Price Leadership and Volatility Linkages between Oil and Renewable Energy Firms during the COVID-19 Pandemic

Abstract

1. Introduction

2. Data and Methodology

2.1. Data

2.2. Methodology: DCC-GARCH

2.3. Methodology: Price Leadership Share

3. Empirical Results

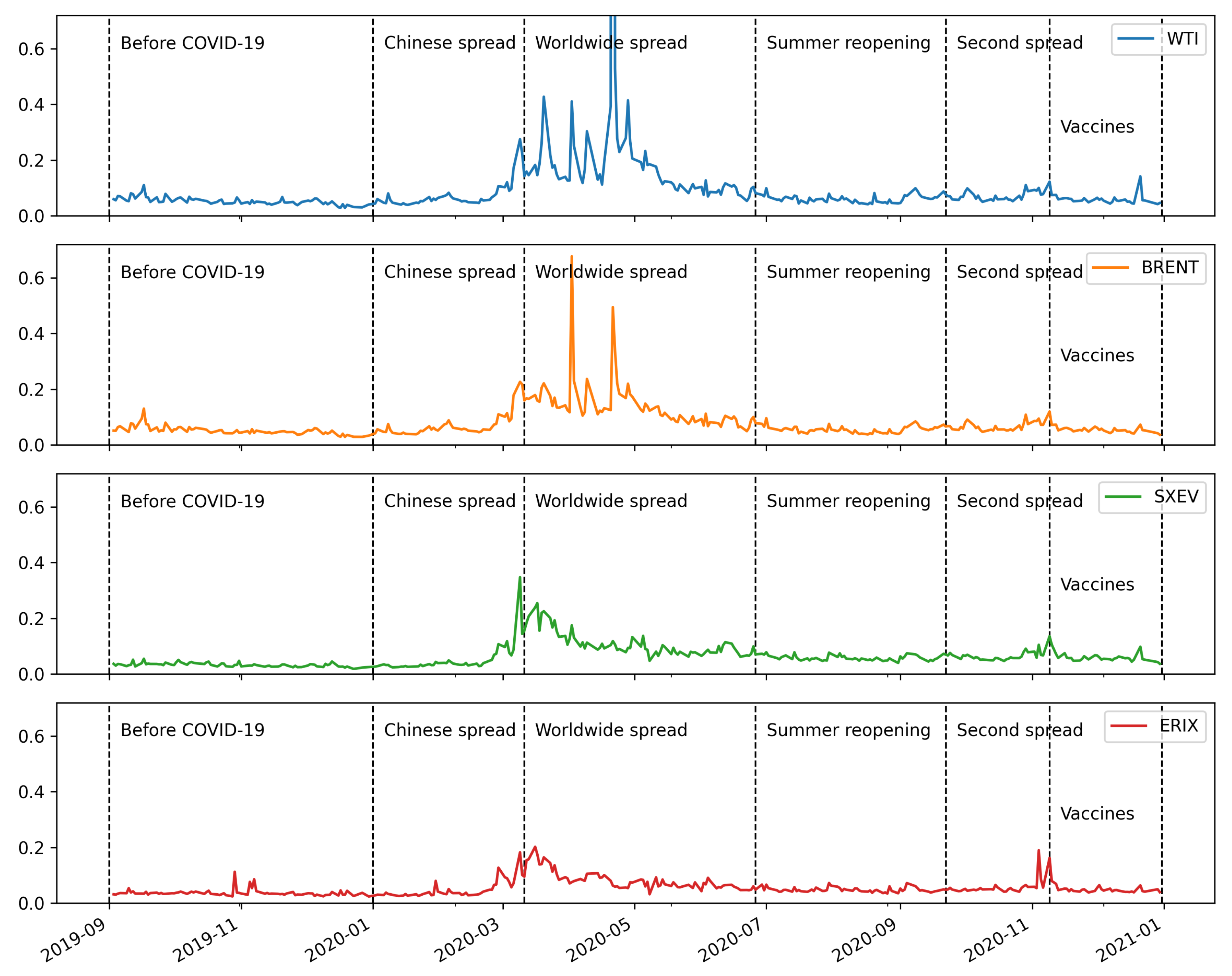

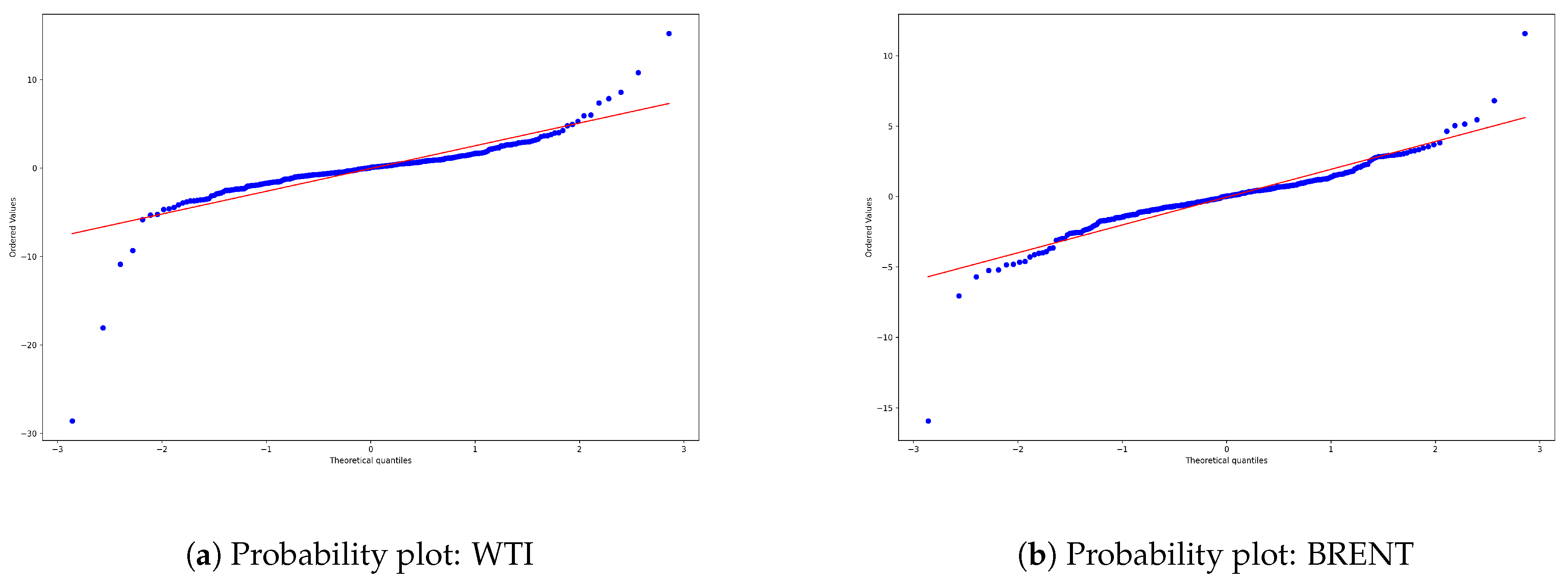

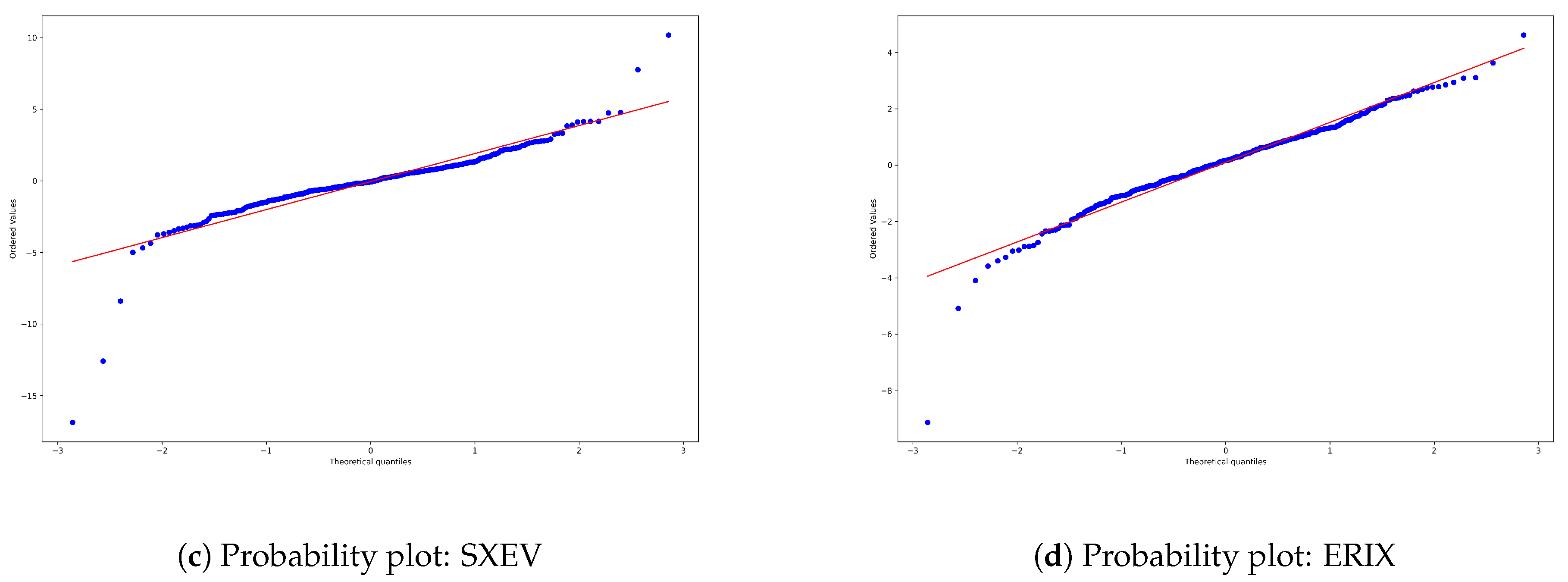

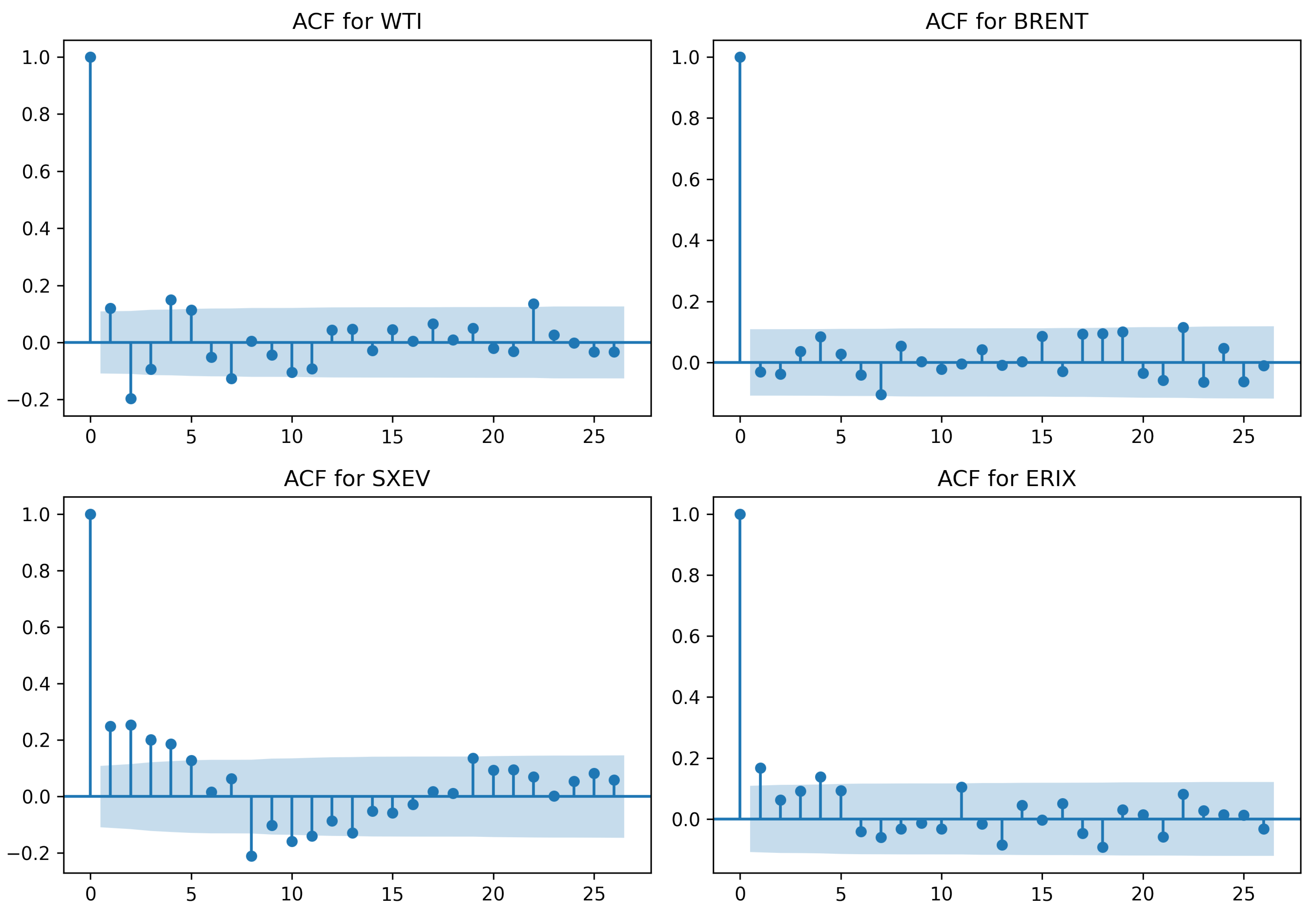

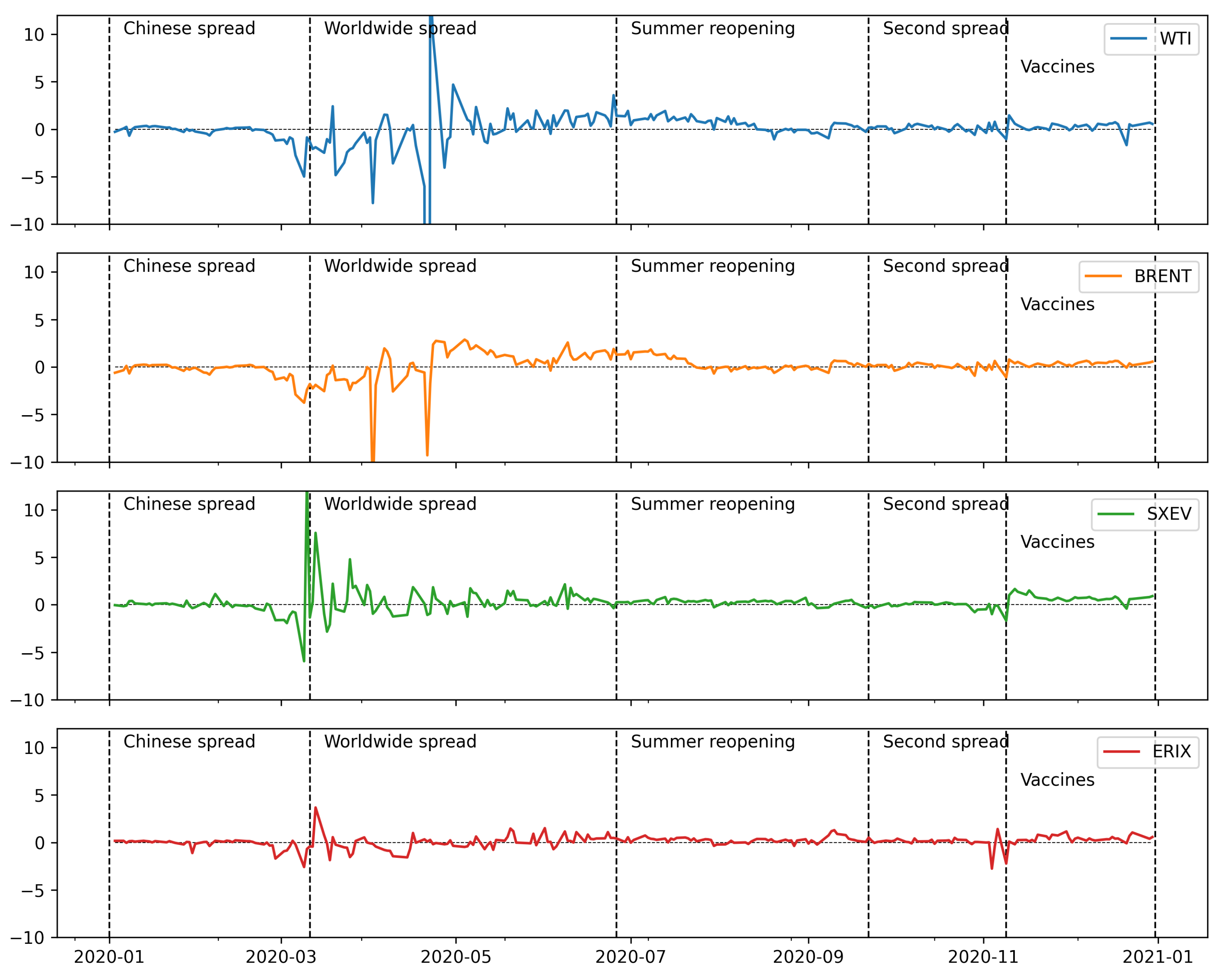

3.1. DCC-GARCH Analysis

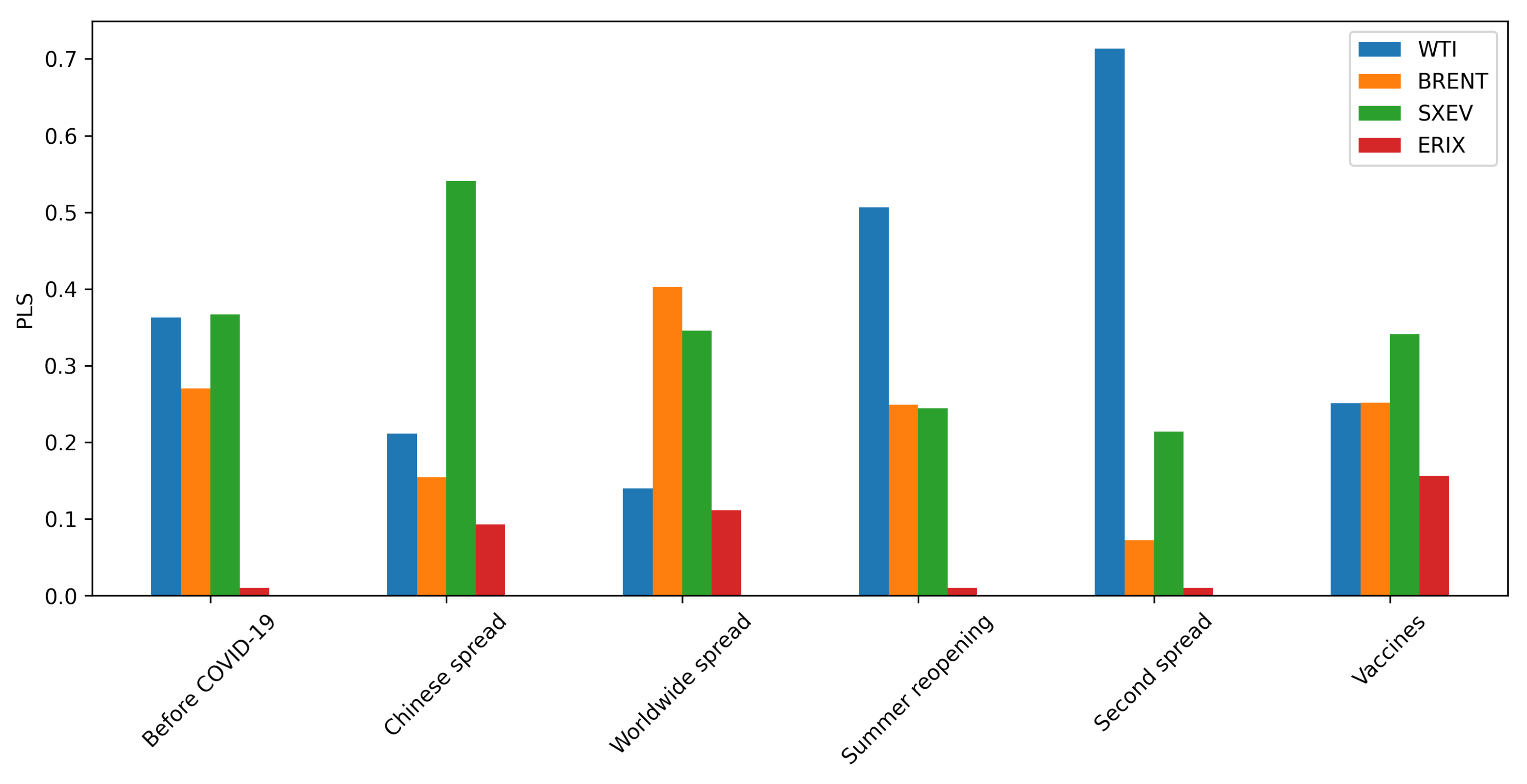

3.2. Price Leadership Analysis

