Modelling Efficiency of Electric Utilities Using Three Stage Virtual Frontier Data Envelopment Analysis with Variable Selection by Loads Method

Abstract

1. Introduction

1.1. History of Electricity Industry

1.2. Regulation in Electricity Industry

1.3. Relationship between Regulation and Efficiency of Electric Utilities

2. Modelling the Efficiency Measurement and Benchmarking

2.1. Variables Selection Methodologies

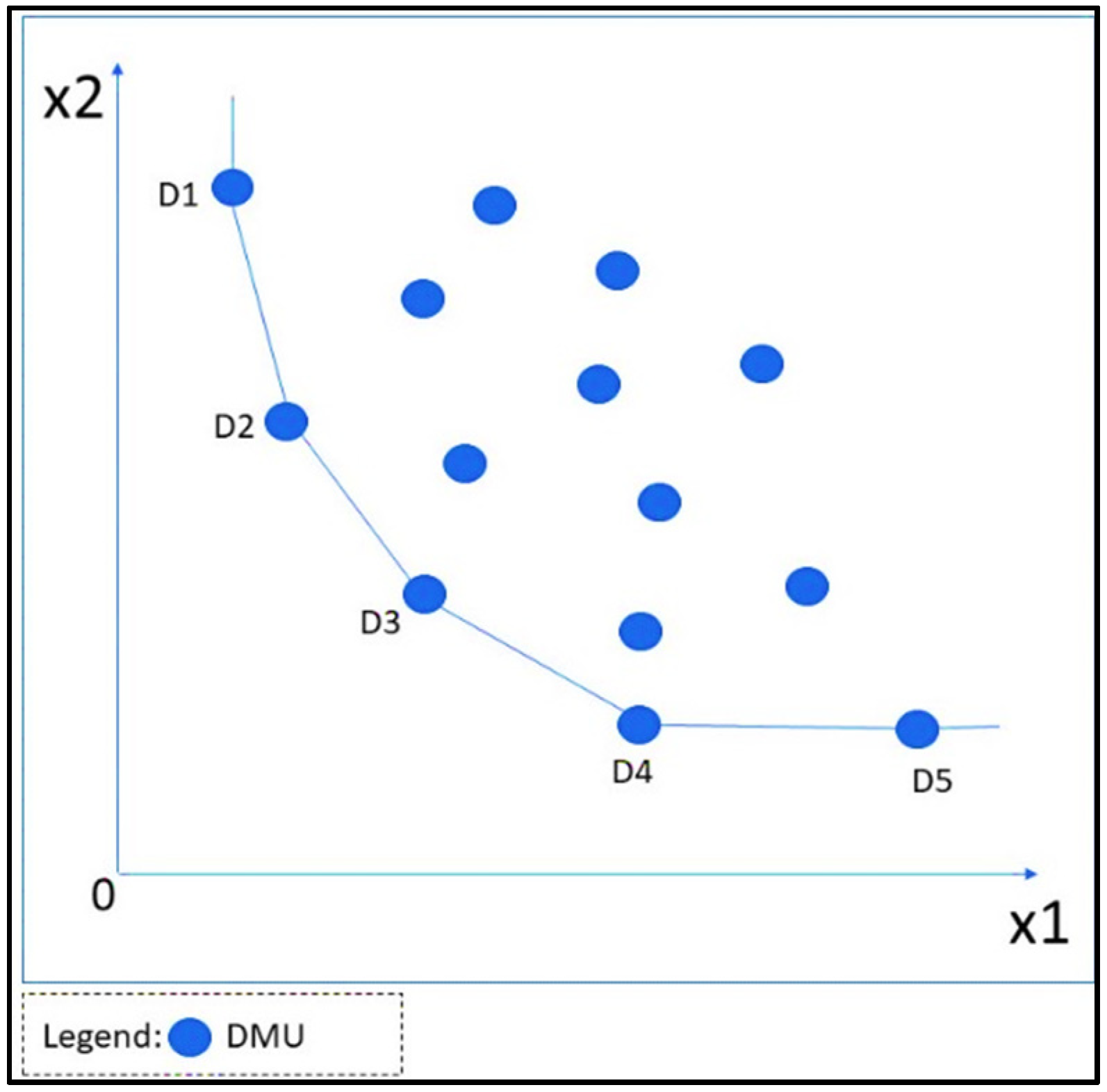

2.2. Efficiency Measurement Methods

- (1)

- First stage: Measure efficiency of DMUs using DEA method,

- (2)

- Second stage: Using the DEA efficiency score from the previous step, conduct stochastic frontier analysis (SFA) to exclude environmental or random factors and adjust the inputs,

- (3)

- Third stage: Measure the efficiency of DMUs using DEA methods and adjusted inputs [45].

