2.1. Theoretical Framework

Determination of the renewable energy drivers and assessing their influence allows accelerating the green transformation process towards overcoming and mitigating the adverse climate change worldwide. However, the systematization of scientific background showed no consensus on the determinants influencing renewable energy advancement despite the relevance of promoting renewable energy. Remarkably, the scientific literature mostly addresses the relationship between energy consumption and economic progress [

20,

21,

22] while focusing on driving forces [

23] for their development. In this context, there are many empirical studies on macroeconomic determinants of REC [

24,

25,

26]. The findings of the variance decomposition analysis [

27] showed economic advancement is the main driving force for REC in Pakistan over 1975–2012.

With reference to the literature on the types of energy, Ponce et al. [

28] analyzed the influence of human capital and non-renewable energy prices on renewable and non-renewable energy consumption based on the data for 53 countries’ biggest consumers of renewable energy during 1990–2017. The findings of generalized least squares (GLS) models confirmed that human capital has a statistically significant and positive influence on REC. At the same time, and non-renewable energy prices provoke the growth of both types of energy. On the other hand, Zhao et al. [

29] employed the fully modified ordinary least squares (FMOLS) technique found that financial development and per capita income have a more substantial impact on REC growth in China. Moreover, the obtained results showed that trade openness and internationalization provoke the growth of the non-renewable energy consumption while decreasing the volume of REC. On the contrary, based on the panel regression analysis results for panel data of 102 countries, Jinkai et al. [

30] highlighted the necessity to strengthen international trade openness to boost renewable energy development. In addition, the authors concluded that the protection of intellectual property rights is the negative factor of renewable energy adoption in the low R&D countries.

Furthermore, Salim and Shafiei [

31] applied the Stochastic Impacts by Regression on Population, Affluence, and Technology (STIRPAT) model for understanding the relationship between urbanization and consumption of renewable and non-renewable energy in OECD countries during 1980–2011. The findings indicated that industrial development results in the growth of both renewable and non-renewable energy consumption. However, the growth of non-renewable energy consumption is higher by 0.114% than REC. Moreover, Granger causality showed no casual linkage between REC and demographic factors such as urbanization, total population, and population density. On the contrary, Nyiwul [

32] stated that population growth increases the REC in Sub-Saharan African countries.

Recently, more scholars have paid attention to CO

2 emission reduction while developing the renewable energy sector without decreasing economic growth [

33,

34,

35]. Having applied a multivariate vector error-correction model, Ang J. [

36] found a significant long-term relationship between the economic output, CO

2 emissions, and energy consumption. The researcher proved that production growth increases CO

2 emissions and energy consumption.

Remarkably, CO

2 emissions could negatively impact human health [

37] and decrease labor productivity. Therefore, there is a focus on intensifying environmental protection measures to protect human health and ensure economic performance.

Nejat et al. [

38] noted that urbanization progress and human development require more energy. On the other hand, it increases greenhouse gas emissions, one of the root causes of global warming and climate change. In the study [

39], the researchers checked how the renewable energy sector and CO

2 emissions influence the economic performance (i.e., gross domestic product). The findings showed that due to different political and macroeconomic stability levels, the effect of renewable energy varies between the EU counties and countries that are potential candidates for EU membership. In the EU countries, the growth of REC (REC) led to economic development. At the same time, the EU potential candidates have faced limited financial recourses to support the renewable energy sector and R&D activity in this sphere. These countries require the elaboration on the effective fiscal incentives, regulatory and financial instruments to boost renewable energy.

The scientific literature covers a number of studies devoted to the effect of financial development on REC [

39,

40,

41,

42,

43]. Erne et al. [

44] proved the positive impact of financial development on REC in India based on the findings of the dynamic ordinary least square method. Anton and Afloarei [

45] used the panel fixed effects model to analyze 28 EU countries from 1990 to 2015. Their findings have evidenced the impact of financial development on REC. The findings confirmed that energy prices, banking sector, bond, and capital markets increase the share of REC, while the influence of foreign direct investment is statistically insignificant. On the other hand, the analyzed literature provides evidence [

46] on no significant causality between financial globalization and REC in the EU countries for 1995–2015.

