Directions and Prospects for the Development of the Electric Car Market in Selected ASEAN Countries

Abstract

:1. Introduction

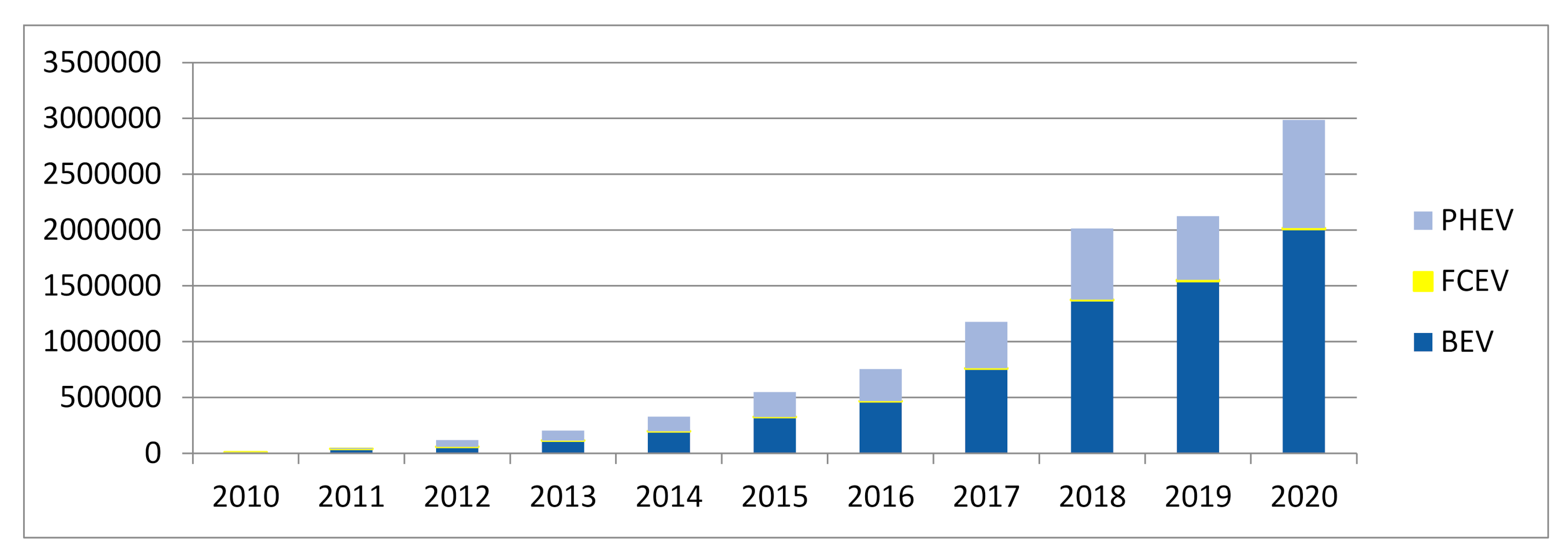

- BEV (Battery Electric Vehicle)—an all-electric vehicle with an installed battery, which is the sole source of power;

- PHEV (Plug-in Hybrid Electric Vehicle)—a hybrid vehicle (i.e., with a gasoline internal combustion engine and an electric motor) with the possibility to recharge electricity from the grid;

- FCEV—Fuel Cell Electric Vehicles—cars powered by hydrogen fuel cells. Such cars, similar to BEVs, use an electric motor, but they acquire energy in a completely different way. Instead of charging a battery, the FCEV stores hydrogen gas in a tank. The fuel cell in the FCEV combines hydrogen with oxygen from the air. The energy created as a result of this reaction reaches an electric motor that powers the vehicle as is the case in BEVs; and

- HEV Hybrid Electric Vehicle)—a hybrid vehicle without the ability to recharge electricity from the grid (electricity is generated by installing a traditional internal combustion engine in the vehicle).

