Optimizing the Life Cycle of Physical Assets through an Integrated Life Cycle Assessment Method

Abstract

1. Introduction

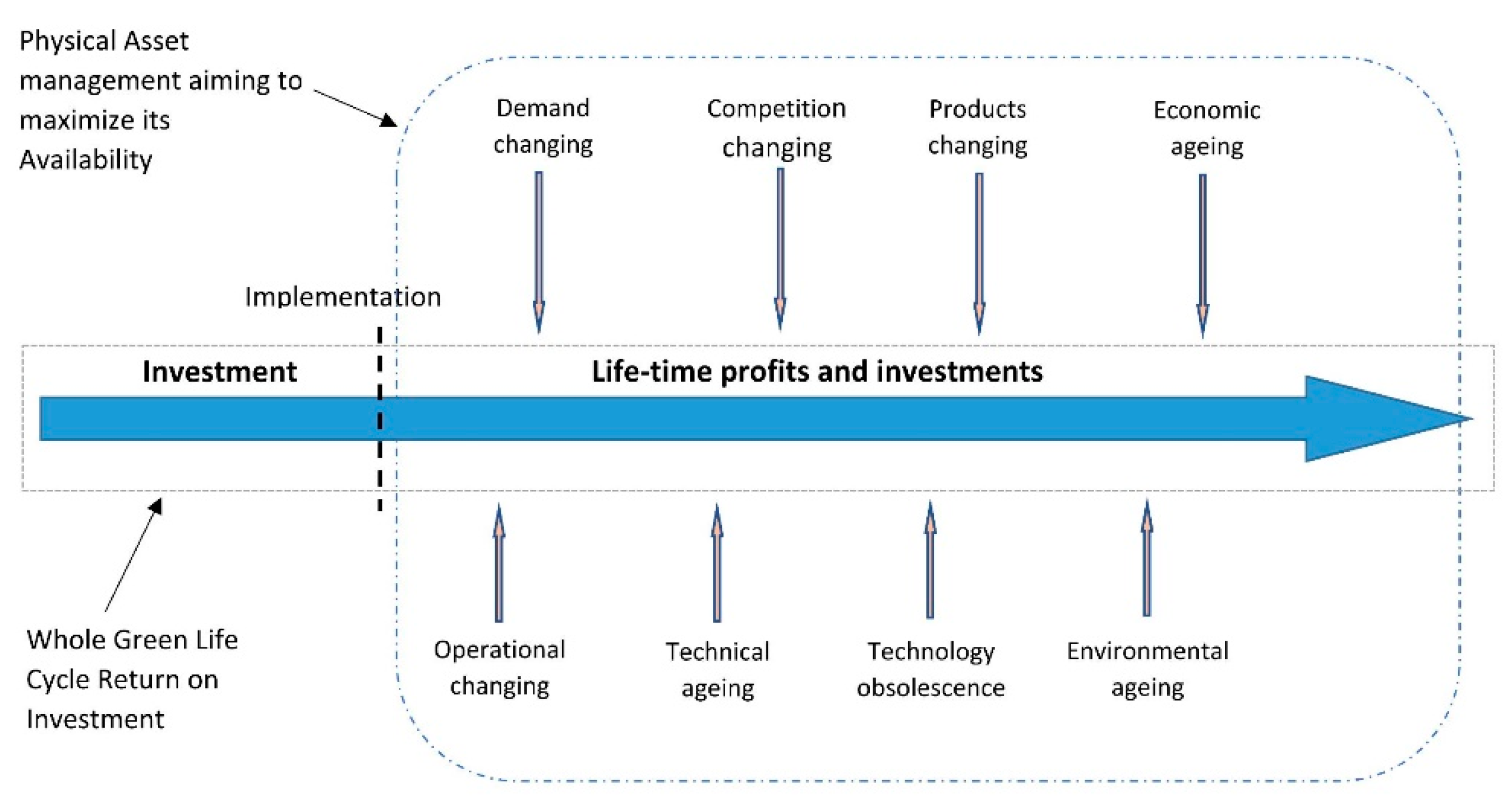

1.1. Framework

“Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”[14]

“The Earth is one but the world is not. We all depend on the biosphere for sustaining our lives. Yet each community, each country, strives for survival and prosperity with little regard for its impact on others. Some consume the Earth′s resources at a rate that would leave little for future generations. Others, many more in number, consume far too little and live with prospect of hunger, squalor, disease, and early death.”[36]

1.2. Aim and Research Methodology

- Research of the existing methods, and their limitations, applied to technology and sustainability investment;

- Design of the new methods to be introduced as decision-making tools in the Strategic Asset Management Plan (SAMP) as part of ISO 55001 requirements;

- Quantitative validation of the methods with investment data.

1.3. Paper Structure

- Section 2 synthesizes relevant literature on asset life cycle models and methods;

- Section 3 presents the Integrated Life Cycle Assessment Method (ILCAM);

- Section 4 presents the Integrated Life Cycle Investment Assessment Method (ILCIAM);

- Section 5 presents a discussion;

- Section 6 offers the conclusions.

