Strategic Planning of Oil and Gas Companies: The Decarbonization Transition

Abstract

:1. Introduction

- Analyze the development of the global energy system and the prospects for oil and gas sector operations in the age of energy transition 4.0 by comparing scenarios collected from various sources.

- Study climate strategies of the world’s largest oil and gas companies and identify emerging challenges and opportunities in decarbonization.

- Define how evolution of the energy balance has influenced the processes of strategic planning for oil and gas companies, and identify the areas for improving the methods and approaches used.

- Submit proposals for strategic climate adaptation planning for an oil and gas company.

2. Literature Review and Research Methodology

3. Results

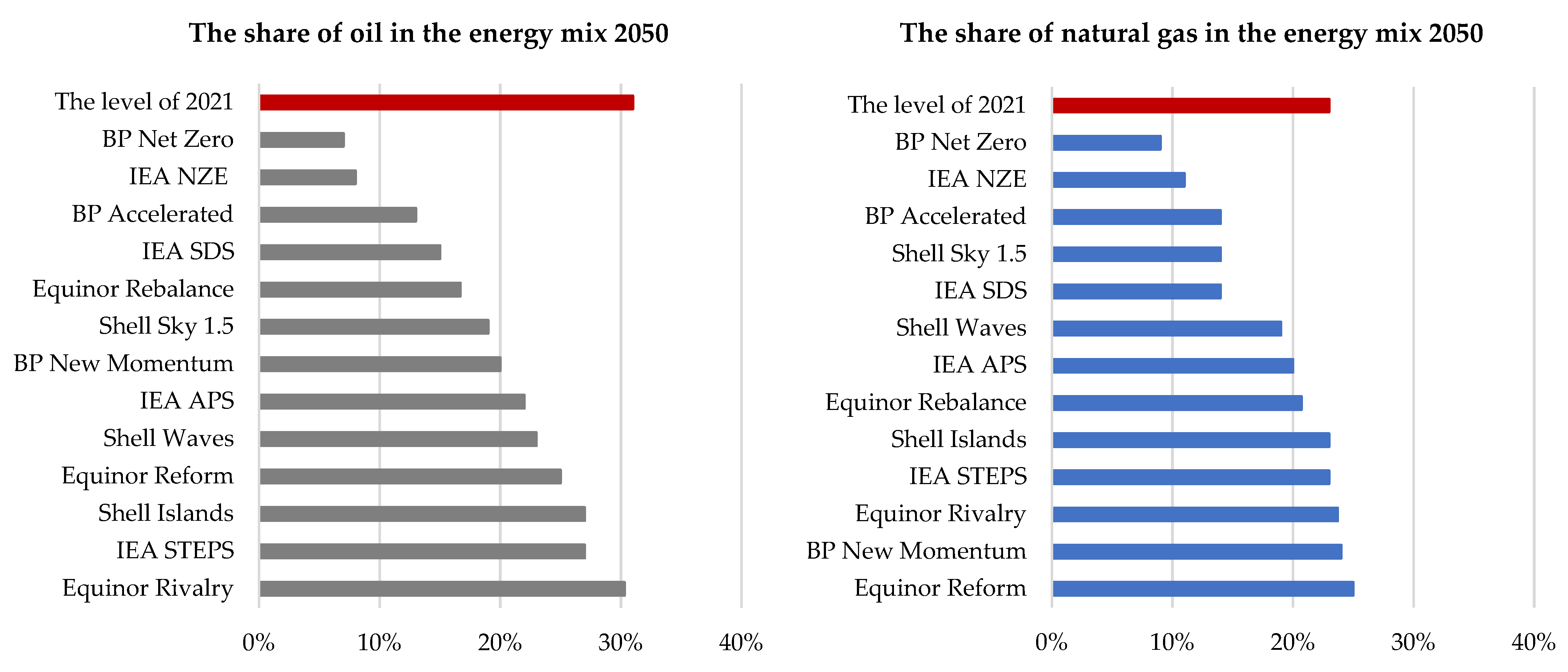

3.1. Energy Mix Transformation: The Dilemma of a Sustainable Energy System

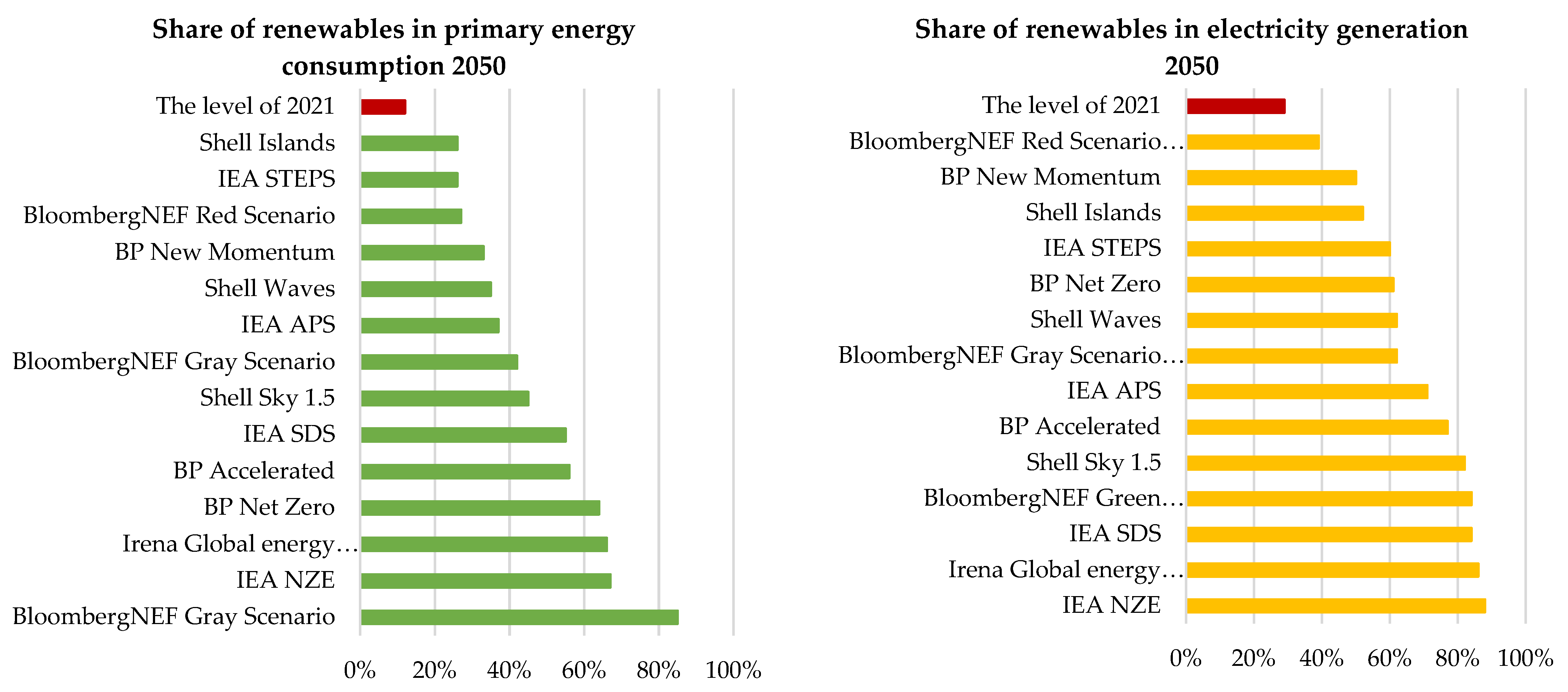

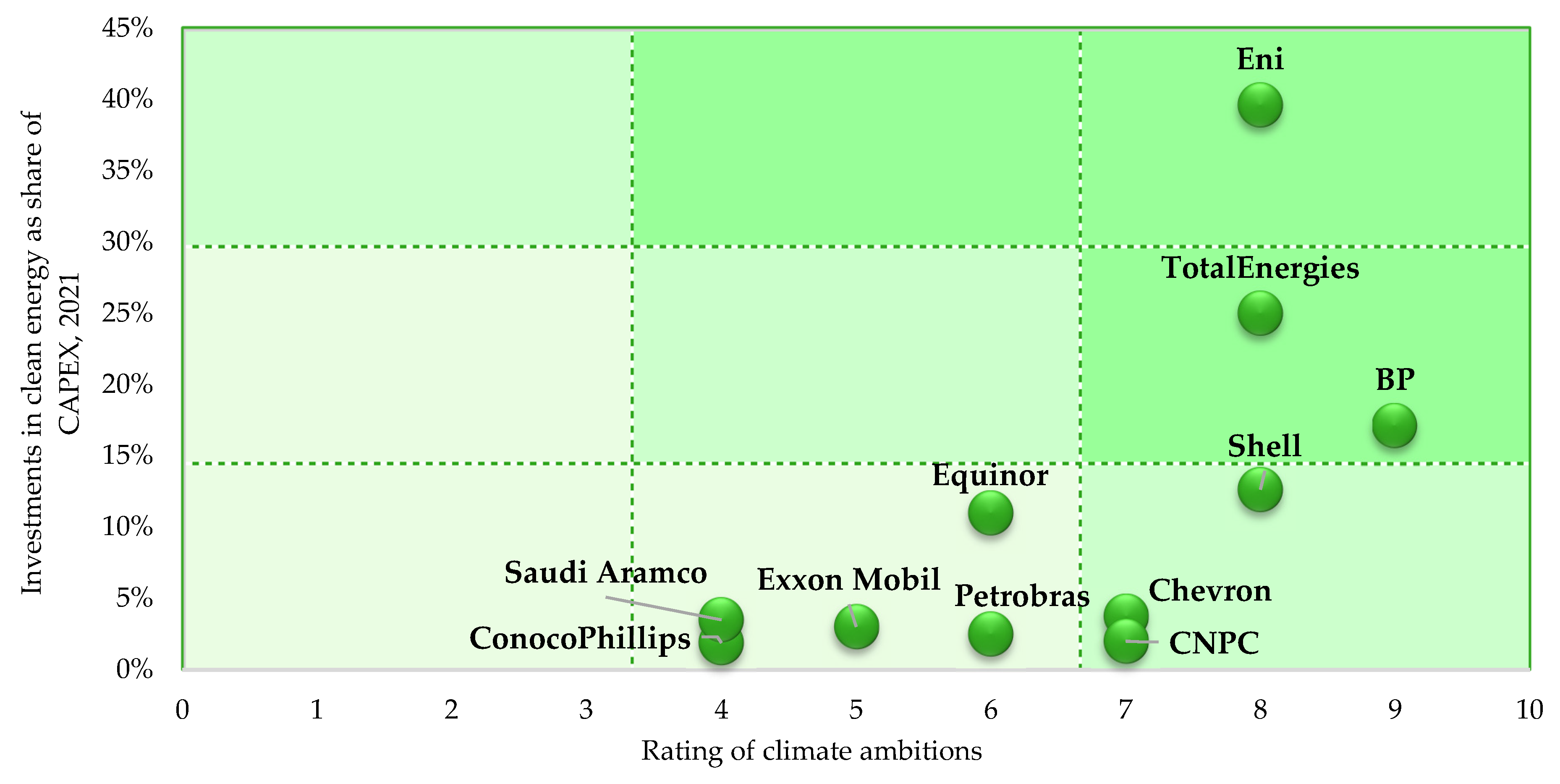

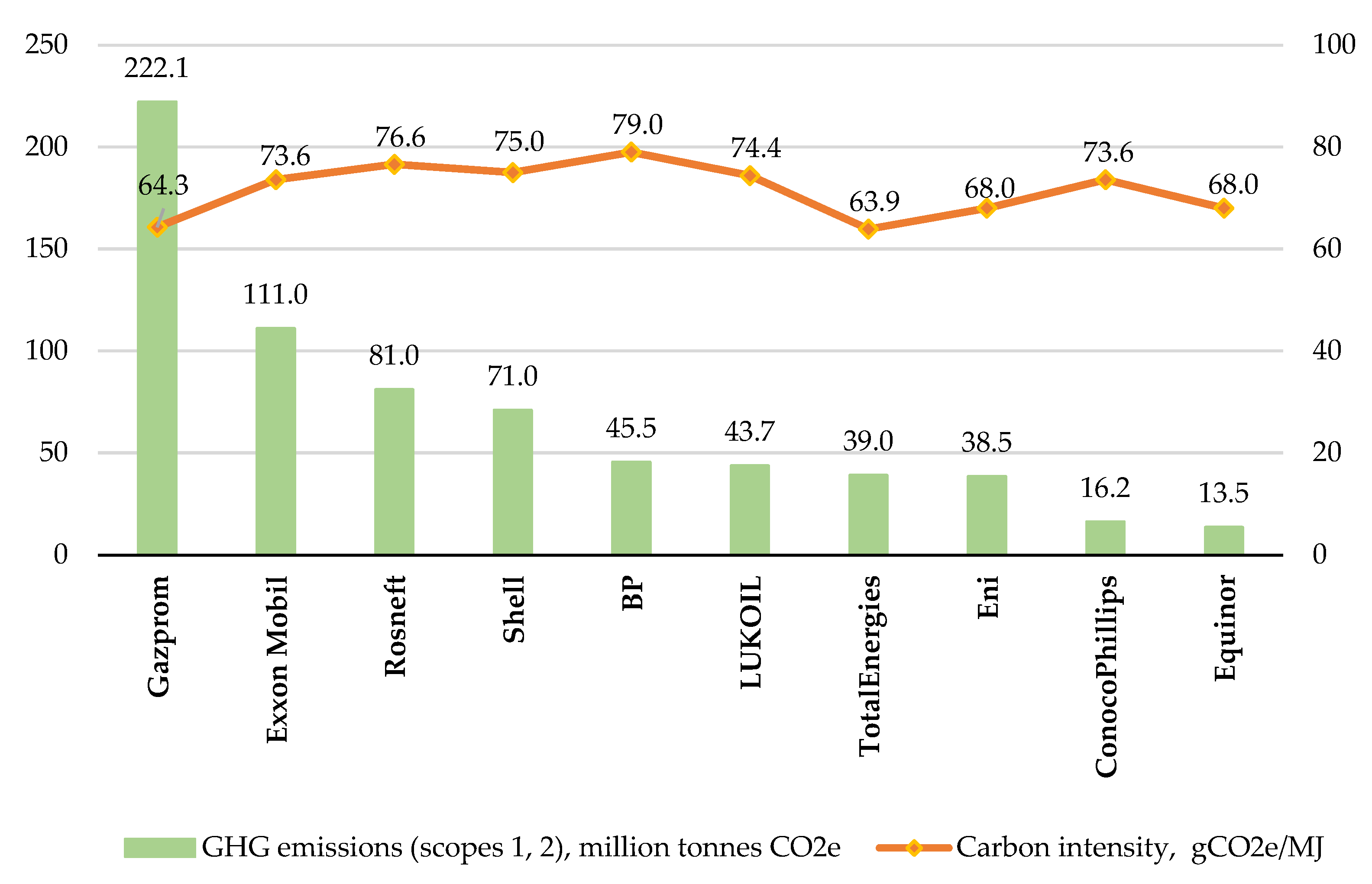

3.2. Global Oil and Gas Companies: From Big Oil to Big Energy

3.3. Russian Oil and Gas Companies: Balance of Interests

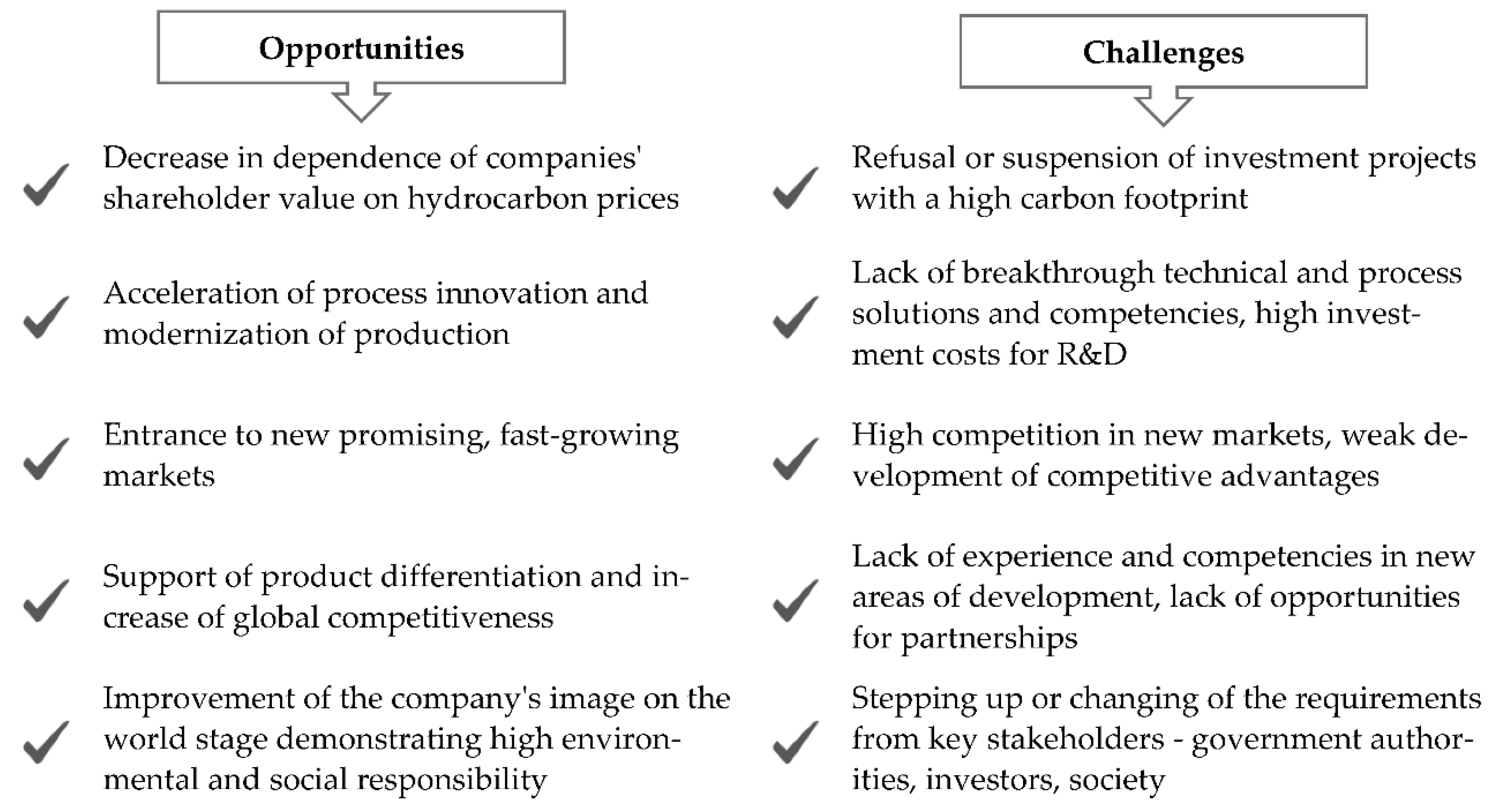

3.4. New Approaches to Strategic Planning of Oil and Gas Companies in the Era of Energy Transition

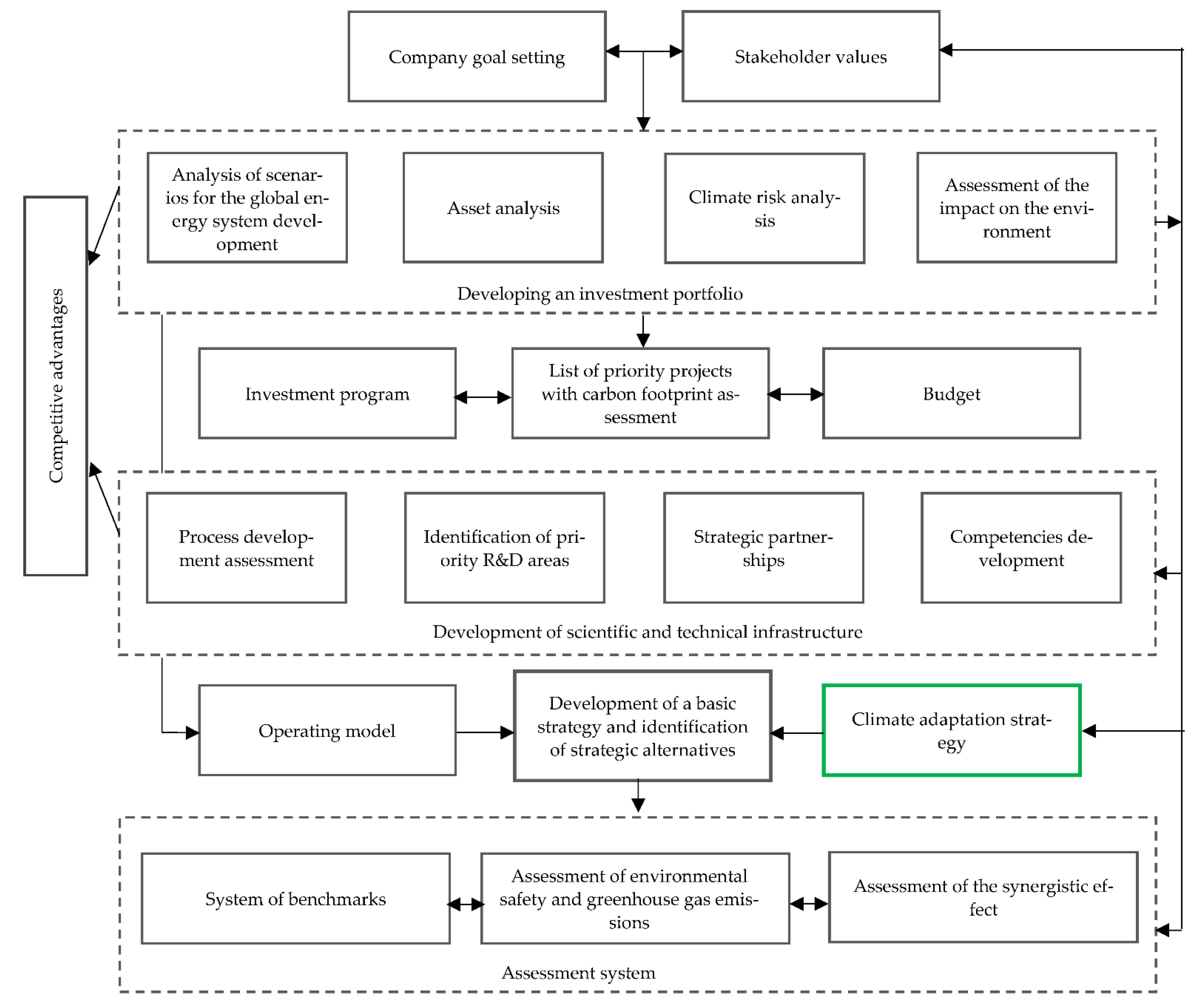

3.5. Strategic Climate Adaptation Planning for an Oil and Gas Company

4. Discussion

- Maintain traditions—Reduction of investment in oil and gas assets will not solve climate problems. Reduction of supply against a background of increased demand threatens access to resources and raises prices. Moreover, hasty portfolio diversification into low-carbon solutions may hinder value creation. It is important for companies to continue to focus on the efficient use of hydrocarbons based on existing reserves. A structured approach, including capital discipline, operational excellence, the latest digital technology, energy