1. Introduction

In recent decades, climate change has become a priority worldwide due to the fact that the impacts derived from it have been intensified, generating strong consequences for the economy and society of different regions. This is the reason why the countries of the world aimed their policies to reduce carbon dioxide emissions to ensure sustainable economic growth and development. However, their average cost of mitigation and adaptation is high in the short term since they set ambitious objectives that must be met in certain years, which leads them to make heavy investments in infrastructure and technology [

1]. The main sources that emit CO

2 into the atmosphere are fossil fuels, which come from natural gas, oil and coal and are used as sources of energy generation in economic activities, being a challenge for large economies to commit to reducing and changing their energy sources [

2,

3].

According to the Statistical Review of World Energy [

4], CO

2 emissions in the European Union went from 4081 million tons in 2000 to 3466 million tons in 2018. In the same period, the consumption of fossil fuels has decreased by approximately 15.32% in the European Union. The energy sources mentioned are mainly responsible for the climate change that has been generated in the world, causing some regions of the world to experience droughts, meteorological phenomena and floods, among others [

5].

In response to the above, different organizations proposed policies focused on changing traditional energy sources that emit pollutant gases and aggravate environmental problems. The countries that make up the European Union stand out in this regard and are the greatest promoters of policies in favor of the environment, aiming at a more ecological and sustainable Europe, characterized by low emissions of pollutant gases, due to the efficient use of resources, being competitive and generating well-being for citizens. In figures presented by the IEA [

6], the carbon dioxide emissions of the European Union went from 4036 to 3475 million tons, from 2000 to 2017, respectively. They are responsible for 10.8% of the emissions that are generated in the world.

In addition, a report by the European Commission [

7] revealed that in the European Union, the energy industry emits 35.9% of CO

2 emissions due to the dependence it still has on fossil fuels. However, prices and costs have varied in recent years, with the first fall in energy prices since 2008 being experienced in 2017, due to the growing competition from renewable energy sources that have emerged, generating 30.7% and 19.7% of electricity and heating in 2017, respectively—being the main sources of renewable energy in charge of covering the demand for heating: biomass, solar thermal and geothermal energy.

In particular, European countries have high and upper-middle incomes, which drives them to have a greater concern for the environment, in which various objectives and targets have been defined to reduce CO

2 emissions at the European Union level. The liberalization of the internal energy market (natural gas and electricity) is included in its measures, which in the third package that was approved in 2011 and had a reform in which the liberalization was extended to both domestic and non-domestic markets. This policy is adopted in order to build a more competitive electricity market that focuses on consumers and covers the production of decarbonized electricity in order to provide a competitive, safe, sustainable and accessible service [

8].

Consequently, the policy proposed in agreement with the European Parliament [

8] aims to achieve energy efficiency and offer consumers a wider range of options to choose their suppliers, as well as contribute to meeting the climate targets set for 2030 and 2050, to reduce its greenhouse gas emissions by 40% and to be an economy with net-zero emissions, respectively [

9] In addition, these types of measures can take on greater force with the emergence of new technologies or green product development to improve environmental sustainability [

10,

11].

Thus, the liberalization of the internal energy market will be essential for the consumption of renewable energy due to the elimination of trade barriers and barriers that prevented this market from developing [

12,

13,

14]. However, despite the opportunities that it implies, there are also risks due to the distortions that are generated in the transition, being a problem for reducing CO

2 emissions [

15,

16,

17].

In this context, the objective of this research is to evaluate the effect of the liberalization of the internal energy market implemented in 2011 on CO

2 emissions in the European Union in order to evaluate the effectiveness of the policy. This research covers 27 European Union countries, which were classified according to their income level from 2004 to 2017. This research will take into account the environmental Kuznets curve (EKC) that provides a solid theoretical framework to analyze the environmental pollution caused by economic growth [

18]. There is extensive literature that supports the hypothesis of the environmental Kuznets curve in different economies, which responds in different ways [

19,

20,

21].

In addition, the aim is to validate the hypothesis that low carbon dioxide emissions are determined by the liberalization of the internal gas and electricity market.

