Elasticity Analysis of Fossil Energy Sources for Sustainable Economies: A Case of Gasoline Consumption in Turkey

Abstract

1. Introduction

2. Background of Gasoline Consumption in Turkey

3. Literature Review on Gasoline Demand

4. Theoretical Framework

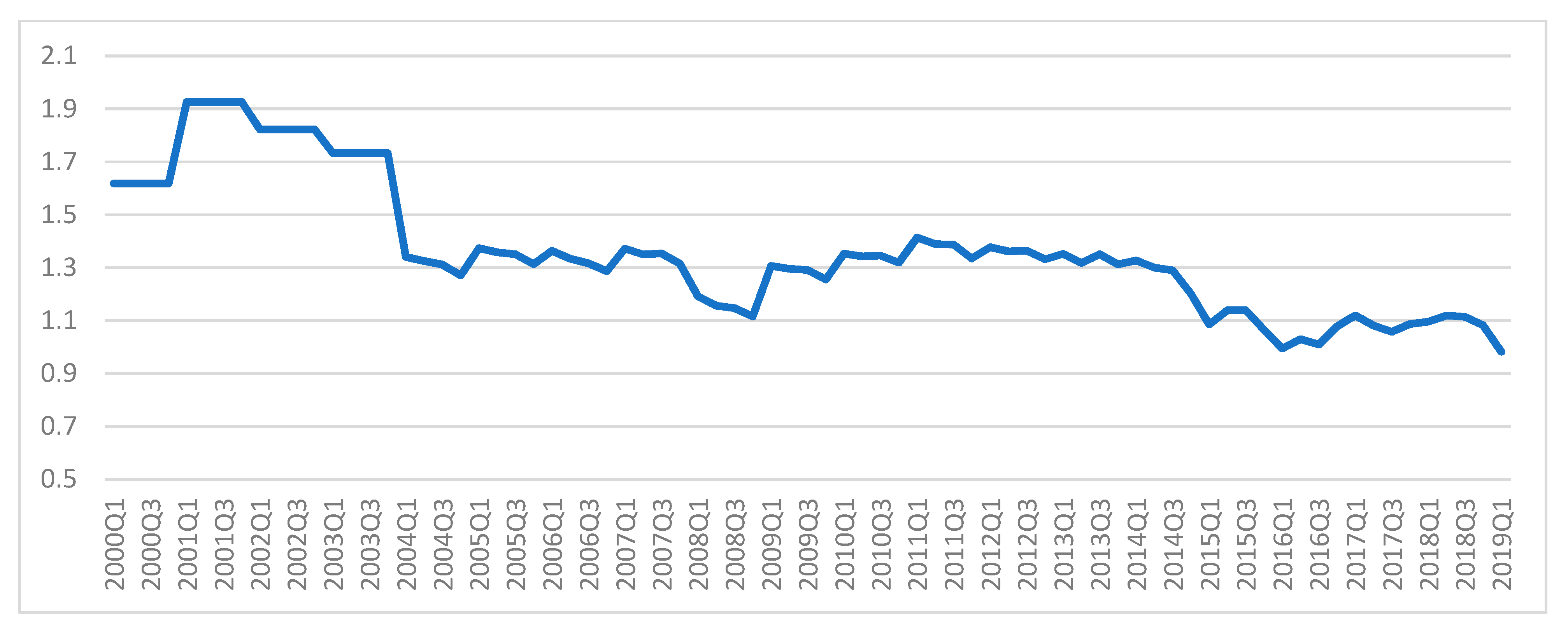

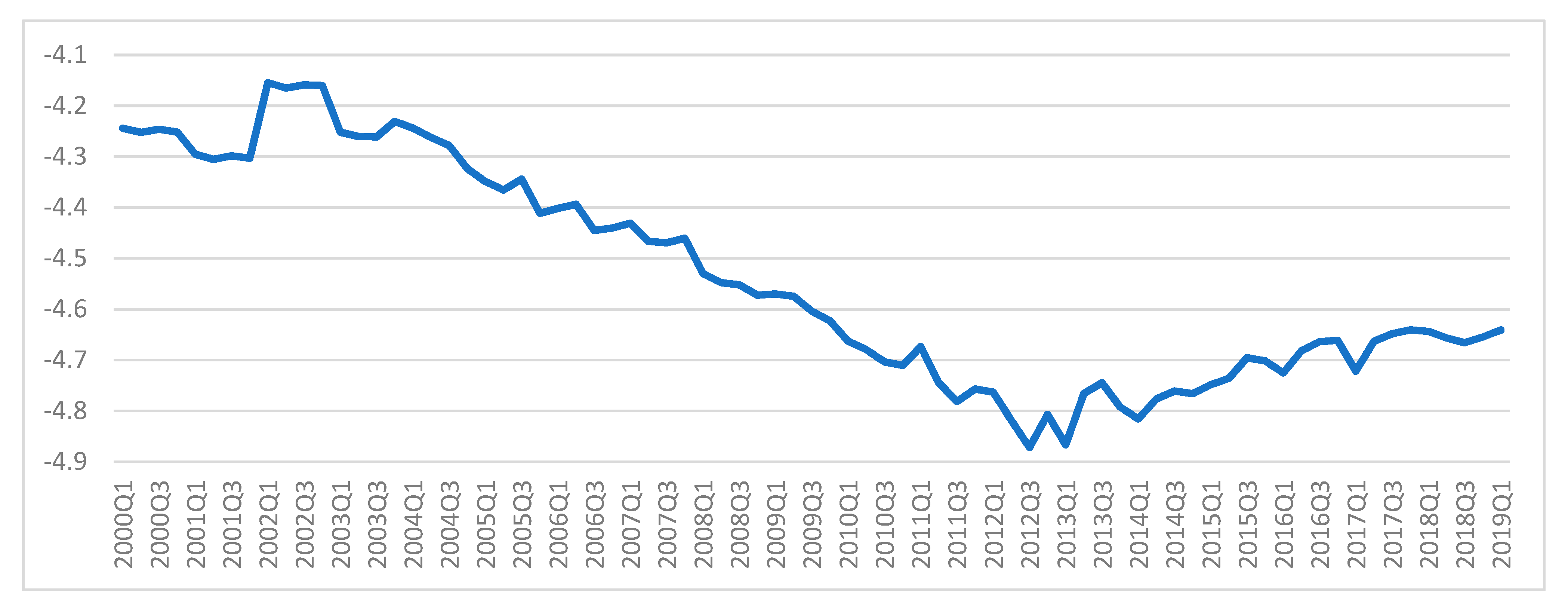

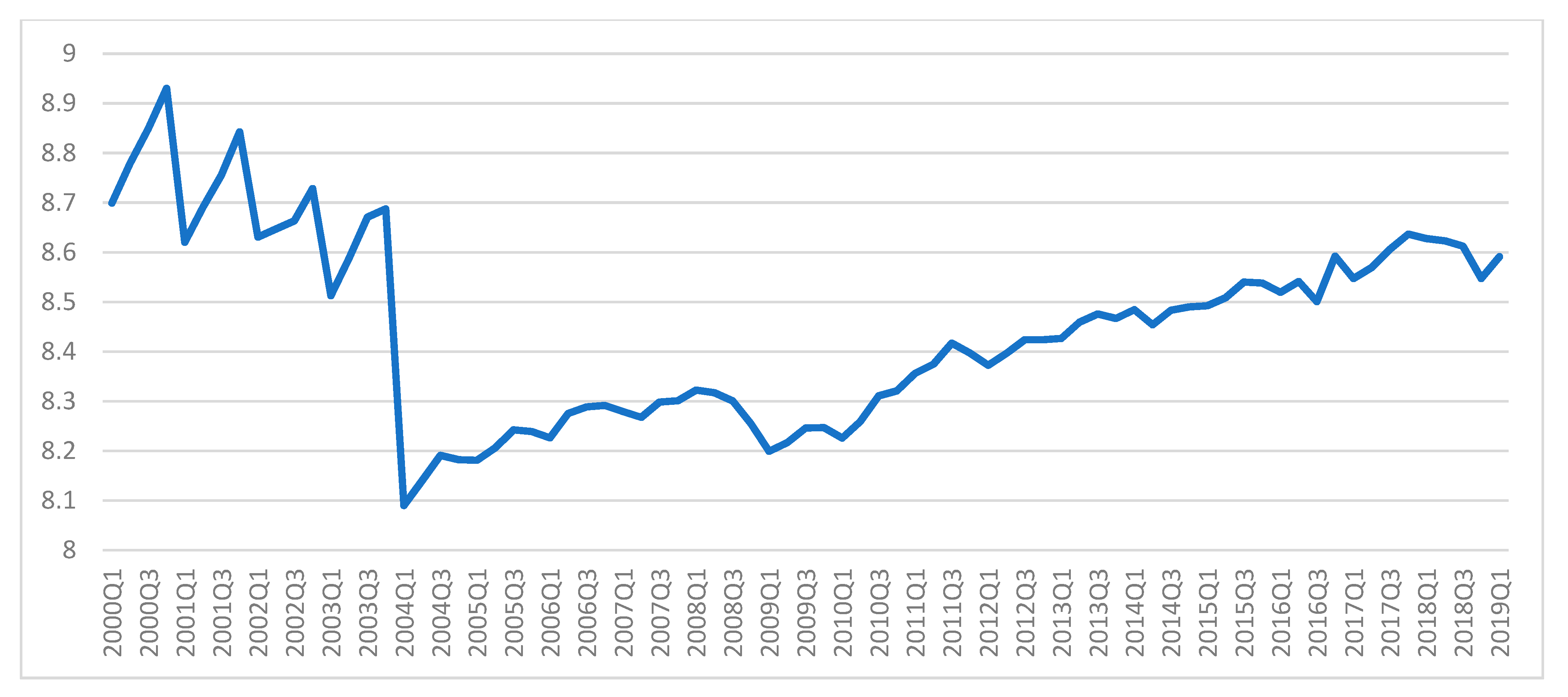

5. Econometric Methodology

5.1. Unit Root and Cointegration Tests

5.2. Long- and Short-Run Estimations

6. Data

7. Empirical Estimation Results

7.1. Unit-root Test Results

7.2. Cointegration Tests’ Results

7.3. Long and Short-Run Estimation Results

8. Discussion of the Empirical Outcomes

Discussion of Empirical Estimation Results

9. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Lehmann, P.; Gawel, E.; Strunz, S. EU climate and energy policy beyond 2020: Are additional targets and instruments for renewables economically reasonable? In The European Dimension of Germany’s Energy Transition; Springer: Cham, Switzerland, 2019; pp. 11–26. [Google Scholar]

