Price-Guided Peer-To-Peer Trading Scheme and Its Effects on Transaction Costs and Network Losses

Abstract

1. Introduction

- A new price-guided P2P electricity trading framework that premises the autonomous decision of prosumers and considers both prosumer welfare and network losses is suggested;

- A methodology of setting the appropriate loss price and reflecting it in bids and offers under the price-guided P2P electricity trading framework is suggested;

- Effects of the new price-guided framework on network efficiency, prosumer welfare, and social welfare are examined through simulation;

- Effects of various loss prices on the new price-guided framework are examined through the simulation.

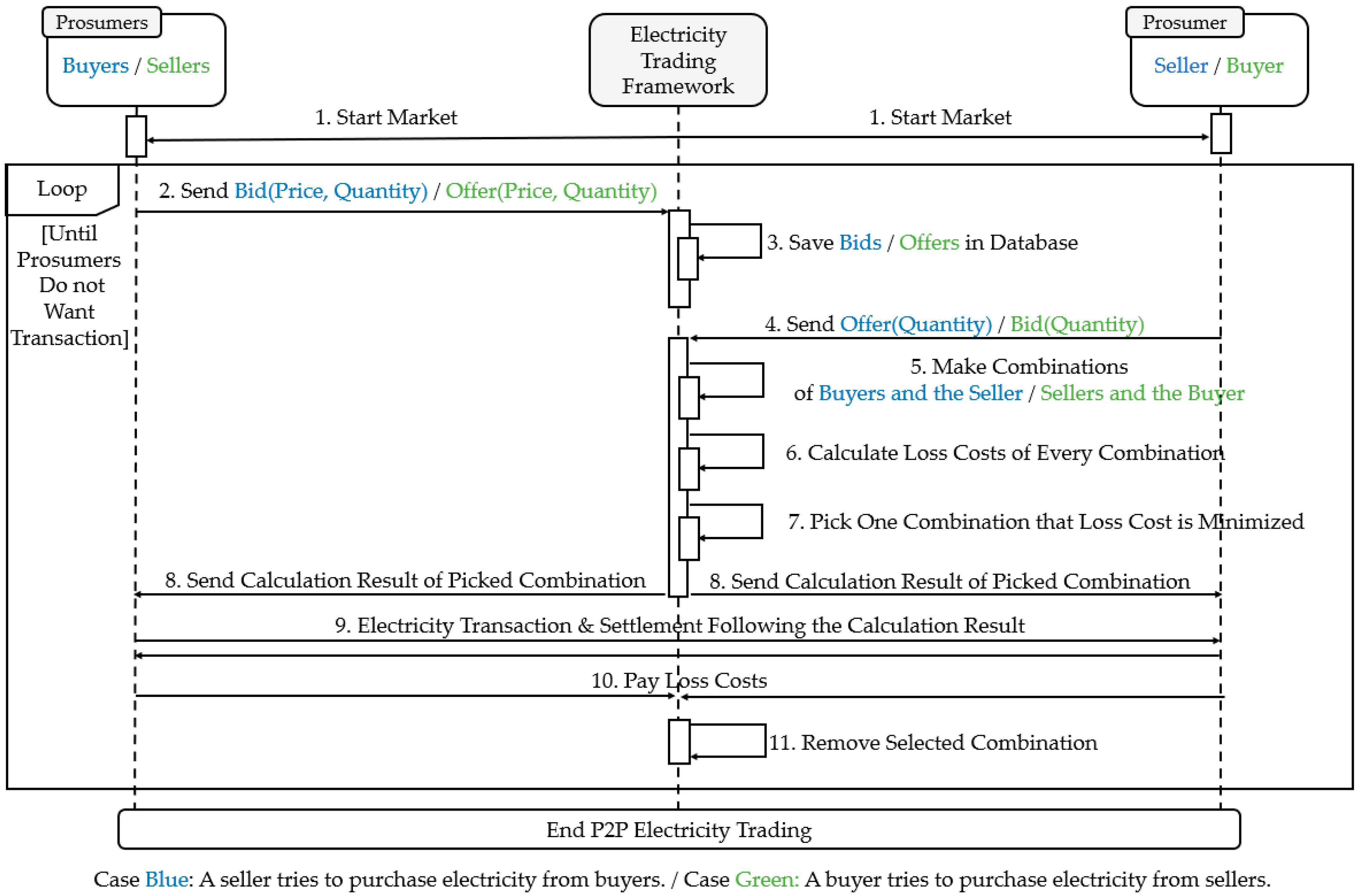

2. Continuous Double Auction in P2P Trading

3. Two Frameworks for P2P Electricity Trading

3.1. Loss-Guided P2P Trading

3.2. Price-Guided P2P Trading

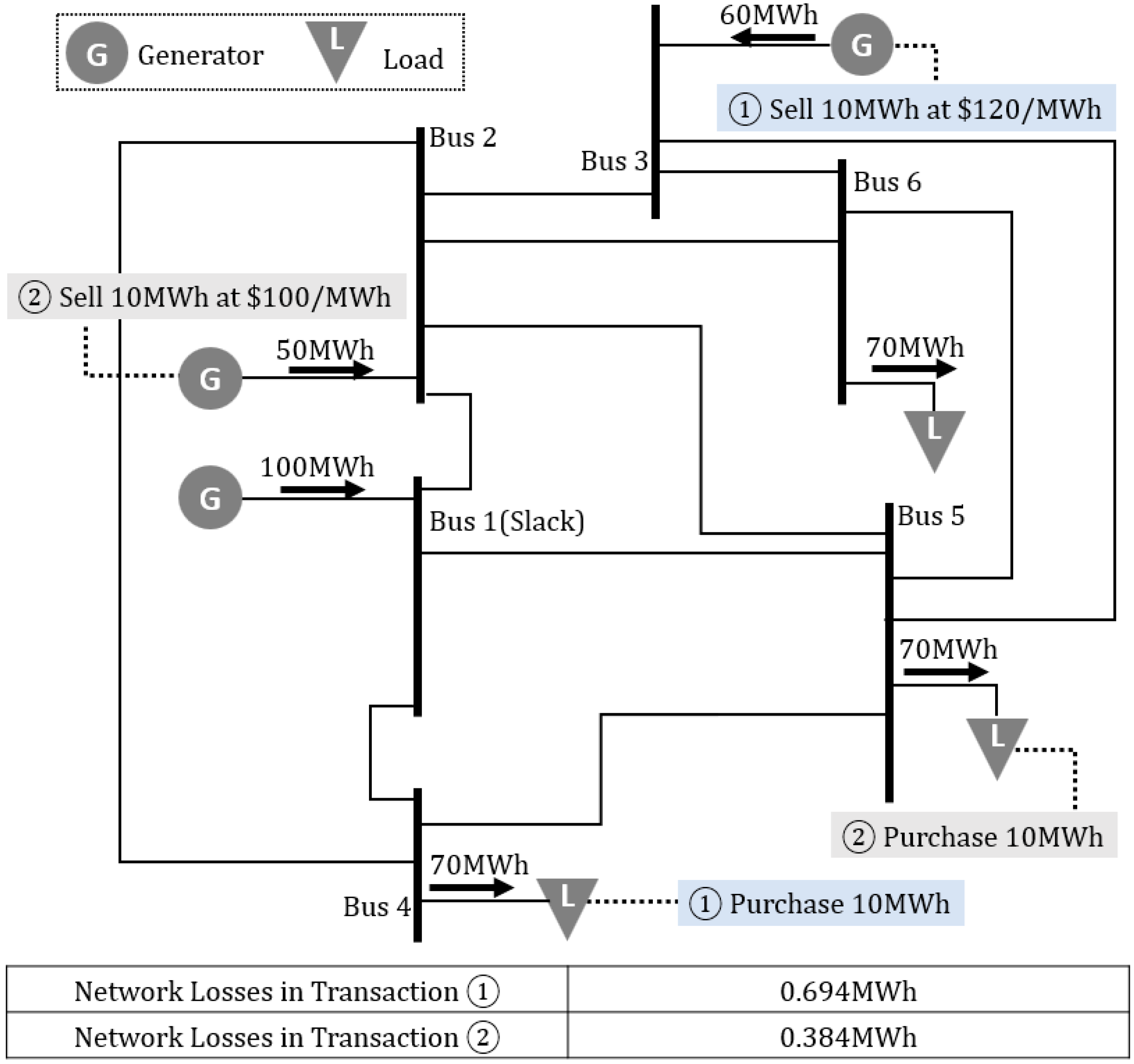

3.3. Example for Loss-Guided and Price-Guided Frameworks

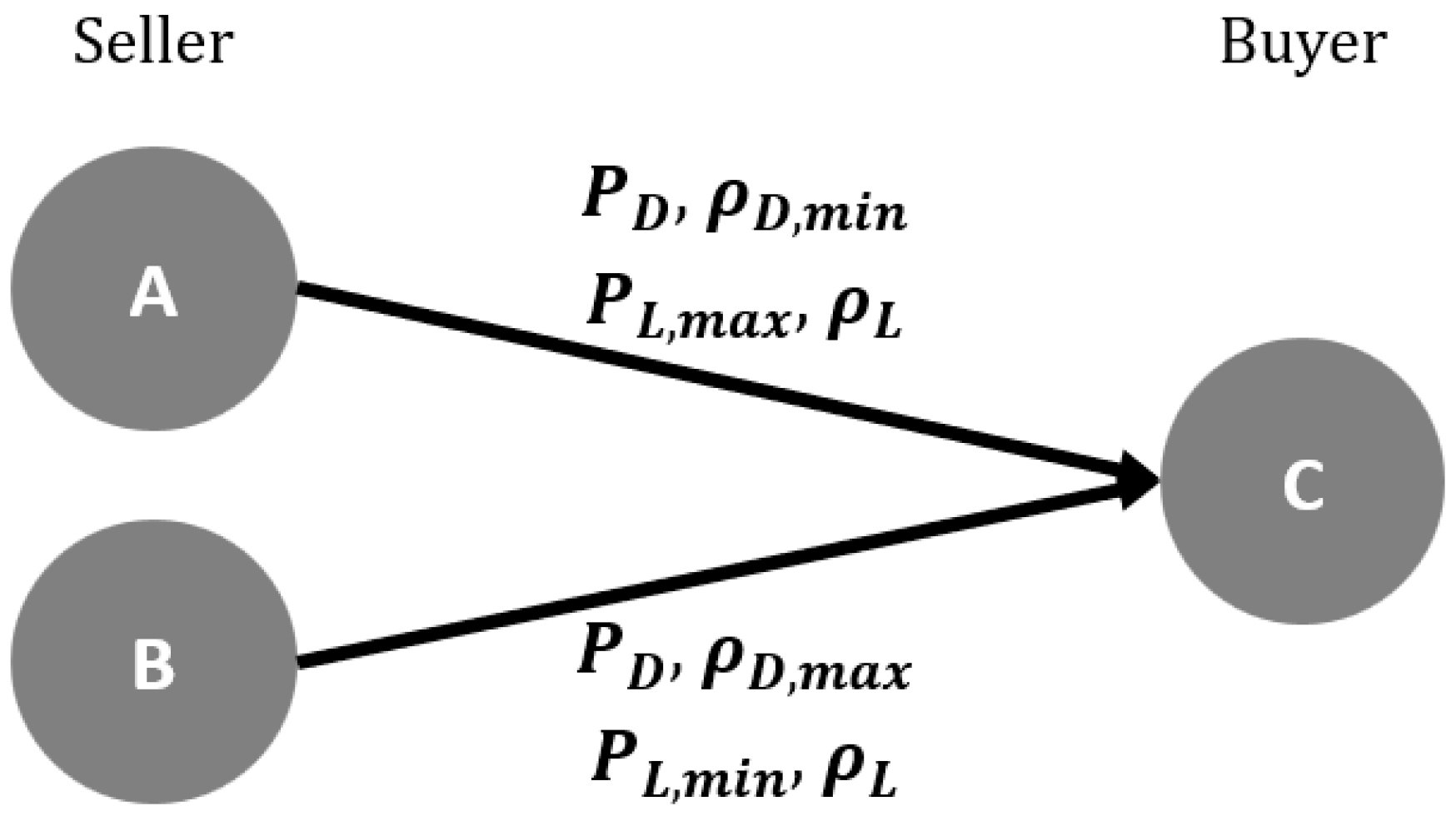

3.4. Appropriate Loss Price under the Price-Guided Electricity Trading Framework

4. Simulation Setup

4.1. Test Cases and Algorithms

