The Price of Wind: An Empirical Analysis of the Relationship between Wind Energy and Electricity Price across the Residential, Commercial, and Industrial Sectors

Abstract

1. Introduction

1.1. Background

1.1.1. Increasing Economic Efficiency

- It: Investment expenditures in year t

- Mt: Operational expenditures in year t

- Et: Electricity generated in year t

- r: Discount rate

- n: Expected lifetime of a wind turbine

- Source: [14].

1.1.2. Transmission and Volatility

1.1.3. Economic Implications

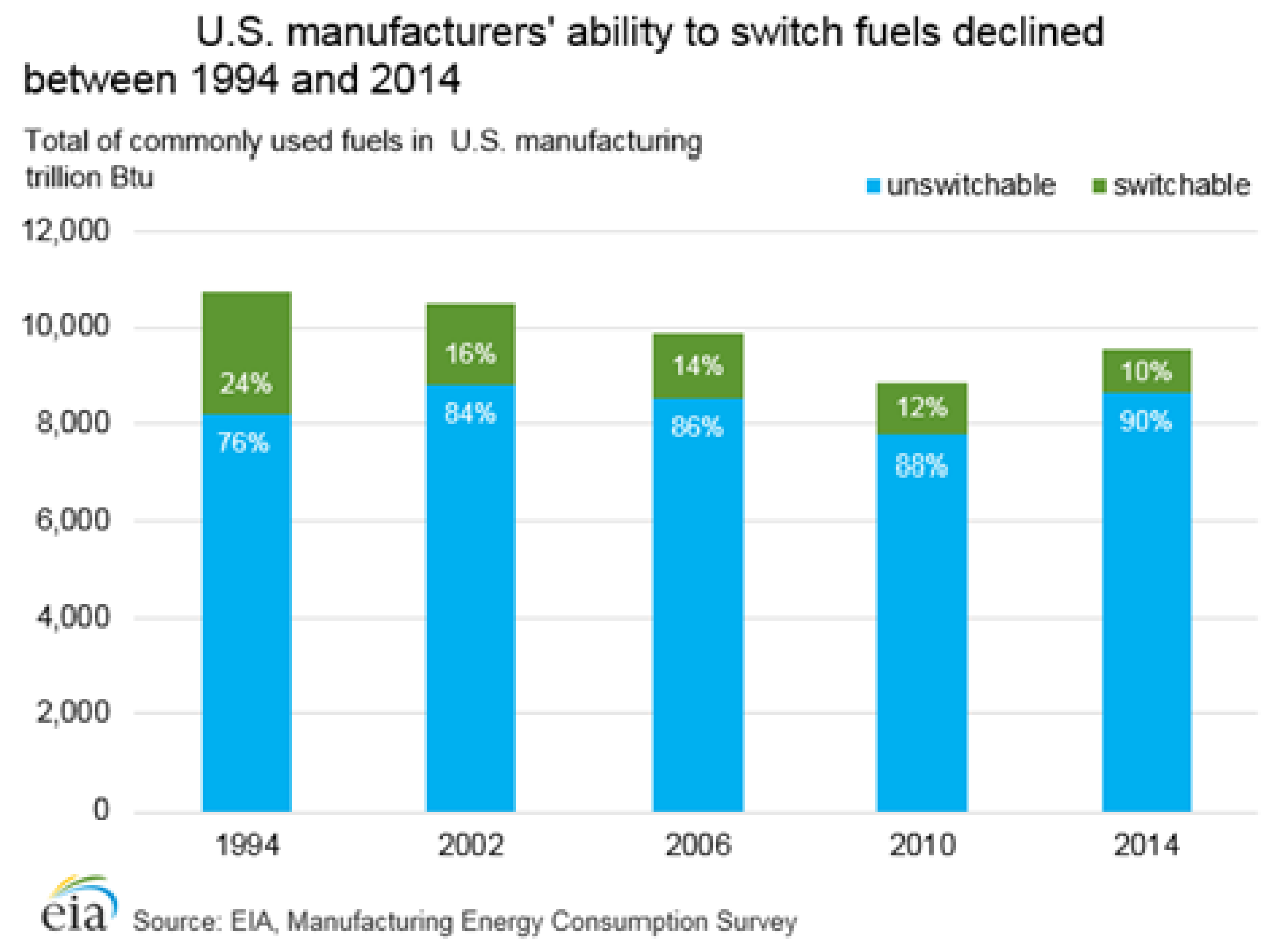

1.1.4. Energy Sectors

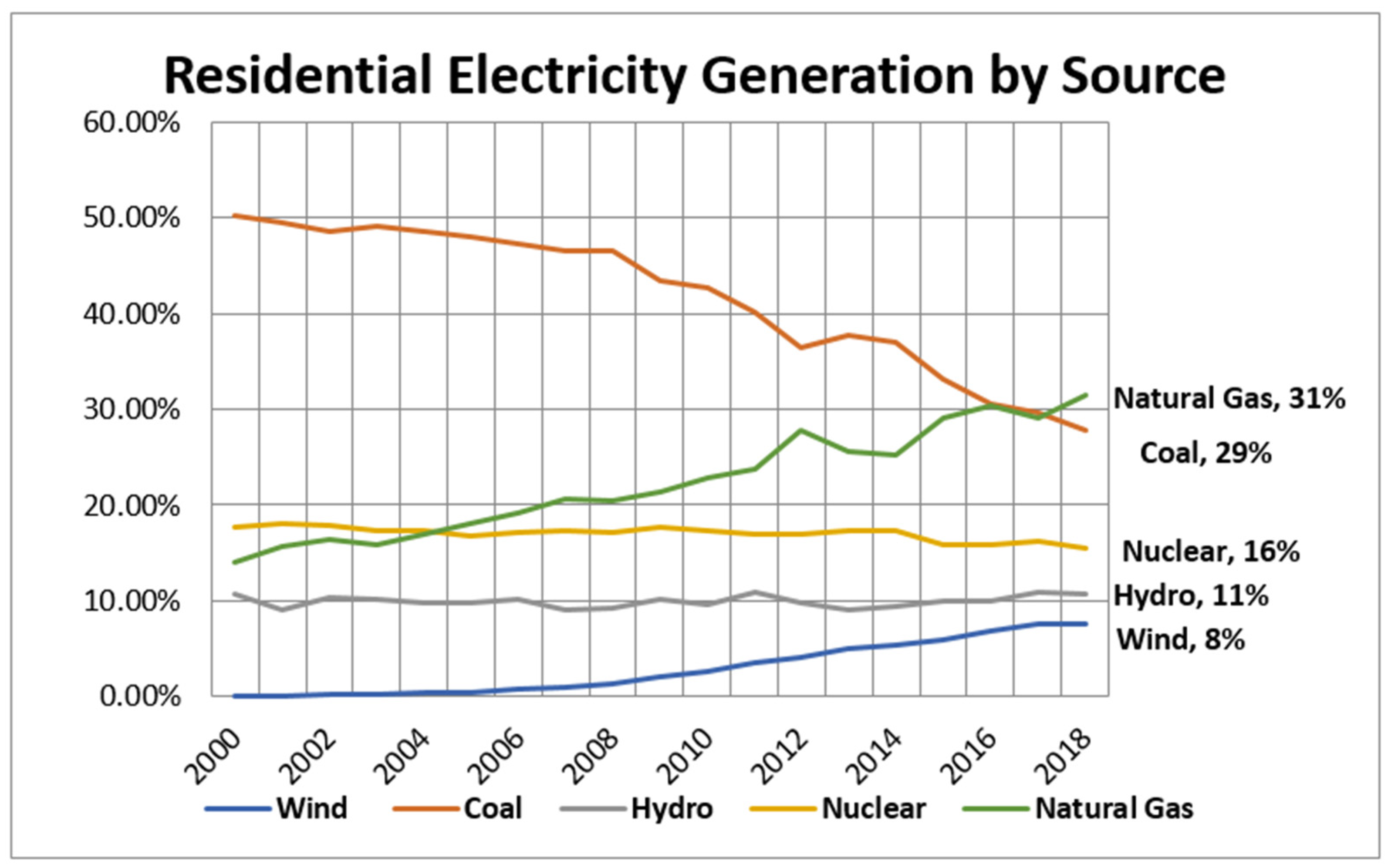

1.1.5. Electricity Market

1.1.6. Price Factors

1.2. Existing Literature

1.3. Purpose

2. Materials and Methods

2.1. Empirical Methodology and Data

2.1.1. Fixed Effects Model

2.1.2. General Method of Moments Model

2.2. Data

2.3. Dependent Variables, Electricity Price

Residential Price—ResPrice, Commercial Price—ComPrice, Industrial Price—IndPrice, and Total Price—TotPrice

2.4. Independent Variables

Wind Energy—Wind

2.5. Socio-Economic

2.5.1. Residential Electricity Customers—ResCus, Industrial Customers—IndCus, Commercial Customers—ComCus, Total Customers—TotCus

2.5.2. Gross Domestic Product—GDP

2.6. Fuel Prices

2.6.1. Coal Price—Coal

2.6.2. Natural Gas Price—NatGas

2.7. Regulation and Policy

2.7.1. Renewable Portfolio Standards—RPS

2.7.2. Market Regulation—DeReg

2.7.3. Government Subsidies—TaxCred

2.8. Weather

Temperature—Temp

3. Results

3.1. Wind Energy

3.2. Socio-Economic

3.3. Policy and Regulation

3.4. Fuel Prices and Weather

4. Discussion

Suggestions for Further Research

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Rand, J.; Hoen, B. Thirty years of North American wind energy acceptance research: What have we learned? Energy Res. Soc. Sci. 2017, 29, 135–148. [Google Scholar] [CrossRef]

