Prospects for the Development of the Russian Rare-Earth Metal Industry in View of the Global Energy Transition—A Review

Abstract

1. Introduction

- -

- To analyze the relationship between the transformation of the global energy sector and rare-earth metals;

- -

- To determine why rare-earth metals are considered to be critical in the transformation of the energy sector; and

- -

- To investigate in what ways the current trends associated with the global energy transition affect Russia and what potential impact they can have on the prospects for the development of the domestic REM industry in the future (taking into account the current state of the national industry).

2. Materials and Methods

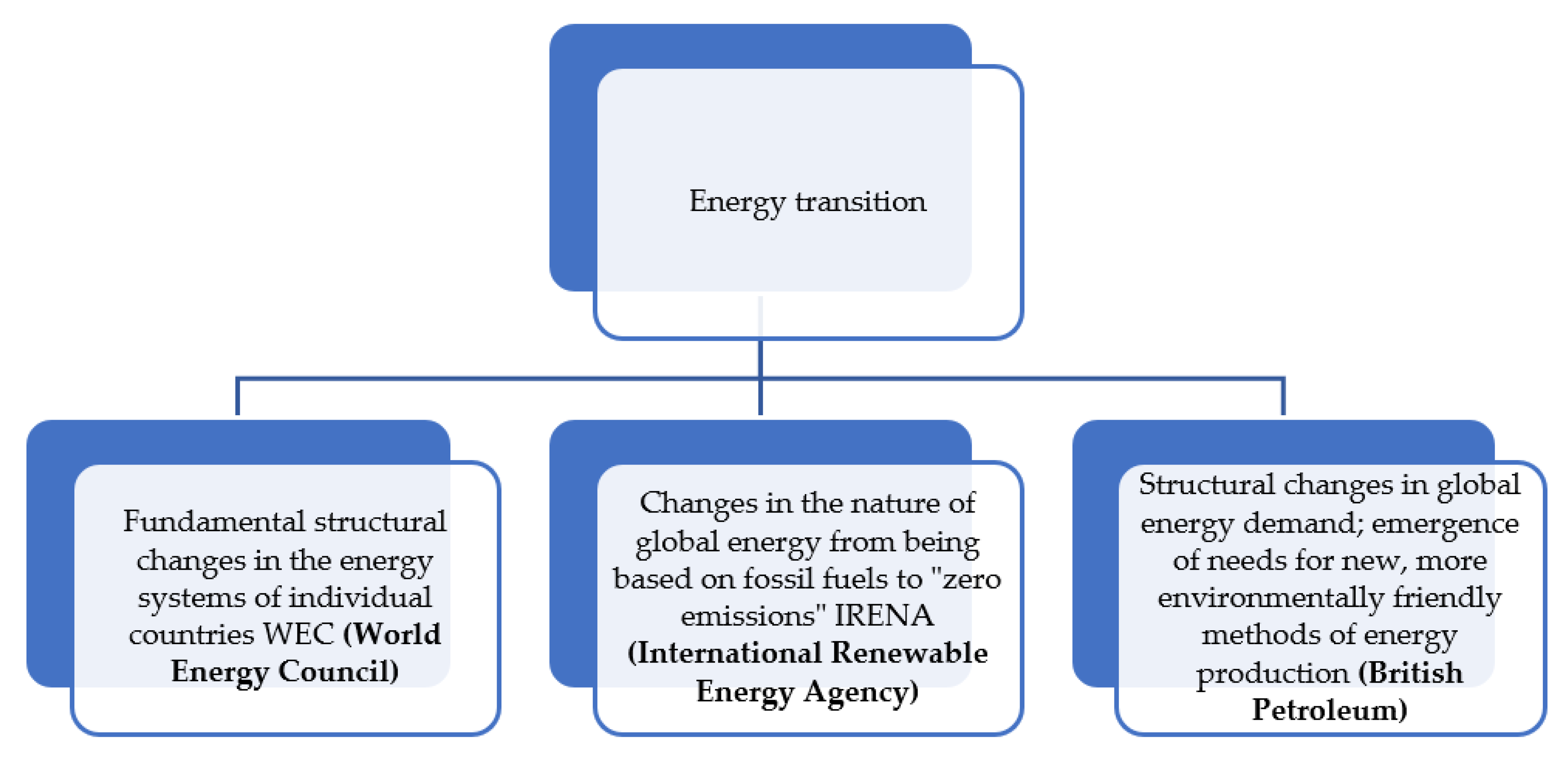

2.1. Global Trends in the Energy Sector and Criticality of Rare-Earth Metals

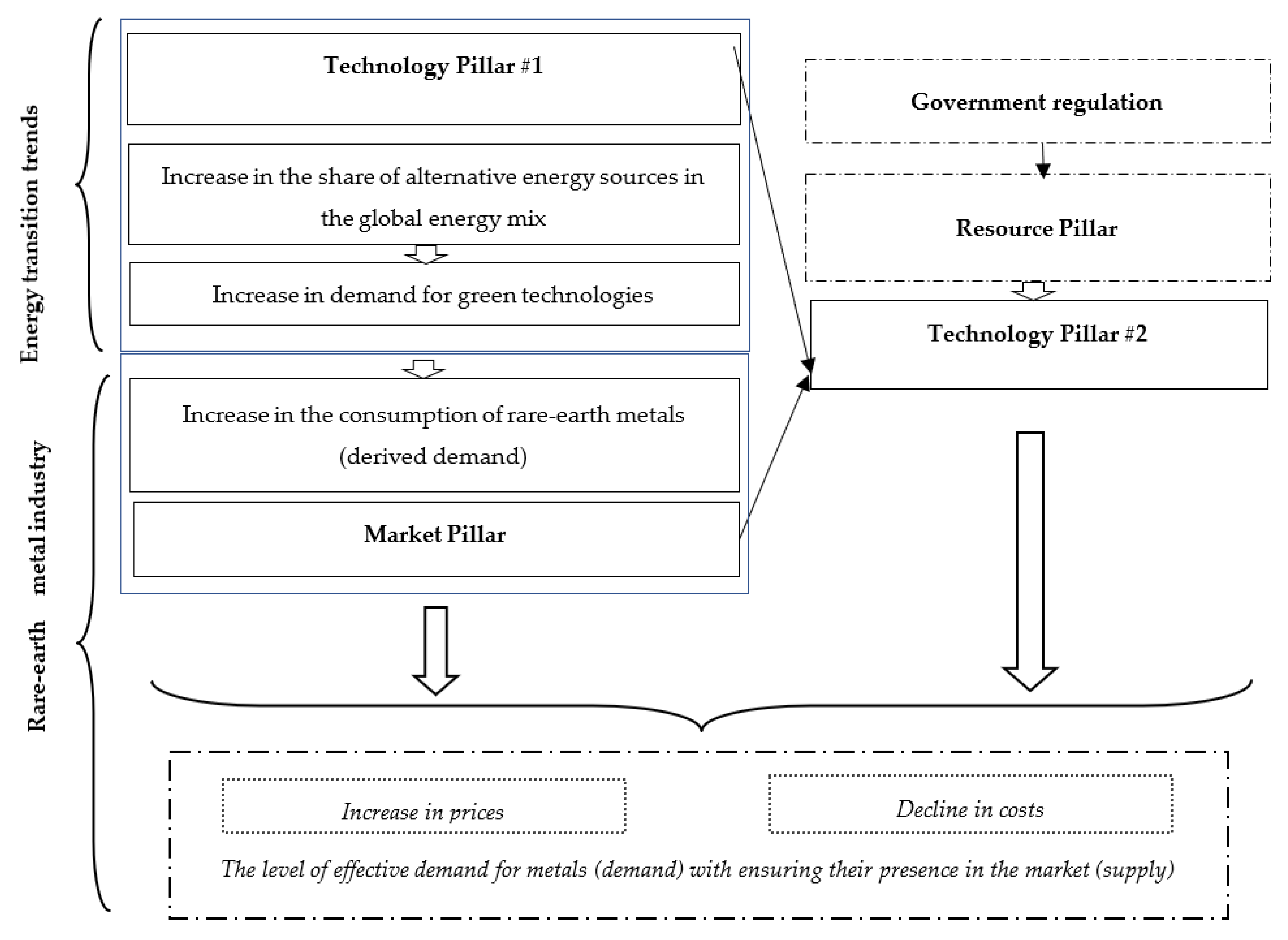

2.2. Conceptual Framework for the Development of the Rare-Earth Metal Industry in the Context of Global Energy Transition Trends

