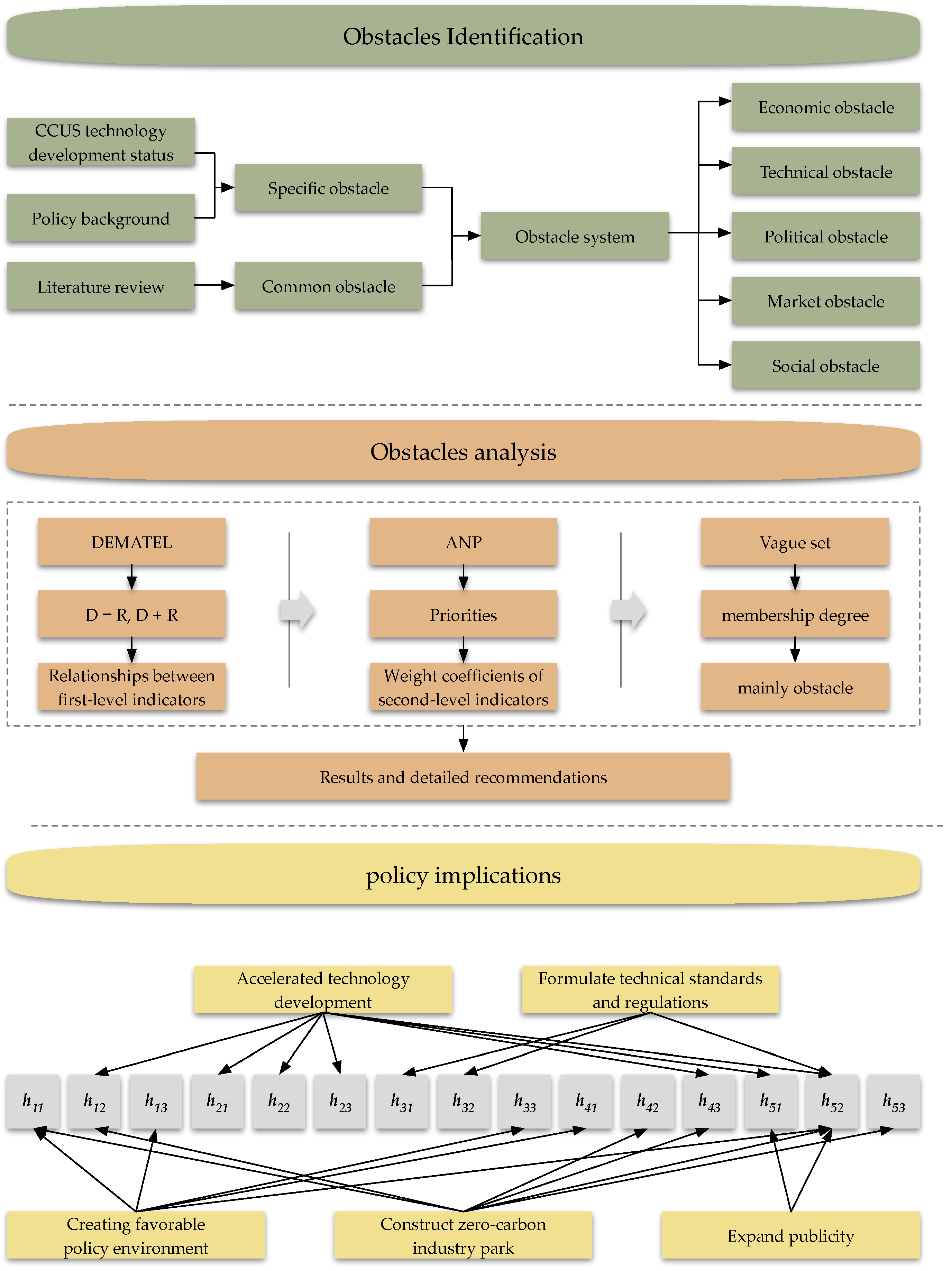

5.1. Results and Discussion

The DEMATEL method was used to determine the relationships between first-level indicators. In this study, the direct-relation matrix

was constructed based on expert judgement.

