Role of Local Investments in Creating Rural Development in Poland

Abstract

1. Introduction

- rural communes, which are located in rural areas and are the most numerous category among Poland’s local government units,

- urban communes—i.e., towns and cities,

- urban-rural communes, which include towns/cities and their surrounding rural areas.

2. Research Materials and Methods

- –is an average variance in case of a dependent draw (without replacement) of c-th class objects (c = 1, ..., C),

- –is an empirical variance of the k-th feature in the sample,

- –is the so-called finite sample N correction.

- there is a very high concentration of the k-th feature in the c-th class (the feature is highly characteristic—negatively or positively),

- there is a high concentration of the k-th feature in the c-th class (the feature is moderately characteristic—negatively or positively),

- there is an average concentration of the k-th feature in the c-th class (the feature does not stand out and is not characteristic).

- pck—a fraction of objects distinguished based on the k-th category in c-th class,

- Pk—a fraction of objects distinguished based on the k-th category in a sample,

- —is a fractional variance in the case of a dependent draw (without replacement) of nc objects of the c-th class from among N of sample objects,

- (1 − pc)—is the so-called finite sample correction, where .

3. Literature Review

3.1. Development Policy and the Importance of Rural Areas

3.2. Local Investments and Their Impact on Rural Development

4. Results of Empirical Research

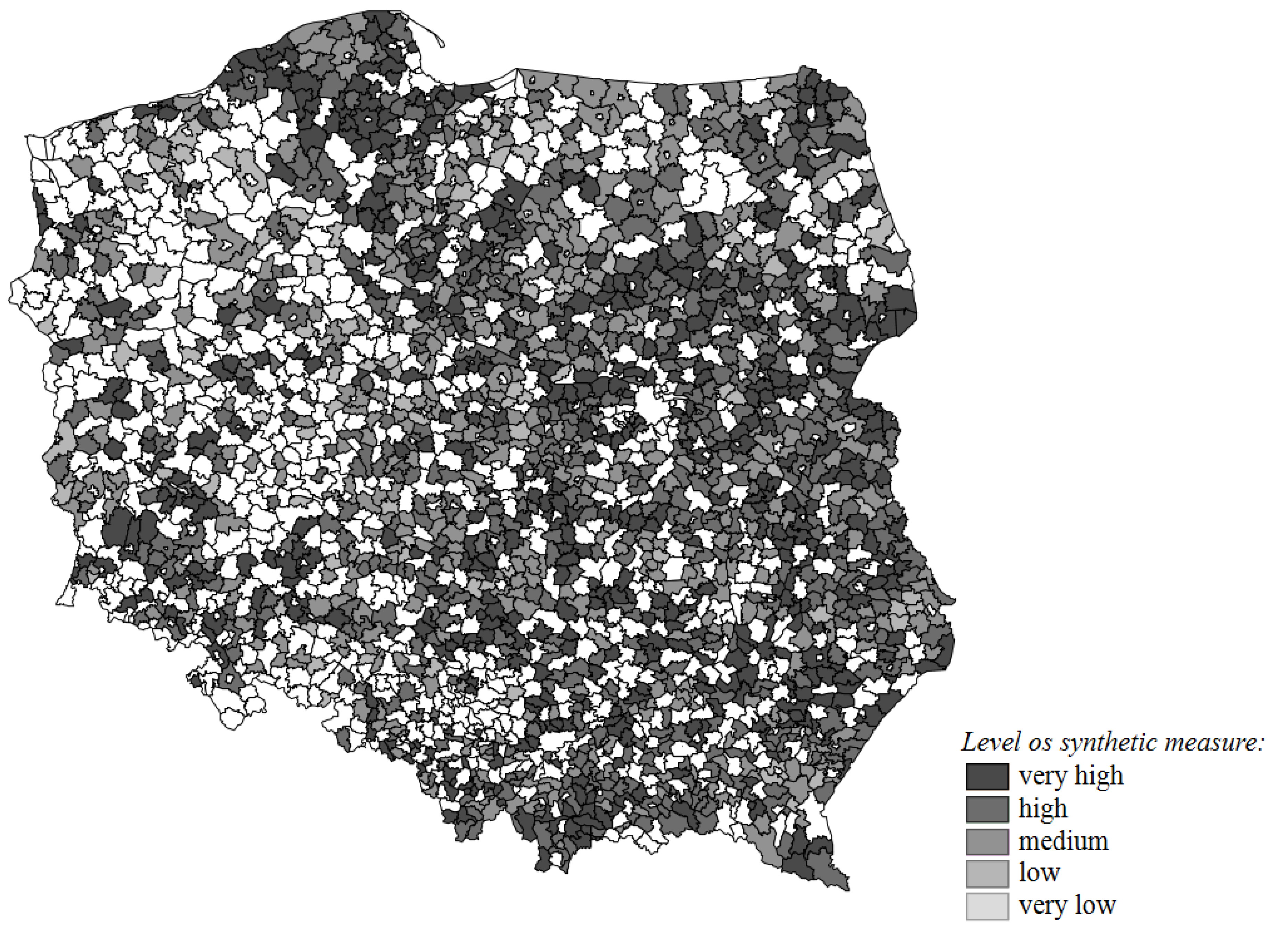

4.1. Assessment of the Level of Investment Activities Carried out by Rural Communes in Poland

4.2. Investment Activity of Rural Communes and the Development Level of Rural Areas in Poland

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sekuła, A. Local Development—The Definition Aspect in the 21st Century. In Company at the Turn of the 21st Century; Politechnika Rzeszowska: Rzeszów, Poland, 2002; pp. 59–64. [Google Scholar]

- Jezierska-Thöle, A. Rozwój obszarów wiejskich Polski Północnej i Zachodniej oraz Niemiec Wschodnich (Development of Rural Areas of Northern and Western Poland and Eastern Germany); Wydawnictwo Naukowe Uniwersytetu Mikołaja Kopernika: Toruń, Poland, 2008. [Google Scholar]

- Kosek-Wojnar, M.; Surówka, K. Podstawy finansów samorządu terytorialnego (Fundamentals of Local Government Finances); Wydawnictwo Naukowe PWN: Warsaw, Poland, 2007. [Google Scholar]

- Local Data Bank of Statistics Poland. Available online: https://bdl.stat.gov.pl/BDL/start (accessed on 15 September 2020).

- Wlaźlak, K. Rozwój regionalny jako zadanie administracji publicznej (Regional Development as a Task of Public Administration); Wolters Kluwer: Warsaw, Poland, 2010. [Google Scholar]

- Fedajev, A.; Nikolic, D.; Radulescu, M.; Sinisi, C.I. Patterns of structural changes in CEE economies in new millennium. Technol. Econ. Dev. Econ. 2019, 25, 1336–1362. [Google Scholar] [CrossRef]

- Obszary wiejskie w Polsce w 2018 r. (Rural areas in Poland in 2018); Główny Urząd Statystyczny: Warsaw-Olsztyn, Poland, 2020.

- Lewis, B.D.; Oosterman, A. Sub-National Government Capital Spending in Indonesia: Level, Structure, and Financing. Public Admin. Dev. 2011, 31, 149–158. [Google Scholar] [CrossRef]

- The Public Finance Act of 2009, Act Dated 27 August 2009. Journal of Laws of 2009 no. 157 Item 1240, with Further Amendments. Available online: http://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20091571240 (accessed on 13 November 2020).