Wang and Zhang [

47] applied the Fully Modified Ordinary Least Squares approach to prove that R&D investments addressed CO

2 emissions contribute to economic growth through decreasing the environmental burden and increasing the REC. Therefore, the carbon-free or low-carbon economic development requires intensification of R&D, employment of new innovative approaches, involving environmentally friendly technologies and processes, etc. [

48]. Furthermore, Schall [

49] noted that green investors are more eager to invest in renewable energy projects if they expect both financial and “psychic return”. Moreover, Marinescu and Fucec [

50] applied an econometric approach to model two linear regression models based on panel data of five European countries for 1995–2011. The findings confirmed that economic freedom is directly proportional to investments in the renewable energy sector. In the study [

51], the findings of the expanded Kaya equation for Logarithmic Mean Divisia Index of Belt and Road Initiative countries showed that energy structure positively influences REC. In contrast, the effect of energy intensity is negative.

Appiah-Otoo et al. [

52] employed the instrumental variable generalized method of the moment to check the influence of crowdfunding on renewable energy generation. Based on the data of 32 countries for 2013–2018, the authors found that 1% growth of crowdfunding increases the renewable energy generation by 0.35%. Moreover, the authors stated that China demonstrates the highest effect of crowdfunding, while the United Arab Emirates is the lowest.

Several previous research studies have addressed new tendencies in the tourism [

53,

54] and agriculture sectors [

55,

56,

57] emphasized the necessity to investigate new green technologies. In the case study for touristy Mediterranean countries over 1995–2014, Granger-causality’s findings [

53] evidenced that tourism’s CO

2 and GDP growth negatively impact the share of REC in total energy consumption. In the literature exploring the boosting drivers of renewable energy adoption in the agriculture sector, Ge et al. [

58] highlighted the necessity to integrate the renewable energy policy with farms’ support schemes and diversification policies in Scotland.

At present, the intentions to increase environmental quality while overcoming income inequality are on the world agenda enhanced by the Sustainable Development Goals (SDGs) [

59,

60,

61]. Improving ecological situations involves intensifying renewable energy such as solar, wind, biomass, and geothermal renewables [

62]. Furthermore, income inequality causes different results in gaining the SDGs among the countries. Based on the estimation of CO

2 emissions, GDP per capita, corruption, and trade openness of 43 developing and developed countries over 2000–2015, Uzar [

63] proved that reducing income inequality and improving institutional quality positively impacts REC growth.

For a panel of twelve EU countries which are net energy importers, Marra and Colantonio [

64] applied panel vector autoregressive model to estimate the relationship among REC, education, income per capita, public awareness, policy stringency, import levels, and lobbying. Their results showed that income growth positively influences CO

2 emissions while negatively influencing REC. In turn, the growing energy needs require countries to lobby for energy efficiency initiatives in the industry sector [

65,

66,

67,

68]. In turn, the shares of REC are higher in the countries with higher education levels. Therefore, the authors [

64] confirmed the necessity for decisive political measures to increase the REC since the public awareness of environmental issues has a slight effect without political regulations [

69,

70]. Moreover, Biresselioglu and Karaibrahimoglu [

71] confirmed the positive influence of the pro-environmental orientation of European governments on REC growth in these countries.

Another strand of the literature revealed the linkage between political and institutional quality and REC [

72,

73,

74]. In another study [

75], the authors built the panel threshold model to determine the impact of democratic institutions’ quality on REC based on data of 97 countries with different levels of democracy. The findings showed that economic growth leads to greater REC in more democratic countries. On the contrary, the less democratic countries ensure economic development due to consuming more non-renewable energy. Moreover, the REC depends less on the growth of oil prices in more democratic countries. For the case of three Latin American, five European, and eight Asian countries, Apergis and Eleftheriou [

76] employed the cutting-edge panel econometrics to check the linkages between REC, political and institutional determinants over 1995–2011. Considering their findings, all investigated variables positively influence REC in the short- and long-term in the analyzed regions.

