1. Introduction

In the coming years, the energy sector, or rather its transformation, will drive the world economy and create new industries and services, and a new division of labour [

1]. Energy security is one of the elements of the energy policies of every country and constitutes a strategic issue, while the energy sector alongside others (e.g., the financial, transportation and food sectors) shapes the efficient functioning of the whole national economy [

2].

Contemporary researchers, when diagnosing energy sector companies with regard to their reports, most often consider the following issues [

3]:

the responsibility a company must take on to uphold its ‘contract’ with society;

risks that threaten profitability;

an opportunity for further growth.

Sustainability reporting initiatives like the Global Reporting Initiative and non-profit organizations have also had an impact on corporate disclosure related to the energy sector for state-owned companies [

4].

The aim of our research is to analyse the relationship between ESG performance and CFP in the energy sector. Until now, such considerations have not been carried out regarding the highly concentrated and mostly state-owned energy sector in Poland. The conducted research answers the following research question: do companies with higher ESG scores operating in the Polish energy sector show better financial results? This is an important issue as the energy sector has a huge impact on many areas of the economy, society and natural environment. Therefore, managing enterprises operating in that specific sector should address the challenge of incorporating the ESG factors, as well as acknowledging their complex network of stakeholders while they pursue profits. Thus, the issue of managing enterprises in the energy sector becomes an important methodological issue. This research presents Polish energy companies in terms of ESG indicators, which has not yet been studied. It is known that companies that take into account ESG issues in their activities (while informing their stakeholders about it) have a chance to improve their image and increase trust in the company, especially during energy transformation. The results of our research are, therefore, the first point of discussion in Poland about changing the perception of the energy sector.

3. Methodology

This paper aims to investigate whether the environmental, social and corporate governance (ESG) score of companies operating in the energy sector is associated with their corporate financial performance (CFP). There are continuous academic efforts to identify the impact of ESG on CFP, since these are efforts to legitimize its social engagement and prove that business can do well by doing good [

76]. Although a causal conclusion remains complex, past academic literature has argued for either a positive or neutral correlation between ESG quality represented by a business and its CFP [

76,

77,

78].

Research examining strictly the link between the ESG profile of companies and their accounting or market measures of CFP reports mostly a positive, although usually weak, relationship. For example, a meta-analysis of 167 studies investigating the effects of ESG performance and CFP since 1972, conducted by Margolis et al. [

77], indicates only a mildly positive relationship between them. The extensive meta-analysis of empirical evidence embracing the time span from 1980 to 2019 by Huang [

79] shows a positive, statistically significant, yet economically modest relationship between ESG performance and CFP. Clark et al.’s [

77] enhanced meta-study based on over 200 sources reports a remarkable correlation between diligent sustainability business practices and economic performance. In particular, 45 of 51 reviewed studies (88%) show that sustainability is positively correlated with operational performance. An earlier study by Eccles et al. [

80] for the US market in 1993–2010 also finds that the portfolio of high-sustainability companies outperforms the low-sustainability ones, both in terms of the stock market and accounting performance. Those results are consistent with theoretical expectations of a null to modestly positive link between ESG and CFP [

81].

In this paper, we contribute to that ongoing discourse of whether ESG performance of companies matters for companies’ CFP by raising the following research question: do companies with higher ESG scores operating in the Polish energy sector show better financial results? We aim to focus on a narrow but very specific segment of the Polish economy—enterprises with leading positions in the energy sector that are highly consolidated, mostly state-owned, strictly regulated, and not governed by the rules of free competition. To the best of our knowledge, the relationship between ESG score and CFP in that segment has not been analysed so far by academics. While searching for an answer to our research question, we are particularly interested in whether findings and conclusions from previous studies on the ESG–CFP nexus can be transferable to that specific sector of the Polish economy.

In order to answer that question, we examine if there is a positive relation between ESG performance and CFP, and we adopt the following as a proxy for the latter accounting-based measures of profitability: return on equity (ROE), return on assets (ROA) and return on sales (ROS). Such a selection is justified by the fact that those ratios have repeatedly appeared in previous research projects on the relation between ESG performance and CFP, as studied in the meta-analysis by Margolis et al. [

77]. Additionally, we refer to the DuPont model, which is widely used in financial analysis and facilitates the decomposition of the different drivers of ROE. This seems to be crucial for a better understanding of CFP as ROE itself might be an insufficient indicator of value creation, while also particularly related to just one group of a company’s stakeholders—namely shareholders. The DuPont model breaks down ROE into the following components: ROA, ROS, total asset turnover (TAT)—a measure of asset use efficiency, and an equity multiplier (A/E) as a measure of financial leverage (see Equations (1) and (2)). This is why we include in our study the two latter indices [

82].

