Reinforcement Learning Based Peer-to-Peer Energy Trade Management Using Community Energy Storage in Local Energy Market

Abstract

:1. Introduction

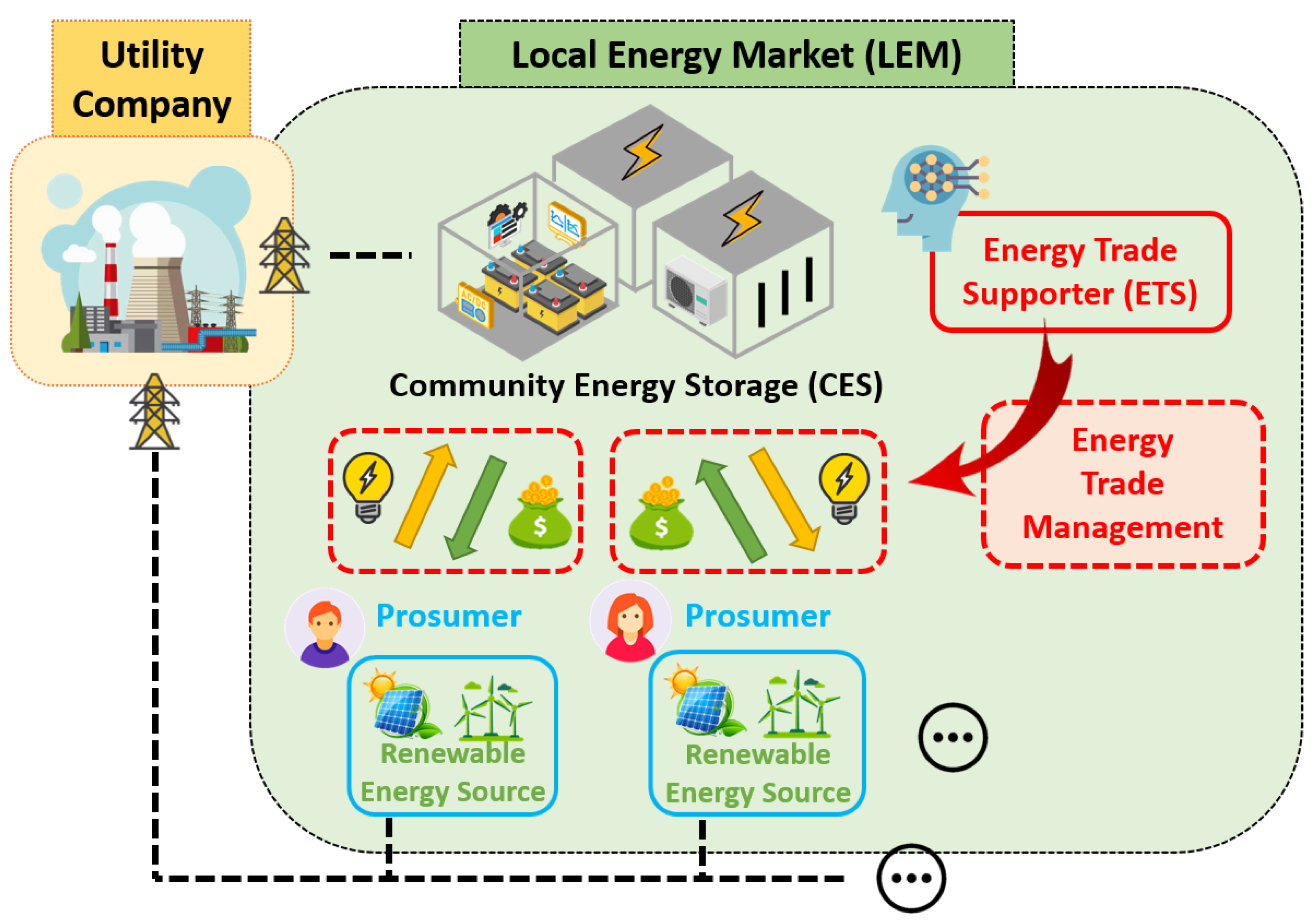

- We designed an LEM where prosumers are not controlled by a central operator. Prosumers freely participate in the LEM, and the trade between prosumers is managed based on the bids and offers submitted by prosumers.

- We proposed a new role called ETS that manages trades in the LEM. ETS not only acts as a middleman between prosumers but also as a supporter for prosumers who failed to trade in real-time LEM.

