1. Introduction

Commitments and efforts in reducing greenhouse gas emissions as well as increasing concerns over energy security have triggered the transitioning of the European Union (EU) energy system toward a higher proportion of clean energy generation and reduction of energy use through the implementation of energy efficiency measures [

1,

2,

3]. In most of the EU much of the transition to decarbonized energy systems has to date been led by major investors and large companies [

4,

5], but smaller players as well as citizens and local communities are increasingly playing an active role in delivering clean energy investments. Transition toward decentralized energy systems, progressive liberalization of energy markets, and technological innovation have left space for an active role of energy users, which are turning into “prosumers” or co-providers of energy services [

6,

7]. While consumers’ participation to energy transition is increasingly concerning the policy makers [

8], community energy (CE) and shared ownership approaches for investments in the energy sector have been developing worldwide [

9,

10,

11]. They enable citizens to collectively develop and manage energy projects or services, presenting a different model of development and ownership than traditional business organizations [

12,

13].

The first CE initiatives date back to early 20th century, when rural electrification cooperatives existed in Europe in countries such as Germany, Italy, or Spain [

14,

15,

16]. They have been later associated with renewable energy production with the rise of wind cooperatives in Denmark in the late 1970s and with new waves of citizens’ initiatives after Chernobyl disaster in 1986 (in particular in Germany and Belgium). It is from the 2000s that they began emerging as new paradigms of people engagement in the energy transition toward renewable energy production, facilitated and driven by the last decade’s energy system liberalization and transition toward more decentralized energy systems [

12].

However, the degree of recognition of the potential contribution of citizens to the energy transition and the level of deployment of CE initiatives still varies considerably across Europe. CE initiatives are more common in Northern Europe, particularly in Denmark, Germany, and the United Kingdom, and far less developed in Southern Europe. Germany hosts more than 800 energy cooperatives, accounting for about 34% of the citizenship [

17] whereas in countries like Spain or Greece less than 10 initiatives have been reported [

16,

18]. Indeed, most of the academic literature researching dynamics, drivers, and conditions for implementation of CE initiatives mainly focus on Northern European countries [

19,

20,

21,

22,

23]. This suggests the need of deeper analysis on the status of the CE sector in Southern Europe.

The intention of this paper is to contribute to this debate by providing new evidence on the Italian CE sector, which has been to date overlooked by scholars. Magnani and Osti [

24] have looked into the role of Italian civil society in energy transition, and few other contributions have studied some specific Italian CE initiatives [

25,

26]. However, no academic contribution has to date provided a comprehensive review of the Italian CE sector.

We use a qualitative and descriptive approach to search, analyze, and present evidence of CE initiatives that emerged in the country in the last decade. We firstly characterize the sector through a systematic review of the Italian CE initiatives which, as experienced in other northern European countries [

14,

21], are very heterogeneous. They can take multiple forms depending on the type and scope of their activity, the approach taken for their development as well as the level of citizens’ financial involvement, ownership, and co-determination implied by their legal structure and governance. The objective of the review is providing novel data and evidence as well as a clearer characterization of CE initiatives in Italy. We then focus the attention on three specific case studies representing those larger initiatives still operating to date with the objective of further analyzing and understanding characteristics and conditions for deployment and success of CE within the Italian energy sector.

The paper is structured as follows:

Section 2 defines the boundaries of the analysis and introduces the methodology adopted.

Section 3 presents the results of the systematic review of the Italian CE sector and the case studies.

Section 4 discusses the results of the systematic review and the comparative case studies and in

Section 5 we present the conclusions, including possible future developments.

2. Materials and Methods

Civil society engagement in energy markets can take several forms [

9,

27] and the concept of CE is subject to different interpretations within the academic literature. Some define it in a broad sense: any sustainable energy initiative led by non-profit organizations, not commercially driven or government led [

4,

28], others have stressed the grassroots innovation nature of CE, as driven by civil society activists and by social and/or environmental needs, rather than rent seeking [

29]. Overall, citizens’ participation is commonly identified as a major defining characteristic of CE, but it can encompass a wide range of initiatives: green associations, collective purchasing of energy services, community or local authority led schemes for renewable energy implementation, community programme for energy poverty alleviation [

17,

30,

31]. Such variety would in turn imply different levels and forms of participation and co-determination of citizens in energy services provisions. Similarly to other relevant contributions in the literature [

13,

29,

32,

33], this paper takes a specific perspective in interpreting citizens’ participation in energy service provision by focusing on CE initiatives:

which imply a form of citizen ownership or financing of an energy project, as well as control over the initiatives;

where citizens directly benefit from the outcomes of the initiative.

This study will not focus on other forms of civic engagement in the energy service provision, such as green associations, collective purchasing of energy services, and ethical consumerism, although present and active in the Italian energy ecosystem and in some instances involved in emerging CE initiatives studied in this paper [

24]. The historical hydroelectric cooperatives established in Italian alpine regions at the beginning of the 20th century are also not included in the analysis. They are very specific and currently not replicable cases, functioning as a group of special legal status which in particular allow them to own and manage the local distribution network. Instead, this paper specifically looks at paradigms of citizens’ financial and ownership involvement in energy initiatives which began appearing in Italy and the rest of Europe since the late 2000s [

12,

15]. They are mostly initiatives focused on development of renewable energy production facilities and, most of all, differentiate themselves from Italian historical cooperatives as they do not benefit from their special legal status and cannot own local distribution networks. We took a stepwise approach to investigate the Italian CE sector (