efficiency, and industrial and natural CO2 capture technology, may significantly increase the climate competitiveness of oil and gas resources. Actively searching for and implementing new solutions that are not available today to reduce the carbon footprint across the value chain will help change the rules of the game and regain investor confidence.

- Analyze new benchmarks of growth—The development of a strategy during the period of energy transition should be formed not only under the pressure of state regulators, investors, and society. Integration of low-carbon solutions into the portfolio of assets should be based on a strategic analysis of the investment attractiveness of new projects, production capabilities, features of the organizational structure, and corporate culture. Only in this case, the chosen lines of development will not be a declaration of intent or a marketing ploy, but an effective and implementable strategic plan.

- Plan to improve flexibility—During the changing energy basis, the concept of strategic planning should be significantly transformed. Today’s bureaucratic and sometimes formal planning process is a structured, organized act of thought to identify the most unexpected market opportunities and turn them into competitive advantages. The leader of the energy transition will be the one who can build an effective strategic planning system that will consider the new realities of the energy landscape, and will be based on transforming threats into opportunities.

5. Conclusions

- Evolution of the energy balance due to a strengthened climate agenda dictates the need for key players in the oil and gas market to revise their strategic plans. European oil and gas companies are actively changing the development pathway and intend to compete in the wider energy arena. However, these companies have yet to prove the benefits of low-carbon investments. US companies and NOCs are maximizing hydrocarbon profits and are less prepared for new market conditions. Regardless of the chosen behavioral model, oil and gas companies need to transform their principles and tools for strategic planning, forecasting, and portfolio management of investment and technology.

