Evaluation of Hierarchical, Multi-Agent, Community-Based, Local Energy Markets Based on Key Performance Indicators †

Abstract

:1. Introduction

1.1. Motivation and Literature Review

1.2. Contributions and Organisation

- We propose a mathematical model for the hierarchical organisation of agent-based local energy markets.

- We implement the proposed hierarchical model in the Grid Singularity Exchange as an open-source code base software tool and show how it can be used for local electricity exchange.

- We analyse the benefits of electricity trading in hierarchical local energy markets with the use of key performance indicators for different market structures, market-clearing mechanisms, and different consumer and prosumer types.

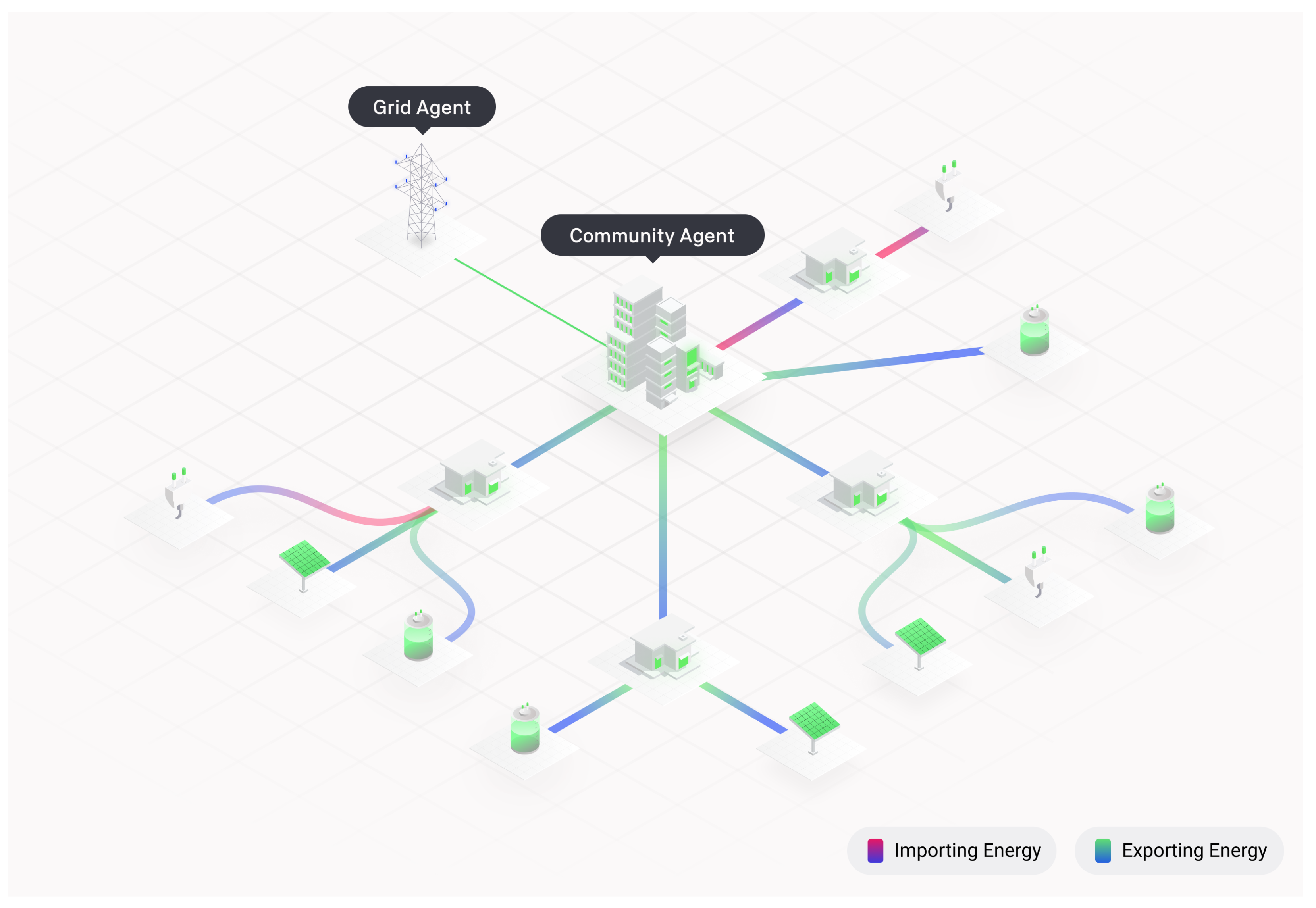

2. Proposed Hierarchical, Community-Based Local Energy Market Structure

2.1. Agents

- The Local Market Operator (LMO) determines the market clearing (one-sided pay-as-offer, two-sided pay-as-bid, and two sided pay-as-clear) mechanism of the LEM and provides access to the LEM’s individual participants. The LMO is responsible for maintaining the LEM exchange agent. The LMO is also in charge of providing market clearing results and market statistics to the DSO, retailer, and the LEM participants.