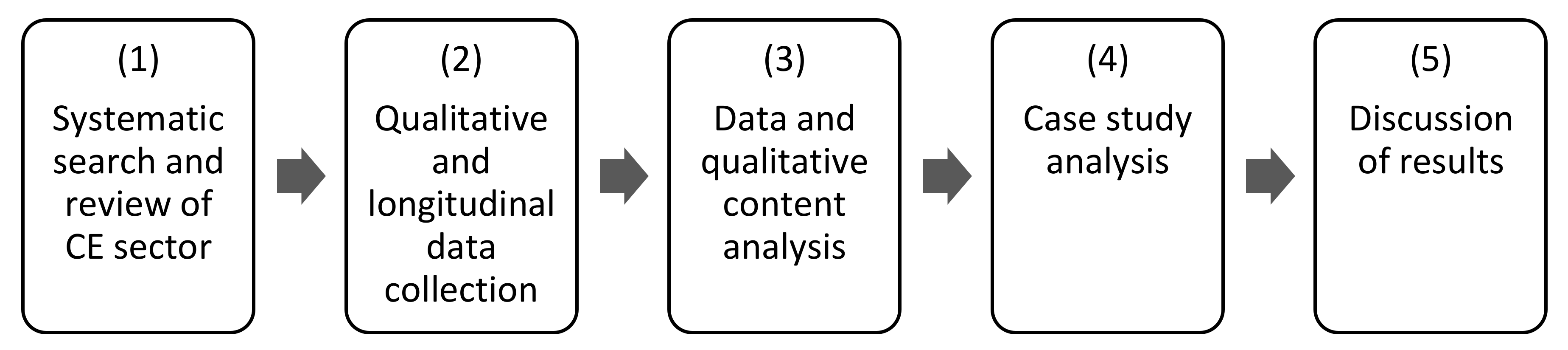

Figure 1).

The first step was a systematic search and review of CE initiatives in Italy (step 1 in

Figure 1). A starting point in the search was the REScoop energy cooperatives inventory [

18] which has been integrated through web-based searches as well as interviews with relevant Italian organizations and stakeholders. These included regional and national green organizations (such as Energoclub, Gas Energia), the Italian ethical bank which has financed several CE initiatives (Banca Etica) and researchers active in the field [

24]. Although the majority of the population has certainly been targeted, it is realistic to assume that some initiatives have slipped through the searching net. This could in particular apply to early stage and civil society led projects not connected to relevant networks and without web presence. The systematic review allowed identification of 17 CE projects in Italy providing a level of financial and/or ownership involvement of citizens.

We then collected qualitative and longitudinal data on the identified initiatives (step 2 in

Figure 1) through semi-structured interviews with one to two representatives for each of them. In some instances, further communication exchange with the representative (both in person and through emailing) allowed us to fine tune and better understand information and data gathered. We gathered data and evidence along the following dimensions:

Dynamics of creation, including information on the timing, the proponent, and the approach adopted for the development of the initiative. We define bottom up approaches as those characterized by strong involvement and initiatives of citizens or other types of grassroots organizations in the initiation and development of the project. Top down approaches are instead those where it is an institution (i.e., a local authority or a private company) leading the process, defining structural features of the project and facilitating citizens’ involvement.

Type of activity and economics, including information on their primary activity (whether energy production, energy consumption, energy services, or a mix of those), characteristics of the projects implemented (e.g., technology type, plant size), and geographical scope of the initiatives (in particular whether citizens involved are geographically close to the project (local) or spread over the national territory (national)).

Organizational structure, including legal form adopted (e.g., cooperative, limited company, or other forms), financing structure (i.e., self-funded, bank loan, coop funds, or a combination of those), finance instrument offered to the citizens (i.e., equity or debt) and ownership structure and level of citizens’ involvement.

Outcomes of the initiatives in terms of benefits offered to members/users, including monetary benefits (returns on investment offered, potential savings on electricity bills) and any other services and benefits accruing from the project (e.g., other energy or community services provided).

We then organized and analyzed data collected together with interviews transcripts and notes (step 3 in

Figure 1). The objective of this evidence gathering was to provide a comprehensive picture of the heterogeneity of the Italian CE sector, to analyze their dynamics of creation, organizational dynamics and level and forms of citizens’ engagement, their type of activity and timing, as well as their outcomes delivered.

Following on we undertook an in-depth comparative case study analysis (step 4 in

Figure 1) of three specific CE initiatives in order to provide a further understanding of CE initiatives conditions for development as well as of success within the Italian energy system (step 5 in

Figure 1).

3. Results of Systematic Review of Italian CE Sector

We used the evidence gathered through the systematic review of the Italian CE initiative to explore their characteristics, dynamics of development, and the forms and level of citizens’ involvement. Although rather complete, the sample is relatively small (17 experiences), but nonetheless provides a snapshot of the Italian CE sector to date and highlights some trends in their characteristics and in the conditions for their development. Data and evidence gathered are presented in

Appendix A (

Table A1,

Table A2,

Table A3) and discussed in what follows.

