Abstract

According to Thomson Reuters DataStream database, 22,458 merger and acquisition (M&A) transactions with a deal value exceeding 7016 billion Euros have occurred in the energy worldwide sector during 1995–2020. International M&A enable promotion of sustainable competitive advantages, accelerates industry developments and helps to promote sustainable social and economic development. Our research aims to systemize empirical studies, which would enable assessment of the relationship between M&A transactions and the principles of sustainable development in the energy sector. To do so, SALSA (search, appraisal, synthesis and analysis) methodology with additional snowballing technique (chain-referral sampling) is conducted. The current research contributes to existing knowledge by providing an extensive systematic literature review of the academic publications on sustainable development and M&A deals. This paper may be insightful for practitioners and scholars because it highlights the most relevant lines of research on the topic and provides a synthesis of the interdisciplinary literature. Practical contributions of this paper come from its synthesis of interconnections between sustainable development and M&A deals in the energy sector, because sustainability matters may be reflected during different M&A processes: target selection, deal due diligence, deal valuation and post-acquisition integration.

1. Introduction

The energy industry has a significant impact on the global economy. As energy prices, especially oil, have fluctuated during the last several decades, they have impacted economic fluctuations at both international and national levels [1]. On the other hand, the energy industry itself has experienced its own transformation, influenced heavily by decarbonisation, decentralization, digitization, internet of energy as well as other recent technology developments in the renewable sector, horizontal drilling, energy storage and hydraulic fracturing among others. Due to these developments, energy production capacities have been enhanced. Furthermore, these changes have led to heavy industry-level merger and acquisition (hereinafter “M&A”) activities [2]. While several theories exist (e.g., behavioral-, neoclassical theories, pursuance of synergies) regarding why M&A activities occur, the key circumstance is that they represent a particular form of economic investment by companies. In addition to the various stakeholders involved (e.g., shareholders, employees, governmental institutions, customers, capital providers, suppliers, etc.), the consequences and effects of M&A transactions are far reaching. According to DataStream 5.1 Thomson Reuters database, in the energy industry alone, over 22 thousand M&A transactions in excess value of 7 trillion US dollars have been completed during 1995–2020. Furthermore, according to the Statista database, the energy and power share of M&A deal value among the total global M&A deal value has increased from 10.1% in 2000 to 14% in 2019. While the spread of COVID-19 in 2020 has caused a decline in economic activities and increased uncertainty levels, energy producers have turned to M&A to manage tensions and changes in global demand. Energy firms are consolidating in order to stay solvent. This will reshape the future of the industry landscape, especially as companies invest in the transformation from fossil to renewable and clean energy generation. Similarly, the recent energy M&A outlook by Deloitte [3] recognizes that consolidation across the sector is set to continue as it enables the achievement of economies of scale, reduces costs and allows operation within the available cash flow. Furthermore, Deloitte foresee that the energy transition will accelerate further.

According to the Brundtland Report [4], sustainable development is defined as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs”. Companies which conveniently identify and respond to environmental developments may benefit from competitive gains and sustainable development [5]. Recently, it has been summarized [6] that most of the existing studies on M&A are characterized by an implicit firm theory and focus primarily on shareholders. However, considering recent developments of increasing social and environmental concerns, there is a need to investigate the interdependencies between M&A deals and sustainability. M&A and sustainability research have progressed individually, as researchers have in most cases not considered the sustainability perspective in their works on the M&A field [7].

As renewable sector, environmental, social and governance spending expands, energy companies are expected to receive more attention from various stakeholders. The sustainability perspective shall be incorporated into M&A processes given recent reporting and environmental requirements, digitalization and the emergence of new risks in the corporate government. M&A research has been mostly discussed through the perspective of an implicit firm theory which attributes primary focus to shareholders and shareholder value creation. However, given the severity and importance of social and environmental concerns which have recently been demonstrated by various organizations, several scholars have already initiated investigations into the interconnections between M&A and corporate sustainability.

M&A events have interested scholars, governing authorities and business practitioners for several decades. Caiazza and Volpe [8] have conducted a structured literature review with the purpose of identifying future research developments and have concluded that motivation, determinants, value creation and payment methods, and behavioural, organizational, and cultural aspects are leading topics in M&A research. However, there is a clear gap of research and studies which approach M&A in the context of sustainability. Furthermore, it has been acknowledged [9] that M&A practice and research requires tools which could break down the complexity of M&A processes and propose ways forward. Manocha [9] recognizes that while M&A synergies impact fundamental changes of environmental, social and governance (ESG) of any firm and its supply chain, the existing literature and research does not explore or understand the challenges for sustainability and ESG product-supply chain due diligence.

M&A are often cited as strategic tools for achieving long term competitive advantage when facing domestic and global competition caused by deregulation, globalization and liberalization of world economies [10]. A merger differs from an acquisition in that a merger occurs between two or more entities which pool resources under a single entity, whereas acquisition refers to the exercise of control by a specific company over the assets of another firm without combining the businesses [11]. Companies may benefit from gaining access to new markets, enhancing management and engaging in cross-selling when proceeding through M&A [12]. Further benefits of M&A refer to stimulating transfer of intangible assets (e.g., knowledge, management, know-how) between targets and acquirers [13]. However, the most commonly cited M&A motives refer to three synergy sources that may be explored during M&A processes: operational, financial and collusive synergies [14]. Operational synergy considers production scale and scope economies, utilization of technological complementarities, or replacement of inefficient management teams. Financial synergy explores the potential benefits of an acquired company having access to cheaper capital for growth. From this perspective, increased market power after absorbing competitors enables the acquirers to benefit from collusive synergies. Overall, it could be summarized that M&A significantly affect companies’ results and sustainable competitive advantage [15].

Considering energy firms operate and dominate energy development, processing, transportation and trade worldwide, recent studies acknowledge that energy companies shape global economy and politics [16]. Rankings of the Fortune Global 500 companies signify the importance of the energy sector. Based on 2020 rankings in regards to operating income, there are six are energy companies in the top of the largest companies: Sinopec Group (407 billion USD), State Grid (383 billion USD), China National Petroleum (379 billion USD), Royal Dutch Shell (352 billion USD), Saudi Aramco (329 billion USD) and BP (282 billion USD).

Many large M&A deals were completed globally, with the energy industry being no exception [17]. M&A make the energy industry more concentrated [18,19,20,21]. It may be further added to the discussion that the entire energy industry chain is a typical producer-driven chain, in which the major production units are large oil companies [22,23]. Due to the strategic nature of energy resources, which they are not only commodities but also strategic natural resources, energy industry M&A reflect both commercial and geopolitical attributes.

Sustainability may be defined as an open concept which embodies three interconnected pillars: environmental, economic and social [24]. The environmental pillar may be viewed as seeking to preserve resources for future generations [2]. From this perspective, companies’ capacities to employ available resources in an efficient way with the goal of preserving these resources for future generations are being fostered. Further, according to the authors, the economic pillar foresees contributing to the external environment in terms of enhancing prosperity and seeking to support future generations. The social pillar considers the value created for society—in terms of the communities, human capital and labor involved—by conducting fair business practices. When looking into the three pillars, a twofold concept may be established. On the one hand, sustainability refers to maintaining the environment. On the other hand, sustainability allows careful assessment, bypassing and correction in cases where certain actions are predicted to have negative effects.

The aim of this research is to systemize empirical studies, allowing for the assessment of the relationship between M&A transactions and the principles of sustainable development in the energy sector. Therefore, a SALSA framework with a snowballing approach is followed in order to perform a credible and reliable systematic literature review. We contribute by recognizing key theoretical and practical aspects which are relevant when assessing, elaborating and incorporating sustainability within the energy industry M&A market.

