A Model for Cost–Benefit Analysis of Privately Owned Vehicle-to-Grid Solutions

Abstract

1. Introduction

- A thorough mathematical cost–benefit model used to analyse accurately to what extent V2G technology can be profitable for a regular end user. This model takes into account parameters that, to the best of the authors’ knowledge, have not been included in any other cost–benefit model that involves different end users for V2G technology depending on their vehicle user profile, like battery discharging while being idle, how the depreciation of the electric vehicle influences its maintenance costs, or the suboptimal trade of electricity that might happen if the vehicle is not available during the most suitable time slots of the day to be recharged.

- The differences in expenditures for V2G solutions when the battery is purchased with the whole vehicle or leased from the manufacturer. This is another contribution that the authors of this paper have not seen in the existing literature about this topic.

- The application of the cost–benefit model to three user profiles for V2G and ICE solutions, along with how they fare after a prolonged period of time. The authors believe that this adds a realistic justification with several examples that make use of actual data and parameter values extracted from updated references in order to know to what extent using V2G may provide an economical benefit to their end users.

- A review of comparable models that have been created by other authors, pointing out the main challenges that have still to be dealt with and why the one put forward by the authors of this manuscript represents an improvement over the previous ones.

2. Related Works

2.1. State of The Art

2.2. Open Issues

- Limitations in the mathematical models. Despite the efforts done by the authors, the mathematical models used show limitations that make them obsolete after a relatively short amount of time. A model that offers a significant number of parameters to measure accurately the cost–benefit of V2G solutions, while at the same time keeping the time required to perform calculations at a reasonable level, is required.

- Lack of orientation to private transport. The evaluations that are done in the literature are mostly concerned about transport fleet or public services. However, the adoption of these solutions by private owners of vehicles is a critical point for V2G, as they are more numerous and the cost of their means of transport is lower when compared to a school bus or a truck. While there are literature references proving that EV owners could be interested in enabling their vehicles with V2G technology if given suitable options (“Our findings suggest that the V2G concept is most likely to help EVs on the market if power aggregators operate either on pay-as-you-go basis”, [34]) they do not show a mathematical model that takes into account different EV user profiles, externalities or battery usage options.

- Reduced scope of numerical results. The studied literature usually reflects how a model can be applied or not by taking into account too specific situations, such as public transport in a city or any other location that is very dependent on meteorological circumstances, the kind of public service that is attended or the route that is taken every day by the vehicles, so it becomes difficult to make an objective analysis of those scenarios.

