Abstract

Natural gas has returned to prominence in the agenda of European countries since the beginning of the invasion of Ukraine by Russia in 2022. However, natural gas is a fossil source with severe environmental implications. This paper aims to verify the impact of natural gas on carbon dioxide (CO2) emissions for a European panel from 1993 to 2018 for sixteen countries. An Autoregressive Distributed Lag (ARDL) model in the form of an unrestricted error correction model was used to identify the short-run impacts, the long-run elasticities, and the speed of adjustment of the model. The results indicate that in the short-run, natural gas has a negligible impact on CO2 emissions when faced with oil consumption (6.7 times less), whereas the consumption of renewables and hydroelectric energy proved to be able to decrease the CO2 emissions both in the short- and long-run. The elasticity of oil consumption is lower than the unit, indicating that efficiency gains have been achieved during the process of the energy transition to clean energy sources. If economies use non-renewable energy, governments must continue to prefer natural gas to oil. Renewables and hydroelectric consumption must be used to revert the path of CO2 emissions. Given the unstable scenario that has been caused by the War in Eastern Europe, politicians should focus on accelerating the transition from fossil to renewable energies.

1. Introduction

The development of the natural gas market in the European Union (EU) happened gradually. Firstly, with the Single European Act entrance, in force since 1986, the target of creating the internal market until 1992 was established. This market would develop an inter-institutional relationship of political cooperation and community competence among the European countries.

Liberalizing the natural gas market would protect consumers’ interests in the final price, the quality of service, environmental sustainability, access to information, and supply security. Furthermore, natural gas is essential for citizens’ lives in both electricity production and residential consumption. According to the article “EU energy mix and import dependency” from Eurostat [1], the European Union (EU) received more than 46% of its natural gas imports from Russia. Other important providers are Norway, Algeria, Qatar, the United States of America, the United Kingdom, Nigeria, and Libya making up collectively with Russia 90% of the EU’s total natural gas imports.

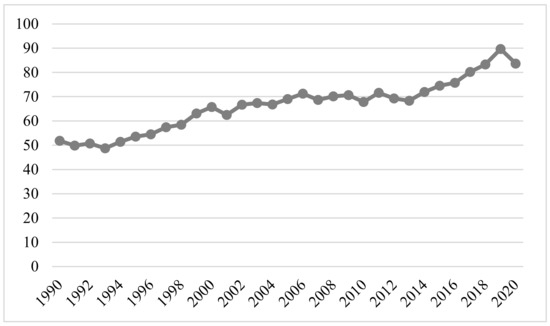

In Figure 1, we show the energy imports dependency, namely natural gas in % of the total energy needs:

Figure 1.

Natural gas in % of the total energy needs. Source: [1].

The numbers that are shown in Figure 1 suggest that some European countries are highly dependent on natural gas imports. However, due to the current scenario of War in Eastern Europe (invasion of Ukraine by Russia) and the strong European dependence on Russian natural gas, in parallel with all targets for reducing global warming, the replacement of natural gas with clean sources of energy is once again a matter of emergency. Finally, considering important aspects that were addressed by [2], such as energy efficiency, energy security in the EU, the living conditions of the population, and the conditions for economic development.

The European Union economy is increasingly using energy that was obtained from renewable energy sources [3]. Nonetheless, regarding the relevance of natural gas for the EU, this research aims to identify the impact of natural gas consumption on carbon dioxide (CO2) emissions, analyzing an EU countries’ panel.

The criteria for selecting countries for this research were: (a) being a member of the EU, a sophisticated natural gas market; (b) having data for a long-time horizon for the series; and (c) availability of data for all the variables. These rules resulted in annual data, a time horizon from 1993 to 2018, and sixteen EU countries.

After the Autoregressive Distributed Lag (ARDL) model estimation, the results support the Kuznets curve’s presence, revealing a negative impact on the gross domestic product (GDP) per capita (PC) in curbing the carbon dioxide (CO2) emissions and evidence of the impact of renewables consumptions on reducing CO2 emissions. The results, as expectable, also reveal that the consumption of natural gas and other fossil energy sources has different environmental impacts. However, the natural gas contribution to increasing CO2 emissions is very small compared to other fossil energy sources. These results provide a better comprehension of the liberalization of natural gas in the European common market and sets a scientific basis for further comprehension of the phenomenon of CO2 emissions in the EU.

The research is organized as follows: The first section shows the introduction. The second section (literature) reviews the existing literature about CO2 emissions and the liberalization of natural gas in the EU. Section three (methodology) describes the data, the methods, and the model that was used. The empirical results and discussion are presented in Section four. Finally, the conclusions and policy recommendations are shown.

2. Literature

There have been significant changes in the integrated energetic gas and electricity market in the last decades. According to the Fact Sheets of the Internal Energy Market [4], the 1990’s directives are the starting point for the liberalization of the internal market for natural gas and electricity since, at this time, the major part of the national markets for electricity and gas were objects of monopoly [4]. The United Kingdom and Wales were the first countries to establish liberalization measures (e.g., [5,6]).

Newbery [5], in his analysis of the liberalization of the British electricity market, points out that the main factors that led to this were the little government incentive for the good use of available resources, in addition to the choice, often by political influence, by managers that were not qualified to take on projects in the area. In addition, liberalization was looking for a system to deliver energy efficiently, safely, and sufficiently at competitive prices [5].

This liberalization in Great Britain was positive, as [7] points out. For example, in the first five years after opening to the private market, the costs decreased by 6%, labor productivity more than doubled, the actual cost of fuel that was used to create energy dropped substantially, and new and important investments were made at a much lower cost (per unit of energy) than the cost before liberalization [7].