The rest of the paper has been structured as follows. Section 2 elaborates on the research context. Section 3 introduces the SALSA method used in the study. Section 4 details the results of the systematic literature review. Further, the discussion section elaborates on possible implications of the study and identifies directions for future research. Finally, the conclusion of the paper synthesizes key points provided in the research.

2. Materials and Methods

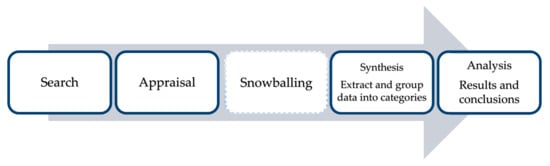

Our research employs the SALSA framework which is performed using four phases: search (defines searching strategy and database used), appraisal (defines pre-defined literature inclusion and exclusion and quality assessment criteria), synthesis (extracts and groups data in various categories), and analysis (narrows results and reaches conclusions).

Pursuing the SALSA framework has several advantages. Firstly, it focuses on synthesis and analysis of previous research in a way that uncovers new perspectives and understanding and raises question for new research [25]. Secondly, exploration, interpretation, synthesis and analysis are important to any study [26]. Other authors [27] note that SALSA is the most suitable tool for literature identification, evaluation and synthesis due to its low subjectivity level. Finally, this method is often approached [28] to guarantee methodological accuracy, comprehensiveness and extensiveness.

Figure 1 below introduces the SALSA framework and its applications for systematic literature review of the research.

Figure 1.

SALSA framework used in the research for literature review.

The first phase of the SALSA technique, defined as “search”, starts with defining the searching strategy. Our search strategy consisted of looking for topics of “sustainability” or “sustainable development”, “mergers and acquisitions” or “M&A” or “takeovers”, and/or “energy industry”, or “energy sector” together in the database. Web of Science (Clarivate Analytics) database was used for this research. This global citation database has over 1.9 billion cited references from over 171 million records and offers a comprehensive platform to perform. We have retrieved 119 results from the Web of Science database. These were scoped in order to establish whether they will be further analyzed. However, most initial search results were found not to be within the scope of our research.

In performance of the second phase of the SALSA framework, “Appraisal”, papers of identified results were browsed and abstracts and reports were read. It was subsequently assessed whether the research found were appropriate for further analysis. A total of 19 articles were qualified for the synthesis phase. Similarly to [29], the “snowballing” technique was added to the SALSA framework and performed after appraisal. According to [30], the snowballing technique may be defined as using the references and citation of papers in order to find more relevant papers.

After the search, appraisals such as snowballing are performed, and synthesis continues according to the SALSA framework. In this step, the identified publications were read and analyzed with an emphasis on the relationship between M&A transactions and the principles of sustainable development in the energy sector. Results presented in various articles and reports were categorized based on their findings (Appendix A).

3. Results

The concept of sustainable development first occurred in the World Conservation Strategy (WCS) in 1980, and has evolved and spread during the 40 years since. The 2030 Agenda for Sustainable Development was endorsed by world leaders during the UN Sustainable Development Summit in 2015. The strength and entrenchment of sustainable development was endorsed on 12 December 2015, when 196 countries approved the first ever universal, legally binding international treaty on climate change. Within its content, this agreement defines 17 interconnected sustainable development goals (SDGs), ranging from climate action to responsible consumption and production, and 169 individual targets addressing the need to reduce ecological footprint by changing consumption and production habits. Table 1 below provides definitions of sustainable development which have been used in the studies identified during performance of the SALSA analysis. While each definition considers a slightly different angle, a future-oriented perspective, preserving resources for future generations, maintaining environmental, social and economic systems, transparency, and corporate governance constitute key components of the definition.

Table 1.

Definition of sustainable development.

Table 2 introduces various M&A definitions which have been used throughout the studies identified during performance of the SALSA analysis. Common themes behind different definitions are strategic management, new competencies, consolidation, corporate control, transaction and expansion.

Table 2.

Definition of M&A.

By combining definitions of sustainable development and M&A, it may be observed that the concept of M&A sustainability defines the long-term and successful post-acquisition M&A performance in order to maintain competitive advantage. Further, sustainability perspective in the M&A raises the requirement for achieving competitive advantage and assuring successful post-acquisition performance.

Based on the SALSA approach and the “snowballing” technique incorporated in the research, Table A1 in the Appendix A provides results of a systematic literature review which is used to elaborate on the sustainability framework for assessment of mergers and acquisitions in the energy sector.

González et al. [2] performed a bibliometric study to assess the intellectual structure of synthesis between M&A and sustainability. Their co-citation analysis has shown that there are two groups of related fields. First, there are studies and works in the field of strategic management (for example, Porter or Teece). Second, other group of studies focus on the application of theories (e.g., stakeholder and agency theories). A common concern of this research is the role of corporate governance in strategic decision-making processes.

Vastola and Russo [6] define M&A as progressively intertwined with sustainability objectives and evidence this perception with well-known M&A deals of socially and environmentally advanced organizations. The authors follow a resource-based view of sustainability and an implicit theory of the firm that attributes primacy to shareholders. Their findings imply that sustainability outcomes are frequently defined in terms of capital or resources, which are usually retrieved during M&A events.

Meglio [7] recognized that M&A and sustainability research have evolved individually and analyzed ways to incorporate sustainability and responsibility content in future research. Furthermore, even though stakeholder perspective is already embedded in the M&A research, topics of sustainability and social responsibility are rarely considered in the research. The stakeholder view of M&A emphasizes multiple stakes and stakeholders involved (e.g., employees, investment banks, legal councilors, advisors, local communities, customers, suppliers, etc.) in the M&A and contradicts shareholder theory, which considers position shareholders and top management only.

Manocha and Srai [9] recognize that M&A may significantly change acquirers’ environmental, social and governance (ESG) track and product-supply chain. Similar to Fischer et al. [36], Manocha and Srai [9] also pursue the resource-based view (RBV) of the firm when linking environmental supply chain innovation to strategic management and M&A. The authors propose several findings. First, environmental sustainability considerations affect M&A. Secondly, environmental product and technology value may be considered as M&A motives. Third, elements of production waste, product cannibalization and technology risk assessment shall be included in the initial operations assessment, operations strategy development and value delivery during M&A processes.

Leon-Gonzales and Tole [12] have questioned whether environmental stringency of an object country is a key factor driving industry M&A and whether stringency of the environmental regime of the buyer country itself has any significant influence over its choice of object country. Authors conclude that weak national environmental standards are not favored by international players. In contrast, firms tend to invest in operations in countries that also have cleaner environments. Therefore, countries seeking to attract M&A should focus on policies that improve their environmental record.

A study by Hu et al. [14] considered competitors’ perspectives in the context of how M&A impact sustainable performance of competing companies; it found that companies consider the potential negative impact on the sustainability of their outside stakeholders, e.g., other firms and the whole industry. Their results imply several findings. First, competitors’ international M&A will negatively influence rivals’ sustainable performance. Second, while acquiring companies experience operational and financial synergies, these benefits are harmful to competitors’ performance. Third, a resource-based view justifies strategic assets to gain effects.

Dicu (2020) et al. [31] acknowledge sustainability concerning both the acquiring and the acquired companies, and focus their research in two directions. On the one side, authors analyze effects of sustainable behavior on the wealth of shareholders involved in the M&A deals. On the other side, the authors refer to the impact of M&A on external shareholders’ performance. The researchers find that, depending on their pollution status, audit opinion and the sector in which a company is operating affects the acquiring company’s decision to purchase a certain amount of stake in target companies.

