Energy M&A Market in the Baltic States Analyzed through the Lens of Sustainable Development

Abstract

1. Introduction

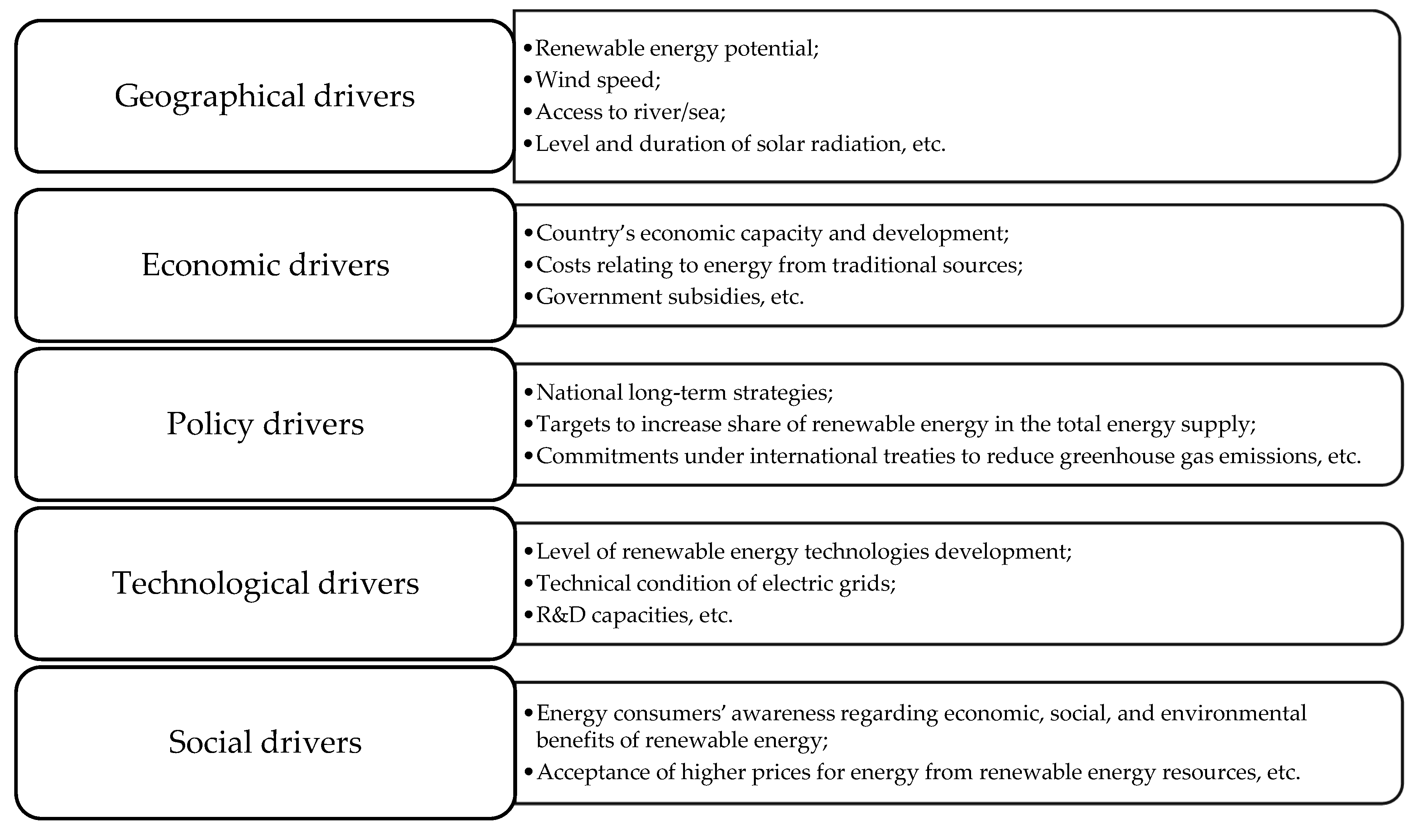

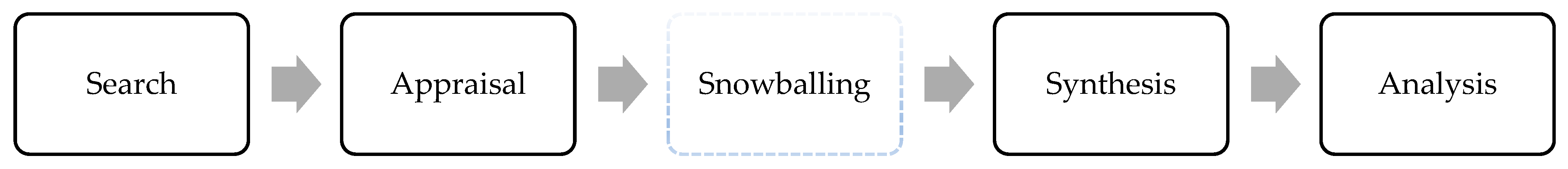

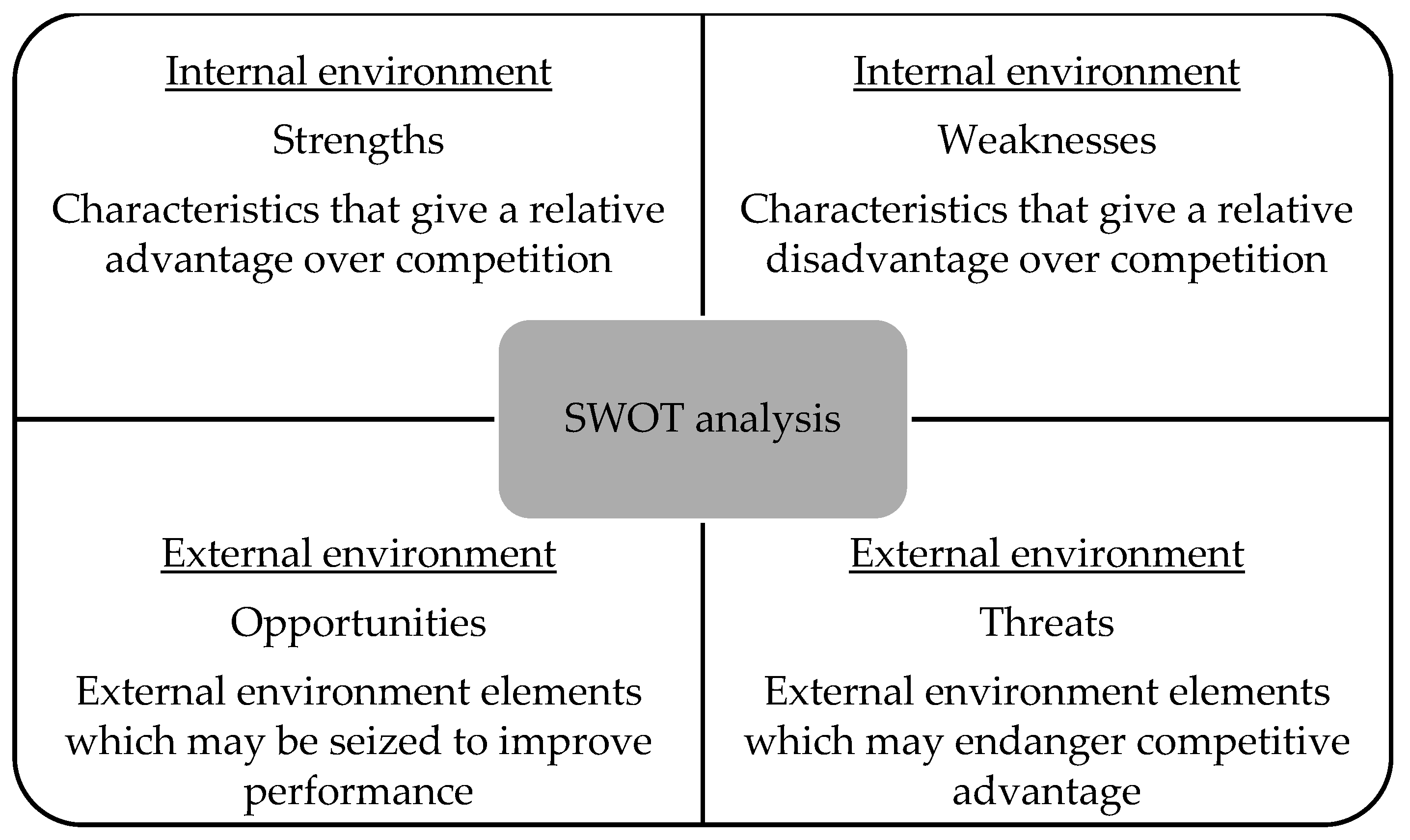

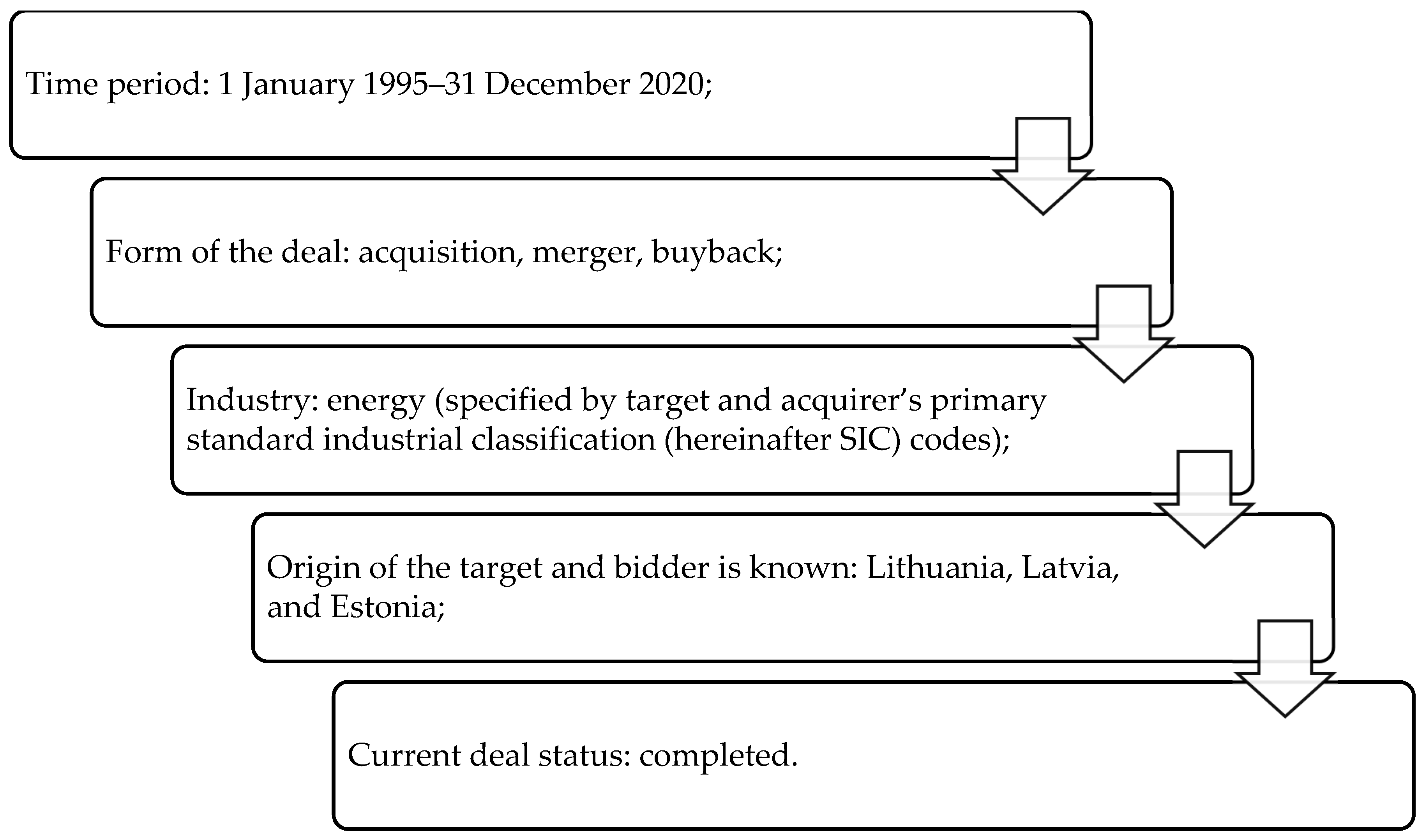

2. Methods

3. Results

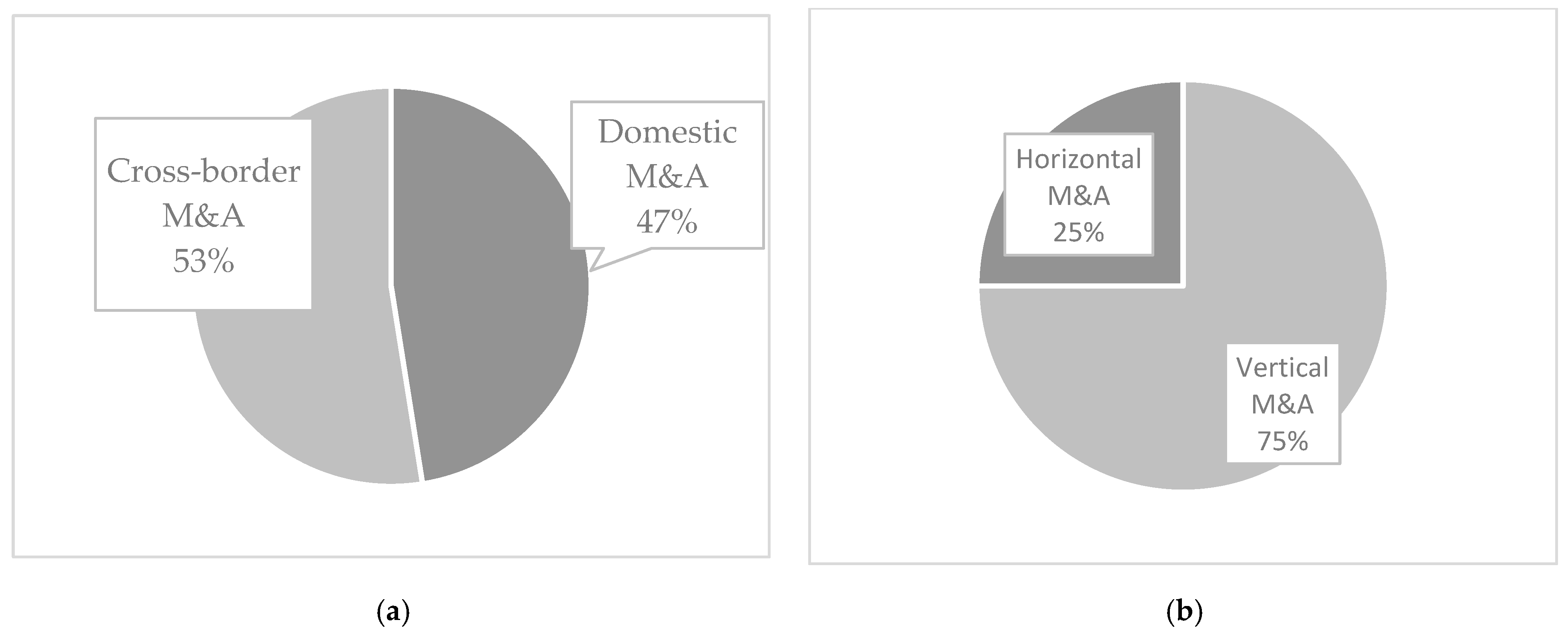

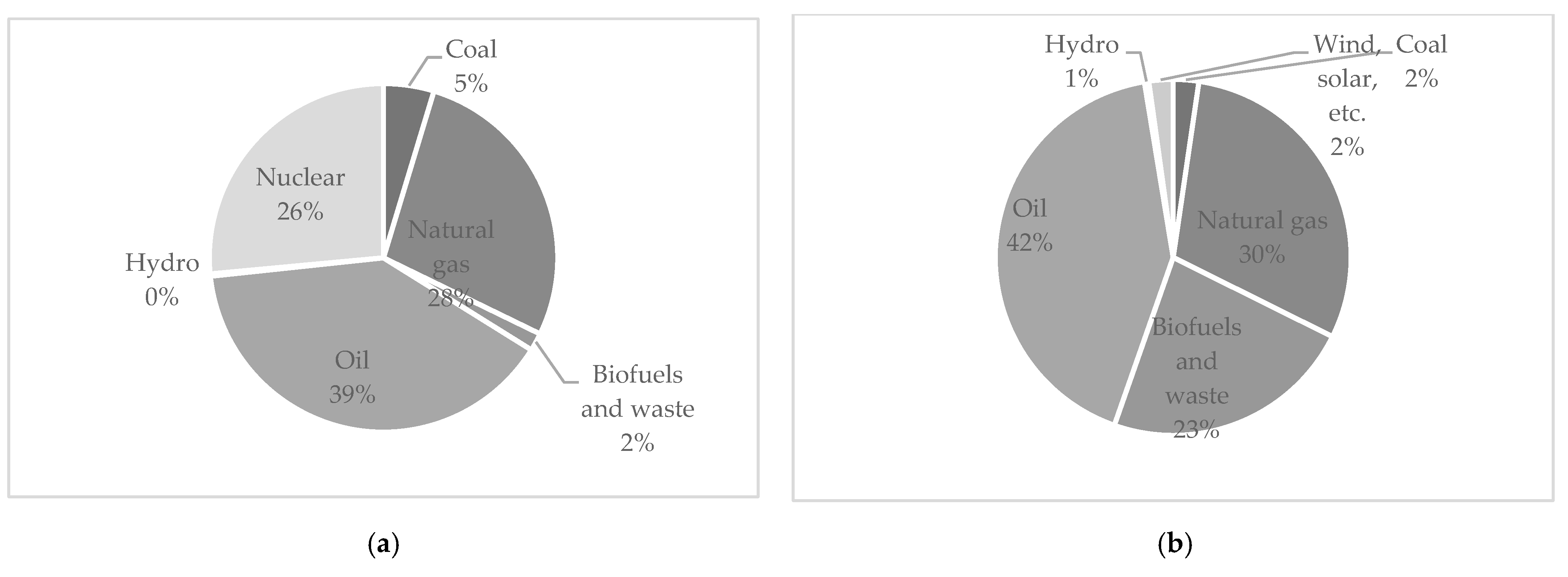

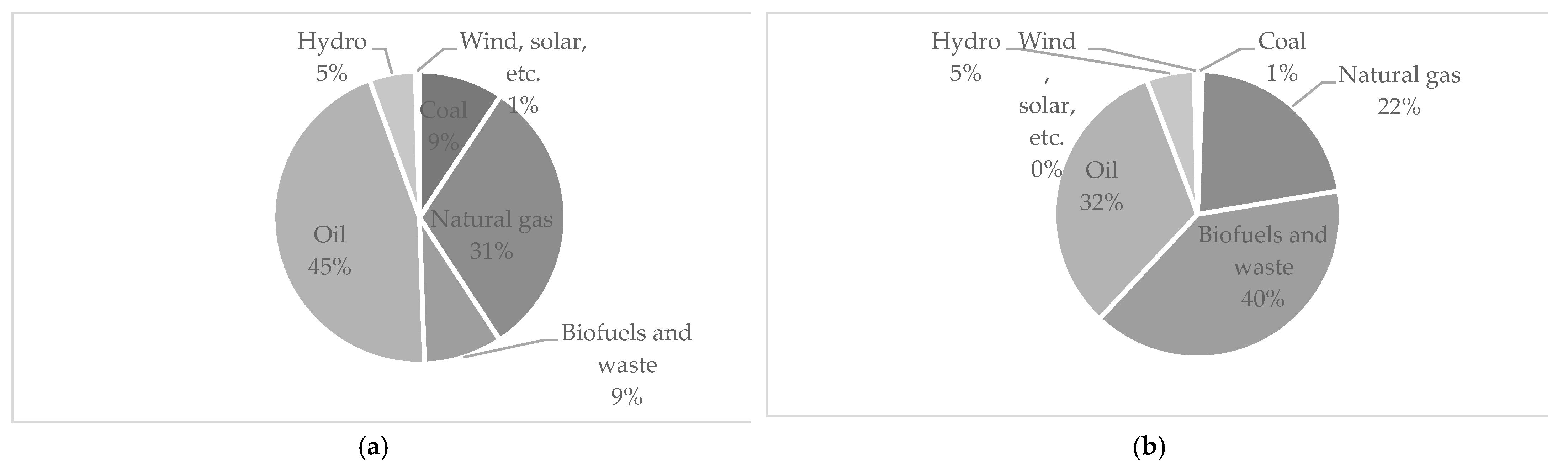

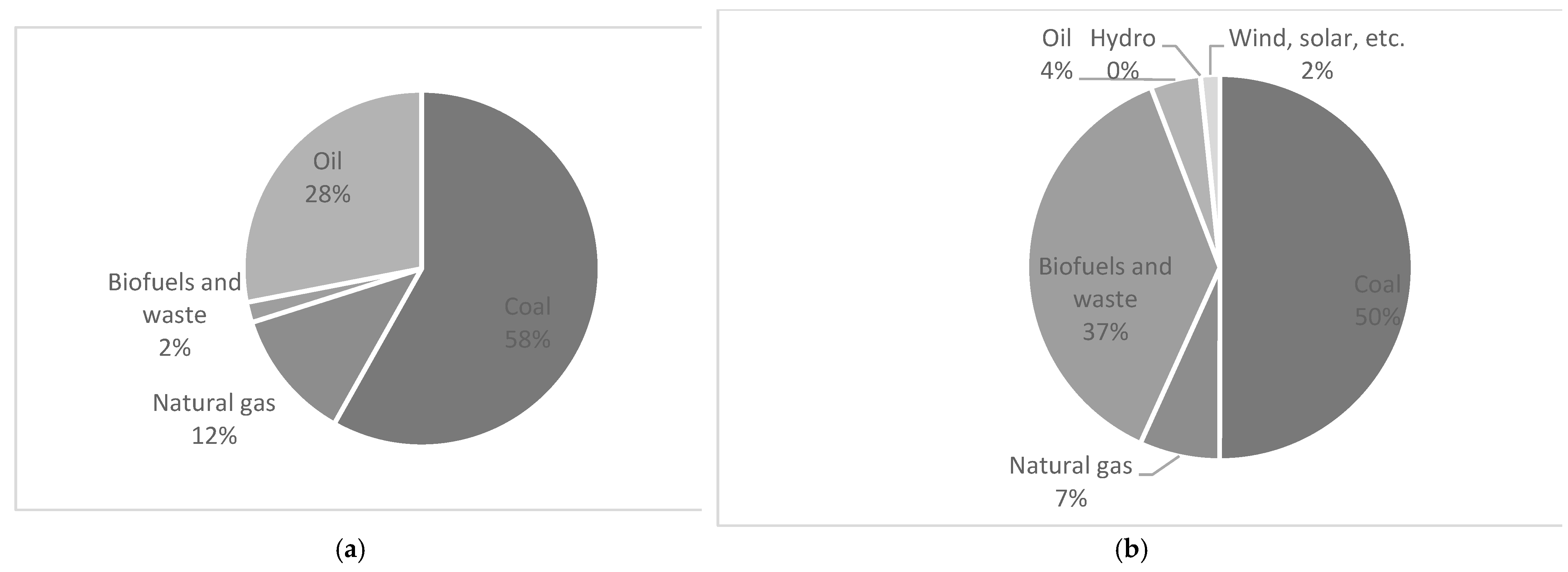

3.1. Outlook of Energy M&A in the Baltic States

3.2. Analysis of M&A in the Energy Industry from the Perspective of Sustainable Development

- Strengths. Liu and Lu [34] acknowledge that digital transformation strengthens the energy industry. Digital technologies may be extended to various industrial applications, e.g., power generation, power grid, status and performance data collection from power assets, etc. From the financial and cost management perspectives, digital transformation may impose savings and cost reduction by improving labor efficiency and operation safety. Markovska et al. [35] have pursued SWOT analysis of the Macedonian energy sector. While some characteristics are country specific, other are applicable to the EU energy industry. The potential of the renewable energy sources (RESs) is among the strengths as RESes contribute to energy supply security and energy import reduction. Furthermore, pursuit of integration, solidarity, and cooperation between EU countries by consolidating energy policies has the capacity to improve EU-wide energy security. Moving from the industry to the firm level, Hong et al. [37] acknowledge the synergy that pursuit of M&A may reallocate resources from target to asset and prolong the operation of the combined firms. Similarly, Zhou, Lingling, et al. [39] found that green M&A improves operational efficiency and strengthens firms’ development capacity. Wu et al. [41] found that M&A can significantly promote innovation performance and innovation investment. Hu et al. [43] consider the strengths of M&A arising from access to valuable resources, increased market share, profitability potential, and improvement of companies’ long-term development capacities. Arndt et al. [45] acknowledge that the EU is diversifying its energy supply and has allocated significant funds to developing renewable energies. Disposal of advanced technologies enables European companies to