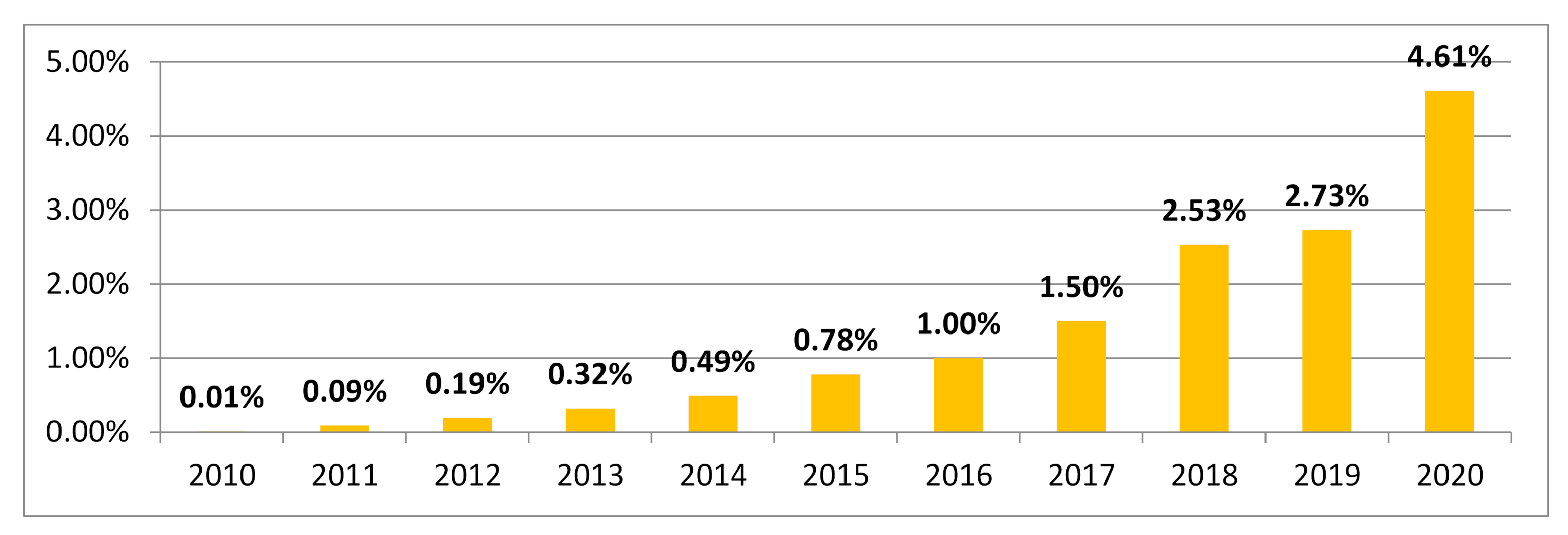

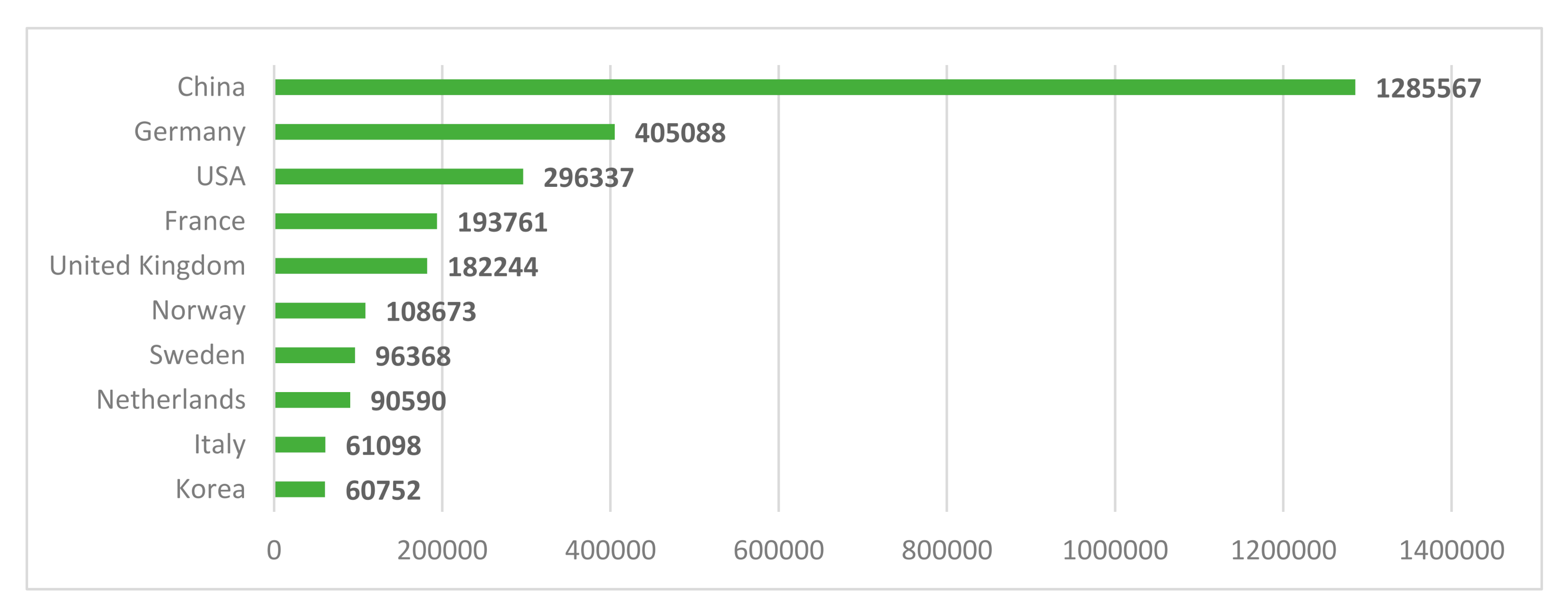

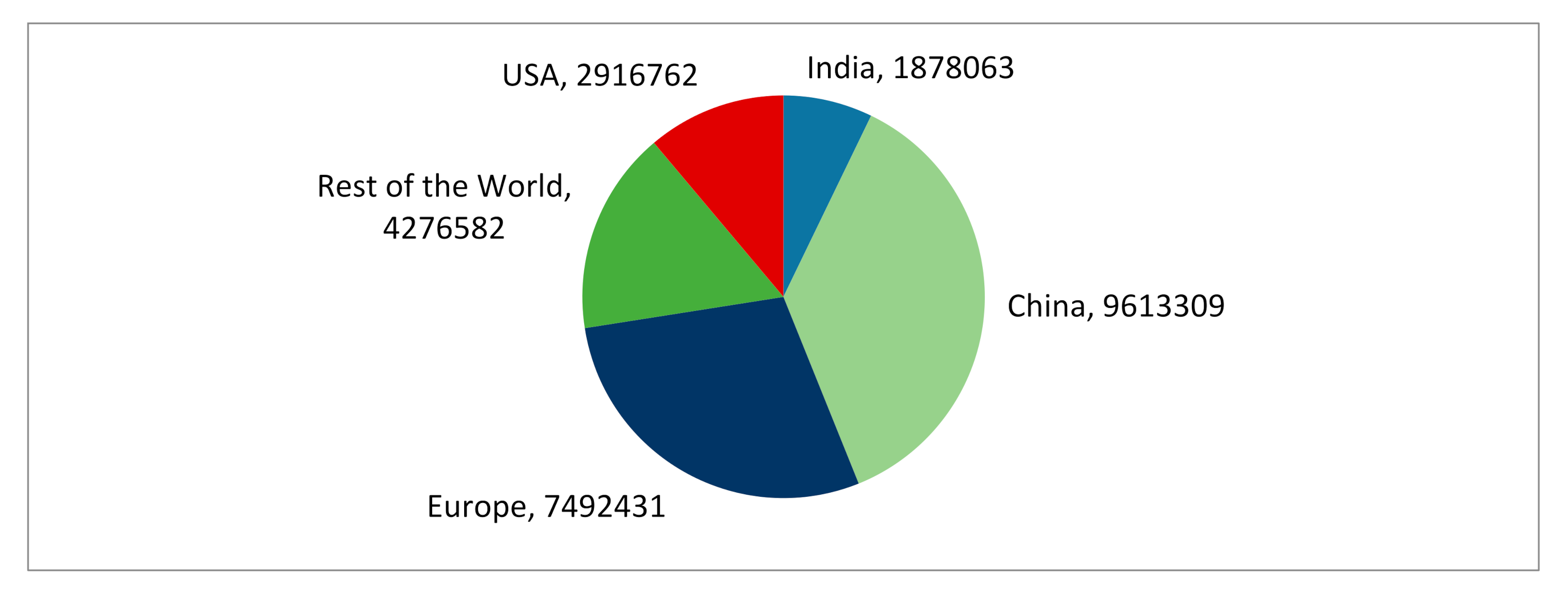

2. Current Situation in Global Markets

- Support in the form of legal and administrative regulations—many countries are increasing the environmental requirements for new vehicles sold, which naturally promotes low-emission vehicles. Further, in 2020, more than 40 countries (including EU countries) announced that they would soon introduce a policy to phase out vehicles with conventional engines, up to and including a complete ban on their sale (it is forecasted that by 2035, the two key markets of China and Europe will be affected by this ban).

- Additional tax incentives and direct subsidies to boost or maintain the levels of electric vehicle sales (some European countries have increased economic incentives; China, for example, has delayed withdrawing its subsidy programme).