Lin and Huang [33] acknowledge that sustainability operations affect the environment, economics and society. They recognize that the most investigated field is currently the traditional financial synergy of shareholder wealth maximization. However, social responsibility and environmental commitments will also be embedded in the sustainability operation.

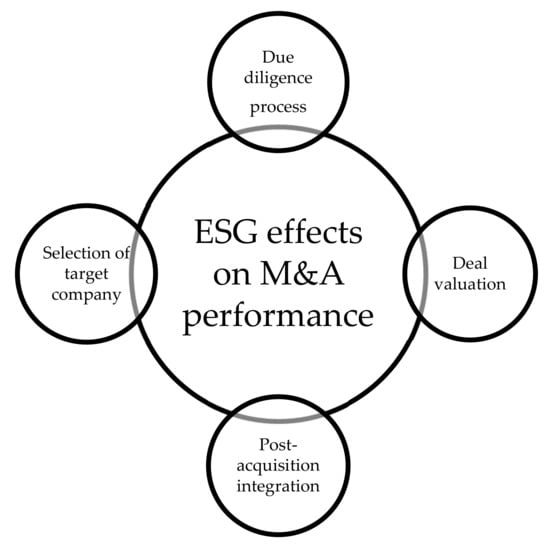

Denčić-Mihajlov [34] proposes that incorporating sustainability in the M&A processes could release the potential sustainability value and reduce the possible faults, subsequently resulting in better strategic investment decisions. Elaborating on Denčić-Mihajlov [34], Figure 2 introduces a framework for assessing environmental, social and governance issues during M&A processes: target company selection, due diligence process, deal valuation and post-acquisition integration.

Figure 2.

Framework for assessing environmental, social and governance (ESG) issues during M&A processes.

Xie et al. [35] analyzed how CEOs’ foreign experience affect cross-border M&A sustainability and investigated how the externally acquired knowledge may be applied to cross-border M&A practice. The authors focus on the organizational learning theory and suggest that extensive M&A experience leads to value creation during post-acquisition performance. The rationale behind this is that firms which accumulate M&A experience develop their M&A management experience and tend to select the right target company and manage post-acquisition integration more effectively in comparison with the acquirers which have little or no M&A experience. Xie et al. [35] provides a comprehensive definition and attributes cross-border M&A sustainability to acquiring company achieving value creation or better performance after acquisition, and realizing sustainable development in the long run.

Fischer et al. [36] elaborate on a resource-based view which accentuates how organizations shall identify, develop and tackle the value potential of heterogeneous resources when pursuing competitive advantage. Furthermore, the authors refer to the VRIO model, which elaborates on four essential sustained competitive advantage’s attributes. Specifically, according to the VRIO model, resources shall be valuable, rare among competitors, inimitable by any equivalent substitutes and tackled by the organization. According to the authors, organizations shall assume more responsibilities for natural resources that are associated with M&A procedures. By introducing a configurational approach, the authors conclude that organizations may develop capabilities that facilitate environmentally sustainable economic activities and enable positive changes of global ecosystems. The configurational approach refers to a wide spectrum of integration structures that could arise for the management of the process integration, the transfer of various knowledge and strategic capabilities.

Bae et al. [37] approach M&A sustainability as something complementary to a firm’s financial performance which relates to the economic sustainability pillar and elaborates on theories of absorptive capacity and a knowledge-based view. According to the knowledge-based view, the foundation of knowledge impacts companies’ learning abilities and promotes the obtaining of sustained competitive advantage. Absorptive capacity being defined as “a company’s ability to recognize the value of new information, assimilate it, and apply it to commercial ends”, it is it is crucial for companies to encompass the importance of combining outside knowledge with inside knowledge that can be used commercially. Accordingly, the concept of absorptive capacity is a driving force behind enhancing M&A sustainability and promoting better post-acquisition performance.

Calza et al. [38] consider proactive environmental strategy. This strategy may be defined as an introduction of strategies and practices that benefit the environment on the one hand and the management of the relationship between business and nature beyond imposed compliance on the other hand. The authors advance the resource-based view (RBV) and recognize that the implementation of resources, capabilities and skills is an essential component of a proactive environmental strategy. However, these components are often lacking from the company. Therefore, companies adopting a proactive environmental strategy are dependent on external sources to acquire the necessary resources.

Gul et al. [39] consider agency and stakeholder theories and analyzed the relationship between corporate social responsibility and empire building theory. The authors find empirical evidence for stakeholder theory; they support that engagement in CSR is negatively related to empire building. On the other hand, the authors find that overconfident CEOs tend to use their firm’s CSR engagement to extract private benefits through empire building activities. Li et al. [40] focus on China and consider the impact of a series of policies which China has introduced in its five year plans with the purpose of restructuring its economy to pursue harmonious and sustainable growth. The authors advance a definition of green M&A and elaborate on legitimacy theory. This theory implies that companies shall adapt to the changing legislative environment and improve their legal status. According to the authors, legitimacy theory has the capacity to improve organizational legitimacy and enables new perspectives in searching for motivation for firm-level green financing and environmental information disclosures.

Introducing sustainability into the due diligence processes enables the provision of an adequate level of information for the acquirer to make decisions on investment in external growth. Subsequently, after all the identified risks are clear and incorporated in the valuation, the acquiring company proceeds with deal valuation. Further, by incorporating sustainability issues into the valuation process the acquiring company has the capacity not only to reflect direct impacts (e.g., cost savings caused by energy efficiency, profit growth of sustainable products), but also indirect effects (e.g., improved reputation, employee engagement, customer loyalty, etc.). According to Denčić-Mihajlov [34], sustainability may impact two M&A types. On the one side, M&A enable the acquiring company to build their presence in key areas with sustainability products. On the other side, through acquisitions of companies with recognized sustainability profile and credibility, M&A strategy assists the acquiring company to improve synergies and consolidate leadership positions.

Krishnamurti et al. [41] analyzed how companies’ corporate social responsibility (CSR) activities impact M&A deal characteristics, target choice and acquisition performance. Their results imply that CSR-oriented companies execute M&A decisions in a manner which aligns shareholders’ perspectives with other stakeholders of the firm.

Clapp [42] has researched M&A in the global agricultural input industry, recognized that M&A impacts industry becoming more concentrated, and analyzed the environmental implications of corporate concentration. However, implications of their results are applicable to other industries as well. Firstly, corporate concentration impacts industry sustainability. Secondly, corporate concentration exposes industry to significant sustainability implications. However, the potential relationship between these issues in international governance measures is rarely recognized.

Ekkayokkayam et al. [43] have recognized studies supporting acquirers of unlisted firms achieving significant gains around bid announcements, whereas acquirers of listed firms do not achieve significant wealth increase. The differential quality of publicly available information on public and private companies affects the accuracy of synergy gains estimates and agency costs reduction. The results imply that announcement-period gains to acquirers of unlisted targets are not sustainable. Therefore, corporate financial managers shall be careful in selecting their targets, whereas governing authorities and regulators shall enhance requirements for information disclosure. Even though advancing disclosure requirements is a costly procedure, there is empirical support behind disclosing more information when listed firms acquire privately held firms.

Aktas et al. [44] have analyzed whether socially responsible investments increase shareholder wealth. The acquiring company’s gains are found to relate positively to the target’s ability to cope with social and environmental risks. Furthermore, acquired firms with better environmental performance are found to deliver larger synergy gains.

Deng et al. [45] have questioned whether M&A investments in CSR activities result in shareholder wealth maximization or help stakeholders at the expense of shareholders. Long term and short term event studies have shown that companies integrating the interests of different stakeholders into their business operations engage in M&A activities that enhance their long-term profitability and efficiency. Subsequently, these investments increase shareholder wealth and corporate value. These authors’ findings support the stakeholder value maximization view.

