Regional Flexibility Markets—Solutions to the European Energy Distribution Grid—A Systematic Review and Research Agenda

Abstract

1. Introduction

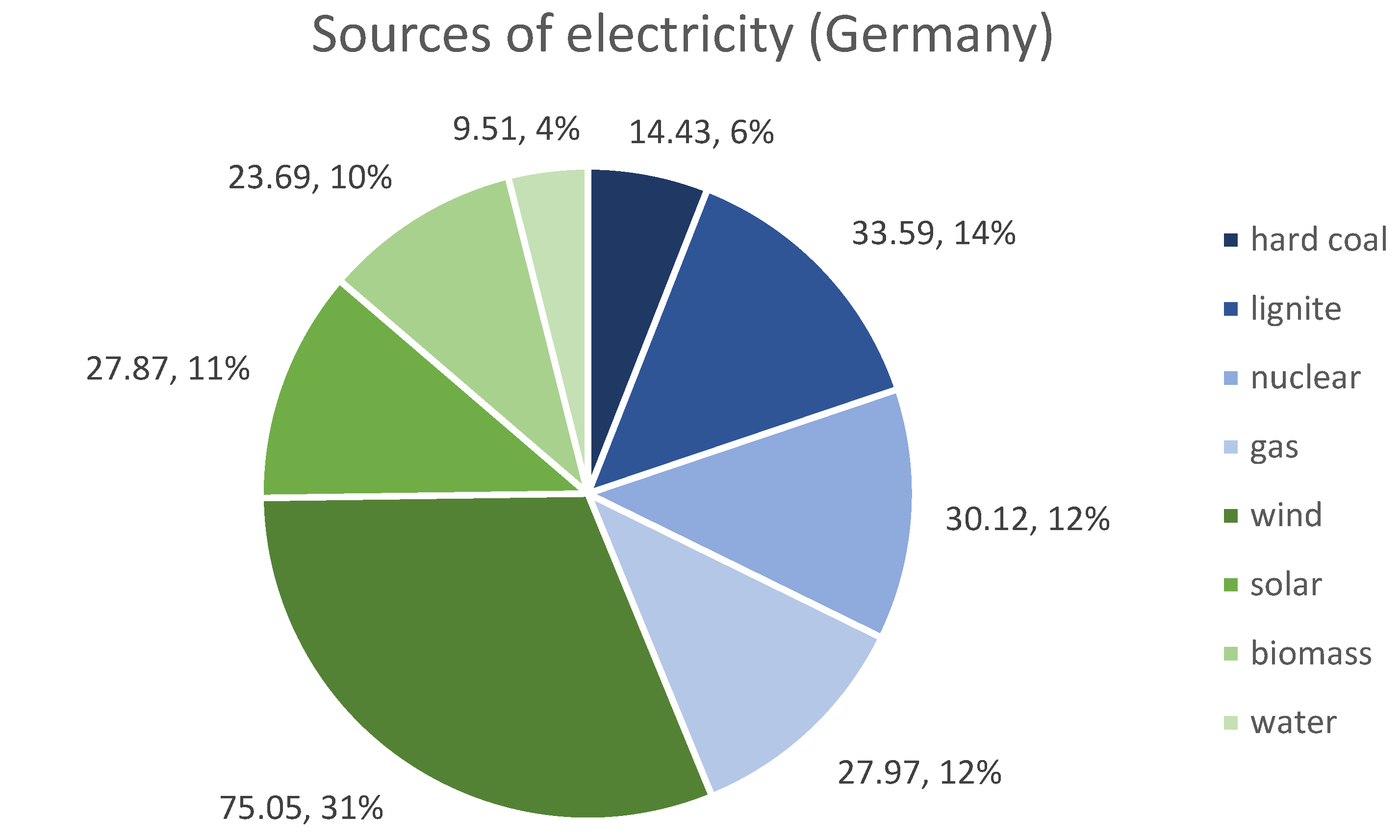

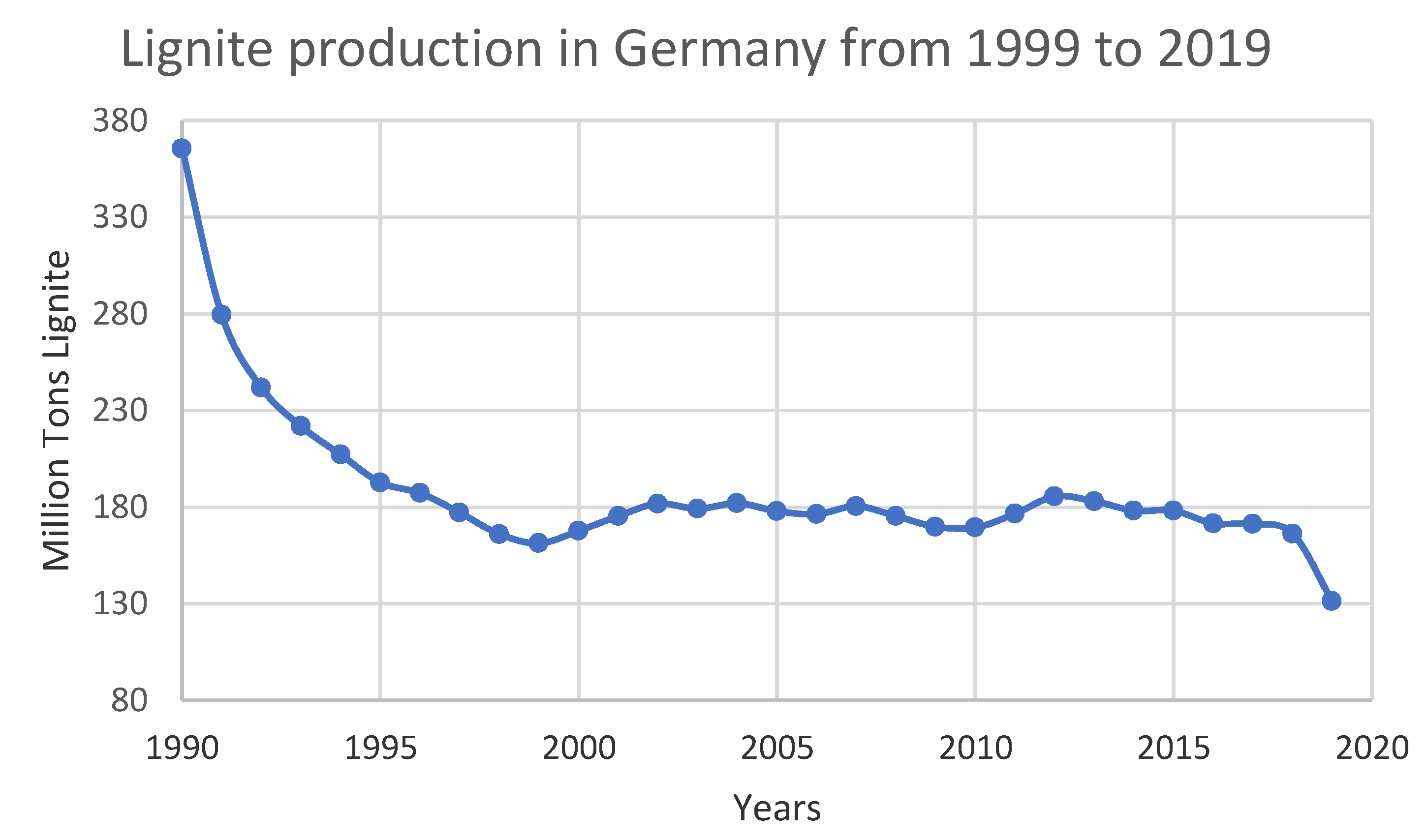

1.1. Germany’s Commitment to Switch to Regenerative Energies (Energiewende)

1.2. Price Regulation Policy

2. Germany’s Dilemmas of Electricity Distribution and Allocation

2.1. Degressive Regenerative Resource Output

2.2. Grid Capacity Restrictions

2.3. Pricing Dilemma

- (a)

- Provider impact

- (b)

- Grid operator impact

- (c)

- Consumer impact

3. A Review Regional Flexibility Market Concepts—A Solution to Germany’s Energy Issue?

3.1. Concept of Regional Subsidiary Flexibility Markets

3.2. Review Method and Overview of Results

4. Blockchain Technology for Energy Allocation

4.1. The Blockchain Technology

4.2. Private Smart Grids—A First Step to Practicabiltiy

4.3. The Vision of Smart Energy Internet

5. Technological Requirements and Standards for Blockchain-Based Flexibility Markets

- Energy feed-in and consumption have to be measured and documented on-time at every consumer and provider by smart metering technologies.

