Assessing Economic Impacts of Thailand’s Fiscal Reallocation between Biofuel Subsidy and Transportation Investment: Application of Recursive Dynamic General Equilibrium Model

Abstract

:1. Introduction

2. Materials and Methods

3. Methodologies

3.1. Production Structure

3.2. Database

3.3. Dynamics Assumption

3.4. Closure and Solution

3.5. Scenarios

3.6. Sensitivity Analysis

4. Results and Discussion

4.1. Model Reliability

4.2. Change in Road Transportation Sectors

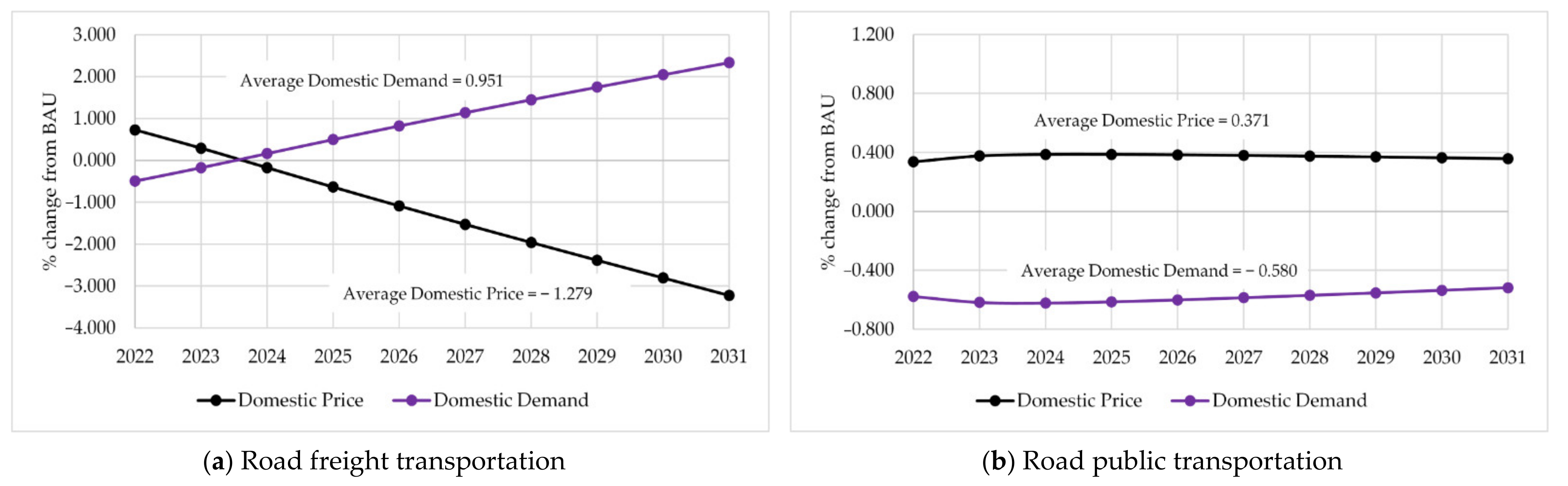

4.2.1. SIM A: Terminating Biofuel Subsidy

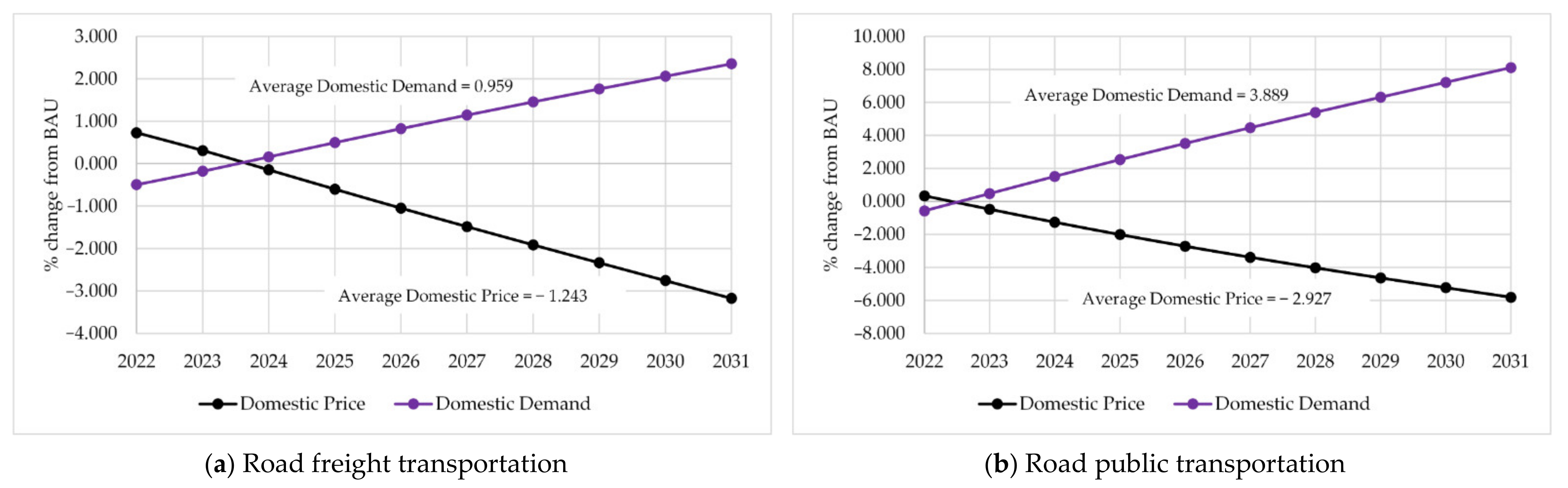

4.2.2. SIM B: Reallocating Biofuel Subsidy to Invest in Road Freight Transportation Sector

4.2.3. SIM C: Reallocating Biofuel Subsidy to Invest in Road Public Transportation Sector

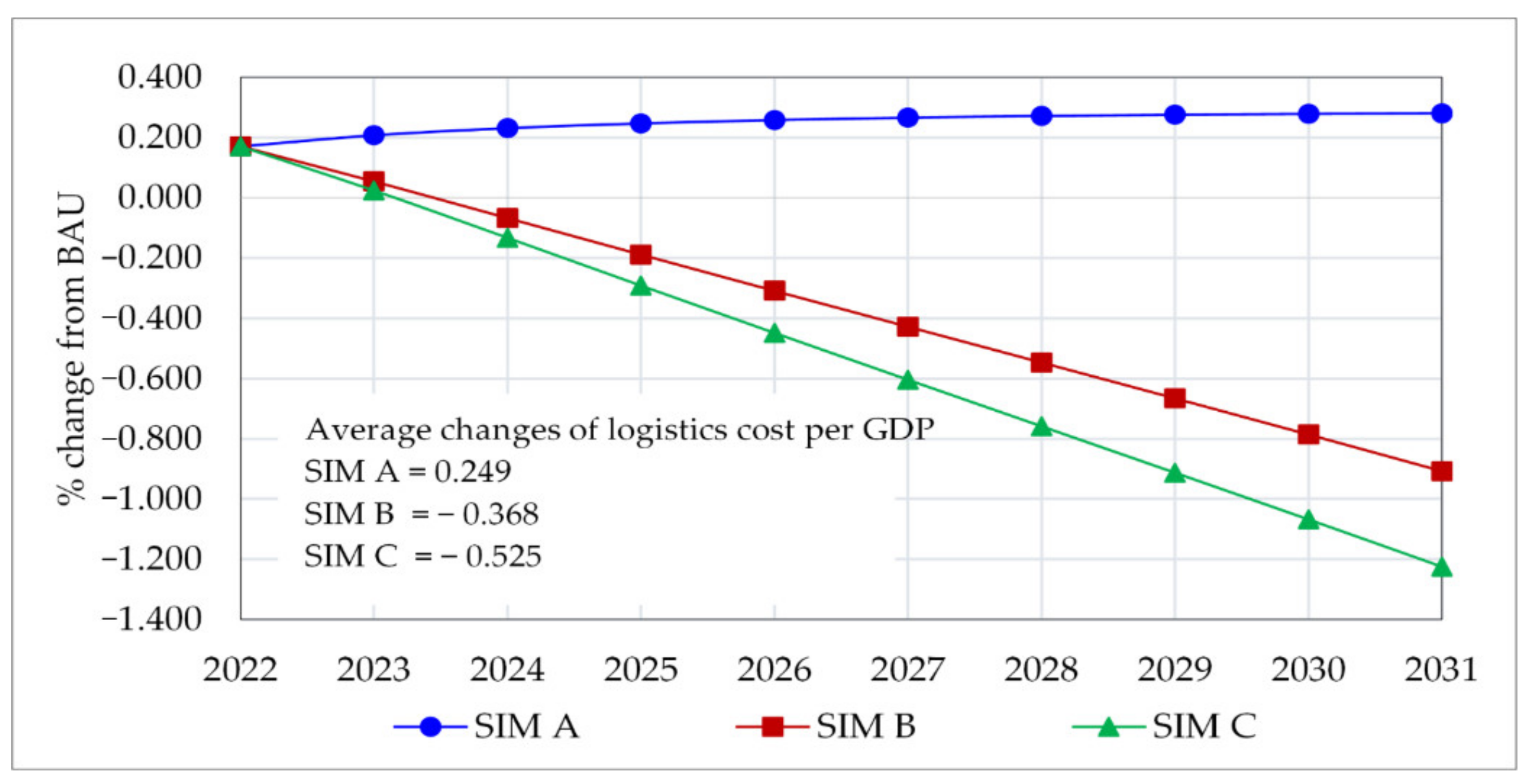

4.3. Change in Logistics Costs

4.4. Change in Macroeconomics

4.4.1. Consumer Price Index (CPI)

4.4.2. Real Gross Domestic Product (Real GDP)

4.4.3. Real Private Consumption (Real PCON)

4.4.4. Real Gross Fixed Capital Formation (Real GFCF)

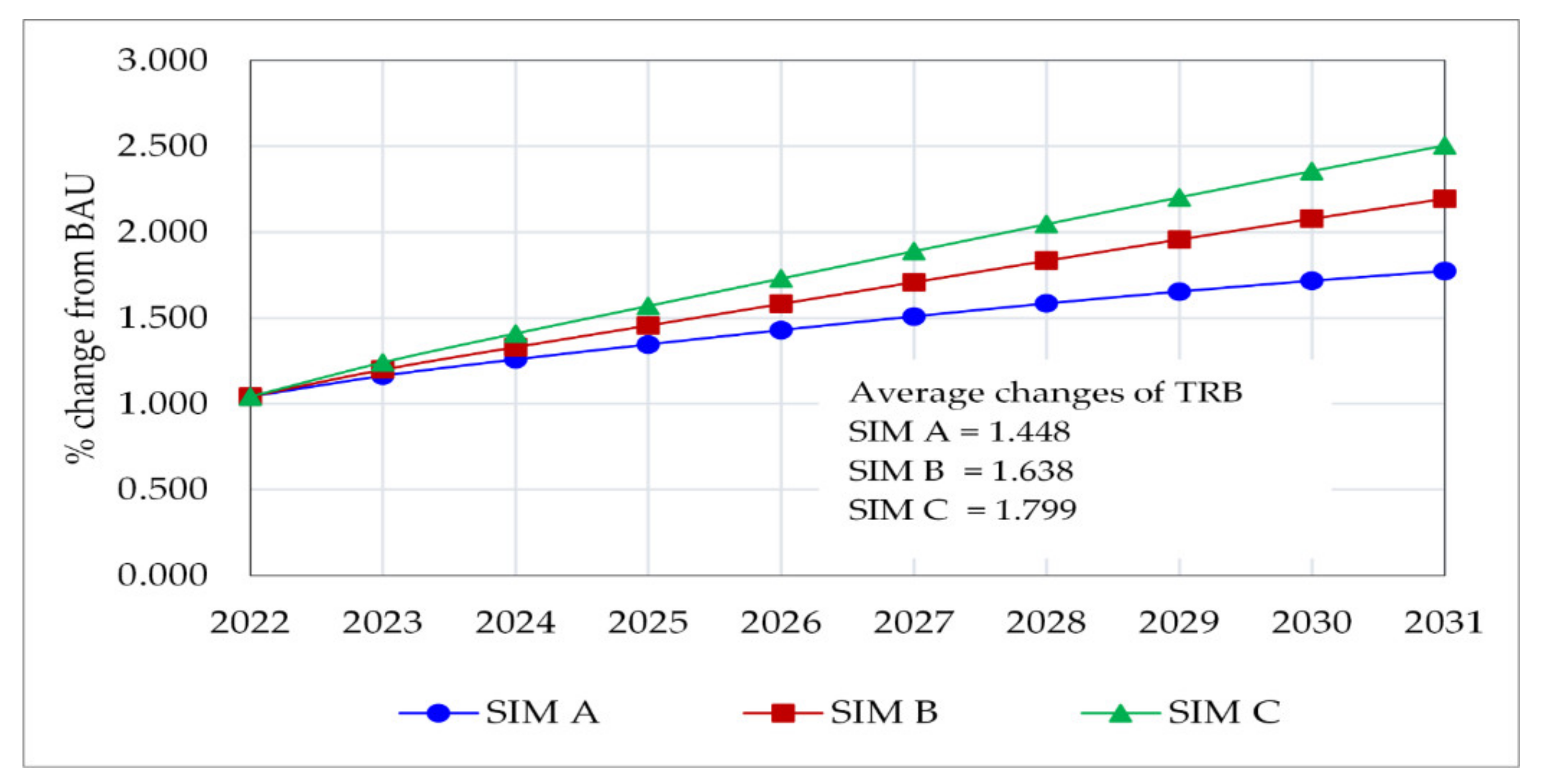

4.4.5. Trade Balance (TRB)

4.5. Sectoral Impacts

4.6. Sensitivity Analysis

4.7. Discussion

- (1)

- The adjustment mechanism of biofuel subsidy removal

- (2)

- The integrated responses of subsidy removal and transportation investment

4.8. Limitations and Further Study

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Sector Number | Industries | IO Code | Commodity Number | Commodities |

|---|---|---|---|---|

| 1 | Agriculture forest and fishery | 001–003, 005–008, 010, 012–029 | 1 | Agriculture forest and fishery |