Thus, there were significant changes in the energy markets [8,9,10]; competitive markets replaced monopolies of public services, and the traditional public management tended to disappear, with its place being taken over by the private administration [5,10].

State members of the EU decided to open their markets gradually to the competition. In 1996, measures were adopted that predicted the countries would establish the rules as the electricity market liberalization until 1998. While for the gas market liberalization, the measures were adopted only two years later and predicted the establishment of legislation until the year 2000 [4].

According to information from the European Commission [11] in 2009, legislation about the energy market, known as the third package of energy, was approved. The package aimed to improve the internal energy market’s functioning and resolve structural problems in the energy sector [11]. Again, according to the European Commission [12], difficulties were found in entering new companies. The increased competition in the energy market failed due to the huge number of regulated prices that are still practiced by the countries.

According to the European Parliament [13], new measures were adopted in June 2019, named the directive 2019/944/EU, and three regulations (Electricity Regulation (2019/943/EU); Risk Preparedness Regulation (2019/941/EU); Regulation EU 2019/942/EU establishing an Agency for the Cooperation of Energy Regulators (ACER)). These measures introduce rules in the energy market to adapt to the necessity of renewable energies, besides attracting new investments. In addition, incentives for consumers and the introduction of the Member States’ obligation to prepare emergency plans to deal with possible electricity crises are also highlighted.

De Campos [14] also points to the importance of the Community Directive 98/30/EC, which approved the opening of the internal gas markets and reported topics such as transportation, infrastructure, storage, organization, and operation of the sector. Ref. [8] stated that these changes over time are attributed to good regulation, which solved unforeseen problems in the proceedings.

The dependence on natural gas from foreign suppliers is very high in the European Union, leaving countries in a unique situation regarding supply security [15]. The EU is dependent on imports of natural gas from an oligopoly of important producers [16].

Hulshof et al. [17] warned that the number of gas suppliers to the European market is limited. The author points out that the market faces periodic shocks in both supply and demand, which is one reason for the price distortion [17]. Given the dependence of Member States on gas imports, following the Russian-Ukrainian dispute (for natural gas) in 2009, the European Parliament established specific regulations (for further details on the regulations please access measure No 994/2010 [4]) that created ways to ensure gas imports [13].

Natural gas has a great advantage over electricity because it can be stored [18,19]. In addition, [20] reports that natural gas, contrary to electricity, does not have what can be described as “captive uses”, forcing natural gas to be market competitive with its substitutes, at least in industrial, domestic, and tertiary sectors.

Golombek et al. [21] pointed out the various effects of partial liberalization of energy markets and stresses that liberalization causes higher CO2 emissions using fossil fuels. Based on extended tests of the proposed model, there would be an increase of approximately 8% in CO2 emissions from Western Europe in a scenario of complete liberalization. Also, according to the model, even with the increase in emissions, the proportion of the overall increase in welfare that would be generated by liberalization is valid [21].

The International Energy Agency [22] highlights that the substitution of coal with natural gas leads to a reduction in the emission of CO2 and methane in the energy sector by 50% and by 33% in the heating sector. In addition, natural gas is the cleanest source compared to other non-renewable energy sources [18]. Another advantage is the backup function for electricity production when renewable sources do not operate [23].

All over the world, several contemporary authors have studied the relationship between natural gas consumption and economic growth. See Table 1.

Table 1.

Literature on gas consumption and growth.

The enormous importance of natural gas for the development of nations goes beyond the articles and its importance in world geopolitics. For example, the main gas-producing countries, such as Iran, have their economy strongly influenced by their price, as the increase in price harms domestic gas consumption, which in turn harms economic growth [31]. Alcaraz & Villalvazo [26] present another example of this direct relationship between the availability of natural gas and the country’s growth in Mexico, which, in 2013, faced a severe lack of gas supply due to a significant increase in consumption, which was not accompanied by investments in infrastructure. This lack of supply was responsible for a 0.28% reduction in the Mexican GDP in the second quarter of 2013 alone.

Due to its direct relationship with economic growth and the increased regulation of CO2 emissions, natural gas consumption has been represented in many countries as an important source of electricity generation [18]. Table 2 shows the relationship between electric energy consumption and economic growth.

Table 2.

Literature on electricity consumption and economic growth hypotheses.

Several studies from several countries report the importance of the relationship between electricity consumption and economic growth. The neutrality, feedback, growth, and conservation hypotheses are usually tested and verified for sets of countries or time-series analyses. Belucio & Fuinhas [49] stated that, in a certain way, electricity consumption can be considered a proxy variable for the general sophistication of a society/economy.

The concern to promote economic development allied with gas emissions control passes through great environmental responsibility goals. In 2019, at COP 25 in Madrid, the need to take even more extreme measures than those that were agreed upon in Paris 2015 during COP 21 was noted, where world leaders accepted the measures that were proposed by the UN (United Nations Organisations) to reduce greenhouse gas emissions [50,51,52].

However, there was no consensus on the measures to be taken. The discussion was postponed since several developing countries, such as Brazil and China, are unwilling to take drastic measures to reduce CO2 emissions. Another significant change in the global scenario was the USA’s departure, the second-largest CO2 emitter in the world, from the Paris Agreement in 2017, seriously compromising the viability of the goals set so far.

Natural gas is an important fuel source for Europe and is expected to remain so for the next decades [53]. However, the way this gas is extracted has changed in recent years, with a significant increase in the extraction of so-called shale gas. According to the Energy Information Administration [54], shale gas is natural gas that is trapped in small pores inside shale formations (more frequent), sandstone, and other sedimentary rocks.