In this way, this research contributes to the literature that relates CO

2 emissions with the policy of the liberalization of the internal energy market by evaluating its effectiveness through a

two-way fixed effects econometric model with panel data for the European Union. It differs from the studies of other authors such as Nicolli and Vona [

12], Meyer [

22] and Akkemik and Oğuz [

23], who base their research on simulations and on the comparison of statistical information of one year with another. In addition, Zhao et al. [

24] carry out a study with a spatial model, although the impact of the policy over time is not clearly observed.

This document is structured as follows: In the introduction, the subject under study is contextualized, the research is justified, and its objective is stated. The second section comprises a review of previous theoretical and empirical research. The third section describes the data used and proposes an econometric strategy. In the fourth section, the results are discussed with the theory and empirical evidence. The fifth and final section presents the conclusions and policy implications of the research.

2. Review of Previous Literature

The climate change experienced in recent decades is linked to an increase in pollutant gas emissions and the economic growth of countries [

5,

25,

26], which is the reason why there are several empirical studies that analyze the relationship between the mentioned variables [

2,

3,

27,

28,

29,

30,

31,

32,

33,

34]. The basic theory used to understand this relationship is the Kuznets curve hypothesis applied to environmental issues.

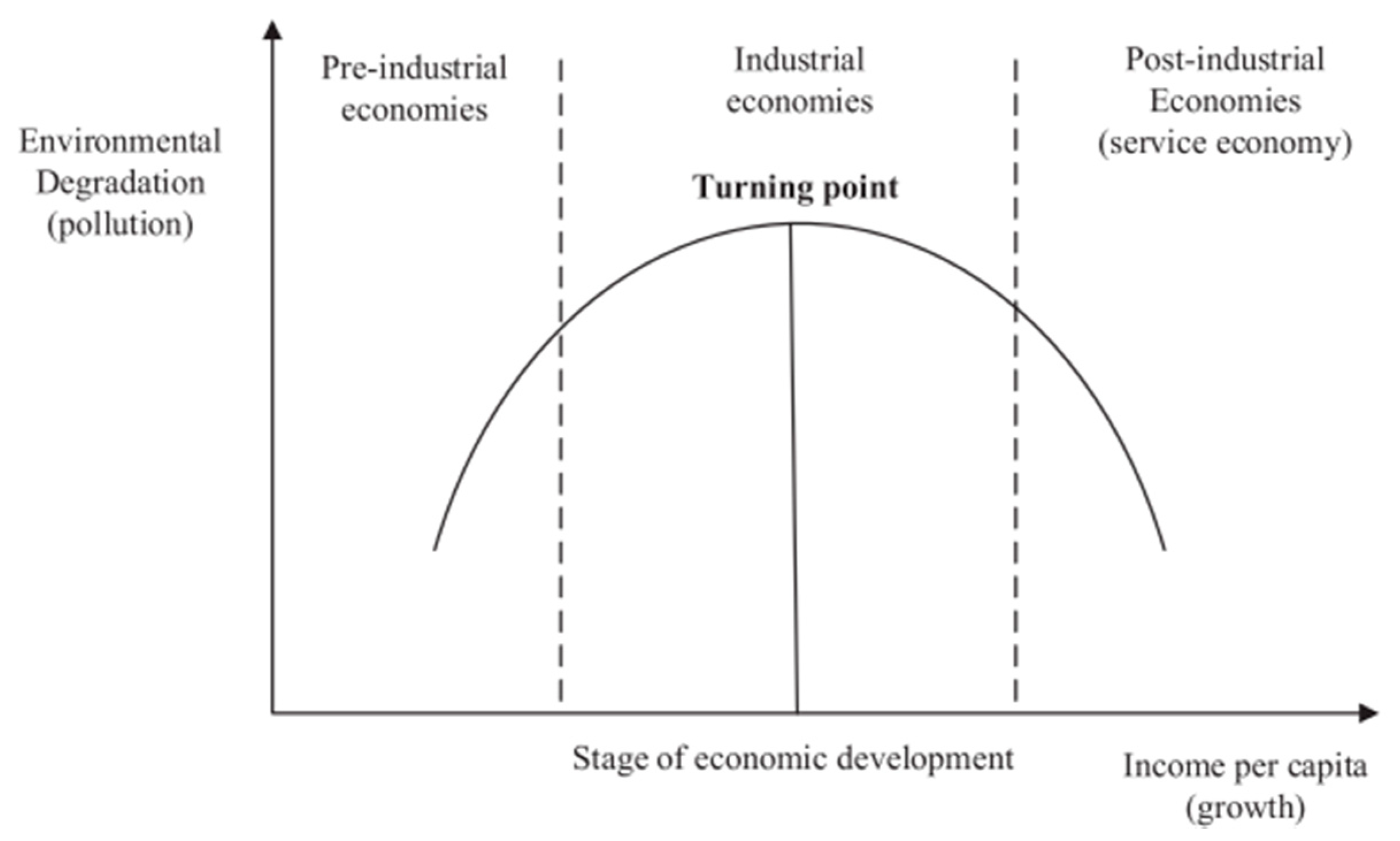

The environmental Kuznets curve (EKC) was used by Panayotou [

18], establishing an inverted U-shaped relationship between economic growth and environmental degradation (see

Figure A1 in

Appendix A). This curve proposes that those countries that are in their initial stages of development cause greater degradation until reaching a certain level of development, and from then on, they tend to decrease their environmental degradation by implementing measures to reverse the situation generated during the process.

Based on the argument presented, the empirical evidence will be divided into two groups. The first one groups those studies that support the hypothesis of the environmental Kuznets curve [

19,

20,

27]. In the second group, we find those investigations that consider the effect of a measure implemented to contribute to an improvement in environmental quality, such as the liberalization of the internal energy market [

22,

35,

36].

In the first group, different empirical investigations validate the existence of the EKC in different contexts according to the study period, and the econometric method used [

37]. A study developed by Alam et al. [

38] for Brazil, China, India and Indonesia with time-series data of carbon emissions, economic growth, energy consumption and population growth demonstrates the existence of the long-term EKC in these countries. Similar studies applied to Croatia, Denmark, Italy and Algeria, using the autoregressive distributed lag method (ARDL) show the same results, where it is seen that as GDP per capita increases, CO