- Johansson, P.O.; Kriström, B. Welfare evaluation of subsidies to renewable energy in general equilibrium: Theory and application. Energy Econ. 2019, 83, 144–155. [Google Scholar] [CrossRef]

- Jin, J.; McKelvey, M. Building a sectoral innovation system for new energy vehicles in Hangzhou, China: Insights from evolutionary economics and strategic niche management. J. Clean. Prod. 2019, 224, 1–9. [Google Scholar] [CrossRef]

- Chen, C.; Polemis, M.; Stengos, T. Can exchange rate pass-through explain the asymmetric gasoline puzzle? Evidence from a pooled panel threshold analysis of the EU. Energy Econ. 2019, 81, 1–12. [Google Scholar] [CrossRef]

- Coglianese, J.; Davis, L.W.; Kilian, L.; Stock, J.H. Anticipation, tax avoidance, and the price elasticity of gasoline demand. J. Appl. Econom. 2017, 32, 1–15. [Google Scholar] [CrossRef]

- Kanjilal, K.; Ghosh, S. Revisiting income and price elasticity of gasoline demand in India: New evidence from cointegration tests. Empir. Econ. 2018, 55, 1869–1888. [Google Scholar] [CrossRef]

- Lim, K.M.; Yoo, S.H. Short-run and long-run elasticities of gasoline demand: The case of Korea. Energy Sour. Part B Econ. Plan. Policy 2016, 11, 391–395. [Google Scholar] [CrossRef]

- Lin, C.Y.C.; Prince, L. Gasoline price volatility and the elasticity of demand for gasoline. Energy Econ. 2013, 38, 111–117. [Google Scholar] [CrossRef]

- Saelim, S. Carbon Tax Incidence on Household Demand: Effects on Welfare, Income Inequality and Poverty Incidence in Thailand. J. Clean. Prod. 2019, 234, 521–533. [Google Scholar] [CrossRef]

- Chi, J. Imperfect reversibility of fuel demand for road transport: Asymmetric and hysteretic effects of income and price changes in Korea. Transp. Policy 2018, 71, 116–125. [Google Scholar] [CrossRef]

- Liu, W. Asymmetric price effects on gasoline consumption: Evidence and Implications. Appl. Econ. Lett. 2019, 1–4. [Google Scholar] [CrossRef]