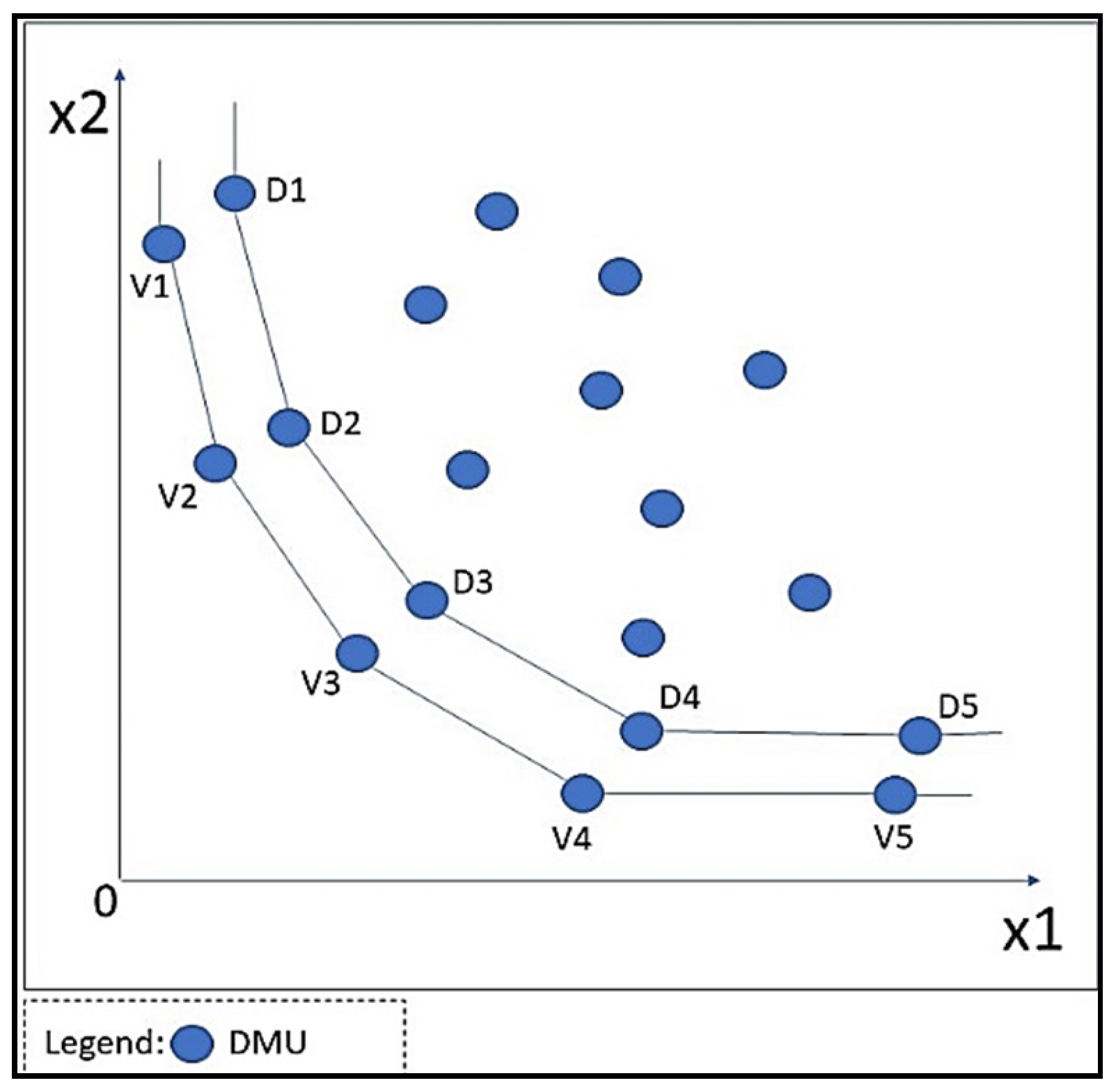

- First stage: Measure efficiency of DMUs using VF-DEA method,

- Second stage: Using the DEA efficiency score from the previous step, conduct stochastic frontier analysis (SFA) to eliminate environmental or random factors and adjust the inputs,

- Third stage: Measure the efficiency of DMUs using VF-DEA methods and adjusted inputs [44].

2.3. DEA Window Analysis

2.4. Benchmarking in Electricity Industry

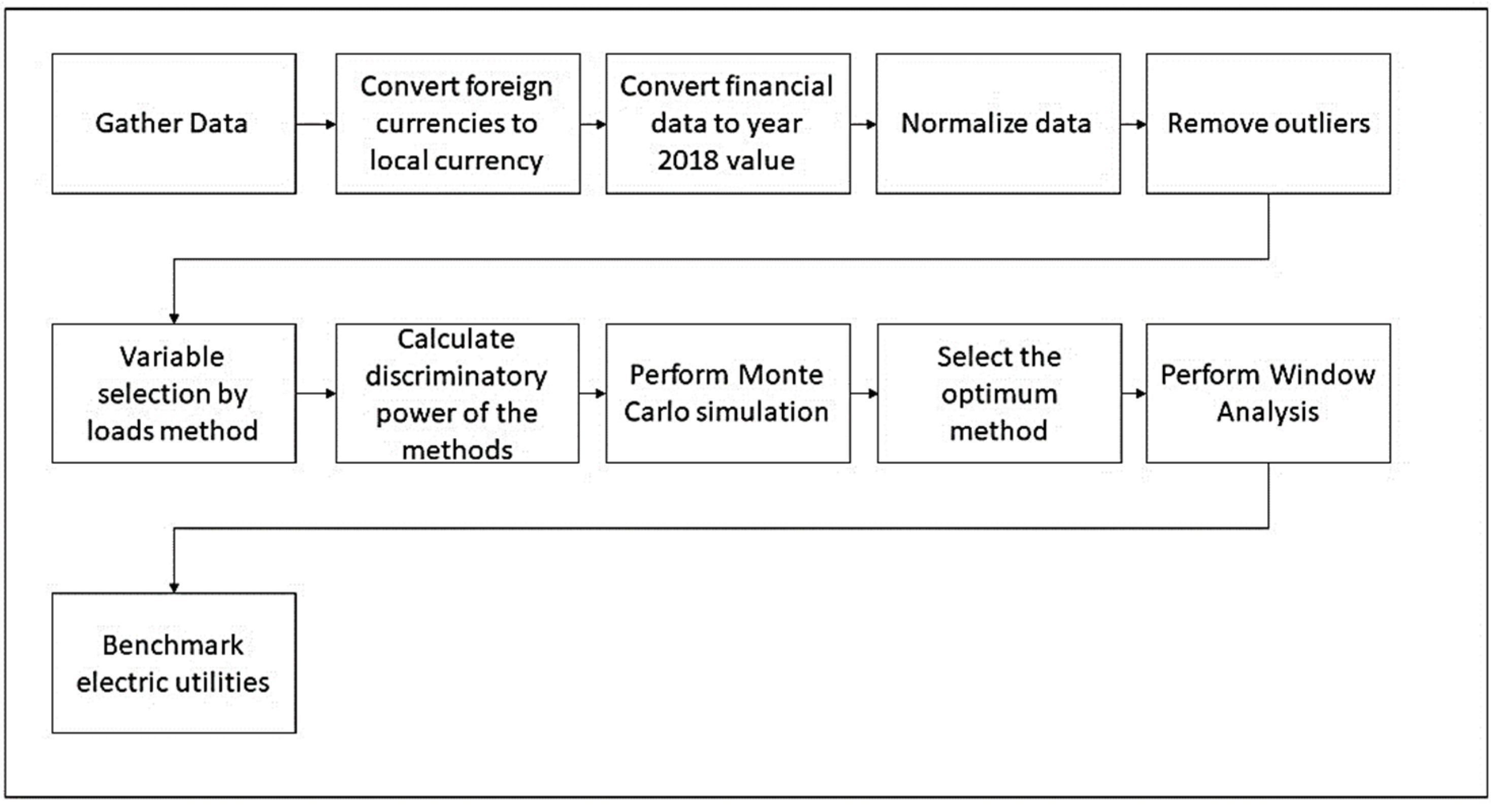

3. Methodology

3.1. Data Collection

3.2. Variable Reduction

- (1)

- Calculate efficiencies of DMUs by using input oriented DMU and with all potential variables,

- (2)

- Calculate the loads of the variables,

- (3)

- Eliminate the variable with the smallest load if the load is below the specified threshold,

- (4)

- Repeat step (1) until all variables’ load are above threshold.