produce renewable energy more efficiently and cost-effectively. Bogner et al. [47] indicate that competition law in the EU energy sector is well established, efficient and further developing. According to the authors, legal and ownership unbundling are employed as policy tools geared towards pushing companies into demerging deals. Ruggiero et al. [57] further acknowledge that the EU energy market strengths arise from intra- and interstate partnership and interaction between various economic actors. Pätäri et al. [46] analyzed corporate sustainability as a term consisting of economic responsibility (profit), social responsibility (profit), and environmental responsibility (planet) dimensions. According to the empirical analysis, there is a positive association between corporate sustainability and firms’ financial performance, especially when performance is measured as the market capitalization value. Furthermore, empirical evidence also supports that M&A activities related to corporate social responsibility have paid off among the energy industry companies. According to the authors of [46], this conclusion is also valid even though in the energy industry the share of environmental costs may be higher due to stringent environmental regulation. Having performed a comparative review of CSR of energy utilities and sustainable energy development trends in the Baltic states, Lu et al. [55] state that M&A and sustainable development reflect common targets: increased energy efficiency, the use of renewable energy sources, and greenhouse gas emission reduction.

- Weaknesses. According to Liu and Lu [34], the energy industry is characterized by a large scale, multiple stakeholders and governing authorities, national security matters, complicated engineering matters, strong professionalism, etc. Taking a sample of Chinese M&A, Borthwick et al. [36] found a negative effect of policy uncertainty on M&A, meaning that M&A likelihood decreases due to policy uncertainty. Guo et al. [38] analyzed the worldwide energy M&A network and found that in comparison with international energy companies, national energy companies are mainly being acquired in order to access natural resources. This motivation threatens sustainability potential as it allows depletion of natural resources. Waterworth and Bradshaw [40] acknowledge new trends and developments in the energy market and fierce competition in