Debt as a Source of Financial Energy of the Farm—What Causes the Use of External Capital in Financing Agricultural Activity? A Model Approach

Abstract

:1. Introduction

2. Materials and Methods

3. Results

3.1. Characteristics of the Surveyed Farms

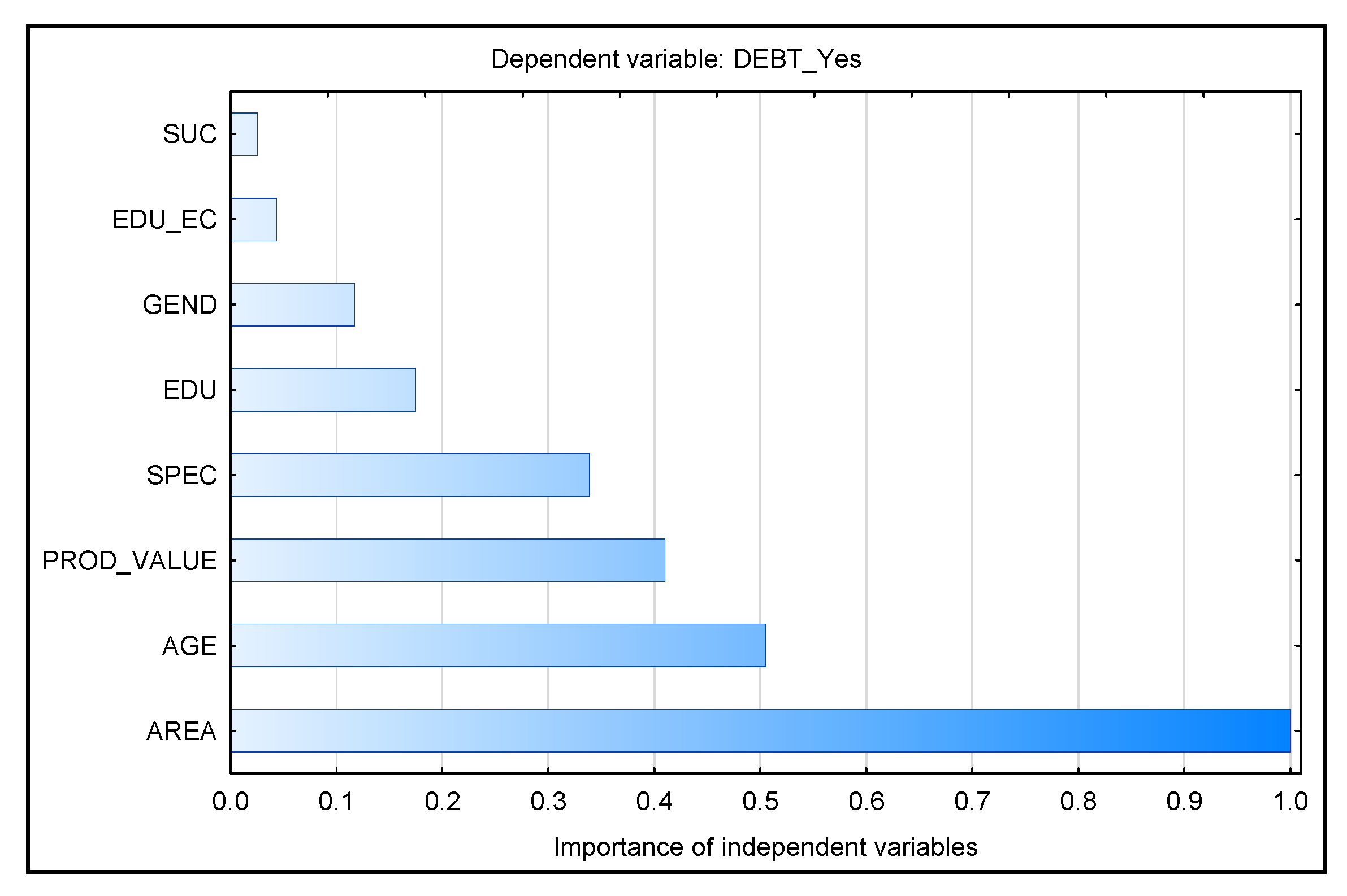

3.2. The Use of External Capital and the Features of a Farm—A Model Approach

4. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Zhang, D. Energy Finance: Background, Concept, and Recent Developments. Emerg. Mark. Financ. Trade 2018, 54, 1687–1692. [Google Scholar] [CrossRef] [Green Version]

- Korol, T. Evaluation of the Macro- and Micro-Economic Factors Affecting the Financial Energy of Households. Energies 2021, 14, 3512. [Google Scholar] [CrossRef]

