Assessment of Energy Transition Policy in Taiwan—A View of Sustainable Development Perspectives

Abstract

:1. Introduction

2. Methods

2.1. Theoretical Model

2.1.1. Function of Power Supply Costs

2.1.2. Expected Risk of Power Mixed

2.1.3. Equation of Capital Accumulation

2.1.4. Greenhouse Gas Emissions Equation

2.1.5. Power Security

2.2. The Optimal Power Portfolio Model

2.3. The Unit Power Generation Cost Prediction under Uncertainty

2.3.1. The Average Growth Rate of Unit Power Generation Cost

2.3.2. The Change Rate of Unit Power Generation Cost Estimation

2.3.3. Capacity Factor and Technology Factor

3. Results and Discussion

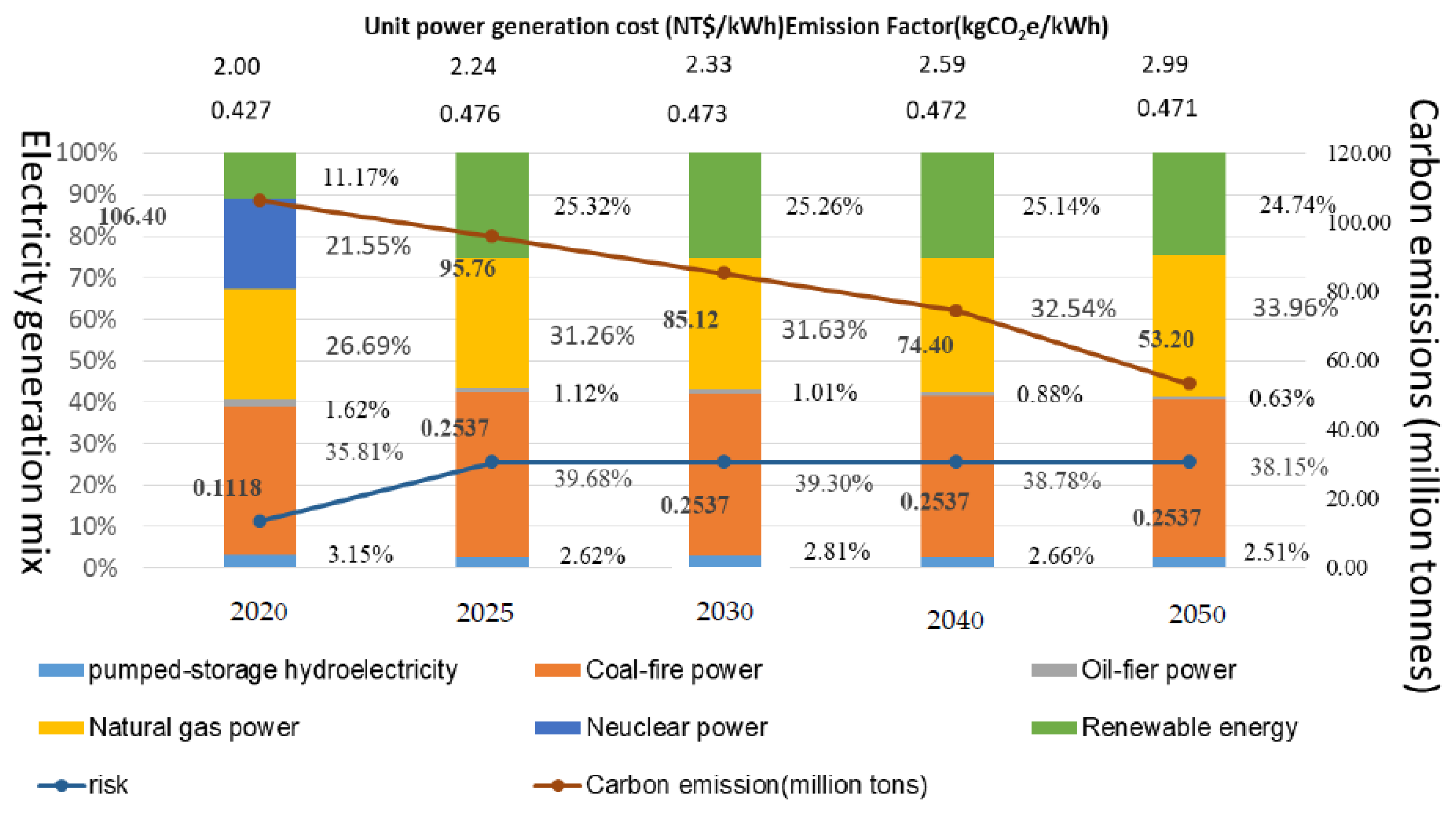

3.1. Optimal Power Generation Portfolio Estimation

3.1.1. Long-Term Unit Cost of Power Generation Estimation

3.1.2. CO2 Emission Target by 2050