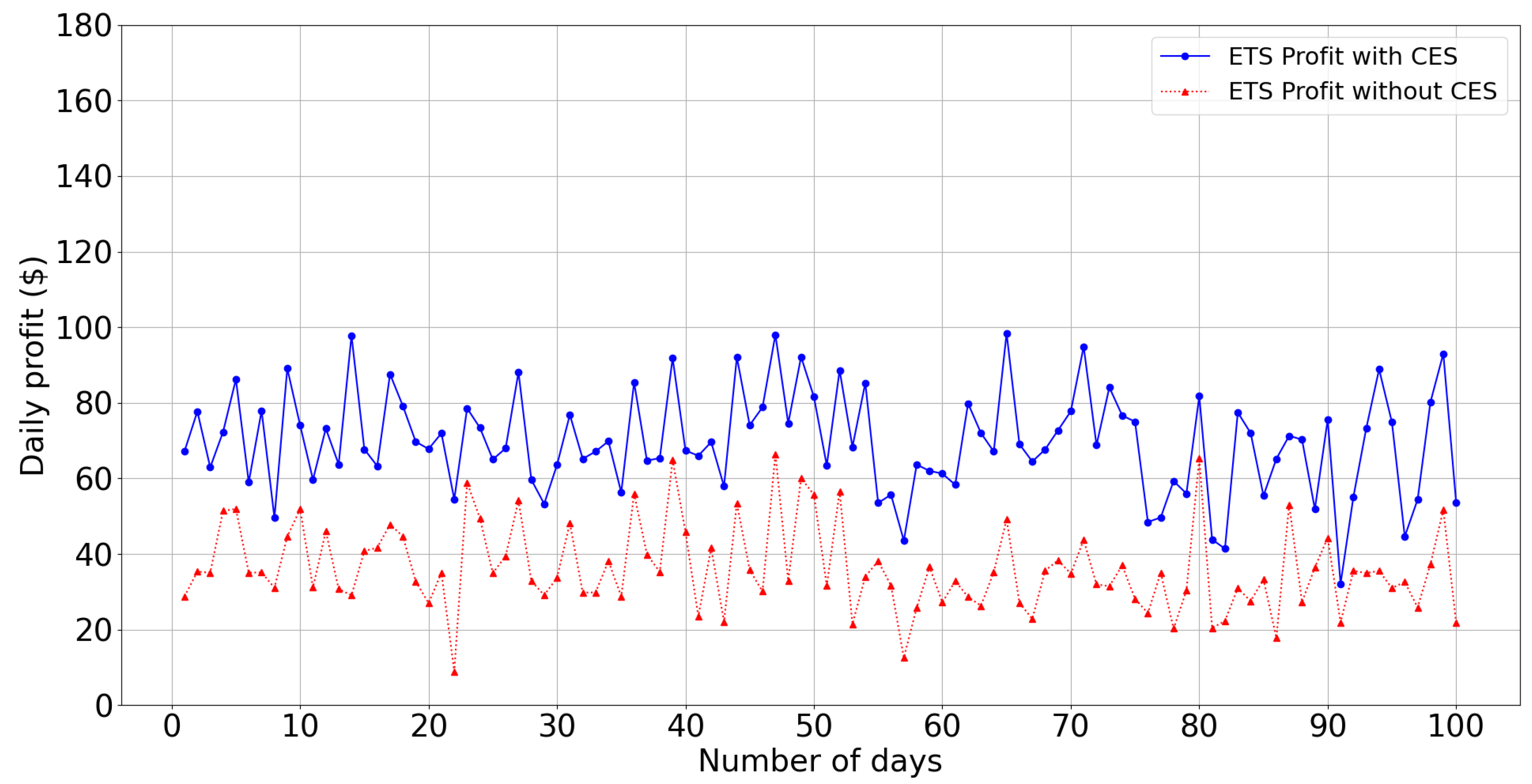

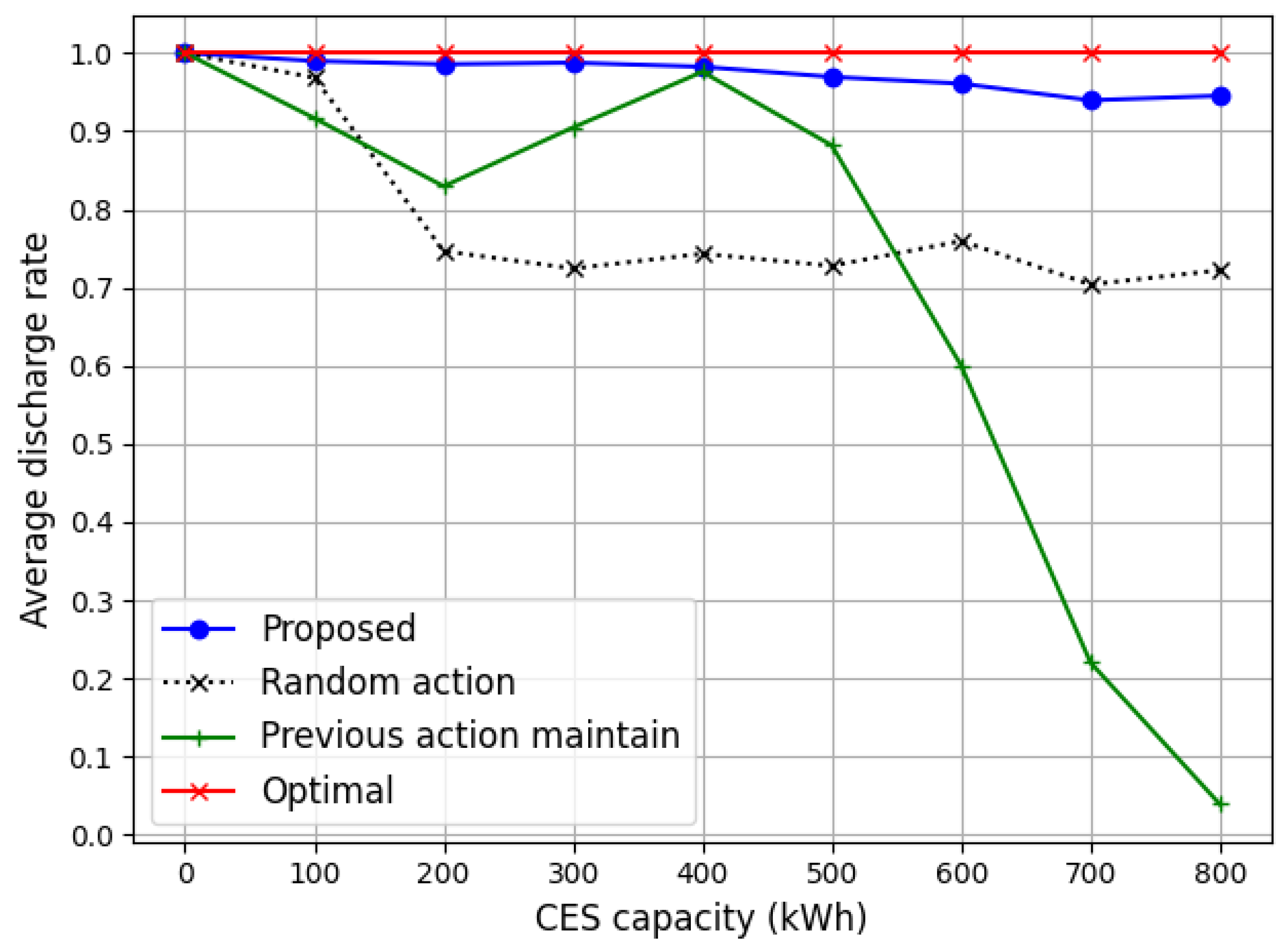

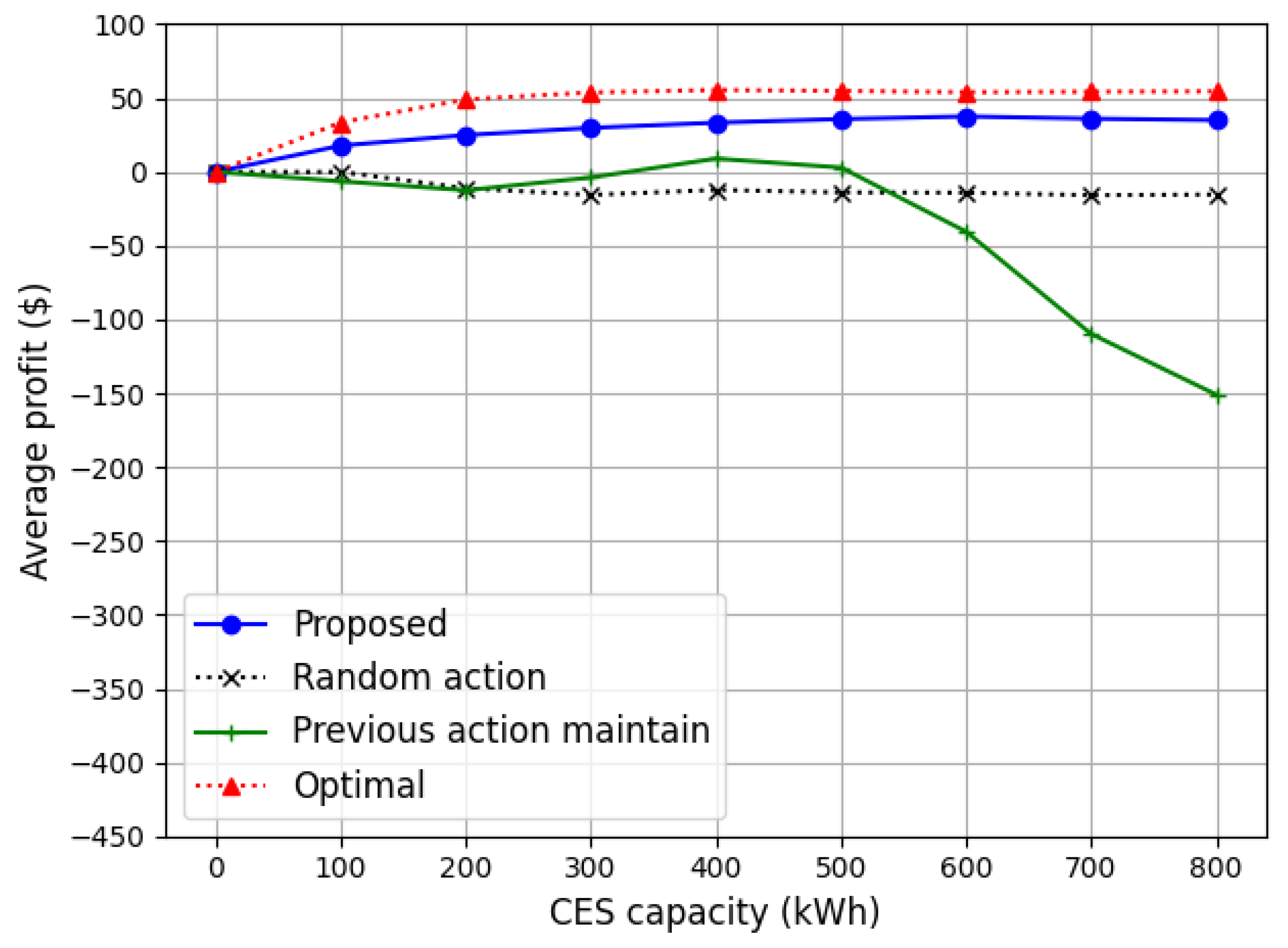

- CES is applied to the LEM and controlled by ETS. CES is used only for prosumers who failed to trade in real-time LEM. Through numerical simulations, we showed that the limited use of CES has more economic benefits than using the CES for all prosumers.