3.1. Dynamics of Creation and Organizational Structures

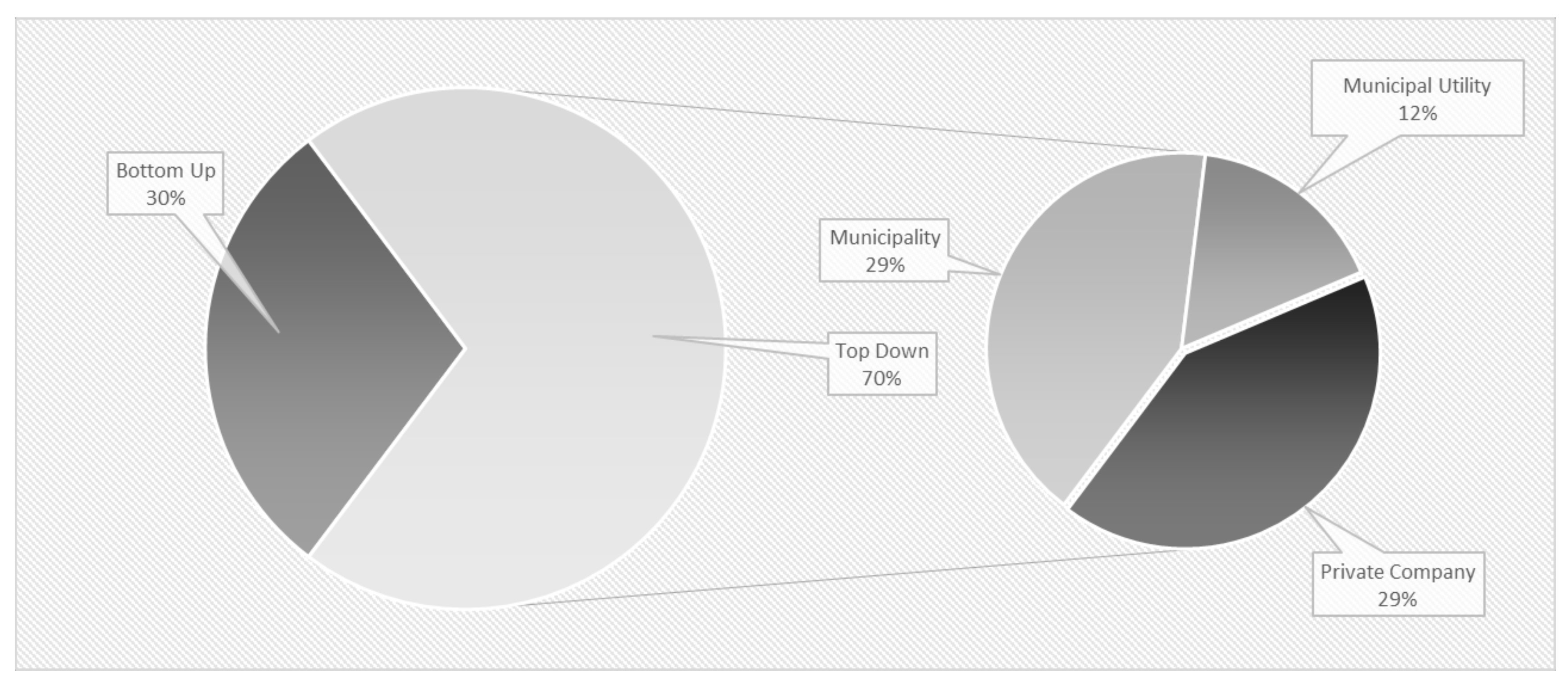

In

Figure 2 we present the distribution of the initiatives between top down and bottom up approaches, i.e., showing to which extent the initiatives identified have been proposed and developed by citizens or other types of grassroot organizations (bottom up) or instead by an institution that defines the project and the form of citizens’ involvement. The majority of the initiatives have been proposed through a top down approach; of those, five have been proposed by a municipality and seven by a commercial actor (either a company or a municipal utility). Only five initiatives have been initiated with a bottom up approach by either a group of citizens or green associations (

Figure 2).

The role of local authorities as facilitators of several projects also emerges, by providing the assets to develop the initiative, such as public building rooftops, or by creating the local regulatory and financing framework conditions to allow it. This reinforces literature views on their potential key position in facilitating energy transitions and influencing local energy system change [

34,

35,

36].

As also experienced in other countries [

12,

17] the legal structure adopted varies, including limited companies, non-profit associations, and cooperatives, which account for about 60% of the sample (

Table A1). Cooperatives are the legal form mostly used in the European CE sector [

12,

14,

37,

38] and are generally deemed to provide the best institutional framework for locally owned and participatory approaches to renewable energy projects. They encompass both the social and economic dimension in their scope and are characterized by a ‘one head one vote’ decision making process, with the aim to provide higher levels of co-determination [

9,

37,

39,

40]. However, generally speaking, the level of participation and co-determination of citizens is not determined only by the legal form adopted and the relative internal governance as defined by national laws and regulations. For example, in the case of cooperatives the ‘one head one vote’ may be applied only in the annual general assembly, resulting in a formal rather than a substantial approach to participation. In order to facilitate co-determination, a wider involvement and influence on the project development and management must be experienced by members of the initiative on a permanent basis and not only sporadically.

For example, Dosso Energia and Kennedy Energia are limited companies, but fully owned, financed, and managed by citizens located close to the renewable generation plant [

41,

42] (

Table A1). Similarly, the Comunità Energetica San Lazzaro has been totally financed and managed by citizens (which also enjoy the relative economic returns and participate in the company governance) although the municipality has retained the formal ownership and the legal form adopted is an association [

43]. Vice versa, evidence shows that some cooperatives may be included among initiatives reaching lower levels of participation and co-determination. They are those developed by companies and/or with a strong top down approach, e.g., Energyland, Masseria del Sole and Comunità Solare. The first two have been promoted by a company, which have firstly fully developed the renewable energy project to offer participation to citizens in a second phase. However, they reached lower levels of citizen ownership than initially planned and through longer processes than other initiatives (several months versus e.g., less than a month for Kennedy Energia [

44,

45]). Comunità Solare shows a similar experience, where ownership has been offered to citizens once PV systems had been already developed by local Energy Service Companies (ESCOs) resulting in very low citizens’ involvement (less than 1% citizens’ ownership [

46]).

Overall, initiatives proposed by companies and with a strong top down approach have been developed with lower involvement of citizens and their organizational structure implies lower citizens’ co-determination. This also emerges from the financing structure adopted: both the three cooperatives proposed by a company and the project proposed by a municipal utility have been initially financed through some form of project financing and then opened to citizens’ financing in a second phase. Instead, initiatives promoted by communities and municipalities have been founded through direct financial contribution of citizens.