| 2 | Cassava plantation | 004 | 2 | Cassava |

| 3 | Sugarcane plantation | 009 | 3 | Sugarcane |

| 4 | Oil palm plantation | 011 | 4 | Oil palm |

| 5 | Food industry | 042–054, 056–066 | 5 | Food products |

| 6 | Crude palm oil production | 047 | 6 | Crude palm oil |

| 7 | Sugar refinery | 055 | 7 | Sugar products |

| 8 | Molasses | |||

| 8 | Coal and lignite mining | 030 | 9 | Coal and lignite |

| 9 | Crude oil and natural gas | 031 | 10 | Crude oil and natural gas |

| 10 | Other mining | 032–041 | 11 | Other mineral products |

| 11 | Petroleum refinery | 093–094 | 12 | Liquefied petroleum gas |

| 13 | Jet and kerosene | |||

| 14 | Fuel oil | |||

| 15 | Other petroleum products | |||

| 16 | Gasohol E10 and gasoline | |||

| 17 | Gasohol E20 and E85 | |||

| 18 | Biodiesel B5/7 (mandatory) | |||

| 19 | Biodiesel B10/B20 (option) | |||

| 12 | Biodiesel production | 093 | 20 | Purified biodiesel (B100) |

| 13 | Ethanol (cassava-based) | 093 | 21 | Ethanol |

| 14 | Ethanol (molasses-based) | 093 | ||

| 15 | Electricity production | 135 | 22 | Electricity |

| 16 | Natural gas separation | 136 | 23 | Natural gas products |

| 17 | Metal and non-metal | 110–111 | 24 | Metal and non-metal |

| 18 | Chemical production | 067–092 | 25 | Chemical products |

| 19 | Rubber and plastic production | 095–109 | 26 | Rubber, plastics, and material |

| 20 | Electrical machinery production | 112–122 | 27 | Electrical machinery and equipment |

| 21 | Transport industry | 123–128 | 28 | Transport machinery and maintenance |

| 22 | Other manufacturing | 129–134 | 29 | Other industrial products |

| 23 | Construction | 137–144 | 30 | Construction |