- Owsiak, S. Finanse publiczne: Teoria i praktyka (Public Finances: Theory and Practice); Wydawnictwo Naukowe PWN: Warsaw, Poland, 2011. [Google Scholar]

- Dworakowska, M. Aktywność inwestycyjna jednostek samorządu terytorialnego w kontekście realizacji zadań publicznych (Investment activity of local government units in the context of the implementation of public tasks). In Kapitalizm a sprawiedliwość społeczna (Capitalism and Social Justice); Osiński, J., Ed.; Oficyna Wydawnicza SGH: Warsaw, Poland, 2016; pp. 371–382. [Google Scholar]

- Wojciechowski, E. Zarządzanie w samorządzie terytorialnym (Management in Local Government); Difin: Warsaw, Poland, 2012. [Google Scholar]

- Gaudemet, P.M.; Molinier, J. Finanse publiczne (Public Finances); Polskie Wydawnictwo Ekonomiczne: Warsaw, Poland, 2000. [Google Scholar]

- Kozłowski, W. Zarządzanie gminnymi inwestycjami infrastrukturalnymi (Management of Municipal Infrastructure Investments); Difin: Warsaw, Poland, 2012. [Google Scholar]

- Heathcote, C.; Mulheirn, I. (Eds.) Global Infrastructure Outlook. In Global Infrastructure Hub; Oxford Economics: Sydney, Australia, 2017. [Google Scholar]

- Dubik, B.M. Problemy informacyjne i decyzyjne w działalności inwestycyjnej (Problemy Informacyjne i Decyzyjne w Działalności Inwestycyjnej); Wydawnictwo Akademii Ekonomicznej im. Karola Adamieckiego w Katowicach: Katowice, Poland, 2005. [Google Scholar]

- Rosner, A.; Stanny, M. Socio-Economic Development of Rural Areas in Poland. The European Fund for the Development of Polish Villages Foundation; Institute of Rural and Agricultural Development, Polish Academy of Sciences: Warsaw, Poland, 2017. [Google Scholar]

- Crescenzi, R.; Rodríguez-Pose, A. Infrastructure and regional growth in the European Union. Pap. Reg. Sci. 2012, 91, 487–513. [Google Scholar] [CrossRef]

- Dijkstra, L.; Annoni, P.; Kozovska, K. A New Regional Competitiveness Index: Theory, Methods and Findings. European Union Regional Policy Working Papers. 2011, Volume 2. Available online: https://ec.europa.eu/regional_policy/sources/docgener/work/2011_02_competitiveness.pdf (accessed on 7 November 2020).

- Kozera, A.; Głowicka-Wołoszyn, R. Identification of functional types of rural communes in Poland. In Proceedings of the 2018 International Scientific Conference Economic Sciences for Agribusiness and Rural Economy; Gołębiewski, J., Ed.; Warsaw University of Life Sciences Press: Warsaw, Poland, 2018; pp. 109–115. [Google Scholar] [CrossRef]

- Macroeconomic Data Bank of Statistics Poland. Available online: https://bdm.stat.gov.pl/ (accessed on 15 September 2020).

- Archive of Medium Courses; National Bank of Poland: Warsaw, Poland, 2018; Available online: https://www.nbp.pl/home.aspx?f=/kursy/arch_a.html (accessed on 15 September 2020).

- Hwang, C.L.; Yoon, K. Multiple Attribute Decision-Making: Methods and Applications; Springer: Berlin, Germany, 1981. [Google Scholar]

- Wysocki, F. Metody taksonomiczne w rozpoznawaniu typów ekonomicznych rolnictwa i obszarów wiejskich (Taxonomic Methods in Recognizing Economic Types of Agriculture and Rural Areas); Wydawnictwo Uniwersytetu Przyrodniczego w Poznaniu: Poznań, Poland, 2010. [Google Scholar]

- Kozera, A.; Wysocki, F. Problem ustalania współrzędnych obiektów modelowych w metodach porządkowania liniowego obiektów (The problem of determining the coordinates of model objects in object linear ordering methods). Res. Pap. Wrocław Univ. Econ. 2016, 27, 131–142. [Google Scholar] [CrossRef]

- Głowicka-Wołoszyn, R.; Wysocki, F. Right-Skewed Distribution of Features and the Identification Problem of the Financial Autonomy of Local Administrative Units. In Classification and Data Analysis: Theory and Applications. Studies in Classification, Data Analysis, and Knowledge Organization; Jajuga, K., Batóg, J., Walesiak, M., Eds.; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Kozera, A.; Łuczak, A.; Wysocki, F. The application of classical and positional TOPSIS methods to assessment financial self-sufficiency levels in local government units. In Data Science: Innovative Developments in Data Analysis and Clustering; Palumbo, F., Montanari, A., Vichi, M., Eds.; Springer: Cham, Switzerland, 2017; pp. 273–284. [Google Scholar]

- Gorbenkova, E.; Shcherbina, E.; Belal, A. Rural Areas: Critical Drivers for Sustainable Development. IFAC PapersOnLine 2018, 30–51, 786–790. [Google Scholar] [CrossRef]

- Górka, A. Landscape Rurality: New Challenge for The Sustainable Development of Rural Areas in Poland. Procedia Eng. 2016, 161, 1373–1378. [Google Scholar] [CrossRef]

- Otiman, P.I.; Toderoiu, F.; Alexandri, C.; Florian, V.; Gavrilescu, C.; Ionel, I.; Sima, E.; Tudor, M.M. Sustainable Development Strategy for the Agri-food Sector and Rural Area—Horizon 2030. Procedia Econ. Financ. 2014, 8, 510–517. [Google Scholar] [CrossRef][Green Version]

- Transforming Our World: The 2030 Agenda for Sustainable Development. 2015. Resolution adopted by the General Assembly on 25 September. Available online: https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_70_1_E.pdf (accessed on 11 March 2021).

- United Nations. Sustainable Development Goals. Available online: https://www.un.org/sustainabledevelopment/sustainable-development-goals/ (accessed on 11 March 2021).

- The European Green Deal. 2019. Communication from the Commission to The European Parliament, The European Council, The Council, The European Economic and Social Committee and the Committee of the Regions, COM(2019) 640 Final. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:b828d165-1c22-11ea-8c1f-01aa75ed71a1.0002.02/DOC_1&format=PDF (accessed on 11 March 2021).

- Next Steps for a Sustainable European Future. European Action for Sustainability. 2016. Communication from The Commission to The European Parliament, The Council, The European Economic and Social Committee and The Committee of the Regions, SWD(2016) 390 Final, COM(2016) 739 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52016DC0739&from=EN (accessed on 11 March 2021).

- Available online: https://ec.europa.eu/info/food-farming-fisheries/key-policies/common-agricultural-policy/rural-development (accessed on 13 March 2021).

- Sixth Progress Report on Economic and Social Cohesion. 2009. Report from The Commission to The European Parliament and The Council, {SEC(2009) 828 Final}, COM(2009) 295 Final. Available online: https://ec.europa.eu/regional_policy/sources/docoffic/official/reports/interim6/com_2009_295_en.pdf (accessed on 26 October 2020).