- LEM participants, also known as local electricity traders (LETs), are local agents who own loads, distributed energy resources, and energy storage systems that are empowered to transact in the LEM.

- The DSO is in charge of maintaining the distribution grid and ensuring grid stability. Moreover, the DSO expresses the state of the distribution grid (e.g., grid-connected and islanded modes based on the interaction between the distribution network and the up-stream grid) as well as assigns static and dynamic grid charges per kWh for electricity traded between LEM participants. Moreover, the grid charges are the cost of maintaining the distribution grid, which is paid per kWh of electricity transacted within the local community; this is incorporated in the process of clearing bids and offers.

- Retailers have a contract with LETs to provide them with continuous energy if they are unable to trade electricity with the LEM.

- The grid agent or the up-stream grid agent acts as an external agent of the LEM, and the local community is able to trade electricity with that in the case of extra local production or consumption. Moreover, the grid agent is modelled as an infinite bus on the distribution grid.

- The exchange agent is an open-source code based on Python and other programming tools; it was developed by Grid Singularity and is called the Grid Singularity Exchange [26]. The exchange agent is responsible for receiving bids and offers, matching the orders, and sending the matched results to LETs, retailers, and the DSO. In the exchange agent, physical agents are defined as those who serve as digital twins for electricity assets such as PVs, electrical loads, and energy storage systems. In addition to electricity asset agents, there are grid and virtual organisation-based agents, including the household, block, sub-community, and community agents in the hierarchy. Thus, the virtual community agents are responsible for energy transactions and forwarding unmatched bids and offers from a lower level to a higher level in the hierarchy. Finally, the grid agent provides the LEM with the external retail electricity price for allowing energy transaction with the up-stream grid.