- Brown, J.P.; Pender, J.; Wiser, R.; Lantz, E.; Hoen, B. Ex post analysis of economic impacts from wind power development in US counties. Energy Econ. 2012, 34, 1743–1754. [Google Scholar] [CrossRef]

- Timilsina, G.R.; van Kooten, G.C.; Narbel, P.A. Global wind power development: Economics and policies. Energy Policy 2013, 61, 642–652. [Google Scholar] [CrossRef]

- The International Renewable Energy Agency. Renewable Capacity Statistics 2021; The International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021. [Google Scholar]

- Energy Information Administration. Renewables and Other Alternative Fuels; Energy Information Administration: Washington, DC, USA, 2021. [Google Scholar]

- Bird, L.; Bolinger, M.; Gagliano, T.; Wiser, R.; Brown, M.; Parsons, B.J.E.P. Policies and market factors driving wind power development in the United States. Energy Policy 2005, 33, 1397–1407. [Google Scholar] [CrossRef]

- Krekel, C.; Zerrahn, A. Does the presence of wind turbines have negative externalities for people in their surroundings? Evidence from well-being data. J. Environ. Econ. Manag. 2017, 82, 221–238. [Google Scholar] [CrossRef]

- Pearce-Higgins, J.W.; Stephen, L.; Douse, A.; Langston, R.H. Greater impacts of wind farms on bird populations during construction than subsequent operation: Results of a multi-site and multi-species analysis. J. Appl. Ecol. 2012, 49, 386–394. [Google Scholar] [CrossRef]

- Peterson, D.A.; Carter, K.C.; Wald, D.M.; Gustafson, W.; Hartz, S.; Donahue, J.; Eilers, J.R.; Hamilton, A.E.; Hutchings, K.S.; Macchiavelli, F.E. Carbon or cash: Evaluating the effectiveness of environmental and economic messages on attitudes about wind energy in the United States. Energy Res. Soc. Sci. 2019, 51, 119–128. [Google Scholar] [CrossRef]

- Sağlam, Ü. A two-stage data envelopment analysis model for efficiency assessments of 39 state’s wind power in the United States. Energy Convers. Manag. 2017, 146, 52–67. [Google Scholar] [CrossRef]

- Shrimali, G.; Kniefel, J. Are government policies effective in promoting deployment of renewable electricity resources? Energy Policy 2011, 39, 4726–4741. [Google Scholar] [CrossRef]

- Energy Information Administration. Electricity, Detailed State Data; Energy Information Administration: Washington, DC, USA, 2020. [Google Scholar]

- Office of Energy Efficiency and Renewable Energy. Wind Vision: A New Era for Wind Power in the United States; Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2020. [Google Scholar]

- Lai, C.S.; Jia, Y.; Xu, Z.; Lai, L.L.; Li, X.; Cao, J.; McCulloch, M.D. Levelized cost of electricity for photovoltaic/biogas power plant hybrid system with electrical energy storage degradation costs. Energy Convers. Manag. 2017, 153, 34–47. [Google Scholar] [CrossRef]

- Office of Energy Efficiency and Renewable Energy. Increasing Wind Turbine Tower Heights: Opportunities and Challenges; Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2019. [Google Scholar]

- Office of Energy Efficiency and Renewable Energy. Research Assesses Tall Turbine Tower Energy Production, Cost, and Viability; Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2019. [Google Scholar]

- Energy Information Administration. Utilities Continue to Increase Spending on the Electric Transmission System; Energy Information Administration: Washington, DC, USA, 2020. [Google Scholar]

- Premalatha, M.; Abbasi, T.; Abbasi, S.A. Wind energy: Increasing deployment, rising environmental concerns. Renew. Sustain. Energy Rev. 2014, 31, 270–288. [Google Scholar]

- Aleem, S.A.; Hussain, S.; Ustun, T.S. A Review of Strategies to Increase PV Penetration Level in Smart Grids. Energies 2020, 13, 636. [Google Scholar] [CrossRef]

- Twomey, P.; Neuhoff, K. Wind power and market power in competitive markets. Energy Policy 2010, 38, 3198–3210. [Google Scholar] [CrossRef]

- Heal, G. The Economics of Renewable Energy; National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar]

- Ketterer, J.C. The impact of wind power generation on the electricity price in Germany. Energy Econ. 2014, 44, 270–280. [Google Scholar] [CrossRef]