- Treaty of Lisbon Amending the Treaty on European Union and the Treaty Establishing the European Community. 2007. OJ C 306, 17 December 2007. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:C:2007:306:FULL&from=EN (accessed on 26 October 2020).

- Territorial Agenda of the European Union 2020, Towards an Inclusive, Smart and Sustainable Europe of Diverse Regions. 2011. Agreed at the Informal Ministerial Meeting of Ministers responsible for Spatial Planning and Territorial Development on 19th May, Gödöllő, Hungary. Available online: https://ec.europa.eu/regional_policy/sources/policy/what/territorial-cohesion/territorial_agenda_2020.pdf (accessed on 26 October 2020).

- Available online: www.ec.europa.eu/regional_policy/pl/policy/what/territorial-cohesion (accessed on 13 March 2021).

- Territorial Agenda of the European Union. Towards a More Competitive and Sustainable Europe of Diverse Regions. 2007. Agreed on the Occasion of the Informal Ministerial Meeting on Urban Development and Territorial Cohesion in Leipzig on 24/25 May. Available online: https://ec.europa.eu/regional_policy/sources/policy/what/territorial-cohesion/territorial_agenda_leipzig2007.pdf (accessed on 26 October 2020).

- First Action Programme for the Implementation of the Territorial Agenda of the European Union. 2007. Informal Ministerial Meeting on Territorial Cohesion and Regional Policy, Ponta Delgada, Azores, 22nd–25th November. Available online: https://ec.europa.eu/regional_policy/sources/policy/what/territorial-cohesion/territorial_agenda_first_action_plan.pdf (accessed on 26 October 2020).

- Green Paper on Territorial Cohesion Turning Territorial Diversity into Strength. 2008. Communication from The Commission to The Council, The European Parliament, The Committee of the Regions and The European Economic and Social Committee, {SEC(2008) 2550}, COM(2008) 616 Final. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2008:0616:FIN:EN:PDF (accessed on 26 October 2020).

- Kopczewska, K. Rola sektora publicznego w przestrzennym rozwoju państwa (The Role of the Public Sector in the Spatial Development of the State); CeDeWu: Warsaw, Poland, 2011. [Google Scholar]

- Stanowisko Rządu Rzeczpospolitej Polskiej do Komunikatu Komisji do Rady, Parlamentu Europejskiego, Komitetu Regionów i Komitetu Ekonomiczno-Społecznego Zielona Księga w sprawie spójności terytorialnej—Przekształcenie różnorodności terytorialnej w siłę (Position of the Government of the Republic of Poland on the Communication of the Commission to the Council, the European Parliament, the Committee of the Regions and the Economic and Social Committee Green Paper on territorial Cohesion—Transforming Territorial Diversity into Strength). 2008. COM(2008) 616. Available online: https://ec.europa.eu/regional_policy/archive/consultation/terco/pdf/2_national/12_2_poland_pl.pdf (accessed on 26 October 2020).

- Kołodziejczyk, D. Lokalny rozwój gospodarczy w Polsce: Konwergencja czy dywergencja? (Local Economic Development in Poland: Convergence or Divergence?). Roczniki Naukowe Stowarzyszenia Ekonomistów Rolnictwa i Agrobiznesu 2014, 16, 135–141. [Google Scholar]

- Stanny, M.; Rosner, A.; Komorowski, Ł. Monitoring Rozwoju Obszarów Wiejskich. Etap III Struktury Społeczno-Gospodarcze, Ich Przestrzenne Zróżnicowanie I Dynamika (Wersja Pełna) (Monitoring of Rural Development. Stage 3. Meaning of, Territorial Disparities and Changes in Socioeconomic Structures (Full Version)); The European Fund for the Development of Polish Villages Foundation (EFRWP), Institute of Rural and Agricultural DevelopmentPolish Academy of Sciences (IRWIR PAN): Warsaw, Poland, 2018; p. 220. [Google Scholar]

- Standar, A. Assessing the Scale of and Financial Reasons behind Differences in the Local Government Units’ Investment Expenditures in the Context of Reducing Disparities in Socio-Economic Development. In Proceedings of the International Scientific Days 2018: Towards Productive, Sustainable and Resilient Global Agriculture and Food Systems: Proceedings, Wolters Kluwer, Prague, 16–17 May 2018; pp. 1462–1475. [Google Scholar] [CrossRef]

- OECD. Poland: Implementing Strategic-State Capability; OECD Publishing: Paris, France, 2013. [CrossRef]

- OECD. Rural Policy Reviews: Poland; OECD Publishing: Paris, France, 2018. [CrossRef]

- OECD. Investing Together: Working Effectively across Levels of Government; OECD Publishing: Paris, France, 2013. [CrossRef]

- Polska wieś 2020. Raport o stanie wsi (Polish Countryside 2020. Report on the State of the Countryside); Fundacja na Rzecz Rozwoju Polskiego Rolnictwa, Wydawnictwo Naukowe Scholar: Warsaw, Poland, 2020.

- Bański, J. Rozwój obszarów wiejskich: Wybrane zagadnienia (Rural Development: Selected Issues); Polskie Wydawnictwo Ekonomiczne: Warsaw, Poland, 2017. [Google Scholar]

- Blakely, E.J. Planning Local Economic Development: Theory and Practice; Sage Publications: London, UK; New York, NY, USA, 1989. [Google Scholar]

- Parysek, J. Podstawy gospodarki lokalnej (Fundamentals of the Local Economy); Wydawnictwo Naukowe UAM: Poznań, Poland, 1997. [Google Scholar]

- Szewczuk, A. Rozwój lokalny i regionalny—Główne determinanty (Local and Regional Development—Main Determinants). In Rozwój lokalny i regionalny: Teoria i praktyka (Local and Regional Development: Theory and Practice); Szewczuk, A., Kogut-Jaworska, M., Zioło, M., Eds.; Wydawnictwo C.H. Beck: Warsaw, Poland, 2011; pp. 13–88. [Google Scholar]

- Kogut-Jaworska, M. Instrumenty interwencjonizmu lokalnego w stymulowaniu rozwoju gospodarczego (Instruments of Local Interventionism in Stimulating Economic Development); CeDeWu: Warsaw, Poland, 2008. [Google Scholar]

- De Toni, A.; Vizzarri, M.; Di Febbraro, M.; Lasserre, B.; Noguera, J.; Di Martino, P. Aligning Inner Peripheries with rural development in Italy: Territorial evidence to support policy contextualization. Land Use Policy 2021, 100, 1–14. [Google Scholar] [CrossRef]

- Capello, R.; Caragliu, A.; Nijkamp, P. Territorial Capital and Regional Growth: Increasing Returns in Cognitive Knowledge Use. Tinbergen Institute Discussion Paper. 2009. TI 2009-059/3. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1443830 (accessed on 7 November 2020).

