aiming to reduce the pressure on natural resources and create sustainable growth and jobs, was adopted by the European Union in March 2020. According to the CEAP framework, firms in the energy sector should include in their corporate strategies, non-financial actions related to their social and environmental impact and disclose them in their sustainability reports.

Some firms present a separate sustainability report but others incorporate various information, financial and non-financial, in a single annual report. The integration of all types of information into a single report achieves a concrete image of the firm, about its future targets and most importantly reflects on the relationship between its financial performance and non-financial performance [15].

Integrated reporting (IR) contains information about the expected income, anticipated cash flow, risks, uncertainties, intellectual capital, social and environmental capital [16]. It improves the quality of traditional accounting information and offers an alternative to a corporate sustainability report. Furthermore, it contributes effectively to the decision making process of the management by ensuring accountability and transparency [17]. The aim to combine financial with non-financial information is to encourage firms to achieve value creation by using all available resources and make optimal allocations, and raise their reputation in the market [7].

The adoption of IR affects the ability of a firm to sustain value in the short, medium and long term [18] and simultaneously affects its environmental, social and governance performances (ESG) [17]. Moreover, IR impacts on a firms’ value [19] and influences the value relevance of the accounting information.

The aims of the present research are both to analyze the impact of IR in energy firms’ value relevance and, to justify the applied methodological approach using statistical and econometrical tools. In the present research, the energy sector is selected to be examined, due to the fact that it is in the spotlight, since energy plays a key role in the economic development of countries [20,21]. This relationship has become even more important since the outbreak of COVID-19 has led to the volatility of energy prices [22]. Another reason for selecting energy sector firms, is that there are only a few empirical studies about them, while many of them concern the South African experience, since the stock exchange of Johannesburg was the first to make IR obligatory for listed firms, in 2010 [21].

The paper is structured as follows. Initially, an introduction to the paper’s core concepts and aim is provided. In the Section 2, a literature review on IR, its value relevance and an IR value relevance in the energy sector is carried out. Next, the paper’s methodology is presented. The Section 4 provides the research results. Last, in the Section 5, the research results are discussed while the paper’s conclusions are provided.

2. Literature Review

2.1. Integrated Reporting

The accounting information is important because it lies in the valuation of equity and explains a firms’ value. The basic characteristics of financial information are reliability and relevance, if they are associated with market value. Firms’ stakeholders, in order to obtain information regarding value creation, need supplementary information related not only to the economic issues but also to social issues, environmental issues, as well as to political and global economic issues. The integration of the above information to annual reports provides stakeholders with more information and enables them to assess the value of the firm, and shifts the corporate responsibility measured by economic indicators in financial reporting to social and environmental factors, internally and externally [23]. The non-financial information maintains the transparency and integrity of the firm’s report and is relevant in reflecting its sustainability performance. The actual role of an integrated report, which includes financial and non-financial information, is to facilitate the investors and creditors understanding of how a firm creates value in the short, medium and long term [24]. The interest for non-financial information integrated in annual reports enhances due to its credibility. Various capitals of the firms affect the IR’s capacity to create value.

The IRC framework classifies six types of capital—financial, manufactured, intellectual, human, social and natural—that compose the organizational capital of the firm and enhance the financial performance and its value [25]. It is a holistic report that illustrates the plans of the firm in order to create a future value by exploiting its resources and connecting the six forms of capitals: financial, manufactured, intellectual, human, social and natural capital [26]. These capitals form the basis of the firm’s value creation. The adoption of IRC has a positive impact on the value relevance of the organizational capital [18], since it concentrates on various capitals and on their ability to provide shareholders’ wealth. It provides to the stakeholders, investors and creditors coherent information about economic, social, environmental and sustainable matters of the firm and reduces information asymmetries [27]. Since IRC minimizes the information asymmetry concerning different forms of capital to the capital providers, the quality of the information disclosure in IR, increases [28].

The adoption of IR depends on its impacts on the capital market, since it affects the firm’s financial value and stock liquidity [26]. The high quality of IR is associated with the stock liquidity.

In recent years, many researchers and academics have started to observe the effects of intellectual, environmental, and manufactured capital information, as also the corporate social responsibility disclosure, on the firms’ financial performance. Orlitzky et al. [29] found in their study, that corporate social responsibility is highly correlated with accounting-based measures of the corporate financial performance (CFP) than with market-based indicators, and the CSP reputation indices are more highly correlated with the CFP than are other indicators of the CSP.

The market valuation of the ESG performance depends on the reporting type, referring to whether it is integrated or not. The ESG performance increases when firms apply IR, taking into consideration the market performance and value relevance, since the ESG performance is considered as valued by investors [17]. IR includes high quality information leading to better value creation, since it improves accountability and transparency and enables a more integrated way of thinking. It affects the firms’ internal decision-making process by providing a more comprehensive and complete picture of the impact of its strategy [30]. IR provides a truthful representation of the ESG performance and leads to a higher value relevance of the ESG performance. As a result, it increases investors’ confidence and simultaneously attracts more investors, it reduces the likelihood of negative consequences of forecasting errors by market actors and, consequently, increases the market value of a firm [31,32].