| 24 | Trading and services | 145–148, 160–164 | 31 | Trading and services |

| 25 | Public administration | 165–171 | 32 | Public administration |

| 26 | Railway freight transportation | 149 | 33 | Railway freight transportation |

| 27 | Railway mass transportation | 149 | 34 | Railway mass transportation |

| 28 | Road public transportation | 150 | 35 | Road public transportation |

| 29 | Road freight transportation (heavy) | 151 | 36 | Road freight transportation (heavy) |

| 30 | Road freight transportation (light) | 151 | 37 | Road freight transportation (light) |

| 31 | Land transportation services | 152 | 38 | Land transportation services |

| 32 | Ocean and coastal transportation | 153–154 | 39 | Ocean and coastal transportation |

| 33 | Water transportation services | 155 | 40 | Water transportation services |

| 34 | Air transportation | 156 | 41 | Air transportation |

| 35 | Other services and activities | 157–159, 172–180 | 42 | Other services and activities |

| Sector Number | Industries | Coefficients of Elasticity of Substitution | ||||

|---|---|---|---|---|---|---|

| [a] | [b] | [c] | [d] | [e] | ||

| 1 | Agriculture forest and fishery | 1.15 | 0.5 | 0.5 | 0.5 | 0.5 |

| 2 | Cassava plantation | 1.15 | 0.5 | 0.5 | 0.5 | 0.5 |

| 3 | Sugarcane plantation | 1.15 | 0.5 | 0.5 | 0.5 | 0.5 |

| 4 | Oil palm plantation | 1.15 | 0.5 | 0.5 | 0.5 | 0.5 |

| 5 | Food industry | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 6 | Crude palm oil production | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 7 | Sugar refinery | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 8 | Coal and lignite mining | 1.1 | 0.5 | 0.5 | 0.5 | 0.5 |

