Abstract

The Limits to Growth was a remarkable, and remarkably influential, model, book and concept published 50 years ago this year. Its importance is that it used, for essentially the first time, a quantitative systems approach and a computer model to question the dominant paradigm for most of society: growth. Initially, many events, and especially the oil crisis of the 1970s, seemed to support the idea that the limits were close. Many economists argued quite the opposite, and the later relaxation of the oil crisis (and decline in gasoline prices) seemed to support the economists’ position. Many argued that the model had failed, but a careful examination of model behavior vs. global and many national data sets assessed by a number of researchers suggests that the model’s predictions (even if they had not been meant for such a specific task) were still remarkably accurate to date. While the massive changes predicted by the model have not yet come to pass globally, they are clearly occurring for many individual nations. Additionally, global patterns of climate change, fuel and mineral depletion, environmental degradation and population growth are quite as predicted by the original model. Whether or not the world as a whole continues to follow the general patterns of the model may be mostly a function of what happens with energy and whether humans can accept constraints on their propensity to keep growing.

1. Limits to Growth: A Short History

The year 2022 is the fiftieth anniversary of The Limits to Growth (LtG). While the famous book by that name was in fact published in 1972, there were important predecessors. The concept originated in 1968 from the meeting and work of the “Club of Rome”, a group of scientists, industrialists and politicians led by Italian industrialist Aurelio Peccei, who had meetings on impending resource issues and their effect on human well-being. Later, influenced by the concept of “Systems Dynamics” and computer modeling being developed by Jay Forester at MIT, the Club of Rome commissioned Forrester and his group to generate a computer model to help understand the complex issues they were discussing. Forrester developed such a model based on five variables thought to be the most important to the human condition and their interactions: population, food production, industrialization, pollution and consumption of nonrenewable natural resources. Its original manifestation was published as a book, World Dynamics, and a summary, “The counterintuitive behavior of social systems”, which appeared in the MIT alumni magazine Technology Review in 1971 [1,2].

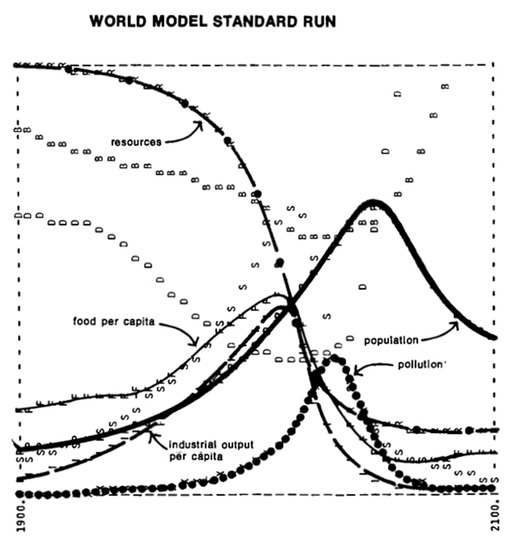

I read this paper while home from graduate school at my father’s encouragement. As an aspiring systems ecologist I was “blown away”, in the parlance of the time, by the article. The idea of the coming difficulties posed by continuing human population and material growth in a finite world was very intuitive to this aspiring systems ecologist and was quite consistent with what I had been learning about natural ecosystems and their own “limits to growth” in graduate school under Howard T. Odum. Forrester gave the development, refinement and promulgation of the project to Donella Meadows, a post doc at Harvard, and his graduate students Dennis Meadows, Jorgen Randers and William Behrens. They refined and ran Forrester’s model under many assumptions and published the results as the book The Limits to Growth [3]. The model and book showed that a continuation of the then exponential growth of the human population and economy, combined with the finite nature of both resources and the Earth’s ability to assimilate pollution, would lead eventually to serious instabilities in basic global economic conditions, a large decline in the material quality of life and even the number of human beings (Figure 1). “The behavior mode of the system shown in Figure 35 (Figure 1 in this paper) is clearly overshoot and collapse… In the very process of that growth … (as) mines are depleted … more and more capital must be used for obtaining resources … Finally investment cannot keep up with depreciation and the industrial base collapses, taking with it the service and agricultural systems which have become dependent upon industrial inputs” (p. 124). One of the most interesting and troubling conclusions from running many variants of the model was that the only way one could stabilize model output (and presumably the future conditions for humans) was to limit population growth, greatly restrict all investments beyond replacing existing infrastructure and assume some technical improvements. The book sold almost 12 million copies, was translated into 37 languages and became the best-selling environmental book of all time. It was selected as one of the most influential environmental books of the 20th century. Many people paid a great deal of attention to it.

Figure 1.

The “Standard model” output for the original Limits to Growth study [3].

Events of that time and shortly after seemed consistent with the conclusions of the LTG model. Long lines at gasoline stations during the “energy crises” of the 1970s and severe economic events, including “stagflation”, as well as a series of quite pessimistic books and reports about the future came out (or had come out) by ecologists Ehrlich and Harden and naturalist Carson. Many additional reports in scientific journals all seemed to give credibility to the point of view that our population and our economy had in many ways exceeded the world’s “carrying capacity” for humans and their activities. The basic message of LtG, that the growth that the world had become adjusted to, and liked, might not continue indefinitely, was counter to almost everything that people were hearing from politicians, economists and advertisements. This came as a great shock to most of society, which had become quite used to the concept, fully promulgated by their political leaders and the media, that each generation would be better off materially than the one before it—that continued growth in populations, economies and affluence were the normal course of events and even their birthright.