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| ADF | Augmented Dickey-Fuller |

| BRENT | Brent crude oil futures |

| DCC | Dynamic Conditional Correlation |

| ERIX | European renewable energy index |

| GARCH | Generalized Autoregressive Conditional Heteroskedasticity |

| ICE | Intercontinental Exchange |

| LB | Ljung-Box |

| LM | Lagrange Multiplier |

| MTD | Mixture Transition Distribution |

| NYMEX | New Your Mercantile Exchange |

| PLS | Price Leadership Share |

| RMSE | Root Mean Square Error |

| SXEV | STOXX Europe 600 oil & gas index |

| WHO | World Health Organization |

| WTI | West Texas Intermediate crude oil futures |

References

- Goodell, J.W. COVID-19 and Finance: Agendas for Future Research. Financ. Res. Lett. 2020, 35, 101512. [Google Scholar] [CrossRef]

- Bouri, E.; Demirer, R.; Gupta, R.; Pierdzioch, C. Infectious Diseases, Market Uncertainty and Oil Market Volatility. Energies 2020, 13, 4090. [Google Scholar] [CrossRef]

- Corbet, S.; Goodell, J.W.; Günay, S. Co-Movements and Spillovers of Oil and Renewable Firms under Extreme Conditions: New Evidence from Negative WTI Prices during COVID-19. Energy Econ. 2020, 92, 104978. [Google Scholar] [CrossRef] [PubMed]

- Engle, R.F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Bekaert, G.; Harvey, C.R. Emerging Equity Market Volatility. J. Financ. Eco. 1997, 43, 29–77. [Google Scholar] [CrossRef]

- Bollerslev, T.; Ole Mikkelsen, H. Modeling and Pricing Long Memory in Stock Market Volatility. J. Econom. 1996, 73, 151–184. [Google Scholar] [CrossRef]

- Engle, R.F. ARCH: Selected Readings; Oxford University Press: Oxford, UK, 1995. [Google Scholar]

- Brailsford, T.J.; Faff, R.W. An Evaluation of Volatility Forecasting Techniques. J. Bank. Financ. 1996, 20, 419–438. [Google Scholar] [CrossRef]

- Choudhry, T. Stock Market Volatility and the Crash of 1987: Evidence from Six Emerging Markets. J. Int. Money Financ. 1996, 15, 969–981. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized Autoregressive Conditional Heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Antoniou, A.; Holmes, P. Futures Trading, Information and Spot Price Volatility: Evidence for the FTSE-100 Stock Index Futures Contract Using GARCH. J. Bank. Financ. 1995, 19, 117–129. [Google Scholar] [CrossRef]