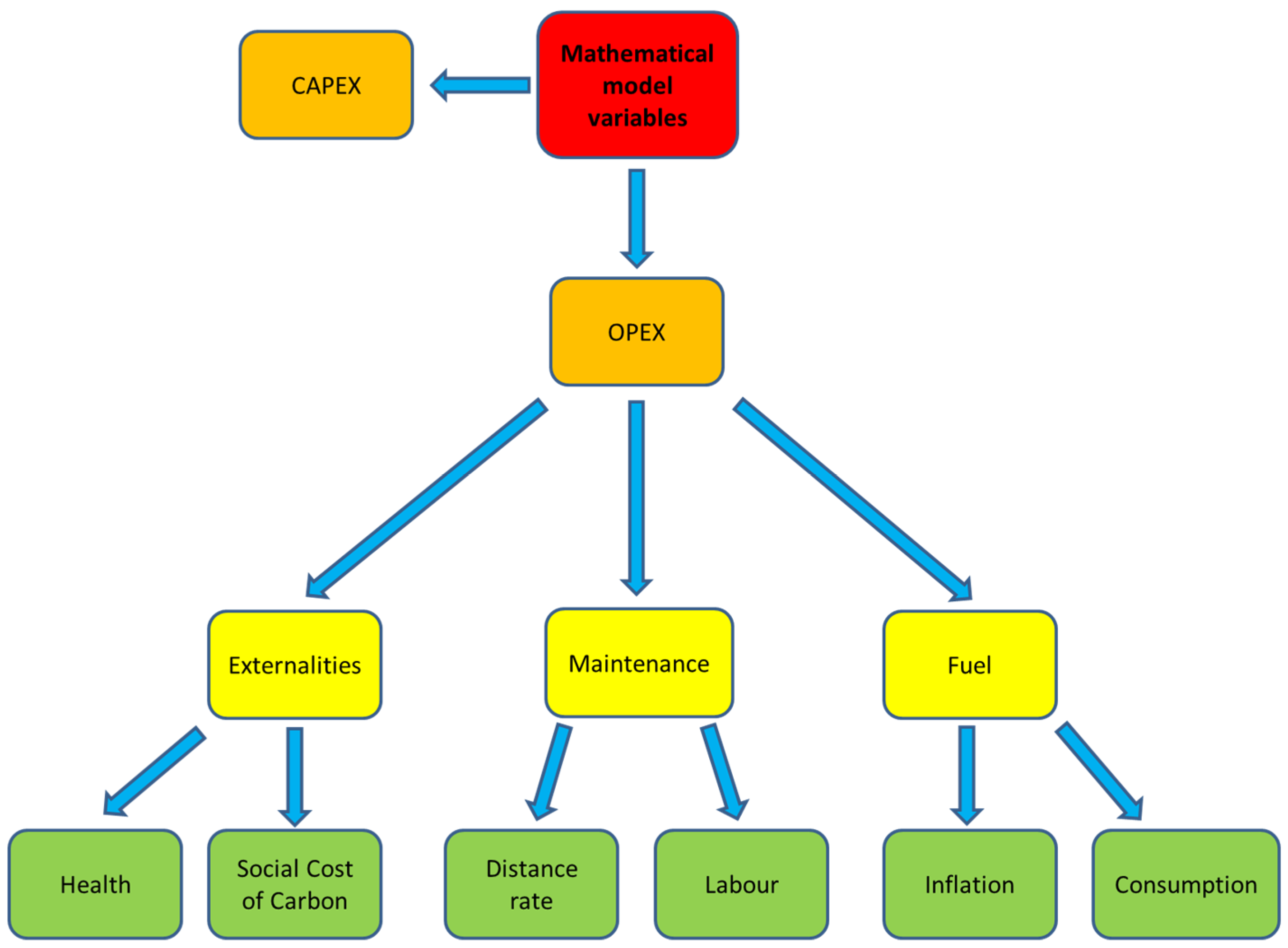

3. Mathematical Model for V2G Integration

3.1. Cost of the Externalities of the Vehicle

3.2. Cost of Yearly Fuel Consumption