- We emphasize that effective strategic planning in a highly turbulent market environment is critical to ensure sustainable competitiveness. The main characteristics of strategic planning in oil and gas companies in the era of energy transition include:

- Carefully monitoring and promptly responding to limitations and prospects offered by the market;

- Determining their role in the low-carbon market and developing new competitive advantages that were previously unavailable;

- Searching for opportunities that promote flexibility and efficiency with simultaneous monitoring of cost and risk management;

- Transitioning from short-term shareholder return to long-term value;

- Moving beyond existing business models, organizational structures, and corporate culture based on experimental modeling.

- The proposed lines of LUKOIL’s climate adaptation strategy have been developed with reference to analysis of the priorities of the national economy and the interests of the company, as well as regulatory restrictions regarding the implementation of low-carbon solutions in Russia. Our proposals will allow the company to take advantage of the opening prospects of energy transition and realize its existing potential.

- A further line of research is empirical research on climate adaptation strategic planning for oil and gas companies.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- BP. Energy Outlook: 2022 Edition; BP p.l.c.: London, UK, 2022; Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2022.pdf (accessed on 15 May 2022).

- IEA. World Energy Outlook; IEA: Paris, France, 2021; Available online: https://www.iea.org/reports/world-energy-outlook-2021 (accessed on 15 May 2022).

