The Role of Resource Consumption Accounting in Achieving Competitive Prices and Sustainable Profitability

Abstract

1. Introduction

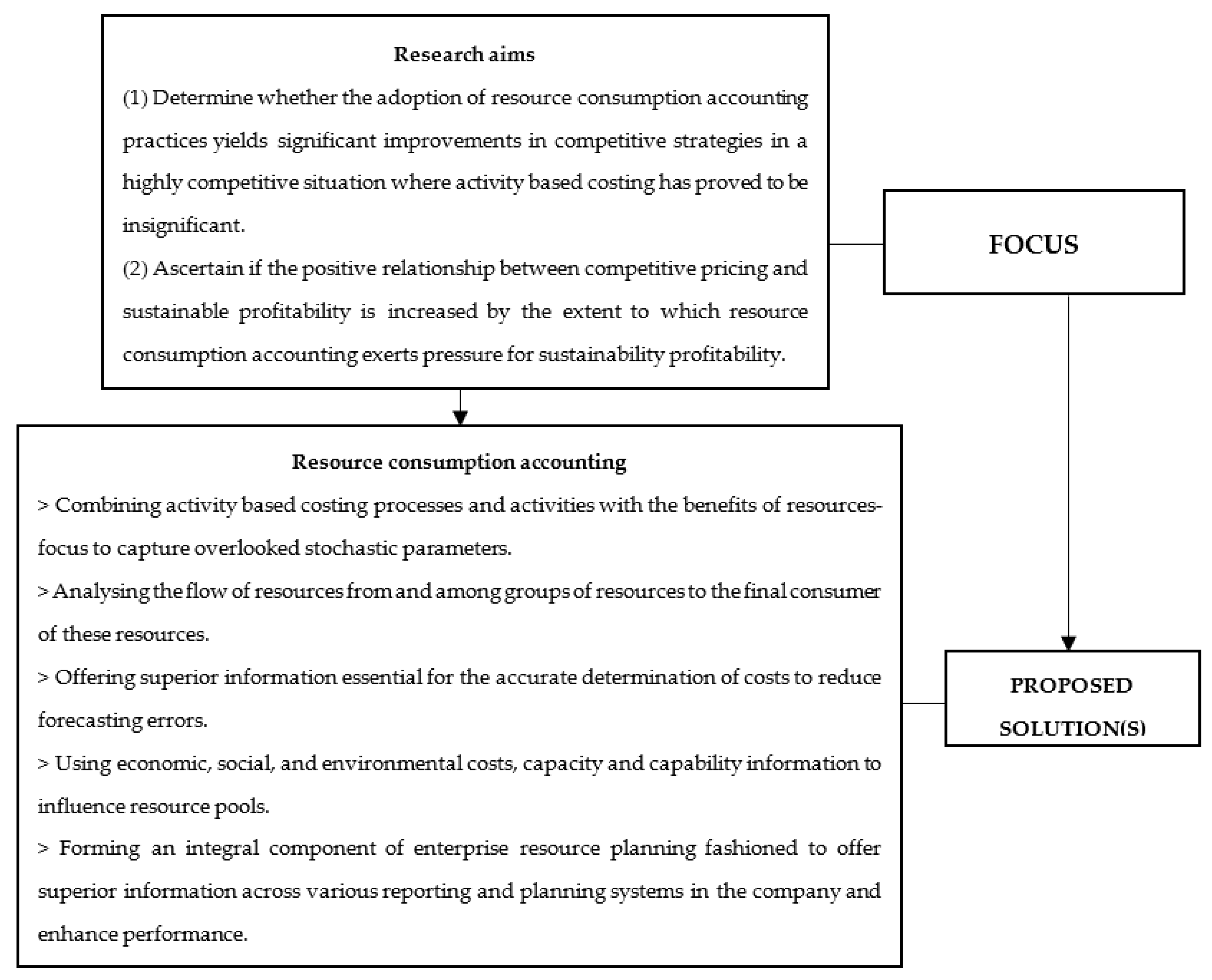

- (1)

- Given cases where applying activity-based costing methods has proved to insignificantly influence competitive pricing strategies, will the application of resource consumption accounting significantly impact companies’ competitive pricing strategies?

- (2)

- Will the positive relationship between competitive pricing and sustainable profitability be increased by the extent to which resource consumption accounting exerts pressure for sustainability profitability?

