Scenario Analysis of the Low Emission Energy System in Pakistan Using Integrated Energy Demand-Supply Modeling Approach

Abstract

1. Introduction

1.1. Background

1.2. Literature Review

1.3. Research Gap and Originality Highlights

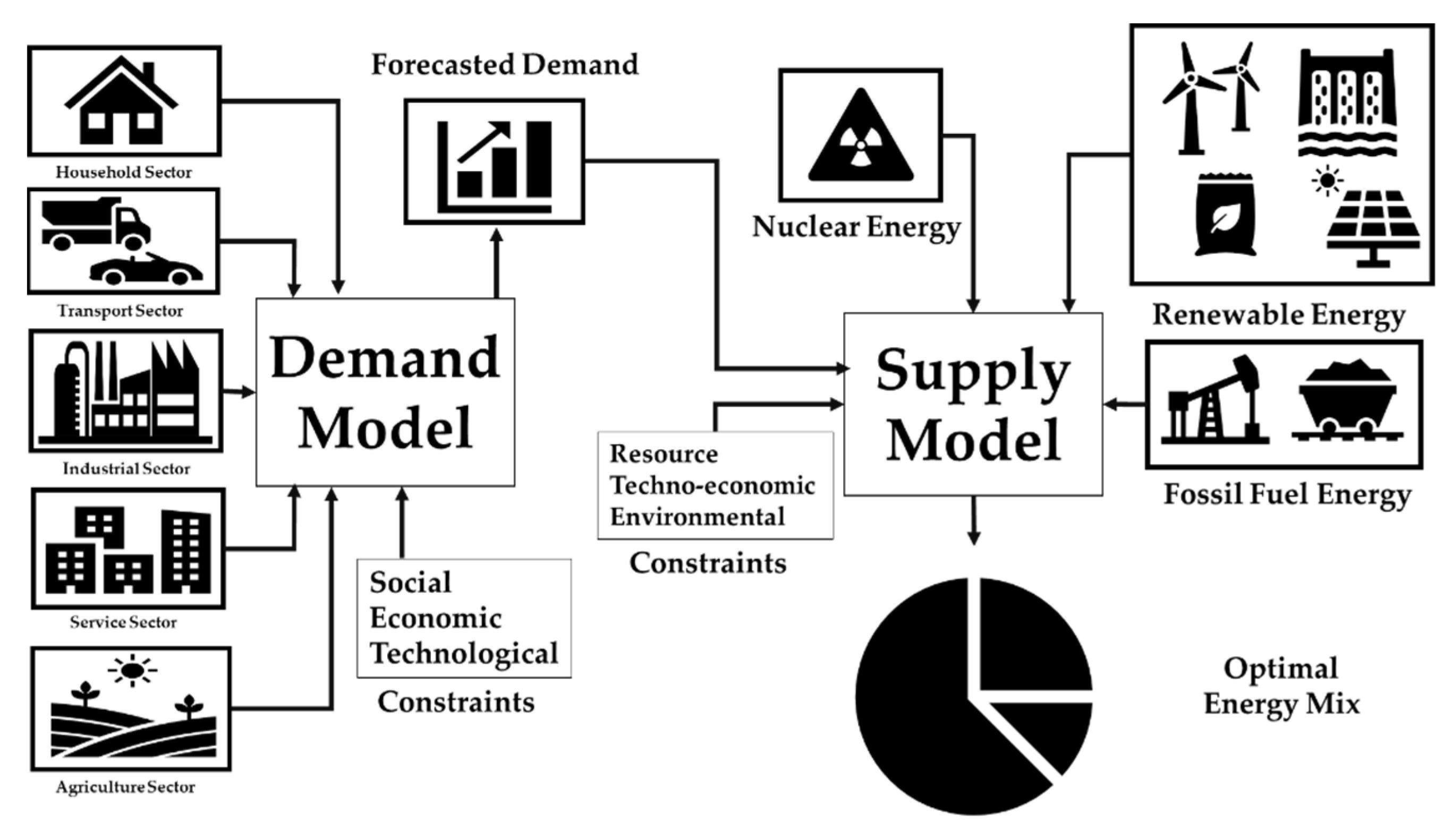

2. Model Development

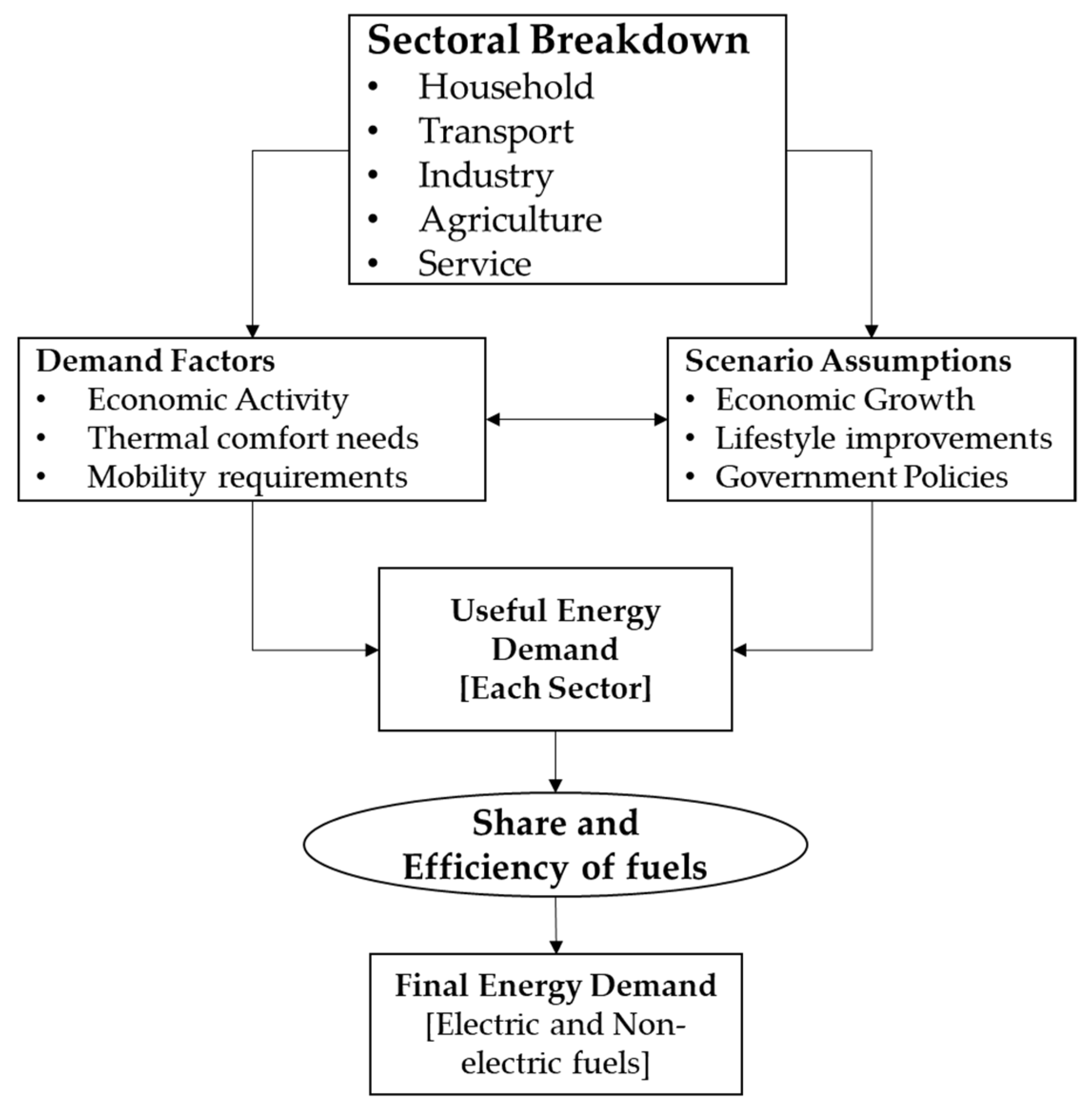

2.1. Demand-Side Model

2.1.1. Top-Down Econometric-Based Demand Model

2.1.2. Bottom-Up Simulation-Based Demand Model

- ○

- The social aspects include the parameters population, household characteristics, and lifestyle.

- ○

- The economic aspect deals with the level of the activity in economic sectors or subsectors.

- ○

- The technological aspect is based on selecting different available technologies (fossil fuel, electricity, renewable and traditional fuel), taking into account their efficiency and market penetration.

