Operation Strategy of Electricity Retailers Based on Energy Storage System to Improve Comprehensive Profitability in China’s Electricity Spot Market

Abstract

:1. Preface

2. Electricity Market Trading Policies and Development in Various Countries

2.1. International Electricity Market Transaction Policy

2.2. Development of China’s Electricity Market Trading Policy

2.2.1. Constant Electricity Price Transaction Mode in the Electricity Market

2.2.2. Spot Trading Model in the Electricity Market

3. Analysis of Various Factors Affecting the Revenue of Electricity Retailers under Different Electricity Price Policy

3.1. Impact of Peak-Valley Price Difference on Electricity Retailer

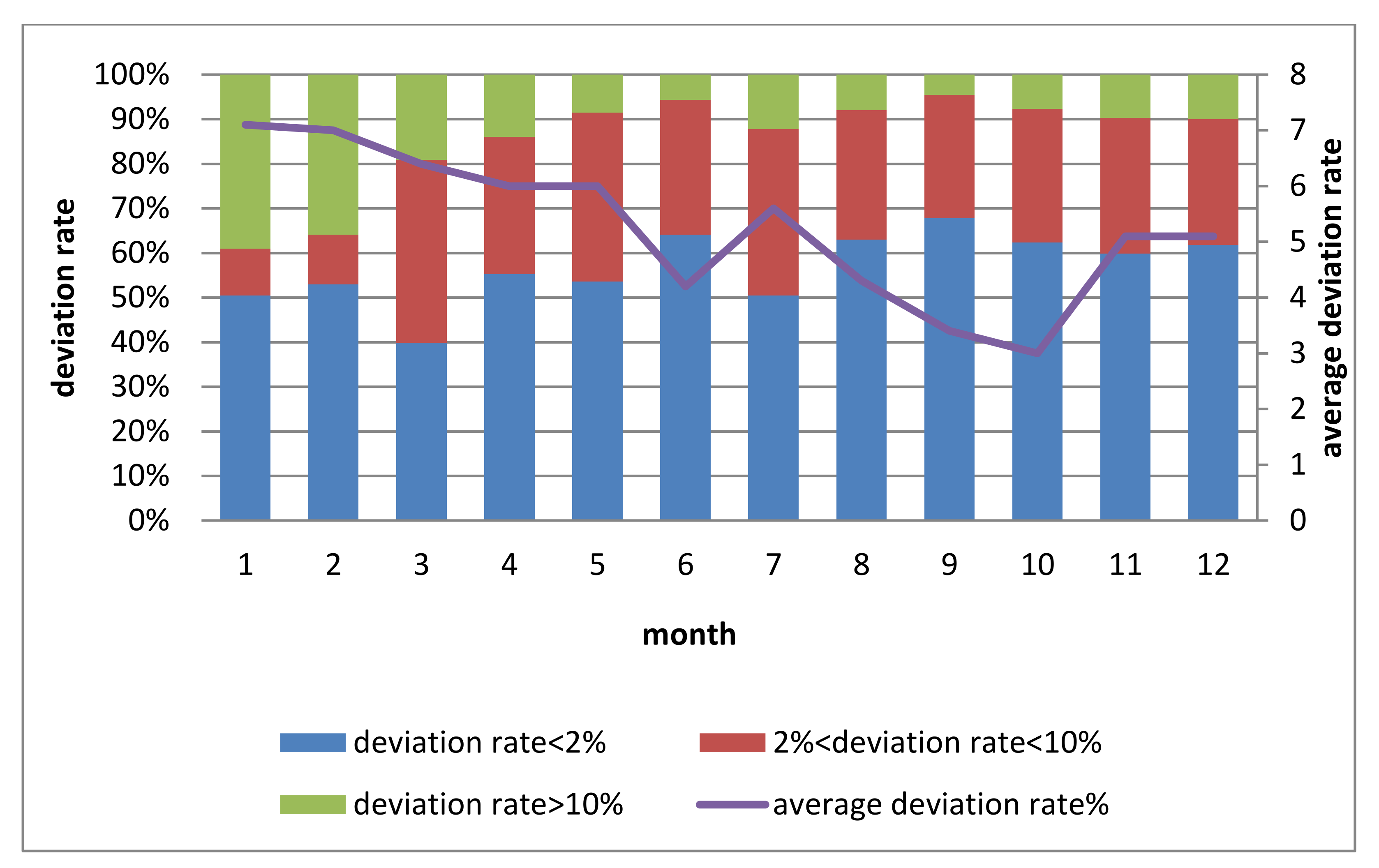

3.2. The Impact of Deviation Assessment on the Cost of Electricity Retailer

3.3. Impact of Emergencies on the Operation of Electricity Retailers

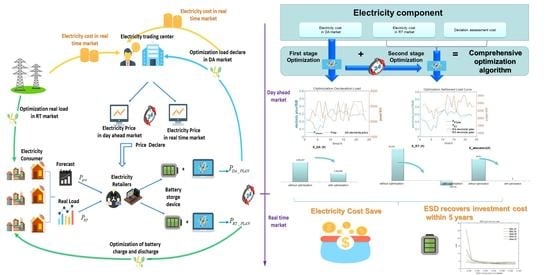