- Melnychenko, O. The Energy of Finance in Refining of Medical Surge Capacity. Energies 2021, 14, 210. [Google Scholar] [CrossRef]

- Korol, T. Examining Statistical Methods in Forecasting Financial Energy of Households in Poland and Taiwan. Energies 2021, 14, 1821. [Google Scholar] [CrossRef]

- Lusher Shute, L. Building a Future with Farmers: Challenges Faced by Young American Farmers and a National Strategy to Help Them Succeed; The National Young Farmers’ Coalition: Hudson, NY, USA, 2011. [Google Scholar]

- Prokop, M.; Vrabelova, T.; Novakowa, M.; Simova, T. Evaluation of Managerial and Decision-Making Skills of Small-Scale Farmers. In Proceedings of the 28th International Scientific Conference Agrarian Perspectives XXVIII, Business Scale in Relation to Economics, Prague, Czech Republic, 18–19 September 2019. [Google Scholar]

- Transforming Our World: The 2030 Agenda for Sustainable Development; A/RES/70/1; United Nations: New York, NY, USA, 2015.

- Kata, R. Endogeniczne i Instytucjonalne Czynniki Kształtujące Powiązania Finansowe Gospodarstw Rolnych z Bankiem. (Endogenous and Institutional Factors Determining Financial Relationship between Agricultural Holdings and Banks); Wydawnictwo Uniwersytetu Rzeszowskiego: Rzeszów, Poland, 2011. [Google Scholar]

- Myers, S. The Capital Structure Puzzle. J. Financ. 1984, 39, 575–592. [Google Scholar] [CrossRef] [Green Version]

- Ullah, A.; Arshad, M.; Kaechele, H.; Khan, A.; Mahmood, N.; Müller, K. Information asymmetry, input markets, adoption of innovations and agricultural land use in Khyber Pakhtunkhwa, Pakistan. Land Use Policy 2020, 90, 104261. [Google Scholar] [CrossRef]

- Goraj, L.; Mańko, S. Rachunkowość i Analiza Ekonomiczna w Indywidualnym Gospodarstwie Rolnym; Difin: Warsaw, Poland, 2009. [Google Scholar]

- Bose, T.K.; Gain, N.; Bristy, J.F. Financing of Agricultural SMEs in Rural Bangladesh. Asian Res. J. Bus. Manag. 2016, 3, 47–55. [Google Scholar]

- Mądra-Sawicka, M.; Wasilewski, M. The significance of financing farms with personal equity in the opinion of individual farmers in Poland. J. Agribus. Rural Dev. 2017, 1, 113–124. [Google Scholar] [CrossRef]

- Strzelecka, A.; Kurdyś-Kujawska, A.; Zawadzka, D. Kapitał obcy a potencjał wytwórczy i wyniki produkcyjno-ekonomiczne towarowych gospodarstw rolnych (Debt Versus Production Potential as Well as Production and Economic Results of Commodity Farms). Sci. J. Wars. Univ. Life Sci. Probl. World Agric. 2019, 19, 110–119. [Google Scholar] [CrossRef] [Green Version]

- Kata, R.; Cyran, K.; Dybka, S.; Lechwar, M.; Pitera, R. Economic and Social Aspects of Using Energy from PV and Solar Installations in Farmers’ Households in the Podkarpackie Region. Energies 2021, 14, 3158. [Google Scholar] [CrossRef]

- Kusz, D. Procesy Inwestycyjne w Praktyce Gospodarstw Rolniczych Korzystających z Funduszy Strukturalnych Unii Europejskiej; Oficyna Wydawnicza Politechniki Rzeszowskiej: Rzeszów, Poland, 2009. [Google Scholar]

- Strzelecka, A. Determinanty Oszczędności Rolniczych Gospodarstw Domowych (Determinants of Farm. Households Savings); Wydawnictwo Uczelniane Politechniki Koszalińskiej: Koszalin, Poland, 2019. [Google Scholar]

- Yang, D.; Liu, Z. Does farmer economic organization and agricultural specialization improve rural income? Evidence from China. Econ. Model. 2012, 29, 990–993. [Google Scholar] [CrossRef]

- Beckman, J.; Schimmelpfennig, D. Determinants of farm income. Agric. Financ. Rev. 2015, 75, 385–402. [Google Scholar] [CrossRef]

- Kocsis, J.; Major, K.A. General Overview of Agriculture and Profitability in Agricultural Enterprises in Central Europe. In Managing Agricultural Enterprises; Bryła, P., Ed.; Palgrave Macmillan: Cham, Switzerland, 2018; pp. 243–265. ISBN 978-3-319-59891-8. [Google Scholar] [CrossRef]

- Średzińska, J. Determinants of the income of farms in EU countries. Stud. Oecon. Posnan. 2018, 6, 54–65. [Google Scholar] [CrossRef]