The application of IR influences significantly the value relevance of the firms’ earnings, compared to the adoption of traditional financial reporting. The value relevance of the financial and non-financial information is associated with a firm’s stock price that reflects investors’ valuation of the firm. Investors’ needs for information cannot be satisfied by traditional accounting information, due to increase value of the intangibles [33].

The level and the extent of IR’s adoption, depends on specific determinants, such as the firm size, sales growth, profitability, leverage, board size, board meeting frequency, liquidity, etc. Lee and Yeo [32], in their study, examined the adoption of IR by the listed firms in South Africa and found that firm age, size, sales and profitability are the most important determinants of IR.

According to Busco et al. [34], European firms apply IR, based on their size, leverage, board size and board meeting frequency. In particular, firms operating in sensitive industries with a great environmental performance, are more likely to adopt IR. Large firms are interested, more for their environmental, social and sustainable performances since they have great pressure from their stakeholders to legitimize their operations.

Ghani et al. [35] examined the extent of the IR adoption by the public listed real property firms in Malaysia and found that only the firm size and audit firm size significantly influenced the level of IR.

The study of Vitolla et al. [36] showed that the quality of IR in the financial institutions is significantly and positively influenced by profitability, size, financial leverage and the civil law system. Firms with a high leverage adopt high quality IR because a high leverage reduces information asymmetry.

Serafeim [31], found that firms with high growth opportunities, which are not characterized as family firms, are the most common firms to apply IR. Investors with social and environmental interests require a high quality of IR; thus the composition of the firm’s investor base influences the adoption of IR.

Last, Haleem et al. [37] investigated the effects of IR and organizational capital in the value relevance of banks in Sri Lanka that are listed in the Colorado stock exchange. According to their findings, the return on equity and size does not affect positively the market value of the bank’s equity. The book value of equity, the earnings before interest and taxation, leverage and organization capital affect the market value of the bank.

2.2. Value Relevance

Value relevance can be defined as the association between accounting amounts and security market values. The accounting amount, in order to be characterized as value relevance, should have a predicted association with the equity market value [38]. Furthermore, non-accounting measures, which enclose information that has an impact on the equity value can be characterized as value relevance [39].

Many researchers, in their empirical studies, have tried to investigate the value relevance with reference to stand alone reports and to IR. Cormier and Magnan [40] focused on the on the relationship between environmental reporting, a firms’ earnings and their stock market value in Germany, France and Canada. Based on their conclusions, the stock market valuation of the French and Canadian firms’ earnings is not significantly influenced by the environmental reporting. Controversially, in Germany, the stock market valuation of a firm’s earnings is found to be moderately impacted by the decisions to report the environmental information.

In Sweden, a firm’s environmental performance is found to have a negative impact on its market value, according to Hassel et al. [39], since the high environmental performance is costly and affects negatively the expected earnings and market values. In the abovementioned study, the market value is expressed as a function of book value, accounting earnings and environmental performance; it is found that the environmental information has value relevance only if the expected future earnings of the listed firms are affected.

Konar & Cohen [41] investigated the relationship of the market value of firms in the S&P 500 index with the objective measures of their environmental performance and found that in poor firms and in publicly traded firms, the toxic chemicals that they emitted legally, have a significant effect on their intangible asset value.

According to Movena and Cuellar [42], the market value of a firm is influenced by the financial environmental disclosures but not by the non-financial ones. In their study, they investigated the relationship of the firms’ market value with two different types of environmental reporting, compulsory and voluntary, in listed Spanish firms.

Research results concerning social reporting are controversial. Qiu et al. [43] examined the relationship between the profitability and market value and the social and environmental performances. They argue that firms with a high social disclosure, have a high market value, due to a higher than expected growth rate in cash flows.

Cardamone et al. [38], in order to answer to the question of whether “the social report is value-relevant in assessing a firm’s market value”, they analyzed the relationship of the value relevance with the social reporting in 178 firms, listed on the Milan Stock Exchange. According to their findings, the firms’ market value is negatively correlated with the social reports. The relevance of earnings per share are not affected by the social reports.

Schadewitz and Niskala [44] analyzed the Finnish listed firms that have adopted the Global Reporting Initiative (GRI) and found that the application of sustainability reporting, which includes the social aspects, affects the performance of the firms. The GRI is an important tool for firms, in order to decrease the information asymmetry between managers and investors.

According to the study of Aureli et al. [45], which is based on the listed firms on the Dow Jones, the integration of social and environmental information in annual reports enhances the positive image of a firm. Investors are interested, more for the long-term sustainability, rather than for the short-term financial performance while they take into account the ESG information in their investment decisions. The ESG reporting increases the firms’ transparency, improves its market efficiency and enhances the confidence of investors and creditors.

2.3. Integrated Reporting in the Energy Sector

The energy sector determines the growth of national economies and affects several industries [20]. Thus, it should be considered in the financial, fiscal, social, welfare and environmental aspects [46]. Energy firms, should integrate in their strategies, operations and financial reports, and their political, economic, social and environmental objectives and actions, in order to create sustainable value for the stakeholders and shareholders and increase their corporate social responsibility. Based on the importance of IR for firms, several researchers have tried to shed some light on its impact on the energy sector firms.