2. The Response of Economists and the Fading of the Message

The message was not popular with many economists who did not accept the absolute scarcity of resources. The return to growth, they said, was just a matter of implementing a series of proper incentives and market-based reforms, as well as dispensing with the dangerous ideas of absolute limits. A series of scathing reports appeared directed at the LtG [4,5,6,7]. They argued that technical innovations and resource substitutions, driven by market incentives, would solve the longer-term issues, as it had in the past. To many, they appeared to be correct as enormous quantities of previously discovered but unexploited oil and gas from Alaska and from outside the U.S. were developed in the 1980s in response to the higher oil prices. Economists felt that their view was validated by this turn of events, the return of economic growth and better economic conditions. Many argued that since the severe changes predicted by the LtG had not come true they could dismiss the model as pure fantasy.

3. Was the Model Incorrect?

Clearly, even the most rabid supporter of limits to growth has to accept that the substantial declines in human numbers and the other large changes “predicted” by the LTG model have not occurred yet for the Earth as a whole. Since 1972, the global human population has more than doubled, and the global economy has increased by a factor of four, fueled by an increase in energy use by 2.6 times. This is true even though it is clear that increased affluence and availability of birth control has dampened population growth (as was included in the original model), and some argue that the human condition has never been better [8]. Whatever adverse environmental or depletion issues may have occurred, they did not seem to have limited the global growth of humans or their economies.

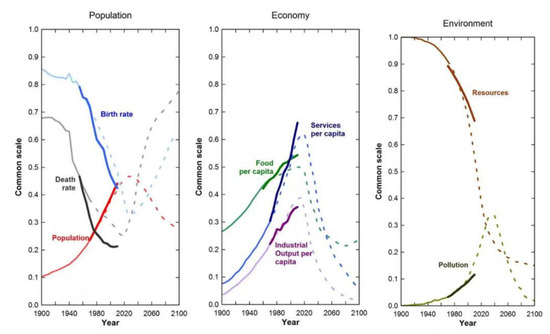

How has this been possible? The most common answer is that technology, combined with market economics or other social-incentive systems, has enormously increased the carrying capacity of the Earth for humans. This is probably true, but the real picture is quite different. First, as stated explicitly by the LtG’s authors, they were not trying to build an explicit predictor but rather a device for understanding the relation of the variables over time which were thought to be the major determinants of the human condition (p. 122). Second, many of the critics of the LtG had misunderstood the time scale on the bottom, partly as a consequence of the computer technology of the time, which put only the start and ending years (1900 and 2100) but did not put on intermediate years, but also because the authors were not trying to build an explicit predictor. Even so, a series of studies by myself and independently by others have shown that the “predictions” of the LTG model have actually been quite accurate (Figure 2) [9,10,11,12,13,14]. Despite our inattention, the issues raised in the LtG model, such as growth of global human populations and pollutants, and resource depletion, have been continuing to unroll relentlessly, pretty much as the model suggested. For example, roughly half of all the oil we will ever use has been produced and turned into CO2. It would seem that the main reason that LtG has received such criticism is that its message is very unpalatable to most of the rest of society.

Figure 2.

Comparison of the limits to growth standard run with subsequent empirical data [13].

4. Limits to Growth Today

In recent decades, there has been renewed discussion in academia and the media about the environmental impacts of human activity, especially those related to climate change and biodiversity loss, but far less on the diminishing resource base for humans. Fossil fuels are seen increasingly as “the bad guys” that generate climate change, rather than as the basis of most of our wealth (both are true). All politicians promise growth in affluence. Concern over climate-related issues has spawned an enormous development of new science, semi-science and pseudoscience focused on one or another aspect of continued growth. The main focus and lexicon have become associated with the words “sustainable” or “unsustainable”, which normally are not defined in a way consistent with the more fundamental questions asked in LtG.

For the general public, anything related to the limits to growth is not an issue of concern or even on their personal radar. Although analysis is muddied by the impacts of COVID-19, there was evidence that even before the virus that economic growth had stopped or declined for Europe and other regions, economies had stopped growing [9], and there is much social unrest associated with economic constrictions. There are additional issues unfolding related to the recent actions of Russia restricting energy flows to Europe. All of these issues are enabled and exacerbated by the fact that we are approaching many limits, although we need more time to see the real patterns.

5. Energy as the Critical Resource

At this point, I may appear to shift my focus somewhat from the actual LTG assessment to my own area of expertise: energy. In fact, while energy was barely considered explicitly in the original LTG studies, it serves as the best example for what the original authors considered “resources”, for three reasons. First, energy is the most important and general resource [15,16]. With enough cheap energy, other resources generally can be derived. Second, if energy is constrained then all other resources are likely to be constrained too, as energy is required to obtain all resources [17,18,19]. Third, the use of energy as “resources” tremendously supports and actualizes the main results of the original LtG model. Thus, I make the case that our present and future energy possibilities play the same role as “resources” in the original LTG model. As the quantity and quality of fossil fuel resources decline, it will represent what is happening with most other non-renewable resources, all of which will result in a diversion of capital from production of consumer products to investments required to maintain flows. The next section develops why energy, at the moment seemingly unconstrained, is likely to be increasingly limited along with the provision of food, industrial products and services.