4. Cost-Optimized Operation of Electricity Retailer in the Electricity Spot Market

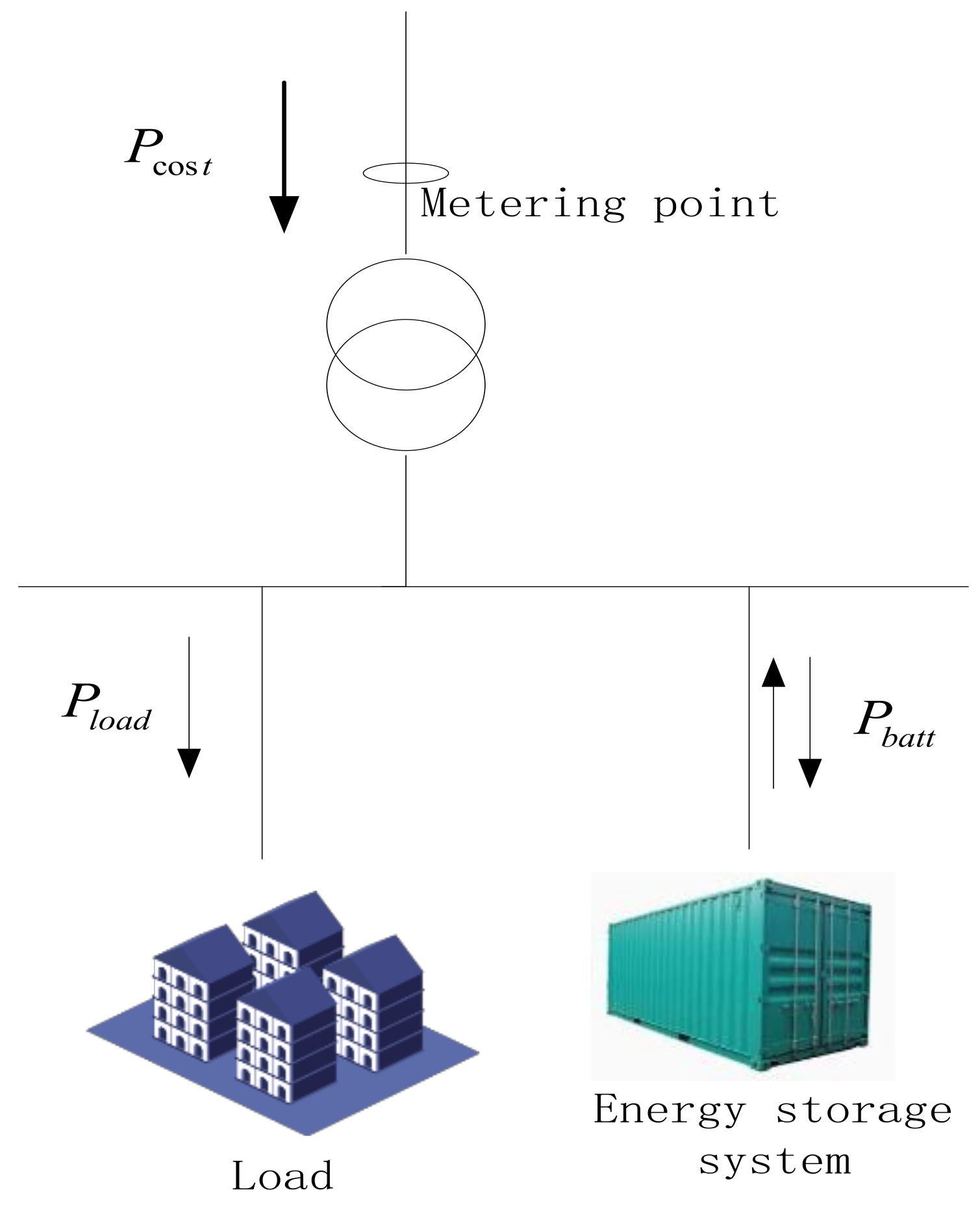

4.1. Impact Analysis of Electricity Retailer Operation Based on the Electricity Spot Market Policy

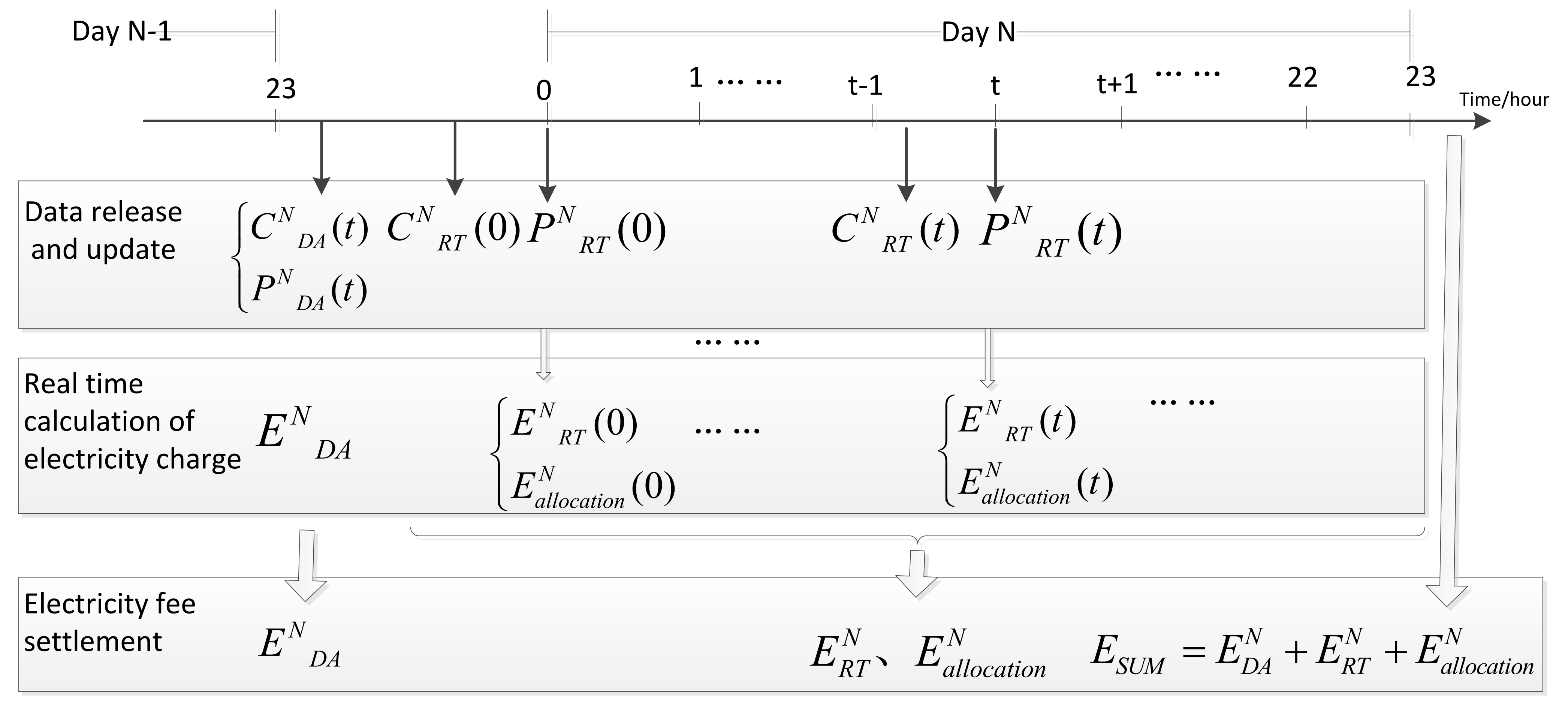

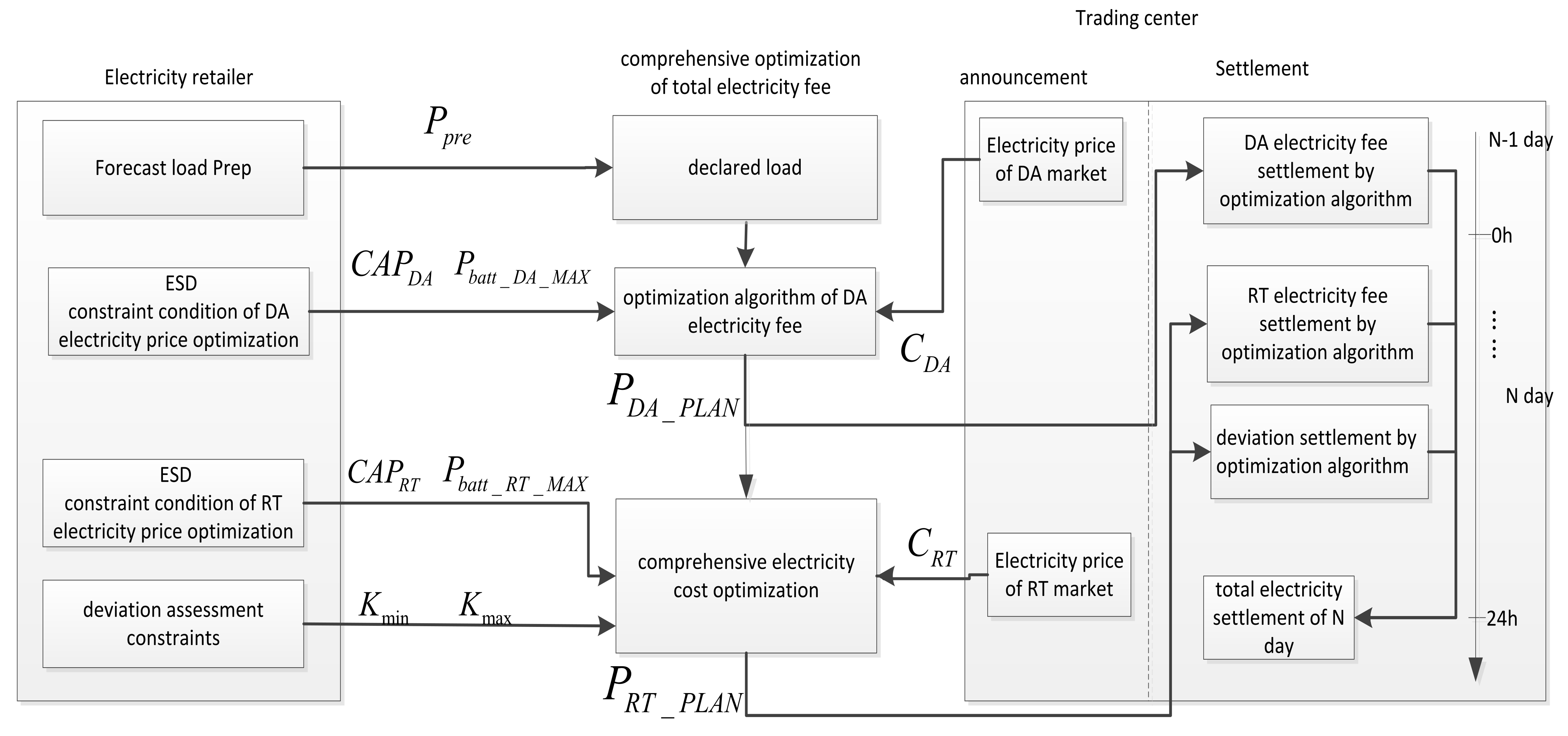

4.2. Electricity Cost Comprehensive Optimization Algorithm of Electricity Retailer in Spot Market

4.2.1. Optimization Strategy of Electricity Cost in DA Market

4.2.2. Comprehensive Electricity Cost Optimization Algorithm

5. Simulation and Analysis

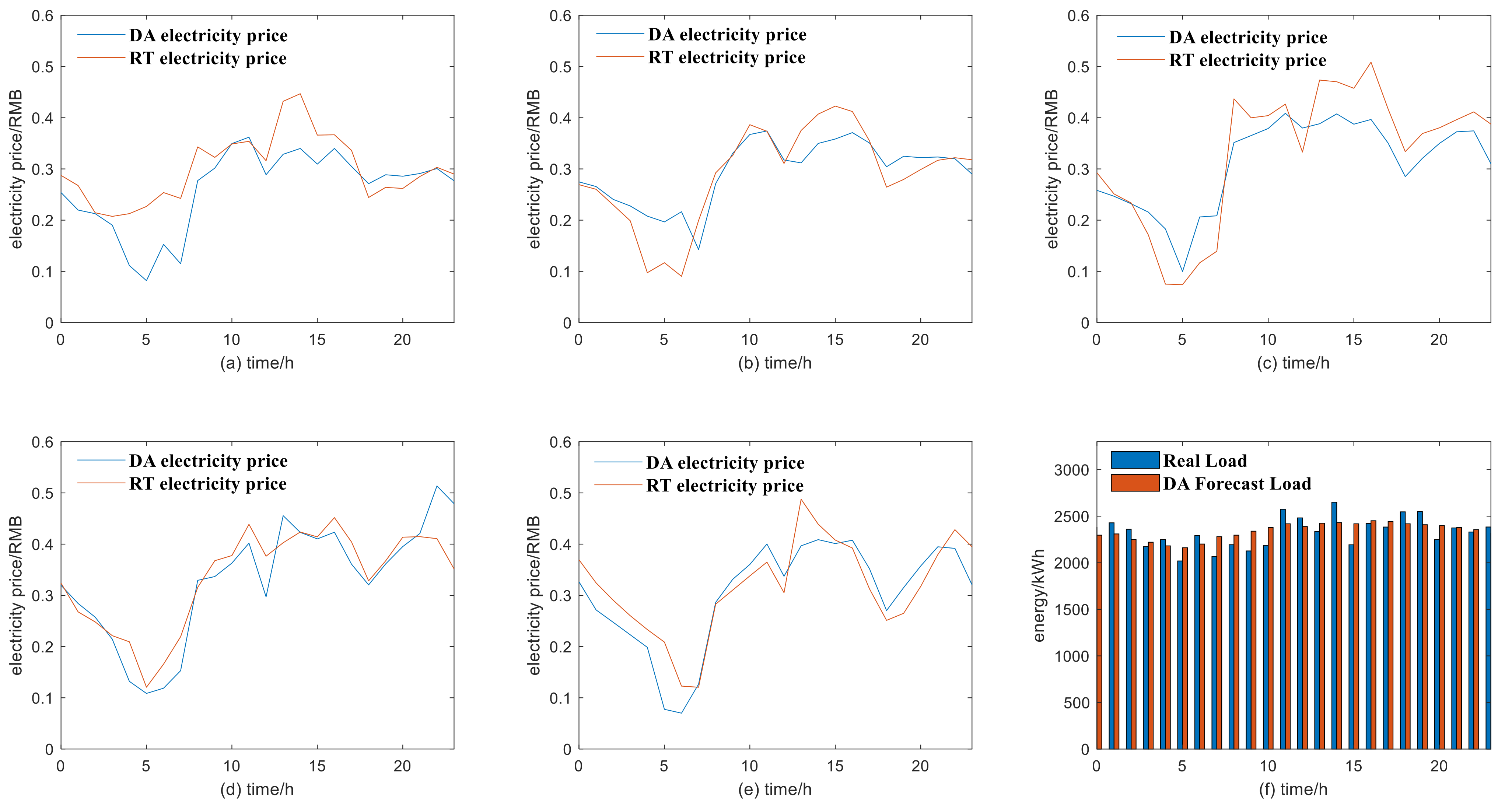

5.1. Case Analysis of Comprehensive Optimization Electricity Cost of Electricity Retailer

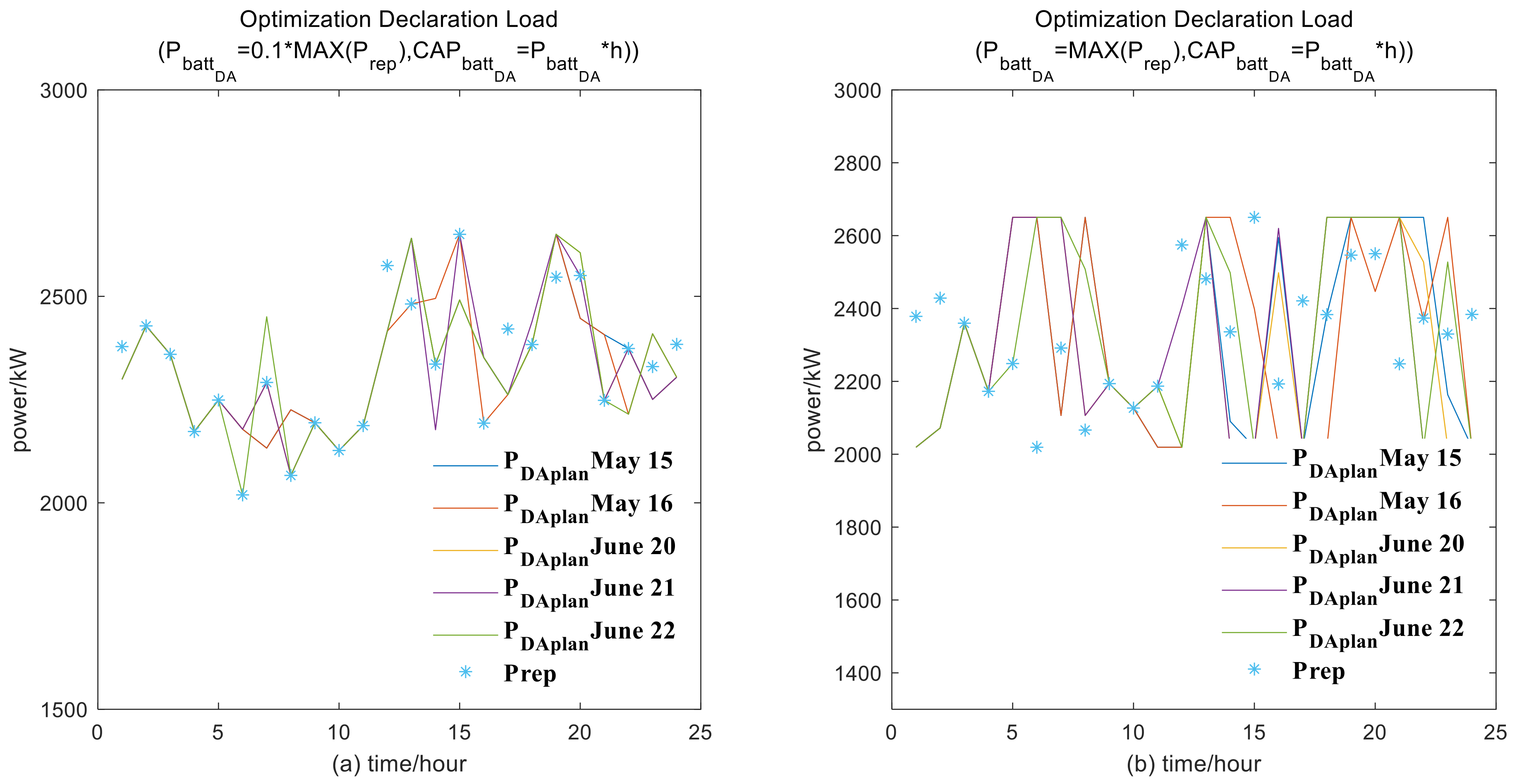

5.1.1. Analysis of the Electricity Purchase Cost with DA Electricity Cost Optimization Algorithm

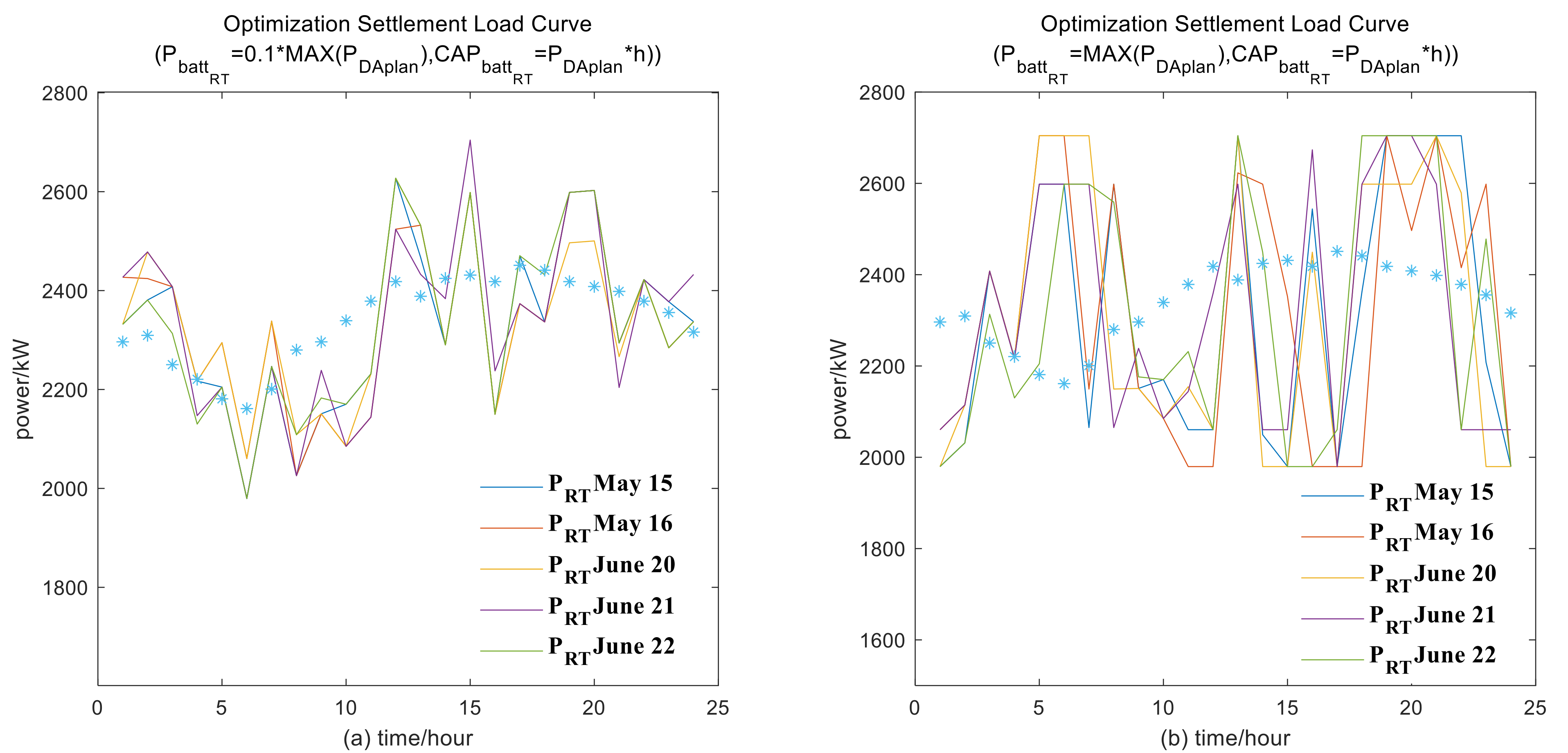

5.1.2. Analysis of Comprehensive Electricity Cost Optimization Result

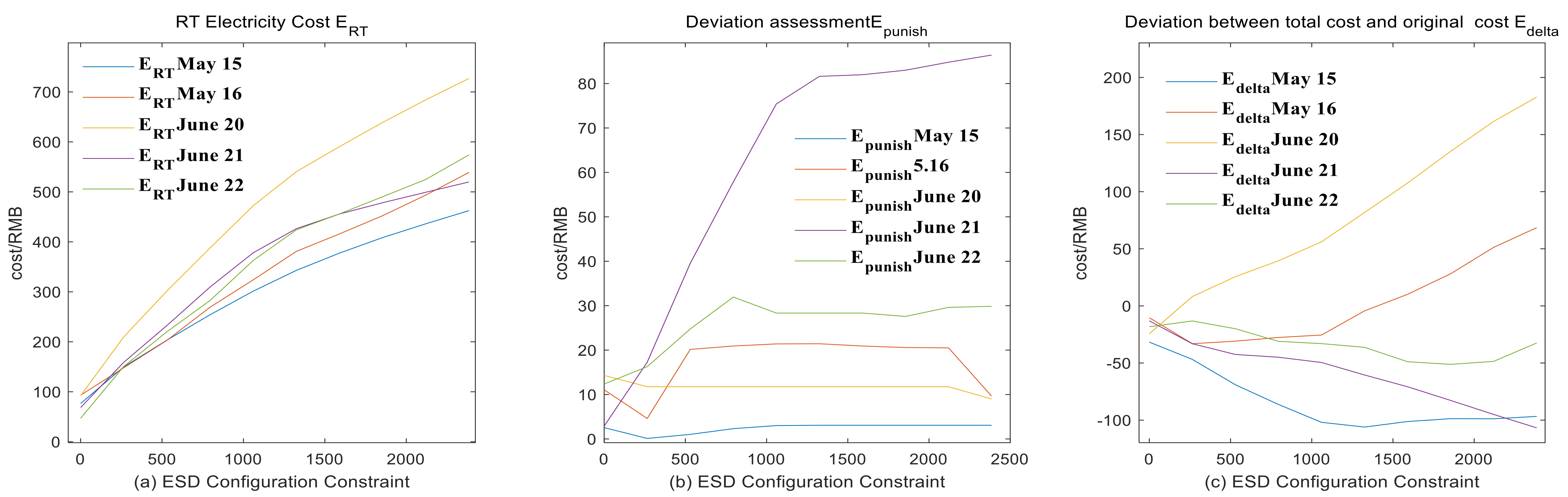