On the other side, Uzar [

77] applied the ARDL-PMG method to examine how institutional and political quality (including law and order, democratic accountability, bureaucratic quality, corruption, and government stability) in 38 developed and developing countries influence REC. In turn, the findings showed the positive influence of political quality on REC, while economic growth leads to the growth of fossil energy consumption.

The econometric analysis [

78] of the 1990–2008 panel dataset of US states and EU countries stated that not all renewable energy policy instruments contribute to renewable energy development. The obtained results showed that the significant factors for renewable energy development were tender, tax, and feed-in tariffs, while the quota had no significant effect. The same findings are supported in the studies [

79,

80] on the role of the tax system in gaining energy and economic independence.

Some previous studies analyzed how democracy regime types (hybrid and authoritarian regimes, full democracy, and flawed democracy) influence the REC. Applied Fully modified ordinary least squares (FMOLS) and Dynamic ordinary least squares (DOLS) panel cointegration techniques, Lyulyov et al. [

81] found that growth of REC is higher in the countries with the hybrid regime. At the same time, Yahya and Rafiq [

82] noted that economies with full and flawed democracies have better public, industrial, trade, and tax policies that contribute to REC growth.

Several existing studies on factors of REC considered green social awareness [

83]. For the case of Thailand, Wall et al. [

84] proved that green awareness, environmental concern, and beliefs about renewable energy benefits are the triggers for intensifying REC among society. In the study [

85], the findings of the partial least square (PLS) method showed that green beliefs and knowledge of consumers have an insignificant impact on REC among generation Y. At the same time, the growing environmental concern and green benefits increase their interest in renewable energy. Ulkhaq [

86] stated that promoting renewable energy would be successful if society was aware of its benefits. This study involved the logistic regression approach to determine the drivers of the Indonesian consumers’ willingness to install renewable energy sources. The findings showed that income per month, education, awareness of renewable energy benefits, employment status, the average electricity price, the concern of energy tax deduction, and the cost of non-renewable energy have a positive impact on the growth of REC.

Based on Group 20’s renewable energy industry analysis, Fang et al. [

87] developed the revised Diamond Model under Porter’s theory to estimate the main driving forces and industry competitive advantages for developing renewable energy worldwide. Remarkably, Lee [

88] concluded that public and private investments are crucial in developing the renewable energy sector in countries with leading economies.

