Sustainability and Society: Do Environmental, Social, and Governance Factors Matter for Foreign Direct Investment?

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. ESG Factors

3.1.1. Environmental Factors (E)

3.1.2. Social Factors (S)

3.1.3. Governance Factors (G)

3.2. Estimation Model

4. Results and Discussion

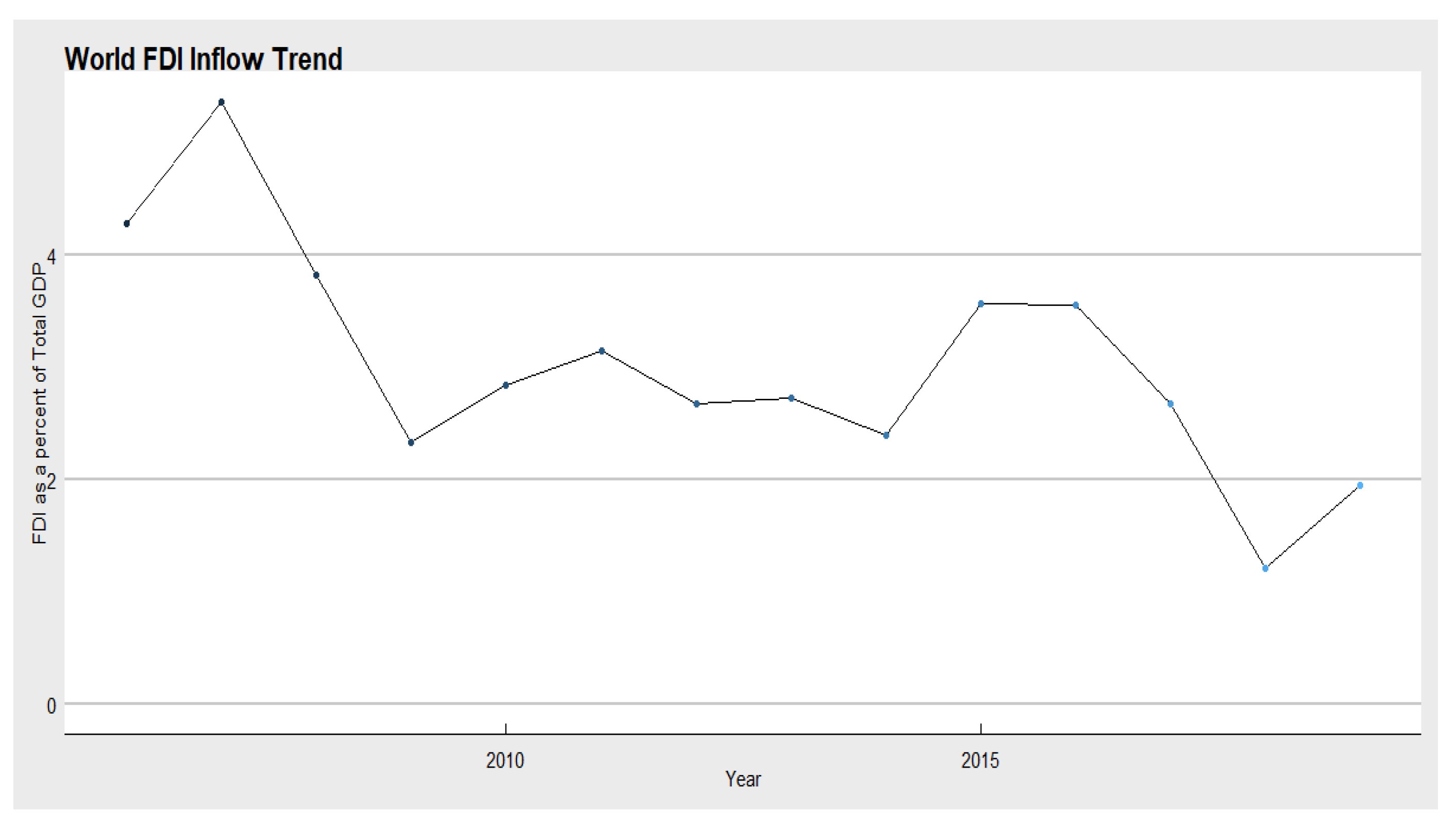