The combined impact matrix

is calculated through Equation (3).

The centrality (

D +

R) and causality (

D −

R) of first level indicators are shown in

Table 1.

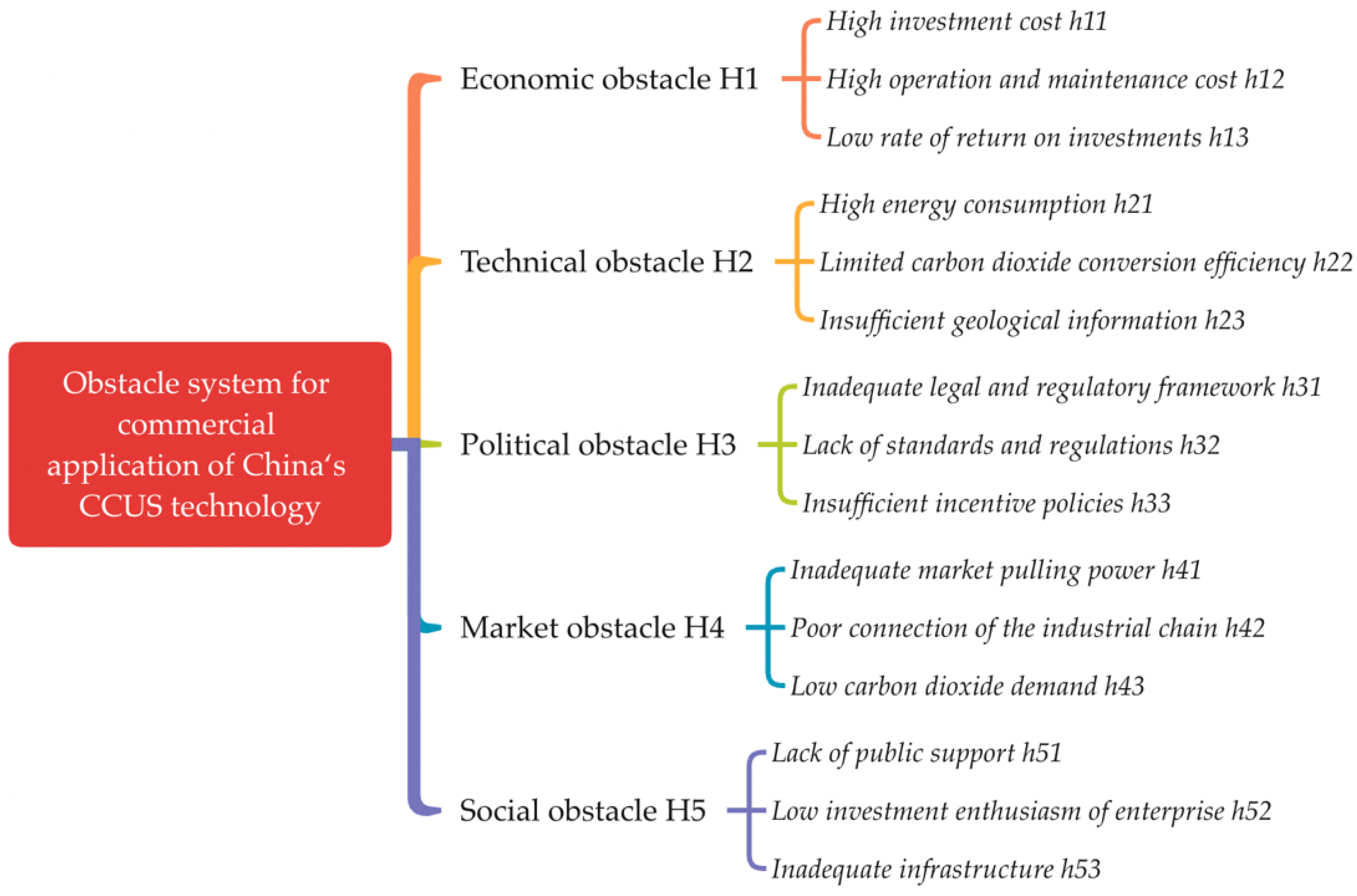