2 emissions are reduced, so measures that have a conservative effect on GDP per capita should not be implemented [

39,

40,

41].

On the other hand, Ardakani and Seyedaliakbar [

27] studied the validity of the environmental Kuznets curve in seven oil-rich Middle East and North African (MENA) countries, using panel data, which combine time series and cross-sectional data, that is, the same cross-sectional unit is studied over time. It was determined that the application of the Kuznets curve varies in each country due to the stage its GDP is in with respect to the inflection point they must reach. According to several studies, an aspect to be taken into account is the consumption of renewable energy, the use of environmentally friendly technologies, as well as urban policies in order to accelerate the process in which the EKC reaches its inflection point [

42,

43,

44].

By contrast, other investigations show the invalidity of the environmental Kuznets curve in their results. Adu and Denkyirah [

45] showed that economic growth has a positive impact on long-term emissions in their study for West Africa. The results suggest that it is necessary to intervene through environmental and economic policies that help prevent environmental degradation without harming economic growth [

46]. In addition, there are studies such as that by Churchill et al. [

20], carried out in 20 OECD countries, in which it was observed that countries such as Australia, Canada and Japan had an N-shaped EKC. These results suggest that these countries should be concerned with maintaining a clean industrial sector with environmentally friendly techniques in the long term [

47].

On the other hand, different studies have included other variables to search for a greater explanation. Wang et al. [

48] stand out with an investigation for the BRICS countries, in which it is shown that corruption plays a regulatory role in this relationship, which means that when there is control over corruption, CO

2 emissions will be lower, and the economic growth of the country will be higher. Other studies included variables such as trade openness and financial development, observing that they increase energy consumption but reduce CO

2 emissions by expanding the options in the energy market [

49].

At the same time, variables such as population size, energy consumption and fossil electricity generation are positively related to CO

2 emissions [

21,

50]. However, the effect of other variables on CO

2 emissions, such as urbanization, varies significantly according to the stage of development and the income level faced by each country [

51].

In the second group, it is observed that when implementing the policy of liberalizing the internal gas and electricity market, this has repercussions not only at the economic level but also at the environmental level. These studies reveal that the effect can be positive, causing more competitive industries to be generated with more environmentally friendly energy sources, which contribute to reducing gases that cause climate change. However, in other cases, the effect can be the opposite of what was expected [

52,

53,

54].