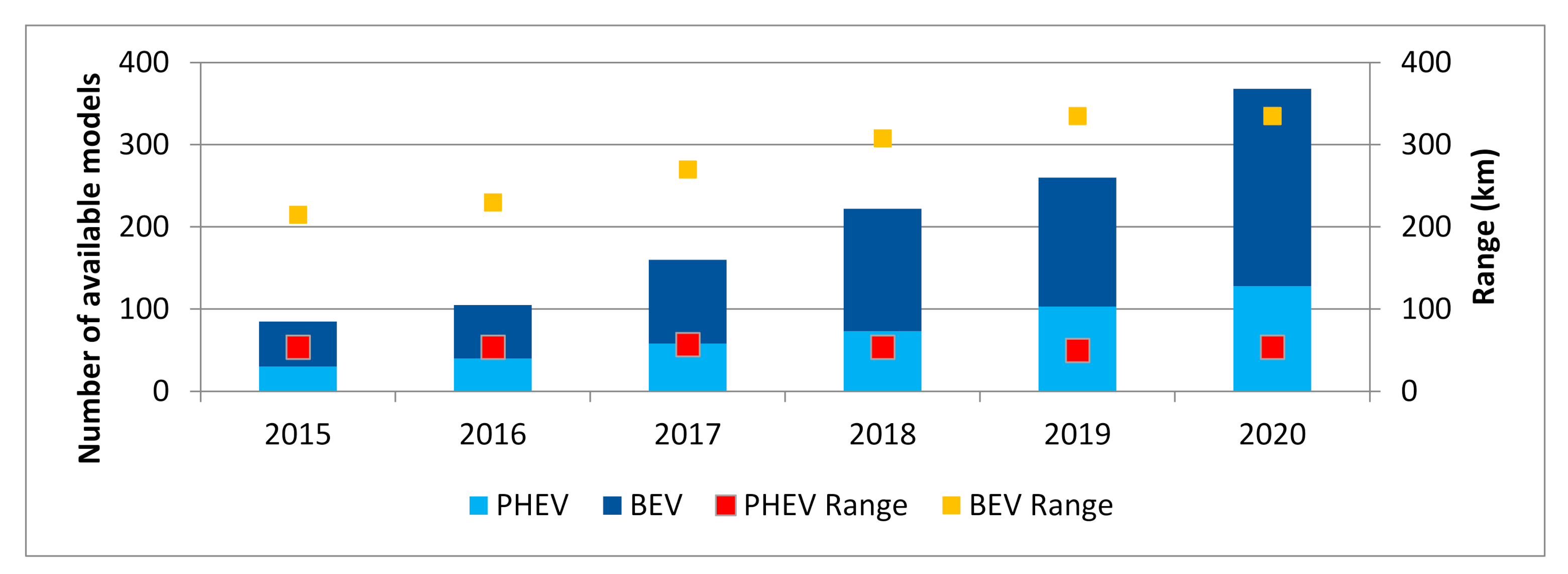

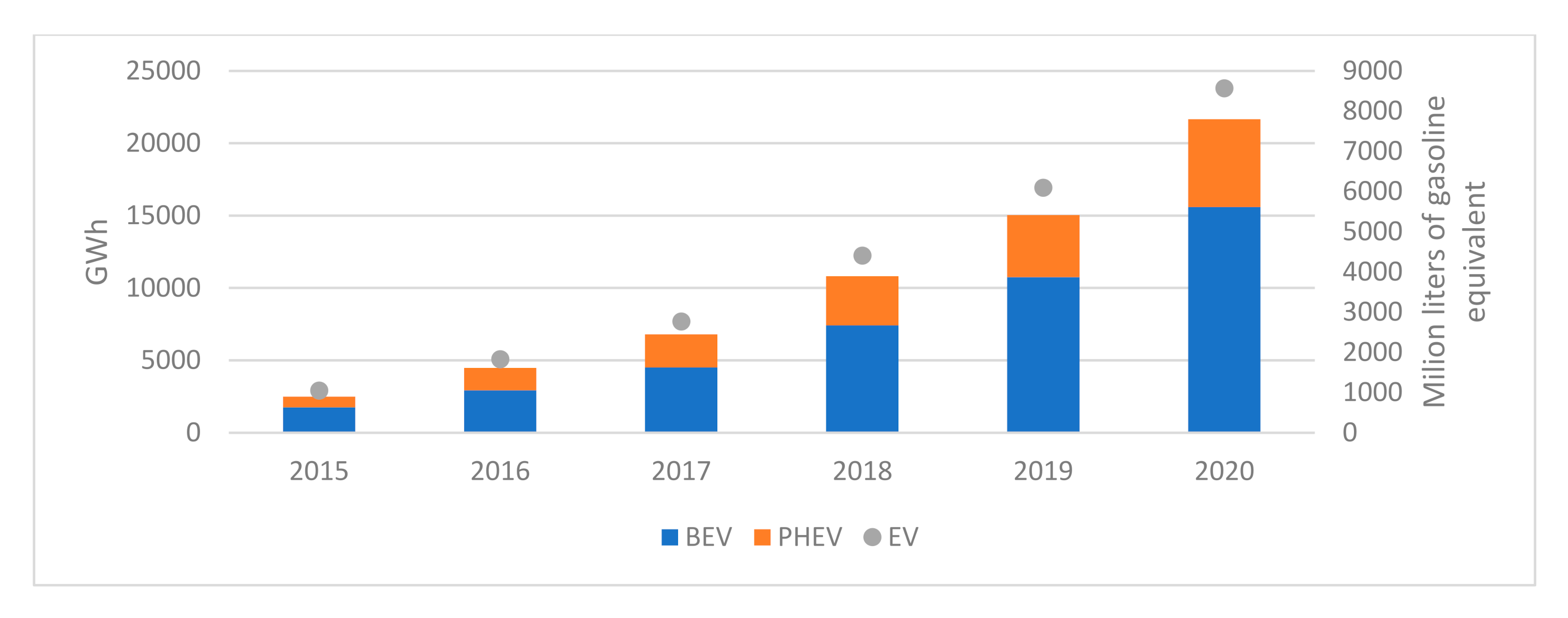

- Continuous increase in the number of EV models on offer, decrease in battery manufacturing costs (an important part of the total cost of a vehicle), increase in vehicle range, and increase in the number of publicly available chargers.