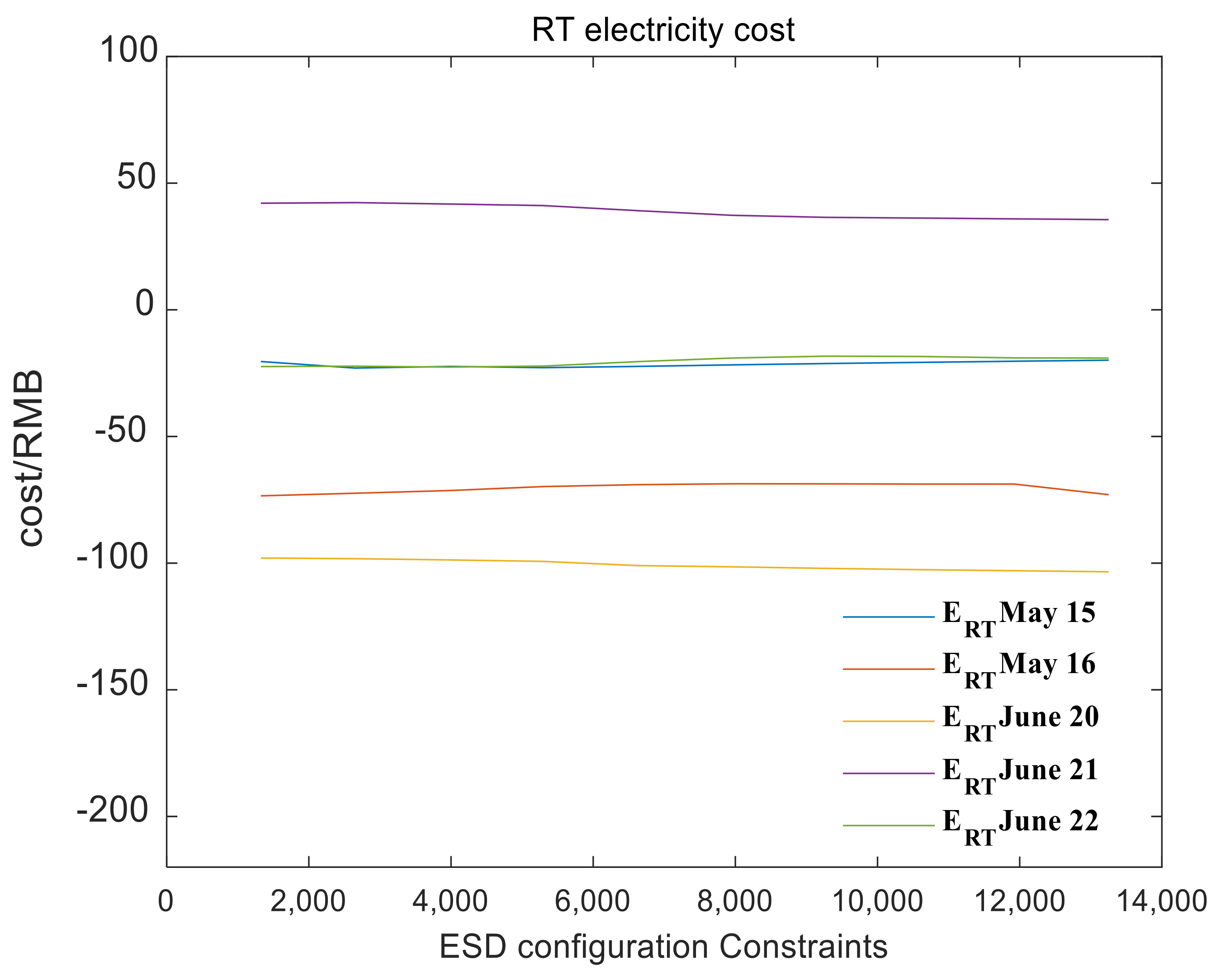

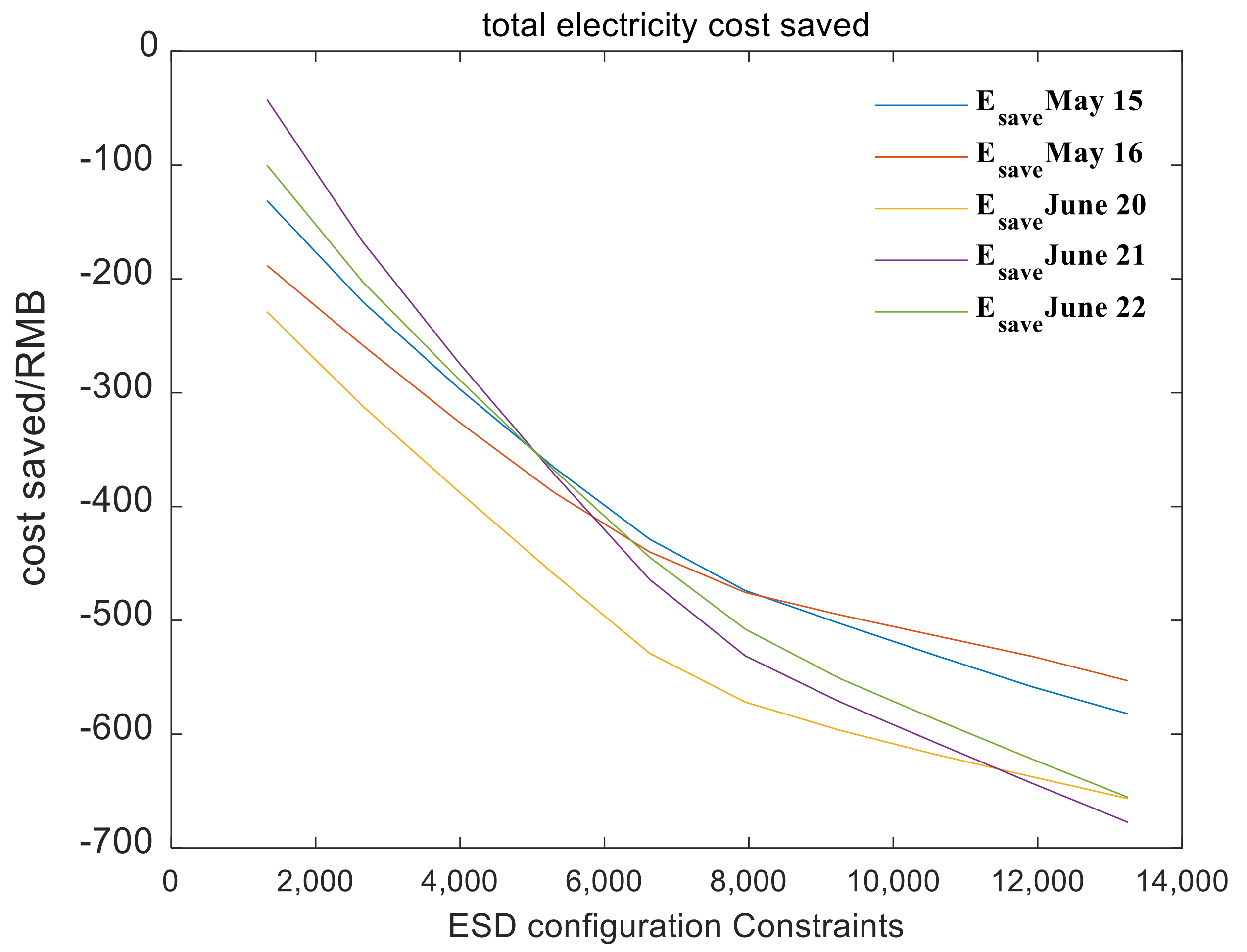

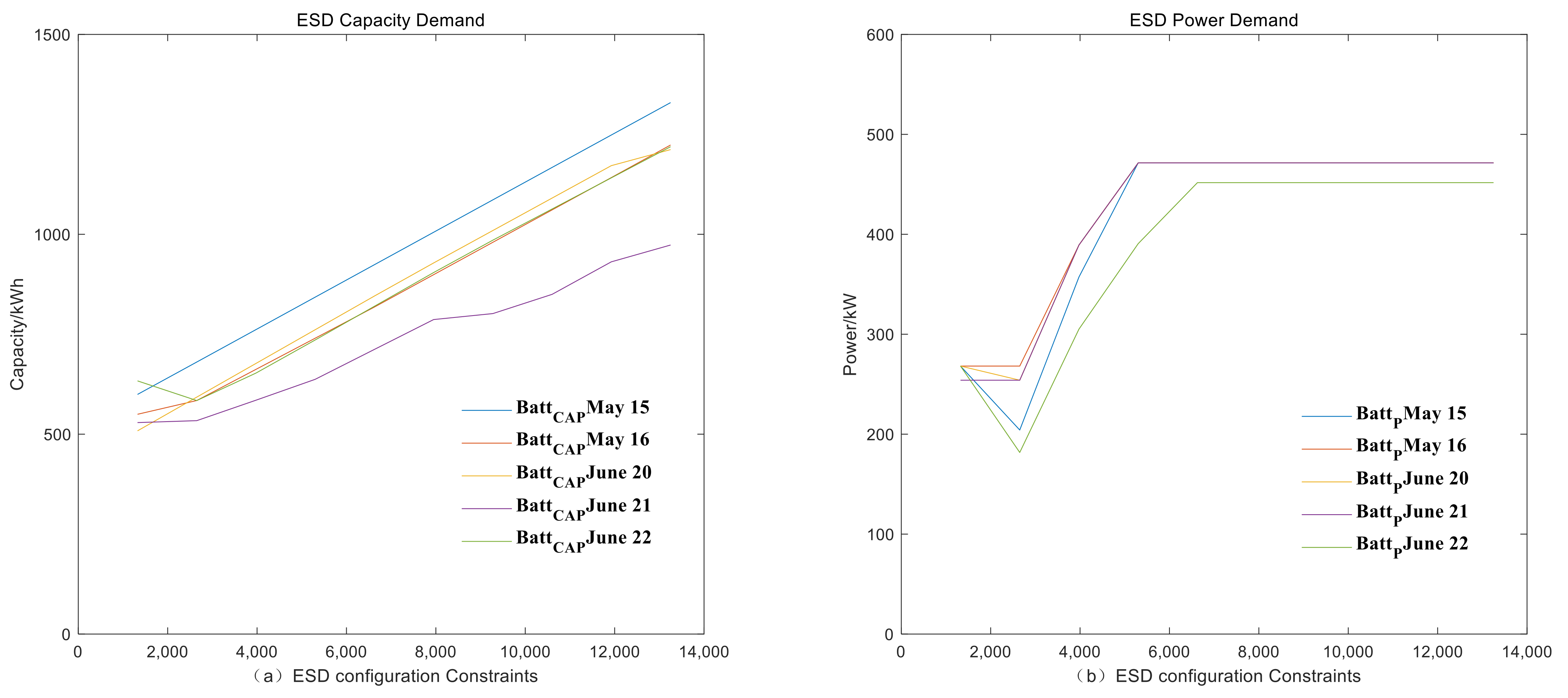

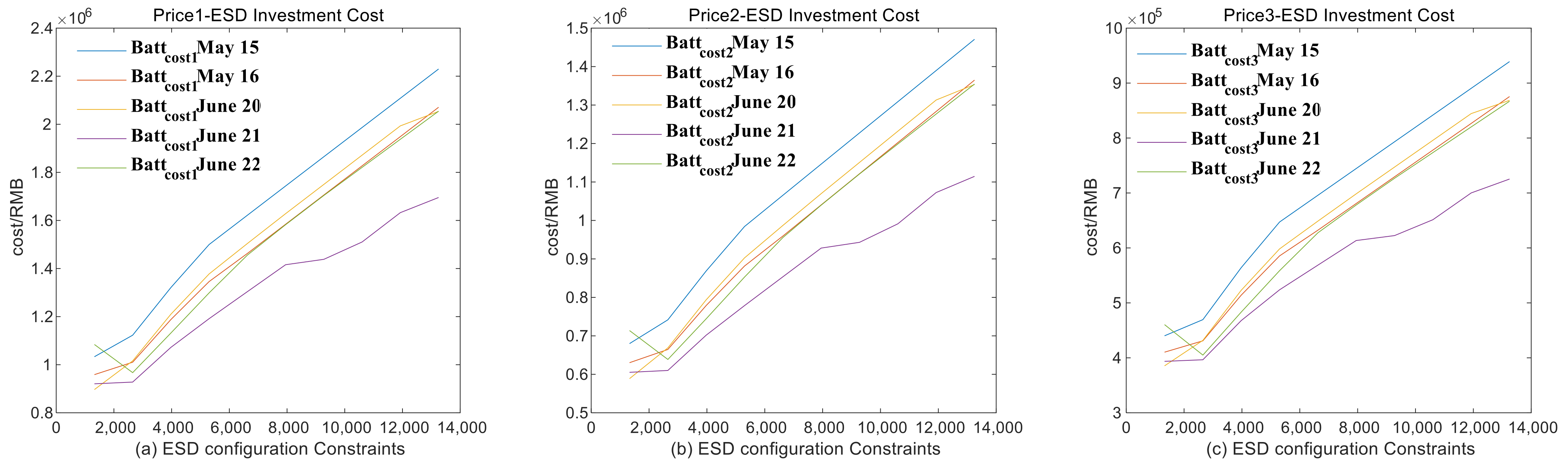

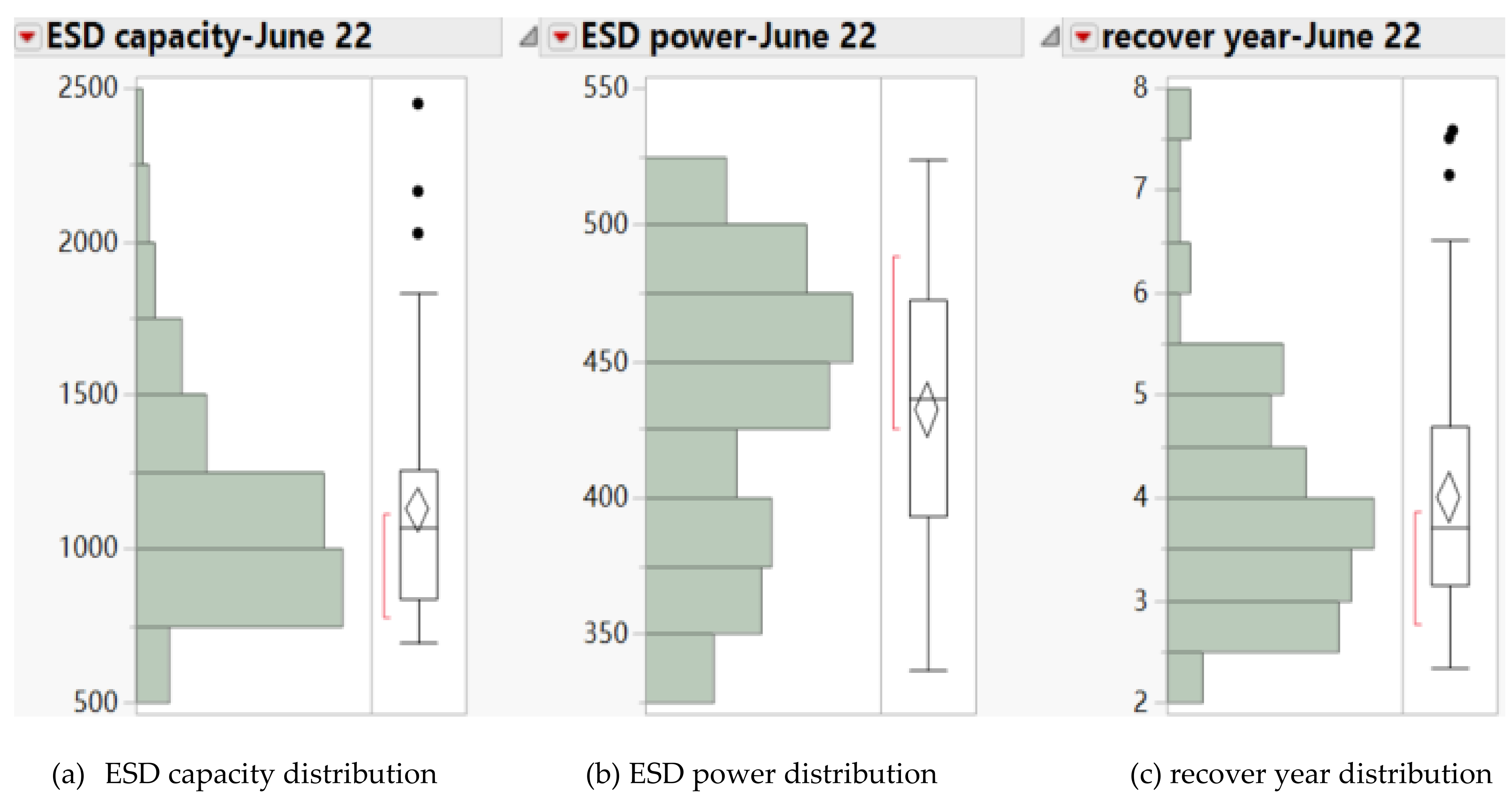

5.1.3. Economic Analysis of ESD under Comprehensive Optimization Algorithm

5.2. Effectiveness Verification of Comprehensive Optimization Algorithm with Different Deviation Assessment

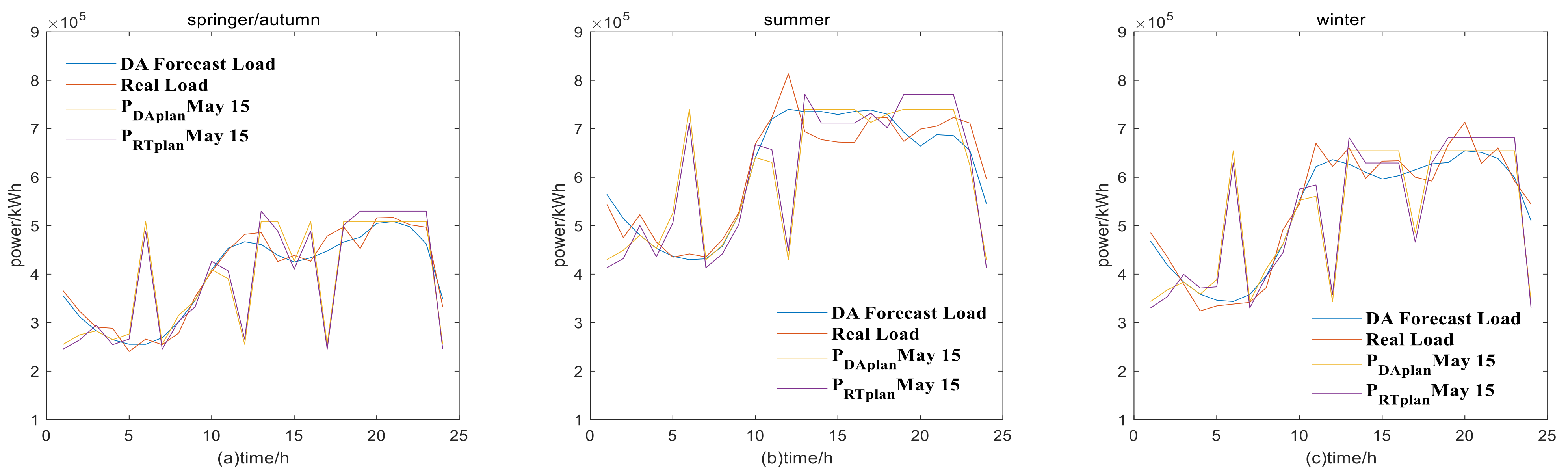

5.3. Effectiveness Verification of Comprehensive Optimization Algorithm with Typical Load in Four Seasons

5.4. Effectiveness Verification of Comprehensive Optimization Algorithm with Random Load

5.5. Effectiveness Verification of Comprehensive Optimization Algorithm with Random Electricity Price

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations and Variables

| Abbreviations | |

| ESD | Energy storage devices |

| DA | Day-ahead |

| RT | Real-time |

| VPP | Virtual power plant |