- Steggals, W.; Gross, R.; Heptonstall, P. Winds of change: How high wind penetrations will affect investment incentives in the GB electricity sector. Energy Policy 2011, 39, 1389–1396. [Google Scholar] [CrossRef]

- Woo, C.-K.; Zarnikau, J.; Moore, J.; Horowitz, I. Wind generation and zonal-market price divergence: Evidence from Texas. Energy Policy 2011, 39, 3928–3938. [Google Scholar] [CrossRef]

- Zerrahn, A. Wind power and externalities. Ecol. Econ. 2017, 141, 245–260. [Google Scholar] [CrossRef]

- Jacobsen, H.K.; Zvingilaite, E. Reducing the market impact of large shares of intermittent energy in Denmark. Energy Policy 2010, 38, 3403–3413. [Google Scholar] [CrossRef]

- Martinez-Anido, C.B.; Brinkman, G.; Hodge, B.-M. The impact of wind power on electricity prices. Renew. Energy 2016, 94, 474–487. [Google Scholar] [CrossRef]

- Valenzuela, J.; Wang, J. A probabilistic model for assessing the long-term economics of wind energy. Electr. Power Syst. Res. 2011, 81, 853–861. [Google Scholar] [CrossRef]

- Energy Information Administration. Renewable Energy Market Update, COVID-19 Impact on Renewable Energy Growth; Energy Information Administration: Washington, DC, USA, 2020. [Google Scholar]

- He, Y.; Zhang, S.; Yang, L.; Wang, Y.; Wang, J. Economic analysis of coal price–electricity price adjustment in China based on the CGE model. Energy Policy 2010, 38, 6629–6637. [Google Scholar] [CrossRef]

- Ezeh, M.C.; Nwogwugwu, U.C.; Ezindu, O.N. Impact of Household Electricity Consumption on Standard of Living in Nigeria. 2020. Available online: https://www.iiste.org/Journals/index.php/JETP/article/view/51525 (accessed on 3 June 2021).

- Bekhet, H.A.; bt Othman, N.S. Causality analysis among electricity consumption, consumer expenditure, gross domestic product (GDP) and foreign direct investment (FDI): Case study of Malaysia. J. Econ. Int. Finance 2011, 3, 228–235. [Google Scholar]

- Energy Information Administration. Electricity Explained, Factors Affecting Electricity Prices; Energy Information Administration: Washington, DC, USA, 2020. [Google Scholar]

- Davis, C. Society, Fracking and environmental protection: An analysis of US state policies. Extr. Ind. Soc. 2017, 4, 63–68. [Google Scholar]

- Power, N. What Determines the Price You Pay for Power? Available online: https://navigatepower.com/determines-price-pay-power/ (accessed on 3 June 2021).

- Energy Information Administration. Industrial Sector Energy Consumption; Energy Information Administration: Washington, DC, USA, 2016. [Google Scholar]

- Nair, N.-K.C.; Garimella, N. Battery energy storage systems: Assessment for small-scale renewable energy integration. Energy Build 2010, 42, 2124–2130. [Google Scholar] [CrossRef]

- Rossetti, P. How Much Would Ending Fossil Fuel Subsidies Help Renewable Energy? American Action Forum 2016. Available online: https://www.americanactionforum.org/research/much-ending-fossil-fuel-subsidies-help-renewable-energy/ (accessed on 3 June 2021).

- Bank, W. Analysis of the Scope of Energy Subsidies and Suggestions for the G-20 Initiative; World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Institute for Energy Research. Renewable Energy Subsidies 6.4 Times Greater than Fossil Fuel Subsidies; 2012. Available online: https://www.instituteforenergyresearch.org/renewable/12704/ (accessed on 3 June 2021).

- González, J.S.; Lacal-Arántegui, R. A review of regulatory framework for wind energy in European Union countries: Current state and expected developments. Renew. Sustain. Energy Rev. 2016, 56, 588–602. [Google Scholar] [CrossRef]

- Energy Information Administration. Use of Energy Explained, Energy Use in Industry; Energy Information Administration: Washington, DC, USA, 2020. [Google Scholar]

- Legas, B. 7 Tips to Reduce Energy Costs; 2017. Available online: https://www.nist.gov/blogs/manufacturing-innovation-blog/7-tips-reduce-energy-costs (accessed on 3 June 2021).