Szczepankiewicz and Mucko’s [47] study focused on the use of corporate social responsibility reporting of Polish energy firms and showed that sustainability reporting draws much attention by the shareholders, but they have diversity in the approaches to the content. These content variations can have a negative impact on the information quality, comparability, verifiability, timeliness and comprehensibility.

Romolini et al. [48] focused in analyzing the quality of the social information disclosed in firms’ reports, in the energy and utilities sectors. Particularly, they compared the data disclosed in the social reporting of Italian, American and Chinese electric, mining and metals, oil and gas firms and they demonstrated that the quality level in Italy is higher than in the USA and China. The quality of information depends on the managers’ stand on the improvement of firms’ environmental and social effectiveness. Firms pay more attention to environmental issues, due to international agreements concerning the world ecosystem, such as the Kyoto Protocol [49]. Activities related to working conditions, labor practices, health and safety of employees, training and education of employees that have a social impact, are limited. Chinese firms’ interests concerned on training and education while Italians and Americans are mainly concerned with health and safety at work, labor practices and employment. Less attention, in energy sector, is paid to product responsibility. In the research, it is found that only Chinese firms are more interested about their product responsibility. They use social reporting, in order to increase their produced goods’ and services’ accreditation in quality, compared to other countries.

In Europe, extracting industry firms, such as mining, oil and gas firms, pay particular attention to disclose the social and environmental information in their reports. They have the highest reporting rate, compared to other industries, since their activities have a great impact on the environment and, in order to respond to social pressures, they disclose their environmental and social actions in their reports. Gianluca [50] carried out a content analysis of the reports of 15 firms in the oil, gas and mining sector in the European Union (including Switzerland). According to this research, firms disclosed environmental information in their reports, related to ecological performance programs, energy efficiency, improvements and reliability of assets. The social aspect of their activities is expressed thought information about employee health and safety and investment for developing new skills and competencies.

3. Materials and Methods

3.1. Sample

The research sample consists of European listed firms in the energy sector. To do so, we have used secondary data from the Refinitiv Eikon database [51], which includes the financial data of global economic, listed firms. This database is considered as one of the most reliable since it covers about 99% of the market capitalization, including data for 72,000 listed firms worldwide at quarterly and annual levels [52]. This database is used in several cases, concerning the energy sector [53,54,55].

It should be noted that in the energy sector, are included firms that produce, supply and distribute energy [52]. In our research, we have exclusively examined firms from the energy distribution industry. In this way, we have limited the sample to firms with a common activity, in order to avoid extreme variations in the sample. Moreover, for the same reason, we have selected firms that have prepared IR for five consecutive years, by the end of 31 December 2019. Despite the fact that this requirement limits the sample size, it ensures that the examined firms adopt systematically IR, as reported in the literature [19,27]. Finally, 38 listed firms from eight different European countries were examined.

In order to fulfill the aim of research, we have used two groups of firms:

- the first group included firms that adopt IR, based on IRC (IR Reporters) while,

- the second group included firms that do not adopt IR, based on IRC (Non-IRC Reporters).

The selected groups consist of an equal number of firms that were selected to be comparable, since they operate in the same industry and in the same country.

The sample’s structure is provided in the following Table 1.

Table 1.

Sample structure.

3.2. Model and Variables

The following equation was used to analyze the relation of the book value, earnings per share and IR, as a dummy variable with the market value:

where:

MVit = c + a1 BVit + a2 EPSit + a3 IR + dt + εit

- MVit is the logarithm price of a share of firm i at fiscal year-end,

- c: constant,

- BV: book value,

- EPSit: net profit before taxes,

- IR: dummy variable that equals 1 if the firm adopts IR,

- dt is a dummy variable that explains the time effect.

4. Results

4.1. Descriptive Analysis

Initially, the descriptive statistics of the equation’s variables are calculated. Based on the data provided in the following Table 2, we obtain that the dependent variable’s (MV) mean (μ = 69.9), which is greater than its median (δ = 22.6); thus, its frequency curve is positively asymmetric. Furthermore, the standard deviation is equal to 109, while it is understood that half of the observations of the stock value do not exceed 22.6.

Table 2.

Descriptive statistics.

Concerning the book value, the mean is equal to 43.4, while the median (δ = 13.3) means that half of the sample’s firms do not have a book value greater than 13.3.

Finally, the net earnings per share (EPS) demonstrated a positive asymmetry, since the mean (μ = 2.96) is greater than the median (δ = 0.940).

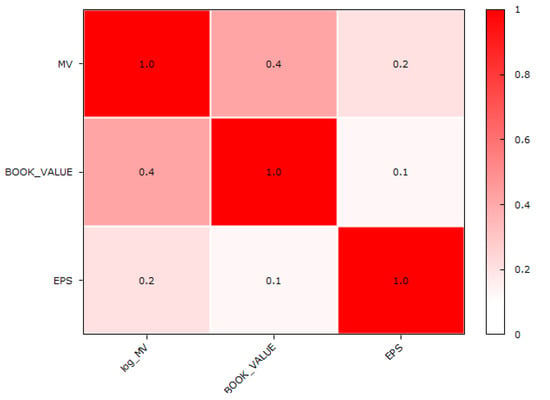

4.2. Correlation Analysis

Initially, we have applied Pearson’s correlation coefficient to examine the possible correlations between the variables. Based on the relevant p-values, we obtain that the market value has a weak positive linear correlation with the book value and the earnings per share. On the contrary, the earnings per share do not have a significant correlation with the book value; however, they are positively correlated with the market value. A positive linear correlation is obtained for the variables, concerning the firms’ earnings per share and market value. The abovementioned relationships are presented in the following Figure 1.