- (A)

- Increases in the event of an increase in demand for finished products;

- (B)

- Decreases if there is a decrease in demand for finished products created with the help of this type of resources.

- (1)

- Global energy transition trends are associated with the intensification of the use of green technologies (Technology Pillar #1).

- (2)

- The level of demand for green technologies will affect the consumption of rare-earth metals and, accordingly, the situation in the rare-earth metal market, where an increase in demand will lead to an increase in prices, especially for heavy group of metals which are more demanded (Market Pillar).

- (3)

- Positive changes in the market stimulate the development of technologies for the extraction and processing of rare-earth metals (Technology Pillar #2), thereby acting as a driver pushing the development of the industry that consists of two basic components, which are government regulation and access to raw materials (Resource Pillar).

- (1)

- Does the country have plans for an energy transition?

- (2)

- Does it plan to use modern green technologies (construct new production facilities)?

- (3)

- How can these trends affect the development of the Russian rare-earth metal industry (taking into account the current state of industrial development)?

3. Results

3.1. The Russian REM Industry: In Search of New Development Drivers

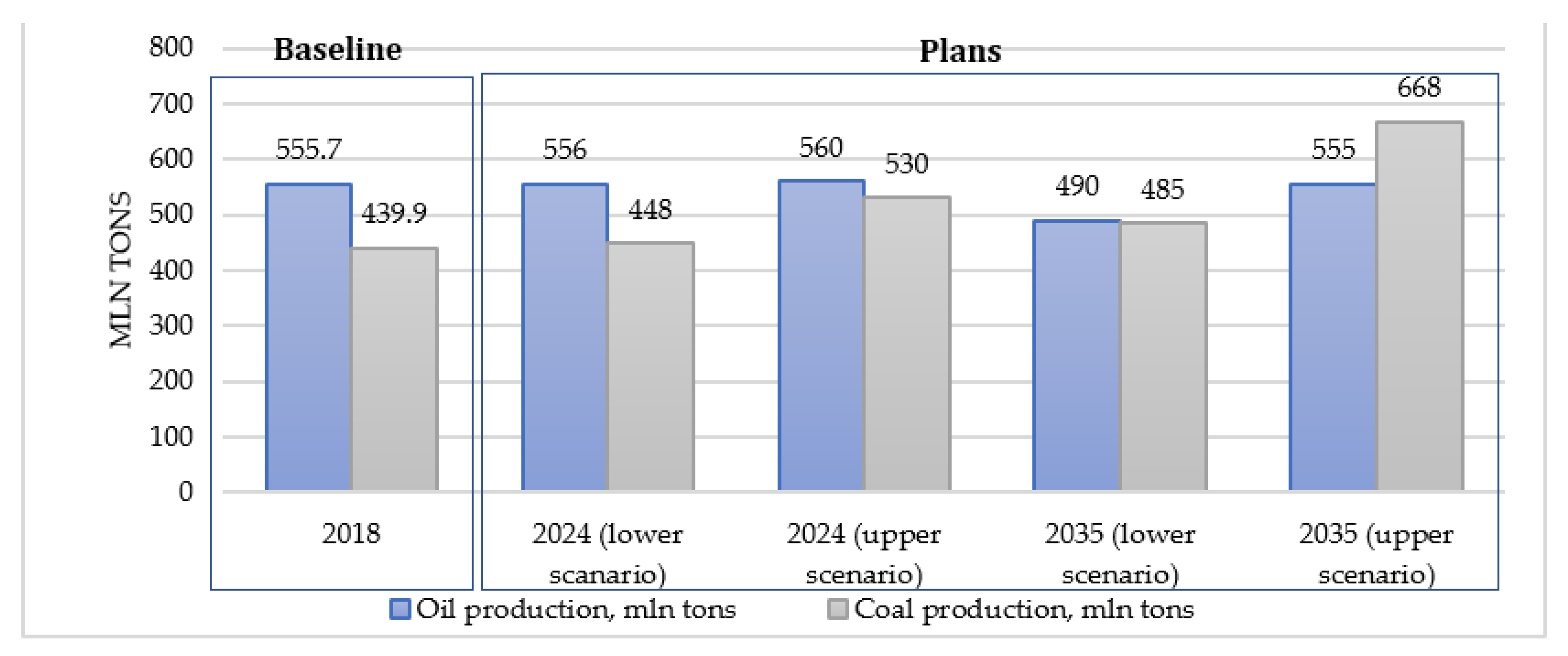

3.2. Global Energy Transition Trends: The Case of Russia

- -

- Renewable energy sources and energy storage;

- -

- Hybrid vehicles and electric vehicles, including cars;

- -

- Hydrogen fuel;

- -

- Unmanned vehicles and intelligent transport systems; and

- -

- Network technologies in the electric power industry.