- Trujillo-Baute, E.; del Río, P.; Mir-Artigues, P. Analysing the impact of renewable energy regulation on retail electricity prices. Energy Policy 2018, 114, 153–164. [Google Scholar] [CrossRef]

- de Miguel, C.; Gago, A.; Manzano, B.J.E.E. New developments in energy economics and policy. Energy Econ. 2013, 40, S1–S2. [Google Scholar] [CrossRef]

- Carley, S. State renewable energy electricity policies: An empirical evaluation of effectiveness. Energy Policy 2009, 37, 3071–3081. [Google Scholar] [CrossRef]

- Shields, L. State Renewable Portfolio Standards and Goals; National Conference of State Legislatures: Washington, DC, USA, 2021. [Google Scholar]

- Többen, J. Regional net impacts and social distribution effects of promoting renewable energies in Germany. Ecol. Econ. 2017, 135, 195–208. [Google Scholar] [CrossRef]

- Fetz, A.; Filippini, M. Economies of vertical integration in the Swiss electricity sector. Energy Econ. 2010, 32, 1325–1330. [Google Scholar] [CrossRef]

- Energy Information Administration. Electricity Explained, How Electricity is Delivered to Consumers; Energy Information Administration: Washington, DC, USA, 2020. [Google Scholar]

- Csereklyei, Z.; Qu, S.; Ancev, T. The effect of wind and solar power generation on wholesale electricity prices in Australia. Energy Policy 2019, 131, 358–369. [Google Scholar] [CrossRef]

- Carbaugh, B.; Sipic, T. Electric Utilities. J. Energy Dev. 2017, 43, 193–211. [Google Scholar]

- Watch, E. What Influences Electricity Pricing? Energy Information Administration: Washington, DC, USA, 2020. [Google Scholar]

- Do, L.P.C.; Lyócsa, Š.; Molnár, P. Impact of wind and solar production on electricity prices: Quantile regression approach. J. Oper. Res. Soc. 2019, 70, 1752–1768. [Google Scholar] [CrossRef]

- Congressional Research Service. The Value of Energy Tax Incentives for Different Types of Energy Resources; Congressional Research Service: Washington, DC, USA, 2019. [Google Scholar]

- Energy Information Administration. Annual Energy Outlook; Energy Information Administration: Washington, DC, USA, 2017. [Google Scholar]

- Quint, D.; Dahlke, S. The impact of wind generation on wholesale electricity market prices in the midcontinent independent system operator energy market: An empirical investigation. Energy 2019, 169, 456–466. [Google Scholar] [CrossRef]

- Frondel, M.; Ritter, N.; Schmidt, C.M.; Vance, C. Economic impacts from the promotion of renewable energy technologies: The German experience. Energy Policy 2010, 38, 4048–4056. [Google Scholar] [CrossRef]

- Lesser, J.A. Wind generation patterns and the economics of wind subsidies. Electr. J. 2013, 26, 8–16. [Google Scholar] [CrossRef]

- Frondel, M.; Sommer, S.; Vance, C. The burden of Germany’s energy transition: An empirical analysis of distributional effects. Econ. Anal. Policy 2015, 45, 89–99. [Google Scholar] [CrossRef]

- Yan, Y.; Zhang, H.; Long, Y.; Zhou, X.; Liao, Q.; Xu, N.; Liang, Y. A factor-based bottom-up approach for the long-term electricity consumption estimation in the Japanese residential sector. J. Environ. Manag. 2020, 270, 110750. [Google Scholar] [CrossRef]

- Mulder, M.; Scholtens, B. The impact of renewable energy on electricity prices in the Netherlands. Renew. Energy 2013, 57, 94–100. [Google Scholar] [CrossRef]

- Crawford, R. Life cycle energy and greenhouse emissions analysis of wind turbines and the effect of size on energy yield. Renew. Sustain. Energy Rev. 2009, 13, 2653–2660. [Google Scholar] [CrossRef]

- Mojarro, N. COVID-19 Is a Game-Changer for Renewable Energy: Here’s Why; World Economic Forum: Cologny, Switzerland, 2021. [Google Scholar]

- Weidlich, A.; Veit, D. A critical survey of agent-based wholesale electricity market models. Energy Econ. 2008, 30, 1728–1759. [Google Scholar] [CrossRef]

- Energy Information Administration. How Much of U.S. Carbon Dioxide Emissions are Associated with Electricity Generation? Energy Information Administration: Washington, DC, USA, 2020. [Google Scholar]

- Moreno, B.; López, A.J.; García-Álvarez, M.T. The electricity prices in the European Union. The role of renewable energies and regulatory electric market reforms. Energy 2012, 48, 307–313. [Google Scholar] [CrossRef]

- Kostakis, I. Socio-demographic determinants of household electricity consumption: Evidence from Greece using quantile regression analysis. Curr. Res. Environ. Sustain. 2020, 1. [Google Scholar] [CrossRef]

- Energy Information Administration. Annual Energy Outlook; Energy Information Administration: Washington, DC, USA, 2016. [Google Scholar]

- Yin, H.; Powers, N. Do state renewable portfolio standards promote in-state renewable generation? Energy Policy 2010, 38, 1140–1149. [Google Scholar] [CrossRef]