Different studies reveal that the liberalization of the energy market will be essential to strengthen the consumption of renewable energy, as a consequence of reducing entry barriers, as well as the monopoly power of energy companies, establishing affordable prices for consumers [

12,

13,

14]. Scholars such as Chapman and Itaoka [

55] establish that the diversity of energy sources will make consumer decisions be guided by environmental reasoning.

Moreover, Meyer [

22] and Akkemik and Oğuz [

23] reveal that the liberalization of the energy market is a complex process, in which support from the government is required in order to achieve greater efficiency and develop energy systems that generate welfare for consumers and the environment, influencing the energy market to promote the production of electricity from renewable energy sources, which contributes to improving environmental sustainability [

56]. However, despite the opportunities that the liberalization of the energy market implies, there are also risks due to the distortions in the transition, which is a problem for reducing CO

2 emissions [

15,

16,

17]. Several studies show that the technology required for the generation of renewable electricity has high costs, so that power plants that use coal, oil, natural gas or nuclear energy remain the most accessible options [

57,

58]. In addition, the lack of incentives to invest in a sustainable energy system has its impact [

59,

60,

61].

Furthermore, Syri et al. [

35] question the statement that nuclear energy is not competitive in the European liberalized electricity market due to the fact that Finland has been liberalizing its market since the 90s and maintains its nuclear power plants active and under development. However, Peña-Torres and Pearson [

62] argued that nuclear technology was unlikely to gain space in liberalized energy industries.