2. Literature Review

- CA: Equipment Cost of Acquisition

- CMj: Cost of Maintenance in year j = 1, 2, 3, … n

- COj: Cost of Operation in year j = 1, 2, 3, … n

- iA: Apparent rate

- Vn: Value of the equipment over a period n = 1, 2, 3 … n

- t: Number of periods considered for MTTR

- d: Number of days per year MTTR Mean Time to Repair

3. Integrated Life Cycle Assessment Method (ILCAM)

- Linear depreciation method—The annual decay of the equipment value is constant over time;

- Sum of the digits method—The annual depreciation is not linear but less than that of the exponential method;

- Exponential method—The annual depreciation is exponential over the equipment’s life.

- Equipment cost of acquisition;

- Cession annual values (calculated according to the above methods or the market values);

- Annual maintenance and operation costs;

- Apparent rate.

- dj: Annual depreciation quota

- II: Initial Investment

- N: Time of life corresponding to VCN

- VCN: Residual value of the equipment at the end of N time periods

- j: j = 1, 2, 3 … n

- Vn: Equipment value in period n = 1, 2, 3 … n

- II: Initial Investment

- Mj: Maintenance in year j = 1, 2, 3, … n

- Fj: Functioning in year j = 1, 2, 3, … n

- iA: Apparent rate

- Vn: Value of the equipment over a period n = 1, 2, 3 … n

- iA: Apparent rate

- iI: Inflation rate

- iC: Capitalization rate

- ROI: Return Over Investment

- II: Initial Investment

- CFj: Cash Flow in year j = 1, 2, 3, … n

- iA: Apparent rate

- II: Initial Investment

- IMj: Integrated Maintenance in year j = 1, 2, 3, … n

- IFj: Integrated Functioning in year j = 1, 2, 3, … n

- TUIj: Technological Upgrade Investment in year j = 1, 2, 3, … n

- TDj: Technology depreciation in year j = 1, 2, 3, … n

- SDj: Sustainability depreciation in year j = 1, 2, 3, … n

- iA: Apparent rate

- Vn: Value of the equipment over a period n = 1, 2, 3 … n

- Rj: Residual value of the upgraded part n = 1, 2, 3 … n

- IROI: Integrated Return Over Investment

- II: Initial Investment

- CFj: Cash Flow in year j = 1, 2, 3, … n

- iA: Apparent rate

- II: Initial Investment

- IMj: Integrated Maintenance in year j = 1, 2, 3, … n