the M&A market, which subsequently increase non-technical risk. Energy M&A, especially in the renewables area, are increasing and drawing more attention from public and private investors. However, Wasilewski et al. [42] acknowledge that advancements in energy generation technologies are capital intensive and require mobilization of ever-increasing investments. Elbassoussy [44] developed an integrated EU energy security theoretical framework concept with a focus on policies, strategies, and challenges faced. Most of them reflect a general trend of rising EU dependence on external energy resources. Further weaknesses of the EU energy market reflect the low level of EU country and firm reserves and global production. Secondly, there is a clear gap between energy production and consumption, meaning the EU is net energy importer. Third, the EU energy system depends on a limited number of suppliers. This weakness has especially become evident after the Russian invasion of Ukraine. While Arndt et al. [45] have recognized that the EU is investing significantly in development energies and pursuit of renewable energy cost-efficiency, renewable energy profitability is subject to the prices in the deployable energy market. From this perspective, development of the renewable energy market is very sensitive to and reflects price changes in traditional energy sources.

- Opportunities. Developments in any industry are subject to investments. Therefore, introduction of significant investments and large-scale block-chain technology developments, together with development of emerging technologies and energy internet development [34], create many opportunities. Energy and climate change together are among the top priorities in the EU’s agenda to pursue sustainability. COVID 19 has further encouraged the EU to approve the European Green Deal, which seeks to transform the EU into a modern, resource-efficient, and competitive economy, ensuring no net emissions of greenhouse gases by 2050 and economic growth decoupled from resource use [13]. The findings of Manocha and Srai [49] suggest that product design and technology selection factors represent sources of M&A value creation when exploring an innovation for a sustainable change management. Zheng et al. [50] consider opportunities arising during M&A integration from corporate reorganizations, and optimization of firm structure which subsequently