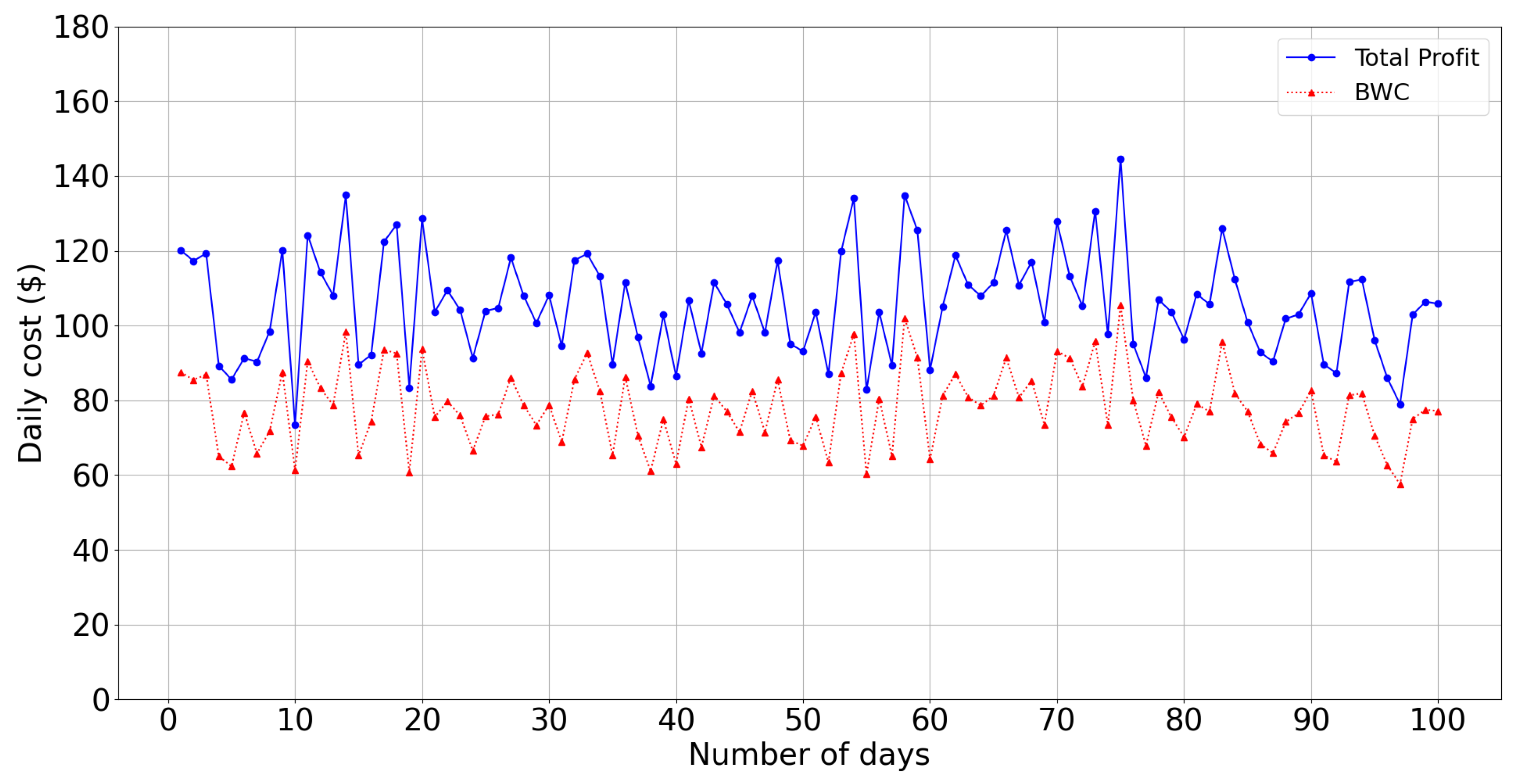

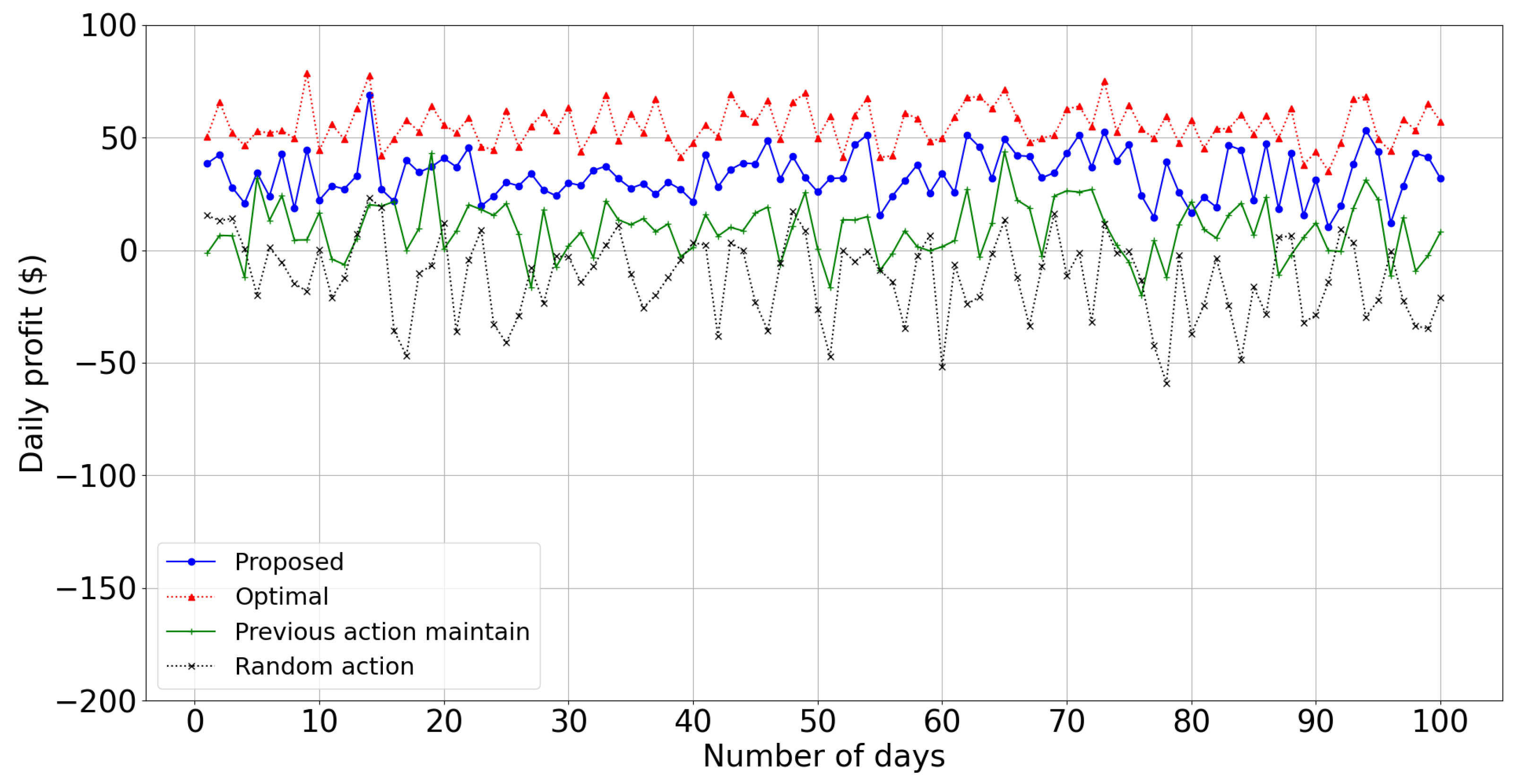

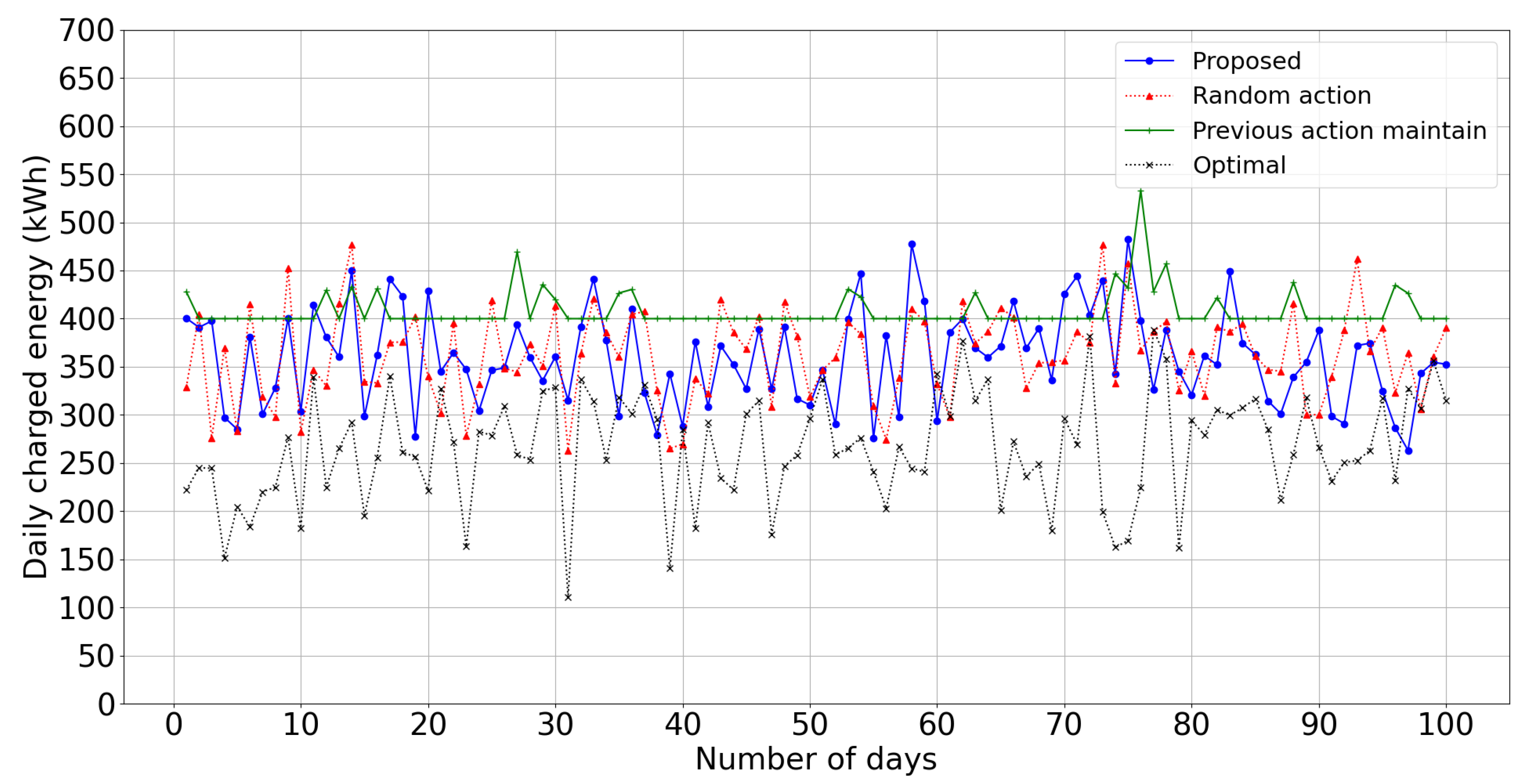

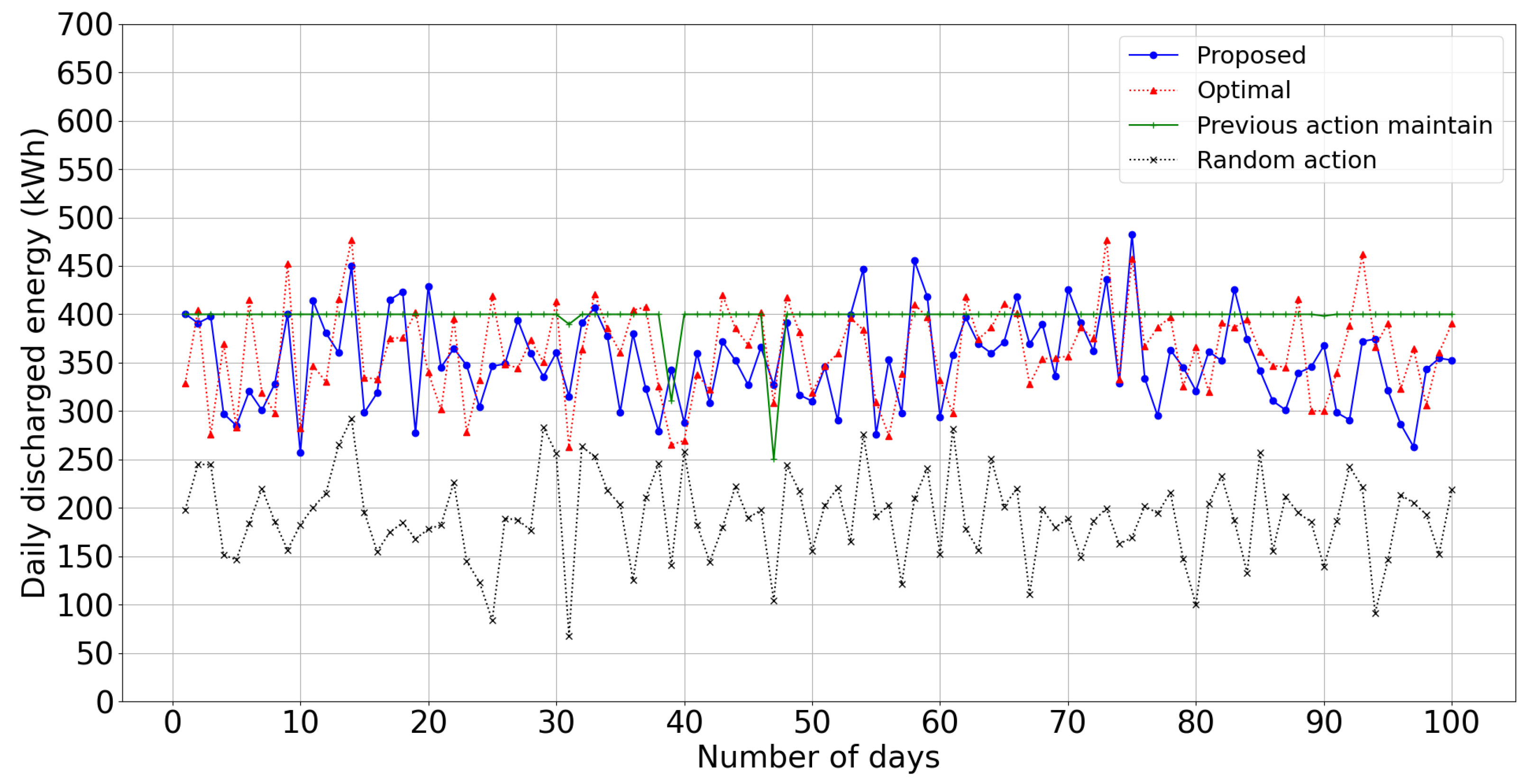

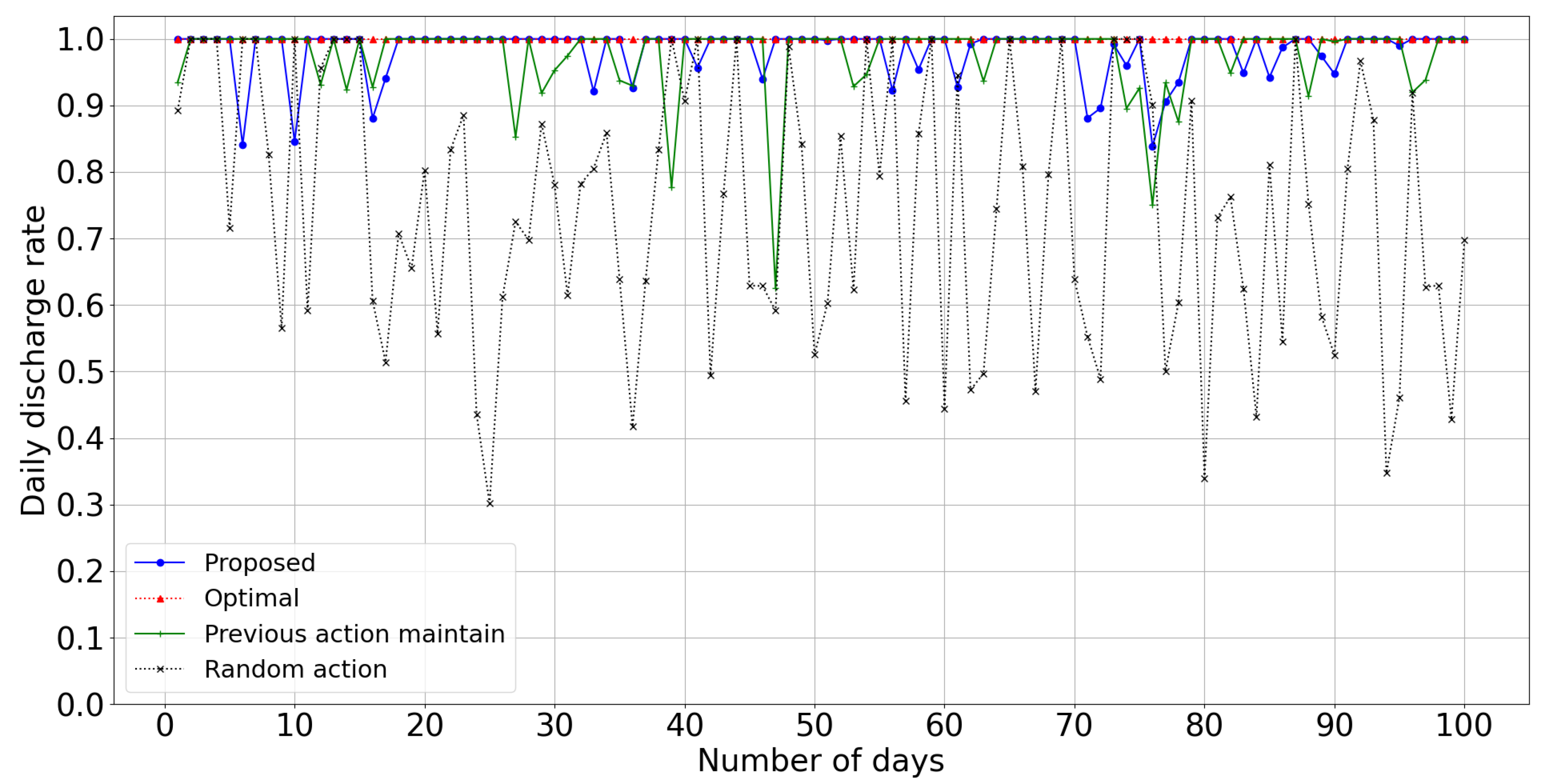

- We adopted an RL-based energy trade management technique for CES, which targets maximizing the trading profit considering BWC. We compared the BWC and economic benefits of CES from the RL-based energy trade management algorithm.