- Annual Energy Outlook; U.S. Energy Information Administration (EIA): Washington, DC, USA, 2022. Available online: https://www.eia.gov/outlooks/aeo/ (accessed on 15 May 2022).

- Resolution Adopted by the General Assembly on 25 September 2015. Transforming Our World: The 2030 Agenda for Sustainable Development. Available online: https://www.un.org/ga/search/view_doc.asp?symbol=A/RES/70/1&Lang=E (accessed on 3 March 2022).

- Paris Agreement. United Nations. 2015. Available online: https://unfccc.int/files/essential_background/convention/application/pdf/english_paris_agreement.pdf (accessed on 3 March 2021).

- What the Coronavirus Means for the Energy Transition. Wood Mackenzie’s 2020 Energy Transition Outlook. Available online: https://www.woodmac.com/news/feature/what-the-coronavirus-means-for-the-energy-transition/ (accessed on 13 March 2022).

- IRENA. Global Energy Transformation: A Roadmap to 2050 (2019 Edition); International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019; Available online: https://www.irena.org/publications/2019/Apr/Global-energy-transformation-A-roadmap-to-2050-2019Edition (accessed on 9 April 2022).

- Khan, I.; Tan, D.; Hassan, S.T. Role of alternative and nuclear energy in stimulating environmental sustainability: Impact of government expenditures. Environ. Sci. Pollut. Res. 2022, 29, 37894–37905. [Google Scholar] [CrossRef] [PubMed]

- International Trends in Renewable Energy Sources. Solar-Wind Energy: More Than Mainstream; Deloitte: London, UK, 2018; Available online: https://www2.deloitte.com/us/en/insights/industry/power-and-utilities/global-renewable-energy-trends.html (accessed on 9 April 2022).

- Decarbonization of Oil & Gas: International Experience and Russian Priorities; SKOLKOVO Energy Centre: Moscow, Russia, 2021; Available online: https://energy.skolkovo.ru/downloads/documents/SEneC/Research/SKOLKOVO_EneC_Decarbonization_of_oil_and_gas_EN_22032021.pdf (accessed on 28 June 2022).