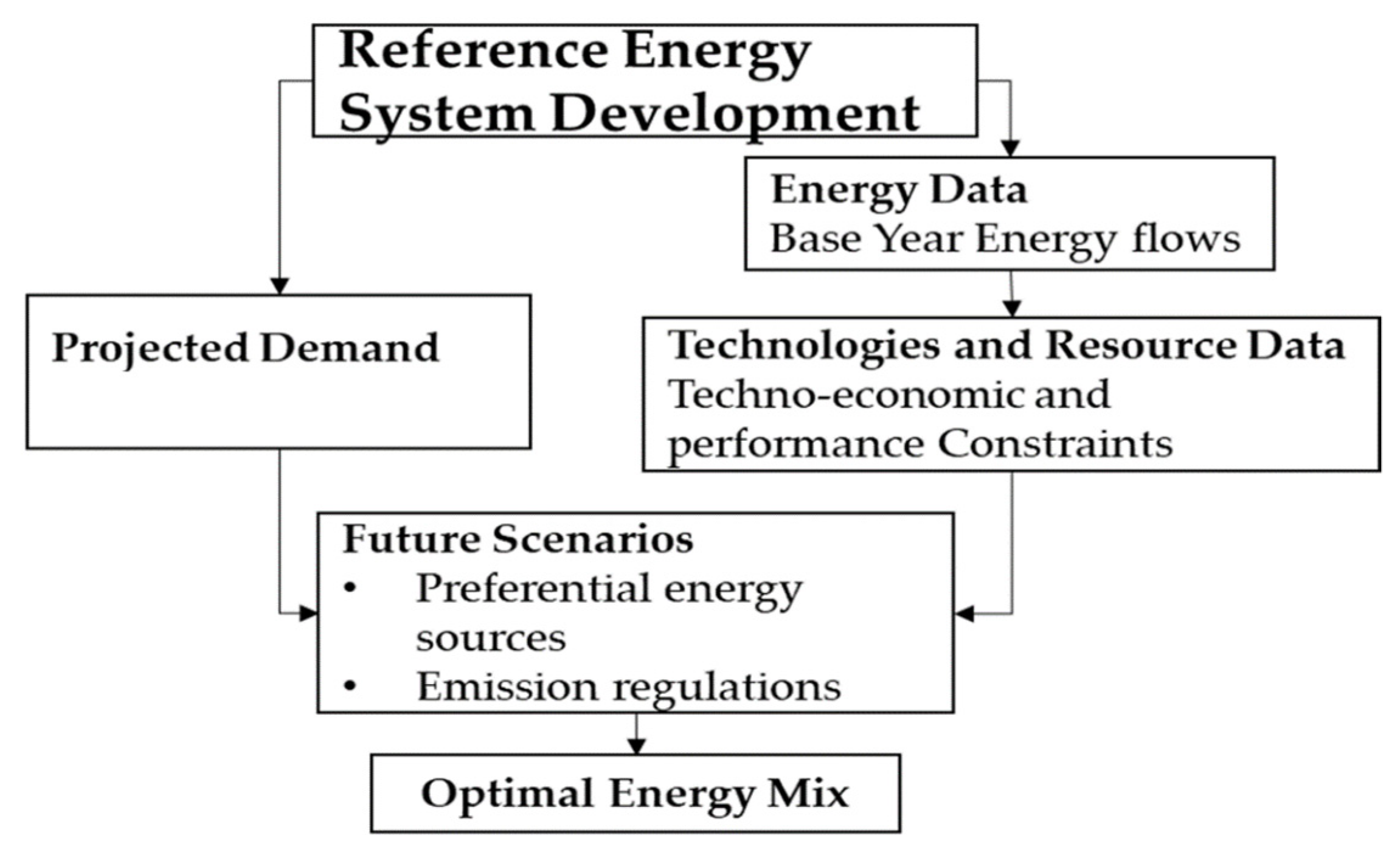

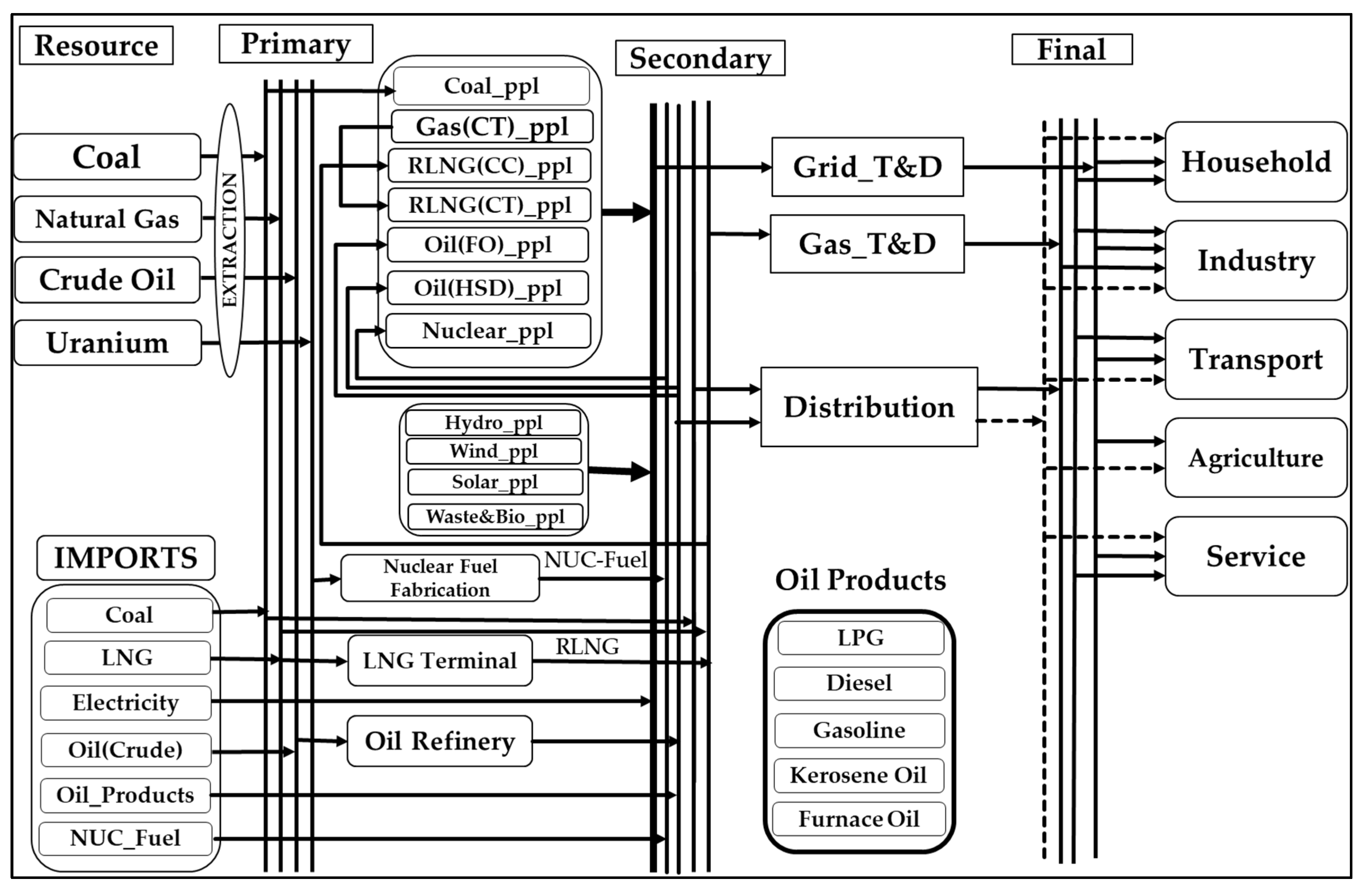

2.2. Energy Supply Model

- Demand constraint:where is the given level of the energy demand of any energy carrier ; at level for each load region, must be met by the total energy flows of all the technologies feeding that level in each year .

- Capacity constraint:

- 3.

- Resource constraint:

2.3. Integration of Demand-Supply Models

3. Data Inventory

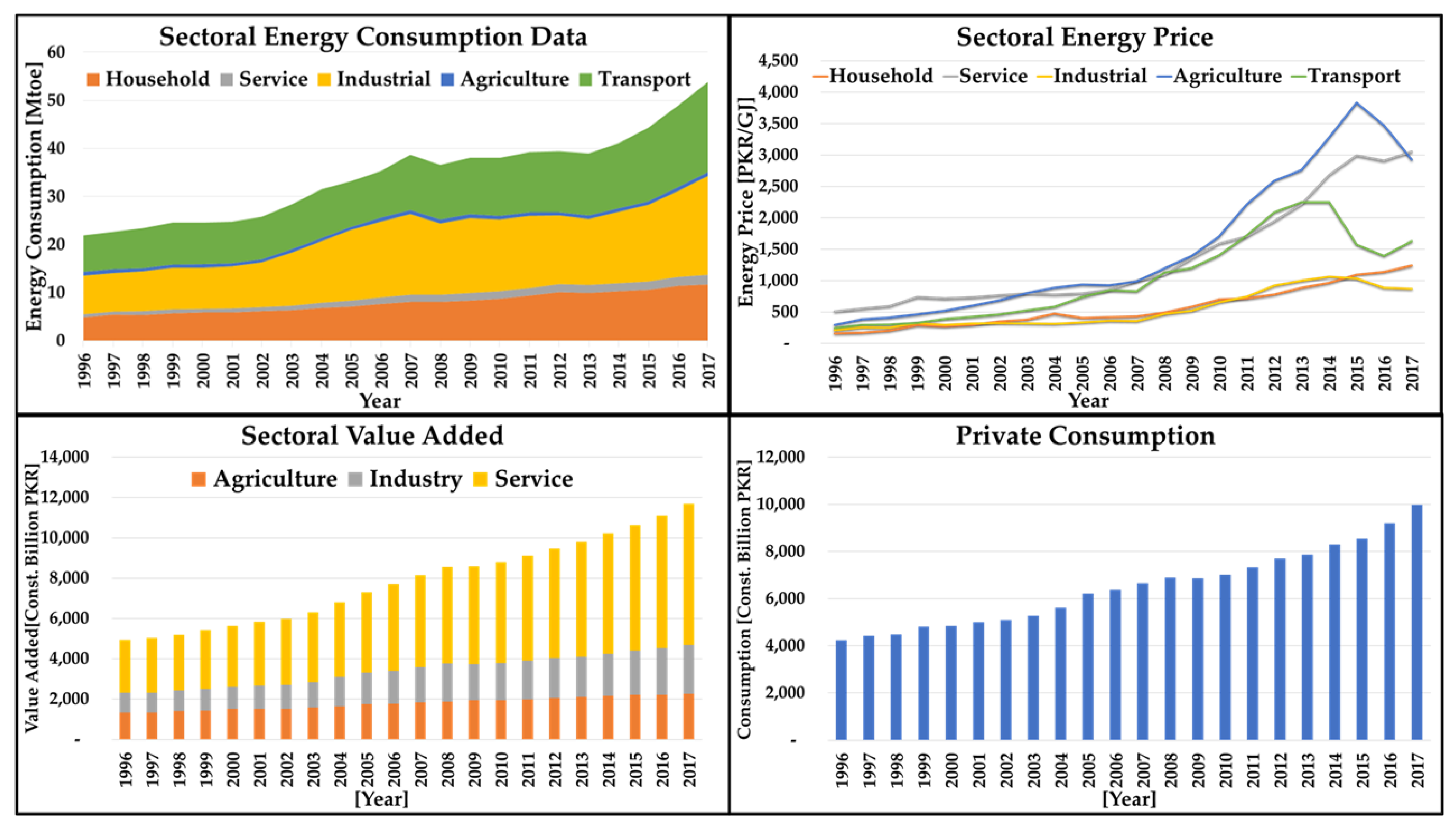

3.1. Top-Down Energy Demand Data

3.2. Bottom-Up Energy Demand Data

| Parameter | Unit | Urban | Rural | ||||

|---|---|---|---|---|---|---|---|

| Small | Medium | Large | Small | Medium | Large | ||

| Dwelling Share | [%] | 24.87 | 69.25 | 5.89 | 30.4 | 64.4 | 5.2 |

| Total Area of Dwelling | [sqr. m] | 76 | 126 | 177 | 126 | 177 | 253 |

| Effective Area for Space Heating | [%] | 12 | 22 | 32 | 11 | 23 | 32 |

| Heat Loss | [Wh/sqm/°C/h] | 0.54 | 0.53 | 0.53 | 0.54 | 0.53 | 0.53 |

| Share of Dwelling Having AC Facility | [%] | 21.7 | 21.7 | 21.7 | 3.8 | 3.8 | 3.8 |