3.3. Benchmarking

4. Findings

4.1. Variable Reduction

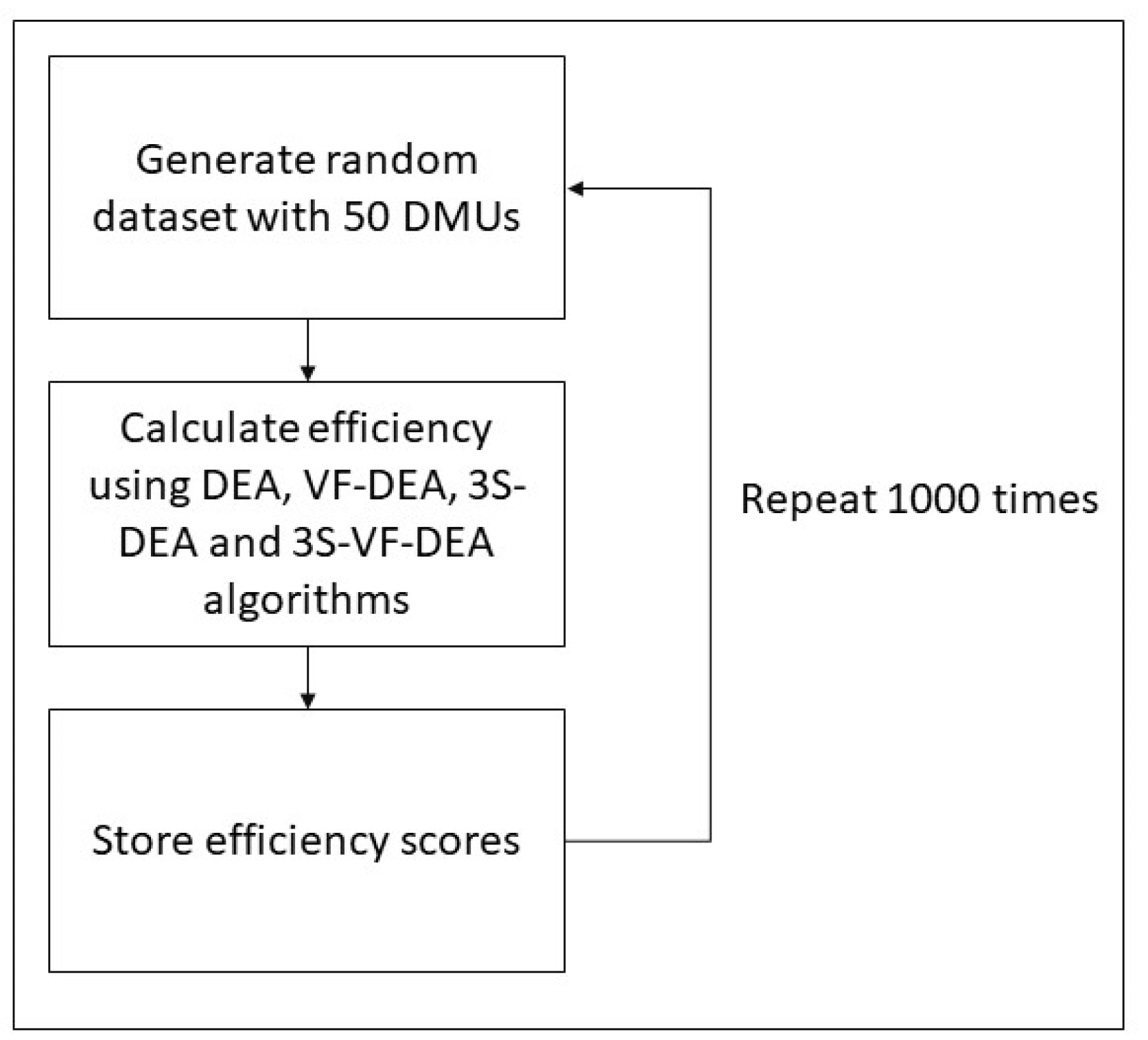

4.2. Method Selection

4.3. Benchmarking

5. Conclusions

- Operations cost over total asset

- Operations cost over revenue

- Inventory over operation cost

- Utilization of net capacity over total assets

- Service area over total manpower

- Total assets over No. of customers

- PPE over total number of interruptions

- Earnings per share

- Profit after tax over total manpower

- Profit after tax over total assets

- Revenue over total manpower

- Revenue over total assets

- EBITDA over revenue

5.1. Methodological and Practical Contributions

5.2. Limitations of the Study and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Giannakis, D.; Jamasb, T.; Pollitt, M. Benchmarking and incentive regulation of quality of service: An application to the UK electricity distribution networks. Energy Policy 2005, 33, 2256–2271. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Operational synergy in the US electric utility industry under an influence of deregulation policy: A linkage to financial performance and corporate value. Energy Policy 2011, 39, 699–713. [Google Scholar] [CrossRef]

- Blacconiere, W.G.; Johnson, M.F.; Johnson, M.S. Market valuation and deregulation of electric utilities. J. Acc. Econ. 2000, 29, 231–260. [Google Scholar] [CrossRef]

- Brunekreeft, G.; Goto, M.; Meyer, R.; Maruyama, M.; Hattori, T. Unbundling of Electricity Transmission System Operators in Germany—An Experience Report, Issue 12. 2014. Available online: https://www.econstor.eu/bitstream/10419/103347/1/800132300.pdf (accessed on 8 January 2021).

- Forrester, R. History of electricity. SSRN Electron. J. 2016, 1–5. [Google Scholar] [CrossRef][Green Version]

- Vujic, J.; Marincic, A.; Ercegovac, M.; Milovanovic, B. Nikola Tesla: 145 years of visionary ideas. In Proceedings of the 5th International Conference on Telecommunications in Modern Satellite, Cable and Broadcasting Service, TELSIKS 2001, Nis, Serbia, 19–21 September 2001; pp. 323–326. [Google Scholar] [CrossRef]

- Rajvanshi, A.K. Nikola Tesla—The creator of the electric age. Resonance 2007, 12, 4–12. [Google Scholar] [CrossRef]

- Sulzberger, C.L. Triumph of AC, Part 2. IEEE Power Energy Mag. 2003, 99, 70–73. [Google Scholar] [CrossRef]

- Kim, K. History of Electrification in Europe. Korean Minjok Leadership Academy. 2007. Available online: http://www.zum.de/whkmla/sp/0809/kyungmook/km2.html (accessed on 8 June 2021).

- Wang, M. Testing the Effectiveness of Deregulation in The Electric Utility Industry: A Market-Based Approach. Ph.D. Thesis, Louisiana Tech University, Ruston, LA, USA, 2003. [Google Scholar] [CrossRef]

- Welling, G.M. Supreme Court Case: Munn v. Illinois 1877. Available online: http://www.let.rug.nl/usa/documents/1876-1900/supreme-court-case-munn-v-illinois-1877.php (accessed on 8 June 2021).

- Adams, A. Impact of Deregulation on Cost Efficiency, Financial Performance and Shareholder Wealth of Electric Utilities in the United States. 2008. Available online: http://etd.library.vanderbilt.edu/available/etd-09052008-143901/unrestricted/AsterAdamsDissertationFinal.pdf (accessed on 8 June 2021).

- Hemphill, R.C.; Meitzen, M.E.; Schoech, P.E. Incentive regulation in network industries: Experience and prospects in the U.S. telecommunications, electricity, and natural gas industries. Rev. Netw. Econ. 2003, 2, 316–337. [Google Scholar] [CrossRef]

- Jamasb, T.; Llorca, M.; Khetrapal, P.; Thakur, T. Institutions and performance of regulated firms: Evidence from electric utilities in the Indian States. Work. Pap. 2018, 70, 68–82. [Google Scholar] [CrossRef]

- Odubiyi, A.O.; Davidson, I.E. England and Wales electricity industry—Experiences in deregulation. J. Eng. Des. Technol. 2005, 3, 24–29. [Google Scholar] [CrossRef]

- Bye, T.; Hope, E. Deregulation of electricity markets: The Norwegian experience. Econ. Political Wkly. 2005, 40, 5269–5278. [Google Scholar] [CrossRef]

- Mirza, F.M.; Rizvi, S.B.U.H.; Bergland, O. Service quality, technical efficiency and total factor productivity growth in Pakistan’s post-reform electricity distribution companies. Util. Policy 2021, 68, 101156. [Google Scholar] [CrossRef]

- Ter-Martirosyan, A.; Kwoka, J. Incentive regulation, service quality, and standards in U.S. electricity distribution. J. Regul. Econ. 2010, 38, 258–273. [Google Scholar] [CrossRef]

- Brandão, R.; Tolmasquim, M.T.; Maestrini, M.; Tavares, A.F.; Castro, N.J.; Ozorio, L.; Chaves, A.C. Determinants of the eco-nomic performance of Brazilian electricity distributors. Util. Policy 2021, 68. [Google Scholar] [CrossRef]

- Wu, J.; Zhu, Q.; Yin, P.; Song, M. Measuring energy and environmental performance for regions in China by using DEA-based Malmquist indices. Oper. Res. 2017, 17, 715–735. [Google Scholar] [CrossRef]

- Al-Eraqi, N.; Salem, A. An Efficiency Analysis of Seaports Using Extended Window Analysis, Malmquist Index and Si-mar-Wilson Approach. Ph.D. Thesis, University Sains Malaysia, Penang, Malaysia, 2009. [Google Scholar]

- Andor, M.; Hesse, F. A Monte Carlo Simulation Comparing DEA, SFA and Two Simple Approaches to Combine Efficiency Estimates. Discussion Paper No. 51. 2011. Available online: https://www.econstor.eu/obitstream/10419/51383/1/672474034.pdf (accessed on 8 June 2021).