| 9 | Crude oil and natural gas | 1.1 | 0.5 | 0.5 | 0.5 | 0.5 |

| 10 | Other mining | 1.1 | 0.5 | 0.5 | 0.5 | 0.5 |

| 11 | Petroleum refinery | 1.1 | 0.5 | 0.5 | 0.5 | 0.5 |

| 12 | Biodiesel production | 1.1 | 0.5 | 0.5 | 0.5 | 0.5 |

| 13 | Ethanol (cassava based) | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 14 | Ethanol (molasses based) | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 15 | Electricity production | 1.02 | 0.5 | 0.5 | 0.5 | 0.5 |

| 16 | Natural gas separation | 1.02 | 0.5 | 0.5 | 0.5 | 0.5 |

| 17 | Metal and non-metal | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 18 | Chemical production | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 19 | Rubber and plastic production | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 20 | Electrical machinery production | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 21 | Transport industry | 0.87 | 0.5 | 0.5 | 0.5 | 0.5 |

| 22 | Other manufacturing | 0.86 | 0.5 | 0.5 | 0.5 | 0.5 |

| 23 | Construction | 0.97 | 0.5 | 0.5 | 0.5 | 0.5 |

| 24 | Trading and services | 0.87 | 0.5 | 0.5 | 0.5 | 0.5 |

| 25 | Public administration | 1.04 | 0.5 | 0.5 | 0.5 | 0.5 |

| 26 | Railway freight transportation | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| 27 | Railway mass transportation | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| 28 | Road public transportation | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| 29 | Road freight transportation (heavy) | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| 30 | Road freight transportation (light) | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| 31 | Land transportation services | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| 32 | Ocean and coastal transportation | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| 33 | Water transportation services | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| 34 | Air transportation | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| 35 | Other services and activities | 1.03 | 0.5 | 0.5 | 0.5 | 0.5 |

| Year | n | eg | ig | itg | etr | ppg | δ | γ |

|---|---|---|---|---|---|---|---|---|

| 2019–2031 | 0.01 | 0.05 | 0.05 | 0.055 | 0.05 | 0.01 | 0.07 | 2 |

Appendix B

Appendix B.1. Set

| j | All sectors |

| pub | Public sectors (sector number 25–30) |

| pri | Private industries (sector number 1–24 and 31–35) |

| j0 | All sectors except sector number 7 and 11 |

| j1 | Sugar and petroleum refinery sector (sector number 7 and 11) |

| i | All commodities |

| ij | All commodities (alias commodities) |

| i1 | All commodities except sector number 16–19 and 33–36 |

| i2 | Mixed gasohol (sector number 16, 17) |

| i3 | Mixed biodiesel (sector number 18, 19) |

| i4 | Mass transportation (sector number 34, 35) |

| i5 | Freight transportation (sector number 33, 36) |

| l | Labor |

| k | Capital |

| ag | All agents (firms, households, government, and the rest of the world) |

| agng | Non-government agents (firms, households, and the rest of the world) |

| agd | Domestic agents (firms, households, and government) |

| gvt | Government |

| row | The rest of the world |

| f | Firms |

| h | Households |

| t | Time for simulation |

Appendix B.2. Parameters

Appendix B.2.1. Input-Output Co-Efficient

| Input-output coefficient of intermediate commodity i for industry j | |

| Input-output coefficient of mixed biodiesel for industry j | |

| Input-output coefficient of mixed gasohol for industry j | |

| Input-output coefficient of freight transportation for industry j | |

| Input-output coefficient of mass transportation for industry j | |

| Input-output coefficient (total intermediate consumption) for industry j | |

| Input-output coefficient (total value added) for industry j |

Appendix B.2.2. Scale Share and Elasticity of Production Function

| Scale parameter (CES—value added) for industry j | |

| Share parameter (CES—value added) for industry j | |

| Elasticity parameter (CES—value added) for industry j; | |

| Elasticity of substitution (CES—value added) for industry j; where | |

| Scale parameter (CES—composite capital) for industry j | |

| Share parameter (CES—composite capital) for industry j | |

| Elasticity parameter (CES—composite capital) for industry j; | |

| Elasticity of substitution (CES—composite capital) for industry j; where | |

| Scale parameter (CES—composite labor) for industry j | |

| Share parameter (CES—composite labor) for industry j | |

| Elasticity parameter (CES—composite labor) for industry j; | |

| Elasticity of substitution (CES—composite labor) for industry j; where | |

| Scale parameter (CES—composite mixed gasohol) for industry j | |

| Share parameter (CES—composite mixed gasohol) for industry j | |

| Elasticity parameter (CES—mixed gasohol) for industry j; | |

| Elasticity of substitution (CES—mixed gasohol) for industry j; where | |

| Scale parameter (CES—composite mixed biodiesel) for industry j | |

| Share parameter (CES—composite mixed biodiesel) for industry j | |

| Elasticity parameter (CES—mixed biodiesel) for industry j; | |

| Elasticity of substitution (CES—mixed biodiesel) for industry j; where | |

| Scale parameter (CES—mass transportation) for industry j | |

| Share parameter (CES—mass transportation) for industry j | |

| Elasticity parameter (CES—mass transportation) for industry j; | |

| Elasticity of substitution (CES—mass transportation) for industry j; where | |

| Scale parameter (CES—freight transportation) for industry j | |

| Share parameter (CES—freight transportation) for industry j | |

| Elasticity parameter (CES—freight transportation) for industry j; | |

| Elasticity of substitution (CES—freight transportation) for industry j; where | |

