Economic Evaluation of Wind Power Projects in a Mix of Free and Regulated Market Environments in Brazil

Abstract

1. Introduction

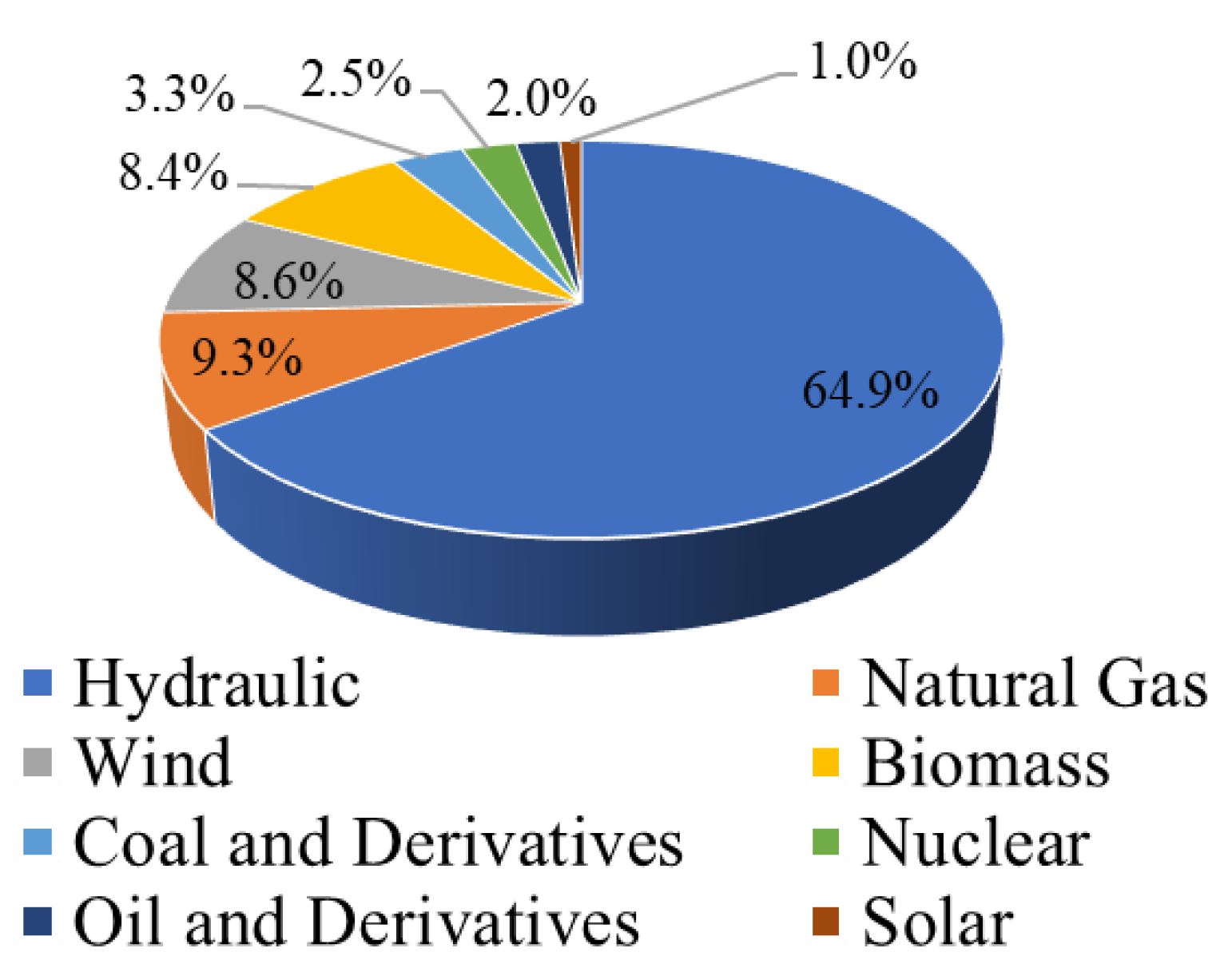

2. The Brazilian Electricity System

2.1. Electricity Market Organization

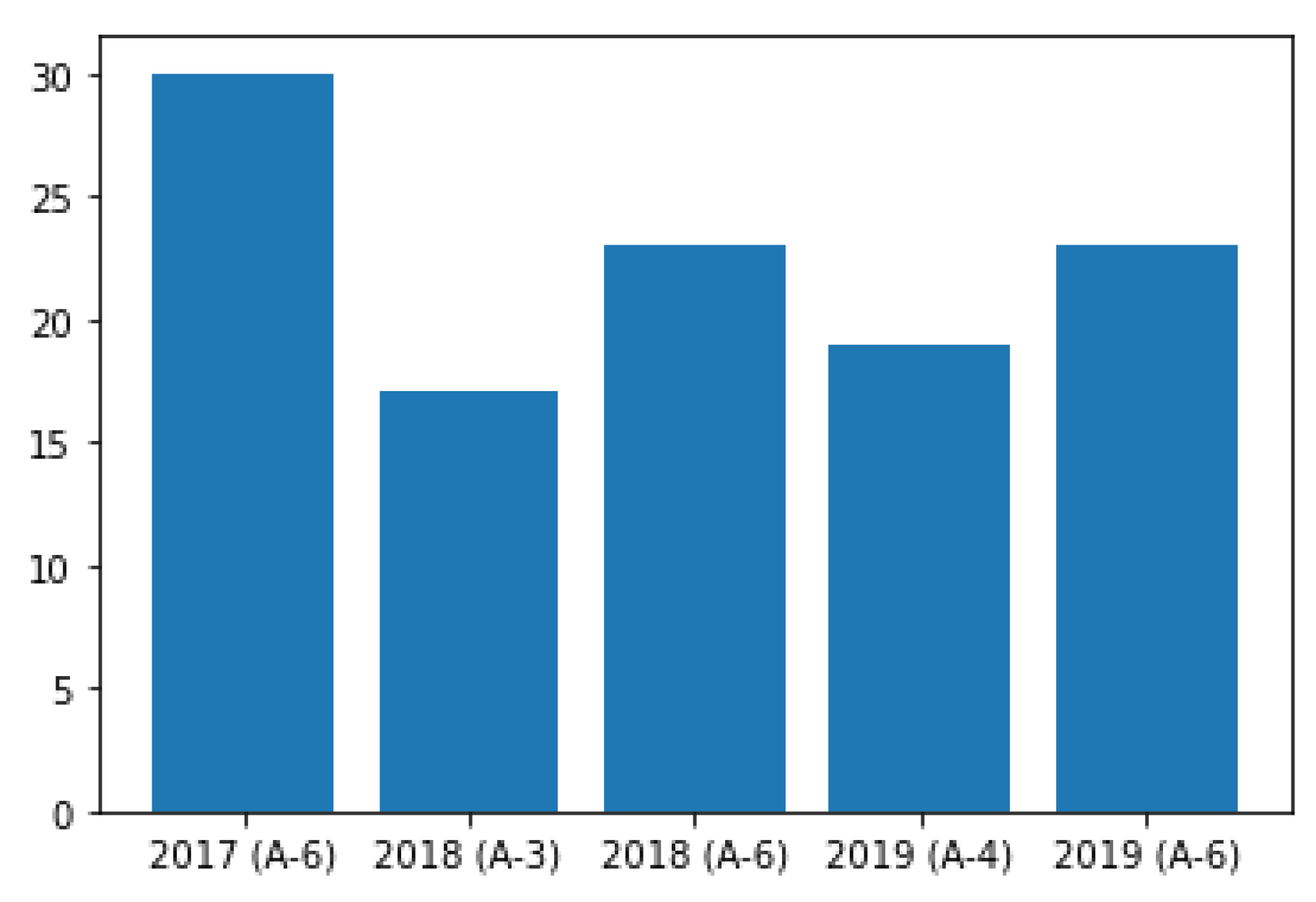

2.2. Wind Power in Brazil

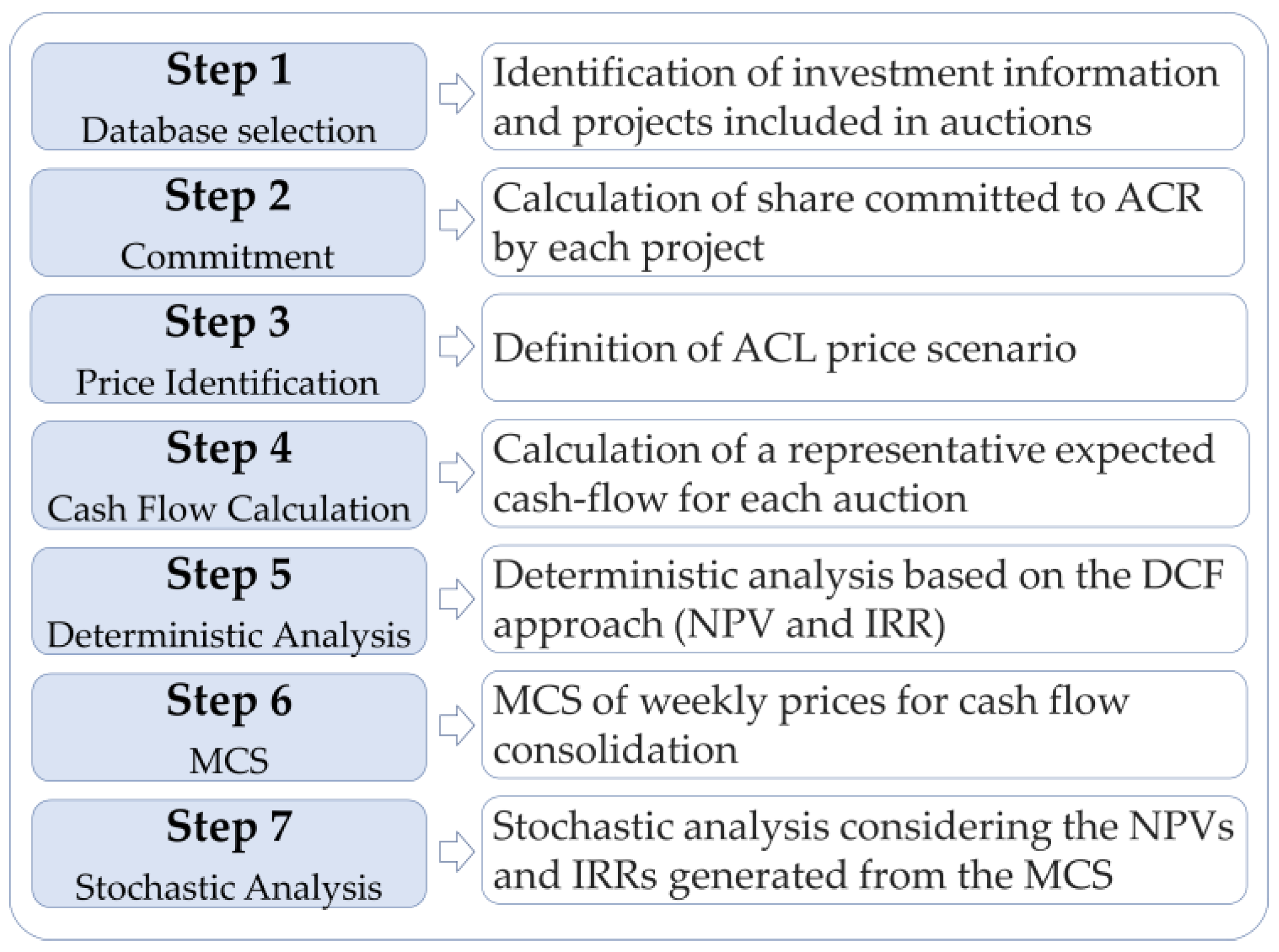

3. Materials and Methods

3.1. Methdological Procedure

3.2. Data and Cash-Flow Model

4. Results

4.1. Deterministic Analysis

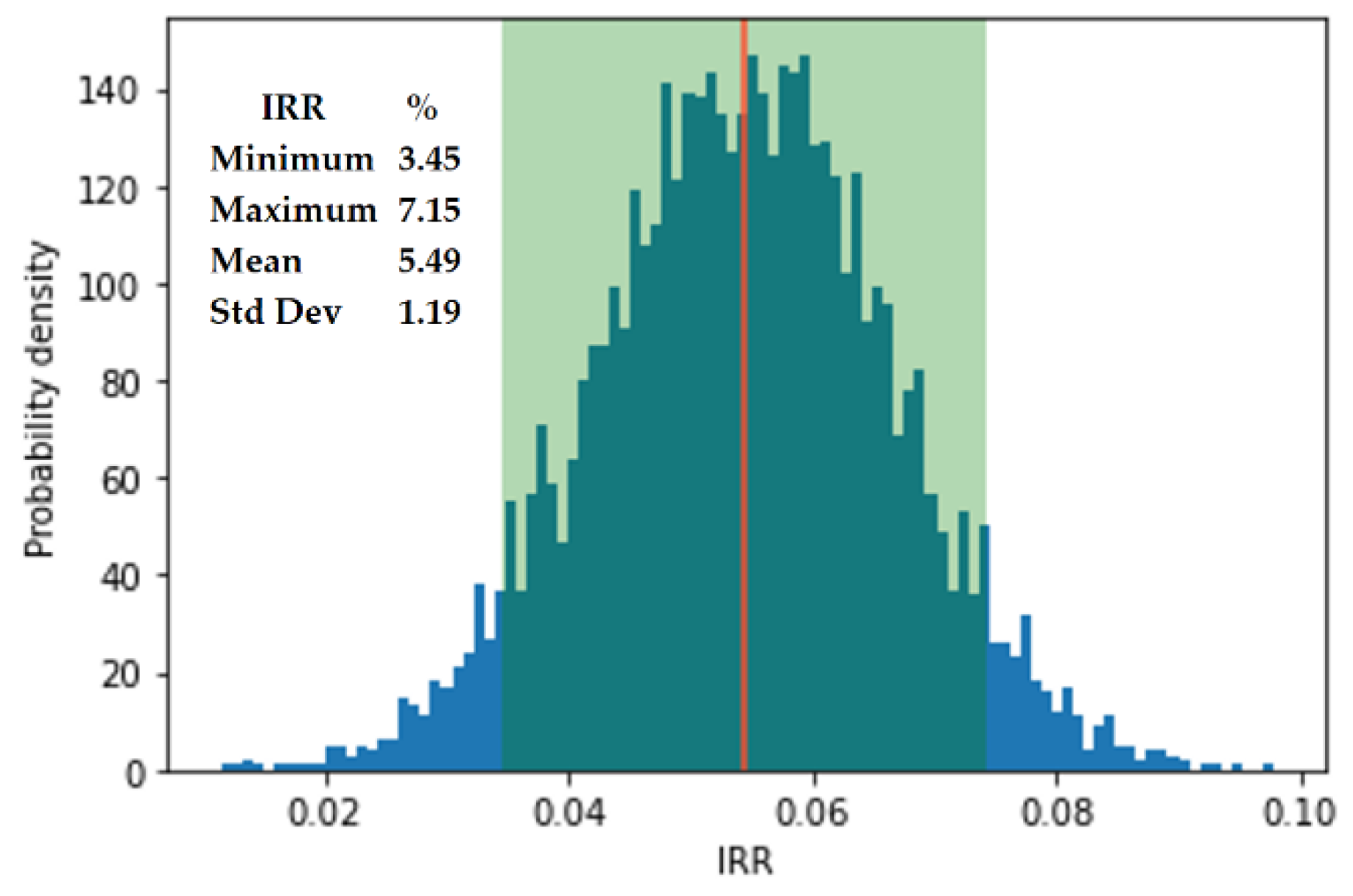

4.2. Stochastic Analysis

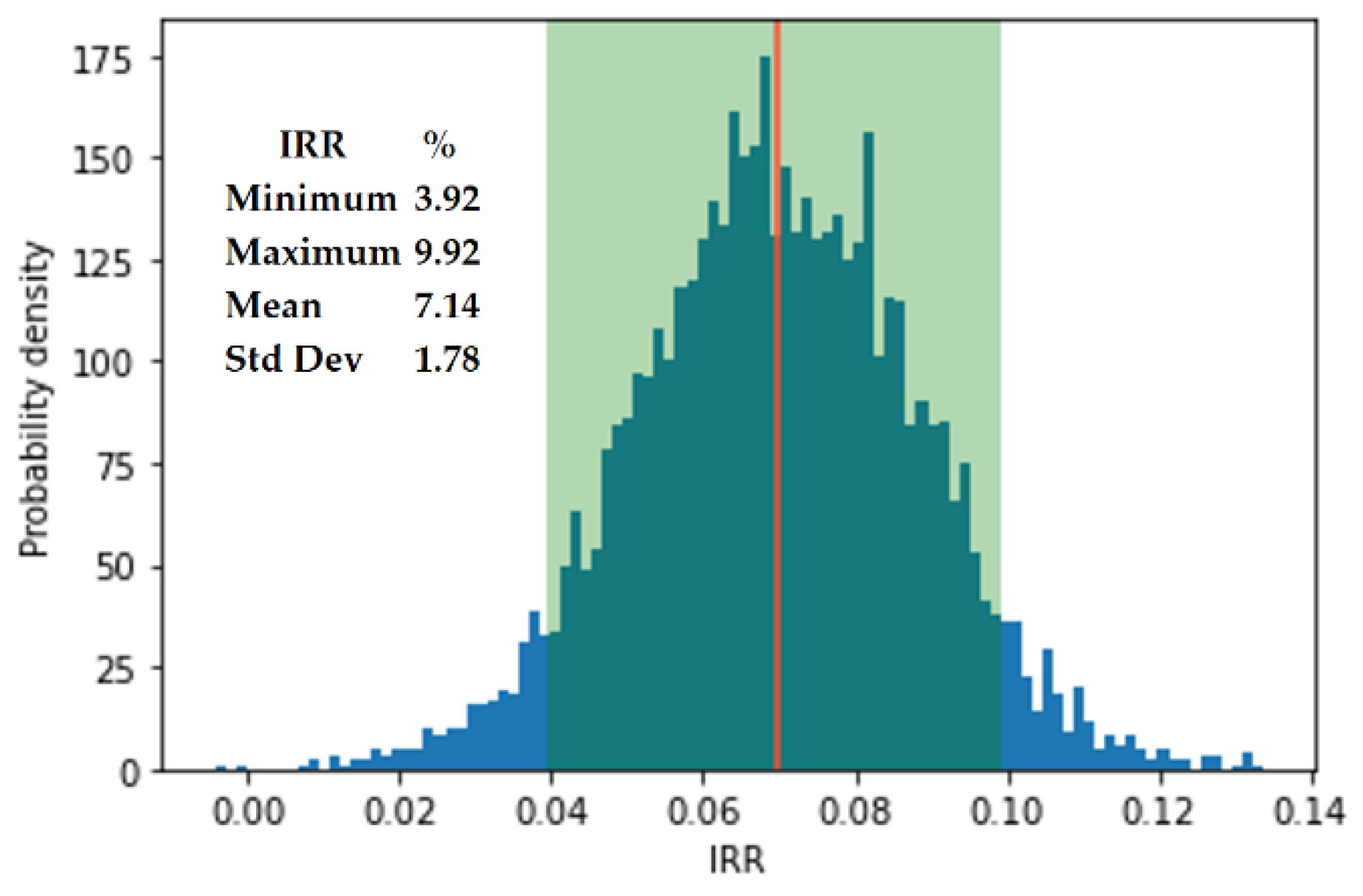

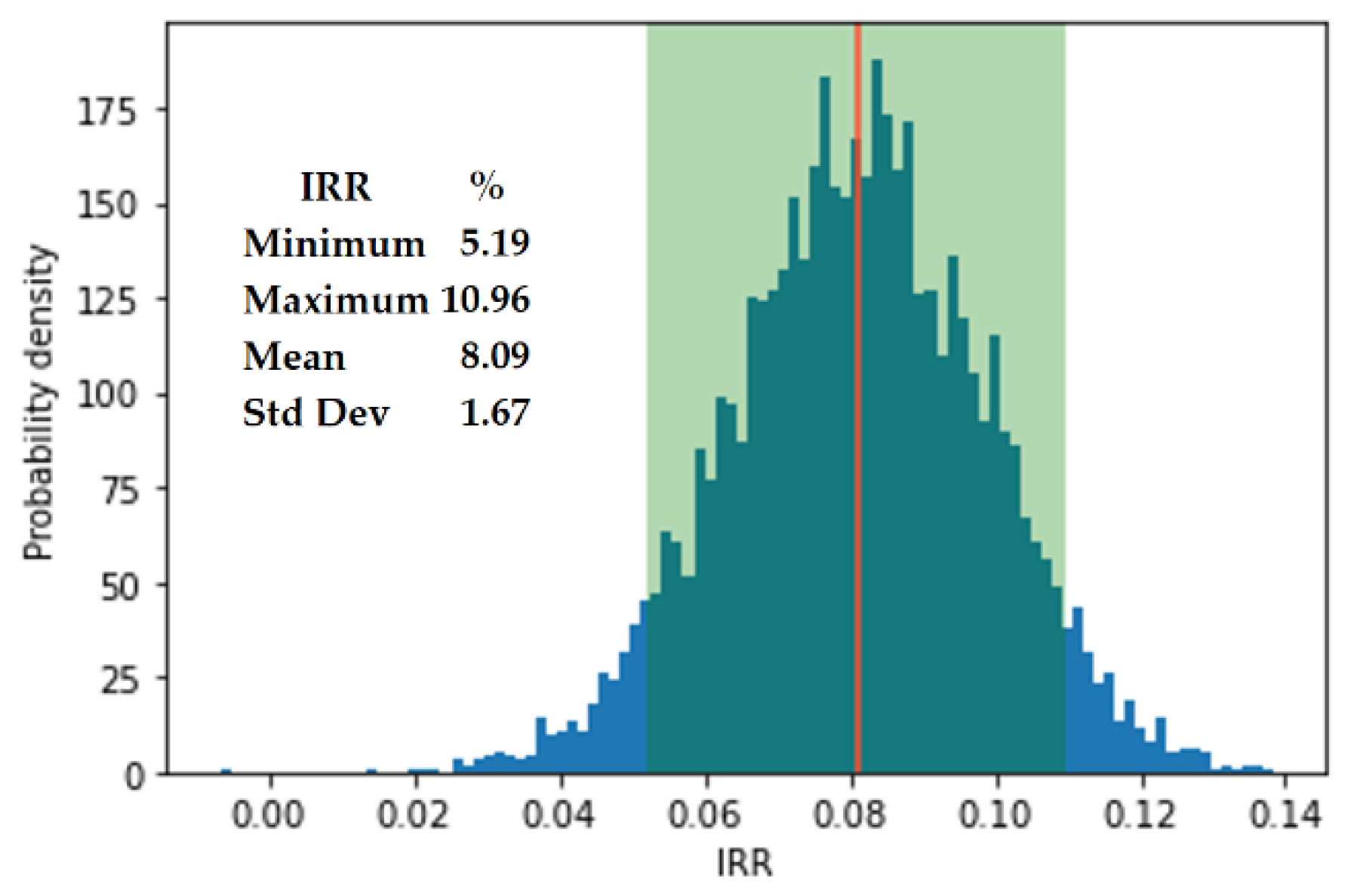

4.2.1. Ex-Ante Average Prices (Scenario C)

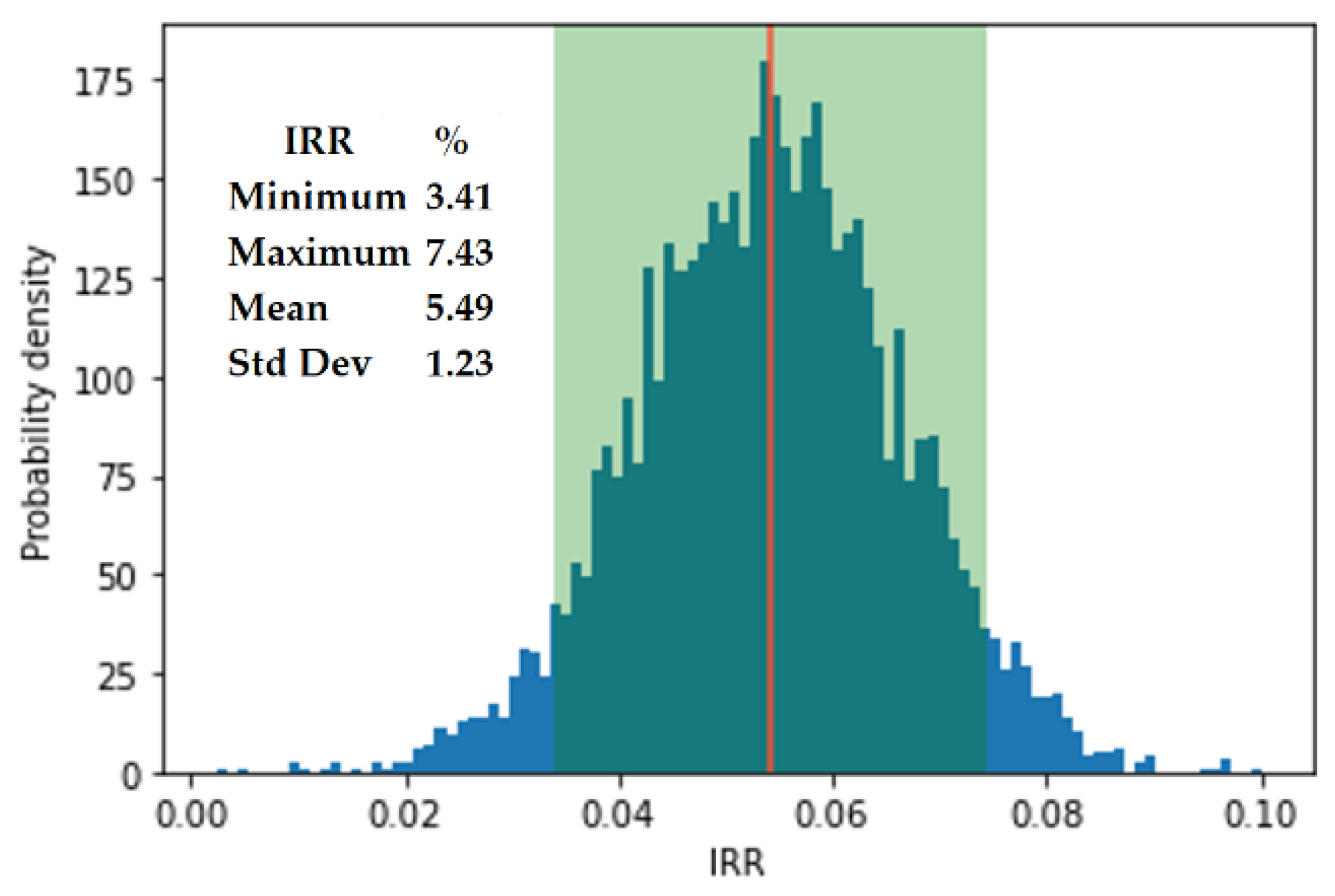

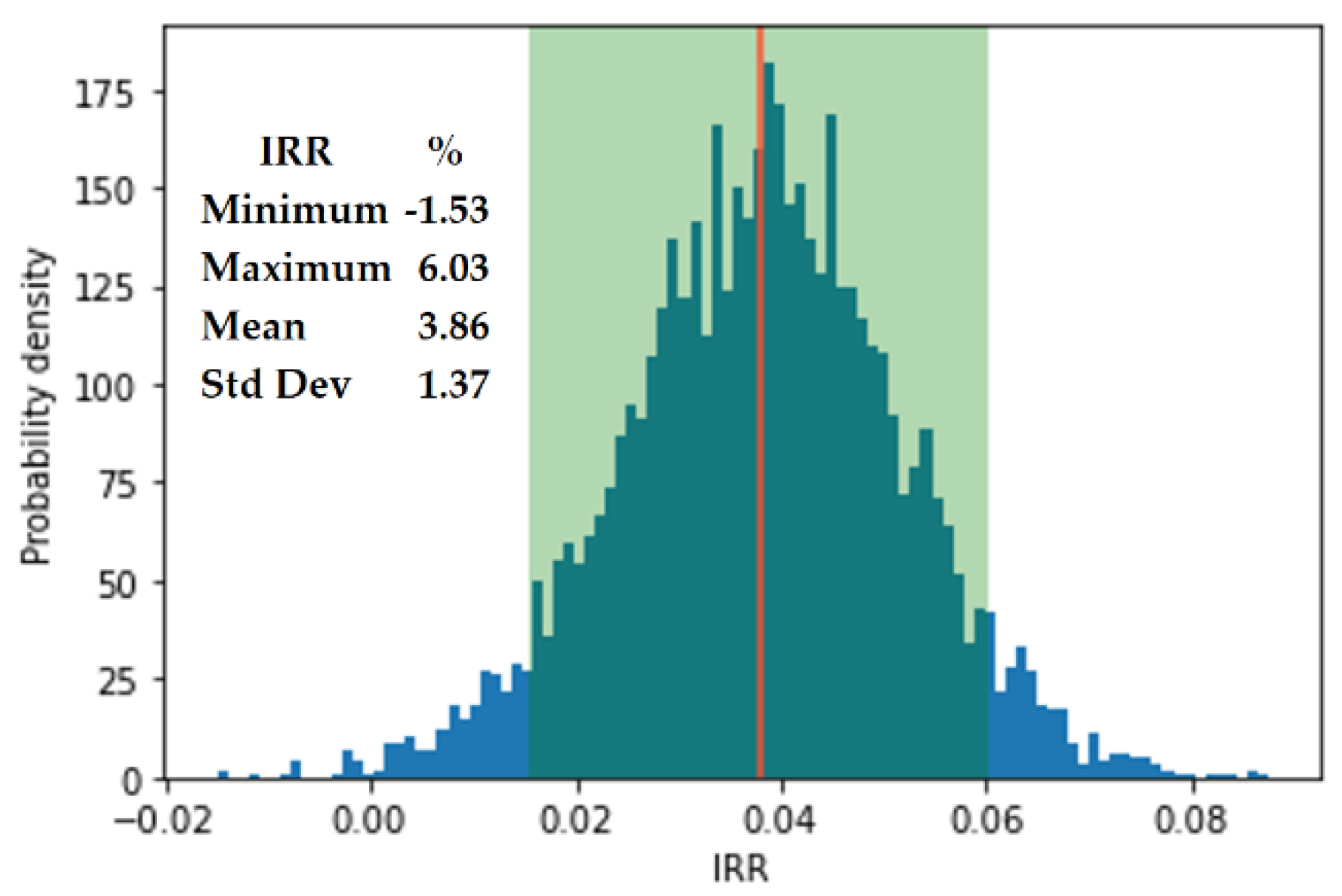

