State Regulation of Energy Transition and Economic Development

Abstract

1. Introduction

2. Materials and Methods

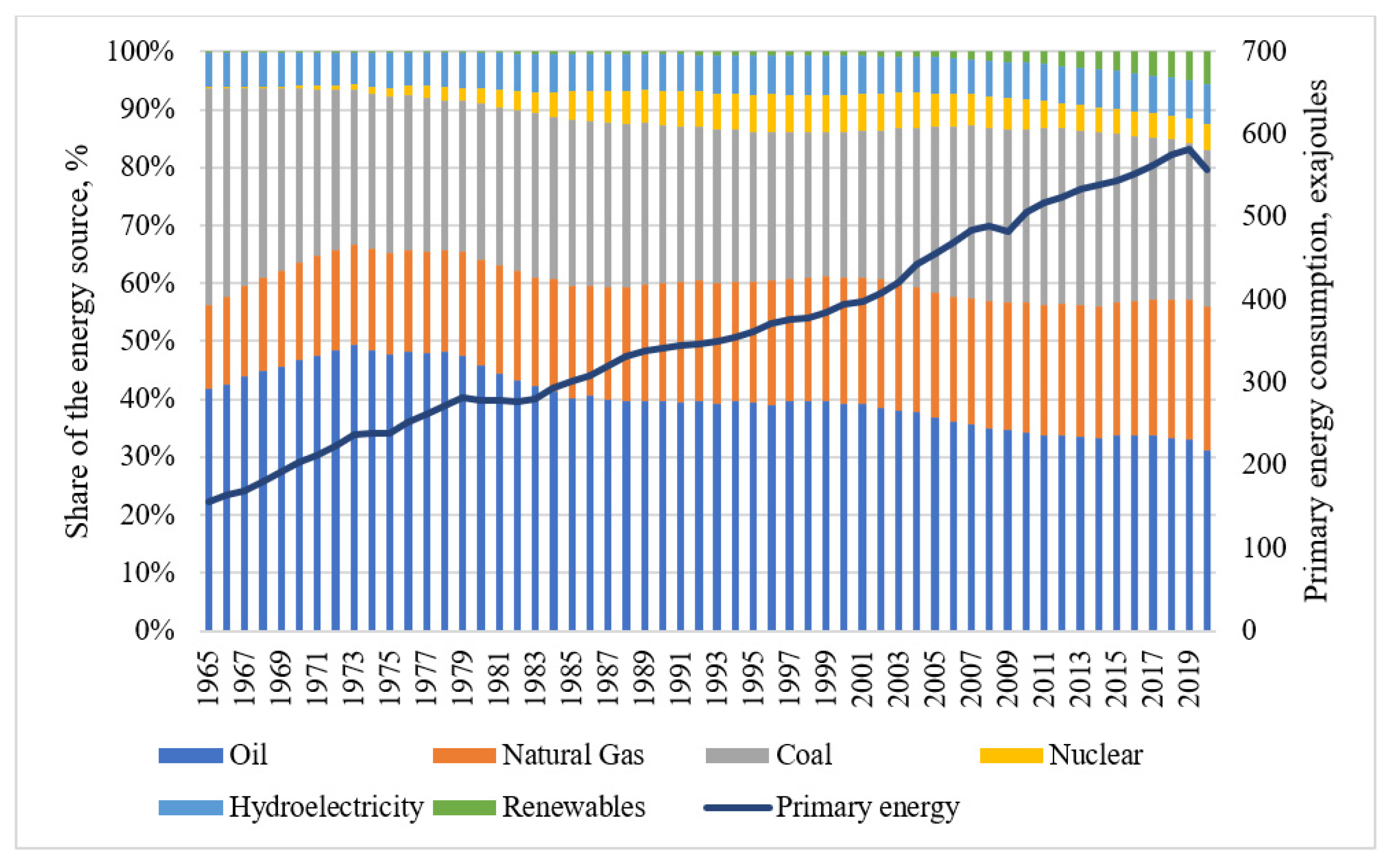

- Analysis of the structure of the primary energy consumption data in the retrospective to evaluate the stage of the current energy transition as well as potential need for state regulation.