2. Literature Review

2.1. The Role of Resource Consumption Accounting in Contemporary Business Situations

2.2. The Role of the Electricity Market and Competitive Pricing Strategies

2.3. The Resource-Based View’s Theoretical Perspectives on RCA, Competitive Pricing and Sustainable Profitability Connections

2.4. Sustainable Profitability

2.5. The Impact of Competitive Prices on Sustainable Profitability

3. Research Methodology

3.1. Methodology

3.2. Description of Variables and Hypothesis Development

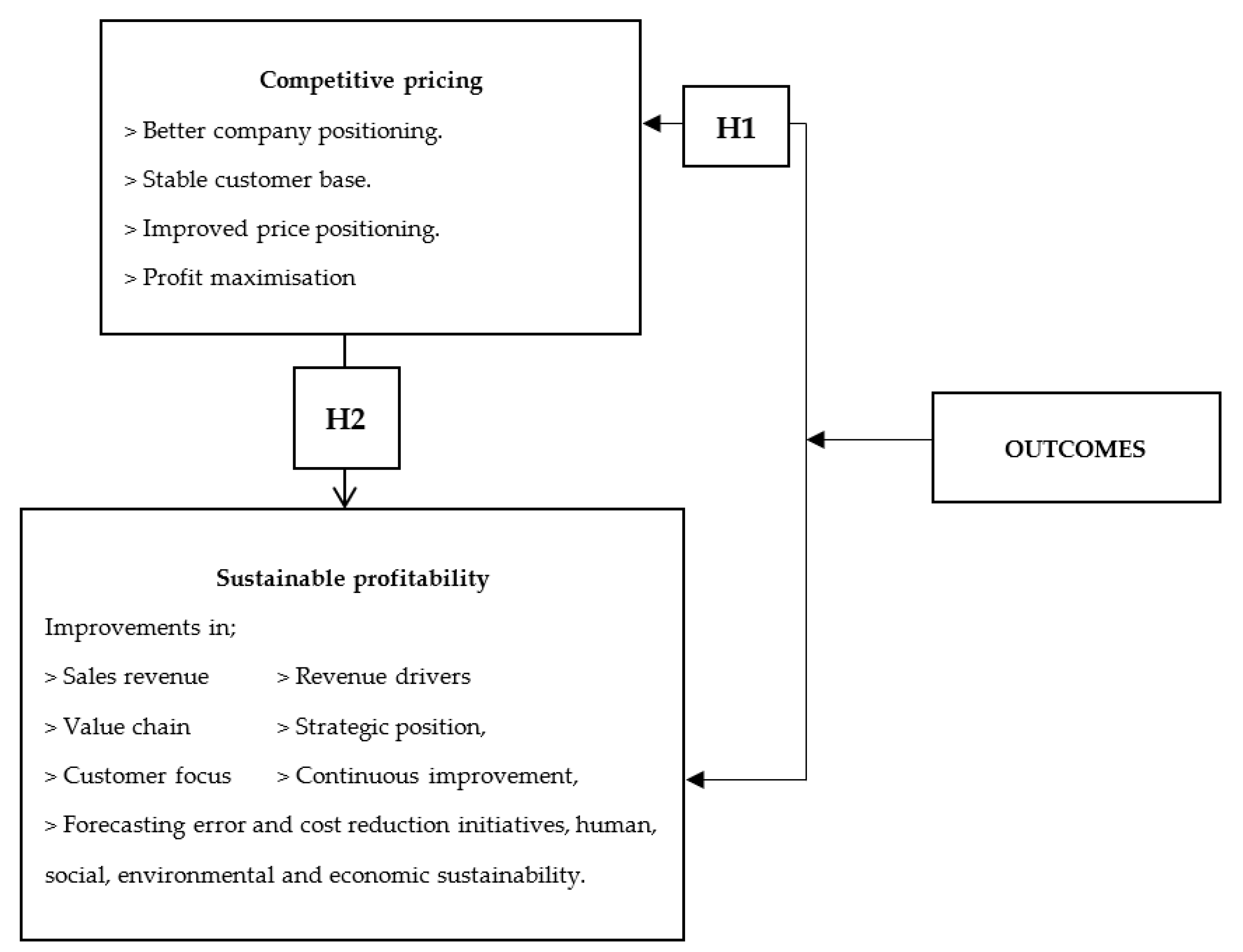

3.2.1. The Influence of Resource Consumption Accounting on Competitive Prices

3.2.2. Insights into the Moderating Effects of Resource Consumption Accounting

3.2.3. Conceptual Framework

3.3. Data

3.3.1. Sampling Methods

3.3.2. Validity and Reliability Tests

4. Research Findings and Discussions

4.1. Factor Analysis

4.2. Discriminant Validity, Internal Consistency and Convergent Validity Tests

4.3. Model Fit

4.4. Path Analysis

4.5. Moderating Effects

5. Conclusions

5.1. Research Limitations

5.2. Future Research Directions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Makadok, R. Invited Editorial: The Four Theories of Profit and Their Joint Effects. J. Manag. 2011, 37, 1316–1334. [Google Scholar] [CrossRef]

- Chen, L. Sustainability and Company Performance: Evidence from the Manufacturing Industry. Ph.D. Thesis, Linköping University, Inköping, Sweden, 2015. [Google Scholar] [CrossRef]

- Song, J.; Su, Y.; Su, T.; Wang, L. The dilemma of winners: Market power, industry competition and subsidy efficiency. Chin. Manag. Stud. 2021. [CrossRef]

- Hartley, K. Rising Costs: Augustine Revisited. Def. Peace Econ. 2021, 31, 434–442. [Google Scholar] [CrossRef]

- Markovic, S.; Koporcic, N.; Arslanagic-Kalajdzic, M.; Kadic-Maglajlic, S.; Bagherzadeh, M.; Islam, N. Business-to-business open innovation: COVID-19 lessons for small and medium-sized enterprises from emerging markets. Technol. Forecast. Soc. Chang. 2021, 170, 120883. [Google Scholar] [CrossRef]