- Tone, K. A slacks-based measure of effciency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Nigam, V.; Thakur, T.; Sethi, V.K.; Singh, R.P. Benchmarking of Indian mobile telecom operators using DEA with sensitivity analysis. Benchmarking Int. J. 2012, 19, 219–238. [Google Scholar] [CrossRef]

- Haney, A.B.; Pollitt, M.G. International benchmarking of electricity transmission by regulators: A contrast between theory and practice? Energy Policy 2013, 62, 267–281. [Google Scholar] [CrossRef]

- Fernandez-Palacin, F.; Lopez-Sanchez, M.A.; Muñoz-Márquez, M. Stepwise selection of variables in Dea using contribution loads. Pesqui. Oper. 2018, 38, 31–52. [Google Scholar] [CrossRef]

- Nataraja, N.R.; Johnson, A.L. Guidelines for using variable selection techniques in data envelopment analysis. Eur. J. Oper. Res. 2011, 215, 662–669. [Google Scholar] [CrossRef]

- Alexandridis, A.; Patrinos, P.; Sarimveis, H.; Tsekouras, G. A two-stage evolutionary algorithm for variable selection in the development of RBF neural network models. Chemom. Intell. Lab. Syst. 2005, 75, 149–162. [Google Scholar] [CrossRef]

- Shuttleworth, G. Benchmarking of electricity networks: Practical problems with its use for regulation. Util. Policy 2005, 13, 310–317. [Google Scholar] [CrossRef]

- Jamasb, T.; Pollitt, M. Benchmarking and regulation: International electricity experience. Util. Policies 2001, 9, 107–130. [Google Scholar] [CrossRef]

- Alizadeh, R.; Gharizadeh Beiragh, R.; Soltanisehat, L.; Soltanzadeh, E.; Lund, P.D. Performance evaluation of complex elec-tricity generation systems: A dynamic network-based data envelopment analysis approach. Energy Econ. 2020, 91, 104894. [Google Scholar] [CrossRef]

- Khodadadipour, M.; Hadi-Vencheh, A.; Behzadi, M.H.; Rostamy-Malkhalifeh, M. Undesirable factors in stochastic DEA cross-efficiency evaluation: An application to thermal power plant energy efficiency. Econ. Anal. Policy 2021, 69, 613–628. [Google Scholar] [CrossRef]

- Mohsin, M.; Hanif, I.; Taghizadeh-Hesary, F.; Abbas, Q.; Iqbal, W. Nexus between energy efficiency and electricity reforms: A DEA-Based way forward for clean power development. Energy Policy 2021, 149, 112052. [Google Scholar] [CrossRef]

- Xue, L.; Zhang, W.; Zheng, Z.; Liu, Z.; Meng, S.; Li, H.; Du, Y. Measurement and influential factors of the efficiency of coal resources of China’s provinces: Based on Bootstrap-DEA and Tobit. Energy 2021, 221, 119763. [Google Scholar] [CrossRef]

- Jindal, A.; Nilakantan, R. Falling efficiency levels of Indian coal-fired power plants: A slacks-based analysis. Energy Econ. 2021, 93, 105022. [Google Scholar] [CrossRef]

- Omrani, H.; Gharizadeh Beiragh, R.; Shafiei Kaleibari, S. Performance assessment of Iranian electricity distribution companies by an integrated cooperative game data envelopment analysis principal component analysis approach. Int. J. Electr. Power Energy Syst. 2015, 64, 617–625. [Google Scholar] [CrossRef]

- Madhanagopal, R.; Chandrasekaran, R. Selecting appropriate variables for DEA using genetic algorithm (GA) search pro-cedure. Int. J. Data Envel. Anal. Oper. Res. 2014, 1, 28–33. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Efficiency-based rank assessment for electric power industry: A combined use of Data Envelopment Analysis (DEA) and DEA-discriminant analysis (DA). Energy Econ. 2012, 34, 634–644. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W. Some models for estimating technical and scale efficiency in data envelopment analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Noh, Y. Evaluation of the resource utilization efficiency of university libraries using DEA techniques and a proposal of alternative evaluation variables. Libr. Hi Tech 2011, 29, 697–724. [Google Scholar] [CrossRef]

- Coelli, T. A Guide to DEAP Version 2.1: A Data Envelopment Analysis (Computer) Program. In CEPA Working Paper 96/08; 1996; pp. 1–49. Available online: https://www.owlnet.rice.edu/~econ380/DEAP.PDF (accessed on 8 June 2021).

- Cui, Q.; Li, Y. Evaluating energy efficiency for airlines: An application of VFB-DEA. J. Air Transp. Manag. 2015, 44–45, 34–41. [Google Scholar] [CrossRef]

- Cui, Q.; Li, Y. The evaluation of transportation energy efficiency: An application of three-stage virtual frontier DEA. Transp. Res. Part D Transp. Environ. 2014, 29, 1–11. [Google Scholar] [CrossRef]

- Li, H.; He, H.; Shan, J.; Cai, J. Innovation efficiency of semiconductor industry in China: A new framework based on gener-alized three-stage DEA analysis. Socio Econ. Plan. Sci. 2019, 66, 136–148. [Google Scholar] [CrossRef]

- Fried, H.O.; Lovell, C.A.K.; Schmidt, S.S.; Yaisawarng, S. Accounting for environmental effects and statistical noise in Data Envelopment Analysis. J. Prod. Anal. 2002, 17, 157–174. [Google Scholar] [CrossRef]

- Shyu, J.; Chiang, T. Measuring the true managerial efficiency of bank branches in Taiwan: A three-stage DEA analysis. Expert Syst. Appl. 2012, 39, 11494–11502. [Google Scholar] [CrossRef]

- Iparraguirre, J.L.; Ma, R. Efficiency in the provision of social care for older people. A three-stage Data Envelopment Analysis using self-reported quality of life. Socio-Econ. Plan. Sci. 2014, 1, 1–14. [Google Scholar] [CrossRef]

- Pereira de Souza, M.V.; Souza, R.C.; Pessanha, J.F.M.; da Costa Oliveira, C.H.; Diallo, M. An application of data envelopment analysis to evaluate the efficiency level of the operational cost of Brazilian electricity distribution utilities. Socio-Econ. Plan. Sci. 2014, 48, 169–174. [Google Scholar] [CrossRef]