| Specific Energy for Cooking | [kWh/cap/yr] | 2728 | 2728 | 2728 | 2728 | 2728 | 2728 |

| Specific Energy for Water Heating | [kWh/cap/yr] | 110 | 110 | 110 | 110 | 110 | 110 |

| Share of Dwelling with Hot Water Facility | [%] | 77 | 77 | 77 | 42 | 42 | 42 |

| Home Appliance | Dwelling Type | Urban [%] | Rural [%] | Units | Wattage | Usage (Day/yr) | Usage (hrs/Day) |

|---|---|---|---|---|---|---|---|

| Air Conditioner | Small | 21.7 | 3.8 | 1 | 1460 @ 75% | 120 | 4 |

| Medium | 21.7 | 3.8 | 1 | 1950 @ 75% | 120 | 4 | |

| Large | 21.7 | 3.8 | 2 | 1950 @ 75% | 120 | 5 | |

| Television | All | 86.4 | 48.1 | 1 | 100 | 365 | 5 |

| Refrigerator | All | 77.1 | 41.9 | 1 | 220 | 365 | 6 |

| Room Cooler | All | 25.1 | 11.2 | 1 | 185 | 180 | 8 |

| Washing Machine | All | 82.9 | 44.4 | 1 | 500 | 53 | 2 |

| Water Pump | All | 68.3 | 46.8 | 1 | 380 | 365 | 1 |

| Fan | All | 99.4 | 95.9 | 3 | 60 | 300 | 8 |

| Lights | All | 99.4 | 95.9 | 5 | 40 | 365 | 4 |

| Fuel | Urban [%] | Rural [%] | |||||

| Space Heating | Water Heating | Cooking | Space Heating | Water Heating | Cooking | ||

| Biomass | 11.71 | 11.71 | 11.71 | 81.33 | 81.33 | 81.33 | |

| Electricity | 2.0 | 2.0 | 2.0 | 2.0 | 2.0 | 2.0 | |

| Solar | 0 | 0 | 0 | 0 | 0 | 0 | |

| Fossil Fuel | 86.3 | 86.3 | 86.3 | 16.7 | 16.7 | 16.7 | |

| Share | Natural Gas | LPG | Kerosene | ||||

| Fossile Fuel [%] | 91.7 | 0.94 | 7.39 | ||||

| Parameter | Unit | Value |

|---|---|---|

| Intracity Distance Travelled | [km/prsn/day] | 38.17 |

| Intercity Distance Travelled | [km/prsn/yr] | 13931 |

| Car Ownership | [person/car] | 25.47 |

| Intercity Car-km | [km/car/yr] | 4000 |

| Freight ton-km (TKM) | [109 tkm] | 349.6 |

| Subsector | Vehicle Category | Vehicle Type | Modal Share [%] | Load Factor [person/vehicle] | Fuel Type | Share by Fuel | Energy Intensity |

|---|---|---|---|---|---|---|---|

| [%] | [l/100 km] * | ||||||

| Intercity Passenger Transport | Private | Car | - | 2.6 | Gasoline | 82 | 9.1 |

| Diesel | 10.5 | 10 | |||||

| CNG | 7.5 | 8.1 | |||||

| Electricity | 0 | 16.5 | |||||

| Public | Vans | 35.72 | 12 | Gasoline | 100 | 5 | |

| CNG | 0 | 5.61 | |||||

| Bus | 47.2 | 50 | Diesel | 100 | 28.6 | ||

| Train | 17.1 | - | Diesel | 100 | 3.1 | ||

| Intracity Passenger Transport | Private | Car | 37.06 | 2.6 | Gasoline | 82 | 9.1 |

| Diesel | 10.5 | 10 | |||||

| CNG | 7.5 | 8.1 | |||||

| Electricity | 0 | 16.5 | |||||

| 2 Wheelers | 47.21 | 1.6 | Gasoline | 100 | 2.5 | ||

| Electricity | 3.3 | ||||||

| Public | Taxi | 2.91 | 2.6 | Gasoline | 91.6 | 7.1 | |

| CNG | 8.37 | 6.4 | |||||

| Electricity | 0 | 13.3 | |||||

| 3 Wheelers | 1.82 | 1.8 | Gasoline | 91.6 | 4.55 | ||

| CNG | 8.37 | 8.1 | |||||

| Electricity | 0 | 6.1 | |||||

| Vans | 5.79 | 12 | Gasoline | 91.6 | 5 | ||

| CNG | 8.37 | 5.61 | |||||

| Bus | 5.21 | 50 | CNG | 100 | 23.14 | ||

| Frieght Transport | - | Pickup | 5.2 | - | Diesel | 100 | 6.7 |

| Truck | 91.6 | Diesel | 100 | 2.3 | |||

| Train | 3.24 | - | Diesel | 100 | 2.3 |

3.3. Energy Supply Data

| Parameters | Efficiency [%] | Capacity Factor [%] | Operation Factor [%] | Reliability Factor [%] | Aux. Power [%] | Base Year Generation [GWa] | Base Year Capacity [GW] | Min. Utilization [%] |

|---|---|---|---|---|---|---|---|---|

| Coal(IMP)_ppl | 39.04 | 100 | 92 | 93 | 0.03 | 1.24 | 2.84 | 25 |

| Coal(LOC)_ppl | 39.04 | 100 | 92 | 93 | 0.03 | 0.00 | 0.03 | 0 |

| Gas_ppl | 34.39 | 100 | 89 | 95 | 2.58 | 3.10 | 8.01 | 50 |

| RLNG(CT)_ppl | 34.39 | 100 | 89 | 95 | 2.58 | 1.40 | 4.02 | 50 |

| RLNG(CC)_ppl | 55.69 | 100 | 89 | 95 | 2.58 | 1.12 | 3.67 | 50 |

| Oil(FO)_ppl | 38.77 | 100 | 92 | 95 | 5.48 | 3.28 | 8.42 | 50 |

| Oil(HSD)_ppl | 33.77 | 100 | 92 | 95 | 2.01 | 0.09 | 0.13 | 50 |

| Nuclear_ppl | 36.75 | 100 | 84 | 95 | 7.12 | 1.13 | 1.47 | 80 |

| Hydro_ppl | 100 | 50 | 97 | 93 | 0.81 | 3.19 | 8.72 | 0 |

| Wind_ppl | 100 | 32.76 | 97 | 100 | 0 | 0.24 | 1.05 | 0 |

| Solar_ppl | 100 | 21 | 100 | 100 | 0 | 0.09 | 0.43 | 0 |

| Waste&Bio_ppl | 100 | 57 | 97 | 93 | 0 | 0.11 | 0.42 | 0 |

| Parameters | Plant Life [Years] | Construction Time [Years] | Investment Cost [$/kW] | Investment Cost Reduction [%] | Fix. Cost [$/kW-Year] | Var. Cost [$/kWa] | Emission Factor [MT CO2/GWa] |