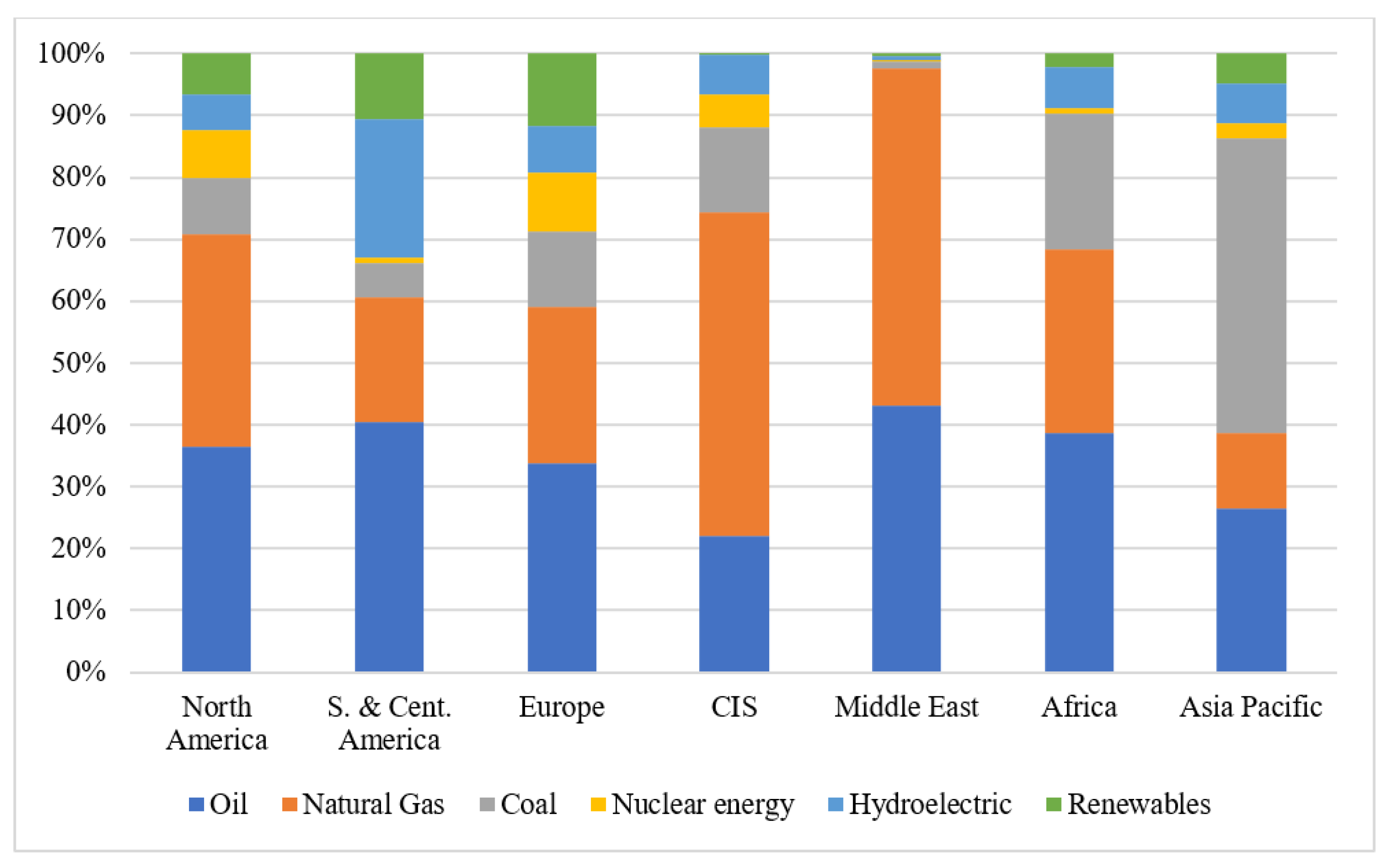

- Analysis of the primary energy consumption by main macroregion and main types of energy sources to identify differences in the fuel and energy balances as basis for regulation.

- Identification of the specific objects of further research, such as countries, provinces and regions of the countries, and intergovernmental unions that can be associated with the active application of carbon regulation.