I start with the simple observation that, historically, most of our economic growth (industrial, service and agricultural output per capita in the original LtG) has been dependent upon the use of more and more energy. Fossil fuels were a bonanza that allowed an enormous increase in human numbers and per capita affluence [15,16,17,18,19] and are the basis of most of our economies, wealth, increased life span, food supply, economic growth and so on. At the time of the publication of the LtG, they provided about 80 percent of our energy supply, which they continue to carry out today, although the absolute amounts are much larger. While “renewables” (usually referring to photovoltaics and wind) are receiving a lot of attention and are growing rapidly, it is from a small base so that all such renewables still represent only about five percent of our energy supply, still less than the traditional renewables of hydropower and firewood.

Technology does not work for free. As originally pointed out in the early 1970s, increased agricultural yield is achieved principally through the greater use of fossil fuels for cultivation, manufacturing and applying fertilizers, water and pesticides, drying crops, food preservation and so on, so that it takes some 10 calories of petroleum to generate each calorie of food that we eat, divided nearly equally between the farm, transport and processing and preparation [19]. The net effect is that nearly 20 percent of all the energy used in the United States, and more elsewhere, goes to our food system. Likewise, energy use is highly correlated with total industrial production as well as GDP [15,16,17,18]. There was a nearly perfect correlation between the increase in GDP and the use of energy in the United States economy from 1904 until 1984 and a continued but less tight relation since [18].

6. Limits to Growth of Energy

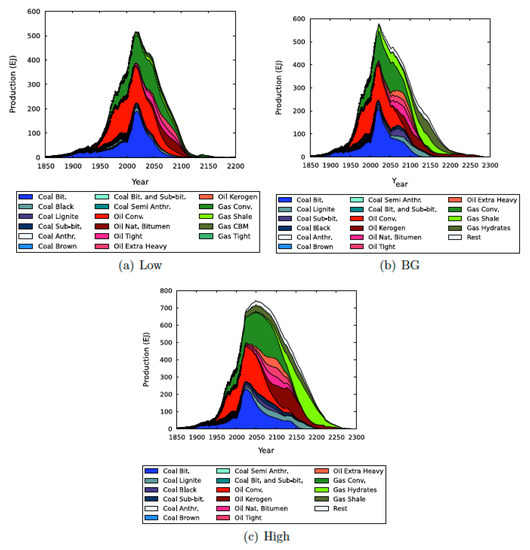

If energy is the most important resource and determines the output of agriculture, services and industrial products (the three main outputs of the LtG model), what is likely to be the future of energy availability? There are two main considerations: quantity and quality. Oil is our most important source of energy, and the concept of “peak oil” once received a lot of attention. Peak oil has retreated into the background with the success of the new technology of “fracking” for oil, increasing concerns about CO2 and, more recently, the economic constrictions of COVID-19. Nevertheless, depletion continues year by year, we are extracting far more oil than we are finding, and global peak oil clearly has occurred for what is normally considered conventional petroleum and even “all liquids”. Some 38 of the 46 largest oil producing countries have reached a peak and then (most) a subsequent decline, most following a classic “Hubbert curve” [20]. Oil production is declining everywhere except the Middle East and arguably Russia and North America, so that peak oil has occurred on five of seven continents and for most oil producing nations [21]. The best estimates for future supplies of oil (and all fossil fuels) are probably those of Mohr et al. [22], which give a pretty sobering account of how much fossil fuel remains and how production may be curtailed shortly (Figure 3). Their “low” and “best estimate” graphs are quite in line with the original LtG prediction of “resources”, i.e., that roughly half have been used up by 2020. All of this has been verified by our own research, which found official estimates of remaining oil to be based on highly flawed methods that resulted in values too high by at least a factor of two [23,24].

Figure 3.

Predictions of future production of all fossil fuels under the assumption of low, medium and high estimates of all resources [22].

Meanwhile EROI, or energy return on investment, the energy recovered from one unit of energy invested in obtaining it, continues to decline [25,26,27,28]. EROI, in a sense, is the most important index of the quality of a deposit. It integrates the two main countervailing forces operating over time that effect the efficiency of winning energy from nature: increases due to technological progress and decreases due to depletion. Since the EROI of most fossil fuels is decreasing, depletion is the dominant force [23,24,25,26,27,28,29].