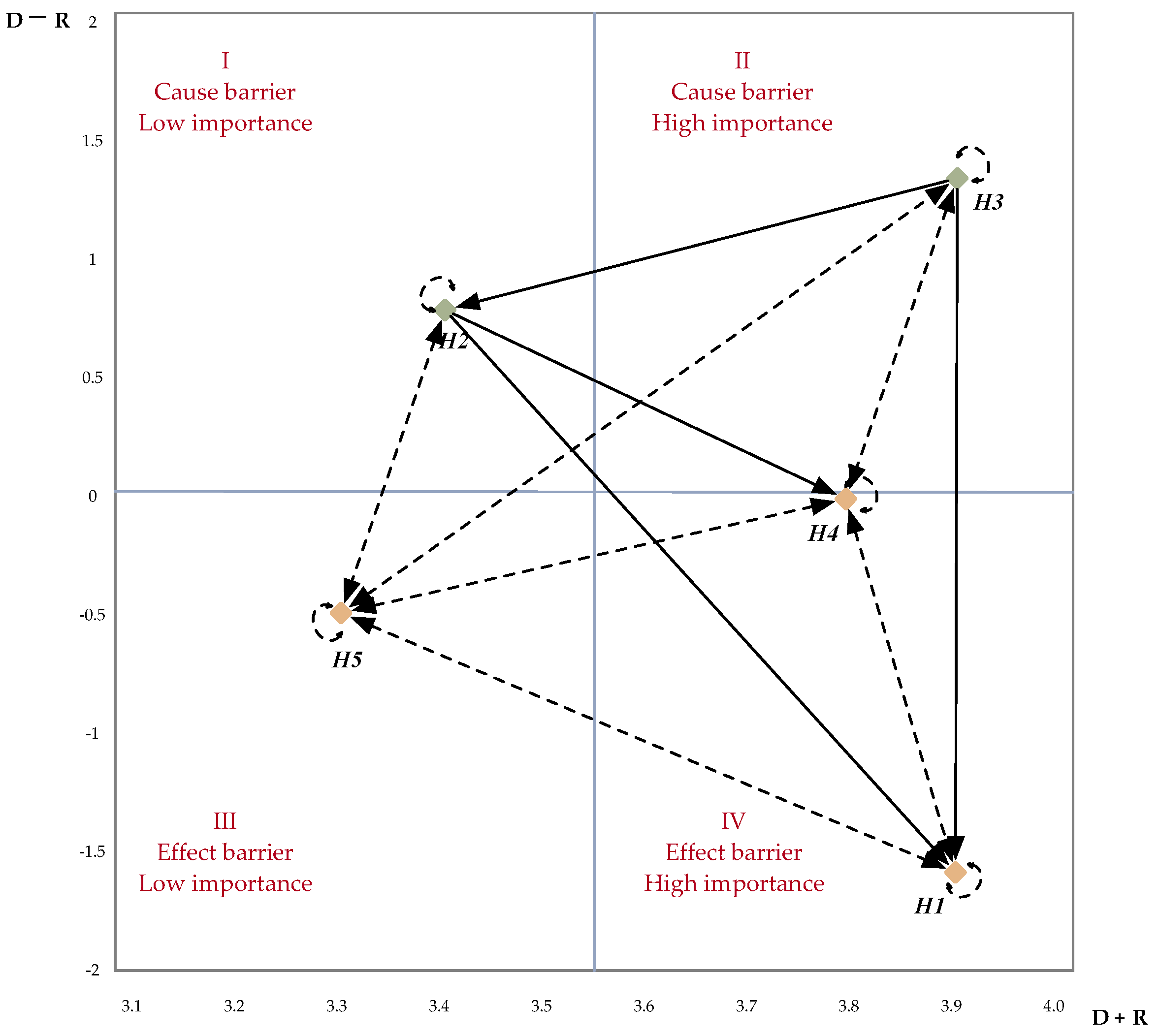

Table 1 shows us the following conclusions: According to the results of the centrality (

D +

R) calculation, the five first-level indicators are ranked in order of importance, political (