- Smart contracts regulate user participation and contractual conditions on the energy blockchain.

- Prosumers Privacy and security concerns of have to be met.

- Energy storage capacities are required to buffer capacities and discharge the grid.

- Smart contract mechanisms are required to reliably organize feed-in and consumption conditions in the blockchain.

- Incentive systems have to be devised to motivate consumers and providers to consume energy in high load situations and feed-in energy when required.

5.1. Smart Metering

5.2. Smart Contract

5.3. Privacy and Security Concerns

5.4. Smart Storage

5.5. Incentive Systems

6. Market Solutions for Energy Distributions—Towards Growing Subsidiarity

6.1. Flexible Pricing Zones

6.2. Power Auctions

6.3. Semi-Central Transactive Grids

6.4. Subsidiary Peer-to-Peer (P2P) Markets

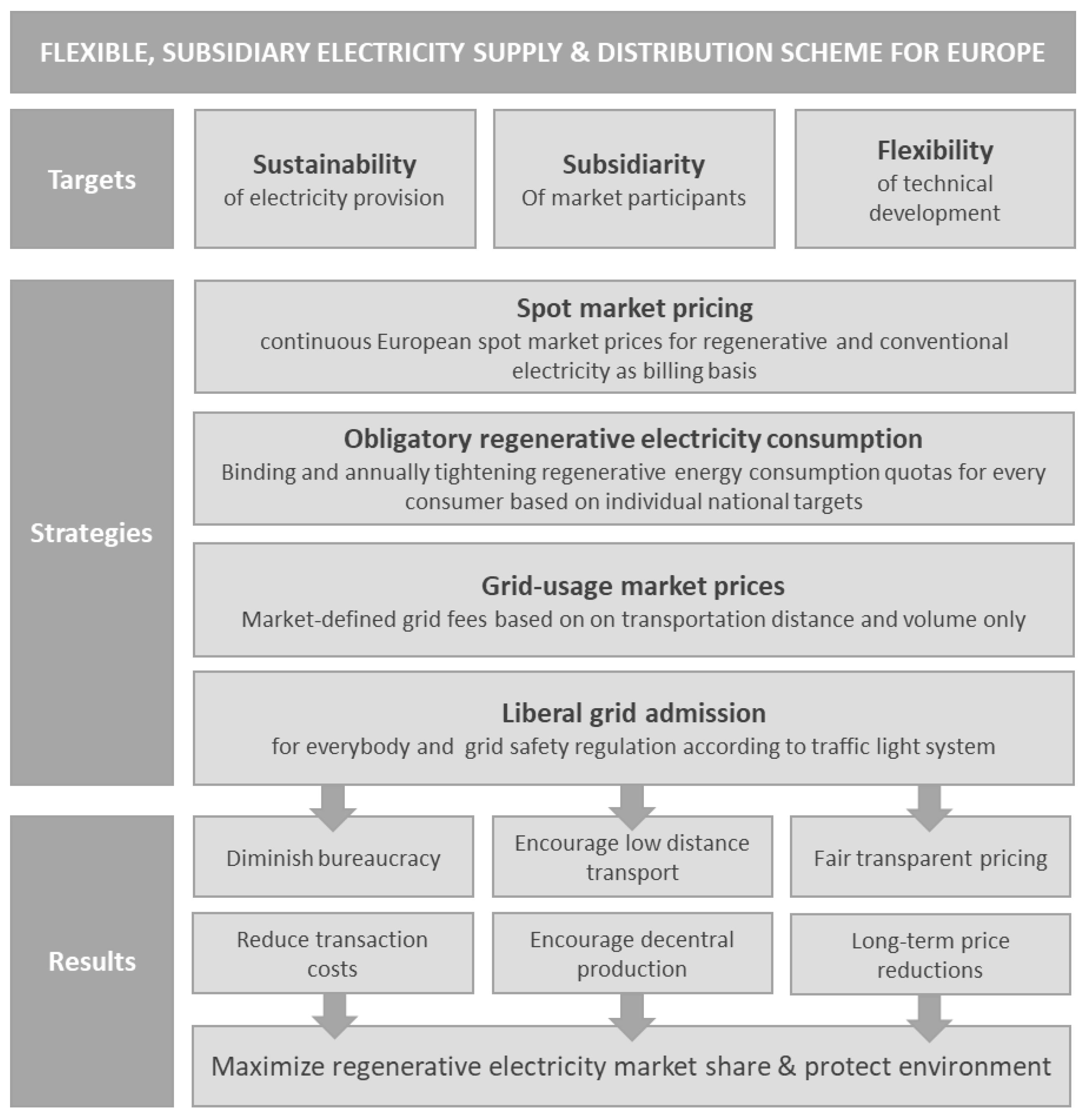

7. A Comprehensive Flexible Supply and Pricing Scheme for Europe’s Electricity Market

7.1. Central Aims and Measures

7.2. Implementation of a Flexible Pricing Scheme Based on Smart Metering and Blockchain Technology

7.3. Blockchain and Smart Metering as Efficient and Ecological Incentive System

7.4. Macroeconomic Impact of a Flexible Pricing Scheme

7.5. Sticky Large Supply Structures

7.6. Inflexible Multilevel Contract Systems

7.7. Fixed Pricing

7.8. Fears Concerning the Marketability of Regenerative Energies

8. Conclusions

8.1. Policy Suggestions to Implement Regional Flexibility Markets in Germany

8.2. Study Limitations and Further Research Needs

Author Contributions

Funding

Conflicts of Interest

References

- Michaelides, E.E.S. Environmental and ecological effects of energy production and consumption. In Alternative Energy Sources; Springer: Berlin/Heidelberg, Germany, 2012; pp. 33–63. [Google Scholar]

- Denning, R.; Mubayi, V. Insights into the societal risk of nuclear power plant accidents. Risk Anal. 2017, 37, 160–172. [Google Scholar] [CrossRef]

- Khodzhiev, A.M. Recycling nuclear wastes to change the pollution problem. Научный Альманах 2019, 11, 183–186. [Google Scholar]

- Anderson, T.R.; Hawkins, E.; Jones, P.D. CO2, the greenhouse effect and global warming: From the pioneering work of Arrhenius and callendar to today’s earth system models. Endeavour 2016, 40, 178–187. [Google Scholar] [CrossRef] [PubMed]

- King, A.D. The drivers of nonlinear local temperature change under global warming. Environ. Res. Lett. 2019, 14, 064005. [Google Scholar] [CrossRef]