- Carls, E.; Ibendahl, G.; Griffin, T.; Yeager, E. Factors Affecting Net Farm Income for Row Crop Production in Kansas. Am. Soc. Farm. Manag. Rural Appraisers 2019, 47–53. [Google Scholar]

- Gummi, U.M.; Mu’azu, A. Effect of Monetary and Non-monetary Factors on Rural Farmers’ Income in Wamakko Lga, Sokoto-Nigeria. Asian J. Rural Dev. 2019, 9, 1–5. [Google Scholar] [CrossRef]

- Stępień, S.; Guth, M.; Smędzik-Ambroży, K. Rola wspólnej polityki rolnej w kreowaniu dochodów gospodarstw rolnych w Unii Europejskiej w kontekście zrównoważenia ekonomiczno-społecznego (The Role of the Common Agricultural Policy in Creating Agricultural Incomes in the European Union in the Context of Socio-Economic Sustainability). Zesz. Nauk. Szkoły Głównej Gospod. Wiej. Warsz. Probl. Rol. Swiat. 2018, 18, 295–305. [Google Scholar] [CrossRef] [Green Version]

- Ściubeł, A. Produktywność czynników produkcji w rolnictwie Polski i w wybranych krajach Unii Europejskiej z uwzględnieniem płatności Wspólnej Polityki Rolnej (Productivity of production factors in Polish agriculture and in the selected European Union countries with regard to the Common Agricultural Policy payments). Zag. Ekon. Rolnej 2021, 1, 46–58. [Google Scholar] [CrossRef]

- Kulov, A.R.; Dzusova, S.S.; Dzusov, S.I. State Suport for the Investment Development of Agricultural Producers in Conditions of Sanctions Restrictions. IOP Conf. Ser. Earth Environ. Sci. 2019, 274, 012083. [Google Scholar] [CrossRef]

- Kurdyś-Kujawska, A.; Strzelecka, A.; Szczepańska-Przekota, A.; Zawadzka, D. Dochody Rolnicze, Determinanty-Zróżnicowanie-Stabilizacja; Wydawnictwo Politechniki Koszalińskiej: Koszalin, Poland, 2019; pp. 79–121. [Google Scholar]

- Sadłowski, A. Average Levels of Direct Support for Farmers in Poland at the Regional Level. Eur. Res. Stud. J. 2021, XXIV, 421–430. [Google Scholar] [CrossRef]

- Zinych, N.; Odening, M. Capital Market Imperfections in Economic Transition: Empirical Evidence From Ukrainian Agriculture. Agric. Econ. 2009, 40, 677–689. [Google Scholar] [CrossRef]

- Kornai, J.; Maskin, E.; Roland, G. Understanding the Soft Budget Constraint. J. Econ. Lit. 2003, 41, 1095–1136. [Google Scholar] [CrossRef]

- Das, A.; Senapati, M.; John, J. Impact of Agricultural Credit on Agriculture Production: An Empirical Analysis in India. Reserve Bank India Occas. Pap. 2009, 30, 2. [Google Scholar]

- Łukaszuk, K. Agriculture Loans in Cooperative Banks of the Podlaskie Voivodeship, Economic and Regional Studies. Stud. Ekon. Reg. 2020, 13, 473–489. [Google Scholar]

- Kata, R. Zadłużenie rolników w Polsce w aspekcie przemian strukturalnych i koniunktury w rolnictwie (Indebtedness of Farmers in Poland in Light of Structural Changes and Economic Fluctuations in Agriculture). Polityki Eur. Finans. I Mark. 2020, 3, 33–44. [Google Scholar]

- Zawadzka, D. Trade Credit Risk in the Business of Agricultural Enterprises in the Middle Pomerania Region. Argum. Oecon. Crac. 2015, 12, 27–39. [Google Scholar] [CrossRef]

- Zawadzka, D.; Kurdyś-Kujawska, A. The credit position of farms and the continuity of production: The example of Poland. In Proceedings of the 27th International Scientific Conference Agrarian Perspectives XXVII. Food Safety-Food Security, Business Scale in Relation to Economics, Prague, Czech Republic, 19–20 September 2018; pp. 452–458. [Google Scholar]

- Zawadzka, D.; Strzelecka, A.; Szafraniec-Siluta, E. Leasing i kredyt jako źródła finansowania nakładów inwestycyjnych w rolnictwie (Leasing and Credit as Sources of Financing Investment in Agriculture). Rocz. Nauk. Stow. Ekon. Rol. Agrobiz. 2014, XVI, 357–362. [Google Scholar]

