1. Introduction

The design of future power systems is more challenging than ever for a variety of reasons. The highly demanding decarbonization targets to achieve by the electricity sector in the forthcoming years are pushing renewable generation technologies to replace conventional ones. For instance, a reduction of 80–95% of greenhouse gas emissions in 2050 compared to the 1990 levels has been established by the European Commission in [

1]. This ambitious benchmark will require, among other measures, that the CO

emissions of the power sector be almost null. However, considering that the availability and dispatchability of the production of most renewable power plants is much lower than those of traditional generating units, a massive incorporation of renewable plants can have sensible consequences on the day to day operation of future power systems. The possibility of increasing the energy storage capacity will be key to facilitate the integration of renewable power units. In this manner, part of the exceeding energy in periods with high renewable production may be used afterwards when the available renewable production be lower. To date, only hydro pumping units have proven to be technical and economically feasible options to store large amounts of energy that can be transformed into electricity. However, the installation of new hydro pumping units is constrained by the existence of hydro resources in appropriate locations and by the huge environmental impact typical of this type of power plants. From the set of new energy storage technologies, electrochemical batteries seem to be the most promising option. This type of energy storage is characterized by high charge and discharge efficiencies, long cycle life, modular structure and flexible power and energy characteristics. As a consequence of these characteristics, batteries can be used for load shifting, mitigation of local load fluctuations and the provision of frequency regulation [

2].

Regarding the presence of renewable units, isolated systems constitute a particular case compared with the current situation of well-connected systems. Due to security reasons, the generation mix of isolated systems is primarily composed by small generators. In this manner, the unexpected failure of one generator does not jeopardize the operation of the system. These small generators are usually thermal generators fed by fossil fuels. The difference between isolated and well-connected systems can be observed if we compare the isolated power systems of the Canary Islands, in Spain, with respect to the mainland Spanish power system in 2019. Although the renewable potentials of the Canary Islands are higher than those in the Iberian Peninsula, generation units based on renewable energies in the Canary Islands only represented 7.5% of the total capacity, whereas these power sources comprised 52% of the capacity in the mainland Spanish power system. Observe that the main reason explaining the low penetration of renewable energies in isolated systems is that the operation of these systems is more vulnerable to the variability and uncertainty of renewable resources than that in well-connected systems.

The objective of this paper is to design a renewable-dominated isolated power system of Las Palmas, Spain, by the year 2050. Las Palmas belongs to the Canary Islands archipelago and is one of the 50 provinces in which Spain is divided into.

