Energy Security of Hydropower Producing Countries—The Cases of Tajikistan and Kyrgyzstan

Abstract

1. Introduction

- The issue of economic benefits for the countries of the region resulting from the trade in hydropower through cross-border energy networks [5].

- Security of supply:

- -

- Seasonality;

- -

- Installed capacity;

- Security of services:

- -

- Energy tariffs;

- -

- Reliability;

- Security of demand.

2. Energy Security

- The non-politicized stage;

- The politicized stage;

- The securitized stage [24].

- Availability—physical access to energy;

- Accessibility—the possibility of obtaining energy resources, considering geographical, political, demographic and technological limitations;

- Affordability—access to inexpensive energy sources;

- Acceptability—access to sources acceptable to society, especially in terms of environmental factors [31].

- The first—technical reasons (infrastructure failure);

- The second—social behavior (e.g., volatility of demand for energy resources, suspension of supplies for political reasons);

- The third—natural threats (e.g., depletion of fossil fuel resources) [43].

3. Central Asia’s Hydropower Potential

4. Tajikistan

4.1. General Information

4.2. Market Structure

4.3. Tajikistan’s Energy Security

4.3.1. Security of Supply

Seasonality of Supplies

Installed Capacity

4.3.2. Security of Services

Electrical Energy Tariffs

Reliability of Services

4.3.3. Security of Demand

- Synchronisation of the Tajik grid with CAPS in 2022, permitting supplies of electrical energy to all Central Asian countries without management of the grid and other operational problems;

- The launch in 2022 of the Central Asia–South Asia (CASA-1000) transmission system, with a capacity of 1300 MW [89].

5. Kyrgyzstan

5.1. General Information

5.2. Market Structure

5.3. Kyrgyzstan’s Energy Security

5.3.1. Security of Supply

Seasonality of Supplies

Installed Capacity

5.3.2. Security of Services

Electrical Energy Tariffs

Reliability of Services

5.3.3. Security of Demand

6. Discussion

- Security of supply;

- Security of services;

- Security of demand.

6.1. Security of Supply

6.2. Security of Services

6.3. Security of Demand

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| IEA | International Energy Agency |

| GDP | Gross Domestic Product |

| CAPS | Central Asian Power System |

| ESS | Energy Security Services |

| CASA | Central Asia–South Asia |

References

- Llamosas, C.; Sovacool, B.K. The future of hydropower? A systematic review of the drivers, benefits and governance dynamics of transboundary dams. Renew. Sustain. Energy Rev. 2021, 137, 110495. [Google Scholar] [CrossRef]

- Llamosas, C.; Sovacool, B.K. Transboundary hydropower in contested contexts: Energy security, capabilities, and justice in comparative perspective. Energy Strategy Rev. 2021, 37, 100698. [Google Scholar] [CrossRef]

- World Energy Outlook 2016. International Energy Agency. 2016. Available online: https://www.iea.org/reports/world-energy-outlook-2016 (accessed on 16 July 2022).

- Lebel, L.; Naruchaikusol, S.; Juntopas, M. Transboundary flows of resources, people, goods and services in the Mekong region. In Climate Risks, Regional Integration, and Sustainability in the Mekong Region; Strategic Information and Research Development Centre (SIRD): Petaling Jaya, Malaysia, 2014; pp. 54–71. [Google Scholar]

- Nakayama, M.; Maekawa, M. Economic benefits and security implications of trading hydropower through transboundary power grids in Asia. Int. J. Water Resour. Dev. 2013, 29, 501–513. [Google Scholar] [CrossRef]

- The Secretariat of the Global Commission on the Geopolitics of Energy Transformation; Van de Graaf, T. A New World: The Geopolitics of the Energy Transformation. 2019. Available online: https://biblio.ugent.be/publication/8588274 (accessed on 16 July 2022).

- Zarfl, C.; Lumsdon, A.E.; Berlekamp, J.; Tydecks, L.; Tockner, K. A global boom in hydropower dam construction. Aquat. Sci. 2014, 77, 161–170. [Google Scholar] [CrossRef]

- Siciliano, G.; Urban, F.; Tan-Mullins, M.; Mohan, G. Large dams, energy justice and the divergence between international, national and local developmental needs and priorities in the global South. Energy Res. Soc. Sci. 2018, 41, 199–209. [Google Scholar] [CrossRef]

- Libert, B.; Lipponen, A. Challenges and Opportunities for Transboundary Water Cooperation in Central Asia: Findings from UNECE’s Regional Assessment and Project Work. Int. J. Water Resour. Dev. 2012, 28, 565–576. [Google Scholar] [CrossRef]

- Zhiltsov, S.S.; Zonn, I.S.; Grishin, O.E.; Egorov, V.G.; Ruban, M.S. Transboundary Rivers in Central Asia: Cooperation and Conflicts Among Countries. In The Handbook of Environmental Chemistry; Springer International Publishing: Cham, Switzerland, 2018; pp. 61–80. [Google Scholar] [CrossRef]

- Jalilov, S.M.; Keskinen, M.; Varis, O.; Amer, S.; Ward, F.A. Managing the water–energy–food nexus: Gains and losses from new water development in Amu Darya River Basin. J. Hydrol. 2016, 539, 648–661. [Google Scholar] [CrossRef]

- Simonov, E.; Egidarev, E. Intergovernmental cooperation on the Amur River basin management in the twenty-first century. Int. J. Water Resour. Dev. 2017, 34, 771–791. [Google Scholar] [CrossRef]

- Hummel, S. Relative Water Scarcity and Country Relations along Cross-Boundary Rivers: Evidence from the Aral Sea Basin. Int. Stud. Q. 2017, 61, 795–808. [Google Scholar] [CrossRef]

- Mohammadi, D.; Ahmadzai, M.I. Hydropolitics of Amu River: Prospects of Conflict & Cooperation between Riparian Nations. Tarzi Research Foundation. 2021. Available online: https://figshare.com/articles/journal_contribution/Hydropolitics_of_Amu_River_Prospects_of_Conflict_Cooperation_between_Riparian_Nations_pdf/13685818/1 (accessed on 16 July 2022). [CrossRef]

- Menga, F.; Mirumachi, N. Fostering Tajik Hydraulic Development: Examining the Role of Soft Power in the Case of the Rogun Dam. Water Altern. 2016, 9, 373–388. [Google Scholar]