- Alfieri, L.; Dottori, F.; Betts, R.; Salamon, P.; Feyen, L. Multi-model projections of river flood risk in Europe under global warming. Climate 2018, 6, 6. [Google Scholar] [CrossRef]

- Huang, P. Time-varying response of ENSO-induced tropical Pacific rainfall to global warming in CMIP5 models. Part I: Multimodel ensemble results. J. Clim. 2016, 29, 5763–5778. [Google Scholar] [CrossRef]

- De Siqueira, E.C.V.; da Luz, C.K. Contextualizing environmental migration: The gap between the legal nature of refuge and environment during the age of global warming and natural catastrophes. Revista de Direito Econômico e Socioambiental 2018, 9, 125–141. [Google Scholar] [CrossRef]

- Ash, K.; Obradovich, N. Climatic stress, internal migration, and Syrian civil war onset. J. Confl. Resolut. 2020, 64, 3–31. [Google Scholar] [CrossRef]

- Selby, J.; Dahi, O.S.; Fröhlich, C.; Hulme, M. Climate change and the Syrian civil war revisited. Political Geogr. 2017, 60, 232–244. [Google Scholar] [CrossRef]

- EHA. Strommix in Deutschland: Rekordhoch für Erneuerbare Energien. 2020. Available online: https://www.eha.net/blog/details/strommix-in-deutschland.html (accessed on 14 April 2021).

- Statista. Braunkohleförderung in Deutschland in den Jahren von 1990 bis 2019. Available online: https://de.statista.com/statistik/daten/studie/156258/umfrage/braunkohlefoerderung-in-deutschland-seit-1990/ (accessed on 15 April 2020).

- BMU (Bundesministerium für Umwelt, Naturschutz und nukleare Sicherheit). Verfassung und Gesetze. Available online: https://www.bmu.de/themen/atomenergie-strahlenschutz/nukleare-sicherheit/rechtsvorschriften-technische-regeln/grundgesetz-atomgesetz/#:~:text=AtG%2DNovelle%2C%20die%20die%20Beendigung,Deutschland%20bis%20sp%C3%A4testens%20Ende%202022 (accessed on 14 April 2021).

- Die Bundesregierung. Energiekonzept. 2010. Available online: https://www.bundesregierung.de/breg-de/themen/energiewende/energiekonzept-614722 (accessed on 8 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §1 (2). 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §4. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- Bundesregierung der Bundesrepublik Deutschland. Das Energiekonzept 2050. Available online: https://www.bundesregierung.de/resource/blob/997532/778196/8c6acc2c59597103d1ff9a437acf27bd/infografik-energie-textversion-data.pdf?download=1 (accessed on 5 August 2020).

- Fraunhofer. Energiekonzept 2050. Eine vision für ein nachhaltiges Energiekonzept auf Basis von Energieeffizienz und 100% erneuerbaren energien. Erstellt vom Fachausschuss “Nachhaltiges Energiesystem 2050” des ForschungsVerbunds Erneuerbare Energien. 2010. Available online: https://www.fvee.de/fileadmin/politik/10.06.vision_fuer_nachhaltiges_energiekonzept.pdf (accessed on 5 August 2020).

- Batrancea, L. An econometric approach regarding the impact of fiscal pressure on equilibrium: Evidence from electricity, gas and oil companies listed on the New York stock exchange. Mathematics 2021, 6, 630. [Google Scholar] [CrossRef]

- Batrancea, I.; Batrancea, L.; Maran Rathnaswamy, M.; Tulai, H.; Fatacean, G.; Rus, M.-I. Greening the financial system in USA, Canada and Brazil: A panel data analysis. Mathematics 2020, 8, 2217. [Google Scholar] [CrossRef]

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §2 (1), (2) and (3). 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- Korte, K.; Gawel, E. Stromnetzinvestitionen und anreizregulierung—Problemfelder und lösungsansätze. Wirtschaftsdienst 2015, 95, 127–134. [Google Scholar] [CrossRef][Green Version]

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §3 Nr 4. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §23. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §7 and §11. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §12. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §8. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §9. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §24. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §30. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §32. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §34. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- Umwelt Bundesamt. Erneuerbare Energien in Deutschland. 2020. Available online: https://www.umweltbundesamt.de/sites/default/files/medien/1410/publikationen/2020-04-03_hgp-ee-in-zahlen_bf.pdf (accessed on 6 August 2020).

- Umwelt Bundesamt. Erneuerbare Energien in Deutschland. 2020, p. 9. Available online: https://www.umweltbundesamt.de/sites/default/files/medien/1410/publikationen/2020-04-03_hgp-ee-in-zahlen_bf.pdf (accessed on 6 August 2020).

- Umwelt Bundesamt. Erneuerbare Energien in Deutschland. 2020, p. 8. Available online: https://www.umweltbundesamt.de/sites/default/files/medien/1410/publikationen/2020-04-03_hgp-ee-in-zahlen_bf.pdf (accessed on 6 August 2020).

- Elsland, R.; Boßmann, T.; Hartel, R.; Gnann, T.; Genoese, M.; Wietschel, M. Analysis of structural changes of the load profiles of the German residential sector due to decentralized electricity generation and e-mobility. In Sustainability in Energy and Buildings; Springer: Berlin/Heidelberg, Germany, 2013; pp. 71–84. [Google Scholar]

- Umweltbundesamt. Nutzung von Flüssen: Wasserkraft. 2019. Available online: https://www.umweltbundesamt.de/themen/wasser/fluesse/nutzung-belastungen/nutzung-von-fluessen-wasserkraft#wasserkraftnutzung-global (accessed on 6 August 2020).

- Fachagentur Windenergie an Land. Ausbausituation der Windenergie an land im Frühjahr 2019. 2019. Available online: https://www.fachagentur-windenergie.de/fileadmin/files/Veroeffentlichungen/Analysen/FA_Wind_Zubauanalyse_Wind-an-Land_Fruehjahr_2019.pdf (accessed on 6 August 2020).

- NDR. Bau von Windkraftanlagen Bricht Drastisch Ein. 2020. Available online: https://www.ndr.de/nachrichten/info/Bau-von-Windkraftanlagen-bricht-drastisch-ein,windkraftanlagen114.html (accessed on 5 August 2020).

- Offshore-windindustrie. de. News rund um die Offshore-Windenergie. 2020. Available online: http://www.offshore-windindustrie.de/ (accessed on 6 August 2020).

- Meister, T. Der Ausbau von offshore-windparks in Deutschland aus einer innovationsperspektive. Raumforschung Raumordnung Spat. Res. Plan. 2018, 76, 19–33. [Google Scholar] [CrossRef]

- Iwr-Start. BNetzA Juni-Ausschreibung: Flaute bei Wind hält an—Solar deutlich überzeichnet. 2020. Available online: https://www.iwr.de/news.php?id=36804 (accessed on 6 August 2020).

- Alexopoulos, S.; Hoffschmidt, B. Solar tower power plant in Germany and future perspectives of the development of the technology in Greece and Cyprus. Renew. Energy 2010, 35, 1352–1356. [Google Scholar] [CrossRef]

- TEnnet. Making the Connection. Integrated Annual Report 2014. Tennet Holding B.V. Available online: https://www.tennet.eu/fileadmin/user_upload/Company/Investor_Relations/Annual_Report/TenneT-AR14_UK.pdf (accessed on 8 February 2020).