| MILP | Mixed integer linear programming |

| Variables and parameters | |

| Electricity price in day-ahead market | |

| Electricity price in real-time market | |

| Peak-valley price | |

| ESD capacity demand in DA market optimization | |

| ESD capacity demand in RT market optimization | |

| Total ESD capacity demand | |

| The daily electricity fee settlement | |

| Deviation assessment cost | |

| Electricity fee in DA market | |

| Electricity fee in RT market | |

| The first component of | |

| The second component of | |

| The ESD power demand in DA market optimization | |

| Upper limit of | |

| The ESD power demand in RT market optimization | |

| Upper limit of | |

| The actual power command of ESD | |

| Power supplied by state grid | |

| The declared load in DA market based on the load forecast data | |

| The optimized value of the declared load in DA market | |

| The actual load in RT market | |

| The optimized value of the RT load | |

| Forecast load | |

| Consumer side load curve | |

| ESD power | |

| Charged state of an energy storage battery | |

| The ratio of to | |

| The deviation assessment range in optimization algorithm | |

| The lower limit of | |

| The upper limit of | |

| Declaration load of DA market | |

| RT load demand of electricity retailer | |

| Deviation assessment range of policy | |

| Deviation assessment price coefficient | |

| Index | |

| Settlement time step | |

| Number of Planned days | |

Appendix A

| Hour | May 15 (CNY/kWh) | May 16 (CNY/kWh) | June 20 (CNY/kWh) | June 21 (CNY/kWh) | June 22 (CNY/kWh) |

|---|---|---|---|---|---|

| 0 | 0.254 | 0.275 | 0.258 | 0.324 | 0.326 |

| 1 | 0.220 | 0.265 | 0.247 | 0.268 | 0.272 |

| 2 | 0.213 | 0.240 | 0.232 | 0.248 | 0.247 |

| 3 | 0.190 | 0.227 | 0.216 | 0.221 | 0.223 |

| 4 | 0.111 | 0.208 | 0.183 | 0.209 | 0.199 |

| 5 | 0.082 | 0.196 | 0.100 | 0.121 | 0.078 |