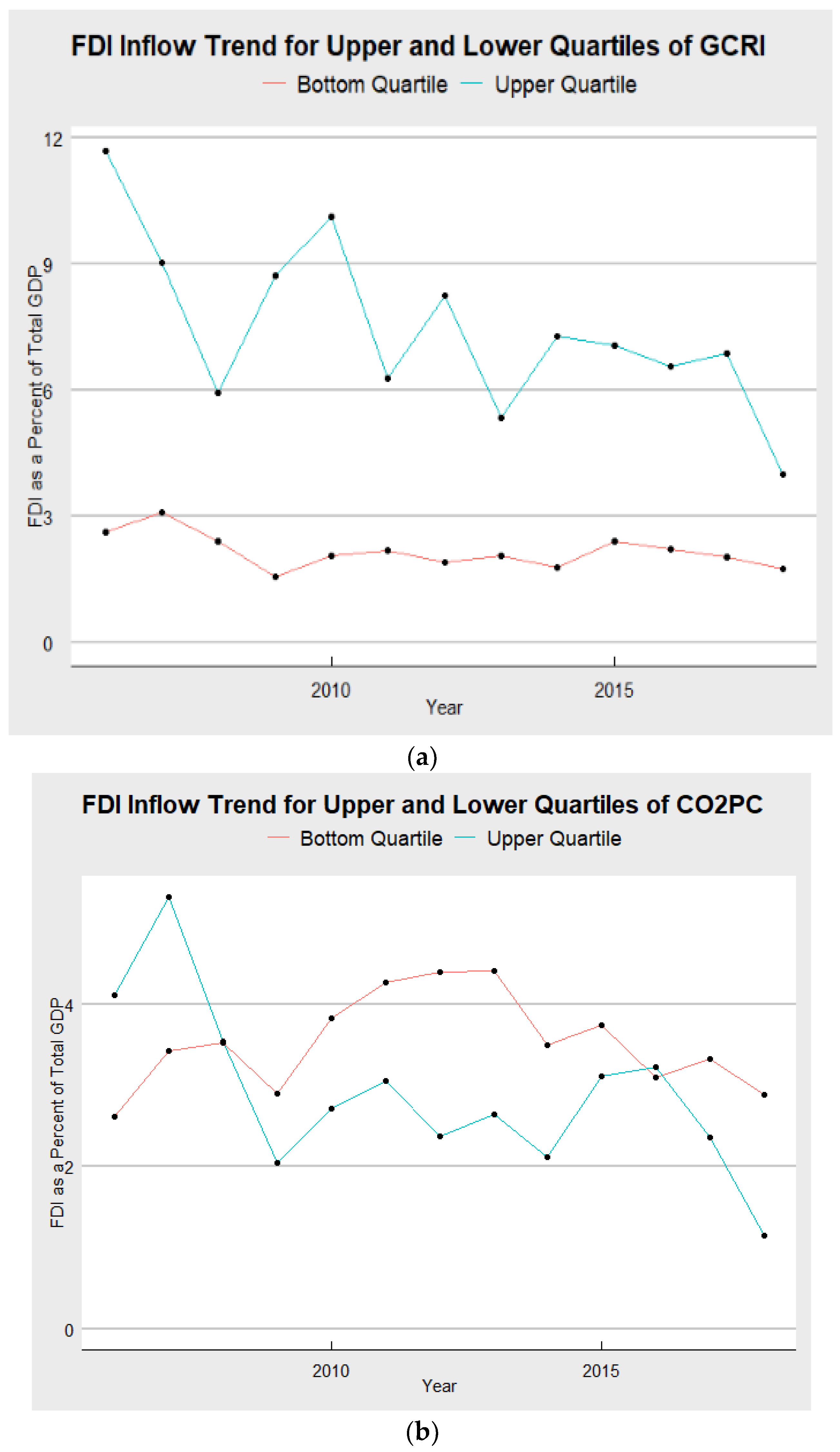

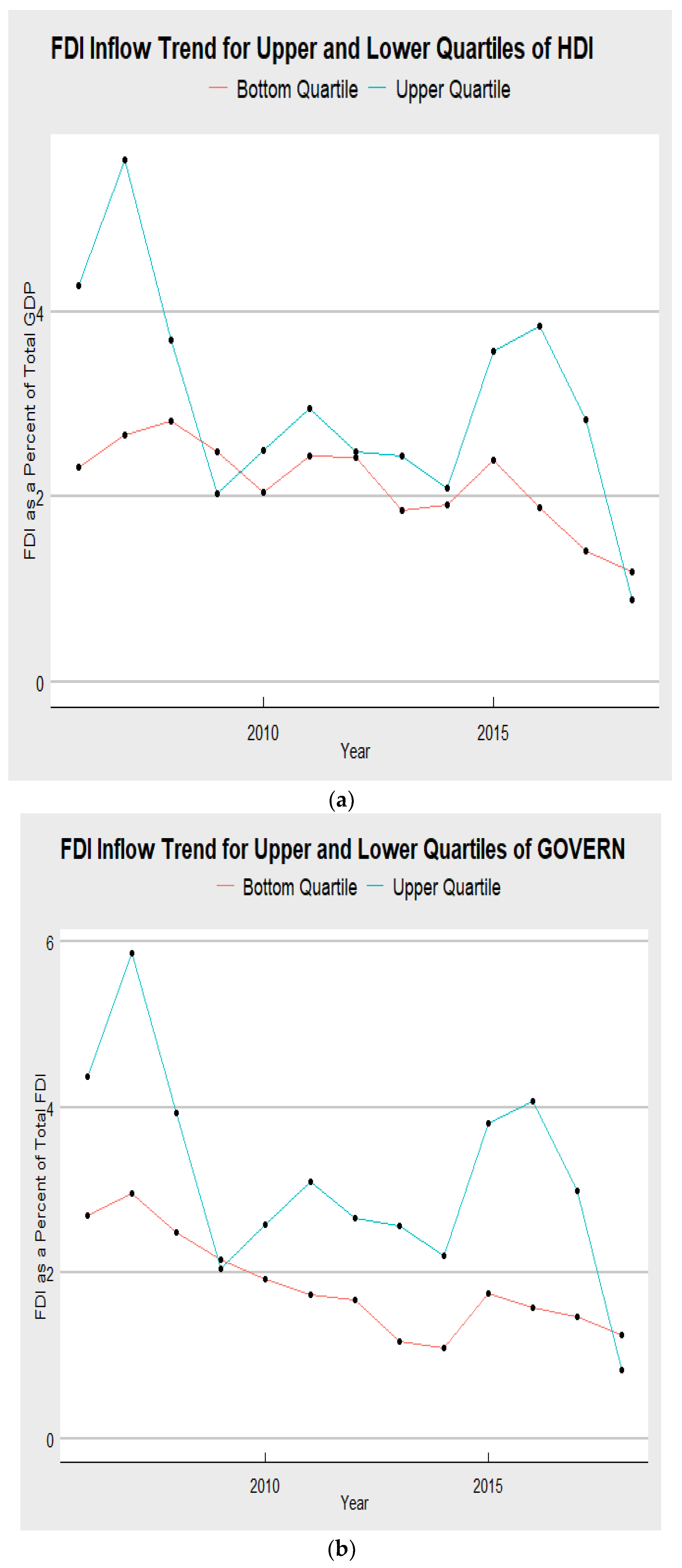

4.1. ESG and FDI Trends

4.2. Full Sample Results

4.3. FDI Inflows to Emerging Markets and Commodity Exporters

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Morgan, J.P. Why Covid-19 Could Be a Major Turning Point for Esg Investing. 1 June 2020. Available online: https://www.jpmorgan.com/insights/research/covid-19-esg-investing (accessed on 15 July 2020).

- US SIF Foundation Report on US Sustainable and Responsible Investing and Impact Investing Trends. 2020. Available online: https://www.ussif.org/files/Publications/2019USSIFAnnualReport_online.pdf (accessed on 21 March 2021).