Additionally, we supplement the set of the chosen accounting metrics by the current ratio (CR) as the most popular indicator of financial liquidity in order to also cover the cash-flow dimension of the financial performance analysis. The values of the aforementioned accounting measures for companies from our research sample have been taken from the Biznes Radar Data Base [

83].

As a proxy of the ESG performance of companies, we use one of the leading global, comprehensive ESG rating methodologies—the Refinitiv ESG scoring, which is available at the DataStream database. The reason for choosing this ESG data provider is that it has the greatest coverage worldwide in comparison with other ESG rating providers (e.g., the SAM Corporate Sustainability Assessment or Sustainalytics). The Refinitiv model comprises two overall ESG scores: ESG Score, which measures the company’s ESG performance based on verifiable reported data in the public domain, and ESG Combined score (ESGC), which overlaps the ESG score with the ESG Controversies Score to provide an evaluation of the company’s sustainability impact and conduct over time [

84]. Employing ESG secondary data in our research allows for reliability and comparability of the results dues to the Refinitiv advanced methodology of data collection and processing, which has been used in numerous previous studies.

Refinitiv calculates over 500 company-level ESG measures, of which a subset of 186 of the most comparable and tangible per industry is used for the overall company assessment and scoring process. The metrics are grouped into 10 categories. The category scores are rolled up into three pillar scores—environmental, social, and corporate governance. The ESG pillar score is a relative sum of the category weights, which vary per industry for the environmental and social categories. The final ESG score reflects the company’s ESG performance, commitment, and effectiveness based on publicly reported information. For each company, the Refinitiv methodology produces a score of between 0 and 100 [

84].

Our research sample embraces companies operating in the Polish energy sector whose ESG profiles have been evaluated by the Refinitiv ESG scoring. There are eight companies which have met those criteria and the sample is homogenous. We do not have to control per sector, size or ownership, since all the analysed companies belong to the same sector, namely the energy sector, according to the Global Industry Classification Standard (GICS), thus, they are qualified as large enterprises according to EU criteria, and are listed on the Warsaw Stock Exchange (WSE).

It is necessary to mention that the Polish enterprises of the energy market that are listed on the stock exchange illustrate far-reaching specifics. This is first and foremost caused by two circumstances. The first is the fact that in this category, enterprises with a prevalence of state ownership are of key significance. The second circumstance is that the energy market is subject to strict administrative regulations. This is why the mechanisms (such as the impact of the indicators of ESG on the financial standing of enterprises), whose very existence would be possible to expect in a different situation, e.g., functioning in conditions of free competition, in Polish conditions may be weakened or even totally eliminated [

85].

In its current form, the concept of the parametric evaluation of enterprises in the sphere of ESG has been shaped since 2005, while its popularization in such countries as Poland took several years [

86]. Due to this fact, the search for correlations between the values of the financial indicators and those which describe the situation of an entity from the perspective of ESG is justified as this type of data is derived from at least the second decade of the 21st century. In order to observe the possible correlations, it is also necessary to approach this period following 2019 with caution as the occurrence of the pandemic, the breakup of the supply chains, and the turbulence of supply and demand for a multitude of goods, distorted the functioning of multiple market phenomena. For this reason, the period of 2010–2019 was chosen for analysis.

The specifics of reporting on the results of the business activities conducted by state companies signifies, among other things, the publication of data in the following formulations: monthly, quarterly and annual reports [

87]. In the opinion of the authors, the monthly data refers to periods which are too short to have a real impact on the changes in the level of the indicators of ESG with regard to the financial performance of enterprises. However, the data in an annual formulation are of an excessively general nature, hence in the research it was assumed that all calculations would be conducted on the basis of quarterly data. The procedure for calculating the values of the correlations was conducted on the basis of a complete set of available data, or in other words, random samples were not availed of in this case.