3.1.3. Reasonable Risk Value by 2050

3.1.4. Optimal Power Generation by 2050

3.1.5. Optimal Power Generation Mixed

3.2. Optimal Electricity Saving Planning

3.2.1. STIRPAT Regression Model

3.2.2. Data Collection and Settings

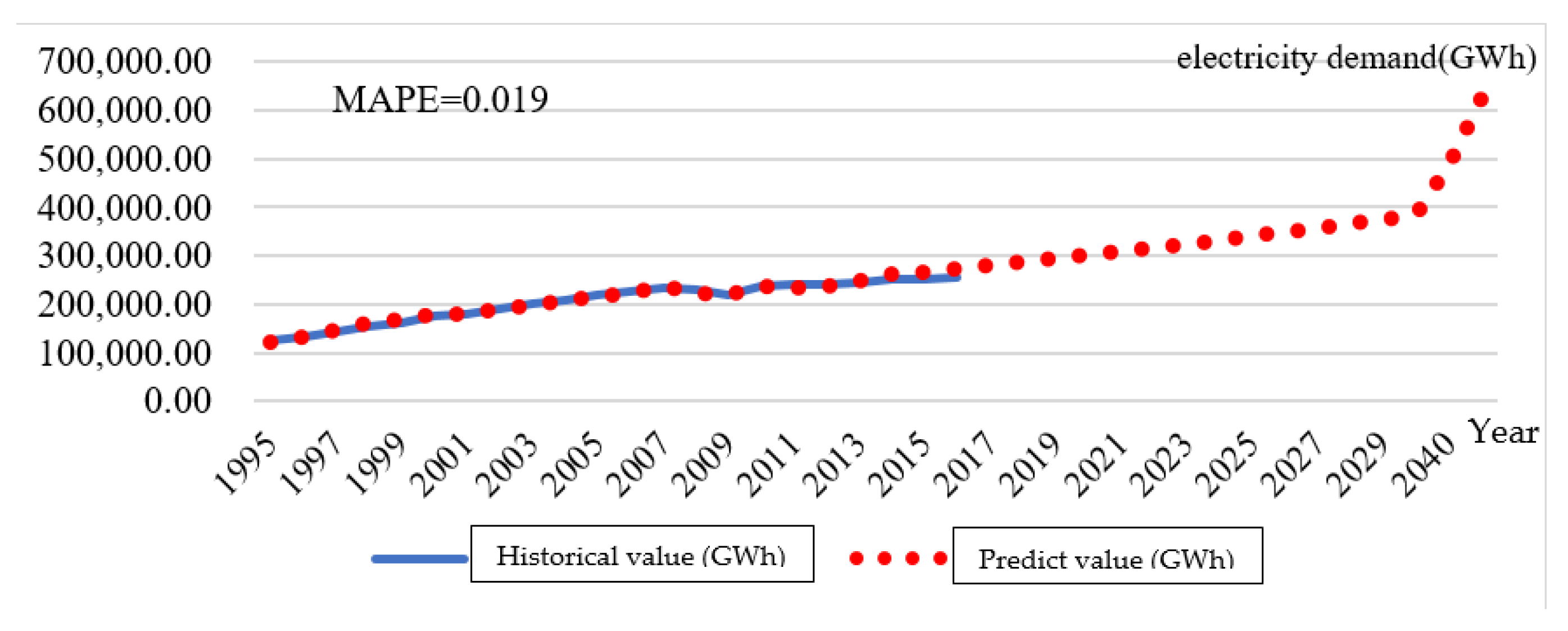

3.2.3. Prediction of the Electricity Demand

3.2.4. The Trajectory of Electricity Saving by 2050

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Seto, K.C.; Davis, S.J.; Mitchell, R.B.; Stokes, E.C.; Unruh, G.; Ürge-Vorsatz, D. Carbon lock-In: Types, causes, and policy implications. Annu. Rev. Environ. Resour. 2016, 41, 425–452. [Google Scholar] [CrossRef] [Green Version]

- Intergovernmental Panel on Climate Change. Global Warming of 1.5 °C; IPCC Special Report 2018; IPCC: Geneva, Switzerland, 2018; Available online: https://www.ipcc.ch/sr15/ (accessed on 23 October 2017).