The world’s reserves of shale gas are vast and also, according to the Energy Information Administration [55], it is estimated that only in technically recoverable reserves outside the USA, there are 6914.1 trillion cubic feet (195.79 trillion cubic meters) of shale gas, with China having the most significant reserves. However, the United States is now the world’s largest producer, which pioneered the development of extraction technologies and increased the percentage of extracted shale gas concerning the total natural gas produced from 1.6% in 2000 to 23.1% in 2010 [26].

Also, in 2019 the Energy Information Administration [54] estimates that dry shale gas production amounted to 25.28 trillion cubic feet (715.85 billion cubic meters), accounting for 75% of the total dry natural gas production in the USA (the main gases on the market are wet natural gas and dry natural gas. Wet gas is composed of several other gases besides methane, making its use as fuel unfeasible. It does not reach the consumer without going through the processing that turns it into dry natural gas, composed almost solely of methane. This, in turn, is the gas that runs through pipelines and is delivered to the final consumer). This significant increase in production caused a drop in the price of natural gas in the USA market, from $7.7 per thousand cubic feet (28.31 cubic meters) in 2007 to $3.8 in 2012 [26].

In the environmental aspect, there is much discussion about the increase in shale gas extraction to the increase in greenhouse gas emissions [56]. According to [57], fugitive (fugitive emissions are the diffuse emissions that occur during the process of extraction, refining and transport of gas, mainly through leaks) greenhouse gas emissions from shale gas extraction in 2010 corresponded to 3.6% of all emissions that related to natural gas.

According to an analysis of methane emissions from shale gas extraction, between 3.6% and 7.9% of the extracted methane escapes into the atmosphere during the lifetime of an extraction well [58]. Also, according to this research, the environmental impact of methane greenhouse gases is greater than that of conventional gas or petroleum for any time horizon observed, especially from 20 years [58].

3. Methodology

3.1. Data

The time horizon comprises of data from 1993 to 2018 for sixteen countries (Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Luxembourg, Ireland, Italy, Netherlands, Poland, Spain, and Sweden). Initially, 25 countries were considered for the study, but the reduction was inevitable due to the lack of statistical data.

Table 3 shows, in detail, the variables that seek to explain the phenomenon of emissions, the origin of the data, and the transformations to which the variables were submitted.

Table 3.

Variables.

In Table 4, the descriptive statistics are presented. The acronyms “l” and “dl” in front of the variables mean that they were transformed into natural logarithms and first differences, respectively. Again, the number of observations makes it possible to confirm that the panel is balanced.

Table 4.

Descriptive statistics.

It is possible to measure the degree of linear association between the variables by the correlation matrix (Table 5), in which we can have three possible results: (i) negative correlation, that is, when one increases, the other always decreases; (ii) positive correlation, shows that the variables vary in the same direction; and (iii) neutral, when the variables do not depend linearly on each other.

Table 5.

Correlation Matrix.

The matrix of correlations shows an apparent absence of collinearity since all the coefficients are below 70%. Although, in order to confirm the existence or not of multicollinearity, we also conduct the VIF (variance inflation factor) test. Multicollinearity can cause distortions in the results, so it is always important to check the statistics. The results of the VIF statistics are shown in Table 6.

Table 6.

VIF Results.

Table 6 confirms that multicollinearity is not a problem for estimating the model, given that the VIF values were all slightly above 1, not reaching the usually accepted benchmark of 10 (if they surpassed this value, multicollinearity could be a problem).

We also conducted Pesaran’s [59] cross-sectional dependence (CD) test (Table 7). Again, the test’s null hypothesis, cross-sectional independence, was rejected, meaning that our panel countries share an interdependency and are susceptible to the same shocks.

Table 7.

Cross-sectional independence.

Finally, the unit root tests showed that our data are constituted by I(0) and I(1) variables and that no variable showed signs of being I(2). The details of the unit root tests are shown in Table A1 in the Appendix A. The unit root testing was conducted by using the Pesaran [60] CIPS test, which is robust to the phenomenon of cross-section dependence.

3.2. Methodology

This study’s methodological approach was based on the autoregressive distributed lag (ARDL) model in the form of an unrestricted error correction model (UECM). This approach enables us to inquire about the explanatory variables’ short- and long-run effects on the dependent variable. Additionally, the ARDL model has the advantage of being appropriate in the presence of cointegration and endogeneity, produces efficient estimates with relatively small or moderate samples, and allows the incorporation of I(0) and I(1) variables in the same estimation. This last point is especially important given that the unit root tests (Table A1) indicated the presence of variables in both integration orders (I(0) and I(1)). In Equation (1), we present the ARDL model specification in the form of an unrestricted error correction model (UECM):

where the represents the intercept, and , with t = 1, …, 5 denotes the estimated parameters, while represents the error term. Again, the prefixes “l” and “dl” denote natural logarithms and first differences, respectively. After this brief explanation of the methodological approach, in the following section, we will present the results from our model and their subsequent discussion.

4. Results and Discussion

Before proceeding with the model estimation, some specifications need to be checked. First, the Hausman test [61] translates into a clarification of which specification is the most correct for the proposed data panel analysis: the rando effects (RE) or the fixed effects (FE)? The test has the following null hypothesis: the random effects are the most suitable specification. If we reject the null, the fixed-effects specification is the most suitable. The outcomes of the Hausman test, with (chi2(9) = 42.00 with Prob > chi2 of 0.000) and without (chi2(9) = 46.41 with Prob > chi2 of 0.000), the Stata sigmamore option (which reflects more robust results), were unanimous, indicating the fixed effect specification has the most suitable one. Next, we computed a series of specification tests to decide on the best-suited estimator to conduct the analysis. Table 8 presents the results of the specification tests.