- Calculation of the net external demand (supply) of the fossil fuels for the chosen countries as a potential factor that can influence the level of regulation.

- Cluster analysis of the chosen objects based on the main proposed factors for regulation.

3. Results

3.1. Global Energy Mix and Carbon Taxes

3.2. Demand for External Energy Sources

3.3. Clustering of the Countries Based on Economic Development and Carbon Price

3.4. Clustering of the Countries Based on Economic Development and Fossil Fuels Demand

4. Discussion

5. Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kryukov, V.; Tokarev, A. Spatial trends of innovation in the Russian oil and gas sector: What does patent activity in Siberia and the Arctic reflect? Reg. Sci. Policy Pract. 2022, 14, 127–146. [Google Scholar] [CrossRef]

- Skjærseth, J.B.; Skodvin, T. Climate Change and the Oil Industry; Manchester University Press: Manchester, UK, 2018. [Google Scholar] [CrossRef][Green Version]

- Brockway, P.E.; Owen, A.; Brand-Correa, L.I.; Hardt, L. Estimation of global final-stage energy-return-on-investment for fossil fuels with comparison to renewable energy sources. Nat. Energy 2019, 4, 612–621. [Google Scholar] [CrossRef]

- Chabrol, M. Re-examining historical energy transitions and urban systems in Europe. Energy Res. Soc. Sci. 2016, 13, 194–201. [Google Scholar] [CrossRef]

- Carley, S.; Konisky, D.M. The justice and equity implications of the clean energy transition. Nat. Energy 2020, 5, 569–577. [Google Scholar] [CrossRef]

- Capellán-Pérez, I.; de Castro, C.; Miguel González, L.J. Dynamic Energy Return on Energy Investment (EROI) and material requirements in scenarios of global transition to renewable energies. Energy Strateg. Rev. 2019, 26, 100399. [Google Scholar] [CrossRef]

- Nieto, J.; Carpintero, Ó.; Miguel, L.J.; de Blas, I. Macroeconomic modelling under energy constraints: Global low carbon transition scenarios. Energy Policy 2020, 137, 111090. [Google Scholar] [CrossRef]

- Carley, S.; Baldwin, E.; MacLean, L.M.; Brass, J.N. Global Expansion of Renewable Energy Generation: An Analysis of Policy Instruments. Environ. Resour. Econ. 2017, 68, 397–440. [Google Scholar] [CrossRef]

- Garcia-Casals, X.; Ferroukhi, R.; Parajuli, B. Measuring the socio-economic footprint of the energy transition. Energy Transit. 2019, 3, 105–118. [Google Scholar] [CrossRef]

- Can Şener, Ş.E.; Sharp, J.L.; Anctil, A. Factors impacting diverging paths of renewable energy: A review. Renew. Sustain. Energy Rev. 2018, 81, 2335–2342. [Google Scholar] [CrossRef]

- Bourcet, C. Empirical determinants of renewable energy deployment: A systematic literature review. Energy Econ. 2020, 85, 104563. [Google Scholar] [CrossRef]

- Darmani, A.; Arvidsson, N.; Hidalgo, A.; Albors, J. What drives the development of renewable energy technologies? Toward a typology for the systemic drivers. Renew. Sustain. Energy Rev. 2014, 38, 834–847. [Google Scholar] [CrossRef]

- Strielkowski, W.; Volkova, E.; Pushkareva, L.; Streimikiene, D. Innovative Policies for Energy Efficiency and the Use of Renewables in Households. Energies 2019, 12, 1392. [Google Scholar] [CrossRef]

- Gökgöz, F.; Güvercin, M.T. Energy security and renewable energy efficiency in EU. Renew. Sustain. Energy Rev. 2018, 96, 226–239. [Google Scholar] [CrossRef]

- Alberini, A.; Bigano, A.; Ščasný, M.; Zvěřinová, I. Preferences for Energy Efficiency vs. Renewables: What Is the Willingness to Pay to Reduce CO2 Emissions? Ecol. Econ. 2018, 144, 171–185. [Google Scholar] [CrossRef]