- Gałązka, A. Teoretyczne podstawy rozwoju regionalnego—Wybrane teorie, czynniki i bariery rozwoju regionalnego (Regional development—Theories, factors and obstacles). Studia BAS 2017, 1, 9–61. [Google Scholar]

- Standar, A.; Kozera, A. The Role of Local Finance in Overcoming Socioeconomic Inequalities in Polish Rural Areas. Sustainability 2019, 11, 5848. [Google Scholar] [CrossRef]

- Wojtowicz, D. Pomoc rozwojowa—sukces czy porażka? Krytyczna analiza wpływu polityki spójności UE na rozwój regionalny i lokalny w Polsce (Development Aid—Success or Failure? Critical Analysis of the Impact of the EU Cohesion Policy on Regional and Local Development in Poland); Wydawnictwo Poltext: Warsaw, Poland, 2019. [Google Scholar]

- Rodríguez-Pose, A. Innovation prone and innovation averse societies: Economic performance in Europe. Growth Chang. 1999, 30, 75–105. [Google Scholar] [CrossRef]

- Zasada, I.; Weltin, M.; Reutter, M.; Verburg, P.H.; Piorr, A. EU’s rural development policy at the regional level—Are expenditures for natural capital linked with territorial needs? Land Use Policy 2018, 77, 344–353. [Google Scholar] [CrossRef]

- Spellerberg, A.; Huschka, D.; Habich, R. Quality of life in rural area. Process of divergence and convergence. Soc. Indic. Res. 2007, 83, 283–307. [Google Scholar] [CrossRef]

- Barkauskas, V.; Barkauskienė, K.; Jasinskas, E. Analysis of macro environmental factors influencing the development of rural tourism: Lithuanian Case. Procedia Soc. Behav. Sci. 2015, 213, 167–172. [Google Scholar] [CrossRef]

- Panasiuk, A.; Wszendybył-Skulska, E. Social Aspects of Tourism Policy in the European Union. The Example of Poland and Slovakia. Economies 2021, 9, 16. [Google Scholar] [CrossRef]

- Gavrilă-Paven, I. Tourism opportunities for valorising the authentic traditional rural space-study case: Ampoi and Mures Valleys microregion, Alba County, Romania. Procedia Soc. Behav. Sci. 2015, 188, 111–115. [Google Scholar] [CrossRef][Green Version]

- Serraino, M.; Lucchi, E. Energy Efficiency, Heritage Conservation, and Landscape Integration: The Case Study of the San Martino Castle in Parella (Turin, Italy). Energy Procedia 2017, 424–434. [Google Scholar] [CrossRef]

- Dolata, M. Znaczenie infrastruktury w koncepcji trwałego i zrównoważonego rozwoju obszarów wiejskich (Importance of Sustainable Infrastructure In Concept of Sustainable Development of Rural Areas). Studia i Prace Wydziału Nauk Ekonomicznych i Zarządzania 2015, 40, 45–55. [Google Scholar] [CrossRef][Green Version]

- Hirschleifer, J. Investment Decision under Uncertainty—Theoretic Approaches. Q. J. Econ. 1965, 74, 509–536. [Google Scholar] [CrossRef]

- Czempas, J. Skłonność jednostek samorządu terytorialnego do inwestowania: Ujęcie ilościowe na przykładzie miast na prawach powiatu województwa śląskiego (Tendency of Local Government Units to Invest: A Quantitative Approach on the Example of Cities with Poviat Rights in the Śląskie Voivodeship); Wydawnictwo Uniwersytetu Ekonomicznego w Katowicach: Katowice, Poland, 2013. [Google Scholar]

- Zimny, A. Uwarunkowania efektywności inwestycji gminnych w sferze infrastruktury technicznej (Determinants of the Effectiveness of Municipal Investments in the Field of Technical Infrastructure); Państwowa Wyższa Szkoła Zawodowa w Koninie: Konin, Poland, 2008. [Google Scholar]

- Kogut-Jaworska, M.; Zawora, J. Działalność inwestycyjna województw samorządowych w Polsce (Investment Activity of Self-Government Voivodships in Poland); Instytut Naukowo-Wydawniczy “Spatium”: Radom, Poland, 2020. [Google Scholar]

- Zawora, J.; Kogut-Jaworska, M.; Jachowicz, A. Działalność inwestycyjna gmin w Polsce (Investment Activity of Communes in Poland); Instytut Naukowo-Wydawniczy “Spatium”: Radom, Poland, 2017. [Google Scholar]

- Czyżewski, B.; Matuszczak, A.; Czyżewski, A.; Brelik, A. Public goods in rural areas as endogenous drivers of income: Developing a framework for country landscape valuation. Land Use Policy 2020, 1–12. [Google Scholar] [CrossRef]

- Public Goods for Economic Development; United Nations Industrial Development Organization: Vienna, Austria. 2008. Available online: https://www.unido.org/sites/default/files/2009-02/Public%20goods%20for%20economic%20development_sale_0.pdf (accessed on 8 November 2020).

- Sankar, U. Global Public Goods. Madras School of Economics Working Paper 2008. Volume 28. Available online: http://www.mse.ac.in/wp-content/uploads/2016/09/Working-Paper-28.pdf (accessed on 8 November 2020).

- Begg, D.; Fischer, S.; Dornbusch, R. Mikroekonomia (Microeconomics); Polskie Wydawnictwo Ekonomiczne: Warsaw, Poland, 2007. [Google Scholar]

- Desai, M. Public Goods: A Historical Perspective. In Providing Global Public Goods: Managing Globalization; Kaul, I., Conceição, P., Le Goulven, K., Mendoza, R.U., Eds.; Oxford University Press: New York, NY, USA, 2003; pp. 63–77. [Google Scholar] [CrossRef]

- Kaul, I.; Mendoza, R.U. Advancing the Concept of Public Goods. In Providing Global Public Goods: Managing Globalization; Kaul, I., Conceição, P., Le Goulven, K., Mendoza, R.U., Eds.; Oxford University Press: New York, NY, USA, 2003; pp. 78–111. [Google Scholar] [CrossRef]

- Dworakowska, M. Investment activity of local government units in the context of finance management. Finanse Rynki Finansowe Ubezpieczenia 2017, 5 Pt 1, 333–341. [Google Scholar] [CrossRef]

- Brezovnik, B.; Oplotnik, Z.J. An analysis of the applicable system of financing the municipalities in Slovenia. Lex Localis J. of Local Self-Gov. 2012, 10, 277–295. [Google Scholar] [CrossRef]

- Crivelli, E. Subnational Fiscal Behavior under the Expectation of Federal Bailouts. J. Econ. Policy Reform 2011, 14, 41–57. [Google Scholar] [CrossRef]

- Satoła, L.; Standar, A.; Kozera, A. Financial Autonomy of Local Government Units: Evidence from Polish Rural Municipalities. Lex Localis J.f Local Self-Gov. 2019, 17, 321–342. [Google Scholar] [CrossRef]

- Firlej, K.; Olejniczak, J.; Pondel, H. Wyzwania rozwojowe obszarów wiejskich (Development Challenges of Rural Areas); Wydawnictwo Naukowe Scholar: Warsaw, Poland, 2019. [Google Scholar]

- Kappeler, A.; Solé-Ollé, A.; Stephan, A.; Välilä, T. Does Fiscal Decentralization Foster Regional Investment in Productive Infrastructure? Eur. J. Polit. Econ. 2013, 31, 15–25. [Google Scholar] [CrossRef]

- Sadowski, A.; Wojcieszak-Zbierska, M.M.; Beba, P. Territorial differences in agricultural investments co-financed by the European Union in Poland. Land Use Policy 2021, 100, 1–13. [Google Scholar] [CrossRef]