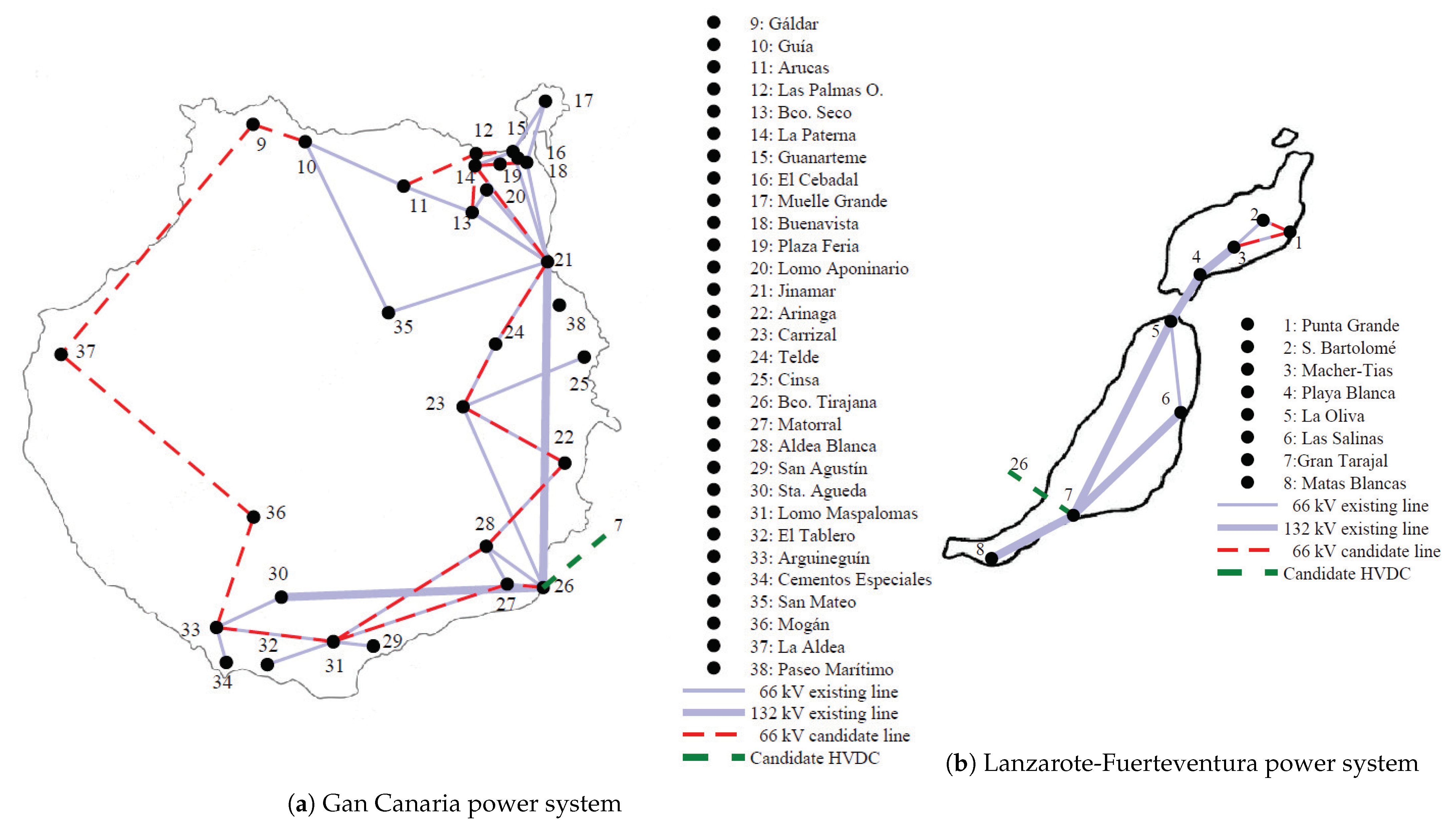

Figure 1 represents graphically the location of the Canarian Islands and Las Palmas. Las Palmas comprises 3 main islands: Gran Canaria (GC), Lanzarote (LZ) and Fuerteventura (FV).

Figure 1b represents in red color those islands belonging to Las Palmas and in blue color the rest of Spain. The power systems of Lanzarote and Fuerteventura are linked since 2015 by a submarine AC cable of 132 kV with a rated capacity of 120 MVA pursuing the objective of increasing the strength of the grid and improving the capacity of integration of new renewable generation [

3].

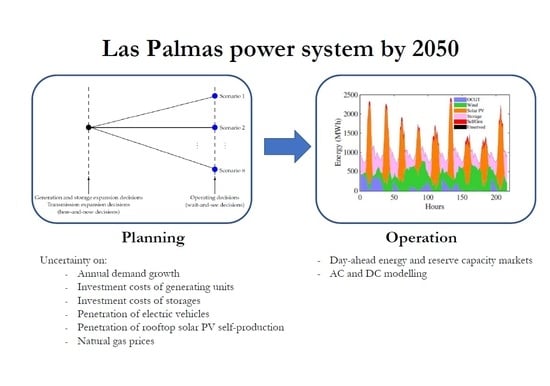

In order to determine the most convenient power system configuration of Las Palmas from technical and economical points of view, a two-stage Generation, Storage and Transmission Expansion Problem (GSTEP) is formulated. The uncertainties considered in this model are the investment costs of immature generating and storage technologies, the annual demand, the number of electric vehicles, the rooftop solar photovoltaic (PV) capacity penetration and natural gas prices. The operation of the resulting power system is modelled considering the energy and reserve capacity markets. Therefore, the main objective of this paper is to determine the investment decisions in generating, storage and transmission capacities to be made in the next years to minimize the total cost, including investment and operation costs. To that end, different minimum renewable energy output requirements can be enforced to ensure the achievement of a renewable-dominated system.