4.2.2. Ex-Post Average Prices (Scenario D)

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- IEA. Global CO2 emissions in 2019, Paris. 2020. Available online: https://www.iea.org/articles/global-co2-emissions-in-2019 (accessed on 28 September 2020).

- BP. Statistical Review of World Energy. 2019. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-full-report.pdf (accessed on 28 November 2020).

- United Nations. Sustainable Development Goals. 2020. Available online: https://www.undp.org/content/undp/en/home/sustainable-development-goals.html (accessed on 28 November 2020).

- De Queiroz, A.R. Stochastic hydro-thermal scheduling optimization: An overview. Renew. Sustain. Energy Rev. 2016, 62, 382–395. [Google Scholar] [CrossRef]

- ANEEL. Sistema de Informações de Geração da ANEEL—SIGA. 2020. Available online: https://www.aneel.gov.br/siga (accessed on 20 January 2021).

- ABEEOLICA. INFOWIND. 2020. Available online: http://abeeolica.org.br/wp-content/uploads/2020/06/InfoventoEN_16.pdf (accessed on 28 January 2021).

- De Jong, P.; Dargaville, R.; Silver, J.; Utembe, S.; Kiperstok, A.; Torres, E.A. Forecasting high proportions of wind energy supplying the Brazilian Northeast electricity grid. Appl. Energy 2017, 195, 538–555. [Google Scholar] [CrossRef]

- EPE. Participação de Empreendimentos Eólicos nos Leilões de Energia no Brasil, Rio de Janeiro—RJ. 2018. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-251/topico-394/NT_EPE-DEE-NT-041_2018-r0.pdf (accessed on 30 January 2021).