- Myna, A. Modele rozwoju lokalnej infrastruktury technicznej (Models of Local Technical Infrastructure Development); Wydawnictwo Uniwersytetu Marii Curie-Skłodowskiej: Lublin, Poland, 2012. [Google Scholar]

- Graczyk, M. Zarządzanie inwestycjami komunalnymi: Dobra praktyka w pozyskiwaniu funduszy europejskich (Management of Municipal Investments: Good Practice in Obtaining European Funds); Oficyna Wydawnicza Branta: Bydgoszcz, Poland, 2007. [Google Scholar]

- Ozbay, K.; Ozmen-Ertekin, D.; Berechman, J. Empirical Analysis of Relationship between Accessibility and Economic Development. J. Urban Plan. Dev. 2003, 129, 97–119. [Google Scholar] [CrossRef]

- Alvarez, A.; Martinez-Ruiz, M.P. Evaluating the economic and regional impact on national transport and infrastructure policies with accessibility variables. Transport 2012, 27, 414–427. [Google Scholar] [CrossRef]

- Dyr, T.; Kozubek, P.R. Ocena transportowych inwestycji infrastrukturalnych współfinansowanych z funduszy Unii Europejskiej (Assessment of Transport Infrastructure Investments Co-Financed from European Union Funds); Instytut Naukowo-Wydawniczy “Spatium”: Radom, Poland, 2011. [Google Scholar]

- Borsa, M. Polityka przestrzenna w gospodarce regionalnej i lokalnej (Spatial policy in the regional and local economy). In Gospodarka regionalna i lokalna (Regional and Local Economy); Strzelecki, Z., Ed.; Wydawnictwo Naukowe PWN: Warsaw, Poland, 2008; pp. 174–196. [Google Scholar]

- Rural Development Program 2014–2020; The Ministry of Agriculture and Rural Development: Warsaw, Poland, 2018.

- Chmielewska, B. Wybrane problemy rozwoju obszarów wiejskich w Polsce—Kontekst regionalny (Selected Problems of Rural Development in Poland—Regional Context); Instytut Ekonomiki Rolnictwa I Gospodarki Żywnościowej-PIB: Warsaw, Poland, 2016. [Google Scholar]

- Borowski, P.F. Finansowanie infrastruktury w JST (Financing infrastructure in local government units). Europejski Doradca Samorządowy 2010, 4, 32–37. [Google Scholar]

- Nell, G.; Signorelli, M. Convergence and divergence. In Palgrave Dictionary of Emerging Markets and Transition Economics; Hölscher, J., Tomann, H., Eds.; Macmillan Palgrave: London, UK, 2015; pp. 437–457. [Google Scholar]

- Barro, R.J. Government Spending in a Simple Model of Endogenous Growth. Natl. Bureau Econ. Res. Work. Pap. 1988, 2588, 23–24. [Google Scholar]

- Aschauer, D.A. Do States Optimize? Public Capital and Economic Growth. Ann. Reg. Sci. 2000, 34, 360. [Google Scholar] [CrossRef]

- Grafton, R.Q.; Knowles, S.; Owen, P.D. Social Divergence and Economic Performance; Department of Economics Working Paper 0103E; University of Ottawa: Ottawa, ON, Canada, 2002. [Google Scholar]

- Yigitcanlar, T.; O’Connor, K.; Westerman, C. The making of knowledge cities: Melbourne’s knowledge-based urban development experience. Cities 2008, 25, 63–72. [Google Scholar] [CrossRef]

- Leigh, N.G.; Blakely, E.J. Planning Local Economic Development: Theory and Practice; SAGE: Los Angeles, CA, USA, 2012. [Google Scholar]

- The Commune Government Act of 1990, Act Dated 8 March 1990, Journal of Laws of 1990 No. 16 Item 95, with Further Amendments. Available online: http://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU19900160095 (accessed on 13 November 2020).

- The County Government Act of 1998, Act Dated 5 June 1998, Journal of Laws of 1998 No. 91 Item 578, with Further Amendments. Available online: http://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU19980910578 (accessed on 13 November 2020).

- The Voivodeship Government Act of 1998, Act Dated 5 June 1998, Journal of Laws of 1998 No. 91 Item 576, with Further Amendments. Available online: http://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU19980910576 (accessed on 13 November 2020).

- The Constitution of the Republic of Poland of 1997, Constitution Dated 2 April 1997, Journal of Laws of 1997 No. 78 Item 483, with Further Amendments. Available online: http://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU19970780483 (accessed on 13 November 2020).

- Blochliger, H.; Charbit, C.; Pinero Campos, J.M.; Vammalle, C. Sub-central Goverments and Economic Crisis: Impact and Policy Responses. OECD Econ. Dept. Work. Pap. 2010, 752. [Google Scholar] [CrossRef]

- The Assistance of the State in Raising Children Act of 2016, Act Dated 11 February 2016, Journal of Laws of 2016 Item 195, with Further Amendments. Available online: http://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20160000195 (accessed on 13 November 2020).

- Zawora, J. Potencjał dochodowy a wydatki inwestycyjne gmin Polski Wschodniej (Income potential and investment expenditure of communes of Eastern Poland). Nierówności Społeczne a Wzrost Gospodarczy 2018, 56, 224–235. [Google Scholar] [CrossRef]

- Dworakowska, M. Determinanty finansowe wzrostu inwestycji jednostek samorządu terytorialnego (Financial determinants of investment growth in territorial self-government units). Studia z Polityki Publicznej 2015, 4, 47–58. [Google Scholar] [CrossRef]

- Gorzelak, G. Polityka regionalna i spójności terytorialnej. Nasza Europa: 15 lat Polski w Unii Europejskiej. Wartości, instytucje, swobody, polityki sektorowe, problemy i kluczowe wyzwania (Regional Policy and Territorial Cohesion. Our Europe: 15 Years of Poland in the European Union. Values, Institutions, Freedoms, Sector Policies, Problems and Key Challenges); CASE: Warsaw, Poland, 2019; pp. 103–112. [Google Scholar]

- Sierak, J. Alokacja funduszy unijnych a wydatki inwestycyjne gmin (Allocation of EU funds and investment expenditure of communes). Optim. Econ. Stud. 2018, 3, 195–208. [Google Scholar] [CrossRef]

- Stanny, M.; Strzelczyk, W. Kondycja finansowa samorządów lokalnych a rozwój społeczno-gospodarczy obszarów wiejskich—Ujęcie przestrzenne (Financial Condition of Local Governments and the Socio-Economic Development of Rural Areas—Spatial Approach); Wydawnictwo Naukowe Scholar: Warsaw, Poland, 2018. [Google Scholar]

- Brusca, I.; Manes Rossi, F.; Aversano, N. Drivers for the financial condition of local government: A comparative study between Italy and Spain. Lex-Localis J. Local Self-Gov. 2015, 13, 161–184. [Google Scholar] [CrossRef]

- Navarro-Galera, A.; Lara-Rubio, J.; Buendia-Carrillo, D.; Rayo-Canton, S. What can increase the default risk in local governments? Int. Rev. Adm. Sci. 2017, 83, 397–419. [Google Scholar] [CrossRef]

- Allers, M.; de Haan, J.; Sterks, C. Partisan Influence on the Local Tax Burden in The Netherlands. Public Choice 2001, 106, 351–363. [Google Scholar] [CrossRef]