|---|---|---|---|---|---|---|---|

| Coal(IMP)_ppl | 40 | 4 | 1556 | 0.30 | 25.56 | 32.32 | 6.31 |

| Coal(LOC)_ppl | 40 | 4 | 1556 | 0.30 | 173.28 | 61.32 | 6.31 |

| Gas_ppl | 30 | 2 | 534 | 0.54 | 19.2 | 16.64 | 4.53 |

| RLNG(CT)_ppl | 30 | 2 | 534 | 0.54 | 19.2 | 16.64 | 4.53 |

| RLNG(CC)_ppl | 30 | 2 | 694 | 0.59 | 17.16 | 31.19 | 4.53 |

| Oil(FO)_ppl | 40 | 4 | 694 | 0.00 | 55 | 6.48 | 5.96 |

| Oil(HSD)_ppl | 30 | 4 | 534 | 0.00 | 36 | 9.63 | 6.68 |

| Nuclear_ppl | 40 | 7 | 4342 | 0.54 | 71.76 | 17.52 | 0.00 |

| Hydro_ppl | 50 | 5 | 2488.4 | 0.00 | 13.16 | 36.79 | 0.00 |

| Wind_ppl | 50 | 2 | 2500 | 1.78 | 25.48 | 0.00 | 0.00 |

| Solar_ppl | 30 | 2 | 1300 | 1.80 | 40.82 | 0.00 | 0.00 |

| Waste&Bio_ppl | 30 | 2 | 4000 | 0.30 | 109.01 | 47.55 | 3.50 |

| Category | Resource | Reserve | Cost | Base Year Extraction | |||

|---|---|---|---|---|---|---|---|

| Unit | Value | Unit | Value | Unit | Value | ||

| Fossil Fuel | Coal | [MT] | 7779.8 | [$/T] | 19.1 | [MT/Year] | 4.3 |

| Natural Gas | [BCF] | 20958.9 | [$/MCF] | 5.1 | [BCF/Year] | 1166.0 | |

| Crude Oil | [MT] | 51.1 | [$/T] | - | [MT/Year] | 4.4 | |

| Uranium | [T] | 33,288.0 | [$/kg] | 360.0 | [T/Year] | 45.0 | |

| Renewables | Hydro | [GW] | 40 | - | - | - | - |

| Wind | [GW] | 120 | - | - | - | - | |

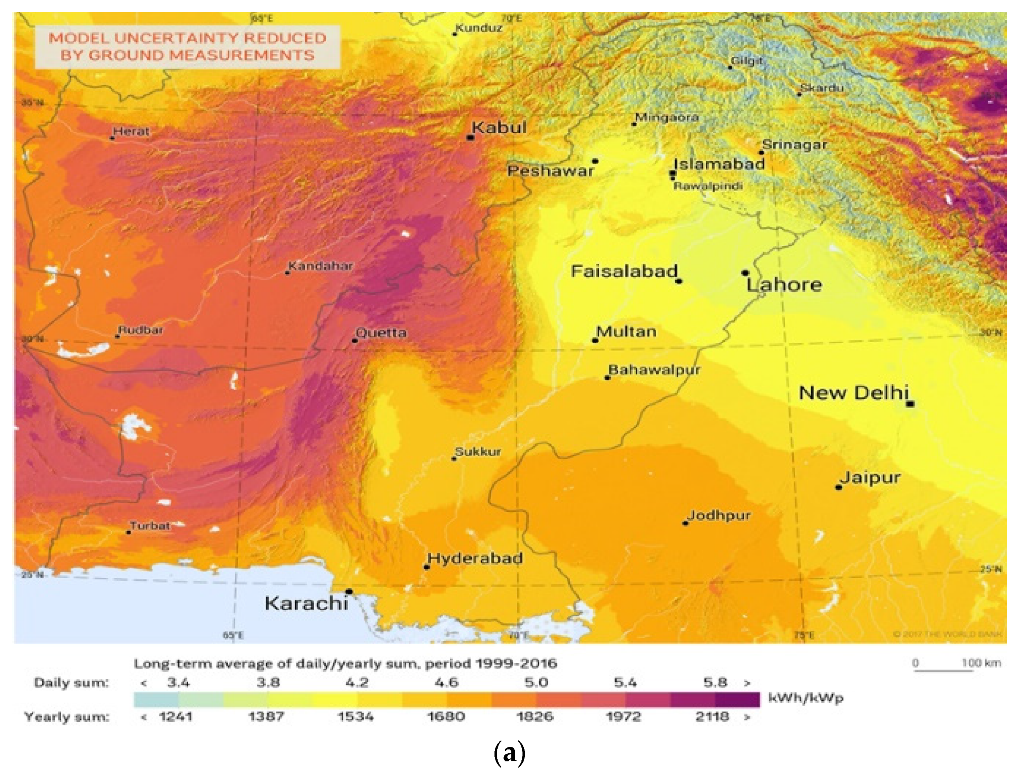

| Solar | [GW] | 2900 | - | - | - | - | |

| Waste and Bio | [GW] | 4.068 | - | - | - | - | |

| Commodity | Imports | Cost * | ||

|---|---|---|---|---|

| Unit | Value | Unit | Value | |

| Electricity | [GWa] | 0.06 | [$/kWa] | 587 |

| Crude Oil | [MT] | 10.33 | [$/T] | - |

| High-Speed Diesel [HSD] | [MT] | 3.85 | [$/T] | 892 |

| Petrol | [MT] | 5.01 | [$/T] | - |

| Furnace Oil | [MT] | 5.87 | [$/T] | 555 |

| LNG | [BCF] | 320.18 | [$/MCF] | 12.5 |

| Coal | [MT] | 13.68 | [$/T] | 131 |

| Nuclear Fuel | [T] | 19.10 | [$/kg] | 2830 |

| LPG | [MT] | 0.40 | [$/T] | - |

3.4. Main Assumptions for Demand and Supply Models

- Local and imported coal have a share of 77.3% and 22.7% in total final energy demand, respectively.

- The peak demand factor (ratio of annual peak load to average yearly load) for electricity is about 2.19 [9] and is assumed to be constant throughout the model horizon.

- Air conditioning and electric appliances are the major consumers of electricity in buildings.

- The future anticipated domestic natural gas production is estimated based on the Oil and Gas Regulatory Authority (OGRA) [48].

- For coal extraction, the maximum production is assumed to be increased at an annual growth rate of 40% with respect to the base year as planned in Pakistan Vision 2025 [49].

- Extraction of domestic natural uranium is limited to 45 T/year.

- The resource cost and imported fuel prices are assumed to be constant throughout the model horizon.

4. Scenario Definition

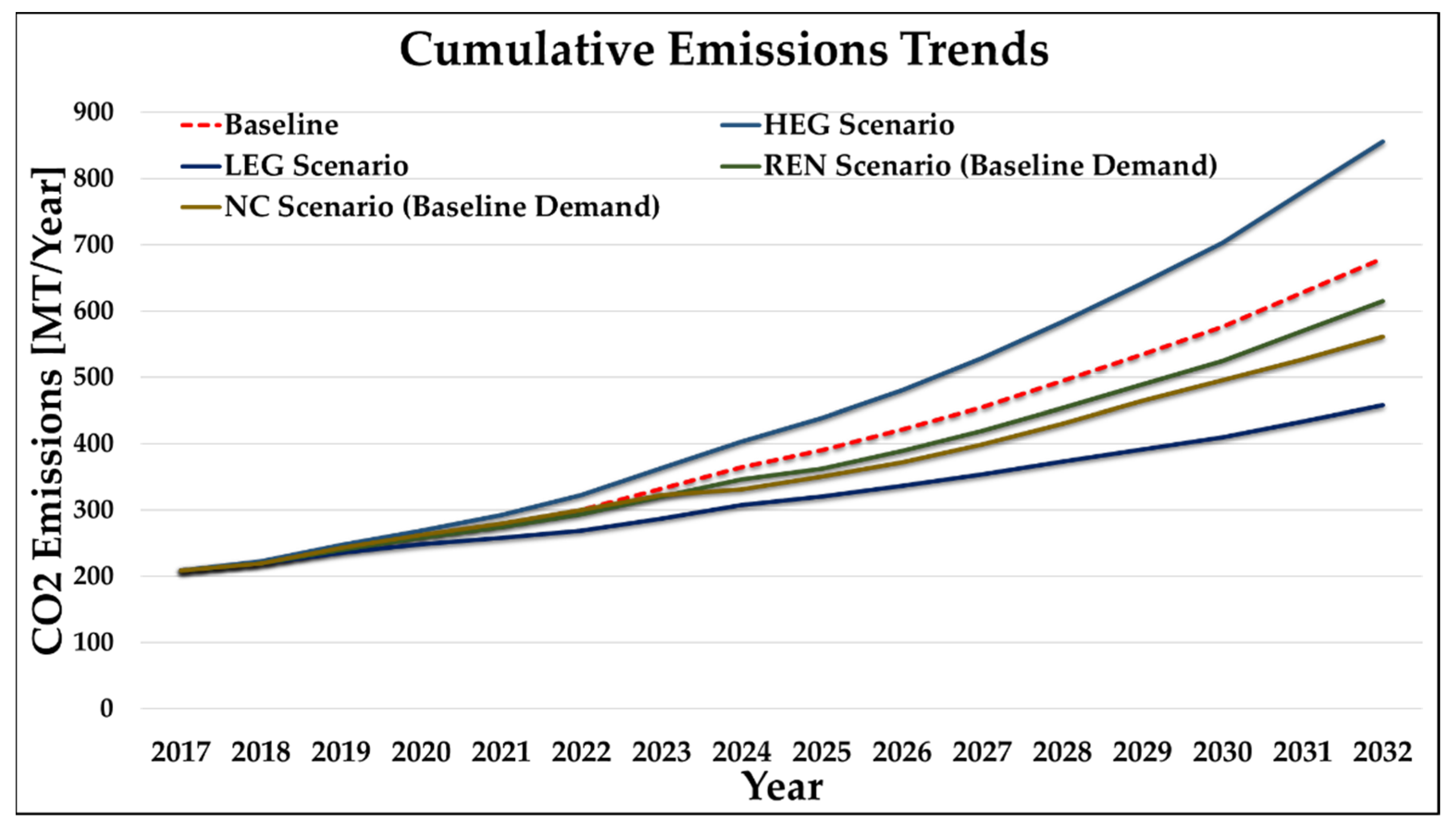

4.1. Demand Side

- The future GDP growth rate and inflation are assumed to be 5.5% and 4.1%, respectively. The sectoral share of GVA is assumed to be consistent with the base year for economic sectors.

- The projection of population is referred to as the medium variant of estimation of the United Nations. The share of different fuels in all sectors is assumed to be constant at the base year level.