- IFj: Integrated Functioning in year j = 1, 2, 3, … n

- TUIj: Technological Upgrade Investment in year j = 1, 2, 3, … n

- TDj: Technology depreciation in year j = 1, 2, 3, … n

- SDj: Sustainability depreciation in year j = 1, 2, 3, … n

- iA: Apparent rate

- Vn: Value of the equipment over a period n = 1, 2, 3 … n

- Rj: Residual value of the upgraded part n = 1, 2, 3 … n

- CFj: Cash Flow in year j = 1, 2, 3 … n

- IROI2: Integrated Return Over Investment

- II: Initial Investment

- IMj: Integrated Maintenance in year j = 1, 2, 3, … n

- IFj: Integrated Functioning in year j = 1, 2, 3, … n

- TUIj: Technological Upgrade Investment in year j = 1, 2, 3, … n

- TDj: Technology depreciation in year j = 1, 2, 3, … n

- SDj: Sustainability depreciation in year j = 1, 2, 3, … n

- iA: Apparent rate

- Vn: Value of the equipment over a period n = 1, 2, 3 … n

- Rj: Residual value of the upgraded part n = 1, 2, 3 … n

- CFj: Cash Flow in year j = 1, 2, 3 … n

- IROI3: Integrated Return Over Investment

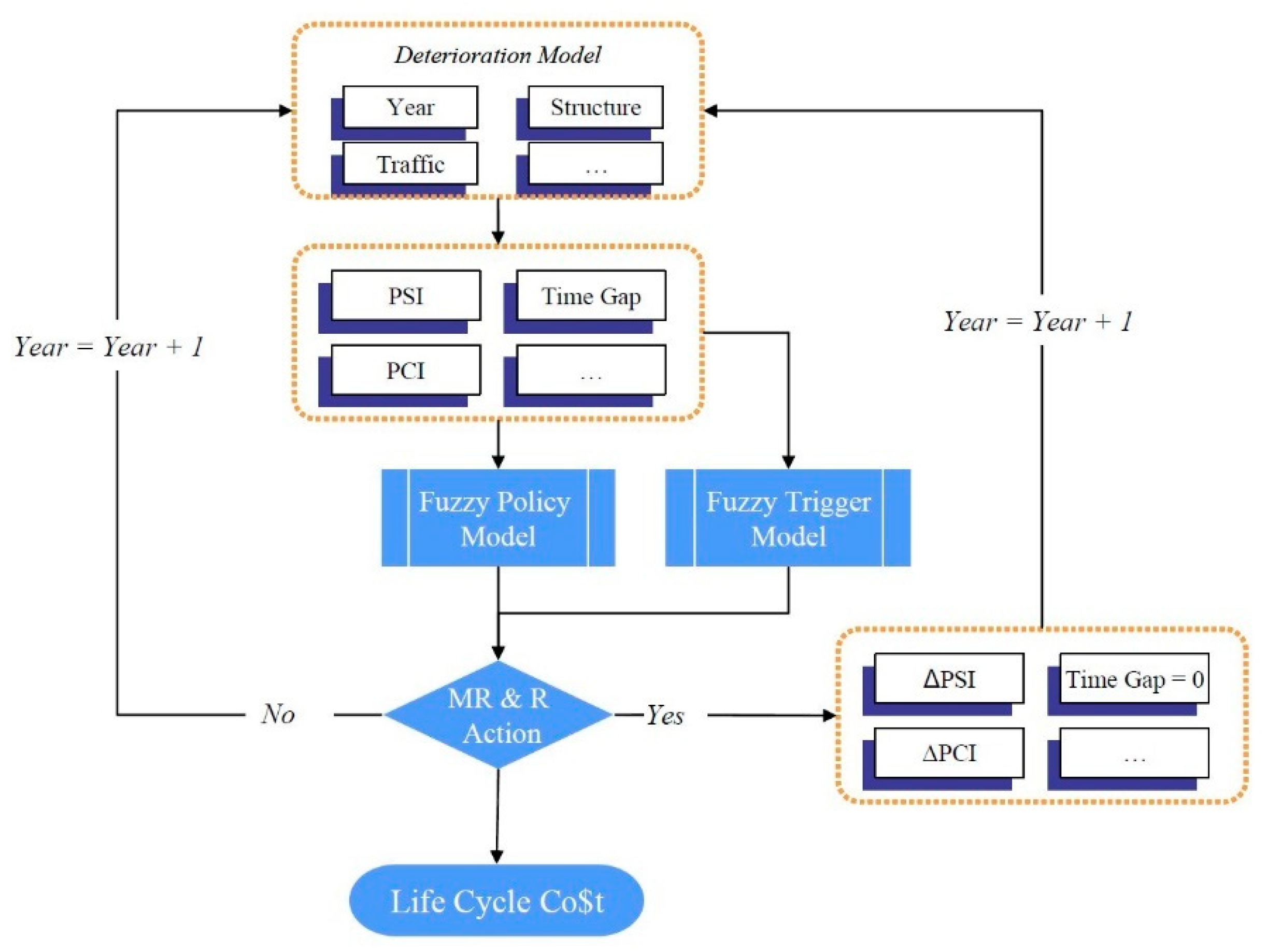

4. Integrated Life Cycle Investment Assessment Method (ILCIAM)

- MTBFj: Mean Time Between Failures

- MWTj: Mean Waiting Time in year j = 1, 2, 3, … n

- MTTRj: Mean Time to Repair

- Fj: Functioning in year j = 1, 2, 3, … n

- Mj: Maintenance in year j = 1, 2, 3, … n

- IRRj: Internal Rate of Return in year j = 1, 2, 3, … n

- Ij: Physical Asset Value in year j = 1, 2, 3, … n

- Bj: Benefit in year j = 1, 2, 3, … n

- MTBFj: Mean Time Between Failures

- MWTj: Mean Waiting Time in year j = 1, 2, 3, … n

- MTTRj: Mean Time to Repair

- IFj: Integrated Functioning in year j = 1, 2, 3, … n

- IMj: Integrated Maintenance in year j = 1, 2, 3, … n

- IRRj: Internal Rate Return in year j = 1, 2, 3, … n

- SDj: Sustainability depreciation in year j = 1, 2, 3, … n

- TDj: Technology depreciation in year j = 1, 2, 3, … n

- TUIj: Technological upgrade investment in year j = 1, 2, 3, … n

- Ij: Physical Asset Value in year j = 1, 2, 3, … n

- Bj: Benefit in year j = 1, 2, 3, … n

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Scopus Document Search. Available online: https://www.scopus.com (accessed on 16 October 2020).