Figure 1.

Correlation matrix. Source: built on the basis of the authors’ calculations.

To further analyze the variables and investigate the relationships between them, we have used panel data analysis methods, since the research sample consists of data for exactly the same firms (sample units) for the examined five-year period [56]. The panel data analysis is applied in cases such as the present research where the data consist of values concerned across the time [57]. The application of the panel data analysis prevents the methodological problems of the time-series analysis and the cross-section methods which, in many cases, cannot identify the dynamic factors with significant effect on the dependent variable [58]. Moreover, the panel data analysis results in the efficient and unbiased estimators and in a larger number of degrees of freedom; in this way it overcomes the restrictive assumptions of the linear regression [56].

Thus, in order to explore the impact of IR in the examined firms’ value relevance, we seek the most appropriate method for the panel data. The first method used is the ordinary least squares (OLS), a commonly used method to estimate the parameters on a regression model while its estimators minimize the sum of the squared errors which refer to the difference between the observed and the predicted values. An alternative method is the weighted least squares (WLS), which fits better in small data sets. Furthermore, we have examined the application of the fixed effects and the random effects methods. The fixed effects model explores the effect of the independent variables when they vary over time; thus, the model’s results cannot be biased by the omitted time-invariant factors. Concerning the random effects method, unlike the fixed effects, the variation is considered to be random and uncorrelated with the model’s variables. Hausman’s test is used, in order to decide which model between the fixed effects and the random effects is more suitable. More specifically, the null hypothesis of the test is that the preferred model is the random effects (in this case the unique errors are not correlated with the regressors) [56,59].

The data analysis, based on the abovementioned methods, has provided the results in the following Table 3.

Table 3.

Model’s results.

Studies of the existing literature concerning the effect of IR on firms’ value relevance, are based either on a panel data regression analysis or on simple linear models [60,61]. Some of them have implemented the OLS method [26]. However, in these studies, it is not clear whether the appropriate tests for the residuals’ heteroscedasticity analysis are carried out or not.

Since the data of the present study are the time series, we initially tested the OLS method’s fitness. To do so, we used the White test, which tests whether the variance of the errors in a regression model is constant therefore, it is commonly used to test the heteroscedasticity. The null hypothesis of the test is that there is no heteroscedasticity [62]. Based on the test’s results (test statistics: TR2 = 24.305012; sig. = 0.028 < 0.05) a null hypothesis is not accepted; consequently, the heteroscedasticity of the residuals is revealed. Thus, we see that the OLS model is not suitable for this case.

Prior to considering the WLS method, we will examine the fixed and random effects methods. To select the method that fits better in our data, we initially carried out Hausman’s test. Based on the test’s results (test statistics: H = 2.16203; sig. = 0.539 > 0.05), we obtained that the test’s null hypothesis is not accepted. Thus, the preferred model for this case is the fixed effects.

Based on the abovementioned results, we initially have two alternative methods that seem to fit well in our data; the WLS and random effects. However, based on relevant studies with heterogeneity, the WLS is expected to have wider confidence intervals and larger p-values than the random effects [63], while the random effects seem to be more biased. The most important advantage of the WLS over the random effects is seen when there is a small-sample bias. Therefore, since we have found heterogeneity, we consider that the WLS fits better than the all others.

Looking into the WLS results, we obtain that the IR, book value and earnings per share significantly affect the firms’ market value. However, the book value and the earnings per share have a positive effect while IR has a negative effect. The R2 value indicates that the regression model is able to explain the relationship between the dependent and independent variables at 82.32%, which is considered as a satisfactory level.

5. Discussion and Conclusions

The aims of this paper were both to analyze the impact of IR in energy firms’ value relevance, and to justify the applied approach of the statistical and econometrical tools.

To fulfill the abovementioned aims of the paper, we selected to examine data concerning 38 listed firms operating in the energy distribution industry from eight different European countries. The data concerned the period between 2015 and 2019, and were collected using the Refinitiv Eikon database. Firms that have not prepared IRs for all of the years of the examined period were excluded from the sample, in order to ensure that all the sample’s units adopt IR systematically.

The collected panel data were analyzed using statistical and econometrical tools. More specifically, we have carried out descriptive and correlation analyses while, we seek for the best model between the OLS, WLS, fixed effects and random effects, in order to analyze the effect of the independent variables on the dependent ones. Finally, the best fitting model was found to be the WLS.

Based on the WLS model’s results, we obtained that firms’ market value is affected by the IR, book value and earnings. However, it is found that IR negatively affects firms’ market value. This is a result which is found in other studies as well [38,61,64]. More specifically this negative impact is explained by the high level of sustainability performance required by the IRC framework [61,64]. Thus, the decline in market value makes intuitive sense, since, typically, investors include unbooked environmental liabilities when they value a firm [61,65,66]. The time required for IRs’ users to become familiar with them would be another possible explanation, as reported in the existing literature [61,67]. Thus, it is expected that this negative relationship can change over time.