2. Related Work

2.1. Transactive EMS

2.2. P2P Energy Trade System

2.3. Energy Trade System with CES

3. System Model

3.1. Proposed Energy Market

3.2. Prosumers

4. Energy Trade Management Algorithm

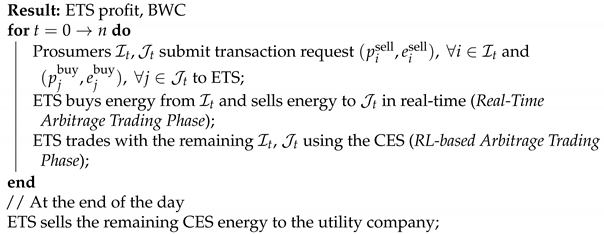

| Algorithm 1: Energy trade management algorithm |

|

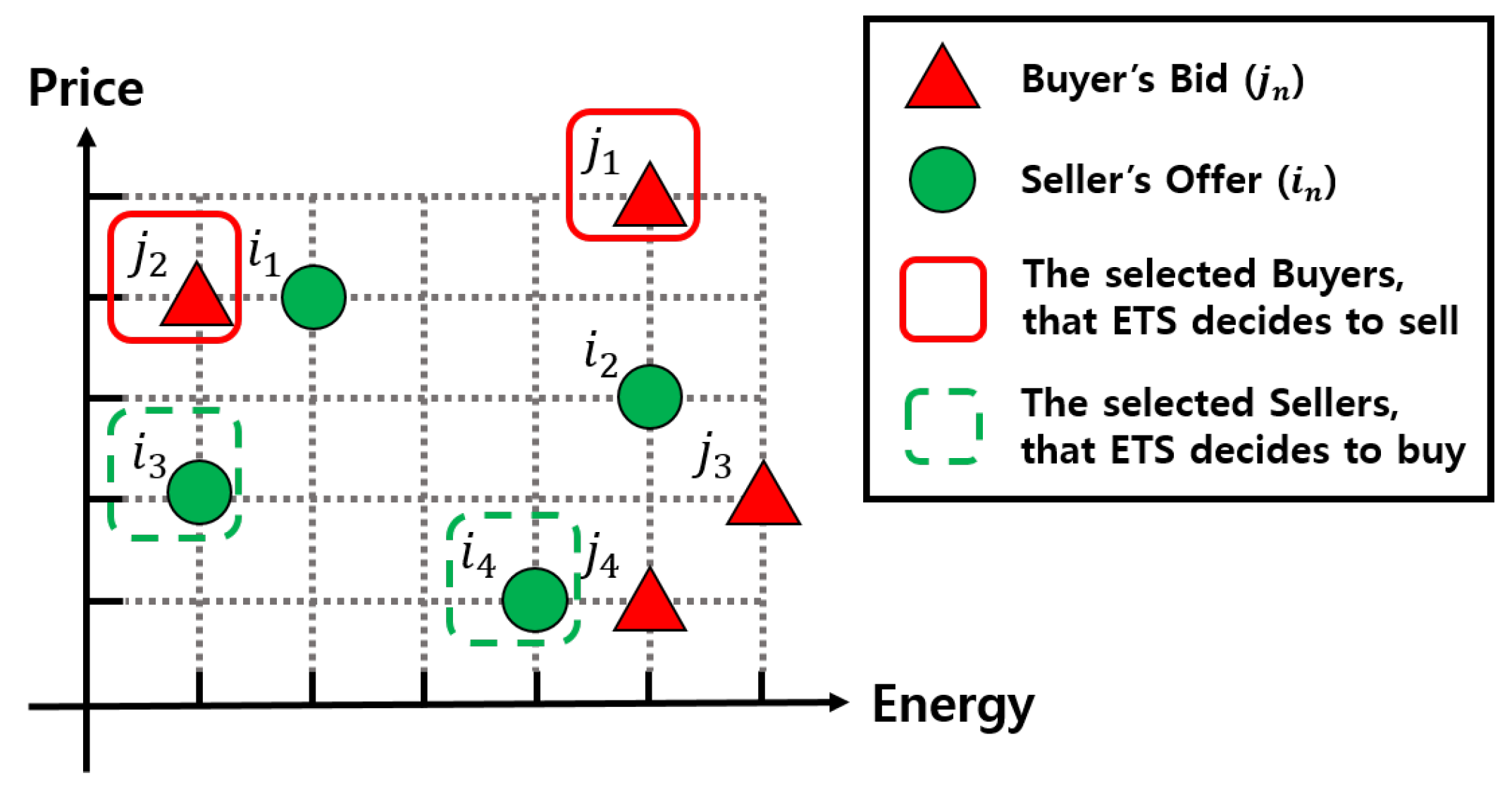

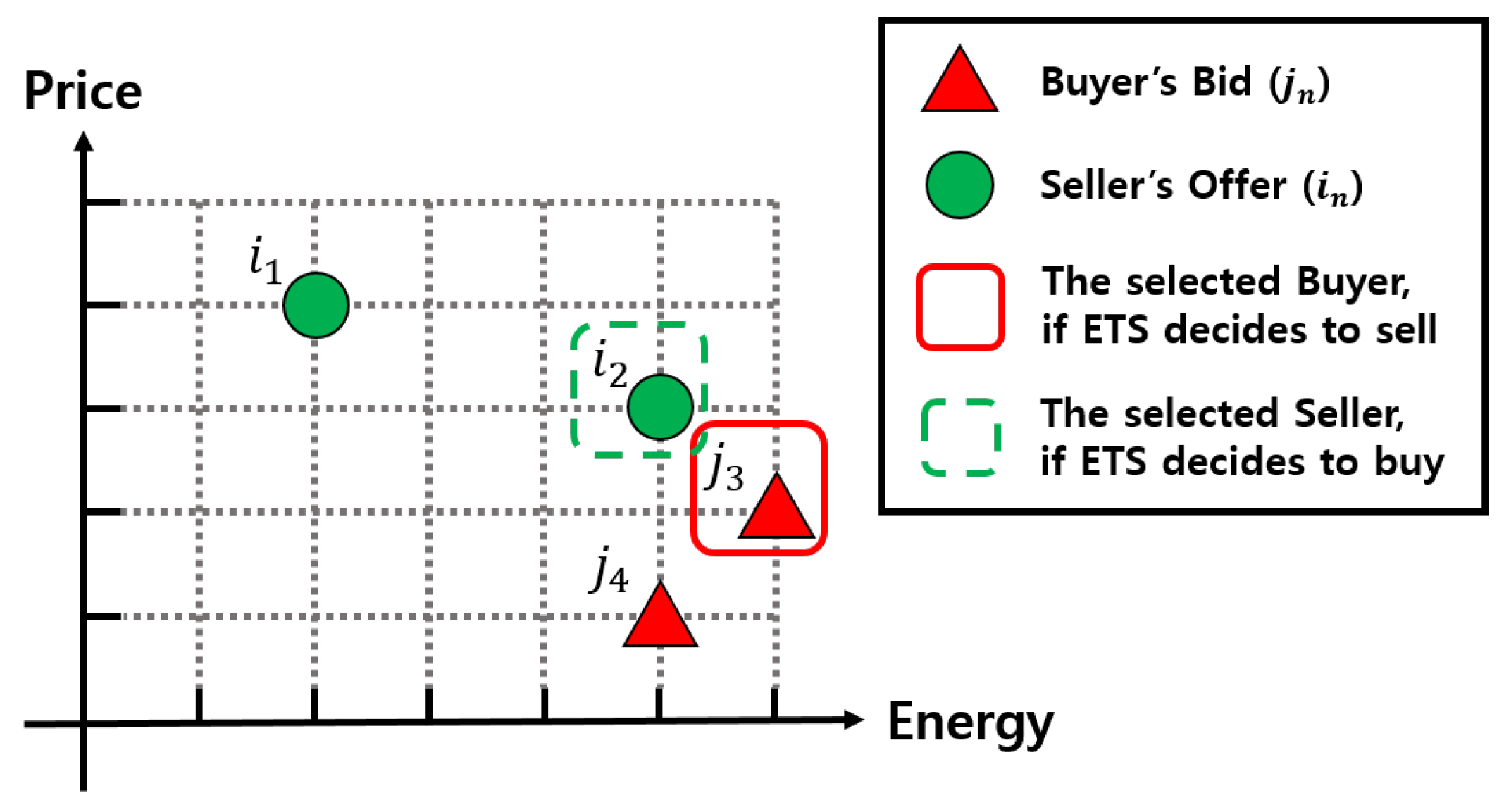

4.1. Real-Time Arbitrage Trading Phase

4.2. RL-Based Arbitrage Trading with CES Phase

5. Numerical Simulation

5.1. Simulation Setting

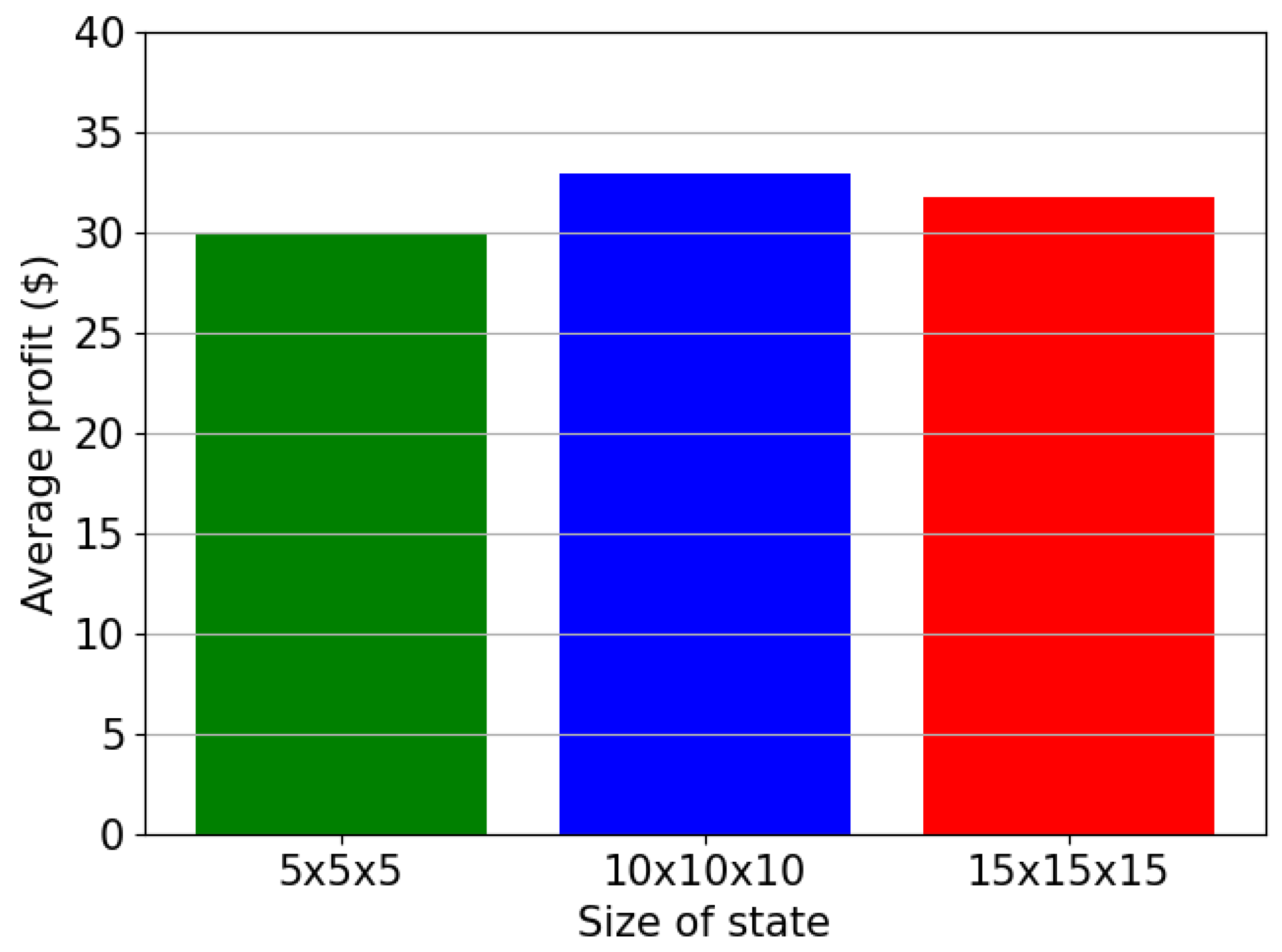

5.2. Simulation Results

5.3. Simulation Analysis