- Franses, P.H.; Dijk, D.V. Forecasting Stock Market Volatility Using (Non-Linear) Garch Models. J. Forecast. 1996, 15, 229–235. [Google Scholar] [CrossRef]

- Dueker, M.J. Markov Switching in GARCH Processes and Mean-Reverting Stock-Market Volatility. J. Bus. Econ. Stat. 1997, 15, 26–34. [Google Scholar] [CrossRef][Green Version]

- Marcucci, J. Forecasting Stock Market Volatility with Regime-Switching GARCH Models. Stud. Nonlinear Dyn. Econ. 2005, 9, 1–55. [Google Scholar] [CrossRef]

- D’Amico, G.; Gismondi, F.; Petroni, F.; Prattico, F. Stock Market Daily Volatility and Information Measures of Predictability. Phys. A Stat. Mech. Appl. 2019, 518, 22–29. [Google Scholar] [CrossRef]

- Engle, R. Dynamic Conditional Correlation. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Ding, L.; Vo, M. Exchange Rates and Oil Prices: A Multivariate Stochastic Volatility Analysis. Q. Rev. Econ. Financ. 2012, 52, 15–37. [Google Scholar] [CrossRef]

- ben Brayek, A.; Sebai, S.; Naoui, K. A Study of the Interactive Relationship between Oil Price and Exchange Rate: A Copula Approach and a DCC-MGARCH Model. J. Econ. Asymmetries 2015, 12, 173–189. [Google Scholar] [CrossRef]

- Singhal, S.; Ghosh, S. Returns and Volatility Linkages between International Crude Oil Price, Metal and Other Stock Indices in India: Evidence from VAR-DCC-GARCH Models. Resour. Policy 2016, 50, 276–288. [Google Scholar] [CrossRef]

- Hou, K.; Moskowitz, T.J. Market Frictions, Price Delay, and the Cross-Section of Expected Returns. Rev. Financ. Stud. 2005, 18, 981–1020. [Google Scholar] [CrossRef]

- Celık, S. The More Contagion Effect on Emerging Markets: The Evidence of DCC-GARCH Model. Econ. Model. 2012, 29, 1946–1959. [Google Scholar] [CrossRef]

- Bauwens, L.; Laurent, S.; Rombouts, J.V.K. Multivariate GARCH Models: A Survey. J. Appl. Econom. 2006, 21, 79–109. [Google Scholar] [CrossRef]

- Ching, W.K.; Fung, E.S.; Ng, M.K. A Multivariate Markov Chain Model for Categorical Data Sequences and Its Applications in Demand Predictions. IMA J. Manag. Math. 2002, 13, 187–199. [Google Scholar] [CrossRef]

- D’Amico, G.; De Blasis, R. A Multivariate Markov Chain Stock Model. Scand. Actuar. J. 2020, 2020, 272–291. [Google Scholar] [CrossRef]

- De Blasis, R. The Price Leadership Share: A New Measure of Price Discovery in Financial Markets. Ann. Financ. 2020, 16, 381–405. [Google Scholar] [CrossRef]

- Raftery, A.E. A Model for High-Order Markov Chains. J. R. Stat. Soc. Ser. B 1985, 47, 528–539. [Google Scholar] [CrossRef]

- Safi, M. Coronavirus: Key Moments–Timeline. The Guardian. 2020. Available online: https://www.theguardian.com/world/ng-interactive/2020/dec/14/coronavirus-2020-timeline-covid-19 (accessed on 6 January 2021).

- A Timeline of COVID-19 Developments in 2020. Available online: https://www.ajmc.com/view/a-timeline-of-covid19-developments-in-2020 (accessed on 6 January 2021).

- Ljung, G.M.; Box, G.E.P. On a Measure of Lack of Fit in Time Series Models. Biometrika 1978, 65, 297–303. [Google Scholar] [CrossRef]

- Bollerslev, T. Modelling the Coherence in Short-Run Nominal Exchange Rates: A Multivariate Generalized Arch Model. Rev. Econ. Stat. 1990, 72, 498–505. [Google Scholar] [CrossRef]

| WTI | BRENT | SXEV | ERIX | ||

|---|---|---|---|---|---|

| Period | |||||

| Full dataset Obs: 172250 | mean | −0.0001 | −0.0001 | −0.0001 | 0.0002 |

| std | 0.5167 | 0.0964 | 0.0752 | 0.0604 | |

| min | −102.0825 | −7.5968 | −4.4378 | −3.7572 | |

| max | 83.2909 | 9.2275 | 2.4850 | 2.7950 | |

| skew | −42.5313 | 2.8789 | −2.0482 | −1.2964 | |

| kurt | 18,424.3171 | 779.9667 | 179.6896 | 170.1605 | |

| Before COVID-19 Obs: 41870 01/09/2019–31/12/2019 | mean | 0.0001 | 0.0002 | 0.0001 | 0.0000 |