- Keeble, B.R. The Brundtland report: ‘Our common future’. Med. War 1988, 4, 17–25. [Google Scholar] [CrossRef]

- Scoones, I. Sustainability. Dev. Pract. 2007, 17, 589–596. [Google Scholar] [CrossRef]

- Zambon, I.; Colantoni, A.; Cecchini, M.; Mosconi, E.M. Rethinking Sustainability within the Viticulture Realities Integrating Economy, Landscape and Energy. Sustainability 2018, 10, 320. [Google Scholar] [CrossRef]

- Paun, D. Sustainability and Financial Performance of Companies in the Energy Sector in Romania. Sustainability 2017, 9, 1722. [Google Scholar] [CrossRef]

- Asif, M. Urban Scale Application of Solar PV to Improve Sustainability in the Building and the Energy Sectors of KSA. Sustainability 2016, 8, 1127. [Google Scholar] [CrossRef]

- Siksnelyte, I.; Zavadskas, E.K.; Streimikiene, D.; Sharma, D. An Overview of Multi-Criteria Decision-Making Methods in Dealing with Sustainable Energy Development Issues. Energies 2018, 11, 2754. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N. Sustainable Solutions for Green Financing and Investment in Renewable Energy Projects. Energies 2020, 13, 788. [Google Scholar] [CrossRef]

- Yumashev, A.; Ślusarczyk, B.; Kondrashev, S.; Mikhaylov, A. Global Indicators of Sustainable Development: Evaluation of the Influence of the Human Development Index on Consumption and Quality of Energy. Energies 2020, 13, 2768. [Google Scholar] [CrossRef]

- Holdren, J.P. Energy and Sustainability. Science 2007, 315, 737. [Google Scholar] [CrossRef] [PubMed]

- Vasylieva, T.; Lyulyov, O.; Bilan, Y.; Streimikiene, D. Sustainable Economic Development and Greenhouse Gas Emissions: The Dynamic Impact of Renewable Energy Consumption, GDP, and Corruption. Energies 2019, 12, 3289. [Google Scholar] [CrossRef]

- Hillerbrand, R. Why Affordable Clean Energy Is Not Enough. A Capability Perspective on the Sustainable Development Goals. Sustainability 2018, 10, 2485. [Google Scholar] [CrossRef]

- Kaczmarczyk, M.; Sowiżdżał, A.; Tomaszewska, B. Energetic and Environmental Aspects of Individual Heat Generation for Sustainable Development at a Local Scale—A Case Study from Poland. Energies 2020, 13, 454. [Google Scholar] [CrossRef]

- WCED. Report of the World Commission on Environment and Development: Our Common Future Acronyms and Note on Terminology Chairman’s Foreword. Rep. World Comm. Environ. Dev. Our Common Futur. 1987, 10, 1–300. [Google Scholar]

- Stahel, W.R. The circular economy. Nature 2016, 531, 435–438. [Google Scholar] [CrossRef]

- Pais, J.; Raposo, H.D.N.; Meireles, A.; Farinha, J.T.; Isec, P.A.C. ISO 55001—A Strategic Tool for the Circular Economy–Diagnosisof the Organization’s State. J. Ind. Eng. Manag. Sci. 2019, 2018, 89–108. [Google Scholar] [CrossRef]

- Zink, T.; Geyer, R. Circular Economy Rebound. J. Ind. Ecol. 2017, 21, 593–602. [Google Scholar] [CrossRef]

- Prieto-Sandoval, V.; Jaca, C.; Ormazabal, M. Towards a consensus on the circular economy. J. Clean. Prod. 2018, 179, 605–615. [Google Scholar] [CrossRef]

- Johnson, D.; Bogers, M.; Hadar, R.; Bilberg, A.; Jiang, R.; Kleer, R.; Piller, F.T.; Gebhardt Andreas, J.-S.H.; Ålgårdh, J.; Strondl, A.; et al. 3D Printing the Next Revolution in Industrial Manufacturing. J. Ind. Ecol. 2017, 237, 1–10. [Google Scholar] [CrossRef]

- Kirchherr, J.; Reike, D.; Hekkert, M. Conceptualizing the circular economy: An analysis of 114 definitions. Resour. Conserv. Recycl. 2017, 127, 221–232. [Google Scholar] [CrossRef]

- Ellen, M.; Company, M. Towards the Circular Economy: Accelerating the Scale-Up Across Global Supply Chains. World Econ. Forum 2014, 1–64. [Google Scholar]

- Ellen MacArthur Foundation. Complete the Picture: How the Circular Economy Tackles Climate Change; Ellen MacArthur Found: Isle of Wight, UK, 2019; pp. 1–62. [Google Scholar]

- Ellen MacArthur Foundation. The Circular Economy in Detail. Available online: https://www.ellenmacarthurfoundation.org/explore/the-circular-economy-in-detail (accessed on 6 June 2021).

- Ellen MacArthur Foundation. The Circular Economy System Diagram. 2019. Available online: https://www.ellenmacarthurfoundation.org/circular-economy/concept/infographic (accessed on 3 June 2021).