- Ashworth, J.; Geys, B.; Heyndels, B. Goverment Weakness and Local Public Debt Development in Flemish Municipalities. Int. Tax Public Financ. 2005, 12, 395–422. [Google Scholar] [CrossRef]

- Wang, X.; Dennis, L.; Tu, Y.S.J. Measuring Financial Condition: A study of US state Public. Budg. Financ. 2007, 27, 1–21. [Google Scholar] [CrossRef]

- Capalbo, E.; Grossi, G. Assessing the Influence of Socioeconomic Drivers on Italian Municipal Financial Destabilization; Public Money & Markets, World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Arunachalam, M.; Chen, C.; Davey, H. A model for measuring financial sustainability of local authorities: Model development and application. Asia-Pac. Manag. Account. J. 2017, 12, 39–76. [Google Scholar]

- Rodriguez Bolivar, M.P.; Navarro Galera, A.; Alcaide Munoz, L.; Lopez Subires, M.D. Analyzing forces to the financial contribution of local goverments to sustainable development. Sustainability 2016, 8, 925. [Google Scholar] [CrossRef]

- Carruthers, J.I.; Ulfarsson, G.F. Urban sprawl and cost of public services. Environ. Plan. B: Plan. Des. 2003, 30, 503–522. [Google Scholar] [CrossRef]

- Kloha, P.; Weissert, C.; Kleine, R. Someone to Watch Over Me: State Monitoring of Local Fiscal Conditions. Am. Rev. Public Adm. 2005, 35, 236–255. [Google Scholar] [CrossRef]

- Giosi, A.; Testarmata, S.; Brunelli, S.; Stagliano, B. The dimensions of fiscal governance as the cornerstone of public sustainability: A general framework. J. Public Budg. Account. Financ. Manag. 2014, 26, 94–139. [Google Scholar] [CrossRef]

- McDonald, B.D., III. Does the charter from improve the fiscal adjustment. Staff Paper 2015, 43, 725–753. [Google Scholar] [CrossRef]

- Park, K. To file or not to file: The causes of municipal bankruptcy in the United States. J. Public Budg. Account. Financ. Manag. 2004, 16, 228–256. [Google Scholar] [CrossRef]

| Steps | Description of Steps | Calculation Formulas | ||

|---|---|---|---|---|

| Step 1. Selection of simple features for research | Substantive selection of simple features for research and their verification in terms of statistics | × | ||

| Step 2. Normalisation ofsimple feature values | Using the classic standard score procedure | (1) | ||

| Step 3. Determining the coordinates of model objects for the positive and negative ideal of development | The coordinates of the positive (A+)and negative ideal (A−) of development are determined as the maximum and minimum values, respectively, in a set of normalised values of simple features, excluding outliers and extreme values | (2) | ||

| (3) | ||||

| Step 4. Calculating the distance of each object from the positive and negative ideal of development | Calculating the distance of each assessed i-th multiple-feature object from the positive and negative ideal of development with the use of Euclidean distance | (4) | ||

| Step 5. Calculating the value of the synthetic measure | (5) | |||

| Description | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Cumulative Level of Expenditures in the Years 2007–2018 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| capital expenditures in PLN billions | |||||||||||||

| (total) local government units | 32.4 | 36.5 | 47.6 | 48.2 | 44.0 | 35.4 | 34.2 | 40.8 | 38.3 | 25.3 | 34.0 | 51.0 | 467.6 |

| total communes, of which: | 12.8 | 14.9 | 18.0 | 21.9 | 19.1 | 14.3 | 13.1 | 15.5 | 14.6 | 11.0 | 16.3 | 25.8 | 197.4 |

| urban communes | 3.0 | 3.6 | 4.2 | 4.6 | 4.0 | 3.0 | 2.5 | 3.0 | 2.9 | 2.3 | 3.3 | 5.3 | 41.8 |

| urban-rural communes | 4.1 | 4.8 | 5.9 | 7.0 | 6.3 | 4.8 | 4.3 | 5.0 | 4.8 | 3.7 | 5.4 | 8.5 | 64.6 |

| rural communes | 5.7 | 6.4 | 8.0 | 10.3 | 8.9 | 6.5 | 6.3 | 7.4 | 6.9 | 5.0 | 7.5 | 12.1 | 91.0 |

| investment expenditures in PLN per capita | |||||||||||||

| (total) local government units | 849.2 | 956.1 | 1245.8 | 1251.5 | 1141.6 | 919.6 | 888.3 | 1059.1 | 997.5 | 658.1 | 884.7 | 1328.3 | 12,179.8 |

| total communes, of which: | 503.0 | 583.7 | 707.4 | 846.8 | 738.1 | 549.9 | 508.0 | 598.1 | 566.9 | 427.3 | 631.8 | 999.6 | 7660.5 |

| urban communes | 495.5 | 590.3 | 688.8 | 740.6 | 642.7 | 485.3 | 414.3 | 500.7 | 479.9 | 391.6 | 562.8 | 889.6 | 6882.0 |

| urban-rural communes | 479.3 | 567.8 | 683.3 | 800.0 | 711.4 | 543.9 | 486.7 | 571.0 | 544.0 | 414.9 | 608.0 | 945.7 | 7355.8 |

| rural communes | 526.0 | 592.4 | 737.0 | 944.7 | 813.8 | 591.1 | 576.6 | 673.3 | 632.9 | 456.7 | 688.6 | 1103.4 | 8336.6 |

| Description | Level of Investment Expenditures per Capita (in PLN) a | Level of Investment Expenditures per km2 (in PLN) a | Share of Investment Expenditures in Total Expenditures (%) b | Level of Funds Obtained by Communes for the Financing and Co-Financing of EU Projects per Capita (in PLN) a |

