A Panel Analysis of the Impact of Green Transformation and Globalization on the Labor Share in the National Income

Abstract

:1. Introduction

- increase in exports of goods and services, liberalization of global financial markets, deregulation of antitrust law, company mergers;

- the presence of new entities on the global stage, e.g., international corporations, the emergence and growing importance of regional integration structures;

- new rules and standards of conduct, e.g., respecting human rights, intellectual property, increasing environmental awareness;

- new means of international communication;

- deregulation of the financial market;

- multilateral trade liberalization;

- regional economic integration.

- Goal 1, “No poverty”—aims to eradicate poverty in all its forms in the world.

- Goal 7, “Affordable and clean energy”—aims to ensure stable, sustainable, and modern energy access.

- Goal 8, “Decent work and economic growth”—relates to promoting stable, sustainable and inclusive growth, full and productive employment.

- Goal 10, “Reduced inequalities”—aims to reduce inequalities within and between countries.

2. Literature Review

3. Materials and Methods

4. Results

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Onaran, O. The Effects of Globalization on Wages, Employment, and Wage Share in Austria. 2018, Vienna. Available online: https://www.arbeiterkammer.at/infopool/akportal/The_Effects_of_Globalization_on_Emplayment.pdf (accessed on 3 April 2020).

- Bentolila, S.; Saint-Paul, G. Explaining Movements in the Labor Share. B.E. J. Macroecon. 2003, 1–33. [Google Scholar] [CrossRef] [Green Version]

- Harrison, A.E. Has Globalization Eroded Labor’s Share? Some Cross-Country Evidence. In MPRA Working Paper; Technical Report 39649; 2005; Available online: https://mpra.ub.uni-muenchen.de/39649/1/MPRA_paper_39649.pdf (accessed on 6 September 2021).

- Lee, K.; Jayadev, A. The Effects of Capital Account Liberalisation on Growth and the Labor Share of Macroeconomics. Available online: https://peri.umass.edu/fileadmin/pdf/ns/NSarjun.pdf (accessed on 6 June 2020).

- Gollin, D. Getting Income Shares Right. J. Political Econ. 2002, 110, 458–474. [Google Scholar] [CrossRef] [Green Version]

- Fields, G. Self-employment and Poverty in Developing Countries. J. Political Econ. 2014, 110. [Google Scholar] [CrossRef] [Green Version]

- de Serres, A.; Scarpetta, S.; de la Maisonneuve, C.H. Sectoral Shifts in Europe and the United States. In OECD Economics Department Working Papers, 2002; No. 326; OECD Publishing: Paris, France, 2002; Available online: http://gesd.free.fr/shifts2.pdf (accessed on 6 September 2021).

- Arpaia, A.; Perez, E.; Pichelmann, K. Understanding Labour Income Share Dynamics in Europe. In European Economy; Economic Papers; European Commission: Brussels, Belgium, 2009; Volume 379. [Google Scholar]

- Guscina, A. Effects of Globalization on Labor’s Share in National Income; IMF Working Paper, 06/294; IMF: Washington, DC, USA, 2006. [Google Scholar]

- Pietrzak, M.B.; Igliński, B.; Kujawski, W.; Iwański, P. Energy Transition in Poland—Assessment of the Renewable Energy Sector. Energies 2021, 14, 2046. [Google Scholar] [CrossRef]

- OECD. Employment Implications of Green Growth: Linking Jobs, Growth, and Green Policies; OECD Report for the G7; Environment Ministers, 2017; Available online: https://www.oecd.org/environment/Employment-Implications-of-Green-Growth-OECD-Report-G7-Environment-Ministers.pdf (accessed on 14 January 2018).

- Lucan, G. The Impacts of the Energy Transition on Growth and Income Distribution [in:] M. Hafner and S. Tagliapietra (eds.), The Geopolitics of the Global Energy Transition. Lect. Notes Energy 2020, 73, 305–318. [Google Scholar]

- WEF. Fostering Effective Energy Transition. 2021. Available online: https://www3.weforum.org/docs/WEF_Fostering_Effective_Energy_Transition_2021.pdf (accessed on 13 May 2021).