- Awerbuch, S.; Spencer, Y. Efficient electricity generating portfolios for Europe: Maximizing energy security and climate change mitigation. EIB Pap. 2007, 12, 8–37. [Google Scholar]

- DeLlano-Paz, F.; Fernandez, P.M.; Soares, I. Addressing 2030 EU policy framework for energy and climate: Cost, risk and energy security issues. Energy 2016, 115, 1347–1360. [Google Scholar] [CrossRef]

- DeLlano-Paz, F.; Fernandez, P.M.; Soares, I. The effects of different CCS technological scenarios on EU low-carbon generation mix. Environ. Dev. Sustain. 2016, 18, 1477–1500. [Google Scholar] [CrossRef]

- Min, D.; Chung, J. Evaluation of the long-term power generation mix: The case study of South Korea’s energy policy. Energy Policy 2013, 62, 1544–1552. [Google Scholar] [CrossRef]

- Zhang, S.; Zhao, T.; Xie, B.C. What is the optimal power generation mix of China? An empirical analysis using portfolio theory. Appl. Energy 2018, 229, 522–536. [Google Scholar] [CrossRef]

- Wu, J.H.; Huang, Y.H. Electricity portfolio planning model incorporating renewable energy characteristics. Appl. Energy 2014, 119, 278–287. [Google Scholar] [CrossRef]

- Li, S.; Mu, H.; Guiand, S.; Li, M. Scenario analysis for optimal allocation of China’s electricity production system. Sustain. Cities Soc. 2014, 10, 241–244. [Google Scholar] [CrossRef]

- Chen, F.F.; Chou, S.C.; Lu, T.K. Scenario analysis of the new energy policy for Taiwan’s electricity Sector until 2025. Energy Policy 2013, 61, 162–171. [Google Scholar] [CrossRef]

- Tsain, M.S.; Chang, S.L. Taiwan’s 2050 low carbon development roadmap: An evaluation with the MARKAL model. Renew. Sustain. Energy Rev. 2015, 49, 178–191. [Google Scholar]

- Lee, C.M.; Rosalez, E.R. Economic growth, carbon abatement technology and decoupling strategy—The case of Taiwan. Aerosol Air Qual. Res. 2017, 17, 1549–1557. [Google Scholar] [CrossRef] [Green Version]

- Blancoa, H.; Nijsb, W.; Rufc, J.; Faaija, A. Potential of power-to-methane in the EU energy transition to a low carbon system using cost optimization. Appl. Energy 2018, 232, 323–340. [Google Scholar] [CrossRef]

- Ryu, H.; Dorjragchaa, S.; Kim, Y.; Kim, K. Electricity-generation mix considering energy security and carbon emission mitigation: Case of Korea and Mongolia. Energy 2014, 64, 1071–1079. [Google Scholar] [CrossRef]

- Portugal-Pereira, J.; Esteban, M. Implications of paradigm shift in Japan’s electricity security of supply: A multi-dimensional indicator assessment. Appl. Energy 2014, 123, 424–434. [Google Scholar] [CrossRef]

- Troldborg, M.; Heslop, S.; Hough, R. Assessing the sustainability of renewable energy technologies using multi-criteria analysis: Suitability of approach for national-scale assessments and associated uncertainties. Renew. Sustain. Energy Rev. 2014, 39, 1173–1184. [Google Scholar] [CrossRef]

- Kumar, A.; Sahb, B.; Singhc, A.R.; Denga, Y.; Hea, X.; Kumarb, P.; Bansald, R.C. A review of multi criteria decision making (MCDM) towards sustainable renewable energy development. Renew. Sustain. Energy Rev. 2017, 69, 596–609. [Google Scholar] [CrossRef]

- Choi, D.H.; Ahn, Y.H.; Choi, D.G. Multi-criteria decision analysis of electricity sector transition policy in Korea. Energy Strategy Rev. 2020, 29, 100485. [Google Scholar] [CrossRef]