2.2. Hierarchical Structure for Electricity Trading in the LEM

2.3. Hierarchical Bids and Offers Forwarding

2.4. Trading Strategies for Physical Agents

2.4.1. EL Agents

2.4.2. EP Agents

2.4.3. ESS Agents

2.5. Performance Indicators

3. Simulation Setup

3.1. Data Description

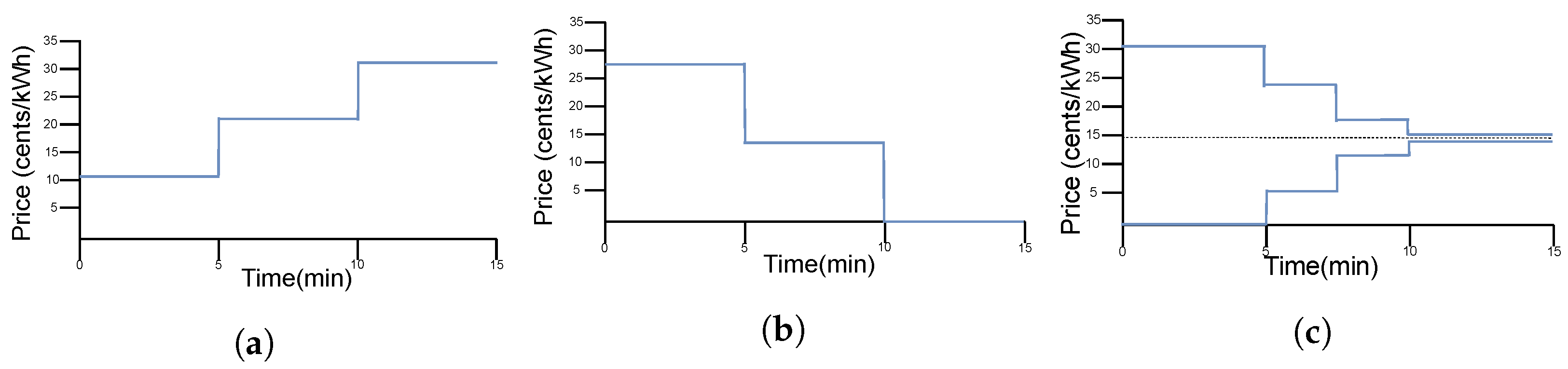

3.2. Price Components

4. Results and Discussion

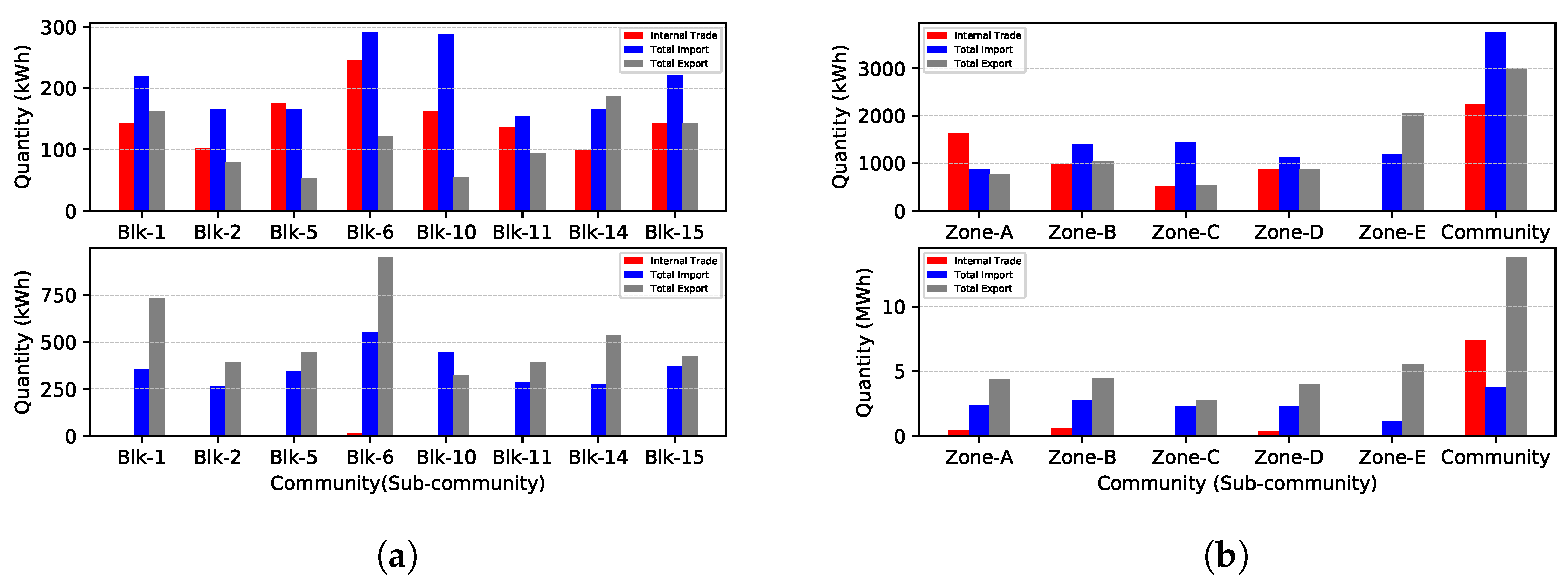

4.1. Energy Exchange per Community Block

4.2. Energy Exchange per Community Zone and Higher Community