- Simpson, B.A.W. Coase v. Pigou’ Reexamined. J. Legal Stud. 1996, 25, 53–97. [Google Scholar]

- Deryugina, T.; Moore, F.; Tol, R.S.J. Environmental applications of the Coase Theorem. Environ. Sci. Policy 2021, 120, 81–88. [Google Scholar] [CrossRef]

- Diswandi, D. A hybrid Coasean and Pigouvian approach to Payment for Ecosystem Services Program in West Lombok: Does it contribute to poverty alleviation? Ecosyst. Serv. 2017, 23, 138–145. [Google Scholar] [CrossRef]

- Kingsbury, B.; Krisch, N.; Stewart, R.B. The Emergence of Global Administrative Law. Law Contemp. Probl. 2005, 68, 15–61. [Google Scholar] [CrossRef]

- Vogt-Schilb, A.; Hallegatte, S. Climate policies and nationally determined contributions: Reconciling the needed ambition with the political economy. Wiley Interdiscip. Rev. Energy Environ. 2017, 6, e256. [Google Scholar] [CrossRef]

- Mehling, M.A.; Ritz, R.A. Going beyond Default Intensities in an EU Carbon Border Adjustment Mechanism; Energy Policy Research Group, University of Cambridge: Cambridge, UK, 2020. [Google Scholar]

- Lockwood, B.; Whalley, J. Carbon-motivated Border Tax Adjustments: Old Wine in Green Bottles? World Econ. 2010, 33, 810–819. [Google Scholar] [CrossRef]

- Sanctuary, M. Border carbon adjustments and unilateral incentives to regulate the climate. Rev. Int. Econ. 2018, 26, 826–851. [Google Scholar] [CrossRef]

- Meckling, J. The Globalization of Carbon Trading: Transnational Business Coalitions in Climate Politics. Glob. Environ. Polit. 2011, 11, 26–50. [Google Scholar] [CrossRef]

- Solomon, B.D.; Krishna, K. The coming sustainable energy transition: History, strategies, and outlook. Energy Policy 2011, 39, 7422–7431. [Google Scholar] [CrossRef]

- Dechezleprêtre, A.; Neumayer, E.; Perkins, R. Environmental regulation and the cross-border diffusion of new technology: Evidence from automobile patents. Res. Policy 2015, 44, 244–257. [Google Scholar] [CrossRef]

- Bergek, A.; Berggren, C. The impact of environmental policy instruments on innovation: A review of energy and automotive industry studies. Ecol. Econ. 2014, 106, 112–123. [Google Scholar] [CrossRef]

- Bergquist, A.K.; Söderholm, K.; Kinneryd, H.; Lindmark, M.; Söderholm, P. Command-and-control revisited: Environmental compliance and technological change in Swedish industry 1970–1990. Ecol. Econ. 2013, 85, 6–19. [Google Scholar] [CrossRef]

- Hájek, M.; Zimmermannová, J.; Helman, K.; Rozenský, L. Analysis of carbon tax efficiency in energy industries of selected EU countries. Energy Policy 2019, 134, 110955. [Google Scholar] [CrossRef]

- Brink, C.; Vollebergh, H.R.J.; van der Werf, E. Carbon pricing in the EU: Evaluation of different EU ETS reform options. Energy Policy 2016, 97, 603–617. [Google Scholar] [CrossRef]

- Cao, J.; Ho, M.S.; Jorgenson, D.W.; Nielsen, C.P. China’s emissions trading system and an ETS-carbon tax hybrid. Energy Econ. 2019, 81, 741–753. [Google Scholar] [CrossRef]

- Filimonova, I.V.; Nemov, V.Y.; Komarova, A.V.; Mishenin, M.V.; Kozhevin, V.D. Relationship of Renewable Energy Consumption to Economic, Environmental and Institutional Factors in Europe. Energy Rep. 2021, 7, 358–365. [Google Scholar] [CrossRef]

- Giddings, B.; Hopwood, B.; O’Brien, G. Environment, economy and society: Fitting them together into sustainable development. Sustain. Dev. 2002, 10, 187–196. [Google Scholar] [CrossRef]