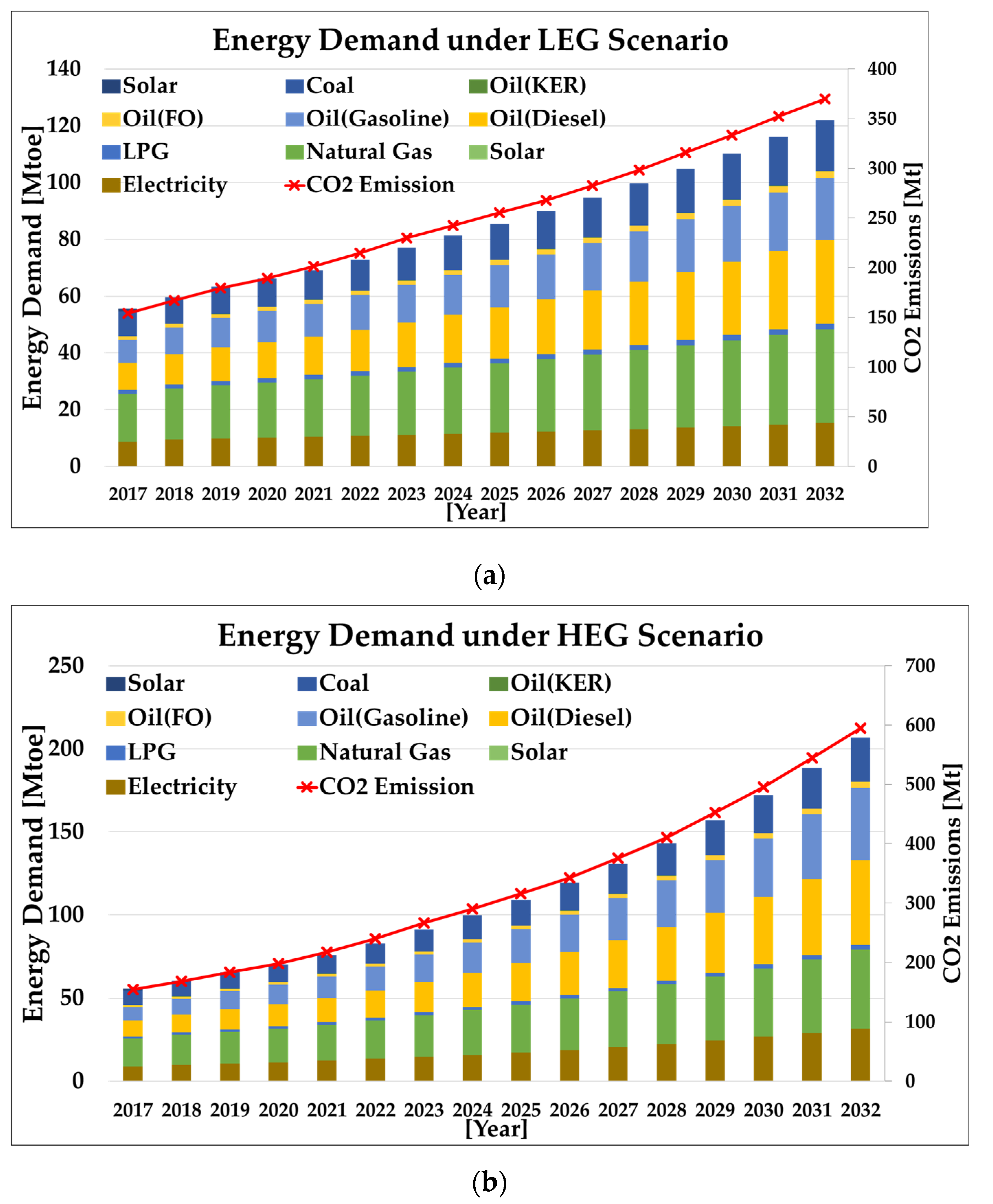

- High Economic Growth (HEG): A growth rate of 7% is assumed to this level of economic activity.

- Low Economic Growth (LEG): In this scenario, a growth rate of 3% is considered. It is lower than the baseline scenario.

4.2. Supply Side

- According to the Renewable Policy 2019, the system gradually accommodates a 20% share by 2025 and a 30% share by 2030 of solar, wind, and waste- and biobased power plants.

- In the wake of climate change challenges, referring to a recent statement by the government regarding the commitment to no more installations of new coal-based power plants, the existing planned and under-construction coal-based power plants are considered for the analysis.