- Jassem, S. Benefits of Switching from Activity-Based Costing to Resource Consumption Accounting: Evidence from a Power Generator Manufacturing Plant. Manag. Account. Rev. 2019, 18, 169–190. [Google Scholar]

- Kbelah, S.I.; Amusawi, E.G.; Almagtome, A. Using Resource Consumption Accounting for Improving the Competitive Advantage in Textile Industry. J. Eng. Appl. Sci. 2019, 14, 575–582. [Google Scholar] [CrossRef]

- Ozyapici, H.; Tanis, V.N. Improving health care costing with resource consumption accounting. Int. J. Health Care Qual. Assur. 2016, 29, 646–663. [Google Scholar] [CrossRef]

- Nyaga, P.K.; Muema, M.W. An analysis of the effect of pricing strategies on profitability of Insurance firms in Kenya. Int. J. Fin. Acc. 2017, 2, 44–65. [Google Scholar] [CrossRef]

- Abbas, K.M.; Wagdi, O. Cost systems adoption in Egyptian manufacturing firms: Competitive study between ABC and RCA Systems. In Proceedings of the 21st International Economic Conference—IECS, Sibiu, Romania, 16 May 2014; pp. 1–8. [Google Scholar]

- Gupta, V.; Ivanov, D.; Choi, T.-M. Competitive pricing of substitute products under supply disruption. Omega 2021, 101, 102279. [Google Scholar] [CrossRef]

- Vidrova, Z.; Krizanova, A.; Gajanova, L. Advantages, Limits and Issues of Using the Competitive Pricing Strategy. Econ. Soc. Dev. Book Proc. 2019, 17, 339–348. [Google Scholar]

- Xu, P.; Xiao, T. Pricing and entry strategies for competitive firms with optimistic entrant. Int. Trans. Oper. Res. 2021, 29, 1159–1187. [Google Scholar] [CrossRef]

- Vlasic, D.; Poldrugovac, K.; Jankovic, S. The Competitive pricing in marina business: Exploring relative price position and price fluctuation. J. Tour. Her. Ser. Mar. 2019, 5, 3–8. [Google Scholar]

- Kumar, M.; Basu, P.; Avittathur, B. Pricing and sourcing strategies for competing retailers in supply chains under disruption risk. Eur. J. Oper. Res. 2018, 265, 533–543. [Google Scholar] [CrossRef]

- Išoraitė, M. The competitive advantages theoretical aspects. Ecoforum J. 2018, 30, 1–6. [Google Scholar]

- Al-Qady, M.; El-Helbawy, S. Integrating Target Costing and Resource Consumption Accounting. J. App. Man. Acc. Res. 2016, 14, 39–54. [Google Scholar]