Gomes et al. [46] were the first to research how CSR performance impacts the choosing of targets for M&A deals. They evidence that target firms obtain on average higher CSR scores than similar non-target firms, leading to the conclusion that CSR performance is important for acquiring companies.

Berchicci et al. [47] support M&A allowing valuable capabilities to be transferred either to newly acquired units or to incumbent operations According to the authors, flow directions are subject to the relative endowments of the acquiring and acquired companies’ shareholders.

Salvi et al. [48] advance the definition of sustainability by introducing the term “green growth”, referring to a new type of economic growth and development which seeks to ensure that future generations have a sufficient level of natural assets, resources and environmental services for their wellbeing. Their empirical research supports that acquiring companies agree to pay larger deal premiums in acquiring companies with superior CSR and environmental management. Larger deal premiums are expected to be covered by reduced risk levels and information asymmetries.

Based on our literature review and SALSA analysis, we have observed that most studies focus on sustainability and the relationship with M&A in general terms. However, we believe that studies reflecting environmental concerns and energy economy are scarce. [49] reminds us that global energy markets, global energy supply and demand are construed not only by domestic, macro-regional energy systems and industry markets, but also by the actions of global players (e.g., companies, NGO’s, governmental institutions, etc.). In line with this, ref. [50] conclude that M&A in the energy industry reflect changes in the environment. Due to government decisions circumstanced by international agreements, which companies have little control over, energy companies pursue M&A to increase internal efficiency and enhance competitiveness. According to the authors [50], growing M&A deals in the energy industry confirm that changes are occurring as a reflection of departure from traditional coal-based energy industry toward changes initiated at the 2015 conference in Paris which sought to ensure a sustainable future and sustainable development by increasing the interest in markets with access to “green and clean” energy while on the other hand increasing the costs of energy companies.

Based on their research of 48 heavy polluting Chines companies which conducted M&A deals in 2018, [51] acknowledge that traditional heavily polluting companies conduct “green” M&A as a path towards green transformation. According to their research, there are six M&A attributes which may affect M&A results: green M&A experience, green M&A transaction value, organizational resources and environmental awareness of particular company, environmental regulations and government green innovation subsidies. Green innovation performance cannot be experienced by the single attributes mentioned above. Instead, innovation performance is the result of multiple attributes. According to the researchers, professional buyer (measured by green M&A experience and M&A transaction value), internal leading (reflected in alignment of environmental awareness and organizational resources) and internal-external linkage (circumstanced by M&A experience and government environmental regulations) leads to most effective and innovative M&A deals. Similarly, [52] have also explored whether green M&A are employed by polluting enterprises to access and promote green innovation and clean technology. The authors support that green M&A promote green innovation, and that green innovation is positively related to governmental support through subsides and negatively related to high CEO remuneration. [53] have also considered that green M&A may be conducted by heavy polluters with the aim of accessing green technology and resources to transform and upgrade the industry. According to the authors, green M&A may promote environmental protection investments. Furthermore, the authors distinguish between vertical and horizontal M&A and find that horizontal M&A have larger positive effects than vertical green M&A. This research implies that environmental protection investment on the one hand improves corporate reputation, environmental awareness, financing ability and subsidies. On the other hand, it increase M&A and management costs.

A recent study by [54] provides a novel approach by linking strategic green marketing perspective and marketing innovation. This research implies that an increase in cross-border M&A completion rates may result as a reflection of conducting corporate social responsibility activities and developing green marketing activities.

Results of the study by [55] are of great importance for companies pursuing green M&A strategy for several reasons. Firstly, taking a sample of polluting Chinese enterprises, the authors find that scale and frequency of green M&A is positively related to export performance. Secondly, green M&A promote green innovation, government subsidies and bank financing capacity, Finally, similarly to [53], ref. [55] also support that horizontal green M&A have the capacity to increase exports more than vertical green M&A.

Through performance of event study of 47 M&A deals conducted during 2008–2010 in the renewable energy industry, [56] have analyzed how M&A events affect enterprise value. The authors have distinguished between homogeneous (M&A within the same industry), heterogeneous-renewable (defined as M&A between firms that produce different renewable energy sources), heterogeneous-energy (defined as M&A between renewable energy company and traditional oil, gas, or electric power firms) and heterogeneous-other (defined as M&A between an investor or firm from a different industry with a renewable energy company). The empirical results prove that companies experience the largest effect on firm value in homogeneous M&A, which showed the biggest effect on enterprise value. Furthermore, heterogeneous M&A in other industries resulted in significant impacts on firm value. Further results imply that renewable energy M&A of existing energy sectors negatively impacts enterprise value.

Questions of how green innovation may be experienced trough international M&A have been analyzed by [57]. The authors distinguish between explorative and exploitive M&A. Their results imply that explorative M&A enhance green innovation through eco-design and process enhancement. On the other side, exploitative M&A help to find the most effective ways to develop green products. Explorative M&A enhance green innovation performance.

Energy M&A in the Czech Republic, Hungary, Poland and Slovakia (a.k.a. Visegrád Group) has been analyzed by [58]. Authors analyze M&A of firms that decide to switch from traditional electricity generation to renewable energy generation. The authors recognize that energy companies use sustainable development goals for their strategies. A key finding of their research is that Czech, Hungarian, Polish and Slovak energy have a common direction of evolution in their strategies, i.e., growing the share of renewable energy sources in their production.

4. Discussion

The SALSA analysis performed has shown that M&A and sustainability are interrelated topics. In their bibliographic analysis, González et al. [2] observed that during 2014–2019 the research on M&A processes sustainability dramatically increased and represents 54.34% of the articles published during 1900–2019. To support this, our research has further shown that 59 out of 119 (e.g., 49.5%) papers found were published during 2018–2020, whereas even 77.2% of papers qualified to be included in the SALSA framework were published during 2018–2020. Therefore, the timing and relevance of the research and its results are evidenced. As research has shown, the scope and consequences of M&A are far reaching. This reflects various regulatory developments, advancing environmental and reporting requirements, digitalization, and the emergence of new risks in the corporate environment. Several studies [49,50] support that M&A in the energy industry reflect changes in the environment, and that companies often pursue M&A strategy in order to cope with increasing pressure towards green transformation and sustainable development [51,52,53]. Therefore, these factors have influenced incorporation of sustainability consideration into M&A processes.

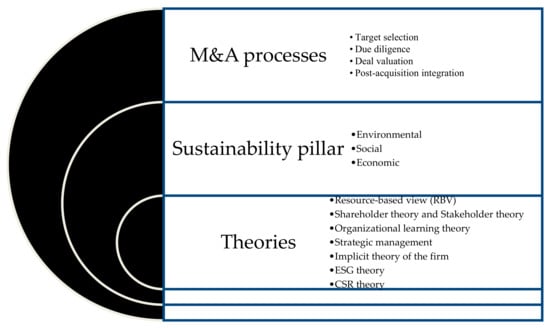

While performing a systematic literature review through the SALSA framework, we focused on different sustainability pillars, milestones and intersections of each piece of research, prevailing theories and methodologies employed, and their key findings.

Based on our research findings, Figure 3 describes a sustainability framework for the assessment of mergers and acquisitions in the energy sector.

Figure 3.

Sustainability framework for assessment of mergers and acquisitions in energy sector.

The framework implies that M&A and sustainability are interrelated topics. There are implicit theories of the firm—RBV, ESG, CSR, shareholder, organizational learning and strategic management—all of which seek and have the capacity to add value in explaining sustainability or M&A processes. Environmental, social and economic pillars comprise the core of sustainability. The SALSA analysis showed that, on the one hand, the pursuit of sustainability may be reflected in the M&A processes. On the other hand, the sustainability path may be sought and explored trough M&A events.