In order to test the correlation between ESG scores and the selected CFP measures, the classical r-Pearson correlation indicator has been used which was calculated according to the statistical formula:

The values of the calculated correlations have been evaluated in accordance with the J. Guilford scale, in which the particular ranges look as follows [

88]:

|r| = 0—lack of correlation

0.0 < |r| ≤ 0.1—faint correlation

0.1 < |r| ≤ 0.3—weak correlation

0.3 < |r| ≤ 0.5—average correlation

0.5 < |r| ≤ 0.7—high correlation

0.7 < |r| ≤ 0.9—very high correlation

0.9 < |r| < 1.0—almost total correlation

|r| = 1—total correlation.

In order to check whether changes in a company’s CFP indicators can be explained by its ESG Combined score, the ordinary least-squares (OLS) method has been used to estimate the regression between each of the six CFP indicators and the ESG Combined score.

where CFP

N represents one of the six indicators: ROE; ROA; ROS; TAT; A/E; CR.

The fit of the regression model has been assessed first on the basis of the F-test (significance F) and second on the basis of the coefficient of determination R2. In the case of statistically significant regression models for which R2 has a low value, the possibility of adding additional variable has been considered based on the R2adj (adjusted) coefficient. According to this idea, the variable expressing the level of diversification of the company’s activity has been taken into account. This is a dummy variable where “0” means no diversification and the value “1” means a situation in which at least 20% of income (the Pareto rule was used) comes from a sector other than the energy sector. As for the supplementary case (with additional variable), the changes in the R2adj coefficient has been analysed.

4. Results

In the research, there was an endeavour to collect data representing the entire population of the entities that form the energy sector in Poland with the reservation that this relates solely to the enterprises whose business activities are of significance in terms of the economy of the whole country. Hence, the results presented below do not include references to the accepted level of significance, nor do they define the p-value. In individual cases, where some of the enterprises failed to publish the appropriate data in the reports for some quarters, this is appropriately marked in the descriptions in the table that displays the results. Ultimately, the research encompassed data derived from eight enterprises of leading positions in the Polish energy sector. This grouping encompassed the following entities:

KGHM Polska Miedź S.A. (KGHM)

Polskie Górnictwo Naftowe i Gazownictwo S.A. (PGNiG)

Grupa Lotos S.A. (Lotos)

PGE Polska Grupa Energetyczna S.A. (PGE)

Polski Koncern Naftowy Orlen S.A. (Orlen)

Enea S.A. (Enea)

Energa S.A. (Energa)

Tauron Polska Energia S.A. (Tauron)