- Fagnart, J.F.; Germain, M. Quantitative versus qualitative growth with recyclable resource. Ecol. Econ. 2011, 70, 929–941. [Google Scholar] [CrossRef]

- Dupont, E.; Germain, M.; Jeanmart, H. Feasibility and Economic Impacts of the Energy Transition. Sustainability 2021, 13, 5345. [Google Scholar] [CrossRef]

- Füllemann, Y.; Moreau, V.; Vielle, M.; Vuille, F. Hire fast, fire slow: The employment benefits of energy transitions. Econ. Syst. Res. 2019, 32, 202–220. [Google Scholar] [CrossRef]

- Prinz, L.; Pegels, A. The role of labour power in sustainability transitions: Insights from comparative political economy on Germany’s electricity transition. Energy Res. Soc. Sci. 2018, 41, 210–219. [Google Scholar] [CrossRef]

- Wang, P.; Zhang, Z.; Zeng, Y.; Yang, S.; Tang, X. The Effect of Technology Innovation on Corporate Sustainability in Chinese Renewable Energy Companies. Front. Energy Res. 2021. [Google Scholar] [CrossRef]

- Hoffmann, U. Can Green Growth Really Work and what are the True (Socio-) Economics of Climate Change. In United Nations Conference on Trade and Development. Discussion Paper; 2015; p. 222. Available online: https://unctad.org/webflyer/can-green-growth-really-work-and-what-are-true-socio-economics-climate-change-ulrich (accessed on 13 May 2021).

- Jacob, K.; Quitzow, R.; Bar, H. Green Jobs: Impacts of a Green Economy on Employment; Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH: 2015. Available online: https://www.greengrowthknowledge.org/sites/default/files/downloads/resource/Jacob,%20Quitzow,%20B%c3%a4r%202014%20Green%20Jobs_ENGLISH.pdf (accessed on 23 April 2021).

- Stockhammer, E. Why Have Wage Shares Fallen? A Panel Analysis of the Determinants of Functional Income Distribution; Conditions of Work and Employment Series; ILO: Geneva, Switzerland, 2013; p. 35. [Google Scholar]

- Oziewicz, E. (Ed.) Przemiany We Współczesnej Gospodarce Światowej; PWE: Warszawa, Poland, 2006. [Google Scholar]

- Globalization and Liberalisation Effects of International Economic Relations on The Least Developed Countries; UNCTAD/ECDC/PA/4/Rev; Geneva, Switzerland, 1996; Volume 1, Available online: https://unctad.org/system/files/official-document/ldc1996_en.pdf (accessed on 9 June 2020).

- Anser, M.K.; Usman, M.; Godil, D.I. Does globalization affect the green economy and environment? The relationship between energy consumption, carbon dioxide emissions, and economic growth. Environ. Sci. Pollut. Res. 2021, 28, 1–4. [Google Scholar] [CrossRef]

- Asongu, S.A.; Nnanna, J. Globalization, Governance, and the Green Economy in Sub-Saharan Africa: Policy Thresholds. World Aff. 2021, 184, 176–212. [Google Scholar] [CrossRef]

- Tang, S.; Wang, Z.; Yang, G.; Tang, W. What Are the Implications of Globalization on Sustainability?—A Comprehensive Study. Sustainability 2020, 12, 3411. [Google Scholar] [CrossRef] [Green Version]

- Zafar, M.; Kousar, S.; Sabir, S.A. Impact of Globalization on Green Growth: A Case of OECD Countries. J. Indian Stud. 2019, 5, 231–244. [Google Scholar]

- Herman, K.S. Green growth and innovation in the Global South: A systematic literature review. Innov. Dev. 2021, 1–27. [Google Scholar] [CrossRef]