Many works have been devoted to analyze the integration of renewable energies in the Canary Islands. For instance, reference [

4] analyzed the results obtained after the application of the first wind power development plan in the Canary Islands. This work concludes that the percentage of wind power capacity installed in the Canary Islands at the end of the planning horizon was smaller than that in mainland Spain, but higher than in most European countries. Reference [

5] assesses the socio-economic potential of wind power in Gran Canaria and Tenerife. Reference [

6] proposes a dynamic model to analyze the installation of a pumped-hydro storage system on Gran Canaria to increase the level of wind power penetration. Reference [

7] determines the optimal size of a hydro pumping unit powered by wind in the island of El Hierro. The authors of [

8] develop a cross-sectoral procedure considering electricity, heating, cooling, desalination, transport and gas sectors to take advantage of possible synergies to obtain a renewable-dominated system in Gran Canaria. Reference [

9] proposes a procedure to achieve by 2050 a 100% renewable power supply for the entire archipelago considering power links between islands. The generation expansion problem in the isolated power system of Lanzarote-Fuertenventura has been formulated in [

10,

11] considering (i) the active participation of electric vehicles and (ii) reserve provision by wind power units, respectively. The potential of on-roof solar PV in the Canary Islands has been discussed in [

12]. The potential of biomass in the Canary Islands has been assessed in [

13]. The influence of natural gas in the future power system of the Canary Islands has been investigated in [

14,

15]. Planning and operating different isolated power systems have been studied in recent years. For instance, reference [

16] proposes a novel control-system to increase the renewable penetration that has been tested on the King island power system. This approach is able to obtain fuel savings with respect to conventional control schemes. The authors of [

17] have developed a multiyear expansion-planning optimization model for the Azores archipelago. The obtained results indicate that the interconnection among different isolated systems increases the usage of clean energies. Reference [

18] has proposed a stochastic planning model devoted to the determination of the renewable transition in isolated Artic power systems. This work concludes that an adequate representation of the variability of renewable sources is key to obtain a robust power system configuration. Finally, reference [

19] studies the Tilos island power system in Greece and analyzes the actual implementation of a configuration based on renewable energies and storage systems.

The technical literature concerning GSTEP approaches is large, [

20]. The work developed in [

21] solves this problem considering the demand, and the availability of generating units as uncertain parameters. Reference [

22] also presents a generation and transmission expansion problem formulation but considering uncertain failures of generating units and transmission lines. The authors of [

23] use equilibrium constraints to formulate the transmission expansion problem considering investments in wind power. Reference [

24] formulates the generation and transmission expansion problem using a three-level equilibrium model. The transformation process of a thermal-dominated system into a renewable-dominated one is formulated in [

25]. Reference [

26] develops a stochastic adaptive robust optimization approach considering simultaneously long- and short-term uncertainties. The authors of [

27] also propose a three-level adaptive robust optimization problem to model this problem. A multistage approach is developed in [

28] to determine generation, storage and transmission investments. Reference [

29] accounts for the spatial distribution of wind speed on the generation and transmission decisions. In [

30], GSTEP is formulated considering a precise modeling of the technical constraints of generating units. Reference [

31] proposes a mixed-integer linear formulation for the GSTEP placing also emphases in the mathematical modeling of the technical aspects of generating units. Finally, the authors of [

32] compare the outcomes of different generation expansion models under uncertainty considering different number of decision stages.