Research has shown that despite the increasing scope and magnitude of M&A as well as global concerns on and trends towards sustainability development, the amount of existing knowledge in the field remains limited. There is an even larger gap of studies and empirical research analyzing energy problems, sustainability and M&A transactions. Most of the studies analyzing M&A focus on shareholder perspective and related theories (e.g., hubris, agency cost, empire building, etc.). However, our results imply that the sustainability framework for assessing M&A shall be based on stakeholder theory. The stakeholder theory implies that organizations shall be seen as a as a set of interdependent relationships between its stakeholders (e.g., employees, customers, suppliers, local communities, etc.) who are jointly committed to its success and contribute by providing financial, human or social capital. Moreover, this study supports that a sustainability framework for M&A assessment shall focus on the full M&A cycle and processes, including target selection, due diligence, deal valuation and post-acquisition performance.

A changing and complex business environment constrains firms to respect the requirements for sustainability management and to carefully lead their growth strategies in order to realize and maintain competitive advantage in the long term.

As appraised by Meglio [7], scholars are important change agents for promoting more sustainable M&A deals through their research, teaching and public engagement. Therefore, in this paper we have supported that the expansion of the concept of sustainability into M&A transactions supports value creation and the prosperity of future generations.

5. Conclusions

Our key research objective was to identify a sustainability framework for the assessment of mergers and acquisitions in the energy sector. We recognize the relevance of adopting sustainability into the M&A perspective. Furthermore, we support that a sustainability framework should not be limited only to complying with certain environmental, social or economic regulations or guidance. The scope and consequences of M&A are far reaching and reflect different regulatory developments, advancing environmental and reporting requirements, digitalization, and the emergence of new risks in the corporate environment. We support that incorporating sustainability into M&A processes (e.g., target selection due diligence, deal valuation, post-acquisition integration) may enhance the potential sustainability value, reduce the possible errors and subsequently result in better strategic investment decisions. According to our analysis, implicit firm theory, resource-based views, and environmental-, social-, governance-, corporate social responsibility-, shareholder-, organizational learning-, and strategic management theories all seek and have the capacity to add value in explaining, delivering value, and interrelating sustainability and M&A events. This article provides an overview of the current state of the research on the combination of sustainability and M&A. The systematic literature review and the results of the SALSA analysis are important and applicable considering the importance and scale of M&A, and the social and institutional focus towards developing sustainable growth. In terms of managerial implications, research supports M&A being important tool for organizations to face sustainability challenges.

Energy companies need to continually cope with the growing expectations of their stakeholders and include the sustainability issues in their M&A strategies, operative management and reporting systems.

However, sustainable developments and M&A processes remain an evolving topic and require further research and reflection. Therefore, among other directions, future research should investigate the impact of sustainability within the M&A context by deconstructing sustainability and M&A performance indicators in order to establish further insights and managerial and scientific applications. We have not grouped or clustered theories, explaining the link of M&A in energy firms in comparison with the M&A of environment and sustainability. Hence, future work could be in this direction. A comparison could also be made with previous authors, searching common ground and new approaches to understand the evolution of the framework. In addition to further qualitative research, a quantitative analysis (e.g., event study) could be conducted with the purpose to assess sustainability and M&A in the energy sector. We have observed that sustainability and M&A are highly regulated fields governed by national authorities and global institutions. Hence, there is a need for local or region analysis and containing further comparisons. Following the approaches listed above may be starting points for future research.

To conclude, a sustainability framework for the assessment of M&A calls for a holistic approach in understanding various interactions (e.g., nature, society, social-ecological systems, etc.), stimulates interdisciplinary rather than multidisciplinary investigation, provokes functional integration of different methodologies, promotes co-production of knowledge and organizational learning through the collaboration of multiple stakeholders involved, and is signified with strong ties to a specific social/local context and institutional background.

Author Contributions

Conceptualization, K.A. and D.Š.; methodology, K.A.; software, K.A.; validation, K.A.; formal analysis, K.A.; investigation, K.A.; resources, K.A.; data curation, K.A.; writing—original draft preparation, K.A.; writing—review and editing, K.A.; visualization, K.A.; supervision, D.Š.; project administration, K.A.; funding acquisition, K.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the European Social Fund under the No. 09.3.3 LMT K 712 “Development of Competencies of Scientists, other Researchers, and Students through Practical Research Activities” measure.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Results of systematic literature review and SALSA analysis.

Table A1.

Results of systematic literature review and SALSA analysis.

| Study | Sustainability Pillar | Focus/Approach/Intersection of Research | Theory/Theoretical Lens | Methodology of the Research | Key Findings |

|---|---|---|---|---|---|

| González [2] | Environmental, economic, social | Synthesis of M&A and sustainability | Strategic management Stakeholder theory Agency theory Strategic decision-making processes | Bibliometric analysis | Results on firm performance of sustainability issues in M&A is a trending topic. |

| Vastola and Russo [6] | Environmental and social | Pre- and post-acquisition elements reflecting acquiring entity’scapacity to advance their sustainability capacity | Resource-based view of sustainability Implicit theory of the firm | Semi-structured interviews and publicly available data | There are 3 different ways for acquirers to advance (significantly or slightly, i.e., embedding or adding sustainability) or worsen (i.e., losing sustainability) their sustainability orientation. Acquiring companies which significantly strengthened their sustainability performance switched from perceiving the inclusion of ESG issues in their decisions and activities as a “must-do.” Companies which slightly improved or decreased their business sustainability looked at ESG matters with interest in the financial payoffs of sustainability. |

| Meglio [7] | Social | Focus on research as it permeates both teaching and public engagement | Stakeholder view of M&A | Conceptual | Scholars may play an active role and contribute to society improvements by remodelling the way M&A are researched and executed. |

| Manocha and Srai [9] | Environmental | Relationship between environmental supply chain innovation for sustainability and M&A | Resource-based view (RBV) of the firm | Case study method | M&A value may be created through product design and technology selection. This implies that companies with ambitious environmental agendas or motives need to reconfigure M&A processes in a way where product design and technology selection are considered primary drivers rather than secondary factors as is currently. |

| Leon-Gonzales and Tole [12] | Environmental | Relationship between environmental stringency and M&A activity | Pollution heaven hypothesis | Multinomial Logit model Dataset of individual investment choices | Acquirers originating in countries with high levels of environmental severity tend to invest and make larger investments in countries with a similar level of environmental stringency. |

| Hu et al. [14] | Economic | Effects of M&A on competing companies sustainable performance | Competitive dynamics literature Spillover effects of international M& ALiterature in the organizational learningResource-based view | Empirical analysis of longitudinal dataset OLS regression | Global industry-level M&A have significant negative effect on the sustainable performance of acquiring company’s competitors. Negative relationship accentuates further in case of horizontal M&A. |

| Dicu et al. [31] | Environmental, economic, social | Acquirers motivation in consideration of targets’ economic and social performance andpollution level exerted on the environment on the other | Stakeholder value maximization view Shareholder expense view | Hierarchical linear regression (HLR) OLS regression | Decision to pursue M&A reflects audit opinion and the sector in which companies operate. Pollution status influences M&A decision. |

| Lin and Huang [33] | Environmental Social | Integration of the value of corporate sustainability operation into the synergy of M&A | Stakeholder theory | Real options approach | The environmental perspective shall be incorporated into sustainability operation in order to decrease the risk of corporate operation. |