- Ellen MacArthur Foundation. Towards the Circular Economy; Ellen MacArthur Found: Isle of Wight, UK, 2013; pp. 23–44. [Google Scholar]

- Ellen MacArthur Foundation. Circular Design Resources; Ellen MacArthur Found: Isle of Wight, UK, 2017; p. 30. [Google Scholar]

- Yong, R. The circular economy in China. J. Mater. Cycles Waste Manag. 2007, 9, 121–129. [Google Scholar] [CrossRef]

- Goodland, R. The Concept of Environmental Sustainability. Annu. Rev. Ecol. Syst. 1995, 26, 1–24. [Google Scholar] [CrossRef]

- Farinha, J.T. The Contribution of Terology for a Sustainable Future. Proc. 3rd WSEAS Int. Conf. Energy Planning, Energy Saving, Environ. Educ. EPESE ’09, Renew. Energy Sources, RES ’09, Waste Manag, WWAI ’09; WSEAS: Tenerife, Spain, 2009; pp. 110–118. [Google Scholar]

- Franciosi, C.; Iung, B.; Miranda, S.; Riemma, S. Maintenance for Sustainability in the Industry 4.0 context: A Scoping Literature Review. IFAC-PapersOnLine 2018, 51, 903–908. [Google Scholar] [CrossRef]

- Komonen, K.; Kortelainen, H.; Räikkönen, M. An Asset Management Framework to Improve Longer Term Returns on Investments in the Capital Intensive Industries. In Proceedings of the Engineering Asset Management; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2008; pp. 418–432. [Google Scholar]

- Bilge, P.; Emec, S.; Seliger, G.; Jawahir, I. Mapping and Integrating Value Creation Factors with Life-cycle Stages for Sustainable Manufacturing. Procedia CIRP 2017, 61, 28–33. [Google Scholar] [CrossRef]

- Liyanage, J.P.; Badurdeen, F.; Ratnayake, R.C. Industrial Asset Maintenance and Sustainability Performance: Economical, Environmental, and Societal Implications. In Handbook of Maintenance Management and Engineering; Springer: London, UK, 2009; pp. 665–693. [Google Scholar] [CrossRef]

- Crippa, M.; Guizzardi, D.; Muntean, M.; Schaaf, E.; Solazzo, E.; Monforti-Ferrario, F.; Vignati, E. Fossil CO2 Emissions of All World Countries-2020 Report; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar]

- EEA. Greenhouse Gas Emissions by Source Sector. 2021. Available online: http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=env_air_gge&lang=en (accessed on 17 June 2021).

- World Commission on Environment and Development. Our Common Future. (The Brundtland Report); Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- World Steel Association. 2020 World Steel in Figures; World Steel Association: Brussels, Belgium, 2020. [Google Scholar]

- Pothen, F.; Growitsch, C.; Engelhardt, J.; Reif, C. Scrap Bonus External Costs and Fair Competition in the Global Value; Fraunhofer-Institute for Microstructure of Materials and Systems IMWS: Halle, Germany, 2019. [Google Scholar]

- Harvey, L.D. Iron and steel recycling: Review, conceptual model, irreducible mining requirements, and energy implications. Renew. Sustain. Energy Rev. 2021, 138, 110553. [Google Scholar] [CrossRef]

- Sun, W.; Wang, Q.; Zhou, Y.; Wu, J. Material and energy flows of the iron and steel industry: Status quo, challenges and perspectives. Appl. Energy 2020, 268, 114946. [Google Scholar] [CrossRef]

- Rehan, R.; Nehdi, M. Carbon dioxide emissions and climate change: Policy implications for the cement industry. Environ. Sci. Policy 2005, 8, 105–114. [Google Scholar] [CrossRef]

- Lüthi, D.; Le Floch, M.; Bereiter, B.; Blunier, T.; Barnola, J.-M.; Siegenthaler, U.; Raynaud, D.; Jouzel, J.; Fischer, H.; Kawamura, K.; et al. High-resolution carbon dioxide concentration record 650,000–800,000 years before present. Nat. Cell Biol. 2008, 453, 379–382. [Google Scholar] [CrossRef]

- Schneider, S.H. What is ’dangerous’ climate change? Nat. Cell Biol. 2001, 411, 17–19. [Google Scholar] [CrossRef]

- Caldeira, K.; Jain, A.K.; Hoffert, M.I. Climate Sensitivity Uncertainty and the Need for Energy without CO2 Emission. Science 2003, 299, 2052–2054. [Google Scholar] [CrossRef]

- Li, Z.-L.; Mu, C.-C.; Chen, X.; Wang, X.-Y.; Dong, W.-W.; Jia, L.; Mu, M.; Streletskaya, I.; Grebenets, V.; Sokratov, S.; et al. Changes in net ecosystem exchange of CO2 in Arctic and their relationships with climate change during 2002–2017. Adv. Clim. Chang. Res. 2021, 12, 475–481. [Google Scholar] [CrossRef]

- Hao, Y.; Chen, H.; Wei, Y.-M.; Li, Y.-M. The influence of climate change on CO 2 (carbon dioxide) emissions: An empirical estimation based on Chinese provincial panel data. J. Clean. Prod. 2016, 131, 667–677. [Google Scholar] [CrossRef]

- Earth Overshoot Days. Past Earth Overshoot Days. 2021. Available online: https://www.overshootday.org/newsroom/past-earth-overshoot-days/ (accessed on 9 July 2021).

