1. Introduction

1.1. Tesco Inaugural Sustainability-Linked Bonds

On 9 October 2020 Tesco Plc, the UK-based multinational retailer, announced that it established a £2.5 bn revolving credit facility, replacing Tesco’s existing £3 bn loans. Tesco intends to benefit from a lower interest rate loan margin if the company delivers environmental targets, aligned with three existing key performance indicators (KPI) included in its sustainability strategy:

Tesco says it was the first business globally to commit to reducing emissions to net zero by 2050—a promise it made in 2009. Its 2025 Sustainability Performance Target (SPT) to reduce the greenhouse gases emissions by 60% with respect to 2015 baseline, was approved by the Science-Based Targets Initiative, meaning that it is regarded as being sufficiently ambitious that Tesco is doing its share to prevent climate change of more than 1.5 °C [

2]. The priority is to reduce its reliance on nonrenewable grid electricity, which contributed 65% of Tesco’s global carbon emissions footprint. According to Tesco’s own estimates, it accounts for 1% of electricity demand in the UK and emissions are also increasing with the 1.5 million weekly delivery slots it is operating. To counter that, Tesco will convert its fleet of 5500 delivery vans to electric power in the coming years. That will help saving 66,000 tons of carbon annually, the equivalent of removing 40,000 cars from driving on the road each day. Tesco already achieved a 50% reduction compared with that of its baseline in 2015–2016. It cut its Scope 2 emissions (electricity) by 92% by converting to renewable power [

3]. The 2015–2016 baseline was deliberately selected to coincide with the Paris Agreement.

On the 29 January 2021 Tesco made a debut in the sustainability-linked bond market in the form of 8.5-year Sustainability-Linked Bonds (SLBs) with a 0.375% coupon (ISIN: XS0295018070). The proceeds of SLBs are to be used for general purposes. The €750 m bonds’ coupon will step up by 25 basis points in July 2027 (6.5 years) if Tesco fails to hit its group SPT of reducing its Scope 1 and 2 greenhouse gas emissions by 60% for the 2025–2026 financial year, using 2015–2016 as the baseline. An independent and external qualified provider (such as KPMG) is to deliver a verification report of the KPI performance against the SPT [

4].

The bond came under Tesco’s new Sustainability-Linked Bond Framework, published in January 2021. It follows the ICMA (International Capital Markets Association) Sustainability-Linked Bond principles and was independently assessed by Sustainalytics, the ESG (environmental, social, and governance), and corporate governance research and ratings provider [

3].

On the same day, Tesco announced a tender offer for its

$1.15 bn, 6.15% 2037 bonds, as well as a bevy of euro and sterling notes. The buy-back was paid for by the new issue. The USD bonds were to take priority in redemption, and the amount of the buyback of the non-USD bonds was to be equal to the new issuance amount less the amount of USD bonds tendered. Tesco made no secret that it was using the tender offer to strengthen its balance sheet by “

addressing upcoming debt maturities and achieving net annual interest savings” [

2].

1.2. Sustainability-Linked Bonds

Sustainability-Linked Bonds are a form of environmental, social, and governance bonds (ESG Bonds). Unlike with the green bonds (more on green bonds, see

Section 1.3), ESG Bonds issuers can design deals around their existing sustainability targets, rather than having to identify specific pools of assets or spending. That can be a good option for companies with no particular project to finance but a general desire to make their businesses more sustainable. SLBs are gaining popularity with issuers embracing the Paris Agreement on climate change that want flexibility in how they use the proceeds. An SLB issuer agrees to pay investors more if it fails to meet preagreed Sustainable Development Goals (SDG) within a certain timeframe. Various different companies already sold SLBs, committing themselves to ambitious pledges to green their businesses.

SLBs are a very young market. They were introduced by Enel, the Italian utility, in 2019, but the second issuer, Brazilian paper company Suzano, did not appear until September 2020. The market is open to a wide range of key performance indicators being used—investors see environmental KPIs as natural, including nonclimate-related ones, but also think social ones and governance are possible [

5].

The preferred option to penalize issuer for breaching its SDG, is a coupon step-up. Coupons would only move one way—in investors’ favor—but there is not to be just one KPI, there can be two or more. The combination of a coupon step-up and step-down—universally used in the loan market—is present only on one private bond so far [

5]. Apart from coupon step-up, the only other structure used to date on public deals is a premium paid to investors at maturity. For instance, Schneider, the French electrical systems company, promises to pay investors an extra 50 bp at maturity if it fails to reach an average sustainability performance score by December 2025. Another possible design can be put options—allowing the investor to put the bonds if the issuer failed to hit sustainability targets.