3.3. The Way to Green Technologies and Forecasting Demand for Rare-Earth Metals

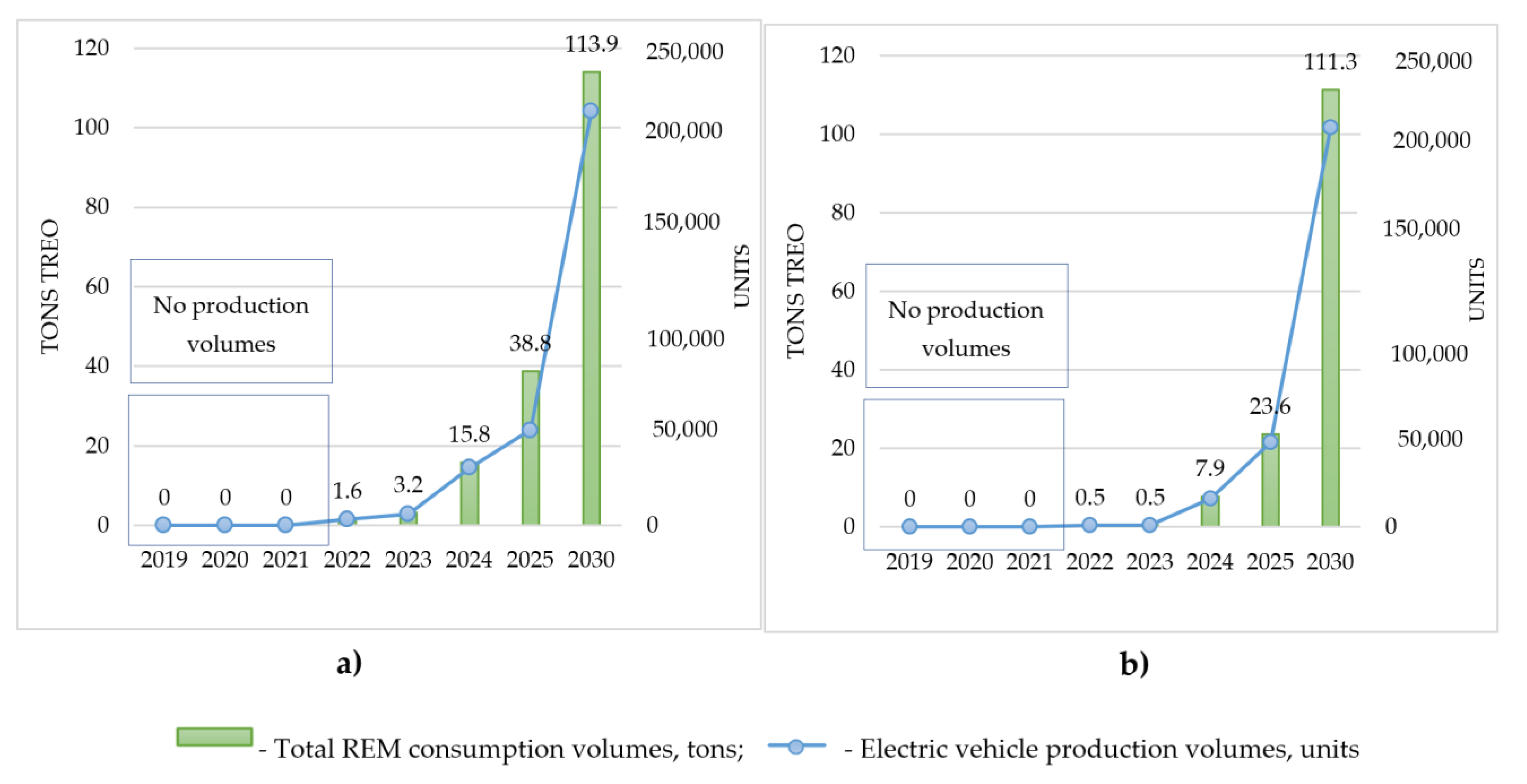

3.3.1. Electric Vehicles

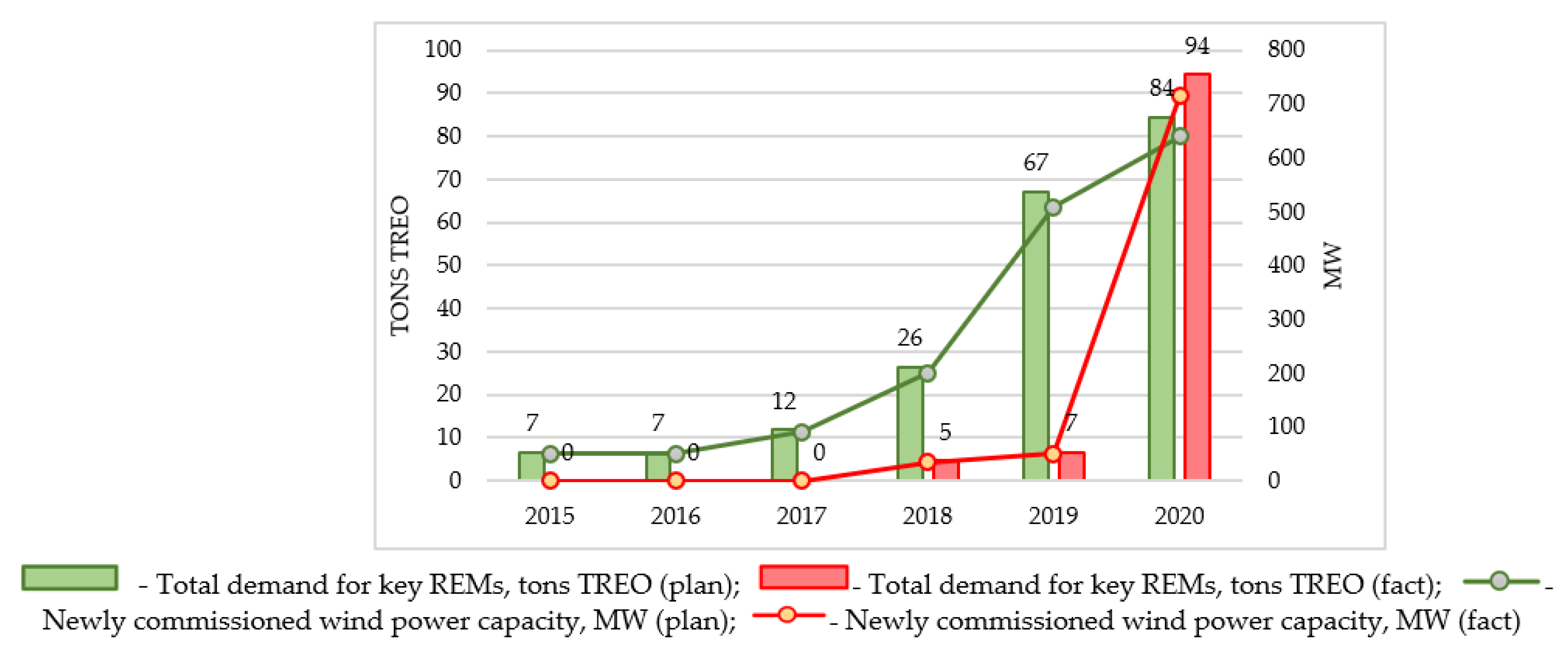

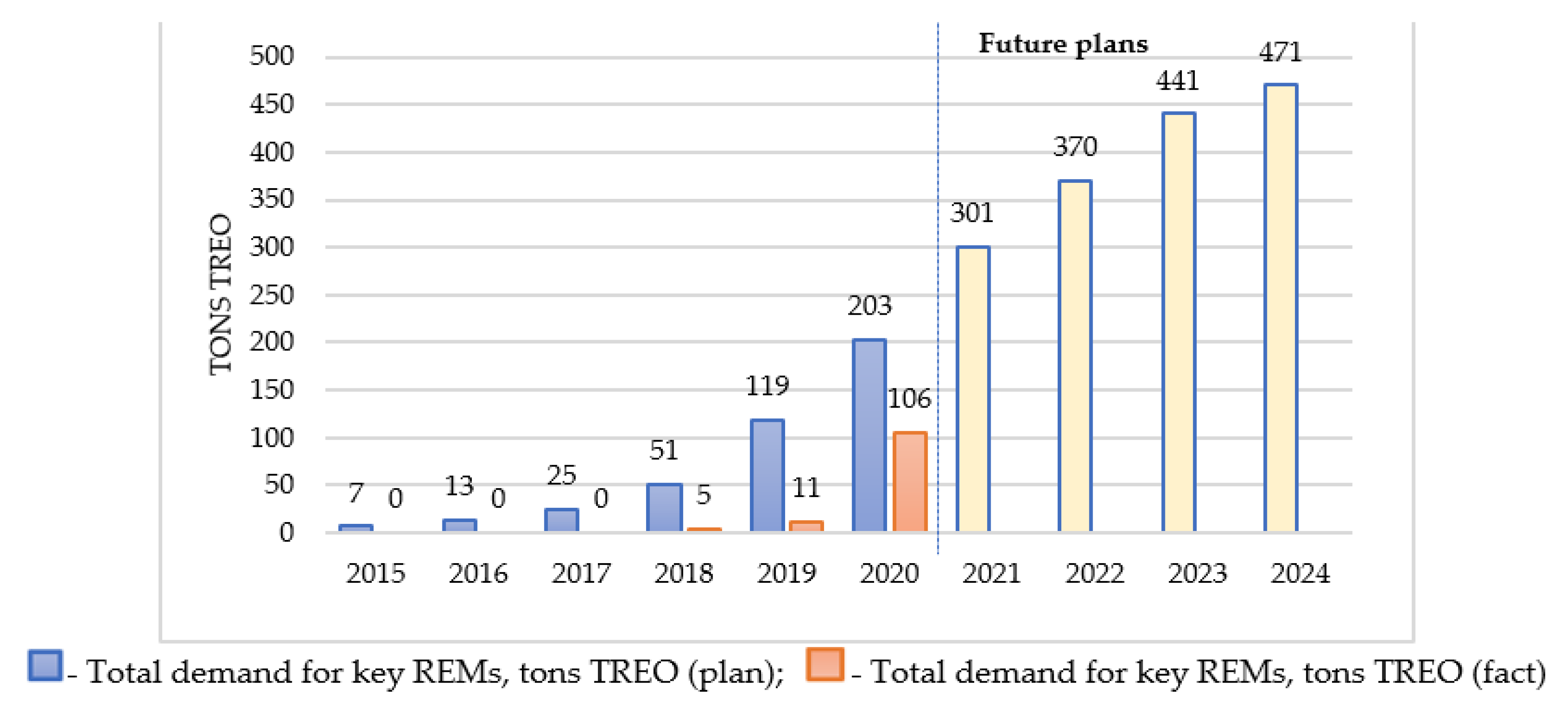

3.3.2. Wind Turbines

- (1)

- Excessive requirements for equipment localization;

- (2)

- Sharp change in the ruble exchange rate in 2014.

3.4. Prospects for the Development of Russia’s REM Industry in View of Current Trends

4. Discussion

5. Conclusions

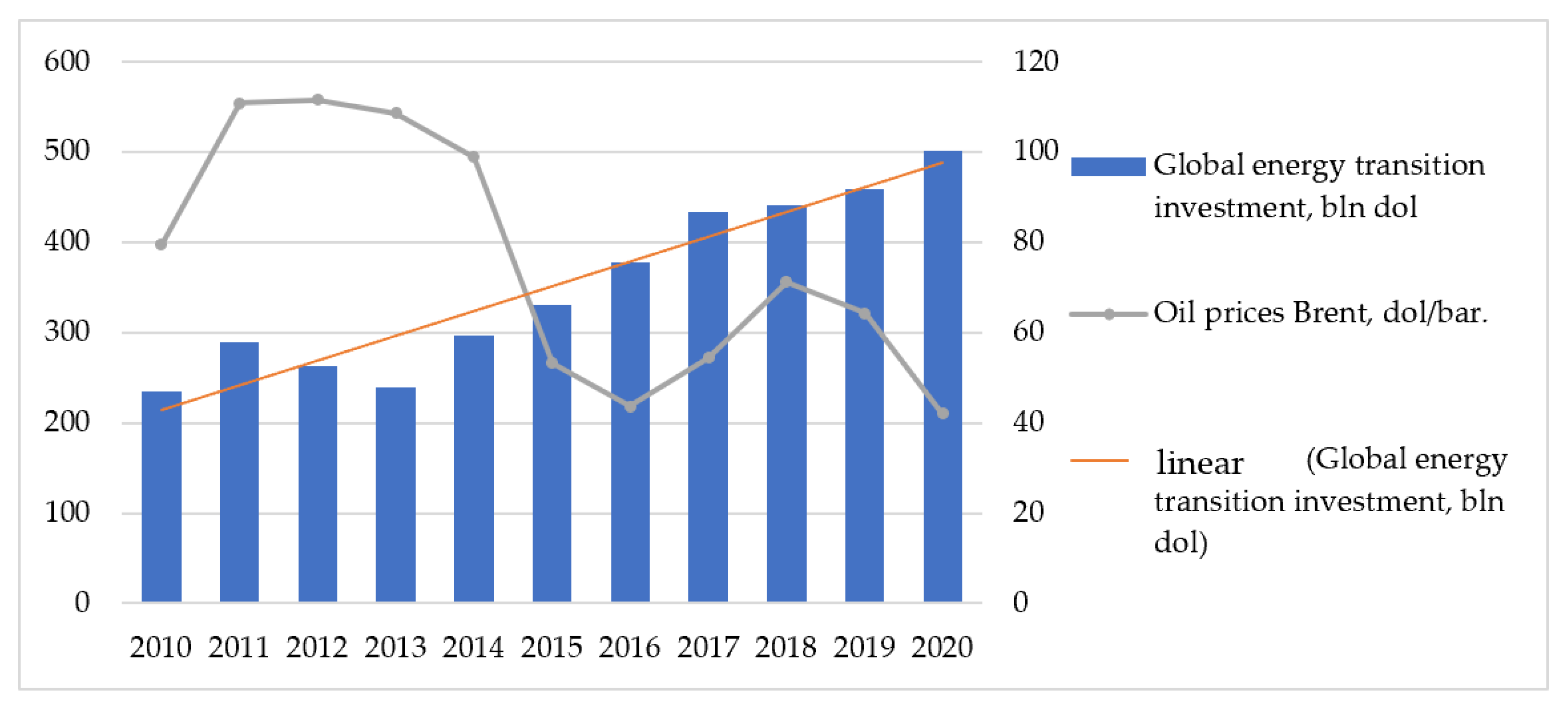

- Global energy transition trends are shaping new development paths for the metal industry in general and the industry of rare-earth metals in particular. Obviously, REMs contribute to the 2030 Agenda as they are part and parcel of the current and future energy sector. It was established that the COVID-19 pandemic only contributed to the transition to renewable energy sources, causing a decrease in demand for traditional energy sources and bigger price volatility in this sector. To produce green technologies, more metals are required, which creates greater demand. In the context of current trends, rare-earth metals have become critical elements for many countries, which is associated with two key factors: (1) high demand, which is partly accounted for by the green technology sector, (2) increased supply risks and limited access to rare-earth metals (monopoly in the global market).

- It can be concluded that Russia has plans to transform its energy sector. The need for the development of clean energy technologies is reflected at the government level in the Energy Strategy of the Russian Federation for the period up to 2035, a fundamental legal document. Nevertheless, the steps to create green technologies, in particular electric vehicles and wind turbines can be called modest in comparison with the measures taken on a global scale.

- Forecasts show that there will be no significant growth in the demand for rare-earth metals due to the implementation of plans for the production of green technologies. If these plans are put into practice, the annual growth will not exceed 7% of the current demand. In view of this, answering the question posed at the beginning of the study, we conclude that although global energy transition trends affect the functioning of the energy market and the economy of Russia, they cannot serve as a driver for the progressive development of the national REM industry. The resulting increase in demand can be covered by imports of products, which does not require additional investments in the development of industries with high added value, including the production of neodymium and dysprosium oxides, which are key components in wind turbines.