- Weber, F.; Jenal, C. Gegen den Wind: Konfliktlinien beim Ausbau erneuerbarer Energien in Großschutzgebieten am Beispiel der Windenergie in den Naturparken Soonwald-Nahe und Rhein-Westerwald; Verlag der ARL-Akademie für Raumforschung und Landesplanung: Hannover, Germany, 2018; pp. 217–249. [Google Scholar]

- EDSO (European Distribution System Operators for Smart Grids). Future-Ready, Smarter, Electricity Grids. 2018. Available online: https://www.edsoforsmartgrids.eu/wp-content/uploads/brochure (accessed on 6 August 2020).

- Kerber, G. Aufnahmefähigkeit von Niederspannungsverteilnetzen für die Einspeisung aus Photovoltaikkleinanlagen. Ph.D. Thesis, Technische Universität München, München, Germany, 2010. [Google Scholar]

- Photovoltaik4all. Aktuelle EEG Vergütungssätze für Photovoltaikanlagen 2021. 2020. Available online: https://www.photovoltaik4all.de/aktuelle-eeg-verguetungssaetze-fuer-photovoltaikanlagen-2017 (accessed on 6 August 2020).

- WINDMONSTER.DE—Einspeisevergütung für Windenergie. Einspeisevergütung. 2012. Available online: https://www.windmonster.de/?Die_Fakten___Einspeiseverguetung#:~:text=Grundverg%C3%BCtung%20f%C3%BCr%20Strom%20aus%20Windkraftanlagen,%2C02%20Cent%2FkWh%20Grundverg%C3%BCtung. (accessed on 6 August 2020).

- Windbranche. de. Neowa setzt bei WEA-Rückbauprojekten auf DIN-Standards. 2020. Available online: https://www.windbranche.de/news/nachrichten/artikel-36888-neowa-setzt-bei-wea-rueckbauprojekten-auf-din-standards (accessed on 6 August 2020).

- Umwelt Bundesamt. Zu geringe Recyclingkapazitäten für Rückbau von Windenergieanlagen. 2020. Available online: https://www.umweltbundesamt.de/presse/pressemitteilungen/zu-geringe-recyclingkapazitaeten-fuer-rueckbau-von (accessed on 6 August 2020).

- Frantál, B. Have local government and public expectations of wind energy project benefits been met? Implications for repowering schemes. J. Environ. Policy Plan. 2015, 17, 217–236. [Google Scholar] [CrossRef]

- Masurowski, F.; Drechsler, M.; Frank, K. A spatially explicit assessment of the wind energy potential in response to an increased distance between wind turbines and settlements in Germany. Energy Policy 2016, 97, 343–350. [Google Scholar] [CrossRef]

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §8-§10. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- Agora. Energiewende: Was bedeuten die neuen Gesetze? 2020. Available online: https://www.agora-energiewende.de/fileadmin2/Projekte/2016/EEG-FAQ/Agora_Hintergrund_FAQ-EEG_WEB.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §62. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- Zander, W.; Rosen, U.; Nolde, A. Regulierung, flexibilisierung und sektorkopplung. In Erstellt im Auftrag des Bundesministeriums für Wirtschaft und Energie; Federal Ministry of Economics and Technology: Berlin, Germany, 2018; p. 4. Available online: https://www.bmwi.de/Redaktion/DE/Publikationen/Studien/digitalisierung-der-energiewende-thema-2.pdf?__blob=publicationFile&v=6 (accessed on 6 August 2020).

- Bundesnetzagentur. Stromnetz Zukunftssicher Gestalten. 2020. Available online: https://www.netzausbau.de/bedarfsermittlung/2022/archiv/de.html;jsessionid=D6CE223B06F56187A2AAEE74A3894EAE (accessed on 6 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §28. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- Schreiner, L.; Madlener, R. Investing in power grid infrastructure as a flexibility option: A DSGE assessment for Germany. SSRN 2019. [Google Scholar] [CrossRef]

- Lenz, A.K. Eine Institutionenökonomische Analyse der Regulierung der Betreiber der Onshore-Stromübertragungsnetze und Offshore-Windpark-Anbindungen in Deutschland. Ph.D. Thesis, Technischen Universität Berlin, Berlin, Germany, 2019; pp. 232–240. [Google Scholar]

- Athamna, I. Zuverlässigkeitsberechnung von Offshore-Windparks. Ph.D. Thesis, Universität Wuppertal, Fakultät für Elektrotechnik, Informationstechnik und Medientechnik, Wuppertal, Germany, 2018; p. 110. [Google Scholar]

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §16. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §72. 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- Netzentwicklungsplan Strom. Stromnetze. 2020. Available online: https://www.netzentwicklungsplan.de/de/wissen/stromnetze (accessed on 6 August 2020).

- European Commission. Quarterly Report on European Electriciy Markets. 2020. Available online: https://ec.europa.eu/energy/sites/ener/files/qr_electricity_q1_2020.pdf (accessed on 6 August 2020).

- EEG. Gesetz für den Ausbau erneuerbarer Energien (ErneuerbareEnergien-Gesetz—EEG 2017). §56 (1). 2020. Available online: http://www.gesetze-im-internet.de/eeg_2014/EEG_2017.pdf (accessed on 5 August 2020).

- Bundesministerium für Wirtschaft und Energie. Förderung der erneuerbaren Energien: Wettbewerbliche Vergütung seit dem 1 Januar 2017. 2020. Available online: https://www.bmwi.de/Redaktion/DE/Artikel/Energie/foerderung-der-erneuerbaren-energien.html (accessed on 6 August 2020).

- Breitkopf, A. Industriestrompreise (inkl. Stromsteuer) in den Jahren 1998 bis 2021. 2020. Available online: https://de.statista.com/statistik/daten/studie/252029/umfrage/industriestrompreise-inkl-stromsteuer-in-deutschland/ (accessed on 6 August 2020).

- Strom-Report. Electricity prices in Europe—who pays the most? 2020. Available online: https://strom-report.de/electricity-prices-europe/#:~:text=The%20average%20values%20vary%20significantly,cents%20%7C%20kWh%2010%20years%20ago. (accessed on 6 August 2020).

- Trinomics. Study on Energy Prices, Costs and Subsidies and their Impact on Industry and Households Rotterdam; Trinomics: Roterdam, The Netherlands, 2018; p. 73. Available online: https://www.enerdata.net/about-us/company-news/energy-prices-and-costs-in-europe.pdf (accessed on 6 August 2020).

- Eurostat. Strompreisstatistik, Strompreise für Private Haushalte. 2019. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Electricity_price_statistics/de#Strompreise_f.C3.BCr_Nichthaushaltskunden (accessed on 6 August 2020).

- Bardt, H.; Schaefer, T. Ensuring industrial competitiveness with a unified European approach to sustainable energy. In The European Dimension of Germany’s Energy Transition; Springer: Berlin/Heidelberg, Germany, 2019; pp. 265–281. [Google Scholar]

- Agora Energiewende. Zehn fragen und antworten zu EEG 2017, strommarkt-und digitalisierungsgesetz. In Energiewende: Was bedeuten die neuen Gesetze; Agora Energiewende: Berlin, Germany, 2020; pp. 18–19. Available online: https://www.agora-energiewende.de/fileadmin2/Projekte/2016/EEG-FAQ/Agora_Hintergrund_FAQ-EEG_WEB.pdf (accessed on 5 August 2020).

- Agora Energiewende. Toolbox für die Stromnetze; Agora Energiewende: Berlin, Germany, 2018; Available online: https://www.agora-energiewende.de/fileadmin2/Projekte/2017/Innovative_Netze_Toolbox/Agora_Netze_Toolbox_WEB.pdf (accessed on 7 August 2020).