- (The loss-guided case) As the simulation in this paper focuses on the limitation of the loss-guided framework suggested in [13], that, even if it has merit in loss management, it has a demerit in considering prosumers’ preference and welfare, the loss-guided framework is used as a benchmark in this paper. As noted in Section 3.1, the framework is for the CDA-based P2P market, and therefore, the prosumers can bid or offer at any time. The selection and match of bid and offer are proceeded by the framework. The framework automatically selects and matches bid and offer in real-time, which minimizes the increase in network losses. Algorithm 1 below is the pseudocode of the logic we used for the loss-guided case. The algorithm is coded using MATLAB and Line 5 and Line 6 in Algorithm 1, which is the procedure of solving power flow and calculating added network losses each, are implemented using the MATPOWER function.

| Algorithm 1: Matching algorithm at time under the loss-guided framework. |

| Input 1: Set of matches of selected bids and buyers Input 2: Total network losses and total energy costs Input 3: for set of buyers Input 4: for set of sellers Input 5: for set of selling bids from sellers 1: while : 2: randomly choose buyer from the set ; 3: define a temporary set ; 4: for j = 1 to : 5: solve power flow for the case ; 6: calculate added network losses and total energy costs ; 7: ; 8: end 9: pick j’ that minimizes from the set ; 10: ; 11: ; ; 12: ; 13: ; 14: ; 15: Return ; 16: end |

- 2.

- (The price-guided case) As also noted earlier, the new price-guided framework in this paper aims to overcome the limitation of the loss-guided framework by reflecting not only network losses but also prosumers’ preference in the unit cost and letting the transaction proceed based on the unit cost while maintaining the CDA structure. The energy costs, network losses, and total costs under this framework will be calculated and compared with those of cases 1 and 3. Algorithm 2 below is the pseudocode of the logic we used for the price-guided case. The algorithm is coded using MATLAB and Line 5 and Line 6 in Algorithm 2, which is the procedure of solving power flow and calculating added network losses each, are implemented using the MATPOWER function.

| Algorithm 2: Matching algorithm at time under the price-guided framework. |

| Input 1: Set of matches of selected bids and buyers and total network losses Input 2: Total network losses , total energy costs and loss price Input 3: for set of buyers Input 4: for set of sellers Input 5: for set of selling bids from sellers 1: while : 2: randomly choose buyer from the set ; 3: define a temporary set ; 4: for j = 1 to : 5: solve power flow for the case ; 6: calculate added network losses ; 7: calculate unit cost ; 8: ; 9: end 10: pick j’ that minimizes from the set ; 11: ; 12: ; ; 13: ; 14: ; 15: ; 16: Return ; 17: end |

- 3.