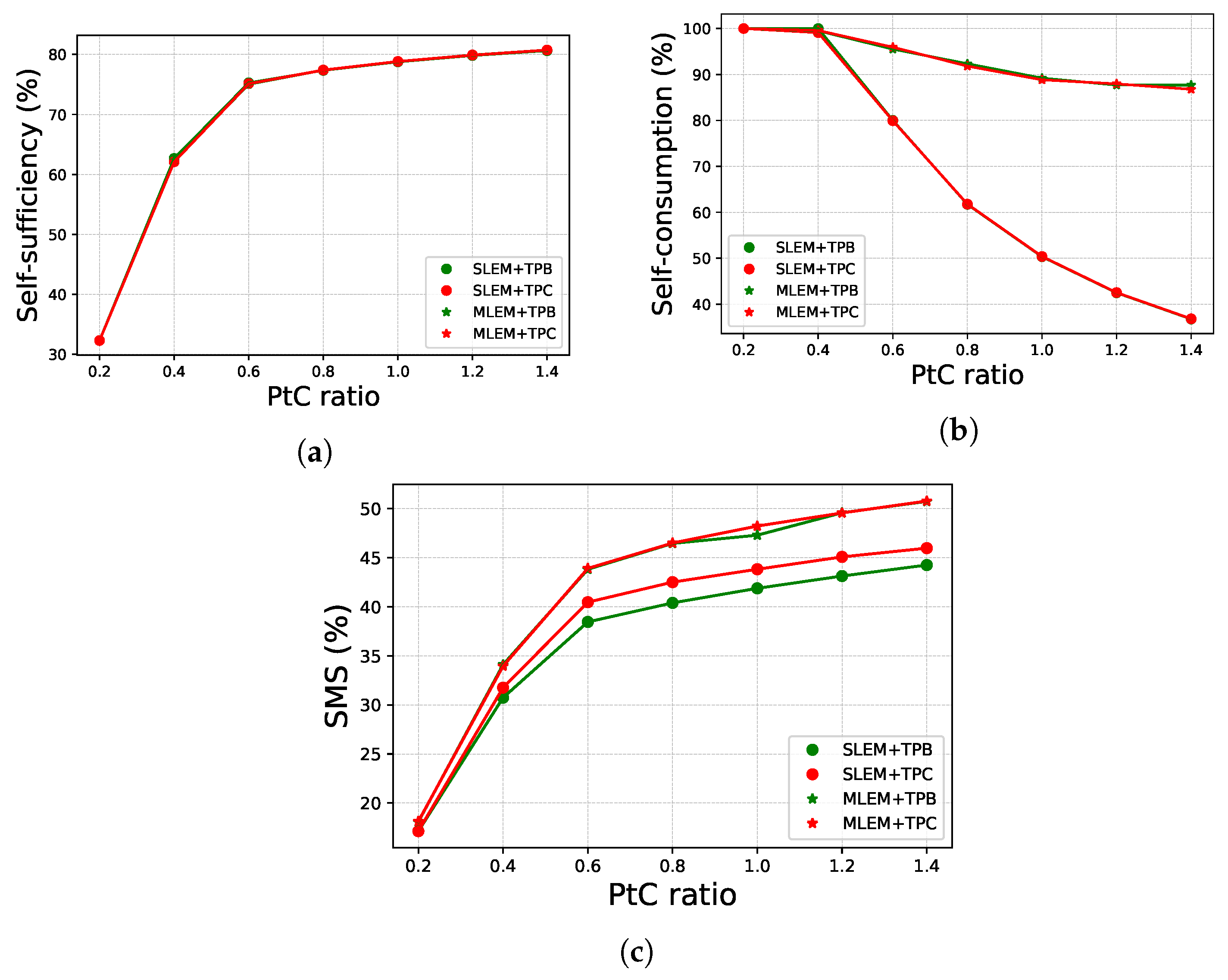

4.3. Comparison of Single-Layer and Multi-Layer, Hierarchical Local Energy Market Models

4.3.1. Share of Individual Savings

4.3.2. Community Self-Sufficiency

4.3.3. Community Self-Consumption

4.3.4. Community Share of Market Savings

4.3.5. Community Average Trade Price

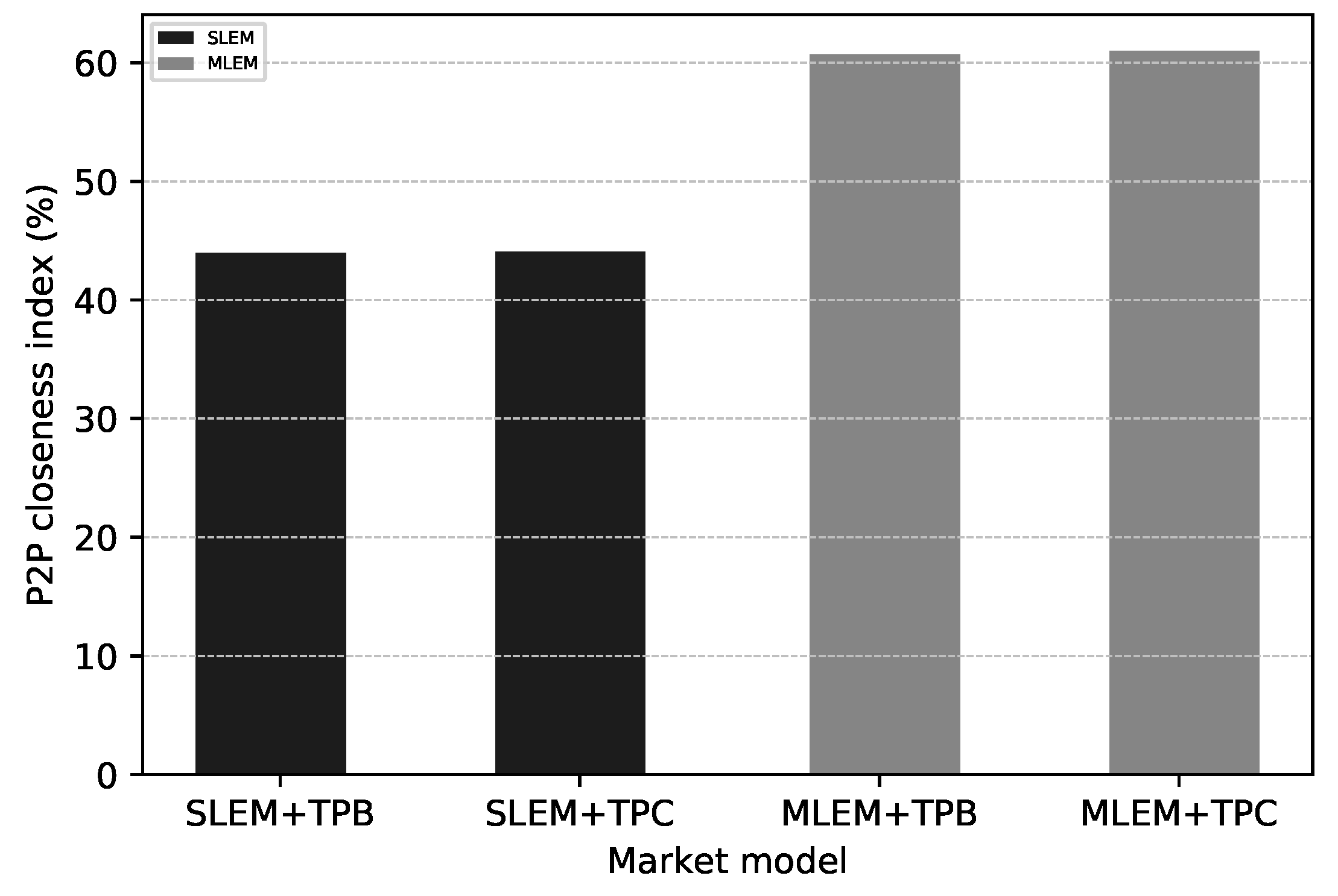

4.3.6. P2P Closeness Index

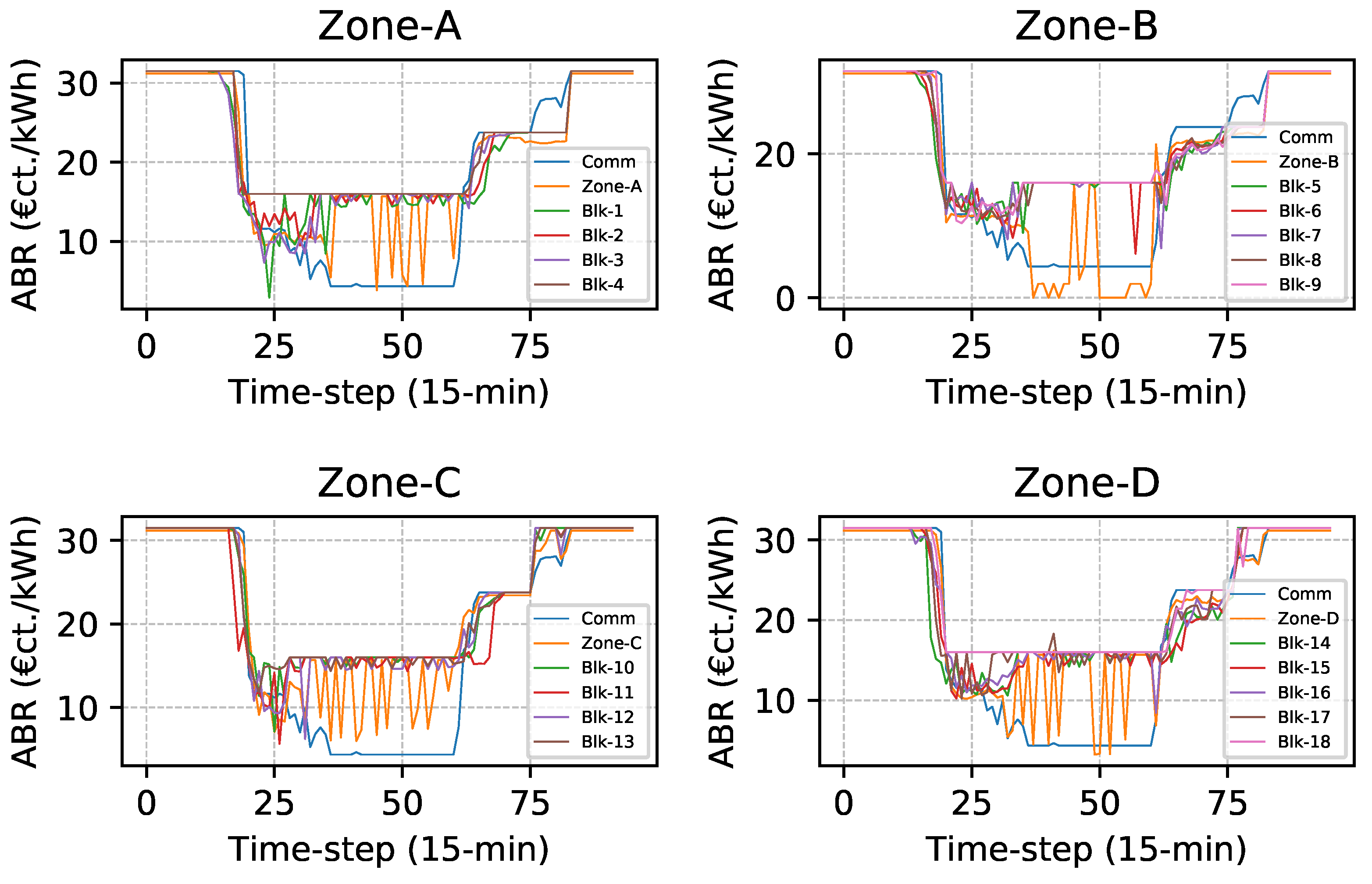

4.4. Comparison of Sub-Community Average Trade Price

4.5. Time Complexity

4.6. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Driesen, J.; Belmans, R. Distributed generation: Challenges and possible solutions. In Proceedings of the 2006 IEEE Power Engineering Society General Meeting, Montreal, QC, Canada, 18–22 June 2006; p. 8. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Bose, S.; Kremers, E.; Eberbach, J.; Hoffmann, B.; Weinhardt, C. Increasing the efficiency of localenergy markets through residential demand response. Energy Inform. 2018, 1, 11. [Google Scholar] [CrossRef]