3.2. Type of Activity and Timing

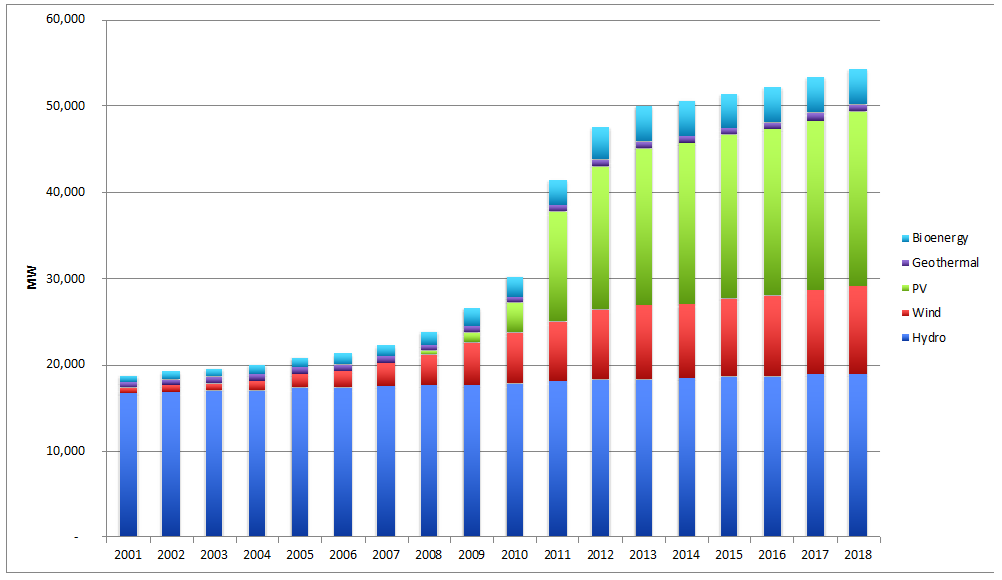

CE projects have been deployed since the second half of the 2000s (

Table A2), particularly since 2010 onwards. This timing coincides with the rapid increase in distributed renewable energy capacity installation in Italy as a result of the implementation of renewable energy support measures, in particular feed in tariffs (FiT) schemes for photovoltaic (PV) systems [

47] (

Figure 3).

Between 2008 and 2013 PV technologies have been benefiting from generous and uncapped FiT schemes [

47] which have guaranteed fixed long-term tariffs and net-metering to PV system owners. Such strong policy support, combined with remarkable reductions in PV modules and installation costs since 2010 [

53,

54], has made PV investments quite profitable and relatively low risk in the wider context of the Italian energy sector. These favorable conditions have been a major driver for the development of Italian CE sector, opening a window of opportunity for the development of PV systems by proponents generally not equipped to deal with large, complex, and high-risk project development in the energy sector. Apart from one initiative providing electricity supply (È Nostra) and one dedicated to wind, electricity production from PV systems is in fact the primary activity across the whole sample (

Table A2).

With the reduction of FiT support in 2013 the Italian PV market has contracted (moving from 3.5 GW/year of installed PV between 2008 and 2013 to 385 MW/year in the period between 2013 and 2018, as shown in

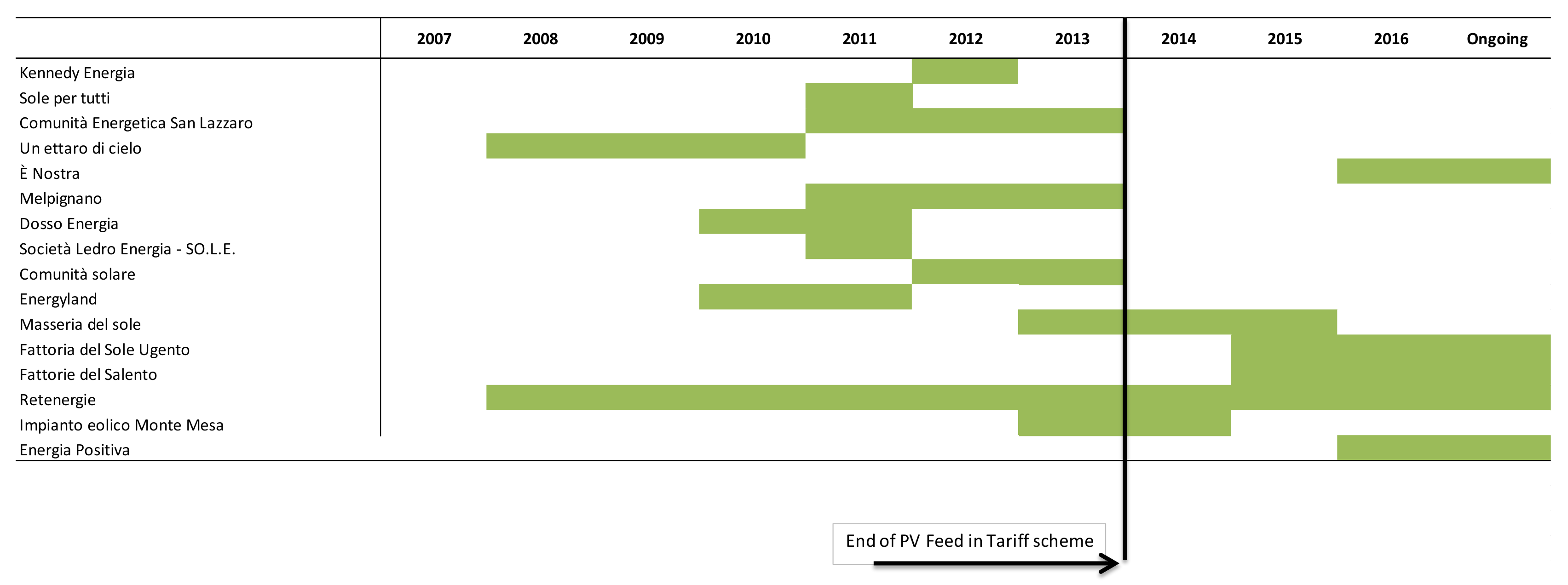

Figure 3) and the Italian CE sector with it. CE sector dependence from PV FiT incentives is clearly shown in

Figure 4, which highlights how the majority of renewable energy plants have been developed between 2008, date of implementation of first FiT scheme in Italy, and 2013, date of discontinuity of FiT support to PV.