- Golden, W.; Powell, P. Towards a definition of flexibility: In search of the Holy Grail? Omega 2000, 28, 373–384. [Google Scholar] [CrossRef]

- Føllesdal, A. Survey article: Subsidiarity. J. Political Philos. 1998, 6, 190–218. [Google Scholar] [CrossRef]

- BDI (Bundesverband der Deutschen Industrie e.V.). Handlungsempfehlungen für ein IKT-gestütztes Stromnetz der Zukunft. In Impulse für Eine Smarte Energiewende; BDI: Berlin, Germany, 2013; p. 9. Available online: https://bdi.eu/media/presse/publikationen/energie-und-rohstoffe/BDI_Impulse_fuer_eine_smarte_Energiewende.pdf (accessed on 6 August 2020).

- Günther, L. Präsentation auf der tagung wie wird die digitale stromversorgung resilienter? In Zellulare Energienetze als Ansatz für eine Resiliente Energieversorgung; Bergische Universität Wuppertal: Wuppertal, Germany, 2017; Available online: https://www.strom-resilienz.de/data/stromresilienz/user_upload/Dateien/G%C3%Bcnther_Zellulare_Energienetze_als_Ansatz_fuer_eine_resiliente_Energieversorgung.pdf (accessed on 6 August 2020).

- VDE/ETG-Studie. Der Zellulare Ansatz Grund-lage Einer Erfolgreichen, Regionenübergreifenden Energiewende; VDE-Studie, Energie-technische Gesellschaft im Verband der Elektrotechnik, Elektronik, Informationstechnik: Frankfurt, Germany, 2015; Available online: VDE_ST_ETG_ZellulareAnsatz_web.pdf(bund-naturschutz.de) (accessed on 21 April 2021).

- Günther, L. Präsentation auf der tagung wie wird die digitale stromversorgung resilienter? In Zellulare Energienetze als Ansatz für eine Resiliente Energieversorgung; Bergische Universität Wuppertal: Wuppertal, Germany, 2017; p. 8. Available online: https://www.strom-resilienz.de/data/stromresilienz/user_upload/Dateien/G%C3%Bcnther_Zellulare_Energienetze_als_Ansatz_fuer_eine_resiliente_Energieversorgung.pdf (accessed on 6 August 2020).

- VDE/ETG-Studie. Der Zellulare Ansatz Grund-lage Einer Erfolgreichen, Regionenübergreifenden Energiewende; VDE-Studie, Energie-technische Gesellschaft im Verband der Elektrotechnik, Elektronik, Informationstechnik: Frankfurt, Germany, 2015; p. 8. Available online: VDE_ST_ETG_ZellulareAnsatz_web.pdf(bund-naturschutz.de) (accessed on 21 April 2021).

- VDE/ETG-Studie. Der Zellulare Ansatz Grund-lage Einer Erfolgreichen, Regionenübergreifenden Energiewende; VDE-Studie, Energie-technische Gesellschaft im Verband der Elektrotechnik, Elektronik, Informationstechnik: Frankfurt, Germany, 2015; p. 12. Available online: VDE_ST_ETG_ZellulareAnsatz_web.pdf(bund-naturschutz.de) (accessed on 21 April 2021).

- Günther, L. Präsentation auf der tagung wie wird die digitale stromversorgung resilienter? In Zellulare Energienetze als Ansatz für eine Resiliente Energieversorgung; Bergische Universität Wuppertal: Wuppertal, Germany, 2017; p. 4. Available online: https://www.strom-resilienz.de/data/stromresilienz/user_upload/Dateien/G%C3%Bcnther_Zellulare_Energienetze_als_Ansatz_fuer_eine_resiliente_Energieversorgung.pdf (accessed on 6 August 2020).

- Bundesnetzagentur. Flexibilität in Stromversorgungssystemen; Bundesnetzagentur: Bonn, Germany, 2017. [Google Scholar]

- Webster, J.; Watson, R.T. Analyzing the past to prepare for the future: Writing a literature review. MIS Q. 2002, 26, 13–23. [Google Scholar]

- Ambrosius, M.; Grimm, V.; Kleinert, T.; Liers, F.; Schmidt, M.; Zöttl, G. Endogenous price zones and investment incentives in electricity markets: An application of multilevel optimization with graph partitioning. Energy Econ. 2020, 92, 104879. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Agung, A.A.G.; Handayani, R. Blockchain for smart grid. J. King Saud Univ. Comput. Inf. Sci. 2020. [Google Scholar] [CrossRef]

- AlSkaif, T.; van Leeuwen, G. Decentralized optimal power flow in distribution networks using blockchain. In Proceedings of the 2nd International Conference on Smart Energy Systems and Technologies, Porto, Portugal, 9–11 September 2019; pp. 1–6. [Google Scholar]

- AlSkaif, T.; Holthuizen, B.; Schram, W.; Lampropoulos, I.; van Sark, W. A blockchain-based configuration for balancing the electricity grid with distributed assets. World Electr. Veh. J. 2020, 11, 62. [Google Scholar] [CrossRef]

- Devine, M.T.; Cuffe, P. Blockchain electricity trading under demurrage. IEEE Trans. Smart Grid 2019, 10, 2323–2325. [Google Scholar] [CrossRef]

- D’Oriano, L.; Mastandrea, G.; Rana, G.; Raveduto, G.; Croce, V.; Verber, M.; Bertoncini, M. Decentralized blockchain flexibility system for smart grids: Requirements engineering and use cases. In Proceedings of the International IEEE Conference and Workshop in Óbuda on Electrical and Power Engineering (CANDO-EPE), Budapest, Hungary, 20–21 November 2018; pp. 39–44. [Google Scholar]

- Fang, X.; Misra, S.; Xue, G.; Yang, D. Smart grid—The new and improved power grid: A survey. IEEE Commun. Surv. Tutor. 2011, 14, 944–980. [Google Scholar] [CrossRef]

- Gao, J.; Asamoah, K.O.; Sifah, E.B.; Smahi, A.; Xia, Q.; Xia, H.; Dong, G. GridMonitoring: Secured sovereign blockchain based monitoring on smart grid. IEEE Access 2018, 6, 9917–9925. [Google Scholar] [CrossRef]

- Gong, G.; Zhang, Z.; Zhang, X.; Mahato, N.K.; Liu, L.; Su, C.; Yang, H. Electric power system operation mechanism with energy routers based on qos index under blockchain architecture. Energies 2020, 13, 418. [Google Scholar] [CrossRef]

- Guan, Z.; Si, G.; Zhang, X.; Wu, L.; Guizani, N.; Du, X.; Ma, Y. Privacy-preserving and efficient aggregation based on blockchain for power grid communications in smart communities. IEEE Commun. Mag. 2018, 56, 82–88. [Google Scholar] [CrossRef]

- Kotthaus, K.; Hermanns, J.; Paulat, F.; Pack, S.; Meese, J.; Neusel-Lange, N.; Braje, T. Concrete design of local flexibility markets using the traffic light approach. In Proceedings of the CIRED Workshop, Ljubljana, Slovenia, 7–8 June 2018. [Google Scholar]

- Kouveliotis-Lysikatos, I.; Kokos, I.; Lamprinos, I.; Hatziargyriou, N. Blockchain-powered applications for smart transactive grids. In Proceedings of the IEEE PES Innovative Smart Grid Technologies Europe (ISGT-Europe), Bucharest, Romania, 29 September–2 October 2019; pp. 1–5. [Google Scholar]

- La Fauci, R.; Yang, X.X.; Ma, W.; Luan, W. Implementing the standardization framework to support the development of non-conventional distribution networks/microgrids development of non-conventional distribution networks/microgrids. In Proceedings of the Cired Workshop, Ljubljana, Slovenia, 7–8 June 2018. [Google Scholar]