- Zaorska, A. Ku globalizacji? Przemiany w Korporacjach Transnarowodych i w Gospodarce Światowej; PWE: Warsaw, Poland, 2002. [Google Scholar]

- Stiglitz, J.E. Globalizacja; PWN: Warsaw, Poland, 2004. [Google Scholar]

- Piasecki, R. Rozwój Gospodarczy a Globalizacja; PWN: Warsaw, Poland, 2003. [Google Scholar]

- Tiba, S.; Omri, A. Literature Survey on the Relationships between Energy, Environment and Economic Growth. Renew. Sustain. Energy Rev. 2017, 69, 1129–1146. [Google Scholar] [CrossRef]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development, Resolution Adopted by the General Assembly on 25 September 2015; 2015; Available online: https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_70_1_E.pdf (accessed on 23 April 2021).

- Sompolska-Rzechuła, A.; Kurdyś-Kujawska, A. Towards Understanding Interactions between Sustainable Development Goals: The Role of Climate-Well-Being Linkages. Experiences of EU Countries. Energies 2021, 14, 2025. [Google Scholar] [CrossRef]

- Hernandez, R.R.; Jordaan, S.M.; Kaldunski, B.; Kumar, N. Aligning Climate Change and Sustainable Development Goals with an Innovation Systems Roadmap for Renewable Power. Front. Sustain. 2020, 1, 583090. [Google Scholar] [CrossRef]

- Gatto, A.; Drago, C. A taxonomy of energy resilience. Energy Policy 2020, 136, 111007. [Google Scholar] [CrossRef]

- Gajdzik, B.; Grabowska, S.; Saniuk, S.; Wieczorek, T. Sustainable Development and Industry 4.0: A Bibliometric Analysis Identifying Key Scientific Problems of the Sustainable Industry 4.0. Energies 2020, 13, 4254. [Google Scholar] [CrossRef]

- Melnychenko, O. Ukrainian Market of Electrical Energy: Reforming, Financing, Innovative Investment, Efficiency Analysis, and Audit. Energies 2021, 14, 5080. [Google Scholar] [CrossRef]

- Gräbner, C.; Heimberger, P.; Kapeller, J.; Springholz, F. Understanding economic openness: A review of existing measures. Rev. World Econ. 2021, 157, 87–120. [Google Scholar] [CrossRef]

- Cibulskiene, D.; Maciulyte-Sniukiene, A. Evaluation of the impact of economic openness on labour productivity in EU countries. Cent. East. Eur. J. Manag. Econ. 2014, 2, 225–253. [Google Scholar]

- Habib, M.M.; Mileva, E.; Stracca, L. The real exchange rate and economic growth: Revisiting the case using external instruments. J. Int. Money Financ. 2017, 73, 386–398. [Google Scholar] [CrossRef] [Green Version]

- Tawiah, V.; Zakari, A.; Adedoyin, F.F. Determinants of green growth in developedand developing countries. Environ. Sci. Pollut. Res. 2021, 28, 39227–39242. [Google Scholar] [CrossRef] [PubMed]

- Hallegatte, S.; Heal, G.; Fay, M.; Treguer, D. From Growth to Green Growth—A Framework; NBER Workin Paper Series; 2011; p. 17841. Available online: https://www.nber.org/system/files/working_papers/w17841/w17841.pdf (accessed on 20 August 2021).