- Wadud, Z. Diesel demand in the road freight sector in the UK: Estimates for different vehicle types. Appl. Energy 2016, 165, 849–857. [Google Scholar] [CrossRef]

- Alper, C.E.; Torul, O. Asymmetric adjustment of retail gasoline prices in turkey to world crude oil price changes: The role of taxes’. Econ. Bull. 2009, 29, 775–787. [Google Scholar]

- Bor, Ö.; İsmihan, M. Gasoline Pricing, Taxation and Asymmetry: The Case of Turkey, (No. 2013/7). Discussion Paper. 2013. Available online: http://www.tek.org.tr/dosyalar/BOR-ISMIHAN-oil.pdf (accessed on 6 February 2020).

- Chou, K.W.; Tseng, Y.H. Oil prices, exchange rate, and the price asymmetry in the Taiwanese retail gasoline market. Econ. Modell. 2016, 52, 733–741. [Google Scholar] [CrossRef]

- TR Report. Why Invest in Turkish Automotive Industry? Report by Presidency of the Republic of Turkey Investment Office. 2018. Available online: http://www.invest.gov.tr/tr-TR/infocenter/publications/Documents/OTOMOTIV.SEKTORU.pdf (accessed on 3 October 2019).

- Turkish Statistical Institute. The Data of Motor Vehicles Registered. 2019. Available online: https://www.ceicdata.com/en/turkey/motor-vehicles-statistics/motor-vehicles-registered (accessed on 3 October 2019).

- Energy Market Regulating Authority of Turkey (EMRA). 2019. Available online: https://www.epdk.org.tr/Detay/Icerik/3-0-143/fiyatlandirma-raporu (accessed on 3 October 2019).

- Hasanov, M. The demand for transport fuels in Turkey. Energy Econ. 2015, 51, 125–134. [Google Scholar] [CrossRef]

- PETDER. Sector Report. 2019. Available online: http://www.petder.org.tr/en-US/petder-sector-report/1260636 (accessed on 9 January 2020).

- World Bank (WB). World Development İndicators. 2019. Available online: https://data.worldbank.org/indicator/ (accessed on 9 January 2019).

- Park, S.Y.; Zhao, G. An estimation of US gasoline demand: A smooth time-varying cointegration approach. Energy Econ. 2010, 32, 110–120. [Google Scholar] [CrossRef]

- Baranzini, A.; Weber, S. Elasticities of gasoline demand in Switzerland. Energy Policy 2013, 63, 674–680. [Google Scholar] [CrossRef]

- Brons, M.; Nijkamp, P.; Pels, E.; Rietveld, P. A meta-analysis of the price elasticity of gasoline demand. A SUR approach. Energy Econ. 2008, 30, 2105–2122. [Google Scholar] [CrossRef]

- Zhu, X.; Li, L.; Zhou, K.; Zhang, X.; Yang, S. A meta-analysis on the price elasticity and income elasticity of residential electricity demand. J. Clean. Prod. 2018, 201, 169–177. [Google Scholar] [CrossRef]

- Algunaibet, I.M.; Matar, W. The responsiveness of fuel demand to gasoline price change in passenger transport: A case study of Saudi Arabia. Energy Effic. 2018, 11, 1341–1358. [Google Scholar] [CrossRef]

- Cheung, K.Y.; Thomson, E. The demand for gasoline in China: A cointegration analysis. J. Appl. Stat. 2004, 31, 533–544. [Google Scholar] [CrossRef]

- Eltony, M.N.; Al-Mutairi, N.H. Demand for gasoline in Kuwait: An empirical analysis using cointegration techniques. Energy Econ. 1995, 17, 249–253. [Google Scholar] [CrossRef]

- Hughes, J.E.; Knittel, C.R.; Sperling, D. Evidence of a shift in the short-run price elasticity of gasoline demand (No. w12530). Natl. Bur. Econ. Res. 2008, 29, 113–134. [Google Scholar]

- Arzaghi, M.; Squalli, J. How price inelastic is demand for gasoline in fuel-subsidizing economies? Energy Econ. 2015, 50, 117–124. [Google Scholar] [CrossRef]

- Atalla, T.; Gasim, A.; Hunt, L. Gasoline Demand, Pricing Policy and Social Welfare in Saudi Arabia (No. ks-2017--dp04). Energy Policy 2018, 114, 123–133. [Google Scholar] [CrossRef]

