Abstract

The energy sector in Poland is currently calling for dynamic redevelopment and cleaner energy. This country is world famous for its high level of coal production, from which it does not want to retreat in the next two decades. For this reason, it is safer to gradually reduce the use of coal while increasing the consumption of gas and simultaneously developing green energy. However, the Polish gas sector is still dependent on Russian gas supplied through the Yamal gas pipeline. Taking into consideration Polish geopolitics, this state of affairs poses a huge challenge and a threat to Poland’s energy security. That is why the concept of the North-South Gas Corridor was introduced. It is intended to be a network of gas pipelines that connect the countries of Central and South Europe to two gas terminals (in Poland and Croatia), which will supply gas from a chosen source. This article presents the current condition of the gas sector in Poland. It focuses on the North-South Gas Corridor project and its impact on the energy security of Poland. An analysis of documents and field research shows that the North-South Gas Corridor provides Poland with an opportunity to diversify the sources and directions of gas supply over the next few years.

1. Introduction

In recent decades, energy security has become a major issue for Poland. The Polish energy sector requires dynamic redevelopment as its current technology is obsolete and mostly carbon based (ca. 50–60% in the energy mix). The energy transition towards low-carbon energy calls for a changeover period, meaning gradual decarbonization through gasification [1,2] (in the first stage) followed by reducing the use of fossil fuels (coal, oil, gas) in favor of renewable energy sources such as wind, solar energy, biomass and biogas (in the second stage). At this point, it is worth emphasizing that decarbonization is a broad concept and applies not only to energy [3], but also technology [4,5,6,7,8], economy and politics [9,10,11,12]. It is believed that within the next decade or two the use of natural gas for the production of electrical energy in Poland will increase. In fact, in the last ten years the consumption of gas has already grown by more than 25% (consumption has been systematically increasing since the 1990s [13] (p. 9)). It should also be pointed out that the Polish gas sector mostly uses Russian gas (ca. 60% [14] (p. 7)), which—taking into consideration Polish-Russian political relations—leaves Poland in a state of a high risk and calls for the immediate diversification of gas resources. In 2022, the financially unfavorable Yamal Contract between Poland and Russia will lapse (The Yamal Contract for natural gas, signed on 25 September 1996 between PGNiG—Polish Oil Mining and Gas Extraction SA and the Russian gas giant Gazprom; in 2010, gas supplies of at least 8.7 bln m3 per year by 2022 were confirmed), but the next gas purchase agreement remains in question. The reasons for this are not necessarily political: the Yamal gas pipeline is simply an unprofitable investment. The North-South Gas Corridor is therefore a chance to diversify gas resources. To succeed, Poland will need to connect two Liquefied Natural Gas (LNG) terminals (in Świnoujście in Poland and Krk in Croatia) to a system of pipelines and interconnectors which will go through the countries of Central Europe. Creating such a corridor will allow gas to be imported from various directions, e.g., the Middle East, North Africa, the USA, Canada or Norway.

Moreover, in 2021 the Energy Policy of Poland until 2040 (EPP 2040) came into force (the previous document was dated 2009). It emphasizes the role natural gas plays in the Polish energy mix and mentions that natural gas will be “a bridge” in the energy transition. The demand for natural gas in the energy sector will rise from 4.2 billion m3 in 2020 per year to 13.4 billion m3 in 2036, and from 2027 to 2040 it will supposedly rise to more than 12 billion m3 per year [15] (p. 46). Therefore, in order to achieve the goals established by the Polish energy policy, stable gas delivery is an absolute must.

As a member of the European Union, Poland is obliged to adopt some international energy strategies [16] (p. 3). In 2014, the European Council approved four objectives for the whole EU to be achieved by 2030. Having been reviewed in 2018 and 2020, these objectives now focus on the reduction of greenhouse gas emission by at least 55% (in relation to 1990), increasing the use of renewable resources in the gross final energy consumption (by at least 32%), increasing energy efficiency by 32.5%, and creating an internal energy market in the EU [17]. The objectives are directly related to the Paris Agreement, which was signed in December 2015 during the twenty-first session of the Conference of the Parties to the United Nations Framework Convention on Climate Change (COP21). Its goal was to limit global warming to well below 2 °C compared to pre-industrial levels [18].

The European Commission also issued an important statement on the 2019 European Green Deal, a strategy which aims to achieve no net emissions of greenhouse gases by 2050 [19]. Within the next three decades of the Polish energy transition, increased consumption of natural gas is planned in order for the climate-neutral objective to be reached.

The main aim of this paper is to define current and future progress in the North-South Gas Corridor project in the context of the development of the Polish gas sector. The paper also attempts to determine whether the North-South Gas Corridor will guarantee Poland’s energy security, taking into consideration the progress of decarbonization and the need to diversify gas resources after the year 2022. Will the North-South Gas Corridor and the development of the Polish gas transmission network make it possible for Central and Eastern Europe to gain autonomy from Russian gas supplies? Taking into consideration its international profile, the North-South Gas Corridor is crucial not only for the redevelopment of the Polish energy sector but also to strengthen CEE’s energy security, which has relied on Russian supplies for many decades [20,21].

This paper reviews the current status of Poland’s gas sector as well as the steps the Polish government is planning in the gas sector, bearing in mind the North-South Gas Corridor project. The research used the method of critical text analysis, the subject of which is the latest Polish energy strategy (in particular, relating to the natural gas sector), and the National Ten-Year Gas Transmission System Development Plan for 2020–2029. The paper points out that the system of producing electrical energy in Poland has a very specific structure (excessive consumption of coal) and needs decarbonization. The Polish government plans to decarbonize the energy sector by gasification. For this reason, the author refers to two forecasts for the energy sector of Poland (in the perspective of 2023 and 2029). Both these forecasts predict the development of gas infrastructure (not only in Poland, but also in CEE countries). In this respect, the North-South Gas Corridor project is of key importance. The data presented in selected documents, reports, analyses and papers were verified in terms of this project’s implementation and expected gas transmission possibilities. The results of this review confirm that the North-South Gas Corridor is a real chance to diversify the sources and directions of the gas supply for Poland and other Central European countries

The first part of the paper focuses on the current and future status of the Polish energy sector. It also indicates the key raw energy materials (coal, natural gas, renewable energy sources) and the most important statements included in the Energy Policy of Poland until 2040 document. The next part of the paper presents the current and future status of the Polish gas transmission network. It also shows the effects of investments in gas infrastructure in Poland. Furthermore, the idea of the North-South Gas Corridor and its role in the diversification of gas delivery to Poland and other Central and Eastern European countries is explained.

2. Polish Energy Sector—Current and Future Status

2.1. Coal

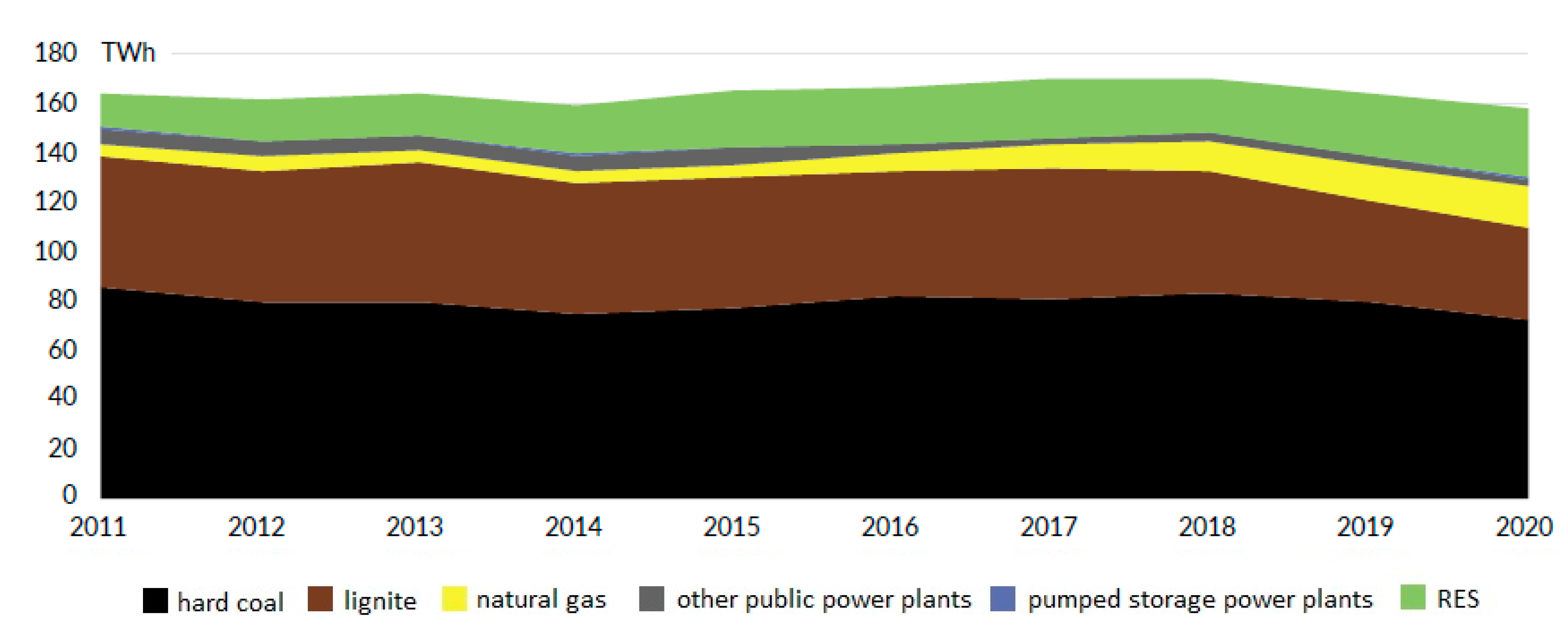

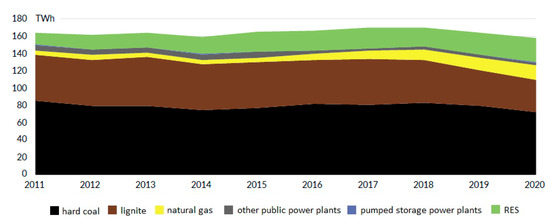

It has been reported that the Polish energy sector has required urgent redevelopment for many years, mostly because the generative structure of electrical energy has not been in line with the demands of contemporary times. As was mentioned above, one of the EU’s objectives is to significantly reduce the emission of greenhouse gases, most of which are generated by coal-fired power plants. Unfortunately, for many years coal has been one of the most important sources of energy in the Polish energy sector. This situation can be explained in a few ways. Firstly, Poland holds rich fields of hard coal and lignite: according to recent data, 64,422.38 million tons and 23,201.64 million tons, respectively [22] (p. 35, 42). These fields are some of the largest in Europe. The coal mining industry is well developed in Poland, especially in Upper Silesia, but this industry is crucial for economic and social development in all coal-rich regions. Moreover, for many decades the production of electrical energy has been based mainly on coal-fired power plants [23] (p. 5), [24] (p. 6). Despite the gradual redevelopment of the Polish energy sector, hard coal and lignite account for 69.7% of the energy mix (2020) [25] (p. 13); however, the use of coal in the production of electrical energy has been decreasing in the last decade. This situation is influenced by the growing consumption of natural gas and the gradual development of RES. It must be noted that Poland’s energy mix has not changed much over the last decade despite large investments in modernization of the energy sector (Figure 1).

Figure 1.

Electricity generation by energy sources. Based on [25] (p. 15).