The main contributions of this paper are twofold:

To design a novel procedure for determining the generation, storage and transmission expansion of a realistic power system. The input data of Las Palmas power system have been elaborated in depth by the authors using publicly available sources, research works and technical reports.

The uncertainty associated with investment costs of immature generating and storage technologies, the annual demand growth, the number of electric vehicles, rooftop solar photovoltaic capacity penetration and natural gas prices has been explicitly considered in this paper. To the best of the authors’ knowledge this is the first work that analyzes this set of uncertain parameters in the GSTEP.

Other specific contributions of this paper are the following:

The rooftop solar photovoltaic potential in Las Palmas power system has been estimated in detail considering each municipality separately.

A novel procedure for estimating the charging profiles of electric vehicles has been proposed using parametric distributions for characterizing the distance driven and the starting charge hour of electric vehicles.

Two novel mixed-integer linear programming formulations have been proposed to determine the system-adequacy and reserve-capacity requirements of a power system formed by several isolated systems.

The reserve-capacity participation of storages has been modeled considering simultaneously the maximum and minimum possible levels of energy stored in each time period depending on the deployment of the scheduled reserves and the participation in the day-ahead energy market.

Unlike usual capacity expansion analyses, this paper includes the elaboration of an out-of-sample analysis to test the performance of the resulting power system during a whole year considering the AC modeling of the system.

The paper is structured as follows. The input data used to define the numerical study is described in

Section 2. The methodology proposed to formulate the planning model is described in

Section 3. The uncertainty characterization is provided in

Section 4. The resulting generation, storage and transmission expansion decisions are provided and discussed in

Section 5. The influence of the uncertain parameters and the renewable energy potentials in the expansion plans are analyzed in

Section 6. Finally, the main conclusions of this study are drawn in

Section 7. In the

Appendix A, the mathematical formulation of the proposed GSTEP is included and described.

3. Methodology

The methodology used to determine the generation, storage and transmission capacity decisions in Las Palmas power system is described in this section. A set of candidate generating and storage units is defined for each bus of the system. Additionally, a set of candidate transmission lines is considered for each island. The description of the candidate investment assets is provided below. The investment decisions to determine consist in: (i) the power capacity to be installed from the candidate set of generating units, (ii) the power/energy capacity to be installed from the set of candidate storage units and (iii) the transmission lines to be installed from the set of candidate transmission lines. Investments on new assets are considered to be at operation in 2050. The variability of the intermittent power production, demand, charge of electric vehicles and rooftop solar PV self-production is characterized in an hourly basis, as indicated in

Section 2. The proposed mathematical formulation and its notation are described in detail in the

Appendix A.

Note that different uncertainties affect to the investment decisions to make in the planning of a power system. In order to handle this uncertainty, a stochastic programming model is proposed.

Figure 5 represents graphically the decision-making framework adopted in this work. The black point represents the time in which investment decisions are made. These are

here-and-now decisions that are made before knowing the actual realizations of the uncertain parameters. The operation of the resulting power system is simulated in the second stage after knowing the realizations of the uncertain parameters. For this reason, operation decisions represented by blue circles are considered as

wait-and-see decisions, which can be different for each scenario. The power system operation consists of the scheduling of the day-ahead energy and reserve capacity markets.

As it is usual in capacity expansion models, investment costs are annualized using the capital recovery factor (CRF), where CRF

,

x is the expected life of the asset, and

r the interest rate. In this study, the expected life of assets is 25 years and the interest rate is 9%. The operation costs of the resulting power system are simulated in the investment capacity problem by modeling the scheduling of the day-ahead market, considering simultaneously energy and up/down reserve capacity markets. These markets are settled down using the estimated values of the demand and wind and solar PV productions. These values are generated by using historical data from 2018 available in [

46]. The transmission network is accounted for in the day-ahead market scheduling and it is represented using a DC model. Storages are assumed to store 0.5 times their energy capacities at the beginning of each day, and they have to be also charged up to that value at the end of the day. The operating costs of intermittent and storage units are assumed to be negligible. The unserved demand penalization cost is equal to 1000 €/MWh. The up and down reserve capacity requirements of the system are computed using the procedure described in [

47]. In this manner, up and down reserve capacities must be greater than 3% of the demand plus 5% of the intermittent production in each hour. Reserve capacity costs are equal to 0.25 times the operating cost for each unit. It is assumed that wind and solar PV units are not qualified to supply reserve capacity.