- Bowen, A.; Hepburn, C. Green growth: An assessment. Oxf. Rev. Econ. Policy 2014, 30, 407–422. [Google Scholar] [CrossRef]

- Fisher, A.G. The Economic Implications of Material Progress. Int. Labour Rev. 1939, 32, 5. [Google Scholar]

- Clark, C. The Conditions of Economic Progres; MacMilian: London, UK, 1951. [Google Scholar]

- Fourastie, J. Myśli Przewodnie; Państwowy Instytut Wydawniczy: Warsaw, Poland, 1996. [Google Scholar]

- Kuc-Czarnecka, M.E.; Olczyk, M.; Zinecker, M. Improvements and Spatial Dependencies in Energy Transition Measures, Measures. Energies 2021, 14, 3802. [Google Scholar] [CrossRef]

- Healy, N.; Barry, J. Politicizing energy justice and energy system transitions: Fossil fuel divestment and a “just transition”. Energy Policy 2017, 108, 451–459. [Google Scholar] [CrossRef] [Green Version]

- Jayadev, A. Capital account openness and the labour share of income. Camb. J. Econ. 2007, 31, 423–443. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. Research on China’s industrial green biased technological progress and its energy conservation and emission reduction effects. Energy Effic. 2021, 14, 1–20. [Google Scholar] [CrossRef]

- Nieto, J.; Carpintero, Ó.; Lobejón, L.F.; Miguel, L.J. An ecological macroeconomics model: The energy transition in the EU. Energy Policy 2020, 145, 111726. [Google Scholar] [CrossRef]