3. Analysis of the Situation in Selected Southeast Asian Countries

3.1. Brunei

3.2. Indonesia

3.3. Malaysia

3.4. Philippines

3.5. Singapore

3.6. Thailand

4. Key Considerations for the Development of the Electric Car Market in Southeast Asia

4.1. Total Cost of Ownership (TCO)

4.2. Battery Range and Life

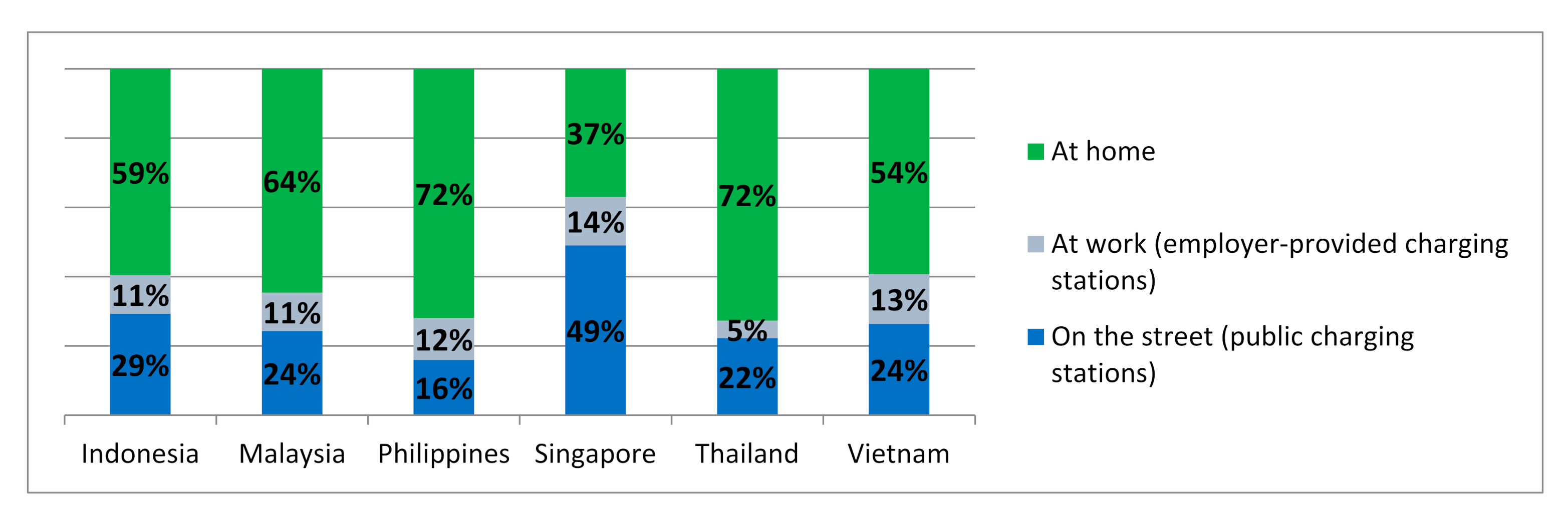

4.3. Charging Networks

4.4. Regulatory Environment and Subsidies

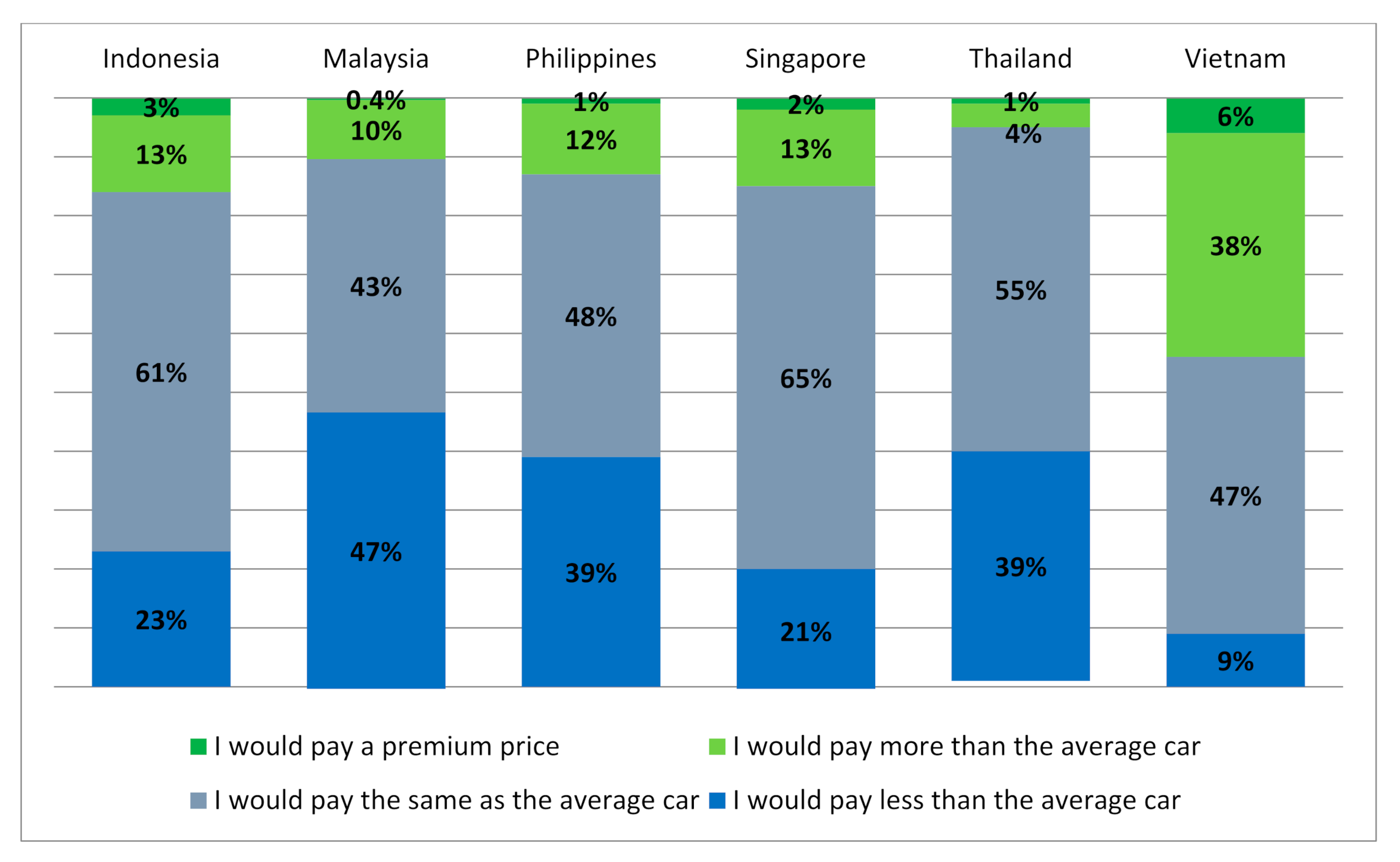

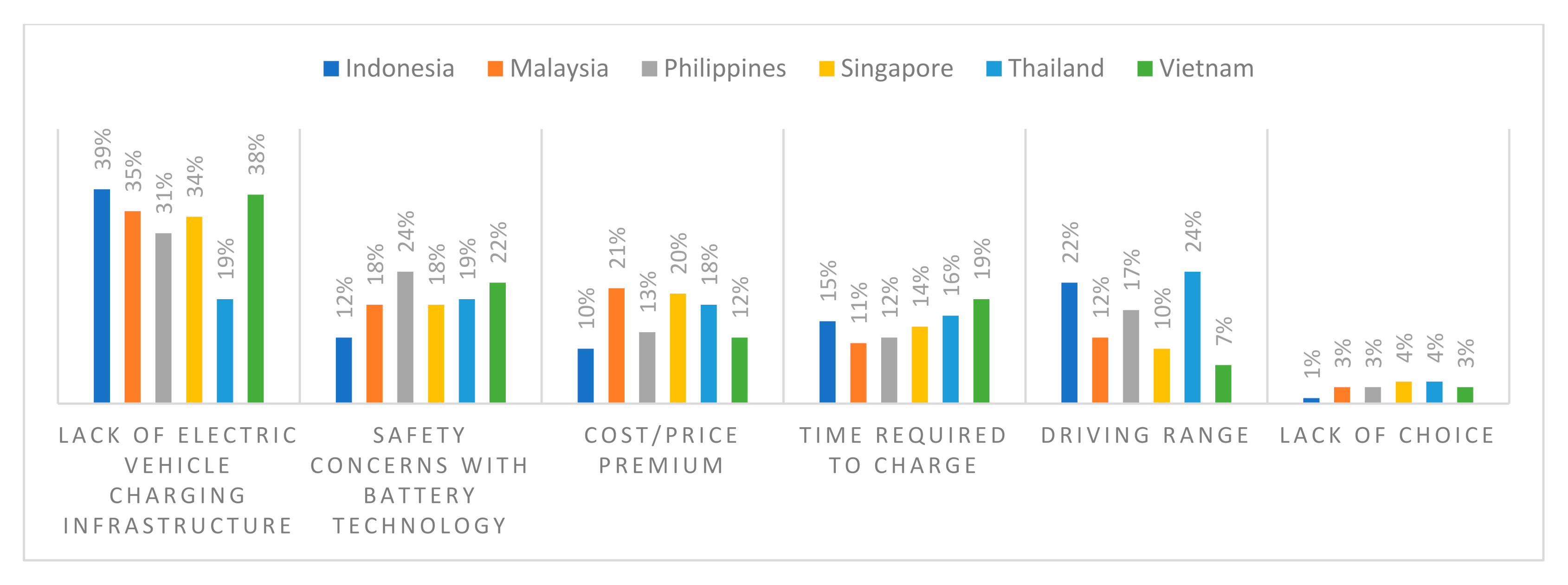

5. Consumer Survey Results in Selected Southeast Asian Countries

- of the total respondents, 64% say they are more likely to consider an electrified vehicle than they were five years ago;

- moreover, 66% believe they will inevitably adopt electrified mobility as a part of their lives in the near future;

- finally, 37% say they would definitely consider an electrified vehicle as their next car purchase in the next three years.

- no charging infrastructure,

- safety issues related to battery use,

- vehicle purchase price,

- charging time,

- vehicle range, and

- small number of models available.