- Da Silva, N.F.; Rosa, L.P.; Freitas, M.A.V.; Pereira, M.G. Wind energy in Brazil: From the power sector’s expansion crisis model to the favorable environment. Renew. Sustain. Energy Rev. 2013, 22, 686–697. [Google Scholar] [CrossRef]

- Pereira, M.G.; Camacho, C.F.; Freitas, M.A.V.; da Silva, N.F. The renewable energy market in Brazil: Current status and potential. Renew. Sustain. Energy Rev. 2012, 16, 3786–3802. [Google Scholar] [CrossRef]

- CCEE. Setor Elétrico. 2019. Available online: https://www.ccee.org.br/portal/faces/pages_publico/onde-atuamos/setor_eletrico?_adf.ctrl-state=68ttd253h_103&_afrLoop=5168273257385 (accessed on 20 February 2021).

- Dalbem, M.C.; Brandão, L.E.T.; Gomes, L.L. Can the regulated market help foster a free market for wind energy in Brazil? Energy Policy 2014, 66, 303–311. [Google Scholar] [CrossRef]

- Aquila, G.; Rocha, L.C.S.; Junior, P.R.; Pamplona, E.d.; de Queiroz, A.R.; de Paiva, A.P. Wind power generation: An impact analysis of incentive strategies for cleaner energy provision in Brazil. J. Clean. Prod. 2016, 137, 1100–1108. [Google Scholar] [CrossRef]

- Aquila, G.; Junior, P.R.; Pamplona, E.d.; de Queiroz, A.R. Wind power feasibility analysis under uncertainty in the Brazilian electricity market. Energy Econ. 2017, 65, 127–136. [Google Scholar] [CrossRef]

- Bradshaw, A. Regulatory change and innovation in Latin America: The case of renewable energy in Brazil. Util. Policy 2017, 49, 156–164. [Google Scholar] [CrossRef]

- de Souza, F.C.; Legey, L.F.L. Brazilian electricity market structure and risk management tools. In Proceedings of the 2008 IEEE Power and Energy Society General Meeting-Conversion and Delivery of Electrical Energy in the 21st Century, Pittsburgh, PA, USA, 20–24 July 2008; pp. 1–8. [Google Scholar]

- Juárez, A.A.; Araújo, A.M.; Rohatgi, J.S.; de Oliveira Filho, O.D.Q. Development of the wind power in Brazil: Political, social and technical issues. Renew. Sustain. Energy Rev. 2014, 39, 828–834. [Google Scholar] [CrossRef]

- Federative Units of Brazil. LAW N. 10,848, 15 March 2004. Regulates the Sale of Electric Energy. 2004. Available online: http://www.planalto.gov.br/ccivil_03/_ato2004-2006/2004/lei/l10.848.htm (accessed on 20 February 2021).