leads to improved corporate governance. Caizza et al. [52] foresee cross-border M&A as providing various opportunities and benefits, such as expeditious entry into new markets by gaining local knowledge, supplier networks, government relationships, and customers coming from the target firm. Bali et al. [53] have questioned what changes the transition towards renewable energy is bringing to EU employment levels. According to the authors, the transition towards renewable energy will have a positive marginal significant effect in the long term. However, the authors do acknowledge a significant short- and medium-term positive effect of renewable energy towards future employment changes. Włodarczyk et al. [54] recognize that the EU Renewable Energy Directive and the European Green Deal will bring many opportunities and contribute in the transition to sustainability. Among other opportunities are significant support for financial investments and strategic plans seeking to support climate neutrality by 2050, reduction of energy disparities between EU countries, and transforming the EU into a resource efficient and competitive economy. Recently, Pereira et al. [56] analyzed strategies of electric utility companies towards the transition to sustainable energy system. The authors do support that M&A will lead to both business expansion and enhanced potential of sustainable energy activities integration. The largest potential opportunities are acquiring sustainable energy activities, leading to activities contributing to decarburization while simultaneously reinforcing the efficiency of the traditional business models. Verde [58] draws attention to convergence between electricity and gas businesses due to liberalization of EU natural gas and electricity industries. However, while liberalization offers many potential synergies (technological advances enable a broader use of natural gas as a source for generating electric power, downstream opportunities to avoid cost duplication, etc.), the natural gas industry is much more concentrated in comparison with the electricity industry and does not have high liquidity levels. Verde [58] proposes that European energy companies may pursue strategies of transformation into new vertically integrated “energy companies” that operate in both gas and electricity businesses as a reflection of the uncertainties of energy demand and price volatilities.