2.2. Natural Gas

Due to the fact that Poland has rather scarce natural gas resources, the use of this fuel in the production of electrical energy remains at a low level. Nevertheless, the importance of natural gas has grown in recent decades and, according to EPP 2040, it will become one of the key factors facilitating decarbonization. The most recent data suggest that, when it comes to gas, Poland’s extractability level is 141,643.38 million m3, half of which represents economic resources [22] (p. 12). Natural gas deposits can be found in the lowland areas of Poland and the Carpathian Foreland. Poland’s hopes to develop the gas sector are also based on shale gas deposits [26,27]. According to the Polish Geological Institute, Poland holds 346–768 billion m3 of shale gas [28]. It seems clear that current production of natural gas in Poland is definitely insufficient if the growing demand is taken into account. In 2019 and 2020, natural gas extraction was 3.8 billion m3 annually, which accounted for only slightly more than 25% of all gas consumption. It is predicted that Polish natural gas production in Poland will increase to 5.2 billion m3 in 2021 as a consequence of growing production capacity in the Norwegian continental shelf and in Pakistan (PGNiG production assets) [29]. Other gas supplies are imported from various areas, the most dominant of which is still Russia: in 2019, 14.85 billion m3 of gas was imported, of which 8.95 billion m3 came from Russia (60.2%); 3.43 billion m3 was LNG (23.1%) and 2.47 billion m3 came from Germany or the Czech Republic (16.7%). In the years 2016–2019, the amount of gas imported from Russia dropped by 1.3 billion m3, while LNG imports rose by 2.46 billion m3. The opening of an LNG terminal in Świnoujście at the end of 2015 made it possible to diversify the directions of natural gas supply to Poland. In previous years, most of the supply came from the east, i.e., Russia and Kazakhstan (88.9% in 2016) [30]. In recent years, both the import and use of natural gas in Poland have been gradually rising. In 2010, it was 14.3 billion m3, while in 2020 it was 18.6 billion m3. Increasing gas consumption and low domestic production of about 4 billion m3 resulted in an increasing difference between import and production. It should be emphasized that in the period from 2010–2020 the Polish economy increasingly depended on imported gas (Table 1). The most substantial amount of gas is used by the industry and households. The numbers show that in 2018 only 14.8% of gas was used by power and heat engineering, which accounted for only 8.8% of the energy mix in Poland [31]. It seems clear that in order to maintain stability in the gas sector, the process of decarbonization should be accompanied by a growing supply of imported gas.

Table 1.

Natural gas imports and production in Poland 2010–2020, bln m3.

2.3. Renewable Energy Sources

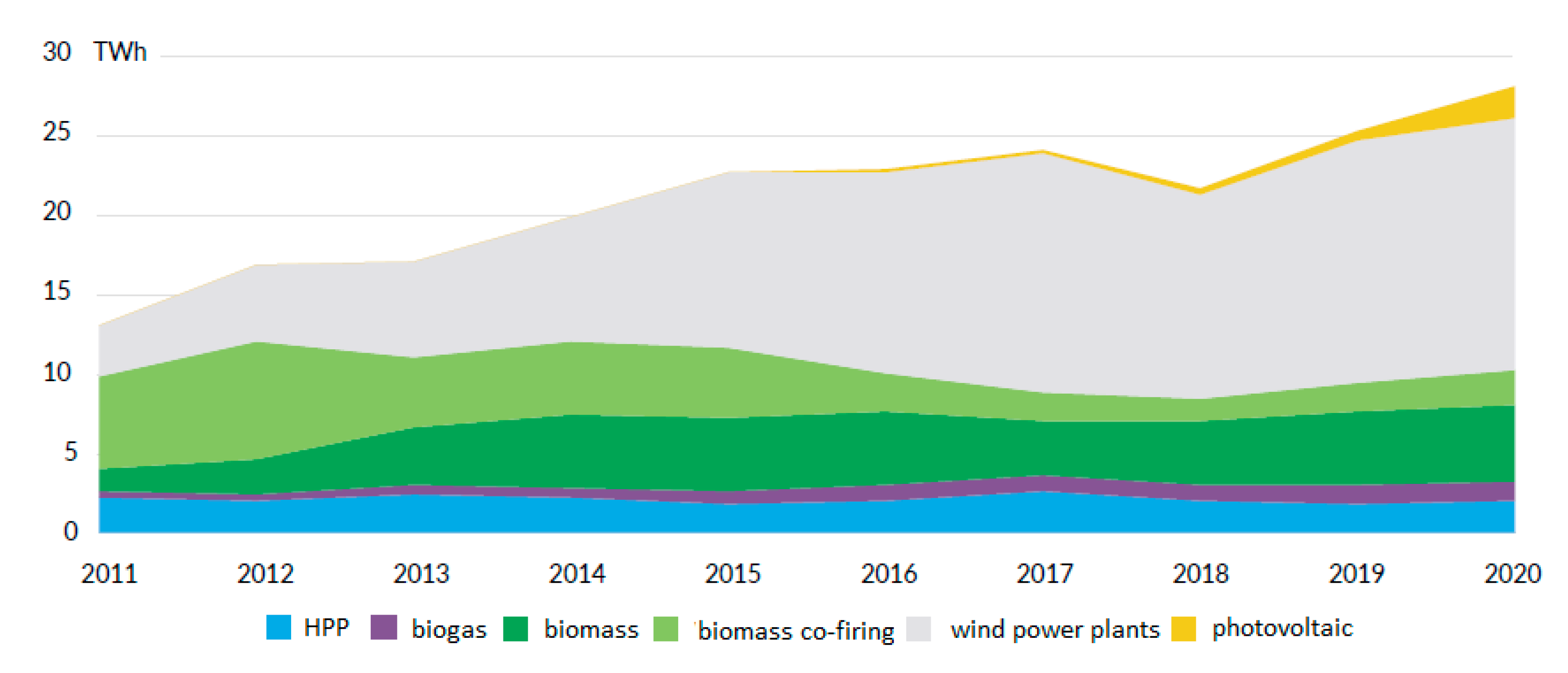

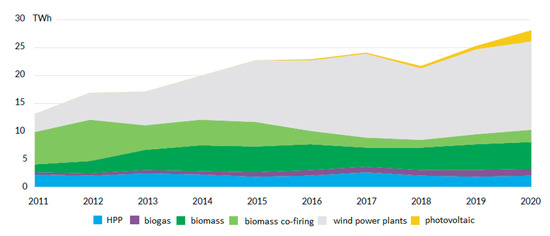

Renewable energy sources are an alternative to fossil fuels and their role in the production of electrical energy has been increasingly dominant. In this aspect, the Polish potential is considerable yet still unfulfilled [34] (p. 3). Wind and solar power are the fastest-growing energy industries [35] (p. 8), as is proven by the numbers: the capacity of wind systems rose from zero to 6509 MW between 2006 and 2021, while the capacity of solar systems grew from zero to 4973 MW in the years 2013–2021 [36]. Despite the dynamic growth of the green energy sector, renewable energy sources accounted for only 15.4% in the energy mix in 2019: wind power plants—9.2%; biomass, biogas and biomass co-firing power plants—4.6%; hydroelectric power stations—2%; photovoltaic—only 0.4% [31]. However, this situation is about to change. In the next decade, Poland will experience further growth of renewable energy sources: by 2030, the share of renewable energy in final energy use will reach 23% (by 2040, this will probably be 28.5%) [37] (p. 62). In 2011–2020, the production of electrical energy from renewable sources doubled, but the dominance of wind power plants is noticeable in this aspect (Figure 2).

Figure 2.

Renewable energy sources in electricity production in Poland, TWh. Based on [25] (p. 16).

2.4. Energy Policy of Poland until 2040 in the Context of the Gas Sector

As has already been mentioned, EPP 2014 directs special attention to the development of the gas sector in Poland. Natural gas will act as a transition fuel which will facilitate the transformation of power and heat production sectors, directing them towards zero-emission standards [37] (p. 36). The serious yet inevitable challenges that Poland will face are diversification of natural gas supply and expansion of gas infrastructure. The Polish government has indicated that the main priorities should be the gradual reduction of gas delivery from Russia, increase of liquefied gas imports, and increased intra-community trade. What is more, the Yamal Contract, under which Poland imports the majority of its gas, will lapse at the end of 2022 [38] (p. 17). This fact raises some serious doubts over whether this agreement should be prolonged and, if so, in what time perspective and under what conditions. It is obvious that the EPP 2040 aims to limit the importance of gas supply from the eastern direction, but this will be hard to achieve within the next few years. In order to diversify gas resources and the supply directions, there must be some alternatives for gas imports, and gas connection systems with neighboring countries will have to be expanded. The plan is that this objective will be achieved by 2023, firstly by increasing the capacity of the LNG terminal in Świnoujście up to 8.3 billion m3 per year (currently, it is ca. 5 billion m3). Subsequently, after 2025, a floating storage regasification unit in Gdańsk Bay (FSRU) with a capacity of at least 4.5 billion m3 annually will be commissioned. Finally, the strategic goal is to build the Baltic Pipe, a gas pipeline connecting the Polish transmission grid to deposits on the Norwegian continental shelf (connections from Norway–Denmark and Denmark–Poland, along with the rebuilding of transmission systems in Denmark and Poland). The project will be finished by October 2022 and will facilitate the annual import of 10 billion m3 of natural gas. In order to realize all these plans, the gas connection systems between neighboring countries must be overhauled: Slovakia and Lithuania by 2022, and later the Czech Republic and Ukraine. Simultaneously, the domestic gas grid and storage infrastructure will be developed; consequently, by 2024 the gas network in Poland will cover 76% of the country (currently ca. 65%). When it comes to natural gas storage, the volume of underground gas storage facilities will be increased from 3.2 billion m3 to 4 billion m3. Projects currently underway in Western, Southern and Southeastern Poland will develop the gas grid between Świnoujście and Czech, Slovak and Ukrainian borders. This will not only enable gas transmission from the LNG terminal and the Baltic Pipe to local customers, but also export to neighboring countries. Moreover, it opens the possibility of importing gas from new suppliers in the south [37] (p. 36). These projects will also directly contribute to the completion of the North-South Gas Corridor and will cement the energy alliance between the countries of Central Europe.

It shall also be mentioned that the geopolitical location of Poland makes it a favorable place to create a so-called gas-hub—a regional gas transmission and gas trading center for Central Europe and the Baltic countries. However, this project requires the development of gas distribution infrastructure, completion of the construction of the Baltic Pipe, redevelopment of the LNG gas terminal in Świnoujście, the building of an FSRU near Gdańsk Bay, and increasing the technical capacity of interconnectors. Additionally, it will also be necessary to increase the volume of natural gas transmitted through Poland and to introduce some commercial and legal regulations which will influence the natural gas market and bilateral cooperation with other countries [37] (p. 50).