- Ito, S.; Khatib, S.E.; Nakayama, M. Conflict over a hydropower plant project between Tajikistan and Uzbekistan. Int. J. Water Resour. Dev. 2015, 32, 692–707. [Google Scholar] [CrossRef]

- Petrov, G.N. Water apportioning and runoff regulation in the joint use of water-power resources of transboundary rivers in Central Asia. Water Resour. 2015, 42, 269–274. [Google Scholar] [CrossRef]

- R Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2021. [Google Scholar]

- RStudio Team. RStudio: Integrated Development Environment for R; RStudio, PBC: Boston, MA, USA, 2022. [Google Scholar]

- Wickham, H. ggplot2: Elegant Graphics for Data Analysis; Springer: New York, NY, USA, 2016. [Google Scholar]

- Palonkorpi, M. Energy Security and the Regional Security Complex Theory; University of Lapland Reports in Education; University of Lapland: Rovaniemi, Finland, 2006; pp. 302–313. [Google Scholar]

- Stern, D. Energy and Economic Growth: The Stylized Facts. 2011. Available online: https://asiaandthepacificpolicystudies.crawford.anu.edu.au/pdf/seminars/2011/20111101_presentation_stern.pdf (accessed on 16 July 2022).

- Mazur, A.; Rosa, E. Energy and Life-Style. Science 1974, 186, 607–610. [Google Scholar] [CrossRef] [PubMed]

- Özcan, S. Securitization of Energy Through the Lenses of Copenhagen School. 2013. Available online: https://www.westeastinstitute.com/wp-content/uploads/2013/04/ORL13-155-Sezer-Ozcan-Full-Paper.pdf (accessed on 16 July 2022).

- Flaherty, C.; Filho, W.L. Energy Security as a Subset of National Security. In Global Energy Policy and Security; Springer: London, UK, 2013; pp. 11–25. [Google Scholar] [CrossRef]

- Roberts, P. The End of Oil. On the Edge of Perilous New World; Houghton Mifflin Harcourt: Boston, MA, USA, 2004. [Google Scholar]

- Kemp, G. Scarcity and Strategy. Foreign Aff. 1978, 56, 396. [Google Scholar] [CrossRef]

- Bahgat, G. Oil Security at the Turn of the Century: Economic and Strategic Implications. Int. Relations 1999, 14, 41–52. [Google Scholar] [CrossRef]

- Cocklin, C. Anatomy of a future energy crisis Restructuring and the energy sector in New Zealand. Energy Policy 1993, 21, 881–892. [Google Scholar] [CrossRef]

- Coates, J.F. Technological change and future growth: Issues and opportunities. Technol. Forecast. Soc. Chang. 1977, 11, 49–74. [Google Scholar] [CrossRef]

- Cherp, A.; Jewell, J. The three perspectives on energy security: Intellectual history, disciplinary roots and the potential for integration. Curr. Opin. Environ. Sustain. 2011, 3, 202–212. [Google Scholar] [CrossRef]

- Skinner, R. Energy Security and Producer-Consumer Dialogue: Avoiding a Maginot Mentality. The Oxford Institute for Energy Studies. 2005. Available online: https://www.oxfordenergy.org/publications/energy-security-and-producer-consumer-dialogue-avoiding-a-maginot-mentality (accessed on 16 July 2022).

- Skinner, R.; Arnott, R. The Oil Supply and Demand Context for Security of Oil Supply to the Eu form the GCC Countries. The Oxford Institute for Energy Studies. 2005. Available online: https://www.oxfordenergy.org/publications/the-oil-supply-and-demand-context-for-security-of-oil-supply-to-the-eu-from-the-gcc-countries/ (accessed on 16 July 2022).

- Yergin, D. Ensuring Energy Security. Foreign Aff. 2006, 85, 69. [Google Scholar] [CrossRef]

- Williams, P.D.; McDonald, M. (Eds.) Energy Security; Routledge: London, UK, 2018; pp. 483–496. [Google Scholar] [CrossRef]

- APERC. A Quest for Energy Security in the 21st Century Resources and Constraints; Institute of Energy Economics: Tokyo, Japan, 2007. [Google Scholar]

- Ren, J.; Sovacool, B.K. Quantifying, measuring, and strategizing energy security: Determining the most meaningful dimensions and metrics. Energy 2014, 76, 838–849. [Google Scholar] [CrossRef]

- Brown, M.A.; Wang, Y.; Sovacool, B.K.; D’Agostino, A.L. Forty years of energy security trends: A comparative assessment of 22 industrialized countries. Energy Res. Soc. Sci. 2014, 4, 64–77. [Google Scholar] [CrossRef]

- Kocaslan, G. International Energy Security Indicators and Turkey’s Energy Security Risk Score. Int. J. Energy Econ. Policy 2014, 4, 735–743. [Google Scholar]

- Sovacool, B.K.; Mukherjee, I. Conceptualizing and measuring energy security: A synthesized approach. Energy 2011, 36, 5343–5355. [Google Scholar] [CrossRef]

- Chomać-Pierzecka, E.; Sobczak, A.; Urbańczyk, E. RES Market Development and Public Awareness of the Economic and Environmental Dimension of the Energy Transformation in Poland and Lithuania. Energies 2022, 15, 5461. [Google Scholar] [CrossRef]

- Marks-Bielska, R.; Bielski, S.; Pik, K.; Kurowska, K. The Importance of Renewable Energy Sources in Poland’s Energy Mix. Energies 2020, 13, 4624. [Google Scholar] [CrossRef]

- Winzer, C. Conceptualizing energy security. Energy Policy 2012, 46, 36–48. [Google Scholar] [CrossRef]

- Energy Security: Reliable, Affordable Access to All Fuels and Energy Sources. International Energy Agency. 2020. Available online: https://www.iea.org/topics/energy-security (accessed on 16 July 2022).

- Study on Energy Supply Security and Geopolitics. European Commission. 2004. Available online: https://www.clingendaelenergy.com/inc/upload/files/Study_on_energy_supply_security_and_geopolitics.pdf (accessed on 16 July 2022).