- Ewing, B.T.; Thompson, M.A. Modeling the Response of Gasoline-Crude Oil Price Crack Spread Macroeconomic Shocks. Atl. Econ. J. 2018, 46, 203–213. [Google Scholar] [CrossRef]

- Dash, D.P.; Sethi, N.; Bal, D.P. Is the demand for crude oil inelastic for India? Evidence from structural VAR analysis. Energy Policy 2018, 118, 552–558. [Google Scholar] [CrossRef]

- Wadud, Z.; Noland, R.B.; Graham, D.J. A semiparametric model of household gasoline demand. Energy Econ. 2010, 32, 93–101. [Google Scholar] [CrossRef]

- Mensah, J.T.; Marbuah, G.; Amoah, A. Energy demand in Ghana: A disaggregated analysis. Renew. Sustain. Energy Rev. 2016, 53, 924–935. [Google Scholar] [CrossRef]

- Havranek, T.; Kokes, O. Income elasticity of gasoline demand: A meta-analysis. Energy Econ. 2015, 47, 77–86. [Google Scholar] [CrossRef]

- Akinboade, O.A.; Ziramba, E.; Kumo, W.L. The demand for gasoline in South Africa: An empirical analysis using co-integration techniques. Energy Econ. 2008, 30, 3222–3229. [Google Scholar] [CrossRef]

- Ma, C.; Liao, H. Income elasticity of cooking fuel substitution in rural China: Evidence from population census data. J. Clean. Prod. 2018, 199, 1083–1091. [Google Scholar] [CrossRef]

- Borchert, I.; Yotov, Y.V. Distance, globalization, and international trade. Econ. Lett. 2017, 153, 32–38. [Google Scholar] [CrossRef]

- Rodrik, D. Populism and the Economics of Globalization. J. Int. Bus. Policy 2018, 1, 12–33. [Google Scholar] [CrossRef]

- Bluszcz, A. European economies in terms of energy dependence. Qual. Quant. 2017, 51, 1531–1548. [Google Scholar] [CrossRef]

- Eftimova, D. Bulgaria’s energy security in the context of energy dependence on the import of oil products. CES Work. Pap. 2018, 10, 98–110. [Google Scholar]

- Maltby, T. Between amity, enmity and europeanisation: EU energy security policy and the example of Bulgaria’s Russian energy dependence. Europe Asia Stud. 2015, 67, 809–830. [Google Scholar] [CrossRef]

- Trotta, G. Assessing energy efficiency improvements, energy dependence, and CO2 emissions in the European Union using a decomposition method. Energy Effic. 2018, 1–18. [Google Scholar] [CrossRef]

- Ghoddusi, H.; Morovati, M.; Rafizadeh, N. Foreign Exchange Shocks and Gasoline Consumption. Energy Econ. 2019, 84. [Google Scholar] [CrossRef]

- Kayser, H.A. Gasoline demand and car choice: Estimating gasoline demand using household information. Energy Econ. 2000, 22, 331–348. [Google Scholar] [CrossRef]

- Tiezzi, S.; Verde, S.F. Differential demand response to gasoline taxes and gasoline prices in the US. Resour. Energy Econ. 2016, 44, 71–91. [Google Scholar] [CrossRef]

- Rivers, N.; Schaufele, B. Salience of carbon taxes in the gasoline market. J. Environ. Econ. Manag. 2015, 74, 23–36. [Google Scholar] [CrossRef]

- Filippini, M.; Heimsch, F. The regional impact of a CO2 tax on gasoline demand: A spatial econometric approach. Resour. Energy Econ. 2016, 46, 85–100. [Google Scholar] [CrossRef]

- Li, Z.; Sun, R.; Dong, K.; Chung, K.H. Increasing stringent regional environmental regulations impact gasoline demand in China. Energy Procedia 2019, 158, 3572–3575. [Google Scholar] [CrossRef]

- Ramanathan, R.; Subramanian, G. Elasticities of gasoline demand in the Sultanate of Oman. Pacific and Asian. J. Energy 2003, 13, 105. [Google Scholar]

- Ramanathan, R. Short-and long-run elasticities of gasoline demand in India: An empirical analysis using cointegration techniques. Energy Econ. 1999, 21, 321–330. [Google Scholar] [CrossRef]

- Liddle, B.; Lung, S. Revisiting energy consumption and GDP causality: Importance of a priori hypothesis testing, disaggregated data, and heterogeneous panels. Appl. Energy 2015, 142, 44–55. [Google Scholar] [CrossRef]

- Mesutoğlu, B. Türkiye’de Benzin Fiyatlarındaki Gelişmeler ve Benzin Talebinin Fiyat Esnekliği üzerine bir Inceleme: (1990–1999). In Devlet Planlama Teşkilatı; 2001. Available online: http://ekutup.dpt.gov.tr/ (accessed on 6 February 2020).