- Lazaroiu, G.C.; Roscia, M. Blockchain and smart metering towards sustainable prosumers. In Proceedings of the International Symposium on Power Electronics, Electrical Drives, Automation and Motion (SPEEDAM), Amalfi, Italy, 20–22 June 2018; pp. 550–555. [Google Scholar]

- Li, Y.; Chen, G. Great revolution: The business perspective of energy internet in China. In Proceedings of the CIRED Workshop, Ljubljana, Slovenia, 7–8 June 2018; p. 8. [Google Scholar]

- Marinopoulos, A.; Vasiljevska, J.; Mengolini, A. Local energy communities: An insight from European smart grid projects. In Proceedings of the CIRED Workshop, Ljubljana, Slovenia, 7–8 June 2018. [Google Scholar]

- Pop, C.; Cioara, T.; Antal, M.; Anghel, I.; Salomie, I.; Bertoncini, M. Blockchain based decentralized management of demand response programs in smart energy grids. Sensors 2018, 18, 162. [Google Scholar] [CrossRef]

- Samuel, O.; Javaid, N.; Awais, M.; Ahmed, Z.; Imran, M.; Guizani, M. A blockchain model for fair data sharing in deregulated smart grids. In Proceedings of the IEEE Global Communications Conference (GLOBECOM), Waikoloa, HI, USA, 9–13 December 2019; pp. 1–7. [Google Scholar]

- Schmidt, R.; Schnittmann, E.; Meese, J.; Müller, T.; Zdrallek, M.; Armoneit, T. Identification and evaluation of marketing opportunities for flexibility in local energy communities. In Proceedings of the Cired Workshop, Ljubljana, Slovenia, 7–8 June 2018. [Google Scholar]

- Stevanoni, C.; Vallée, F.; de Grève, Z.; Deblecker, O. Optimized decentralized and centralized load management techniques in industrial microgrids. In Proceedings of the Cired Workshop, Ljubljana, Slovenia, 7–8 June 2018. [Google Scholar]

- Verma, P.; O’Regan, B.; Hayes, B.; Thakur, S.; Breslin, J.G. EnerPort: Irish blockchain project for peer-to-peer energy trading. Energy Inform. 2018, 1, 1–9. [Google Scholar] [CrossRef]

- Wang, S.; Taha, A.F.; Wang, J.; Kvaternik, K.; Hahn, A. Energy crowdsourcing and peer-to-peer energy trading in blockchain-enabled smart grids. IEEE Trans. Syst. Man Cybern. Syst. 2019, 49, 1612–1623. [Google Scholar] [CrossRef]

- Wörner, A.; Meeuw, A.; Ableitner, L.; Wortmann, F.; Schopfer, S.; Tiefenbeck, V. Trading solar energy within the neighborhood: Field implementation of a blockchain-based electricity market. Energy Inform. 2019, 2, 1–12. [Google Scholar] [CrossRef]

- Xu, Y.; Ahokangas, P.; Yrjölä, S.; Koivumäki, T. The fifth archetype of electricity market: The blockchain marketplace. Wirel. Netw. 2019, 9, 1–17. [Google Scholar] [CrossRef]

- Zhang, Y.; Gu, C.; Li, F. Distributed iterative local energy bidding in agent-based microgrids. In Proceedings of the Cired Workshop, Ljubljana, Slovenia, 7–8 June 2018. [Google Scholar]

- Zhao, Y.; Peng, K.; Xu, B.; Liu, Y.; Xiong, W.; Han, Y. Applied engineering programs of energy blockchain in US. Energy Procedia 2019, 158, 2787–2793. [Google Scholar] [CrossRef]

- Christidis, K.; Devetsikiotis, M. Blockchains and smart contracts for the internet of things. IEEE Access 2016, 4, 2292–2303. [Google Scholar] [CrossRef]

- Notheisen, B.; Cholewa, J.B.; Shanmugam, A.P. Trading real-world assets on blockchain. Bus. Inf. Syst. Eng. 2017, 59, 425–440. [Google Scholar] [CrossRef]

- Chiu, J.; Koeppl, T.V. Blockchain-based settlement for asset trading. Rev. Financ. Stud. 2019, 32, 1716–1753. [Google Scholar] [CrossRef]

- Pan, Y.; Zhang, X.; Wang, Y.; Yan, J.; Zhou, S.; Li, G.; Bao, J. Application of blockchain in carbon trading. Energy Procedia 2019, 158, 4286–4291. [Google Scholar] [CrossRef]

- Chen, S.Y.; Song, S.F.; Li, L.X.; Shen, J. Survey on smart grid technology. Power Syst. Technol. 2009, 33, 1–7. [Google Scholar]

- Ekanayake, J.B.; Jenkins, N.; Liyanage, K.; Wu, J.; Yokoyama, A. Smart Grid: Technology and Applications; John Wiley & Sons: Hoboken, NJ, USA, 2012. [Google Scholar]

- Xue-Song, Z.; Li-Qiang, C.; You-Jie, M. Research on smart grid technology. In Proceedings of the International Conference on Computer Application and System Modeling (ICCASM 2010), Taiyuan, China, 22–24 October 2010; pp. V3–V599. [Google Scholar]

- Gungor, V.C.; Sahin, D.; Kocak, T.; Ergut, S.; Buccella, C.; Cecati, C.; Hancke, G.P. Smart grid technologies: Communication technologies and standards. IEEE Trans. Ind. Inform. 2011, 7, 529–539. [Google Scholar] [CrossRef]

- Li, Y.; Chen, G. Great revolution: The business perspective of energy internet in China. In Proceedings of the Cired Workshop, Ljubljana, Slovenia, 7–8 June 2018; p. 13. [Google Scholar]

- Gawron-Deutsch, T.; Apel, R.; Diwold, K.; Einfalt, A.; Mosshammer, R.; Lugmaier, A. Marktbasierter ansatz für die koordination von markt und netz. In Von Smart Grids zu Smart Markets; Energietechnische Gesellschaft im VDE (ETG): Frankfurt, Germany, 2015; pp. 25–26. [Google Scholar]

- Samuel, O.; Javaid, N.; Awais, M.; Ahmed, Z.; Imran, M.; Guizani, M. A blockchain model for fair data sharing in deregulated smart grids. In Proceedings of the IEEE Global Communications Conference (GLOBECOM), Waikoloa, HI, USA, 9–13 December 2019; pp. 7–11. [Google Scholar]

- Lund, H.; Østergaard, P.A.; Connolly, D.; Ridjan, I.; Mathiesen, B.V.; Hvelplund, F.; Sorknæs, P. Energy storage and smart energy systems. Int. J. Sustain. Energy Plan. Manag. 2016, 11, 3–14. [Google Scholar]

- Krajačić, G.; Duić, N.; Zmijarević, Z.; Mathiesen, B.V.; Vučinić, A.A.; da Graça Carvalho, M. Planning for a 100% independent energy system based on smart energy storage for integration of renewables and CO2 emissions reduction. Appl. Therm. Eng. 2011, 31, 2073–2083. [Google Scholar] [CrossRef]

- Speh, R.M. Der Zellulare Ansatz—Grundlage einer Erfolgreichen, Regionen Übergreifenden Energiewende; Energietechnische Gesellschaft im VDE (ETG): Frankfurt, Germany, 2016; Available online: http://www.ecotrinova.de/downloads/2016/160702-Prof_Speh-ZellularerAnsatzVDE-GET_Vortragprint.pdf (accessed on 6 August 2020).