This way or the other, SLBs effectively reward investors when the issuer misses green or social performance goals. The controversy is, that conventional SLBs investors wouldn’t want the issuer to meet its targets from an economical perspective, but from a sustainability perspective they want the goals to be achieved. To get rid of this dilemma, Nomura Research Institute Ltd. of Japan issued notes, where achieving SDGs entitles Nomura to redeem the debt early. That means that if Nomura misses its targets, investors may be stuck with the bond for an extra period of time, though with a higher coupon in line with the longer maturity. Investors tend to prefer that bonds be called at the first opportunity possible to reduce the risk of interest rate moves [

6]. There are some deals in the loan market, offering another way of avoiding investors gains if the issuer fails to keep sustainability criteria promised. In such an instance, any penalty would be reinvested by the company (presumably to achieve a sustainability objective), either in its own operations or externally [

5].

However, not keeping up with KPIs does not necessarily mean a gain for a bondholder. Much of the drive for sustainable finance is based around the idea that a business scoring highly on ESG factors is a better business [

7]. This implies that failing to meet a material sustainability target would by its nature likely be damaging to an issuer’s credit profile. At the same time, if demand for SLBs is based partly on their value as an ESG-compliant investment, failing to meet the agreed goals may turn off some investors and result in a fall in the price of the bond [

8].

1.3. Sustainable Finance, Green Bonds

Both ESG Bonds and green bonds are a member of a Sustainable Finance Family. Refinitiv data [

9] give an idea how vigorous the newcomers are. According to Refinitiv, sustainable Finance bonds totaled US

$286.5 billion during the first quarter of 2021, more than double issuance levels seen during the first quarter of 2020 and an all-time quarterly record.

Green bonds are debt securities whose proceeds must exclusively finance or re-finance new or existing projects with environmental benefits. They were first issued by the World Bank in 2007 [

10], but it was not until 2015 (with an advent of Paris Agreement) that the green bond market took off [

11]. A distinguishing feature of green bonds issues is a third party or an authorized agent verification to ensure compliance with declared proceeds allocation [

12]. Yeow and Ng (2021) [

10] findings imply that green bond’s “

dependency on external certification may be a consequence of an underdeveloped green bond market, where weak governance still dominates the green bond market. Because of this, corporations tend to take advantage of green finance’s growing popularity, causing the greenwashing problem”.

In the European Union’s (EU) policy context, the EU Taxonomy Regulation (2020/852) on the establishment of a framework to facilitate sustainable investment classifies environmentally sustainable economic activities based on uniform criteria. Also at the European level, a main legal reference when trying to frame ESG factors is the ‘Regulation on sustainability-related disclosures in the financial services sector’ (SFDR) (2019/2088) [

13]. Investor demand for a more standardized approach to classifying green bonds led to the development of the Green Bond Principles developed by the International Capital Market Association. In the EU, a proposal for the EU Green Bond Standard was developed which would be a certification scheme to ensure that financial products marketed as green bonds could be verified as such and their use of proceeds would fully align with the EU Taxonomy [

14].

The European issuers dominate the sustainable finance market now worth over

$1 trillion [

15]. The upturn in the sustainable finance market has created an even greater imperative for participants to find common disclosure standards and metrics. The development of green bond standards, together with a third-party monitoring protect investors from so-called ‘greenwashing’, whereby an issuer exaggerates the ‘greenness’ of projects funded. Comparably, worries about credibility of corporate targets are rising in a booming SLB market, as some investors question how green these bonds really are [

15,

16].

Surprisingly, the strict division between SLB and green bonds is not always existent. There are notes on the market representing a mixture of these both. Verbund, the Austrian electricity company, became the first issuer to sell a green SLB in April 2021. It was the first to combine green and sustainability-linked structures, had a long duration, and was in line with the most recent draft of the EU Taxonomy, published at the end of 2020. Verbund will use proceeds from the bond to expand and upgrade an existing hydroelectric power plant, and to expand its domestic power grid. The coupon will step up if Verbund fails to hit a target of having at least 2GW of installed renewable capacity, and 12,000 megavolt-ampere additional transformer capacity [

17].

1.4. ESG Spread

A bulk of literature concentrate on widely known green bonds rather than SLBs. The studies focus on the benefits of green bonds in terms of bond market premium [

18,

19,

20] identifying a small bond market premium for green bonds compared to that of conventional bonds [

11]. The structural model for the premium paid by bondholders for green bonds when compared to that of conventional bonds (so-called ‘greenium’) was forged by E. & R. Agliardi [

21].