- (The random transaction case) The price-guided framework suggested in this paper may improve some characteristics of the loss-guided case. However, after applying the new framework, it is possible that some characteristics could be impaired. Therefore, the random transaction case, which does not consider network losses as well as prosumers’ preferences, but is just based on the CDA structure, is tested to see if adopting the price-guided framework itself has any benefit. Algorithm 3 below is the pseudocode of the logic we used for the random transaction case which is also used in the previous study. The algorithm is coded using MATLAB and Line 3 and Line 4 in Algorithm 3, which is the procedure of solving power flow and calculating added network losses each, are implemented using the MATPOWER function.

| Algorithm 3: Matching algorithm at time under the random transaction. |

| Input 1: Set of matches of selected bids and buyers Input 2: Total network losses and total energy costs Input 3: for set of buyers Input 4: for set of sellers Input 5: for set of selling bids from sellers 1: while : 2: randomly choose buyer from and seller , from ; 3: solve power flow for the case ; 4: calculate added network losses and total energy costs ; 5: ; 6: ; ; 7: ; 8: ; 9: ; 10: Return ; 11: end |

4.2. Simulation Descriptions

5. Simulation Results

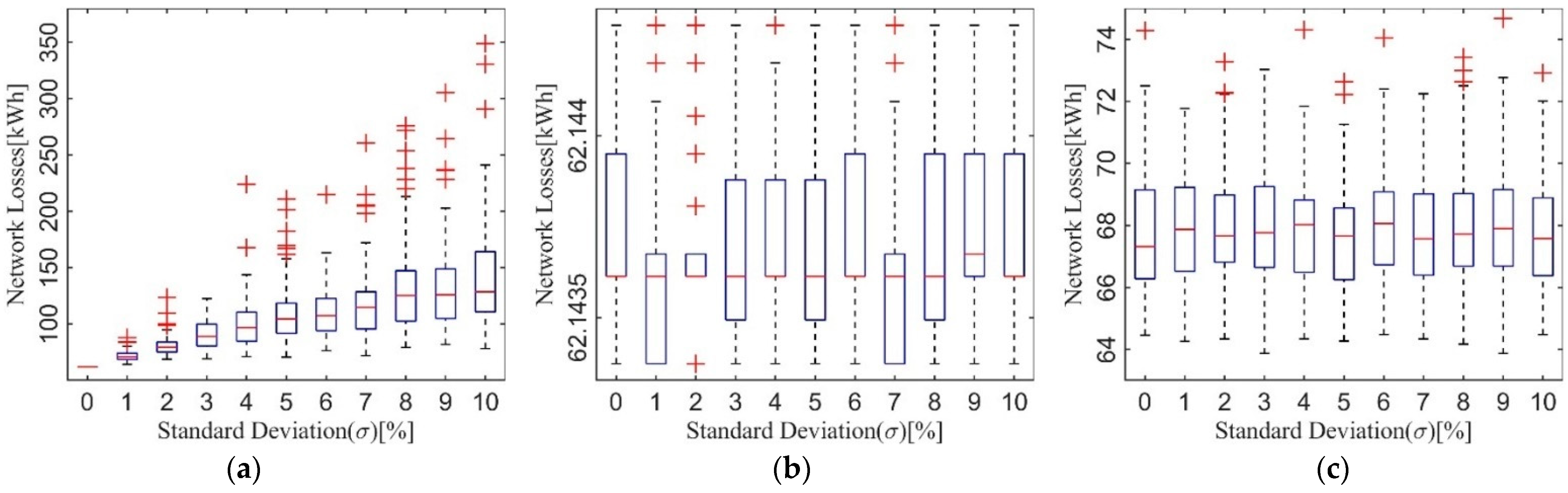

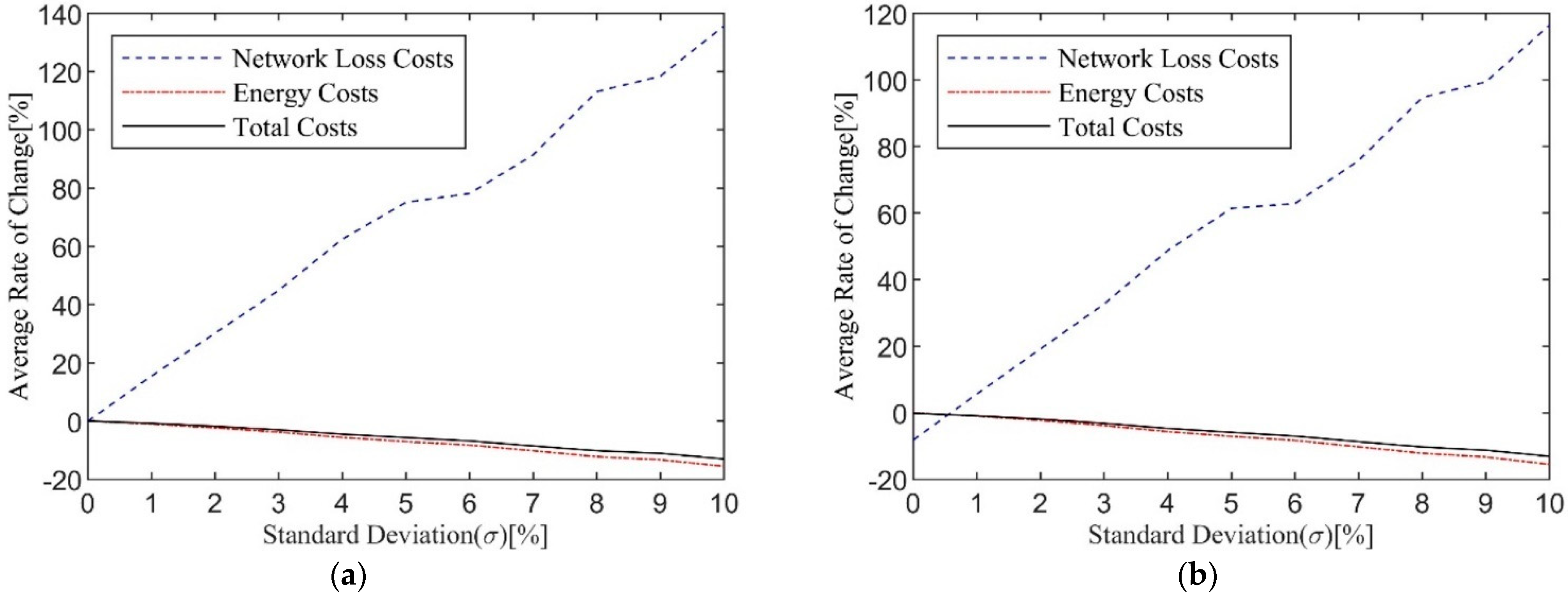

5.1. The Effect of the Price-Guided Framework with Different Ranges of Offer Prices

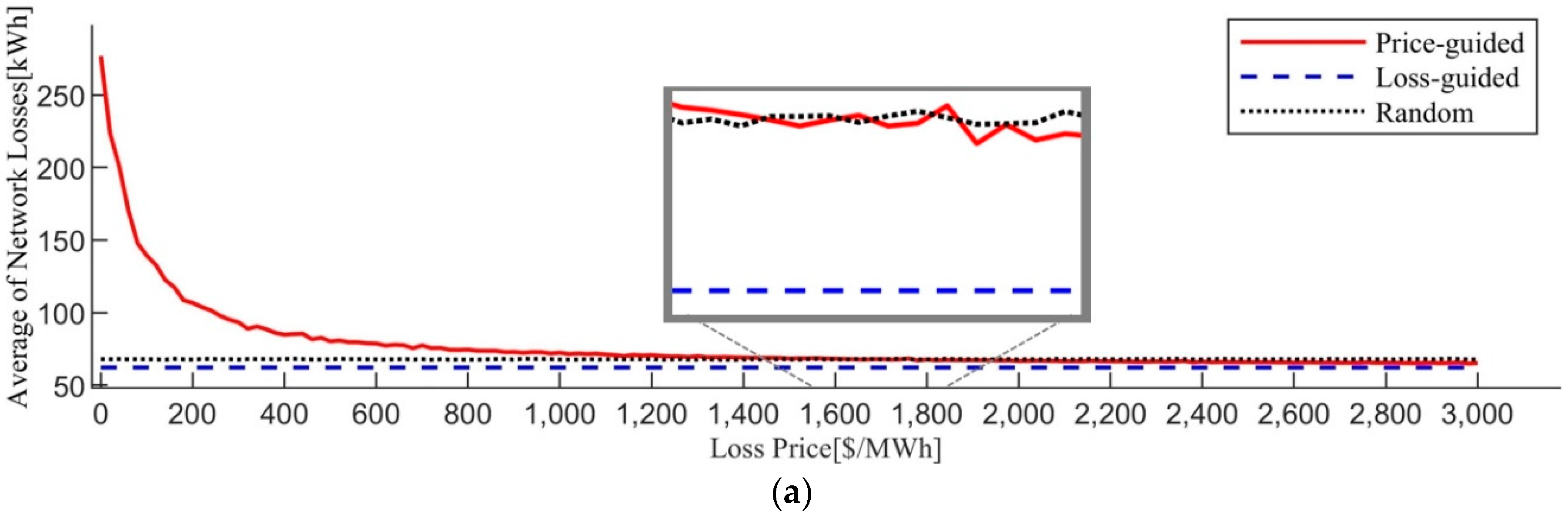

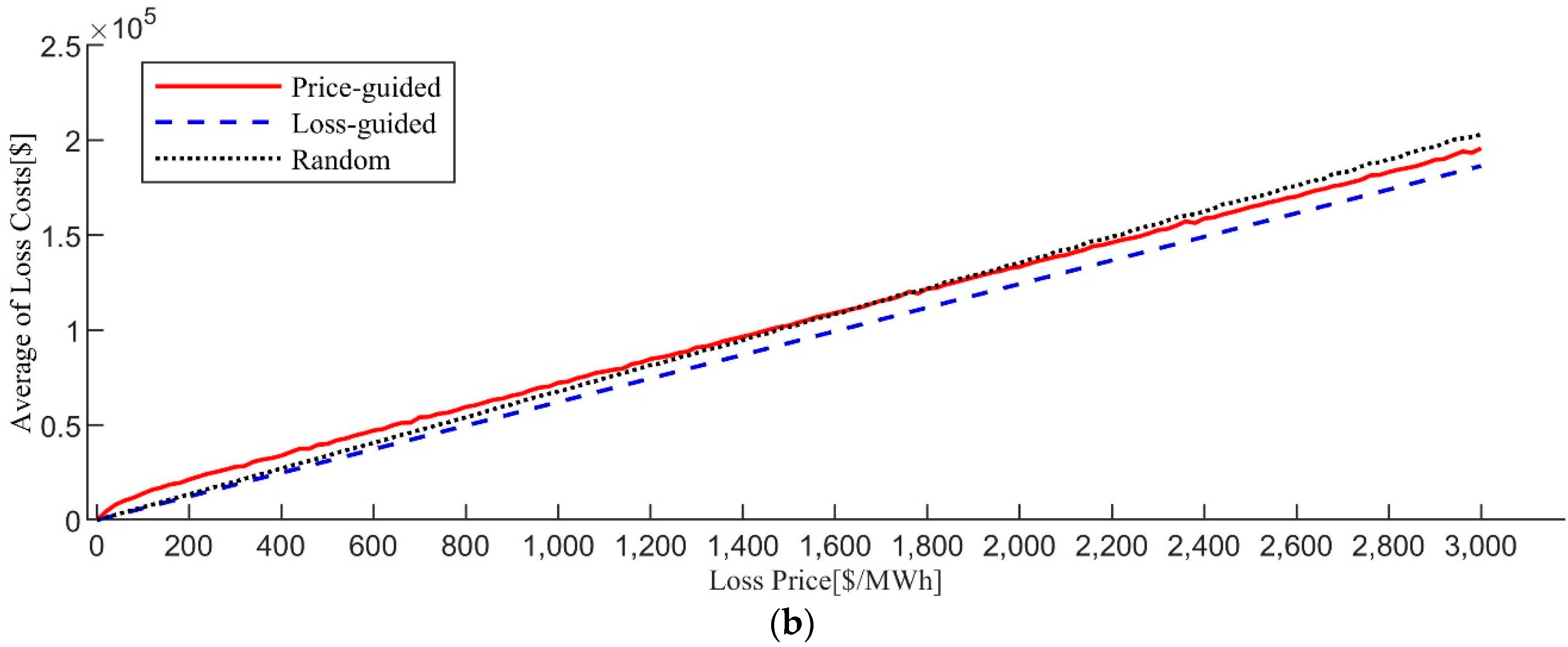

5.2. The Effect of Different Loss Prices on the Price-guided Framework

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Sepulveda, N.A.; Jenkins, J.D.; de Sisternes, F.J.; Lester, R.K. The Role of Firm Low-Carbon Electricity Resources in Deep Decarbonization of Power Generation. Joule 2018, 2, 2403–2420. [Google Scholar] [CrossRef]

- Furby, L.; Slovic, P.; Fischhoff, B.; Gregory, R. Public perceptions of electric power transmission lines. J. Environ. Psychol. 1988, 8, 19–43. [Google Scholar] [CrossRef]

- Akorede, M.F.; Hizam, H.; Pouresmaeil, E. Distributed energy resources and benefits to the environment. Renew. Sustain. Energy Rev. 2010, 14, 724–734. [Google Scholar] [CrossRef]