, 3.93122260) > economic (

, 3.91535766) > market (

, 3.81553357) > technical (

, 3.41224494) > social (

, 3.33966240), with political obstacle being the most significant obstacle to the commercialization of CCUS technology in China. According to the results of the causality (

D −

R) calculation, technical and political have a positive causality (

D −

R), indicating that they are causative indicators. Economic, market, and social causality (

D −

R) are all negative, indicating that they are result indicators. That is, technological and political obstacles have an impact on economic, market, and social barriers. Furthermore, causality (

D −

R) values show that policy is the most important causative indicator (1.32605887) and economic is the most obvious result indicator (1.32605887). The five first-level indicators interact with each other and their interactions are shown in

Figure 3 below.

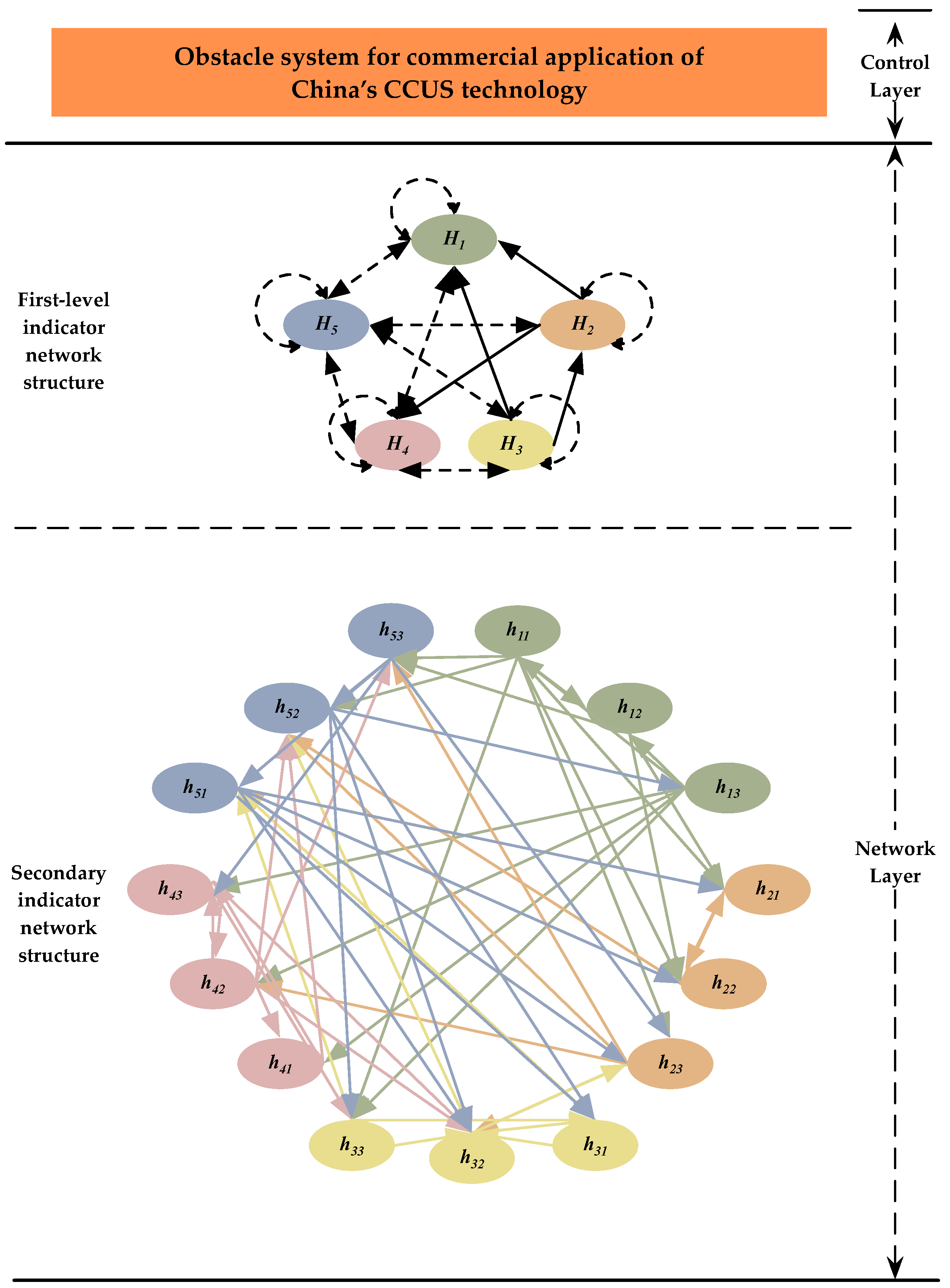

Afterwards, on the basis of the identified inter-influence relationships of the first-level indicators (