Moreover, up to 2013, the Italian CE sector has been mainly characterized by the development of rather small, ‘ad hoc’ initiatives with a strong local focus. While PV systems installed vary in size and application, the majority are small/medium size projects, more easily developed and financed by actors with lower experience in the energy sector (see

Table A2). The focus on smaller, roof mounted PV plants has also been reported by some representatives interviewed as a consequence of a deliberate choice of community or municipality led projects to focus activities on investments perceived more sustainable and with lower impact on the local environment than large ground mounted plants [

41,

42,

55]. The largest projects (ground mounted PV systems in the megawatt range and a wind farm) have been developed by the initiatives led by commercial actors, either company or municipal utility (see also

Table A1). They developed larger projects thanks to their higher internal technical knowledge and expertise which made the founding and development process easier; they were also more connected with economic networks which allow them to get access to capital more easily, making them able to develop more complex projects and bear higher risks (e.g., the risk of not raising enough capital among citizens to finance the investment).

Figure 4 shows how only a few CE initiatives have been developing renewable energy plants after the cancellation of the FiT in 2013, the larger ones and with a national scope in their activities or promoted by commercial actors: Retenergie (which has then merged with È nostra), Masseria del sole, Fattoria del Sole e Fattorie del Salento (the latter three developed by the same company, ForGreen), and Energia Positiva. Moreover, those still operating after 2013 have rarely developed new renewable energy plants and mostly focused their activity on acquiring operating PV plants on the secondary market, which are still benefiting from the FiT support. We will further analyze these initiatives in

Section 3.4.

3.3. Outcomes of CE Initiatives

All the CE initiatives surveyed involve a form of financing or ownership from members against which a monetary return is offered. The returns on investment offered to citizens can vary quite substantially, from 8% to about 1% (

Table A3). Such variation is particularly striking considering that most initiatives have been investing in the same energy technology, PV systems (see

Table A2). This can be partly explained by the size and typology of the PV system: larger ground mounted plants allow higher economies of scale in the investment (both in terms of initial capital costs and transaction costs) and therefore higher returns than smaller roof mounted systems. However, what makes a stronger impact on the monetary returns offered to citizens is the typology of the initiative. Indeed, two distinctive typologies of initiatives emerge (

Table A3):

Initiatives whose primary activity is the production of electricity from a renewable energy plant (in most cases PV) and having as their main objective the distribution among their members of the revenues accruing from the operation of a renewable generation project. The revenues are generally distributed in monetary terms or in electricity bill savings or a combination of both. These kinds of initiatives have generally developed a single renewable generation project, as unique primary activity. Higher financial returns, on average around 6%–8%, are offered by these initiatives. Sole per tutti is the only exception generating lower returns due to the inclusion of roof insulation in the initial total investment cost

Other initiatives which are set up not just to develop renewable energy plants and aggregate citizens around the relative financing and ownership, but also to offer other energy and social services to benefit both cooperative members and wider local communities. These initiatives generally offer on average lower financial returns on the investment as they tend to have more complex financing and organizational structures and, mostly, redistribute revenues from investments in renewable generation projects across a wider set of activities including those that do not generate monetary benefits for their members. An example is Retenergie which offers returns around 0%–3%, but besides fostering deployment of renewable generation plants offers to their members energy and community services, including domestic energy efficiency audits and consultancy, collective purchasing of energy services (for PV systems, storage, electric bikes, and cars as well as wider services such as discounted insurance, banking, internet provision) as well as wider community development schemes (such as information campaign or activities with schools) [

46,

55].

3.4. Case Studies

In what follows we focus the attention on three specific case studies: Retenergie/È nostra, WeForGreen, and Energia Positiva. They are the only CE initiatives that managed to continue activities after 2013. The following paragraphs describe and analyze the initiatives in greater detail and explore the reasons behind their success.

3.4.1. Retenergie and E’nostra

Retenergie was founded by 12 citizens in 2008 with a strong bottom up approach. Its aim was to “contribute to a new economy based on the principles of environmental sustainability, sobriety and solidarity” by promoting renewable production and supply as well as energy efficiency services [

55]. By 2017 Retenergie had developed 13 projects, seven of which newly built PV rooftop plants, developed under FiT support (

Table 1). Since the discontinuity of FiT support to PV in 2013 Retenergie has acquired four PV plants on the secondary market (hence plants initially developed under FiT support) and managed to develop a small wind power project (60 kW turbine located in Sardinia) and an energy efficiency project (the energy retrofit of a building in Vicenza acting as an ESCo) [

56].

The cooperative has been growing steadily in members (

Table 2) which have been progressively involved in the initiative through public meetings and campaigning in collaboration with social and environmental associations, collective purchasing groups, and other actors active in the Italian solidarity economy. It was later organized as a national initiative across territorial nodes in order to facilitate the development of local initiatives.

Renewable plant development has been mainly financed through members/citizens contributions (about 70% of the total investment, with the remaining 30% covered by debt) which could take two forms: (1) citizens can buy equity of the cooperative (minimum quote of 500 €) or, (2) they can finance the cooperative through social lending. In the first case returns for citizens depended on the annual profits of the cooperative and on the assembly decision on whether to redistribute them or keep them as reserve capital (to date the assembly has never earmarked any return on the capital invested,

Table 2). Social lending returns were instead from 1.5% to 3% for two years to six years bonds.

Retenergie also offered a series of other services, which were granted against a membership of 50 € for those that had not already invested in the cooperative. They included discounts on different services and products (insurance, internet providers, bank services, magazines, and books) and collective purchasing groups for PV, storage systems, and electric vehicles. Retenergie had also established a network of energy advisors that offered discounted domestic energy audits to the members of the cooperative.

In 2014, Retenergie was one of the founding members of È nostra, the first electricity supply cooperative in Italy. È nostra activities started in 2015, with a membership campaign and in 2016 began to supply green electricity to its members, i.e., domestic and commercial consumers and not for profit organizations (the latter benefiting of a special tariffs).