- Ganc, M.; Domańska, T. Leasing jako forma finansowania majątku przedsiębiorstw rolniczych (Leasing as a form of financing agricultural enterprises). Zesz. Nauk. Szkoły Głównej Gospod. Wiej. Wars. Ekon. Organ. Gospod. Żywnościowej 2016, 113, 185–197. [Google Scholar] [CrossRef]

- Mgbakor, M.N.; Uzendu, P.O.; Ndubisi, D.O. Sources of Agricultural Credit to Small-Scale Farmers in EZEAGU Local Government Area of Enugu State, Nigeria. IOSR J. Agric. Vet. Sci. 2014, 7, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Zhao, J. Formal Credit Constraint and Prevalence of Reciprocal Loans in Rural China. Open Econ. 2021, 4, 1–13. [Google Scholar] [CrossRef]

- Petrick, M. Farm Investment, Credit Rationing, and Governmentally Promoted Credit Access in Poland: A Cross-Sectional Analysis. Food Policy 2004, 29, 275–294. [Google Scholar] [CrossRef]

- Bierlen, R.; Barry, P.J.; Dixon, B.L.; Ahrendsen, B.L. Credit Constraints, Farm Characteristics and the Arm Economy: Differential Impacts on Feeder Cattle and Beef Cow Inventories. Am. J. Agric. Econ. 1998, 80, 709. [Google Scholar] [CrossRef]

- Kata, R. Relacje rolników z instytucjami w aspekcie finansowania gospodarstw ze źródeł zewnętrznych. In Konkurencyjność podmiotów Rynkowych; Kopycińska, D., Ed.; Wydawnictwo Uniwersytetu Szczecińskiego: Szczecin, Poland, 2008; pp. 125–136. [Google Scholar]

- Winter-Nelson, A.; Temu, A.A. Liquidity constraints, access to credit and pro-poor growth in rural Tanzania. J. Int. Dev. 2005, 17, 867–882. [Google Scholar] [CrossRef]

- Reyes, A.; Lensink, R.; Kuyvenhoven, A.; Moll, H. Impact of access to credit on farm productivity of fruit and vegetable growers in Chile. In Proceedings of the the International Association of Agricultural Economists (IAAE) Triennial Conference, Foz do Iguaçu, Brazil, 18–24 August 2012. [Google Scholar] [CrossRef]

- Kashif, A.R.; Zafar, N.; Arzoo, F. Impact of Agricultural Credit and its Nature on Agricultural Productivity: A Study of Agriculture Sector of Pakistan. J. Environ. Agric. Sci. 2016, 9, 59–68. [Google Scholar]

- Zulfiqar, F.; Shang, J.; Zada, M.; Alam, Q.; Rauf, T. Identifying the determinants of access to agricultural credit in Southern Punjab of Pakistan. GeoJournal 2020. [Google Scholar] [CrossRef]

- Shivaswamy, G.P.; Raghavendra, K.J.; Anuja, A.R.; Singh, K.N.; Rajesh, T.; Harish Kumar, H.V. Impact of institutional credit on agricultural productivity in India: A time series analysis. Indian J. Agric. Sci. 2020, 90, 412–417. [Google Scholar]

- Szymańska, E.J.; Dziwulski, M. The Impact of Fixed Asset Investments on the Productivity of Production Factors in Agriculture. Eur. Res. Stud. J. 2021, XXIV, 382–394. [Google Scholar]

- Mądra, M. Kształtowanie poziomu zadłużenia w zależności od powierzchni użytków rolniczych gospodarstw rolnych (The relation between the debt level and cropland area in agriculture farms). Zesz. Nauk. Szkoły Głównej Gospod. Wiej. Wars. Ekon. Organ. Gospod. Żywnościowej 2009, 77, 199–214. [Google Scholar]

- Kiplimo, J.; Ngenoh, E.; Koech, W.; Bett, J.K. Determinants of Access to Credit Financial Services by Smallholder Farmers in Kenya. J. Dev. Agric. Econ. 2015, 7, 303–313. [Google Scholar]

- Datta, S.; Tiwari, A.K.; Shylajan, C.S. An empirical analysis of nature, magnitude and determinants of farmers’ indebtedness in India. Int. J. Soc. Econ. 2018, 45, 888–908. [Google Scholar] [CrossRef]

- Mądra, M. Koszt kapitału własnego w towarowych gospodarstwach rolniczych (The Equity Cost of Capital in Agriculture Holdings Farms). Zesz. Nauk. Szkoły Głównej Gospod. Wiej. Wars. Ekon. Organ. Gospod. Żywnościowej 2012, 99, 33–45. [Google Scholar]