- Konstantas, A.; Stamford, L.; Azapagic, A. Economic sustainability of food supply chains: Life cycle costs and value added in the confectionary and frozen desserts sectors. Sci. Total Environ. 2019, 670, 902–914. [Google Scholar] [CrossRef] [PubMed]

- Rapa, M.; Gobbi, L.; Ruggieri, R. Environmental and Economic Sustainability of Electric Vehicles: Life Cycle Assessment and Life Cycle Costing Evaluation of Electricity Sources. Energies 2020, 13, 6292. [Google Scholar] [CrossRef]

- Medina-Salgado, M.; García-Muiña, F.; Cucchi, M.; Settembre-Blundo, D. Adaptive Life Cycle Costing (LCC) Modeling and Applying to Italy Ceramic Tile Manufacturing Sector: Its Implication of Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 101. [Google Scholar] [CrossRef]

- Pais, J.; Farinha, J.T.; Cardoso, A.J.M.; Raposo, H. Optimizing the Life Cycle of Physical Assets—A Review. WSEAS Trans. Syst. Control. 2020, 15, 417–430. [Google Scholar] [CrossRef]

- Farinha, J.T.; Raposo, H.N.; Galar, D. Life Cycle Cost versus Life Cycle Investment—A new Approach. WSEAS Trans. Syst. Control. 2020, 15, 743–753. [Google Scholar] [CrossRef]

- Raposo, H.; Farinha, J.T.; Pais, E.; Galar, D. An Integrated Model for Dimensioning the Reserve Fleet based on the Maintenance Policy. WSEAS Trans. Syst. Control. 2021, 16, 43–65. [Google Scholar] [CrossRef]

- International Organization for Standardization. ISO 55002: Asset Management—Management Systems—Guidelines for the Application of ISO Geneva; International Organization for Standardization: Geneva, Switzerland, 2018. [Google Scholar]

- The Institute of Asset Management. Asset Management—An Anatomy (v3); The Institute of Asset Management: London, UK, 2015; pp. 1–84. [Google Scholar]

- IAM and BSI. PAS 55-1:2008-Asset Management-Part 1: Specification for the Optimized Management of Physical Assets; IAM and BSI: Milton Keynes, UK, 2008. [Google Scholar]

- Jardine, A.K.S.; Tsang, A.H.C. Maintenance, Replacement, and Reliability-Theory and Applications; 2nd ed.; CRC Press: Boca Raton, FL, USA, 2013. [Google Scholar]

- Campbell, J.D.; Jardine, A.K.S.; McGlynn, J. Asset Management Excellence-Optimizing Equipment Life-Cycle Decisions, 2nd ed.; CRC Press: Boca Raton, FL, USA, 2011. [Google Scholar]

- Ellram, L.M. Total cost of ownership. Int. J. Phys. Distrib. Logist. Manag. 1995, 25, 4–23. [Google Scholar] [CrossRef]

- Woodward, D.G. Life cycle costing—Theory, information acquisition and application. Int. J. Proj. Manag. 1997, 15, 335–344. [Google Scholar] [CrossRef]

- Norris, G.A. Integrating life cycle cost analysis and LCA. Int. J. Life Cycle Assess. 2001, 6, 118–120. [Google Scholar] [CrossRef]

- Chen, C. Fuzzy Logic-Based Life-Cycle Costs.pdf. In Proceedings of the 6th Int. Conf. Manag. Pavements, Brisbane, Australia, 19–24 October 2004; pp. 1–12. [Google Scholar]

- Tokede, O.; Roetzel, A.; Ruge, G. A Holistic Life Cycle Sustainability Evaluation of a Building Project. Sustain. Cities Soc. 2021, 73, 103107. [Google Scholar] [CrossRef]

- Haanstra, W.; Braaksma, A.; van Dongen, L. Designing a hybrid methodology for the Life Cycle Valuation of capital goods. CIRP J. Manuf. Sci. Technol. 2021, 32, 382–395. [Google Scholar] [CrossRef]

- Boomen, M.V.D.; Schoenmaker, R.; Wolfert, A. A life cycle costing approach for discounting in age and interval replacement optimisation models for civil infrastructure assets. Struct. Infrastruct. Eng. 2017, 14, 1–13. [Google Scholar] [CrossRef]

- Fox, B. Letter to the Editor—Age Replacement with Discounting. Oper. Res. 1966, 14, 533–537. [Google Scholar] [CrossRef][Green Version]

- Chen, C.; Savits, T.H. A discounted cost relationship. J. Multivar. Anal. 1988, 27, 105–115. [Google Scholar] [CrossRef]

- Van Noortwijk, J.M. Explicit formulas for the variance of discounted life-cycle cost. Reliab. Eng. Syst. Saf. 2003, 80, 185–195. [Google Scholar] [CrossRef]

- van Noortwijk, J.M.; Frangopol, D. Two probabilistic life-cycle maintenance models for deteriorating civil infrastructures. Probabilistic Eng. Mech. 2004, 19, 345–359. [Google Scholar] [CrossRef]