6. Conclusions and Discussion

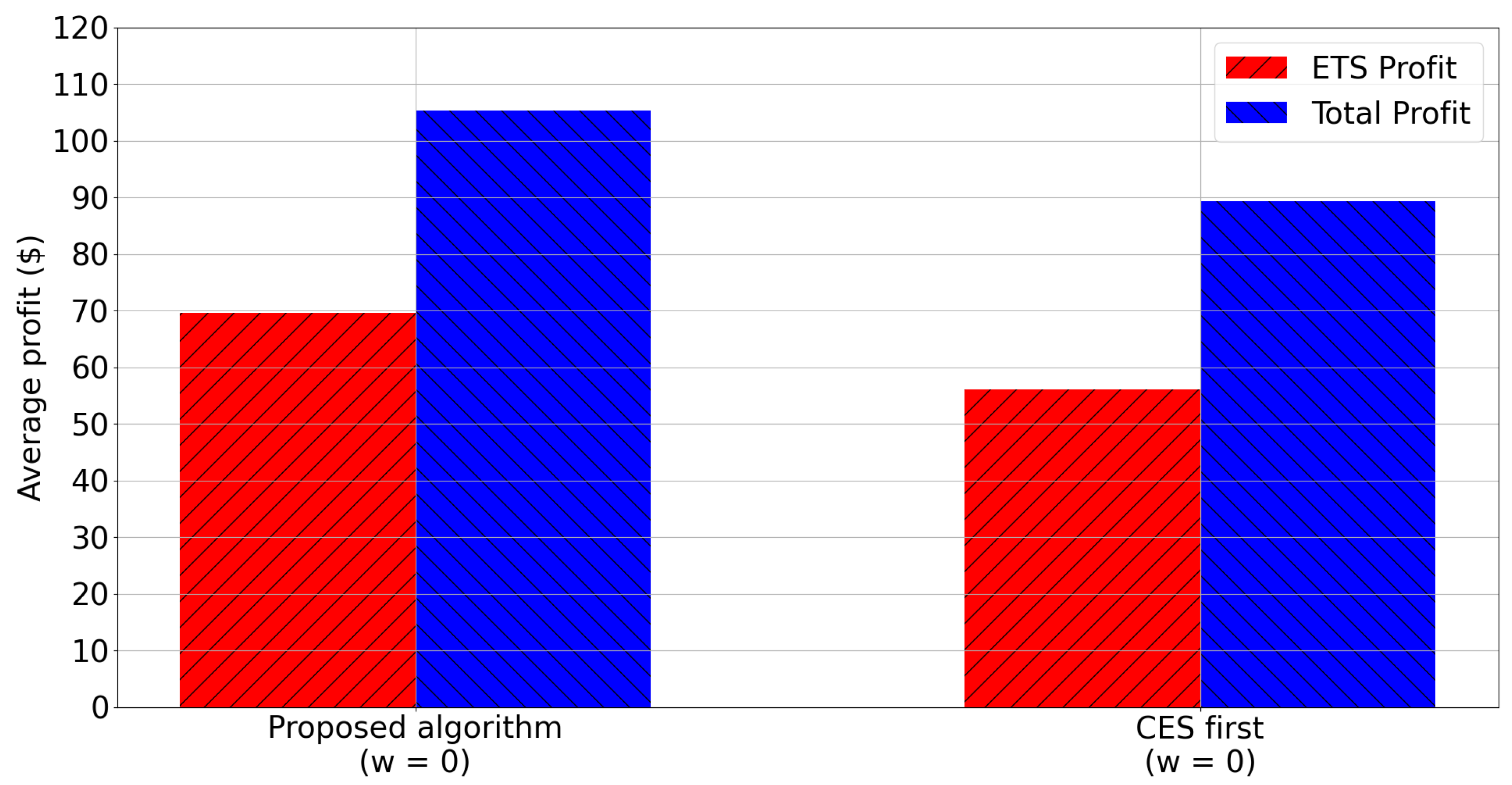

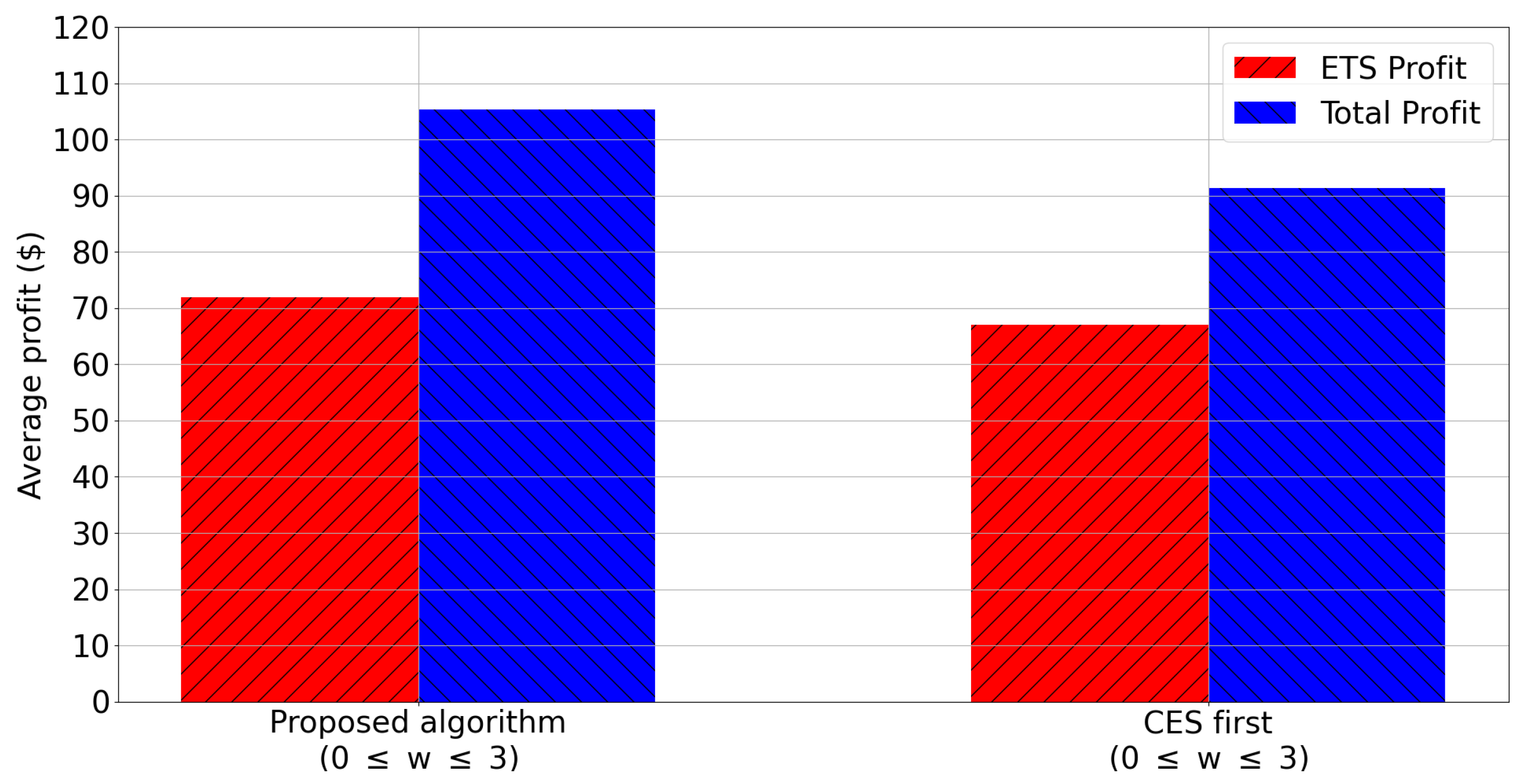

- The total profit of the proposed energy management algorithm is $105.34 per day. If CES is used in the real-time trading phase, the total profit decreases to $89.37 per day.

- The BWC of the proposed energy management algorithm is about $77.89 per day. This result reveals that the proposed algorithm using CES yields a profit of $27.45 per day in the proposed LEM.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Energy and the Environment Explained: Where Greenhouse Gases Come From. Available online: https://www.eia.gov/energyexplained/energy-and-the-environment/where-greenhouse-gases-come-from.php (accessed on 2 January 2021).

- Sources of Greenhouse Gas Emissions. Available online: https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions (accessed on 4 January 2021).

- Global Trends in Renewable Energy Investment. 2019. Available online: https://wedocs.unep.org (accessed on 6 January 2021).

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 1–6. [Google Scholar] [CrossRef]

- Brooklyn Microgrid|Community Powered Energy. Available online: https://www.brooklyn.energy/ (accessed on 8 January 2021).