Table 8.

Specification’s tests.

In Table 8, we show the results from the modified Wald’s test [62], Wooldridge’s test [63], Pesaran’s [59], and Friedman’s tests [64] for cross-sectional independence, and the Breusch-Pagan Lagrange multiplier (LM) [65]. All the tests reject the null at the 1% level, meaning there is evidence of heteroscedasticity, first-order autocorrelation, and contemporaneous correlation in the model. Given these results, the use of the Driscoll & Kraay [66] estimator (fixed effects (FE)-DK) seems to be the most suitable option, given that it “is capable of producing standard errors robust to the disturbances being cross-sectionally dependent, heteroskedastic, and autocorrelated up to some lag” [67].

Before presenting the results, we should refer to that in the first model estimation, the variables “dlgdppc” and “lngcpc” were not statistically significant. Consequently, they were excluded from the model estimation. Therefore, the most parsimonious model has now the following specification (Equation (2)):

Additionally, six dummy variables were included in the model to correct the outliers that were detected in the residual’s analysis (e.g., [68]). There were three dummies for Denmark (den1996, den2003, and den2006, for the years 1996, 2003, and 2006, respectively); two for Finland (fin2005 and fin2006, for the years 2005 and 2006, respectively); and one for Luxembourg (lux1995, for the year 1995) that were used. For Denmark, the explanations for these outliers were a peak in coal consumption and an increase in oil and gas in 1996, and peaks in coal consumption in 2003 and 2006. Finland experienced a sharp drop in coal consumption in 2005. However, it is unclear what caused the 2006 abnormal increase in CO2 emissions (it may just be the effect of returning to the pre-existing situation). Luxembourg faced a sharp drop in coal consumption in 1995. In Table 9, we display the results from the model estimation (the specification tests from Table 8 were remade to ensure that the results concerning their null hypotheses stayed the same for this most parsimonious model). Moreover, we also present the results with the FE estimator to see the differences in using the FE-DK estimator.

Table 9.

Estimation results.

With the analysis of the results (Table 9), we see that the estimated coefficients have the expected signal according to economic theory. The ECM coefficient has the expected (negative) sign, which is within the expected range [−1; 0], being statistically significant at the 1% significance level.

Although the information is displayed in Table 9, we should note that the long-run elasticities are not shown in this table. This is because they had to be calculated by dividing the coefficients of the variables by the lCO2pc (ECM) coefficient, both lagged once, and then we had to multiply this ratio by (−1). Table 10 shows the short-run impacts, the model speed of adjustment, and the computed long-run elasticities.

Table 10.

Elasticities and speed of adjustment.

As we can see by the results from Table 10, the impact of natural gas consumption on CO2 emissions is positive and statically significant, but only in the short -un. This fact is not in line with, for example, the results from [69], who analyzed a similar relationship for the case of 14 Asia-Pacific countries, and whose results pointed to the existence of a short- and long-run relationship between natural gas consumption and CO2 emissions. Nevertheless, this result probably derives from the fact that although for many years, natural gas has been seen as a precious energy source, the natural gas development in Europe has been suffering a deceleration due to environmental concerns, with policy-makers starting to primarily focus on the investment on renewable sources of energy [28]. This contrasts with the situation of Asia-Pacific countries, where it is predicted that natural gas consumption will continue to grow steadily in the future [70]. In addition, there is also the case of the extreme dependence of the European countries on, for example, Russian natural gas, a fact which also contributed to cooling the consolidation of natural gas in the energy mix of many European countries due to economic and political reasons [28]. Moreover, the fact that natural gas presents a positive coefficient is not surprising, given that although natural gas emits less CO2 when it is compared with oil or coal, it still emits some amount of CO2 [71].

Nevertheless, in the short-run, we see a great difference in terms of oil consumption vs. natural gas impacts. More precisely, when compared with oil consumption, natural gas has an impact that is 6.7 times lower on CO2 emissions. Moreover, we should also stress that contrary to natural gas, oil consumption has also presented a positive and statistically significant effect on CO2 emissions in the long run. This result was far from unexpected, given that oil consumption is considered one of the major contributors to CO2 emissions increase [72].

Another result that is far from unexpected is the one from renewable and hydroelectric energy consumption. As we can see in Table 10, the energy consumption from this type of source negatively impacts CO2 emissions both in the short- and long-run. However, in the long-run, the coefficient is only statistically significant at the 10% level. Despite this last fact, we can say that the estimation results corroborate the already widely accepted view that investment in renewables is one of the major strategies to reduce emissions in the short- and long-term [73].

Regarding the GDP, the results point to, in this group of countries, economic growth had been grounded in a way that contributes to the decrease in CO2 emissions. More precisely, looking at Table 10, we see that the coefficient of GDP is revealed to have a negative sign and to be statistically significant at the 1% level in the long-run. This result is similar to the one from Dogan & Aslan [74], who analyzed a similar relationship for the case of a panel of EU countries and candidate countries. The authors also found a negative coefficient for the case of the effect of GDP on emissions, with this result following the Environmental Kuznets Curve (EKC) hypothesis. Indeed, the authors state that since their sample is primarily composed of high-income and upper-middle-income countries, the countries from their panel should be beyond the threshold level, enabling “increases in real income lead to environmental improvements” [74].