- Costa, M.A.; Lopes, A.L.M.; de Pinho Matos, G.B.B. Statistical evaluation of Data Envelopment Analysis versus COLS Cobb–Douglas benchmarking models for the 2011 Brazilian tariff revision. Socio-Econ. Plan. Sci. 2014, 2010. [Google Scholar] [CrossRef]

- Cambini, C.; Croce, A.; Fumagalli, E. Output-based incentive regulation in electricity distribution: Evidence from Italy. Energy Econ. 2014, 45, 205–216. [Google Scholar] [CrossRef]

- Gouveia, M.C.; Dias, L.C.; Antunes, C.H.; Boucinha, J.; Inácio, C.F. Benchmarking of maintenance and outage repair in an electricity distribution company using the value-based DEA method. Omega 2015, 53, 104–114. [Google Scholar] [CrossRef]

- Barros, C.P.; Wanke, P.; Dumbo, S.; Manso, J.P. Efficiency in Angolan hydro-electric power station: A two-stage virtual frontier dynamic DEA and simplex regression approach. Renew. Sustain. Energy Rev. 2017, 78, 588–596. [Google Scholar] [CrossRef]

- Liu, X.; Chu, J.; Yin, P.; Sun, J. DEA cross-efficiency evaluation considering undesirable output and ranking priority: A case study of eco-efficiency analysis of coal-fired power plants. J. Clean. Prod. 2017, 142, 877–885. [Google Scholar] [CrossRef]

- Jia, T.; Yuan, H. The application of DEA (Data Envelopment Analysis) window analysis in the assessment of influence on operational efficiencies after the establishment of branched hospitals. BMC Health Serv. Res. 2017, 17, 1–8. [Google Scholar] [CrossRef]

- Nepal, R.; Jamasb, T. Incentive regulation and utility benchmarking for electricity network security. Econ. Anal. Policy 2015, 1993, 1–11. [Google Scholar] [CrossRef]

- Lowry, M.N.; Getachew, L. Statistical benchmarking in utility regulation: Role, standards and methods. Energy Policy 2009, 37, 1323–1330. [Google Scholar] [CrossRef]

- Kuosmanen, T.; Saastamoinen, A.; Sipiläinen, T. What is the best practice for benchmark regulation of electricity distribution? Comparison of DEA, SFA and StoNED methods. Energy Policy 2013, 61, 740–750. [Google Scholar] [CrossRef]

- Bjørndal, E.; Bjørndal, M.; Fange, K.-A. Benchmarking in regulation of electricity networks in Norway: An overview. In Energy, Natural Resources and Environmental Economics; Springer: Berlin/Heidelberg, Germany, 2010; pp. 317–342. [Google Scholar] [CrossRef]

- Shrivastava, N.; Sharma, S.; Chauhan, K. Efficiency assessment and benchmarking of thermal power plants in India. Energy Policy 2012, 40, 159–176. [Google Scholar] [CrossRef]

- Cardoso de Mendonça, M.J.; Pereira, A.O.; Medrano, L.A.; Pessanha, J.F.M. Analysis of electric distribution utilities efficiency levels by stochastic frontier in Brazilian power sector. Socio-Econ. Plan. Sci. 2020, 100973. [Google Scholar] [CrossRef]

- Núñez, F.; Arcos-Vargas, A.; Villa, G. Efficiency benchmarking and remuneration of Spanish electricity distribution compa-nies. Util. Policy 2020, 67. [Google Scholar] [CrossRef]

- See, K.F.; Coelli, T. Total factor productivity analysis of a single vertically integrated electricity utility in Malaysia using a Törnqvist index method. Util. Policy 2014, 28, 62–72. [Google Scholar] [CrossRef]

- Llorca, M.; Orea, L.; Pollitt, M.G. Using the latent class approach to cluster firms in benchmarking: An application to the US electricity transmission industry. Oper. Res. Perspect. 2014, 1, 6–17. [Google Scholar] [CrossRef]

- Çelen, A.; Yalçın, N. Performance assessment of Turkish electricity distribution utilities: An application of combined FAHP/TOPSIS/DEA methodology to incorporate quality of service. Util. Policy 2012, 23, 59–71. [Google Scholar] [CrossRef]

- Odyakmaz, N.; Scarsi, G.C. Electricity distribution benchmarking in Turkey for regulatory purposes: The case of Tedas. In Proceedings of the 9th IAEE European Conference on Energy Markets and Sustainability in a Larger Europe, Florence, Italy, 10–31 June 2007. [Google Scholar]

- Dyson, R.G.; Allen, R.; Camanho, A.S.; Podinovski, V.V.; Sarrico, C.S.; Shale, E.A. Pitfalls and protocols in DEA. Eur. J. Oper. Res. 2001, 13, 245–259. [Google Scholar] [CrossRef]

- Cui, R.Y.; Hultman, N.; Edwards, M.R.; He, L.; Sen, A.; Surana, K.; McJeon, H.; Iyer, G.; Patel, P.; Yu, S.; et al. Quantifying operational lifetimes for coal power plants under the Paris goals. Nat. Commun. 2019, 10, 1–9. [Google Scholar] [CrossRef]

- Shimomugi, K.; Kido, T.; Kobayashi, T. How Transformers Age | T&D World. T&D World. 2019. Available online: https://www.tdworld.com/substations/article/20972255/how-transformers-age (accessed on 8 June 2021).

| Objective | Variables | Author, Year, [Reference] |

|---|---|---|

| To measure and evaluate the performance of electricity generation systems | Energy produced, labor, fuel consumption, capacity of transfer stations, length of transmission lines, energy delivered, total energy sold, number of consumers and total distribution transformers | Alizadeh et al., 2020, [31] |

| To measure and evaluate the efficiency of 32 thermal power plants | Energy produced, generation capacity, number of employees, CO2 emission and water pollution | Khodadadipour et al., 2021, [32] |

| To evaluate the impact of energy reforms on energy efficiency | GDP, labor, energy consumption and CO2 per capita | Mohsin et al., 2021, [33] |

| To measure and identify significant factors of China’s coal resources | GDP, total coal consumption, resident population, GDP, pollution control investment, science & technology expenditure, and industry structure | Xue et al., 2021, [34] |

| To measure the efficiency of coal fires power plants in India | Installed capacity, GDP, capacity utilization, availability factor, coal consumption, secondary fuel oil consumption and auxiliary power consumption. | Jindal & Nilakantan, 2021, [35] |

| Objective | Method | Author, Year [Reference] |

|---|---|---|

| To evaluate the operational cost efficiency of electric distribution utilities. | DEA (Adjusted Contingent Weight Restrictions), DEA (Constant Return to Scale) and DEA (Non-Decreasing Return to Scale). | Pereira de Souza et al., 2014, [49] |

| To select the appropriate variables for DEA to assess the relative efficiency of Decision-Making Units (DMU). | DEA and Genetic Algorithm (GA) | Madhanagopal & Chandrasekaran, 2014, [37] |

| To evaluate the operational efficiency of power distribution utilities. | DEA and Corrected Ordinary Least Squares (COLS) with Cobb Douglas production function. | Costa et al., 2014, [50] |

| To measure the efficiency of electric distribution in terms of cost reduction and also with respect of overall regulatory framework. | Two stage DEA. | Cambini et al., 2014, [13,51] |