- Amjad, S.; Hasnu, S. Smallholders’ access to rural credit: Evidence from Pakistan. Lahore J. Econ. 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Hussain, A.; Thapa, G.B. Smallholders’ access to agricultural credit in Pakistan. Food Secur. 2012, 4, 73–85. [Google Scholar] [CrossRef]

- Kata, R. Przesłanki oraz mikroekonomiczne determinanty korzystania przez rolników z kredytów bankowych (Reasons and Microeconomic Determinants of Using Bank Credits by Farmers). Rocz. Ekon. Kuj. Pomor. Szkoły Wyższej W Bydg. 2012, 5, 241–260. [Google Scholar]

- Strzelecka, A.; Zawadzka, D.; Kurdyś-Kujawska, A. Factors Affecting Incomes of Small Agricultural Holdings in Poland. In Proceedings of the 28th International Scientific Conference Agrarian Perspectives XXVIII. Business Scale in Relation to Economics, Prague, Czech Republic, 18–19 September 2019; pp. 289–295. [Google Scholar]

- Thorat, V.S.; Garde, Y.; Arhant, A. Incidence and determinants of indebtedness of agricultural households in Gujarat. Econ. Aff. 2020, 65, 249–254. [Google Scholar] [CrossRef]

- Chandio, A.A.; Jiang, Y.; Rehman, A.; Twumasi, M.A.; Pathan, A.G.; Mohsin, M. Determinants of demand for credit by smallholder farmers’: A farm level analysis based on survey in Sindh, Pakistan. J. Asian Bus. Econ. Stud. 2020. [Google Scholar] [CrossRef]

- Zawadzka, D.; Szafraniec-Siluta, E.; Ardan, R. Factors Influencing The Use of Debt Capital on Farms. Pr. Nauk. Uniw. Ekon. Wrocławiu 2015, 412, 356–366. [Google Scholar]

- Barniak, M. Alternatywny model finansowania w polskim rolnictwie na przykładzie zagranicznych wzorców (An alternative model of financing in agriculture on the example of foreign models). Ekon. Międzynarodowa 2020, 29, 5–21. [Google Scholar] [CrossRef]

- Key, N. Off-farm Income, Credit Constraints, and Farm Investment. J. Agric. Appl. Econ. 2020, 52, 1–22. [Google Scholar] [CrossRef]

- Wu, F.; Guan, Z.; Myers, R. Farm capital structure choice: Theory and an empirical test. Agric. Financ. Rev. 2014, 74. [Google Scholar] [CrossRef]

- Kata, R. Czynniki behawioralne i demograficzne wpływające na korzystanie przez rolników z kredytów inwestycyjnych (Behavioral and Demographic Factors Determining the Use of Investment Loans by Farmers). Zesz. Nauk. Szkoły Głównej Gospod. Wiej. Wars. Ekon. Organ. Gospod. Żywnościowej 2013, 103, 53–65. [Google Scholar]

- Subash, S.P.; Ali, J. Correlates of agrarian indebtedness in rural India. J. Agribus. Dev. Emerg. Econ. 2019, 9, 125–138. [Google Scholar] [CrossRef]

- Kumar, A.; Saroj, S. Access to Credit and Indebtedness Among Rural Households in Uttar Pradesh: Implications for Farm Income and Poverty. In Growth, Disparities and Inclusive Development in India. India Studies in Business and Economics; Mamgain, R., Ed.; Springer: Singapore, 2019. [Google Scholar] [CrossRef]

- Omonona, B.T.; Lawal, J.O.; Oyinlana, A.O. Determinants of credit constraint conditions and production efficiency among farming households in Southwestern Nigeria. In Proceedings of the 2010 AAAE Third Conference/AEASA 48th Conference, African Association of Agricultural Economists (AAAE) & Agricultural Economics Association of South Africa (AEASA), (No. 95775), Cape Town, South Africa, 19–23 September 2010. [Google Scholar]

- Ojo, T.O.; Baiyegunhi, L.J.S. Determinants of credit constraints and its impact on the adoption of climate change adaptation strategies among rice farmers in South-West Nigeria. J. Econ. Struct. 2020, 9, 28. [Google Scholar] [CrossRef]

- Diep, H.; Viên, H.T. Determinants of income diversification and its effects on rural household income in Vietnam. J. Sci. 2017, 6. [Google Scholar] [CrossRef]

- Kuchciak, I. Wykluczenie Bankowe w Polsce w Aspekcie Ekonomicznym i Społecznym; Wydawnictwo Uniwersytetu Łódzkiego: Łódź-Kraków, Poland, 2020. [Google Scholar]

- Wałęga, G. Społeczno-ekonomiczne determinanty zadłużenia gospodarstw domowych w Polsce (Socio-economic Determinants of Household Debt in Poland). Prace Nauk. Uniw. Ekon. Wroc. 2012, 245, 600–610. [Google Scholar]