Finally, the power system adequacy has been explicitly formulated in the proposed model. This adequacy refers to the ability of the power system to supply its peak load through electricity generation under normal operating conditions. Therefore, the total installed capacity considering all technologies has to be greater than the highest expected demand. In order to ensure power system adequacy, the power capacities of OCGT and storage units have been derated 10%. Considering that the peak demand happens at night in this system and the non-dispatchability of intermittent power units, wind and solar PV capacities have been derated 90 and 100%, respectively. The peak demand is equal to 1.2 times the maximum hourly demand expected in 2050 in each system. The provision of frequency support is not modeled in this work. It is assumed that inverter-connected generation and storage units will be able to support system inertia in 2050 by the provision of virtual inertia. The provision of virtual inertia has been investigated in [

48,

49,

50,

51].

5. Results and Discussion

In this section, we include the results obtained by solving the generation, storage and transmission expansion model described above. All mathematical problems have been solved using GAMS (see [

69]) and CPLEX 12.6.111 (see [

70]) in a linux-based server of four 3.0 GHz processors and 250 GB of RAM. Regarding the computational cost, each single case has been solved in less than 36 h.

A number of cases have been solved to test the performance of the proposed procedure and to quantify, qualitatively and quantitatively, the influence of the variation of some key parameters in the resulting generation, storage and transmission expansion. First, a base case has been solved considering the input data described in

Section 2. This solution is compared with that obtained if a minimum percentages of non-thermal power production is enforced (95%). Additionally, the base case solution has been compared with that obtained if the transmission link between the power systems of GC and LZ-FV is built. Finally, an out-of-sample analysis has been performed using the demand and renewable power availability observed in year 2019. For doing that, an optimal power flow has been solved for each hour of the year considering the AC modeling of the power system.

5.1. Results from the Investment Model

This section analyzes the following three cases:

Base. This case corresponds with solving the generation, storage and transmission expansion problem considering the input data described in

Section 2.

95%Ren. This case is similar to Base case but enforcing that at least 95% of the power production must be generated from non-thermal generating units.

FixedLink. This case is similar to Base case but enforcing that the transmission link between the power systems of Gran Canaria and Lanzarote-Fuerteventura is built.

Table 11 provides the expected costs resulting in each case. This table reveals that, for every case, the investments in new generation units achieve the highest costs. On the contrary, investments in transmission lines are much lower, specially in

Base and

95%Ren cases. If

Base and

95%Ren cases are compared, it can be concluded that imposing a strong minimum requirement of non-thermal production (at least 95%) leads to higher generation, storage and transmission investment costs. Particularly, the investments costs in these three concepts in

95%Ren case are 66.4, 20.6 and 56.3% higher than those in

Base case, respectively. However, the day-ahead energy costs decrease 64% in

95%Ren case because of the low operation costs of renewable units. The increased usage of renewable units has the non desirable consequence of increasing the reserve capacity costs, which grow in

95%Ren case 9.6% with respect to those in

Base case. It is worth noting that there is unserved demand in

95%Ren case, which is equal to 1.42% of the total demand.

If the impact of building a power line between GC and LZ-FV power systems on total costs is analyzed, it can be observed that the total cost increases 6%. Therefore, we can conclude that linking GC and LZ-FV power systems cannot be only justified by economic reasons. Additionally, other factors as security supply or efficiency must be taken into account in order to analyze the installation of this transmission facility. The most relevant consequence of installing the linking line between both systems is that the total investment cost of storage units decreases significantly, 8.5%.