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Wen, A.; Yang, S.; Zhou, P.; Gao, S.Z. Impacts of COVID-19 on the electric vehicle industry: Evidence from China. Renew. Sustain. Energy Rev. 2021, 144, 111024. Available online: https://www.sciencedirect.com/science/article/abs/pii/S1364032121003142 (accessed on 4 November 2021). [CrossRef]

- Global EV Data Explorer. Available online: https://www.iea.org/articles/global-ev-data-explorer (accessed on 1 November 2021).

- Malmgren, I. Quantifying the Societal Benefits of Electric Vehicles. World Electr. Veh. J. 2016, 8, 996–1007. Available online: https://www.mdpi.com/2032-6653/8/4/996/pdf (accessed on 22 October 2021). [CrossRef] [Green Version]

- The Impact of Government Policy on Promoting New Energy Vehicles (NEVs)—The Evidence in APEC Economies. 2017. Available online: https://www.apec.org/-/media/APEC/Publications/2017/3/The-Impact-of-Government-Policy-on-Promoting-New-Energy-Vehicles-NEVs--The-Evidence-in-APEC-Economie/217_AD_Report--CTI-26-2014A-final-version-0225.pdf (accessed on 21 October 2021).

- Asia Pacific Energy Research Centre (APERC). Challenges and Perspectives of Deployment of BEVs and FCEVs. 2020. Available online: https://aperc.or.jp/file/2020/2/13/BEV_FCEV_draft_20200205V2.pdf (accessed on 24 October 2021).

- Kawamoto, R.; Mochizuki, H.; Moriguchi, Y.; Nakano, T.; Motohashi, M.; Sakai, Y.; Inaba, A. Estimation of CO2 Emissions of Internal Combustion Engine Vehicle and Battery Electric Vehicle Using LCA. Sustainability 2019, 11, 2690. Available online: https://www.researchgate.net/publication/333046826_Estimation_of_CO2_Emissions_of_Internal_Combustion_Engine_Vehicle_and_Battery_Electric_Vehicle_Using_LCA (accessed on 14 October 2021). [CrossRef] [Green Version]

- Global Perspective on Electric Vehicle 2020. Int. J. Eng. Res. Technol. 2021, 9, 8–11. Available online: https://www.researchgate.net/publication/341875087_Global_Perspective_on_Electric_Vehicle_2020 (accessed on 11 October 2021).

- Kasprzak, P.; Sterniński, R. Administrative and taxation mechanisms supporting the purchase and maintenance of electric vehicles based on the example of Poland and other selected European countries. Econ. Reg. Stud. 2017, 10, 96–107. Available online: http://www.ers.edu.pl/administracyjne-i-podatkowe-mechanizmy-wsparcia-zakupu-i-eksploatacji-samochodow,92893,0,2.html (accessed on 10 October 2021). [CrossRef] [Green Version]

- Baranowski, M. (Ed.) Samochody Elektryczne i Hybrydowe. 2015. Available online: Eco-driving.info;outlanderphev.mitsubishi.pl (accessed on 27 September 2021).

- Sanguesa, J.A.; Torres-Sanz, V.; Garrido, P.; Martinez, F.J.; Marquez-Barja, J.M. A reviev on Electric Vehicles: Technologies and Challenges. Smart Cities 2021, 4, 372–404. Available online: https://www.mdpi.com/2624-6511/4/1/22/pdf (accessed on 9 October 2021). [CrossRef]

- Vu Trieu, M.; Abouelkheir, M.; Mart, T. Design and simulations of dual clutch transmission for hybrid electric vehicles. Int. J. Electr. Hybrid Veh. IJEHV 2017, 9, 302–321. Available online: https://www.inderscience.com/offer.php?id=89873 (accessed on 8 October 2021).

- Gorner, M.; Paoli, L. How Global Electric Car Sales Defie COVID-19 in 2020. 2021. Available online: https://www.iea.org/commentaries/how-global-electric-car-sales-defied-covid-19-in-2020 (accessed on 7 October 2021).

- Wagner, I. Number of Electric Cars and Plug-In Hybrids in Norway from 2012 to 2020. 2021. Available online: https://www.statista.com/statistics/696187/electric-and-hybrid-cars-number-in-norway/ (accessed on 24 October 2021).

- Electric Vehicles and Asia Investing. 2021. Available online: https://www.ubs.com/global/en/asset-management/insights/emerging-markets/2021/electric-vehicles-asia-investing.html (accessed on 14 October 2021).

- Hardman, S.; Chandan, A.; Tal, G.; Turrentine, T. The effectiveness of financial purchase incentives for battery electric vehicles—A review of the evidence. Renew. Sustain. Energy Rev. 2017, 80, 1100–1111. Available online: https://phev.ucdavis.edu/wp-content/uploads/2017/09/purchase-incentives-literature-review.pdf (accessed on 14 October 2021). [CrossRef]

- Gómez Vilchez, J.J.; Thiel, C. The Effect of Reducing Electric Car Purchase Incentives in the European Union. World Electr. Veh. J. 2019, 10, 64. Available online: https://www.mdpi.com/2032-6653/10/4/64/pdf (accessed on 8 October 2021). [CrossRef] [Green Version]

- Goulding Caroll, S. EU Signac End of Internal Combustion Engine by 2035. 2021. Available online: https://www.euractiv.com/section/electric-cars/news/eu-signals-end-of-internal-combustion-engine-by-2035/ (accessed on 9 October 2021).

- Global EV Outlook. 2021. Available online: https://iea.blob.core.windows.net/assets/ed5f4484-f556-4110-8c5c-4ede8bcba637/GlobalEVOutlook2021.pdf (accessed on 8 October 2021).

- Mruzek, M.; Gajdáč, I.; Kucera, L.; Gajdošík, T. The Possibilities of Increasing the Electric Vehicle Range. Procedia Eng. 2017, 192, 621–625. Available online: https://www.researchgate.net/publication/317826400_The_Possibilities_of_Increasing_the_Electric_Vehicle_Range (accessed on 24 October 2021). [CrossRef]

- Gómez Vilchez, J.J. The Impact of Electric Cars on Oil Demand and Greenhouse Gas Emissions in Key Markets. 2019. Available online: https://d-nb.info/1188427881/34 (accessed on 14 October 2021).