Figure 3), this study analyses the second-level indicators and their interactions. The ANP network hierarchy of the obstacle system was drawn by collating the expert opinions (as shown in

Figure 4 and the interaction among indicators is specified in

Table 2). After that, according to the relationship between the indicators in

Figure 3 and

Figure 4, the weight coefficients of the second-level indicators,

, were calculated using Super Decision software and the results are shown in

Table 3.

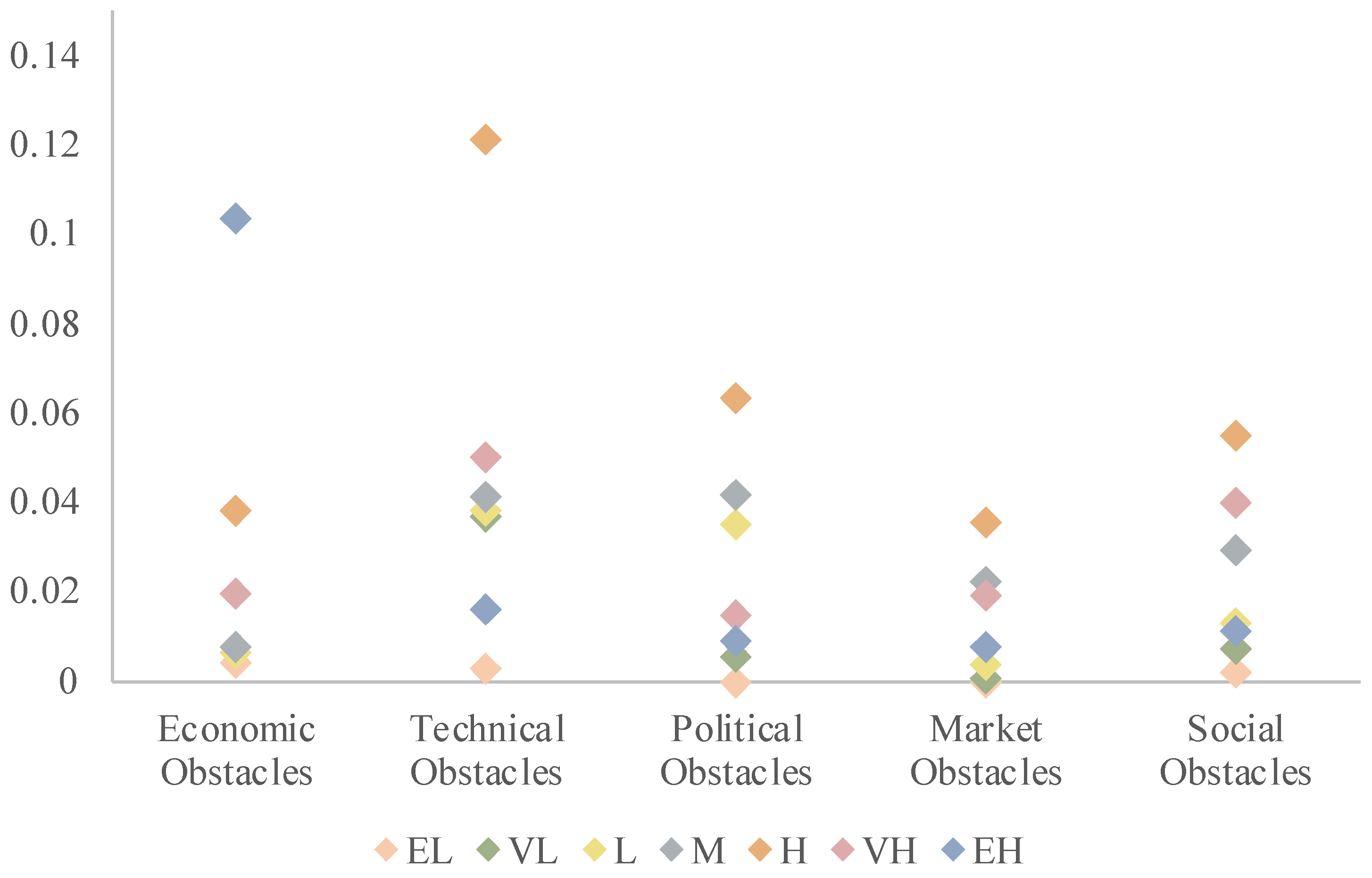

The degree of influence of the 15 second-level indicators on the commercialization of CCUS technology in China is ranked as follows based on the weighting calculation results: . There are four indicators with a weight coefficient greater than 0.1, including limited carbon dioxide conversion, high energy consumption, low rate of return on investments and low investment enthusiasm of enterprise.

To further determine the specific degree of influence of each dimension on the commercialization of CCUS technology in China, this study classifies the degree of influence into seven levels, including extremely low (

), very low (

), low (

), medium (

), high (

), very high (

), extremely high (

). Following that, we invited relevant scholars and experts to complete a questionnaire to assess the degree of impact of each indicator. Based on the comprehensive consideration of the expert evaluation results, this paper constructed the Vague value for each indicator, and then established the Vague set evaluation matrix of the evaluation index system, as shown in

Table 4.

Next, according to Equations (16)–(20), the membership degree of five categories of obstacles can be calculated and the results are shown in

Table 5 and

Table 6.

The order of the total membership degree on CCUS technology commercialization is

. This result indicates that China is facing massive challenges in promoting CCUS technology. Economic obstacle has an extremely high effect on the CCUS promotion process. Subsequently, we examined the distribution of membership degree and found that the difference in membership degree of economic and technical obstacles is substantial. In combination with the results of the expert evaluations, there was low hesitancy degree in the assessment of both economic and technical obstacles. That is to say, it is a consensus that economic and technological are the mainly obstacles limiting the commercialization of CCUS technology in China (as shown in