IR in the energy sector reflects the responsibility of firms for their impacts on the environment and society and the quality of information disclosed is an index on the fulfilment of their responsibility. The traditional financial information is insufficient to assess firms’ impact on the community, in terms of social and environmental aspects and the sustainability reports fail to link environmental, social and governance issues to business strategy and performance, due to their weakness [68]. IR merges economic and financial data to information relevant to environmental, social responsibility and corporate governance, by providing the full range of material risks and opportunities, market context and drivers that firms need to understand and respond [69].

The findings of this study point out the importance of IR for energy firms, taking into consideration their impact on various aspects of modern economies and societies. IR is a powerful tool that can support energy firms, in order to redefine their strategy and ensure that sustainability will be incorporated into their operations. In this way, stakeholders will obtain better information on the firms’ strategies, since integrated reporting can provide the needed transparency [70]. At the same time, energy firms can improve the allocation of their capitals and can have a better access to capital markets and business partners. Furthermore, IR can improve energy firms’ cost efficiency, which along with the above-mentioned benefits, can lead to competitive advantages. Thus, it is proposed that firms develop all the needed mechanisms that will enable them to adopt IR.

The research results should be considered in light of some limitations. First, the panel data used concern only energy distribution firms. This means that the research results could be representative only for this specific part of the energy sector, despite the relevant findings reported in the relevant literature and that concern the whole sector of energy. Furthermore, in order to ensure that the sample consists of systematic adopters of IR, we have excluded firms that adopt IR for less than five consecutive years. Should we have included them, we could have obtained some specific results about them, since time seems to play a role in the effects of IR. Moreover, in our sample, we have not included IRs later than the end of 2019. This was a conscious choice, since COVID-19 has affected the time IRs were developed and the information included in them [53,71]. More specifically, new information about internal pandemic management systems and the financial and other consequences of the pandemic on firms and the remedies adopted to deal with them are expected to be included in IRs [71]. Last, another limitation is that the panel data used do not account for the impact of country specifics but for firms from all of the different European countries; despite the fact that this choice strengthens the results, since the sample concerns countries of a union where the firms’ sustainable behavior is regulated by several mechanisms for many years [55] the specific characteristics of different countries are not taken into consideration.

The present study offers several avenues for future research. First, it is proposed that a future research concerns all of the possible types of firms operating in the energy sector. In this way, useful insights would be gained on how IR affects the market of different types of the energy sector’s firms. Moreover, a more detailed research at the country level would provide more evidence on the effects of IR adoption in energy firms and reveal possible differences between the examined countries where different regulation frameworks may apply. Moreover, the inclusion of data, concerning the period after the outbreak of the COVID-19 pandemic in a future research, could provide evidence on the level of relevance to the effects of the pandemic information disclosure and their impact on a firms’ market value. Last, a future research could take into account the impact of the current energy crisis [72,73] on the information disclosed in energy firms’ IRs and the effect of this information on their market value.

Author Contributions

Conceptualization, P.K. and A.E.D.; methodology, A.E.D. and M.S.; software, A.E.D. and M.S.; validation, A.E.D.; formal analysis, P.K.; investigation, P.K.; resources, A.E.D. and P.K.; data curation, M.S.; writing—original draft preparation, A.X.; writing—review and editing, A.X. and M.S.; visualization, A.X.; supervision, M.S.; project administration, P.K. All authors have read and agreed to the published version of the manuscript.

Funding

The paper received funding from the University of West Attica Special Account for Research Grants.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Kolk, A.; van Tulder, R. International Business, Corporate Social Responsibility and Sustainable Development. Int. Bus. Rev. 2010, 19, 119–125. [Google Scholar] [CrossRef]

- Skordoulis, M.; Ntanos, S.; Kyriakopoulos, G.; Arabatzis, G.; Galatsidas, S.; Chalikias, M. Environmental Innovation, Open Innovation Dynamics and Competitive Advantage of Medium and Large-Sized Firms. J. Open Innov. Technol. Mark. Complex. 2020, 6, 195. [Google Scholar] [CrossRef]

- Skordoulis, M.; Kyriakopoulos, G.; Ntanos, S.; Galatsidas, S.; Arabatzis, G.; Chalikias, M.; Kalantonis, P. The Mediating Role of Firm Strategy in the Relationship between Green Entrepreneurship, Green Innovation, and Competitive Advantage: The Case of Medium and Large-Sized Firms in Greece. Sustainability 2022, 14, 3286. [Google Scholar] [CrossRef]

- Kalantonis, P.; Delegkos, A.E.; Sotirchou, E.; Papagrigoriou, A. Modern Business Development and Financial Reporting: Exploring the Effect of Corporate Governance on the Value Relevance of Accounting Information—Evidence from the Greek Listed Firms. Oper. Res. 2022, 22, 2879–2897. [Google Scholar] [CrossRef]

- Kalantonis, P.; Schoina, S.; Missiakoulis, S.; Zopounidis, C. The Impact of the Disclosed R & D Expenditure on the Value Relevance of the Accounting Information: Evidence from Greek Listed Firms. Mathematics 2020, 8, 730. [Google Scholar] [CrossRef]