- Chang, R.D.; Zuo, J.; Zhao, Z.; Zillante, G.; Gan, X.; Soebarto, V. Evolving Theory of Sustainability and Firms: History, future Directions and implications for renewable energy research. Renew. Sustain. Energy Rev. 2017, 72, 48–56. [Google Scholar] [CrossRef]

- Bowen, H.R.; Johnson, F.E. Social Responsibility of a Business; Harper & Brothers: New York, NY, USA, 1953. [Google Scholar]

- Caroll, A.B. A Three -dimensional conceptual model of Corporate Performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef] [Green Version]

- Freeman, R.E. Stratgeic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Eccles, R.; Klimento, S. The Investor Revolution-Shareholders are getting serious about sustainability. Harv. Bus. Rev. 2019, 97, 106–116. [Google Scholar]

- Dowling, J.; Pfeffer, J. Organizational legitimacy: Social values and organizational behavior. Pac. Sociol. Rev. 1975, 18, 122–136. [Google Scholar] [CrossRef]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development, Sustainable Development Knowledge Platform; United Nations: New York, NY, USA, 2015; Available online: https://sustainabledevelopment.un.org/post2015/transformingourworld/publication (accessed on 15 July 2020).

- Buchanan, B.G.; Le, Q.V.; Rishi, M. Foreign direct investment and institutional quality: Some empirical evidence. Int. Rev. Financ. Anal. 2012, 21, 81–89. [Google Scholar] [CrossRef]

- Dunning, J.H. Location and the multinational enterprise: A neglected factor? J. Int. Bus. Stud. 1998, 29, 45–66. [Google Scholar] [CrossRef]

- Hong, E.; Lee, I.H.; Makino, S. Outbound Foreign Direct Investment (FDI) Motivation and Domestic Employment by Multinational Enterprises (MNEs). J. Int. Manag. 2019, 25, 100657. [Google Scholar] [CrossRef]

- UNCTAD. Global Trade Update. October 2020. Available online: https://unctad.org/webflyer/global-trade-update-october-2020 (accessed on 20 January 2021).

- UNCTAD. World Investment Report 2021. Available online: https://unctad.org/webflyer/world-investment-report-2021 (accessed on 15 June 2021).

- Iamsiraroj, S. The foreign direct investment–economic growth nexus. Int. Rev. Econ. Financ. 2016, 42, 116–133. [Google Scholar] [CrossRef]

- Bernow, S.; Klempner, B.; Magnin, C. From Why’ to ‘Why not’: Sustainable Investing as the New Normal; McKinsey & Company: New York, NY, USA, 2017; Available online: https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/from-why-to-why-not-sustainable-investing-as-the-new-normal (accessed on 15 June 2020).

- Bassen, A.; Timo, B.; Gunnar, F. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar]

- Khan, M.; Serafeim, G.; Yoon, A. Corporate Sustainability: First Evidence on Materiality. Account. Rev. 2016, 91, 1697–1724. [Google Scholar] [CrossRef] [Green Version]

- Anthony, C.N.; Rezaee, Z. Business sustainability performance and cost of equity capital. J. Corp. Financ. 2015, 34, 128–149. [Google Scholar]

- Chipalkatti, N.; Le, Q.V.; Rishi, M. Portfolio Flows to Emerging Markets: Do Corporate Transparency and Public Governance Matter? Bus. Soc. Rev. 2007, 112, 227–249. [Google Scholar] [CrossRef]

- Pisani, N.; Kolk, A.; Ocelík, V.; Wu, G. Does it pay for cities to be green? An investigation of FDI inflows and environmental sustainability. J. Int. Bus. Policy 2019, 2, 62–85. [Google Scholar] [CrossRef]

- Wang, J.; Yu, J.; Zhong, R. Country Sustainable Development and Economic Growth: The International Evidence. 11 February 2020. Available online: https://ssrn.com/abstract=3350232 (accessed on 25 June 2020). [CrossRef]

- Hübel, B. Do Markets Value ESG Risks in Sovereign Credit Curves? Q. Rev. Econ. Financ. 2020. Available online: https://doi.org/10.1016/j.qref.2020.11.003 (accessed on 20 June 2021). [CrossRef]

- Crifo, P.; Diaye, M.A.; Oueghlissy, R. The Effect of Countries’ ESG Ratings on their Sovereign Borrowing Costs. Q. Rev. Econ. Financ. 2017, 66, 13–20. [Google Scholar] [CrossRef]

- Golub, S.S.; Kauffmann, C.; Yeres, P. Defining and Measuring Green FDI: An Exploratory Review of Existing Work and Evidence. In OECD Working Papers On International Investment; 2011/02; OECD Publishing: Paris, France, 2011. [Google Scholar]