- Jiayi, H.; Chuanwen, J.; Rong, X. A review on distributed energy resources and MicroGrid. Renew. Sustain. Energy Rev. 2008, 12, 2472–2483. [Google Scholar] [CrossRef]

- Driesen, J.; Katiraei, F. Design for distributed energy resources. IEEE Power Energy Mag. 2008, 6, 30–40. [Google Scholar]

- Alarcon-Rodriguez, A.; Ault, G.; Galloway, S. Multi-objective planning of distributed energy resources: A review of the state-of-the-art. Renew. Sustain. Energy Rev. 2010, 14, 1353–1366. [Google Scholar] [CrossRef]

- Zhang, L.; Gari, N.; Hmurcik, L.V. Energy management in a microgrid with distributed energy resources. Energy Convers. Manag. 2014, 78, 297–305. [Google Scholar] [CrossRef]

- Facchini, A. Distributed energy resources: Planning for the future. Nat. Energy 2017, 2, 17129. [Google Scholar] [CrossRef]

- IRENA. Innovation Landscape Brief: Peer-to-Peer Electricity Trading; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Tushar, W.; Saha, T.K.; Yuen, C.; Smith, D.; Poor, H.V. Peer-to-peer trading in electricity networks: An overview. IEEE Trans. Smart Grid 2020, 11, 3185–3200. [Google Scholar] [CrossRef]