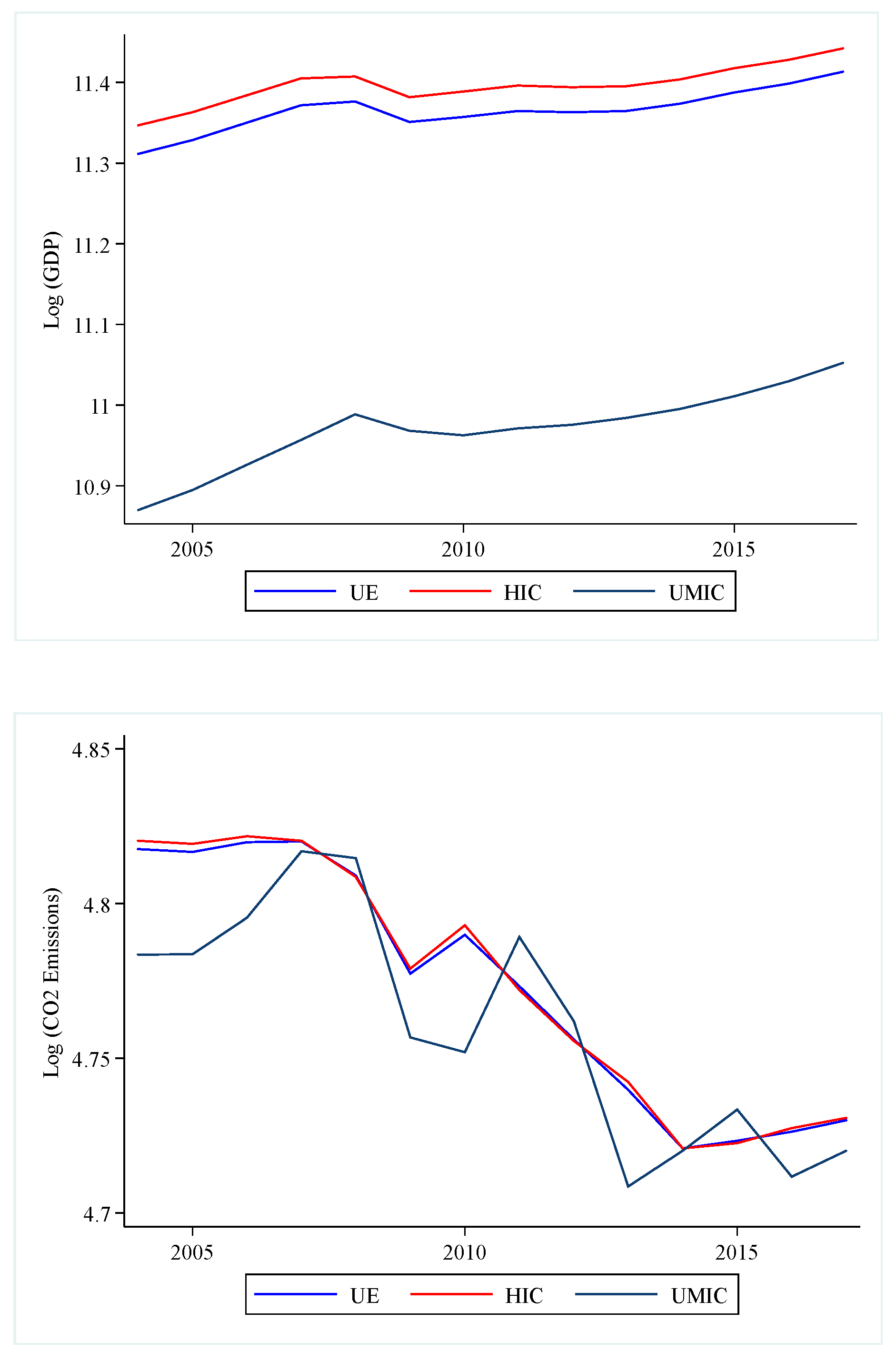

4. Results and Discussion

This section presents the results obtained from calculating the equations presented in the methodology for 27 European Union countries. By means of the first equation, the hypothesis of the environmental inverted U of Kuznets [

66] is verified, both EU and according to the income level of European countries. The results as shown in

Table 3 when estimating Equation (1) indicate that the EKC hypothesis is rejected for European countries, as for the HIC and UMIC, because the sign of the log (GDP) and log (GDP)

2 coefficients are not as expected and are also not significant, except for HIC.

The results obtained for HIC are related to those of Adu and Denkyirah [

45], which suggest that economic growth will impact CO

2 emissions positively in the long term, which means that the quality of the environment will be affected.

The results of the second equation are shown in

Table 4, in which the policy of liberalization of the internal energy market was included, observing that at the EU level and according to the income level, economic growth is positively related to carbon dioxide emissions. However, when implementing the policy, its effect on carbon dioxide emissions is negative, which coincides with what is established by Nicolli and Vona [

12], Iimura and Cross [

13] and Tsybina et al. [

14], who explains that it is a measure that helps to strengthen the renewable energy market by eliminating the barriers imposed by protectionism, benefiting both the environment and consumers. However, these results are in contradiction with Ringel [

15] and Daví-Arderius et al. [

59], who state that this measure has risks that cause the objective set not to be met due to the distortions found in markets and the complexity of the transition.

The third stage consists of adding the control variables to the model to give it greater consistency.

Table 5 presents the results of Equation (3) at the EU level. It can be seen that incorporating the trade openness variable has a negative and significant impact on carbon dioxide emissions. This result coincides with Rafindadi [

49], Alam et al. [

38], Olale et al. [

37] and Muhammad [

44], who found that commercial openness increases energy consumption as commercial activity increases; however, it also reduces CO

2 emissions since more competitive environments are created that encourage the use of energy-efficient technologies that contribute to improving environmental quality. Having access to a variety of renewable and non-renewable energy sources, according to Chapman and Itaoka [

55], will result in them choosing those that best suit their preferences, with their environmental reasoning predominating.

Consequently, the consumption of renewable and non-renewable energy was included in the model, which are negatively and positively related to CO

2 emissions, respectively. In turn, the increase in the consumption of renewable energy in the European Union is positively associated with the implementation of food tariff policies and green certificates [

71,

72,

73], as well as the interconnection to the electricity grid [

74]. The relationship between the consumption of renewable energy and CO

2 emissions is consistent with that proposed by Yang [

52] and Lise and Kruseman [

54], who established that the energy obtained from renewable resources such as wind, sunlight, water resources (tides, rivers and waves), among others, do not emit CO

2 emissions. Similarly, Nathaniel and Khan [

75] and Khan, Yu, Belhadi, and Mardani [

76] establish that the consumption of renewable energy is a driver to avoid deterioration and environmental degradation. However, this study does not take into account the land needed to install the wind, solar thermal and hydroelectric plants. On the contrary, those that come from fossil fuels, according to Dong et al. [

21] and Hdom [

50], are the ones that generate the highest emissions of pollutant gases, being the cause of climate change that our planet is experiencing.