| To benchmark an electric distribution company’s outage repair and maintenance activities. | Value Based DEA. | Gouveia et al., 2015, [52] |

| To measure the performance of electric distribution companies in Iran. | Data Envelopment Analysis (DEA), Game theory and, Principal Component Analysis (PCA). | Omrani et al., 2015, [36] |

| To measure the efficiency of hydroelectric power plants in Angola. | Two stage virtual frontier dynamic DEA | Barros et al., 2017, [53] |

| To analyze the eco-efficiency of coal-fired plants in China. | DEA cross efficiency model | Liu et al., 2017, [54] |

| To measure the efficiency of thermal power plants. | DEA cross efficiency model | Khodadadipour et al., 2021, [32] |

| Objective | Benchmarking Period | Author, Year [Reference] |

|---|---|---|

| To analyze efficiency of Indian coal fired power plants | 2005–2014 | Jindal & Nilakantan, 2021, [35] |

| To analyze efficiency of Brazilian electric distribution utilities | 2003–2016 | Cardoso de Mendonça et al., 2020, [61] |

| To benchmark electricity distribution companies in Spain | 2016 | Núñez et al., 2020, [62] |

| To carry out total factor productivity (TFP) analysis of vertically integrated electric utility in Malaysia using a Törnqvist index method. | 1975–2005 | See & Coelli, 2014, [63] |

| To benchmark transmission electric utilities in United States of America using latent class approach | 2001–2009 | Llorca et al., 2014, [64] |

| To assess the performance of electricity distribution utilities in Turkey using FAHP/TOPSIS/DEA methodology and incorporating quality of service. | 2002–2009 | Çelen & Yalçın, 2012, [65] |

| To benchmark 72 distribution electric utilities in Turkey for regulatory purposes | 2004 | Odyakmaz & Scarsi, 2007, [66] |

| Description | Source | Website |

|---|---|---|

| Database for electric utilities in the United States of America | US Department of Energy | www.energy.gov (accessed on 26 January 2021) |

| Malaysian electricity sector statistics | Suruhanjaya Tenaga, Malaysia | www.st.gov.my (accessed on 26 January 2021) |

| Annual report including financial report and performance. | Electric utilities | www.pugetenergy.com (accessed on 26 January 2021); www.fpl.com (accessed on 26 January 2021); www.duke-energy.com (accessed on 26 January 2021); www.aep.com (accessed on 26 January 2021); www.sarawakenergy.com (accessed on 26 January 2021); www.egat.co.th (accessed on 26 January 2021); www.eon.com (accessed on 26 January 2021); www.iplpower.com (accessed on 26 January 2021); www.centerpointenergy.com (accessed on 26 January 2021); www.nmgco.com (accessed on 26 January 2021); www.epelectric.com (accessed on 26 January 2021); www.myavista.com (accessed on 26 January 2021); www.xcelenergy.com (accessed on 26 January 2021); www.entergy.com (accessed on 26 January 2021); www.oncor.com (accessed on 26 January 2021); www.tnb.com.my (accessed on 26 January 2021); www.pacificorp.com (accessed on 26 January 2021); www.midamericanenergy.com (accessed on 26 January 2021) |

| Security exchange annual report | United States Securities and Exchange Commission | www.sec.gov (accessed on 26 January 2021) |

| Indiana’s electric utility reliability report | Indiana Utility Regulatory Commission | www.in.gov (accessed on 26 January 2021) |

| Reliability improvement initiatives | Quanta Technology LLC | www.all4energy.org (accessed on 26 January 2021) |

| Ireland’s energy generation capacity | Eirgrid Group | www.eirgridgroup.com (accessed on 26 January 2021) |

| Florida’s electricity service reliability report | Florida Public Service Commission | www.psc.state.fl.us (accessed on 26 January 2021) |

| Performance of electric utilities in Florida, USA | Florida Public Service Commission | www.publicpower.com (accessed on 26 January 2021) |

| Performance of electric utilities in Oklahoma, USA | Oklahoma Corporation Commission | oklahoma.gov (accessed on 26 January 2021) |

| Ireland’s energy statistics | Sustainable Energy Authority of Ireland | www.seai.ie (accessed on 26 January 2021) |

| Indiana statewide analysis of peak demand reduction initiatives | Indiana Advance Energy Economy | www.aee.net (accessed on 26 January 2021) |

| Iowa’s electricity performance report | Mid-American Energy Company | iub.iowa.gov (accessed on 26 January 2021) |

| Mid-American and IPL Reliability Indices | Iowa Utilities Board | iub.iowa.gov (accessed on 26 January 2021) |

| PLN’s electricity statistics | PLN Indonesia | web.pln.co.id (accessed on 26 January 2021) |

| Avista’s electric service reliability report | Avista Corp | www.utc.wa.gov (accessed on 26 January 2021) |

| AEP reliability performance report | American Electric Power Company | www.aepsustainability.com (accessed on 26 January 2021) |

| Germany electricity market monitoring report | Bundesnetzagentur | www.bundesnetzagentur.de (accessed on 26 January 2021) |

| Distribution Performance Report | ESB Network Ltd. | www.esbnetworks.ie (accessed on 26 January 2021) |

| Indiana’s electricity power forecast | State Utility Forecasting Group, Indiana | www.psc.state.fl.us (accessed on 26 January 2021) |

| NIPSCO Demand Side Management Market Potential Study | Applied Energy Group | www.nipsco.com (accessed on 26 January 2021) |

| California’s electricity reliability report | Pacific Corp | www.cpuc.ca.gov (accessed on 26 January 2021) |

| Texas’s electricity reliability report | Public Utility Commission of Texas | www.puc.texas.gov (accessed on 26 January 2021) |

| Data on California electric utilities | City of Los Angeles | ens.lacity.org (accessed on 26 January 2021) |

| Oregon’s electricity reliability report | Oregon Public Utility Commission | www.oregon.gov (accessed on 26 January 2021) |

| Indiana’s electricity statistics | NiSource Inc | www.eei.org (accessed on 26 January 2021) |

| NiSource’s statistical summary | NiSource | www.nisource.com (accessed on 26 January 2021) |

| Variable Description | Type | Variable Code |

|---|---|---|

| Operation Cost over Manpower | Input | A1 |

| Operations Cost over Customer | Input | A2 |

| Operations Cost over Total Asset | Input | A3 |

| Operations Cost over Revenue | Input | A4 |

| Operation Cost over Service Area | Input | A5 |

| Inventory over Operation Cost | Input | A6 |

| Utilization of net capacity over Total Assets | Input | A7 |

| Service Area over Total Manpower | Input | A8 |

| Total Assets over No of Customers | Input | A9 |

| Inventory over Total assets | Input | A10 |

| Revenue Over Total Outage Duration | Output | B1 |

| Profit After Tax Over Total Outage Duration | Output | B2 |

| Property, Plant & Equipment (PPE) Over Total Outage Duration | Output | B3 |

| Revenue Over Total no of Interruptions | Output | B4 |

| Profit After Tax Over Total Number of Interruptions | Output | B5 |

| Total Assets over Total Number of Interruptions | Output | B6 |

| PPE over Total Number of Interruptions | Output | B7 |

| Earnings per Share | Output | B8 |

| Profit After Tax over Number of Customer | Output | B9 |

| Profit After Tax Over Total Manpower | Output | B10 |

| Profit After Tax Over Total Assets | Output | B11 |

| Revenue over Number of Customers | Output | B12 |

| Revenue over Total Manpower | Output | B13 |

| Revenue over Total Assets | Output | B14 |

| Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) over Revenue | Output | B15 |