- Siano, P.; De Marco, G.; Rolán, A.; Loia, V. A survey and evaluation of the potentials of distributed ledger technology for peer-to-peer transactive energy exchanges in local energy markets. IEEE Syst. J. 2019, 13, 3454–3466. [Google Scholar] [CrossRef]

- Bjarghov, S.; Loschenbrand, M.; Ibn Saif, A.U.N.; Alonso Pedrero, R.; Pfeiffer, C.; Khadem, S.K.; Rabelhofer, M.; Revheim, F.; Farahmand, H. Developments and Challenges in Local Electricity Markets: A Comprehensive Review. IEEE Access 2021, 9, 58910–58943. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef] [Green Version]

- Gazafroudi, A.S.; Khajeh, H.; Shafie-khah, M.; Laaksonen, H.; Corchado, J.M. Local market models. In Local Electricity Markets; Elsevier: Amsterdam, The Netherlands, 2021; pp. 79–90. [Google Scholar]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Hybrid trading scheme for peer-to-peer energy trading in transactive energy markets. IET Gen. Trans. Dist. 2019, 14, 245–253. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Staudt, P.; Garttner, J.; Weinhardt, C. Trading on local energy markets: A comparison of market designs and bidding strategies. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Morstyn, T.; Farrell, N.; Darby, S.J.; McCulloch, M.D. Using peer-to-peer energy-trading platforms to incentivize prosumers to form federated power plants. Nat. Energy 2018, 3, 94–101. [Google Scholar] [CrossRef]

- Gazafroudi, A.S.; Mezquita, Y.; Shafie-khah, M.; Prieto, J.; Corchado, J.M. Islanded microgrid management based on blockchain communication. In Blockchain-Based Smart Grids; Elsevier: Amsterdam, The Netherlands, 2020; pp. 181–193. [Google Scholar]

- Morstyn, T.; McCulloch, M.D. Multiclass energy management for peer-to-peer energy trading driven by prosumer preferences. IEEE Trans. Power Syst. 2018, 34, 4005–4014. [Google Scholar] [CrossRef]

- Teotia, F.; Mathuria, P.; Bhakar, R. Peer-to-peer local electricity market platform pricing strategies for prosumers. IET Gen. Trans. Dist. 2020, 14, 4388–4397. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C. Evaluation of peer-to-peer energy sharing mechanisms based on a multiagent simulation framework. Appl. Energy 2018, 222, 993–1022. [Google Scholar] [CrossRef]

- Naval, N.; Yusta, J.M. Virtual power plant models and electricity markets—A review. Renew. Sustain. Energy Rev. 2021, 149, 111393. [Google Scholar] [CrossRef]

- Zia, M.F.; Benbouzid, M.; Elbouchikhi, E.; Muyeen, S.M.; Techato, K.; Guerrero, J.M. Microgrid Transactive Energy: Review, Architectures, Distributed Ledger Technologies, and Market Analysis. IEEE Access 2020, 8, 19410–19432. [Google Scholar] [CrossRef]

- Wang, C.; Li, J.; Li, W.; Zhang, Z.; Shi, Y.; Li, W. Study on the bi-level optimal clearing model of electricity market considering the weight of consumption responsibility. Energy Rep. 2021, 7, 5527–5535. [Google Scholar] [CrossRef]

- Georgilakis, P.S. Review of Computational Intelligence Methods for Local Energy Markets at the Power Distribution Level to Facilitate the Integration of Distributed Energy Resources: State-of-the-art and Future Research. Energies 2020, 13, 186. [Google Scholar] [CrossRef] [Green Version]

- Shokri Gazafroudi, A.S.; Prieto, J.; Corchado, J.M. Virtual Organization Structure for Agent-Based Local Electricity Trading. Energies 2019, 12, 1521. [Google Scholar] [CrossRef] [Green Version]

- Oprea, S.V.; Bâra, A. Devising a trading mechanism with a joint price adjustment for local electricity markets using blockchain. Insights for policy makers. Energy Policy 2021, 152, 112237. [Google Scholar] [CrossRef]

- Okwuibe, G.C.; Wadhwa, M.; Brenner, T.; Tzscheutschler, P.; Hamacher, T. Analysis of Key Performance Indicators for Local Electricity Markets’ Design Analyse des indicateurs clés de performance pour la conception des marchés locaux de l’électricité. IEEE Can. J. Electr. Comput. Eng. 2021, 44, 411–422. [Google Scholar] [CrossRef]

- Gazafroudi, A.S.; Khorasany, M.; Razzaghi, R.; Laaksonen, H.; Shafie-khah, M. Hierarchical approach for coordinating energy and flexibility trading in local energy markets. Appl. Energy 2021, 302, 117575. [Google Scholar] [CrossRef]

- Solanki, B.; Agarwal, A.; Meena, R.; Mahiya, N.; Sharma, D.; Kushwaha, P.; Mathuria, P.; Bhakar, R. Blockchain-based Decentralized Hybrid P2P Energy Trading. In Proceedings of the 2021 9th IEEE International Conference on Power Systems (ICPS), Kharagpur, India, 16–18 December 2021; pp. 1–5. [Google Scholar] [CrossRef]