| Denčić-Mihajlov [34] | Environmental and social | M&A processes | Review article | Firm pursuing M&A should address sustainability issues during selection of target firm, procedures of due diligence, processes of deal valuation and post-deal integration. M&A have become strategic investments which are less concerned to generate high yields in the short period. | |

| Xie et al. [35] | Economic | Impact of CEO host country experience on cross-border M&A sustainability | Organizational learning theory | Empirical analysis | Foreign experience in the country of acquired company positively improves M&A sustainability. Host country specific work experience of executive teams is more important role than education experience. |

| Fischer et al. [36] | Environmental | Integration (comprised of sets of integration mechanisms) | Natural-resource-based view (NRBV) and the resulting competences and capabilities | Review article | Process of integration, the transfer of knowledge and strategic capabilities are sources for value creation and sustainability development during M&A. |

| Bae et al. [37] | Economic | Absorptive capacity plays a crucial part in a firm’s achievement of CBMA sustainability | Theories of absorptive capacity Concept of a knowledge-based view | Tobin’s Q and OLS regression of different effects of absorptive capacity between domestic- and cross-border M&A. | Acquiring firm’s greater absorptive capacity leads to better post-merger performance. |

| Calza et al. [38] | Environmental | Environmental reactivity | Resource-based view (RBV) Proactive environmental strategy | Empirical analysis) CSRHub database for data on companies’ environmental performance) Zephyr database | External knowledge motivates environmental proactivity. Firms involved in M&A with environmental goals achieve greater environmental performance than companies that use M&A to acquire external knowledge. Size of the companies matters as importance of environmental collaboration is found to be more important for small firms rather than large firms. |

| Gul et al. [39] | Social | Relationship between corporate social responsibility, overconfident CEOs and empire building | Agency theory of Jensen and Meckling (1976) Stakeholder theory Hubris theory posited by Roll (1986) | Empirical analysis) MSCI ESG KLD STATS database for CSR activity) Executive compensation for gathering options and cashcompensation data to measure CEO overconfidence | Corporate social responsibility is associated with lower empire building, consistent with stakeholder theory. |

| Li et al. [40] | Environmental | Green M&A deals | Legitimacy theory | Empirical analysis | Green M&A enable companies to get access to resources, to relieve financing limitations and reduce tax liabilities. Therefore, it implies improved organisational legitimacy and capacity for greater risk-aversity. Policies that encourage green M&A are effective in reforming environmental problems. |

| Krishnamurti et al. [41] | Environmental and social | Companys’ corporate social responsibility (CSR) activities relationship with M&A deal characteristics, target choice and acquisition performance. | Shareholder theory Stakeholder theory | Abnormal returns, event study) Empirical analysis, including multivariate analysis | Targets which are active in CSR tend more often to be acquired by CSR-oriented acquiring companies. Cash payment and preference of domestic target are common deal features of CSR oriented companies. Firms with CSR activities tend to offer a lower bid premium during M&A. Capital markets evaluate CSR engaged companies positively as positive abnormal returns are experienced upon M&A announcement day. |

| Clapp [42] | Environmental | Environmental implications of corporate concentration Role of international companies in transformation of sustainability policies. | Strategic managementStakeholder theory | Literature review | There is an increasing trend that a small number of strong international companies play a significant role in shaping various industries. |

| Ekkayokkayam et al. [43] | Economic | Long run sustainability of unlisted-target acquirers’ superior announcement-period gains | Synergy gains Agency costs | Long term event study) Short term event study | The regulators and governing authorities need to consider the potential importance of mandating disclosure on unlisted firms. |

| Aktas et al. [44] | Social Environmental | Relationship between corporate sustainability and post-acquisition performance | Organizational learning (acquirer learning from the target’s socially responsible investments practices) | Innovest’s Intangible Value Assessment (IVA) ratings | Capital market rewards acquiring companies for making socially and environmentally responsible investments. Environmental and social performance of the acquirer increases following the acquisition of a socially responsible investments aware target. |

| Deng et al. [45] | Social | Relationship between CSR and post-acquisition performance of acquiring firm. | Stakeholder value maximization view of stakeholder theory | Empirical analysis (long term and short term event studies) | Social performance is an important determinant of M&A performance and the probability of its completion |

| Gomes et al. [46] | Social | CSR performance impact on choosing the target in M&A deals | Resource-based view | Propensity score matching analysis | Company’s CSR is positively associated with chances of becoming an M&A target |

| Berchicci et al. [47] | Environmental | Transfer of environmental competences | Stakeholder theoryResource-based viewFull capability theory of M&A | Longitudinal empirical analysis | Environmental performance and corporate strategy are deeply intertwined. Environmental capabilities simultaneously provide the input for a strategic decision and itself are influenced by the particular decision. |

| Salvi et al. [48] | Enviromental | Sustainability role in post-acquisition performance | Stakeholder theory | Empirical analysis (post-acquisition performance, return on assets) | Acquiring companies which pursue “green” M&A deals may obtain better financial results in comparison to companies which perform deals in other sectors. Companies prefer “green” M&A in order to enhance their external growth and obtain better operating and financial results. Organizations tend to attribute a green identity to corporate image and environment. |

| Rudkovskyy [49] | Social | Transformation of the world energy market under the influence of investment | Market, institutional and organizational theories | Methods of analysis and synthesis, method of comparative analysis, graphical method, statistical method | Dynamics of prices does not coincide with the dynamics of aggregate supply and demand in the global energy market. Decrease in the share of investment in fossil fuels; increase of investments in renewable energy and electricity networks and energy efficiency. |

| Niemczyk et al. [50] | Financial, enviromental | Motives behind the M&A deald conducted by companies operating in the electrical energy generation sector | Theory of green economy | Critical literature analysis, desk research | The motives behind M&A are changing from positional approaches to motives closer to green economy and resource approaches. |

| Zhang et al. [21] | Enviromental, financial | M&A attributes, Organizational characteristics, and External environment (M-O-E) framework | Green transformation, competitive advantage, organizational theory | Fuzzy-set qualitative comparative analysis (fsQCA) | Green technology innovation performance after GMA of heavily polluting enterprises is the outcome of multiple antecedents, and no singular antecedent is sufficient for achieving it. |

| Liang et al. [52] | Enviromental, financial | China’ sdevelopment direction for heavily polluting enterprises | Resource-based theory, innovation capacity, institutional theory, Echelons Theory | Content Analysis, empirical analysis | M&A by heavily polluting enterprises can promote green innovation, and this impact is promoted with the support of government subsidies |

| Lu [53] | Enviromental | 1. Effects of green M&A on environmental impact of heavy pollution listed companies 2. Comparison of impact of different green M&A on environmental protection investments | Corporate environmental governance | Propensity score matching (PSM-DID); interaction effect Model; Nonlinear-DID Model; Heterogeneous sample analysis | Green M&A restricts environmental protection investments by increasing merger and acquisition cost and management cost, and stimulates environmental protection investments by improving corporate reputation, environmental awareness, enhancing financing ability and subsidies. |

| Gao et al. [54] | Financial | Green marketing innovation in the context of cross-border M&A | Strategic green marketing, marketing innovation, defensive green marketing, assertive green marketing | Empirical research including dependent- explanatory-, and control variables Correlations of variables logistic regression | Conducting CSR activities as a defensive green marketing approach, green patents’ development as an assertive green marketing approach, and hiring financial advisors as a marketing channel may improve cross-border M&A completion rates. |

| Lu [55] | Financial, environmental | Improvement of export viability and corporate image of polluting enterprises | Green M&A reputation, sustain- able development theory, scale economy theory, financial synergy effects, market share theory, information asymmetry, public participation theory | Propensity score matching—double differ- ence (PSM-DID) method | 1. Green M&A increase export performance. 2. M&A increase export performance by promoting green innovation, government subsidies and bank financing capacity, and reduce export performance by increasing environmental governance costs. 3. Horizontal M&A outperform vertical M&A in regards to export increase. |