- Among the largest threats stands inertia in traditional business modes. It reflects the large investments already made in traditional equipment and supply chains. Further, various security risks threaten the energy industry. Dasgupta et al. [48] acknowledge the potential harm of a path towards digital transition and transformation that involves geomagnetic storms, malware, ransomware, phishing, botnets, etc., and raises significant risks to national security. Moving from industry to the firm level, Hong et al. [37] recognize that due to the significant cost and uncertainty, M&A activities involve high risk. Cultural compatibility and corporate culture may serve as potential threats to M&A, especially cross-border M&A, because different cultures may not align common visions regarding certain aspects and subsequently reduce M&A performance [51]. Further threats to sustainability and M&A in the energy industry, according to Ruggiero et al. [57], are caused by the energy industry remaining financially and timewise dominated by large-scale projects, and subsequently its control by a small number of national and international companies. In addition to that, the authors also acknowledge that sustainability is further threatened by the circumstances of a growing number of countries becoming increasingly dependent on a limited number of energy suppliers.

4. Discussion

5. Conclusions

- The outlook of energy M&A in the Baltic states has shown that the market is relatively small (40 M&A deals in total excess value of EUR 4.8 billion from 1995 to 2020). Considering profiles of the target companies, only 4 deals (10% of total volume) with a value of EUR 40 million (1% of total value) involved a target with its main activities in cogeneration and alternative energy sources. Hence, it may be observed that the main M&A motives in the region are other than pursuit of sustainability. Furthermore, M&A of renewable companies are relatively small and M&A is dominated by traditional energy companies. Looking into the Lithuanian, Latvian, and Estonian energy market supply, common themes are pursuit of energy security, targets for emission reductions, renewables and energy efficiency, support of EU climate neutrality, and a greater emphasis on the mitigation of climate change. Analyzing a sample of Lithuanian, Latvian, and Estonian energy M&A deals showed that enlargement of the EU has expanded the EU energy market, thus increasing the number of actors, all of which have their own interests and agendas. Similarly to Liu and Lu [34] and Verde [58], the current study acknowledges the strategic nature of the EU energy system and resources as the EU energy system is more than the sum of its parts (e.g., national energy systems). Understanding energy security, national and international interests, and aligning corporate and national interests with a sustainable development perspective are critical current developmental challenges. Furthermore, the real life situation is even more complicated as private and state-owned energy companies, national governments (both EU countries and non-country states), and the EU represented by its institutions, in particular the Commission, are involved in the system.

- The practical significance of the current work lies in the description and analysis of various strengths, weaknesses, opportunities, and threats of M&A in the energy industry through the perspective of a sustainable development SWOT analysis. We believe that pursuit of traditional SWOT guidance and building on strengths, eliminating weaknesses, further exploiting opportunities, and mitigating the effects of threats may add value for practitioners and future researchers. M&A events are significant strategic tools for continuous adaptation, sustainable corporate development, and external growth. At the same time, M&A events are affecting not only companies, but the broader set of stakeholders involved. Therefore, M&A affect social, environmental, and economic sustainability pillars. Maintaining a balance and enhancing sustainability has become an important task for corporate, national, and global development in all countries. Within the framework of the EU, pursuit of sustainability was established by the 2015 Paris Agreement under the UN Framework Convention on Climate Change, and the EU’s commitments towards the UN’s 2030 Agenda [61] with its 17 sustainable development goals, whereas recently even greater emphasis has been placed on sustainability by the European Commission approving the EU Green Deal. The current research faces some limitations which, if properly and methodologically addressed, may serve as directions for future research. Firstly, SWOT analysis was performed through a 2 × 2 rather than 3 × 3 matrix. Use of a 3 × 3 matrix would have allowed us to draw more strategic conclusions and actions rather than systematizing factors according to four dimensions only. Furthermore, the article set for SALSA analysis that was used in the SWOT assessment was collected on a certain date and used specific keywords. Therefore, there are risks related to limitations in time and circumstances, as using several keywords might have excluded relevant articles that do not use the exact keywords. Third, we have based the current research on a systematic literature review and descriptive statistics of the energy M&A market in the Baltic states. Finally, while the methodological framework developed allows us to trace market developments through the lens of sustainable development, it does not enable us to fully grasp and differentiate sustainability matters from general aspects induced or supported by M&A transactions.

- Future studies should embrace a quantitative approach and include econometric analysis elaborating on the relationship between the energy M&A market and sustainable development. Even though the EU energy sector is on a convergence path, there are differences between energy market structures and players within different EU countries. Therefore, in order to improve applicability of the results, future studies should consider analyzing a wider country set of energy M&A events.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Lithuania | Latvia | Estonia | Total | |||||

|---|---|---|---|---|---|---|---|---|

| Year | Deal Value (mil. Eur) | Number of Deals | Deal Value (Mil. Eur) | Number of Deals | Deal Value (Mil. Eur) | Number of Deals | Deal Value (Mil. Eur) | Number of Deals |

| 1996 | €844.68 | 1 | €14.82 | 1 | €859.51 | 2 | ||

| 1997 | €126.43 | 1 | €23.20 | 1 | €149.63 | 2 | ||

| 1998 | €13.09 | 2 | €13.09 | 2 | ||||

| 1999 | €188.86 | 3 | €18.50 | 1 | €207.36 | 4 | ||

| 2000 | €13.00 | 1 | €6.36 | 1 | €19.36 | 2 | ||

| 2001 | €3.73 | 1 | €3.73 | 1 | ||||

| 2002 | €202.81 | 5 | €119.66 | 1 | €322.48 | 6 | ||

| 2003 | €1.93 | 1 | €1.93 | 1 | ||||

| 2004 | €- | 0 | ||||||

| 2005 | €- | 0 | ||||||

| 2006 | €2352.54 | 2 | €2352.54 | 2 | ||||

| 2007 | €3.52 | 1 | €3.52 | 1 | ||||

| 2008 | €- | 0 | ||||||

| 2009 | €2.86 | 1 | €1.23 | 1 | €4.09 | 2 | ||

| 2010 | €485.49 | 2 | €7.34 | 1 | €492.83 | 3 | ||

| 2011 | €- | 0 | ||||||

| 2012 | €21.77 | 1 | €21.77 | 1 | ||||

| 2013 | €- | 0 | ||||||

| 2014 | €73.91 | 1 | €34.18 | 1 | €108.08 | 2 | ||

| 2015 | €115.97 | 2 | €22.61 | 1 | €138.58 | 3 | ||

| 2016 | €30.50 | 1 | €27.53 | 1 | €58.04 | 2 | ||

| 2017 | €5.12 | 1 | €31.84 | 1 | €36.96 | 2 | ||

| 2018 | €3.14 | 1 | €3.14 | 1 | ||||

| 2019 | €87.03 | 1 | €87.03 | 1 | ||||

| 2020 | €- | 0 | ||||||

| Total: | €3376.87 | 18 | €1334.41 | 10 | €172.37 | 12 | €4883.64 | 40 |

Appendix B

| Title 1 | 1990 | 1995 | 2000 | 2005 | 2010 | 2015 | 2020 | |

|---|---|---|---|---|---|---|---|---|

| Lithuania | Coal | 33.384 | 10.283 | 3.843 | 7.717 | 8.623 | 7.566 | 6.394 |

| Natural gas | 195.855 | 84.929 | 86.404 | 103.984 | 104.326 | 86.561 | 82.553 | |