Figure 5).

To sum up, according to the results, the following points can be drawn from the study.

1. Overall, economic obstacle is the mainly obstacle of CCUS technology commercialization in China, which is consistent with the findings of previous studies. However, the underlying cause that hinders the CCUS technology from being commercialized is not the economic obstacle, it is the political obstacle. According to the results, the political obstacle has the highest centrality (D + R) and causality (D − R) values, which are 3.93122260 and 1.32605887, respectively, indicating that the political obstacle is the primary reason why CCUS technology cannot be commercialized in China, and as a cause indicator, it also has a significant impact on other indicators. Thus, describing the problems of commercializing CCUS technology as primarily economic (high investment costs, high O&M costs and low returns) is misleading. Hence, CCUS technology commercialization cannot be prompted just by financial support for project construction. The political obstacle has proven to be tougher than anticipated for CCUSs’ commercialization. This explains why a number of the CCUS projects failed despite adequate funding support.

2. In terms of priority, the second-level indicators are ranked as: . The weights of the second-level indicators show that the factors with the greatest impact on the commercialization of CCUS projects in China belong to technical rather than economic obstacles. This finding further illustrates that the economic obstacle is only the tip of the iceberg. Simultaneously, combined with the results of the DEMATEL analysis, seven critical obstacles must be highlighted: three political obstacles and four obstacles with weights greater than 0.1. They are lack of standards and regulations (), inadequate legal and regulatory framework (), insufficient incentive policies (), limited carbon dioxide conversion efficiency (), high energy consumption (), low rate of return on investments () and low investment enthusiasm of enterprise (). Among them, despite the fact that the indicator weights of and are less than 0.1, they should be considered as critical obstacles since they belong to political obstacles and have a significant impact on other barriers.