| Yoo et al. [56] | Financial | Effects of renewable energy M&A on firm value | General theory of diversification | Event study, including generalized autoregressive conditional heteroskedasticity and the OLS methodologies | 1. Homogeneous M&Ashows the biggest effect on enterprise value. 2. Renewable energy is considered to have potential as an investment product. 3. Wind power is found to have a high potential for growth as an industry forinvestment. 4. Energy M&A in existing energy industries have negative effects onfirma value. |

| Wu & Qu [57] | Environmental, financial | Conceiving and realizing green innovation relationship between exploratory international M&A, Exploitative international M&A and green innovation performance | Green innovation theory, competitive advantage theory, organizational learning theory | Questionnaire survey | Exploratory and exploitative international M&A are beneficial for green innovation performance. Firms whose international behaviors fit such internal strategy as pursuing green image will experience higher green innovation performance. |

| Sulich and Sołoducho [58] | Environmental | Sustainability strategy types among Czech, Hungarian, Polish and Slovak energy producers, who decided to generate electrical energy from the renewable resources | Strategic management | Inductive inference methodology, statistical reference method, SWOT analysis | Even though transition towards a green economy has gained attention in recent year, but implementation is an illusion, because majority of generated energy comes from nonrenewable resources. Main problem is that nuclear energy is considered safe and ecofriendly within the region. |

References

- Hsu, K.-C.; Wright, M.; Zhu, Z. What motivates merger and acquisition activities in the upstream oil & gas sectors in the U.S.? Energy Econ. 2017, 65, 240–250. [Google Scholar] [CrossRef]

- González-Torres, T.; Rodríguez-Sánchez, J.-L.; Pelechano-Barahona, E.; García-Muiña, F.E. A Systematic Review of Research on Sustainability in Mergers and Acquisitions. Sustainability 2020, 12, 513. [Google Scholar] [CrossRef] [Green Version]

- Delloite. 2021 Oil and Gas M&A Outlook: Consolidation through the Price Cycle. Available online: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/mergers-acqisitions/us-2021-Oil_And_Gas-MA_Outlook_3.6rev_02_22_21_FINAL.pdf (accessed on 10 March 2021).

- Brundtland, G. Report of the World Commission on Environment and Development: Our Common Future. 1987. Available online: https://www.are.admin.ch/are/en/home/sustainable-development/internationalcooperation/2030agenda/un-_-milestones-in-sustainable-development/1987--brundtland-report.html (accessed on 15 April 2021).

- Li, D.-Y.; Liu, J. Dynamic capabilities, environmental dynamism, and competitive advantage: Evidence from China. J. Bus. Res. 2014, 67, 2793–2799. [Google Scholar] [CrossRef]

- Vastola, V.; Russo, A. Exploring the effects of mergers and acquisitions on acquirers’ sustainability orientation: Embedding, adding, or losing sustainability. Bus. Strategy Environ. 2021, 30, 1094–1104. [Google Scholar] [CrossRef]

- Meglio, O. Towards More Sustainable M&A Deals: Scholars as Change Agents. Sustainability 2020, 12, 9623. [Google Scholar] [CrossRef]

- Caiazza, R.; Volpe, T. M&A process: A literature review and research agenda. Bus. Process Manag. J. 2015, 21, 205–220. [Google Scholar] [CrossRef]

- Manocha, P.; Srai, J.S. Exploring Environmental Supply Chain Innovation in M&A. Sustainability 2020, 12, 10105. [Google Scholar] [CrossRef]

- Ferreira, M.P.; Santos, J.C.; de Almeida, M.I.R.; Reis, N.R. Mergers & acquisitions research: A bibliometric study of top strategy and international business journals, 1980–2010. J. Bus. Res. 2014, 67, 2550–2558. [Google Scholar] [CrossRef]

- Gupta, P.K. Mergers and acquisitions (M&A): The strategic concepts for the nuptials of corporate sector. Innov. J. Bus. Manag. 2012, 1, 60–68. Available online: http://innovativejournal.in/index.php/ijbm/article/view/389/374 (accessed on 23 March 2022).

- Leon-Gonzales, R.; Tole, L. The determinants of mergers & acquisitions in a resource-based industry: What role for environmental sustainability? Rev. Econ. Anal. 2015, 7, 111–134. [Google Scholar] [CrossRef]

- Seth, A.; Song, K.P.; Pettit, R. Synergy, managerialism or hubris? An empirical examination of motives for foreign acquisitions of US firms. J. Int. Bus. Stud. 2000, 31, 387–405. [Google Scholar] [CrossRef]

- Hu, X.; Yin, X.; Jin, Z.; Li, J. How Do International M&As Affect Rival Firm’s Sustainable Performance?—Empirical Evidence from an Emerging Market. Sustainability 2020, 12, 1318. [Google Scholar] [CrossRef] [Green Version]

- Laamanen, T.; Keil, T. Performance of serial acquirers: Toward an acquisition program perspective. Strateg. Manag. J. 2008, 29, 663–672. [Google Scholar] [CrossRef]

- Van De Graaf, T.; Bradshaw, M. Stranded wealth: Rethinking the politics of oil in an age of abundance. Int. Aff. 2018, 94, 1309–1328. [Google Scholar] [CrossRef]

- Guo, Y.; Yang, Y.; Wang, C. Global energy networks: Geographies of mergers and acquisitions of worldwide oil companies. Renew. Sustain. Energy Rev. 2021, 139, 110698. [Google Scholar] [CrossRef]

- Gaughan, P. Mergers, Acquisitions, and Corporate Restructurings, 4th ed.; Wiley: New York, NY, USA, 2007. [Google Scholar]

- Gregoriou, G.N.; Renneboog, L. International Mergers and Acquisitions Activity since 1990: Recent Research and Quantitative Analysis, 1st ed.; Academic Press: New York, NY, USA, 2007. [Google Scholar]

- Martynova, M.; Renneboog, L. A century of corporate takeovers: What have we learned and where do we stand? J. Bank. Financ. 2008, 32, 2148–2177. [Google Scholar] [CrossRef]

- Beyazay-Odemis, B. The Nature of the Firm in the Oil Industry: International Oil Companies in Global Business; Routledge: London, UK, 2016. [Google Scholar]

- Gereffi, G. The Organization of Buyer-Driven Global Commodity Chains: How US Retailers Shape Overseas Production Networks. Commodity Chains and Global Capitalism; Praeger: London, UK, 1994; pp. 95–122. [Google Scholar]

- Bridge, G. Global production networks and the extractive sector: Governing resource-based development. J. Econ. Geogr. 2008, 8, 389–419. [Google Scholar] [CrossRef]

- Purvis, B.; Mao, Y.; Robinson, D. Three pillars of sustainability: In search of conceptual origins. Sustain. Sci. 2019, 14, 681–695. [Google Scholar] [CrossRef] [Green Version]

- Bruce, C. Interpreting the Scope of Their Literature Reviews: Significant Differences in Research Students’ Concerns; New Library World: Novato, CA, USA, 2001; Volume 102, pp. 158–166. [Google Scholar]

- Major, C.; Savin-Baden, M. An Introduction to Qualitative Research Synthesis: Managing the Information Explosion in Social Science Research; Routledge: London, UK, 2010. [Google Scholar]

- Amo, I.F.; Erkoyuncu, J.A.; Roy, R.; Palmarini, R.; Onoufriou, D. A systematic review of Augmented Reality content-related techniques for knowledge transfer in maintenance applications. Comput. Ind. 2018, 103, 47–71. [Google Scholar] [CrossRef]