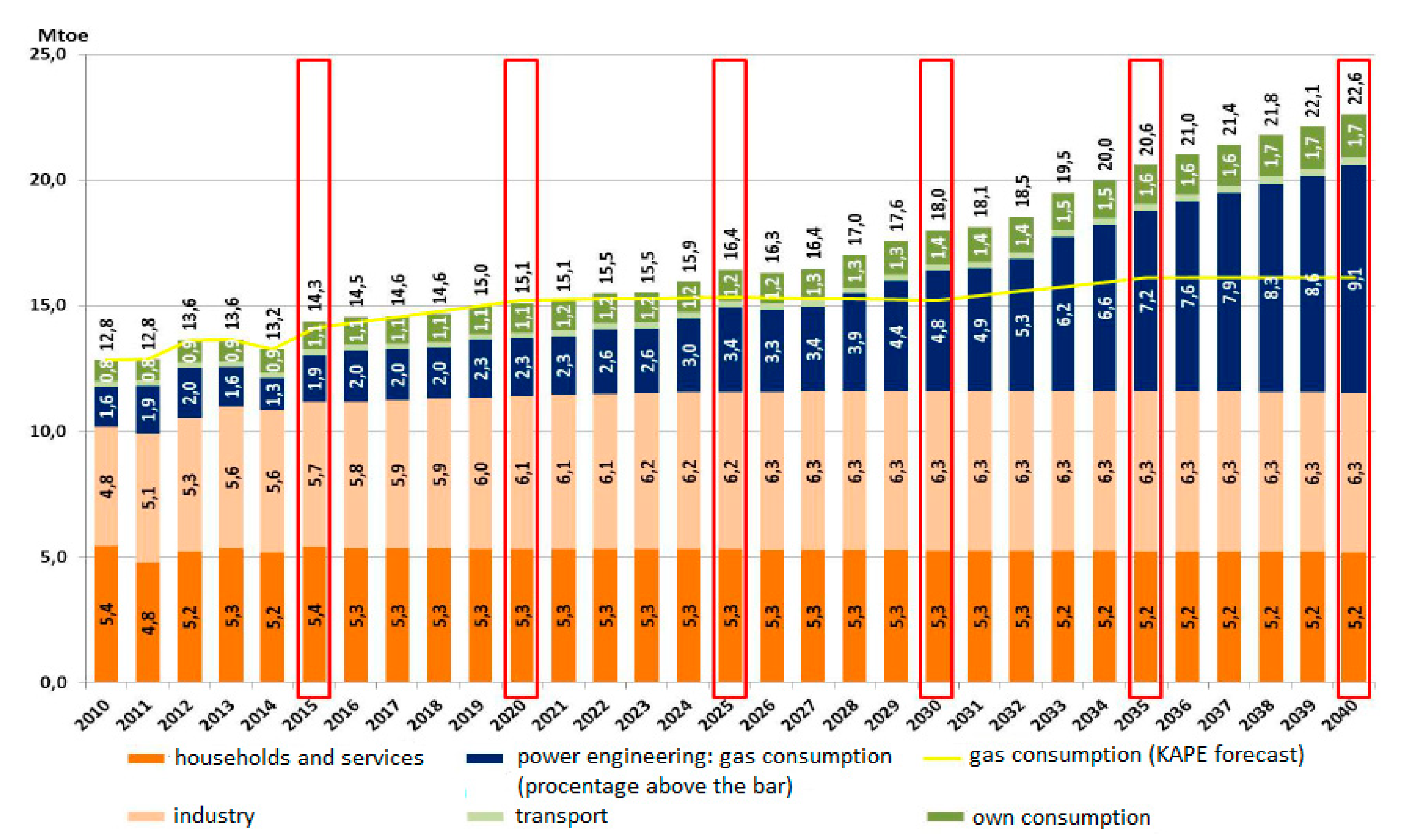

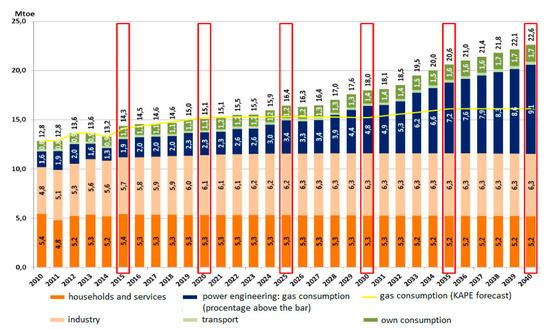

The dynamic growth of the natural gas consumption will be especially crucial in the early stages of the decarbonization process (between 2021 and 2025). Currently, this commodity is mostly used by industry and households (mainly during the heating season); therefore, within the next decade there will be a visible shift in gas consumption by heat and power engineering plants. The EPP 2040 plan is to connect the power engineering, gas and heat sectors (so-called sector coupling) through the development of storage technology, power engineering, gas grid infrastructure and gas storage capacity [37] (p. 51). The development of gas infrastructure in Poland is directly related to the expected growth in the use of natural gas within the next two decades, especially in power engineering. It is expected that in the next twenty years (2020–2040) gas consumption by the energy sector will increase from 2.3 MToe to 9.1 MToe. In this way, the energy sector will be decarbonized by gasifying (Figure 3).

Figure 3.

The demand for natural gas in the national economy of Poland, Mtoe. Based on [39] (p. 52).

3. The Gas Transmission System in Poland, and the North-South Gas Corridor

3.1. The Gas Transmission System in Poland—Current and Future Status

One of the most important documents which defines the developmental plans of the gas sector in Poland is the “National Ten-Year Network Development Plan. Development Plan to Meet the Future Demands for Gas Fuels in the Years 2020-2029”. This document presents two development forecasts:

- 2023 Time frame—focuses on the existing investment projects described in the Development Plan for years 2018–2027 as well as on actions taken in relation to the diversification of the natural gas supply;

- 2029 Time frame—takes into consideration the investment objectives, the success of which will depend on how well the natural gas market is developed in Poland and in the CEE region [40] (p. 6).

The existing transmission network consists of two cooperating systems: the Transit Gas Pipeline System and the National Gas Transmission System. In terms of the import of natural gas, the entry points can be geographically divided into the eastern border (Belarus—Kondratki and Wyskoje; Ukraine—Drozdowicze), the western border (Germany—Lasówand Malinow), the southern border (the Czech Republic—Cieszyn) and the north of Poland (LNG terminal). It is noticeable that there are large regional differences in access to gas transmission networks. In this context, it is necessary to point to Northeastern Poland (Warmia-Masuria Province), which has still not been supplied with natural gas (Figure 4).

Figure 4.

Polish transmission system with imported gas entry points. Based on [40] (p. 11).

What should be considered in the diversification of the sources and directions of the gas supply is the technical details of the cross-border entry points to the Polish gas transmission system. In 2020, technical capacity was dominated by the east, i.e., the entry points on the border with Belarus and Ukraine, which constituted of almost 53 billion m3 of the total of 66 billion m3 of gas imported annually. The capacity of the remaining entry points is still rather low: LNG terminal—5 billion m3 a year; Germany—7.7 billion m3 a year; the Czech Republic—0.6 billion m3 a year [15] (p. 28).