| std | 0.0545 | 0.0533 | 0.0335 | 0.0385 | |

| min | −1.3276 | −1.3291 | −0.3874 | −1.8567 | |

| max | 0.9375 | 0.8087 | 0.4583 | 1.5288 | |

| skew | −0.7698 | −0.9137 | −0.0603 | −1.5519 | |

| kurt | 32.8249 | 30.1682 | 11.4476 | 282.9432 | |

| Chinese spread Obs: 24910 01/01/2020–10/03/2020 | mean | −0.0007 | −0.0007 | −0.0016 | 0.0002 |

| std | 0.0845 | 0.0804 | 0.0725 | 0.0555 | |

| min | −1.0919 | −1.4157 | −4.4378 | −2.3398 | |

| max | 1.8138 | 1.6868 | 1.5918 | 1.4196 | |

| skew | 0.5385 | −0.0268 | −20.5752 | −3.3521 | |

| kurt | 29.3838 | 31.0702 | 1204.6331 | 199.2002 | |

| Worldwide spread Obs: 38690 11/03/2020–25/06/2020 | mean | −0.0007 | −0.0007 | 0.0000 | −0.0005 |

| std | 1.0833 | 0.1673 | 0.1187 | 0.0876 | |

| min | −102.0825 | −7.5968 | −1.5095 | −1.5770 | |

| max | 83.2909 | 9.2275 | 2.4850 | 1.5260 | |

| skew | −20.5485 | 2.5072 | 0.6524 | −0.0496 | |

| kurt | 4244.3328 | 379.5144 | 18.5669 | 21.1941 | |

| Summer reopening Obs: 31800 26/06/2020–21/09/2020 | mean | 0.0001 | 0.0000 | −0.0004 | 0.0005 |

| std | 0.0622 | 0.0563 | 0.0584 | 0.0481 | |

| min | −0.8001 | −0.6795 | −0.5547 | −0.6053 | |

| max | 1.0206 | 0.4540 | 0.4982 | 0.5568 | |

| skew | 0.0066 | −0.0971 | −0.0057 | −0.0422 | |

| kurt | 8.1460 | 4.6936 | 4.5363 | 9.3955 | |

| Second spread Obs: 17490 22/09/2020–08/11/2020 | mean | 0.0003 | 0.0002 | 0.0001 | 0.0010 |

| std | 0.0726 | 0.0676 | 0.0645 | 0.0611 | |

| min | −0.8661 | −0.7144 | −0.8050 | −3.7572 | |

| max | 0.6104 | 0.4884 | 0.9364 | 1.1464 | |

| skew | −0.1302 | −0.0582 | 0.2196 | −12.7377 | |

| kurt | 6.9856 | 4.3737 | 7.9225 | 830.9181 | |

| Vaccines Obs: 17490 09/11/2020–31/12/2020 | mean | 0.0009 | 0.0009 | 0.0016 | 0.0006 |