- CCEE. PLD Preços Médios. 2020. Available online: https://www.ccee.org.br/portal/faces/pages_publico/o-que-fazemos/como_ccee_atua/precos/precos_medios?_afrLoop=517725417725855&_adf.ctrl-state=w2rc8dbwt_1#!%40%40%3F_afrLoop%3D517725417725855%26_adf.ctrl-state%3Dw2rc8dbwt_5 (accessed on 20 February 2021).

- Pao, H.-T.; Fu, H.-C. Renewable energy, non-renewable energy and economic growth in Brazil. Renew. Sustain. Energy Rev. 2013, 25, 381–392. [Google Scholar] [CrossRef]

- EPE. Balanço Energético Nacional 2020: Ano Base 2019. Rio de Janeiro—RJ. 2020. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-479/topico-521/RelatórioSínteseBEN2020-ab2019_Final.pdf (accessed on 20 March 2021).

- Simas, M.; Pacca, S. Assessing employment in renewable energy technologies: A case study for wind power in Brazil. Renew. Sustain. Energy Rev. 2014, 31, 83–90. [Google Scholar] [CrossRef]

- EPE. Plano Decenal de Expansão de Energia 2029. Brasília-DF. 2019. Available online: http://www.mme.gov.br/c/document_library/get_file?uuid=a18d104e-4a3f-31a8-f2cf-382e654dbd20&groupId=36189 (accessed on 20 March 2021).

- IRENA. Renewable Energy Capacity Statistics 2020. 2020. Available online: File:///C:/Users/vande/Downloads/IRENA_RE_Capacity_Statistics_2020.pdf (accessed on 20 March 2021).

- Abraceel. Nordeste é Responsável por 86% da Produção de Energia Eólica no País. 2019. Available online: https://abraceel.com.br/clipping/2019/05/nordeste-e-responsavel-por-86-da-producao-de-energia-eolica-no-pais (accessed on 20 September 2020).

- MME. Portaria N. 101. 2016. Available online: http://www2.aneel.gov.br/cedoc/prt2016101mme.pdf (accessed on 20 September 2020).

- Lai, C.S.; Locatelli, G. Economic and financial appraisal of novel large-scale energy storage technologies. Energy 2021, 214, 118954. [Google Scholar] [CrossRef]

- Pindyck, R.S. The dynamics of commodity spot and futures markets: A primer. Energy J. 2001, 22. [Google Scholar] [CrossRef]

- de Abreu Pereira Uhr, D.; Chagas, A.L.S.; Uhr, J.G.Z. Estimation of elasticities for electricity demand in Brazilian households and policy implications. Energy Policy 2019, 129, 69–79. [Google Scholar] [CrossRef]

- Custódio, R.S. Energia Eólica Para Produção de Energia Elétrica; Synergia: Rio de Janeiro, Spain, 2013. [Google Scholar]

- de Energia, C.C.P. Manual de Avaliação Técnico-Econômica de Empreendimentos Eólicos-Elétricos Curitiba-PR. 2007. Available online: File:///C:/Users/vande/Downloads/ManualdeAvaliacaoTecnicoEconomicadeEmpreendimentosEolioEletricos.pdf (accessed on 20 January 2021).

- Aquila, G.; de Queiroz, A.R.; Balestrassi, P.P.; Junior, P.R.; Rocha LC, S.; Pamplona, E.O.; Nakamura, W.T. Wind energy investments facing uncertainties in the Brazilian electricity spot market: A real options approach. Sustain. Energy Technol. Assess. 2020, 42, 100876. [Google Scholar] [CrossRef]

- ANEEL. Nota Técnica n° 146/2018-SGT/ANEEL. Estabelecimento das Tarifas de Uso do Sistema de Transmissão—T U S T para o Ciclo 2018–2019. 2018. Available online: https://www.aneel.gov.br/consultas-publicas-antigas?p_p_id=participacaopublica_WAR_participacaopublicaportlet&p_p_lifecycle=2&p_p_state=normal&p_p_mode=view&p_p_cacheability=cacheLevelPage&p_p_col_id=column-2&p_p_col_pos=1&p_p_col_count=2&_participacaopub (accessed on 20 January 2021).

- ANEEL. Resolução Normativa n. 77. 2004. Available online: http://www2.aneel.gov.br/cedoc/bren2004077.pdf (accessed on 20 September 2020).

- ANEEL. Diretoria da ANEEL Aprova Nova Metodologia Para WACC. 2020. Available online: http://bit.ly/2Q3iTDf (accessed on 20 March 2021).

- Federative Units of Brazil. LAW N. 12,783, From January 2013. 2013. Available online: http://www.planalto.gov.br/ccivil_03/_ato2011-2014/2013/lei/l12783.htm (accessed on 20 March 2021).

- ANEEL. Limites do PLD Para 2018 São Homologados. 2018. Available online: https://www.aneel.gov.br/sala-de-imprensa-exibicao-2/-/asset_publisher/zXQREz8EVlZ6/content/limites-do-pld-para-2018-sao-homologados/656877/pop_up?_101_INSTANCE_zXQREz8EVlZ6_viewMode=print&_101_INSTANCE_zXQREz8EVlZ6_languageId=pt_BR (accessed on 20 September 2020).

- ANEEL. Audiência Pública Sobre Limites de PLD. 2019. Available online: https://www.aneel.gov.br/sala-de-imprensa-exibicao-2/-/asset_publisher/zXQREz8EVlZ6/content/audiencia-publica-sobre-limites-de-pld-recebe-contribuicoes-ate-2-8-2019/656877/pop_up?_101_INSTANCE_zXQREz8EVlZ6_viewMode=print&_101_INSTANCE_zXQREz8EVlZ6_languag (accessed on 20 September 2020).