The importance of a high EROI for the production of wealth can be seen clearly from the work conducted by Carey King [29]. About half of the economic activity of England from about 1300 to 1750 was dedicated to generating the energy (food, fodder, wood) to run the other half of the economy, implying an EROI of something like 2:1 for the energy sector. Civilization certainly existed, and people may or may not have been basically happy, but they were certainly poor by today’s standards, with very constrained food options, generally short lifespans, little travel and little or no recreation as we understand it. This ratio held until the beginning of the industrial revolution (about 1750), when the EROI increased to perhaps 5:1 with coal and then 10:1 or more with oil [28]. For the first time, many people became fairly well off. This relative affluence for many continues today, when we pay only about five percent of our GDP for energy (except when, in periodic “energy crises”, it goes up to and above 10 percent). Thus, for a modern civilization with education, health care, complex arts, etc., we do not need just a positive EROI but a substantially positive one, with an EROI of something like at least 10 or 12:1 [25,26]. One can imagine a modern society existing on an EROI of say 2:1, as England did in 1500, but in this society half of all economic activity would be dedicated to generating the fuels that would allow the other half to exist [27]. Society could be as poor as England in 1700, and this ignores the fact that there are many more people to feed.

Many studies suggest that in the past few decades our best oil and gas fields and coal mines are increasingly depleted, and the EROI for all fuels has been decreasing [25,26,27,28,29,30]. Laherrere believes that our current “official” estimates of oil remaining (e.g., from EIA) are several times too high since they are inflated with “ghost” amounts that are politically but not geologically derived [23,24], include large amounts of ultra-heavy “tar sands” and use inappropriate accounting procedures. Such assessments give support for Mohr’s “low” estimates (Figure 3) and the decline in resource availability in the original LtG.

7. What about Efficiency?

Limiting the growth of people or economies is extremely unpopular among economists, politicians and probably most voters, who have been conditioned on the supposed virtues of indefinite economic growth. Hence, most advocates of less energy use in the future often focus on improved efficiency, promising “green growth” and that we can have our cake and eat it too. By some arguments, the efficiency of turning energy into wealth has been increasing by about one percent a year. However, there are a number of problems with increased efficiency as a solution. First, it may be an artifact of GDP accounting, which must be corrected year by year for inflation. Some (arguably) believe that inflation is deliberately underestimated by about one percent per year [31]. If this is true, there has been little or no increase in efficiency. Other arguments have been that the United States had in past decades moved heavy polluting industrial production overseas, which would also make our energy intensity appear to be less [32]. Technology is a double-edged sword, and the benefits of efficiency can be blunted substantially by Jevons’s paradox, the concept that increases in efficiency often lead to lower prices and greater use. “When, to save coal, the efficiency of steam engines (in the first half of the 1800s) was increased they became cheaper, more uses were found for them, and the rate of coal use increased” [33]. A striking modern example is that, while aviation fuel use per passenger-mile is down 70 percent since 1995, air traffic rose more than 10-fold, and global aviation fuel use rose over 50 percent [33]. While the world economy has become somewhat more efficient, going from generating about 100 constant dollars of GDP per gigajoule of energy in 2000 to generating about 180 in 2020, the total use of energy has increased by 150 percent. The increase in efficiency achieved clearly has not resulted in less energy used [34,35]. Efficiency can be a useful tool only if there was first instituted some kind of upper level of fuel use or economic activity. In other words, some kind of limits to growth.

8. The Transition Imperative

If anything like modern society is to survive (and for how long?), it is clear that society must transform to an economy based on renewable (or, conceivably, nuclear) fuels. There are two reasons for this: fossil fuels, being non-renewable, will eventually run out or become so depleted that they are not worth exploiting, as is the case with coal in England today [34]. The second reason is that it is increasingly clear that burning fossil fuels and generating CO2 appears to be the main contributor to climate change, and there are many pressures for reducing the production of CO2. Some analysts suggest that the investments required for this transition would be about the world’s annual GDP [35]. There is considerable disagreement on just how difficult this transition will be. Assessments based on biophysical approaches (e.g., energy and material) requirements tend to find the transition considerably more difficult and onerous than those based on financial assessments [35,36,37,38]. At a minimum, if this transition is to be undertaken, there is likely to be a major diversion of energy and hence wealth production from consumption to investment, although some argue that this will provide more net jobs and perhaps lower eventual energy costs [39].

Unfortunately, there is a series of serious additional technical and social factors that will make this transition extremely difficult. Most obviously, the growth of human populations and of material expectations provides very strong pressure for increasing economic output. Since The Limits to Growth was published, a discussion of population growth has basically disappeared from public discussion. There is probably even greater prejudice about discussing a reduction in economic growth, as essentially every political candidate promises economic growth and campaigns on how his or her economic approaches will generate more economic growth than the competition. Nevertheless, many or most serious assessments of our current environmental/resources situation call for the reduction or elimination of material growth [36,37,38]. This does not necessarily mean that the currently energy impoverished need remain that way, although asking any group to reduce their energy use is likely to be very tricky.

9. Can We Move Physically from Fossil Fuels to Renewables?

The economists’ usual response to any discussion of physical limits to anything is substitution, and fossil fuels are no exception. We hear almost daily about the need for “green”, “renewable” or related energy in the form of photovoltaic or wind-derived electricity, hydrogen or occasionally biomass. At this time, only about five percent of the world’s energy supply comes from these “new renewables”, considerably less than that once generated from the traditional renewable energies of firewood and hydroelectric power, which, like fossil fuels, are usually characterized by high EROIs and high “dispatch-ability”, meaning they can be used when needed.