| 6 | 0.153 | 0.219 | 0.206 | 0.166 | 0.070 |

| 7 | 0.115 | 0.139 | 0.208 | 0.219 | 0.127 |

| 8 | 0.277 | 0.286 | 0.351 | 0.316 | 0.286 |

| 9 | 0.302 | 0.335 | 0.365 | 0.368 | 0.331 |

| 10 | 0.350 | 0.372 | 0.379 | 0.378 | 0.360 |

| 11 | 0.362 | 0.374 | 0.409 | 0.439 | 0.400 |

| 12 | 0.289 | 0.311 | 0.380 | 0.376 | 0.337 |

| 13 | 0.329 | 0.313 | 0.388 | 0.403 | 0.397 |

| 14 | 0.340 | 0.355 | 0.407 | 0.424 | 0.409 |

| 15 | 0.309 | 0.360 | 0.387 | 0.414 | 0.401 |

| 16 | 0.340 | 0.374 | 0.397 | 0.452 | 0.408 |

| 17 | 0.305 | 0.345 | 0.350 | 0.404 | 0.352 |

| 18 | 0.271 | 0.298 | 0.285 | 0.328 | 0.270 |

| 19 | 0.289 | 0.332 | 0.321 | 0.367 | 0.315 |

| 20 | 0.286 | 0.321 | 0.350 | 0.414 | 0.357 |

| 21 | 0.291 | 0.324 | 0.373 | 0.415 | 0.395 |

| 22 | 0.301 | 0.320 | 0.374 | 0.411 | 0.392 |

| 23 | 0.277 | 0.284 | 0.310 | 0.352 | 0.321 |

| Hour | May 15 (CNY/kWh) | May 16 (CNY/kWh) | June 20 (CNY/kWh) | June 21 (CNY/kWh) | June 22 (CNY/kWh) |