Table 12 lists the generation and storage capacity installed in each case. The percentage values in this table indicate the percentage of capacity installed over the potential of each technology in each island. It can be observed from the

Base case that the generation technology most installed with respect to its potential is solar PV (92.1%). Opposite to this, OCGT and wind units are installed below 35% of their potentials. However, the wind power capacity installed in GC is 95%. The reason of this result is that this island has associated a much higher demand than the other two islands. It also interesting to note that the storage capacity installed in GC is above 90%, whereas it is below 50% in LZ and FV. The high penetration of intermittent power units in GC (above 90% in wind and solar PV units) motivates the high capacity of storage units installed in this island.

The generation and storage capacities installed in 95%Ren case are substantially different to those resulting in Base case. First, it is observed that the OCGT capacity is reduced 33%. As a consequence of this, the total capacity of renewable units (wind and solar PV) increases 39.7%, from 4597.8 to 6423.1 MW. This increase is mainly due to wind power, that grows from 1111.7 to 2840.1 MW (155.5%). In the same manner, the storage capacity increases 20.5%.

From the FixedLink case it can be noticed that the generation capacity installed is quite similar to that resulting from the Base case. However, a small reduction of solar PV capacity is observed, which is compensated by an increase of wind power units. As commented above, the storage investments in this case are significantly smaller than those in the Base case.

Table 13 shows in an aggregated manner the investments in transmission lines in each case. It can be observed that most of new transmission lines are built in GC. Comparing

Base and

95%Ren cases, it is noticed that the number of installed transmission lines increases significantly as the renewable power penetration grows. It is also worth noting that the construction of the transmission link between GC and LZ-FV power systems causes a remarkable increase in the transmission investment costs.

The average and maximum usage of new lines is included in

Table 14. Only those candidate lines that have been installed in one of the cases have been included in this table. It is observed that the average usage of the new lines is always lower than 60%. However, the maximum usage is equal to 99.9% in those lines linking buses 21–24 (candidate lines 15 and 16), buses 23–24 (candidate line 18) in GC and the transmission link between GC and LZ-FV power systems (candidate line 27).

Table 15 and

Table 16 present the annual energy produced and the reserve capacity scheduled by each technology, respectively. The percentage values in

Table 15 refer to the percentage of the production of a given technology over the total production in each island.

Table 15 shows that OCGT units only represent 9.5% of the total electricity production in

Base case, which results in an annual emission of 387.3 MTon of CO

. Considering the capacity installed of OCGT units provided in

Table 12, it is observed that this technology is producing energy during only 1967.7 equivalent hours pear year. On the contrary, solar PV is the generating technology with highest production, which generates 42.2% of the energy consumed in GC and LZ-FV power systems. It is also worth noting that 2.5% of the demand is supplied by solar PV rooftop facilities. Regarding

95%Ren case, we can observe a high reduction of the energy produced by OCGT units, which only represents 4.4% of the total energy production. It is noteworthy that OCGT units only participate in the day-ahead market of the GC power system, whereas the OCGT units located in LZ only participate in the reserve capacity market. No OCGT units have been installed in FV. The expected annual emissions of CO

in this case are equal to 193.6 MTon, which are 50% less than those in the

Base case. The reduction of the production of OCGT units is mainly counterbalanced by an increment of the production of wind power units, which is increased by 42.1%. The energy produced by each technology in

FixedLink case does not vary much with respect to the values reported for

Base case. It is observed a slightly increment of the energy produced by wind power units, with results in a decrease of the production of solar PV and storage units.

The results provided in

Table 12 and

Table 15 indicate that the number of charge/discharge cycles of storages per year for

Base and

95%Ren cases are 222 and 160, respectively. The number of cycles can be estimated as the energy discharged annually divided by the energy capacity of the storage. Considering a conservative maximum number of charge/discharge cycles of Li-ion batteries equal to 4500 cycles, the expected lifetime of the storages in both cases is more than 20 years.