- Bogdanov, D.; Ram, M.; Aghahosseini, A.; Gulagi, A.; Oyewo, A.S.; Child, M.; Caldera, U.; Sadovskaia, K.; Farfan, J.; Barbosa, L.D.; et al. Low-cost renewable electricity as the key driver of the global energy transition towards sustainability. Energy 2021, 227, 120467. [Google Scholar] [CrossRef]

- Bilgili, F.; Koçak, E.; Bulut, Ü. The dynamic impact of renewable energy consumption on CO2 emissions: A revisited Environmental Kuznets Curve approach. Renew. Sustain. Energy Rev. 2016, 54, 838–845. [Google Scholar] [CrossRef]

- Gielen, D.; Boshell, F.; Saygin, D.; Bazilian, M.D.; Wagner, N.; Gorini, R. The role of renewable energy in the global energy transformation. Energy Strategy Rev. 2019, 24, 38–50. [Google Scholar] [CrossRef]

- ÓhAiseadha, C.; Quinn, G.; Connolly, R.; Connolly, M.; Soon, W. Energy and Climate Policy—An Evaluation of Global Climate Change Expenditure 2011–2018. Energies 2020, 13, 4839. [Google Scholar] [CrossRef]

- Hemrit, W.; Benlagha, N. Does renewable energy index respond to the pandemic uncertainty? Renew. Energy 2021, 177, 336–347. [Google Scholar] [CrossRef]

- Hoang, A.T.; Nižetić, S.; Olcer, A.I.; Ong, H.C.; Chen, W.H.; Chong, C.T.; Thomas, S.; Bandh, S.A.; Nguyen, X.P. Impacts of COVID-19 pandemic on the global energy system and the shift progress to renewable energy: Opportunities, challenges, and policy implications. Energy Policy 2021, 154, 112322. [Google Scholar] [CrossRef]

- Hosseini, S.E. An outlook on the global development of renewable and sustainable energy at the time of COVID-19. Energy Res. Soc. Sci. 2020, 68, 101633. [Google Scholar] [CrossRef]

- Saygin, D.; Kempener, R.; Wagner, N.; Ayuso, M.; Gielen, D. The Implications for Renewable Energy Innovation of Doubling the Share of Renewables in the Global Energy Mix between 2010 and 2030. Energies 2015, 8, 5828–5865. [Google Scholar] [CrossRef]

- Deng, Y.Y.; Blok, K.; van der Leun, K. Transition to a fully sustainable global energy system. Energy Strategy Rev. 2012, 1, 109–121. [Google Scholar] [CrossRef]

- Brook, B.W.; Blees, T.; Wigley, T.M.L.; Hong, S. Silver Buckshot or Bullet: Is a Future “Energy Mix” Necessary? Sustainability 2018, 10, 302. [Google Scholar] [CrossRef]

- Harjanne, A.; Korhonen, J.M. Abandoning the concept of renewable energy. Energy Policy 2019, 127, 330–340. [Google Scholar] [CrossRef]

- Chowdhury, M.S.; Rahman, K.S.; Chowdhury, T.; Nuthammachot, N.; Techato, K.; Akhtaruzzaman, M.; Tiong, S.K.; Sopian, K.; Amin, N. An Overview of Solar Photovoltaic Panels’ End-of-Life Material Recycling. Energy Strategy Rev. 2020, 27, 100431. [Google Scholar] [CrossRef]

- Seibert, M.K.; Rees, W.E. Through the Eye of a Needle: An Eco-Heterodox Perspective on the Renewable Energy Transition. Energies 2021, 14, 4508. [Google Scholar] [CrossRef]

- Gasparatos, A.; Doll, C.N.H.; Esteban, M.; Ahmed, A.; Olang, T.A. Renewable energy and biodiversity: Implications for transitioning to a Green Economy. Renew. Sustain. Energy Rev. 2017, 70, 161–184. [Google Scholar] [CrossRef]

- Ahn, K.; Chu, Z.; Lee, D. Effects of renewable energy use in the energy mix on social welfare. Energy Econ. 2021, 96, 105174. [Google Scholar] [CrossRef]

- IEA. Global Energy Review; IEA: Paris, France, 2021; Available online: https://www.iea.org/reports/global-energy-review-2021 (accessed on 23 March 2022).

- BloombergNEF. The New Energy Outlook (NEO). 2021. Available online: https://about.bnef.com/new-energy-outlook/ (accessed on 24 March 2022).

- Energy Perspectives 2021: An Uncertain Future, Equinor. 2021. Available online: https://www.equinor.com/en/sustainability/energy-perspectives.html (accessed on 2 July 2022).

- The Energy Transformation Scenarios; Shell: London, UK, 2021; Available online: https://www.shell.com/energy-and-innovation/the-energy-future/scenarios/the-energy-transformation-scenarios.html#iframe=L3dlYmFwcHMvU2NlbmFyaW9zX2xvbmdfaG9yaXpvbnMv (accessed on 2 July 2022).

- Magdanov, P.V. Modern approach to strategic planning. Art Manag. 2011, 1, 11–26. [Google Scholar]

- Porter, M.E. The Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strat. Mgmt. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Beinhocker, E. Robust Adaptive Strategy. In Strategic Thinking for the Next Economy; Cusumano, M.A., Markides, C.C., Eds.; Jossey-Bass: San Francisco, CA, USA, 2001. [Google Scholar]

- Ansoff, I.; Sullivan, P. Optimizing profitability optimizing in turbulent environment: A formula of strategic success. Long Range Plan. 1993, 26, 11–23. [Google Scholar] [CrossRef]

- Rumelt, R.P. Strategy, Structure and Economic Performance; Harvard Business School Press: Boston, MA, USA, 1974. [Google Scholar]

- Teece, D.J. Economies of scope and the scope of the enterprise. J. Econ. Behav. Organ. 1980, 1, 223–247. [Google Scholar] [CrossRef]

- Andrews, K.R. The Concept of Corporate Strategy; Dow Jones-Irwin: Homewood, IL, USA, 1971. [Google Scholar]

- Andrews, K.; Bower, J.; Christensen, C.R.; Hamermesh, R.; Porter, M.E. Business Policy: Text and Cases 6; Richard D. Irwin: Homewood, IL, USA, 1986. [Google Scholar]

- Ansoff, H.I. Corporate Strategy; Penguin Books Ltd.: Harmondsworth, UK, 1968. [Google Scholar]

- Steiner, G.A. Strategic Planning: What Every Manager Must Know; Free Press: New York, NY, USA, 1979. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard—Measures That Drive Performance. Harv. Bus. Rev. 1992, 83, 172. [Google Scholar]

- Mintzberg, H. The fall and rise of strategic planning. Harv. Bus. Rev. 1994, 72, 107–114. [Google Scholar]

- Boyd, B.K.; Reuning-Elliott, E. A Measurement model of strategic planning. Strat. Man. J. 1998, 19, 181–192. [Google Scholar] [CrossRef]

- Hichens, R.E.; Robinson, S.J.Q.; Wade, D.P. The Directional Policy Matrix: Tool for strategic Planning. Long Range Plan. 1978, 11, 8–15. [Google Scholar] [CrossRef]

- Vecchiato, R. Scenario planning, cognition, and strategic investment decisions in a turbulent environment. Long Range Plan. 2019, 52, 101865. [Google Scholar] [CrossRef]

- Ilinova, A.A.; Solovyova, V.M. Strategic planning and forecasting: Changing the essence and role in the conditions of energy instability. North Mark. Form. Econ. Order 2021, 2, 56–68. [Google Scholar] [CrossRef]

