Examination of the Spillover Effects among Natural Gas and Wholesale Electricity Markets Using Their Futures with Different Maturities and Spot Prices

Abstract

1. Introduction

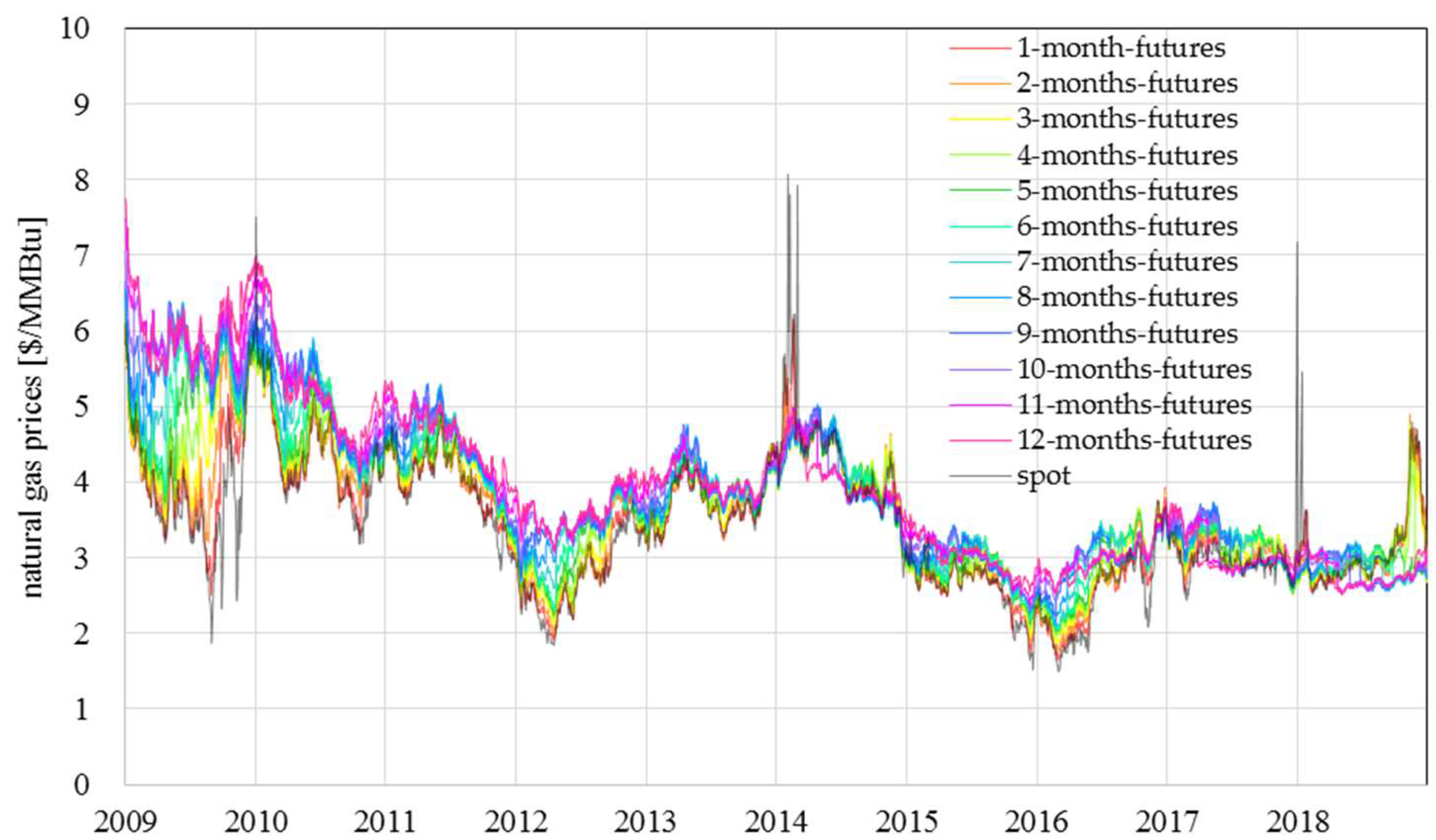

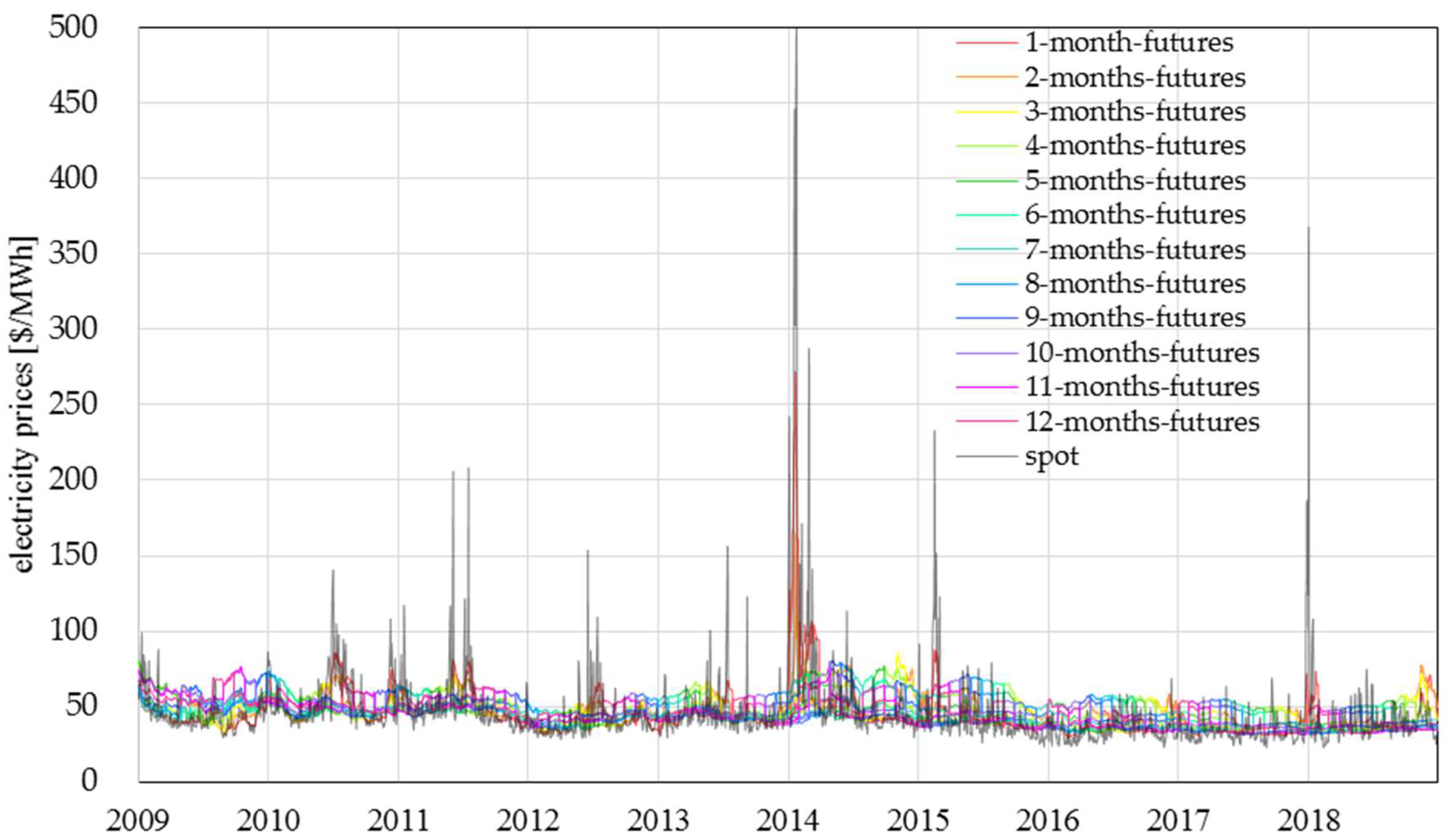

2. Data and Preliminary Analyses

2.1. Data

2.2. Preliminary Analyses

3. Methodology

4. Empirical Results

4.1. Between Spot and Others

4.2. Between Natural Gas Futures

4.3. Between Natural Gas Futures and Electricity Futures

4.4. Between Electricity Futures

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- BP p.l.c., 1 St James’s Square, London SW1Y 4PD, UK. BP’s Statistical Review of World Energy 2019, 68th ed. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-full-report.pdf (accessed on 4 February 2020).