- At the same time, assessing the resource potential of Russia in the context of critical materials, we can conclude that the country can make a contribution to support global energy transition trends, competing with China. However, the question of whether the global energy market and new trends will be able to become an impetus for the creation of facilities in Russia to manufacture products requiring rare-earth metals remains to be answered.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hoang, A.T.; Nižetić, S.; Olcer, A.I.; Ong, H.C.; Chen, W.-H.; Chong, C.T.; Thomas, S.; Bandh, S.A.; Nguyen, X.P. Impacts of COVID-19 pandemic on the global energy system and the shift progress to renewable energy: Opportunities, challenges, and policy implications. Energy Policy 2021, 154, 112322. [Google Scholar] [CrossRef]

- Kuzemko, C.; Bradshaw, M.J.; Bridge, G.; Goldthau, A.; Jewell, J.; Overland, I.; Scholten, D.; Van de Graaf, T.; Westphal, K. Covid-19 and the Politics of Sustainable Energy Transitions. Energy Res. Soc. Sci. 2020, 68, 101685. [Google Scholar] [CrossRef] [PubMed]

- Tian, J.; Yu, L.; Xue, R.; Zhuang, S.; Shan, Y. Global low-carbon energy transition in the post-COVID-19 era. Appl. Energy 2021, 118205. [Google Scholar]

- Alvik, S.; Bakken, B.E.; Onur, O.; Horschig, H.; Koefoed, A.L.; McConnel, E.; Rinaldo, M.; Shafiei, E.; Zwarts, R.J. Energy Transition Outlook 2020. A Global and Regional Forecast to 2050; DNV GL: Hovik, Norway, 2020; 305p. [Google Scholar]

- BP. Statistical Review of World Energy 2020, 69th ed.; BP p.l.c.: London, UK, 2020; 66p. [Google Scholar]

- Gielen, D. Critical Minerals for the Energy Transition; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021; 43p. [Google Scholar]

- Lee, J.; Bazilian, M.; Sovacool, B.; Hund, K.; Jowitt, S.M.; Nguyen, T.P.; Månberger, A.; Kah, M.; Greene, S.; Galeazzi, C.; et al. Reviewing the material and metal security of low-carbon energy transitions. Renew. Sustain. Energy Rev. 2020, 124, 109789. [Google Scholar] [CrossRef]

- Hund, K.; La Porta, D.; Fabregas, T.P.; Laing, T.; Drexhage, J. Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition; International Bank for Reconstruction and Development/The World Bank: Washington, DC, USA, 2020; 112p. [Google Scholar]

- Dominish, E.; Florin, N.; Teske, S. Responsible Minerals Sourcing for Renewable Energy; Institute for Sustainable Futures, University of Technology: Sydney, Australia, 2019; 61p. [Google Scholar]

- Baldi, L.; Peri, M.; Vandone, D. Clean energy industries and rare earth materials: Economic and financial issues. Energy Policy 2014, 66, 53–61. [Google Scholar] [CrossRef]

- Zhou, B.; Li, Z.; Chen, C. Global Potential of Rare Earth Resources and Rare Earth Demand from Clean Technologies. Minerals 2017, 7, 203. [Google Scholar] [CrossRef]

- Zhou, B.; Li, Z.; Zhao, Y.; Zhang, C.; Wei, Y. Rare Earth Elements supply vs. clean energy technologies: New problems to be solve. Gospod. Surowcami Miner. 2016, 32, 29–44. [Google Scholar] [CrossRef]

- Kumar, J.R.; Lee, J.-Y. Recovery of Critical Rare Earth Elements for Green Energy Technologies. Miner. Met. Mater. Ser. 2017, 19–29. [Google Scholar]

- Watari, T.; McLellan, B.C.; Giurco, D.; Dominish, E.; Yamasue, E.; Nansai, K. Total material requirement for the global energy transition to 2050: A focus on transport and electricity. Resour. Conserv. Recycl. 2019, 148, 91–103. [Google Scholar] [CrossRef]

- Balaram, V. Rare earth elements: A review of applications, occurrence, exploration, analysis, recycling, and environmental impact. Geosci. Front. 2019, 10, 1285–1303. [Google Scholar] [CrossRef]

- Eggert, R.; Wadia, C.; Anderson, C.; Bauer, D.; Fields, F.; Meinert, L.; Taylor, P. Rare earths: Market disruption, innovation, and global supply chains. Annu. Rev. Environ. Resour. 2016, 41, 199–222. [Google Scholar] [CrossRef]

- Goodenough, K.M.; Wall, F.; Merriman, D. The Rare Earth Elements: Demand, Global Resources, and Challenges for Resourcing. Future Gener. Nat. Resour. Res. 2018, 27, 201–216. [Google Scholar] [CrossRef]

- Abraham, D.S. The Elements of Power: Gadgets, Guns, and the Struggle for a Sustainable Future in the Rare Metal Age; Yale University Press: New Haven, CT, USA; London, UK, 2015; 336p. [Google Scholar]

- Campbell, G.A. Rare earth metals: A strategic concern. Miner. Econ. 2014, 27, 21–31. [Google Scholar] [CrossRef]

- Van Gosen, B.S.; Verplanck, P.L.; Long, K.R.; Gambogi, J.; Seal, R.R., II. The Rare-Earth Elements—Vital to Modern Technologies and Lifestyles: USGS Mineral Resources Program Fact Sheet 2014–3078; USGS: Reston, VA, USA, 2014. [Google Scholar]

- Gao, A.; Wietlisbach, S. Rare Earth Elements—The Vitamins of Modern Industry. Chemicals Research & Analysis. HIS Markit. 25 October 2019. Available online: https://ihsmarkit.com/research-analysis/rare-earth-elements--the-vitamins-of-modern-industry.html (accessed on 18 April 2021).

- Ngai, C. Replacing Oil Addiction with Metals Dependence? National Geographic. 1 October 2020. Available online: https://www.nationalgeographic.com/news/2010/10/101001-energy-rare-earth-metals/ (accessed on 22 February 2021).

- Brennan, E. The Next Oil? Rare Earth Metals. The Diplomat. 10 January 2013. Available online: https://thediplomat.com/2013/01/the-new-prize-china-and-indias-rare-earth-scramble/ (accessed on 15 May 2021).

- European Commission. Report on Critical Raw Materials and the Circular Economy; European Commission: Brussels, Belgium, 2018; 78p. [Google Scholar]

- Wilson, J. Strategies for Securing Critical Material Value Chains; Perth US Asia Centre: Crawley, Australia, 2020; 24p. [Google Scholar]

- European Commission. Study on the EU’s List of Critical Raw Materials—Final Report; European Commission: Brussels, Belgium, 2020; 158p. [Google Scholar]

- U.S. Department of Energy. Critical Materials Strategy; U.S. Department of Energy: Washington, DC, USA, 2010; 166p.

- Moreau, V.; Dos Reis, P.C.; Vuille, F. Enough Metals? Resource Constraints to Supply a Fully Renewable Energy System. Resources 2019, 8, 29. [Google Scholar] [CrossRef]

- Morimoto, S.; Seo, Y. Current Trend of Medium—Long Term Rare Earth Demand Forecast. J. MMIJ 2014, 130, 219–224. [Google Scholar] [CrossRef][Green Version]

- Pitron, G. The Rare Metals War the Dark Side of Clean Energy and Digital Technologies; Scribe: Brunswick, Australia, 2020; 288p. [Google Scholar]

- United Nations. The Sustainable Development Goals Report 2021. Available online: https://unstats.un.org/sdgs/report/2021/ (accessed on 30 October 2021).