- CCEE. Weekly PLD Average Prices. 2021. Available online: https://www.ccee.org.br/portal/faces/preco_horario_veja_tambem/preco_media_semanal?_adf.ctrl-state=19e1rie1ii_1&_afrLoop=218510562303619 (accessed on 20 March 2021).

| Characteristics | ACL Market | ACR Market |

|---|---|---|

| Participants | Generators, traders, free and special consumers | Generators, distributors, and traders |

| Contracts | Free negotiation between buyers and sellers | Energy auctions promoted by CCEE, delegated by the regulatory agency (ANEEL) |

| Kind of Contract | Freely established agreement between the agents | Regulated by ANEEL. Called Electric Energy Trading Contract in the Regulated Environment. (CCEAR) |

| Price | Freely agreed between the agents | Given in the auction |

| Year | Number of Companies | Auction | % | Standard Deviation (%) |

|---|---|---|---|---|

| 2018 | 48 | 28 | 54.69 | 27.03 |

| 2019 | 3 | 29 | 30.24 | 0.17 |

| 2019 | 44 | 30 | 36.27 | 17.13 |

| Total | 95 | Average | 40.04% |

| Price\Year | 2018 | 2019 |

|---|---|---|

| Min. (A) | 10.37 | 10.23 |

| Max. (B) | 130.53 | 124.12 |

| Average (C) | 70.45 | 67.17 |

| Average (D) | 70.78 | 40.39 |

| Auction | Projects’ Investments Costs (USD) | Installed Power (MW) | ||||||

|---|---|---|---|---|---|---|---|---|

| Min | Max | Average | Std. Dev. | Min | Max | Average | Std. Dev. | |

| 28 | 9,767,441 | 89,534,883 | 31,410,153 | 16,851,000 | 8.4 | 69.3 | 26.05 | 15.09 |

| 29 | 20,803,442 | 53,875,657 | 42,851,585 | 15,590,391 | 21 | 37.1 | 31.73 | 7.59 |

| 30 | 8,115,942 | 73,043,478 | 24,642,585 | 14,161,714 | 8.4 | 75.6 | 23.64 | 13.83 |

| Cash Flow Assumptions | ACRCF | ACLCF |

|---|---|---|

| Initial Investment | Auction 28: 31,410,153 Auction 29: 42,851,585 Auction 30: 24,642,585 | |

| Duration (Years) | 20 | |

| Estimated Production (MWh/year) | Auction 28: 76,668 Auction 29: 44,384 Auction 30: 36,055 | Auction 28: 43,556 Auction 29: 102,270 Auction 30: 59,549 |

| Price (USD/MWh) | Auction 28: 23.31 Auction 29: 19.32 Auction 30: 23.85 | Table 3 |

| Weekly Volatility (%) | - | 34.75 |

| Revenue (USD) | Price × Estimated Production | Price × Estimated Production |

| (−) PIS/PASEP (% of Revenue) | 1.65 | 1.65 |

| (−) COFINS (% of Revenue) | 7.6 | 7.6 |

| (−) Operational Costs (% of Revenue) | 12.5 | 12.5 |

| (−) ONS/CCEE tariff (% of Revenue) | 1 | 1 |

| (−) Leasing (% of Revenue) | 1 | 1 |

| (−) Transmission cost (USD/kWh) | Auction 28: 30.12 Auction 29: 43.71 Auction 30: 28.49 | - |

| (=) Cash Flow | (USD) | (USD) |

| (−) Depreciation (% of Revenue) | 5 | 5 |

| (=) Taxable Cash Flow | (USD) | (USD) |

| (−) Social Contribution | (% Taxable Cash Flow) | (% Taxable Cash Flow) |

| (−) Income Tax | (% Taxable Cash Flow) | (% Taxable Cash Flow) |

| (+) Depreciation | (USD) | (USD) |

| (=) Free Cash Flow | (USD) | (USD) |

| Scenarios | Auction | NPV (USD) | IRR (%) | IRR–WACC (%) |

|---|---|---|---|---|

| A | 28th | −18,993,520 | −1.53 | −9.19 |

| 29th | −31,649,641 | −5.11 | −12.50 | |

| 30th | −16,331,533 | −3.04 | −10.43 | |

| B | 28th | 7,761,046 | 10.33 | 2.67 |

| 29th | 29,364,263 | 14.07 | 6.68 | |

| 30th | 19,310,951 | 14.90 | 7.51 | |

| C | 28th | −5,619,755 | 5.46 | −2.20 |

| 29th | −1,129,753 | 7.09 | −0.30 | |

| 30th | 1,538,147 | 8.09 | 0.7 | |

| D | 28th | −5,543,244 | 5.49 | −2.17 |

| 29th | −15,557,752 | 2.64 | −4.75 | |

| 30th | −6,880,476 | 3.86 | −3.53 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Delapedra-Silva, V.A.; Ferreira, P.; Cunha, J.; Kimura, H. Economic Evaluation of Wind Power Projects in a Mix of Free and Regulated Market Environments in Brazil. Energies 2021, 14, 3325. https://doi.org/10.3390/en14113325

Delapedra-Silva VA, Ferreira P, Cunha J, Kimura H. Economic Evaluation of Wind Power Projects in a Mix of Free and Regulated Market Environments in Brazil. Energies. 2021; 14(11):3325. https://doi.org/10.3390/en14113325

Chicago/Turabian StyleDelapedra-Silva, Vanderson Aparecido, Paula Ferreira, Jorge Cunha, and Herbert Kimura. 2021. "Economic Evaluation of Wind Power Projects in a Mix of Free and Regulated Market Environments in Brazil" Energies 14, no. 11: 3325. https://doi.org/10.3390/en14113325

APA StyleDelapedra-Silva, V. A., Ferreira, P., Cunha, J., & Kimura, H. (2021). Economic Evaluation of Wind Power Projects in a Mix of Free and Regulated Market Environments in Brazil. Energies, 14(11), 3325. https://doi.org/10.3390/en14113325