- Hedenus, F.; Azar, C.; Johansson, D.J. Energy security policies in EU-25—The expected cost of oil supply disruptions. Energy Policy 2010, 38, 1241–1250. [Google Scholar] [CrossRef]

- Kazantsev, A. Policy networks in European–Russian gas relations: Function and dysfunction from a perspective of EU energy security. Communist Post-Communist Stud. 2012, 45, 305–313. [Google Scholar] [CrossRef]

- Parag, Y. From Energy Security to the Security of Energy Services: Shortcomings of Traditional Supply-Oriented Approaches and the Contribution of a Socio-Technical and User-Oriented Perspectives. Sci. Technol. Stud. 2014, 27, 97–108. [Google Scholar] [CrossRef]

- Karl, T.L. The Paradox of Plenty; University of California Press: Berkeley, CA, USA, 1997. [Google Scholar] [CrossRef]

- Collier, P. The Bottom Billion: Why the Poorest Countries are Failing and What Can Be Done about It; Oxford University Press: Oxford, UK, 2008. [Google Scholar]

- Practical Action. Poor People’s Energy Outlook 2014: Key Messages on Energy for Poverty Alleviation; Practical Action Publishing: Rugby, UK, 2014. [Google Scholar] [CrossRef]

- Mitchell, J. Will Western Europe Face the Energy Shortage? Energy Council of France: Strasbourg, France, 1997. [Google Scholar]

- Alhajji, A. What is Energy Security? OGEL. Available online: https://www.ogel.org/article.asp?key=2787 (accessed on 16 July 2022).

- Auty, R. Sustaining Development in Mineral Economies; Routledge: London, UK, 2002. [Google Scholar] [CrossRef]

- Ang, B.; Choong, W.; Ng, T. Energy security: Definitions, dimensions and indexes. Renew. Sustain. Energy Rev. 2015, 42, 1077–1093. [Google Scholar] [CrossRef]

- Jenergeticheskij krizis v Tadzhikistane v Zimnij Period: Al’ternativnye Varianty Obespechenija Balansa Sprosa i Predlozhenija. World Bank. 2012. Available online: https://web.worldbank.org/archive/website01419/WEB/IMAGES/TAJ_WI-2.PDF (accessed on 16 July 2022).

- Mamatkanov, D. Optimal Ways od Use of Transboundary Water Resources by the States of Central Asian Republics. Nauka Novye Tehnol. i Innovacii Kyrg. 2018, 3, 155–158. [Google Scholar]

- Investment in the Water and Energy Complex of Central Asia. Eurasian Development Bank. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3945355 (accessed on 16 July 2022).

- Sovershenstvovanie Upravlenija Vodnymi Resursami i Transgranichnogo Vodnogo Sotrudnichestva v Central’noj Azii: Rol’ Prirodohrannyh Konvencij EJeK OON. United Nations Economic Commission for Europe. 2011. Available online: https://unece.org/fileadmin/DAM/env/water/publications/documents/Water_Management_Ru.pdf (accessed on 16 July 2022).

- Hurramov, H.H. Politicheskij aspekt vodno-jenergeticheskih problem v Central’noj Azii. Probl. Postsovetskogo Prostranstva 2015, 4, 100–108. [Google Scholar]

- GDP (Current US$)—Tajikistan. World Bank. 2020. Available online: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=TJ (accessed on 16 July 2022).

- Poverty in Tajikistan 2020. World Bank. 2020. Available online: https://www.worldbank.org/en/news/infographic/2020/10/15/poverty-in-tajikistan-2020 (accessed on 16 July 2022).

- Population, Total—Tajikistan. World Bank. 2020. Available online: https://data.worldbank.org/indicator/SP.POP.TOTL?locations=TJ (accessed on 16 July 2022).

- Lang, J. Tajikistan: A Chronic Stagnation. Centre for Eastern Studies. 2016. Available online: https://www.osw.waw.pl/en/publikacje/osw-commentary/2016-03-16/tajikistan-a-chronic-stagnation (accessed on 16 July 2022).

- Vodnye Resursy. Ministerstvo Jenergetiki i Vodnyh resursov Respubliki Tadzhikistan. 2021. Available online: https://www.mewr.tj/?page_id=390 (accessed on 16 July 2022).

- Gidrojenergeticheskie Resursy Tadzhikistana. Ministerstvo Jenergetiki i Vodnyh Resursov Respubliki Tadzhikistan. 2022. Available online: https://www.mewr.tj/?page_id=614 (accessed on 16 July 2022).

- Petrov, G. Opyt Razvitija Maloj Gidrojenergetiki v Tadzhikistane. 2010. Available online: https://www.researchgate.net/publication/340827151_Opyt_razvitia_maloj_gidroenergetiki_v_Tadzikistane?channel=doi&linkId=5e9fbb20a6fdcc20bb3606e4&showFulltext=true (accessed on 16 July 2022). [CrossRef]

- Eastern Europe, Caucasus and Central Asia. International Energy Agency. 2015. Available online: https://iea.blob.core.windows.net/assets/63aaa8a4-d16d-4ff4-84a8-387f440304be/IDR_EasternEuropeCaucasus_2015.pdf (accessed on 16 July 2022).

- Number of Dams by Country Members. International Energy Agency. 2022. Available online: https://www.icold-cigb.org/article/GB/world_register/general_synthesis/number-of-dams-by-country-members (accessed on 16 July 2022).

- Obzor Jenergeticheskogo Sektora Respubliki Tadzhikistan. Ministerstvo Inostrannyh del Respubliki Tadzhikistan. 2019. Available online: https://mfa.tj/ru/main/tadzhikistan/energetika (accessed on 16 July 2022).

- Proizvodstvo i Potreblenie. Ministerstvo Jenergetiki i Vodnyh Resursov Respubliki Tadzhikistan. 2017. Available online: https://www.mewr.tj/?page_id=563 (accessed on 16 July 2022).

- Worlds’s Highest Dams. International Energy Agency. 2021. Available online: https://www.icold-cigb.org/article/GB/world_register/general_synthesis/worldss-highest-dams (accessed on 16 July 2022).

- Rogunskaja GJeS. Ministerstvo Jenergetiki i Vodnyh Resursov Respubliki Tadzhikistan. 2020. Available online: https://www.mewr.tj/?page_id=618 (accessed on 16 July 2022).