Another direction is to study the way through which the issuance of green bonds can affect financial results [

11]. In general, issuance of green bonds has a positive effect on financial and environmental performance [

22,

23], however other studies [

10] have a contrary finding, arguing that green bonds do not influence financial situation of an issuer.

To the best of our knowledge, there are no studies on the relationship between SLBs and straight bond yields (or prices), not mentioning theoretical explanation. SLBs are an extremely new area of research even in comparison to green bonds. Our study on price and yield behavior of SLBs is pioneering in terms of detecting potential discrepancies between SLBs’ and regular notes’ yields. The intuition is that there exists an analogue to a greenium in the SLBs world, that is, a negative spread (in terms of yield) or premium (in terms of price) that makes SLBs more expensive to investors than other bonds from the same issuer. We propose to call it ‘ESG spread’. A negative spread is regarded favorably by issuers because it can lower their funding costs (and all without rigorous funding allocation constrains as with green bonds), while investors will receive a slightly lower yield compared to existing similar bonds [

21]. A common explanation for the greenium is that environmental factors are increasingly integral to the investment process. Some investors deliberately exclude companies operating in sectors deemed to be non-ESG compliant, such as coal mining [

20]. For the same reason investors may be willing to add SLBs into their portfolios, especially that even when the SDGs are not met, a bondholder ends up with extra payments. In such instance the question arises, what if an event triggering coupon step-up materializes. Therefore, we are going to inspect how do the step-up corrected yields look like in comparison to profitability the straight (also called ‘plain vanilla’) bonds offer. Or, in other words, is there a temptation for the potential bondholders to profit more from expected materialization of step-up clause than holding conventional notes to maturity.

2. Data and Methodology

The goal of our research is to observe the attitude of the investors to the issuance of SLB by Tesco which should be reflected in yields. There is no SLB and regular bond sharing exactly the same coupon, maturity, size or issue date so direct comparison is impossible. Therefore, we compare the bid and ask yields of SLB with the interpolated yields, calculated for the yields of Tesco plain vanilla bonds maturing on 10 April 2047, and respectively, the yields of Tesco notes maturing on 29 May 2026, or the yields of Carrefour bonds maturing on 15 December 2027. This makes Carrefour notes closer to the SLBs in terms of maturity (27 July 2029) but there is a bias due to different issuer. All bonds considered are senior notes, which means they are nonsubordinated, ranking pari-passu in case of issuer’s bankruptcy. They are all Euro-denominated. For the selected bonds’ details please refer to the

Table 1.

The credit risk of the bonds analyzed lies within the ‘BBB’ range. An obligation rated BBB by S&P and Fitch rating agencies (Baa3 by Moody’s) indicates that expectations of credit risk are currently low. The capacity for payment of financial commitments is considered adequate, but adverse business or economic conditions are more likely to impair this capacity. The modifiers “+” or “−” appended to a rating denote relative status within major rating categories [

24].

We selected bonds as shown in the

Table 1 among all the EUR denominated issues of following BBB rated retailers: UK Tesco, French Carrefour and German Metro (ticker: BDB) according to criterium of proximity to maturity date of Tesco SLBs. For all the Euro denominated issues details, please refer to

Table 2.