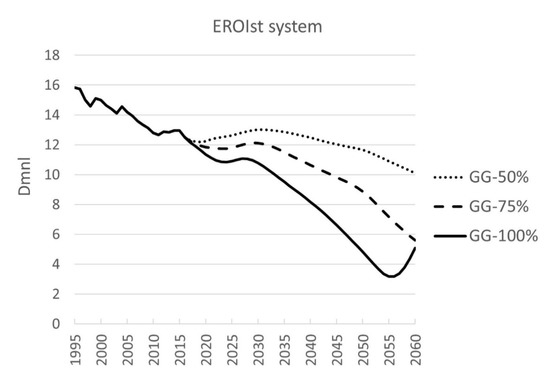

Modern renewables have an EROI approaching or in some cases exceeding that of fossil fuels [40,41,42], but there is a serious hitch. These fuels are intermittent. Their energy is available only roughly a third of the time. This means that considerable energy must be used to generate storage, dispatchable backups, excess capacity, linking wires or other procedures—especially as the proportion of renewables increase [43]. Capellán-Pérez and colleagues examined the EROI of the global society and its probable path with and without introducing 50, 75 or 100 percent renewables over the next 30 years [44]. Because of the often lower EROIs of renewables, their need for expensive backups or storage and the fact that their energy investments are up front, these authors estimate that the EROI for a world transforming to renewables would drop to as low as 4:1 or 2:1 over the next 50 or so years (Figure 4). Obviously, that would require a considerable decline in the energy going to consumption and hence the material standard of living of societies, as we predicted in 2008 [39]. It would also require enormous additional inputs of various other resources, such as copper and nickel, probably more than is available [45,46,47,48,49].

Figure 4.

Estimated EROI for the global society from 1995 to 2015, and predictions into the future with and without massive switching of fossil fuels to renewables (from 50 to 100 percent “Green Growth” renewables by 2050). Y-axis is the return to one unit invested. Source: Capellan Perez et al., 2018 [38].

A crucial issue here is investments. I prefer to consider the material investments required, although since money can be considered a lien on the energy to provide the good or service desired, they are in a sense the same. Money invested carries out nothing unless the energy is supplied to perform what is being invested in. An important constraint is that, essentially, there are but two things one can undertake with the output of an economy: one can consume it or invest it. It is a zero-sum game: one cannot both consume and invest with the same GDP. Thus, the investments that would be required for a transition to renewable energies will have to be diverted from consumption. This is likely to be a recipe for social disruption as the energy required for new investments will need to be diverted from consumption.

10. The LTG Model Is Happening Now in Many Nations

For an increasing number of nations in the world, the limits to growth are not an abstract notion but reality. When energy availability increases, as when a nation finds and develops significant new oil resources, there tends to be a general increase in the level of affluence. People buy more expensive food and housing. Prices are cheap, and the government can afford to increase the availability and level of pensions, health care, educational service and grand public works. Gasoline and bus fares are often heavily subsidized. Particular political parties take credit for the increasing affluence and levels of social services, even as politicians often skim the cream off the top of the affluence. There is enough new wealth to go around. People are happy and tend not to demonstrate against the government. They also tend to think that their affluence and increasing affluence is the way it was meant to be, a product of their cleverness and hard work. It is commonly and delightfully heard that each generation was better off than the one before—at least until recently.

However, there is a new pattern that is unrolling around the world now in many less affluent, and some affluent, nations. It was heard on the news media essentially daily in 2019 and 2020 as labor strikes, anti-government riots and general social chaos. What is not so obvious is that this social chaos tends to have a general cause and pattern that is as predicted by the LTG model. When peak oil for an oil-producing nation inevitably occurs, government revenues fall, and governments must raise previously subsidized prices for gasoline and buses and cut social services. Anger at the government and often political chaos ensues. This pattern of oil increase then decline, followed by riots and chaos, has occurred in recent years in Syria, Iran, Mexico, Egypt, Argentina, Ecuador, Venezuela, Colombia, Algeria (and its main consumer France) and in fact in most oil-producing nations. Nafeez Ahmed has analyzed this well in his book Failing States, Collapsing Systems: BioPhysical Triggers of Political Violence, but such outcomes are not surprising to anyone who views such events from a “BioPhysical” perspective [50]. All of these national patterns are an almost perfect replay of the LtG standard run but for nations rather than the world as a whole. No one views this as the limits to growth playing out but rather as a failure of whatever political party is in power. However, in fact, it is the unrolling of the issues laid out so clearly by the authors of LtG in 1972. At least four recent studies have shown that for the world the LtG model is a pretty good predictor for most parameters, even though it was not designed to be an explicit predictor (Figure 2) [10,11,12,13,14]. In addition, there is a whole suite of environmental issues barely recognized in the original study [51]. Obviously, many factors can play into social unrest, but it is simply wrong to dismiss their original model as incorrect, whatever your political, economic or philosophical leanings.