- Schreiber, M.; Wainstein, M.E.; Hochloff, P.; Dargaville, R. Flexible electricity tariffs: Power and energy price signals designed for a smarter grid. Energy 2015, 93, 2568–2581. [Google Scholar] [CrossRef]

- Vlot, M.C.; Knigge, J.D.; Slootweg, J.G. Economical regulation power through load shifting with smart energy appliances. IEEE Trans. Smart Grid 2013, 4, 1705–1712. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Bundesnetzagentur. Eckpunktepapier—Smart Grid und Smart Market; Bundesnetzagentur: Bonn, Germany, 2011; Available online: https://www.bundesnetzagentur.de/EN/Areas/Energy/Companies/GridDevelopment/SmartGridMarket/SmartGrid.html (accessed on 21 April 2021).

- Bundesnetzagentur. Flexibilität im Stromversorgungssystem. Bestandsaufnahme, Hemmnisse und Ansätze zur Verbesserten Erschließung von Flexibilität; Bundesnetzagentur: Bonn, Germany, 2017. [Google Scholar]

- Chen, C.; Duan, S.; Cai, T.; Liu, B.; Hu, G. Smart energy management system for optimal microgrid economic operation. IET Renew. Power Gener. 2011, 5, 258–267. [Google Scholar] [CrossRef]

- Zdrallek, M. Regionale Flexibilitätsmärkte zur Entlastung des Verteilnetzes. 2018. Available online: https://edna-bundesverband.de/wp-content/uploads/2019-11-21-ZDRALLEK-RegioFlex_final.pdf (accessed on 5 August 2020).

- Lund, H.; Andersen, A.N.; Østergaard, P.A.; Mathiesen, B.V.; Connolly, D. From electricity smart grids to smart energy systems—A market operation based approach and understanding. Energy 2012, 42, 96–102. [Google Scholar] [CrossRef]

- Zander, W.; Rosen, U.; Nolde, A. Regulierung, flexibilisierung und sektorkopplung. In Erstellt im Auftrag des Bundesministeriums für Wirtschaft und Energie; Federal Ministry of Economics and Technology: Berlin, Germany, 2018; p. 20. Available online: https://www.bmwi.de/Redaktion/DE/Publikationen/Studien/digitalisierung-der-energiewende-thema-2.pdf?__blob=publicationFile&v=6 (accessed on 6 August 2020).

- Pöppe, M. Smart market—Konzept und nutzen. In Energy 2.0 Kompendium; Publish-industry Verlag GmbH: Munich, Germany, 2012; pp. 84–87. [Google Scholar]

- Colak, I.; Sagiroglu, S.; Fulli, G.; Yesilbudak, M.; Covrig, C.F. A survey on the critical issues in smart grid technologies. Renew. Sustain. Energy Rev. 2016, 54, 396–405. [Google Scholar] [CrossRef]

- Gesetz über den Messstellenbetrieb und die Datenkommunikation in Intelligenten Energienetzen (Messstellenbetriebsgesetz—MsbG). Messstellenbetriebsgesetz vom 29. August 2016 (BGBl. I S. 2034), das Zuletzt Durch Artikel 90 des Gesetzes vom 20. November 2019 (BGBl. I S. 1626) Geändert Worden Ist. 2016. Available online: http://www.gesetze-im-internet.de/messbg/MsbG.pdf (accessed on 8 November 2020).

- Stahl, A. Startschuss Für Den Smart-Meter-Rollout Ist Gefallen, Energie Messenger.ch. 2020. Available online: https://www.energate-messenger.de/news/199942/startschuss-fuer-den-smart-meter-rollout-ist-gefallen (accessed on 8 November 2020).

- Lee, L. New kids on the blockchain: How bitcoin’s technology could reinvent the stock market. Hastings Bus. Law J. 2015, 12, 81. [Google Scholar] [CrossRef]

- Sikorski, J.J.; Haughton, J.; Kraft, M. Blockchain technology in the chemical industry: Machine-to-machine electricity market. Appl. Energy 2017, 195, 234–246. [Google Scholar] [CrossRef]

- Mautz, R.; Byzio, A.; Rosenbaum, W. Auf dem Weg zur Energiewende. Die Entwicklung der Stromproduktion aus erneuerbaren Energien in Deutschland; Eine Studie aus dem Soziologischen Forschungsinstitut Göttingen (SOFI); Universitätsverlag Göttingen: Göttingen, Germany, 2008. [Google Scholar]

- Gruber, S. Implikationen von Kapazitätsmärkten auf das Akteursverhalten: Eine spieltheoretische Analyse des Investitionsverhaltens deutscher Energieerzeuger; Springer Gabler: Wiesbaden, Germany, 2015. [Google Scholar]

- Fraunhofer ISE. Aktuelle Fakten zur Photovoltaik in Deutschland; Fraunhofer ISE: Freiburg, Germany, 2020; pp. 9–12. Available online: https://www.ise.fraunhofer.de/content/dam/ise/de/documents/publications/studies/aktuelle-fakten-zur-photovoltaik-in-deutschland.pdf (accessed on 7 August 2020).

- Joos, F. Energiewende—Quo vadis? Beiträge zur Energieversorgung; Springer Gabler: Wiesbaden, Germany, 2016. [Google Scholar]

- Zimmermann, F.M.; Pizzera, J. Globalisierung und ökonomische nachhaltigkeit—Schein oder sein? In Nachhaltigkeit Wofür; Springer: Berlin/Heidelberg, Germany, 2016; pp. 85–112. [Google Scholar]

- Felber, C. Die Gemeinwohl-Ökonomie: Eine Demokratische Alternative wächst; Deuticke: Vienna, Austria, 2012. [Google Scholar]

- Brunner, F.; Drage, T. Nachhaltigkeit in der stadt—Von herausforderungen, partizipation und integrativen konzepten. In Nachhaltigkeit Wofür; Springer: Berlin/Heidelberg, Germany, 2016; pp. 113–146. [Google Scholar]

- Sensfuß, F. Analysen zum Merit-Order Effekt Erneuerbarer Energien; Update für das Jahr; Fraunhofer-Institut für System- und Innovationsforschung (ISI): Karlsruhe, Germany, 2010. [Google Scholar]

- Clò, S.; Cataldi, A.; Zoppoli, P. The merit-order effect in the Italian power market: The impact of solar and wind generation on national wholesale electricity prices. Energy Policy 2015, 77, 79–88. [Google Scholar] [CrossRef]

- McConnell, D.; Hearps, P.; Eales, D.; Sandiford, M.; Dunn, R.; Wright, M.; Bateman, L. Retrospective modeling of the merit-order effect on wholesale electricity prices from distributed photovoltaic generation in the Australian national electricity market. Energy Policy 2013, 58, 17–27. [Google Scholar] [CrossRef]

- Cludius, J.; Hermann, H.; Matthes, F.C.; Graichen, V. The merit order effect of wind and photovoltaic electricity generation in Germany 2008–2016: Estimation and distributional implications. Energy Econ. 2014, 44, 302–313. [Google Scholar] [CrossRef]

- Stellungnahme des Umweltbundesamtes (UBA). Konsultation des BMWi-Grünbuchs „Ein Strommarkt für die Energiewende“; The Umweltbundesamt: Dessau-Roßlau, Germany, 2015. [Google Scholar]

- Pham, T.; Lemoine, K. Impacts of Subsidized Renewable Electricity Generation on Spot Market Prices in Germany: Evidence from a Garch Model with Panel Data; Paris Dauphine University: Paris, France, 2020. [Google Scholar]