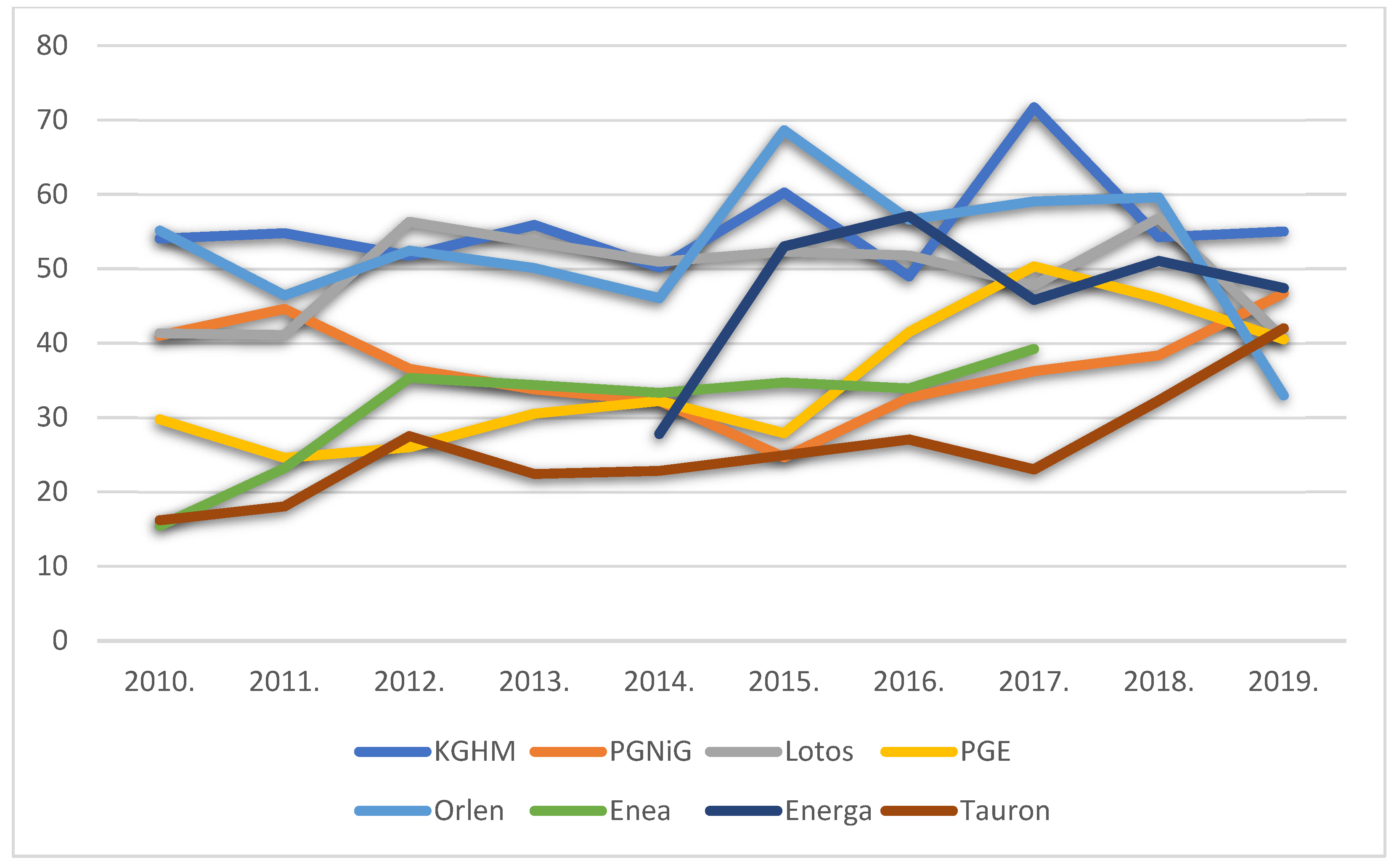

As among the indicators enumerated as the group of ESG, a leading role is played by ESG Combined, thus empirical data, which reflects its measurement, constitutes the basis for the analysis presented. As regards the registered value noted by the particular enterprises in the subsequent years in this sphere, great differentiation occurs here. Throughout the period under review, these changes are of a rather turbulent and unrelated nature. Only in the final phase of this period are there combined and simultaneous approximations of the results for the entire group of the analysed entities. This occurs at a level that is generally higher than reading the analysed values from the beginning of the time period under review (this holds true with reference to 6 out of 8 analysed cases). Hence, it is possible to state that the group of analysed enterprises treated as a whole achieved a certain degree of success in the sphere of ESG (

Figure 2).