- Schumacher, K.; Yang, Z. The determinants of wind energy growth in the United States: Drivers and barriers to state-level development. Renew. Sustain. Energy Rev. 2018, 97, 1–13. [Google Scholar] [CrossRef]

- American Wind Energy Association. U.S. Wind Industry Market Reports; American Clean Power: Washington, DC, USA, 2019. [Google Scholar]

- Yi, H.; Feiock, R.C. Renewable energy politics: Policy typologies, policy tools, and state deployment of renewables. Policy Stud. J. 2014, 42, 391–415. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econ. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. GMM estimation with persistent panel data: An application to production functions. Econom. Rev. 2000, 19, 321–340. [Google Scholar] [CrossRef]

- Horrace, W.C.; Oaxaca, R.L. Results on the bias and inconsistency of ordinary least squares for the linear probability model. Econ. Lett. 2006, 90, 321–327. [Google Scholar] [CrossRef]

- Hsiao, C. Analysis of Panel Data; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Biresselioglu, M.E.; Kilinc, D.; Onater-Isberk, E.; Yelkenci, T. Estimating the political, economic and environmental factors’ impact on the installed wind capacity development: A system GMM approach. Renew. Energy 2016, 96, 636–644. [Google Scholar] [CrossRef]

- Nickell, S.; Nicolitsas, D. How does financial pressure affect firms? Eur. Econ. Rev. 1999, 43, 1435–1456. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Dahlberg, M.; Johansson, E. An examination of the dynamic behaviour of local governments using GMM bootstrapping methods. J. Appl. Econom. 2000, 15, 401–416. [Google Scholar] [CrossRef]

- Bouayad-Agha, S.; Vedrine, L. Estimation strategies for a spatial dynamic panel using GMM. A new approach to the convergence issue of European regions. Spat. Econ. Anal. 2010, 5, 205–227. [Google Scholar] [CrossRef]

- Mehrhoff, J. A Solution to the Problem of Too Many Instruments in Dynamic Panel data GMM. 2009. Available online: https://www.econstor.eu/handle/10419/32105 (accessed on 6 June 2021).

- Ullah, S.; Akhtar, P.; Zaefarian, G. Dealing with endogeneity bias: The generalized method of moments (GMM) for panel data. Ind. Mark. Manag. 2018, 71, 69–78. [Google Scholar] [CrossRef]

- Baum, C.F.; Schaffer, M.E.; Stillman, S. Instrumental variables and GMM: Estimation and testing. Stata J. 2003, 3, 1–31. [Google Scholar] [CrossRef]

- Roodman, D. How to do xtabond2: An introduction to difference and system GMM in Stata. Stata J. 2009, 9, 86–136. [Google Scholar] [CrossRef]

- Installed Wind Energy Capacity; Office of Energy Efficiency & Renewable Energy. 2018. Available online: https://www.energy.gov/eere/wind/downloads/2017-wind-technologies-market-report (accessed on 3 June 2021).

- Hamilton, J.; Liming, D. Careers in Wind Energy; United States Bureau of Labor Statistics. 2010. Available online: https://scholar.google.com.hk/scholar?hl=zh-TW&as_sdt=0%2C5&q=Careers+in+wind+energy+-+Bureau+of+Labor+Statistics&btnG= (accessed on 6 June 2021).

- U.S. Census Bureau. 2018. Available online: https://www.census.gov/topics/population.html (accessed on 3 June 2021).

- Clean Energy Technology Center. Database of State Incentives for Renewables & Efficiency, Renewable Portfolio Standards; Clean Energy Technology Center: Raleigh, NC, USA, 2018. [Google Scholar]

- Eisenbach Consulting. Deregulated Energy States & Markets; 2021. Available online: https://www.electricchoice.com/map-deregulated-energy-markets/ (accessed on 7 June 2021).

- National Centers for Environmental Information. 2019. Available online: https://www.nodc.noaa.gov/ (accessed on 3 June 2021).

- REN21 ENABLING TECHNOLOGIES AND ENERGY SYSTEMS INTEGRATION, Global Status Report. Available online: https://www.ren21.net/gsr-2017/chapters/chapter_06/chapter_06/#energy-storage-markets (accessed on 3 June 2021).

- Energy Information Administration. The Capability of U.S. Manufacturing to Switch Fuels. 2014. Available online: https://www.eia.gov/consumption/manufacturing/reports/2014/fuel_switching/ (accessed on 3 June 2021).

- Austin, R. Renewable Energy Mandates Raise Electricity Prices; Earth Techling. Available online: https://earthtechling.com/renewable-energy-mandates-raise-electricity-prices/ (accessed on 3 June 2021).

- Conca, J. Why Do Federal Subsidies Make Renewable Energy So Costly? Forbes: 2017. Available online: https://www.forbes.com/sites/jamesconca/2017/05/30/why-do-federal-subsidies-make-renewable-energy-so-costly/?sh=2caedcc9128c (accessed on 3 June 2021).