- Clinton, B.D.; Keys, D.E. Resource consumption accounting: The next generation of cost management systems. Focus Mag. 2002, 5, 35–42. [Google Scholar]

- Webber, S.; Clinton, B.D. Resource consumption accounting applied: The Clopay case. Manag. Account. Q. 2004, 6, 1–14. [Google Scholar]

- Yilmaz, B.; Ceran, M.B. The role of resource consumption accounting in organizational change and innovation. Econ. Man. Fin Mar. 2017, 12, 131–140. [Google Scholar]

- Gibson, R.B. Specification of Sustainability-based Environmental Assessment Decision Criteria and Implications for Deter-mining “Significance” in Environmental Assessment; Paper prepared under a contribution agreement with the Canadian Environmental Assessment Agency Research and Development Programme; Ottawa, Canada. Sus. Dev. Res. Inst. 2001, 1–55. [Google Scholar]

- Elkington, J. Towards the Sustainable Corporation: Win-Win-Win Business Strategies for Sustainable Development. Calif. Manag. Rev. 1994, 36, 90–100. [Google Scholar] [CrossRef]

- Zimon, D.; Tyan, J.; Sroufe, R. Drivers of sustainable supply chain management: Practices to alignment with un sustainable development goals. Inter. J. Qual. Res. 2020, 14, 219–236. [Google Scholar] [CrossRef]

- Schipper, C.; Dekker, G.; Visser, B.; Bolman, B.; Lodder, Q. Characterization of SDGs towards Coastal Management: Sustainability Performance and Cross-Linking Consequences. Sustainability 2021, 13, 1560. [Google Scholar] [CrossRef]

- Claro, P.B.D.O.; Esteves, N.R. Sustainability-oriented strategy and Sustainable Development Goals. Mark. Intell. Plan. 2021, 39, 613–630. [Google Scholar] [CrossRef]

- Cramton, P. Electricity market design. Oxf. Rev. Econ. Policy 2007, 33, 589–612. [Google Scholar] [CrossRef]

- Gougheri, S.S.; Jahangir, H.; Golkar, M.A.; Ahmadian, A.; Golkar, M.A. Optimal participation of a virtual power plant in electricity market considering renewable energy: A deep learning-based approach. Sustain. Energy Grids Netw. 2021, 26, 100448. [Google Scholar] [CrossRef]

- Sadeghi, S.; Jahangir, H.; Vatandoust, B.; Golkar, M.A.; Ahmadian, A.; Elkamel, A. Optimal bidding strategy of a virtual power plant in day-ahead energy and frequency regulation markets: A deep learning-based approach. Int. J. Electr. Power Energy Syst. 2020, 127, 106646. [Google Scholar] [CrossRef]

- Hasan, M.K.; Mohammad, N. An Outlook over Electrical Energy Generation and Mixing Policies of Bangladesh to Achieve Sustainable Energy Targets-Vision 2041. In Proceedings of the International Conference on Electrical, Computer and Communication Engineering (ECCE), Cox’s Bazar, Bangladesh, 7–9 February 2019; pp. 1–5. [Google Scholar]

- Parker, G.G.; Tan, B.; Kazan, O. Electric Power Industry: Operational and Public Policy Challenges and Opportunities. Prod. Oper. Manag. 2019, 28, 2738–2777. [Google Scholar] [CrossRef]

- Pourhaji, N.; Asadpour, M.; Ahmadian, A.; Elkamel, A. The Investigation of Monthly/Seasonal Data Clustering Impact on Short-Term Electricity Price Forecasting Accuracy: Ontario Province Case Study. Sustainability 2022, 14, 3063. [Google Scholar] [CrossRef]

- Jahangir, H.; Tayarani, H.; Baghali, S.; Ahmadian, A.; Elkamel, A.; Golkar, M.A.; Castilla, M.A. Novel electricity price fore-casting approach based on dimension reduction strategy and rough artificial neural networks. IEEE Trans. Ind. Inform. 2019, 16P, 2369–2381. [Google Scholar]

- Vatandoust, B.; Ahmadian, A.; Golkar, M.A.; Elkamel, A.; Almansoori, A.; Ghaljehei, M. Risk-Averse Optimal Bidding of Electric Vehicles and Energy Storage Aggregator in Day-Ahead Frequency Regulation Market. IEEE Trans. Power Syst. 2018, 34, 2036–2047. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Sadeghi, R. Pricing strategies in the competitive reverse supply chains with traditional and e-channels: A game theoretic approach. Int. J. Prod. Econ. 2019, 215, 48–60. [Google Scholar] [CrossRef]