3. In promoting the commercialization of CCUS technology, China is caught in a negative feedback loop, where solving the economic and technical problems does not really lead to the CCUSs’ commercial application. To break this cycle, China needs to introduce more incentives and build a sound legal and regulatory system, which will result in a shift in interests (and economics) as well as accelerated development of the technology. Unlike nuclear power, there are no significant opponents to CCUS commercialization, but neither are there many strong supporters. Instead, there are many in the midst who are hesitant. Therefore, in the absence of a rapid technological breakthrough, the commercialization of CCUS technology in China requires a strong push from the government to instill confidence in the public, investors and other stakeholders through policy incentives and to promote a positive cycle (e.g., creating an enabling policy environment for CCUS projects, accelerating investment, improving technical performance, etc.).

5.2. Development Proposals for CCUS Commercialization

From the above analysis, overcoming the problem of enterprise project capital investment will not allow China to break out of its negative cycle. According to expert review, political and technical obstacles, which are causal obstacles that must be overcome first, followed by economic, market, and social obstacles in order to develop the commercialization of CCUS technology in China. Detailed recommendations are as follows.

1. Political obstacle. According to the results of the calculation, the political obstacle has the highest centrality (D + R) and causality (D − R) values, which are 3.93122260 and 1.32605887, respectively, indicating that the political obstacles are the most important and have the greatest influence on the other level indicators. The three second-level indicators under political obstacle are, in order of importance, the lack of standards and regulations (0.0960), inadequate legal and regulatory framework (0.0565) and insufficient incentive policies (0.0364). As a result, removing the political obstacle requires, first, the development of a set of standards applicable to CCUS technology and carbon accounting to serve as a regulatory foundation, second, the enhancement of the existing legal and regulatory system, and third, the promotion of CCUS technology commercialization through incentives.

2. Technical obstacle. The centrality (D + R) and causality (D − R) values for technical obstacle were 3.41224494 and 0.79016880, respectively, where the three second-level indicators were in order of importance: limited carbon dioxide conversion efficiency (0.1551), high energy consumption (0.1241) and insufficient geological information (0.0595). Despite the low importance, technical obstacles should be addressed as they influences other indicators as a causative indicator and have a high secondary indicator weighting. Based on the results, two types of technology are in desperate need of a breakthrough. One is carbon capture technology. In the carbon capture stage, reducing energy consumption and improving conversion efficiency through technological breakthroughs is the key to reducing the O&M costs of carbon capture equipment. Another is geological exploration and assessment. Through technological enhancement, more detailed geological information will be available, providing a valid basis for determining the safety of sequestered CO2.

3. Economic obstacle. The centrality (D + R) and causality (D − R) values for technical obstacle were 3.91535766 and −1.50460996, respectively, where the three second-level indicators were in order of importance: low rate of return on investments (0.1100), high operation and maintenance cost (0.0507) and high investment cost (0.0330). Although economic obstacles are influenced by other types of barriers and cannot be completely eliminated, the rate of return of CCUS projects can be increased by designing CCUS business models (including investment and financing models and benefit sharing mechanisms, for example, Public–Private Partnership (PPP) model), which will support in the commercialization of CCUS.

4. Market obstacle. Market obstacle has a centrality (D + R) score of 3.81553357, second only to economic obstacle, and the causality (D − R) value is of close to zero at −0.06708203, indicating that market obstacle is important and less influenced by other factors. The three second-level indicators were in order of importance: poor connection of the industrial chain (0.0466), low carbon dioxide demand (0.0338) and inadequate market pulling power (0.0151). Therefore, to remove market obstacle, the first step is to strengthen the link between upstream and downstream enterprises in the industry chain, and resolving this issue would also promote a CO2 supply–demand balance.

5. Social obstacle. In terms of the centrality (D + R) and causality (D − R) value for social obstacle, it is not a significant barrier factor. However, it is worth noting that the weight of low investment enthusiasm of enterprise exceeds 0.1 for the three second-level indicators, which is the same as the low rate of return on investments in economic difficulty and significantly higher than the other two secondary indicators (lack of public support 0.0397 and inadequate infrastructure 0.0335). As a result, while the social obstacle is not the most important, the increased willingness of companies to invest requires special attention.