|---|---|---|---|---|

| Total rural communes | ||||

| Minimum | 1751.6 | 417.6 | 2.6 | 34.6 |

| Lower quartile | 5841.1 | 2586.7 | 12.6 | 1261.9 |

| Median value | 7354.3 | 3912.7 | 15.9 | 1863.8 |

| Mean c | 8177.4 | 5943.1 | 16.4 | 2175.2 |

| Upper quartile | 9260.7 | 6307.3 | 19.7 | 2693.9 |

| Maximum | 216,558.2 | 104,826.1 | 41.6 | 15,512.3 |

| Positional coefficient of variation (%) | 23.2 | 47.5 | 22.4 | 38.4 |

| Rural communes with less than 5 thousand inhabitants | ||||

| Minimum | 1751.6 | 417.6 | 2.6 | 115.8 |

| Lower quartile | 5694.3 | 1899.1 | 11.5 | 1438.9 |

| Median value | 7221.0 | 2847.9 | 14.8 | 2177.8 |

| Mean c | 7932.0 | 3354.2 | 15.1 | 2512.9 |

| Upper quartile | 9269.5 | 3941.2 | 18.3 | 3106.7 |

| Maximum | 49,250.1 | 44,215.9 | 41.6 | 11,489.2 |

| Positional coefficient of variation (%) | 24.8 | 35.9 | 22.8 | 38.3 |

| Rural communes with 5–20 thousand inhabitants | ||||

| Minimum | 2113.2 | 664.8 | 4.1 | 246.0 |

| Lower quartile | 5862.9 | 3207.2 | 13.2 | 1166.8 |

| Median value | 7373.9 | 4756.7 | 16.4 | 1721.8 |

| Mean c | 8216.4 | 6953.2 | 17.0 | 1986.4 |

| Upper quartile | 9175.8 | 7888.6 | 20.0 | 2473.9 |

| Maximum | 216,558.2 | 104,826.1 | 40.7 | 15,512.3 |

| Positional coefficient of variation (%) | 22.5 | 49.2 | 20.8 | 38.0 |

| Rural communes with 20 thousand inhabitants or more | ||||

| Minimum | 5869.2 | 7404.0 | 16.0 | 34.6 |

| Lower quartile | 8164.5 | 11,745.2 | 18.6 | 878.8 |

| Median value | 10,317.3 | 21,291.3 | 22.0 | 1513.3 |

| Mean c | 11,942.8 | 25,564.2 | 23.7 | 1532.8 |

| Upper quartile | 15,645.6 | 29,640.9 | 27.4 | 1818.1 |

| Maximum | 32,302.6 | 75,454.0 | 40.0 | 3753.2 |

| Positional coefficient of variation (%) | 36.3 | 42.0 | 20.0 | 31.0 |

| Description | Typological Class /Level of Investment Activity | Total | ||||

|---|---|---|---|---|---|---|

| I | II | III | IV | V | ||

| Very High | High | Average | Low | Very Low | ||

| Synthetic measure value | Si ∈ (0.80,1.00> | Si∈ (0.60,0.80> | Si∈ (0.40,0.60> | Si∈ (0.20,0.40> | Si∈ <0.00,0.20> | |

| Number of communes | 123 | 375 | 529 | 427 | 93 | 1547 |

| Percentage of communes (%) | 8.0 | 24.2 | 34.2 | 27.6 | 6.0 | 100.0 |

| Level of investment expenditures per capita (in PLN) | 12,852.1 | 9578.9 | 7416.9 | 5569.0 | 3982.9 | 7354.3 |

| Level of investment expenditures per km2 (in PLN) | 7471.6 | 5247.3 | 3954.0 | 2867.2 | 1760.4 | 3912.7 |

| Share of investment expenditures in total expenditures (%) | 25.7 | 20.2 | 16.1 | 12.2 | 8.3 | 15.9 |

| Level of funds obtained by communes for the financing and co-financing of EU projects per capita (in PLN) | 4072.7 | 2571.0 | 1868.3 | 1397.6 | 823.3 | 1863.8 |

| Description | Typological Class /Level of Investment Activity | Total (Number and Percent of Rural Communes in the Macroregion) | ||||

|---|---|---|---|---|---|---|

| I | II | III | IV | V | ||

| Very High | High | Average | Low | Very Low | ||

| South-Western macroregion | 12 | 28 | 32 | 32 | 9 | 113 |

| Percent from the column | 9.8 | 7.5 | 6.0 | 7.5 | 9.7 | 7.3 |

| Percent from the line | 10.6 | 24.8 | 28.3 N | 28.3 | 8.0 | |

| Northern macroregion | 19 | 53 | 72 | 81 | 15 | 240 |

| Percent from the column | 15.4 | 14.1 | 13.6 | 19.0 | 16.1 | 15.5 |

| Percent from the line | 7.9 | 22.1 | 30.0 | 33.8 N | 6.3 | |

| Eastern macroregion | 20 | 107 | 116 | 92 | 16 | 351 |

| Percent from the column | 16.3 | 28.5 | 21.9 | 21.5 | 17.2 | 22.7 |

| Percent from the line | 5.7 N | 30.5 P | 33.0 | 26.2 | 4.6 | |

| North-Western macroregion | 4 | 35 | 66 | 65 | 30 | 200 |

| Percent from the column | 3.3 | 9.3 | 12.5 | 15.2 | 32.3 | 12.9 |

| Percent from the line | 2.0 N | 17.5 N | 33.0 | 32.5 N | 15.0 N | |

| Central macroregion | 23 | 38 | 70 | 60 | 8 | 199 |

| Percent from the column | 18.7 | 10.1 | 13.2 | 14.1 | 8.6 | 12.9 |

| Percent from the line | 11.6 P | 19.1 N | 35.2 | 30.2 | 4.0 | |

| Southern macroregion | 19 | 63 | 86 | 46 | 3 | 217 |

| Percent from the column | 15.4 | 16.8 | 16.3 | 10.8 | 3.2 | 14.0 |

| Percent from the line | 8.8 | 29.0 P | 39.6 P | 21.2 P | 1.4 | |

| The Mazowieckie Voivodeship macroregion | 26 | 51 | 87 | 51 | 12 | 227 |

| Percent from the column | 21.1 | 13.6 | 16.4 | 11.9 | 12.9 | 14.7 |

| Percent from the line | 11.5 P | 22.5 | 38.3 P | 22.5 P | 5.3 P | |

| Total rural communes | 123 | 375 | 529 | 427 | 93 | 1547 |

| Percent from the column | 8.0 | 24.2 | 34.2 | 27.6 | 6.0 | 100 |

| Description | Wilcoxon Signed-Rank Test | |

|---|---|---|

| Test Values | Significance Level | |

| Population density (population per km2) | 11.39 | 0.000 |

| Rate of natural increase per 1000 people | 16.59 | 0.000 |

| Migration balance per 1000 people | 10.38 | 0.000 |

| Percentage of the unemployed in the total working-age population (%) | 33.29 | 0.000 |

| Percentage of councillors with higher education (%) | 17.81 | 0.000 |

| Number of foundations, associations and social organisations per 1000 residents | 33.66 | 0.000 |

| Number of enterprises in industry and services in general | 29.54 | 0.000 |

| Beneficiaries of social community care per 10 thous. residents | 33.40 | 0.000 |

| The number of entities entered to the National Business Register (REGON) per 10 thous. residents | 32.69 | 0.000 |

| The number of natural persons conducting business activities per 10,000 population | 29.77 | 0.000 |

| The number of entities with 50 or more employees per 10 thous. working-age population | 0.10 | 0.920 |

| Number of accommodation places per 1000 residents | 6.86 | 0.000 |

| Average floor space per capita (in m2) | 33.90 | 0.000 |

| Percentage of all homes with central heating systems (%) | 34.04 | 0.000 |

| Percentage of the total population using the sewage system (%) | 32.14 | 0.000 |

| Percentage of the total population using a gas distribution network (%) | 24.61 | 0.000 |

| Description | Years | Typological Class /Level of Investment Activity | Total | ||||

|---|---|---|---|---|---|---|---|

| I | II | III | IV | V | |||

| Very High | High | Average | Low | Very Low | |||

| Population density (population per km2) | 2007–2009 | 75.3 | 76.3 | 69.8 | 64.5 | 45.6 N | 68.9 |

| 2016–2018 | 81.0 | 81.5 | 72.8 | 65.8 | 45.3 N | 72.0 | |

| Rate of natural increase per 1000 people | 2007–2009 | 0.5 | 0.5 | 0.5 P | 0.2 N | 0.3 | 0.4 |

| 2016–2018 | −0.3 P | −0.4 P | −0.6 P | −1.1 N | −1.4 N | −0.7 | |

| Migration balance per 1000 people | 2007–2009 | 3.2 P | 3.1 P | 0.5 | 0.2 N | −2.5 N | 1.1 |