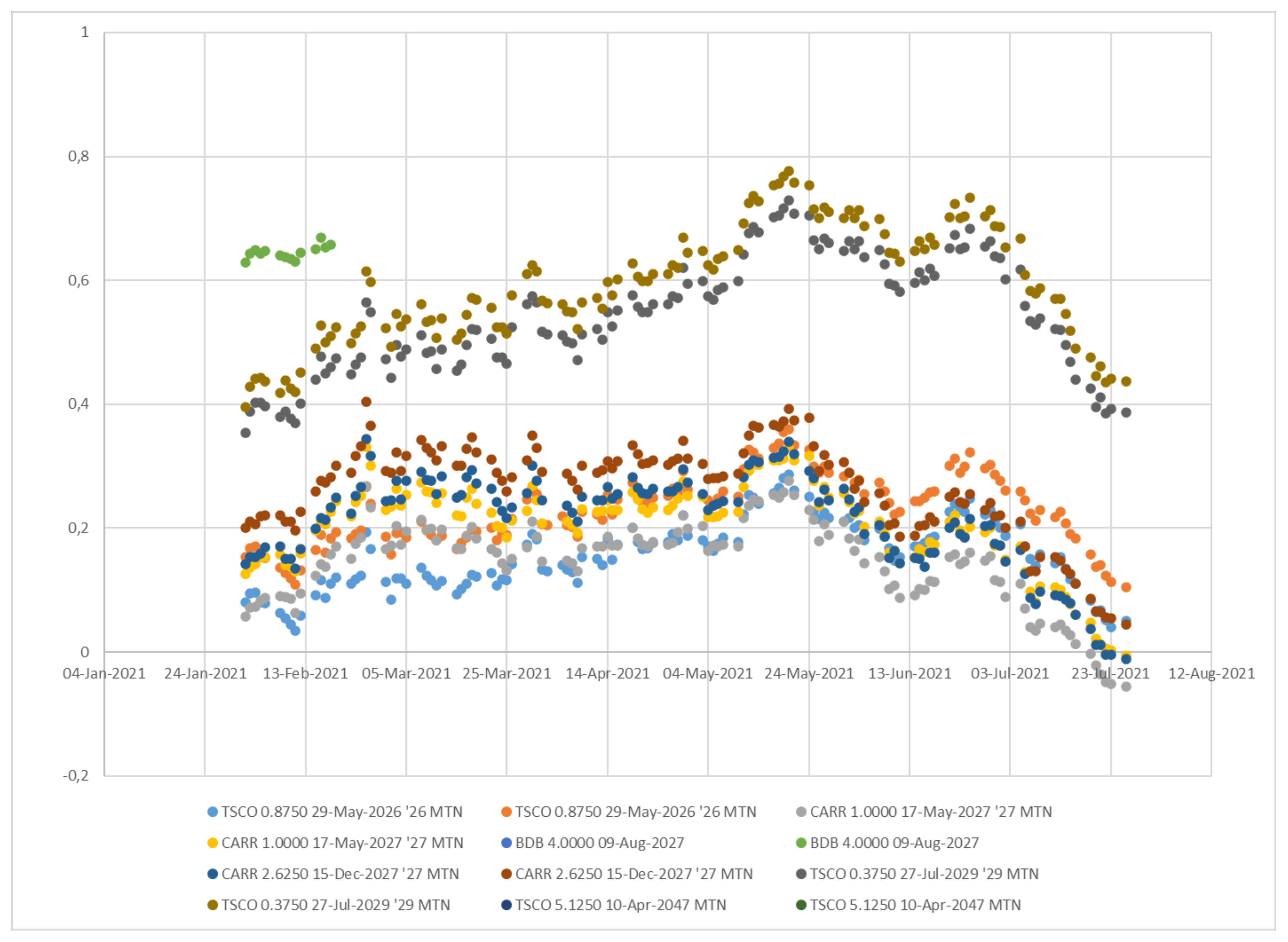

Looking at the

Figure 1, we may see that in period 29 January–26 July 2021, the yields of Tesco, Carrefour, and Metro bonds moved synchronically, and neither of them was noticeably affected by the issuer specific risk.

Next, we show in this section how to draw out the interpolation formula for yields of fixed coupon bonds.

Let t denote time to maturity and B(t) the today value of a “stripped” bond paying at maturity t one monetary unit in case of no default of the issuer and recovery rate in case of the default.

We base on the approximation, for

t > 0,

where

v(

t) denotes the yield.

Next, we apply an interpolation formula, for 0 <

T1 <

t <

T2,

Which gives us the following interpolation of yields

Neglecting the higher powers of

v’s, we get a linearization

The error of such approximation depends on the difference of yields

v(

T1) and

v(

T2). It is smaller than

It follows from the generalized Bernoulli inequality. For

x ≥ 0 and 0 ≤

a ≤ 1

Since

we get for

v(

T2) ≥

v(

T1) ≥ 0

and

For a fixed market day

D, for ask yields we put

where

T2 is time to maturity in years of the Tesco bond maturing at 10 April 2047 calculated at day D;

T1 is time to maturity in years of the Tesco bond maturing at 29 May 2026, or respectively of Carrefour bond maturing at 15 December 2027, calculated at day D;

t is time to maturity in years of the Tesco SLB maturing at 27 July 2029 calculated at day D;

v1 is an ask yield of the Tesco bond maturing at 10 April 2047 reported at day D;

v2 is an ask yield of the Tesco bond maturing at 29 May 2026, and respectively of Carrefour bond maturing at 15 December 2027, reported at day D.

For bid yields, we follow the same formula, just change v1 and v2 to bid yields. We take into consideration bid-ask yields to not get disturbed by the liquidity concerns.