- Dahl, C.A. Measuring global gasoline and diesel price and income elasticities. Energy Policy 2012, 41, 2–13. [Google Scholar] [CrossRef]

- Melikoglu, M. Demand forecast for road transportation fuels including gasoline, diesel, LPG, bioethanol and biodiesel for Turkey between 2013 and 2023. Renew. Energy 2014, 64, 164–171. [Google Scholar] [CrossRef]

- Erdogdu, E. Motor fuel prices in Turkey. Energy Policy 2014, 69, 143–153. [Google Scholar] [CrossRef]

- Yalta, A.T.; Yalta, A.Y. The dynamics of fuel demand and illegal fuel activity in Turkey. Energy Econ. 2016, 54, 144–158. [Google Scholar] [CrossRef]

- Keskin, R. Yapısal Kırılmalar Altında Türkiye’de Ekonomik Büyüme ve Petrol Tüketimi Arasındaki İlişki. Yönetim ve Ekonomi Celal Bayar Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi 2017, 24, 877–892. [Google Scholar]

- Beenstock, M.; Willcocks, P. Energy consumption and economic activity in industrialized countries: The dynamic aggregate time series relationship. Energy Econ. 1981, 3, 225–232. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Griffin, J.M. Gasoline demand in the OECD: An application of pooling and testing procedures. Eur. Econ. Rev. 1983, 22, 117–137. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.J. Co-integration and Error Correction: Representation, Estimation and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Ouliaris, S. Asymptotic Properties of Residual Based Tests for Cointegration. Econometrica 1990, 58, 165–193. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Saikkonen, P. Asymptotically efficient estimation of cointegrated regressions. Econ. Theory 1991, 7, 1–21. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.W. A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica 1993, 61, 783–820. [Google Scholar] [CrossRef]

- Phillips, P.B.; Hansen, B.E. Statistical Inference in Instrumental Variables Regression with I(1) Processes. Rev. Econ. Stud. 1990, 57, 99–125. [Google Scholar] [CrossRef]

- Park, J.Y. Canonical Cointegrating Regressions. Econometrica 1992, 60, 119–143. [Google Scholar] [CrossRef]

- Hendry, D.F.; Pagan, A.R.; Sargan, J.D. Dynamic Specification. In Handbook of Econometrics; Griliches, Z., Michael, M.D., Eds.; Intriligator: Amsterdam, The Netherlands, 1984; Volume 2, pp. 1023–1100. [Google Scholar]

- Ericsson, N.R.; Campos, J.; Tran, H.T. PC-GIVE and David Hendry’s Econometric Methodology. Rev. Econom. 1990, 10, 7–117. [Google Scholar] [CrossRef]

- Mackinnon, J.G. Numerical distribution functions for unit root and cointegration test. J. Appl. Econ. 1996, 11, 601–618. [Google Scholar] [CrossRef]

- Doornik, J.A. The Methodology and Practice of Econometrics: A Festschrift in Honour of David F. Hendry. In Autometrics; Castle, J.L., Shephard, N., Eds.; Oxford University Press: Oxford, UK, 2009; Chapter 4; pp. 88–121. [Google Scholar]

- Castle, J.L.; Hendry, D.F. Model selection in under-specified equations with breaks. J. Econ. 2014, 178, 286–293. [Google Scholar] [CrossRef]

- Castle, J.L.; Doornik, J.A.; Hendry, D.F.; Pretis, F. Detecting location shifts during model selection by step-indicator saturation. Econometrics 2015, 3, 240–264. [Google Scholar] [CrossRef]

- Birol, F.; Guerer, N. Modelling the transport sector fuel demand for developing economies. Energy Policy 1993, 1163–1172. [Google Scholar] [CrossRef]

- Franzén, M. Gasoline Demand: A Comparison of Models. Ph.D. Thesis, Department of Economics, University of Gothenburg, Gothenburg, Sweden, 1994. [Google Scholar]