- Vozobnovljaemye Istochniki Jenergii Tadzhikistana. Pochemu jeto Vazhno Dlja Strany, No ne v Prioritete. Central Asian Bureau for Analytical Reporting. 2021. Available online: https://cabar.asia/ru/vozobnovlyaemye-istochniki-energii-tadzhikistana-pochemu-eto-vazhno-dlya-strany-no-ne-v-prioritete (accessed on 16 July 2022).

- Doing Business 2020—Economy Profile Tajikistan. World Bank Group. 2020. Available online: https://www.doingbusiness.org/content/dam/doingBusiness/country/t/tajikistan/TJK.pdf (accessed on 16 July 2022).

- The Global Competitiveness Report 2019. World Economic Forum. 2019. Available online: http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf (accessed on 16 July 2022).

- «Barki Tochik»: Esli Budem Vvodit’ Limit, ni ot Kogo ne Budem Skryvat’. Barki Toji. 2015. Available online: http://www.barqitojik.tj/info/massmedia/196617/ (accessed on 16 July 2022).

- Ocenka Situacii, Svjazannoj s Nehvatkoj Jenergii dlja Naselenija v Tadzhikistane. World Bank. 2014. Available online: https://documents1.worldbank.org/curated/en/137401468303580524/pdf/888370WP0P14530tajikistant0ru0ebook.pdf (accessed on 16 July 2022).

- CAPE Tajikistan: Assessment of the Energy Sector. Asian Development Bank. 2014. Available online: https://www.adb.org/sites/default/files/linked-documents/10-Energy-Sector.pdf (accessed on 16 July 2022).

- Tajikistan Country Profile 2013. World Bank. 2013. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/20927/924550WP0Box380LIC00Tajikistan02013.pdf?sequence=1&isAllowed=y (accessed on 16 July 2022).

- Tajikistan, Enterprise Survey. World Bank. 2019. Available online: https://www.enterprisesurveys.org/en/data/exploreeconomies/2019/tajikistan (accessed on 16 July 2022).

- Tajikistan Power Utility Financial Recovery Program. World Bank. 2020. Available online: http://documents1.worldbank.org/curated/ar/685981582945276030/pdf/Tajikistan-Power-Utility-Financial-Recovery-Program-for-Results.pdf (accessed on 16 July 2022).

- Hashimov, S. Reformy Jenergeticheskogo Sektora Tadzhikistana: Javljaetsja li Jeksport Jelektrojenergii Edinstvennym Vyhodom. Central Asian Bureau for Analytical Reporting. 2020. Available online: https://cabar.asia/ru/reformy-energeticheskogo-sektora-tadzhikistana-yavlyaetsya-li-eksport-elektroenergii-edinstvennym-vyhodom#_ftn6 (accessed on 16 July 2022).

- Jenergodeficit, «neprikasaemye» i Hishhenija. Chto Proishodit v Sfere Jenergetiki? Information Agency Avesta. 2021. Available online: http://avesta.tj/2021/02/06/energodefitsit-neprikasaemye-i-hishheniya-chto-proishodit-v-sfere-energetiki-mnenie-eksperta/ (accessed on 16 July 2022).

- Tadzhikistan. Doklad ob Jekonomike Osennij Vypusk 2019 g. World Bank Group. 2019. Available online: https://thedocs.worldbank.org/en/doc/778131575020956619-0080022019/original/Tajikistaneconomicupdatefall2019ru.pdf (accessed on 16 July 2022).

- Zhiteli Tadzhikistana Zhalujutsja na Otkljuchenija Sveta, a Jeksport Jelektrojenergii za Rubezh Prodolzhaetsja. Radio Ozodi. 2021. Available online: https://rus.ozodi.org/a/31567434.html (accessed on 16 July 2022).

- Putz, C. Tajikistan Resumes Supplying Uzbekistan with Electricity. The Diplomat. 2018. Available online: https://thediplomat.com/2018/04/tajikistan-resumes-supplying-uzbekistan-with-electricity/ (accessed on 16 July 2022).

- Jeksport-Import. Ministerstvo Jenergetiki i Vodnyh Resursov Respubliki Tadzhikistan. Available online: https://www.mewr.tj/?page_id=566 (accessed on 16 July 2022).

- Proekty. Barki Tojik. 2021. Available online: http://www.barqitojik.tj/activity/projects/308/197542/?sphrase_id=4806 (accessed on 16 July 2022).

- Proekt CASA-1000. CASA-1000. 2021. Available online: https://casa-1000.kg/faq (accessed on 16 July 2022).

- Lang, J. CASA 1000: Energia z Azji Centralnej popłYnie na Południe. Centre for Eastern Studies. 2016. Available online: https://www.osw.waw.pl/pl/publikacje/analizy/2016-05-18/casa-1000-energia-z-azji-centralnej-poplynie-na-poludnie (accessed on 16 July 2022).

- Proekt Peredachi i Torgovli Jelektrojenergiej Central’naja Azija—Juzhnaja Azija (CASA-1000). World Bank. 2016. Available online: https://www.vsemirnyjbank.org/ru/news/speech/2016/05/10/central-asia-south-asia-electricity-transmission-and-trade-project-casa-1000 (accessed on 16 July 2022).

- Uzbekistan Vozobnovil Postavki Gaza v Tadzhikistan. Radio Ozodi. 2018. Available online: https://rus.ozodi.org/a/29153790.html (accessed on 16 July 2022).

- The World Bank in the Kyrgyz Republic. World Bank. 2021. Available online: https://www.worldbank.org/en/country/kyrgyzrepublic/overview#1 (accessed on 16 July 2022).

- Kyrgyz Republic Partnership Program Snapshot. World Bank. 2015. Available online: http://documents.worldbank.org/curated/en/206341486990416988/World-Bank-Kyrgyz-Republic-partnership-program-snapshot (accessed on 16 July 2022).

- Nacional’nyj Otchet Kyrgyzskoj Respubliki. Global Water Partnership. 2006. Available online: http://www.cawater-info.net/ucc-water/pdf/ucc_water_report_kyrg_rus.pdf (accessed on 16 July 2022).