- Dimitriou, L. Optimal competitive pricing in European port container terminals: A game-theoretical framework. Transp. Res. Interdiscip. Perspect. 2021, 9, 100287. [Google Scholar] [CrossRef]

- Farham-Nia, S.; Ghaffari-Hadigheh, A. Optimal pricing strategy in uncertain dual distribution channel with retail services. J. Model. Manag. 2021, 3, 799–824. [Google Scholar] [CrossRef]

- Li, P.; Rao, C.; Goh, M.; Yang, Z. Pricing strategies and profit coordination under a double echelon green supply chain. J. Clean. Prod. 2021, 278, 123694. [Google Scholar] [CrossRef]

- Lockett, A.; Thompson, S.; Morgenstern, U. The development of the resource-based view of the firm: A critical appraisal. Int. J. Manag. Rev. 2009, 11, 9–28. [Google Scholar] [CrossRef]

- Barney, J.B. Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view. J. Man. 2001, 27, 643–650. [Google Scholar] [CrossRef]

- Ahmed, A.; Khuwaja, F.M.; Brohi, N.A.; Othman, I.B.L. Organizational Factors and Organizational Performance: A Resource-Based view and Social Exchange Theory Viewpoint. Int. J. Acad. Res. Bus. Soc. Sci. 2018, 8, 594–614. [Google Scholar] [CrossRef]

- Sroufe, R.; Gopalakrishna-Remani, V. Management, social sustainability, reputation, and financial performance relationships: An empirical examination of US firms. Org. Environ. 2019, 32, 31–62. [Google Scholar] [CrossRef]

- Jum’A, L.; Zimon, D.; Ikram, M.; Madzík, P. Towards a sustainability paradigm; the nexus between lean green practices, sustainability-oriented innovation and Triple Bottom Line. Int. J. Prod. Econ. 2022, 245, 108393. [Google Scholar] [CrossRef]

- Cui, H.; Wang, R.; Wang, H. An evolutionary analysis of green finance sustainability based on multi-agent game. J. Clean. Prod. 2020, 269, 121799. [Google Scholar] [CrossRef]

- Mareai Senan, N.A.; Alhebri, A.A. Role of Resource Consumption Accounting in Supporting the Practices of Value-Maximizing and Cost-Reduction in Strategic Thought: A Theoretical Study. Talent. Dev. Excell. 2020, 12, 3731–3743. [Google Scholar]

- Strand, R.; Freeman, R.E.; Hockerts, K. Corporate Social Responsibility and Sustainability in Scandinavia: An Overview. J. Bus. Ethics 2015, 127, 1–15. [Google Scholar] [CrossRef]

- Bodhanwala, S.; Bodhanwala, R. Does corporate sustainability impact firm profitability? Evidence from India. Manag. Decis. 2018, 56, 1734–1747. [Google Scholar] [CrossRef]

- De Figueiredo, J.M. Finding sustainable profitability in electronic commerce. MIT Sloan Manag. Rev. 2000, 1, 41. [Google Scholar]

- Porter, M.E. The five competitive forces that shape strategy. Harv. Bus. Rev. 2008, 86, 78–93. [Google Scholar]

- Daly, J.L. Pricing for Profitability: Activity-Based Pricing for Competitive Advantage; John Wiley & Sons: New York, NY, USA, 2002. [Google Scholar]

- De Toni, D.; Milan, G.S.; Saciloto, E.B.; Larentis, F. Pricing strategies and levels and their impact on corporate profitability. Rev. Adm. 2017, 52, 120–133. [Google Scholar] [CrossRef]

- Hinterhuber, A.; Liozu, S. Is it time to rethink your pricing strategy. MIT Sloan Manag. Rev. 2012, 53, 69–77. [Google Scholar]

- Kohli, C.; Suri, R. The price is right? Guidelines for pricing to enhance profitability. Bus. Horiz. 2021, 54, 563–573. [Google Scholar] [CrossRef]

- Liu, Z.; Chen, J.; Diallo, C. Optimal production and pricing strategies for a remanufacturing firm. Int. J. Prod. Econ. 2018, 204, 290–315. [Google Scholar] [CrossRef]