- Serletis, A.; Herbert, J. The message in North American energy prices. Energy Econ. 1999, 21, 471–483. [Google Scholar] [CrossRef]

- Emery, G.W.; Liu, W.Q. An analysis of the relationship between electricity and natural-gas futures prices. J. Futures Mark. 2002, 22, 95–122. [Google Scholar] [CrossRef]

- Woo, C.; Olson, A.; Horowitz, I.; Luk, S. Bi-directional causality in California’s electricity and natural-gas markets. Energy Policy 2006, 34, 2060–2070. [Google Scholar] [CrossRef]

- Serletis, A.; Shahmoradi, A. Measuring and testing natural gas and electricity markets volatility: Evidence from Alberta’s deregulated markets. Stud. Nonlinear Dyn. Econ. 2006, 10, 10. [Google Scholar] [CrossRef]

- Brown, S.P.A.; Yücel, M.K. Deliverability and regional pricing in U.S. natural gas markets. Energy Econ. 2008, 30, 2441–2453. [Google Scholar] [CrossRef]

- Mjelde, J.W.; Bessler, D.A. Market integration among electricity markets and their major fuel source markets. Energy Econ. 2009, 31, 482–491. [Google Scholar] [CrossRef]

- Mohammadi, H. Electricity prices and fuel costs: Long-run relations and short-run dynamics. Energy Econ. 2009, 31, 503–509. [Google Scholar] [CrossRef]

- Nakajima, T.; Hamori, S. Testing causal relationships between wholesale electricity prices and primary energy prices. Energy Policy 2013, 62, 869–877. [Google Scholar] [CrossRef]

- Toda, H.Y.; Yamamoto, T. Statistical inference in vector autoregressions with possibly integrated processes. J. Econ. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Cheung, Y.W.; Ng, L.K. A causality-in-variance test and its application to financial market prices. J. Econ. 1996, 72, 33–48. [Google Scholar] [CrossRef]

- Efimova, O.; Serletis, A. Energy markets volatility modelling using GARCH. Energy Econ. 2014, 43, 264–273. [Google Scholar] [CrossRef]

- Alexopoulos, T.A. The growing importance of natural gas as a predictor for retail electricity prices in USA. Energy 2017, 137, 219–233. [Google Scholar] [CrossRef]

- Nakajima, T. Expectations for statistical arbitrage in energy futures markets. J. Risk Financ. Manag. 2019, 12, 14. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Yang, L. Connectedness of economic policy uncertainty and oil price shocks in a time domain perspective. Energy Econ. 2019, 80, 219–233. [Google Scholar] [CrossRef]

- Singh, V.K.; Kumar, P.; Nishant, S. Feedback spillover dynamics of crude oil and global assets indicators: A system-wide network perspective. Energy Econ. 2019, 80, 321–335. [Google Scholar] [CrossRef]

- Pham, L. Do all clean energy stocks respond homogeneously to oil price? Energy Econ. 2019, 81, 355–379. [Google Scholar] [CrossRef]

- Jin, J.; Yu, J.; Hu, Y.; Shang, Y. Which one is more informative in determining price movements of hedging assets? Evidence from Bitcoin, gold and crude oil markets. Phys. A 2019, 527, 121121. [Google Scholar] [CrossRef]

- Wang, B.; Wei, Y.; Xing, Y.; Ding, W. Multifractal detrended cross-correlation analysis and frequency dynamics of connectedness for energy futures markets. Phys. A 2019, 527, 121194. [Google Scholar] [CrossRef]

- Husain, S.; Tiwari, A.K.; Sohag, K.; Shahbaz, M. Connectedness among crude oil prices, stock index and metal prices: An application of network approach in the USA. Resour. Policy 2019, 62, 57–65. [Google Scholar] [CrossRef]

- Albulescu, C.T.; Demirer, R.; Raheem, I.D.; Tiwari, A.K. Does the U.S. economic policy uncertainty connect financial markets? Evidence from oil and commodity currencies. Energy Econ. 2019, 83, 375–388. [Google Scholar] [CrossRef]

- Chen, S.; Härdle, W.K.; Cabrera, B.L. Regularization approach for network modeling of German power derivative market. Energy Econ. 2019, 83, 180–196. [Google Scholar] [CrossRef]

- Scarcioffolo, A.R.; Etienne, X.L. How connected are the U.S. regional natural gas markets in the post-deregulation era? Evidence from time-varying connectedness analysis. J. Commod. Mark. 2019, 15, 100076. [Google Scholar] [CrossRef]

- Kang, S.H.; Tiwari, A.K.; Albulescu, C.T.; Yoon, S.M. Exploring the time-frequency connectedness and network among crude oil and agriculture commodities V1. Energy Econ. 2019, 84, 104543. [Google Scholar] [CrossRef]

- Malik, F.; Umar, Z. Dynamic connectedness of oil price shocks and exchange rates. Energy Econ. 2019, 84, 104501. [Google Scholar] [CrossRef]

- Ready, R.C. Oil Prices and the Stock Market. Rev. Financ. 2018, 22, 155–176. [Google Scholar] [CrossRef]