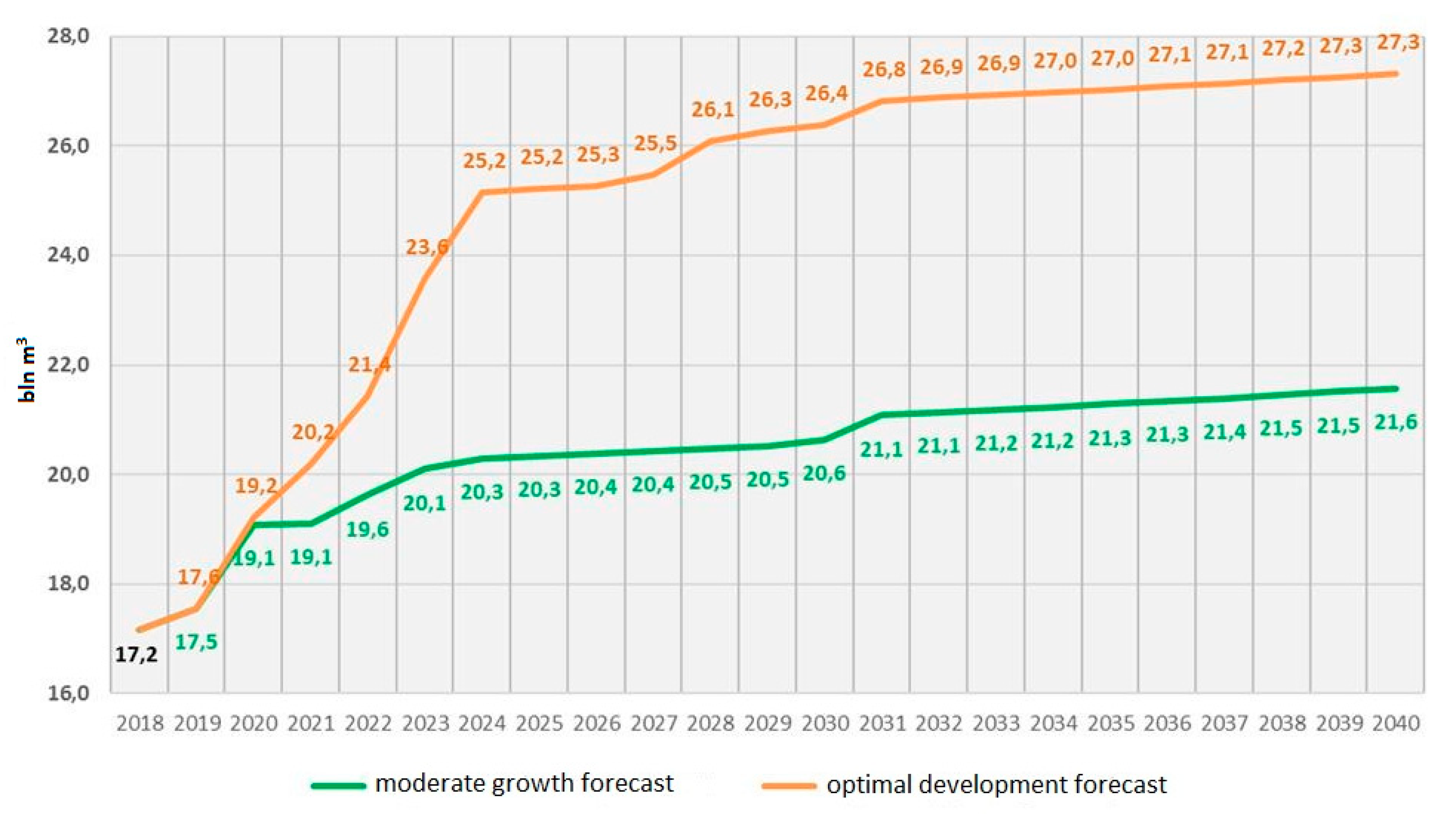

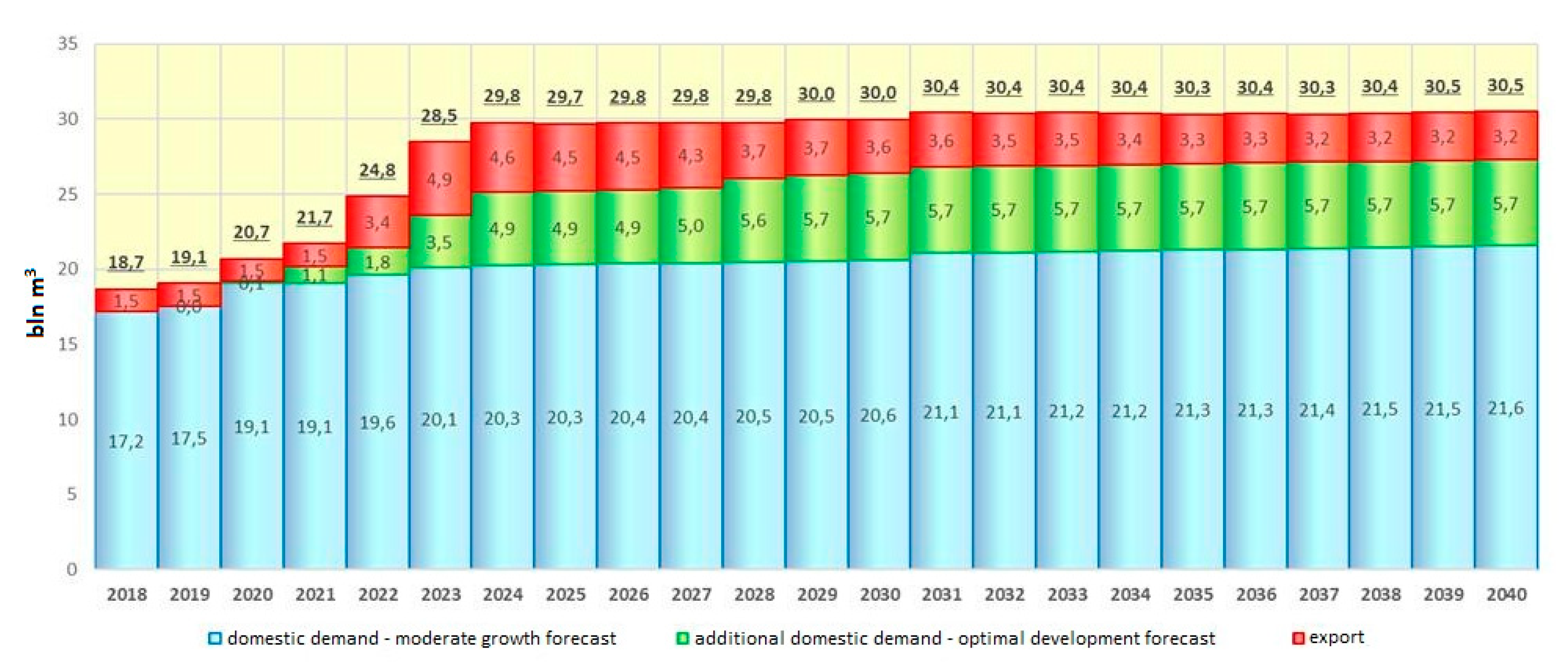

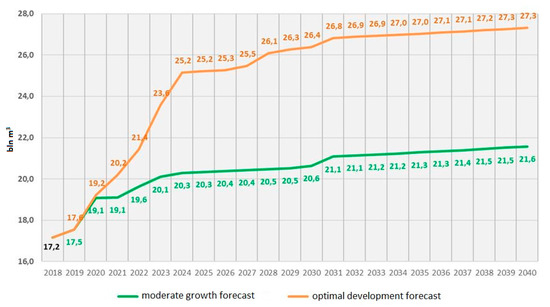

The development of the transmission system also depends on the expected growth in gas demand and transmission demand. The “National Development Plan for the Years 2020–2029” specifies two potential transmission demand forecasts for between 2018 and 2040. Both forecasts are based on gas-use data provided by Statistics Poland. The data specifies gas use in accordance with administrative units and customer groups from 2009–2017. It also includes a report from GAZ-SYSTEM S.A. that is based on billing data from the years 2010–2017, the analysis of transmission system performance in the same time period, the analysis of investment plans in the power engineering sector based on signed gas connection contracts, and the issuance to potential customers from this economy sector of technical conditions for connection to the gas network. Key factors influencing transmission demand in 2018–2040 are GDP growth, the production of electrical energy and heat based on natural gas, and the price of gas [40] (p. 19). Bearing all the above in mind, two forecasts emerged: a moderate growth forecast and an optimal development forecast. The former predicts the growth of production of electrical energy and heat based on signed contracts and ongoing investments, slow GDP growth, potential recession, as well as rising gas prices due to high demand in the EU (gas imports from Russia). The latter anticipates the growth of production of electrical energy and heat based on signed contracts and the most realistic investments, moderate GDP growth, no recession, as well as a moderate increase in gas prices thanks to wider access to the internal EU market and the global LNG market [40].

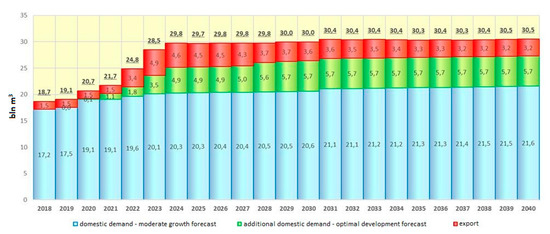

The dynamic growth of gas transmission demand will occur only if natural gas-based power engineering continues to develop. As was pointed out previously, gas consumption will definitely increase in the initial stage of Polish decarbonization (in 2020s), therefore both forecasts predict a growth in demand. The moderate growth forecast assumes it will increase by 3.1 billion m3 in 2030 (from 17.5 bln m3 in 2019 to 20.6 bln m3), while the optimal development forecast predicts an increase of 8.8 billion m3 (from 17.6 bln m3 in 2019 to 26.4 bln m3) (Figure 5).

Figure 5.

Forecast variants—annual demand for the transmission service, bln m3. Based on [40] (p. 22).

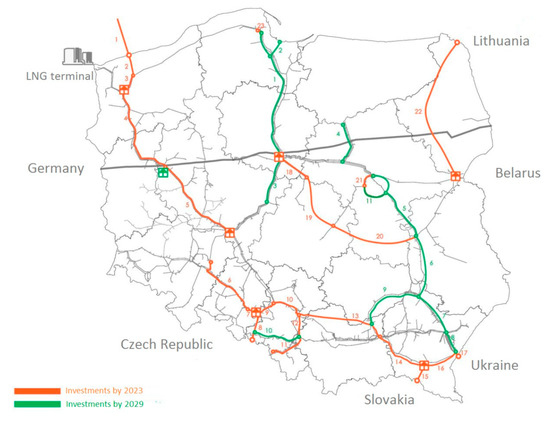

Furthermore, Poland is currently expanding its transit and export potential, especially towards the east and the south (Ukraine, Slovakia) [41], but also the north (Lithuania) [42] (p. 135). Commissioning new interconnectors will significantly increase potential in this regard. Therefore, when forecasting gas transmission demand, one should take into consideration not only the domestic demand for the product but also transit and gas export (Figure 6).

Figure 6.

Demand for the transmission service, including exports, bln m3. Based on [40] (p. 23).

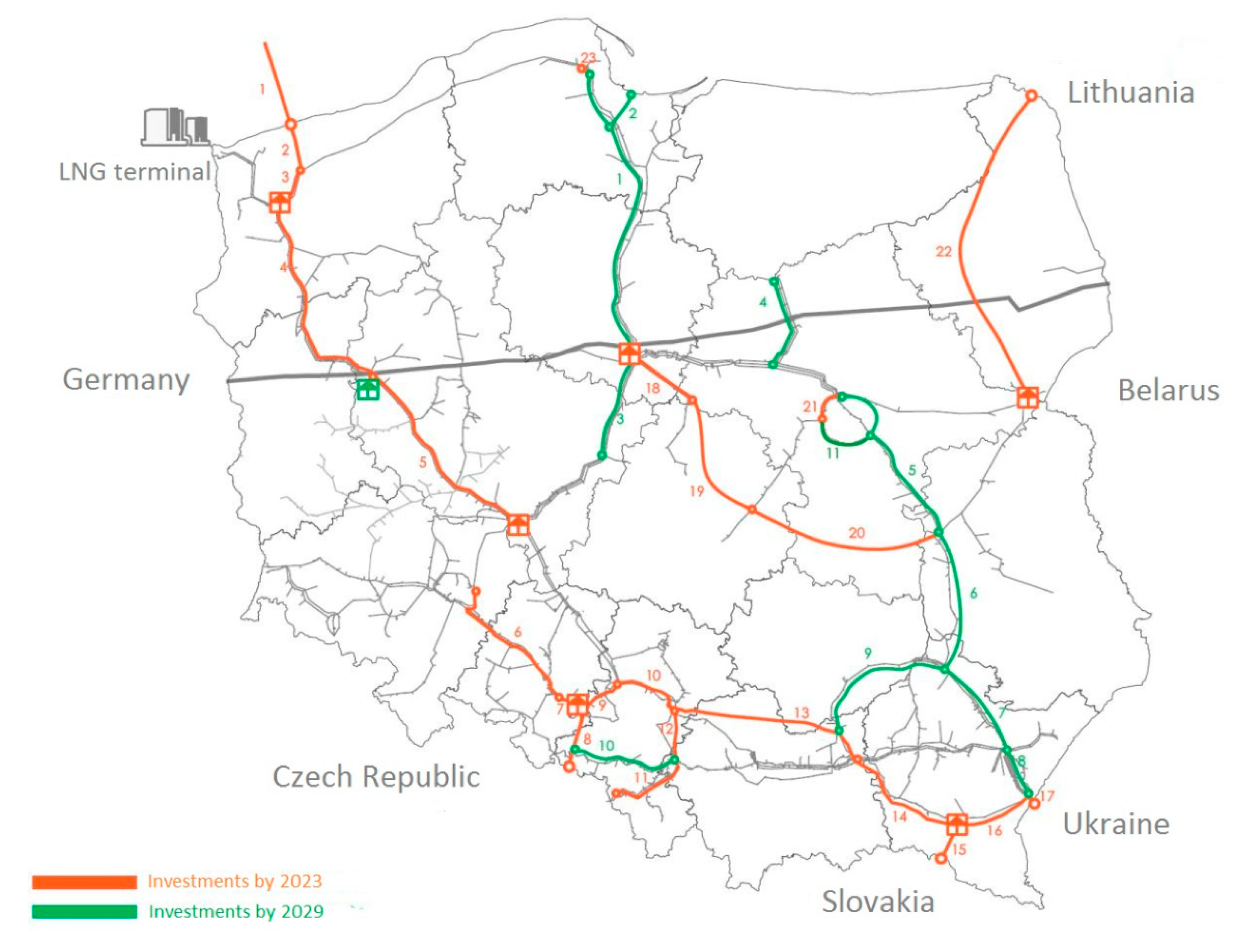

As has been mentioned, there are two different time frames for the investments planned for 2020–2029. The first predicts that the infrastructure investments will be finished by 2023, while the second relates to completion by 2029 (Figure 7, Table 2). Within the next two years, the North-South Gas Corridor project will be realized: building new interconnectors (with Denmark, Lithuania and Slovakia) and underground gas storage facilities, increasing LNG import capacity, expansion of the domestic transmission network, as well as commissioning the Baltic Pipe. In terms of diversification of gas resources and supply directions to Poland and Central Europe, the North-South Gas Corridor is particularly important. The decision to build the Baltic Pipe was made in 2018 and the project has been underway since then. This investment will allow an underground gas pipeline to be commissioned in the North Sea and the Baltic Sea, an extension of the transmission network to Denmark, including the construction of a compressor station in Everdrup, as well as redevelopment of the Polish transmission network, including three compressor stations (Goleniów, Gustorzyn and Odolanów) [43]. In the same year, GAZ-SYSTEM (the Polish gas transmission system operator) and Amber Grid (the Lithuanian gas transmission system operator) signed a Connection Agreement on a gas link between Poland and Lithuania that will substantially increase the countries’ gas distribution capacity [44]. The Poland–Slovakia interconnector will be discussed later in the text. The planned investments clearly indicate that the gas sector in Poland will be intensively developed in the next decade. A total of 3,166 km of new transmission networks will be built by 2029, which will allow for the diversification of gas sources and the gasification of the energy sector of Poland.

Figure 7.

Investments planned in Poland. Based on [40] (p. 25).

Table 2.

Investments in the perspective of 2023 and 2029.