- Grant, M.J.; Booth, A. A typology of reviews: An analysis of 14 review types and associated methodologies. Health Inf. Libr. J. 2009, 26, 91–108. [Google Scholar] [CrossRef]

- Malinauskaite, L.; Cook, D.; Davíðsdóttir, B.; Ögmundardóttir, H.; Roman, J. Ecosystem services in the Arctic: A thematic review. Ecosyst. Serv. 2019, 36, 100898. [Google Scholar] [CrossRef]

- Gunnarsdottir, I.; Davidsdottir, B.; Worrell, E.; Sigurgeirsdottir, S. Review of indicators for sustainable energy development. Renew. Sustain. Energy Rev. 2020, 133, 110294. [Google Scholar] [CrossRef]

- Dicu, R.M.; Robu, I.; Aecoae, G.; Mardiros, D. Rethinking the Role of M&As in Promoting Sustainable Development: Empirical Evidence Regarding the Relation between the Audit Opinion and the Sustainable Performance of the Romanian Target Companies. Sustainability 2020, 12, 8622. [Google Scholar] [CrossRef]

- Orhan, G.; Tasci, D. The role of integration in achieving sustainable benefits from airline alliances. Int. J. Sustain. Aviat. 2019, 5, 70–86. [Google Scholar] [CrossRef]

- Lin, T.T.; Huang, Y.S. Merger and Acquisition Decisions Analysis with Sustainability Operation Concept. In Proceedings of the 2011 IEEE International Conference on Industrial Engineering and Engineering Management IEEM, Singapore, 6–9 December 2011; pp. 51–55. [Google Scholar] [CrossRef]

- Denčić-Mihajlov, K. Does sustainability matter in mergers and acquisitions? The case of the Serbian food industry. Econ. Agric. 2020, 67, 25–36. [Google Scholar] [CrossRef]

- Xie, Z.; Lin, R.; Mi, J.; Li, N. Improving Enterprises’ Cross-Border M&A Sustainability in the Globalization Age—Research on Acquisition and Application of the Foreign Experience. Sustainability 2019, 11, 3180. [Google Scholar] [CrossRef] [Green Version]

- Fischer, S.; Rodwell, J.; Pickering, M. A Configurational Approach to Mergers and Acquisitions. Sustainability 2021, 13, 1020. [Google Scholar] [CrossRef]

- Bae, Y.; Lee, K.; Roh, T. Acquirer’s Absorptive Capacity and Firm Performance: The Perspectives of Strategic Behavior and Knowledge Assets. Sustainability 2020, 12, 8396. [Google Scholar] [CrossRef]

- Calza, F.; Parmentola, A.; Tutore, I. For green or not for green? The effect of cooperation goals and type on environmental performance. Bus. Strategy Environ. 2021, 30, 267–281. [Google Scholar] [CrossRef]

- Gul, F.A.; Krishnamurti, C.; Shams, S.; Chowdhury, H. Corporate social responsibility, overconfident CEOs and empire building: Agency and stakeholder theoretic perspectives. J. Bus. Res. 2020, 111, 52–68. [Google Scholar] [CrossRef]

- Li, B.; Xu, L.; McIver, R.; Wu, Q.; Pan, A.L. Green M&A, legitimacy and risk-taking: Evidence from China’s heavy polluters. Account. Financ. 2020, 60, 97–127. [Google Scholar] [CrossRef]

- Krishnamurti, C.; Shams, S.; Pensiero, D.; Velayutham, E. Socially responsible firms and mergers and acquisitions performance: Australian evidence. Pac.-Basin Financ. J. 2019, 57, 101–193. [Google Scholar] [CrossRef]

- Clapp, J. Mega-Mergers on the Menu: Corporate Concentration and the Politics of Sustainability in the Global Food System. Glob. Environ. Politics 2018, 18, 12–33. [Google Scholar] [CrossRef]

- Ekkayokkayam, M.; Holmes, P.; Paudyal, K. Limited Information and the Sustainability of Unlisted-Target Acquirers’ Returns. J. Bus. Financ. Account. 2009, 36, 1201–1227. [Google Scholar] [CrossRef]

- Aktas, N.; De Bodt, E.; Cousin, J.G. Do financial markets care about SRI? Evidence from mergers and acquisitions. J. Bank. Financ. 2011, 35, 1753–1761. [Google Scholar] [CrossRef]

- Deng, X.; Kang, J.K.; Low, B.S. Corporate social responsibility and stakeholder value maximization: Evidence from mergers. J. Financ. Econ. 2013, 110, 87–109. [Google Scholar] [CrossRef]

- Gomes, M.; Marsat, S. Does CSR impact premiums in M&A transactions? Financ. Res. Lett. 2018, 26, 71–80. [Google Scholar] [CrossRef] [Green Version]

- Berchicci, L.; Dowell, G.; King, A.A. Environmental performance and the market for corporate assets. Strateg. Manag. J. 2017, 38, 2444–2464. [Google Scholar] [CrossRef]

- Salvi, A.; Petruzzella, F.; Giakoumelou, A. Green M&A Deals and Bidders’ Value Creation: The Role of Sustainability in Post-Acquisition Performance. Int. Bus. Res. 2018, 11, 96–105. [Google Scholar] [CrossRef]

- Rudkovskyy, S. The Influence of the Investment Factor on the Transformation of the Global Energy Market. Technol. Audit Prod. Reserves 2020, 4, 23–239. [Google Scholar] [CrossRef]

- Niemczyk, J.; Sus, A.; Borowski, K.; Jasinski, B.; Jasinska, K. The Dominant Motives of Mergers and Acquisitions in the Energy Sector in Western Europe from the Perspective of Green Economy. Energies 2022, 15, 1065. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, Z.; Sun, M.; Zhou, Y. The effective path of green transformation of heavily polluting enterprises promoted by green merger and acquisition—Qualitative comparative analysis based on fuzzy sets. Environ. Sci. Pollut. Res. 2022, 1–17. [Google Scholar] [CrossRef] [PubMed]

- Liang, X.; Li, S.; Luo, P.; Li, Z. Green mergers and acquisitions and green innovation: An empirical study on heavily polluting enterprises. Environ. Sci. Pollut. Res. 2022, 1–16. [Google Scholar] [CrossRef] [PubMed]

- Juan, L.U. Can the green merger and acquisition strategy improve the environmental protection investment of listed company? Environ. Impact Assess. Rev. 2021, 86, 106470. [Google Scholar]

- Gao, Q.; Zhang, Z.; Li, Z.; Li, Y.; Shao, X. Strategic green marketing and cross-border merger and acquisition completion: The role of corporate social responsibility and green patent development. J. Clean. Prod. 2022, 343, 130961. [Google Scholar] [CrossRef]

- Lu, J. Green merger and acquisition and export expansion: Evidence from China’s polluting enterprises. Sustain. Prod. Consum. 2022, 30, 204–217. [Google Scholar] [CrossRef]

- Yoo, K.; Lee, Y.; Heo, E. Economic effects by merger and acquisition types in the renewable energy sector: An event study approach. Renew. Sustain. Energy Rev. 2013, 26, 694–701. [Google Scholar] [CrossRef]

- Wu, H.; Qu, Y. How do firms promote green innovation through international mergers and acquisitions: The moderating role of green image and green subsidy. Int. J. Environ. Res. Public Health 2021, 18, 7333. [Google Scholar] [CrossRef]

- Sulich, A.; Sołoducho-Pelc, L. Renewable Energy Producers’ Strategies in the Visegrád Group Countries. Energies 2021, 14, 3048. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).