- Vozobnovljaemye Istochniki Jenergii Kyrgyzstana. Gosudarstvennyj Komitet Promyshlennosti, Jenergetiki i Nedropol’zovanija Kyrgyzskoj Respubliki. 2017. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Events/2018/Oct/4-Kyrgyzstan-country-presentation-Beknur-Maratbekov.pdf?la=en&hash=E5334BFA69F762D756C02EA2BC7D248CF67A570D (accessed on 16 July 2022).

- Gidrojenergetika Kyrgyzstana. Hydroenergetica. 2021. Available online: https://www.hydroenergetica.kg/gidroenergetika-kyrgyzstana (accessed on 16 July 2022).

- Analysis of the Kyrgyz Republic’s Energy Sector. World Bank. 2017. Available online: https://documents1.worldbank.org/curated/en/370411513356783137/pdf/122080-WP-PUBLIC-TheStateoftheKyrgyzRepublicsEnergySectorFinalMay.pdf (accessed on 16 July 2022).

- Przewodnik po Rynku. Republika Kirgiska. PARP. 2008. Available online: https://www.parp.gov.pl/component/publications/publication/kirgistan-przewodnik-rynkowy (accessed on 16 July 2022).

- Osnovnye Pokazateli RABOTY Jelektrojenergetiki Kyrgyzskoj Respubliki v 2019 Godu. Nacional’nyj Statisticheskij Komitet Kyrgyzskoj Respubliki. 2020. Available online: http://www.stat.kg/ru/news/osnovnye-pokazateli-raboty-elektroenergetiki-kyrgyzskoj-respubliki-v-2019-godu/ (accessed on 16 July 2022).

- Kyrgyzskaja Respublika: Ustojchivaja Jekonomika na Traektorii Medlennogo Rosta. World Bank Group. 2017. Available online: https://documents1.worldbank.org/curated/en/941231496767990727/pdf/115684-RUSSIAN-WP-KyrgyzRepBEURusfinal.pdf (accessed on 16 July 2022).

- Deficit Jelektrojenergii: Kyrgyzstanu Nedostaet okolo 6 mlrd kW/h. Economist. 2021. Available online: https://economist.kg/novosti/2021/10/11/deficit-elektroenergii-kyrgyzstanu-nedostaet-okolo-6-mlrd-kvt-ch/ (accessed on 16 July 2022).

- Kaskad Toktogul’skih GJeS. Jelektricheskie Stancii. 2021. Available online: http://www.energo-es.kg/ru/o-kompanii/filialy/kaskad-toktogulskikh-ges/ (accessed on 16 July 2022).

- Modernizacija Toktogul’skoj GJeS: Idet Zamena Ustarevshego Oborudovanija. 24KG. 2020. Available online: https://24.kg/vlast/177311_modernizatsiya_toktogulskoy_ges_idet_zamena_ustarevshego_oborudovaniya/ (accessed on 16 July 2022).

- Osmonalieva, B. Kirgizija Predlozhila Rossii Vernut’sja k Stroitel’stvu GJeS. Vedomosti. 2019. Available online: https://www.vedomosti.ru/business/articles/2019/02/06/793480-kirgiziya (accessed on 16 July 2022).

- Stroit’ Narynskie GJeS v Kirgizii budet Chehija, a ne Rossija. Vedomosti. 2017. Available online: https://www.vedomosti.ru/business/news/2017/07/10/717724-stroit-ges-kirgizii (accessed on 16 July 2022).

- Doing Business 2020—Economy Profile. Kyrgyz Republic. World Bank Group. 2020. Available online: https://www.doingbusiness.org/content/dam/doingBusiness/country/k/kyrgyz-republic/KGZ.pdf (accessed on 16 July 2022).

- Dikambaev, S. Nacional’nyj Plan Dejstvij po Ustojchivoj Jenergetike Kyrgyzskoj Respubliki. United Nations Economic Commission for Europe. 2019. Available online: https://unece.org/fileadmin/DAM/project-monitoring/unda/16_17X/E2_A2.3/NSEAP_Kyrgyzstan_RUS.pdf (accessed on 16 July 2022).

- Toktomatov, N. Razrabotka Kompleksnyh Obshhih i Otraslevyh Indikatorov dlja Ocenki Vklada Prjamyh Inostrannyh Investicij v Ustojchivoe razvitie v Kyrgyzskoj Respublike. 2019. Available online: https://www.unescap.org/sites/default/files/Toktomatov-Kyrgyzstan%20FDI%20indicator%20study-final_Russian%20version.pdf (accessed on 16 July 2022).

- Dzhuraev, S. Jenergeticheskij Krizis v Kyrgyzstane: Prichiny i Sledstvija. EUCAM. 2009. Available online: https://eucentralasia.eu/ru/energy-emergency-in-kyrgyzstan-causes-and-consequences-ru/ (accessed on 16 July 2022).

- Nacjenergoholding: Do oktjabrja Budut Pereboi s Podachej Jelektrojenergii. Radio Azattyk. 2021. Available online: https://rus.azattyk.org/a/do-oktyabrya-v-kyrgyzstane-budut-nablyudatsya-pereboi-s-podachey-elektroenergii/31369513.html (accessed on 16 July 2022).

- Kyrgyzstan Is Among Countries with Cheapest Electricity in World. 24KG. 2021. Available online: https://24.kg/english/216604_Kyrgyzstan_is_among_countries_with_cheapest_electricity_in_world/ (accessed on 16 July 2022).

- The Price of Electricity per KWh in 230 Countries. Cable. 2021. Available online: https://www.cable.co.uk/energy/worldwide-pricing/#highlights (accessed on 16 July 2022).

- Jenergetika KR: Milliardnyj Deficit i Popytki Povysit’ Tarify. Radio Azattyk. 2022. Available online: https://rus.azattyk.org/a/kyrgyzstan-energy-economic/29079931.html (accessed on 16 July 2022).

- Group, W.B. Analysis of the Kyrgyz Republic’s Energy Sector. World Bank Group. 2017. Available online: https://openknowledge.worldbank.org/handle/10986/29045 (accessed on 16 July 2022).

- Tatyana, K. Consequences of Toktogul HPP Breakdown Liquidated, Its Units Put into Operation. 24KG. 2015. Available online: https://24.kg/archive/en/incidents/178634-news24.html/ (accessed on 16 July 2022).