- Solarz, M. Odpowiedzialne decyzje pożyczkowe jako instrument inkluzji finansowej (Responsible Loan Decisions as the Instrument of Financial Inclusion). Stud. Ekon. 2014, 198, 216–226. [Google Scholar]

- Wright, W.; Brown, P. Succession and investment in New Zealand farming. N. Z. Econ. Pap. 2019, 53, 203–214. [Google Scholar] [CrossRef]

- Kusz, D. Egzogeniczne i endogeniczne uwarunkowania procesu modernizacji rolnictwa (Exogenous and Endogenous Determinants of the Agricultural Modernization Process). Rocz. Ekon. Rol. I Rozw. Obsz. Wiej. 2012, 99, 1–15. [Google Scholar]

- Harris, J.M.; Mishra, A.K.; Williams, R.P. The Impact of Farm Succession Decisions on the Financial Performance of The Farm. In Proceedings of the 2012 Annual Meeting, Agricultural and Applied Economics Association, Seattle, WA, USA, 12–14 August 2012; p. 124749. [Google Scholar]

- Hosmer, D.W.; Lemeshow, S. Applied Logistic Regression, 2nd ed.; John Wiley & Sons: New York, NY, USA, 2000. [Google Scholar]

- Strzelecka, A.; Kurdyś-Kujawska, A.; Zawadzka, D. Application of logistic regression models to assess household financial decisions regarding debt, Proceedings of 24th International Conference on Knowledge-Based and Intelligent Information & Engineering Systems. Procedia Comput. Sci. 2020, 176C, 3418–3427. [Google Scholar] [CrossRef]

- Robles, V.; Bielza, C.; Larrañaga, P.; González, S.; Ohno-Machado, L. Optimizing logistic regression coefficients for discrimination and calibration using estimation of distribution algorithms. TOP 16 2008, 345–366. [Google Scholar] [CrossRef] [Green Version]

- Menard, S. Logistic Regression: From Introductory to Advanced Concepts and Applications; SAGE: Los Angeles, CA, USA, 2010. [Google Scholar]

- Maddala, G.S. Introduction to Econometrics, 2nd ed.; Macmillan Publishing Company: New York, NY, USA, 1992. [Google Scholar]

- Danieluk, B. Zastosowanie Regresji Logistycznej w Badaniach Eksperymentalnych (Application of Logistic Regression in Experimental Research). Psychol. Społeczna 2010, 5, 2–3, 199–216. [Google Scholar]

- Sato, T.; Takano, Y.; Miyashiro, R.; Yoshise, A. Feature subset selection for logistic regression via mixed integer optimization. Comput. Optim. Appl. 2016, 64, 865–880. [Google Scholar] [CrossRef] [Green Version]

- Smith, T.J.; McKenna, C.M. A comparison of logistic regression pseudo R2 indices. Mult. Linear Regres. Viewp. 2013, 39, 17–26. [Google Scholar]

- Sperandei, S. Understanding logistic regression analysis. Biochem. Med. 2014, 24, 12–18. [Google Scholar] [CrossRef]

- Bożek, A. Prognozowanie kondycji ekonomiczno-finansowej przedsiębiorstw z wykorzystaniem drzew decyzyjnych. Barom. Reg. 2006, 2, 76–81. [Google Scholar]

- Dudzińska-Baryła, R. Analiza drzew decyzyjnych na gruncie teorii perspektywy (Decision Tree Analysis Based on Prospect Theory). Zesz. Naukow. Organ. Zarz. 2017, 113, 67–82. [Google Scholar]

- Gatnar, E.; Walesiak, M. (Eds.) Metody Statystycznej Analizy Wielowymiarowej w Badaniach Marketingowych; Wydawnictwo Akademii Ekonomicznej im. Oskara Langego we Wrocławiu: Wrocław, Poland, 2004. [Google Scholar]

- Gatnar, E. Nieparametryczna Metoda Dyskryminacji i Regresji; Wydawnictwo Naukowe PWN: Warsaw, Poland, 2001. [Google Scholar]

- Gatnar, E. Analiza dyskryminacyjna—Stan aktualny i kierunki rozwoju (Discriminant Analysis—State of the Art and Future Developments). Stud. Ekon. Metod. Wnioskowania Stat. Bad. Ekon. 2013, 152, 119–139. [Google Scholar]

- Wickramarachchi, D.C.; Robertson, B.; Reale, M.; Price, C.; Brown, J. A reflected feature space for CART. Aust. N. Z. J. Stat. 2019, 61, 380–391. [Google Scholar] [CrossRef]

- Daniya, T.; Geetha, M.; Kumar, K.S. Classification And Regression Trees with Gini Index, Advances in Mathematics. Sci. J. 2020, 9, 8237–8247. [Google Scholar] [CrossRef]