- Adams, B. Green Development; Routledge: London, UK, 2008. [Google Scholar] [CrossRef]

- Cooke, P. Green governance and green clusters: Regional & national policies for the climate change challenge of Central & Eastern Europe. J. Open Innov. Technol. Mark. Complex. 2015, 1, 1. [Google Scholar] [CrossRef]

- Gibbs, D.; Jonas, A.; While, A. Changing governance structures and the environment: Economy–environment relations at the local and regional scales. J. Environ. Policy Plan. 2002, 4, 123–138. [Google Scholar] [CrossRef]

- Gan, G.; Ma, C.; Wu, J. Data Clustering: Theory, Algorithms, and Applications; ASA-SIAM Series on Statistics and Applied Mathematics; Society for Industrial and Applied Mathematics: Philadelphia, PA, USA, 2007. [Google Scholar] [CrossRef]

- Yu, Y.; Zhang, Y.; Song, F. World Energy Intensity Revisited: A Cluster Analysis. Appl. Econ. Lett. 2015, 22, 1158–1169. [Google Scholar] [CrossRef]

- Skovgaard, J.; Ferrari, S.S.; Knaggård, Å. Mapping and Clustering the Adoption of Carbon Pricing Policies: What Polities Price Carbon and Why? Clim. Policy 2019, 19, 1173–1185. [Google Scholar] [CrossRef]

- Parobek, J.; Paluš, H.; Kalamárová, M.; Loučanová, E.; Šupín, M.; Križanová, A.; Štofková, K.R. Energy Utilization of Renewable Resources in the European Union—Cluster Analysis Approach. BioResources 2016, 11, 984–995. [Google Scholar] [CrossRef]

- Mughal, N.; Kashif, M.; Arif, A.; Guerrero, J.W.G.; Nabua, W.C.; Niedbała, G. Dynamic effects of fiscal and monetary policy instruments on environmental pollution in ASEAN. Environ. Sci. Pollut. Res. 2021, 28, 65116–65126. [Google Scholar] [CrossRef]

- Mahmood, H.; Adow, A.H.; Abbas, M.; Iqbal, A.; Murshed, M.; Furqan, M. The Fiscal and Monetary Policies and Environment in GCC Countries: Analysis of Territory and Consumption-Based CO2 Emissions. Sustainability 2022, 14, 1225. [Google Scholar] [CrossRef]

- Martins, F.; Felgueiras, C.; Smitkova, M.; Caetano, N. Analysis of Fossil Fuel Energy Consumption and Environmental Impacts in European Countries. Energies 2019, 12, 964. [Google Scholar] [CrossRef]

- Stringer, T.; Joanis, M. Assessing energy transition costs: Sub-national challenges in Canada. Energy Policy 2022, 164, 112879. [Google Scholar] [CrossRef]

- Halkos, G.E.; Paizanos, E.A. The Effects of Fiscal Policy on CO2 Emissions: Evidence from the U.S.A. Energy Policy 2016, 88, 317–328. [Google Scholar] [CrossRef]

- Stepanov, I.A.; Makarov, I.A. Greenhouse Gas Emissions Regulation in Fossil Fuels Exporting Countries: Opportunities and Challenges for Russia. Post-Communist Econ. 2021, 1–28. [Google Scholar] [CrossRef]

- Tagliapietra, S. The impact of the global energy transition on MENA oil and gas producers. Energy Strateg. Rev. 2019, 26, 100397. [Google Scholar] [CrossRef]

- Sinha, A.; Shah, M.I.; Sengupta, T.; Jiao, Z. Analyzing technology-emissions association in Top-10 polluted MENA countries: How to ascertain sustainable development by quantile modeling approach. J. Environ. Manag. 2020, 267, 110602. [Google Scholar] [CrossRef]

- Moz-Christofoletti, M.A.; Pereda, P.C. Winners and Losers: The Distributional Impacts of a Carbon Tax in Brazil. Ecol. Econ. 2021, 183, 106945. [Google Scholar] [CrossRef]

- Inoue, N.; Matsumoto, S.; Morita, M. Inequalities in the Impact of the Carbon Tax in Japan. In Carbon Pricing in Japan; Arimura, T.H., Matsumoto, S., Eds.; Economics, Law, and Institutions in Asia Pacific; Springer: Singapore, 2021; pp. 217–234. [Google Scholar] [CrossRef]