| Biofuels and waste | 11.916 | 19.312 | 27.019 | 35.139 | 41.647 | 55.851 | 63.348 | |

| Oil | 280.964 | 124.543 | 85.863 | 11.838 | 107.346 | 105.003 | 115.616 | |

| Hydro | 1.490 | 1.343 | 1.224 | 1.624 | 1.944 | 1.256 | 1.082 | |

| Wind, solar, etc. | 128 | 996 | 3.244 | 6.050 | ||||

| Nuclear | 188.551 | 131.565 | 94.007 | 114.697 | ||||

| Total: | 712.160 | 371.975 | 298.360 | 275.127 | 264.882 | 259.481 | 275.043 | |

| Latvia | Coal | 29.718 | 11.202 | 5.503 | 3.414 | 4.560 | 1.947 | 984 |

| Natural gas | 99.653 | 42.279 | 45.736 | 56.852 | 61.206 | 45.987 | 38.111 | |

| Biofuels and waste | 27.581 | 42.102 | 39.696 | 49.852 | 48.386 | 59.431 | 69.179 | |

| Oil | 142.836 | 78.178 | 52.920 | 59.612 | 58.608 | 57.346 | 56.327 | |

| Hydro | 16.186 | 10.573 | 10.148 | 11.974 | 12.674 | 6.697 | 9.371 | |

| Wind, solar, etc. | 1.458 | 14 | 169 | 184 | 531 | 694 | ||

| Total: | 315.974 | 184.334 | 154.003 | 181.704 | 185.434 | 171.408 | 173.972 | |

| Estonia | Coal | 248.963 | 145.948 | 124.440 | 133.709 | 164.314 | 163.011 | 108.231 |

| Natural gas | 51.175 | 24.388 | 27.717 | 33.481 | 23.551 | 16.348 | 14.576 | |

| Biofuels and waste | 7.865 | 20.623 | 21.454 | 24.376 | 34.671 | 38.408 | 80.962 | |

| Oil | 120.083 | 35.658 | 27.173 | 32.275 | 23.673 | 12.062 | 9.017 | |

| Hydro | 7 | 18 | 79 | 97 | 97 | 112 | ||

| Wind, solar, etc. | 194 | 997 | 2.574 | 3.467 | ||||

| Total: | 428.086 | 226.624 | 200.802 | 224.114 | 247.303 | 232.500 | 216.365 |

References

- Schaeffer, G.J. Energy sector in transformation, trends and prospects. Procedia Comput. Sci. 2015, 52, 866–875. [Google Scholar] [CrossRef]

- Kurbatova, T.; Perederii, T. Global trends in renewable energy development. In Proceedings of the 2020 IEEE KhPI Week on Advanced Technology (KhPIWeek), Kharkiv, Ukraine, 5–10 October 2020; pp. 260–263. [Google Scholar]

- Xu, X.; Wei, Z.; Ji, Q.; Wang, C.; Gao, G. Global renewable energy development: Influencing factors, trend predictions and countermeasures. Resour. Policy 2019, 63, 101470. [Google Scholar] [CrossRef]

- Shivakumar, A.; Dobbins, A.; Fahl, U.; Singh, A. Drivers of renewable energy deployment in the EU: An analysis of past trends and projections. Energy Strategy Rev. 2019, 26, 100402. [Google Scholar] [CrossRef]

- Mihaiu, D.M.; Șerban, R.A.; Opreana, A.; Țichindelean, M.; Brătian, V.; Barbu, L. The Impact of Mergers and Acquisitions and Sustainability on Company Performance in the Pharmaceutical Sector. Sustainability 2021, 13, 6525. [Google Scholar] [CrossRef]

- Gomes, E.; Angwin, D.N.; Weber, Y.; Yedidia Tarba, S. Critical success factors through the mergers and acquisitions process: Revealing pre-and post-M&A connections for improved performance. Thunderbird Int. Bus. Rev. 2013, 55, 13–35. [Google Scholar]

- Meglio, O. Towards More Sustainable M&A Deals: Scholars as Change Agents. Sustainability 2020, 12, 9623. [Google Scholar]

- Barros, V.; Matos, P.V.; Sarmento, J.M.; Vieira, P.R. M&A activity as a driver for better ESG performance. Technol. Forecast. Soc. Chang. 2022, 175, 121338. [Google Scholar] [CrossRef]

- Sachs, J.D.; Schmidt-Traub, G.; Mazzucato, M.; Messner, D.; Nakicenovic, N.; Rockstrom, J. Six Transformations to achieve the Sustainable Development Goals. Nat. Sustain. 2019, 2, 805–814. [Google Scholar] [CrossRef]

- Montiel, I.; Cuervo-Cazurra, A.; Park, J.; Antolín-López, R.; Husted, B.W. Implementing the United Nations’ sustainable development goals in international business. J. Int. Bus. Stud. 2021, 52, 999–1030. [Google Scholar] [CrossRef]

- Van Zanten, J.A.; van Tulder, R. Multinational enterprises and the Sustainable Development Goals: An institutional approach to corporate engagement. J. Int. Bus. Policy 2018, 1, 208–233. [Google Scholar] [CrossRef]

- Benson, M.; Boda, C.; Das, R.R.; King, L.; Park, C. Sustainable Development and Canada’s Transitioning Energy Systems. Sustainability 2022, 14, 2213. [Google Scholar] [CrossRef]

- European Commission. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en (accessed on 25 June 2022).

- Jing, W.; Tao, M. Research on clean energy development strategy of China Three Gorges Corporation based on SWOT framework. Sustain. Energy Technol. Assess. 2021, 47, 101335. [Google Scholar] [CrossRef]

- Agyekum, E.B. Energy poverty in energy rich Ghana: A SWOT analytical approach for the development of Ghana’s renewable energy. Sustain. Energy Technol. Assess. 2020, 40, 100760. [Google Scholar] [CrossRef]

- Lakatos, E.; Arsenopoulos, A. Investigating EU financial instruments to tackle energy poverty in households: A SWOT analysis. Energy Sources Part B Econ. Plan. Policy 2019, 14, 235–253. [Google Scholar] [CrossRef]

- Bruce, C. Interpreting the Scope of Their Literature Reviews: Significant Differences in Research Students’ Concerns; New Library World: Novato, CA, USA, 2001; Volume 102, pp. 158–166. [Google Scholar]

- Major, C.; Savin-Baden, M. An Introduction to Qualitative Research Synthesis: Managing the Information Explosion in Social Science Research; Routledge: London, UK, 2010. [Google Scholar]