- Roda, I.; Macchi, M.; Albanese, S. Building a Total Cost of Ownership model to support manufacturing asset lifecycle management. Prod. Plan. Control. 2019, 31, 19–37. [Google Scholar] [CrossRef]

- Maletič, D.; Maletič, M.; Al-Najjar, B.; Gomišček, B. Development of a Model Linking Physical Asset Management to Sustainability Performance: An Empirical Research. Sustainability 2018, 10, 4759. [Google Scholar] [CrossRef]

- Dojutrek, M.; Makwana, P.; Labi, S. A Methodology for Highway Asset Valuation in Indiana. In A Methodology for Highway Asset Valuation in Indiana; Joint Transportation Research Program, Indiana Department of Transportation and Purdue University: West Lafayette, IN, USA, 2012; p. 75. [Google Scholar] [CrossRef][Green Version]

- Deng, J.; Han, X.; Pan, Z.; Wang, J.; Zhang, H.; Geng, G.; Ling, C. Research on Physical Depreciation Methods of Non-Toll Road Assets. In CICTP 2020; American Society of Civil Engineers: Reston, VA, USA, 2020; pp. 1011–1021. [Google Scholar]

- Shokouhi, M.; Moniri, M.; Shahheidar, B. Selecting the Appropriate Physical Asset Life Cycle Model with a Multi-Criteria Decision-Making Approach (Case Study: Petroleum Pipelines). Pet. Bus. Rev. 2019, 3, 51–62. [Google Scholar] [CrossRef]

- Durán, O.; Afonso, P.S.; Durán, P.A. Spare Parts Cost Management for Long-Term Economic Sustainability: Using Fuzzy Activity Based LCC. Sustainabilty 2019, 11, 1835. [Google Scholar] [CrossRef]

- Farinha, J.T. Manutenção: A Terologia e as Novas Ferramentas de Gestão, 1st ed.; Monitor Lisboa: Lisbon, Portugal, 2011. [Google Scholar]

- Farinha, J. Asset Maintenance Engineering Methodologies; CRC Press; Taylor & Francis Group: Boca Raton, FL, USA, 2018. [Google Scholar]

- Farinha, J.T.; Fonseca, I.; Simoes, A.; Barbosa, M.; Bastos, P.; Carvas, A. A Better Environment through Better Terology. Recent Adv. Energy Environ. 2010, 384–390. [Google Scholar]

- International Organization for Standardization. ISO 55000: Asset Management–Overview, Principles and Terminology; International Organization for Standardization: Geneva, Switzerland, 2014. [Google Scholar]

- International Organization for Standardization. ISO 55001—Asset Management—Management systems—Requirements; International Organization for Standardization: Geneva, Switzerland, 2014; p. 38. [Google Scholar]

- Martins, A.B.; Farinha, J.T.; Cardoso, A.M. Calibration and Certification of Industrial Sensors—A Global Review. WSEAS Trans. Syst. Control. 2020, 15, 394–416. [Google Scholar] [CrossRef]

- Balduíno, M.; Farinha, J.T.; Cardoso, A.M. Production Optimization versus Asset Availability—A Review. WSEAS Trans. Syst. Control. 2020, 15, 320–332. [Google Scholar] [CrossRef]

- Rodrigues, J.; Farinha, J.T.; Cardoso, A.M. Predictive Maintenance Tools—A Global Survey. WSEAS Trans. Syst. Control. 2021, 16, 96–109. [Google Scholar] [CrossRef]

- Oliveira, J.A.N. Engenharia Económica–Uma abordagem às Decisões de Investimento; McGraw-Hill: São Paulo, Brazil, 1982. [Google Scholar]

- Khakian, R.; Karimimoshaver, M.; Aram, F.; Benis, S.Z.; Mosavi, A.; Varkonyi-Koczy, A.R. Modeling Nearly Zero Energy Buildings for Sustainable Development in Rural Areas. Energies 2020, 13, 2593. [Google Scholar] [CrossRef]

- De La Cruz-Lovera, C.; Perea-Moreno, A.-J.; De La Cruz-Fernández, J.-L.; Alvarez-Bermejo, J.A.; Manzano-Agugliaro, F. Worldwide Research on Energy Efficiency and Sustainability in Public Buildings. Sustainablity 2017, 9, 1294. [Google Scholar] [CrossRef]

- Morseletto, P. Targets for a circular economy. Resour. Conserv. Recycl. 2020, 153, 104553. [Google Scholar] [CrossRef]

- Geng, Y.; Sarkis, J.; Bleischwitz, R. How to globalize the circular economy. Nat. Cell Biol. 2019, 565, 153–155. [Google Scholar] [CrossRef] [PubMed]

- Halkos, G.; Petrou, K.N. Analysing the Energy Efficiency of EU Member States: The Potential of Energy Recovery from Waste in the Circular Economy. Energies 2019, 12, 3718. [Google Scholar] [CrossRef]