- Spatareanu, M. Searching for Pollution Havens: The Impact of Environmental Regulations on Foreign Direct Investment. J. Environ. Dev. 2007, 16, 161–182. [Google Scholar] [CrossRef]

- Dam, L.; Scholtens, B. Environmental regulation and MNEs location: Does CSR matter? Ecol. Econ. 2008, 67, 55–65. [Google Scholar] [CrossRef]

- MacDermott, R. Trade Agreements and the Environment: An Industry Level Study for NAFTA. Glob. Econ. J. 2006, 6, 1850090. [Google Scholar] [CrossRef]

- MacDermott, R. A Panel Study of the Pollution-Haven Hypothesis. Glob. Econ. J. 2009, 9, 1850154. [Google Scholar] [CrossRef]

- Rezza, A. A meta-analysis of FDI and environmental Regulations. Environ. Dev. Econ. 2014, 20, 185–208. [Google Scholar] [CrossRef]

- Cave, L.; Blomquist, G. Environmental policy in the European Union: Fostering the development of pollution havens? Ecol. Econ. 2008, 65, 253–261. [Google Scholar] [CrossRef]

- Eskeland, G.; Harrison, A. Moving to greener pastures? Multinationals and the pollution haven hypothesis. J. Dev. Econ. 2003, 70, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Mukhopadhyay, K.; Chakraborty, D. Pollution Haven and Factor Endowment Hypotheses Revisited: Evidence from India. J. Quant. Econ. 2006, 4, 111–132. [Google Scholar] [CrossRef]

- Marconi, D. Environmental Regulation and Revealed Comparative Advantages in Europe: Is China a Pollution Haven? Rev. Int. Econ. 2013, 20, 616–635. [Google Scholar] [CrossRef]

- Poelhekke, S.; van der Ploeg, F. Green Haven and Pollution Havens. (October 29, 2012). De Nederlandsche Bank Working Paper No. 353. Available online: http://dx.doi.org/10.2139/ssrn.2168237 (accessed on 25 June 2020).

- Benhabib, J.; Spiegel, M.M. The role of human capital in economic development: Evidence from aggregate -country data. J. Monet. Econ. 1994, 34, 143–173. [Google Scholar] [CrossRef]

- Nelson, R.R.; Phelps, E.S. Investment in humans, technological diffusion, and economic growth. Am. Econ. Rev. 1966, 56, 69–75. [Google Scholar]

- Borensztein, E.; De Gregorio, J.; Lee, J.-W. How does foreign direct investment affect economic growth? J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef] [Green Version]

- Li, X.; Liu, X. Foreign direct investment and economic growth: An increasingly endogenous relationship. World Dev. 2005, 33, 393–407. [Google Scholar] [CrossRef]

- Sharma, B.; Gani, A. The Effects of Foreign Direct Investment on Human Development. Glob. Econ. J. 2004, 4, 1850025. [Google Scholar] [CrossRef]

- Canh, N.P.; Binh, N.T.; Thanh, S.D.; Schinckus, C. Determinants of foreign direct investment inflows: The role of economic policy uncertainty. Int. Econ. 2020, 161, 159–172. [Google Scholar] [CrossRef]

- Globerman, S.; Shapiro, D. Governance Infrastructure and US Foreign Direct Investment. J. Int. Bus. Stud. 2003, 34, 19–39. [Google Scholar] [CrossRef]

- Mengistu, A.A.; Bishnu, K.A. Does good governance matter for FDI inflows? Evidence from Asian economies. Asia Pac. Bus. Rev. 2011, 17, 281–299. [Google Scholar] [CrossRef]

- Saidi, Y.; Ochi, A.; Ghadri, H. Governance and FDI Attractiveness: Some Evidence from Developing and Developed Countries. Glob. J. Manag. Bus. Res. 2013, 13, 14–24. [Google Scholar]

- Brada, J.C.; Drabek, Z.; Méndez, J.A.; Pérez, M.F. National levels of corruption and foreign direct investment. J. Comp. Econ. 2018, 47, 31–49. [Google Scholar] [CrossRef]

- Bailey, N. Exploring the relationship between institutional factors and FDI attractiveness: A meta-analytic review. Int. Bus. Rev. 2018, 27, 139–148. [Google Scholar] [CrossRef]