- Gokhale, H. Japan’s Carbon Tax Policy: Limitations and Policy Suggestions. Curr. Res. Environ. Sustain. 2021, 3, 100082. [Google Scholar] [CrossRef]

- Kuo, T.C.; Hong, I.-H.; Lin, S.C. Do Carbon Taxes Work? Analysis of Government Policies and Enterprise Strategies in Equilibrium. J. Clean. Prod. 2016, 139, 337–346. [Google Scholar] [CrossRef]

- Elliott, J.; Fullerton, D. Can a Unilateral Carbon Tax Reduce Emissions Elsewhere? Resour. Energy Econ. 2014, 36, 6–21. [Google Scholar] [CrossRef]

- Best, R.; Burke, P.J.; Jotzo, F. Carbon Pricing Efficacy: Cross-Country Evidence. Environ. Resour. Econ. 2020, 77, 69–94. [Google Scholar] [CrossRef]

| Factor | Indicator | Description |

|---|---|---|

| Level of state (regional) regulation | Price of carbon | Price of carbon obtained as effective tax rate of carbon tax or price formed at ETS |

| Economic development | GDP (GRP) per capita | Total gross domestic or regional product of the considered area divided by the population |

| Emissions | CO2 emission per capita | Total emissions of greenhouse gasses in CO2 equivalent divided by the population |

| Fossil fuel dependence | Net external demand (supply) of the fossil fuels per capita | Difference between the production and consumption of the primary energy sources (crude oil, natural gas, coal) divided by the population |

| Country | Oil | Natural Gas | Coal | Total |

|---|---|---|---|---|

| Canada | 6.63 | 1.84 | 0.50 | 8.97 |

| Mexico | 0.93 | −2.04 | −0.31 | −1.42 |

| USA | −4.27 | 2.91 | 2.95 | 1.59 |

| Argentina | 0.09 | −0.18 | −0.03 | −0.12 |

| Chile | −0.76 | −0.23 | −0.31 | −1.31 |

| Colombia | 1.36 | −0.01 | 2.22 | 3.57 |

| Denmark | −0.10 | 0.01 | −0.04 | −0.13 |

| Estonia | −0.06 | −0.02 | −0.12 | −0.20 |

| Finland | −0.39 | −0.07 | −0.15 | −0.61 |

| France | −3.14 | −1.57 | −0.27 | −4.98 |

| Iceland | −0.04 | 0.00 | −0.00 | −0.04 |

| Ireland | −0.32 | −0.19 | −0.04 | −0.55 |

| Latvia | −0.08 | −0.05 | −0.00 | −0.13 |

| Norway | 3.00 | 3.95 | −0.03 | 6.91 |

| Poland | −1.36 | −0.61 | 0.01 | −1.96 |

| Portugal | −0.50 | −0.22 | −0.05 | −0.78 |

| Slovenia | −0.11 | −0.03 | −0.04 | −0.18 |

| Spain | −2.70 | −1.30 | −0.09 | −4.08 |

| Sweden | −0.6 | 0.0 | −0.1 | −0.7 |

| Switzerland | −0.44 | −0.12 | −0.00 | −0.57 |

| Ukraine | −0.48 | −0.32 | −0.49 | −1.29 |

| United Kingdom | −0.82 | −1.36 | −0.15 | −2.34 |

| China | −19.78 | −4.71 | −2.03 | −26.52 |

| Japan | −7.32 | −3.89 | −4.89 | −16.10 |

| New Zealand | −0.36 | −0.18 | 0.02 | −0.52 |

| Singapore | −3.0 | −0.5 | 0.0 | −3.5 |

| South Korea | −5.16 | −2.02 | −3.42 | −10.60 |

| Cluster | Country | Indicator * | Mean | Max | Min |

|---|---|---|---|---|---|

| 1 | Newfoundland and Labrador, Canada; RGGI, USA; California, USA; Tokyo, Japan; Singapore Alberta, Canada ** | Carbon price | 13.8 | 23.9 | 3.7 |