- Trzpiot, G.; Ganczarek-Gamrot, A. Drzewa decyzyjne w statystycznej analizie decyzji na przykładzie wirtualnych łańcuchów dostaw (Decision Trees in Statistical Analysis—A Virtual Supply Chain Example). Acta Univ. Lodz. Folia Oecon 2012, 271, 57–70. [Google Scholar]

- Wójcik-Gront, E.; Studnicki, M. Long-Term Yield Variability of Triticale (×Triticosecale Wittmack) Tested Using a CART Model. Agriculture 2021, 11, 92. [Google Scholar] [CrossRef]

- Zawadzka, D.; Strzelecka, A.; Kurdyś-Kujawska, A. Effectiveness of production potential of farms as a factor determining the use of short-term sources of financing. In Proceedings of the 28th International Scientific Conference Agrarian Perspectives XXVIII, Business Scale in Relation to Economics, Prague, Czech Republic, 18–19 September 2019; pp. 356–362. [Google Scholar]

- Strzelecka, A.; Zawadzka, D.; Kurdyś-Kujawska, A. Potencjał produkcyjny a zadłużenie przedsiębiorstw rolniczych—Ujęcie modelowe (Production Potential vs. the Debt of Agricultural Enterprises—A Model Approach). Pr. Nauk. Uniw. Ekon. We Wrocławiu Res. Pap. Wroc. Univ. Econ. 2018, 533, 206–218. [Google Scholar]

- Hornowski, A.; Kotyza, P. Production Factors and Economic Results of Small Farms in Selected European Union Countries. Econ. Sci. Rural Dev. Conf. Proc. 2018, 47, 100–107. [Google Scholar] [CrossRef]

- Ogłoszenie Prezesa Agencji Restrukturyzacji i Modernizacji Rolnictwa z Dnia 16 Września 2020r., w Sprawie Wielkości Średniej Powierzchni Gruntów Rolnych w Gospodarstwie Rolnym w Poszczególnych Województwach Oraz Średniej Powierzchni Gruntów Rolnych w Gospodarstwie Rolnym w Kraju w 2020 Roku. ARMIR. Available online: https://www.arimr.gov.pl/pomoc-krajowa/srednia-powierzchnia-gospodarstwa.html (accessed on 30 May 2021).

- Informacja o wstępnych wynikach Powszechnego Spisu Rolnego 2020; Główny Urząd Statystyczny: Warsaw, Poland, 2021.

- Roy, K.; Kar, S.; Ambure, P. On a simple approach for determining applicability domain of QSAR models. Chemom. Intell. Lab. Syst. 2015, 145, 22–29. [Google Scholar] [CrossRef]

- De Assis, T.M.; Gajo, G.C.; de Assis, L.C.; Garcia, L.S.; Silva, D.R.; Ramalho, T.C.; da Cunha, E.F. QSAR Models Guided by Molecular Dynamics Applied to Human Glucokinase Activators. Chem. Biol. Drug Des. 2016, 87, 455–466. [Google Scholar] [CrossRef]

- Roy, K.; Chakraborty, P.; Mitra, I.; Ojha, P.K.; Kar, S.; Das, R.N. Some case studies on application of “rm2” metrics for judging quality of quantitative structure–activity relationship predictions: Emphasis on scaling of response data. J. Comput. Chem. 2013, 34. [Google Scholar] [CrossRef] [PubMed]

- Gajo, G.C.; de Assis, T.M.; de Assis, L.C.; Ramalho, T.C.; da Cunha, E.F. Quantitative Structure-Activity Relationship Studies for Potential Rho-Associated Protein Kinase Inhibitors. J. Chem. 2016, 2016, 9198582. [Google Scholar] [CrossRef] [Green Version]

| Variable | Description of the Variable and Its Categories | Expected Sign | Impact Confirmed by Scientific Research |

|---|---|---|---|

| DEB | Dependent variable: Farm debt: yes; no | ||

| AGE | Age of the head of the households (years) | −/+ | Amjad and Hasnu (2007) [53] Kata (2012) [55] Kumar and Saroj (2019) [65] Subash and Ali (2019) [64] |

| GEND | Gender of the head of the household: female = 1, male = 2 | + | Kata (2013) [63] Subash and Ali (2019) [64] |

| EDU | Education of the head of a household: 1—basic; 2—basic vocational; 3—secondary; 4—post-secondary; 5—higher | + | Kata (2012) [55] Kiplimo et al. (2015) [50] Chandio et al. 2020 [58] |

| EDU_EC | Economic education of the head of the household: yes; no | + | Wałęga (2012) [70] Solarz (2014) [71] Kuchciak (2020) [69] |