- Song, Y.; Ji, Q.; Du, Y.; Geng, J. The dynamic dependence of fossil energy, investor sentiment and renewable energy stock markets. Energy Econ. 2019, 84, 104564. [Google Scholar] [CrossRef]

- Xiao, B.; Yang, Y.; Peng, X.; Fang, L. Measuring the connectedness of European electricity markets using the network topology of variance decompositions. Phys. A 2019, 535, 122279. [Google Scholar] [CrossRef]

- Sun, Q.; An, H.; Gao, X.; Guo, S.; Wang, Z.; Liu, S.; Wen, S. Effects of crude oil shocks on the PPI system based on variance decomposition network analysis. Energy 2019, 189, 116378. [Google Scholar] [CrossRef]

- Nakajima, T.; Toyoshima, Y. Measurement of connectedness and frequency dynamics in global natural gas markets. Energies 2019, 12, 3927. [Google Scholar] [CrossRef]

- He, Y.; Nakajima, T.; Hamori, S. Connectedness between natural gas price and BRICS exchange rates: Evidence from time and frequency domains. Energies 2019, 12, 3970. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Nasreen, S.; Shahbaz, M.; Hammoudeh, S. Time-frequency causality and connectedness between international prices of energy, food, industry, agriculture and metals. Energy Econ. 2020, 85, 104529. [Google Scholar] [CrossRef]

- Barbaglia, L.; Croux, C.; Wilms, I. Volatility spillovers in commodity markets: A large t-vector autoregressive approach. Energy Econ. 2020, 85, 104555. [Google Scholar] [CrossRef]

- Guhathakurta, K.; Dash, S.R.; Maitra, D. Period specific volatility spillover based connectedness between oil and other commodity prices and their portfolio implications. Energy Econ. 2020, 85, 104566. [Google Scholar] [CrossRef]

- Lovcha, Y.; Perez-Laborda, A. Dynamic frequency connectedness between oil and natural gas volatilities. Econ. Model. 2020, 84, 181–189. [Google Scholar] [CrossRef]

- Zhang, W.; He, X.; Nakajima, T.; Hamori, S. How does the spillover among natural gas, crude oil, and electricity utility stocks change over time? Evidence from North America and Europe. Energies 2020, 13, 727. [Google Scholar] [CrossRef]

- Nakajima, T. Inefficient and opaque price formation in the Japan Electric Power Exchange. Energy Policy 2013, 55, 329–334. [Google Scholar] [CrossRef]

- Moutinho, V.; Vieira, J.; Moreira, A.C. The crucial relationship among energy commodity prices: Evidence from the Spanish electricity market. Energy Policy 2011, 39, 5898–5908. [Google Scholar] [CrossRef]

| Return Series | Mean | Maximum | Minimum | Standard Deviation | Skewness | Kurtosis | Jarque–Bera (p-Value) |

