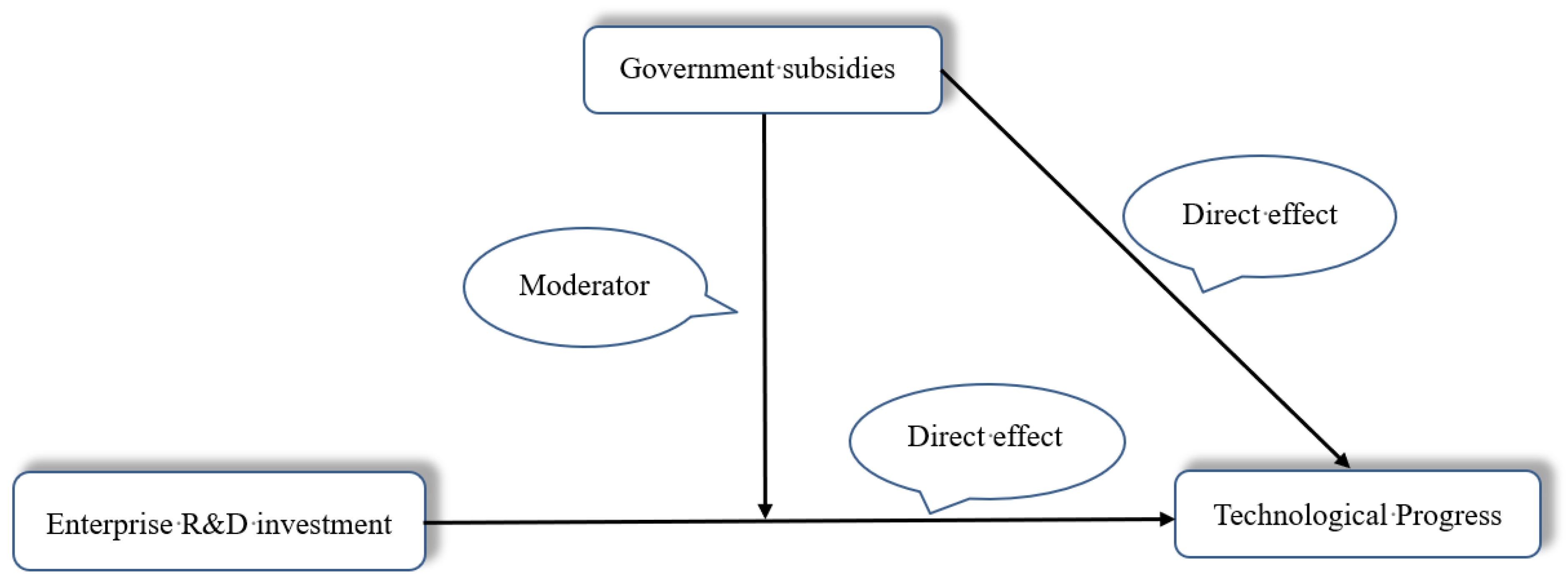

4.3.1. Direct Effect of R&D Investment

As can be observed from Model 1 in

Table 4, the respective estimated coefficients for enterprise R&D investment (RDI), R&D investment squared (RDI

2), and R&D investment cubed (RDI

3) are 0.757, −0.134, and 0.007, which are significant at 1%, 5%, and 10% levels, respectively, indicating that there may be an N-shaped non-linear nexus between R&D investment and technological progress and thereby validating the rationale of Hypothesis 1. In Model 3, the respective estimated coefficients for RDI, RDI

2, and RDI

3 are 1.193, −0.299, and 0.021, respectively, which are significant at the 1% level. This still indicates that there is an N-shaped nexus between R&D investment and technological progress, verifying Hypothesis 1 once again.

Technological progress and low production costs are two major driving forces that profoundly change the development paradigm of China’s PV industry. According to the findings of this research, a non-linear N-shaped curve represents the nexus between PV enterprises’ R&D investment and technological progress. Therefore, it has been necessary to increase R&D investment in the early development stage of China’s PV industry. The R&D investment of Chinese PV enterprises, especially in the upstream crystalline silicon, silicon wafer, and midstream module manufacturing links of the industrial chain, maintained a growth trend from 1999 to 2019. With the increase in R&D investment, China’s PV industry has been able to achieve innovative development. Crystal silicon and battery products with different technical routes are emerging continuously, such as high-purity polycrystalline silicon, monocrystalline passivated emitters and rear cells, and films. The photoelectric conversion efficiency in China has reached more than 24%, representing the world’s leading level.