11. Implications for Teaching

One of the implications of LtG relates to the kind of economics we should use. Conventional economics requires growth, does not include energy as a factor of production and fails to meet the basic requirements required for real science [52,53,54,55]. Including the role of energy in economies, as the new discipline called BioPhysical Economics does, accomplishes what conventional economics does not: it is consistent with known scientific laws, it makes sense of history, it gives lie to indefinite growth, it explains the residual in Cobb–Douglas equations, explains the failure of the Phillips curve in the 1970s and gives an absolute limit to market solutions [17]. These ideas linking economics to the biophysical world are not new, have been part of economic thinking since 1750 and are emphasized by many natural and social scientists, including Francois Quesnay, Nicholai Georgescu Roegan, Leslie White, Frederick Cottrell, Herman Daly, Howard Odum and many others, who often expressed incredulity at how most modern economists in their theories could continuously ignore and even flaunt things known with great certainty in the natural sciences [52]. The main difference between conventional economics and BioPhysical Economics with respect to sustainability is the emphasis, indeed requirement, for continued growth in the neoclassical economics model and the acknowledgment of the physical impossibility of such indefinite growth in BPE. Increased debt can generate the illusion of continued growth and may in fact “prime the pump” for a while, but it eventually generates only inflation, as has been shown countless times in history. These fundamental problems make conventional economics a useless tool for understanding genuine sustainability.

12. What This Means for the Future: Political Implications

If, and presumably as, per capita net energy declines over the next decades, as is happening in many nations now, and probably if and as there is a transition to a very high penetration of renewable fuels, there is likely to be much less energy available per capita to support consumption. As people begin to feel the pinch, there will be increasing social and political pressure to use whatever net energy is produced to support consumption (vs. investment), whether that be for the luxury consumption of the wealthiest 10 percent or for health care for all. This will lead to less energy/money available for investment for the transition to renewables, leaving society increasingly dependent upon fossil fuels with declining output and lowering EROI or renewables with huge storage and upfront energy costs. Most people will (and do) see this as inflation.

This situation is exacerbated by essentially every political candidate, because each of them attempts to gain votes and power by promising more growth than the policies of their competitors, while blaming any reduction in growth on the policies of his or her opposition. Mention of nature’s limitations, if in any way understood, is verboten. Sometimes, the sudden availability of resources helps politicians, such as Margaret Thatcher with the North Sea oil or Donald Trump with debt-induced fracking, and sometimes the contraction hurts them, as with Jimmy Carter and peak U.S. oil or Nicolas Maduro in Venezuela [55]. However, no one gives the increase or decrease of oil or its price their due for their political success or failure, and this is unlikely to happen if and as the peak of fossil fuels unrolls, even, or perhaps especially, with the increased penetration of renewables. There are real limits to growth, and they have to be taken into account. In addition, we need a new economics to reflect this, as in [17].

13. Conclusions

The Limits to Growth, after some 50 years, remains a vital and in most respects reasonably accurate assessment of the state of the world. Many of the headlines of the world today are consistent with its predictions and for the reasons identified in the original study, although they are seldom identified as such. What is different is that, so far, it seems to be unfolding on a national or regional basis, not simultaneously for the whole world. While the original authors indicated that the model was used to understand patterns, not to make exact predictions, the world as a whole is still following fairly closely the original results of their standard run, which in fact did not predict major declines as of 2021. In their 30-year update, the authors noted that little had been accomplished toward ameliorating, or even recognizing, these problems, although there was still time. This is still true (with perhaps the exception of climate), except that we have 20 years less time.

Additionally, while resources in general remain important and often depleting, energy appears to be the special resource that limits most others, is an excellent and perhaps better understood proxy and is also following along the pattern predicted by the original model. While climate change has attracted the attention of many, it is only a part of the overall problem of too much human impact, and many of the approaches put forth for dealing with climate change (or sustainability) are at least partially, and more probably terminally, self-defeating and will cause the basic problems as identified in the LTG to continue and be exacerbated. It is likely to be impossible to continue growth as we know it, and we need politicians and political institutions that can deal with this reality honestly. If we do not undertake that now, most people will blame future resource constraints, which they will see principally as inflation, on politicians of the left or the right rather than on resource and population reality. This is a recipe for making the future of governing impossible just when we need it most. It is time to acknowledge that there are limits to growth and act accordingly.

Funding

This research received no external funding, however funding for enabling public access of this paper was generously provided by the Biophysical Economics Institute.

Acknowledgments

Roger Bentley and Jon Cooksey made important editing comments. Various other reviewers made helpful (and sometimes unhelpful) comments.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Forrester, J.W. World Dynamics; Wright-Allen Press: Cambridge, MA, USA, 1971. [Google Scholar]

- Forrester, J. Counterintuitive Behavior of Social Systems. Technol. Rev. 1971, 73, 52–68. [Google Scholar]

- Meadows, D.H.; Meadows, D.L.; Randers, J.; Behrens, W.W. The Limits to Growth: A Report for the Club of Rome’s Project on the Predicament of Mankind; Universe Books: New York, NY, USA, 1972. [Google Scholar]

- Passell, P.; Roberts, M.; Ross, L. The Limits to Growth. The New York Times, 2 April 1972. [Google Scholar]

- Cole, H.S.D.; Freeman, C.; Jahoda, M.; Pavitt, K.L.R. Models of Doom: A Critique of the Limits to Growth; Universe Publishing: Bloomington, IL, USA, 1973. [Google Scholar]

- Nordhaus, W. World dynamics: Measurement without data. Econ. J. 1973, 83, 1156–1183. [Google Scholar] [CrossRef]

- Castro, R. Arguments on the imminence of global collapse are premature when based on simulation models. GAIA 2012, 21, 271–273. [Google Scholar] [CrossRef]

- Roser, M. The Short History of Global Living Conditions and Why It Matters That We Know It. 2017. Available online: https://ourworldindata.org/a-history-of-global-living-conditions-in-5-charts (accessed on 1 June 2022).