| Scale parameter (CES—composite commodity) | |

| Share parameter (CES—composite commodity) | |

| Elasticity parameter (CES—composite commodity); | |

| Elasticity of substitution (CES—composite commodity); where | |

| Scale parameter (CET—exports and local sales) | |

| Share parameter (CET—exports and local sales) | |

| Elasticity parameter (CET—exports and local sales); | |

| Elasticity of transformation (CET—total output); where | |

| Scale parameter (CET—total output) for industry j | |

| Share parameter (CET—total output) for industry j | |

| Elasticity parameter (CET—total output) for industry j; | |

| Elasticity of transformation (CET—total output) for industry j; where | |

| Price-elasticity of the world demand for exports of product i | |

| Export growth rate of product i |

Appendix B.2.3. Parameters for Income Saving and Investment of Institutes

| Share of type k capital income received by agent ag | |

| Share of type l labor income received by type h households | |

| Intercept (type h household savings) | |

| Slope (type h household savings) | |

| Marginal share of commodity i in type h household consumption budget | |

| Share of commodity i in total private investment expenditures | |

| Share of commodity i in total public investment expenditures | |

| Share of commodity i in total current public expenditures on goods and services | |

| Scale parameter (price for new private capital) | |

| Scale parameter (price for new public capital) | |

| Scale parameter (allocation of investment to industry) | |

| Deprecation rate of capital k used in public |

Appendix B.2.4. Tax and Transfer

| Share parameter (transfer functions) between ag | |

| Price elasticity of indexed transfers and parameters | |

| Rate of transport margin applied to domestic commodity i | |

| Rate of transport margin applied to export commodity i | |

| Intercept (transfers by type h households to government) | |

| Marginal rate of transfers by type h households to government | |

| Tax rate on commodity i | |

| Intercept (income taxes of type f businesses) | |

| Marginal income tax rate of type f businesses | |

| Intercept (income taxes of type h households) | |

| Marginal income tax rate of type h households | |

| Tax rate on type k capital used by industry j | |

| Rate of taxes and duties on imports of commodity i | |

| Tax rate on the production of industry j | |

| Tax rate on type l worker compensation in industry j | |

| Export tax rate on exported commodity i |

Appendix B.3. Variables

Appendix B.3.1. Prices and Wages

| Basic price of industry j’s production of commodity i | |

| Purchaser price of composite commodity i (including all taxes and margins) | |

| Purchaser price of composite commodity i (base year) | |

| Intermediate consumption price index of industry j | |

| Price of local product i sold on the domestic market | |

| Aggregate price of mixed biodiesel by industry j | |

| Price received for exported commodity i (excluding export taxes) | |

| FOB price of exported commodity i (in local currency) | |

| Aggregate price of freight transportation by industry j | |

| Aggregate price of mixed gasohol by industry j | |

| Consumer price index | |

| GDP deflator | |

| Public expenditures price index | |

| Private Investment price index | |

| Public Investment price index | |

| Price of new private capital | |

| Price of new public capital | |

| Price of local product i (excluding all taxes on products) | |

| Price of imported product i (including all taxes and margins) | |

| Aggregate price of mass transportation by industry j | |

| Industry j unit cost | |

| Basic price of industry j output | |

| Price of industry j value added | |

| World price of imported product i (expressed in foreign currency) | |

| World price of exported product i (expressed in foreign currency) | |

| Rental rate of type k capital in industry j | |

| Rental rate of industry j composite capital | |

| Rental rate paid by industry j for type k capital, including capital taxes | |

| Wage rate of type l labor | |

| Wage rate of industry j composite labor | |

| Wage rate paid by industry j for type l labor, including payroll taxes | |

| User cost of type k capital in private industry | |

| User cost of type k capital in public industry |

Appendix B.3.2. Taxes

| Income taxes of type f businesses | |

| Total government revenue from business income taxes | |

| Income taxes of type h households | |

| Total government revenue from household income taxes | |

| Government revenue from indirect taxes on product i | |

| Total government receipts of indirect taxes on commodities | |

| Government revenue from taxes on type k capital used by industry j | |

| Total government revenue from taxes on capital | |

| Government revenue from import duties on product i | |

| Total government revenue from import duties | |

| Government revenue from taxes on industry j production (excluding taxes directly related to the use of capital and labor) | |

| Total government revenue from production taxes (excluding taxes directly related to the use of capital and labor) | |