Finally, the ECM coefficient (i.e., the model’s speed of adjustment) is negative and statistically significant at the 1% level, as it should, and has a value of 14.73%, which is fast enough for the model to achieve the equilibrium in the medium-run.

5. Conclusions

A per capita analysis of natural gas’ impact on carbon dioxide emissions was performed for sixteen European countries from 1993 to 2018. An autoregressive distributed lag (ARDL) model in the form of an unrestricted error correction model, controlling for the variable’s renewables and hydroelectric consumption, oil consumption, and gross domestic product was used to conduct the analysis. The ARDL approach is a robust econometric technique that identifies the short-run impacts, the long-run elasticities, and the speed of adjustment in the variables’ relationships.

Denmark (in 1996, 2003, and 2006), Finland (in 2005 and 2006), and Luxembourg (in 1995) suffered shocks in CO2 emissions that can be related to changes in their energy mix. Furthermore, these outliers can be related to atypical coal consumption, stressing that alterations in the energy mix favoring coal use result in additional environmental damage. To cope with these outliers, “country-year” impulse dummies were included in the models’ estimation. This artifact allows for modeling of the relationships without being disturbed by the anomalous events on CO2 emissions.

The results from the ARDL model were essentially the following: (1) natural gas consumption has a positive impact on carbon dioxide emissions in the short-run; (2) oil consumption has a positive impact on carbon dioxide emissions both in the short- and long-run; (3) renewables and hydroelectric energy consumption have a negative impact on carbon dioxide emissions both in the short- and long-run; and (4) the GDP has a negative impact on carbon dioxide emissions in the long-run.

Due to these results, we can state that, first, it seems that this group of countries is being able to reduce the environmental impacts (measured by CO2 emissions) of their economic activity. The fact that GDP presents a negative coefficient in the long-run highlights the environmental improvements that are made in these economies and follows the EKC hypothesis (we should not forget that the countries from our sample are mostly high-income or upper-middle-income economies). In this sense, these countries should continue on this path. More appropriately, these countries’ governments should continue to promote the energy transition process in their respective economies. The importance of such a transition becomes clear when we look at the impacts of oil consumption vs. renewables/hydroelectric consumption on CO2 emissions. Suppose these countries want to decrease their level of emissions. In that case, they need to continue to support the promotion of low carbon energy sources, with the increase of the share of renewables in their energy mix and, at the same time, reduce the dependence of their economic activity on fossil fuels, as well as the incentives to the use of this type of energy (e.g., fossil fuel subsidies). Regarding natural gas consumption, we can state that the lack of a statistically significant long-term effect does not fully allow us to develop more profound political implications regarding this energy source. Strictly speaking, although theoretically natural gas is seen as an effective alternative to reduce greenhouse gases (it emits a significantly lower level of emissions during combustion when compared with oil and coal), the lack of a long-run relationship between this energy source and CO2 emissions does not allow us to completely corroborate this hypothesis for the sample of countries under study. However, even with the absence of a statistically significant effect in the long-run, if we compare the overall effects of natural gas and oil on CO2 emissions, it seems that the use of natural gas is indeed less harmful to the environment than oil (in the short-run, natural gas has an impact that is 6.7 times lower on CO2 emissions). Thus, we can say that, by the results that were achieved, it appears that having to use non-renewable energy, governments should continue to prefer natural gas over oil.

Given this last issue/limitation (the lack of a statistically significant effect from natural gas in the long run), future investigations on this thematic should be centered on a panel of European countries where natural gas already has a considerable weight in their energy mix and where the natural gas industry is already at an adequate level of development. This approach is required to obtain more robust results regarding the impact of natural gas on CO2 emissions.

Author Contributions

Conceptualization, M.B., J.A. and L.B.; Methodology, M.B., R.S., J.A. and J.A.F.; Software, R.S., M.B. and J.A.; Supervision, J.A.F.; Writing—original draft, M.B., R.S., J.A.F., L.B. and J.A.; Writing—review & editing, M.B., R.S., J.A.F., L.B. and J.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by CeBER R&D unit funded by national funds through FCT—Fundação para a Ciência e a Tecnologia, I.P., project UIDB/05037/2020.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data available on request from the corresponding authors.

Acknowledgments

The first author gratefully acknowledges the support of The Economy of Francesco (EoF) Fellowship Program 2021/2022. The authors expressed gratitude to the reviewers for their valuable comments.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Unit roots test Pesaran [61] Panel Unit Root test (CIPS).

Table A1.

Unit roots test Pesaran [61] Panel Unit Root test (CIPS).