Furthermore,

Table 5 shows the positive relationship between the added value of the industry and CO

2 emissions. The results that coincide with Liu et al. [

3], Awaworyi Churchill et al. [

28] and Zafar et al. [

34] make economic sense since increased industrial activity produces higher CO

2 emissions if the sources used to satisfy its energy demand are non-renewable. In addition, due to the activity, they are engaged in, according to EUROSTAT [

64] data, the manufacturing and construction industry is responsible for emitting 443.64 million tons of CO

2 annually, due to the fact that they are dedicated to the production of iron and steel, nonmetallic minerals, chemicals, food processing, beverages and tobacco, pulp, paper and printing, among others. On the other hand, it is observed that the urbanization rate and population growth are negatively related to CO

2 emissions. Wang et al. [

51] and Fujii et al. [

43] express that their impact will vary according to the development stage and level of income received by the study countries. In the case of European Union countries that maintain a high and upper-middle-income level, the population has a greater environmental awareness that is negatively related to carbon dioxide emissions.

Table 6 and

Table 7 show the results of Equation (3) according to the income level of the countries that are classified as high and upper-middle, respectively. Contrasting the results obtained, it can be seen that in the case of the HIC, the policy and variables of trade openness, renewable energy, non-renewable energy, industry, urbanization rate and population growth are significant and act in a similar way at the EU level.

In the case of the UMIC, they have some peculiarities and act in a different way from the UE level case. The countries belonging to this group are Bulgaria and Romania, where it is evident that the policy is significant without the inclusion of the control variables. Thus, when implementing the trade openness variable in the model, the policy loses its significance. However, the impact of this variable on carbon dioxide emissions is negative. These results may be associated with the establishment of competitive environments that encourage countries to innovate and improve business productivity, using more efficient technology [

49].

The consumption of renewable energy is also included in the model, which loses its significance by including a variable that measures the consumption of non-renewable energy. These results may be associated with the fact that, according to EUROSTAT [

64], 18.9% of the energy consumed by the European Union comes from renewable sources, currently being part of the largest electricity producers. However, fossil fuels continue to dominate the energy market, setting the general trends in electricity prices [

50,

60,

62].

Consequently, the last model includes the industry variable, which shows a positive and statistically significant relationship with CO

2 emissions. For example, this is due to the fact that the industrial sector represents 23.8% of the GDP for Bulgaria and 29% of the GDP for Romania [

64] because they demand more fossil fuels. Then the urbanization rate is added, which is not significant, along with the population growth that is negatively correlated with CO

2 emissions. Results opposed to the findings of Dong et al. [

21], who showed that population growth has a positive impact. However, other studies show that the characteristics of each country should be considered [

43,

48]. It should be noted, as mentioned by Meyer [

22], that the transition is complex, and countries need time to adapt and have the expected results.