- Eid, C.; Codani, P.; Chen, Y.; Perez, Y.; Hakvoort, R. Aggregation of demand side flexibility in a smart grid: A review for European market design. In Proceedings of the 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar]

| Author, Year | Technology | Advantages/Potentials | Limitations/Development Needs | Applicability Level |

|---|---|---|---|---|

| Ambrosius et al. 2018 [87] | Price zone optimization | Welfare gains by price zone Dynamic pricing techniques | Complex and dynamic determination of price zones | Case study (virtual) |

| Andoni] 2019 [88] | Applications of blockchain technology in energy grids: grid management, decentral training, stationary & mobile feed in metering & coordination | On-time coordination between grid operators Availability planning and recording of energy market participants | Limited through put and transaction speed | Conceptual stage |

| Agung and Handayani, 2020 [89] | Blockchain to manage smart grid transactions | Implementation, verification and recording of small user interactions | Limited transaction frequency Price sensitivity to speculation Computer performance limits Criminal attacks | Conceptual stage |

| Alskaif and van Leeuwen, 2019 [90] | Private blockchain test in Amsterdam based on optimal power flow model & smart contracts | Direct interconnection of provider/ consumers without third party | Attack proof but only tested in small grid Payment scheme required based on available electricity amount | Practice test |

| Alskaif and van et al., 2020 [91] | Blockchain application for operational planning and scheduling, smart metering and verification & settlement | Lower entrance barriers to electricity markets Higher transparency & liquidity | Limited number of participants and high transaction times due to technical limitations Coordination by “virtual grid operator” to keep control | Conceptual stage |

| Devine, 2019 [92] | Demurrage (devaluation in time) system for energy trading in blockchain (national token marketplace) | Incentivize energy consumption when local abundance Alignment of demand & supply | Conceptual stage | |

| D’Oriano, 2018 [93] | Blockchain for smart energy contracts based on penalties and incentives to control power flows | Automatic control of prosumers enhances grid stability Tamper proof documentation | Conceptual stage | |

| Fang, 2019 [94] | Blockchain to control energy flows, information and communication | Enable bidirectional power flows Failure protection Coordination and communication of participants | Diffusion of smart meters among small prosumers Costs for smart metering, grid maintenance Complex and defect-prone communication infrastructure | Conceptual stage |

| Gao, et al. 2018 [95] | Sovereign blockchain technology based on smart metering, use of private tokens | Transparency of origin | Avoids: Abuse of sensitive data | Conceptual stage |

| Gong et al., 2020 [96] | Semi-centralized-Blockchain technology located at energy routers at transmission & distribution networks | Enhanced network control Double stability control Bottom-up control mechanism for autonomous energy coordination | Bidirectional power flow complicates grid control & coordination | Conceptual stage |

| Guan et al., 2018 [97] | Smart metering: privacy efficient data aggregation scheme in blockchain groups | Collect private electricity consumption (habits) | Users’ privacy Develop pseudonyms | Practice test |

| Kotthaus et al., 2018 [98] | Local flexibility markets in an auction timetable, traffic light concept to schedule grid inflow | Concrete scheme for grid facility planning | Lack of liquidity and gaps between individua grid territories | Conceptual stage |

| Kouveliotis-Lysikatos, 2019 [99] | Smart grid applications with blockchain vehicle and central contract | Decentralized markets in microgrids already existent | Smart meters have to be reliable Infrastructure operator has to be trusted | Conceptual stage |

| La Fauci et al., 2018 [100] | microgrids | Lowering costs for communication, control and equipment | Lack of a homogenous standard | Early application |

| Lazaroiu and Roscia, 2018 [101] | Smart metering & blockchains for prosumers Energy market trading agent algorithm communicates with smart meters | Balancing supply and demand for unsteady sustainable resource supply | Ensure security Smart appliances in IoT required | Case study |

| Li et al., 2018 [102] | Energy internet Integrating diverse producers and prosumers by control center | Energy production& consumption integrated Asset investment & trading optimized Information value added | Market access and exit mechanism Reward & punishment mechanism to be developed Financing required | Conceptual stage |

| Marinopoulos et al., 2018 [103] | Local energy communities in smart grids | Regional/ local energy communities link prosumers and DSO | Motivate DSO to integrate local prosumer communities | Early application |

| Pop et al., 2018 [104] | Blockchain mechanism for energy flexibility. Smart metering, smart contracts with rewards & penalties, rules for demand-supply balancing in grid | Prototype prove success of matching demand and supply In future: flexible peer-to-peer decentralized energy trading mechanism | Limitations as grid level have to be observed | Conceptual stage |

| Samuel et al., 2019 [105] | Grid access mechanism via blockchain enabling differential privacy and reputation scores, aggregators coordinate smart contract | Proof of authority at aggregator level enables participation of small prosumers | Smart metering data cannot be shared in between households due to privacy concern so aggregator required | Conceptual stage |

| Schmidt et al., 2018 [106] | Short term energy market, balancing power auction, local flexibility markets for DSO | Flexibility markets result in revenue increases in simulation | Conceptual stage (local grids exist) | |

| Stevanoni, 2018 [107] | Industrial microgrids in distribution networks | Share locally produced energy Surplus is sold outside | Communication and operation costs, IT technique | Industrial micro grids in application |

| Verma et al., 2018 [108] | Irish blockchain for P2P energy trade, coalition formation, double auction | Subsidiarity of local communities | Revenue/ cost distribution Definition of adequate trading model | Ener Port project (prototype) |

| Wang et al., 2019 [109] | Blockchain based individual P2P interaction, day ahead and hourly planning | Seamless energy trade also for separated communities | Potential malicious attacks Malicious market operators & outsiders | Prototype/ case study |

| Wörner et al., 2019 [110] | Swiss blockchain electricity market: individual P2P price determining and auction algorithm | Subsidiarity of local communities More efficient usage of regenerative energy resources | Centralized power market | Prototype/ case study |

| Xu et al., 2021 [111] | Energy bloc chain using smart grid architecture | Autonomous and automated energy trading to integrate small decentral regenerative sources | Present fully and semi-centralized electricity markets | Conceptual stage |

| Zhang et al., 2018 [112] | Bidding process for prosumers in microgrids suing Bayesian game technology | Efficient matching of supply & demand | Application technology for large grids | Conceptual stage |

| Zhao et al., 2019 [113] | Blockchain for P2P energy trading and share Ev charging, U.S. Projects | Blockchain enhances information management in IOT | Local versions have to be rolled out at larger scale | Prototype/ case study (U.S.) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rösch, T.; Treffinger, P.; Koch, B. Regional Flexibility Markets—Solutions to the European Energy Distribution Grid—A Systematic Review and Research Agenda. Energies 2021, 14, 2403. https://doi.org/10.3390/en14092403

Rösch T, Treffinger P, Koch B. Regional Flexibility Markets—Solutions to the European Energy Distribution Grid—A Systematic Review and Research Agenda. Energies. 2021; 14(9):2403. https://doi.org/10.3390/en14092403

Chicago/Turabian StyleRösch, Tobias, Peter Treffinger, and Barbara Koch. 2021. "Regional Flexibility Markets—Solutions to the European Energy Distribution Grid—A Systematic Review and Research Agenda" Energies 14, no. 9: 2403. https://doi.org/10.3390/en14092403

APA StyleRösch, T., Treffinger, P., & Koch, B. (2021). Regional Flexibility Markets—Solutions to the European Energy Distribution Grid—A Systematic Review and Research Agenda. Energies, 14(9), 2403. https://doi.org/10.3390/en14092403