5. Results and Discussion

5.1. Demand-Side Analysis

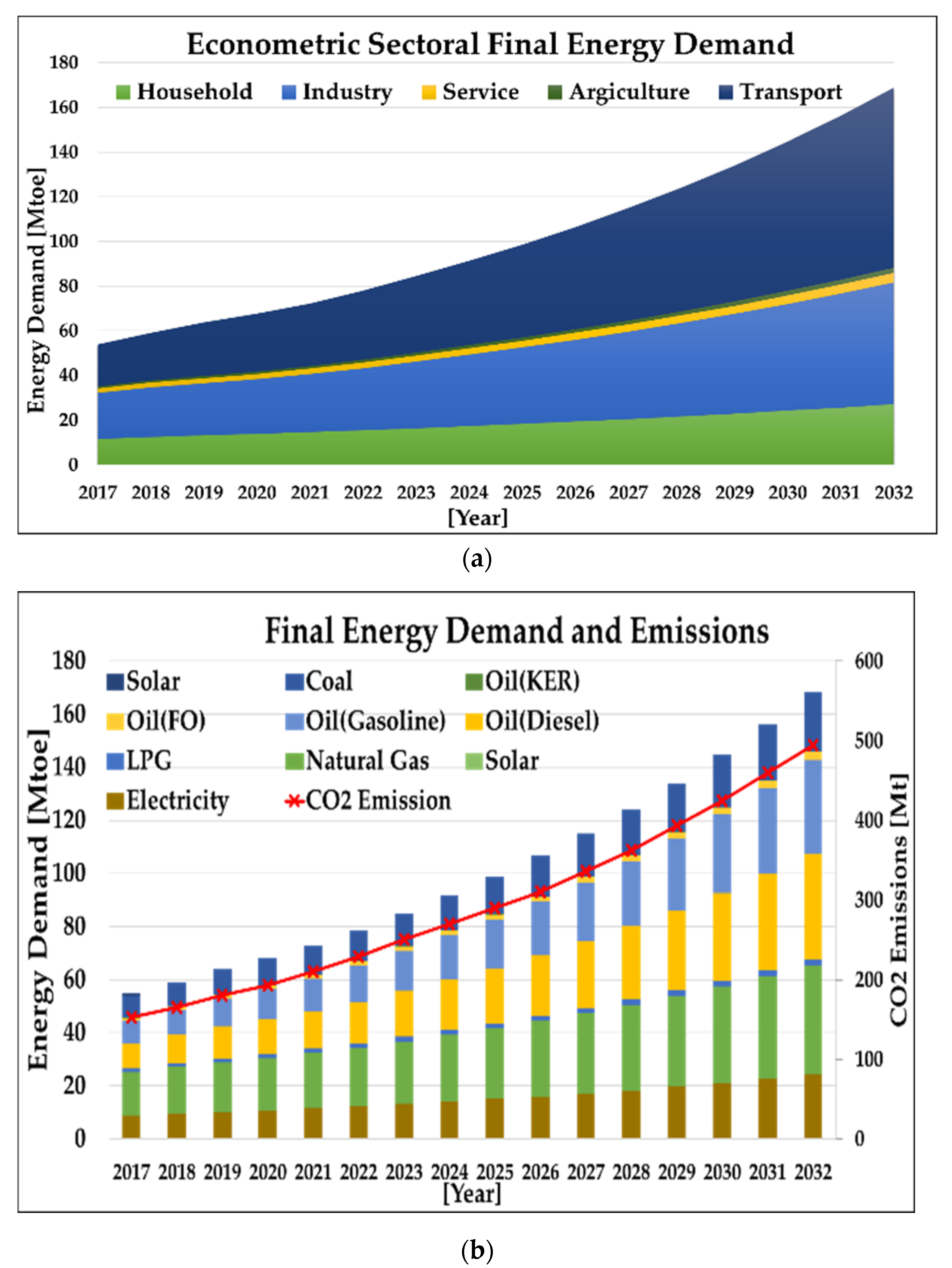

5.1.1. Baseline Scenario

5.1.2. Economic Scenario

5.2. Supply-Side Analysis

5.2.1. Baseline Scenario

5.2.2. REN and NC Scenario

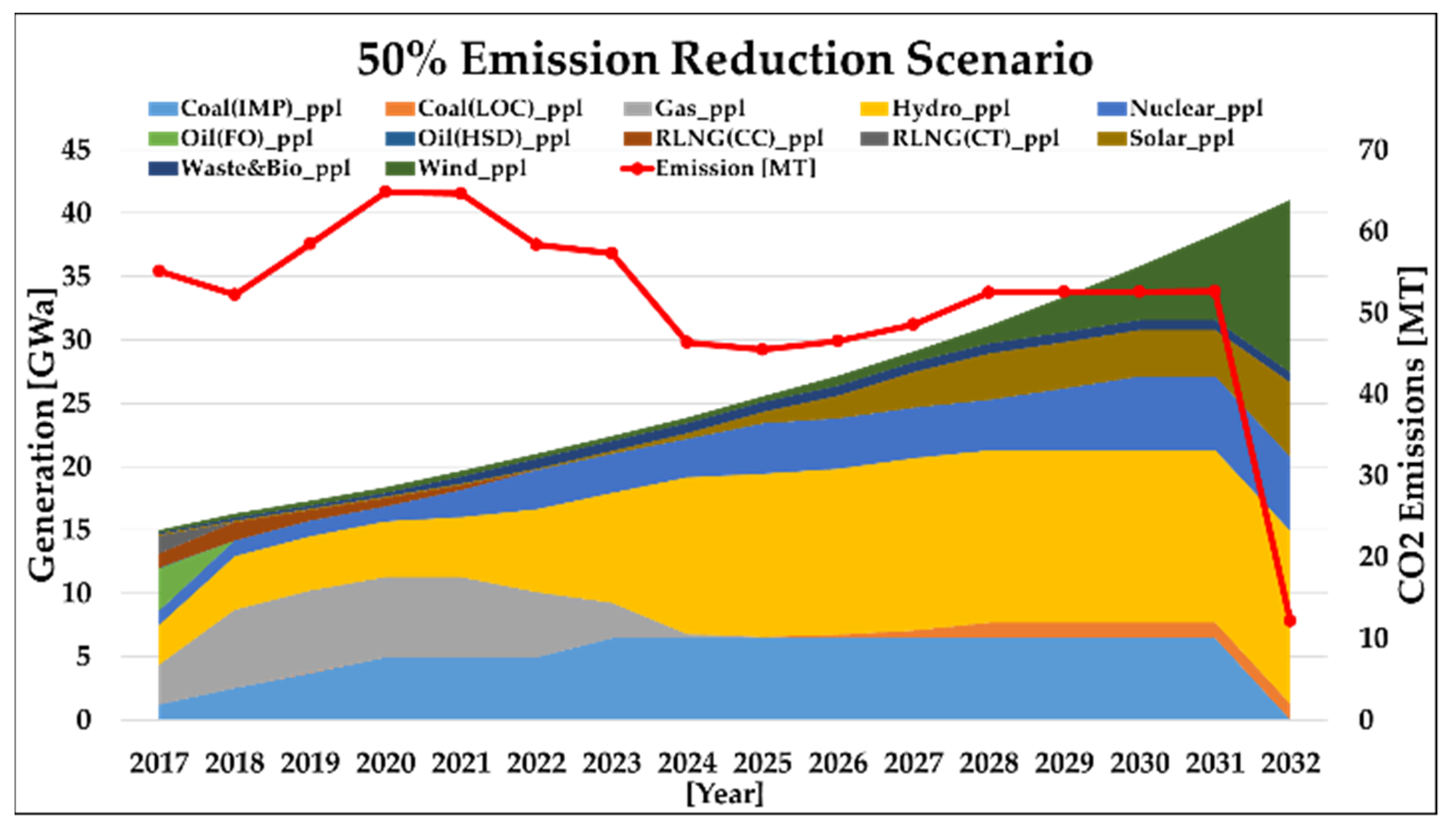

5.3. Emission Reduction Targets

5.4. Integrated Demand-Supply Scenarios Analysis

6. Challenges and Opportunities

7. Conclusions

- Expending the model horizon to accommodate advanced and prospect carbon mitigation technologies (i.e., carbon capture and utilization, coal liquefaction);

- Evaluation of capacity value or contribution (based on the correlation of generation with load profile) for renewable sources;

- Enhancement of temporal resolution to include more details on operation and load patterns (i.e., seasonality);

- Analysis of conventional schemes, various storage options, and demand response programs to match the flexibility requirements in high penetration of renewable energy sources in the future;

- Updating the estimation of the trend of extraction of local resources;

- Estimating the future costs of local resources and imported energy commodities, especially the analysis of imported LNG in case of the depletion of domestic natural gas reserves;

- Study of more scenarios on the demand and supply sides, such as the impact of fuel switching (from traditional biomass to modern and clean options) in the residential sector.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Sectors | Variable | Level | First Diff. | Decision | ||

|---|---|---|---|---|---|---|

| t-Stat | p-Val. | t-Stat | p-Val. | |||

| Household (HH) | ln (EC_HH)t | −0.589 | 0.853 | −6.556 | 0.000 | I(1) |

| ln (EP_HH)t | −2.469 | 0.137 | −5.040 | 0.001 | I(1) | |

| ln (CONS)t | 0.794 | 0.991 | −3.887 | 0.009 | I(1) | |

| Transport (TRNS) | ln (EC_TRNS)t | 1.065 | 0.996 | −4.050 | 0.006 | I(1) |

| ln (EP_TRNS)t | −1.625 | 0.453 | −3.837 | 0.009 | I(1) | |

| ln (CONS)t | 0.794 | 0.991 | −3.887 | 0.009 | I(1) | |

| Industry (IND) | ln (EC_IND)t | −0.840 | 0.785 | −2.475 | 0.136 | I(2) |

| ln (EP_IND)t | −1.60758 | 0.461 | −6.5936 | 0.000 | I(1) | |

| ln (VA_IND)t | −0.47101 | 0.879 | −4.20294 | 0.0043 | I(1) | |

| Service (SRV) | ln (EC_SRV)t | −1.05949 | 0.71 | −2.64199 | 0.1015 | I(2) |

| ln (EP_SRV)t | −2.31065 | 0.178 | −5.88428 | 0.0001 | I(1) | |

| ln (VA_SRV)t | 0.094845 | 0.957 | −2.33057 | 0.1727 | I(2) | |

| Agriculture (AGRI) | ln (EC_AGRI)t | −2.24377 | 0.198 | −3.29012 | 0.0293 | I(1) |

| ln (EP_AGRI)t | −1.77701 | 0.38 | −2.90758 | 0.0621 | I(2) | |

| ln (VA_AGRI)t | −0.77251 | 0.806 | −6.0167 | 0.0001 | I(1) | |

Appendix B

| Sector | Variable | Coefficient | Std. Error | t-Stat | Prob. |

|---|---|---|---|---|---|

| Household (HH) | ln(EC_HH)t−1 | 0.402 | 0.179 | 2.249 | 0.038 |

| ln(EP_HH)t | −0.046 | 0.057 | −0.814 | 0.427 | |

| ln(CONS)t | 0.622 | 0.189 | 3.289 | 0.004 | |

| Constant | −8.568 | 2.680 | −3.196 | 0.005 | |

| Transport (TRNS) | ln(EC_TRNS)t−1 | 0.652 | 0.254 | 2.568 | 0.030 |

| ln(EC_TRNS)t−2 | −0.554 | 0.271 | −2.046 | 0.071 | |

| ln(EC_TRNS)t−3 | 0.202 | 0.229 | 0.879 | 0.402 | |

| ln(EP_TRNS) | −0.289 | 0.071 | −4.080 | 0.003 | |

| ln(EP_TRNS)t−1 | 0.255 | 0.129 | 1.976 | 0.080 | |

| ln(EP_TRNS)t−2 | −0.265 | 0.120 | −2.213 | 0.054 | |

| ln(CONS)t | 0.616 | 0.382 | 1.611 | 0.142 | |

| ln(CONS)t−1 | −0.776 | 0.568 | −1.365 | 0.205 | |

| ln(CONS)t−2 | 1.055 | 0.448 | 2.357 | 0.043 | |

| Constant | −13.009 | 3.605 | −3.608 | 0.006 | |

| Industry (IND) | ln(EC_IND)t−1 | 0.876 | 0.248 | 3.533 | 0.003 |

| ln(EC_IND)t−2 | −0.406 | 0.193 | −2.109 | 0.052 | |

| ln(EP_IND)t | −0.283 | 0.116 | −2.434 | 0.028 | |

| ln(VA_IND)t | 0.402 | 0.152 | 2.654 | 0.018 | |

| Constant | −0.911 | 2.196 | −0.415 | 0.684 | |

| Service (SRV) | ln(EC_SRV)t−1 | 0.677 | 0.175 | 3.864 | 0.001 |

| ln(EP_SRV)t | −0.108 | 0.075 | −1.434 | 0.171 | |

| ln(VA_SRV)t | 1.191 | 0.558 | 2.136 | 0.049 | |

| ln(VA_SRV)t−1 | −0.853 | 0.594 | −1.435 | 0.171 | |

| Constant | −4.559 | 3.360 | −1.357 | 0.194 | |

| Agriculture (AGRI) | ln(EC_AGRI)t−1 | 0.289 | 0.212 | 1.362 | 0.206 |

| ln(EC_AGRI)t−2 | 0.400 | 0.220 | 1.815 | 0.103 | |

| ln(EC_AGRI)t−3 | −0.750 | 0.178 | −4.199 | 0.002 | |

| ln(EP_AGRI)t | −0.578 | 0.133 | −4.329 | 0.002 | |

| ln(EP_AGRI)t−1 | 0.288 | 0.158 | 1.824 | 0.102 | |

| ln(EP_AGRI)t−2 | 0.057 | 0.136 | 0.416 | 0.687 | |

| ln(EP_AGRI)t−3 | −0.309 | 0.162 | −1.905 | 0.089 | |

| ln(VA_AGRI)t | −0.507 | 0.571 | −0.888 | 0.397 | |

| ln(VA_AGRI)t−1 | 1.152 | 0.617 | 1.866 | 0.095 | |

| Constant | −0.077 | 3.773 | −0.020 | 0.984 |

References

- UN. Paris Agreement; UN: New York, NY, USA, 2015. [Google Scholar]

- Farzaneh, H. Devising a Clean Energy Strategy for Asian Citie; Springer Nature: Basingstoke, UK, 2019. [Google Scholar]

- GERMANWATCH. Global Climate Risk Index 2020; GERMANWATCH: Bonn, Germany, 2020. [Google Scholar]

- UNFCCC. Pakistan’s Intended Nationally Determined Constribution (PAK-INDC); UNFCCC: Bonn, Germany, 2016. [Google Scholar]

- International Energy Agency. CO2 emissions from fuel combustion. Outlook 2019, 1–92. [Google Scholar]

- Perwez, U.; Sohail, A. Forecasting of Pakistan’s net electricity energy consumption on the basis of energy pathway scenarios. Energy Procedia 2014, 61, 2403–2411. [Google Scholar] [CrossRef]

- Farooq, M.K.; Kumar, S.; Shrestha, R.M. Energy, environmental and economic effects of renewable portfolio standards (RPS) in a developing country. Energy Policy 2013, 62, 989–1001. [Google Scholar]

- Arif, A.; Rizwan, M.; Elkamel, A.; Hakeem, L.; Zaman, M. Optimal selection of integrated electricity generation systems for the power sector with low greenhouse gas (GHG) emissions. Energies 2020, 13, 4571. [Google Scholar] [CrossRef]

- NTDC. IGCEP Plan 2018–2040; NTDC: Lahore, Pakistan, 2019.