- Advantages and Challenges of Wind Energy. Available online: https://www.energy.gov/eere/wind/advantages-and-challenges-wind-energy (accessed on 3 June 2021).

- Byrne, R.H.; Nguyen, T.A.; Copp, D.A.; Chalamala, B.R.; Gyuk, I. Energy management and optimization methods for grid energy storage systems. IEEE Access 2017, 6, 13231–13260. [Google Scholar] [CrossRef]

- Fan, X.; Liu, B.; Liu, J.; Ding, J.; Han, X.; Deng, Y.; Lv, X.; Xie, Y.; Chen, B.; Hu, W. Battery technologies for grid-level large-scale electrical energy storage. Trans. Tianjin Univ. 2020, 26, 92–103. [Google Scholar] [CrossRef]

- Castillo, A.; Gayme, D.F. Grid-scale energy storage applications in renewable energy integration: A survey. Energy Convers. Manag. 2014, 87, 885–894. [Google Scholar] [CrossRef]

- Laugs, G.A.; Benders, R.M.; Moll, H.C. Balancing responsibilities: Effects of growth of variable renewable energy, storage, and undue grid interaction. Energy Policy 2020, 139, 111203. [Google Scholar] [CrossRef]

- Bailera, M.; Lisbona, P.; Romeo, L.M.; Espatolero, S. Power to Gas projects review: Lab, pilot and demo plants for storing renewable energy and CO2. Renew. Sustain. Energy Rev. 2017, 69, 292–312. [Google Scholar] [CrossRef]

- Ma, J.; Li, Q.; Kühn, M.; Nakaten, N. Power-to-gas based subsurface energy storage: A review. Renew. Sustain. Energy Rev. 2018, 97, 478–496. [Google Scholar] [CrossRef]

- Götz, M.; Lefebvre, J.; Mörs, F.; Koch, A.M.; Graf, F.; Bajohr, S.; Reimert, R.; Kolb, T. Renewable Power-to-Gas: A technological and economic review. Renew. Energy 2016, 85, 1371–1390. [Google Scholar] [CrossRef]

- Hassan, A.; Patel, M.K.; Parra, D. An assessment of the impacts of renewable and conventional electricity supply on the cost and value of power-to-gas. Int. J. Hydrog. Energy 2019, 44, 9577–9593. [Google Scholar] [CrossRef]

- Clement-Nyns, K.; Haesen, E.; Driesen, J. The impact of vehicle-to-grid on the distribution grid. Electr. Power Syst. Res. 2011, 81, 185–192. [Google Scholar] [CrossRef]

- Kempton, W.; Tomić, J. Vehicle-to-grid power fundamentals: Calculating capacity and net revenue. J. Power Sources 2005, 144, 268–279. [Google Scholar] [CrossRef]

- Mwasilu, F.; Justo, J.J.; Kim, E.-K.; Do, T.D.; Jung, J.-W. Electric vehicles and smart grid interaction: A review on vehicle to grid and renewable energy sources integration. Renew. Sustain. Energy Rev. 2014, 34, 501–516. [Google Scholar] [CrossRef]

- Quinn, C.; Zimmerle, D.; Bradley, T.H. An evaluation of state-of-charge limitations and actuation signal energy content on plug-in hybrid electric vehicle, vehicle-to-grid reliability, and economics. IEEE Trans. Smart Grid 2012, 3, 483–491. [Google Scholar] [CrossRef]

- Energy Information Administration. U.S. Electric System Is Made Up of Interconnections and Balancing Authorities. Available online: https://www.eia.gov/todayinenergy/detail.php?id=27152 (accessed on 3 June 2021).

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| ResPrice | 950 | 1.07 | 0.12 | 0.84 | 1.59 |