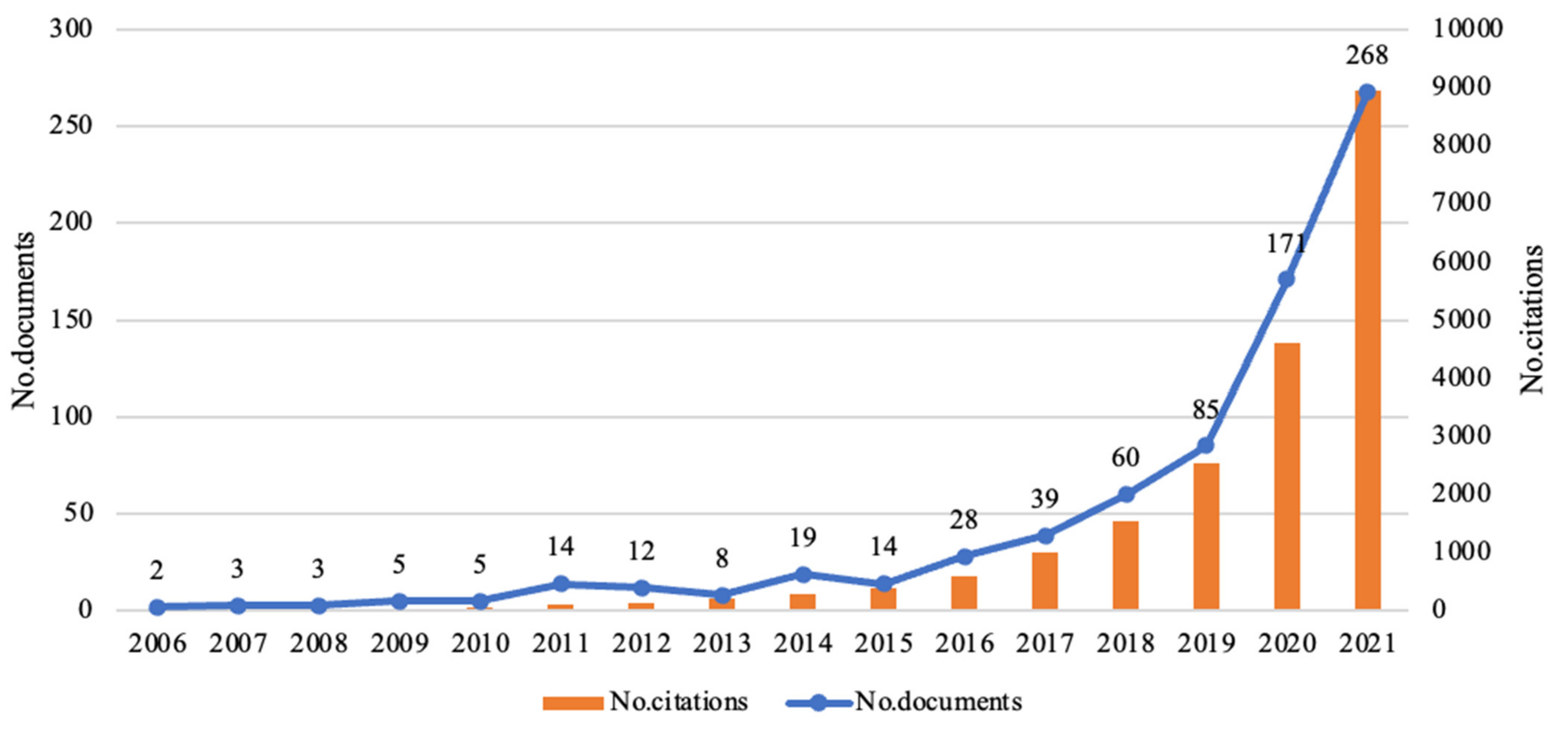

To identify the factors most influencing REC and determine the most usable approaches in assessing their influence, a bibliometric analysis was conducted. A total of 470 most relevant publications presented in the Scopus database were reviewed. The date range is from January 2000 to October 2021. To generate the sample, the combinations of keywords “renewable energy consumption”, “factors”, “determinants”, and “influence” were used with boolean operators “OR” and “AND”. The search was conducted in “Article title, Abstract, Keywords”.

2.2. Study Area Selection

Analysis of the searched results using the Scopus Toolkit showed that REC concerns received two main stimuli to boost in 2016 (after the Paris climate agreement execution in 2015) and 2020 (after the European Green Deal declaration in 2019). The number of analyzed publications increased by more than 19 times. The findings of citation analysis showed the number of cited documents concerning REC impact constantly grows. As of October 2021, the presented publications were cited 8949 times. It is 12 times more than the number of publications.

Figure 4 shows that the European Green Deal declaration in 2019 was a powerful kick in activating the research interest in this direction.