Figure 10 represents the energy production and consumption in each considered day for

Base and

95%Ren cases in scenario 7 (see

Table 9). As observed in this table, scenario 7 has associated the highest demand and penetration of electric vehicles. In both cases, it is observed that, additionally to the satisfaction of the demand, solar PV energy is mostly used to charge energy storages that are afterwards discharged to procure the demand in periods in which solar PV production is not available. OCGT units, together with wind power units, are used to procure the rest of the demand. The higher participation of wind power units in

95%Ren case is evident. In this case, OCGT units are used in those periods with very low production of wind and solar PV units. However, unserved demand is observed in

95%Ren case in those night-time periods with insufficient production of wind power. It is worth noting that the consumption profile is deeply altered by the charge of storages during midday. It is also interesting to observe that the higher presence of wind power units in

95%Ren case causes a lower usage of storages in all periods, except in those corresponding to days 5 and 6.

Table 16 shows that the up-reserve capacity is exclusively provided by OCGT units, whereas the down-reserve capacity is provided by OCGT and storage units. It is observed that the highest up-reserve capacity is scheduled in

95%Ren case, 579 GW, which is 3.5% higher than that scheduled in

Base case. It is also worth noting that OCGT units only provide 31.1% of the down-reserve capacity in

95%Ren case, which is a percentage 35.6% lower than that in

Base case. Finally, observe that the up-reserve capacity scheduled in

FixedLink case, 556.3 GW, is 0.5 and 3.9% lower than those in

Base and

95%Ren cases, respectively.

5.2. Out-of-Sample Analysis Using the AC Model of the System

The performance of the obtained expansion plans has been assessed by implementing an out-of-sample analysis using input data pertaining to year 2019. In this manner, all investment decisions are fixed to their optimal values obtained from solving

Base case using the initial set of days generated by using the input data pertaining to 2018. After that, each of the 365 days of year 2019 is simulated to compute how the hourly demand is satisfied in each hour of every day. In order to simulate the steady-state operation of the power system, an optimal AC power flow problem has been solved for each day of the year including active and reactive power flows, losses and voltage magnitudes [

71].

Then, hourly demand and power availabilities of wind and solar PV units and solar rooftop facilities in year 2019 have been considered. The demand associated with electric vehicles has been randomly generated for each day using the procedure described in

Section 3. As usual, electric vehicle chargers are assumed to operate with power factor equal to 1. The power factor of the rest of loads is assumed to be equal to 0.98. It is considered the conservative criterion stating that only OCGT units are able to provide reactive power. The rest of technologies are considered to operate with power factor equal to 1. The minimum and maximum values of voltage magnitudes are 0.9 and 1.1 times the nominal values.

In order to analyze the operation of the system, two different scenarios are considered:

Favourable. This scenario corresponds to the case in which all uncertain parameters related to the operation of the system take favourable values from the operation point of view: low demand, low penetration of electric vehicles, high capacity of solar PV self-production facilities and low natural gas prices.

Unfavourable. In contrast to the Favourable scenario, this scenario corresponds to the case in which all uncertain parameters related to the operation of the system take unfavourable values from the operation point of view: high demand, high penetration of electric vehicles, low capacity of solar PV self-production facilities and high natural gas prices.

Figure 11 represents the daily operation costs and percentage of demand supplied by OCGT units in each of the scenarios described above considering the investment capacity decisions obtained from the

Base case. Note that values are increasingly ordered to facilitate the visualization of the figure. The solution time of each daily simulation is in average equal to 5.3 min, resulting in a total of 32.4 h for each represented curve. The total daily cost in the

Favourable scenario is 269 million €, which is 72.4% lower than in

Unfavourable scenario, 974 million €. The mean percentage of demand provided by OCGT units in

Favourable and

Unfavourable scenarios is 20.2% and 22.6%, respectively. Observe that this value is higher than that observed in the DC simulation of year 2018 (