Table 3 presents the increase in members, contracts, and sales volume of È nostra between 2015 and 2018.

Since the beginning of the operations Retenergie and È nostra activities were closely linked: È nostra purchased from Retenergie the electricity produced by renewable energy plants and Retenergie offered to È nostra members the services provided by its network of energy advisors.

In 2018, Retenergie merged into È nostra, thus creating a cooperative able to provide both production and supply of renewable electricity and to serve a national community of prosumers, with the objective of enabling them to access sustainable electricity provision and energy services at better conditions than the traditional market.

This new EC stands on three pillars: production, supply, and energy services. The renewable electricity produced by the plants owned by the cooperative currently covers about 15% of the members’ consumption and the remaining is covered with certified renewable electricity purchased on the national electricity market. Similarly to Retenergie, the new È nostra also provides energy services to its members, besides renewable electricity production and supply. The cooperative provides assistance to its members, both domestic and commercial, in designing energy efficiency measures, including energy audit, thermal plants renewal, insulation, and PV installation.

3.4.2. WeForGreen

ForGreen is a limited company born as a spinoff of an Italian multi-utility in 2010 [

57] with the aim of developing PV systems and energy efficiency services. The first project, Energyland, was a 1 MWp ground mounted PV plant in Verona province. The project was initially fully financed by a local finance company (Finval) and opened to the participation of citizens afterward. It was intended mainly as a local project, addressed to people living in the Verona province. Citizens could invest in quotas of the plant, each meant to finance 1 kW of the PV plant at a cost of 3600 €, of which 1000 € was contribution to cooperative capital and 2600 € social lending. Citizens would get annually: (1) return on the capital invested (as determined by the annual assembly), here assumed to vary between 0% and 4%; (2) one twentieth of the social lending contribution, i.e., 130 € per year per quota; (3) the value of electricity bill savings over a consumption of 1000 kWh per year, per quota (for a varying electricity price, here assumed between 0.17 € and 0.20 € /kWh). Accounting for the variability of return on capital (0%–4%) and of the electricity price (0.17 € to 0.20 € /kWh), this sums up roughly to a return of 6.5% to 8.8% on the total investment (

Table 4). The value of the electricity bill savings accounts for the higher share of returns offered to citizens (≈500–600 € per year). The initial aim was to involve around 333 people each contributing for 3 kW [

57,

58], in order to cover the full investment cost of 3.6 M€ [

45]. In the end about 123 households have joined the cooperative, for a total of approximately 1 M€ (≈28% of the total investment) [

45].

The group of people that initiated the Energyland project decided to replicate the scheme on a national scale. In 2011 ForGreen developed a new 1 MWp PV plant in Apulia region, which was financed by the company through bank loan. In 2014 a new cooperative (Masseria del sole) was set up to give people the chance to invest in this PV plant. The financial scheme was very similar to Energyland with calculated expected returns for citizens investing of 8% (over 15 years). As in the case of Energyland, participation has been lower than initially planned, with 187 households joining the cooperative out of the about 300 initially planned [

45].

Each project developed by ForGreen focuses on the development of a single plant and with the aim of supplying green electricity to its members through an electricity bill saving scheme, which represents a relevant component of the guaranteed return. The electricity produced by the PV plants is sold to an electricity supplier and each member of the cooperative gets an annual amount of kilowatt-hours free of charge for each kilowatt purchased. The change of supplier for each member is associated with the purchase of cooperatives shares, thus the size of the three cooperatives allowed ForGreen to have bargaining power on the electricity supply market. This in addition to its commercial background and other activities in the electricity sector.

In 2015 a new cooperative, WeForGreen Sharing, was founded. The cooperative now works as an umbrella for all projects. WeForGreen, besides managing the previous two projects, has developed three new projects, applying a similar structure to the previous ones: Fattoria del sole di Ugento and the two Fattorie del Salento (

Table 5). These three additional PV plants are not new built, but they have been acquired by the cooperative in the secondary market of PV. They were built in 2011, thus still benefiting from FiT support. A 112 kW hydroelectric plant (named Lucense 1923) is also currently under development in Montorio, Veneto region, with expected annual production around 700 MWh. Similarly, to Retenergie/È nostra, WeForGreen has also integrated its activities with the supply of green electricity to its members. It is now possible to become member of WeForGreen in two different ways: Socio Autoproduttore (Self-Producing Member), by investing capital in the acquisition of quotas of existing generation plants, or Socio Consumatore (Consumer Member), by simply switching to ForGreeen 100% renewable electricity supply.

3.4.3. Energia Positiva

Energia Positiva was founded and promoted by one individual with the aim of “bringing to the market a participative initiative, which could bring benefits not just to the environment but to the whole collectivity”. Energia Positiva started its operation in 2016, developing a new wind turbine project in Basilicata (Southern Italy). The Muro Lucano wind turbine (19.98 kWp for an expected annual production of approximately 64 MWh) required an investment of 126 k€ and was the first of a series of projects. By the end of 2019 Energia Positiva had developed 15 projects, 10 of which are PV plants benefiting of FiT support acquired on the secondary market (for a total of 1.5 MWp approximately, see

Table 6). The cooperative has also acquired one additional 20 kW wind turbine and developed four energy saving projects. At January 2020, Energia Positiva reports a total investment almost 5 M€ by 415 members (average investment of about 12,000 € per member) [

59].

To become members of Energia Positiva individuals invest in quotas of the cooperative, which are linked to specific projects in order to become owners of a “virtual renewable energy plant”. The return on the investment is guaranteed with a direct discount on the electricity bill. Energia Positiva in fact manages the electricity bill of its members, in partnership with Dolomiti Energia a national supplier of green electricity with more than 400,000 customers.