- Weinhardt, C.; Mengelkamp, E.; Cramer, W.; Hambridge, S.; Hobert, A.; Kremers, E.; Otter, W.; Pinson, P.; Tiefenbeck, V.; Zade, M. How far along are Local Energy Markets in the DACH+ Region? In Proceedings of the Tenth ACM International Conference on Future Energy Systems, Phoenix, AZ, USA, 25–28 June 2019; ACM: New York, NY, USA, 2019; Volume 06152019, pp. 544–549. [Google Scholar] [CrossRef]

- Gazafroudi, A.S.; Okwuibe, G.C.; Hambridge, S.; Dietrich, C.; Trbovich, A.; Tzscheutschler, P.; Hamacher, T.; Shafie-khah, M. Mathematical Model for Agent-based Local Energy Exchange Engine (D3A). In Proceedings of the 2021 International Conference on Smart Energy Systems and Technologies (SEST), Vaasa, Finland, 6–8 September 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Uslar, M.; Rohjans, S.; Neureiter, C.; Pröstl Andrén, F.; Velasquez, J.; Steinbrink, C.; Efthymiou, V.; Migliavacca, G.; Horsmanheimo, S.; Brunner, H.; et al. Applying the Smart Grid Architecture Model for Designing and Validating System-of-Systems in the Power and Energy Domain: A European Perspective. Energies 2019, 12, 258. [Google Scholar] [CrossRef] [Green Version]

- Trbovich, A.; Hambridge, S.; van den Biggelaar, D.; Hesse, E.; Sioshansi, F. D3A energy exchange for a transactive grid. In Behind and Beyond the Meter; Elsevier: Amsterdam, The Netherlands, 2020; pp. 267–284. [Google Scholar]

- Okwuibe, G.C.; Wadhwa, M.; Brenner, T.; Tzscheutschler, P.; Hamacher, T. Intelligent Bidding Strategies in Local Electricity Markets: A Simulation-based Analysis. In Proceedings of the 2020 IEEE Electric Power and Energy Conference (EPEC), Edmonton, AB, Canada, 9–10 November 2020; pp. 1–7. [Google Scholar] [CrossRef]

- Tjaden, T.; Bergner, J.; Weniger, J.; Quaschning, V. Representative Electrical Load Profiles of Residential Buildings in Germany with a Temporal Resolution of One Second. Dataset, HTW Berlin—University of Applied Sciences, License: CC-BY-NV-4.0. Available online: https://www.researchgate.net/publication/285577915_Representative_electrical_load_profiles_of_residential_buildings_in_Germany_with_a_temporal_resolution_of_one_second (accessed on 14 February 2021).

- Pflugradt, N. LoadProfileGenerator. Available online: https://www.loadprofilegenerator.de/ (accessed on 2 July 2021).

- Pflugradt, N. Modellierung von Wasser und Energieverbräuchen in Haushalten. Ph.D. Dissertation, Technische Universität Chemnitz, Chemnitz, Germany, 2016. [Google Scholar]

- Stromnetz-Berlin. Netznutzer -Standardlastprofile. Available online: https://www.stromnetz.berlin/netz-nutzen/netznutzer (accessed on 2 July 2021).

- Fünfgeld, C.; Tiedemann, R. Anwendung der Repräsentativen VDEW-Lastprofile: Step-by-Step. Available online: https://www.bdew.de/media/documents/2000131_Anwendung-repraesentativen_Lastprofile-Step-by-step.pdf (accessed on 8 July 2021).

- Pfenninger, S.; Staffell, I. Long-term patterns of European PV output using 30 years of validated hourly reanalysis and satellite data. Energy 2016, 114, 1251–1265. [Google Scholar] [CrossRef] [Green Version]

- Pfenninger, S.; Staffell, I. Renewables Ninja. Available online: https://www.renewables.ninja/ (accessed on 12 July 2021).

- German VAT Refund. Available online: https://www.germany.info/us-en/service/09-Taxes/vat-refund/906296 (accessed on 12 April 2021).

- Electricity Prices in Europe. Available online: https://strom-report.de/electricity-prices-europe/. (accessed on 14 April 2021).