| 2016–2018 | 2.0 P | 1.8 P | −0.3 N | −1.3 N | −3.3 N | −0.1 | |

| Percentage of the unemployed in the total working-age population (%) | 2007–2009 | 8.0 P | 7.9 P | 8.4 | 9.1 N | 10.4 N | 8.6 |

| 2016–2018 | 5.4 P | 5.1 P | 5.5 | 5.8 N | 6.5 N | 5.5 | |

| Percentage of councillors with higher education (%) | 2007–2009 | 23.6 | 21.8 | 21.6 | 20.7 | 17.9 | 21.3 |

| 2016–2018 | 30.5 P | 30.0 P | 27.5 | 28.5 | 24.9 | 28.5 | |

| Number of foundations, associations and social organisations per 1000 residents | 2007–2009 | 93.2 | 92.5 | 91.7 N | 91.6 N | 89.9 N | 91.9 |

| 2016–2018 | 95.3 P | 94.8 P | 94.3 | 93.9 N | 92.1 N | 94.3 | |

| Beneficiaries of social community care per 10 thous. residents | 2007–2009 | 1234.7 | 1213.6 | 1321.6 | 1374.7 | 1596.4 | 1319.7 |

| 2016–2018 | 817.0 | 779.9 | 845.4 | 893.0 | 969.9 | 847.9 | |

| The number of entities entered to the National Business Register (REGON) per 10 thous. residents | 2007–2009 | 667.4 | 636.1 | 585.4 | 563.9 | 555.5 | 596.5 |

| 2016–2018 | 798.0 | 761.6 | 700.4 | 672.3 | 649.2 | 712.2 | |

| The number of natural persons conducting business activities per 10,000 population | 2007–2009 | 53.7 | 51.6 P | 47.2 N | 45.6 N | 44.1 N | 48.1 |

| 2016–2018 | 62.6 | 60.6 P | 55.2 N | 53.3 N | 50.1 N | 56.3 | |

| The number of entities with 50 or more employees per 10 thous. working-age population | 2007–2009 | 6.4 P | 4.8 | 4.8 | 4.1 N | 4.4 | 4.7 |

| 2016–2018 | 6.1 P | 5.0 P | 4.7 | 4.2 N | 4.1 N | 4.7 | |

| Number of accommodation places per 1000 residents | 2007–2009 | 38.2 | 36.1 | 14.8 N | 8.2 N | 7.5 N | 19.6 |

| 2016–2018 | 44.8 | 38.5 | 16.5 | 9.3 N | 10.2 | 21.7 | |

| The percentage of farms with an area of 15 ha and more in the total number of farms (%) | 2007–2009 | 36.8 | 40.4 | 40.7 N | 46.1 P | 59.9 P | 42.9 |

| 2016–2018 | 36.8 | 40.4 | 40.7 N | 46.1 P | 59.9 P | 42.9 | |

| Average floor space per capita (in m2) | 2007–2009 | 87.3 | 88.0 P | 86.1 | 84.8 N | 82.1 N | 86.1 |

| 2016–2018 | 93.9 | 94.3 P | 91.8 | 90.4 N | 86.8 N | 91.9 | |

| Percentage of all homes with central heating systems (%) | 2007–2009 | 62.7 | 63.4 | 61.1 | 61.7 | 60.2 | 61.9 |

| 2016–2018 | 69.8 | 69.9 P | 67.7 N | 68.2 | 66.9 | 68.5 | |

| Percentage of the total population using the sewage system (%) | 2007–2009 | 26.1 | 24.8 P | 21.7 | 19.9 N | 19.9 | 22.2 |

| 2016–2018 | 49.2 P | 43.3 P | 37.0 | 32.6 N | 29.6 | 37.8 | |

| Percentage of the total population using a gas distribution network (%) | 2007–2009 | 14.7 | 15.7 | 15.3 P | 10.8 N | 4.7 N | 13.5 |

| 2016–2018 | 18.7 | 19.9 P | 17.5 | 12.9 N | 5.9 N | 16.2 | |

| The number of natural persons conducting business activities per 10,000 population | 2007–2009 | 53.7 | 51.6 P | 47.2 N | 45.6 N | 44.1 N | 48.1 |

| 2016–2018 | 62.6 | 60.6 P | 55.2 N | 53.3 N | 50.1 N | 56.3 | |

| The number of entities with 50 or more employees per 10 thous. working-age population | 2007–2009 | 6.4 P | 4.8 | 4.8 | 4.1 N | 4.4 | 4.7 |

| 2016–2018 | 6.1 P | 5.0 P | 4.7 | 4.2 N | 4.1 N | 4.7 | |

| Number of accommodation places per 1000 residents | 2007–2009 | 38.2 | 36.1 | 14.8 N | 8.2 N | 7.5 N | 19.6 |

| 2016–2018 | 44.8 | 38.5 | 16.5 | 9.3N | 10.2 | 21.7 | |

| The percentage of farms with an area of 15 ha and more in the total number of farms (%) | 2007–2009 | 36.8 | 40.4 | 40.7 N | 46.1 P | 59.9 P | 42.9 |

| 2016–2018 | 36.8 | 40.4 | 40.7 N | 46.1 P | 59.9 P | 42.9 | |

| Average floor space per capita (in m2) | 2007–2009 | 87.3 | 88.0 P | 86.1 | 84.8 N | 82.1 N | 86.1 |

| 2016–2018 | 93.9 | 94.3 P | 91.8 | 90.4 N | 86.8 N | 91.9 | |

| Percentage of all homes with central heating systems (%) | 2007–2009 | 62.7 | 63.4 | 61.1 | 61.7 | 60.2 | 61.9 |

| 2016–2018 | 69.8 | 69.9 P | 67.7 N | 68.2 | 66.9 | 68.5 | |

| Percentage of the total population using the sewage system (%) | 2007–2009 | 26.1 | 24.8 P | 21.7 | 19.9 N | 19.9 | 22.2 |

| 2016–2018 | 49.2 P | 43.3 P | 37.0 | 32.6 N | 29.6 | 37.8 | |

| Percentage of the total population using a gas distribution network (%) | 2007–2009 | 14.7 | 15.7 | 15.3 P | 10.8 N | 4.7 N | 13.5 |

| 2016–2018 | 18.7 | 19.9 P | 17.5a | 12.9 N | 5.9 N | 16.2 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kozera, A.; Dworakowska-Raj, M.; Standar, A. Role of Local Investments in Creating Rural Development in Poland. Energies 2021, 14, 1748. https://doi.org/10.3390/en14061748

Kozera A, Dworakowska-Raj M, Standar A. Role of Local Investments in Creating Rural Development in Poland. Energies. 2021; 14(6):1748. https://doi.org/10.3390/en14061748

Chicago/Turabian StyleKozera, Agnieszka, Małgorzata Dworakowska-Raj, and Aldona Standar. 2021. "Role of Local Investments in Creating Rural Development in Poland" Energies 14, no. 6: 1748. https://doi.org/10.3390/en14061748

APA StyleKozera, A., Dworakowska-Raj, M., & Standar, A. (2021). Role of Local Investments in Creating Rural Development in Poland. Energies, 14(6), 1748. https://doi.org/10.3390/en14061748