- Huang, Y.H.; Lee, C.M. Designing an optimal water supply portfolio for Taiwan under the impact of climate change: Case study of the Penghu area. J. Hydrol. 2019, 573, 235–245. [Google Scholar] [CrossRef]

- Su, K.; Lee, C.M. When will China achieve its carbon emission peak? A scenario analysis based on optimal control and the STIRPAT model. Ecol. Indic. 2020, 112, 106138. [Google Scholar] [CrossRef]

- Pan, B.; Zhang, Y. Impact of affluence, nuclear and alternative energy on US carbon emissions from 1960 to 2014. Energy Strategy Rev. 2020, 32, 100581. [Google Scholar] [CrossRef]

- Copeland, T.; Antikarov, V. Real Options: A Practitioner’s Guide; University of Michigan: Texere, NY, USA, 2001; Available online: https://books.google.com.tw/books/about/Real_Options.html?id=fnhPAAAAMAAJ&redir_esc=y (accessed on 8 November 2007).

- Taiwan Power Company. Long-Term Financial Planning and Capital Expenditure Control Project Group; Accounting Office Newsletter of Taiwan Power Company: Taipei city, Taiwan, 2016. [Google Scholar]

- Dietz, T.; Rosa, E.A. Rethinking the environmental impacts of population, affluence and technology. Hum. Ecol. Rev. 1994, 1, 277–300. [Google Scholar]

- York, R.; Rosa, E.A.; Diet, Z.T. STIRPAT, IPAT and ImPACT: Analytic tools for unpacking the driving forces of environmental impacts. Ecol. Econ. 2003, 46, 351–365. [Google Scholar] [CrossRef]

- Bureau of Energy Bureau of Energy. Energy Statistics Handbook 2015; Ministry of Economic Affairs: Taipei city, Taiwan, 2015.

| Technology | Pumped-Storage Hydroelectricity | Coal-Fired Power | Oil-Fired Power | Gas-Fired Power | Nuclear Power | Renewable Energy Resources | |

|---|---|---|---|---|---|---|---|

| Parameter | |||||||

| Unit cost of power generation () (US$/kWh) | 0.14 | 0.05 | 0.15 | 0.09 | 0.04 | 0.07 | |

| Capacity factor () (%) | 16.59 | 89.23 | 40.48 | 70.00 | 80.94 | 35.26 | |

| αi | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | |

| Annual growth rate of unit power generation cost () (%) | 6.77 | 3.40 | 3.50 | 1.18 | 10.92 | 5.02 | |

| Risk-free rate () (%) | 1.18 | 1.18 | 1.18 | 1.18 | 1.18 | 1.18 | |

| Increasing rate of unit cost (u) (%) | 1.403 | 1.185 | 1.191 | 1.061 | 1.726 | 1.285 | |

| Decline rate of unit rate (d) (%) | 0.713 | 0.844 | 0.839 | 0.942 | 0.579 | 0.778 | |

| Allocation ratio of increasing rate (x) (%) | 43.33 | 49.21 | 48.98 | 58.47 | 37.71 | 46.08 | |

| Allocation ratio of decline rate (1 − x) (%) | 56.67 | 50.79 | 51.02 | 41.53 | 62.29 | 53.92 | |

| Fuel | Pumped-Storage Hydroelectricity | Coal-Fired Power | Oil-Fired Power | Gas Power | Nuclear Power | Renewable Energy Resources | |