However, it is not necessarily the case that the more money spent on R&D, the better. The efficiency of R&D input and output is the key to improving the innovation of PV enterprises. Penrose’s resource-based theory holds that enterprise efficiency is determined not only by the investment in resources but also by the management of those resources [

42]. PV enterprises that only focus on R&D investment and ignore R&D management will lack innovation ability and only reap the effects of a “mountain of labor”. As such, Chinese PV enterprises should pay attention to the R&D IQ concept proposed by Knott and focus on R&D efficiency [

20]. In addition, reducing costs is an important factor for Chinese PV enterprises if they are to increase their market share by bettering the competition, which they can achieve by increasing their production capacity and building large-scale industrial development. Yet, many PV enterprises may “squeeze out” some of their R&D funds, which may delay their technological progress. Moreover, when the R&D investment of PV enterprises exceeds the inflection point, it will not bring the same degree of enterprise technological innovation performance improvement. This conclusion is basically consistent with the findings of [

21,

43]. Yet, all these studies indicate that, in the long run, increasing R&D investment is still the fundamental driving force for improving enterprises’ innovation capability and sustainable development.

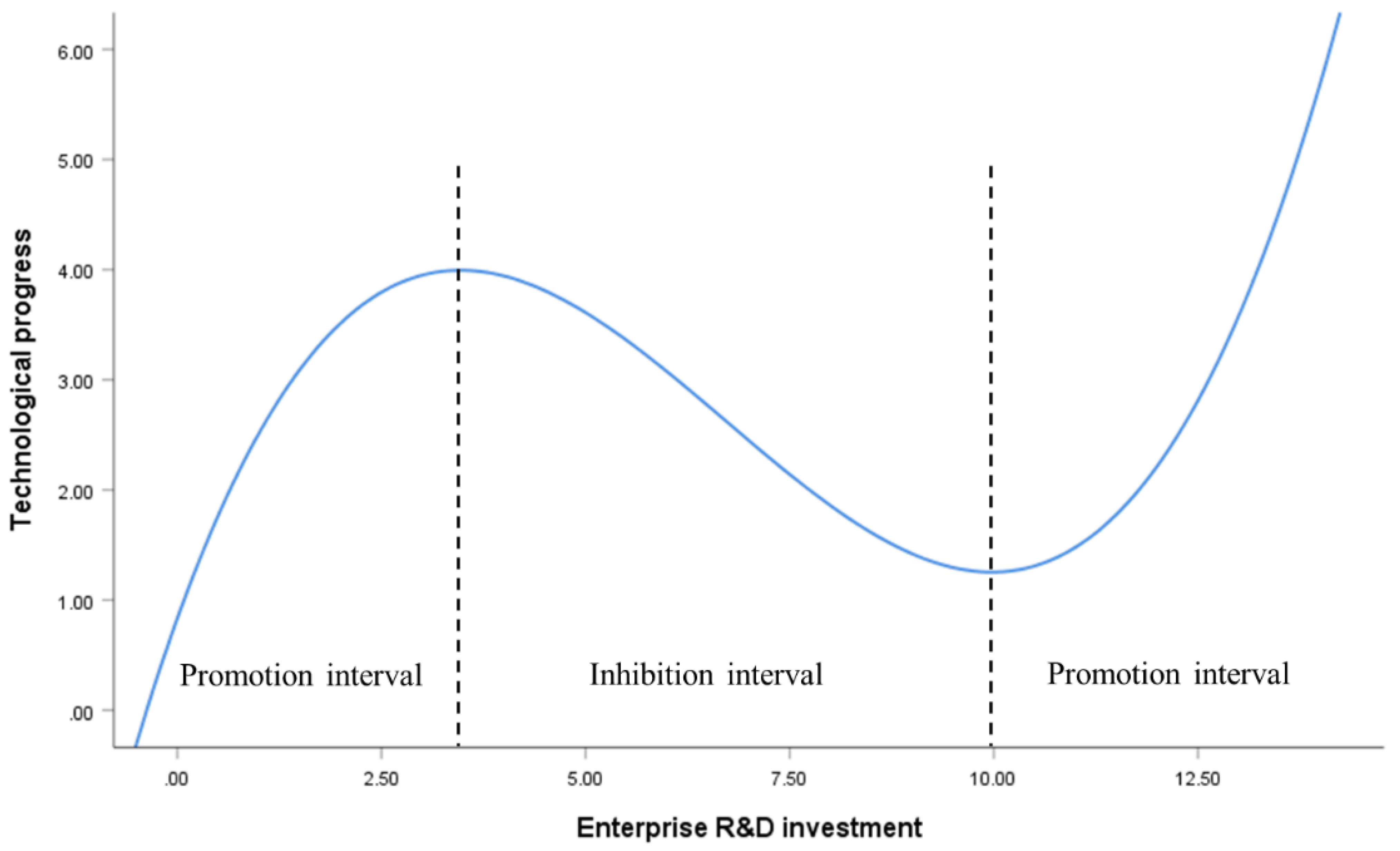

To explain Hypothesis 1 further intuitively, we have drawn a fitting diagram of R&D investment (RDI) and technological progress (lnPatents) free of the influence of other variables, as shown in

Figure 7. The line graph illustrates the changing trend of technological progress at different levels of enterprise R&D investment without considering other variables. As can be seen in

Figure 7, the nexus between R&D investment and technological progress is an N-shaped curve. Supporting this, the preliminary conclusion drawn from the previous descriptive statistical analysis was that the R&D investment and technological progress of PV enterprises may be very different. In fact, most PV enterprises have a serious lack of R&D investment and have not taken the initiative to make technological progress. Accordingly, most of the enterprises in the sample are located at the left “promotion interval” of the first inflection point of the N-shaped curve, seeking to promote their technological progress by increasing R&D investment. Meanwhile, only a very small number of PV enterprises are at the right end of the second inflection point. So, we consider that China’s PV industry is still in the climbing stage, and will remain there for a long time in the future. For now, Chinese PV enterprises must continue to increase R&D investment to promote technological progress.

4.3.2. Direct Positive Effect of Government Subsidies

As we can see from Model 2 in