| Without Trend | With Trend | ||||||

|---|---|---|---|---|---|---|---|

| Variable | Lags | Zt−bar | p-Value | Variable | Lags | Zt−bar | p-Value |

| lCO2pc | 0 | −3.259 | 0.001 | lCO2pc | 0 | −3.062 | 0.001 |

| lCO2pc | 1 | −2.110 | 0.017 | lCO2pc | 1 | −1.861 | 0.031 |

| lgdppc | 0 | 1.643 | 0.950 | lgdppc | 0 | 1.573 | 0.942 |

| lgdppc | 1 | −1.599 | 0.055 | lgdppc | 1 | −1.683 | 0.046 |

| lngcpc | 0 | −3.092 | 0.001 | lngcpc | 0 | −4.825 | 0.000 |

| lngcpc | 1 | −1.553 | 0.060 | lngcpc | 1 | −4.028 | 0.000 |

| locpc | 0 | 0.443 | 0.671 | locpc | 0 | −3.233 | 0.001 |

| locpc | 1 | 1.354 | 0.912 | locpc | 1 | −2.053 | 0.020 |

| lrchcpc | 0 | −3.525 | 0.000 | lrchcpc | 0 | −3.193 | 0.001 |

| lrchcpc | 1 | −1.93 | 0.027 | lrchcpc | 1 | −1.185 | 0.118 |

| dlCO2pc | 0 | −13.29 | 0.000 | dlCO2pc | 0 | −11.987 | 0.000 |

| dlCO2pc | 1 | −9.44 | 0.000 | dlCO2pc | 1 | −7.86 | 0.000 |

| dlgdppc | 0 | −5.770 | 0.000 | dlgdppc | 0 | −3.805 | 0.000 |

| dlgdppc | 1 | −3.938 | 0.000 | dlgdppc | 1 | −2.137 | 0.016 |

| dlngcpc | 0 | −11.614 | 0.000 | dlngcpc | 0 | −9.811 | 0.000 |

| dlngcpc | 1 | −8.741 | 0.000 | dlngcpc | 1 | −6.51 | 0.000 |

| dlocpc | 0 | −12.596 | 0.000 | dlocpc | 0 | −11.217 | 0.000 |

| dlocpc | 1 | −7.988 | 0.000 | dlocpc | 1 | −5.849 | 0.000 |

| dlrchcpc | 0 | −13.933 | 0.000 | dlrchcpc | 0 | −12.567 | 0.000 |

| dlrchcpc | 1 | −8.284 | 0.000 | dlrchcpc | 1 | −6.534 | 0.000 |

References

- Eurostat. EU Energy Mix and Import Dependency. 2022. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=EU_energy_mix_and_import_dependency#Natural_gas (accessed on 25 March 2022).

- Brodny, J.; Tutak, M. Analysis of the efficiency and structure of energy consumption in the industrial sector in the European Union countries between 1995 and 2019. Sci. Total Environ. 2022, 808, 152052. [Google Scholar] [CrossRef] [PubMed]

- Tutak, M.; Brodny, J. Renewable energy consumption in economic sectors in the EU-27. The impact on economics, environment and conventional energy sources. A 20-year perspective. J. Clean. Prod. 2022, 345, 131076. [Google Scholar]

- European Parliament and Council of the European Union. Regulation (EU) 2017/1938 of the European Parliament and of the Council. 2017. Available online: https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX:32017R1938 (accessed on 9 April 2022).

- Newbery, D. Electricity liberalization in Britain and the evolution of market design. In Electricity Market Reform: An International Perspective; Elsevier: Oxford, UK, 2006; pp. 319–382. [Google Scholar]

- Sioshansi, F.P.; Pfaffenberger, W. (Eds.) Electricity Market Reform: An International Perspective; Elsevier: Oxford, UK, 2006. [Google Scholar]

- Newbery, D.M.; Pollitt, M.G. The restructuring and privatization of Britain’s CEGB—Was it worth it? J. Ind. Econ. 1997, 45, 269–303. [Google Scholar] [CrossRef]

- Batalla-Bejerano, J.; Costa-Campi, M.T.; Trujillo-Baute, E. Collateral effects of liberalization: Metering, losses, load profiles, and cost settlement in Spain’s electricity system. Energy Policy 2016, 94, 421–431. [Google Scholar] [CrossRef]

- García, L.A.R. The liberalization of the Spanish gas market. Energy Policy 2006, 34, 1630–1644. [Google Scholar] [CrossRef]

- Ferreira, P.; Soares, I.; Araújo, M. Liberalization, consumption heterogeneity, and the dynamics of energy prices. Energy Policy 2005, 33, 2244–2255. [Google Scholar] [CrossRef]

- European Commission. Third Energy Package. 2020. Available online: https://ec.europa.eu/energy/topics/markets-and-consumers/market-legislation/third-energy-package_en (accessed on 26 April 2022).

- European Commission. EU Energy Markets in Gas and Electricity—State of Play of Implementation and Transposition. 2010. Available online: https://www.europarl.europa.eu/meetdocs/2009_2014/documents/itre/dv/a_itre_st_2009_14_eu_energy_markets_/a_itre_st_2009_14_eu_energy_markets_en.pdf (accessed on 30 January 2022).

- European Parliament. Mercado Interno da Energia. 2021. Available online: https://www.europarl.europa.eu/factsheets/pt/sheet/45/mercado-interno-da-energia (accessed on 17 July 2022).

- De Campos, V.L.P. Harmonização, uniformização e unificação das normas jurídicas: A integração para o desenvolvimento do mercado de gás natural. Rev. Bras. De Direito Do Petróleo Gás E Energ. 2013, 2, 149–195. [Google Scholar] [CrossRef]

- Baltensperger, T.; Füchslin, R.M.; Krütli, P.; Lygeros, J. European Union gas market development. Energy Econ. 2017, 66, 466–479. [Google Scholar] [CrossRef][Green Version]

- Slabá, M.; Gapko, P.; Klimešová, A. Main drivers of natural gas prices in the Czech Republic after the market liberalization. Energy Policy 2013, 52, 199–212. [Google Scholar] [CrossRef]

- Hulshof, D.; van der Maat, J.P.; Mulder, M. Market fundamentals, competition, and natural-gas prices. Energy Policy 2016, 94, 480–491. [Google Scholar] [CrossRef]

- Destek, M.A. Natural gas consumption and economic growth: Panel evidence from OECD countries. Energy 2016, 114, 1007–1015. [Google Scholar] [CrossRef]

- Solarin, S.A.; Shahbaz, M. Natural gas consumption and economic growth: The role of foreign direct investment, capital formation, and trade openness in Malaysia. Renew. Sustain. Energy Rev. 2015, 42, 835–845. [Google Scholar] [CrossRef]

- Percebois, J. The supply of natural gas in the European Union—Strategic issues. OPEC Energy Rev. 2008, 32, 33–53. [Google Scholar] [CrossRef]

- Golombek, R.; Brekke, K.A.; Kittelsen, S.A.C. Is electricity more important than natural gas? Partial liberalization of the Western European energy markets. Econ. Model. 2013, 35, 99–111. [Google Scholar] [CrossRef]

- International Energy Agency. The Role of Gas in Today’s Energy Transitions. 2019. Available online: https://www.iea.org/reports/the-role-of-gas-in-todays-energy-transitions (accessed on 14 April 2022).