- Al-Rawi, A.M.; Al-Hafiz, H.A. The role of resource consumption accounting (RCA) in improving cost management in the Jor-danian commercial banks. Int. J. Econ. Fin. 2018, 10, 28–39. [Google Scholar] [CrossRef][Green Version]

- Brierley, J.A. An examination of the use of profitability analysis in manufacturing industry. Int. J. Account. Audit. Perform. Eval. 2016, 12, 85. [Google Scholar] [CrossRef]

- Mulandi, C. Survey of the Factors Determining Profitability of Microfinance Institutions in Kenya. Ph.D. Thesis, University of Nairobi, Nairobi, Kenya, 2010; pp. 1–74. [Google Scholar]

- Tse, M.; Gong, M. Recognition of idle resources in time-driven activity-based costing and resource consumption accounting models. J. App. Man. Acc. Re. 2009, 7, 41–54. [Google Scholar]

- Yijuan, L.; Ting, W. Management Accounting Tools and Application Cases Resource Consumption Accounting Method and Application. Adv. Soc. Sci. Educ. Humanit. Res. 2017, 121, 408–414. [Google Scholar]

- Wang, C.-H.; Chen, Y.-C.; Sulistiawan, J.; Bui, T.-D.; Tseng, M.-L. Hybrid Approach to Corporate Sustainability Performance in Indonesia’s Cement Industry. Sustainability 2021, 13, 14039. [Google Scholar] [CrossRef]

- Kuhlman, T.; Farrington, J. What is Sustainability? Sustainability 2010, 2, 3436–3448. [Google Scholar] [CrossRef]

- Zheng, G.W.; Siddik, A.B.; Masukujjaman, M.; Fatema, N. Factors Affecting the Sustainability Performance of Financial In-stitutions in Bangladesh: The Role of Green Finance. Sustainability 2021, 18, 10165. [Google Scholar] [CrossRef]

- Avila, M.M.; García-Machado, J.J.; Moreno, E.F. A Multiple Full Mediating Effect in a PLS Hierarchical Component Model: Application to the Collaborative Public Management. Mathematics 2021, 9, 1910. [Google Scholar] [CrossRef]

- Ringle, C.M.; Sarstedt, M.; Mitchell, R.; Gudergan, S.P. Partial least squares structural equation modeling in HRM research. Int. J. Hum. Resour. Manag. 2020, 31, 1617–1643. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial least squares structural equation modeling. Hand. Mar. Res. 2017, 26, 1–40. [Google Scholar]

- Cohen, L.; Manion, L.; Morrison, K. Validity and reliability. In Research Methods in Education; Routledge: London, UK, 2019; pp. 245–284. [Google Scholar]

- Yong, A.G.; Pearce, S. A Beginner’s Guide to Factor Analysis: Focusing on Exploratory Factor Analysis. Tutorials Quant. Methods Psychol. 2013, 9, 79–94. [Google Scholar] [CrossRef]

- Shumacker, R.E. Interaction and Nonlinear Effects in Structural Equation Modeling; Routledge: London, UK, 2017. [Google Scholar]

- Ramayah, T.; Cheah, J.; Chuah, F.; Ting, H.; Memon, M.A. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using smartPLS 3.0.; Springer: Cham, Switzerland, 2018; pp. 1–72. [Google Scholar]

- Ringle, C.; Da Silva, D.; Bido, D. Structural equation modeling with the SmartPLS. Braz. J. Mark. 2015, 13, 56–73. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 4th ed.; Prentice Hall: Hoboken, NJ, USA, 2010. [Google Scholar]

- Wong, K.K.K. Mastering Partial Least Squares Structural Equation Modeling (PLS-Sem) with Smartpls in 38 Hours; IUniverse: Bloomington, IN, USA, 2019. [Google Scholar]

| Sustainable Profitability Perspectives | Aspect | No. | Criteria |

|---|---|---|---|

| Economic perspective | Financial performance | SP1 | Sales volume |

| SP2 | Revenue inflows | ||

| SP3 | Costs drivers | ||

| SP4 | Investments | ||

| Environmental perspective | Resource usage | SP5 | Decreasing harmful materials |

| SP6 | Reducing waste as inputs | ||

| SP7 | Efficiency of raw materials | ||

| SP8 | Renewable energy resources | ||

| Environmental pollution | SP9 | Total waste disposal | |

| SP10 | Greenhouse gas emissions | ||

| SP11 | Noise pollution | ||

| Human perspective | Human resources development | SP12 | Employee satisfaction |