- Stevens, P. International Oil Companies. The Death of the Old Business Model; Chatam House: London, UK, 2016. [Google Scholar]

- Magrini, A.; Lins, L.D.S. Integration between environmental management and strategic planning in the oil and gas sector. Ener. Policy 2007, 35, 4869–4878. [Google Scholar] [CrossRef]

- Blinova, E.; Ponomarenko, T.; Knysh, V. Analyzing the Concept of Corporate Sustainability in the Context of Sustainable Business Development in the Mining Sector with Elements of Circular Economy. Sustainability 2022, 14, 8163. [Google Scholar] [CrossRef]

- Pickl, M.J. The renewable energy strategies of oil majors—From oil to energy? Energy Strategy Rev. 2019, 26, 100370. [Google Scholar] [CrossRef]

- Zhong, M.; Bazilian, M.D. Contours of the energy transition: Investment by international oil and gas companies in renewable energy. Electr. J. 2018, 31, 82–91. [Google Scholar] [CrossRef]

- IEA. Global Methane Tracker; IEA: Paris, France, 2022; Available online: https://www.iea.org/reports/global-methane-tracker-2022 (accessed on 10 June 2022).

- IEA. World Energy Investment; IEA: Paris, France, 2022; Available online: https://www.iea.org/reports/world-energy-investment-2022 (accessed on 10 June 2022).

- Upstream Spending, Cut by $285 Billion in Two Years, Will Struggle to Recover to Pre-Pandemic Levels. Rystad Energy 2021. Available online: https://www.rystadenergy.com/newsevents/news/press-releases/upstream-spending-cut-by-$285-billion-in-two-years-will-struggle-to-recover-to-pre-pandemic-levels/ (accessed on 18 June 2022).

- EU Power Sector in 2020. Ember. Available online: https://ember-climate.org/project/eu-power-sector-2020/ (accessed on 1 July 2022).

- The European Green Deal. European Commission, Brussels, 11.12.2019. Available online: https://ec.europa.eu/info/sites/default/files/european-green-deal-communication_en.pdf (accessed on 10 June 2022).

- The Biden Plan for a Clean Energy Revolution and Environmental Justice. Available online: https://joebiden.com/climate-plan/ (accessed on 10 June 2022).

- How China Can Achieve Carbon Neutrality by 2060. Boston Consulting Group. 2021. Available online: https://www.bcg.com/ru-ru/publications/2021/how-china-can-achieve-carbon-neutrality (accessed on 10 June 2022).

- Liu, H.; Saleem, M.M.; Al-Faryan, M.A.; Khan, I.; Zafar, M.W. Impact of governance and globalization on natural resources volatility: The role of financial development in the Middle East North Africa countries. Resour. Policy 2022, 78, 102881. [Google Scholar] [CrossRef]

- Arslan, H.M.; Khan, I.; Latif, M.I.; Komal, B.; Chen, S. Understanding the dynamics of natural resources rents, environmental sustainability, and sustainable economic growth: New insights from China. Environ. Sci. Pollut. Res. 2022, 29, 58746–58761. [Google Scholar] [CrossRef]

- Ponomarenko, T.; Reshneva, E.; Mosquera Urbano, A.P. Assessment of Energy Sustainability Issues in the Andean Community: Additional Indicators and Their Interpretation. Energies 2022, 15, 1077. [Google Scholar] [CrossRef]

- Oil and Gas after COVID-19: The Day of Reckoning or a New Age of Opportunity? McKinsey & Company: Tokyo, Japan, 2020; Available online: https://www.mckinsey.com/industries/oil-and-gas/our-insights/oil-and-gas-after-covid-19-the-day-of-reckoning-or-a-new-age-of-opportunity (accessed on 17 May 2022).

- Semenova, T.; Al-Dirawi, A. Economic Development of the Iraqi Gas Sector in Conjunction with the Oil Industry. Energies 2022, 15, 2306. [Google Scholar] [CrossRef]

- IEA. The Oil and Gas Industry in Energy Transitions; IEA: Paris, France, 2022; Available online: https://www.iea.org/reports/the-oil-and-gas-industry-in-energy-transitions (accessed on 25 May 2022).

- Sustainability & Climate 2022 Progress Report; TotalEnergies: Courbevoie, France, 2022; Available online: https://totalenergies.com/system/files/documents/2022-03/Sustainability_Climate_2022_Progress_Report_EN.pdf (accessed on 20 April 2022).

- Universal Registration Document 2021, Including the Annual Financial Report; TotalEnergies: Courbevoie, France, 2022; Available online: https://publications.totalenergies.com/DEU_2021/URD_2021_EN_XBRL.html#p_330251 (accessed on 20 April 2022).

- Our Transformation; BP: London, UK, 2021; Available online: https://www.bp.com/en/global/corporate/who-we-are/our-ambition.html (accessed on 15 April 2022).

- Sustainability Report; BP: London, UK, 2021; Available online: https://www.bp.com/en/global/corporate/sustainability/reporting-centre-and-archive/quick-read.html (accessed on 15 April 2022).

- Energy Transition Progress Report; Shell: London, UK, 2021; Available online: https://reports.shell.com/energy-transition-progress-report/2021/ (accessed on 18 April 2022).

- Eni and IRENA Launch a Partnership to Accelerate the Energy Transition. Available online: https://www.irena.org/newsroom/pressreleases/2021/Sep/Eni-and-IRENA-Launch-a-Partnership-to-Accelerate-the-Energy-Transition (accessed on 4 April 2022).

- Eni’s Strategy on Climate Change; Eni: Rome, Italy, 2022; Available online: https://www.eni.com/en-IT/low-carbon/strategy-climate-change.html (accessed on 4 April 2022).

- Eni Annual Report. 2021. Available online: https://www.eni.com/assets/documents/eng/reports/2021/Annual-Report-2021.pdf (accessed on 4 April 2022).

- Our Climate Ambitions; Equinor: Stavanger, Norway, 2022; Available online: https://www.equinor.com/sustainability/climate-ambitions (accessed on 19 April 2022).

- 2021 Sustainability Report; Equinor: Stavanger, Norway, 2021; Available online: https://cdn.sanity.io/files/h61q9gi9/global/df1f0cb19f173c1e616f83263540fd98e366212f.pdf?sustainaiblity-report-2021-equinor.pdf (accessed on 19 April 2022).

- Plan for the Net-Zero Energy Transition, ConocoPhillips. Available online: https://www.conocophillips.com/sustainability/managing-climate-related-risks/strategy/plan-for-the-net-zero-energy-transition/ (accessed on 28 April 2022).

- The Advancing Climate Solutions—2022 Progress Report, Formerly the Energy & Carbon Summary; ExxonMobil: Irving, TX, USA, 2022; Available online: https://corporate.exxonmobil.com/Climate-solutions/Advancing-climate-solutions-progress-report (accessed on 28 April 2022).

- Climate Change Resilience. Advancing a Lower Carbon Future; Chevron: San Ramon, CA, USA, 2021; Available online: https://www.chevron.com/-/media/chevron/sustainability/documents/2021-climate-change-resilience-report.pdf (accessed on 28 April 2022).

- Climate Change. Supporting the Energy Transition; Saudi Aramco: Dhahran, Saudi Arabia, 2022; Available online: https://www.aramco.com/en/sustainability/climate-change/supporting-the-energy-transition (accessed on 22 April 2022).