| CO2 emission | 14.2 | 21.3 | 8.4 | ||

| GDP per capita | 66.8 | 69.9 | 63.1 | ||

| 2 | Quebec, Canada; Canada (country); Prince Edward Island, Canada; Denmark; UK; New Zealand; Korea; British Columbia, Canada | Carbon price | 25.5 | 35.8 | 15.9 |

| CO2 emission | 9.8 | 15.5 | 5.4 | ||

| GDP per capita | 47.3 | 61.6 | 33.4 | ||

| 3 | Argentina; Guangdong, China; Fujian, China; Hubei, China; Shenzhen, China; Colombia; Latvia; Mexico; Zacatecas, Mexico; Chile; Ukraine | Carbon price | 5.3 | 14.1 | 0.4 |

| CO2 emission | 3.8 | 5.1 | 1.6 | ||

| GDP per capita | 11.3 | 17.8 | 3.1 | ||

| 4 | Beijing, China; Saitama, Japan; Japan; Estonia; Slovenia; Portugal; Poland; Spain; Tianjin, China; Chongqing, China; Shanghai, China | Carbon price | 8.6 | 28.2 | 0.1 |

| CO2 emission | 7.7 | 13.7 | 4.0 | ||

| GDP per capita | 23.4 | 39.8 | 10.6 | ||

| 5 | Switzerland; Ireland; Iceland; EU; Finland; France; Norway Sweden ** | Carbon price | 49.2 | 72.8 | 34.8 |

| CO2 emission | 6.2 | 8.0 | 4.4 | ||

| GDP per capita | 61.2 | 86.4 | 35.7 |

| Cluster | Country | Indicator * | Mean | Max | Min |

|---|---|---|---|---|---|

| 1 | China; Argentina; Colombia; Latvia; Mexico; Ukraine; Chile; Poland | Carbon price | 4.60 | 14.10 | 0.08 |

| CO2 emission | 4.63 | 8.24 | 1.60 | ||

| GDP per capita | 13.33 | 23.18 | 3.10 | ||

| Net demand | −0.02 | 0.07 | −0.07 | ||

| 2 | USA; Canada | Carbon price | 20.26 | 31.83 | 8.69 |

| CO2 emission | 15.37 | 15.50 | 15.24 | ||

| GDP per capita | 54.76 | 63.06 | 46.45 | ||

| Net demand | 0.12 | 0.24 | 0.01 | ||

| 3 | UK; Denmark; New Zealand; Spain; Portugal; Slovenia | Carbon price | 24.14 | 28.19 | 17.62 |

| CO2 emission | 5.81 | 6.77 | 4.84 | ||

| GDP per capita | 37.98 | 61.59 | 23.55 | ||

| Net demand | −0.07 | −0.11 | −0.02 | ||

| 4 | Korea; Estonia; Japan Singapore ** | Carbon price | 6.95 | 15.89 | 2.35 |

| CO2 emission | 11.02 | 12.22 | 8.74 | ||

| GDP per capita | 32.09 | 39.81 | 23.05 | ||

| Net demand | −0.16 | −0.13 | −0.21 | ||

| 5 | EU; Finland; France; Ireland; Iceland; Switzerland Sweden ** | Carbon price | 49.21 | 72.83 | 34.83 |

| CO2 emission | 6.22 | 8.04 | 4.40 | ||

| GDP per capita | 61.20 | 86.39 | 35.73 | ||

| Net demand | −0.09 | −0.07 | −0.12 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Komarova, A. State Regulation of Energy Transition and Economic Development. Energies 2022, 15, 4304. https://doi.org/10.3390/en15124304

Komarova A. State Regulation of Energy Transition and Economic Development. Energies. 2022; 15(12):4304. https://doi.org/10.3390/en15124304

Chicago/Turabian StyleKomarova, Anna. 2022. "State Regulation of Energy Transition and Economic Development" Energies 15, no. 12: 4304. https://doi.org/10.3390/en15124304

APA StyleKomarova, A. (2022). State Regulation of Energy Transition and Economic Development. Energies, 15(12), 4304. https://doi.org/10.3390/en15124304