- Siano, P. Demand response and smart grids—A survey. Renew. Sustain. Energy Rev. 2014, 30, 461–478. [Google Scholar] [CrossRef]

- Kim, S.; Chu, Y.; Kim, H.; Kim, H.; Moon, H.; Sung, J.; Yoon, Y.; Jin, Y. Analyzing Various Aspects of Network Losses in Peer-to-Peer Electricity Trading. Energies 2022, 15, 686. [Google Scholar] [CrossRef]

- Oh, E.; Son, S.-Y. Peer-to-Peer Energy Transaction Mechanisms Considering Fairness in Smart Energy Communities. IEEE Access 2020, 8, 216055–216068. [Google Scholar] [CrossRef]

- Liu, N.; Yu, X.; Wang, C.; Li, C.; Ma, L.; Lei, J. Energy-Sharing Model With Price-Based Demand Response for Microgrids of Peer-to-Peer Prosumers. IEEE Trans. Power Syst. 2017, 32, 3569–3583. [Google Scholar] [CrossRef]

- Sorin, E.; Bobo, L.; Pinson, P. Consensus-Based Approach to Peer-to-Peer Electricity Markets With Product Differentiation. IEEE Trans. Power Syst. 2018, 34, 994–1004. [Google Scholar] [CrossRef]

- Khorasany, M.; Mishra, Y.; Ledwich, G. A Decentralized Bilateral Energy Trading System for Peer-to-Peer Electricity Markets. IEEE Trans. Ind. Electron. 2019, 67, 4646–4657. [Google Scholar] [CrossRef]

- Ullah, H.; Park, J.-D. Peer-to-Peer Energy Trading in Transactive Markets Considering Physical Network Constraints. IEEE Trans. Smart Grid 2021, 12, 3390–3403. [Google Scholar] [CrossRef]

- Paudel, A.; Khorasany, M.; Gooi, H.B. Decentralized Local Energy Trading in Microgrids With Voltage Management. IEEE Trans. Ind. Informatics 2020, 17, 1111–1121. [Google Scholar] [CrossRef]

- Guerrero, J.; Chapman, A.C.; Verbic, G. Decentralized P2P Energy Trading Under Network Constraints in a Low-Voltage Network. IEEE Trans. Smart Grid 2018, 10, 5163–5173. [Google Scholar] [CrossRef]

- Feng, C.; Liang, B.; Li, Z.; Liu, W.; Wen, F. Peer-to-Peer Energy Trading under Network Constraints Based on Generalized Fast Dual Ascent. IEEE Trans. Smart Grid 2022. early access. Available online: https://ieeexplore.ieee.org/document/9744103 (accessed on 1 October 2022). [CrossRef]

- Wang, Z.; Wang, L.; Li, Z.; Cheng, X.; Li, Q. Optimal distributed transaction of multiple microgrids in grid-connected and islanded modes considering unit commitment scheme. Int. J. Electr. Power Energy Syst. 2021, 132, 107146. [Google Scholar] [CrossRef]

- Liu, Y.; Wu, L.; Li, J. Peer-to-peer (P2P) electricity trading in distribution systems of the future. Electr. J. 2019, 32, 2–6. [Google Scholar] [CrossRef]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- MATLAB, Version 9.10.0 (R2021a); The MathWorks Inc.: Natick, MA, USA, 2021.

- Zimmerman, R.D.; Murillo-Sanchez, C.E.; Thomas, R.J. MATPOWER: Steady-State Operations, Planning, and Analysis Tools for Power Systems Research and Education. IEEE Trans. Power Syst. 2010, 26, 12–19. [Google Scholar] [CrossRef]

- Conejo, A.; Arroyo, J.; Alguacil, N.; Guijarro, A. Transmission loss allocation: A comparison of different practical algorithms. IEEE Trans. Power Syst. 2002, 17, 571–576. [Google Scholar] [CrossRef]

- Abdelkader, S.M. Transmission Loss Allocation Through Complex Power Flow Tracing. IEEE Trans. Power Syst. 2007, 22, 2240–2248. [Google Scholar] [CrossRef]

- Bialek, J. Tracing the flow of electricity. IEE Proc.-Gener. Transm. Distrib. 1996, 143, 313–320. [Google Scholar] [CrossRef]

- Kirschen, D.; Allan, R.; Strbac, G. Contributions of individual generators to loads and flows. IEEE Trans. Power Syst. 1997, 12, 52–60. [Google Scholar] [CrossRef]

- Strbac, G.; Kirschen, D.; Ahmed, S. Allocating transmission system usage on the basis of traceable contributions of generators and loads to flows. IEEE Trans. Power Syst. 1998, 13, 527–534. [Google Scholar] [CrossRef]