- Roberts, M.B.; Bruce, A.; MacGill, I. Impact of shared battery energy storage systems on photovoltaic self-consumption and electricity bills in apartment buildings. Appl. Energy 2019, 245, 78–95. [Google Scholar] [CrossRef]

- Mediwaththe, C.P.; Stephens, E.R.; Smith, D.B.; Mahanti, A. Competitive energy trading framework for demand-side management in neighborhood area networks. IEEE Trans. Smart Grid 2017, 9, 4313–4322. [Google Scholar] [CrossRef] [Green Version]

- Albadi, M.H.; El-Saadany, E.F. A summary of demand response in electricity markets. Electric Power Syst. Res. 2008, 78, 1989–1996. [Google Scholar] [CrossRef]

- Chen, S.; Liu, C.C. From demand response to transactive energy: State of the art. J. Mod. Power Syst. Clean Energy 2017, 5, 10–19. [Google Scholar] [CrossRef] [Green Version]

- Daneshvar, M.; Mohammadi-Ivatloo, B.; Asadi, S.; Anvari-Moghaddam, A.; Rasouli, M.; Abapour, M.; Gharehpetian, G.B. Chance-constrained models for transactive energy management of interconnected microgrid clusters. J. Clean. Prod. 2020, 271, 122177. [Google Scholar] [CrossRef]

- Nizami, M.S.H.; Hossain, J.; Fernandez, E. Multi-agent based transactive energy management systems for residential buildings with distributed energy resources. IEEE Trans. Ind. Inform. 2019, 16, 1836–1847. [Google Scholar] [CrossRef]

- Koltsaklis, N.; Panapakidis, I.P.; Pozo, D.; Christoforidis, G.C. A Prosumer Model Based on Smart Home Energy Management and Forecasting Techniques. Energies 2021, 14, 1724. [Google Scholar] [CrossRef]

- Celik, B.; Roche, R.; Bouquain, D.; Miraoui, A. Decentralized neighborhood energy management with coordinated smart home energy sharing. IEEE Trans. Smart Grid 2017, 9, 6387–6397. [Google Scholar] [CrossRef] [Green Version]

- Akter, M.N.; Mahmud, M.A.; Haque, M.E.; Oo, A.M. An optimal distributed energy management scheme for solving transactive energy sharing problems in residential microgrids. Appl. Energy 2020, 270, 115133. [Google Scholar] [CrossRef]

- Akter, M.N.; Mahmud, M.A.; Oo, A.M. A hierarchical transactive energy management system for microgrids. In Proceedings of the 2016 IEEE Power and Energy Society General Meeting (PESGM), Boston, MA, USA, 17–21 July 2016; pp. 1–5. [Google Scholar]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Chen, T.; Su, W. Local energy trading behavior modeling with deep reinforcement learning. IEEE Access 2018, 6, 62806–62814. [Google Scholar] [CrossRef]

- Chen, T.; Su, W. Indirect customer-to-customer energy trading with reinforcement learning. IEEE Trans. Smart Grid 2018, 10, 4338–4348. [Google Scholar] [CrossRef]

- Long, C.; Zhou, Y.; Wu, J. A game theoretic approach for peer to peer energy trading. Energy Procedia 2019, 159, 454–459. [Google Scholar] [CrossRef]

- Jing, R.; Xie, M.N.; Wang, F.X.; Chen, L.X. Fair P2P energy trading between residential and commercial multi-energy systems enabling integrated demand-side management. Appl. Energy 2020, 262, 114551. [Google Scholar] [CrossRef]

- Bose, S.; Kremers, E.; Mengelkamp, E.M.; Eberbach, J.; Weinhardt, C. Reinforcement learning in local energy markets. Energy Inform. 2021, 4, 1–21. [Google Scholar] [CrossRef]

- Kim, J.G.; Lee, B. Automatic P2P Energy Trading Model Based on Reinforcement Learning Using Long Short-Term Delayed Reward. Energies 2020, 13, 5359. [Google Scholar] [CrossRef]

- Guerrero, J.; Chapman, A.C.; Verbič, G. Decentralized P2P energy trading under network constraints in a low-voltage network. IEEE Trans. Smart Grid 2018, 10, 5163–5173. [Google Scholar] [CrossRef] [Green Version]

- Thakur, S.; Hayes, B.P.; Breslin, J.G. Distributed double auction for peer to peer energy trade using blockchains. In Proceedings of the 2018 5th International Symposium on Environment-Friendly Energies and Applications (EFEA) IEEE, Rome, Italy, 24–26 September 2018; pp. 1–8. [Google Scholar]

- Umer, K.; Huang, Q.; Khorasany, M.; Afzal, M.; Amin, W. A novel communication efficient peer-to-peer energy trading scheme for enhanced privacy in microgrids. Appl. Energy 2021, 296, 117075. [Google Scholar] [CrossRef]

- Bucciarelli, M.; Paoletti, S.; Vicino, A. Optimal sizing of energy storage systems under uncertain demand and generation. Appl. Energy 2018, 225, 611–621. [Google Scholar] [CrossRef]

- Han, S.; Han, S.; Aki, H. A practical battery wear model for electric vehicle charging applications. Appl. Energy 2014, 113, 1100–1108. [Google Scholar] [CrossRef]

- Nykvist, B.; Nilsson, M. Rapidly falling costs of battery packs for electric vehicles. Nat. Clim. Chang. 2015, 5, 329–332. [Google Scholar] [CrossRef]

- Koirala, B.P.; van Oost, E.; van der Windt, H. Community energy storage: A responsible innovation towards a sustainable energy system? Appl. Energy 2018, 231, 570–585. [Google Scholar] [CrossRef]

- Anvari-Moghaddam, A.; Rahimi-Kian, A.; Mirian, M.S.; Guerrero, J.M. A multi-agent based energy management solution for integrated buildings and microgrid system. Appl. Energy 2017, 203, 41–56. [Google Scholar] [CrossRef] [Green Version]

- Lüth, A.; Zepter, J.M.; del Granado, P.C.; Egging, R. Local electricity market designs for peer-to-peer trading: The role of battery flexibility. Appl. Energy 2018, 229, 1233–1243. [Google Scholar] [CrossRef] [Green Version]

- Double Auction. Available online: https://en.wikipedia.org/wiki/Double_auction (accessed on 26 January 2021).

- Feed-in Tariff. Available online: https://en.wikipedia.org/wiki/Feed-in_tariff (accessed on 29 January 2021).

- Q-Learning. Available online: https://en.wikipedia.org/wiki/Q-learning (accessed on 9 January 2021).

- What German Households Pay for Power. Available online: https://www.cleanenergywire.org/factsheets/what-german-households-pay-power (accessed on 19 January 2021).

- Germany Installed 700 MW of PV in First Two Months of 2020. Available online: https://www.pv-magazine.com/2020/04/01/germany-installed-700-mw-of-pv-in-first-two-months-of-2020/ (accessed on 19 January 2021).

- Battery Pack Prices Cited Below $100/kWh for the First Time in 2020, While Market Average Sits at $137/kWh. Available online: https://about.bnef.com/blog/battery-pack-prices-cited-below-100-kwh-for-the-first-time-in-2020-while-market-average-sits-at-137-kwh/ (accessed on 19 January 2021).

| Notations | Descriptions | Values | Units |

|---|---|---|---|

| n | Number of time step | 72 | - |

| T | Interval between time steps | - | |

| Number of sellers | 50 | - | |

| Number of buyers | 50 | - | |

| Market entry time of seller i | T | ||

| Market entry time of buyer j | T | ||

| Waiting time of seller i | w | T | |

| Waiting time of buyer j | w | T | |

| w | Waiting time of prosumers | 0 ~ 3 | T |

| Offer price of seller i | $ | ||

| Bid price of buyer j | $ | ||

| Offer energy of seller i | kWh | ||

| Bid energy of buyer j | kWh | ||

| Price regulation of the ETS | 0 | $ | |

| Battery capacity | 100 ~–800 | kWh | |

| Battery efficiency | 0.95 | - | |

| Battery round trip efficiency | 0.9025 | - | |

| Learning rate | 0.1 | - | |

| Discount factor | 0.1 | - | |

| Epsilon-greedy parameter | 0.1 | - | |

| Weight coefficient | 5 | - | |

| Weight coefficient | 2.5 | - | |

| Weight coefficient | 2 | - | |

| Weight coefficient | 2 | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zang, H.; Kim, J. Reinforcement Learning Based Peer-to-Peer Energy Trade Management Using Community Energy Storage in Local Energy Market. Energies 2021, 14, 4131. https://doi.org/10.3390/en14144131

Zang H, Kim J. Reinforcement Learning Based Peer-to-Peer Energy Trade Management Using Community Energy Storage in Local Energy Market. Energies. 2021; 14(14):4131. https://doi.org/10.3390/en14144131

Chicago/Turabian StyleZang, Hannie, and JongWon Kim. 2021. "Reinforcement Learning Based Peer-to-Peer Energy Trade Management Using Community Energy Storage in Local Energy Market" Energies 14, no. 14: 4131. https://doi.org/10.3390/en14144131

APA StyleZang, H., & Kim, J. (2021). Reinforcement Learning Based Peer-to-Peer Energy Trade Management Using Community Energy Storage in Local Energy Market. Energies, 14(14), 4131. https://doi.org/10.3390/en14144131