- Samseth, J. Will the introduction of renewable energy in Europe lead to CO2 reduction without nuclear energy? Environ. Dev. 2013, 6, 130–132. [Google Scholar] [CrossRef]

- Ummalla, M.; Samal, A. The impact of natural gas and renewable energy consumption on CO2 emissions and economic growth in two major emerging market economies. Environ. Sci. Pollut. Res. 2019, 26, 20893–20907. [Google Scholar] [CrossRef]

- Bouwmeester, M.C.; Oosterhaven, J. Economic impacts of natural gas flow disruptions between Russia and the EU. Energy Policy 2017, 106, 288–297. [Google Scholar] [CrossRef]

- Alcaraz, C.; Villalvazo, S. The effect of natural gas shortages on the Mexican economy. Energy Econ. 2017, 66, 147–153. [Google Scholar] [CrossRef]

- Solarin, S.A.; Ozturk, I. The relationship between natural gas consumption and economic growth in OPEC members. Renew. Sustain. Energy Rev. 2016, 58, 1348–1356. [Google Scholar] [CrossRef]

- Balitskiy, S.; Bilan, Y.; Strielkowski, W.; Štreimikienė, D. Energy efficiency and natural gas consumption in the context of economic development in the European Union. Renew. Sustain. Energy Rev. 2016, 55, 156–168. [Google Scholar] [CrossRef]

- Furuoka, F. Natural gas consumption and economic development in China and Japan: An empirical examination of the Asian context. Renew. Sustain. Energy Rev. 2016, 56, 100–115. [Google Scholar] [CrossRef]

- Ozturk, I.; Al-Mulali, U. Natural gas consumption and economic growth nexus: Panel data analysis for GCC countries. Renew. Sustain. Energy Rev. 2015, 51, 998–1003. [Google Scholar] [CrossRef]

- Heidari, H.; Katircioglu, S.T.; Saeidpour, L. Natural gas consumption and economic growth: Are we ready to natural gas price liberalization in Iran? Energy Policy 2013, 63, 638–645. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H.; Farooq, A. Natural gas consumption and economic growth in Pakistan. Renew. Sustain. Energy Rev. 2013, 18, 87–94. [Google Scholar] [CrossRef]

- Khan, H.; Khan, I.; Bibi, R. The role of innovations and renewable energy consumption in reducing environmental degradation in OECD countries: An investigation for Innovation Claudia Curve. Environ. Sci. Pollut. Res. 2022, 29, 43800–43813. [Google Scholar] [CrossRef]

- Jamil, M.N. Critical Analysis of Energy Consumption and Its Impact on Countries Economic Growth: An empirical analysis base on Countries income level. J. Environ. Sci. Econ. 2022, 1, 1–14. [Google Scholar] [CrossRef]

- Khan, I.; Han, L.; Khan, H.; Kim Oanh, L.T. Analyzing renewable and nonrenewable energy sources for environmental quality: Dynamic investigation in developing countries. Math. Probl. Eng. 2021, 2021, 3399049. [Google Scholar] [CrossRef]

- Fuinhas, J.A.; Marques, A.C. (Eds.) The Extended Energy-Growth Nexus: Theory and Empirical Applications; Academic Press: Cambridge, MA, USA, 2019; ISBN 9780128157190. [Google Scholar]

- Belucio, M.; Lopes, C.; Fuinhas, J.A.; Marques, A.C. Energy–growth nexus, domestic credit, and environmental sustainability: A panel causality analysis. In The Extended Energy-Growth Nexus: Theory and Empirical Applications; Fuinhas, J.A., Marques, A.C., Eds.; Academic Press: Cambridge, MA, USA, 2019; pp. 173–197. [Google Scholar] [CrossRef]

- Shahbaz, M.; Mallick, H.; Mahalik, M.K.; Sadorsky, P. The role of globalization on the recent evolution of energy demand in India: Implications for sustainable development. Energy Econ. 2016, 55, 52–68. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The impact of renewable energy consumption to economic growth: A panel data application. Energy Econ. 2016, 53, 58–63. [Google Scholar] [CrossRef]

- Osman, M.; Gachino, G.; Hoque, A. Electricity consumption and economic growth in the GCC countries: Panel data analysis. Energy Policy 2016, 98, 318–327. [Google Scholar] [CrossRef]

- Menegaki, A.N. On energy consumption and GDP studies; A meta-analysis of the last two decades. Renew. Sustain. Energy Rev. 2014, 29, 31–36. [Google Scholar] [CrossRef]

- Aşıcı, A.A. Economic growth and its impact on the environment: A panel data analysis. Ecol. Indic. 2013, 24, 324–333. [Google Scholar] [CrossRef]

- Chen, Z.M.; Chen, G.Q. An overview of energy consumption of the globalized world economy. Energy Policy 2011, 39, 5920–5928. [Google Scholar] [CrossRef]