| SUC | Having a successor who will take over the farm: yes, no | + | Harris et al. (2012) [74] Wright and Brown (2019) [72] |

| PROD_ VALUE | Annual production value of an agricultural holding: ≤PLN 100,000; >PLN 100,000 | + | Kata (2012) [55] Zawadzka et al. (2015) [59] Zawadzka et al. (2019) [93] |

| AREA | Farm area (ha) | + | Kata (2012) [55] Zawadzka et al. (2015) [59] Strzelecka et al. (2018) [94] Subash and Ali (2019) [64] Thorat et al. (2020) [57] |

| SPEC | Farm specialization: yes, no | + | Zawadzka et al. (2015) [59] |

| Continuous Variables | |||||||||||||||||

| Variable | Average | Median | Minimum | Maximum | Standard deviation | ||||||||||||

| AREA | 56.75 | 38.02 | 0.88 | 430.00 | 56.53 | ||||||||||||

| AGE | 46.93 | 47.00 | 23.00 | 73.00 | 11.66 | ||||||||||||

| Discrete variables | |||||||||||||||||

| Variable | Average | Number of households in particular classes of net income per one person in a household | |||||||||||||||

| 1 basic | 2 basic vocational | 3 secondary | 4 post- secondary | 5 higher | |||||||||||||

| No. | Share | No. | Share | No. | Share | No. | Share | No. | Share | ||||||||

| EDU | 3.0 | 15 | 4.31 | 123 | 35.35 | 129 | 37.07 | 10 | 2.87 | 71 | 20.40 | ||||||

| Dichotomous variables | |||||||||||||||||

| Variable | Occurrences 0 | Occurrences 1 | |||||||||||||||

| No. | Share | No. | Share | ||||||||||||||

| EDU_EC | 326 | 93.68 | 22 | 6.32 | |||||||||||||

| GEND | 61 | 17.53 | 287 | 82.47 | |||||||||||||

| SUC | 177 | 50.86 | 171 | 49.14 | |||||||||||||

| SPEC | 99 | 28.45 | 249 | 71.55 | |||||||||||||

| PROD_VALUE | 192 | 55.17 | 156 | 44.83 | |||||||||||||

| Variable | Variable Parameter | Standard Error | z Wald Test | Significance Level | Odds Ratio |

|---|---|---|---|---|---|

| AREA | 0.012 | 0.003 | 16.649 | 0.000 | 1.012 |

| AGE | −0.037 | 0.012 | 8.951 | 0.003 | 0.964 |

| GEND_Male | 0.766 | 0.370 | 4.300 | 0.038 | 2.152 |

| SUC | 0.568 | 0.279 | 4.141 | 0.042 | 1.764 |

| SPEC | −0.678 | 0.281 | 5.803 | 0.016 | 0.508 |

| PROD_VALUE | 1.221 | 0.277 | 19.494 | 0.000 | 3.392 |

| Intercept | −0.553 | 0.637 | 0.752 | 0.386 | 0.575 |

| AIC = 384.06 Cox-Snell R2 = 0.228 Nagelkerke R2 = 0.310 count R2 = 0.73 AUC = 0.785 LR = 89.87 (df = 6; p ≤ 0.001) | |||||

| Classification of Objects Based on the Logit Model | Real Belonging of Objects | Sum | |

|---|---|---|---|

| 75 | 55 | 130 | |

| 39 | 179 | 218 | |

| Sum | 114 | 234 | 348 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zawadzka, D.; Strzelecka, A.; Szafraniec-Siluta, E. Debt as a Source of Financial Energy of the Farm—What Causes the Use of External Capital in Financing Agricultural Activity? A Model Approach. Energies 2021, 14, 4124. https://doi.org/10.3390/en14144124

Zawadzka D, Strzelecka A, Szafraniec-Siluta E. Debt as a Source of Financial Energy of the Farm—What Causes the Use of External Capital in Financing Agricultural Activity? A Model Approach. Energies. 2021; 14(14):4124. https://doi.org/10.3390/en14144124

Chicago/Turabian StyleZawadzka, Danuta, Agnieszka Strzelecka, and Ewa Szafraniec-Siluta. 2021. "Debt as a Source of Financial Energy of the Farm—What Causes the Use of External Capital in Financing Agricultural Activity? A Model Approach" Energies 14, no. 14: 4124. https://doi.org/10.3390/en14144124

APA StyleZawadzka, D., Strzelecka, A., & Szafraniec-Siluta, E. (2021). Debt as a Source of Financial Energy of the Farm—What Causes the Use of External Capital in Financing Agricultural Activity? A Model Approach. Energies, 14(14), 4124. https://doi.org/10.3390/en14144124