- Lèbre, É.; Stringer, M.; Svobodova, K.; Owen, J.R.; Kemp, D.; Côte, C.; Arratia-Solar, A.; Valenta, R.K. The social and environmental complexities of extracting energy transition metals. Nat. Commun. 2020, 11, 4823. [Google Scholar] [CrossRef]

- McLellan, B.C.; Corder, G.D.; Golev, A.; Ali, S.H. Sustainability of the Rare Earths Industry. Procedia Environ. Sci. 2014, 20, 280–287. [Google Scholar] [CrossRef]

- Liang, X.; Ye, M.; Yang, L.; Fu, W.; Li, Z. Evaluation and Policy Research on the Sustainable Development of China’s Rare Earth Resources. Sustainability 2018, 10, 3792. [Google Scholar] [CrossRef]

- Samsonov, N.Y.; Semyagin, I.N. Review of the world and Russian market of rare earth metals. ECO. All-Russ. Sci. J. 2014, 2, 45–54. [Google Scholar]

- Sergeev, I.B.; Ponomarenko, T.V. Incentives for creation the competitive rare-earth industry in Russia in the context of global market competition. J. Min. Inst. 2015, 211, 104–116. [Google Scholar]

- Petrov, I.M. Russia Imports Up to 90% of Rare Earth Metals. The Rare Earth Magazine. 3 August 2016. Available online: http://rareearth.ru/ru/pub/20160803/02352.html (accessed on 12 November 2021).

- Kryukov, V.A.; Zubkova, S.A. Reindustrialization without its own rare earths? ECO. All-Russ. Sci. J. 2016, 8, 5–24. [Google Scholar]

- Paschke, M.; Sergeev, I.B.; Lebedeva, O.Y. The Supply of Rare Earths for “Green” Energy and Sustainable Development. Bull. St. Petersburg State Univ. 2016, 3, 56–73. [Google Scholar] [CrossRef][Green Version]

- Leaton, J.; Halan, V.; Bokil, M.; Marty, P.; Marinelarena, E.R.; Cahill, B.; Davison, A. ESG—Global: COVID Effects Likely to Accelerate the Energy Transition; Moody’s Investor Service: New York, NY, USA, 2020; 11p. [Google Scholar]

- World Energy Council. World Energy Resources 2016; World Energy Council: London, UK; Available online: https://www.worldenergy.org/assets/images/imported/2016/10/World-Energy-Resources-Full-report-2016.10.03.pdf (accessed on 26 October 2021).

- IRENA. Global Energy Transformation: A Roadmap to 2050; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2018; 76p. [Google Scholar]

- International Energy Agency. Global Energy Review 2019. The Latest Trends in Energy and Emissions in 2019; OECD: Paris, France, 2020; 47p. [Google Scholar]

- BP. The Energy Outlook, 2020. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2020.pdf (accessed on 10 June 2021).

- Sönnichsen, N. Average Annual Brent Crude Oil Price from 1976 to 2021 (in U.S. Dollars per Barrel). Statista. 7 December 2021. Available online: https://www.statista.com/statistics/262860/uk-brent-crude-oil-price-changes-since-1976/ (accessed on 11 December 2021).

- Bloomberg, N.E.F. Energy Transition Investment Trends. Tracking Global Investment in the Low-Carbon Energy Transition, 2021. Available online: https://assets.bbhub.io/professional/sites/24/Energy-Transition-Investment-Trends_Free-Summary_Jan2021.pdf (accessed on 10 October 2021).

- Mitrova, T.; Melnikov, Y. Energy transition in Russia. Energy Transit 2019, 3, 73–80. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). The Role of Critical World Energy Outlook Special Report Minerals in Clean Energy Transitions. World Energy Outlook Special Report. 2021. Available online: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions (accessed on 13 October 2021).

- Elshkaki, A.; Graedel, T.E.; Ciacci, L.; Reck, B.K. Copper demand, supply, and associated energy use to 2050. Glob. Environ. Chang. 2016, 39, 305–315. [Google Scholar] [CrossRef]

- Raw Materials for the Energy Transition. Securing a Reliable and Sustainable Supply. 2018. Available online: https://www.leopoldina.org/uploads/tx_leopublication/2018_ESYS_Position_Paper_Raw_materials.pdf (accessed on 5 October 2021).

- IEA. Clean Energy Progress after the Covid-19 Crisis Will Need Reliable Supplies of Critical Minerals; IEA: Paris, France, 2020; Available online: https://www.iea.org/articles/clean-energy-progress-after-the-covid-19-crisis-will-need-reliable-supplies-of-critical-minerals (accessed on 22 February 2021).

- Chen, Y.; Zheng, B. What Happens after the Rare Earth Crisis: A Systematic Literature Review. Sustainability 2019, 11, 1288. [Google Scholar] [CrossRef]

- Hurst, C. China’s Rare Earth Elements Industry: What Can the West Learn? Institute for the Analysis of Global Security (IAGS): Washington, DC, USA, 2010; 42p. [Google Scholar]

- Serpell, O.; Paren, B.; Chu, W.-Y. Rare Earth Elements: A Resource Constraint of the Energy Transition; Kleiman Center for Energy Policy: Philadelphia, PA, USA, 2021; 12p. [Google Scholar]

- Adomaitis, N. Norway Eyes Sea Change in Deep Dive for Metals instead of Oil OSLO. Reuters. 12 January 2021. Available online: https://www.reuters.com/article/norway-deepseamining-idINKBN29H273 (accessed on 21 May 2021).

- Rystad Energy. Marine Minerals: Norwegian Value Creation Potential. 2020. Available online: https://www.norskoljeoggass.no/contentassets/f7a40b81236149ea898b87ff2e43a0e3/20201120-marine-minerals---norwegian-value-creation-potential.pdf (accessed on 16 September 2021).

- Alonso, E.; Sherman, A.M.; Wallington, T.J.; Everson, M.P.; Field, F.R.; Roth, R.; Kirchain, R.E. Evaluating Rare Earth Element Availability: A Case with Revolutionary Demand from Clean Technologies. Environ. Sci. Technol. 2012, 46, 3406–3414. [Google Scholar] [CrossRef]

- Energy Critical Elements: Securing Materials for Emerging Technologies. A Report by the APS Panel on Public Affairs & the Materials Research Society, 2011. Available online: https://www.aps.org/policy/reports/popa-reports/upload/elementsreport.pdf (accessed on 16 September 2021).

- Church, C.; Crawford, A. Minerals and the Metals for the Energy Transition: Exploring the Conflict Implications for Mineral-Rich, Fragile States. Geopolit. Glob. Energy Transit. Lect. Notes Energy 2020, 73, 279–304. [Google Scholar]

- U.S. Geological Survey. Mineral Commodity Summaries 2020; U.S. Geological Survey: Reston, VA, USA, 2020; 200p. [CrossRef]

- State Report on the State and Use of Mineral Resources of the Russian Federation in 2015; Ministry of Natural Resources and Environment of the Russian Federation: Moscow, Russia, 2016; 344p.

- State Report on the State and Use of Mineral Resources of the Russian Federation in 2019; Ministry of Natural Resources and Environment of the Russian Federation: Moscow, Russia, 2020; 494p.