|---|---|---|---|---|---|---|---|

| G0 | 0.0% | 70.1% | −43.9% | 4.4% | 1.5 | 45.6 | 186,350 (0) |

| G1 | 0.0% | 26.8% | −18.1% | 3.1% | 0.6 | 8.3 | 2983 (0) |

| G2 | 0.0% | 23.4% | −22.6% | 2.8% | 0.3 | 9.3 | 4143 (0) |

| G3 | 0.0% | 21.6% | −20.2% | 2.6% | 0.4 | 9.7 | 4730 (0) |

| G4 | 0.0% | 18.6% | −37.7% | 2.5% | −1.0 | 30.9 | 79,780 (0) |

| G5 | 0.0% | 21.7% | −10.1% | 2.1% | 0.7 | 9.3 | 4291 (0) |

| G6 | 0.0% | 19.3% | −10.9% | 2.0% | 0.7 | 10.1 | 5398 (0) |

| G7 | 0.0% | 13.7% | −11.3% | 1.9% | 0.4 | 8.0 | 2661 (0) |

| G8 | 0.0% | 11.6% | −12.8% | 1.8% | 0.2 | 7.1 | 1721 (0) |

| G9 | 0.0% | 13.2% | −14.8% | 1.7% | −0.1 | 10.0 | 4954 (0) |

| G10 | 0.0% | 12.2% | −17.7% | 1.6% | −0.6 | 13.2 | 10,680 (0) |

| G11 | 0.0% | 13.0% | −17.2% | 1.6% | −0.7 | 15.4 | 15,992 (0) |

| G12 | 0.0% | 11.9% | −18.1% | 1.5% | −0.7 | 16.9 | 19,984 (0) |

| E0 | 0.0% | 203.2% | −153.0% | 20.2% | 0.1 | 13.8 | 11,994 (0) |

| E1 | 0.0% | 55.1% | −67.0% | 5.3% | −0.8 | 42.4 | 158,546 (0) |

| E2 | 0.0% | 46.7% | −45.6% | 4.0% | 0.5 | 41.0 | 147,920 (0) |

| E3 | 0.0% | 37.8% | −30.1% | 3.4% | 1.9 | 43.2 | 166,958 (0) |

| E4 | 0.0% | 46.1% | −29.5% | 3.3% | 2.0 | 57.9 | 309,913 (0) |

| E5 | 0.0% | 33.7% | −30.7% | 3.1% | 1.1 | 48.1 | 208,672 (0) |

| E6 | 0.0% | 40.4% | −32.7% | 3.2% | 1.6 | 57.7 | 307,247 (0) |

| E7 | 0.0% | 42.9% | −37.5% | 3.3% | 1.4 | 63.4 | 373,262 (0) |

| E8 | 0.0% | 44.7% | −29.6% | 3.2% | 2.2 | 62.4 | 362,439 (0) |

| E9 | 0.0% | 40.8% | −27.1% | 3.1% | 1.8 | 58.1 | 311,279 (0) |

| E10 | 0.0% | 39.8% | −26.6% | 3.1% | 1.1 | 57.0 | 298,650 (0) |

| E11 | 0.0% | 36.6% | −28.9% | 3.0% | 0.7 | 56.3 | 290,411 (0) |

| E12 | 0.0% | 33.2% | −32.1% | 3.1% | 0.6 | 52.2 | 247,347 (0) |

| Return Series | Augmented Dickey-Fuller–t Value (p-Value) | |

|---|---|---|

| Exogenous: Constant | Exogenous: Constant, Trend | |

| G0 | −16.34 (0.000) | −16.34 (0.000) |

| G1 | −53.70 (0.000) | −53.69 (0.000) |

| G2 | −54.08 (0.000) | −54.08 (0.000) |

| G3 | −53.27 (0.000) | −53.27 (0.000) |

| G4 | −53.59 (0.000) | −53.59 (0.000) |

| G5 | −33.63 (0.000) | −33.62 (0.000) |

| G6 | −29.50 (0.000) | −29.50 (0.000) |

| G7 | −52.53 (0.000) | −52.52 (0.000) |

| G8 | −52.42 (0.000) | −52.41 (0.000) |

| G9 | −52.59 (0.000) | −52.59 (0.000) |

| G10 | −52.50 (0.000) | −52.50 (0.000) |

| G11 | −53.17 (0.000) | −53.18 (0.000) |

| G12 | −30.07 (0.000) | −30.09 (0.000) |

| E0 | −22.95 (0.000) | −22.95 (0.000) |

| E1 | −48.01 (0.000) | −48.00 (0.000) |

| E2 | −21.03 (0.000) | −21.03 (0.000) |

| E3 | −48.29 (0.000) | −48.28 (0.000) |

| E4 | −49.58 (0.000) | −49.57 (0.000) |

| E5 | −49.46 (0.000) | −49.45 (0.000) |

| E6 | −50.06 (0.000) | −50.05 (0.000) |

| E7 | −50.44 (0.000) | −50.43 (0.000) |

| E8 | −49.54 (0.000) | −49.53 (0.000) |

| E9 | −48.79 (0.000) | −48.78 (0.000) |

| E10 | −48.75 (0.000) | −48.74 (0.000) |

| E11 | −49.92 (0.000) | −49.91 (0.000) |

| E12 | −50.38 (0.000) | −50.38 (0.000) |

| To | From | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| G0 | G1 | G2 | G3 | G4 | G5 | G6 | G7 | G8 | G9 | G10 | G11 | G12 | E0 | E1 | E2 | E3 | E4 | E5 | E6 | E7 | E8 | E9 | E10 | E11 | E12 | Others | |

| G0 | 24.8 | 7.4 | 6.3 | 5.7 | 5.1 | 5.5 | 5.3 | 5.0 | 4.8 | 4.5 | 4.3 | 4.5 | 4.4 | 1.2 | 0.9 | 1.4 | 1.3 | 1.3 | 1.1 | 0.9 | 0.7 | 0.6 | 0.5 | 0.6 | 0.9 | 1.0 | 2.9 |