| std | 0.0637 | 0.0573 | 0.0634 | 0.0555 | |

| min | −2.7700 | −1.0395 | −0.5734 | −0.6306 | |

| max | 0.7251 | 0.6735 | 0.9992 | 2.7950 | |

| skew | −4.6746 | −0.3737 | 0.4145 | 7.1639 | |

| kurt | 213.7327 | 15.1881 | 11.2031 | 374.2154 |

| WTI | BRENT | SXEV | ERIX | |

|---|---|---|---|---|

| Before COVID-19 | 0.053 | 0.051 | 0.033 | 0.036 |

| Chinese spread | 0.072 | 0.069 | 0.051 | 0.047 |

| Worldwide spread | 0.286 | 0.140 | 0.110 | 0.081 |

| Summer reopening | 0.061 | 0.055 | 0.058 | 0.047 |

| Second spread | 0.071 | 0.066 | 0.063 | 0.056 |

| Vaccines | 0.060 | 0.055 | 0.060 | 0.051 |

| WTI | BRENT | SXEV | ERIX | |

|---|---|---|---|---|

| WTI | 1.000000 | 0.495386 | 0.161341 | 0.089098 |

| BRENT | 0.495386 | 1.000000 | 0.665709 | 0.515934 |

| SXEV | 0.161341 | 0.665709 | 1.000000 | 0.876430 |

| ERIX | 0.089098 | 0.515934 | 0.876430 | 1.000000 |

| WTI | BRENT | SXEV | ERIX | |

|---|---|---|---|---|

| Panel A: summary statistics (returns in %) | ||||

| mean | −0.0532 | −0.0480 | −0.0539 | 0.1002 |

| std | 3.0212 | 2.1115 | 2.1455 | 1.4463 |

| min | −28.5979 | −15.9417 | −16.8673 | −9.1300 |

| max | 15.2176 | 11.5714 | 10.1787 | 4.6155 |

| skew | −2.7681 | −0.9060 | −1.7426 | −0.9769 |

| kurt | 30.3941 | 12.6321 | 16.5461 | 5.1810 |

| Panel B: returns diagnostics | ||||

| ADF | −8.561 *** | −18.506 *** | −6.859 *** | −6.953 *** |

| LM lag 1 | 100.513 *** | 52.324 *** | 2.532 | 26.523 *** |

| LM lag 2 | 104.585 *** | 60.992 *** | 4.530 | 26.527 *** |

| LM lag 3 | 104.263 *** | 62.262 *** | 46.043 *** | 26.509 *** |

| Panel C: squared returns diagnostics | ||||

| LB lag 1 | 101.744 *** | 52.954 *** | 2.563 | 26.829 *** |

| LB lag 2 | 116.732 *** | 52.991 *** | 5.018 * | 28.240 *** |

| LB lag 3 | 117.808 *** | 53.007 *** | 50.329 *** | 28.240 *** |

| Panel D: absolute returns diagnostics | ||||

| LB lag 1 | 121.734 *** | 51.150 *** | 37.802 *** | 27.021 *** |

| LB lag 2 | 171.196 *** | 54.647 *** | 63.006 *** | 37.223 *** |

| LB lag 3 | 184.032 *** | 55.471 *** | 108.108 *** | 37.992 *** |

| WTI | BRENT | SXEV | ERIX | |

|---|---|---|---|---|

| WTI | 1.000 | 0.495 | 0.161 | 0.089 |

| BRENT | 0.495 | 1.000 | 0.666 | 0.516 |

| SXEV | 0.161 | 0.666 | 1.000 | 0.876 |

| ERIX | 0.089 | 0.516 | 0.876 | 1.000 |

| WTI L1 | 0.091 | 0.331 | 0.136 | 0.078 |

| BRENT L1 | 0.141 | 0.635 | 0.589 | 0.499 |

| SXEV L1 | 0.135 | 0.592 | 0.821 | 0.738 |

| ERIX L1 | 0.117 | 0.481 | 0.749 | 0.732 |

| Panel A: Univariate GARCH parameters | ||||

| WTI | BRENT | SXEV | ERIX | |

| 0.095 | 0.074 | −0.032 | 0.177 *** | |

| (0.372) | (0.430) | (0.670) | (0.006) | |

| 1.161 *** | 0.114 | 0.358 | 0.310 | |

| (0.006) | (0.221) | (0.379) | (0.347) | |

| 0.645 ** | 0.126 *** | 0.483 | 0.252 ** | |

| (0.036) | (0.005) | (0.100) | (0.033) | |

| 0.283 ** | 0.851 *** | 0.516 * | 0.601 ** | |

| (0.047) | (0.000) | (0.068) | (0.023) | |

| Panel B: DCC-GARCH parameters | ||||

| 0.050 *** | ||||

| (0.000) | ||||

| 0.887 *** | ||||

| (0.000) | ||||

| Panel C: DCC-GARCH residuals diagnostic | ||||

| WTI | BRENT | SXEV | ERIX | |

| LB | 1.787 | 0.147 | 3.194 * | 1.169 |

| (0.181) | (0.701) | (0.074) | (0.280) | |

| LB () | 0.996 | 0.698 | 0.038 | 0.917 |

| (0.318) | (0.404) | (0.846) | (0.338) | |

| WTI | BRENT | SXEV | ERIX | |

|---|---|---|---|---|

| Chinese spread | 0.966618 | 0.914734 | 2.235645 | 0.552730 |

| Worldwide spread | 23.905959 | 2.445554 | 1.473740 | 0.804769 |

| Summer reopening | 0.868118 | 0.731535 | 0.354176 | 0.406645 |

| Second spread | 0.353359 | 0.322304 | 0.306062 | 0.582914 |

| Vaccines | 0.579485 | 0.447151 | 0.859321 | 0.622851 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

De Blasis, R.; Petroni, F. Price Leadership and Volatility Linkages between Oil and Renewable Energy Firms during the COVID-19 Pandemic. Energies 2021, 14, 2608. https://doi.org/10.3390/en14092608

De Blasis R, Petroni F. Price Leadership and Volatility Linkages between Oil and Renewable Energy Firms during the COVID-19 Pandemic. Energies. 2021; 14(9):2608. https://doi.org/10.3390/en14092608

Chicago/Turabian StyleDe Blasis, Riccardo, and Filippo Petroni. 2021. "Price Leadership and Volatility Linkages between Oil and Renewable Energy Firms during the COVID-19 Pandemic" Energies 14, no. 9: 2608. https://doi.org/10.3390/en14092608

APA StyleDe Blasis, R., & Petroni, F. (2021). Price Leadership and Volatility Linkages between Oil and Renewable Energy Firms during the COVID-19 Pandemic. Energies, 14(9), 2608. https://doi.org/10.3390/en14092608