- Khatkov, V.Y.; Boyarko, G.Y. Administrative methods of import substitution management of deficient types of mineral raw materials. J. Min. Inst. 2018, 234, 683–692. [Google Scholar] [CrossRef]

- Marinin, M.; Marinina, O.; Wolniak, R. Assessing of Losses and Dilution Impact on the Cost Chain: Case Study of Gold Ore Deposits. Sustainability 2021, 13, 3830. [Google Scholar] [CrossRef]

- Nedosekin, A.O.; Rejshahrit, E.I.; Kozlovskij, A.N. Strategic Approach to Assessing Economic Sustainability Objects of Mineral Resources Sector of Russia. J. Min. Inst. 2019, 237, 354–360. [Google Scholar] [CrossRef]

- Nevskaya, M.A.; Seleznev, S.G.; Masloboev, V.A.; Klyuchnikova, E.M.; Makarov, D.V. Environmental and Business Challenges Presented by Mining and Mineral Processing Waste in the Russian Federation. Minerals 2019, 9, 445. [Google Scholar] [CrossRef]

- Ponomarenko, T.V.; Nevskaya, M.A.; Marinina, O.A. Complex use of mineral resources as a factor of the competitiveness of mining companies under the conditions of the global economy. Int. J. Mech. Eng. Technol. 2018, 9, 1215–1223. [Google Scholar]

- Yurak, V.V.; Dushin, A.V.; Mochalova, L.A. Vs sustainable development: Scenarios for the future. J. Min. Inst. 2020, 242, 242–247. [Google Scholar] [CrossRef]

- Kalgina, I.S. Models for assessment of public-private partnership projects in subsurface management. J. Min. Inst. 2017, 224, 247–254. [Google Scholar]

- The Draft Strategy for the Development of the Industry of Rare and Rare Earth Metals in the Russian Federation for the Period Up to 2035. 2019. Available online: https://minpromtorg.gov.ru/docs/#!strategiya_razvitiya_otrasli_redkih_i_redkozemelnyh_metallov_rossiyskoy_federacii_na_period_do_2035_goda (accessed on 11 October 2021).

- Doriomedov, M.S.; Sevastyanov, D.V.; Skripachyov, S.Y.; Daskovskiy, M.I. Reference documentation in the field of rare earth elements. Proc. VIAM 2018, 5, 18–23. [Google Scholar] [CrossRef]

- Polyakov, E.G.; Nechaev, A.V.; Smirnov, A.V. Metallurgy of Rare Earth Metals, 2nd ed.; Yurait: Moscow, Russia, 2021; 501p. [Google Scholar]

- Rare-Earth Metals Market by (Lanthanum, Cerium, Neodymium, Praseodymium, Samarium, Europium, & Others), and Application (Permanent Magnets, Metals Alloys, Polishing, Additives, Catalysts, Phosphors), Region—Global Forecast to 2026. Available online: https://www.marketsandmarkets.com/Market-Reports/rare-earth-metals-market-121495310.html (accessed on 14 April 2021).

- Ilinova, A.A.; Chanysheva, A.F. Algorithm for Assessing the Prospects of Offshore Oil and Gas Projects in the Arctic. Energy Rep. 2020, 6, 504–509. [Google Scholar] [CrossRef]

- Romasheva, N.; Dmitrieva, D. Energy Resources Exploitation in the Russian Arctic: Challenges and Prospects for the Sustainable Development of the Ecosystem. Energies 2021, 14, 8300. [Google Scholar] [CrossRef]

- Makarov, I.; Chen, Y.-H.; Paltsev, S. Finding Itself in the Post-Paris World: Russia in the New Global Energy Landscape; Report 324; MIT Joint Program Global Change: Cambridge, MA, USA, 2017; 16p. [Google Scholar]

- Zakaev, D.R.; Nikolaichuk, L.A.; Filatova, I.I. Problems of Oil Refining Industry Development in Russia. Int. J. Eng. Res. Technol. 2020, 2, 267–270. [Google Scholar]

- Nikolaichuk, L.A.; Tsvetkov, P.S. Prospects of Ecological Technologies Development in the Russian Oil Industry. Int. J. Appl. Eng. Res. 2016, 11, 5271–5276. [Google Scholar]

- Gavrikova, E.; Burda, Y.; Gavrikov, V.; Sharafutdinov, R.; Volkova, I.; Rubleva, M.; Polosukhina, D. Clean Energy Sources: Insights from Russia. Resources 2019, 8, 84. [Google Scholar] [CrossRef]

- Dmitrieva, D.; Romasheva, N. Sustainable Development of Oil and Gas Potential of the Arctic and Its Shelf Zone: The Role of Innovations. J. Mar. Sci. Eng. 2020, 8, 1003. [Google Scholar] [CrossRef]

- Asmelash, E.; Gorini, R. International Oil Companies and the Energy Transition; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021; 54p. [Google Scholar]

- Gusev, A. Evolution of Russian Climate Policy: From the Kyoto Protocol to the Paris Agreement. Dans L’Europe Form. 2016, 2, 39–52. [Google Scholar] [CrossRef]

- Energy Strategy of the Russian Federation until 2035 (Government Decree No. 1523-r of 2020). 2020. Available online: https://policy.asiapacificenergy.org/node/1240 (accessed on 15 September 2021).

- Alekseev, A.N.; Bogoviz, A.V.; Goncharenko, L.P.; Sybachin, S.A. A Critical Review of Russia’s Energy Strategy in the Period until 2035. Int. J. Energy Econ. Policy 2019, 9, 95–102. [Google Scholar] [CrossRef]

- Russia’s National Security Strategy. Official Internet Portal of Legal Information. Available online: http://publication.pravo.gov.ru/Document/View/0001202107030001 (accessed on 11 April 2021).

- Fostering Effective Energy Transition 2020 Edition. World Economic Forum. 2020. Available online: https://www3.weforum.org/docs/WEF_Fostering_Effective_Energy_Transition_2020_Edition.pdf (accessed on 9 September 2021).

- The Growing Role of Minerals and Metals for a Low Carbon Future; International Bank for Reconstruction and Development/The World Bank: Washington, DC, USA, 2017; 112p.

- Volkov, A.V.; Sidorov, A.A. Subsoil of the Russian Arctic—A storehouse of metals for “green” technologies. Bull. Russ. Acad. Sci. 2020, 1, 56–62. [Google Scholar]

- The Strategy for the Development of the Automotive Industry until 2025. 2018. Available online: http://government.ru/docs/32547/ (accessed on 11 June 2021).

- Russian Automotive Market 1H 2019 Results and Outlook Electric Vehicles. Special Issue PWC, 2019. Available online: https://www.pwc.ru/en/automotive/publications/assets/pwc-auto-press-briefing-1h2019-en.pdf (accessed on 14 September 2021).

- Eurasia Network. Production of the Electric Car Zetta to Start before 2022. 2021. Available online: https://eurasianetwork.eu/2021/04/19/production-of-the-electric-car-zetta-to-start-before-2022/ (accessed on 15 June 2021).

- Sanatov, D.V.; Abakumov, A.M.; Aydemirov, A.Y.; Borovkov, A.I.; Vaseyev, I.Y.; Gareyev, T.R.; Godunova, Y.A.; Gumerov, I.F.; Kashin, A.M.; Klepach, A.N.; et al. Prospects for the Development of the Market for Electric Transport and Charging Infrastructure in Russia: Expert and Analytical Report; Borovkova, A.I., Knyaginina, V.N., Eds.; SPb. Polytech-Press: St Petersburg, Russia, 2021; 44p. [Google Scholar]

- Russian Association of Wind Industry. Overview of the Russian Wind Energy Market and Rating of Russian Regions for 2019. 2020. Available online: https://rawi.ru/wp-content/uploads/2020/rawi-report-for-2019-rus.pdf (accessed on 25 October 2021).