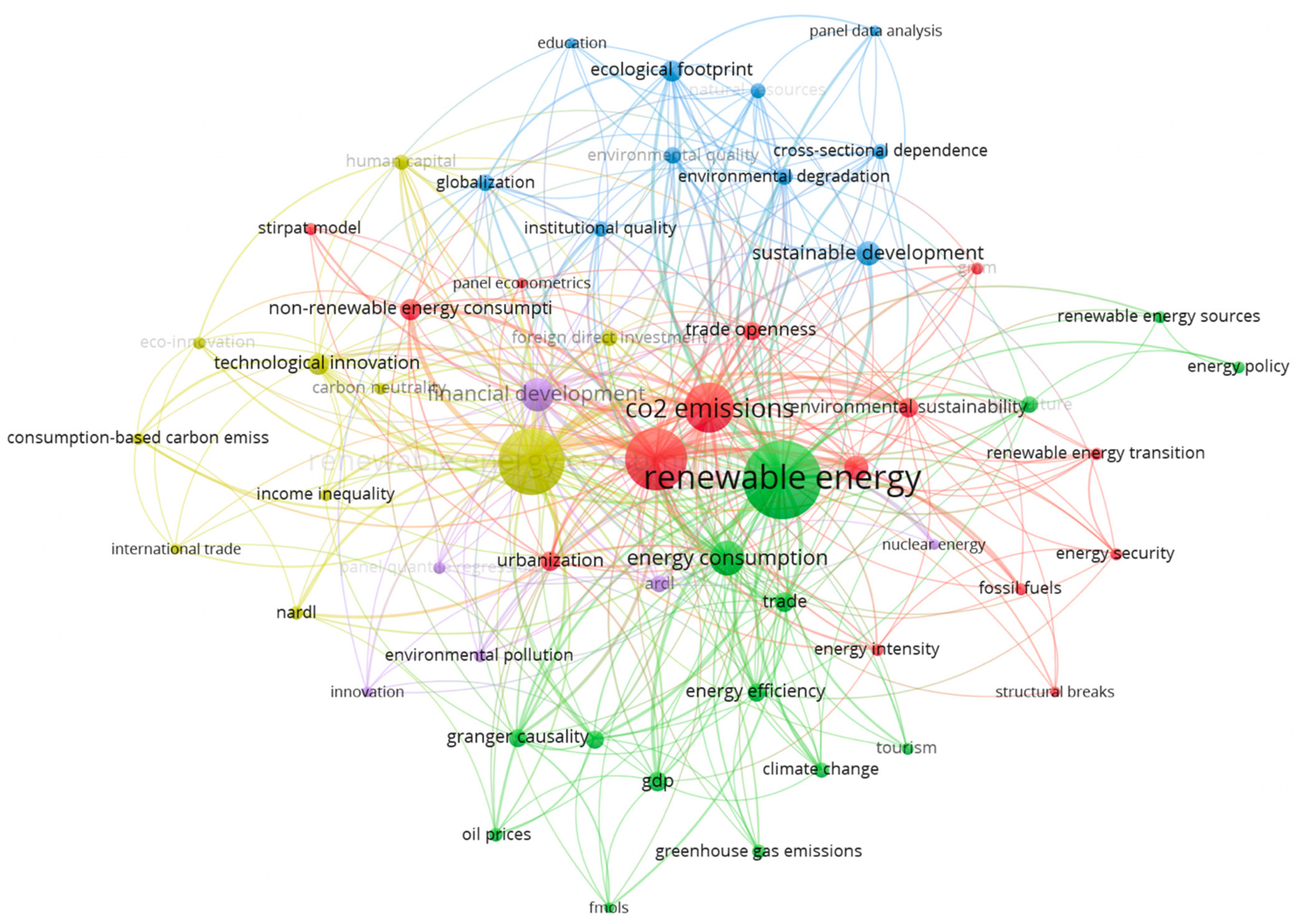

Then, the VOSviewer text mining functionality was applied to visualize the main determinants of REC in the studies gained from a body of analyzed Scopus literature for 2000–2021 (October).

Figure 5 visualizes four clusters with a total link of 224 and total link strength of 608. The in-depth analyses of link strengths allow determining the factors influencing the REC and analytical procedures used to its estimation.

The first biggest (red) cluster primarily addresses the concept of renewable energy consumption (occurrences—172, links—47, total link strength—258) under environmental degradation, foreign direct investments, globalization, institutional quality, international trade, carbon neutrality, human capital, etc. The methodology is presented with approaches of NARLD (Nonlinear Autoregressive Distributed Lag) and the Generalized Method of Moments (GMM).