- Mion, L.; Georgakopoulos, G.; Kalantonis, P.; Eriotis, N. The Value Relevance of Accounting Information in Times of Crisis: An Empirical Study. Int. J. Corp. Financ. Account. 2014, 1, 44–67. [Google Scholar] [CrossRef]

- Utami, W.; Wahyuni, P.D. Forward-Looking Information Based on Integrated Reporting Perspective: Value Relevance Study in Indonesia Stock Exchanges. Emerg. Issues Dev. Econ. Trade 2020, 3, 66–77. [Google Scholar] [CrossRef]

- Aljifri, K.; Hussainey, K. The Determinants of Forward-looking Information in Annual Reports of UAE Companies. Manag. Audit. J. 2007, 22, 881–894. [Google Scholar] [CrossRef]

- Skordoulis, M.; Ntanos, S.; Arabatzis, G. Socioeconomic Evaluation of Green Energy Investments: Analyzing Citizens’ Willingness to Invest in Photovoltaics in Greece. Int. J. Energy Sect. Manag. 2020, 14, 871–890. [Google Scholar] [CrossRef]

- Diakakis, M.; Skordoulis, M.; Savvidou, E. The Relationships between Public Risk Perceptions of Climate Change, Environmental Sensitivity and Experience of Extreme Weather-Related Disasters: Evidence from Greece. Water 2021, 13, 2842. [Google Scholar] [CrossRef]

- Diakakis, M.; Skordoulis, M.; Kyriakopoulos, P. Public Perceptions of Flood and Extreme Weather Early Warnings in Greece. Sustainability 2022, 14, 10199. [Google Scholar] [CrossRef]

- Janik, A.; Ryszko, A.; Szafraniec, M. Greenhouse Gases and Circular Economy Issues in Sustainability Reports from the Energy Sector in the European Union. Energies 2020, 13, 5993. [Google Scholar] [CrossRef]

- Ntanos, S.; Kyriakopoulos, G.; Skordoulis, M.; Chalikias, M.; Arabatzis, G. An Application of the New Environmental Paradigm (NEP) Scale in a Greek Context. Energies 2019, 12, 239. [Google Scholar] [CrossRef]

- Bhasin, M. Integrated Reporting: The Future of Corporate Reporting. Int. J. Manag. Soc. Sci. Res. 2017, 6, 17–31. [Google Scholar]

- Jensen, J.C.; Berg, N. Determinants of Traditional Sustainability Reporting Versus Integrated Reporting. An Institutionalist Approach. Bus. Strategy Environ. 2012, 21, 299–316. [Google Scholar] [CrossRef]

- Steyn, M. Organisational Benefits and Implementation Challenges of Mandatory Integrated Reporting: Perspectives of Senior Executives at South African Listed Companies. Sustain. Account. Manag. Policy J. 2014, 5, 476–503. [Google Scholar] [CrossRef]

- Lebriez, H.; Esch, M.; Wald, A.; Heinzelmann, R. What Does Integrated Reporting Mean for the Value-Relevance of Environmental, Social, and Governmental Performance? Beta 2019, 33, 178–194. [Google Scholar] [CrossRef]

- Tlili, M.; Ben Othman, H.; Hussainey, K. Does Integrated Reporting Enhance the Value Relevance of Organizational Capital? Evidence from the South African Context. J. Intellect. Cap. 2019, 20, 642–661. [Google Scholar] [CrossRef]

- Cooray, T.; Senaratne, S.; Gunarathne, A.D.N.; Herath, R.; Samudrage, D. Does Integrated Reporting Enhance the Value Relevance of Information? Evidence from Sri Lanka. Sustainability 2020, 12, 8183. [Google Scholar] [CrossRef]

- Ntanos, S.; Skordoulis, M.; Kyriakopoulos, G.; Arabatzis, G.; Chalikias, M.; Galatsidas, S.; Batzios, A.; Katsarou, A. Renewable Energy and Economic Growth: Evidence from European Countries. Sustainability 2018, 10, 2626. [Google Scholar] [CrossRef]

- Piesiewicz, M.; Ciechan-Kujawa, M.; Kufel, P. Differences in Disclosure of Integrated Reports at Energy and Non-Energy Companies. Energies 2021, 14, 1253. [Google Scholar] [CrossRef]

- Christopoulos, A.G.; Kalantonis, P.; Katsampoxakis, I.; Vergos, K. COVID-19 and the Energy Price Volatility. Energies 2021, 14, 6496. [Google Scholar] [CrossRef]

- Fernando, K.; Hermawan, A.A. Relative and Incremental Value Relevance of Accounting Information under the Integrated Reporting Approach: Evidence from South Africa; Atlantis Press: Paris, France, 2019; pp. 421–426. [Google Scholar]

- Man, M.; Bogeanu-Popa, M.-M. Impact of Non-Financial Information on Sustainable Reporting of Organisations’ Performance: Case Study on the Companies Listed on the Bucharest Stock Exchange. Sustainability 2020, 12, 2179. [Google Scholar] [CrossRef]