- Schröder, M.; Iwasaki, F. Current Situation of Electric Vehicles in ASEAN in Promotion of Electromobility in ASEAN: States, Carmakers, and International Production Networks. ERIA Res. Proj. Rep. 2021, 3, 1–32. Available online: https://www.eria.org/uploads/media/Research-Project-Report/2021-03-Promotion-Electromobility-ASEAN/5_ch.1-Current-Situation-Electric-Vehicle-ASEAN.pdf (accessed on 14 October 2021).

- ASEAN Automotive Outlook. 2021. Available online: https://finance.yahoo.com/news/asean-automotive-outlook-2021-094700237.html?guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAANk-Mt_DZY-6uCe4NhDOdPku7fVtCTSlZEDsKb0ssHSKr3C8LIYZ3YnD7YZ5l-c7XjCPi0MNTzxAAbLVp963tXBbqNKvk-u1_VrvADcLovjqEdb1-hrdrfIbM17lbALJ0TyMJeuBJz5laRJ_gZm-DcD9S22LPBGf9uS2xg36Qoya&guccounter=2 (accessed on 25 October 2021).

- Electric Mobility Projects in Asia and the Pacific. Available online: https://www.unep.org/explore-topics/transport/what-we-do/electric-mobility/electric-mobility-projects-asia-and-pacific (accessed on 24 October 2021).

- ASEAN Automotive Federation Statistics. Available online: http://www.asean-autofed.com/statistics.html (accessed on 27 October 2021).

- Enthusiasm for Electric Vehicles Grows in Southeast Asia. 2021. Available online: https://www.warc.com/newsandopinion/news/enthusiasm-for-electric-vehicles-grows-in-southeast-asia/46654 (accessed on 27 October 2021).

- Automotive Yearly Sales by Country. Available online: https://www.marklines.com/en/vehicle_sales/search_country/search/?searchID=1701312 (accessed on 29 October 2021).

- World Economic Outlook Database. 2021. Available online: https://www.imf.org/en/Publications/WEO/weo-database/2021/April/weo-report (accessed on 24 October 2021).

- MTIC. Review to Formulate a Roadmap and Draft National Masterplan for a Sustainable Land Transportation System for Brunei Darussalam; Executive Summary; MTIC: Bandar Seri Begawan, Brunei, 2014; Volume 5. [Google Scholar]

- Brunei Target 60 pct Nationwide Electric Vehicle Sales by 2035: Report. 2020. Available online: http://www.xinhuanet.com/english/2020-09/27/c_139401941.htm (accessed on 6 October 2021).

- ASEAN Low Carbon Energy Programme (LCEP). Available online: https://www.copperalliance.asia/sites/default/files/2021-08/ICASEA-LCEP.pdf (accessed on 4 October 2021).

- Wirabuana, R.N. Indonesia Looks to Accelerate Battery Electric Vehicle Program. 2019. Available online: https://www.ssek.com/blog/indonesia-looks-to-accelerate-battery-electric-vehicle-program (accessed on 17 October 2021).

- Ministry of Energy, Green Technology and Water (KeTTHA). Green Technology Master Plan Malaysia 2017–2020. Available online: https://www.pmo.gov.my/wp-content/uploads/2019/07/Green-Technology-Master-Plan-Malaysia-2017-2030.pdf (accessed on 16 October 2021).

- Malaysia’s EV Drive and Lessons from the Past. 2021. Available online: https://www.just-auto.com/comment/malaysias-ev-drive-and-lessons-from-the-past/ (accessed on 19 October 2021).

- Malaysia to Have 1,000 EV Charging Stations by 2025. Available online: https://techwireasia.com/2021/08/malaysia-to-have-1000-ev-charging-stations-by-2025/ (accessed on 24 October 2021).

- Electric Vehicle Charging Infrastructure in ASEAN: Need of the Hour and Challenges in Way. Available online: https://powertechresearch.com/electric-vehicle-charging-infrastructure-in-asean-need-of-the-hour-and-challenges-in-way/ (accessed on 24 October 2021).

- Launch of Singapore’s Electric Vehicle Test-Bed. Available online: https://www.ema.gov.sg/media_release.aspx?news_sid=20140609xajR79y5ws2j (accessed on 30 October 2021).

- The Journey of Electric Vehicles in ASEAN. Available online: https://assets.kpmg/content/dam/kpmg/sg/pdf/2021/04/Decarbonisation_of_transport.pdf (accessed on 5 October 2021).

- Aravindan, A. Singapore’s Electric Car-Sharing Program Hits the Road. 2017. Available online: https://www.reuters.com/article/us-singapore-electricvehicles-idUSKBN1E60OF (accessed on 12 October 2021).

- Factsheet: 20 More Electric Buses Deployed for Passenger Service. 2021. Available online: https://www.lta.gov.sg/content/ltagov/en/newsroom/2021/8/news-releases/20_more_e-buses_deployed.html (accessed on 1 October 2021).

- Electric Vehicles. Available online: https://www.lta.gov.sg/content/ltagov/en/industry_innovations/technologies/electric_vehicles.html (accessed on 1 October 2021).

- OICA. 2019 Production Statistics. Available online: https://www.oica.net/category/production-statistics/2019-statistics/ (accessed on 14 October 2021).

- Natsuda, K.; Thoburn, J. Industrial policy and the development of the automotive industry in Thailand. J. Asia-Pac. Econ. 2013, 18, 413–437. [Google Scholar] [CrossRef]

- BMW Group. Thailand Localizes High-Voltage Battery Production, Press Release. Available online: https://www.press.bmwgroup.com/global/article/detail/T0287652EN/bmw-group-thailandlocalizes-high-voltage-battery-production?language=en (accessed on 15 October 2021).

- Apisitniran, L. Roadmap Sees ASEAN EV Hub by 2025. 2020. Available online: https://www.bangkokpost.com/business/1876654/roadmap-sees-asean-ev-hub-by-2025 (accessed on 8 October 2021).