| ComPrice | 950 | 1.00 | 0.12 | 0.75 | 1.56 |

| IndPrice | 950 | 0.86 | 0.15 | 0.60 | 1.51 |

| TotPrice | 950 | 0.99 | 0.13 | 0.74 | 1.55 |

| Wind | 950 | 0.03 | 0.06 | 0.00 | 0.37 |

| ResCus | 950 | 6.20 | 0.43 | 5.35 | 7.13 |

| ComCus | 950 | 5.36 | 0.40 | 4.58 | 6.26 |

| IndCus | 950 | 3.90 | 0.51 | 2.27 | 5.23 |

| TotCus | 950 | 6.26 | 0.42 | 5.44 | 7.19 |

| GDP | 950 | 11.28 | 0.45 | 10.37 | 12.45 |

| RPS | 950 | 0.47 | 0.50 | 0.00 | 1.00 |

| DeReg | 950 | 0.30 | 0.46 | 0.00 | 1.00 |

| TaxCred | 950 | 10.12 | 0.26 | 9.67 | 10.41 |

| Temp | 931 | 1.71 | 0.07 | 1.39 | 1.87 |

| NatGas | 950 | 1.03 | 0.07 | 0.89 | 1.14 |

| Coal | 950 | 1.54 | 0.12 | 1.33 | 1.67 |

| Variable | Residential | Industrial | Commercial | Total |

|---|---|---|---|---|

| Wind | 0.064 ** | 0.126 *** | 0.090 *** | 0.057 * |

| (0.027) | (0.044) | (0.032) | (0.031) | |

| Customers | −0.050 | −0.064 *** | −0.197 *** | −0.105 |

| (0.082) | (0.014) | (0.059) | (0.094) | |

| GDP | 0.031 | −0.066 | −0.021 | 0.010 |

| (0.040) | (0.051) | (0.040) | (0.045) | |

| RPS | 0.011 *** | −0.002 | 0.004 | 0.007 |

| (0.004) | (0.006) | (0.005) | (0.004) | |

| DeReg | 0.032 *** | 0.021 | 0.009 | 0.021 |

| (0.012) | (0.019) | (0.014) | (0.013) | |

| TaxCred | −0.006 | 0.005 | −0.018 | 0.000 |

| (0.015) | (0.024) | (0.018) | (0.017) | |

| NatGas | −0.075 *** | 0.173 *** | 0.039 * | 0.006 |

| (0.018) | (0.029) | (0.021) | (0.020) | |

| CoalPrice | 0.224 *** | 0.186 *** | 0.224 | 0.209 *** |

| (0.036) | (0.057) | (0.044) | (0.040) | |

| Temp | 0.266 *** | −0.183 | 0.170 | 0.150 |

| (0.092) | (0.147) | (0.108) | (0.103) | |

| _cons | 0.353 | 1.640 *** | 1.786 *** | 0.935 * |

| (0.438) | (0.619) | -(0.478) | (0.496) |

| Variable | Residential | Industrial | Commercial | Total |

|---|---|---|---|---|

| L1. | 0.861 *** | 0.814 *** | 0.883 *** | 0.866 *** |

| (0.028) | (0.027) | (0.024) | (0.024) | |

| Wind | 0.016 | 0.078 * | 0.066 ** | 0.034 |

| (0.028) | (0.044) | (0.031) | (0.031) | |

| Customers | −0.085 ** | 0.013 | 0.0382 ** | −0.068 |

| (0.042) | (0.011) | (0.019) | (0.047) | |

| GDP | 0.053 | −0.029 | −0.043 ** | 0.038 |

| (0.039) | (0.020) | (0.018) | (0.043) | |

| RPS | 0.015 ** | 0.010 | 0.007 | 0.014 *** |

| (0.004) | (0.007) | (0.005) | (0.005) | |

| DeReg | 0.010 | 0.016 | 0.028 *** | 0.009 |

| (0.007) | (0.012) | (0.011) | (0.008) | |

| TaxCred | −0.008 | −0.017 | −0.017* | −0.005 |

| (0.009) | (0.014) | (0.010) | (0.009) | |

| NatGas | 0.090 *** | 0.212 *** | 0.123 *** | 0.126 *** |

| (0.012) | (0.019) | (0.013) | (0.013) | |

| Coal | 0.009 | −0.022 | 0.004 | −0.024 |

| (0.021) | (0.034) | (0.024) | (0.022) | |

| Temp | 0.001 ** | 0.000 | 0.000 | 0.001 * |

| (0.000) | (0.001) | (0.001) | (0.000) | |

| _cons | −0.021 | 0.427 * | 0.406 * | 0.038 |

| (0.224) | (0.160) | (0.218) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dorrell, J.; Lee, K. The Price of Wind: An Empirical Analysis of the Relationship between Wind Energy and Electricity Price across the Residential, Commercial, and Industrial Sectors. Energies 2021, 14, 3363. https://doi.org/10.3390/en14123363

Dorrell J, Lee K. The Price of Wind: An Empirical Analysis of the Relationship between Wind Energy and Electricity Price across the Residential, Commercial, and Industrial Sectors. Energies. 2021; 14(12):3363. https://doi.org/10.3390/en14123363

Chicago/Turabian StyleDorrell, John, and Keunjae Lee. 2021. "The Price of Wind: An Empirical Analysis of the Relationship between Wind Energy and Electricity Price across the Residential, Commercial, and Industrial Sectors" Energies 14, no. 12: 3363. https://doi.org/10.3390/en14123363

APA StyleDorrell, J., & Lee, K. (2021). The Price of Wind: An Empirical Analysis of the Relationship between Wind Energy and Electricity Price across the Residential, Commercial, and Industrial Sectors. Energies, 14(12), 3363. https://doi.org/10.3390/en14123363