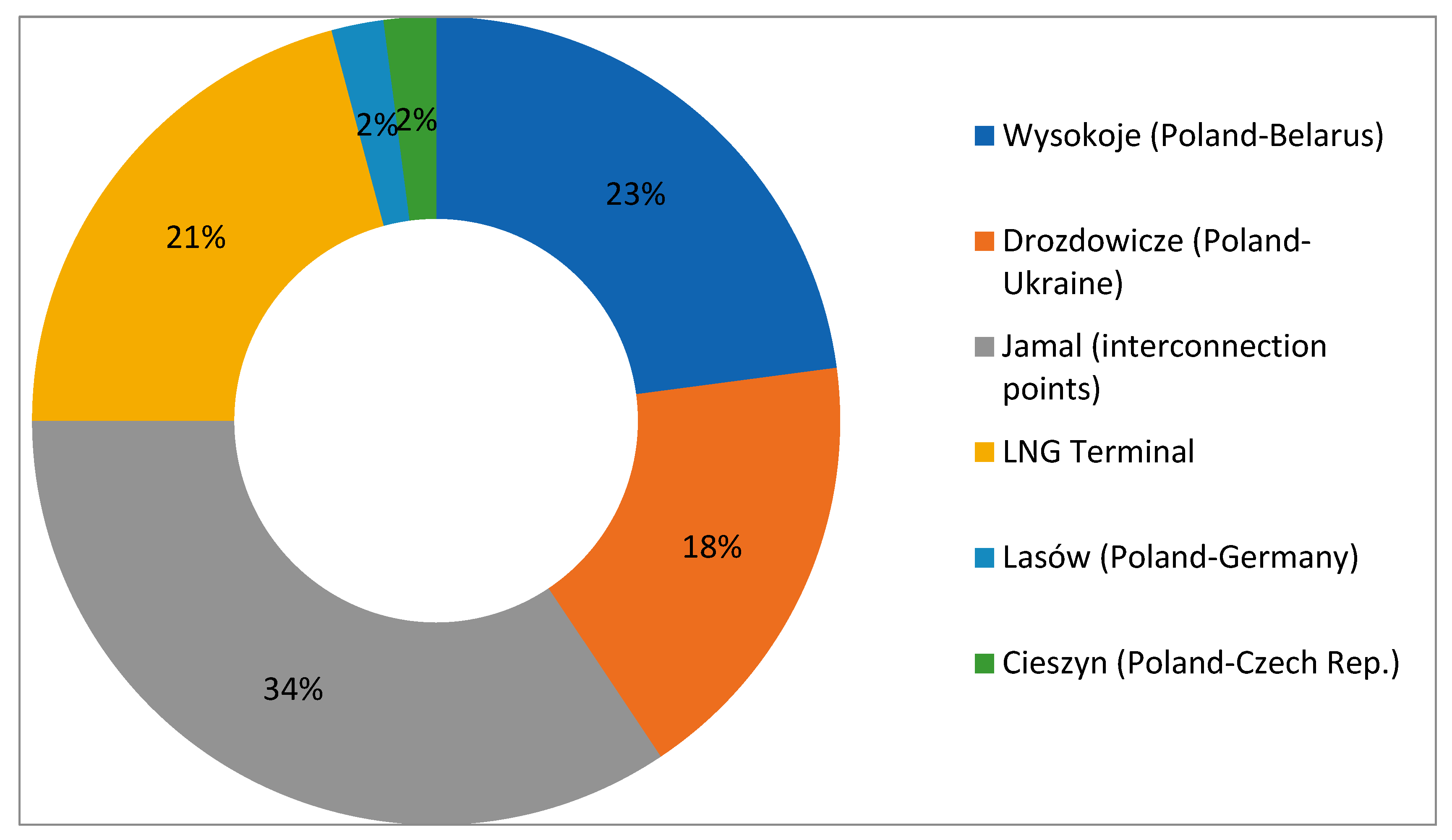

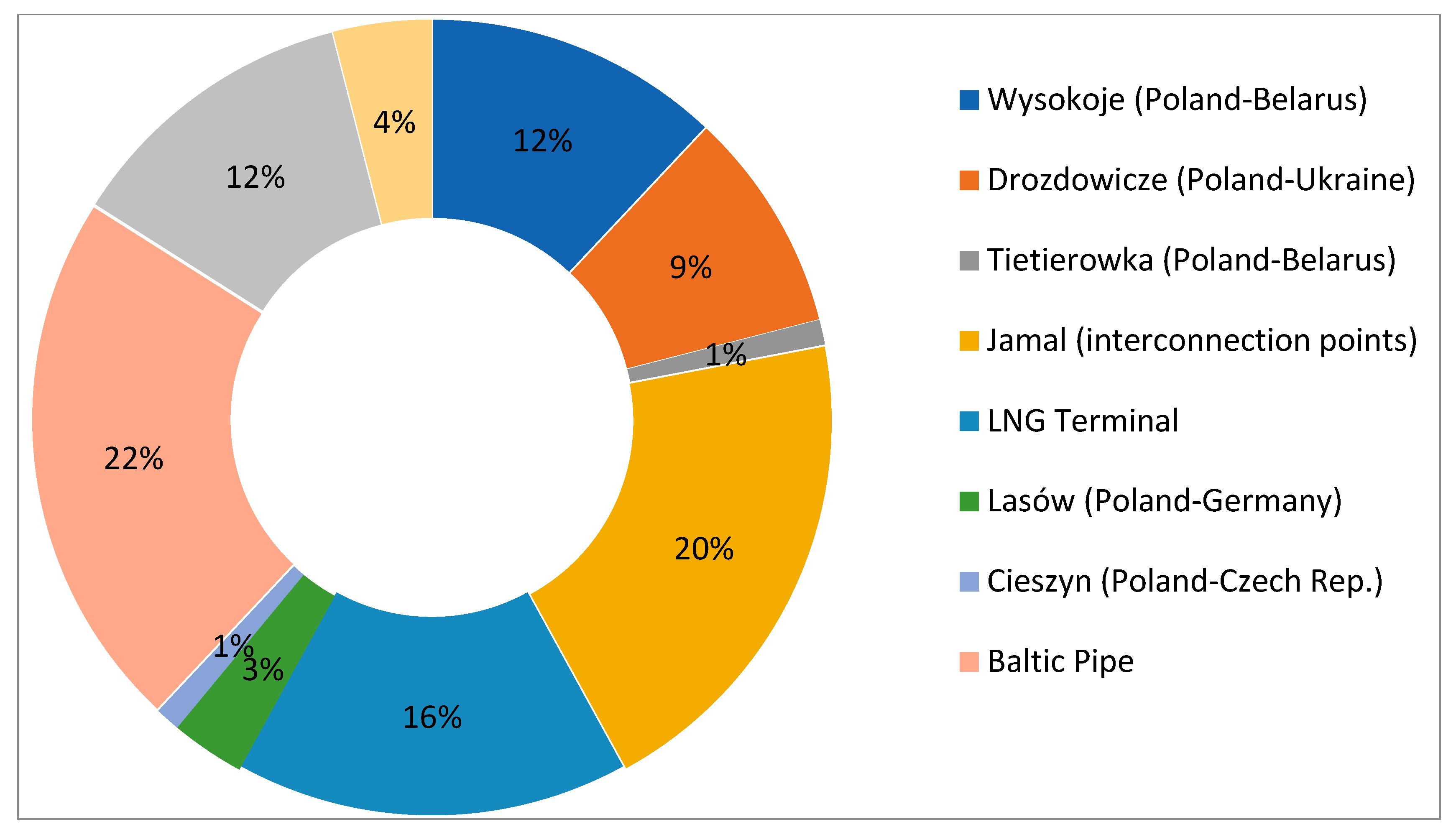

3.2. The Gas Transmission System in Poland—The Effects of the Investment

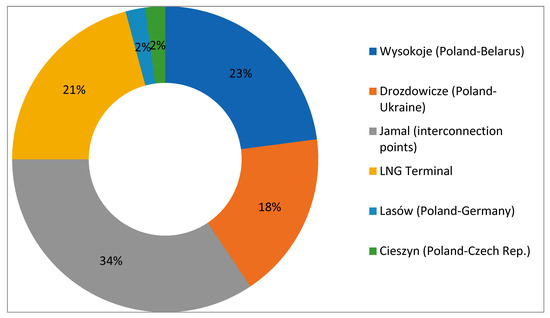

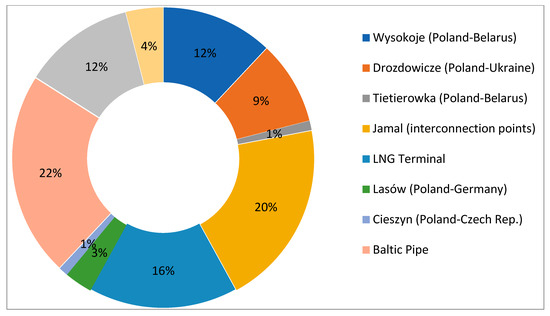

The investments which will be finished by 2023 will facilitate the diversification of the gas resources and supply directions to Poland. In comparison with 2016, the technical capacity on the eastern border is likely to be replaced with delivery from other directions. The capacity of the Wysokoje, Drozdowicze and Jamal interconnection points will decrease from 75% in 2016 to 42% in 2023; however, without a fully operational Baltic Pipe, this will not be possible (Figure 8 and Figure 9). Politically and economically, reducing gas imports from Russia is essential, especially bearing in mind that the agreement with Gazprom will lapse in 2022. Investments will also open access to alternative markets through the Baltic Pipe and interconnectors with neighboring countries. Moreover, by 2029 the domestic gas pipeline network will have expanded by 3000 km, which will enhance the gasification process in the energy sector. The expansion of gas infrastructure might make Poland a transition country and, consequently, strengthen its position on the regional gas market [40] (pp. 28–30).

Figure 8.

Interconnector capacity in 2016. Own work, based on [40] (p. 28).

Figure 9.

Interconnector capacity in 2023. Own work, based on [40] (p. 29).

4. The North-South Gas Corridor—A Perfect Opportunity to Diversify Gas Resources

4.1. The North-South Gas Corridor—Concept and Its Implementation

The idea of the North-South Gas Corridor was conceived by members of the Visegrád Group (V4) during the V4+ regional energy summit in February 2010 in Budapest. In fact, this meeting was an outcome of the gas crisis in 2009, which directly influenced energy security in the region. The summit highlighted the need for greater cooperation in order to integrate gas grids and diversify gas resources and supply directions by building suitable infrastructure [45]. In 2016, twelve Central European countries (the Three Seas Initiative) became involved in a political and economic initiative which aimed to boost gas market development projects in the region. It turned out that the concept of the North-South Gas Corridor appeals not only to V4 countries but also to those which might want to significantly improve their energy security (especially Bulgaria [46] (p. 120), Romania [47] (p. 162), and Serbia [48]).

The North-South Gas Corridor has been a major investment in the energy sector in recent years in Central Europe. In total, the project involves building not only ca. 800 km of new gas pipelines but also 17 major investment projects financed by the countries involved as well as the European Union (Infrastructure and Environment Programme). This initiative has become an infrastructural priority for the EU, i.e., North-South Gas Interconnection in Central and South-Eastern Europe (NSI East Gas). It has also been granted the status of a Project of Common Interests (PCI). The total cost in Poland is estimated to be PLN 4.9 billion (ca. 1.1 billion euro), out of which PLN 2.185 billion (ca. 0.5 billion euro) will be granted by the EU [49].

The main aim of the North-South Gas Corridor is to strengthen the energy security of Central European countries, in particular Poland. The security will be provided by diversification of gas resources and supply directions, regional gas market integration, and greater cooperation in terms of energy. The North-South gas pipeline will guarantee gas supply autonomy for Central European countries as this region still very much depends on Russian supplies [50] (p. 3). Additionally, the corridor plays a vital role in EU strategy, according to which member states should reach climate neutrality within the next three decades. The expansion of gas infrastructure will facilitate the transition from coal to energy sources whose environmental impact is significantly lower; one example is natural gas, which can be used as a separate source of energy or as a fuel, thus stabilizing the renewable energy sources used in the power and heat engineering sector [49]. Other investments which accompany the corridor project should change the traditional model of gas distribution in Central Europe by not relying solely on the East-West direction and introducing a North-South alternative.