The member benefits from a discount on the electricity bill equal to 5% of the investment and can buy a maximum number of quotas equivalent to its annual electricity consumption. Furthermore, Energia Positiva has qualified as an innovative start-up, which, under the current Italian regulation, implies a tax rebate. If the member stays in the cooperative for at least three years, he or she can obtain a tax rebate equal to the 30% of the capital invested. Assuming an average customer with an annual consumption of 2700 kWh, in

Table 7 we calculate possible total investment and benefits. Considering an investment of 10,500 € for a duration of 10 years, the internal rate of return is approximately equal to ≈9%.

Energia Positiva offers membership only to domestic customers. In order to expand the activities, the promoters very recently set up a parallel cooperative (EpCo), which offers the same participation model (investment in virtual renewable energy plant to benefit from electricity bill savings) to commercial customers. To further support their activity of development and acquisition of renewable energy plants they also ran in 2019 an equity crowdfunding campaign which raised about 650,000 €.

4. Discussion

After decades of inaction the CE sector in Italy has experienced a new growth between 2008 and 2013 with the development of initiatives aimed at people engagement in the energy transition. The majority were local energy community projects, mostly developing PV plants generally of a size below 100 kW, and only very few were initiatives with wider territorial scope and able to develop megawatt size plants or different projects summing up to several hundred of kilowatts.

Despite the prevalence of the local dimension, only a few initiatives (the 24%) have been developed with a bottom up approach, hence characterized by strong involvement of citizens or other types of grassroots organizations in the initiation and development of the project. The majority have been developed with a top down approach, i.e., with an institution (i.e., a local authority or a private company) leading the process, defining structural features of the project and facilitating citizens’ involvement. Among those, the role of municipalities and municipal utilities is nonetheless remarkable, which have often acted as promoters or as facilitators of the initiatives.

As also experienced within the CE sector in other European countries, the cooperative emerges as the most utilized legal form. However, evidence presented shows that, although it implies ‘a one head one vote’ rule, it does not necessarily bring high levels of citizens’ participation in the development and in the decision process. The level of participation rather depends on the practices adopted. Overall, initiatives proposed by companies and with a strong top down approach have been developed with lower involvement of citizens and their organizational structure implies lower citizens’ co-determination.

A major driver for this new wave of CE initiatives in Italy has been the implementation of the FiT scheme support, which has made PV investments quite profitable and relatively low risk, thus suitable for shared ownership projects and accessible to small scale, local projects. All but two (Energia Positiva and È nostra) of the CE initiatives mapped were established between 2008, date of implementation of first FiT scheme in Italy, and 2013, which has marked a watershed for the Italian CE sector. Since the progressive discontinuity of risk reducing support mechanisms such as FiT and the reintroduction of market-based support (such as capacity and auction-based mechanisms) the scaling up of the sector, either by developing large plants or replicating smaller projects, has proven in most cases to be challenging. The small-scale model became not any more profitable and sustainable, and new approaches were needed.

The three case studies presented managed to start (in the case of Energia Positiva) or continue their activities because they all embraced a different avenue from the small, local scale approach. Firstly, they all increased their activities by focusing on larger size projects and/or developing multiple projects. As a consequence of this evolution they enlarged the territorial scale of their activities, both by developing projects in different locations across the country and by involving members at a national scale. They thus managed to achieve economies of scale in their activities, which allowed them to involve and hire professionals as permanent staff and progressively enhance the services provided.

In a context of a contracted Italian renewable energy market (as also discussed in

Section 3.2,

Figure 3) they managed to develop new projects mainly focusing on the secondary market of PV, thus investing in PV plants with higher profitability and lower risk because they were still benefiting from the FiT support. More recently they have started differentiating projects activities by also developing energy efficiency projects and a wind project (Energia Positiva and È nostra).

As a result, although on one hand they lost the local dimension in project development, on the other they could integrate the proposition offered to their members with a model which combines participative renewable energy production with provision of green electricity. They managed to do so in different ways. È nostra is a proper electricity supplier and directly provides electricity to its members (which then also participate in the investments in renewable energy production) and to non-members. Energia Positiva and WeForGreen instead provide the service through an agreement with other green electricity supply companies, and link the electricity supply directly (and proportionally) to the investment of their members into the renewable production plants. Nonetheless, they all have developed a sort of ‘virtual’ prosumer model, which allows citizens across the entire Italian territory to support and participate in their renewable energy production projects while also directly consuming green electricity.

In summary the three case studies have managed to continue their activities after 2013 because they have grown to a national scale, have developed multiple projects, and have expanded their member base over time, also thanks to a progressive diversification of their proposition, i.e., offering a combination of production with consumption of green electricity.

A closer look at the three initiatives also highlights different approaches in their development and growth over time. Evidence presented on the Italian CE sector has highlighted two typologies of initiatives: those whose primary activity is the production of electricity from a renewable energy plant (having as their main objective the distribution among their members of the revenues accruing from its operation), and other initiatives which are set up not just to develop renewable energy plants and aggregate citizens around the relative financing and ownership, but also to offer other energy and social services to benefit both cooperative members and wider local communities. Energia Positiva and WeForGreen belong to the first typology. Indeed, Energia Positiva’s growth seems to be rooted in the successful replication of a model in which the investments in single renewable energy projects are shared among members through a sort of quota system in exchange of participation in the revenues accruing from them (despite in the form of electricity bill savings). This modular approach has allowed a constant grow over time of the initiative, which has been steadily developing projects and has recently raised more finance through a crowdfunding campaign to support further expansion. A very similar approach has been followed by WeForGreen which has developed less projects than Energia Positiva, but of larger size, probably thanks to the fact that they are supported by an energy company. These typologies of initiatives are typically able to offer higher financial returns and, among all those mapped within the Italian CE sector, Energia Positiva and WeForGreen offer the highest, around 8%–9%.