- Irwin, N. We’re in a Low-Growth World. How Did We Get Here? The New York Times, 6 August 2016. [Google Scholar]

- Hall, C.A.S.; Day, J.W., Jr. Revisiting the Limits to Growth After Peak Oil. Am. Sci. 2009, 97, 230–237. [Google Scholar] [CrossRef]

- Turner, G.M. A comparison of the Limits to Growth with 30 years of reality. Glob. Environ. Chang. 2008, 18, 397–411. [Google Scholar] [CrossRef]

- Bardi, U. Cassandra’s Curse: How “The Limits to Growth” Was Demonized. 2011. Available online: https://www.resilience.org/stories/2011-09-15/cassandras-curse-how-limits-growth-was-demonized/ (accessed on 1 June 2022).

- Turner, G. Is Global Collapse Imminent? Melbourne Sustainable Society Institute, The University of Melbourne. 2014. Available online: http://sustainable.unimelb.edu.au/sites/default/files/docs/MSSI-ResearchPaper-4_Turner_2014.pdf (accessed on 1 June 2022).

- Branderhorst, G. Update to Limits to Growth: Comparing the World3 Model with Empirical Data. Master’s Thesis, Harvard Extension School, Cambridge, MA, USA, 2020. [Google Scholar]

- Ayres, R.; Warr, D. Accounting for growth: The role of physical work. Chang. Econ. Dyn. 2005, 16, 211–220. [Google Scholar] [CrossRef]

- Smil, V. Energy and Civilization; MIT Press: Cambridge, MA, USA, 2017. [Google Scholar]

- Hall, C.A.S.; Klitgaard, K. Energy and the Wealth of Nations: An introduction to BioPhysical Economics, 2nd ed.; Springer: New York, NY, USA, 2017. [Google Scholar]

- Cleveland, C.J.; Costanza, R.; Hall, C.A.S.; Kaufmann, R. Energy and the United States economy: A biophysical perspective. Science 1984, 225, 890–897. [Google Scholar] [CrossRef] [Green Version]

- Pimentel, D.; Pimentel, M. Food, Energy, and Society, 3rd ed.; Taylor & Francis: Abingdon, UK, 2008. [Google Scholar]

- Hallock, J.L., Jr.; Wu, W.; Hall, C.A.S.; Jefferson, M. Forecasting the limits to the availability and diversity of global conventional oil supply: Validation. Energy 2014, 64, 130–153. [Google Scholar] [CrossRef] [Green Version]

- Mushalik, M.; (Crude Oil Peak, Sidney, Australia). Personal communication, 2019.

- Mohr, S.H.; Wang, J.; Ellem, G.; Ward, J.; Giurco, D. Projection of world fossil fuels by country. Fuel 2015, 141, 120–135. [Google Scholar] [CrossRef]

- Laherrere, J. ASPO (Association for the Study of Peak Oil, Boussay, France). Available online: https://www.peakoil.net/ (accessed on 1 June 2022).

- Jean, L.; Hall, C.A.S.; Bentley, R. How much oil remains or the world to produce? Comparing assessment methods, and separating fact from fiction. Curr. Res. Environ. Sustain. 2022, in press. [Google Scholar]

- Hall, C.A.S.; Balogh, S.; Murphy, D.J.R. What is the Minimum EROI that a Sustainable Society Must Have? Energies 2009, 2, 25–47. [Google Scholar] [CrossRef]

- Lambert, J.; Hall, C.A.S.; Balogh, S.; Gupta, A.; Arnold, M. Energy, EROI and quality of life. Energy Policy 2014, 64, 153–167. [Google Scholar] [CrossRef] [Green Version]

- Hall, C.A.S. Energy Return on Investment: A Unifying Principle for Biology, Economics and Sustainability; Springer-Nature: New York, NY, USA, 2017. [Google Scholar]

- Hall, C.A.S.; Lambert, J.G.; Balogh, S.B. EROI of different fuels and the implications for society. Energy Policy 2014, 64, 141–152. [Google Scholar] [CrossRef] [Green Version]

- King, C.W. Comparing world economic and net energy metrics, Part 3: Macroeconomic Historical and Future Perspectives. Energies 2015, 8, 12997–13020. [Google Scholar] [CrossRef] [Green Version]

- Masnadi, M.S.; Brandt, A.R. Energetic productivity dynamics of global super-giant oilfields. Energy Environ. Sci. 2017, 10, 1493–1504. [Google Scholar] [CrossRef]

- Available online: https://en.wikipedia.org/wiki/Shadowstats.com (accessed on 14 June 2022).