| Variable Code | Minimum | Maximum | Mean | Std. Deviation |

|---|---|---|---|---|

| A1 | 0.0311 | 0.4606 | 0.2189 | 0.0891 |

| A2 | 0.0158 | 0.7110 | 0.2293 | 0.1312 |

| A3 | 0.0144 | 0.2809 | 0.0998 | 0.0450 |

| A4 | 0.0422 | 0.3485 | 0.1513 | 0.0593 |

| A5 | 0.0000 | 0.5647 | 0.2250 | 0.1122 |

| A6 | 0.0016 | 0.5566 | 0.1543 | 0.0951 |

| A7 | 0.0000 | 1.0000 | 0.3084 | 0.2005 |

| A8 | 0.0000 | 1.0000 | 0.1930 | 0.1918 |

| A9 | 0.0000 | 1.0000 | 0.3119 | 0.1825 |

| A10 | 0.0016 | 0.4720 | 0.1755 | 0.0868 |

| B1 | 0.0003 | 0.3401 | 0.0889 | 0.0622 |

| B2 | 0.3789 | 0.6197 | 0.4821 | 0.0361 |

| B3 | 0.0010 | 0.8501 | 0.2517 | 0.1597 |

| B4 | 0.0005 | 0.6456 | 0.2146 | 0.1312 |

| B5 | 0.2953 | 0.5378 | 0.4037 | 0.0328 |

| B6 | 0.0000 | 0.1888 | 0.0619 | 0.0344 |

| B7 | 0.0000 | 0.7566 | 0.2777 | 0.1703 |

| B8 | 0.5401 | 0.8613 | 0.7075 | 0.0452 |

| B9 | 0.5761 | 0.8831 | 0.7463 | 0.0417 |

| B10 | 0.4592 | 0.7945 | 0.6015 | 0.0465 |

| B11 | 0.8274 | 0.9755 | 0.9034 | 0.0231 |

| B12 | 0.0074 | 0.6742 | 0.2354 | 0.1295 |

| B13 | 0.0074 | 0.6742 | 0.2354 | 0.1295 |

| B14 | 0.0318 | 0.2851 | 0.1042 | 0.0461 |

| B15 | 0.0991 | 0.5747 | 0.3220 | 0.0741 |

| Step No | Total Variables | Loads | Input Variables | Output Variables |

|---|---|---|---|---|

| 1 | 25 | 0.2808 | A1, A2, A3, A4, A5, A6, A7, A8, A9, A10 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12, B13, B14, B15 |

| 2 | 24 | 0.3084 | A1, A2, A3, A4, A5, A6, A7, A8, A9, A10 | B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12, B13, B14, B15 |

| 3 | 23 | 0.3127 | A1, A3, A4, A5, A6, A7, A8, A9, A10 | B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12, B13, B14, B15 |