| G1 | 0.7 | 10.5 | 9.5 | 8.5 | 7.0 | 7.1 | 6.9 | 6.8 | 6.6 | 6.1 | 5.7 | 5.6 | 6.0 | 0.0 | 0.8 | 2.2 | 2.0 | 1.5 | 1.0 | 1.0 | 1.2 | 0.9 | 0.7 | 0.7 | 0.5 | 0.6 | 3.4 |

| G2 | 0.6 | 9.2 | 10.2 | 9.4 | 7.7 | 7.2 | 6.7 | 6.7 | 6.7 | 6.4 | 5.9 | 5.4 | 5.5 | 0.0 | 0.7 | 2.1 | 2.0 | 1.5 | 0.9 | 0.9 | 1.1 | 0.9 | 0.7 | 0.7 | 0.5 | 0.5 | 3.5 |

| G3 | 0.6 | 8.2 | 9.4 | 10.1 | 8.7 | 7.8 | 6.7 | 6.5 | 6.5 | 6.5 | 6.3 | 5.6 | 5.1 | 0.0 | 0.6 | 1.7 | 1.9 | 1.5 | 0.9 | 1.0 | 1.1 | 0.9 | 0.7 | 0.7 | 0.5 | 0.5 | 3.5 |

| G4 | 0.6 | 7.3 | 8.3 | 9.4 | 10.9 | 8.9 | 7.2 | 6.4 | 6.1 | 6.3 | 6.3 | 5.9 | 5.0 | 0.0 | 0.5 | 1.6 | 1.8 | 1.4 | 0.9 | 1.0 | 1.1 | 0.9 | 0.7 | 0.7 | 0.5 | 0.6 | 3.4 |

| G5 | 0.5 | 6.7 | 7.0 | 7.6 | 8.1 | 10.0 | 9.0 | 7.6 | 6.6 | 6.2 | 6.5 | 6.6 | 6.2 | 0.0 | 0.5 | 1.4 | 1.5 | 1.3 | 0.9 | 1.0 | 1.2 | 1.0 | 0.7 | 0.7 | 0.6 | 0.6 | 3.5 |

| G6 | 0.6 | 6.7 | 6.7 | 6.8 | 6.8 | 9.3 | 10.4 | 9.1 | 7.5 | 6.3 | 6.0 | 6.2 | 6.5 | 0.0 | 0.5 | 1.4 | 1.4 | 1.2 | 0.9 | 1.0 | 1.2 | 1.0 | 0.7 | 0.7 | 0.6 | 0.6 | 3.4 |

| G7 | 0.5 | 6.8 | 6.9 | 6.7 | 6.1 | 8.0 | 9.2 | 10.5 | 9.0 | 7.3 | 6.2 | 5.6 | 6.1 | 0.0 | 0.5 | 1.5 | 1.4 | 1.1 | 0.9 | 1.0 | 1.2 | 1.0 | 0.7 | 0.7 | 0.6 | 0.6 | 3.4 |

| G8 | 0.5 | 6.6 | 7.0 | 6.9 | 5.9 | 7.0 | 7.7 | 9.2 | 10.6 | 8.9 | 7.3 | 5.8 | 5.4 | 0.0 | 0.5 | 1.5 | 1.4 | 1.1 | 0.9 | 1.0 | 1.3 | 1.0 | 0.7 | 0.7 | 0.6 | 0.6 | 3.4 |

| G9 | 0.5 | 6.3 | 6.8 | 6.9 | 6.2 | 6.7 | 6.6 | 7.6 | 9.0 | 10.8 | 8.9 | 7.0 | 5.6 | 0.0 | 0.4 | 1.5 | 1.4 | 1.2 | 0.9 | 1.0 | 1.2 | 1.0 | 0.7 | 0.7 | 0.6 | 0.6 | 3.4 |

| G10 | 0.5 | 5.9 | 6.4 | 6.8 | 6.3 | 7.2 | 6.4 | 6.5 | 7.5 | 9.0 | 11.0 | 8.5 | 6.8 | 0.0 | 0.4 | 1.4 | 1.4 | 1.2 | 1.0 | 1.0 | 1.2 | 0.9 | 0.7 | 0.7 | 0.6 | 0.6 | 3.4 |

| G11 | 0.5 | 6.0 | 6.1 | 6.3 | 6.2 | 7.6 | 6.9 | 6.2 | 6.3 | 7.4 | 9.0 | 11.5 | 8.8 | 0.0 | 0.4 | 1.4 | 1.4 | 1.2 | 1.0 | 0.9 | 1.2 | 1.0 | 0.7 | 0.8 | 0.6 | 0.6 | 3.4 |