The second cluster (green) focused on the environmental pressure from economic activity visualized with items of CO2 emissions (occurrences—97, links—42, total link strength—153), financial development, non-renewable energy consumption, urbanization, energy policy, nuclear energy, agriculture, etc. The applied methodological approaches were the Autoregressive Distributed Lag Model (ARDL), the panel quantile regression, and the STIRPAT model.

The third cluster (blue) focused on energy consumption (occurrences—50, links—29, total link strength—67) in the view of energy efficiency, GDP, climate change, greenhouse gas emissions, oil prices, tourism, trade, etc. The methodology presented with the Fully Modified Least Square (FMOLS), Granger causality, panel cointegration, etc.

The fourth cluster (yellow) is formed around the concept of economic growth (occurrences—154, links—45, total link strength—227) in the view of energy intensity, energy security, environmental quality, environmental sustainability, fossil fuels, renewable energy transition, trade openness, education, etc. The most usable methodological approaches were structural breaks.

Table 1 demonstrates the most significant co-occurrence keywords in the general scope of literature concerning the determinants of REC. Therefore, it could be assumed that the main drivers of REC were considered to be “economic growth”, “CO

2 emissions”, “financial development”, “energy consumption”, “trade”, “urbanization”, “GDP”, “human capital”, ”energy intensity”, and “foreign direct investments”.

Therefore, following the studies [

89,

90], the main drivers of REC are GDP and CO

2 emissions. Applied the panel cointegration techniques [

89], the authors stated that the growth of GDP and CO

2 per capita increases renewable energy consumption. However, the Chinese researchers proved that CO

2 emission impact on REC differs among the regions [

91]. Besides, this study involved the indicators of imports and exports of goods and services. The findings showed the weak impact of imports and the significant influence of export on REC. The same consumption is presented in [

92,

93]. Therefore, imports and exports of goods and services are other bound determinants of REC.

The findings of the study [

94] indicated the impact of the gross capital formation, CO

2 emissions, total labor force on renewable energy. The authors noted that the negative influence of CO

2 emissions was mostly coming from industry. Apergis and Payne [

95], employing panel error correction model, found the bidirectional causality between REC, gross fixed capital formation, GDP, and the labor force in 80 countries during 1990–2007. Therefore, gross capital formation and labor force are also decisive factors for REC.

Furthermore, several studies indicated the role of industrialization [

96,

97] in enhancing renewable energy. Thus, it is appropriate to apply the variables of energy consumption in industry, industry, and manufacturing to check their influence on REC. The findings [

92,

98] showed the innovation and R&D positively affect REC. However, in the study [

99], the obtained results of the random effect model showed no statistically significant relationship between foreign direct investment and REC in the Eastern European and Central Asian countries during 1996–2018. Moreover, the regression analysis results of the panel data from the Baltic-Black Sea region countries during 1999–2018 [

100] showed that the foreign direct investment inflow positively affects the ecological situation. At the same time, the strict standard environmental legislation and growth of greenhouse gas emissions in the analyzed countries are the main barriers in attracting foreign direct investments. Thus, it drives us to consider the impact of foreign direct investment in ensuring REC.

Applied the dynamic panel estimation approach for panel data from sub-Saharan African countries, Kalu et al. [

101] confirmed the strong relationships among value added in industry, energy consumption, and economic advancement. Moreover, Sineviciene et al. [

102] determined that the variables such as share of industry, CO

2 emission per capita, and fixed capital are the main drivers of energy-efficient development in the Eastern European countries from 1996 to 2013. Kirikkaleli and Adebayo [

103] found that REC contributed to decreasing the consumption-based carbon dioxide emissions in India. In addition, Samusevych et al. [

104,

105] confirmed that gross fixed capital formation, industry value-added, CO

2 intensity, GDP per capita, and CO

2 emissions are the leading energy and economic security triggers in the six Eastern European countries.

Therefore, the vast range of factors (depending on the country) that influence renewable energy consumption actualizes the identification of the most significant factors considering the homogeneity of EU countries.