- Contractor, F.; Dangol, R.; Nuruzzaman, N.; Raghunath, S. How do country regulations and business environment impact foreign direct investment (FDI) inflows? Int. Bus. Rev. 2020, 29, 101640. [Google Scholar] [CrossRef]

- Goh, S.K.; Wong, K.; Tham, S.Y. Trade linkages of inward and outward FDI: Evidence from Malaysia. Econ. Model. 2013, 35, 224–230. Available online: https://EconPapers.repec.org/RePEc:eee:ecmode:v:35:y:2013:i:c:p:224-230 (accessed on 15 July 2020). [CrossRef] [Green Version]

- Villaverde, J.; Maza, A. Foreign Direct Investment in Spain: Regional Distribution and Determinants. Int. Bus. Rev. 2012, 21, 722–733. [Google Scholar] [CrossRef]

- Reiter, S.L.; Steensma, H.K. Human Development and Foreign Direct Investment in Developing Countries: The Influence of FDI Policy and Corruption. World Dev. 2010, 38, 1678–1691. [Google Scholar] [CrossRef]

- World Bank. World Bank Country and Lending Groups. Available online: https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups (accessed on 15 July 2020).

- IMF. World Economic Outlook, “Adjusting to Lower Commodity Prices” Annex Table 2.1.2. Available online: https://www.imf.org/external/pubs/ft/weo/2015/02/ (accessed on 15 July 2020).

- World Development Indicators. Available online: https://databank.worldbank.org/home (accessed on 15 July 2020).

- Global Climate Risk Index. Available online: https://germanwatch.org/en/cri (accessed on 15 July 2020).

- Initiative for Responsible Investment. Global CSR Disclosure. Available online: https://iri.hks.harvard.edu/ (accessed on 15 July 2020).

- Sen, A. Commodities and Capabilities; Elsevier Science Publishing Co.: North-Holland, Amsterdam, The Netherlands, 1985. [Google Scholar]

- United Nations Development Prgram. Human Development Indicators. Available online: http://hdr.undp.org/en/content/human-development-index-hdi (accessed on 15 July 2020).

- World Bank. World Governance Indicators. Available online: https://datacatalog.worldbank.org/dataset/worldwide-governance-indicators (accessed on 15 July 2020).

| Time | FDI (Percent of GDP) | Gross Capital Formation (Percent of GDP) | Trade as (Percent of GDP) | GDP Per Capita Growth | CO2 Per Capita Emissions (Tons) | Governance Score | Global Climate Risk Score | Human Development Index |