| SP13 | Training and development | ||

| Social perspective | Community interests | SP14 | Socio-oriented mission statement |

| SP15 | Charity contribution |

| Variable | Description | Frequency | Percentage |

|---|---|---|---|

| Gender | Male Female Total | 84 45 129 | 92.25 28.81 100 |

| Age group | 18–30 years 31–45 years 46–60 years Total | 14 95 20 129 | 11.02 73.73 15.25 100 |

| Job position | Cost accountant Finance manager General manager Marketing manager Human resources manager Total | 24 26 24 30 14 129 | 20.34 22.03 15.25 23.73 11.86 100 |

| Industry | Telecommunication Food and agriculture Construction Mining industry Manufacturing Total | 14 36 33 13 22 129 | 11.86 30.51 27.97 11.02 18.64 100 |

| CP | RCA | SP | |

| Mean | 3.12 | 4.08 | 4.12 |

| Standard deviation | 0.78 | 0.64 | 0.78 |

| Variable Elements | Factor Loadings | Variable Elements | Factor Loadings | Variable Elements | Factor Loadings |

|---|---|---|---|---|---|

| RCA3 | 0.784 | CP1 | 0.770 | SP2 | 0.740 |

| RCA4 | 0.730 | CP4 | 0.780 | SP4 | 0.760 |

| RCA6 | 0.780 | CP5 | 0.740 | SP5 | 0.740 |

| RCA8 | 0.820 | CP7 | 0.820 | SP6 | 0.777 |

| RCA9 | 0.810 | CP8 | 0.760 | SP7 | 0.754 |

| RCA11 | 0.800 | CP11 | 0.820 | SP10 | 0.748 |

| RCA13 | 0.840 | CP12 | 0.800 | SP12 | 0.777 |

| RCA | CP | SP | |

|---|---|---|---|

| RCA | 0.760 | ||

| CP | 0.610 | 0.740 | |

| SP | 0.714 | 0.650 | 0.771 |

| Cronbach’s Alpha | rho_A | Composite Reliability | AVE | |

|---|---|---|---|---|

| RCA | 0.815 | 0.770 | 0.870 | 0.588 |

| CP | 0.836 | 0.820 | 0.884 | 0.570 |

| SP | 0.844 | 0.865 | 0.890 | 0.580 |

| NFI | Chi-Square | d_G | d_ULS | SRMR | |

|---|---|---|---|---|---|

| Saturated Model | 0.750 | 210.814 * | 0.415 | 1.045 | 0.084 |

| Estimated Model | 0.750 | 210.814 * | 0.415 | 1.045 | 0.084 |

| Estimate | p Values | Impact | Hypothesis | |

|---|---|---|---|---|

| RCA→CP | 0.728 | 0.000 | Significant | H1: Accepted |

| RCA→SP | 0.610 | 0.038 | Significant | |

| CP→SP | 0.326 | 0.000 | Significant |

| Estimate | p Values | Hypothesis | |

|---|---|---|---|

| RCA → CP → SP | 0.443 | 0.000 | - |

| CP → RCA → SP | 0.674 | 0.000 | H2: Accepted |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mustafa, A.M.; Azimli, A.; Sabir Jaf, R.A. The Role of Resource Consumption Accounting in Achieving Competitive Prices and Sustainable Profitability. Energies 2022, 15, 4155. https://doi.org/10.3390/en15114155

Mustafa AM, Azimli A, Sabir Jaf RA. The Role of Resource Consumption Accounting in Achieving Competitive Prices and Sustainable Profitability. Energies. 2022; 15(11):4155. https://doi.org/10.3390/en15114155

Chicago/Turabian StyleMustafa, Abdurrahman Mawlood, Asil Azimli, and Rizgar Abdullah Sabir Jaf. 2022. "The Role of Resource Consumption Accounting in Achieving Competitive Prices and Sustainable Profitability" Energies 15, no. 11: 4155. https://doi.org/10.3390/en15114155

APA StyleMustafa, A. M., Azimli, A., & Sabir Jaf, R. A. (2022). The Role of Resource Consumption Accounting in Achieving Competitive Prices and Sustainable Profitability. Energies, 15(11), 4155. https://doi.org/10.3390/en15114155