- Tatyana, K. Jenergokrizis v Kyrgyzstane. Remontov net, no Otkljuchenija Prodolzhajutsja. 24KG. 2021. Available online: https://24.kg/obschestvo/213891_energokrizis_vkyirgyizstane_remontov_net_nootklyucheniya_prodoljayutsya/ (accessed on 16 July 2022).

- «Nacional’naja Jelektricheskaja set’ Kyrgyzstana» Prizyvaet Jekonomit’ Jelektrojenergiju vo Izbezhanie Peregruzov Oborudovanija Jelektricheskih setej 220-110 kV. Nacional’naja Jelektricheskaja Set’ Kyrgyzstana. 2021. Available online: http://www.nesk.kg/ru/svyazi-s-obshchestvennostyu/novosti-i-press-relizy/2307-20-02-2021 (accessed on 16 July 2022).

- Informacija ob Otkljuchenii Jelektrojenergii v g. Bishkek. Nacional’naja Jelektricheskaja set’ Kyrgyzstana. Available online: http://www.nesk.kg/ru/svyazi-s-obshchestvennostyu/novosti-i-press-relizy/2315-01-02-2022 (accessed on 16 July 2022).

- O Kompanii. Jelektricheskie Stancii. 2022. Available online: http://www.energo-es.kg/ru/o-kompanii/ (accessed on 16 July 2022).

- Tushite Svet. Jenergetika Kyrgyzstana na Grani Kollapsa. Radio Azattyk. 2021. Available online: https://rus.azattyk.org/a/31071410.html (accessed on 16 July 2022).

- O Kompanii. Nacional’naja Jelektricheskaja Set’ Kyrgyzstana. 2022. Available online: http://www.nesk.kg/ru/ (accessed on 16 July 2022).

- Gordost’ i Pozor Strany. Chto iz Sebja Predstavljaet Jenergetika Kyrgyzstana. Radio Azattyk. 2022. Available online: https://rus.azattyk.org/a/30649740.html (accessed on 16 July 2022).

- O Kompanii. Severjelektro. 2022. Available online: https://www.severelectro.kg/ (accessed on 16 July 2022).

- O Kompanii. Oshelektro. 2022. Available online: https://oshelectro.kg/ru/ (accessed on 16 July 2022).

- O Kompanii. Zhalalabatjelektro. 2022. Available online: https://jae.kg/ (accessed on 16 July 2022).

- Sostojanie Sektora Jenergetiki Kyrgyzskoj Respubliki. World Bank Group. 2021. Available online: https://thedocs.worldbank.org/en/doc/d09067e56f5e3e092e150cba0257da9e-0080012021/original/The-State-of-the-Kyrgyz-Energy-Sector-June-2021-ru.pdf (accessed on 16 July 2022).

- Sistema Raspredelenija i Potreblenija Jelektrojenergii v Kyrgyzstane: Analiz i Ocenka Upravlenija. Unison Group. 2013. Available online: https://www.unisongroup.org/ru/content/sistema-raspredeleniya-i-potrebleniya-0 (accessed on 16 July 2022).

- Pojasnenie k Interv’ju General’nogo Direktora OAO «KJeRC» T.A. Bajgazieva po Povodu Tarifov. Kyrgyzskij Jenergeticheskij Raschetnyj Centr. 2021. Available online: https://esep.energo.kg/?p=1953 (accessed on 16 July 2022).

- Korrupcija v Jenergetike Kyrgyzstana: Boj s Ten’ju. Stan Radar. 2014. Available online: http://www.stanradar.com/news/full/7699-korruptsija-v-energetike-kyrgyzstana-boj-s-tenju.html (accessed on 16 July 2022).

- Vneshnejekonomicheskaja Dejatel’nost’. Nacional’nyj Statisticheskij Komitet Kyrgyzskoj Respubliki. 2022. Available online: http://www.stat.kg/ru/statistics/vneshneekonomicheskaya-deyatelnost (accessed on 16 July 2022).