Technically, the North-South Gas Corridor will connect the LNG terminal in Świnoujście with the LNG terminal in Croatia through Poland, the Czech Republic, Slovakia and Hungary. It will be constructed with bi-directional gas interconnection points and domestic gas pipelines [51]. Poland and the Czech Republic have had an interconnector since 2011; however, in the near future another interconnector will be constructed that will increase the transmission capacity in both directions (Stork II [52]). The Czechs are also planning to build an interconnector with Austria (BACI [53]). Neither of these projects appeared on the list of investments supported by the EU (Project of Common Interest), which means they might not be realized in the near future [54]. Moreover, the gas infrastructure in Slovakia is also in need of modernization, therefore greater cooperation between CEE countries in recent years should lead to the opening of new gas connections [55]. In 2015, Slovakia commissioned an interconnector on the border with Hungary, and by 2022 the interconnector with Poland will have been finished. Apart from the Slovak interconnector, Hungary also has a shared interconnector with Romania (since 2010) and Croatia (since 2011), but their capacity is insufficient, therefore they need redevelopment [56,57]. In the last two years, some key corridor-related investments have been completed in Croatia. In 2020, reverse gas flow with Hungary was commissioned (until then, gas transmission was possible only from Hungary to Croatia [58]), and the LNG Croatia terminal opened at the beginning of 2021 (its capacity equals 2.6 billion m3 annually) [59]. The North-South Gas Corridor project has not yet been fully realized yet, but there is a good chance that within the next few years the corridor will be sufficiently operative to allow diversification of gas resources and supply directions in Central European countries. The status of the Polish investments in the corridor project is promising. The progress is substantial, and all the projects should be finished by the end of 2022. So far, 10 out of 15 sections of the gas pipeline have been built (Table 3). One of the most distinctive ongoing projects is a 164 km long, two-way interconnector between Poland and Slovakia. Its completion will strengthen the energy security of both countries. This connection will increase gas transmission to 5.7 billion m3 a year to Poland and 4.7 billion m3 to Slovakia. This solution will also increase Polish distribution capacity to the south and facilitate gas import possibilities [60].

Table 3.

Investments within the North-South Gas Corridor implemented in Poland.

4.2. The North-South Gas Corridor—Importance for Poland and Central European Countries

The main reason behind the construction of the North-South Gas Corridor is the transmission capacity it can offer, especially when it comes to gas distribution from Russia in the years to come. One of the most frequently expressed doubts is the necessity to minimize Central European dependency on Russian gas supplies. Bearing in mind the current status of Polish-Russian relations, the renewal of the Yamal Contract (valid until 31 December 2022) appears to be rather controversial. It is likely that at the beginning of 2023 there will be a significant reduction or a complete suspension of gas delivery to Poland via the Yamal gas pipeline. If this occurs, opening Nord Stream II (NS II) might play a major role since the Yamal gas pipeline delivers gas not only to Poland but also to Germany. Commissioning NS II will make it possible to exclude Poland from gas transit from Russia to Germany. Russia will gain sufficient leverage to exert political and economic pressure by threatening Poland with a gas delivery shut-off (as happened during Ukrainian-Russian gas crises [62,63]). Therefore, if NS II is commissioned as planned (at the end of 2022), and if Poland does not manage to diversify gas directions and supply resources by then, its energy security in the gas sector will be undermined. In such a situation, Poland will be unable to stop using Russian gas, which may, in turn, lead to renewal of the Yamal Contract under unfavorable conditions yet again. However, if Poland manages to guarantee gas delivery from other directions and sources within the next months, this might force Gazprom to negotiate a contract tailored to Polish needs or even to terminate the agreement. Completely giving up Russian gas might, in fact, be economically unjustified, especially when we take into consideration the expected process of gasification in Poland in the near future. If there is a chance to suspend gas delivery from Russia by the end of 2022, the Polish position in the negotiation with Gazprom will be sufficiently strong to work out favorable conditions for a future agreement (in terms of both price and quantity).

The current status of the North-South Gas Corridor project gives hope that it will be operative within the next two years. By 2021, gas pipelines (in Poland) will be operational, and by 2022 the interconnector with Slovakia and the Baltic Pipe will come online. It is also worth mentioning that their capacity will equal 15.7 billion m3 a year, which will substantially influence the potential for diversification of gas sources and direction of supplies to Poland. Clearly, there are some separate issues that will have to be addressed, such as signing agreements with potential suppliers, or, in the case of Slovakian interconnector, the capacity of the domestic gas grid and gas interconnectors with neighboring countries (especially with Hungary). Expansion of the gas infrastructure network in Hungary, Croatia and the Czech Republic is of crucial importance for Poland in order to have gas imported from the south. Hungary has already announced that the capacity of the interconnector with Slovakia will be increased to 5 billion m3 a year by the end of 2024 [57]. As was already mentioned, reverse gas flow from Croatia to Hungary started in 2020, which made it technically possible to provide gas transmission from the south to Poland. The opening of the FSRU terminal in Croatia (at the beginning of 2021) has increased the potential for diversification even more, although its capacity is rather low (2.6 billion m3 a year). Increasing these capacities will have to be a priority if we take into consideration potential gas distribution to Poland. As a matter of fact, one of the main gas importers from the Croatian FSRU terminal will be Hungary [64], which—similarly to Poland—seeks greater autonomy from Russian supplies. Unfortunately, what has put the gas corridor project on hold is delayed or frozen investment in the Czech Republic. These canceled or suspended projects mostly concern interconnectors with Poland and Austria; therefore, Poland’s current distribution capacity is extremely limited—the Czech-Polish interconnector has very low capacity (0.5 billion m3 a year) and without expanding it any further its role would be rather symbolic.

The North-South Gas Corridor offers a chance to diversify gas sources and supply directions not only to Poland but also to Central European countries [65]. This is an outcome which Poland and other countries in the region want or have to accomplish. Furthermore, the success of this investment would also open the possibility of creating a regional gas hub in Poland, which will enhance the Polish position in the region in terms of energy security. Promoting political, economic and social partnership within the Visegrád Group or the Three Seas Initiative will lead to close energy cooperation between these countries [66]. It should be remembered that, in comparison with the year 2020, the expected parameters of the cross-border entry points to the gas transmission system in Poland will be increased by 55% in 2025 (ca. 102 billion m3 a year in 2025 versus ca. 66 billion m3 in 2020) [15] (p. 28). It seems clear that the pipe sections of the North-South Gas Corridor are crucial for increasing gas transmission capacity. Other factors which will definitely increase this capacity are the full functionality of the Baltic Pipe and LNG terminals (in Świnoujście and the FSRU that is planned near Gdańsk Bay). Taking into consideration the relatively small amounts of gas consumed in Central European countries as well as the expected growth in gas demand, it should be pointed out that doubling the capacity of the entry points of the Polish gas transmission system will increase the chance of setting up a regional gas hub. Increasing gas storage capacity will also be an important factor, especially in the context of a potential gas crisis, such as limited or irregular gas delivery from Russia.

The North-South Gas Corridor will undoubtedly contribute to the development of the gas sector in Poland and will also play a crucial part in the process of decarbonization of the Polish energy sector. As we already know, the energy sector in Poland is still mainly based on coal, but within the next few decades it is planned that this will be replaced with low-carbon energy sources. The most profitable of which are unquestionably renewable energy sources which successfully replace fossil fuels; however, it seems that the Polish situation is more challenging than in other EU countries. Naturally, the transition from carbon-based energy to green energy within a decade or two is possible; however, what makes Poland’s case even more problematic is the obligation to guarantee its energy security. That is why the process of decarbonization needs a transition period (several years at least), which will allow for the gradual redevelopment of the Polish energy sector. The process of a systematic reduction of coal use ought to be accompanied by growth in green energy and natural gas consumption. Additionally, building a nuclear power plant might be unavoidable (initially planned for 2033 [67]) [68]. In the near future, natural gas will function as a transition fuel that also supports renewable energy sources in the Polish energy sector. It seems clear that gas will be of key importance for the Polish energy sector. In 2020–2040, the net capacities of electrical energy sources in heat and power plants that run on gas will grow systematically from 2688 MW in 2020 to 8521 MW in 2040. This means an increase in the share of natural gas in electricity generation from 5.53% to 11.82% (Table 4).

Table 4.

The forecast share of natural gas in electricity generation, MW.

Is the North-South Gas Corridor a chance for Poland to diversify gas sources and directions? The answer is yes. Although the project has encountered some construction obstacles (e.g., in the Czech Republic), it is undoubtedly the most important investment of the last decade in the gas sector in Poland and other Central European countries. The completion of this project will strengthen the region by giving the autonomy (partial or full) from Russian gas delivery (some studies shows that Russia will not dominate European imports in the near future [69,70,71,72]). Central Europe (including Poland) will become a highly competitive area of growing strategic (economic) importance. As its name suggests, the North-South Gas Corridor will facilitate gas distribution from both directions and from a chosen source (LNG terminals, the Baltic Pipe). This will provide alternatives for traditional gas import from the east (Russia). Since political and economic relations between Poland and Russia have been strained for many decades, this issue remains of crucial importance for Poland.

5. Conclusions

Poland has to redevelop its energy sector in a relatively short time. At the moment, coal still remains Poland’s main energy source, which is a problem because the EU aims to achieve a zero-emission goal. One possible solution is investments in renewable energy sources. In this, Poland has made significant progress, mostly in the wind power sector. Unfortunately, these investments have been insufficient and have not resulted in decreased use of coal. For this reason, gasification of the Polish energy sector might be a more favorable solution. Additionally, the process of decarbonization could proceed in a harmonious way without putting energy security at risk, as a reduction in coal use would be accompanied by gasification and would be supported by renewable sources (along with nuclear power in the 2030s). It seems that this method will enable “coal” countries such as Poland to progress smoothly through the process of energy transformation. However, gas deliveries might pose some problems because Poland, along with other CEE countries (especially Slovakia [73]), imports gas mostly from Russia, which creates dependency.

For Poland and other Central European countries, the North-South Gas Corridor is a real chance to diversify the sources and directions of the gas supply. The main advantage of the corridor is that it strengthens Poland’s energy security and provides autonomy from Russia, which has long been the key or the only gas supplier to Central European countries. Completion of the corridor will definitely contribute to regular and sufficient gas deliveries to customers. It will also improve the technical condition of the domestic gas grid, enable export and import through interconnectors, and provide access to LNG (from the north—Świnoujście in Poland; from the south—Krk in Croatia). Additionally, making the corridor fully functional by the end of 2022 (by commissioning the Baltic Pipe and expansion of gas terminal in Świnoujście) will contribute to a reduction in Russian gas import, which is especially crucial if we take into consideration the potential renewal of the Yamal Contract.

Nevertheless, there have already been some complications related to the construction of the North-South Gas Corridor. Although investments in Poland will enable gas transmission to the south, the lack of interconnectors or their low capacity will reduce distribution to Central European countries, i.e., the Czech Republic, Slovakia or Hungary. Likewise, gas transmission from Croatia to Poland seems similarly problematic. Therefore, there is a great need for investments that develop the gas sectors in all the countries involved in the construction of the North-South Gas Corridor.

In summary, when it is functioning, the North-South Gas Corridor will have many advantages. Poland will increase its ability to decarbonize the energy sector and will also become the main country distributing gas in the south. This, in turn, will strengthen Poland’s position globally. The corridor could also contribute to establishing an internal energy market across the whole region. This will integrate the gas markets in CEE and Baltic countries, which might improve competition in the market and the security of gas supplies [74,75,76]. It could also influence free trade in energy, which will lead to optimization of network capacity by removing the so called “choke points” which are currently hampering the transmission between the north and the south.

In fact, the issue presented in the paper has not been sufficiently discussed and calls for further research, especially in the context of dynamic changes which are taking place in the gas sector of Poland and other CEE countries. Therefore, analysis and evaluation of the North-South Gas Corridor project should be discussed in a longer time perspective, in particular when the outcome of the corridor becomes visible. Nevertheless, this paper highlights an issue of utmost importance: the significance of the North-South Gas Corridor project, which might be a milestone for the energy transformation of CEE countries and might determine the further process of decarbonization.

Funding

The proofreading/translation/open access license and/or publishing fee of the publication was funded by the Priority Research Area Society of the Future under the programme “Excellence Initiative–Research University” at the Jagiellonian University in Krakow.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The author declares no conflict of interest.