- Environment & Society; CNPC: Beijing, China, 2022; Available online: https://www.cnpc.com.cn/en/environmentsociety/society_index.shtml (accessed on 22 April 2022).

- Climate Change and Transitioning to Low Carbon; Petrobras: Janeiro, Brazil, 2022; Available online: https://petrobras.com.br/en/society-and-environment/environment/climate-changes/ (accessed on 22 April 2022).

- Ulanov, V.L.; Ulanova, E.Y. Impact of External Factors on National Energy Security. J. Min. Inst. 2019, 238, 474. [Google Scholar] [CrossRef]

- Decree of the Government of the Russian Federation Dated 09.06.2020 No. 1523-r “On Approval of the Energy Strategy of the Russian Federation for the Period Up to 2035”. Available online: https://legalacts.ru/doc/rasporjazhenie-pravitelstva-rf-ot-09062020-n-1523-r-ob-utverzhdenii/ (accessed on 15 June 2022).

- Decree of the President of the Russian Federation No. 666 dated 04.11.2020 “On Reducing Greenhouse Gas Emissions”. Available online: http://www.kremlin.ru/acts/bank/45990 (accessed on 15 June 2022).

- Alexander Novak Spoke about the Prospects of Decarbonization and the Development of Hydrogen Energy in Russia. Official Website of the Russian Government. 2021. Available online: http://government.ru/news/42422/ (accessed on 19 June 2022).

- Semenova, T. Value Improving Practices in Production of Hydrocarbon Resources in the Arctic Regions. J. Mar. Sci. Eng. 2022, 10, 187. [Google Scholar] [CrossRef]

- Action Plan “Development of Hydrogen Energy in the Russian Federation until 2024”. Available online: http://static.government.ru/media/files/7b9bstNfV640nCkkAzCRJ9N8k7uhW8mY.pdf (accessed on 19 June 2022).

- Gazprom Environmental Report. 2021. Available online: https://www.gazprom.ru/f/posts/57/982072/gazprom-environmental-report-2021-ru.pdf (accessed on 5 June 2022).

- Renewable Power Generation; LUKOIL: Moscow, Russia, 2022; Available online: https://www.lukoil.com/Sustainability/Climatechange/Renewablepowergeneration (accessed on 5 June 2022).

- Rosneft Announces Climate Targets until 2035; Rosneft: Moscow, Russia, 2020; Available online: https://www.rosneft.ru/press/releases/item/204425/ (accessed on 5 June 2022).

- BCG Estimated the Carbon Tax Burden for Russia at 3–4.8 Billion Dollars; Boston Consulting Group: Boston, MA, USA, 2020; Available online: https://www.accenture.com/us-en/blogs/accenture-energy/2022-year-of-action (accessed on 24 June 2022).

- Transition Pathway Initiative. Available online: https://www.transitionpathwayinitiative.org/ (accessed on 20 June 2022).

- Nedosekin, A.O.; Rejshahrit, E.I.; Kozlovskij, A.N. Strategic approach to assessing economic sustainability objects of mineral resources sector of Russia. J. Min. Inst. 2019, 237, 354. [Google Scholar] [CrossRef]

- Khan, I.; Hou, F. The Impact of Socio-Economic and Environmental Sustainability on CO2 Emissions: A Novel Framework for Thirty IEA Countries. Soc. Indic. Res. 2021, 155, 1045–1076. [Google Scholar] [CrossRef]

- LUKOIL. Annual Report. 2021. Available online: https://lukoil.ru/FileSystem/9/587033.pdf (accessed on 5 July 2022).

- LUKOIL. Sustainability Report. 2021. Available online: https://www.lukoil.com/Sustainability/SustainabilityReport (accessed on 5 July 2022).

- Kopteva, A.; Kalimullin, L.; Tcvetkov, P.; Soares, A. Prospects and Obstacles for Green Hydrogen Production in Russia. Energies 2021, 14, 718. [Google Scholar] [CrossRef]

- Ilinova, A.A.; Romasheva, N.V.; Stroykov, G.A. Prospects and social effects of carbon dioxide sequestration and utilization projects. J. Min. Inst. 2020, 244, 493–502. [Google Scholar] [CrossRef]

- Tcvetkov, P. Climate Policy Imbalance in the Energy Sector: Time to Focus on the Value of CO2. Energies 2021, 14, 411. [Google Scholar] [CrossRef]

- LUKOIL Joins the Society of Decarbonaries. Available online: https://www.kommersant.ru/doc/5139325 (accessed on 10 July 2022).

| Company | 2050 Emissions Target | Reduction of Oil Production | Increase in Gas Production | Solar Energy | Wind Energy | Geothermal Energy | Energy Efficiency | Bioenergy | CCUS | Low-Carbon Hydrogen | Nature-Based Solutions |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Shell | Net zero (Scopes 1, 2, 3) |  |  |  |  |  |  |  |  | ||

| TotalEnergies | Net zero (Scopes 1, 2, 3) |  |  |  |  |  |  |  |  | ||

| BP | Net zero (Scopes 1, 2, 3) |  |  |  |  |  |  |  |  |  | |

| Eni | Net zero (Scopes 1, 2, 3) |  |  |  |  |  |  |  |  | ||

| ConocoPhillips | Net zero (Scopes 1, 2) |  |  |  |  | ||||||

| Exxon Mobil | Net zero (Scopes 1, 2) |  |  |  |  |  | |||||

| Chevron | Net zero Upstream emissions (Scope 1, 2) |  |  |  |  |  |  |  | |||

| Equinor | Net zero (Scopes 1, 2, 3) |  |  |  |  |  |  | ||||

| Saudi Aramco | Net zero (Scopes 1, 2) |  |  |  |  | ||||||

| CNPC | “Near zero” emissions |  |  |  |  |  |  |  | |||

| Petrobras | Net zero (Scopes 1, 2) |  |  |  |  |  |  |

| Approach | Recent Development of the Energy System | Transition to a Sustainable Energy System |

|---|---|---|

| The role of strategic planning | Strategic decisions are made in response to emerging opportunities and challenges and are incorporated into strategic plans | Forward-looking response to new opportunities and commitments based on continuous monitoring of the energy landscape |

| Goal setting | Definition of long-term strategic intentions based on competitive advantages | Inclusion of climate goals and the short-term targets to achieve it in the strategy |

| Resources | High priority—development of oil and gas assets; emphasis—performance planning | Of high priority is optimizing the current portfolio of oil and gas assets and searching for new low-carbon solutions; while emphasis means the reduction of carbon footprint along the entire value chain |

| Operational arrangements | Vertical integration | Virtual integration based on the assessment of low-carbon opportunities and technologies that may be tightly integrated with global company operations, markets, and competencies |

| Planning horizon | Cyclical nature of planning | Reduction of planning time horizons; planning out of cycles |

| Financial planning | Minimization of the cost of capital involved in oil and gas projects; continuous value creation | Planning for sustainable value with increased investment in low-carbon projects; assessment of the financial impact of implementation of carbon regulation |

| Scenario planning | Multi-scenario planning for strategic flexibility | Planning with reference to technical development scenarios and climate risks; testing strategies and asset portfolios in various scenarios |