- WB. World Bank Data: Motor Vehicles (per 1000 People). The World Bank. Archived from the Original on 9 February 2014. 2014. Available online: https://web.archive.org/web/20140209114811/http://data.worldbank.org/indicator/IS.VEH.NVEH.P3 (accessed on 6 February 2020).

| Mean | Correlation Matrix | |||||||

| lgd | ly | lp | lcars | lgd | ly | lp | lcars | |

| −2.022 | 8.451 | 1.358 | −2.514 | lgd | 1.000 | 0.181 | 0.697 | 0.780 |

| ly | 0.247 | 1.000 | 0.387 | −0.099 | ||||

| Standard Deviation | lp | 0.697 | 0.387 | 1.00 | 0.499 | |||

| 0.174 | 0.190 | 0.247 | 0.046 | lcars | 0.780 | −0.099 | 0.499 | 1.000 |

| Variables | lgd | ly | lp | lcars |

|---|---|---|---|---|

| level | −1.434 | −2.068 | −2.397 | −1.323 |

| (0.562) | (0.554) | (0.378) | (0.615) | |

| First difference | −9.737 | −3.663 | −8.752 | −2.673 |

| (0.000) | (0.007) | (0.000) | (0.084) |

| Panel A: DOLS Based Test Results | Panel B: VECM Based | ||||||

|---|---|---|---|---|---|---|---|

| Engle–Granger Tests | Phillips–Ouliaris Tests | Max-Eigenvalue Statistics | Trace Statistics | ||||

| Test Value | p-Value | Test Value | p-Value | 53.04 *** | 82.758 *** | ||

| Tau-stat | −5.668 | 0.001 | −5.647 | 0.001 | 15.880 | 29.710 | |

| Z-stat | −45.048 | 0.001 | −43.303 | 0.001 | 11.797 | 15.495 | |

| Specifications | Model 1 | Model 2 | ||||

|---|---|---|---|---|---|---|

| DOLS | FMOLS | CCR | DOLS | FMOLS | CCR | |

| ly | 0.251 *** | 0.285 *** | 0.274 *** | 0.383 *** | 0.284 *** | 0.272 *** |

| lp | −0.266 * | −0.337 *** | −0.316 *** | −0.394 ** | −0.342 ** | −0.325 *** |

| lcars | −0.801 *** | −0.999 *** | −0.926 *** | − | − | − |

| lpr | − | −0.863 *** | −0.584 * | −0.542 * | ||

| lcps | −0.919 *** | −0.621 *** | −0.593 * | |||

| Panel A: Short-run Estimation Results | Panel B: Diagnostic Tests’ Results | |||

|---|---|---|---|---|

| SoA | Test Statistic | p-Value | ||

| coefficient | −0.370 | AR 1–5 | 1.600 | 0.192 |

| p-value | 0.000 | ARCH 1–4 | 0.510 | 0.729 |

| Normality | 1.925 | 0.382 | ||

| Hetero | 0.627 | 0.431 | ||

| Reset | 0.526 | 0.596 | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mikayilov, J.I.; Mukhtarov, S.; Dinçer, H.; Yüksel, S.; Aydın, R. Elasticity Analysis of Fossil Energy Sources for Sustainable Economies: A Case of Gasoline Consumption in Turkey. Energies 2020, 13, 731. https://doi.org/10.3390/en13030731

Mikayilov JI, Mukhtarov S, Dinçer H, Yüksel S, Aydın R. Elasticity Analysis of Fossil Energy Sources for Sustainable Economies: A Case of Gasoline Consumption in Turkey. Energies. 2020; 13(3):731. https://doi.org/10.3390/en13030731

Chicago/Turabian StyleMikayilov, Jeyhun I., Shahriyar Mukhtarov, Hasan Dinçer, Serhat Yüksel, and Rıdvan Aydın. 2020. "Elasticity Analysis of Fossil Energy Sources for Sustainable Economies: A Case of Gasoline Consumption in Turkey" Energies 13, no. 3: 731. https://doi.org/10.3390/en13030731

APA StyleMikayilov, J. I., Mukhtarov, S., Dinçer, H., Yüksel, S., & Aydın, R. (2020). Elasticity Analysis of Fossil Energy Sources for Sustainable Economies: A Case of Gasoline Consumption in Turkey. Energies, 13(3), 731. https://doi.org/10.3390/en13030731