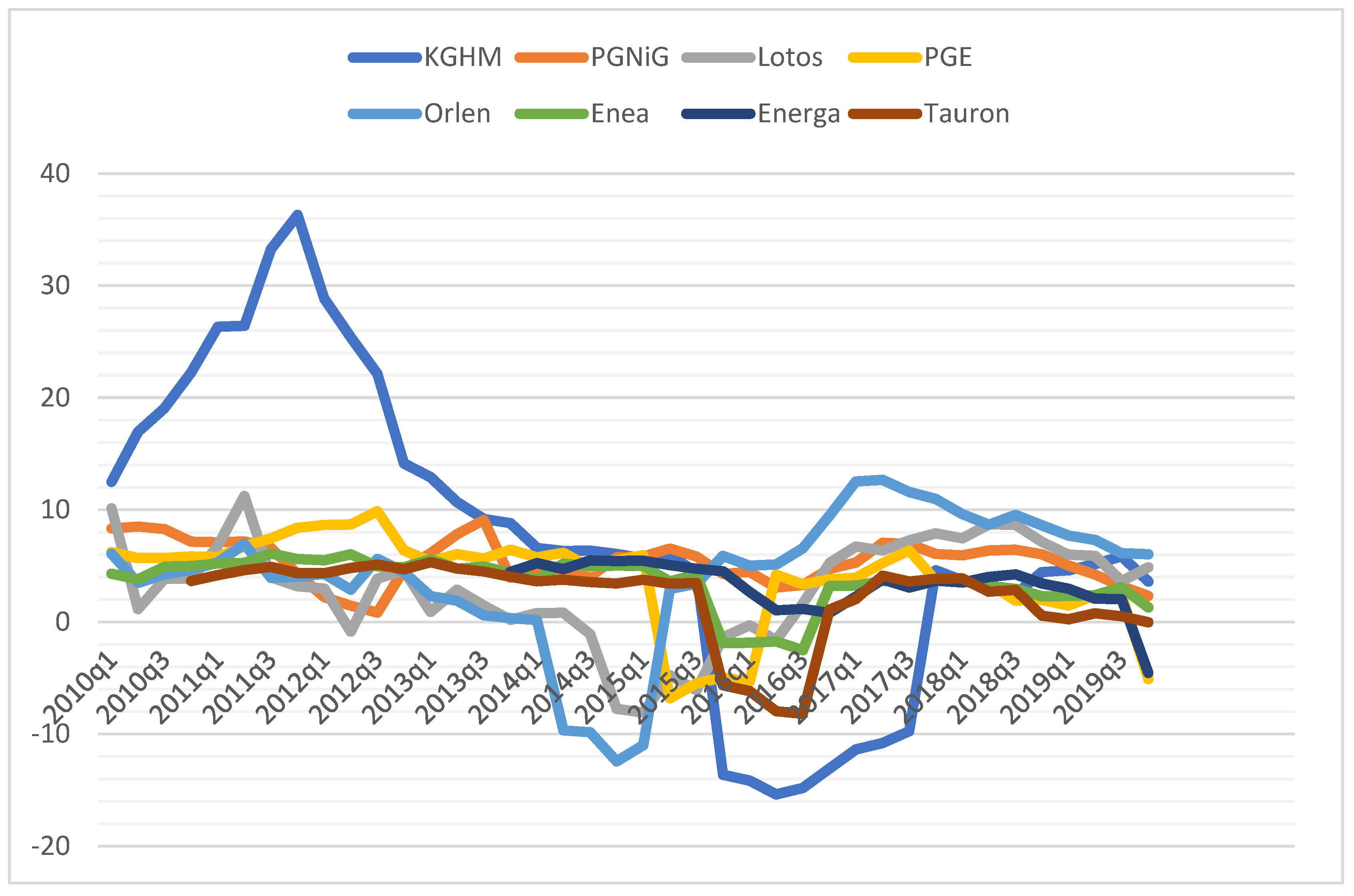

In the case of the ROE indicator (

Figure 3), two circumstances attract particular attention. The first of these is associated with the distinction of the set of data characterizing the situation of the enterprise KGHM. This is due to the fact that business activities in the energy sector are secondary from the perspective of this entity (the primary business activity is operating in the market of metal resources). Nevertheless, due to the magnitude of the secondary business activity involving the production and distribution of energy, the aforesaid enterprise is becoming one of the leaders of the analysed sector. The latter circumstance that draws attention is the multitude of negative readings of the ROE indicators in the period of 2014–2017.

The ROA indicator reacted in a manner that was approximate to the ROE indicator in the period under analysis (

Figure 4). Likewise, a clear distinction is revealed in terms of the set of data characteristic for the situation of the enterprise KGHM. In the second diagram, this phenomenon is even more visible than in the first one. A similar period of 2014–2017 noted the occurrence of a range of negative readings.

In the case of the enterprise KGHM Polska Miedź S.A. (

Table 3), attention is drawn to the values of the high correlation between the indicators of the ESG Score and the financial indicators of ROE, ROA, ROS (all three are negative dependencies), while also A/E (positive dependency). Likewise, ESG Controversies indicates similar connections with the set of three indicators of ROE, ROS, A/E (in which the return of each of these dependencies changes to the opposite scale in comparison with the situation described as the first one). In the remaining cases, the correlation is at the level of average or weak.

The correlation combining the indicators characterizing the situation of the enterprise Polskie Górnictwo Naftowe i Gazownictwo S.A. (

Table 4) in the majority of cases is of little strength. As regards the financial aspect, attention is drawn to the high level of correlation (negative dependency) between the indicators A/E and the set of indicators ESG Score and ESG Combined. The relation between the indicators CR and ESG Combined is close to the threshold of the correlation, which is possible to define as high (negative).