- Amo, I.F.; Erkoyuncu, J.A.; Roy, R.; Palmarini, R.; Onoufriou, D. A systematic review of Augmented Reality content-related techniques for knowledge transfer in maintenance applications. Comput. Ind. 2018, 103, 47–71. [Google Scholar]

- Grant, M.J.; Booth, A. A typology of reviews: An analysis of 14 review types and associated methodologies. Health Inf. Libr. J. 2009, 26, 91–108. [Google Scholar] [CrossRef]

- Benzaghta, M.A.; Elwalda, A.; Mousa, M.M.; Erkan, I.; Rahman, M. SWOT analysis applications: An integrative literature review. J. Glob. Bus. Insights 2021, 6, 55–73. [Google Scholar] [CrossRef]

- Rozmi, A.N.A.; Nordin, A.; Bakar, M.I.A. The perception of ICT adoption in small medium enterprise: A SWOT analysis. Int. J. Innov. Bus. Strategy 2018, 19, 69–79. [Google Scholar]

- Dyson, R.G. Strategic development and SWOT analysis at the University of Warwick. Eur. J. Oper. Res. 2004, 152, 631–640. [Google Scholar] [CrossRef]

- Vlados, C. On a correlative and evolutionary SWOT analysis. J. Strategy Manag. 2019, 12, 347–363. [Google Scholar] [CrossRef]

- Arslan, O.; Er, I.D. SWOT analysis for safer carriage of bulk liquid chemicals in tankers. J. Hazard. Mater 2008, 154, 901–913. [Google Scholar] [CrossRef] [PubMed]

- Sharma, M.; Sehrawat, R. Quantifying SWOT analysis for cloud adoption using FAHP-DEMATEL approach: Evidence from the manufacturing sector. J. Enterp. Inf. Manag. 2020, 33, 1111–1152. [Google Scholar] [CrossRef]

- Falcone, P.M.; Tani, A.; Tartiu, V.E.; Imbriani, C. Towards a sustainable forest based bioeconomy in Italy: Findings from a SWOT analysis. Forest Policy Econ. 2020, 110, 101910. [Google Scholar] [CrossRef]

- Stefko, R.; Heckova, J.; Gavurova, B.; Valentiny, T.; Chapcakova, A.; Ratnayake Kascakova, D. An analysis of the impact of economic context of selected determinants of cross-border mergers and acquisitions in the EU. Econ. Res.-Ekon. Istraživanja 2022, 1–18. [Google Scholar] [CrossRef]

- Lee, S.J.; Kim, S.; Kim, J. A comparative study of cross-border and domestic acquisition performances in the South Korean M&A Market: Testing the two competing theories of culture. Sustainability 2019, 11, 2307. [Google Scholar]

- Barbieri, E.; Huang, M.; Pi, S.; Pollio, C.; Rubini, L. Investigating the linkages between industrial policies and M&A dynamics: Evidence from China. China Econ. Rev. 2021, 69, 101654. [Google Scholar]

- International Energy Agency Lithuania 2021 Energy Policy Review. Available online: https://www.iea.org/countries/Latvia (accessed on 6 June 2022).

- Database of the International Energy Agency. Available online: https://www.iea.org/data-and-statistics/data-sets (accessed on 10 June 2022).

- Bompard, E.; Zalzar, S.; Huang, T.; Purvins, A.; Masera, M. Baltic power systems’ integration into the EU market coupling under different desynchronization schemes: A comparative market analysis. Energies 2018, 11, 1945. [Google Scholar] [CrossRef]

- Liu, P.; Lu, C. Strategic analysis and development plan design on digital transformation in the energy industry: A global perspective. Int. J. Energy Res. 2021, 45, 19657–19670. [Google Scholar] [CrossRef]

- Markovska, N.; Taseska, V.; Pop-Jordanov, J. SWOT analyses of the national energy sector for sustainable energy development. Energy 2009, 34, 752–756. [Google Scholar] [CrossRef]

- Borthwick, J.; Ali, S.; Pan, X. Does policy uncertainty influence mergers and acquisitions activities in China? A replication study. Pac. Basin Financ. J. 2020, 62, 101381. [Google Scholar] [CrossRef]

- Hong, X.; Lin, X.; Fang, L.; Gao, Y.; Li, R. Application of Machine Learning Models for Predictions on Cross-Border Merger and Acquisition Decisions with ESG Characteristics from an Ecosystem and Sustainable Development Perspective. Sustainability 2022, 14, 2838. [Google Scholar] [CrossRef]

- Guo, Y.; Yang, Y.; Wang, C. Global energy networks: Geographies of mergers and acquisitions of worldwide oil companies. Renew. Sustain. Energy Rev. 2021, 139, 110698. [Google Scholar] [CrossRef]

- Zhou, L.; Teo, B.S.X.; Yusoff, S.K.M. The Effect of Green Transformation on the Operating Efficiency of Green M&A Enterprises: Evidence from China. J. Asian Financ. Econ. Bus. 2022, 9, 299–310. [Google Scholar]

- Waterworth, A.; Bradshaw, M.J. Unconventional trade-offs? National oil companies, foreign investment and oil and gas development in Argentina and Brazil. Energy Pol. 2018, 122, 7–16. [Google Scholar] [CrossRef]

- Wu, M.; Luo, T.; Tian, Y. The Effects of Open Innovation Based on Mergers and Acquisitions on Innovative Behavior of Enterprise: An Evidence from Chinese listed Enterprises. Front. Psychol. 2022, 12, 6288. [Google Scholar] [CrossRef]

- Wasilewski, M.; Zabolotnyy, S.; Osiichuk, D. Characteristics and Shareholder Wealth Effects of Mergers and Acquisitions Involving European Renewable Energy Companies. Energies 2021, 14, 7126. [Google Scholar] [CrossRef]

- Hu, M.; Mou, J.; Tuilautala, M. How trade credit affectsmergers and acquisitions. Int. Rev. Econ. Financ 2020, 67, 1–12. [Google Scholar] [CrossRef]

- Elbassoussy, A. European energy security dilemma: Major challenges and confrontation strategies. Rev. Econ. Political Sci. 2019, 4, 321–343. [Google Scholar] [CrossRef]

- Arndt, C.; Miller, M.; Tarp, F.; Zinaman, O.; Arent, D. The Political Economy of Clean Energy Transitions; Oxford University Press: New York, NY, USA, 2017; p. 640. [Google Scholar] [CrossRef]

- Pätäri, S.; Jantunen, A.; Kyläheiko, K.; Sandström, J. Does sustainable development foster value creation? Empirical evidence from the global energy industry. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 317–326. [Google Scholar] [CrossRef]

- Bogner, S.; Gasser, S.M.; Rammerstorfer, M. Mergers and Acquisitions in European and North American Energy Markets: Empirical Analysis of Legal and Ownership Unbundling. J. Compet. Law Econ. 2015, 11, 935–954. [Google Scholar] [CrossRef]

- Dasgupta, R.; Sakzad, A.; Rudolph, C. Cyber attacks in transactive energy market-based microgrid systems. Energies 2021, 14, 1137. [Google Scholar] [CrossRef]

- Manocha, P.; Srai, J.S. Exploring Environmental Supply Chain Innovation in M&A. Sustainability 2020, 12, 10105. [Google Scholar]

- Zheng, D.; Yuan, Z.; Ding, S.; Cui, T. Enhancing environmental sustainability through corporate governance: The merger and acquisition perspective. Energy Sustain. Soc. 2021, 11, 41. [Google Scholar] [CrossRef]

- Gazzola, P.; Amelio, S.; Grechi, D.; Alleruzzo, C. Culture and sustainable development: The role of merger and acquisition in I talian BC orps. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1546–1559. [Google Scholar] [CrossRef]

- Caizza, R.; Shimizu, K.; Yoshikawa, T. Cross-Border M&A: Challenges and Opportunities in Global Business Environment. Guest Editors’ Introduction. 2017. Available online: https://ink.library.smu.edu.sg/lkcsb_research_all/20/ (accessed on 29 August 2022).