3. Results

The

Figure 2 presents the series of T-interpolated yields (based on TSCO 29 May 2026 and TSCO 10 April 2047)—upper two series, C-interpolated series (based on CARR 15 December 2027 and TSCO 10 April 2047)—two middle series and SLB yields—lower two series.

From the first day of SLBs listing (29 January 2021) till the last day of observation (26 July 2021), investors accepted the lower yields the SLBs offered in comparison to Tesco’s straight bonds as well as corresponding regular bond issue from Carrefour. That negative difference marks existence of ESG spread.

Now, we are going to investigate how the instance of coupon-step up influences the SLBs yield. Therefore, we added 25 basis points to the basic coupon of 0.3750% and got the last three coupon payments of 0.6250%. We are using the following formula:

where

P0 is a market price of a bond

CPN is a coupon payment

N is a nominal (redemption) value

B(t) is so-called discount factor, so it embeds yields—please refer to Equation (1).

The results are as follows (see

Figure 3).

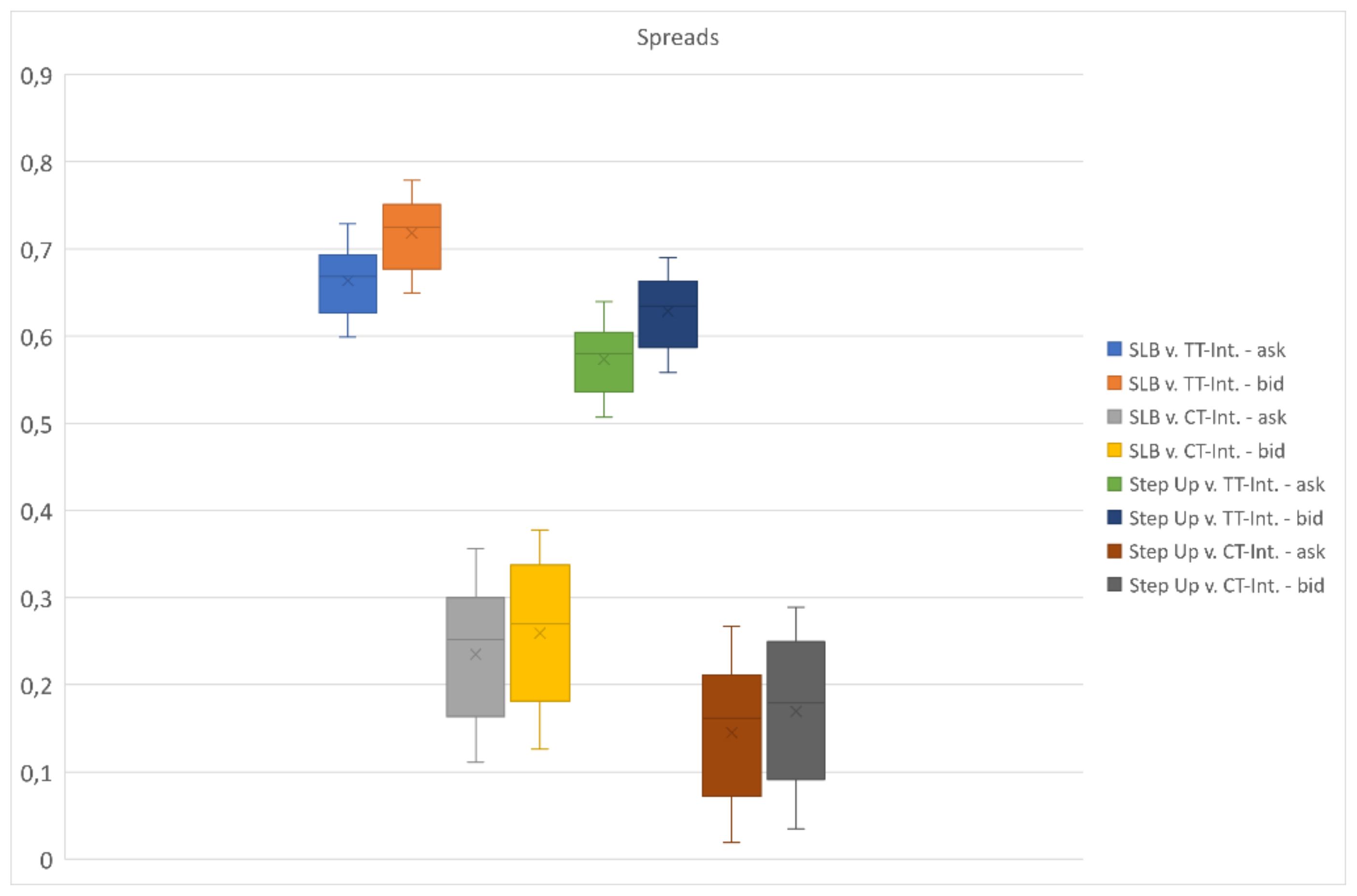

SLBs’ bid and ask yields with the last three coupons rise of 25 bp (‘Step up bid’ and ‘Step up ask’ on the

Figure 3) are above the SLBs’ yield without the step-up. What is more interesting, even when SLBs’ coupons increase, their yield still lies below respective yields of the conventional reference notes (see

Figure 3).