| Government revenue from payroll taxes on type l labor in industry j | |

| Total government revenue from payroll taxes | |

| Government revenue from export taxes on product i | |

| Total government revenue from export taxes |

Appendix B.3.3. Quantity

| Consumption of commodity i by type h households | |

| Minimum consumption of commodity i by type h households | |

| Public consumption of commodity i (volume) | |

| Total intermediate consumption of industry j | |

| Consumption budget of type h households | |

| Real consumption expenditure of households h | |

| Domestic demand for commodity i produced locally | |

| Intermediate consumption of commodity i by industry j | |

| Aggregate intermediate consumption of mixed biodiesel by industry j | |

| Aggregate intermediate consumption of freight transportation by industry j | |

| Aggregate intermediate consumption of mixed gasohol by industry j | |

| Aggregate intermediate consumption of mass transportation by industry j | |

| Total intermediate demand for commodity i | |

| Supply of commodity i by sector j to the domestic market | |

| Quantity of product i exported by sector j | |

| World demand for exports of product i | |

| World demand for exports of product i (base year) | |

| Quantity of product i imported | |

| Volume of new type k capital investment to sector j | |

| Final demand of commodity i for investment purposes | |

| Final demand of commodity i for private investment purposes | |

| Final demand of commodity i for public investment purposes | |

| Demand for type k capital by industry j | |

| Industry j demand for composite capital | |

| Supply of type k capital | |

| Demand for type l labor by industry j | |

| Industry j demand for composite labor | |

| Supply of type l labor | |

| Demand for commodity i as a trade or transport margin | |

| Quantity demanded of composite commodity i | |

| Value added of industry j | |

| Inventory change of commodity i | |

| Industry j production of commodity i | |

| Total aggregate output of industry j |

Appendix B.3.4. Value

| Current account balance | |

| Current government expenditures on goods and services | |

| Real government expenditures | |

| Real GDP at basic price | |

| Real GDP at market price | |

| Real private gross fixed capital formation | |

| Real public gross fixed capital formation | |

| Gross fixed capital formation | |

| GDP at basic prices | |

| GDP at purchasers’ prices from the perspective of final demand | |

| GDP at market prices (income-based) | |

| GDP at market prices | |

| Total investment expenditures | |

| Total private investment expenditures | |

| Total public investment expenditures | |

| Reallocation budget k for industry j | |

| Savings of type f businesses | |

| Government savings | |

| Rest-of-the-world savings | |

| Savings of type h households | |

| Transfers from agent ag to type h households | |

| Total government revenue from taxes on products and imports | |

| Total government revenue from other taxes on production | |

| Disposable income of type f businesses | |

| Disposable income of type h households | |

| Total income of type f businesses | |

| Capital income of type f businesses | |

| Transfer income of type f businesses | |

| Total government income | |

| Government capital income | |

| Government transfer income | |

| Total income of type h households | |

| Capital income of type h households | |

| Labor income of type h households | |

| Transfer income of type h households | |

| Rest-of-the-world income |

Appendix B.3.5. Monetary

| Exchange rate; price of foreign currency in terms of local currency | |

| Interest rate |

Appendix B.4. Equation

References

- Asian Development Bank. Thailand Transport Sector Assessment, Strategy, and Road Map; Asian Development Bank: Manila, Philippines, 2011; ISBN 978-92-9092-415-9. [Google Scholar]

- Asian Development Bank. Financing Infrastructure in Asia and the Pacific: Capturing Impacts and New Sources; Asian Development Bank: Manila, Philippines, 2018; ISBN 978-4-89974-071-1. [Google Scholar]

- Office of the National Economic and Social Development Council. Thailand Logistic Report 2019; Office of the National Economic and Social Development Council: Bangkok, Thailand, 2019; p. 33.

- Arvis, J.-F.; Ojala, L.; Wiederer, C.; Shepherd, B.; Raj, A.; Dairabayeva, K.; Kiiski, T. Connecting to Compete 2018: Trade Logistics in the Global Economy; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Limcharoen, A.; Jangkrajarng, V.; Wisittipanich, W.; Ramingwong, S. Thailand Logistics Trend: Logistics Performance Index. IJAER 2017, 12, 4882–4885. [Google Scholar]

- Office of the National Economic and Social Development Council. The Third Thailand Logistics Development Plan (2017–2022); Office of the National Economic and Social Development Council: Bangkok, Thailand, 2019.

- Traivivatana, S.; Wangjiraniran, W.; Junlakarn, S.; Wansophark, N. Impact of Transportation Restructuring on Thailand Energy Outlook. Energy Procedia 2017, 138, 393–398. [Google Scholar] [CrossRef]

- Gibbons, S.; Lyytikäinen, T.; Overman, H.G.; Sanchis-Guarner, R. New road infrastructure: The effects on firms. J. Urban Econ. 2019, 110, 35–50. [Google Scholar] [CrossRef]

- Laborda, L.; Sotelsek, D. Effects of Road Infrastructure on Employment, Productivity and Growth: An Empirical Analysis at Country Level. J. Infrastruct. Dev. 2019, 11, 81–120. [Google Scholar] [CrossRef]

- Preecha, R.; Wianwiwat, S. The Effect of Abolishing the Oil Fund on the Thai Economy: A Computable General Equilibrium Analysis. Int. Energy J. 2017, 17, 155–162. [Google Scholar]

- Chanthawong, A.; Dhakal, S.; Kuwornu, J.K.M.; Farooq, M.K. Impact of Subsidy and Taxation Related to Biofuels Policies on the Economy of Thailand: A Dynamic CGE Modelling Approach. Waste Biomass Valorization 2020, 11, 909–929. [Google Scholar] [CrossRef]

- Phomsoda, K.; Puttanapong, N.; Piantanakulchai, M. Economic Impacts of Thailand’s Biofuel Subsidy Reallocation Using a Dynamic Computable General Equilibrium (CGE) Model. Energies 2021, 14, 2272. [Google Scholar] [CrossRef]

- Solaymani, S.; Kari, F. Impacts of energy subsidy reform on the Malaysian economy and transportation sector. Energy Policy 2014, 70, 115–125. [Google Scholar] [CrossRef]

- Breisinger, C.; Engelke, W.; Ecker, O. Leveraging Fuel Subsidy Reform for Transition in Yemen. Sustainability 2012, 4, 2862–2887. [Google Scholar] [CrossRef] [Green Version]

- Kim, E.; Hewings, G.J.D.; Hong, C. An Application of an Integrated Transport Network– Multiregional CGE Model: A Framework for the Economic Analysis of Highway Projects. Econ. Syst. Res. 2004, 16, 235–258. [Google Scholar] [CrossRef]

- Kim, E.; Hewings, G.J.D. An Application of an Integrated Transport Network–Multiregional CGE Model to the Calibration of Synergy Effects of Highway Investments. Econ. Syst. Res. 2009, 21, 377–397. [Google Scholar] [CrossRef]

- Kim, E.; Kim, H.S.; Hewings, G.J.D. An Application of the Integrated Transport Network—Multi-Regional CGE Model: An Impact Analysis of Government-Financed Highway Projects. J. Transp. Econ. Policy 2011, 45, 223–245. [Google Scholar]

- Boonpanya, T.; Masui, T. Assessing the economic and environmental impact of freight transport sectors in Thailand using computable general equilibrium model. J. Clean. Prod. 2021, 280, 124271. [Google Scholar] [CrossRef]

- Chen, Z.; Haynes, K.E. Transportation Capital in the United States: A Multimodal General Equilibrium Analysis. Public Work. Manag. Policy 2013, 19, 97–117. [Google Scholar] [CrossRef]

- Arman, S.A.; Manesh, A.S.; Izady, A.T. Design of a CGE Model to Evaluate Investment in Transport Infrastructures: An Application for Iran. Asian Econ. Financ. Rev. 2015, 5, 532–545. [Google Scholar] [CrossRef] [Green Version]