- Ur Rehman, S.A.; Cai, Y.; Fazal, R.; Walasai, G.D.; Mirjat, N.H. An integrated modeling approach for forecasting long-term energy demand in Pakistan. Energies 2017, 10, 1868. [Google Scholar]

- Ur Rehman, S.A.; Cai, Y.; Siyal, Z.A.; Mirjat, N.H.; Fazal, R.; Kashif, S.U.R. Cleaner and sustainable energy production in Pakistan: Lessons learnt from the Pak-times model. Energies 2019, 13, 108. [Google Scholar] [CrossRef]

- Jamil, R. Hydroelectricity consumption forecast for Pakistan using ARIMA modeling and supply-demand analysis for the year 2030. Renew. Energy 2020, 154, 1–10. [Google Scholar] [CrossRef]

- Mirjat, N.H.; Uqaili, M.A.; Harijan, K.; Walasai, G.D.; Mondal, M.A.H.; Sahin, H. Long-term electricity demand forecast and supply side scenarios for Pakistan (2015–2050): A LEAP model application for policy analysis. Energy 2018, 165, 512–526. [Google Scholar] [CrossRef]

- Aized, T.; Shahid, M.; Bhatti, A.A.; Saleem, M.; Anandarajah, G. Energy security and renewable energy policy analysis of Pakistan. Renew. Sustain. Energy Rev. 2018, 84, 155–169. [Google Scholar]

- Ishaque, H. Is it wise to compromise renewable energy future for the sake of expediency? An analysis of Pakistan’s long-term electricity generation pathways. Energy Strateg. Rev. 2017, 17, 6–18. [Google Scholar]

- Azam, A.; Rafiq, M.; Shafique, M.; Ateeq, M.; Yuan, J. Causality relationship between electricity supply and economic growth: Evidence from Pakistan. Energies 2020, 13, 837. [Google Scholar] [CrossRef]

- JICA. Project for Least Cost Power Generation and Transmission Expansion Plan Final Report; JICA: Tokyo, Japan, 2016.

- Anwar, J. Analysis of energy security, environmental emission and fuel import costs under energy import reduction targets: A case of Pakistan. Renew. Sustain. Energy Rev. 2016, 65, 1065–1078. [Google Scholar] [CrossRef]

- Gul, M.; Qureshi, W.A. Modeling diversified electricity generation scenarios for Pakistan. In Proceedings of the 2012 IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012; pp. 1–7. [Google Scholar]

- Hussain, A.; Rahman, M.; Memon, J.A. Forecasting electricity consumption in Pakistan: The way forward. Energy Policy 2016, 90, 73–80. [Google Scholar] [CrossRef]

- NTDC. Electricity Demand Forecast Based on Multiple Regression Analysis 2014; NTDC: Lahore, Pakistan, 2014; pp. 1–111.

- Shahbaz, M.; Lean, H.H. The dynamics of electricity consumption and economic growth: A revisit study of their causality in Pakistan. Energy 2012, 39, 146–153. [Google Scholar] [CrossRef]

- Zaman, K.; Khan, M.M.; Ahmad, M.; Rustam, R. Determinants of electricity consumption function in Pakistan: Old wine in a new bottle. Energy Policy 2012, 50, 623–634. [Google Scholar] [CrossRef]

- Farzaneh, H.; Doll, C.N.H.; Puppim De Oliveira, J.A. An integrated supply-demand model for the optimization of energy flow in the urban system. J. Clean. Prod. 2016, 114, 269–285. [Google Scholar] [CrossRef]

- Haider, A.; Husnain, M.I.U.; Rankaduwa, W.; Shaheen, F. Nexus between nitrous oxide emissions and agricultural land use in agrarian economy: An ardl bounds testing approach. Sustainability 2021, 13, 2808. [Google Scholar] [CrossRef]

- Abumunshar, M.; Aga, M.; Samour, A. Oil price, energy consumption, and CO2 emissions in Turkey. New evidence from a bootstrap ARDL test. Energies 2020, 13, 5588. [Google Scholar] [CrossRef]

- Busu, M. Analyzing the impact of the renewable energy sources on economic growth at the EU level using an ARDL model. Mathematics 2020, 8, 1367. [Google Scholar] [CrossRef]

- Samuelson. Foundations of Economic Analysis, Enlarged Edition; Harvard University Press: Cambridge, MA, USA, 1983. [Google Scholar]

- Farzaneh, H. Energy Systems Modeling: Principles and Applications; Springer: New York, NY, USA, 2019. [Google Scholar]

- Huppmann, D.; Gidden, M.; Fricko, O.; Kolp, P.; Orthofer, C.; Pimmer, M.; Kushin, N.; Vinca, A.; Mastrucci, A.; Riahi, K.; et al. The MESSAGEix Integrated Assessment Model and the ix modeling platform (ixmp): An open framework for integrated and cross-cutting analysis of energy, climate, the environment, and sustainable development. Environ. Model. Softw. 2019, 112, 143–156. [Google Scholar] [CrossRef]

- Sullivan, P.; Krey, V.; Riahi, K. Impacts of considering electric sector variability and reliability in the MESSAGE model. Energy Strateg. Rev. 2013, 1, 157–163. [Google Scholar] [CrossRef]

- Ministry of Energy (Petroleum Division) Hydrocarbon Development Institute of Pakistan. Pakistan Energy Year Book 2018. 2018; 156. [Google Scholar]

- World Bank. World Development Indicators (WDI); World Bank: Washington, DC, USA, 2021. [Google Scholar]

- Pakistan Burea of Statistics. Pakistan Social and Living Standards Measurement Survey; Pakistan Burea of Statistics: Islamabad Pakistan, 2015.

- Pakistan Bureau of Statistics. District Wise Population by Sex and Rural/Urban Government of Pakistan. 6th Population Census; Pakistan Bureau of Statistics: Islamabad, Pakistan, 2017; Volume 13.

- United Nations, Department of Economic and Social Affairs, Population Division (2019). World Population Prospects 2019, Online Edition. Rev. 1. Available online: https://population.un.org/wpp/ (accessed on 1 May 2021).

- Finance Division (Government of Pakistan). Economic Survey (Multiple Issues) 2017-18. 2018. Available online: http://www.finance.gov.pk/survey_1718.html (accessed on 1 May 2021).

- PEC. Buidling Codes of Pakistan (Energy Provision 2011); Pakistan Engineering Council: Islamabad, Pakistan, 2011. [Google Scholar]

- Amber, K.P.; Aslam, M.W.; Ikram, F.; Kousar, A.; Ali, H.M.; Akram, N.; Afzal, K.; Mushtaq, H. Heating and cooling degree-days maps of Pakistan. Energies 2018, 11, 94. [Google Scholar] [CrossRef]

- Biresselioglu, M.E.; Demir, M.H.; Rashid, A.; Solak, B.; Ozyorulmaz, E. What are the preferences of household energy use in Pakistan?: Findings from a national survey. Energy Build 2019, 205, 109538. [Google Scholar] [CrossRef]

- Ravindranath, N.H.; Ramakrishna, J. Energy options for cooking in India. Energy Policy 1997, 25, 63–75. [Google Scholar] [CrossRef]

- Sudhakara Reddy, B. Electrical vs solar water heater: A case study. Energy Convers. Manag. 1995, 36, 1097–1106. [Google Scholar] [CrossRef]

- Shabbir, R.; Ahmad, S.S. Monitoring urban transport air pollution and energy demand in Rawalpindi and Islamabad using leap model. Energy 2010, 35, 2323–2332. [Google Scholar] [CrossRef]

- Saxena, S.; Gopal, A.; Phadke, A. Electrical consumption of two-, three- and four-wheel light-duty electric vehicles in India. Appl. Energy 2014, 115, 582–590. [Google Scholar] [CrossRef]

- The National Renewable Energy Laboratory (NREL). Annual Technology Baseline (ATB) 2019. Available online: https://atb.nrel.gov/electricity/2019/summary.html (accessed on 1 May 2021).

- Ghafoor, A.; Rehman, T.U.; Munir, A.; Ahmad, M.; Iqbal, M. Current status and overview of renewable energy potential in Pakistan for continuous energy sustainability. Renew. Sustain. Energy Rev. 2016, 60, 1332–1342. [Google Scholar] [CrossRef]

- Private Power and Infrastructure Board. Pakistan Hydel Power Potential. Pakistan Hydel. Power Potential, 2002; 112. [Google Scholar]

- Oil & Gas Regulatory Authority of Pakistan. State of regulated petroleum industry 2017–2018. 2019; 53, 1689–1699. [Google Scholar]

- Ministry of Planning, Development and Reforms (Government of Pakistan). Pakistan 2025. Available online: https://www.pc.gov.pk/uploads/vision2025/Pakistan-Vision-2025.pdf (accessed on 1 May 2021).

- Global Solar Atlas 2.0, Web-Based Application Is Developed and Operated by the Company Solargis s.r.o. on Behalf of the World Bank Group, Utilizing Solargis Data, with Funding Provided by the Energy Sector Management Assistance Program (ESMAP). Available online: https://globalsolaratlas.info (accessed on 1 May 2021).

- Global Wind Atlas 3.0, a Free, Web-Based Application Developed, Owned and Operated by the Technical University of Denmark (DTU). The Global Wind Atlas 3.0 is Released in Partnership with the World Bank Group, Utilizing Data Provided by Vortex, Using Funding Provided by the Energy Sector Management Assistance Program (ESMAP). Available online: https://globalwindatlas.info (accessed on 1 May 2021).