| 4 | 21 | 0.3242 | A1, A3, A4, A5, A6, A7, A8, A9 | B3, B4, B5, B6, B7, B8, B9, B10, B11, B12, B13, B14, B15 |

| 5 | 20 | 0.4085 | A1, A3, A4, A5, A6, A7, A8, A9 | B3, B5, B6, B7, B8, B9, B10, B11, B12, B13, B14, B15 |

| 6 | 19 | 0.4404 | A1, A3, A4, A5, A6, A7, A8, A9 | B5, B6, B7, B8, B9, B10, B11, B12, B13, B14, B15 |

| 7 | 18 | 0.4472 | A3, A4, A5, A6, A7, A8, A9 | B5, B6, B7, B8, B9, B10, B11, B12, B13, B14, B15 |

| 8 | 17 | 0.4741 | A3, A4, A6, A7, A8, A9 | B5, B6, B7, B8, B9, B10, B11, B12, B13, B14, B15 |

| 9 | 13 | 0.5007 | A3, A4, A6, A7, A8, A9 | B7, B8, B10, B11, B13, B14, B15 |

| 10 | 12 | 0.5282 | A3, A4, A6, A7, A8, A9 | B8, B10, B11, B13, B14, B15 |

| 11 | 6 | 0.6411 | A3, A4 | B10, B11, B13, B15 |

| 12 | 5 | 0.6546 | A3, A4 | B10, B11, B15 |

| 13 | 3 | 0.6729 | A4 | B10, B15 |

| 14 | 2 | 1 | A4 | B15 |

| Variable Description | Type | Variable Code |

|---|---|---|

| Operations Cost over Total Asset | Input | A3 |

| Operations Cost over Revenue | Input | A4 |

| Inventory over Operation Cost | Input | A6 |

| Utilization of net capacity over Total Assets | Input | A7 |

| Service Area over Total Manpower | Input | A8 |

| Total Assets over No of Customers | Input | A9 |

| PPE over Total Number of Interruptions | Output | B7 |

| Earnings per Share | Output | B8 |

| Profit After Tax Over Total Manpower | Output | B10 |

| Profit After Tax Over Total Assets | Output | B11 |

| Revenue over Total Manpower | Output | B13 |

| Revenue over Total Assets | Output | B14 |

| EBITDA over Revenue | Output | B15 |

| Method | DEA | VF-DEA | 3S-DEA | 3S-VF-DEA |

|---|---|---|---|---|

| Percentage Efficient DMUs | 65.43% | 38.76% | 65.48% | 26.35% |

| No of DMUs | DEA | VF-DEA | 3S-DEA | 3S-VF-DEA |

|---|---|---|---|---|

| 50 | 0.00178 | 0.00178 | 0.00196 | 0.00214 |

| 100 | 0.00180 | 0.00227 | 0.00204 | 0.00238 |

| 150 | 0.00225 | 0.00234 | 0.00226 | 0.00225 |

| 250 | 0.00245 | 0.00210 | 0.00251 | 0.00257 |

| 300 | 0.00271 | 0.00215 | 0.00261 | 0.00234 |

| 350 | 0.00268 | 0.00236 | 0.00257 | 0.00233 |

| 400 | 0.00255 | 0.00235 | 0.00286 | 0.00254 |

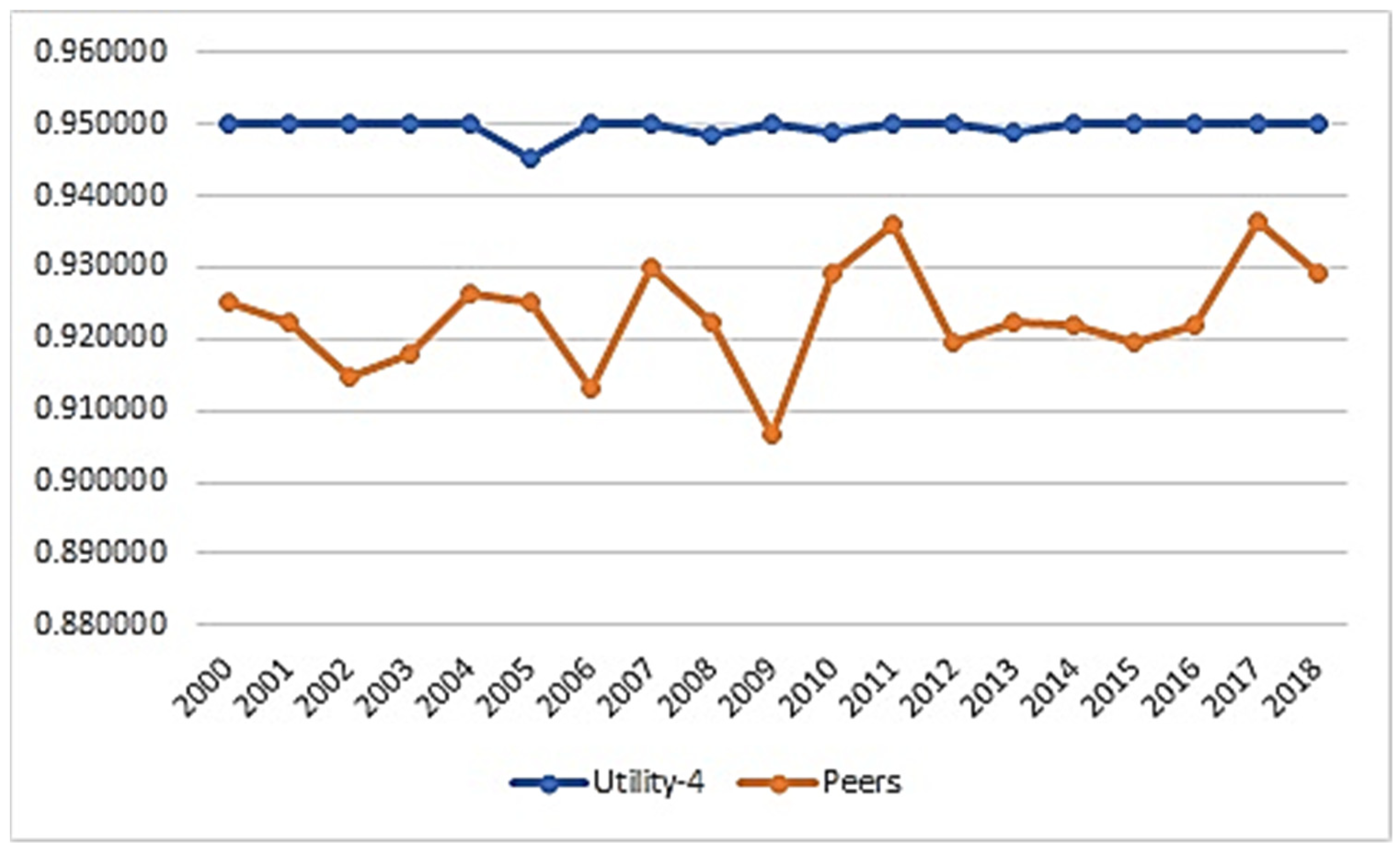

| Utility | Window | DEA | VF-DEA | 3S-DEA | 3S-VF-DEA |

|---|---|---|---|---|---|

| Utility-4 | 2000–2009 | 0.999322 | 0.949356 | 0.999321 | 0.949341 |

| 2001–2010 | 0.999285 | 0.949321 | 0.999285 | 0.949316 | |

| 2002–2011 | 0.999095 | 0.949141 | 0.999095 | 0.949134 | |

| 2003–2012 | 0.998667 | 0.948580 | 0.998667 | 0.948574 | |

| 2004–2013 | 0.999430 | 0.949406 | 0.999430 | 0.949402 | |

| 2005–2014 | 0.999656 | 0.949593 | 0.999656 | 0.949589 | |

| 2006–2015 | 0.999404 | 0.949290 | 0.999404 | 0.949284 | |

| 2007–2016 | 0.999501 | 0.949486 | 0.999501 | 0.949476 | |

| 2008–2017 | 0.999884 | 0.949795 | 0.999884 | 0.949788 | |

| 2009–2018 | 1.000000 | 0.950000 | 1.000000 | 0.949993 | |

| Average | 0.999424 | 0.949397 | 0.999424 | 0.949390 |

| Utility | DEA | VF-DEA | 3S-DEA | 3S-VF-DEA |

|---|---|---|---|---|

| Utility-1 | 1.000000 | 0.949907 | 1.000000 | 0.949905 |

| Utility-2 | 1.000000 | 0.949971 | 1.000000 | 0.949968 |

| Utility-3 | 0.997890 | 0.947358 | 0.997890 | 0.947355 |

| Utility-4 | 0.999424 | 0.949397 | 0.999424 | 0.949390 |

| Utility-5 | 0.995613 | 0.942379 | 0.995612 | 0.942374 |

| Utility-6 | 1.000000 | 0.950000 | 1.000000 | 0.949994 |

| Utility-7 | 0.994875 | 0.939257 | 0.994875 | 0.939252 |

| Utility-8 | 0.964164 | 0.896576 | 0.964161 | 0.896568 |

| Utility-9 | 0.997409 | 0.930511 | 0.997409 | 0.930505 |

| Utility-10 | 0.980539 | 0.922352 | 0.980538 | 0.922346 |

| Utility-11 | 0.998033 | 0.946898 | 0.998033 | 0.946894 |

| Utility-12 | 0.969406 | 0.913471 | 0.969404 | 0.913465 |

| Utility-13 | 0.955205 | 0.887640 | 0.955203 | 0.887634 |

| Utility-14 | 0.989981 | 0.936039 | 0.989980 | 0.936034 |

| Utility-15 | 0.998075 | 0.947762 | 0.998074 | 0.947757 |

| Utility-16 | 0.921527 | 0.855464 | 0.921522 | 0.855454 |

| Utility-17 | 0.926803 | 0.857814 | 0.926798 | 0.857804 |

| Utility-18 | 0.967181 | 0.895631 | 0.967178 | 0.895624 |

| Utility-19 | 0.999251 | 0.944828 | 0.999250 | 0.944823 |

| Utility-20 | 0.989688 | 0.930621 | 0.989688 | 0.930616 |

| Utility-21 | 0.998636 | 0.947567 | 0.998636 | 0.947559 |

| Average | 0.983033 | 0.925783 | 0.983032 | 0.925777 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kannan, P.M.; Marthandan, G.; Kannan, R. Modelling Efficiency of Electric Utilities Using Three Stage Virtual Frontier Data Envelopment Analysis with Variable Selection by Loads Method. Energies 2021, 14, 3436. https://doi.org/10.3390/en14123436

Kannan PM, Marthandan G, Kannan R. Modelling Efficiency of Electric Utilities Using Three Stage Virtual Frontier Data Envelopment Analysis with Variable Selection by Loads Method. Energies. 2021; 14(12):3436. https://doi.org/10.3390/en14123436

Chicago/Turabian StyleKannan, Pavala Malar, Govindan Marthandan, and Rathimala Kannan. 2021. "Modelling Efficiency of Electric Utilities Using Three Stage Virtual Frontier Data Envelopment Analysis with Variable Selection by Loads Method" Energies 14, no. 12: 3436. https://doi.org/10.3390/en14123436

APA StyleKannan, P. M., Marthandan, G., & Kannan, R. (2021). Modelling Efficiency of Electric Utilities Using Three Stage Virtual Frontier Data Envelopment Analysis with Variable Selection by Loads Method. Energies, 14(12), 3436. https://doi.org/10.3390/en14123436