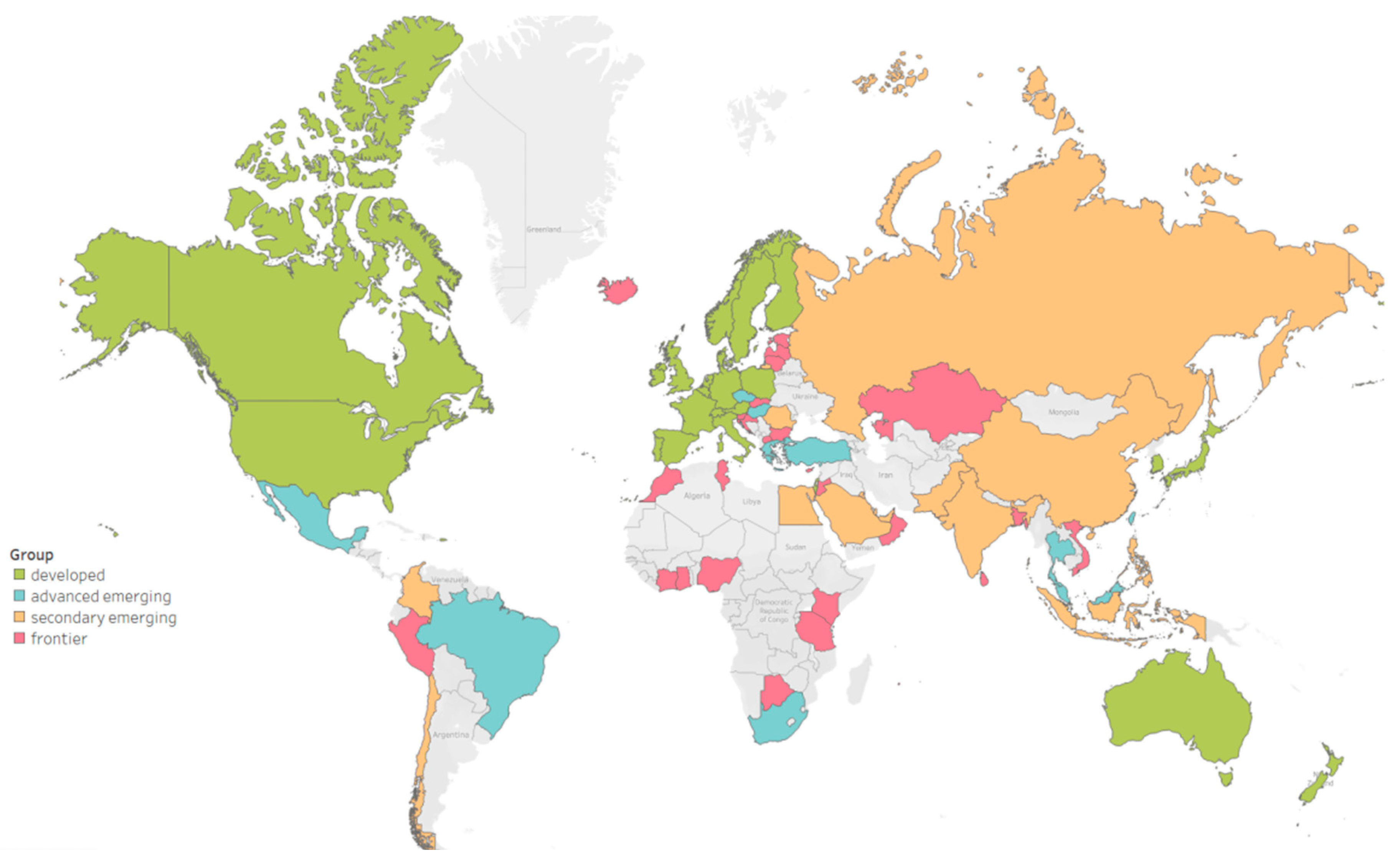

- FTSE Russel. FTSE Equity Country Classification March 2021 Interim Update. 2021. Available online: https://research.ftserussell.com/products/downloads/FTSE-Country-Classification-Update_latest.pdf (accessed on 27 April 2021).

- FTSE Russel. FTSE Equity Country Classification Process, September 2021. Available online: https://research.ftserussell.com/products/downloads/FTSE_Equity_Country_Classification_Paper.pdf?_ga=2.140757938.1827811411.1631013797-646606433.1617273360 (accessed on 23 April 2021).

- TED (2020). The Conference Board Total Economy Database™ (Original Version), July 2020. Available online: https://www.conference-board.org (accessed on 7 April 2021).

- Doan, H.T.T.; Wan, G. Globalization and the Labor Share in National Income; ADBI Working Papers; Asian Development Bank Institute: Tokyo, Japan, 2017; p. 639. Available online: https://www.adb.org/sites/default/files/publication/223671/adbi-wp639.pdf (accessed on 12 April 2021).

- Guerriero, M. Democracy and Labour Share of Income: A Cross-Country Analysis; ADBI Working Paper Series; Asian Development Bank Institute: Tokyo, Japan, 2019. [Google Scholar]

- Lawless, M.; Whelan, K. Understanding the Dynamics of Labour Shares and Inflation; European Central Bank Working Paper Series; European Central Bank: Frankfurt am Main, Germany, 2007; p. 784. [Google Scholar]

- Biørn, E. Econometrics of Panel Data: Methods and Applications; Oxford University Press: Oxford, UK, 2016; Published to Oxford Scholarship Online: December 2016. [Google Scholar] [CrossRef]

- Stock, J.H.; Wathon, M.W. Introduction to Econometrics 4th Global Edition; Pearson Education Limited: Harlow, UK, 2020. [Google Scholar]

- Arrelano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef] [Green Version]

- Torres-Reyna, O. Panel Data Analysis Fixed and Random Analysis Using Stata; Data and Statistical Services: Princeton University; Princeton University: New York, NJ, USA, 2007. [Google Scholar]

- Ibarra, C.A.; Ros, J. The decline of the labour share in Mexico 1990–2015. In Capital Flight and Capital Controls in Developing Countries; Esptein, G., Ed.; WIDER Working Paper; 2017/183; Income Distribution, Conditions of Work and Employment Series No. 35 (Geneva: ILO). Income: Reviewing and Extending the Cross-Country Evidence; Cheltenham Edward Elgar, 2017; Available online: https://www.wider.unu.edu/sites/default/files/Publications/Working-paper/PDF/wp2017-183.pdf (accessed on 7 April 2021).