- Savin, N.E.; White, K.J. The Durbin-Watson Test for Serial Correlation with Extreme Sample Sizes or Many Regressors. Econometrica 1977, 45, 1989–1996. [Google Scholar] [CrossRef]

- Perwez, U.; Sohail, A.; Hassan, S.F.; Zia, U. The long-term forecast of Pakistan’s electricity supply and demand: An application of long range energy alternatives planning. Energy 2015, 93, 2423–2435. [Google Scholar] [CrossRef]

- Mackinnon, J.G. Numerical distribution functions for unit root and cointegration tests. J. Appl. Econom. 1996, 11, 601–618. [Google Scholar] [CrossRef]

| Purpose of Study | Focus Field | Future Model Horizon | Methodological Approach | Tool/Techniques Employed | Reference |

|---|---|---|---|---|---|

| Estimation of emissions of major air pollutants from energy transformation processes in the country | Supply | 2015–2035 | Optimization | ANSWER-TIMES | [11] |

| A forecasting study of hydroelectricity consumption in Pakistan based on the historical data of the past 53 years | Supply | 2017–2030 | Time Series Analysis | ARIMA | [12] |

| To develop Pakistan’s LEAP modeling framework | Supply | 2015–2050 | Accounting/ Simulation | LEAP | [13] |

| Analyzing renewable energy policy of Pakistan and examining and finding the ways to secure energy supplies in future | Supply | 2012–2030 | Accounting/ Simulation | LEAP | [14] |

| Analyzing the long-term electricity demand for Pakistan’s economy as envisaged in Pakistan Vision 2025 fomented by high economic growth | Supply | 2014–2035 | Accounting/ Simulation | LEAP | [15] |

| To explore the Granger causality relationship between electricity supply and economic growth (EG) | Supply | - | Econometrics | Granger causality | [16] |

| Under National Power Policy 2013, the development of an efficient and consumer-oriented sustainable and economical electric power system | Supply | 2015–2035 | Optimization/ Simulation | WASP | [17] |

| Evaluate the impact of import reduction on energy supply, resource diversification, cost energy security, and environmental emissions | Supply | 2005–2050 | Optimization | MARKAL | [18] |

| Modeling tools-based pathways for Pakistan power sector to depict the future challenges and aspects associated with its forecasting and planning | Supply | 2011–2030 | Accounting/ Simulation | LEAP | [19] |

| Energy supply modeling based on the forecasted demand in Pakistan | Supply | 2005–2030 | Accounting/ Simulation | LEAP | [10] |

| Using historical series data to forecast total and component-wise electricity consumption in Pakistan | Demand | 2012–2020 | Time Series | ARIMA, Holt-Winters | [20] |

| Electricity demand forecast based on multiple regression | Demand | 2014–2037 | Statistics | Multiple Regression | [21] |

| Revisit the relationship between electricity consumption and economic growth in Pakistan by controlling and investigating the effects of two major production factors—capital and labor | Demand | - | Econometrics | Econometric | [22] |

| To reinvestigate the multivariate electricity consumption function for Pakistan | Demand | - | Econometrics | ARDL | [23] |

| Sector | Explanatory Variable | Explaining Variable * |

|---|---|---|

| Household | Energy Consumption | Income, Energy Price |

| Transport | Energy Consumption | Income, Energy Price |

| Industry | Energy Consumption | Value Added, Energy Price |

| Service | Energy Consumption | Value Added, Energy Price |

| Agriculture | Energy Consumption | Value Added, Energy Price |

| Sector | Sub Sector | Activity Indicator |

|---|---|---|

| Household | Space Heating | Heating area [m2] |

| Air Conditioning | Units [Nos.] | |

| Cooking | Population | |

| Water Heating | Population | |

| Electric Appliances | Units [Nos.] | |

| Transport | Passenger Transportation | Passenger-km [PKM] |

| Freight Transportation | Freight-km [PKM] | |

| Industry | - | Sectoral Value Added [$] |

| Service | - | Sectoral Value Added [$] |

| Agriculture | - | Sectoral Value Added [$] |

| Technology | Flexibility Factor [%] |

|---|---|

| Coal(IMP)_ppl | 0.15 |

| Coal(LOC)_ppl | 0.15 |

| Gas(CT)_ppl | 1 |

| Gas(CC)_ppl | 0.5 |

| Oil(FO)_ppl | 0.5 |

| Oil(HSD)_ppl | 1 |

| Nuclear_ppl | 0 |

| Hydro_ppl | 0.5 |

| Waste&Bio_ppl | 0.3 |

| Elect_T&D | −0.1 |

| Storage | 1 |

| Wind_ppl | −0.08 |

| Solar_ppl | −0.05 |

| Sectors | Variable | Mean | Median | Max. | Min. | Std.Dev. | Obs. |

|---|---|---|---|---|---|---|---|

| Household (HH) | ln (EC_HH)t | 8.94 | 8.96 | 9.36 | 8.48 | 0.27 | 22 |

| ln (EP_HH)t | 6.09 | 6.06 | 6.41 | 5.91 | 0.13 | 22 | |

| ln (CONS)t | 8.75 | 8.78 | 9.21 | 8.35 | 0.25 | 22 | |

| Transport (TRNS) | ln (EC_TRNS)t | 9.29 | 9.28 | 9.83 | 8.93 | 0.25 | 22 |

| ln (EP_TRNS)t | 6.62 | 6.59 | 6.93 | 6.33 | 0.18 | 22 | |

| ln (CONS)t | 8.75 | 8.78 | 9.21 | 8.35 | 0.25 | 22 | |

| Industry (IND) | ln (EC_IND)t | 9.44 | 9.58 | 9.93 | 8.99 | 0.30 | 22 |

| ln (EP_IND)t | 6.06 | 6.05 | 6.47 | 5.80 | 0.17 | 22 | |

| ln (VA_IND)t | 7.34 | 7.43 | 7.80 | 6.87 | 0.31 | 22 | |

| Service (SRV) | ln (EC_SRV)t | 7.09 | 7.26 | 7.61 | 6.50 | 0.37 | 22 |

| ln (EP_SRV)t | 6.99 | 7.00 | 7.29 | 6.77 | 0.14 | 22 | |

| ln (VA_SRV)t | 8.35 | 8.40 | 8.86 | 7.87 | 0.31 | 22 | |

| Agriculture (AGRI) | ln (EC_AGRI)t | 6.61 | 6.59 | 6.75 | 6.49 | 0.08 | 22 |

| ln (EP_AGRI)t | 6.95 | 6.93 | 7.35 | 6.63 | 0.19 | 22 | |

| ln (VA_AGRI)t | 7.48 | 7.50 | 7.72 | 7.21 | 0.17 | 22 |

| Parameter | Unit | Value |

|---|---|---|

| Population | [million] | 207.77 |

| Urban | ||

| Urban Population | [million] | 75.58 |

| Urban Dwellings | [million] | 12.19 |

| Share of Urban Population | [%] | 36.38 |

| Urban Household Size | [Capita/HH] | 6.2 |

| Share of Population in Large Cities | [%] | 19.1 |

| Rural | ||

| Rural Population | [million] | 132.19 |

| Rural Dwellings | [million] | 20.01 |

| Rural Household Size | [Capita/HH] | 6.61 |

| Sectors | Model Specification ARDL (q,p,p) | R2 | F-Statistics | Durbin–Watson Stat |

|---|---|---|---|---|

| Household | ARDL (1,0,0) | 0.99 | 615.24 | 2.07 |

| Transport | ARDL (3,2,2) | 0.98 | 97.08 | 1.84 |

| Industry | ARDL (2,0,0) | 0.99 | 104.83 | 2.41 |

| Service | ARDL (1,0,1) | 0.99 | 389.64 | 1.79 |

| Agriculture | ARDL (3,3,1) | 0.77 | 7.61 | 1.82 |

| Sectors | Variable | Test Stats | |||

|---|---|---|---|---|---|

| Coefficient | Std. Error | t-Stat | p-Val. | ||

| Household (HH) | ln (EP_HH)t | −0.095 | 0.075 | −1.269 | 0.222 |

| ln (CONS)t | 1.032 | 0.040 | 25.569 | 0.000 | |

| Constant | 0.516 | 0.644 | 0.801 | 0.434 | |

| Transport (TRNS) | ln (EP_TRNS)t | −0.370 | 0.358 | −1.034 | 0.341 |

| ln (CONS)t | 1.193 | 0.274 | 4.349 | 0.005 | |

| Constant | 1.369 | 0.383 | 3.577 | 0.012 | |

| Industry (IND) | ln (EP_IND)t | −0.644 | 0.053 | −12.064 | 0.001 |

| ln (VA_IND)t | 0.692 | 0.021 | 32.551 | 0.000 | |

| Constant | 8.241 | 0.470 | 17.526 | 0.000 | |

| Service (SRV) | ln (EP_SRV)t | −0.353 | 0.047 | −7.515 | 0.002 |

| ln (VA_SRV)t | 1.120 | 0.029 | 38.300 | 0.000 | |

| Constant | 0.248 | 0.538 | 0.460 | 0.669 | |

| Agriculture (AGRI) | ln (EP_AGRI)t | −0.502 | 0.046 | −10.805 | 0.000 |

| ln (VA_AGRI)t | 0.558 | 0.045 | 12.358 | 0.000 | |

| Constant | 5.897 | 0.149 | 39.529 | 0.000 | |

| Scenario | Subscenario | Average Annual Emissions [MT] | LCOE [Cents/kWh] | RE Share [%] in 2032 |

|---|---|---|---|---|

| Baseline | - | 102.5 | 7.00 | 17.16 |

| REN | - | 77.4 | 7.94 | 45.69 |

| NC | - | 63.8 | 8.00 | 62.61 |

| Scenario | Sub-Scenario | Average Annual Emissions [MT] | LCOE [Cents/kWh] | RE Share [%] in 2032 |

|---|---|---|---|---|

| Emission Targets | 10% | 32.47 | 7.36 | 32.47 |

| 20% | 82.0 | 7.60 | 45.12 | |

| 30% | 71.7 | 7.70 | 52.92 | |

| 40% | 61.5 | 7.87 | 60.92 | |

| 50% | 51.2 | 8.48 | 82.74 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abrar, S.; Farzaneh, H. Scenario Analysis of the Low Emission Energy System in Pakistan Using Integrated Energy Demand-Supply Modeling Approach. Energies 2021, 14, 3303. https://doi.org/10.3390/en14113303

Abrar S, Farzaneh H. Scenario Analysis of the Low Emission Energy System in Pakistan Using Integrated Energy Demand-Supply Modeling Approach. Energies. 2021; 14(11):3303. https://doi.org/10.3390/en14113303

Chicago/Turabian StyleAbrar, Sajid, and Hooman Farzaneh. 2021. "Scenario Analysis of the Low Emission Energy System in Pakistan Using Integrated Energy Demand-Supply Modeling Approach" Energies 14, no. 11: 3303. https://doi.org/10.3390/en14113303

APA StyleAbrar, S., & Farzaneh, H. (2021). Scenario Analysis of the Low Emission Energy System in Pakistan Using Integrated Energy Demand-Supply Modeling Approach. Energies, 14(11), 3303. https://doi.org/10.3390/en14113303