- D’Adamo, I. Adopting a Circular Economy: Current Practices and Future Perspectives. Soc. Sci. 2019, 8, 328. [Google Scholar] [CrossRef]

- Rokicki, T.; Perkowska, A.; Klepacki, B.; Szczepaniuk, H.; Szczepaniuk, E.K.; Bereziński, S.; Ziółkowska, P. The Importance of Higher Education in the EU Countries in Achieving the Objectives of the Circular Economy in the Energy Sector. Energies 2020, 13, 4407. [Google Scholar] [CrossRef]

- Desing, H.; Widmer, R.; Beloin-Saint-Pierre, D.; Hischier, R.; Wäger, P. Powering a Sustainable and Circular Economy—An Engineering Approach to Estimating Renewable Energy Potentials within Earth System Boundaries. Energies 2019, 12, 4723. [Google Scholar] [CrossRef]

| Year | Overshoot Day | Year | Overshoot Day | Year | Overshoot Day |

|---|---|---|---|---|---|

| 1970 | 30 December | 1988 | 14 October | 2005 | 24 August |

| 1971 | 20 December | 1989 | 11 October | 2006 | 18 August |

| 1972 | 10 December | 1990 | 10 October | 2007 | 13 August |

| 1973 | 26 November | 1991 | 9 October | 2008 | 13 August |

| 1974 | 27 November | 1992 | 11 October | 2009 | 16 August |

| 1975 | 30 November | 1993 | 11 October | 2010 | 6 August |

| 1976 | 17 November | 1994 | 9 October | 2011 | 3 August |

| 1977 | 11 November | 1995 | 3 October | 2012 | 2 August |

| 1978 | 7 November | 1996 | 30 September | 2013 | 1 August |

| 1979 | 29 October | 1997 | 28 September | 2014 | 2 August |

| 1980 | 4 November | 1998 | 28 September | 2015 | 3 August |

| 1981 | 11 November | 1999 | 28 September | 2016 | 3 August |

| 1982 | 15 November | 2000 | 22 September | 2017 | 30 July |

| 1983 | 14 November | 2001 | 21 September | 2018 | 25 July |

| 1984 | 7 November | 2002 | 18 September | 2019 | 26 July |

| 1985 | 4 November | 2003 | 8 September | 2020 1 | 22 August |

| 1986 | 30 October | 2004 | 30 August | 2021 | 29 July |

| 1987 | 23 October |

| Model or Approach | Author | Year | Advantages | Disadvantages |

|---|---|---|---|---|

| Asset Management Process | Campbell | 1995 | • Nine step process | • Not a model |

| BELCAM Decision-support Tool | Vanier et al. | 1996 | • Gathers information only in order to use in the analysis of life cycle | • Based on buildings |

| • Don’t introduce mathematical models | ||||

| Asset Management Program | Malano et al. | 1999 | • Introduce elements of an asset management program | • Based on water utility |

| • Don’t introduce mathematical models | ||||

| • Not a model | ||||

| Asset Life Cycle Management | National Treasury guidelines | 2004 | • Sets a framework for asset management | • Not a model |

| Asset Management Modelling Framework | Malano et al. | 2005 | • LCC model is proposed | • Requires lots of data that may not be available |

| • Introduce mathematical models | ||||

| Asset Life Cycle Management | Schuman and Brent | 2005 | • Introduce elements of an asset management program | • Don’t introduce mathematical models |

| Asset Life Cost Management | Haffejee and Brent | 2008 | • Considers economic, environmental, social, and technical factors and performances; | • Based on water utility |

| • Assets management from before acquisition to disposal; | • Don’t introduce mathematical models |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

de Almeida Pais, J.E.; Raposo, H.D.N.; Farinha, J.T.; Cardoso, A.J.M.; Marques, P.A. Optimizing the Life Cycle of Physical Assets through an Integrated Life Cycle Assessment Method. Energies 2021, 14, 6128. https://doi.org/10.3390/en14196128

de Almeida Pais JE, Raposo HDN, Farinha JT, Cardoso AJM, Marques PA. Optimizing the Life Cycle of Physical Assets through an Integrated Life Cycle Assessment Method. Energies. 2021; 14(19):6128. https://doi.org/10.3390/en14196128

Chicago/Turabian Stylede Almeida Pais, José Edmundo, Hugo D. N. Raposo, José Torres Farinha, Antonio J. Marques Cardoso, and Pedro Alexandre Marques. 2021. "Optimizing the Life Cycle of Physical Assets through an Integrated Life Cycle Assessment Method" Energies 14, no. 19: 6128. https://doi.org/10.3390/en14196128

APA Stylede Almeida Pais, J. E., Raposo, H. D. N., Farinha, J. T., Cardoso, A. J. M., & Marques, P. A. (2021). Optimizing the Life Cycle of Physical Assets through an Integrated Life Cycle Assessment Method. Energies, 14(19), 6128. https://doi.org/10.3390/en14196128