- Bekele, S.; Ferede, T. Economy-wide Impact of Investment in Road Infrastructure in Ethiopia: A Recursive Dynamic CGE Approach. Ethiop. J. Bus. Econ. 2015, 5, 187–213. [Google Scholar] [CrossRef] [Green Version]

- Chen, Z.; Daito, N.; Gifford, J.L. Socioeconomic impacts of transportation public-private partnerships: A dynamic CGE assessment. Transp. Policy 2017, 58, 80–87. [Google Scholar] [CrossRef]

- Piskin, M.; Hewings, G.J.D.; Hannum, C.M. Synergy effects of highway investments on the Turkish economy: An application of an integrated transport network with a multiregional CGE model. Transp. Policy 2020, 95, 78–92. [Google Scholar] [CrossRef]

- Dixon, P.B.; Rimmer, M.T.; Waschik, R. Linking CGE and specialist models: Deriving the implications of highway policy using USAGE-Hwy. Econ. Model. 2017, 66, 1–18. [Google Scholar] [CrossRef]

- Kim, E.; Samudro, Y.N. Structural Path Analysis of Fuel Subsidy and Road Investment Policies: Application of Indonesian Financial Social Accounting Matrix. J. Transp. Res. 2016, 23, 119–143. [Google Scholar] [CrossRef]

- Kim, E.; Hewings, G.J.D.; Amir, H. Economic evaluation of transportation projects: An application of Financial Computable General Equilibrium model. Res. Transp. Econ. 2017, 61, 44–55. [Google Scholar] [CrossRef]

- Kim, E.; Samudro, Y.N. Reducing Fuel Subsidies and Financing Road Infrastructure in Indonesia: A Financial Computable General Equilibrium Model. Bull. Indones. Econ. Stud. 2021, 57, 111–133. [Google Scholar] [CrossRef]

- Henseler, M.; Maisonnave, H. Low world oil prices: A chance to reform fuel subsidies and promote public transport? A case study for South Africa. Transp. Res. Part A Policy Pract. 2018, 108, 45–62. [Google Scholar] [CrossRef]

- Bhattarai, K.; Benjasak, C. Growth and redistribution impacts of income taxes in the Thai Economy: A dynamic CGE analysis. J. Econ. Asymmetries 2021, 23, e00189. [Google Scholar] [CrossRef]

- Decaluwe, B.; Lemelin, A.; Maisonnave, H.; Robichaud, V. PEP Standard CGE Models. Available online: https://www.pep-net.org/pep-standard-cge-models (accessed on 17 July 2020).

- Bretschger, L.; Zhang, L. Carbon policy in a high-growth economy: The case of China. Resour. Energy Econ. 2017, 47, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Annabi, N.; Cockburn, J.; Decaluwe, B. A Sequential Dynamic CGE Model for Poverty Analysis; CIRPÉE, Département d’économique Québec (Québec): Montreal, QC, Canada, 2004; p. 23. [Google Scholar]

- Office of the National Economic and Social Development Council National Income of Thailand (NI). Available online: https://www.nesdc.go.th/nesdb_en/more_news.php?cid=154&filename=index (accessed on 11 February 2021).

- University of Groningen; University of California. Davis Total Factor Productivity at Constant National Prices for Thailand. Available online: https://fred.stlouisfed.org/series/RTFPNATHA632NRUG (accessed on 10 March 2021).

- Asian Productivity Organization. APO Productivity Databook 2020; Asian Productivity Organization: Tokyo, Japan, 2020. [Google Scholar]

- Hosoe, N.; Gasawa, K.; Hashimoto, H. Textbook of Computable General Equilibrium Modeling: Programming and Simulations, 2010th ed.; Palgrave Macmillan: Basingstoke, UK, 2010; ISBN 978-0-230-24814-4. [Google Scholar]

- Kaenchan, P.; Puttanapong, N.; Bowonthumrongchai, T.; Limskul, K.; Gheewala, S.H. Macroeconomic modeling for assessing sustainability of bioethanol production in Thailand. Energy Policy 2019, 127, 361–373. [Google Scholar] [CrossRef]

- Sue Wing, I. Computable General Equilibrium Models and Their Use in Economy-Wide Policy Analysis. Joint Program Technical Note TN #6. 2004. Available online: http://globalchange.mit.edu/publication/13808 (accessed on 14 July 2021).

- Dixon, P.B.; Jorgenson, D. Handbook of Computable General Equilibrium Modeling; North-Holland: Oxford, UK, 2013. [Google Scholar]

- Mary, S.; Phimister, E.; Roberts, D.; Santini, F. A Monte Carlo filtering application for systematic sensitivity analysis of computable general equilibrium results. Econ. Syst. Res. 2018, 31, 404–422. [Google Scholar] [CrossRef]

- Belgodere, A.; Vellutini, C. Identifying key elasticities in a CGE model: A Monte Carlo approach. Appl. Econ. Lett. 2011, 18, 1619–1622. [Google Scholar] [CrossRef]

- Puttanapong, N. The Computable General Equilibrium (CGE) Models with Monte-Carlo Simulation for Thailand: An Impact Analysis of Baht Appreciation. Ph.D. Thesis, Cornell University, Ithaca, NY, USA, 2008. [Google Scholar]

- Puttanapong, N. Impacts of Climate Change on Major Crop Yield and the Thai Economy: A Nationwide Analysis Using Static and Monte-Carlo Computable General Equilibrium Models. Thail. World Econ. 2013, 31, 68–87. [Google Scholar]

- Phomsoda, K.; Puttanapong, N.; Piantanakulchai, M. Effects of Transport Margin Reduction to Thailand’s Economy Using CGE Model. Asia Pacif. Struct. Eng. Constr. J. 2015, 12, 15–21. [Google Scholar]

- Puttanapong, N.; Wachirarangsrikul, S.; Phonpho, W.; Raksakulkarn, V. A Monte-Carlo Dynamic CGE Model for the Impact Analysis of Thailand’s Carbon Tax Policies. J. Sustain. Energy Environ. 2015, 6, 43–53. [Google Scholar]