The situation of the enterprise Grupa Lotos S.A. (

Table 5) does not facilitate the observation of the existence of the values of the indicator of the correlation at a level that could be defined as high (more so, as very high). With regard to the financial aspect in the analysis conducted, the dependency is close to the aforementioned level between the indicators A/E and ESG Controversies. The second case to some extent stands out against the backdrop of the others, having low values, namely the relation between the indicators A/E and ESG Score.

The table of correlations formulated on the basis of analysis of the data associated with the enterprise PGE includes three values that attract attention (

Table 6). A significant role is played here by two out of six financial indicators taken into account. Thus, it is worth noting the values expressing the relation between A/E and ESG Controversies (high negative value), while also TAT with two indicators of ESG (Score and Combined) of high negative dependency.

In the case of the enterprise Orlen (

Table 7), the financial indicators feature slight connections with the sphere of ESG. Nevertheless, it is possible here to indicate total regularity. In the case of all the columns of the table, the scope of the absolute values of the stated correlations read (namely, by omitting the events involving the change of the sign for an opposite), rises during the course of moving from the left to the right side. This is certified by the fact that the controversies discovered surrounding the analysed enterprise (whose significance was measured by means of the ESG Controversies indicator) had a lower impact on the financial standing of the enterprise than the fundamental achievements of Orlen with regard to the sphere of ESG.

Of the financial indicators that characterize the situation of the enterprise of Enea (

Table 8), the strongest values of the positive correlation combine the indicator of A/E with the ESG Score (high positive dependency), while also the ESG Combined (identical high positive dependency). A further value of the correlation that requires noting (this time at a level of very high negative), occurs between the indicators CR and ESG Score and ESG Combined. The lack of significant events evoking controversies around the analysed enterprise (whose significance was measured with the aid of the ESG Controversies indicator), results here in the lack of difference between the values of the correlation combining the sphere of finance both with the indicators of ESG Combined and ESG Score.

The results of calculations conducted with reference to the enterprise Energa indicate a high range of correlations (

Table 9). These dependencies combine the indicator of ESG Score with ROA and TAT (negative correlation), as well as the indicator ESG Controversies with ROE, ROA, CR, ROS (positive dependency). The acquired set of values registered in the table indicates that apart from one case (the A/E indicator), greater impact on the sphere of finances of the analysed enterprise was exerted by the occurrence of potential events that evoked controversies around the enterprise of Energa (whose significance was measured by means of the ESG Controversies indicator).

In the case of the final entity analysed, the enterprise Tauron (

Table 10), among the financial indicators a high correlation only occurred between the indicator A/E and ESG Score and ESG Combined (in both cases the dependency is positive). Once again (as in the case of Enea S.A.), there was a lack of significant events that evoked controversies around Tauron (whose significance was measured by means of the ESG Controversies indicator), which resulted in a lack of differences between the values of the correlation and combined the sphere of finances with both the indicators of ESG Combined and ESG Score.

The acquired results do not create an unequivocal picture of the situation. Despite the occurrence of cases of correlation at a high level, and sometimes very high, the particular cases for analysis significantly differ from one another. There is a lack of regularity here, or a repeated pattern, which would facilitate the discovery of a pattern of the impact of the sphere of ESG on the financial standing of the enterprise.

In the case of ROE, ROA, ROS and CR indicators, the significance F value indicates that there is no statistically significant relationship between these indicators and the value of the ESG Combined indicator (

Table 11). The results show also that regarding the TAT and A/E indicators, there is statistically significant relationship between these indicators and the value of the ESG Combined indicator but the value of the R

2 coefficient is very low. R

2 indicates that models explain only 0.1798 changes in TAT indicator and 0.1767 changes in A/E indicator. In the case of TAT, an increase in the ESG Combined value by one unit causes the TAT value to increase by 0.0160, and in the case of A/E, the corresponding increase is 0.0116. This leads to the conclusion that the linear regression model (estimated by the classical method of least squares) is of little use for explaining the influence of ESG score on CFP in the analysed sample. The obtained results lead us to consider the possibility of adding an additional variable to the regression model in the form of an assessment of the degree of diversification of the activities of the surveyed entities. Such an observation will allow determination of whether, in the case of operating in sectors other than energy, the relationship between ESG and financial indicators will change significantly.