- Oll, J.; Rommerskirchen, S. What’s Wrong with Integrated Reporting? A Systematic Review. Nachhalt. Sustain. Manag. Forum 2018, 26, 19–34. [Google Scholar] [CrossRef]

- Dey, P.K. Value Relevance of Integrated Reporting: A Study of the Bangladesh Banking Sector. Int. J. Discl. Gov. 2020, 17, 195–207. [Google Scholar] [CrossRef]

- Cortesi, A.; Vena, L. Disclosure Quality under Integrated Reporting: A Value Relevance Approach. J. Clean. Prod. 2019, 220, 745–755. [Google Scholar] [CrossRef]

- García-Sánchez, I.-M.; Noguera-Gámez, L. Integrated Reporting and Stakeholder Engagement: The Effect on Information Asymmetry. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 395–413. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 2003, 24, 403–411. [Google Scholar] [CrossRef]

- Esch, M.; Schnellbächer, B.; Wald, A. Does Integrated Reporting Information Influence Internal Decision Making? An Experimental Study of Investment Behavior. Bus. Strategy Environ. 2019, 28, 599–610. [Google Scholar] [CrossRef]

- Serafeim, G. Integrated Reporting and Investor Clientele. J. Appl. Corp. Financ. 2015, 27, 34–51. [Google Scholar] [CrossRef]

- Lee, K.-W.; Yeo, G.H.-H. The Association between Integrated Reporting and Firm Valuation. Rev. Quant. Financ. Account. 2016, 47, 1221–1250. [Google Scholar] [CrossRef]

- Giuliani, M.; Marasca, S. Construction and Valuation of Intellectual Capital: A Case Study. J. Intellect. Cap. 2011, 12, 377–391. [Google Scholar] [CrossRef]

- Busco, C.; Malafronte, I.; Pereira, J.; Starita, M.G. The Determinants of Companies’ Levels of Integration: Does One Size Fit All? Br. Account. Rev. 2019, 51, 277–298. [Google Scholar] [CrossRef]

- Ghani, E.K.; Jamal, J.; Puspitasari, E.; Gunardi, A. Factors Influencing Integrated Reporting Practices among Malaysian Public Listed Real Property Companies: A Sustainable Development Effort. Int. J. Manag. Financ. Account. 2018, 10, 144–162. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N.; Rubino, M.; Garzoni, A. The Determinants of Integrated Reporting Quality in Financial Institutions. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 429–444. [Google Scholar] [CrossRef]

- Haleem, A.; Ahamed, S.T.; Kumarasing, W.S.L. Investigation on the Value Relevance of Integrated Reporting and Organizational Capital: Evidence from Sri Lanka. Int. J. Financ. Res. 2020, 11, 372. [Google Scholar] [CrossRef]

- Cardamone, P.; Carnevale, C.; Giunta, F. The Value Relevance of Social Reporting: Evidence from Listed Italian Companies. J. Appl. Account. Res. 2012, 13, 255–269. [Google Scholar] [CrossRef]

- Hassel, L.; Nilsson, H.; Nyquist, S. The Value Relevance of Environmental Performance. Eur. Account. Rev. 2005, 14, 41–61. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M. The Revisited Contribution of Environmental Reporting to Investors’ Valuation of a Firm’s Earnings: An International Perspective. Ecol. Econ. 2007, 62, 613–626. [Google Scholar] [CrossRef]

- Konar, S.; Cohen, M.A. Does the Market Value Environmental Performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Moneva, J.M.; Cuellar, B. The Value Relevance of Financial and Non-Financial Environmental Reporting. Environ. Resour. Econ. 2009, 44, 441–456. [Google Scholar] [CrossRef]

- Qiu, Y.; Shaukat, A.; Tharyan, R. Environmental and Social Disclosures: Link with Corporate Financial Performance. Br. Account. Rev. 2016, 48, 102–116. [Google Scholar] [CrossRef]

- Schadewitz, H.; Niskala, M. Communication via Responsibility Reporting and Its Effect on Firm Value in Finland. Corp. Soc. Responsib. Environ. Manag. 2010, 17, 96–106. [Google Scholar] [CrossRef]

- Aureli, S.; Gigli, S.; Medei, R.; Supino, E. The Value Relevance of Environmental, Social, and Governance Disclosure: Evidence from Dow Jones Sustainability World Index Listed Companies. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 43–52. [Google Scholar] [CrossRef]

- Katsampoxakis, I.; Christopoulos, A.; Kalantonis, P.; Nastas, V. Crude Oil Price Shocks and European Stock Markets during the COVID-19 Period. Energies 2022, 15, 4090. [Google Scholar] [CrossRef]

- Szczepankiewicz, E.I.; Mućko, P. CSR Reporting Practices of Polish Energy and Mining Companies. Sustainability 2016, 8, 126. [Google Scholar] [CrossRef]

- Romolini, A.; Gori, E.; Fissi, S. The Disclosure in Social Reporting of Energy Sector: Experiences from Italy, the USA and China. Corp. Ownersh. Control 2014, 11, 277–287. [Google Scholar] [CrossRef]

- Papageorgiou, A.; Skordoulis, M.; Trichias, C.; Georgakellos, D.; Koniordos, M. Emissions trading scheme: Evidence from the European Union countries. In Creativity in Intelligent Technologies and Data Science; Communications in Computer and Information Science; Springer: Cham, Switzerland, 2015; Volume 535, pp. 204–215. ISBN 978-3-319-23765-7. [Google Scholar]

- Gianluca, Z. Quality of Information Disclosed in Integrated Reports, in the Extracting Sector: Insights from Europe. Stud. Univ. Babeș-Bolyai Oeconomica 2021, 66, 1–20. [Google Scholar]

- Eikon Financial Analysis & Trading Software. Available online: https://www.refinitiv.com/en/products/eikon-trading-software (accessed on 27 October 2022).