|---|---|---|---|---|---|

| 0 | 0.287 | 0.269 | 0.293 | 0.320 | 0.370 |

| 1 | 0.268 | 0.260 | 0.251 | 0.284 | 0.324 |

| 2 | 0.214 | 0.230 | 0.233 | 0.257 | 0.291 |

| 3 | 0.207 | 0.199 | 0.171 | 0.214 | 0.260 |

| 4 | 0.213 | 0.097 | 0.075 | 0.132 | 0.233 |

| 5 | 0.227 | 0.117 | 0.074 | 0.109 | 0.209 |

| 6 | 0.254 | 0.090 | 0.117 | 0.119 | 0.123 |

| 7 | 0.242 | 0.199 | 0.139 | 0.153 | 0.121 |

| 8 | 0.343 | 0.292 | 0.437 | 0.329 | 0.283 |

| 9 | 0.323 | 0.326 | 0.400 | 0.337 | 0.310 |

| 10 | 0.349 | 0.386 | 0.404 | 0.363 | 0.338 |

| 11 | 0.354 | 0.373 | 0.426 | 0.402 | 0.365 |

| 12 | 0.316 | 0.311 | 0.333 | 0.297 | 0.305 |

| 13 | 0.432 | 0.375 | 0.473 | 0.456 | 0.488 |

| 14 | 0.447 | 0.407 | 0.470 | 0.423 | 0.439 |

| 15 | 0.366 | 0.423 | 0.457 | 0.410 | 0.408 |

| 16 | 0.367 | 0.412 | 0.508 | 0.423 | 0.392 |

| 17 | 0.336 | 0.355 | 0.417 | 0.361 | 0.313 |

| 18 | 0.244 | 0.264 | 0.334 | 0.320 | 0.251 |

| 19 | 0.264 | 0.280 | 0.369 | 0.361 | 0.265 |

| 20 | 0.262 | 0.299 | 0.380 | 0.395 | 0.318 |

| 21 | 0.285 | 0.317 | 0.396 | 0.421 | 0.380 |

| 22 | 0.303 | 0.322 | 0.411 | 0.514 | 0.428 |

| 23 | 0.290 | 0.318 | 0.387 | 0.479 | 0.395 |

| Hour | Real Load/kWh | Forecast Load/kWh |

|---|---|---|

| 0 | 2526.75 | 2296.3 |

| 1 | 2539.92 | 2309.47 |

| 2 | 2474.07 | 2250.21 |

| 3 | 2437.86 | 2220.58 |

| 4 | 2395.06 | 2181.07 |

| 5 | 2375.31 | 2161.32 |

| 6 | 2418.11 | 2200.82 |

| 7 | 2507 | 2279.84 |

| 8 | 2530.04 | 2296.3 |

| 9 | 2569.55 | 2339.09 |

| 10 | 2615.64 | 2378.6 |

| 11 | 2658.44 | 2418.11 |

| 12 | 2628.81 | 2388.48 |

| 13 | 2665.02 | 2424.69 |

| 14 | 2678.19 | 2431.28 |

| 15 | 2661.73 | 2418.11 |

| 16 | 2691.36 | 2451.03 |

| 17 | 2681.48 | 2441.15 |

| 18 | 2658.44 | 2418.11 |

| 19 | 2645.27 | 2408.23 |

| 20 | 2638.68 | 2398.35 |

| 21 | 2615.64 | 2378.6 |

| 22 | 2592.59 | 2355.56 |

| 23 | 2549.79 | 2316.05 |

| Hour | Spring/Autumn Load | Summer Load | Winter Load |

|---|---|---|---|

| 1 | 355451 | 564621 | 468466 |

| 2 | 312280 | 514612 | 419273 |

| 3 | 283109 | 480451 | 383623 |

| 4 | 264807 | 453275 | 358761 |

| 5 | 255471 | 436940 | 346327 |

| 6 | 255341 | 429871 | 343613 |

| 7 | 268795 | 431788 | 358339 |

| 8 | 301551 | 457646 | 396627 |

| 9 | 346249 | 523007 | 461771 |

| 10 | 409459 | 640632 | 552525 |

| 11 | 453593 | 719997 | 621665 |

| 12 | 467014 | 740300 | 636119 |

| 13 | 461097 | 735308 | 626799 |

| 14 | 439215 | 735509 | 610328 |

| 15 | 424986 | 729357 | 596403 |

| 16 | 433901 | 735630 | 603235 |

| 17 | 447888 | 738553 | 615303 |

| 18 | 466494 | 730022 | 627561 |

| 19 | 476206 | 692555 | 630476 |

| 20 | 504771 | 664214 | 654616 |

| 21 | 508813 | 687881 | 651127 |

| 22 | 498017 | 685875 | 638631 |

| 23 | 462737 | 655001 | 599842 |

| 24 | 349613 | 545541 | 510307 |

References

- Energy Bureau of Guangdong Province, South China Supervision Bureau of National Energy Administration. Notice on the Daily Trial Settlement of the Southern Power Spot Market (Starting from Guangdong Province); Guangdong Electric Power Trading Center Co., Ltd.: Guangdong, China, 2019. [Google Scholar]

- Song, Y.; Bao, M.; Ding, Y.; Shao, C.; Shang, N. Review of Chinese Electricity Spot Market. Key Issues and Its Suggestions under the New Round of Chinese Power System Reform. Proc. CSEE 2020, 40, 3172–3187. [Google Scholar]

- Luo, S.; Wang, X.; Yang, M.; Wang, J.; Yin, S. Power Trading Strategy and Risk Assessment of Electricity Retailing Company Under Power System Reform. Power Syst. Technol. 2019, 43, 944–953. [Google Scholar]

- Emarati, M.; Keynia, F.; Rashidinejad, M. A two-stage stochastic programming framework forrisk-based day-ahead operation of a virtual power plant. Int. Trans. Electr. Energy Syst. 2020, 30, e12255. [Google Scholar] [CrossRef]

- Çanakoğlu, E.; Adıyeke, E. Comparison of Electricity Spot Price Modelling and Risk Management Applications. Energies 2020, 13, 4698. [Google Scholar] [CrossRef]

- Guo, H.; Gao, R.; Yang, P.J. Two-stage Dispatch of Microgrid Based on CVaR Theory Under Electricity Spot Market. Power System Technology 2019, 43, 2665. [Google Scholar]

- Gao, R.; Guo, H.; Zhang, R.; Mao, T. A Two-Stage Dispatch Mechanism for Virtual Power Plant. Utilizing the CVaR Theory in the Electricity Spot Market. Energies 2019, 12, 3402. [Google Scholar] [CrossRef] [Green Version]

- Najafi, A.; Tavakoli, A.; Pourakbari-Kasmaei, M.; Lehtonen, M. A risk-based optimal self-scheduling of smart energy hub in the day-ahead and regulation markets. J. Clean. Prod. 2021, 279, 123631. [Google Scholar] [CrossRef]

- Wang, L.; Zhang, L.; Zhang, F.; Jin, D. Decision-making and Risk Assessment of Purchasing and Selling Business for Electricity Retailers. Autom. Electr. Power Syst. 2018, 42, 143. [Google Scholar]

- Ren, Y.; Zhou, M.; Li, G. Bi-level Model of Electricity Procurement and Sale Strategies for Electricity Retailers Considering User’ Demand Response. Autom. Electr. Power Syst. 2017, 41, 30–36. [Google Scholar]

- Kettunen, J.; Salo, A.; Bunn, D.W. Optimization of Electricity Retailer’s Contract Portfolio Subject to Risk Preferences. IEEE Trans. Power Syst. 2010, 25, 117–128. [Google Scholar] [CrossRef]

- GAO, R. Research on Control. Strategy of Spot Market. Deviation of Electricity Sales Company Based on User-Side Adjustable Resources. Electr. Power Constr. 2019, 40, 114–122. [Google Scholar]

- Li, P.; Han, P.; Zheng, M.; Huang, M.; Sun, J. Short-Term Load Forecasting of Smart Grid Based on Long-Short-Term Memory Recurrent Neural Networks in Condition of Real-Time Electricity Price. Power Syst. Technol. 2018, 42, 4045–4052. [Google Scholar]

- Wei, Q.; Chen, S.; Huang, W.; Ma, G.; Tao, C. Forecasting Method of Clearing Price in Spot Market by Random Forest Regression. Proc. CSEE 2021, 41, 1360–1367. [Google Scholar]

- Bo, L. Model and Application of Electricity Procurement and Sale Strategies for Electricity Retailers Considering Demand Response and Price Uncertainties; Chongqing University: Chongqing, China, 2018. [Google Scholar]

- Yang, M.; Tang, L.; Guo, S.; Luo, G. Optimal Trading Strategy in Balancing Market for Electricity Retailer Considering Risk Aversion. Power Syst. Technol. 2016, 40, 29–38. [Google Scholar]

- Liangyuan, F.S. Trading Model in Balanced Market. for Power Retailers Considering Risk Aversion. Proc. CSU-EPSA 2020, 32, 22–27. [Google Scholar]

- Yicheng, Y.L. Optimal Model for CCHP of Power Retailer Considering the Daily Deviation Penalty. Electr. Power Constr. 2020, 41, 98–105. [Google Scholar]

- Rui, M.J. Optimal Model for Daily Deviation Penalty of Electricity Retailer Considering Real-time Electricity Trading. Electr. Power Constr. 2019, 40, 11–19. [Google Scholar]

- Mingzheng, T.W. Combine the day-ahead market and real-time market optimization of electric vehicles. Heilongjiang Electr. Power 2018, 40, 461–466. [Google Scholar]

- Xiaofeng, G.K. Optimization Strategy of Incentive-based Demand Response for Electricity Retailer in Spot Market Environment. Autom. Electr. Power Syst. 2020, 44, 28–37. [Google Scholar]

- Song, H.; Liu, Y.; Liu, J.; Wang, L.; Li, C.; Liu, J. Intelligent Dynamic Pricing of Electricity Retailers Considering Distributed Energy Storage Interaction on User Side. Proc. CSEE 2020, 40, 7959–7972. [Google Scholar]

- Mirhoseini, P.; Ghaffarzadeh, N. Economic battery sizing and power dispatch in a grid-connected charging station using convex method. J. Energy Storage 2020, 31, 101651. [Google Scholar] [CrossRef]

- Zhang, T.; Wang, L.; Wang, Y.; Lei, S. Multi-Objective Optimal Dsipatching Model of Electricity Retailers with Distributed Generator under Energy Deviation Penalty. Trans. China Electrotech. Soc. 2019, 34, 3265–3274. [Google Scholar]

- Rassaei, F.; Soh, W.S.; Chua, K.-C. Distributed Scalable Autonomous Market-Based Demand Response via Residential Plug-In Electric Vehicles in Smart Grids. IEEE Trans. Smart Grid 2016, 9, 3281–3290. [Google Scholar] [CrossRef]

- He, Y.; Han, A. Short-Term Power Load Probability Density Forecasting Method Based on Real Time Price and Support Vector Quantile Regression. Proc. CSEE 2017, 37, 768–776. [Google Scholar]

- Long, S.; Xu, J.; Yang, Z.; Feng, S. Research on Unbalanced Cost Composition and Allocation Mechanism in Spot Electricity Market. Power Syst. Technol. 2019, 43, 2649–2657. [Google Scholar]

- Li, J.X. Electricity Regulatory Mechanisms in Australia and Its Enlightenment to China. Autom. Electr. Power Syst. 2021, 45, 1–12. [Google Scholar]