In the case of the TAT index, adding a variable describing the diversification of the company’s activity to the regression model causes that the R

2adj coefficient reaches the value of 0.4985 (

Table 12). In the case of the A/E index, adding a variable describing the diversification of the company’s activity to the regression model causes the R

2adj coefficient to reach the value of 0.2433. The significance F value is sufficiently low for both TAT and A/E, which allows the resulting models to be used. In both cases, adding an additional variable is an effective and justified procedure and the comparison of the values of the b

ESG and b

DIV parameters shows that the influence of the ESG Combined indicator on the TAT and A/E indicators is marginal in relation to the circumstances of operating only in the energy sector or in a diversified manner (this means in sectors where the free market rules apply). Such a situation may result from the fact that activities in the field of ESG (in the energy sector) are mainly adaptive to dynamically changing legal provisions and look similar in relation to all entities (the legally required scope of the changes is very wide and expensive, therefore enterprises do not undertake additional activities of a significant nature). In addition, revenues are generated on a market that is subject to strict administrative regulations (both in terms of prices and limited market access). What is more, all surveyed entities are partially state-controlled (as one of the key shareholders) and therefore the principles of conducting business activity by energy sector enterprises cannot be considered fully free-market.

5. Discussion

The research conducted reveals that the energy sector has an enormous impact on the majority of the sectors of the economy. This is particularly visible in the period of the energy transformation, which is caused by the necessity to refrain from the use of bituminous and lignite coal in the energy sector. Simultaneously, the issue of the management of enterprises in the energy sector is becoming an important practical and methodological issue.

During the past several decades, climate change has become an economic problem visible in the annual reports of enterprises. Based on the theories of organizational legitimization where the state or status in which it exists, when the system of values of the entity is in accordance with the system of values of a great social system, if an entity is part of the energy sector it should consider adjustment to climate change as the principal part of its behaviour and subsequently publish full reports [

89,

90,

91].

This would increase the value of the organization by showing how it is socially responsible and may even have an impact on the positive phenomena (e.g., trust, loyalty and civic behaviour), while also eliminating negative phenomena (e.g., organizational silence) and organizational human resources. This problem blends in with the theory of the stakeholders, according to whom the organization should act not only in the interests of shareholders but also internal and external stakeholders, such as employees, suppliers, governments, etc. In accordance with this theory, the energy sector may enhance its credibility by providing various stakeholders with all the required information [

92,

93].

With the aims of easing the problem of the transformation of the energy sector, which is essential, the Ministry of State Assets (MSA) submitted a draft of a document entitled “Transformation of the energy sector in Poland. Phasing out the coal production assets from state-owned companies” for consultation [

94]. The process aimed at phasing out coal production assets from energy companies that belong to the State Treasury has commenced. This will probably facilitate the secure and gradual transformation of the electroenergy sector that is adjusted to Polish circumstances, in the direction of the acquisition of energy from low- and zero-emission sources over many years. The document emphasizes that the program constitutes the implementation of the “Energy Policy of Poland up to 2040” in the area of supervision by the owner of the companies that belong to the State Treasury and is aimed at adjusting energy concerns to the challenges of the transformation. Following the phasing out of coal assets, they will focus on the execution of low- and zero-emission investments.

The document assumes the acquisition by the State Treasury of PGE Polskiej Grupy Energetycznej S.A., ENEA S.A., TAURON Polska Energia S.A. and companies dealing with the production of electric power in conventional entities powered by coal. The proposed program envisages the phasing out of only the coal power stations while simultaneously leaving the heating plants and co-generation plants within the structure, which will in turn be gradually replaced by gas production units adjusted to being powered in the future by zero-emission hydrogen.

In relation to the inseparability of the energy complexes powered by lignite coal among the acquired assets, there are also lignite coal mines. However, assets associated with the extraction of bituminous coal will not be acquired. The subject of phasing out will also not include power plants employing the combustion of coal, as their modernization is planned in the direction of low- and zero-emission sources.

MSA has provided information about the integration of the acquired assets in one capital group as a company totally owned by the State Treasury that will function in accordance with the principles of the Code of Commercial Companies [

93].

The owner of the coal assets will be the National Agency of Energy Security (NAEB), which aims to guarantee the security of energy for the country, thus ensuring the essential availability of power in the energy system and restricting itself to the necessary replacement investments and gradual phasing out of coal units in favour of the progressive growth of power from low- or zero-emission sources [

95]. Together with the connection to the National Grid System of the new low- or zero-emission sources of generation, NAEB shall withdraw the coal units from use.