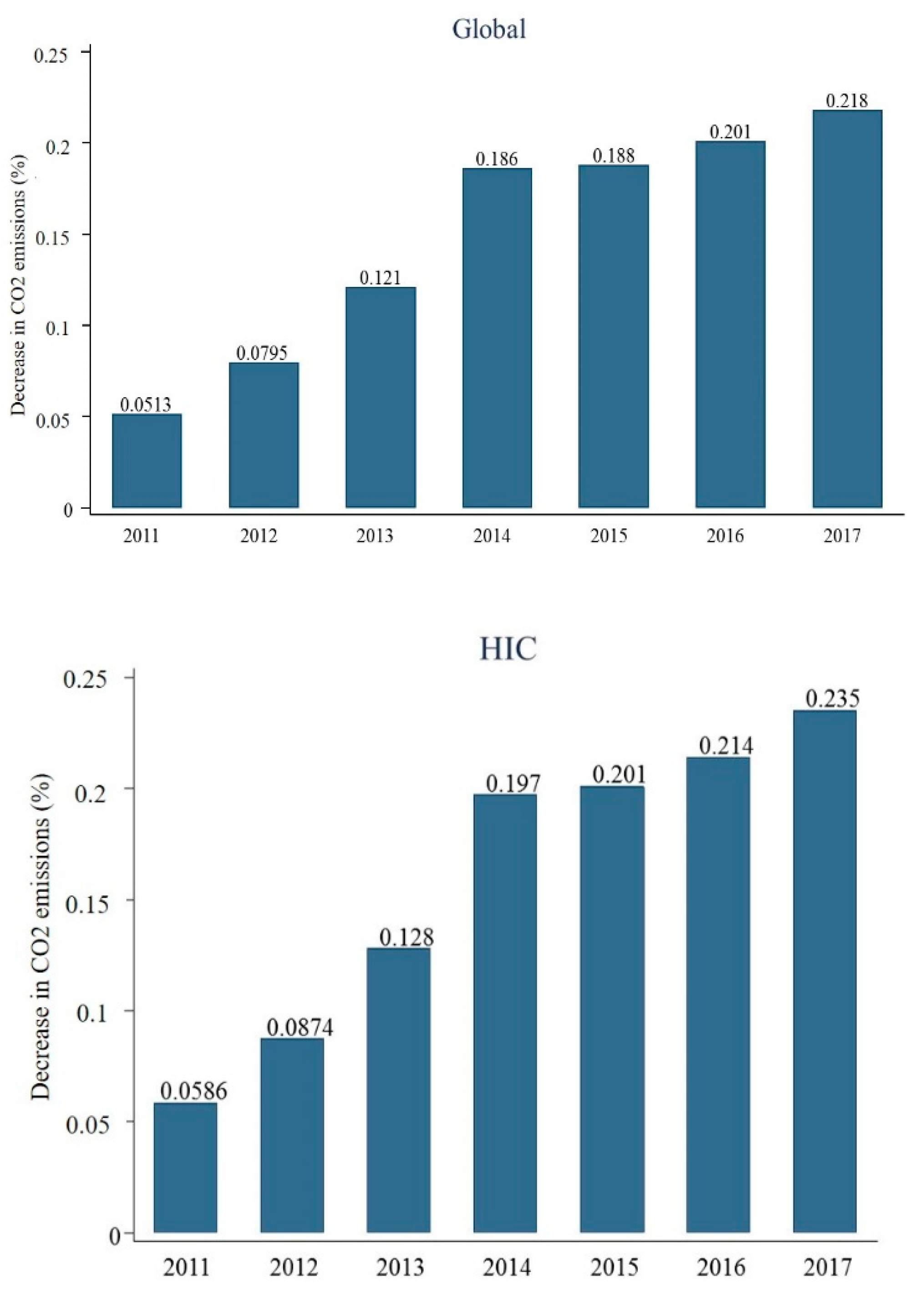

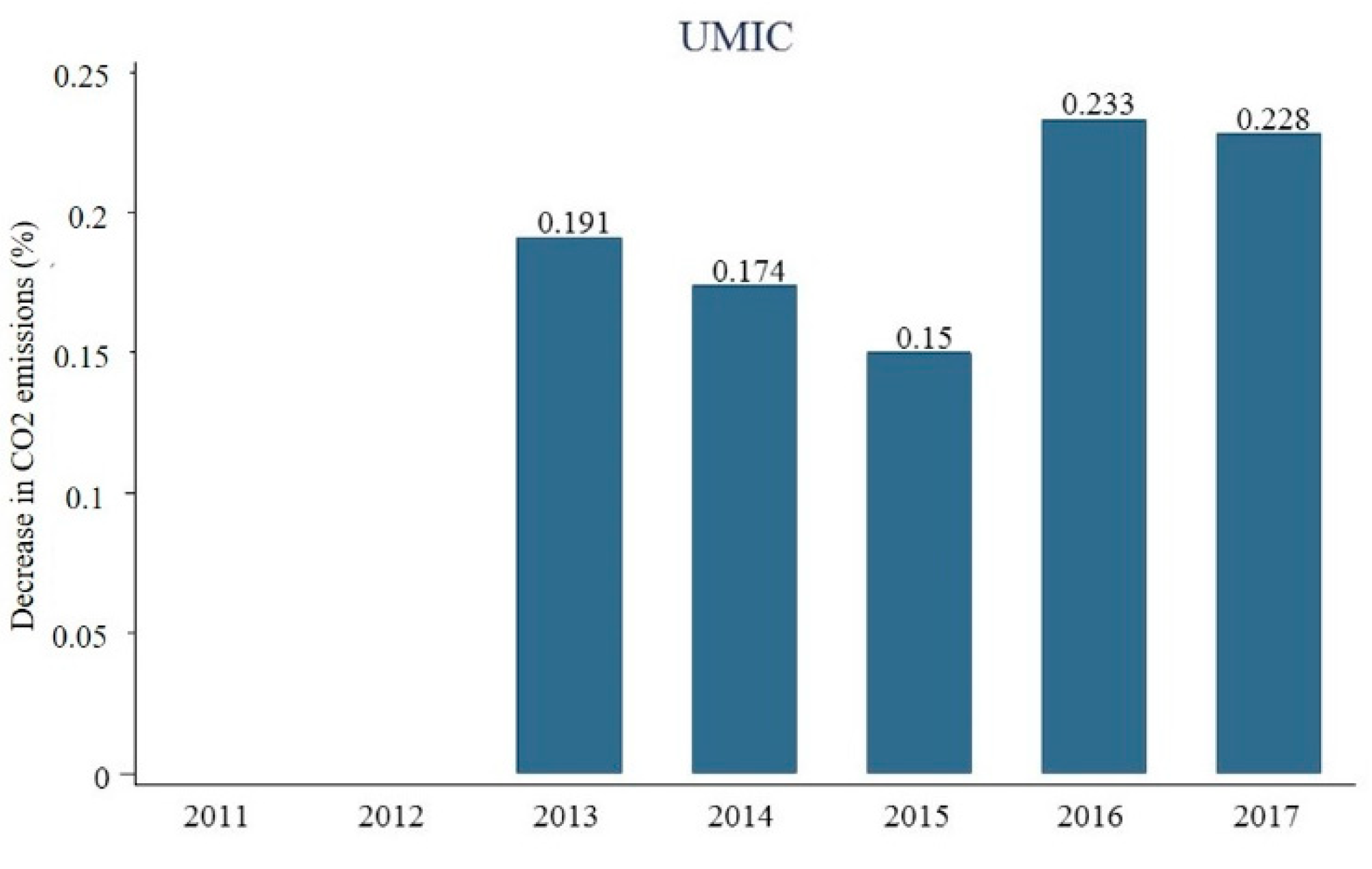

Having identified the effects of the policy in general and of different variables on carbon dioxide emissions in the period analyzed (2004–2017), we proceed to evaluate the effect of liberalizing the internal energy market each year, from the moment the policy entered in force. Thus, we apply the timing effects to evaluate the effect of the policy in each of the years in which it is in force. To capture the effect over time since the policy was implemented (2011–2017), a binary variable was included. This specification allows the effect of the policy to be quantified for each year in the study countries and according to the income level they have.

Table 8 shows that the effect of the policy over time at the EU level was immediate. The result obtained is due to the liberalization process that the European Union started in 1996. Taking the coefficients into account, a pattern can be observed, which indicates that the reduction in carbon dioxide emissions tended to increase from the fourth year after the policy was implemented, going from a reduction of 0.05% to 0.19% in carbon dioxide emissions. According to Sánchez and da Silveira [

77], this result is due to the fact that the liberalization of the internal energy market has been a progressive process in which there have been different stages, which, according to the characteristics of the countries, have been fulfilled at different times.

When analyzing the effect of the policy according to the income level of the countries that make up the European Union, it is observed that in the HIC, the effect was immediate. Emissions began to decrease by 0.05% until reaching a decrease of 0.24% in 2017. However, in the UMIC, there was a two-year delay in the effect of the policy to be able to observe significant effects on carbon dioxide emissions, starting with a 0.19% reduction in carbon dioxide emissions from energy systems. Bulgaria and Romania belong to the UMIC category, which according to the documentation of the European Parliament [

8] took advantage of the different deadlines granted by the European Union to fully liberalize their internal energy market, taking them more time than the HIC, who was already executing the measure progressively, presenting a higher environmental performance [

36].

Generally, it is expected that the benefits from the liberalization of the internal energy market will be achieved with some delay, due to the particular characteristics of the different countries that make up the European Union, in which some adjustments are required by their respective governments, so that they adapt to the new system, ensuring the functioning of an affordable, sustainable energy market that protects consumers’ interests [

61].

Substantial long-term effects of at least seven to eight years are regularly confirmed. In order to gain a better assessment,

Figure 2 shows the patterns of the effects that occurred in carbon dioxide emissions at the EU level and according to the income level of the countries (the values represent the percentage decrease in contamination).