To compare spread distributions between several bond issues, we generated a Tukey box plot of the data by calculating minimum, maximum, median, first quartile, and third quartile of relevant spreads (see

Figure 4). In all cases the lower whisker (the minimum) is above and well separated from 0. This observation confirms that ESG spread did exist, at least in period 29 January–26 July 2021.

4. Discussion

All the notes analyzed in the paper are Euro-denominated and all are senior. Seniority means that bondholders are equally ranked in terms of their claims to an issuer’s assets if there is a default. In other words, SLBs are just as likely to be repaid as Tesco straight bonds. Despite of no difference in credit risk, there is an observable lower yield attached to SLB bonds relative to Tesco’s non-ESG and non-green plain vanilla bonds. We called this yield difference an ‘ESG spread’. The ESG spread still holds on when we replace the Tesco bond with similarly ranked BBB Carrefour note, both maturing before SLBs’ final settlement date.

It is not an easy task to extract ESG component from the spread. Structure, size, and liquidity can all contribute to differences in yields between two bonds from a single issuer. By making an interpolation we got the Tesco yield curve, so ESG spread is the spread of a SLBs to the issuer’s non-SLB and nongreen curve. It is too early, however, to generalize the outcomes of our findings in a sense, that yield composition can vary across the sectors and currencies.

How to interpret the existence of this yield difference? The most straightforward explanation is that demand for SLBs is greater than its supply. This is the case of green bonds with their greenium, that is premium paid by investors for green bonds comparing to straight notes, or in a language of yields, a negative spread. It is not uncommon for green issues to be oversubscribed many times over. In fact, the deal received strong investor demand enabling Tesco to print a €750 m bond from €5.75 bn of orders [

2]. Then, a question arises: what makes investors so willingly queue for Tesco notes? As we proved, even 100% probability of a coupon step-up reduces—but not eliminates—the ESG spread. Then, one cannot say that investors bet on Tesco not keeping up with its ambitious sustainability-based targets. Probably the explanation would lie not far from that for a greenium. The investors are willing to add SLBs to their portfolios not only because of growing environmental consciousness but presumably because of the existing and anticipated rules and regulations promoting ESG component in building investment portfolios as well as business strategies of financial institutions. EU’s Taxonomy Regulations, SFDR, as well as the recent European Banking Authority Report on management and supervision of ESG risks for credit institutions and investment firms [

13], make ESG criteria more and more imprinted into financial services.

Low coupon of SLBs contrasting with those of other Tesco straight bonds (see

Table 1), not offset by the lower bond prices, means lower cost of funding for Tesco. It is very important if Tesco wants to achieve its goals of reducing greenhouse gas emissions by 60% by 2025 and 85% by 2030 to ultimately achieve zero emissions by 2050. As of the 2015/2016 baseline year, grid electricity is made up the majority of such emissions, followed by refrigerant gases, heating, and distribution. Considering this, Tesco’s efforts to procure renewable energy via power purchasing agreements will play a large role in its overall strategy to achieve its SPTs [

25].

5. Conclusions

5.1. Theoretical Implications

Our main finding is that yield differential between comparable SLBs and non-ESG bonds of the same issuer (Tesco) are less than 0. Issuing SLBs enables Tesco to reduce borrowing costs in comparison to standard debt. SLBs generally penalize issuers with higher borrowing costs if they don’t meet certain ESG metrics. This may give rise to charges that SLBs involve a conflict of interest, since investors are paid more if issuers fall short of their KPIs and SPTs. However, we proved that an instance of coupon step-up does not transform the yield difference from negative into positive. This observation dismisses concerns that investors look for issuers to fail in pursuit of material changes in their carbon footprints.

5.2. Managerial Implications

On the issuer’s part, the conclusion might be that the step-up penalties of 25 basis points don’t create sufficient incentive for Tesco to pursue its objectives. This raises the question of interplay between KPIs and credit quality—particularly the possibility that missing targets could indicate increased reputational risk. Consistent failures are more likely to lead to bondholders selling out of SLBs than holding on for additional coupon. In turn, that could raise issuers’ cost of capital.