References

- Sadik-Zada, E.R.; Gatto, A. Energy Security Pathways in South East Europe: Diversification of the Natural Gas Supplies, Energy Transition, and Energy Futures. In From Economic to Energy Transition. Three Decades of Transitions in Central and Eastern Europe; Mišík, M., Oravcová, V., Eds.; Springer International Publishing: Cham, Switzerland, 2021; pp. 491–514. [Google Scholar] [CrossRef]

- Holz, F.; Richter, P.M.; Egging, R. The Role of Natural Gas in a Low-Carbon Europe: Infrastructure and Supply Security. Energy J. 2016, 37, 33–59. [Google Scholar] [CrossRef]

- Papadis, E.; Tsatsaronis, G. Challenges in the decarbonization of the energy sector. Energy 2020, 205, 118025. [Google Scholar] [CrossRef]

- Bataille, C.; Åhman, M.; Neuhoff, K.; Nilsson, L.J.; Fischedick, M.; Lechtenböhmer, S.; Solano-Rodriquez, B.; Denis-Ryan, A.; Stiebert, S.; Waisman, H.; et al. A review of technology and policy deep decarbonization pathway options for making energy-intensive industry production consistent with the Paris Agreement. J. Clean. Prod. 2018, 187, 960–973. [Google Scholar] [CrossRef]

- Wilson, C.; Grubler, A.; Bento, N.; Healey, S.; De Stercke, S.; Zimm, C. Granular technologies to accelerate decarbonization. Science 2020, 368, 36–39. [Google Scholar] [CrossRef] [PubMed]

- Karlsson, I.; Rootzén, J.; Toktarova, A.; Odenberger, M.; Johnsson, F.; Göransson, L. Roadmap for Decarbonization of the Building and Construction Industry—A Supply Chain Analysis Including Primary Production of Steel and Cement. Energies 2020, 13, 4136. [Google Scholar] [CrossRef]

- Mercader-Moyano, P.; Roldán-Porras, J. Evaluating Environmental Impact in Foundations and Structures through Disaggregated Models: Towards the Decarbonisation of the Construction Sector. Sustainability 2020, 12, 5150. [Google Scholar] [CrossRef]

- Mallouppas, G.; Yfantis, E. Decarbonization in Shipping Industry: A Review of Research, Technology Development, and Innovation Proposals. J. Mar. Sci. Eng. 2021, 9, 415. [Google Scholar] [CrossRef]

- Csedő, Z.; Zavarkó, M.; Vaszkun, B.; Koczkás, S. Hydrogen Economy Development Opportunities by Inte-Organizational Digital Knowledge Networks. Sustainability 2021, 13, 9194. [Google Scholar] [CrossRef]

- Haas, T.; Sander, H. Decarbonizing Transport in the European Union: Emission Performance Standards and the Perspectives for a European Green Deal. Sustainability 2020, 12, 8381. [Google Scholar] [CrossRef]

- Misztal, A.; Kowalska, M.; Fajczak-Kowalska, A.; Strunecky, O. Energy Efficiency and Decarbonization in the Context of Macroeconomic Stabilization. Energies 2021, 14, 5197. [Google Scholar] [CrossRef]

- Gillingham, K.; Huang, P. Is Abundant Natural Gas a Bridge to a Low-carbon Future or a Dead-end? Energy J. 2019, 40, 1–26. [Google Scholar] [CrossRef]

- Kosowski, P.; Kosowska, K. Valuation of Energy Security for Natural Gas—European Example. Energies 2021, 14, 2678. [Google Scholar] [CrossRef]

- Yermakov, V.; Sobczak, K. Russia-Poland gas relationship: Risk and uncertainties of the ever after. The Oxford Institute for Energy Studies. Energy Insight 2020, 70, 1–32. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2020/06/Russian-Poland-gas-relationship-risks-and-uncertainties-Insight-70.pdf (accessed on 25 July 2021).

- Jakóbik, W. Poland Will Need 2.6–8.4 Billion Cubic Meters More Gas (Polska będzie potrzebowła o 2.6–8.4 miliardów metrów sześciennych gazu więcej); Biznes Alert: Warsaw, Poland, 2019; Available online: https://biznesalert.pl/polska-gaz-26-84-mld-m-szesc-wiecej-gaz-system-plan/ (accessed on 25 July 2021). (In Polish)

- Sobczyk, W.; Sobczyk, E. Varying the Energy Mix in the EU-28 and in Poland as a Step towards Sustainable Development. Energies 2021, 14, 1502. [Google Scholar] [CrossRef]

- European Council. Council of the European Union. Latest EU Policy Actions on Climate Change; European Council. Council of the European Union: Brussels, Belgium, 2021; Available online: https://www.consilium.europa.eu/en/policies/climate-change/eu-climate-action/ (accessed on 25 July 2021).

- United Nations. Article 2. Paris Agreement; United Nations: Paris, France, 2015; Available online: https://unfccc.int/sites/default/files/english_paris_agreement.pdf (accessed on 25 July 2021).

- European Commission. The European Green Deal, Communication from the Commission to the European Parliament, the European Council, the Council. In Proceedings of the European Economic and Social Committee and the Committee of the Regions, COM (2019) 640 Final, Brussels, Belgium, 11 December 2019; European Commission: Brussels, Belgium, 2019. Available online: https://ec.europa.eu/info/sites/default/files/european-green-deal-communication_en.pdf (accessed on 25 July 2021).

- Tichý, L.; Dubský, Z. Russian energy discourse on the V4 countries. Energy Policy 2019, 137, 111128. [Google Scholar] [CrossRef]

- Mišík, M. On the way towards the Energy Union: Position of Austria, the Czech Republic and Slovakia towards external energy security integration. Energy 2016, 111, 68–81. [Google Scholar] [CrossRef]

- Szuflicki, M.; Malon, A.; Tymiński, M. The Balance of Mineral Resources Deposit in Poland as of 31 December 2020 (Bilans zasobów złóż kopalnych wg stanu na 31 XII 2020); Państwowy Instytut Geologiczny—Państwowy Instytut Badawczy, Państwowa Służba Geologiczna: Warszawa, Poland, 2021. Available online: http://geoportal.pgi.gov.pl/css/surowce/images/2020/bilans_2020.pdf (accessed on 25 July 2021). (In Polish)

- Gawlik, L.; Mokrzycki, E. Changes in the Structure of Electricity Generation in Poland in View of the EU Climate Package. Energies 2019, 12, 3323. [Google Scholar] [CrossRef]

- Nyga-Łukaszewska, H.; Aruga, K.; Stala-Szlugaj, K. Energy Security of Poland and Coal Supply: Price Analysis. Sustainability 2020, 12, 2541. [Google Scholar] [CrossRef]

- Jędra, M. Energy Transformation in Poland, 2021st ed.; (Transformacja Energetyczna w Polsce. Edycja 2021); Forum Energii: Warsaw, Poland, 2021; Available online: https://www.forum-energii.eu/pl/analizy/transformacja-2021 (accessed on 25 July 2021). (In Polish)

- Adamus, W.; Florkowski, W.J. The evolution of shale gas development and energy security in Poland: Presenting a hierarchical choice of priorities. Energy Res. Soc. Sci. 2016, 20, 168–178. [Google Scholar] [CrossRef]

- LaBelle, M. A state of fracking: Building Poland’s national innovation capacity for shale gas. Energy Res. Soc. Sci. 2017, 23, 26–35. [Google Scholar] [CrossRef]

- Polish Geological Institute–National Research Institute. Assessment of Recoverable Natural Gas and Crude Oil Resources in Lower Paleozoic Shale Formations of Poland. Baltic-Podlasie-Lublin Basin. (Ocena zasobów Wydobywalnych gazu Ziemnego i ropy Naftowej w Formacjach Łupkowych Dolnego Paleozoiku w Polsce); Państwowy Instytut Geologiczny–Państwowy Instytut Badawczy: Warszawa, Poland, 2012. Available online: https://www.pgi.gov.pl/docman-tree/aktualnosci-2012/zasoby-gazu/771-raport-pl/file.html (accessed on 25 July 2021). (In Polish)

- Polish Oil Mining and Gas Extraction SA. Stable Increase in the Production of Natural Gas and Crude Oil (Stabilny Wzrost Wydobycia Gazu Ziemnego i Ropy Naftowej); Polskie Górnictwo Naftowe i Gazownictwo SA: Warszawa, Poland, 2019; Available online: https://pgnig.pl/aktualnosci/-/news-list/id/stabilny-wzrost-wydobycia-gazu-ziemnego-i-ropy-naftowej/newsGroupId/10184 (accessed on 25 July 2021). (In Polish)

- Polish Oil Mining and Gas Extraction SA. PGNiG: Less Gas from Russia, LNG Imports are Growing (PGNiG: Mniej Gazu z Rosji, Rośnie Import LNG); Polskie Górnictwo Naftowe i Gazownictwo SA: Warszawa, Poland, 2020; Available online: https://pgnig.pl/aktualnosci/-/news-list/id/pgnig-mniej-gazu-z-rosji-rosnie-import-lng/newsGroupId/10184?changeYear=2020¤tPage=1 (accessed on 25 July 2021). (In Polish)

- Macuk, R. Energy Transformation in Poland, 2020th ed.; (Transformacja Energetyczna w Polsce. Edycja 2020); Forum Energii: Warsaw, Poland, 2021; Available online: https://www.forum-energii.eu/pl/dane-o-energetyce/za-rok-2019 (accessed on 25 July 2021). (In Polish)

- Cieślik, T.; Górowska, K.; Metelska, K.; Szurlej, A. Natural gas consumption by voivodships. (Zużycie gazu ziemnego w podziale na województwa). Nierówności Społeczne A Wzrost Gospod. 2018, 54, 190–205. Available online: http://yadda.icm.edu.pl/yadda/element/bwmeta1.element.ekon-element-000171518258 (accessed on 25 July 2021). (In Polish) [CrossRef]

- Polish Oil Mining and Gas Extraction SA. Company Presentation. (Prezentacja Spółki); Polskie Górnictwo Naftowe i Gazownictwo SA: Warszawa, Poland, 2019; Available online: https://pgnig.pl/documents/10184/2580770/Company-Overview_PL_May2019.pdf/5da1eb13-8aaf-47ef-93b2-a8a18a6aae5c (accessed on 25 July 2021). (In Polish)

- Pietrzak, M.; Igliński, B.; Kujawski, W.; Iwański, P. Energy Transition in Poland—Assessment of the Renewable Energy Sector. Energies 2021, 14, 2046. [Google Scholar] [CrossRef]

- Marks-Bielska, R.; Bielski, S.; Pik, K.; Kurowska, K. The Importance of Renewable Energy Sources in Poland’s Energy Mix. Energies 2020, 13, 4624. [Google Scholar] [CrossRef]

- Electric Market. In June, Almost 540 MW of Installed Capacity RES Was Added. (W Czerwcu Przybyło Prawie 540MW Mocy Zainstalowanej OZE); Rynek Elektryczny: Warszawa, Poland, 2021; Available online: https://www.rynekelektryczny.pl/moc-zainstalowana-oze-w-polsce/ (accessed on 25 July 2021). (In Polish)

- Ministry of Climate and Environment. Poland’s Energy Policy Until 2040. (Ministerstwo Klimatu i Środowiska. Polityka Energetyczna Polski do 2040 r.); Ministry of Climate and Environment: Warszawa, Poland, 2021. Available online: https://www.gov.pl/web/klimat/polityka-energetyczna-polski (accessed on 25 July 2021). (In Polish)

- Ruszel, M. Evaluation of the Security of Natural Gas Supplies to Poland: The Present State and the 2025 Perspective. (Ocena bezpieczeństwa dostaw gazu ziemnego do Polski—Stan obecny i perspektywa do 2025 r.). Polityka Energetyczna–Energy Policy J. 2017, 20, 5–22. Available online: https://epj.min-pan.krakow.pl/Evaluation-of-the-security-of-natural-gas-supplies-to-Poland-nthe-present-state-and,96155,0,2.html (accessed on 25 July 2021). (In Polish).