The Ministry of State Assets has announced that PGE Polska Grupa Energetyczna, Enea, and Tauron Polska Energia shall continue to develop their business activities on the basis of the assets held in the areas of distribution, heating, turnover and generation of energy from low- and zero-emission sources. In the area of production, the companies shall focus on ensuring new production power that is to replace the currently used coal-generated power in the National Power Grid. The phasing out of coal assets will facilitate execution of the controlled energy transformation [

94].

In the context of the suggestions of the Ministry of State Assets, it is necessary to indicate that within the framework of the transformation of the energy sector in Poland, a document was signed in February 2021 entitled “Energy Policy of Poland up to 2040”. EPP [

96] is a strategic and directional document, the necessity of adoption of which arises from the Energy Law. Its essence is to undertake strategic investment decisions that are aimed at the use of the national economic potential, while also the potential of raw materials, technological and personnel resources, and driving the economy by means of the energy sector, which would favour fair transformation. In the document, the aims, scope and elements of energy policy in Poland are specified, which include ensuring energy security for the country, the growth of the level of competitiveness of the economy and its energy efficiency, and consequently environmental protection. These are convergent with the EU aims in part, but not as a whole, as in the EU there is a prevalence of issues in the sphere of environmental protection and the climate (here the priority is the decarbonization of the energy sector and, in the future, the climate neutrality of the economy), whereas in Poland, the priority is the security of energy. EPP constitutes a document that contains a prognostic section that encompasses no less than 20 years (thus, the time horizon of the project is up to 2040), while its principal composite element includes a program of executive actions describing the instruments to facilitate their implementation while also evaluating the energy policy of the state. The scope of the document is wide-ranging, as it encompasses the fuel–energy balance of the country, as well as the production and transmission capacity, while also the directions of restructuring and transformation in this sector.

It is necessary to indicate that the Polish enterprises of the energy sector that are listed on the stock exchange illustrate far-reaching specifics. This is first and foremost caused by the fact that in this category of entities, enterprises with a prevalent level of state ownership are of key importance, while also the fact that the energy market is subject to strict administrative regulations. Hence, the mechanisms (such as the impact of the indicators of ESG on the financial standing of enterprises), whose very existence may be expected in conditions of free competition, albeit in the Polish conditions they are weakened and frequently eliminated.

The specifics of reporting on the results of the business activities conducted by state-owned companies signifies, among other things, the publication of data in the following formulations: on a monthly, quarterly and annual basis. In the opinions of the authors, monthly data refer to excessively short periods in order to have a real impact on the change of the level of the indicators of ESG on the financial performance of the enterprises. However, data on an annual basis are of an excessively general nature, thus it was assumed in the research that all calculations should be conducted on a quarterly basis. The procedure of calculating the values of correlations was conducted on the basis of a complete set of available data, in other words, random samples were not availed of.

6. Conclusions

In this paper, the difficulties that occur in the sphere of the modernization of power engineering have been described, while simultaneously a critical assessment of the role played by the state in this process has been provided. The energy sector is a very specific one in which, due to the intricacy of the process, the regulatory ownership role of the state may remain justified, the more so as the intricacy and frailty of the energy market also overlaps with global trends of a decline in the identification of employees with corporations in which they are employed. The aforementioned arguments support the need to increase the ownership quality of the impact of the state on the sector and not necessarily its total elimination.

In sum, it has been indicated that the Polish energy sector has delayed its transformation, thanks to the way it functions in a protected system, in which their own defensive mechanisms were shaped by, among other things, strong trade unions, ties with politics, as well as the acceptance of the existing tools for coordinating the employment structure (collective wage agreements, social welfare packages and the modified tool of restructuring for the purposes of protecting the internal status quo). In effect, the employment structure in the Polish energy sector has remained ineffective, which may be illustrated by comparing the fundamental indicators of operations with other countries, as well as with reference to the most efficient plants in the sector, which in turn has led to the deepening of the competence gap and brought with it a paralysis of the internal tools of modernization of the employment structure, giving rise to the theory that the modernization of energy enterprises has been delayed. Such conditions may hamper the potential of the energy sector in Poland to incorporate ESG factors into the operations of individual entities, and thus might limit the materiality of the relationship between socially responsible activities and the economic results of companies.