- Rodríguez, R.; Negrete-Pincetic, M.; Olivares, D.; Lorca, Á.; Figueroa, N. The value of aggregators in local electricity markets: A game theory based comparative analysis. Sustain. Energy Grids Net. 2021, 27, 100498. [Google Scholar] [CrossRef]

- Long, C.; Wu, J.; Zhang, C.; Cheng, M.; Al-Wakeel, A. Feasibility of Peer-to-Peer Energy Trading in Low Voltage Electrical Distribution Networks. Energy Procedia 2017, 105, 2227–2232. [Google Scholar] [CrossRef]

| Location of Buyer and Seller | Trade Index |

|---|---|

| Same block | 0.8 |

| Different blocks but same zone | 0.6 |

| Different zones but same community | 0.4 |

| Different communities | 0.2 |

| Community | No. of Pros [Type] | No. of Cons [Type] | Sub-Communities | Community Storage |

|---|---|---|---|---|

| Blk-1 | 3 [HH] | 4 [HH] | - | - |

| Blk-2 | 2 [HH] | 4 [HH] | - | - |

| Blk-3 | 4 [HH] | 5 [HH] | - | - |

| Blk-4 | - | 4 [HH] | - | - |

| Blk-5 | 1 [HH], 1 [HHS] | 3 [HH] | - | - |

| Blk-6 | 1 [HH], 1 [HHS], 1 [CMS] | 4 [HH] | - | - |

| Blk-7 | 2 [HHS] | 3 [HH] | - | - |

| Blk-8 | 1 [HH], 1[HHS] | 4 [HH] | - | - |

| Blk-9 | 2 [HHS] | 4 [HH] | - | - |

| Blk-10 | 2 [HH] | 3 [HH] | - | - |

| Blk-11 | 2 [HH] | 3 [HH] | - | - |

| Blk-12 | 2 [HH], 1 [CM] | 4 [HH] | - | - |

| Blk-13 | 2 [HH] | 4 [HH] | - | - |

| Blk-14 | 2 [HHS] | 3 [HH] | - | - |

| Blk-15 | 2 [HHS] | 3 [HH] | - | - |

| Blk-16 | 1 [HH], 2 [HHS] | 4 [HH] | - | - |

| Blk-17 | 1 [HHS] | 4 [HH] | - | - |

| Blk-18 | - | 4 [HH] | - | - |

| Zone-A | 2 [CM] | 1 [CM] | [Blk-1, Blk-4] | 1 |

| Zone-B | 2 [CM] | - | [Blk-5, Blk-9] | 1 |

| Zone-C | 1 [CM] | 2 [CM] | [Blk-10, Blk-13] | - |

| Zone-D | 2 [IND] | 1 [CM] | [Blk-14, Blk-18] | - |

| Zone-E | 4 [IND] | - | - | - |

| Community | - | - | [Zone-A, Zone-E] | - |

| Components | Block | Zonal | Community | Up-Stream Grid |

|---|---|---|---|---|

| Trades | Trades | Trades | Trades | |

| Energy price (ct/kWh) | [0 24.50] | [0 23.50] | [0 22.50] | [0 17.75] |

| Metering fee (ct/kWh) | 0.32 | 0.32 | 0.32 | 0.32 |

| Local grid fee (ct/kWh) | - | 1.61 | 3.33 | 3.33 |

| Up-stream grid fee (ct/kWh) | - | - | - | 4.75 |

| Value-added-tax (VAT) (ct/kWh) | [0.06 4.72] | [0.37 4.83] | [0.85 4.96] | [1.60 5.35] |

| Total (ct/kWh) | [0.38 29.54] | [2.30 30.26] | [4.50 31.11] | [10.00 31.50] |

| Market Model | Average Computation Time per Slot (s) |

|---|---|

| SLEM + TPB | 185.41 |

| SLEM + TPC | 181.55 |

| MLEM + TPB | 83.36 |

| MLEM + TPC | 81.55 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Okwuibe, G.C.; Gazafroudi, A.S.; Hambridge, S.; Dietrich, C.; Trbovich, A.; Shafie-khah, M.; Tzscheutschler, P.; Hamacher, T. Evaluation of Hierarchical, Multi-Agent, Community-Based, Local Energy Markets Based on Key Performance Indicators. Energies 2022, 15, 3575. https://doi.org/10.3390/en15103575

Okwuibe GC, Gazafroudi AS, Hambridge S, Dietrich C, Trbovich A, Shafie-khah M, Tzscheutschler P, Hamacher T. Evaluation of Hierarchical, Multi-Agent, Community-Based, Local Energy Markets Based on Key Performance Indicators. Energies. 2022; 15(10):3575. https://doi.org/10.3390/en15103575

Chicago/Turabian StyleOkwuibe, Godwin C., Amin Shokri Gazafroudi, Sarah Hambridge, Christopher Dietrich, Ana Trbovich, Miadreza Shafie-khah, Peter Tzscheutschler, and Thomas Hamacher. 2022. "Evaluation of Hierarchical, Multi-Agent, Community-Based, Local Energy Markets Based on Key Performance Indicators" Energies 15, no. 10: 3575. https://doi.org/10.3390/en15103575

APA StyleOkwuibe, G. C., Gazafroudi, A. S., Hambridge, S., Dietrich, C., Trbovich, A., Shafie-khah, M., Tzscheutschler, P., & Hamacher, T. (2022). Evaluation of Hierarchical, Multi-Agent, Community-Based, Local Energy Markets Based on Key Performance Indicators. Energies, 15(10), 3575. https://doi.org/10.3390/en15103575