Retenergie and È nostra belong to the other typology of initiatives. Retenergie was a bottom up initiative, initially constituted with the aim of promoting renewable energy production, supply, and energy services. Over the years, Retenergie activities have in fact been focusing on the development of collectively owned renewable energy plants, but also on offering energy and community services to its members. The structure of the initiative was more complex than Energia Positiva and WeForGreen, both in term of its activities (as it combined renewable electricity production projects with energy and community services) and in its financial structure and citizens’ engagement process. Revenues generated by investments in renewable generation projects have been redistributed across a wider set of activities (including energy and community services), which did not generate direct monetary benefits for their members. This has resulted in lower returns offered to their members (ranging from 0% to 3%). Compared to Energia Positiva and WeForGreen, such more complex structure would make quick replication and upscale of the model less viable. Nonetheless, the cooperative managed to continue growing, probably thanks to its longer history (practically one of the first to be founded in Italy), its national scope, a large member base, and the development of an internal structure of permanent staff at the time of the contraction of the renewable energy market in Italy. In addition, the merging with È nostra has been crucial, which has allowed expansion of its member base and support of additional activities. The new È nostra that emerged from the merging has further diversified the initial proposition of Retenergie, by providing to its members not only collectively owned renewable energy production and energy services, but also electricity supply.

In conclusion the evidence presented on the three case studies highlight different scaling up strategies which are affected by the choices on the initiatives’ activities and organizational structures made since the founding stage of the initiatives [

60]. Energia Positiva and WeForGreen follow a growth path more focused on serving mutual interest (i.e., serving the interest of their members) while Retenergie/E Nostra scale up has been more informed by general/public interest (i.e., serving the broader interest of society) [

26].

5. Conclusions

This paper elicits and presents novel evidence on CE initiatives that emerged in Italy in the 2000s, filling a gap in the literature to date. The findings of this study contribute to better understand the different phases in the development of the Italian CE sector and to explore the conditions that made some initiatives more successful than others.

The evidence presented in the systematic review depicts an Italian CE sector still at its niche level. It has been initially mainly characterized by the development of rather small, ‘ad hoc’ initiatives, for the majority dedicated to PV system deployment and with a strong local focus. Its development has been largely dependent on generous PV FiT schemes and since its discontinuity in 2013, only three larger initiatives have been able to keep growing and diversifying their activities (i.e., Retenergie/È nostra, WeForGreen, and Energia Positiva). This has been possible thanks to a progressive change in the business and implementation model. They have moved from a paradigm of small, local CE initiatives to a large and national scale, expanding their member base, developing multiple projects, and integrating the proposition offered to their members with other activities, including green electricity supply. This has allowed them to benefit from economies of scale, to hire permanent staff, and become more professional in their service provision.

Recently, community energy has attracted the attention of the legislator both at EU and national level, with a progressive recognition of its potential role within the EU as well as the Italian energy system. In

Table 8 we summarize the most relevant legislative milestones for the Italian CE sector.

Energy communities were first mentioned within the Italian legislation and regulatory framework by the Italian Energy Strategy in 2017 and, subsequently, by the National Energy and Climate Plan in 2018. However, they were both legislative framework documents which did not imply any concrete measure to support the implementation of community energy initiatives in the country. In 2018, the Piedmont region implemented a law on energy communities, which has mainly been a declaration of intent, although politically relevant, being the first legislative initiative explicitly dedicated to the Italian CE sector. A recent call for proposal launched by RSE (a public company devoted to research on the energy system) is also acting as showcase and test of pilot projects of energy communities, here intended as local, collective self-consumption initiatives. The conclusions of these pilot experiences are likely to provide the supporting evidence for the design of new incentive schemes currently under discussion.

The process of national implementation of the two EU directives (December 2018 and June 2019) supporting two different models of energy communities (renewable energy communities and citizen energy communities) is creating the momentum for the possible design of a national legislative framework in support of the development of the CE sector. In particular, EU Directive 2018/2001 defines the framework for the implementation of place-based renewable energy communities, with the objective of fostering local self-consumption as well as collective self-consumption. The focus is on experiences that link production and consumption on a proximity base. As an initial step toward the national implementation of the EU Directive, a provision has been included in the recent Italian Law 8/2020 to allow small-scale, collective self-consumption of renewable energy plants of size below 200 kW, for customers linked to the same low voltage distribution sub-grid. A typical case is the block of flats, where the electricity produced by a collective PV plant can now be directly supplied to the customers living in the flats.

This regulatory framework goes in the direction of reducing the distance between production and consumption (with positive impacts on grid management), thus increasing the opportunities for citizens and consumers to become prosumers. The three larger Italian EC initiatives presented in the case studies have already made a step in this direction, by integrating their electricity production activities with green electricity supply. They have done so by developing different types of ‘virtual’ prosumer models, allowing citizens across the entire Italian territory to participate to their renewable energy production projects while also directly consuming green electricity. However, these models work on a national scale, while the evolution of the Italian regulatory framework is likely to foster the development of new small scale, local initiatives across the country.

Thus, in terms of business models, the regulation could lead to a renewed development of local, place-based energy communities. These energy communities could well be deployed by small, local initiatives which might not require a complex organizational structure, including permanent and professional staff. On the other hand, national energy communities (such as those presented in the case studies) may also be well placed to deliver new energy community initiatives, as they might benefit from economies of scale, from a deeper understanding of the energy market and regulation as well as of an internal organization supported by professional permanent staff. An open question remains regarding how they will be able to reconcile the national, larger size of their business models with the dynamics of community engagement at the local level, including the possibility of guaranteeing a high level of participation of their members in the decision processes.

In conclusion, the national evolution of the regulatory framework for energy communities joint with the renewed national support to renewable energy, implemented in July 2019, will progressively shape the CE sector in Italy, which might be on the verge of a profound evolution. As of February 2020, only a first step has been taken by the national legislators (Law 8/2020), which enables small scale initiatives (below 200 kW). Which other CE implementation models that will be supported by the legislator will depend on the policy decisions that will be taken in the future steps of the EU Directive implementation process. Whether this will lead to a revival of local, small-scale experiences as those developed in the 2008–2013 period or will reinforce the national paradigm developed by the larger Italian CE initiatives (or a combination of both) is an open question worthy of analysis and discussion in the future.