- Kaufmann, R.K. A Biophysical analysis of the energy/real GDP ratio: Implications for substitution and technical change. Ecol. Econ. 1992, 6, 35–56. [Google Scholar] [CrossRef]

- Jevons, S. The Coal Question; MacMillan: London, UK, 1866. [Google Scholar]

- Brockway, P.E.; Sorrell, S.; Semieniuk, G.; Heun, M.K.; Court, V. Energy efficiency and economy-wide rebound effects: A review of the evidence and its implications. Renew. Sustain. Energy Rev. 2021, 141, 110781. [Google Scholar] [CrossRef]

- Yale School of the Environment. The Global Price Tag for 100 Percent Renewable Energy: $73 Trillion (vs. World GDP 2019 of 87 Trillion Dollars); Yale School of the Environment: New Haven, CT, USA, 2019. [Google Scholar]

- The Postcarbon Institute. The Human Superorganism. Various Publications. Available online: https://youtu.be/oNewKEOby80 (accessed on 1 June 2022).

- Millward-Hokpins, J.; Steinberger, J.K.; Rao, N.D.; Oswalda, Y. Providing decent living with minimum energy: A global scenario. Glob. Environ. Chang. 2020, 65, 102168. [Google Scholar]

- Semieniuk, G.; Taylor, L.; Rezai, A.; Foley, D.K. Plausible energy demand patterns in a growing global economy with climate policy. Nat. Clim. Chang. 2021, 11, 313–318. [Google Scholar] [CrossRef]

- Hall, C.A.S.; Powers, R.; Schoenberg, W. Peak oil, EROI, investments and the economy in an uncertain future. In Renewable Energy Systems: Environmental and Energetic Issues; Pimentel, D., Ed.; Elsevier: London, UK, 2008; pp. 113–136. [Google Scholar]

- Kubiszewski, I.; Cleveland, C.J.; Endres, P.K. Meta-analysis of net energy return for wind power systems. Renew. Energy 2010, 35, 218–225. [Google Scholar] [CrossRef]

- Brockway, P.E.; Owen, A.; Brand-Correa, L.I.; Hardt, L. Estimation of global final-stage energy-return-on-investment for fossil fuels with comparison to renewable energy sources. Nat. Energy 2019, 4, 612–621. [Google Scholar] [CrossRef] [Green Version]

- DuPont, E.; Koppelaar, R.; Jeanmart, H. Global available wind energy with physical and energy return on investment constraints. Appl. Energy 2018, 209, 322–338. [Google Scholar] [CrossRef]

- Palmer, G.; Floyd, J. Energy Storage and Civilization: A Systems Approach; Springer: Berlin/Heidelberg, Germany, 2020. [Google Scholar]

- Capellán-Pérez, I.; de Castro, C.; Miguel González, L.J. Dynamic Energy Return on Energy Investment (EROI) and material requirements in scenarios of global transition to renewable energies. Energy Strategy Rev. 2019, 26, 100399. [Google Scholar] [CrossRef]

- de Castro, C.; Capellán-Pérez, I. Standard, Point of Use, and Extended Energy Return on Energy Invested (EROI) from Comprehensive Material Requirements of Present Global Wind, Solar, and Hydro Power Technologies. Energies 2020, 13, 3036. [Google Scholar] [CrossRef]

- Mills, M.P. The Hard Math of Minerals. Issues in Science and Technology, 27 January 2022. [Google Scholar]

- Cembalist, M. Annual Energy Paper Future; JP Morgan Asset and Wealth Management: New York, NY, USA, 2021. [Google Scholar]

- Heard, B.P.; Brook, B.W.; Wigley, T.M.L.; Bradshaw, C.J.A. Burden of proof: A comprehensive review of the feasibility of 100% renewable-electricity systems. Renew. Sustain. Energy Rev. 2021, 76, 1122–1133. [Google Scholar] [CrossRef]

- Brown, T.W.; Bischof-Niemz, T.; Blok, K.; Breyer, C.; Lund, H.; Mathiesen, B. Response to ‘Burden of proof: A comprehensive review of the feasibility of 100% renewable-electricity systems. Renew. Sustain. Energy Rev. 2018, 92, 834–847. [Google Scholar] [CrossRef]

- Ahmed, N. Failing States, Collapsing Systems: BioPhysical Triggers of Political Violence; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar]

- Rockström, J.; Steffan, W.; Noone, K.; Persson, A.; Chapin III, S.; Lambin, E.; Lentin, T.M.; Scheffer, M.; Folke, C.; Joachim, H.; et al. A safe operating space for humanity. Nature 2009, 461, 472–475. [Google Scholar] [CrossRef]

- Leontief, W. Academic economics. Science 1982, 217, 104. [Google Scholar] [CrossRef]

- Hall, C.; Lindenberger, D.; Kummel, R.; Kroeger, T.; Eichhorn, W. The need to reintegrate the natural sciences with economics. BioScience 2001, 51, 663–673. [Google Scholar] [CrossRef] [Green Version]

- Kümmel, R.; Lindenberger, D. How energy conversion drives economic growth far from the equilibrium of neoclassical economics. N. J. Phys. 2014, 16, 125008. [Google Scholar] [CrossRef] [Green Version]

- Hall, C. Does Trump have a bunch of ‘losers’ to thank for a growing economy? The Hill, 16 November 2020. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).