- Marques, A.C.; Fuinhas, J.A.; Manso, J.R.P. Motivations driving renewable energy in European countries: A panel data approach. Energy Policy 2010, 38, 6877–6885. [Google Scholar] [CrossRef]

- Payne, J.E. A survey of the electricity consumption-growth literature. Appl. Energy 2010, 87, 723–731. [Google Scholar] [CrossRef]

- Ozturk, I. A Literature survey on energy-growth nexus. Energy Police 2010, 38, 340–349. [Google Scholar] [CrossRef]

- Erdal, G.; Erdal, H.; Esengün, K. The causality between energy consumption and economic growth in Turkey. Energy Policy 2008, 36, 3838–3842. [Google Scholar] [CrossRef]

- Kraft, J.; Kraft, A. On the Relationship between Energy and GNP. J. Energy Dev. 1978, 3, 401–403. [Google Scholar]

- Belucio, M.; Fuinhas, J.A. Fatores que influenciam as visitas turístico-religiosas ao Santuário de Fátima: Uma perspectiva econômica. Estud. De Relig. 2019, 33, 159–180. [Google Scholar] [CrossRef]

- Christoff, P. The promissory note: COP 21 and the Paris Climate Agreement. Environ. Politics 2016, 25, 765–787. [Google Scholar] [CrossRef]

- Lal, R. Beyond COP 21: Potential and challenges of the “4 per Thousand” initiative. J. Soil Water Conserv. 2016, 71, 20A–25A. [Google Scholar] [CrossRef]

- Morgan, J. Paris COP 21: Power that speaks the truth? Globalizations 2016, 13, 943–951. [Google Scholar] [CrossRef]

- Dilaver, Ö.; Dilaver, Z.; Hunt, L.C. What drives natural gas consumption in Europe? Analysis and projections. J. Nat. Gas Sci. Eng. 2014, 19, 125–136. [Google Scholar] [CrossRef]

- Energy Information Administration. How Much Shale Gas is Produced in the United States? 2020. Available online: https://www.eia.gov/tools/faqs/faq.php?id=907&t=8 (accessed on 1 April 2022).

- Energy Information Administration. World Shale Resources Assessments. 2015. Available online: https://www.eia.gov/analysis/studies/worldshalegas/ (accessed on 5 April 2022).

- Jacoby, H.; O’Sullivan, F.; Paltsev, S. The Influence of Shale Gas on U.S. Energy and Environmental Policy. Econ. Energy Environ. Policy 2012, 1, 37–52. [Google Scholar] [CrossRef]

- O’Sullivan, F.; Paltsev, S. Shale Gas Production: Potential versus Actual Greenhouse Gas Emissions. Environ. Res. Lett. 2012, 7, 44030. [Google Scholar] [CrossRef]

- Howarth, R.W.; Santoro, R.; Ingraffea, A. Methane and the greenhouse-gas footprint of natural gas from shale formations. Clim. Change 2011, 106, 679–690. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; Cambridge Working Papers in Economics; Faculty of Economics, University of Cambridge: Cambridge, UK, 2004; p. 435. [Google Scholar]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification tests in econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 4th ed.; Prentice Hall: Englewood Cliffs, NJ, USA, 2000. [Google Scholar]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; The MIT Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Friedman, M. The use of ranks to avoid the assumption of normality implicit in the analysis of variance. J. Am. Stat. Assoc. 1937, 32, 675–701. [Google Scholar] [CrossRef]

- Breusch, T.S.; Pagan, A.R. The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Driscoll, J.C.; Kraay, A.C. Consistent covariance matrix estimation with spatially dependent panel data. Rev. Econ. Stat. 1998, 80, 549–559. [Google Scholar] [CrossRef]

- Santiago, R.; Fuinhas, J.A.; Marques, A.C. The impact of globalization and economic freedom on economic growth: The case of the Latin America and Caribbean countries. Econ. Change Restruct. 2020, 53, 61–85. [Google Scholar] [CrossRef]

- Koengkan, M.; Santiago, R.; Fuinhas, J.A. The impact of public capital stock on energy consumption: Empirical evidence from Latin America and the Caribbean region. Int. Econ. 2019, 160, 43–55. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Li, H.; Liao, H. Does natural gas consumption mitigate CO2 emissions: Testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew. Sustain. Energy Rev. 2018, 94, 419–429. [Google Scholar] [CrossRef]

- Xiong, P.; Li, K.; Shu, H.; Wang, J. Forecast of natural gas consumption in the Asia-Pacific region using a fractional-order incomplete gamma grey model. Energy 2021, 237, 121533. [Google Scholar] [CrossRef]

- Shearer, C.; Bistline, J.; Inman, M.; Davis, S.J. The effect of natural gas supply on US renewable energy and CO2 emissions. Environ. Res. Lett. 2014, 9, 94008. [Google Scholar] [CrossRef]

- Bildirici, E.M.; Bakirtas, T. The relationship among oil and coal consumption, carbon dioxide emissions, and economic growth in BRICTS countries. J. Renew. Sustain. Energy 2016, 8, 45903. [Google Scholar] [CrossRef]

- Saidi, K.; Omri, A. Reducing CO2 emissions in OECD countries: Do renewable and nuclear energy matter? Prog. Nucl. Energy 2020, 126, 103425. [Google Scholar] [CrossRef]

- Dogan, E.; Aslan, A. Exploring the relationship among CO2 emissions, real GDP, energy consumption and tourism in the EU and candidate countries: Evidence from panel models robust to heterogeneity and cross-sectional dependence. Renew. Sustain. Energy Rev. 2017, 77, 239–245. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).