|---|---|---|---|---|---|---|---|

| Scenarios | |||||||

| 2020 | high | 0.191 | 0.055 | 0.173 | 0.099 | 0.066 | 0.095 |

| medium | 0.144 | 0.047 | 0.147 | 0.093 | 0.044 | 0.076 | |

| low | 0.097 | 0.039 | 0.122 | 0.088 | 0.022 | 0.058 | |

| 2025 | high | 0.202 | 0.056 | 0.175 | 0.099 | 0.076 | 0.098 |

| medium | 0.158 | 0.048 | 0.151 | 0.094 | 0.055 | 0.080 | |

| low | 0.069 | 0.033 | 0.102 | 0.083 | 0.013 | 0.045 | |

| 2030 | high | 0.221 | 0.057 | 0.180 | 0.099 | 0.095 | 0.103 |

| medium | 0.178 | 0.050 | 0.156 | 0.094 | 0.073 | 0.086 | |

| low | 0.073 | 0.033 | 0.104 | 0.083 | 0.015 | 0.046 | |

| 2040 | high | 0.350 | 0.070 | 0.222 | 0.106 | 0.218 | 0.142 |

| medium | 0.246 | 0.054 | 0.172 | 0.095 | 0.147 | 0.104 | |

| low | 0.057 | 0.029 | 0.089 | 0.079 | 0.011 | 0.038 | |

| high | 0.571 | 0.086 | 0.276 | 0.113 | 0.524 | 0.199 | |

| 2050 | medium | 0.368 | 0.062 | 0.196 | 0.097 | 0.330 | 0.133 |

| low | 0.046 | 0.025 | 0.078 | 0.074 | 0.008 | 0.020 |

| Target | Power Generation (GWh/Year) | CO2 Emissions (MtCO2e) | Risk Value | |

|---|---|---|---|---|

| Year | ||||

| 2020 | 249,290 | 106.4 | 0.1118 | |

| 2025 | 234,748 | 95.8 | 0.2537 | |

| 2030 | 218,151 | 85.1 | 0.2537 | |

| 2040 | 200,715 | 73.4 | 0.2537 | |

| 2050 | 165,534 | 53.2 | 0.2537 | |

| Variable | Data Source | Setting of Prediction Value |

|---|---|---|

| GDP per capita | National Statistics, Taiwan. | Estimated using the average annual growth rate of 2.92% as calculated from the data of GDP per capital in the past 10 years. |

| Energy intensity | Bureau of Energy (2015), “Energy Statistics Handbook” [26] | Estimated using the average annual decline rate of 1.45% from 1998 to 2015. |

| Electricity demand amount | Bureau of Energy (2015), “Energy Statistics Handbook” [26] | Projected by substituting the independent variables into the model as established using the regression results. |

| Year | 2020 | 2025 | 2030 | 2040 | 2050 | |

|---|---|---|---|---|---|---|

| Variable | ||||||

| GDP per capita (NT$/population) | 824,868 | 952,581 | 1,100,068 | 1,467,084 | 1,956,547 | |

| Energy intensity (Liter oil equivalent/NT$1000) | 6.83 | 6.35 | 5.91 | 5.11 | 4.42 | |

| 1.000 | 0.784 | |

| 0.784 | 1.000 |

| Variables | Coefficient | t Value | p Value | |

|---|---|---|---|---|

| Constant | −7.421 *** | −9.116 | 0.00 | 0.988 |

| GDPP | 1.379 *** | 28.450 | 0.00 | |

| EGDP | 0.673 *** | 6.998 | 0.00 |

| 2020 | 2025 | 2030 | 2040 | 2050 | |

|---|---|---|---|---|---|

| Electricity supply (GWh) | 249,290 | 234,748 | 218,151 | 200,715 | 165,534 |

| Electricity demand (GWh)) | 302,002 | 340,681 | 384,314 | 489,061 | 622,358 |

| Electricity Saving (GWh) | 52,712 | 105,933 | 166,163 | 288,346 | 456,824 |

| Electricity Saving rate (%) | 17.5 | 31.1 | 43.2 | 59.0 | 73.4 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, C.-K.; Lee, C.-M.; Hong, Y.-R.; Cheng, K. Assessment of Energy Transition Policy in Taiwan—A View of Sustainable Development Perspectives. Energies 2021, 14, 4402. https://doi.org/10.3390/en14154402

Wang C-K, Lee C-M, Hong Y-R, Cheng K. Assessment of Energy Transition Policy in Taiwan—A View of Sustainable Development Perspectives. Energies. 2021; 14(15):4402. https://doi.org/10.3390/en14154402

Chicago/Turabian StyleWang, Chun-Kai, Chien-Ming Lee, Yue-Rong Hong, and Kan Cheng. 2021. "Assessment of Energy Transition Policy in Taiwan—A View of Sustainable Development Perspectives" Energies 14, no. 15: 4402. https://doi.org/10.3390/en14154402

APA StyleWang, C.-K., Lee, C.-M., Hong, Y.-R., & Cheng, K. (2021). Assessment of Energy Transition Policy in Taiwan—A View of Sustainable Development Perspectives. Energies, 14(15), 4402. https://doi.org/10.3390/en14154402