- Lin, B.; Li, A. Impacts of removing fossil fuel subsidies on China: How large and how to mitigate? Energy 2012, 44, 741–749. [Google Scholar] [CrossRef]

- Farajzadeh, Z.; Bakhshoodeh, M. Economic and environmental analyses of Iranian energy subsidy reform using Computable General Equilibrium (CGE) model. Energy Sustain. Dev. 2015, 27, 147–154. [Google Scholar] [CrossRef]

- Manzoor, D.; Shahmoradi, A.; Haqiqi, I. An analysis of energy price reform: A CGE approach. OPEC Energy Rev. 2012, 36, 35–54. [Google Scholar] [CrossRef]

- Aydın, L.; Acar, M. Economic impact of oil price shocks on the Turkish economy in the coming decades: A dynamic CGE analysis. Energy Policy 2011, 39, 1722–1731. [Google Scholar] [CrossRef]

- Organisation for Economic Co-operation and Development (OECD); International Labor Organization (ILO). How Immigrants Contribute to Thailand’s Economy; OECD Publishing: Paris, France, 2017; ISBN 978-92-64-28774-7. [Google Scholar]

| Scenarios | Terminating Biofuel Subsidy | % Reallocation for Capital Investment | |

|---|---|---|---|

| Road Freight Transportation | Road Public Transportation | ||

| SIM A | +100% | - | - |

| SIM B | +100% | +50% | - |

| SIM C | +100% | - | +50% |

| Macroeconomic Indices (Unit: Million Baht) | Data | 2015 | 2016 | 2017 | 2018 | 2019 | %RMSE |

|---|---|---|---|---|---|---|---|

| GDP | Model results | 13,916.25 | 14,481.36 | 15,073.66 | 15,696.82 | 16,354.22 | 2.59 |

| Official data | 13,916.25 | 14,816.27 | 15,581.15 | 16,214.62 | 16,756.07 | ||

| PCON | Model results | 7256.41 | 7557.51 | 7872.46 | 8203.21 | 8551.57 | 2.88 |

| Official data | 7056.81 | 7296.68 | 7579.74 | 8002.73 | 8448.32 | ||

| GCON | Model results | 2144.16 | 2251.36 | 2363.93 | 2482.13 | 2606.23 | 6.86 |

| Official data | 2353.04 | 2460.82 | 2521.45 | 2643.38 | 2722.78 | ||

| GFCF | Model results | 3287.62 | 3478.01 | 3678.94 | 3890.97 | 4114.70 | 4.56 |

| Official data | 3371.07 | 3459.90 | 3579.85 | 3726.89 | 3814.37 | ||

| IMP | Model results | 8221.10 | 8515.06 | 8832.76 | 9174.77 | 9541.91 | 7.22 |

| Official data | 7861.68 | 7806.46 | 8397.74 | 9169.69 | 8543.41 | ||

| EXP | Model results | 9264.69 | 9524.48 | 9805.49 | 10,109.18 | 10,437.00 | 3.79 |

| Official data | 9295.64 | 9785.87 | 10,326.73 | 10,616.16 | 10,086.59 | ||

| CPI * | Model results | 100.00 | 101.24 | 102.39 | 103.46 | 104.45 | 1.33 |

| Official data | 100.00 | 100.19 | 100.85 | 101.93 | 102.65 |

| Scenario | Highest Positive Sectoral Impact | %Change | Highest Negative Sectoral Impact | %Change |

|---|---|---|---|---|

| SIM A | Manufacturing | 0.212 | Ethanol (cassava-based) | −1.636 |

| Construction | 0.203 | Coastal and water transportation | −1.154 | |

| Metal and non-metal | 0.200 | Public road transportation | −1.024 | |

| Industrial electrical machinery | 0.188 | Petroleum refinery | −1.023 | |

| Railway freight transportation | 0.186 | Biodiesel production | −0.649 | |

| SIM B | Road freight transportation (heavy) | 4.199 | Ethanol (cassava-based) | −1.643 |

| Road freight transportation (light) | 0.951 | Coastal and water transportation | −1.146 | |

| Construction | 0.347 | Petroleum refinery | −0.794 | |

| Rubber plastics and chemicals production | 0.251 | Biodiesel production | −0.794 | |

| Manufacturing | 0.243 | Public road transportation | −0.580 | |

| SIM C | Road freight transportation (heavy) | 4.216 | Ethanol (cassava-based) | −1.233 |

| Public road transportation | 3.889 | Coastal and water transportation | −1.180 | |

| Land transportation services | 0.988 | Petroleum refinery | −0.499 | |

| Road freight transportation (light) | 0.959 | Biodiesel production | −0.499 | |

| Transport industries | 0.394 | Water transportation services | −0.495 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Phomsoda, K.; Puttanapong, N.; Piantanakulchai, M. Assessing Economic Impacts of Thailand’s Fiscal Reallocation between Biofuel Subsidy and Transportation Investment: Application of Recursive Dynamic General Equilibrium Model. Energies 2021, 14, 4248. https://doi.org/10.3390/en14144248

Phomsoda K, Puttanapong N, Piantanakulchai M. Assessing Economic Impacts of Thailand’s Fiscal Reallocation between Biofuel Subsidy and Transportation Investment: Application of Recursive Dynamic General Equilibrium Model. Energies. 2021; 14(14):4248. https://doi.org/10.3390/en14144248

Chicago/Turabian StylePhomsoda, Korrakot, Nattapong Puttanapong, and Mongkut Piantanakulchai. 2021. "Assessing Economic Impacts of Thailand’s Fiscal Reallocation between Biofuel Subsidy and Transportation Investment: Application of Recursive Dynamic General Equilibrium Model" Energies 14, no. 14: 4248. https://doi.org/10.3390/en14144248

APA StylePhomsoda, K., Puttanapong, N., & Piantanakulchai, M. (2021). Assessing Economic Impacts of Thailand’s Fiscal Reallocation between Biofuel Subsidy and Transportation Investment: Application of Recursive Dynamic General Equilibrium Model. Energies, 14(14), 4248. https://doi.org/10.3390/en14144248