Table 4, the regression coefficient of government subsidies (GovSub) is 4.546, which is significant at the 5% level. In Model 3, the regression coefficient of GovSub is 4.764, which is significant at the 10% level. These results show that the incentivizing effect of government subsidies obtained by PV enterprises is clear, thus validating Hypothesis 2.

First of all, from the perspective of the resource base, government subsidies can influence the innovation of enterprises through direct resource supplementation. Yet, technological progress is associated with positive externalities and high risks, which are particularly prominent for the PV industry, a new energy industry. To overcome market failures and prevent enterprises from having high risks and low returns, the government will share the risks with enterprises. Its own financial strength and adequacy of information, shared with enterprises through various government subsidies, will mean the industry achieves Pareto efficiency improvement. Plus, the government subsidies signal that the industry is worthy of recognition, guiding external investors to provide greater external financing to large PV enterprises, and ultimately, helping large enterprises to improve their technological innovation. Given these mechanisms at work, many scholars accept that government subsidies can promote technological progress.

4.3.3. Negative Moderating Effect of Government Subsidies

As can be observed from Model 3 in

Table 4, the interaction coefficient of enterprise R&D investment and government subsidies (GovSub × RDI) is −9.316, the interaction coefficient of government subsidies and R&D investment squared (GovSub × RDI

2) is 2.848, and the interaction coefficient of government subsidies and R&D investment cubed (GovSub × RDI

3) is −0.200, all of which are significant at the 5% level. This demonstrates that government subsidies have a negative moderating effect on the relationship between enterprise R&D investment and technological advancement, meaning Hypothesis 2 is confirmed.

Although there have been controversies in academic circles about the role of government subsidies in the development of strategic industries, judging from the actual effect of China’s PV industry’s development, government subsidies have effectively promoted the growth of the PV industry. However, our empirical results show that government subsidies have not played an incentivizing and guiding role in industrial-technological innovation. We believe this may be for the following reasons:

First, due to the high initial manufacturing cost of PV products, it is difficult for enterprises to absorb the cost independently, and the creation of a terminal market is facing a series of bottlenecks. The original intention of the government subsidy policies was actually to cultivate this market, promote industry socialization, and reduce the operational risks and production costs faced by enterprises, rather than directly stimulate enterprises’ R&D investment.