- Karaman, A.S.; Orazalin, N.; Uyar, A.; Shahbaz, M. CSR Achievement, Reporting, and Assurance in the Energy Sector: Does Economic Development Matter? Energy Policy 2021, 149, 112007. [Google Scholar] [CrossRef]

- Demers, E.; Hendrikse, J.; Joos, P.; Lev, B. ESG Did Not Immunize Stocks during the COVID-19 Crisis, but Investments in Intangible Assets Did. J. Bus. Financ. Account. 2021, 48, 433–462. [Google Scholar] [CrossRef]

- Shakil, M.H. Environmental, Social and Governance Performance and Financial Risk: Moderating Role of ESG Controversies and Board Gender Diversity. Resour. Policy 2021, 72, 102144. [Google Scholar] [CrossRef]

- Wieczorek-Kosmala, M.; Marquardt, D.; Kurpanik, J. Drivers of Sustainable Performance in European Energy Sector. Energies 2021, 14, 7055. [Google Scholar] [CrossRef]

- Pesaran, M.H. Time Series and Panel Data Econometrics; Oxford University Press: Oxford, UK, 2015; ISBN 978-0-19-873691-2. [Google Scholar]

- Deaton, A. Panel Data from Time Series of Cross-Sections. J. Econom. 1985, 30, 109–126. [Google Scholar] [CrossRef]

- Beck, N.; Katz, J.N. Modeling Dynamics in Time-Series–Cross-Section Political Economy Data. Annu. Rev. Polit. Sci. 2011, 14, 331–352. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis; Pearson Education: London, UK, 2011; ISBN 978-0-13-299789-8. [Google Scholar]

- Condello, S.; Del Pozzo, A.; Loprevite, S.; Ricca, B. Potential and Limitations of D.E.A. as a Bankruptcy Prediction Tool in the Light of a Study on Italian Listed Companies. Appl. Math. Sci. 2017, 11, 2185–2207. [Google Scholar] [CrossRef]

- Baboukardos, D.; Rimmel, G. Value Relevance of Accounting Information under an Integrated Reporting Approach: A Research Note. J. Account. Public Policy 2016, 35, 437–452. [Google Scholar] [CrossRef]

- White, H. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 1980, 48, 817–838. [Google Scholar] [CrossRef]

- Stanley, T.D.; Doucouliagos, H. Neither Fixed nor Random: Weighted Least Squares Meta-Analysis. Stat. Med. 2015, 34, 2116–2127. [Google Scholar] [CrossRef]

- Zhou, S.; Simnett, R.; Green, W. Does Integrated Reporting Matter to the Capital Market? Abacus 2017, 53, 94–132. [Google Scholar] [CrossRef]

- Barth, M.E.; McNichols, M.F. Estimation and Market Valuation of Environmental Liabilities Relating to Superfund Sites. J. Account. Res. 1994, 32, 177. [Google Scholar] [CrossRef]

- Hughes, K.E., II. The Value Relevance of Nonfinancial Measures of Air Pollution in the Electric Utility Industry. Account. Rev. 2000, 75, 209–228. [Google Scholar] [CrossRef]

- Iatridis, G.; Rouvolis, S. The Post-Adoption Effects of the Implementation of International Financial Reporting Standards in Greece. J. Int. Account. Audit. Tax. 2010, 19, 55–65. [Google Scholar] [CrossRef]

- Krzus, M.P. Integrated Reporting: If Not Now, When? Integr. Report. 2011, 6, 271–276. [Google Scholar]

- Rezaee, Z. Business Sustainability: Performance, Compliance, Accountability and Integrated Reporting; Routledge: London, UK, 2017; ISBN 978-1-351-28428-8. [Google Scholar]

- Ayoola, T.J.; Olasanmi, O.O. Business Case for Integrated Reporting in the Nigerian Oil and Gas Sector. Issues Soc. Environ. Account. 2013, 7, 30. [Google Scholar] [CrossRef]

- García-Sánchez, I.-M.; Raimo, N.; Marrone, A.; Vitolla, F. How Does Integrated Reporting Change in Light of COVID-19? A Revisiting of the Content of the Integrated Reports. Sustainability 2020, 12, 7605. [Google Scholar] [CrossRef]

- von Homeyer, I.; Oberthür, S.; Dupont, C. Implementing the European Green Deal during the Evolving Energy Crisis. JCMS J. Common Mark. Stud. 2022, 60, 125–136. [Google Scholar] [CrossRef]

- Milne, A. An Economic Narrative for Better Managing the European Energy Crisis. Available online: https://papers.ssrn.com/abstract=4202887 (accessed on 27 October 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).