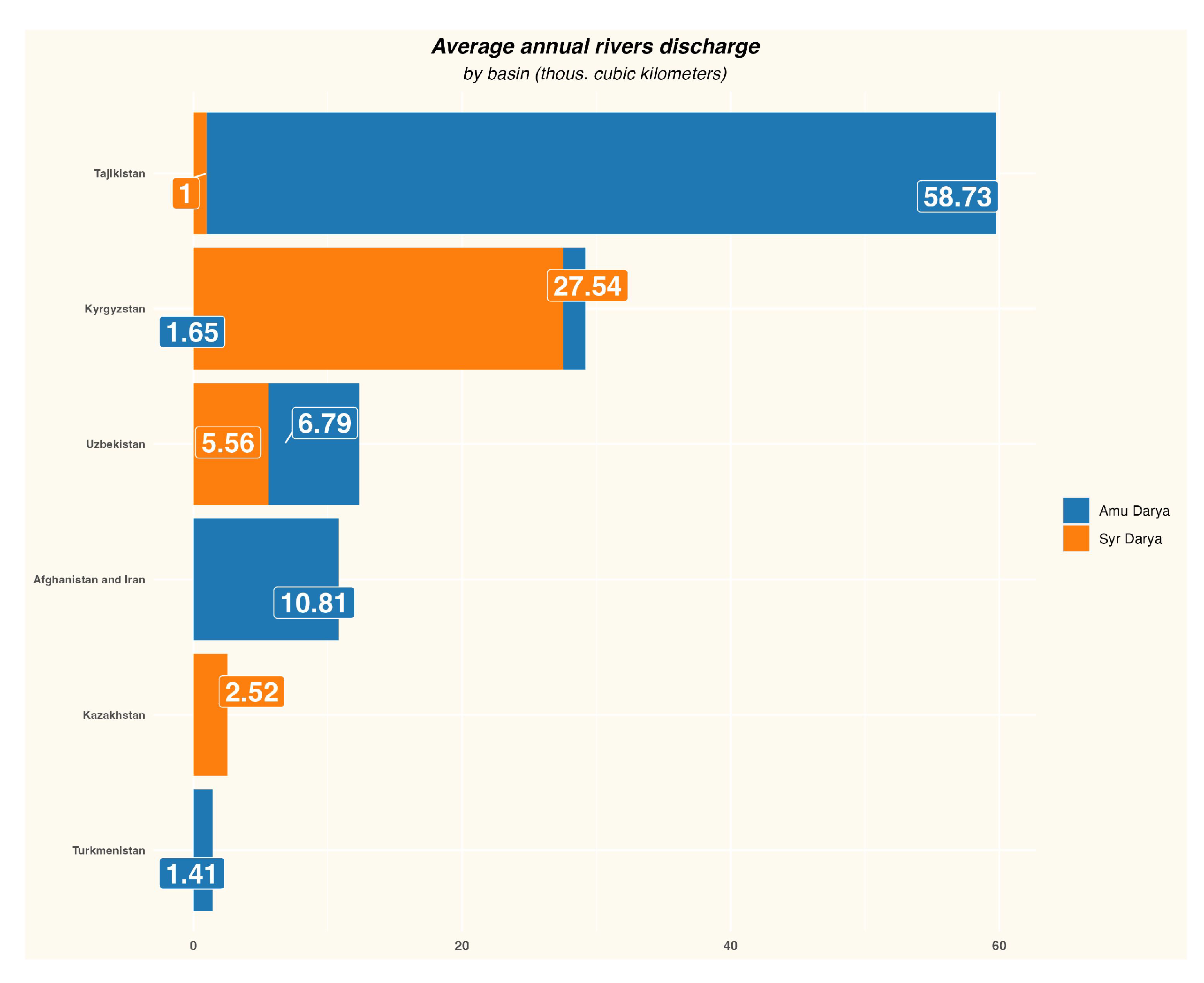

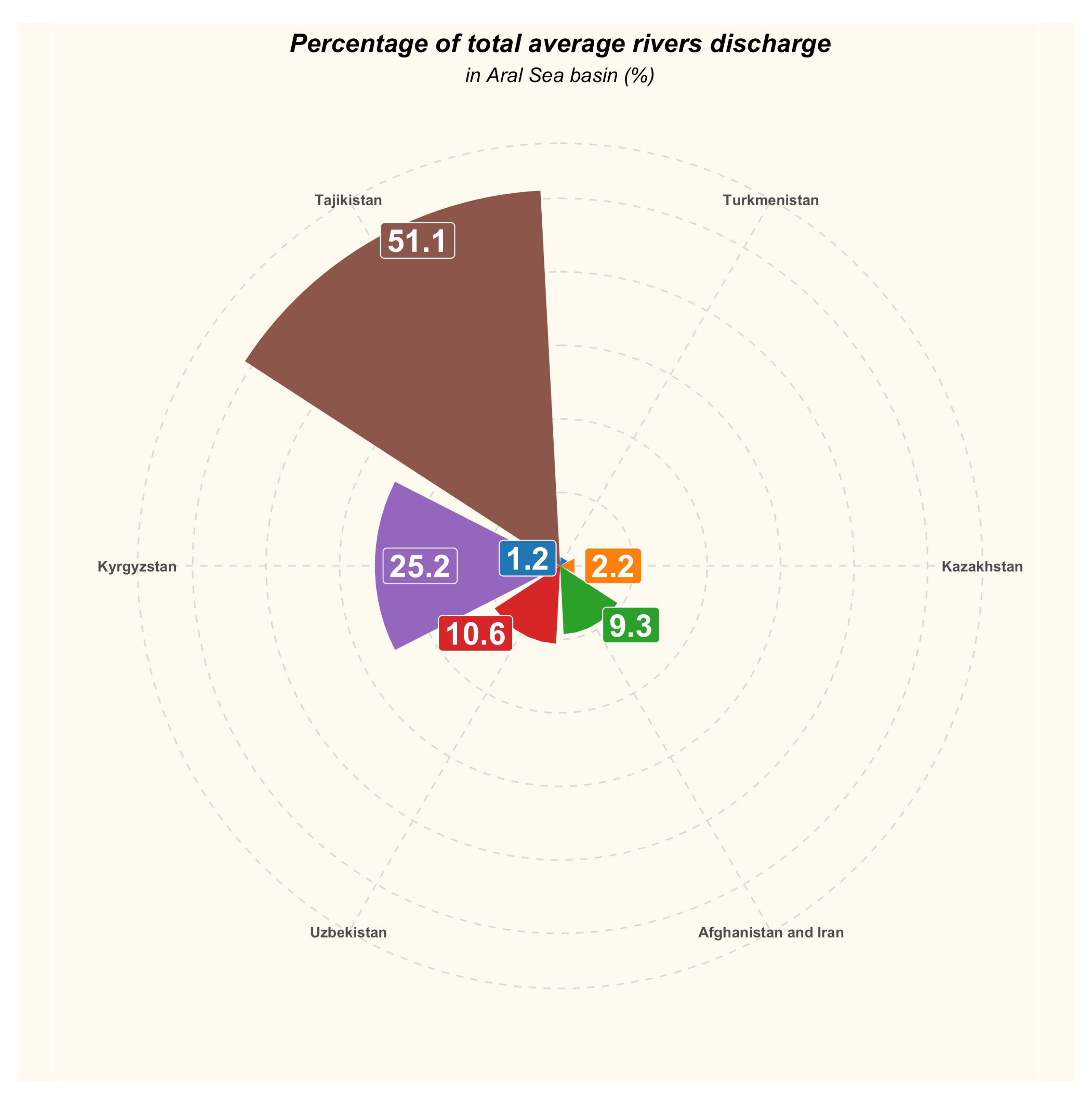

| River Basin | Aral Sea Basin | |||

|---|---|---|---|---|

| Country | Syr Darya | Amu Darya | km | % |

| Kazakhstan | 2516 | - | 2516 | 2.2 |

| Kyrgyzstan | 27,542 | 1654 | 29,196 | 25.2 |

| Tajikistan | 1005 | 58,732 | 59,737 | 51.1 |

| Turkmenistan | - | 1405 | 1405 | 1.2 |

| Uzbekistan | 5562 | 6791 | 12,353 | 10.6 |

| Afghanistan and Iran | - | 10,814 | 10,814 | 9.3 |

| Total | 36,625 | 79,396 | 116,021 | 100.0 |

| Name | Owner | Capacity (MW) | River |

|---|---|---|---|

| Nurek HPP | Barki Tojik | 3000 | Vakhsh |

| Sangtuda HPP-1 | Sangob (Iran) | 670 | Vakhsh |

| Baipaza HPP | Barki Tojik | 600 | Vakhsh |

| Golovnaya HPP | Barki Tojik | 240 | Vakhsh |

| Sangtuda HPP-2 | Sangtudinskaya GES-1 | 220 | Vakhsh |

| Kairakum HPP | Barki Tojik | 126 | Syr Darya |

| Pereadnaya HPP | Barki Tojik | 29.95 | Vakhsh Canal |

| Pamir-1 HPP | Pamir Energy | 28 | Gunt |

| Centralnaya HPP | Barki Tojik | 15.1 | Vakhsh Canal |

| Varzob HPP-2 | Barki Tojik | 14.7 | Varzob |

| Varzob HPP-1 | Barki Tojik | 9.5 | Varzob |

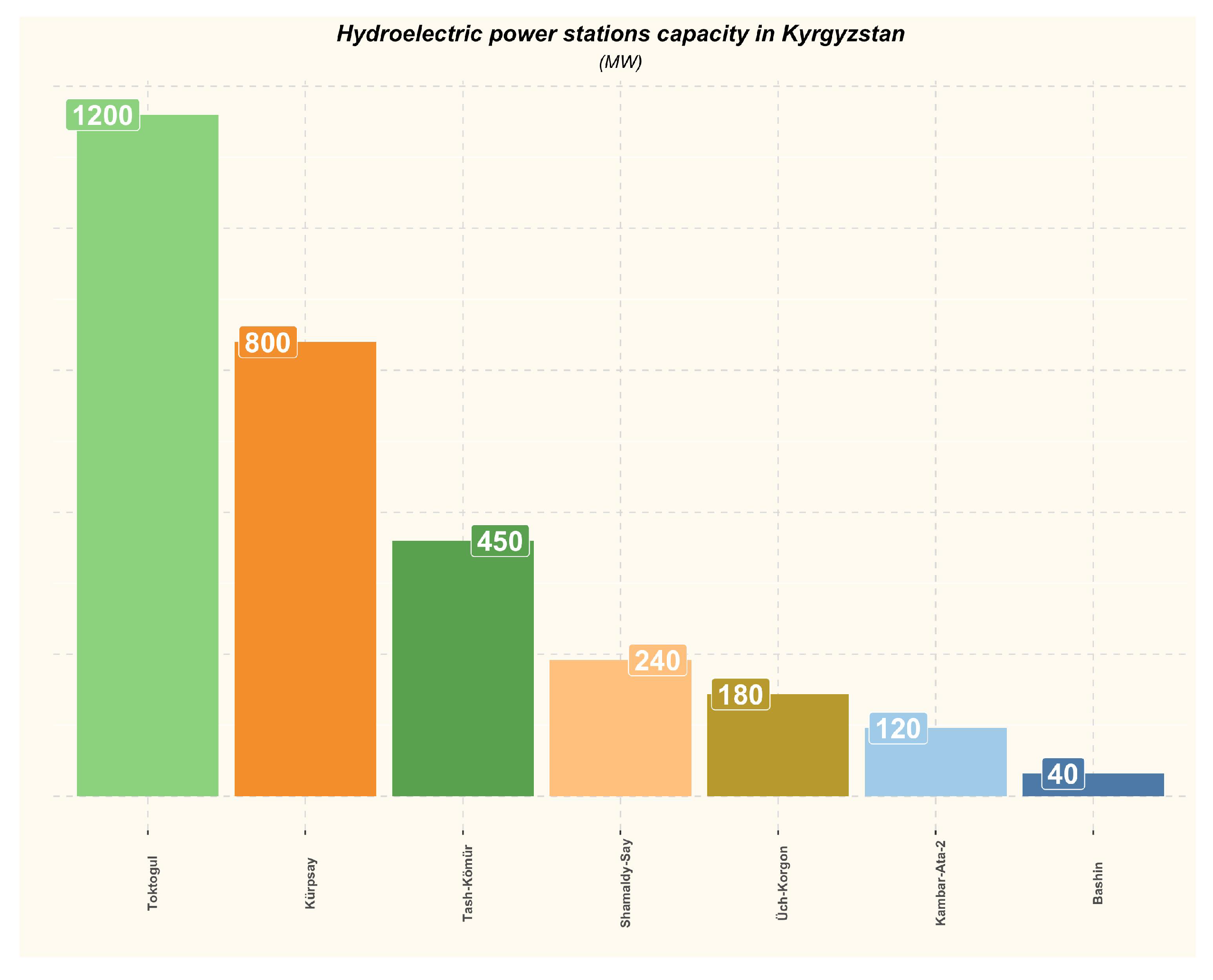

| Name | Capacity (MW) | River |

|---|---|---|

| Toktogul Hydropower plant | 1200 | Naryn |