Second, since government subsidies are a “free lunch”, they have negative consequences. Many loopholes have been exposed in the implementation of government subsidies. Some PV enterprises take advantage of their information advantages to defraud tax incentives and government subsidies through deliberate concealment and false declarations, which seriously distort the final policy effect and reverse the stimulus effect of government subsidy policies. In particular, the government subsidy policies for China’s PV industry, especially the early “chaotic” subsidy policy, to some extent, induced many PV enterprises to regard government subsidies as a “free lunch”, resulting in a huge waste of financial resources and loss of control of industrial development, which created overcapacity and excessive competition in the industry. As a result, the European and American developed countries initiated anti-dumping and anti-subsidy regulations against China, which disrupted the structural adjustment and technological progress rhythm of the PV industry.

Third, government subsidies lead to immorality in the management of listed PV enterprises. To a certain extent, government subsidies can increase enterprises’ net profits and improve their financial statements, but to a certain extent, this will lead to inertia. Listed PV enterprises will come to rely on government subsidies to support their performance, resulting in management laziness, excessive compensation, and lack of effort. Enterprises will no longer pay attention to improving their core competitiveness and making technological progress.

To better demonstrate the moderating effect and further intuitively explain Hypothesis 3, this paper followed the guidelines set out in [

44] and plotted significant interactions after grouping the sample by the government subsidy intensity (GovSub).

Figure 8 shows three geometric features: (1) The regression line of the low government subsidy group is above that of the high group; (2) As the intensity of government subsidies increases, all inflection points of the N-shaped curve move to the right (the R&D investment values corresponding to the first and second inflection points of low government subsidies (less than one standard deviation) are 3.08 and 5.03); (3) As the intensity of government subsidies increases, the positive and negative slopes of the nexus between R&D investment and technological progress become smaller, and the curve flattens. This shows that the sensitivity of technological progress to R&D investment will be weakened, and the impact of R&D investment on technological progress will become less positive (more negative). This shows how the role of R&D investment in promoting technological progress weakens.

Figure 8 illustrates the increasingly obvious inhibitory effect of government subsidy policies. We can see that government subsidies are a “double-edged sword” when we combine their positive direct effects. The figure further shows that government subsidy policies are not as widespread among enterprises as they should be, and it is vital to withdraw government subsidies in a timely manner.

Figure 9 demonstrates the marginal effect of government subsidies, showing their impact on technological progress at different levels of subsidy. It can be seen from

Figure 9 that the marginal effect of government subsidies changes from positive to negative, and the overall performance is negative, showing a downward trend. Combined with the above regression results, this further indicates that the negative moderating effect of government subsidies gradually strengthens, and timely withdrawal of government subsidies is crucial.

The control variables can be seen from Model 3 in

Table 4. The coefficient of the enterprise R&D personnel (RDP) is positive and significant at the 5% level, indicating that enterprises can promote technological progress by increasing their investment in R&D personnel. R&D personnel are an important subject to promote the technological progress of PV enterprises, and as such, are the core resources that all enterprises focus on introducing and developing. The investment in R&D personnel will directly impact technological progress. The coefficient of the enterprise scale (lnAssets) is positive and significant at the 1% level, and this result is consistent with the fundamental realities of China. In general, the larger the enterprise, the less restricted the funds, meaning the enterprise can invest more funds in R&D for technological progress. Accordingly, larger enterprises have an advantage in terms of technological progress.

The estimated coefficient of the enterprise age (lnAGE) is negative and not significant. This may be particular to the PV industry, where mass government subsidies have caused many enterprises to swarm to this emerging industry like “hungry wolves”. Yet, repeated construction, disorderly implementation, and overcapacity, combined with the 2008 global financial crisis and anti-dumping regulations from European and American countries, have caused many PV enterprises to close down. Therefore, throughout the development history of China’s PV industry, over the past 21 years, PV enterprises have entered and exited frequently.

The debt-to-asset ratio (Debt) estimated coefficients are positive and not significant, while the equity ratio (ER) estimated coefficients are negative and significant. The coefficient of the operating income growth rate (OIGR) is positive, and the coefficient of the return on total assets ratio (ROA) is negative, with neither significant. The coefficient of Tobin’s Q (TQ) is positive but not significant. Since TQ value reflects the market potential of an enterprise, a higher TQ value indicates better enterprise growth. The better the growth, the more it can be recognized by investors, and the easier it then is for the enterprise to obtain further innovative financing to promote technological innovation. The index regression coefficient, meanwhile, is positive and consistent with common sense.