| G12 | 0.6 | 6.8 | 6.4 | 6.0 | 5.5 | 7.5 | 7.6 | 7.0 | 6.1 | 6.3 | 7.5 | 9.2 | 12.1 | 0.0 | 0.4 | 1.5 | 1.5 | 1.2 | 0.9 | 0.9 | 1.2 | 1.0 | 0.8 | 0.8 | 0.6 | 0.6 | 3.4 |

| E0 | 3.4 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 88.2 | 3.0 | 0.6 | 0.2 | 0.2 | 0.3 | 0.1 | 0.2 | 0.1 | 0.2 | 0.2 | 0.2 | 0.2 | 0.5 |

| E1 | 0.6 | 3.7 | 3.3 | 2.9 | 2.4 | 2.4 | 2.5 | 2.3 | 2.1 | 2.0 | 2.0 | 1.9 | 2.7 | 1.9 | 49.1 | 8.9 | 1.0 | 0.1 | 0.2 | 0.7 | 5.6 | 0.8 | 0.1 | 0.5 | 0.0 | 0.3 | 2.0 |

| E2 | 0.0 | 6.1 | 5.9 | 4.6 | 3.8 | 3.9 | 4.0 | 4.5 | 4.2 | 3.7 | 3.5 | 3.4 | 3.6 | 0.1 | 4.8 | 27.3 | 5.4 | 0.3 | 0.0 | 0.0 | 1.4 | 7.8 | 0.9 | 0.1 | 0.5 | 0.0 | 2.8 |

| E3 | 0.3 | 5.0 | 5.6 | 5.2 | 4.1 | 3.6 | 3.2 | 3.6 | 4.3 | 4.0 | 3.2 | 3.1 | 3.1 | 0.1 | 0.5 | 4.8 | 24.0 | 4.6 | 0.2 | 0.5 | 0.1 | 0.8 | 12.3 | 2.0 | 0.6 | 1.3 | 2.9 |

| E4 | 0.5 | 3.9 | 4.1 | 4.6 | 4.2 | 3.4 | 3.2 | 3.2 | 3.1 | 3.9 | 3.9 | 3.0 | 2.9 | 0.1 | 0.0 | 0.2 | 5.2 | 26.6 | 3.6 | 0.6 | 0.8 | 0.5 | 1.5 | 14.4 | 1.6 | 1.0 | 2.8 |

| E5 | 0.6 | 3.1 | 3.0 | 3.1 | 3.2 | 3.4 | 2.8 | 3.4 | 3.5 | 2.8 | 3.8 | 3.9 | 2.5 | 0.1 | 0.1 | 0.1 | 0.3 | 4.2 | 31.8 | 2.2 | 0.7 | 0.9 | 0.6 | 1.7 | 17.1 | 1.0 | 2.6 |

| E6 | 0.3 | 2.9 | 3.3 | 3.2 | 2.8 | 3.7 | 3.4 | 2.9 | 3.8 | 4.1 | 2.7 | 3.1 | 2.9 | 0.0 | 0.5 | 0.1 | 0.6 | 0.7 | 2.1 | 30.7 | 3.9 | 0.7 | 1.9 | 0.5 | 1.4 | 17.7 | 2.7 |

| E7 | 0.1 | 3.6 | 3.6 | 3.8 | 3.3 | 4.1 | 4.8 | 4.6 | 3.8 | 4.3 | 4.8 | 3.4 | 4.1 | 0.0 | 3.6 | 1.7 | 0.1 | 1.0 | 0.7 | 4.1 | 32.2 | 2.2 | 1.5 | 2.0 | 0.2 | 2.3 | 2.6 |

| E8 | 0.1 | 3.5 | 3.3 | 3.0 | 2.8 | 3.3 | 3.9 | 5.1 | 4.4 | 3.2 | 3.5 | 4.0 | 3.0 | 0.0 | 0.6 | 9.9 | 1.2 | 0.7 | 1.0 | 0.7 | 2.3 | 34.0 | 2.0 | 2.1 | 2.1 | 0.3 | 2.5 |

| E9 | 0.1 | 2.6 | 3.0 | 2.8 | 2.2 | 2.4 | 2.2 | 2.9 | 4.0 | 3.6 | 2.3 | 2.6 | 2.7 | 0.0 | 0.1 | 1.1 | 16.8 | 1.9 | 0.6 | 2.1 | 1.6 | 2.0 | 32.8 | 2.6 | 2.4 | 2.8 | 2.6 |