Another practical outcome is that the structure needs to be monitored for greenwashing since an issuer may also be incentivized to adopt a more conservative sustainability agenda for fear of missing its targets and incurring a penalty as a result. Additional reporting and external verification requirement may raise costs for issuers. There is no exhaustive list of KPIs, so issuers are free to select KPIs which are most relevant to their business.

5.3. Limitations and Perspectives

SLBs offer more flexibility to the issuer as how to make a use of proceeds. They are interesting option for firms that may find it difficult to find sufficient green projects to issue a green bond, owing to the nature of their business. Unlike green bonds, the proceeds from sustainability-linked debt are not earmarked for specific green projects. Instead, the bond addresses the sustainability of the issuer’s entire activities by applying one or more key performance indicators, such as cutting carbon emissions by a specific amount, which are linked to pricing.

Addressing the need to transition entire businesses is a merit of SLBs over project-level use of proceeds bonds. That means, however, that it is impossible for an investor to know how the proceeds of the bonds were directed and what specific outcomes they delivered. One must remember though, that investors in green bonds alone cannot legally force the issuer to use the proceeds for the stated projects or to deliver them on time. Therefore, the distinguishing feature of a SLB is an existence of a direct and enforceable monetary incentive for the issuer to perform, rather than reputational risk only (as is the case with green bonds).

Putting aside the exact yield composition of Tesco notes, one may draw a general remark that SLBs’ mechanism of investor’s benefit if an issuer fails to meet its environmental goals, may create a misalignment of objectives between the issuer and its investors. This moral dilemma imprinted in a coupon step-up feature may be viewed as main limitation to the SLBs and turn out to be decisive on their perspectives, despite of the blooming SLBs market of today.

In view of the above, the critical elements for the viability of SLBs are interim goals, historical KPI performance, science-based criteria (particularly for greenhouse gases emissions-related targets) plus properly calculated step-up in the coupon (typically of 25–50 basis points). A bond is misleadingly labelled a ‘sustainability-linked’ when targets are gamed to make them relatively easy to achieve, sometimes based on the issuer’s current trajectory, and without the need for meaningful new investment.

Author Contributions

P.J., K.L., M.L.; methodology, P.J., K.L., M.L.; software, P.J., K.L., M.L.; validation, P.J., K.L., M.L.; formal analysis, P.J., K.L., M.L.; investigation, P.J., K.L., M.L.; resources, P.J., K.L., M.L.; data curation, P.J., K.L., M.L.; writing—original draft preparation, P.J., K.L., M.L.; writing—review and editing, P.J., K.L., M.L.; visualization, P.J., K.L., M.L.; supervision, P.J., K.L., M.L.; project administration, P.J., K.L., M.L.; funding acquisition, P.J., K.L., M.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to fact that Refinitiv Eikon, the data provider, is not an open access database.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Tesco Press Release. 2020. Available online: https://www.tescoplc.com/news/2020/tesco-renews-25bn-committed-facility-establishing-link-to-sustainability-targets/ (accessed on 19 November 2021).

- Turner, M. Tesco Readies SLB to Fund Multi-Bond Buy-Back. Global Capital. February 2021:N.PAG. Available online: http://search-1ebscohost-1com-1o8h9l0180423.han.sgh.waw.pl/login.aspx?direct=true&db=bsu&AN=148542061&lang=pl&site=bsi-live (accessed on 26 July 2021).

- Tesco. Tesco Sustainability-Linked Bond Framework. 2021. Available online: https://www.tescoplc.com/media/756888/tesco-sustainability-linked-bond-framework.pdf (accessed on 19 November 2021).

- KPMG. Independent Limited Assurance Report to Tesco PLC. 13 April 2021. Available online: https://www.tescoplc.com/media/757149/assurance-report-signed.pdf (accessed on 19 November 2021).

- Hay, J. Investors Open to SLB Coupon Step-Downs. Global Capital. April 2021:N.PAG. Available online: http://search-1ebscohost-1com-1o8h9l0ba00c9.han.sgh.waw.pl/login.aspx?direct=true&db=bsu&AN=149645390&lang=pl&site=bsi-live (accessed on 27 July 2021).

- Morita, R. New Type of Bond Cuts Investor Bonus for Missing ESG Goals. Bloomberg.com. March 2021: N.PAG. Available online: http://search-1ebscohost-1com-1o8h9l0ba00cf.han.sgh.waw.pl/login.aspx?direct=true&db=bsu&AN=149332954&lang=pl&site=bsi-live (accessed on 27 July 2021).