- Raustad, R. Electric Vehicle Life Cycle Cost Analysis, Final Research Project Report EVTC Project 6. Electric Vehicle Transportation Center. Florida. 2017. Available online: www.fsec.ucf.edu (accessed on 23 October 2021).

- Lambert, F. Electric Vehicle Battery Cost Dropped 80% in 6 Years Down (…). 2017. Available online: www.electrek.co (accessed on 24 October 2021).

- Tu, J.C.; Yang, C. Key Factors Influencing Consumers’ Purchase of Electric Vehicles. Sustainability 2019, 11, 3863. Available online: https://www.mdpi.com/2071-1050/11/14/3863/pdf (accessed on 24 October 2021). [CrossRef] [Green Version]

- Kristensen, F.S.; Thomassen, M.L.; Jakobsen, L.H. The Norwegian EV Initiative (Norway)—Case Study Report. 2018. Available online: https://jiip.eu/mop/wp/wp-content/uploads/2018/09/NO_Electric-Vehicles-Initiative_SkovKristensenLaugeThomassenJakobsen.pdf (accessed on 6 October 2021).

- Norwegian EV Policy. Available online: https://elbil.no/english/norwegian-ev-policy/ (accessed on 24 October 2021).

- Japan to Offer up to ¥800,000 in Subsidies for Electric Vehicles. 2020. Available online: https://www.japantimes.co.jp/news/2020/11/25/business/subsidies-electric-vehicles/ (accessed on 26 October 2021).

- Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles. Available online: https://www.fueleconomy.gov/feg/taxevb.shtml (accessed on 24 October 2021).

- Loh, D.; Sugiura, E. Slow charge: ASEAN Aims to Bring Lofty EV Goals within Range. 2021. Available online: https://asia.nikkei.com/Spotlight/Asia-Insight/Slow-charge-ASEAN-aims-to-bring-lofty-EV-goals-within-range (accessed on 22 October 2021).

- Full Speed Ahead. Supercharging Electric Mobility in Southeast Asia. 2021. Available online: https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/strategy/sea-strategy-operations-full-speed-ahead-report.pdf (accessed on 21 October 2021).

| Group | Country | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|

| PHEV | Japan | 12,413 | 5365 | 31,504 | 19,761 | 14,965 | 11,315 |

| EV | 10,356 | 15,203 | 17,441 | 26,127 | 20,424 | 12,976 | |

| FCV | 411 | 1055 | 849 | 575 | 644 | 717 | |

| PHEV | Korea | 273 | 281 | 233 | 3434 | 2436 | 8548 |

| EV | 3025 | 5483 | 13,766 | 30,100 | 29,480 | 33,342 | |

| FCV | 0 | 80 | 61 | 17 | 0 | 79 | |

| PHEV | Taiwan | 0 | 0 | 0 | 0 | 0 | 0 |

| EV | 20 | 2 | 14 | 40 | 71 | 31 | |

| PHEV | Thailand | 0 | 0 | 17 | 0 | 13 | 1 |

| EV | 0 | 0 | 0 | 0 | 126 | 1071 | |

| PHEV | Malaysia * | 0 | 0 | 0 | 0 | 0 | 0 |

| EV | 11 | 95 | 0 | 0 | 0 | 0 | |

| PHEV | Indonesia | 0 | 0 | 7 | 1 | 4 | 82 |

| EV | 0 | 0 | 0 | 0 | 0 | 5 | |

| PHEV | Philippines | 0 | 0 | 12 | 3 | 19 | 21 |

| EV | 0 | 0 | 0 | 0 | 1 | 0 | |

| PHEV | Singapore | ||||||

| EV | 2 | 5 | 236 | 185 | 281 | 22 | |

| PHEV | India | 0 | 0 | 0 | 0 | 0 | 0 |

| EV | 0 | 0 | 0 | 434 | 50 | 1148 | |

| PHEV | Australia | 69 | 32 | 29 | 206 | 563 | 540 |

| EV | 286 | 134 | 120 | 202 | 675 | 830 | |

| PHEV | New Zealand | 0 | 0 | 0 | 0 | 0 | 0 |

| EV | 21 | 24 | 244 | 254 | 802 | 593 |

| Country | Population in Million | GDP Nominal (Millions of USD) | GDP Nominal (per Capita USD) | |

|---|---|---|---|---|

| 1 | Indonesia | 272.270 | 1,158,783 | 4256 |

| 2 | Thailand | 69.947 | 538,735 | 7702 |

| 3 | Philippines | 110.432 | 402,638 | 3646 |

| 4 | Malaysia | 33.358 | 387,093 | 11,604 |

| 5 | Singapore | 5.840 | 374,394 | 64,103 |

| 6 | Vietnam | 98.328 | 354,868 | 3609 |

| 7 | Myanmar | 53.545 | 76,195 | 1423 |

| 8 | Cambodia | 15.836 | 27,239 | 1720 |

| 9 | Laos | 7.371 | 2044 | 2773 |

| 10 | Brunei | 0.461 | 15,278 | 33,097 |

| ASEAN in total | 667.393 | 3,355,655 | 4849 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gomółka, K.; Kasprzak, P. Directions and Prospects for the Development of the Electric Car Market in Selected ASEAN Countries. Energies 2021, 14, 7509. https://doi.org/10.3390/en14227509

Gomółka K, Kasprzak P. Directions and Prospects for the Development of the Electric Car Market in Selected ASEAN Countries. Energies. 2021; 14(22):7509. https://doi.org/10.3390/en14227509

Chicago/Turabian StyleGomółka, Krystyna, and Piotr Kasprzak. 2021. "Directions and Prospects for the Development of the Electric Car Market in Selected ASEAN Countries" Energies 14, no. 22: 7509. https://doi.org/10.3390/en14227509

APA StyleGomółka, K., & Kasprzak, P. (2021). Directions and Prospects for the Development of the Electric Car Market in Selected ASEAN Countries. Energies, 14(22), 7509. https://doi.org/10.3390/en14227509