- Olkuski, T.; Sikora, A.; Sikora, M.P.; Szurlej, A. The forecasted production, consumption, and net exports of energy resources in Poland. (Prognozy wydobycia, konsumpcji i saldo wymiany surowców energetycznych w Polsce). Polityka Energetyczna–Energy Policy J. 2017, 20, 41–58. Available online: https://epj.min-pan.krakow.pl/The-forecasted-production-consumption-and-net-exports-of-nenergy-resources-in-Poland,96167,0,2.html (accessed on 25 July 2021). (In Polish).

- Gas Transmission Operator GAZ-SYSTEM SA. National Ten-Year Transmission System Development Plan. Development Plan for Satisfying the Current and Future Transmission Demand for Natural Gas for 2020–2029. Excerpt. (Krajowy Dziesięcioletni plan Rozwoju Systemu Przesyłowego. Plan Rozwoju w Zakresie Zaspokojenia Obecnego i Przyszłego Zapotrzebowania na Paliwa Gazowe na lata 2020-2029. Wyciąg); GAZ-SYSTEM SA: Warszawa, Poland, 2019; Available online: https://www.gaz-system.pl/fileadmin/Krajowy_Dziesiecioletni_Plan_Rozwoju_Systemu_Przesylowego_na_lata_2020-2029_01.pdf (accessed on 25 July 2021). (In Polish)

- Kuś, P. Construction of a Gas Interconnection between Poland and Slovakia; GAZ-SYSTEM SA: Warszawa, Poland, 2019; Available online: https://en.gaz-system.pl/fileadmin/pliki/open-season/02_CONSTRUCTION_OF_A_GAS_INTERCONNECTION_BETWEEN_POLAND_AND_SLOVAKIA.pdf (accessed on 25 July 2021).

- International Energy Agency. Lithuania 2021, Energy Policy Review; International Energy Agency (IEA): Paris, France, 2021; Available online: https://iea.blob.core.windows.net/assets/4d014034-0f94-409d-bb8f-193e17a81d77/Lithuania_2021_Energy_Policy_Review.pdf (accessed on 25 July 2021).

- Baltic Pipe Project. Offshore Gas Pipeline-Implementation Stage. Available online: https://www.baltic-pipe.eu/wp-content/uploads/2020/08/BalticPipe-Project-Implementation-Stage.pdf (accessed on 25 July 2021).

- Gas Transmission Operator GAZ-SYSTEM SA. Gaz-System and Amber Grid Made Positive Investment Decision Regarding Construction of Gas Interconnector between Poland and Lithuania; GAZ-SYSTEM SA: Warszawa, Poland, 2018; Available online: https://en.gaz-system.pl/press-centre/news/information-for-the-media/artykul/202756/ (accessed on 25 July 2021).

- Visegrad Group. Declaration of the Budapest V4+ Energy Security Summit; Visegrad Group: Budapest, Hungary, 2010; Available online: https://www.visegradgroup.eu/2010/declaration-of-the (accessed on 25 July 2021).

- Hebda, W. Energy strategy of the Republic of Bulgaria until the year 2020. (Strategia energetyczna Republiki Bułgarii do 2020 roku). Polityka Energetyczna–Energy Policy J. 2015, 18, 111–128. Available online: https://epj.min-pan.krakow.pl/Energy-strategy-of-the-Republic-of-Bulgaria-until-nthe-year-2020,96087,0,2.html (accessed on 25 July 2021). (In Polish).

- Hebda, W. Politics and Energy Sector in the Selected Countries of Southeast Europe. Serbia, Croatia, Bulgaria, Greece, Romania (Polityka oraz sektor energetyczny w wybranych państwach Europy Południowo-Wschodniej. Serbia, Chorwacja, Bułgaria, Grecja, Rumunia); Księgarnia Akademicka: Kraków, Poland, 2019; pp. 145–168. Available online: https://ruj.uj.edu.pl/xmlui/handle/item/245414 (accessed on 25 July 2021). (In Polish)

- Pavlović, B.; Ivezić, D.; Živković, M. Prioritization of strategic measures for strengthening the security of supply of the Serbian natural gas sector. Energy Policy 2021, 148, 111936. [Google Scholar] [CrossRef]

- Dominiak, I.; North-South Corridor. The International Gas Main with Poland in the Lead Role. (Korytarz Północ-Południe. Międzynarodowa Magistrala Gazowa z Polską w roli Głównej); Krakow, Poland, 3 December 2020. Available online: https://wydarzenia.interia.pl/artykul-sponsorowany/news-korytarz-polnoc-poludnie-miedzynarodowa-magistrala-gazowa-z-,nId,4893296 (accessed on 25 July 2021). (In Polish).

- Rqiq, Y.; Beyza, J.; Yusta, J.M.; Bolado-Lavin, R. Assessing the Impact of Investments in Cross-Border Pipelines on the Security of Gas Supply in the EU. Energies 2020, 13, 2913. [Google Scholar] [CrossRef]

- Gas Transmission Operator GAZ-SYSTEM SA. North-South Gas Corridor; GAZ-SYSTEM SA: Warszawa, Poland, 2021; Available online: https://en.gaz-system.pl/nasze-inwestycje/integracja-z-europejski-systemem/korytarz-polnoc-poludnie/ (accessed on 25 July 2021).

- Net4gas. Czech-Polish Gas Interconnector; Net4gas: Prague, Czech Republic, 2016; Available online: https://www.net4gas.cz/files/en/projects/n4g_pci_info_leaflet_storkii_en.pdf (accessed on 25 July 2021).

- Net4gas. Bidirectional Austrian-Czech Interconnection; Net4gas: Prague, Czech Republic, 2016; Available online: https://www.net4gas.cz/files/en/projects/n4g_pci_info_leaflet_baci_en.pdf (accessed on 25 July 2021).

- Sawicki, B. The Construction of the New Gas Connection between Poland and the Czech Republic Is Suspended (Realizacja Nowego Połączenia Gazowego Między Polską a Czechami Zostaje Zawieszona); Biznes Alert: Warsaw, Poland, 2020; Available online: https://biznesalert.pl/gazociag-polska-czechy-stork-ii-zawieszony-gaz-systemnet4gas-gaz-energetyka/ (accessed on 25 July 2021). (In Polish)

- Mišík, M.; Nosko, A. The Eastring gas pipeline in the context of the Central and Eastern European gas supply challenge. Nat. Energy 2017, 11, 844–848. [Google Scholar] [CrossRef]

- SEE Energy News. Romania-Hungary Gas Interconnection Not Enough Demand for Capacity Increase; Serbia Energy: Belgrade, Serbia, 2020; Available online: https://serbia-energy.eu/romania-hungary-gas-interconnection-not-enough-demand-for-capacity-increse/ (accessed on 25 July 2021).

- Reuters. Hungary to Triple Capacity of Gas Pipeline to Slovakia; Reuters. Commodities News: London, UK, 2020; Available online: https://www.reuters.com/article/hungary-slovakia-gas-interconnector-idAFL8N2DF2M5 (accessed on 25 July 2021).

- Plinacro. Reverse Flow with Hungary Enabled; Plinacro: Zagreb, Croatia, 2020; Available online: https://www.plinacro.hr/default.aspx?id=1131 (accessed on 25 July 2021).

- European Commission. First Croatian LNG Terminal Officially Inaugurated in Krk Island; European Commision: Brussels, Belgium, 2021; Available online: https://ec.europa.eu/inea/en/news-events/newsroom/first-croatian-lng-terminal-officially-inaugurated-krk-island (accessed on 25 July 2021).

- Eustream. Gas Interconnection Poland-Slovakia; Eustream: Bratislava, Slovak Republic, 2017; Available online: https://www.eustream.sk/files/docs/eng/SKPL/PLSK_booklet_2017.pdf (accessed on 25 July 2021).

- Gas Transmission Operator GAZ-SYSTEM SA. Our Investments; GAZ-SYSTEM SA: Warszawa, Poland, 2021; Available online: https://en.gaz-system.pl/nasze-inwestycje/ (accessed on 25 July 2021).

- Jirušek, M. The attitude of the Visegrad Group Countries towards Russian Infrastructural Projects in the gas sector. Energy Policy 2020, 139, 111340. [Google Scholar] [CrossRef]

- Božić, F.; Karasalihović Sedlar, D.; Smajla, I.; Ivančić, I. Analysis of Changes in Natural Gas Physical Flows for Europe via Ukraine in 2020. Energies 2021, 14, 5175. [Google Scholar] [CrossRef]

- Kiss, A.; Selei, A.; Tóth, B.T. A Top-Down Approach to Evaluating Cross-Border Natural Gas Infrastructure Project in Europe. Energy J. 2016, 37, 61–79. [Google Scholar] [CrossRef]

- Figulová, A.; Wertlen, D. Between Energy Security and Energy Transition: Visegrad Gas Hub. In From Economic to Energy Transition. Three Decades of Transitions in Central and Eastern Europe; Mišík, M., Oravcová, V., Eds.; Springer International Publishing: Cham, Switzerland, 2021; pp. 315–339. [Google Scholar] [CrossRef]

- Bieliszczuk, B. Three Seas Initiative: Benefits for Regional Gas Markets and the EU (Trójmorze: Współpraca na Rzecz Unijnego i Regionalnego Rynku Gazu); The Polish Institute of International Affairs: Warszawa, Poland, 2017; Available online: https://pism.pl/publikacje/Tr_jmorze__wsp__praca_na_rzecz_unijnego_i_regionalnego_rynku_gazu (accessed on 25 July 2021). (In Polish)

- Ministry of Climate and Environment. Polish Nuclear Power Program—2020 Version (Ministerstwo Klimatu i Środowiska. Program Polskiej Energetyki Jądrowej—Wersja z 2020 r); Ministry of Climate and Environment: Warszawa, Poland, 2021. Available online: https://www.gov.pl/web/polski-atom/program-polskiej-energetyki-jadrowej-2020-r (accessed on 25 July 2021). (In Polish)

- Gierszewski, J.; Młynarkiewicz, Ł.; Nowacki, T.R.; Dworzecki, J. Nuclear Power in Poland’s Energy Transition. Energies 2021, 14, 3626. [Google Scholar] [CrossRef]

- Holz, F.; Hirschhausen, C.; Kemfert, C. Perspectives of the European Natural Gas Markets Until 2025. Energy J. 2009, 30, 137–150. [Google Scholar] [CrossRef]

- Hartley, P.R.; Medlock, K.B. Potential Futures for Russian Natural Gas Exports. Energy J. 2009, 30, 73–96. [Google Scholar] [CrossRef]

- Ritz, R.A. A Strategic Perspective on Competition between Pipeline Gas and LNG. Energy J. 2019, 40, 195–220. [Google Scholar] [CrossRef]

- Hinchey, N. The Impact of Securing Alternative Energy Sources on Russian-European Natural Gas Pricing. Energy J. 2018, 39, 87–102. [Google Scholar] [CrossRef]

- Kratochvíl, P.; Mišík, M. Bad external actors and good nuclear energy: Media discourse on energy supplies in the Czech Republic and Slovakia. Energy Policy 2020, 136, 111058. [Google Scholar] [CrossRef]

- Dyduch, J.; Skorek, A. Go South! Southern dimension of the V4 states’ energy policy strategies—An assessment of viability and prospect. Energy Policy 2020, 140. [Google Scholar] [CrossRef]

- Baltensperger, T.; Füchslin, R.M.; Krütli, P.; Lygeros, J. European Union gas market development. Energy Econ. 2017, 66, 466–479. [Google Scholar] [CrossRef]

- Ruszel, M. The significance of the Baltic Sea Region for natural gas supplies to the V4 countries. Energy Policy 2020, 146. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).