- Guangdong Electric Power Trading Center Co., Ltd. Basic Rules of Guangdong Electricity Market Trading; Southern Energy Regulatory Bureau: Guangdong, China; Guangdong Provincial Economic and Information Technology Commission: Guangdong, China; Guangdong Provincial Development and Reform Commission: Guangdong, China, 2018. [Google Scholar]

- Guangdong Electric Power Trading Center Co., Ltd. System Operation Management Implementation Rules; Guangzhou Power Exchange Center: Guangdong, China; Southern Energy Regulatory Bureau: Guangdong, China; Guangdong Provincial Economic and Information Technology Commission: Guangdong, China; Guangdong Provincial Development and Reform Commission: Guangdong, China, 2018. [Google Scholar]

- Guangdong Electric Power Trading Center Co., Ltd. Transaction Settlement Rules; Guangzhou Power Exchange Center, Ed.; Southern Energy Regulatory Bureau: Guangdong, China; Guangdong Provincial Economic and Information Technology Commission: Guangdong, China; Guangdong Provincial Development and Reform Commission: Guangdong, China, 2018. [Google Scholar]

- Energy Bureau of Guangdong Province, South China Supervision Bureau of National Energy Administration. Guangdong Spot Electricity Market Trading Implementation Rules; Guangdong Electric Power Trading Center Co., Ltd.: Guangdong, China, 2018. [Google Scholar]

- Xue, J.; Tao, Q.; Wang, D.; Sang, B.; Yang, B. Economic Feasibility of User-Side Battery Energy Storage Based on Whole-Life-Cycle Cost Model. Power Syst. Technol. 2016, 40, 2471–2476. [Google Scholar]

- Guangdong Electric Power Market. 2018 Annual Report; Guangzhou Power Exchange Center: Guangdong, China, 2018. [Google Scholar]

- Weixin, H.S. Negative Price in National Electricity Market of Australia and its Enlightenment. Sino-Glob. Energy 2021, 26, 1–8. [Google Scholar]

- Guoqiang, L.Q. Impact of COVID-19 on China’s Total Electricity Consumption in 2020 and Its Trend. Electr. Power Constr. 2020, 53, 248–257. [Google Scholar]

- Zhang, J. Research on Hybrid Forecasting Model of Short Term Eleetricity Price in Electricity Market Environment; North China Electric Power University: Beijing, China, 2011. [Google Scholar]

- Kazempour, J.; Hobbs, B.F. Value of Flexible Resources, Virtual Bidding, and Self-Scheduling in Two-Settlement Electricity Markets with Wind Generation—Part I: Principles and Competitive Model. IEEE Trans. Power Syst. 2018, 33, 749–759. [Google Scholar] [CrossRef] [Green Version]

| Deviation Assessment Range: | <−5% | <−5% or >5% | <−4% or >4% | <−3% or >3% |

| Regions | Guizhou, Shaanxi, Zhejiang, Inner Mongolia, Beijing, Tianjin, Tangshan, northern Hebei, Jilin | Henan, Beijing, Xinjiang, Liaoning, Jiangxi, Guangxi, Heilongjiang, Qinghai, Ningxia | Guangdong, Hainan, Shanghai (July to September) | Sichuan, Fujian, Hubei, Chongqing, Hunan, Yunnan, Jiangsu |

| Deviation Assessment Range: | <−2% or >3% | <−3% | <−2% | <−2% or >6% |

| Regions | Anhui | Gansu | Shanxi | Shandong |

| Difference of Peak and Valley Price/RMB (Below 1 kV) | Provinces and Cities |

|---|---|

| 0.4~0.5 | Shanghai (unitary system), Ningxia (unitary system), Shanxi, Yunnan (abundant water period) |

| 0.5~0.6 | Shaanxi Yulin, Hebei, Yunnan (dry season), Xinjiang, Qinghai (below 100 KVA), Anhui (some months) |

| 0.6~0.7 | Tianjin, Beijing (development zone), Shaanxi, Henan, Gansu, Guangdong (5 cities), Hainan (power grid retailer), Qinghai (above 100 KVA), Anhui (July–September) |

| 0.7~0.8 | Shanghai (non-summer and two-part tariff), Shandong (unitary system), Guangdong (9 cities), Hainan (electric vehicle charging and replacing) |

| 0.8~0.9 | Shanghai (summer and two-part tariff), Jiangsu, Zhejiang, Guangdong (5 cities) |

| 1.1~1.2 | Beijing (urban, suburban) |

| Electricity Growth (%) | First Quarter | Second Quarter | Third Quarter |

|---|---|---|---|

| Total | −10.40% | −2.30% | 0.50% |

| Primary industry | 0 | 0 | 0 |

| The secondary industry | −12.10% | −1.10% | 1.20% |

| The tertiary industry | −16.50% | −10.20% | −1.60% |

| Electricity Cost (¥) | May 15 | May 16 | June 20 | June 21 | June 22 |

|---|---|---|---|---|---|

| DA electricity cost | 14,735.5 | 16,574.0 | 17,573.5 | 18,565.1 | 17,142.2 |

| RT electricity cost | 76.6 | 93.3 | 92.2 | 68.4 | 47.0 |

| Deviation assessment cost | 34.3 | 21.4 | 38.7 | 16.0 | 30.6 |

| Total electricity cost | 14,846.4 | 16,688.7 | 17,704.4 | 18,649.5 | 17,219.8 |

| Unit Price | Price 1 | Price 2 | Price 1 |

|---|---|---|---|

| Capacity of ESD | 1500 CNY/kWh | 1000 CNY/kWh | 600 CNY/kWh |

| Power of ESD | 500 CNY/kWh | 300 CNY/kWh | 300 CNY/kWh |

| Recover Year/Price | May 15 | May 16 | June 20 | June 21 | June 22 |

|---|---|---|---|---|---|

| Recover year with ESD cost1 | 11 y | 11 y | 9 y | 7 y | 9 y |

| Recover year with ESD cost2 | 7 y | 7 y | 6 y | 5 y | 6 y |

| Recover year with ESD cost3 | 5 y | 5 y | 4 y | 3 y | 4 y |

| Cost Save | ||||||

|---|---|---|---|---|---|---|

| ±4% | 1 | 14,490.3 | 14,516.34 | −26.0375 | 0 | −272.13 |

| ±4% | 2 | 14,490.3 | 14,516.34 | −26.0375 | 0 | −272.13 |

| ±2% | 1 | 14,496.96 | 14,516.34 | −19.3819 | 0 | −265.48 |

| ±2% | 2 | 14,496.96 | 14,516.34 | −19.3819 | 0 | −265.48 |

| (¥) | (¥) | |||

|---|---|---|---|---|

| Spring/autumn | 2,639,786 | 2,593,358 | 41,594 | 4834 |

| Summer | 4,044,774 | 4,031,940 | −2972 | 15,807 |

| winter | 3,557,041 | 3,495,037 | 55,230 | 6774 |

| (¥) | (¥) | Cost Save | |||

|---|---|---|---|---|---|

| Spring/autumn | 2,489,039 | 2,492,502 | −3463.74 | 0 | −150,747 |

| Summer | 3,895,740 | 3,899,111 | −3370.92 | 0 | −149,034.3 |

| winter | 3,351,233 | 3,359,089 | −7855.33 | 0 | −205,807.6 |

| Capacity and Power Configuration | May 15 | May 16 | June 20 | June 21 | June 22 |

|---|---|---|---|---|---|

| Average energy storage capacity/kWh | 1185 | 1249 | 1260 | 1048 | 1127 |

| Average energy storage power/kW | 443 | 452 | 452 | 452 | 432 |

| Average recovery years/year | 5.2 | 6.7 | 5.2 | 4.0 | 4.1 |

| Electricity Price Deviation | May 15 | May 16 | June 20 | June 21 | June 22 |

|---|---|---|---|---|---|

| Mean/¥ | 0.0391439 | −0.005673 | 0.0200903 | −0.006479 | −0.0139309 |

| Maximum/¥ | 0.1448512 | 0.064257 | 0.111842 | 0.127431 | 0.13121 |

| Minimum/¥ | −0.0269366 | −0.1261046 | −0.107666 | −0.0793696 | −0.050216 |

| Recover Year\Random Price | Type 1 | Type 2 | Type 3 | Type 4 | Type 5 |

|---|---|---|---|---|---|

| Average recover year/year | 4.9 | 5.1 | 4.4 | 4.2 | 4.7 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lu, T.; Zhang, W.; Ding, X. Operation Strategy of Electricity Retailers Based on Energy Storage System to Improve Comprehensive Profitability in China’s Electricity Spot Market. Energies 2021, 14, 6424. https://doi.org/10.3390/en14196424

Lu T, Zhang W, Ding X. Operation Strategy of Electricity Retailers Based on Energy Storage System to Improve Comprehensive Profitability in China’s Electricity Spot Market. Energies. 2021; 14(19):6424. https://doi.org/10.3390/en14196424

Chicago/Turabian StyleLu, Ting, Weige Zhang, and Xiaowei Ding. 2021. "Operation Strategy of Electricity Retailers Based on Energy Storage System to Improve Comprehensive Profitability in China’s Electricity Spot Market" Energies 14, no. 19: 6424. https://doi.org/10.3390/en14196424

APA StyleLu, T., Zhang, W., & Ding, X. (2021). Operation Strategy of Electricity Retailers Based on Energy Storage System to Improve Comprehensive Profitability in China’s Electricity Spot Market. Energies, 14(19), 6424. https://doi.org/10.3390/en14196424