| Investment | Acceleration of monetary flow to ensure returns; targeted investment; cost reduction | Investment in a new type of asset: flexible, responsive to market conditions, and operating at low costs and with a low carbon footprint |

| Process development | Application of standard engineering solutions | Implementation of technologies aimed at emissions reduction; digitalization of production and management processes |

| Targets | Development of efficiency targets (financial, operational); strategic guidelines; balanced scorecard | Development of inflexible efficiency targets based on financial and economic assessment of development options and assessment of risks and opportunities for energy transition. |

| Strategic partnerships | Tactical strategic alliances on a contractual basis | Building of closer partnerships that involve joint development and integration of knowledge and experience |

| Competencies development | Development of professional competencies in line with industry trends | Development of competencies on climate issues |

| Indicator | 2019 | 2020 | 2021 | 2025 | 2030 | 2035 | 2040 | 2050 | |

|---|---|---|---|---|---|---|---|---|---|

| Prospects | 1. Greenhouse gas emissions (Scopes 1, 2), million tons CO2-eq. | 48.4 | 43.7 | 41.5 | 38.0 | 35.2 | 28.0 | 13.0 | 0 |

| 2. Intensity of methane emissions, % | 0.3 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.1 | 0 | |

| 3. Share of investments in renewables and energy solutions out of the total volume of investments, % | <1 | <1 | <1 | 2–3 | 3–5 | 3–5 | 5–7 | 7–10 | |

| Finance | 1. ROACE, % | 14.8 | 3.2 | 14.7 | 15.0 | 15.0 | 15.0 | 15.0 | 15.0 |

| 2. Fitch Credit Rating | BBB+ | BBB+ | BBB+ | BBB+ | A | A | A | AA | |

| 3. EBITDA growth rate, % | 10.9 | −44.4 | 97.2 | 15–20 | 15–20 | 15–20 | 15–20 | 15–20 | |

| Involved parties | 1. Share of commercial electricity generation from renewables out of the total volume of electricity generated, % | 6.0 | 4.8 | 6.4 | 8.0 | 10.9 | 12.5 | 12.8 | 11.8 |

| 2. Share of natural gas in the production structure, % | 24 | 24 | 24 | 27 | 30 | 30 | 30-35 | 30-35 | |

| 3. Share of new suppliers that have been assessed according to environmental criteria, % | 44 | 50 | 62 | 70 | 100 | 100 | 100 | 100 | |

| Business processes | 1. Volume of APG flaring, million m3 | 282 | 260 | 291 | <100 | <50 | 0 | 0 | 0 |

| 2. Electric energy savings as a result of the implementation of measures to improve energy efficiency, million kWh | 159 | 146 | 105 | 163 | 189 | 205 | 223 | 250 | |

| 3. Renewable energy capacity, GW | 0.4 | 0.4 | 0.4 | 1.0 | 1–5 | 5–10 | 10–15 | 15 | |

| Training and development | 1. Development of climate-related competencies | <200 | <200 | <200 | >500 | >700 | >1000 | >1500 | >2000 |

| 2. Number of patents received | 30 | 25 | 26 | >50 | >100 | >100 | >100 | >150 |

| Actual | Accelerated | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| Electricity generation from renewables, TWh | 7137 | 7493 | 7931 | 11692 | 15358 | 20818 | 27670 | 34987 | 40552 |

| Share of electricity in total final consumption, % | 20.5 | 20.0 | 20.0 | 21.7 | 23.2 | 26.4 | 31.2 | 36.8 | 42.4 |

| Primary energy consumption, EJ | 587 | 564 | 595 | 661 | 670 | 670 | 676 | 685 | 692 |

| LUKOIL commercial power generation, TWh | 18.3 | 17.1 | 15.8 | 19.0 | 20.6 | 23.5 | 28.0 | 33.5 | 38.9 |

| LUKOIL commercial power generation from renewables, TWh | 1.1 | 0.8 | 1.0 | 1.5 | 1.9 | 2.6 | 3.5 | 4.4 | 5.1 |

| Share of commercial power generation from renewables in LUKOIL commercial power generation, % | 6.0 | 4.8 | 6.4 | 7.7 | 9.4 | 11.2 | 12.5 | 13.2 | 13.1 |

| Actual | Net Zero | ||||||||

| 2019 | 2020 | 2021 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| Electricity generation from renewables, TWh | 7137 | 7493 | 7931 | 12119 | 17845 | 24211 | 31705 | 38245 | 41188 |

| Share of electricity in total final consumption, % | 20.5 | 20.0 | 20.0 | 22,0 | 24,3 | 29,2 | 37,1 | 45,1 | 50,9 |

| Primary energy consumption, EJ | 587 | 564 | 595 | 651 | 637 | 628 | 636 | 648 | 653 |

| LUKOIL commercial power generation, TWh | 18.3 | 17.1 | 15.8 | 19.0 | 20.6 | 24.3 | 31.3 | 38.8 | 44.1 |

| LUKOIL commercial power generation from renewables, TWh | 1.1 | 0.8 | 1.0 | 1.5 | 2.2 | 3.1 | 4.0 | 4.8 | 5.2 |

| Share of commercial power generation from renewables in LUKOIL commercial power generation, % | 6.0 | 4.8 | 6.4 | 8.0 | 10.9 | 12.5 | 12.8 | 12.4 | 11.8 |

| Actual | New Momentum | ||||||||

| 2019 | 2020 | 2021 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| Electricity generation from renewables, TWh | 7137 | 7493 | 7931 | 9715 | 11968 | 15379 | 19356 | 22864 | 26462 |

| Share of electricity in total final consumption, % | 20.5 | 20.0 | 20.0 | 21.6 | 22.7 | 24.4 | 26.8 | 29.3 | 31.5 |

| Primary energy consumption, EJ | 587 | 564 | 595 | 667 | 691 | 708 | 730 | 747 | 760 |

| LUKOIL commercial power generation, TWh | 18.3 | 17.1 | 15.8 | 19.1 | 20.8 | 22.9 | 26.0 | 29.0 | 31.8 |

| LUKOIL commercial power generation from renewables, TWh | 1.1 | 0.8 | 1.0 | 1.2 | 1.5 | 1.9 | 2.4 | 2.9 | 3.3 |

| Share of commercial power generation from renewables in LUKOIL commercial power generation, % | 6.0 | 4.8 | 6.4 | 6.4 | 7.2 | 8.5 | 9.4 | 9.9 | 10.5 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cherepovitsyn, A.; Rutenko, E. Strategic Planning of Oil and Gas Companies: The Decarbonization Transition. Energies 2022, 15, 6163. https://doi.org/10.3390/en15176163

Cherepovitsyn A, Rutenko E. Strategic Planning of Oil and Gas Companies: The Decarbonization Transition. Energies. 2022; 15(17):6163. https://doi.org/10.3390/en15176163

Chicago/Turabian StyleCherepovitsyn, Alexey, and Evgeniya Rutenko. 2022. "Strategic Planning of Oil and Gas Companies: The Decarbonization Transition" Energies 15, no. 17: 6163. https://doi.org/10.3390/en15176163

APA StyleCherepovitsyn, A., & Rutenko, E. (2022). Strategic Planning of Oil and Gas Companies: The Decarbonization Transition. Energies, 15(17), 6163. https://doi.org/10.3390/en15176163