| E10 | 0.5 | 2.2 | 2.4 | 2.7 | 2.3 | 2.4 | 2.4 | 2.5 | 2.5 | 3.5 | 3.5 | 2.3 | 2.7 | 0.1 | 0.3 | 0.1 | 2.7 | 17.9 | 1.8 | 0.6 | 2.1 | 2.0 | 2.7 | 33.1 | 2.8 | 1.9 | 2.6 |

| E11 | 0.9 | 2.3 | 1.9 | 2.0 | 2.0 | 2.1 | 2.0 | 2.5 | 2.4 | 2.1 | 3.5 | 3.4 | 1.8 | 0.1 | 0.0 | 0.7 | 0.9 | 2.2 | 19.3 | 1.6 | 0.2 | 2.2 | 2.6 | 3.0 | 36.0 | 2.4 | 2.5 |

| E12 | 0.6 | 2.4 | 2.7 | 2.2 | 1.8 | 2.4 | 2.2 | 2.1 | 2.9 | 2.8 | 2.0 | 2.9 | 2.6 | 0.1 | 0.2 | 0.1 | 1.9 | 1.3 | 1.1 | 20.3 | 2.5 | 0.3 | 3.0 | 2.1 | 2.4 | 35.3 | 2.5 |

| Others | 0.6 | 4.8 | 5.0 | 4.9 | 4.4 | 4.9 | 4.7 | 4.8 | 4.8 | 4.7 | 4.6 | 4.4 | 4.1 | 0.2 | 0.8 | 1.9 | 2.2 | 2.0 | 1.7 | 1.8 | 1.4 | 1.2 | 1.5 | 1.5 | 1.5 | 1.5 | 75.6 |

| Months Difference | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Correlation coefficients | 0.32 | −0.35 | −0.88 | −0.37 | 0.38 | 0.80 |

| Return Series | E1 | E2 | E3 | E4 | E5 | E6 | E7 | E8 | E9 | E10 | E11 | E12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| E1 | 1.00 | |||||||||||

| E2 | 0.43 | 1.00 | ||||||||||

| E3 | 0.05 | 0.42 | 1.00 | |||||||||

| E4 | −0.10 | −0.05 | 0.41 | 1.00 | ||||||||

| E5 | −0.01 | −0.22 | −0.21 | 0.39 | 1.00 | |||||||

| E6 | 0.15 | −0.06 | −0.33 | −0.24 | 0.32 | 1.00 | ||||||

| E7 | 0.40 | 0.29 | −0.15 | −0.37 | −0.25 | 0.37 | 1.00 | |||||

| E8 | 0.17 | 0.63 | 0.24 | −0.24 | −0.39 | −0.24 | 0.33 | 1.00 | ||||

| E9 | −0.10 | 0.22 | 0.77 | 0.25 | −0.25 | −0.42 | −0.27 | 0.30 | 1.00 | |||

| E10 | −0.20 | −0.14 | 0.31 | 0.79 | 0.29 | −0.23 | −0.43 | −0.31 | 0.32 | 1.00 | ||

| E11 | −0.10 | −0.30 | −0.20 | 0.32 | 0.79 | 0.24 | −0.23 | −0.44 | −0.30 | 0.36 | 1.00 | |

| E12 | 0.10 | −0.11 | −0.39 | −0.23 | 0.29 | 0.81 | 0.28 | −0.24 | −0.45 | −0.28 | 0.32 | 1.00 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nakajima, T.; Toyoshima, Y. Examination of the Spillover Effects among Natural Gas and Wholesale Electricity Markets Using Their Futures with Different Maturities and Spot Prices. Energies 2020, 13, 1533. https://doi.org/10.3390/en13071533

Nakajima T, Toyoshima Y. Examination of the Spillover Effects among Natural Gas and Wholesale Electricity Markets Using Their Futures with Different Maturities and Spot Prices. Energies. 2020; 13(7):1533. https://doi.org/10.3390/en13071533

Chicago/Turabian StyleNakajima, Tadahiro, and Yuki Toyoshima. 2020. "Examination of the Spillover Effects among Natural Gas and Wholesale Electricity Markets Using Their Futures with Different Maturities and Spot Prices" Energies 13, no. 7: 1533. https://doi.org/10.3390/en13071533

APA StyleNakajima, T., & Toyoshima, Y. (2020). Examination of the Spillover Effects among Natural Gas and Wholesale Electricity Markets Using Their Futures with Different Maturities and Spot Prices. Energies, 13(7), 1533. https://doi.org/10.3390/en13071533