|---|---|---|---|---|---|---|---|---|

| 2006 | 8.42 | 24.24 | 88.45 | 4.29 | 4.48 | −0.64 | 59.34 | 0.66 |

| 2007 | 9.42 | 25.41 | 90.15 | 4.32 | 4.46 | −0.59 | 55.24 | 0.66 |

| 2008 | 7.21 | 26.04 | 92.30 | 2.32 | 4.43 | −0.57 | 58.92 | 0.67 |

| 2009 | 5.95 | 23.95 | 81.70 | −1.31 | 4.50 | −0.61 | 58.97 | 0.67 |

| 2010 | 6.57 | 24.56 | 86.35 | 2.87 | 4.33 | −0.60 | 72.80 | 0.68 |

| 2011 | 6.81 | 24.92 | 90.94 | 2.31 | 4.32 | −0.58 | 67.21 | 0.68 |

| 2012 | 7.33 | 25.11 | 91.99 | 2.87 | 4.37 | −0.58 | 81.95 | 0.69 |

| 2013 | 5.06 | 24.73 | 92.02 | 1.82 | 4.28 | −0.56 | 74.28 | 0.69 |

| 2014 | 5.34 | 24.74 | 90.79 | 1.92 | 4.20 | −0.50 | 78.64 | 0.70 |

| 2015 | 5.56 | 24.96 | 87.72 | 1.48 | 4.15 | −0.52 | 79.61 | 0.70 |

| 2016 | 4.59 | 24.85 | 85.21 | 1.56 | 4.15 | −0.53 | 85.13 | 0.70 |

| 2017 | 4.26 | 24.45 | 88.21 | 2.06 | 4.16 | −0.55 | 77.34 | 0.71 |

| 2018 | 3.03 | 24.81 | 90.55 | 2.01 | 4.16 | −0.55 | 79.89 | 0.71 |

| GCRI | CO2PC | HDI | SUSDUM | GOVERN | |

| GCRI | 1 | ||||

| CO2PC | 0.1093 * | 1 | |||

| HDI | 0.0247 | 0.5861 * | 1 | ||

| SUSDUM | −0.0828 * | 0.1003 * | 0.2809 * | 1 | |

| GOVERN | 0.0186 | 0.4314 * | 0.7672 * | 0.2875 * | 1 |

| GCFGDP | 0.0473 | 0.0742 | 0.0427 | −0.036 | −0.0199 |

| GDPPCAPGR | −0.036 | −0.1131 * | −0.059 | −0.0444 | −0.0800 * |

| TRADEGDP | 0.2522 * | 0.2358 * | 0.2881 * | −0.0731 * | 0.3271 * |

| GCFGDP | GDPPCAGR | TRADEGDP | |||

| GCFGDP | 1 | ||||

| GDPPCAPGR | 0.2336 * | 1 | |||

| TRADEGDP | 0.1013 * | 0.0268 | 1 |

| VARIABLES | FULL SAMPLE |

|---|---|

| GCFGDP | 0.0268 *** |

| (0.00452) | |

| GDPPCAPGR | 0.0315 *** |

| (0.00645) | |

| TRADEGDP | 0.00462 *** |

| (0.00158) | |

| GCRI | −0.00131 * |

| (0.000771) | |

| CO2PC | 0.0357 |

| (0.0281) | |

| SUSDUM | 0.142 |

| (0.114) | |

| GOVERN | 0.0974 *** |

| (0.0318) | |

| HDI | −4.884 *** |

| (1.170) | |

| CRISIS | −0.109 * |

| (0.0604) | |

| LAG FDIGDP | 0.203 *** |

| (0.0469) | |

| CONSTANT | 3.099 *** |

| (0.822) | |

| Observations | 1583 |

| Countries | 161 |

| R-squared | 0.700 |

| (1) | (2) | |

|---|---|---|

| VARIABLES | Emerging Markets | Commodity Exporters |

| GCFGDP | 0.0497 ** | 0.0277 *** |

| (0.0215) | (0.00859) | |

| GDPPCAPGR | 0.0573 ** | 0.0448 *** |

| (0.0239) | (0.0118) | |

| TRADEGDP | 0.00437 | 0.00848 *** |

| (0.00705) | (0.00316) | |

| GCRI | −0.000430 | −0.00172 |

| (0.00193) | (0.00130) | |

| CO2PC | 0.369 * | 0.101 |

| (0.218) | (0.0850) | |

| SUSDUM | 0.239 | 0.485 *** |

| (0.150) | (0.138) | |

| GOVERN | 0.0330 | 0.0302 |

| (0.0598) | (0.0454) | |

| HDI | −6.487 ** | −6.787 *** |

| (2.691) | (2.300) | |

| CRISIS | 0.0523 | −0.134 |

| (0.126) | (0.113) | |

| LAG FDIGDP | 0.113 | 0.141 |

| (0.0973) | (0.0924) | |

| CONSTANT | 2.275 | 3.726 ** |

| (1.632) | (1.445) | |

| Observation | 168 | 465 |

| Countries | 14 | 46 |

| R-squared | 0.537 | 0.632 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chipalkatti, N.; Le, Q.V.; Rishi, M. Sustainability and Society: Do Environmental, Social, and Governance Factors Matter for Foreign Direct Investment? Energies 2021, 14, 6039. https://doi.org/10.3390/en14196039

Chipalkatti N, Le QV, Rishi M. Sustainability and Society: Do Environmental, Social, and Governance Factors Matter for Foreign Direct Investment? Energies. 2021; 14(19):6039. https://doi.org/10.3390/en14196039

Chicago/Turabian StyleChipalkatti, Niranjan, Quan Vu Le, and Meenakshi Rishi. 2021. "Sustainability and Society: Do Environmental, Social, and Governance Factors Matter for Foreign Direct Investment?" Energies 14, no. 19: 6039. https://doi.org/10.3390/en14196039

APA StyleChipalkatti, N., Le, Q. V., & Rishi, M. (2021). Sustainability and Society: Do Environmental, Social, and Governance Factors Matter for Foreign Direct Investment? Energies, 14(19), 6039. https://doi.org/10.3390/en14196039