| Kürpsay Hydropower plant | 800 | Naryn |

| Tash-Kömür Hydropower Plant | 450 | Naryn |

| Shamaldy-Say Hydropower Plant | 240 | Naryn |

| Üch-Korgon Hydropower Plant | 180 | Naryn |

| Kambar-Ata-2 Hydropower Plant | 120 | Naryn |

| Bashin Hydropower Plant | 40 | At-Bashy |

| Name | Capacity (MW) | City |

|---|---|---|

| Bishkek Power Plant | 812 | Bishkek |

| Osh Power Plant | 50 | Osh |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kosowska, K.; Kosowski, P. Energy Security of Hydropower Producing Countries—The Cases of Tajikistan and Kyrgyzstan. Energies 2022, 15, 7822. https://doi.org/10.3390/en15217822

Kosowska K, Kosowski P. Energy Security of Hydropower Producing Countries—The Cases of Tajikistan and Kyrgyzstan. Energies. 2022; 15(21):7822. https://doi.org/10.3390/en15217822

Chicago/Turabian StyleKosowska, Katarzyna, and Piotr Kosowski. 2022. "Energy Security of Hydropower Producing Countries—The Cases of Tajikistan and Kyrgyzstan" Energies 15, no. 21: 7822. https://doi.org/10.3390/en15217822

APA StyleKosowska, K., & Kosowski, P. (2022). Energy Security of Hydropower Producing Countries—The Cases of Tajikistan and Kyrgyzstan. Energies, 15(21), 7822. https://doi.org/10.3390/en15217822