- Lanshina, T. Wind Power Russian Market: Development Potential of the New Economy. 2021. Available online: https://www.fes-russia.org/fileadmin/user_upload/documents/210316-FESMOS-windenergy-ru.pdf?fbclid=IwAR3jqNAltsIkuSzGRk-TmkUZTmIb7SBvyBiUfE4OENtgoMOECmlOzoeDZ24 (accessed on 19 June 2021).

- International Energy Agency. Renewables 2020 Analysis and Forecast to 2025. 2020. Available online: https://iea.blob.core.windows.net/assets/1a24f1fe-c971-4c25-964a-57d0f31eb97b/Renewables_2020-PDF.pdf (accessed on 25 October 2021).

| Primary Energy by Fuel | Shares of Primary Energy in 2010–2019, % | Shares of Primary Energy in 2050 (by Different Scenarios) | Main Future Trend | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2015 | 2018 | 2019 | Rapid | Net Zero | BAU | |||||

| Shares in 2050, % | Change 2019–2050, % | Shares in 2050, % | Change 2019–2050, % | Shares in 2050, % | Change 2019–2050, % | ||||||

| Oil | 32 | 32 | 33 | 31 | 14 | −54.84 | 6.8 | −78.06 | 24 | −22.58 | decline |

| Natural gas | 21 | 22 | 24 | 23 | 21 | −8.70 | 13 | −43.48 | 26 | 13.04 | stability |

| Coal | 28 | 28 | 27 | 26 | 3.9 | −85.00 | 1.9 | −92.69 | 17 | −34.62 | decline |

| Nuclear | 6 | 5 | 4.2 | 5 | 7 | 40.00 | 9.1 | 82.00 | 4.2 | −16.00 | stability |

| Hydro | 5 | 5 | 6.5 | 4 | 9.1 | 127.50 | 9.9 | 147.50 | 7.1 | 77.50 | increase |

| Renewables | 8 | 9 | 4.7 | 10 | 44 | 340.00 | 59 | 490.00 | 22 | 120.00 | increase |

| Pillars | Meaning | Description | Factor |

|---|---|---|---|

| Technology Pillar #1 (T1) | Development of technologies ensuring growth in demand for rare-earth metals | Rare-earth metals are essential for the creation of green technologies. Under the influence of global energy transition trends, the scale of application of these technologies will grow. | Demand factor |

| Market Pillar (M) | Changing market trends | Upward changes in demand and prices (favorable conditions for the manufacturer) | Demand factor |

| Technology Pillar #2 (T2) | Development of technologies that ensure a reduction in the cost of producing rare-earth metals | Development of innovative technologies for the extraction and processing of rare-earth metals in order to obtain products with high added value; without a demand for rare-earth metals, the creation and implementation of such science-intensive and capital-intensive technologies has no practical sense. | Supply factor |

| Resource Pillar (R) | Supply of raw materials for the production of finished products | The availability of resources is one of the determining factors affecting the level of criticality of rare-earth metals. | Supply factor |

| Government regulation (G) | Current policy in the development of the potential of the mineral resources sector | Resource management and support measures | Supply factor |

| Deposit/Company | Products | Annual Production Capacity for Rare-Earth Metals | Investments Required | Estimated Implementation Time |

|---|---|---|---|---|

| Tomtor Deposit/IST Group | REEs, ferroniobium, didymium | 2.4 thousand tons of REEs | RUB 53 billion | 2025–2026 |

| Zashikhinskoye Deposit/Technoinvest Alliance | Ferroniobium, niobium, tantalum, zirconium, rare-earth metals | 240 tons of concentrates of REE oxides | RUB 27.6 billion | 2024–2025 |

| Afrikanda Deposit /SGK Arkmineral LLC | Niobium, tantalum, titanium dioxide, rare-earth metals | 400 tons of mixed REE concentrate | About RUB 70 billion (taking into account the cost of technology) | 2020–2039 |

| Seligdar Deposit | Apatite concentrate, rare-earth metals | 100 tons of REE concentrate | RUB 46 billion | No data available |

| Name | Estimated Costs | Needs for REMs |

|---|---|---|

| ZETTA (Zero Emission Terra Transport Asset) | 550 thousand rubles | REMs are not used (this explains the relatively low cost of the proposed vehicles) |

| GAZelle e-NN | NA | The first cars will be equipped with Chinese motors and batteries. But over time, manufacturers plan to switch to REM components of domestic production. |

| Cama-1 (St. Petersburg Polytechnic University) | About 1 million rubles | Requirements for rare-earth metals were not disclosed |

| Pillars | Factors | |

|---|---|---|

| Present | ||

| Technology Pillar #1 (T1) | Electric vehicles | Wind turbines |

| No production | There are production capacities; a plan for the introduction of new capacities has been developed and approved | |

| Market Pillar (M) | No demand for REMs from this sector | The annual demand for rare-earth metals does not exceed 100 tons of TREO |

| Technology Pillar #2 (T2) | Lack of incentives to develop technologies for obtaining REM products | Technologies for producing neodymium and dysprosium oxides (heavy group of metals) |

| Future (2021 to 2030) | ||

| Technology Pillar #1 (T1) | Electric vehicles | Wind turbines |

| The launch of the first production facilities is planned by 2022 with subsequent growth in production volumes | Further implementation of the developed plan for the introduction of new wind power capacities until 2024 | |

| Market Pillar (M) | By 2025, the annual demand for rare-earth metals will amount to 7–15 tons of TREO (depending on the models launched into production). By 2030, the demand for REM products will exceed 100 tons of TREO per year | The annual demand for rare-earth metals will vary between 60 and 70 tons of TREO. By 2024, the total demand for REM products will reach 470 tons of TREO |

| Technology Pillar #2 (T2) | Technologies for producing neodymium and dysprosium oxides (heavy group of metals) | Technologies for producing neodymium and dysprosium oxides (heavy group of metals) |

| Additional factors | ||

| Government regulation | Government initiatives are aimed at intensifying the development of the national industry of rare-earth metals (fiscal mechanisms are being implemented; there are opportunities to attract additional funding to REM projects) | |

| Resource Pillar | Russia possesses significant REM reserves, ranking fourth in the world | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cherepovitsyn, A.; Solovyova, V. Prospects for the Development of the Russian Rare-Earth Metal Industry in View of the Global Energy Transition—A Review. Energies 2022, 15, 387. https://doi.org/10.3390/en15010387

Cherepovitsyn A, Solovyova V. Prospects for the Development of the Russian Rare-Earth Metal Industry in View of the Global Energy Transition—A Review. Energies. 2022; 15(1):387. https://doi.org/10.3390/en15010387

Chicago/Turabian StyleCherepovitsyn, Alexey, and Victoria Solovyova. 2022. "Prospects for the Development of the Russian Rare-Earth Metal Industry in View of the Global Energy Transition—A Review" Energies 15, no. 1: 387. https://doi.org/10.3390/en15010387

APA StyleCherepovitsyn, A., & Solovyova, V. (2022). Prospects for the Development of the Russian Rare-Earth Metal Industry in View of the Global Energy Transition—A Review. Energies, 15(1), 387. https://doi.org/10.3390/en15010387