Table 15). While the out-of-sample analysis is performed using different input data (year 2019), note that the need for using a DC model in the planning optimization for computational reasons may underestimate the energy production of OCGT units. The reason of this result is twofold: first, the AC modeling considers additional constraints as those related to the reactive power supply or to voltage magnitude limits; second, the AC formulation considered in this study assumes that storages and intermittent power units do not participate in the provision of reactive power. However, it is expected that these technologies be key to provide this resource, and other ancillary services, in renewable-dominated power systems. Finally, note that there is not unserved demand in the

Favourable scenario, and only 0.2% in the

Unfavourable scenario.

7. Conclusions

This paper has proposed a novel generation, storage and transmission expansion formulation considering a number of uncertain parameters: investment costs of renewable and storage units, demand growth, penetration of electric vehicles, solar PV self-production capacity and natural gas prices. The proposed procedure has been applied to the isolated power system of Las Palmas (Spain) for 2050. The proposed generation, storage and transmission capacity to be installed has been determined by solving a two-stage stochastic programming problem, where the operation of the power system has been simulated by modeling the day-ahead energy and reserve capacity markets in a set of characteristic days.

Several case studies have been analyzed considering a (i) base case, (ii) a minimum percentage of renewable generation, (iii) the installation of a transmission line between GC and LZ-FV systems and (iv) different renewable capacity potentials. Furthermore, the impact of the realization of different scenarios has been tested in the obtained expansion plan. Finally, the performance of the resulting power system has been assessed by solving an out-of-sample analysis using the AC model of the resulting power system.

Based on the numerical results presented in the case study, the following conclusions can be made:

The highest investment costs are associated with the investments in new generation capacity. On the contrary, investments in transmission lines are significantly smaller.

The enforcement of a strong minimum requirement of non-thermal production (95%) causes higher investment costs and lower operation costs. For instance, generation and storage investments costs increase 66.4 and 20.6% with respect to the base case.

The reserve capacity cost increases 9.5% if a minimum of 95% of non-thermal production is enforced. The up-reserve capacity is exclusively procured by OCGT units, whereas the down-reserve capacity is provided by OCGT and storage units.

The case with a minimum of 95% of non-thermal production has associated 1.42% of unserved demand.

The construction of a transmission link between GC and LZ-FV power systems cannot be justified solely by economic reasons. If this link is built, a 8.5% reduction of the investment cost in storage units is achieved.

The generation technology most used is solar PV, which is installed 92.1% over its potential and produces 42.2% of the total demand.

OCGT units only satisfy 9.5% of the total demand and they are at operation only 1967.7 equivalent hours per year.

The investments in transmission lines grow as the renewable power penetration increases (56.3% in case with 95% of non-thermal production).

The natural gas price is the uncertain parameter that has the highest influence in the total cost. It is observed that the day-ahead energy cost increases 41.6% if natural gas prices are high with respect to the case in which natural gas prices are equal to their expected value.

The number of electric vehicles and the demand growth have also a great influence in the total operation costs. It is worth noting that 95% of penetration of electric vehicles increases the total cost 6.5% with respect to the case with 75% penetration of electric vehicles.

If the installed capacity of solar PV rooftop facilities increases from 5 to 10%, the total operation cost decreases 1.6%.

The total cost increases 53.4% if the renewable potential decreases up to 25% of the nominal value. The installation of storage units is highly dependent on the presence of renewable units. If the renewable potential decreases up to 25%, the capacity installed of storage units decreases 73.7%.

The results of the AC out-of-sample analysis indicate that the usage of the DC modeling in the formulation of the capacity expansion problem may underestimate the production of OCGT units if storages and intermittent power units are not considered to provide reactive power.

Future research lines are the formulation of the GSTEP considering: (i) system frequency limits and the provision of virtual inertia by inverter-connected generation and storage units, and (ii) combined-cycle gas turbines with a precise modeling of their different operation modes.