- Bali Swain, R.; Karimu, A.; Gråd, E. Sustainable development, renewable energy transformation and employment impact in the EU. Int. J. Sustain. Dev. World Ecol. 2022, 29, 695–708. [Google Scholar] [CrossRef]

- Włodarczyk, B.; Firoiu, D.; Ionescu, G.H.; Ghiocel, F.; Szturo, M.; Markowski, L. Assessing the Sustainable Development and Renewable Energy Sources Relationship in EU Countries. Energies 2021, 14, 2323. [Google Scholar] [CrossRef]

- Lu, J.; Ren, L.; Yao, S.; Qiao, J.; Strielkowski, W.; Streimikis, J. Comparative review of corporate social responsibility of energy utilities and sustainable energy development trends in the Baltic states. Energies 2019, 12, 3417. [Google Scholar] [CrossRef]

- Pereira, G.I.; Niesten, E.; Pinkse, J. Sustainable energy systems in the making: A study on business model adaptation in incumbent utilities. Technol. Forecast. Soc. Chang. 2022, 174, 121207. [Google Scholar] [CrossRef]

- Ruggiero, F.; Vlad, L.B.; Vlăsceanu, G.; Gavriș, A.; Vasile, D. Energy Cooperation–The Strength of the EU’s Economic Development. Amfiteatru Econ. J. 2015, 17, 1080–1094. [Google Scholar]

- Verde, S. Everybody merges with somebody—The wave of M&As in the energy industry and the EU merger policy. Energy Policy 2008, 36, 1125–1133. [Google Scholar] [CrossRef]

- Qadir, S.; Al-Motairi, H.; Tahir, F.; El-Fagih, L. Incentives and strategies for financing the renewable energy transition: A review. Energy Rep. 2021, 7, 3590–3606. [Google Scholar] [CrossRef]

- Eikeland, P.O.; Skjærseth, J.B. Oil and power industries’ responses to EU emissions trading: Laggards or low-carbon leaders? Environ. Polit. 2019, 28, 104–124. [Google Scholar] [CrossRef]

- UN General Assembly, Transforming our world: The 2030 Agenda for Sustainable Development, 21 October 2015, A/RES/70/1. Available online: https://www.refworld.org/docid/57b6e3e44.html (accessed on 11 October 2022).

| Author | Strengths | Author | Weaknesses |

| Liu and Lu [34] | Digital transformation: extensible industrial applications, mature digital technology, and high efficiency of platform operation | Liu and Lu [34] | Large size of the industry (e.g., huge asset scale worldwide) Lack of the impetus of revolution (e.g., complex managerial hierarchy, long decision-making process) Various restrictions imposed by political system, economic and social development, technology innovation, international cooperation, etc. |

| Markovska et al. [35] | Potential of the renewable energy sources (RESs) Progressive adoption of EU standards in energy policy and regulation | Borthwick et al. [36] | Negative influence of macro policy uncertainty on M&A. Economic policy uncertainty significantly reduces firm M&A activities |

| Hong et al. [37] | Resource reallocation and synergy potential: complementarity for both parties can exert more potential synergy, thereby increasing the capacity of the merged firms to develop sustainably | Guo et al. [38] | Motivation of access to natural resources. Global oil and gas M&A are mostly domestic M&A, because cross-border M&A risks are closely related to many complex political and economic relationships |

| Zhou, Lingling et al. [39] | Green M&A improves operational efficiency | Waterworth and Bradshaw [40] | Different contract mechanisms and non-technical risk increase in the current capital constrained world. Hence, competition comes from countries with different contractual mechanisms, political risks and regulatory framework. |

| Wu et al. [41] | M&A promotes innovation performance and innovation investment. | Wasilewski et al. [42] | Capital intensity and mobilization of ever-increasing investments are among prerequisites to deliver energy projects and ensure satisfactory internal investment return |

| Hu et al. [43] | Access to resources, increase of market share, profitability potential, and improvement in long-term development | Elbassoussy [44] | Dependence of external energy resources; EU is net energy importer; energy system depends on limited number of suppliers |

| Arndt et al. [45] | Significant investments allocated by the EU for developing renewable energies | Arndt et al. [45] | Renewable energy profitability is subject to the fluctuations in energy prices |

| Pätäri et al. [46] | Sustainability-driven firms better control their costs and better generate profits in comparison with the conventional energy companies | ||

| Bogner et al. [47] | Efforts of EU institutions to increase the effectiveness of competition law in the energy sector. Strong competition law is geared toward preventing companies from anticompetitive behavior by promoting and protecting market competition. Competition law enables authorities to supervise M&A and even to intervene | ||

| Author | Opportunities | Author | Threats |

| Liu and Lu [34] | Increasing investment Development of emerging technologies Energy internet development | Liu and Lu [34] | Inertia in traditional business models favors maintaining currently running equipment distributed among supply chains |

| European Commission [13] | European Green Deal | Dasgupta et al. [48] | Potential harm of security risks (e.g., such as geomagnetic storms, malware, ransomware, phishing, botnets, etc.) |

| Manocha and Srai [49] | Product design and technology selection factors represent sources of M&A value creation | Hong et al. [37] | High cost and uncertainty increases M&A risks |

| Zheng et al. [50] | Corporate reorganizations, firm structure optimization, improved corporate governance | Gazzola et al. [51] | Corporate culture/cultural compatibility allows companies to operate according to common or similar visions regarding certain aspects that other companies probably find less important. |

| Caizza et al. [52] | Local knowledge, supplier networks, government relationships, clientele of target firm | Caizza et al. [52] | Post-merger integration (PMI) |

| Bali et a. [53] | Changes in employment. Renewable energy consumption and sector M&A contribute substantially to future changes in employment in the short and medium terms. | ||

| Włodarczyk et al. [54] | EU Renewable Energy Directive; European Green Deal | ||

| Lu et al. [55] | Developments towards increase in energy efficiency, the use of renewable energy sources, and greenhouse gas emission reduction | ||

| Pereira et al. [56] | Complementarities among new sustainable activities |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Andriuškevičius, K.; Štreimikienė, D. Energy M&A Market in the Baltic States Analyzed through the Lens of Sustainable Development. Energies 2022, 15, 7907. https://doi.org/10.3390/en15217907

Andriuškevičius K, Štreimikienė D. Energy M&A Market in the Baltic States Analyzed through the Lens of Sustainable Development. Energies. 2022; 15(21):7907. https://doi.org/10.3390/en15217907

Chicago/Turabian StyleAndriuškevičius, Karolis, and Dalia Štreimikienė. 2022. "Energy M&A Market in the Baltic States Analyzed through the Lens of Sustainable Development" Energies 15, no. 21: 7907. https://doi.org/10.3390/en15217907

APA StyleAndriuškevičius, K., & Štreimikienė, D. (2022). Energy M&A Market in the Baltic States Analyzed through the Lens of Sustainable Development. Energies, 15(21), 7907. https://doi.org/10.3390/en15217907