| Variable Name | Description | Source |

|---|---|---|

| LS | the logarithm of share of total labour compensation in GDP | TED |

| FDI_I | the logarithm of foreign direct investment: inward flow as % of GDP | UNCTADstat |

| FDI_O | the logarithm of foreign direct investment: outward flow as % of GDP | UNCTADstat |

| REER | the logarithm of the real effective exchange rate index (GDP deflator based—2005) | UNCTADstat |

| Open | the logarithm of average imports and exports in relation to GDP | UNCTADstat |

| ICT | the logarithm of the share of ICT capital compensation in GDP | TED |

| GDPg | growth of GDP, change in the natural log | TED |

| TFPg | growth of total factor productivity | TED |

| GDPpc | the logarithm of GDP per capita—US dollars at constant prices (2015) | UNCTADstat |

| CPI | consumer price indices, annual | UNCTADstat |

| GC | the logarithm of general government final consumption expenditure as % of GDP | UNCTADstat |

| Man | the logarithm of GDP share of manufacturing | UNCTADstat |

| EU | the logarithm of the energy use (kg of oil equivalent per capita) | World Bank |

| REC | the logarithm of renewable energy consumption (% of total final energy consumption) | World Bank |

| CO2 | the logarithm of CO2 emissions (metric tons per capita) | World Bank |

| Group of Countries | ||||

|---|---|---|---|---|

| Developed (DV) | Advanced Emerging (AE) | Secondary Emerging (SE) | Frontier (FR) | |

| Employment in services (in %) | 75.6 | 62.0 | 54.7 | 57.8 |

| Employment in industry (in %) | 19.8 | 25.8 | 27.1 | 23.2 |

| Employment in agriculture (in %) | 4.6 | 12.2 | 18.2 | 19.0 |

| Labour share (in %) | 54.0 | 53.4 | 43.7 | 46.2 |

| Group of Countries | ||||

|---|---|---|---|---|

| Explanatory Variables | Developed (DV) | Advanced Emerging (AE) | Secondary Emerging (SE) | Frontier (FR) |

| 4.61 | 1.61 | 2.45 | 13.67 | |

| 4.89 | 1.35 | 2.22 | 7.57 | |

| 100.97 | 109.95 | 137.87 | 121.44 | |

| 55.71 | 47.62 | 34.59 | 56.22 | |

| 3.33 | 3.15 | 2.90 | 2.92 | |

| 1.46 | 2.35 | 4.66 | 3.70 | |

| -0.29 | -0.22 | -0.74 | -0.10 | |

| 47670.75 | 11821.80 | 15175.54 | 11672.61 | |

| 1.08 | 0.59 | 2.99 | 3.85 | |

| 19.97 | 17.31 | 13.82 | 15.15 | |

| 4399.45 | 2488.81 | 3894.00 | 2960.24 | |

| 19.97 | 17.12 | 15.58 | 30.42 | |

| 8.30 | 5.56 | 9.11 | 4.67 | |

| Variable | Period 2000–2009 | Period 2010–2018 | ||||||

|---|---|---|---|---|---|---|---|---|

| DV | AE | SE | FR | DV | AE | SE | FR | |

| 0.0013 (0.573) | −0.010 (0.061) | −0.022 (0.015) | 0.013 (0.025) | 0.001 (0.733) | −0.002 (0.503) | 0.020 (0.202) | −0.002 (0.743) | |

| 0.0013 (0.582) | −0.002 (0.620) | 0.0070.241) | 0.003 (0.388) | −0.001 (0.704) | 0.005 (0.102) | 0.004 (0.671) | 0.003 (0.476) | |

| 0.017 (0.521) | −0.199 (0.0001) | −0.135 (0.075) | 0.142 (0.004) | −0.010 (0.630) | −0.068 (0.048) | −0.022 (0.769) | −0.135 (0.014) | |

| −0.085 (0.030) | −0.182 (0.0001) | 0.029 (0.618) | −0.113 (0.009) | −0.063 (0.032) | −0.070 (0.019) | −0.157 (0.085) | −0.040 (0.207) | |