- Flammer, C. Corporate green bonds. Acad. Manag. Proceed. 2019, 1, 15250. [Google Scholar] [CrossRef]

- Cox, J. SLBs and Escaping Secular Stagnation. Global Capital. February 2021:N.PAG. Available online: http://search-1ebscohost-1com-1o8h9l0ba00d1.han.sgh.waw.pl/login.aspx?direct=true&db=bsu&AN=148857464&lang=pl&site=bsi-live (accessed on 27 July 2021).

- Refinitiv Deals Intelligence. Sustainable Finance Review. First Quarter 2021. Available online: https://www.refinitiv.com/en/financial-data/deals-data (accessed on 25 November 2021).

- Yeow, K.E.; Ng, S.-H. The impact of green bonds on corporate environmental and financial performance. Manag. Financ. 2021, 47, 1486–1510, in print. [Google Scholar] [CrossRef]

- Cioli, V.; Colonna, L.A.; Giannozzi, A.; Roggi, O. Corporate green bond and stock price reaction. Int. J. Bus. Manag. 2021, 16, 75. [Google Scholar] [CrossRef]

- Fu, J.; Ng, A.W. Scaling up renewable energy assets: Issuing green bond via structured public-private collaboration for managing risk in an emerging economy. Energies 2021, 14, 3076. [Google Scholar] [CrossRef]

- European Banking Authority. EBA Report on Management and Supervision of ESG Risks for Credit Institutions and Investment Firms, EBA/REP/2021/18. 2021. Available online: https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Reports/2021/1015656/EBA%20Report%20on%20ESG%20risks%20management%20and%20supervision.pdf (accessed on 19 November 2021).

- European Commission. Commission Puts Forward New Strategy to Make the EU’s Financial System More Sustainable and Proposes New EUROPEAN Green Bond Standard, Press Release. 2021. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_21_3405 (accessed on 19 November 2021).

- Ritchie, G. Green Bond Boom Is Leaving Out Countries Most at Climate Risk. Bloomberg.com. March 2021. 2021. Available online: http://search-1ebscohost-1com-1o8h9l0ba00cc.han.sgh.waw.pl/login.aspx?direct=true&db=bsu&AN=149602548&lang=pl&site=bsi-live (accessed on 19 November 2021).

- Oxford Analytica. Sustainable bond issuance will increase markedly. Expert Brief. 2020. [Google Scholar] [CrossRef]

- Turner, M. Verbund Creates New Mix of Green and Sustainability-Linked Bond. Global Capital. April 2021:N.PAG. Available online: http://search-1ebscohost-1com-1o8h9l0ba00c7.han.sgh.waw.pl/login.aspx?direct=true&db=bsu&AN=149759079&lang=pl&site=bsi-live (accessed on 27 July 2021).

- Ehlers, T.; Packer, F. Green bond finance and certification. BIS Q. Rev. 2017, 89–104. [Google Scholar]

- Zerbib, O.D. The green bond premium. J. Bank. Financ. 2017, 98, 39–60. [Google Scholar] [CrossRef]

- Zerbib, O.D. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. J. Bank. Financ. 2019, 98, 39–60. [Google Scholar] [CrossRef]

- Agliardi, E.; Agliardi, R. Corporate green bonds: Understanding the greenium in a two-factor structural model. Environ. Resour. Econ. 2021, 80, 257–278. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Chen, X.; Li, X.; Yu, J.; Zhong, R. The market reaction to green bond issuance: Evidence from China. Pac. Basin Financ. J. 2021, 60, 101294. [Google Scholar] [CrossRef]

- Wagner, M.; Van Phu, N.; Azomahou, T.; Wehrmeyer, W. The relationship between the environmental and economic performance of firms: An empirical analysis of the European paper industry. Corp. Soc. Responsib. Environ. Manag. 2002, 9, 133–146. [Google Scholar] [CrossRef]

- Final Terms, Issue of €750,000,000 0.375 per cent. ESG Notes due 2029 Guaranteed by Tesco PLC under the £15,000,000,000 Euro Note Programme. Available online: https://www.tescoplc.com/media/756930/8198m_1-2021-1-25.pdf (accessed on 19 November 2021).

- Sustainalytics. 31 December 2020, Second-Party Opinion. Tesco Sustainability-Linked Bond. Available online: https://www.tescoplc.com/media/756887/tesco-sustainability-linked-bond-second-party-opinion.pdf (accessed on 19 November 2021).

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).