- Wood, A.J.; Wollenberg, B.F.; Sheblé, G.B. Power Generation, Operation, and Control; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Hu, J.; Wu, J.; Ai, X.; Liu, N. Coordinated energy management of prosumers in a distribution system considering network congestion. IEEE Trans. Smart Grid 2020, 12, 468–478. [Google Scholar] [CrossRef]

| Loss-Guided Electricity Trading Framework | Price-Guided Electricity Trading Framework | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S T E p | Peers | Cost | S T E p | Peers | Cost | ||||||||

| Load | Gen. | Energy | Loss | Load | Gen. | Energy | Loss | ||||||

| Price [$/MWh] | Volume [MWh] | Price [$/MWh] | Volume [MWh] | Price [$/MWh] | Volume [MWh] | Price [$/MWh] | Volume [MWh] | ||||||

| 1 | Bus4 | Bus1 | 1 | 10 | 100 | 0.694 | 1 | Bus4 | Bus1 | 80 | 10 | 100 | 0.694 |

| Bus4 | Bus2 | 100 | 10 | 100 | 0.259 | (Matched) | Energy Cost: $800 | Loss Cost: $69.40 | |||||

| Bus4 | Bus3 | 120 | 10 | 100 | 0.199 | Bus4 | Bus2 | 100 | 10 | 100 | 0.259 | ||

| (Matched) | Energy Cost: $1200 | Loss Cost: $19.900 | Bus4 | Bus3 | 120 | 10 | 100 | 0.199 | |||||

| Total Cost in Step 1: $1219.900 | Total Cost in Step 1: $869.400 | ||||||||||||

| 2 | Bus5 | Bus1 | 80 | 10 | 100 | 0.805 | 2 | Bus5 | Bus2 | 100 | 10 | 100 | 0.384 |

| Bus5 | Bus2 | 100 | 10 | 100 | 0.389 | (Matched) | Energy Cost: $1000 | Loss Cost: $38.40 | |||||

| (Matched) | Energy Cost: $1000 | Loss Cost: $38.900 | Bus5 | Bus3 | 120 | 10 | 100 | 0.310 | |||||

| Total Cost in Step 2: $1038.900 | Total Cost in Step 2: $1038.400 | ||||||||||||

| Bus Number | Total Demand [kWh] | Available Supply [kWh] | Bus Number | Total Demand [kWh] | Available Supply [kWh] | Bus Number | Total Demand [kWh] | Available Supply [kWh] |

|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 100 | 12 | 60 | 500 | 23 | 90 | 0 |

| 2 | 100 | 500 | 13 | 60 | 0 | 24 | 420 | 500 |

| 3 | 90 | 0 | 14 | 120 | 500 | 25 | 420 | 500 |

| 4 | 120 | 500 | 15 | 60 | 0 | 26 | 60 | 0 |

| 5 | 60 | 0 | 16 | 60 | 0 | 27 | 60 | 0 |

| 6 | 60 | 0 | 17 | 60 | 0 | 28 | 60 | 0 |

| 7 | 200 | 500 | 18 | 90 | 500 | 29 | 120 | 500 |

| 8 | 200 | 0 | 19 | 90 | 0 | 30 | 200 | 500 |

| 9 | 60 | 0 | 20 | 90 | 0 | 31 | 150 | 0 |

| 10 | 60 | 0 | 21 | 90 | 0 | 32 | 210 | 500 |

| 11 | 45 | 0 | 22 | 90 | 0 | 33 | 60 | 500 |

| Step No. | Mean [$/MWh] | Standard Deviation [$/MWh] | Step No. | Mean [$/MWh] | Standard Deviation [$/MWh] |

|---|---|---|---|---|---|

| 1 | 100 | 0 (0% of mean) | 7 | 100 | 6 (6% of mean) |

| 2 | 100 | 1 (1% of mean) | 8 | 100 | 7 (7% of mean) |

| 3 | 100 | 2 (2% of mean) | 9 | 100 | 8 (8% of mean) |

| 4 | 100 | 3 (3% of mean) | 10 | 100 | 9 (9% of mean) |

| 5 | 100 | 4 (4% of mean) | 11 | 100 | 10 (10% of mean) |

| 6 | 100 | 5 (5% of mean) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, S.; Yoon, Y.; Jin, Y. Price-Guided Peer-To-Peer Trading Scheme and Its Effects on Transaction Costs and Network Losses. Energies 2022, 15, 8274. https://doi.org/10.3390/en15218274

Kim S, Yoon Y, Jin Y. Price-Guided Peer-To-Peer Trading Scheme and Its Effects on Transaction Costs and Network Losses. Energies. 2022; 15(21):8274. https://doi.org/10.3390/en15218274

Chicago/Turabian StyleKim, SungJoong, YongTae Yoon, and YoungGyu Jin. 2022. "Price-Guided Peer-To-Peer Trading Scheme and Its Effects on Transaction Costs and Network Losses" Energies 15, no. 21: 8274. https://doi.org/10.3390/en15218274

APA StyleKim, S., Yoon, Y., & Jin, Y. (2022). Price-Guided Peer-To-Peer Trading Scheme and Its Effects on Transaction Costs and Network Losses. Energies, 15(21), 8274. https://doi.org/10.3390/en15218274