| 0.015 (0.390) | −0.059 (0.114) | −0.042 (0.225) | 0.002 (0.870) | −0.001 (0.954) | −0.036 (0.087) | −0.142 (0.023) | −0.012 (0.372) | |

| 0.001 (0.851) | 0.001 (0.845) | −0.010 (0.019) | −0.001 (0.515) | −0.005 (0.006) | −0.002 (0.069) | 0.004 (0.497) | −0.015 (<0.0001) | |

| −0.002 (0.207) | −0.003 (0.325) | 0.004 (0.253) | 0.000 (0.981) | 0.003 (0.075) | −0.001 (0.418) | −0.005 (0.452) | 0.014 (0.0001) | |

| −0.146 (0.0001) | 0.000 (0.775) | 0.002 (0.974) | −0.001 (0.979) | −0.183 (<0.0001) | 0.000 (0.348) | 0.072 (0.594) | −0.050 (0.399) | |

| 0.002 (0.062) | 0.001 (0.017) | −0.0 (0.117) | 0.002 (0.144) | −0.001 (0.582) | 0.001 (0.046) | 0.002 (0.392) | −0.006 (0.002) | |

| 0.248 (<0.0001) | −0.100 (0.257) | 0.194 (0.018) | −0.078 (0.0001) | 0.247 (<0.0001) | 0.123 (0.098) | 0.382 (0.001) | 0.090 (0.048) | |

| 0.057 (0.023) | −0.041 (0.668) | 0.047 (0.556) | 0.148 (0.018) | −0.058 (0.030) | 0.037 (0.383) | 0.065 (0.588) | −0.023 (0.624) | |

| −0.044 (0.270) | −0.011 (0.943) | 0.195 (329) | −0.047 (0.569) | 0.031 (0.550) | −0.053 (0.342) | −0.277 (0.040) | 0.170 (0.014) | |

| −0.015 (0.063) | 0.019 (0.684) | −0.076 (0.393) | 0.021 (0.555) | −0.009 (0.305) | 0.044 (0.019) | −0.022 (0.343) | 0.048 (0.083) | |

| −0.056 (0.188) | 0.084 (0.611) | −0.316 (0.112) | −0.054 (0.347) | −0.013 (0.630) | 0.054 (0.223) | −0.210 (0.130) | 0.043 (0.410) | |

| Units | 25 | 9 | 14 | 28 | 25 | 9 | 14 | 28 |

| Within-R2 | 0.490 | 0.518 | 0.583 | 0.232 | 0.675 | 0.748 | 0.410 | 0.512 |

| LSDV-R2 | 0.980 | 0.981 | 0.977 | 0.951 | 0.987 | 0.993 | 0.976 | 0.944 |

| BP Test | (<0.0001) | (<0.0001) | (<0.0001) | (<0.0001) | (<0.0001) | (<0.0001) | (<0.0001) | (<0.0001) |

| H Test | 0.002 | ** | ** | 0.0005 | 0.001 | ** | ** | 0.001 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gawrycka, M.; Szymczak, A. A Panel Analysis of the Impact of Green Transformation and Globalization on the Labor Share in the National Income. Energies 2021, 14, 6967. https://doi.org/10.3390/en14216967

Gawrycka M, Szymczak A. A Panel Analysis of the Impact of Green Transformation and Globalization on the Labor Share in the National Income. Energies. 2021; 14(21):6967. https://doi.org/10.3390/en14216967

Chicago/Turabian StyleGawrycka, Małgorzata, and Anna Szymczak. 2021. "A Panel Analysis of the Impact of Green Transformation and Globalization on the Labor Share in the National Income" Energies 14, no. 21: 6967. https://doi.org/10.3390/en14216967

APA StyleGawrycka, M., & Szymczak, A. (2021). A Panel Analysis of the Impact of Green Transformation and Globalization on the Labor Share in the National Income. Energies, 14(21), 6967. https://doi.org/10.3390/en14216967