3.3. Cost of Maintenance

4. Numerical Assessment

4.1. Considerations

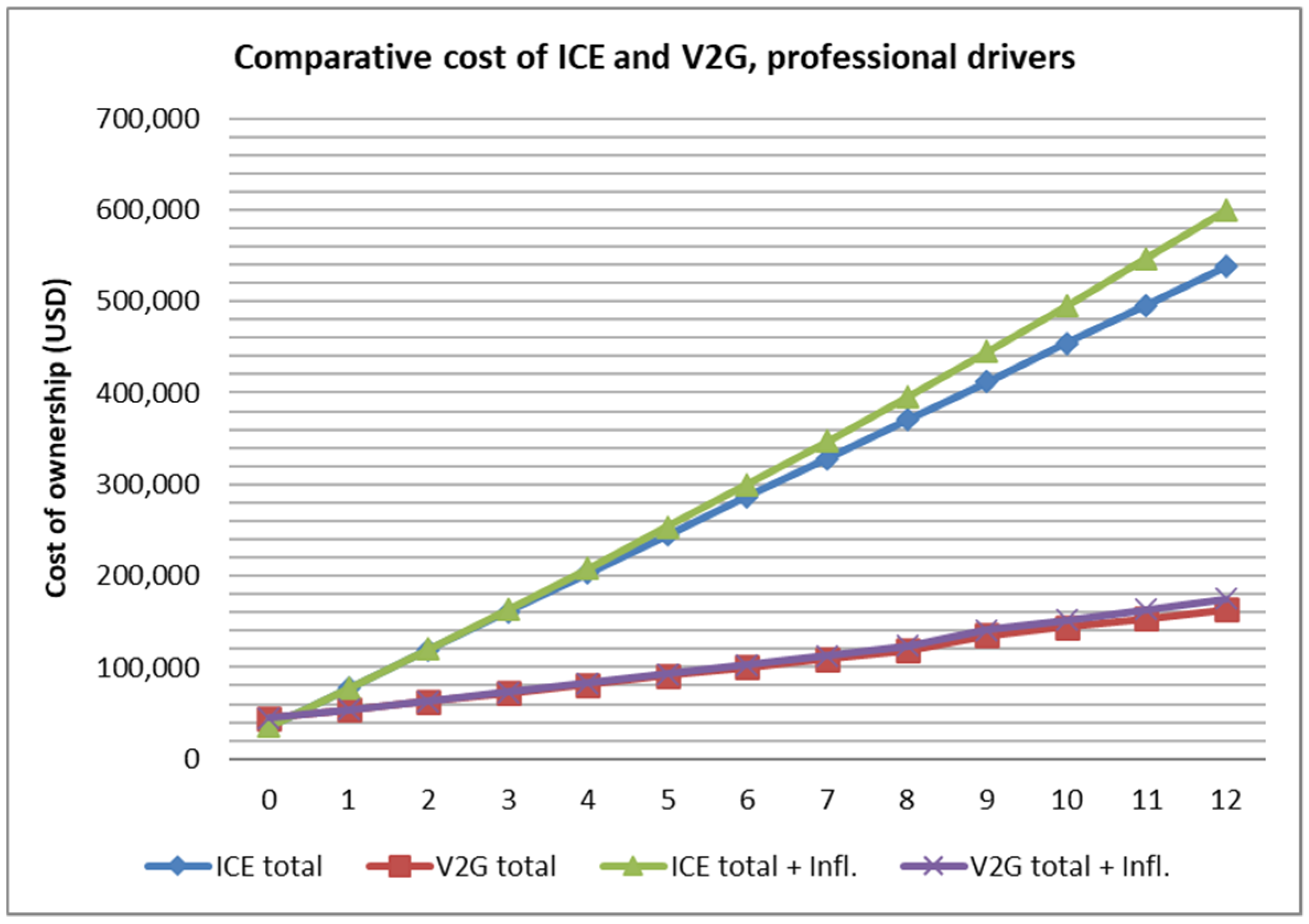

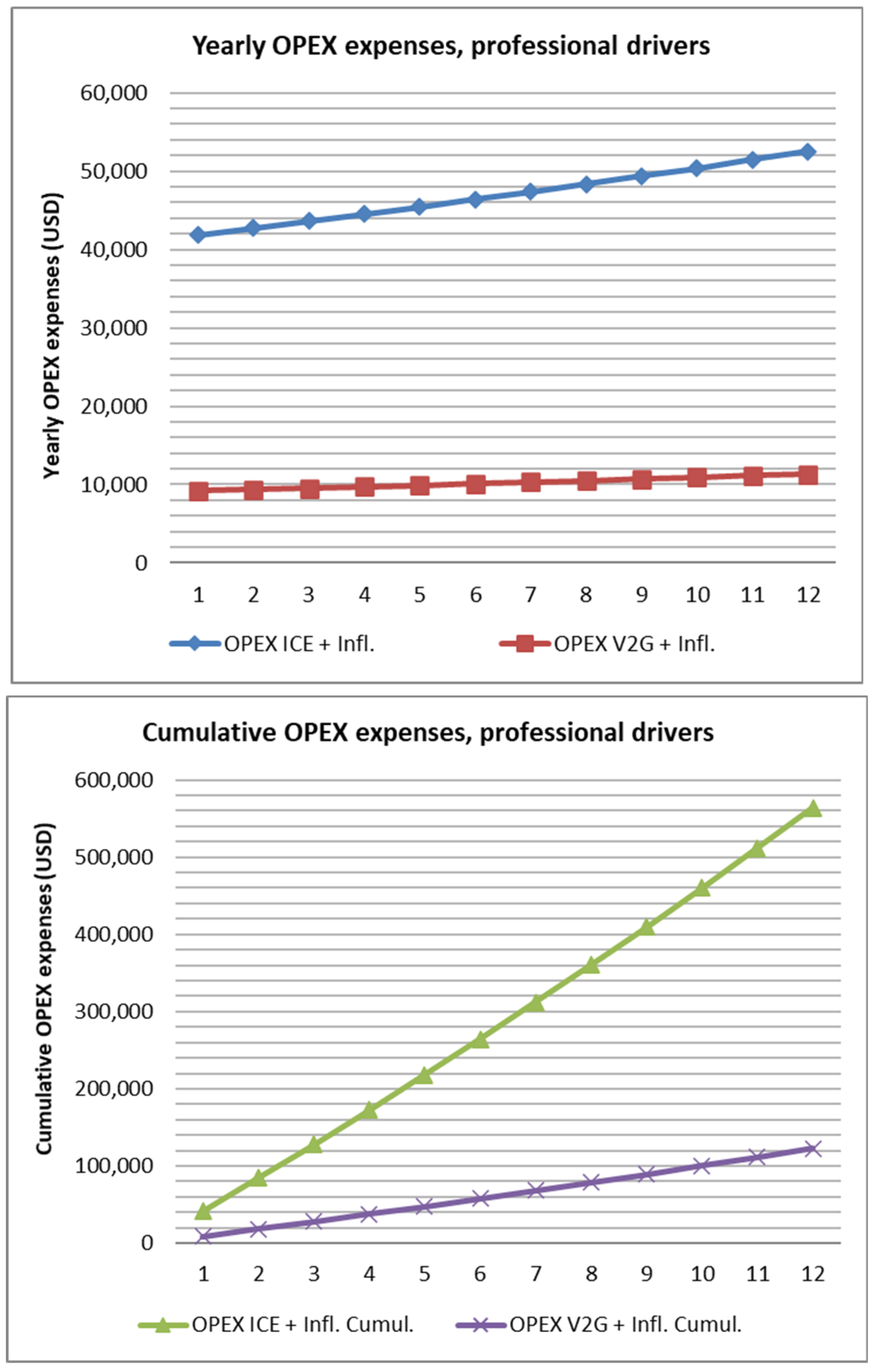

4.2. Case Study A: Professional Drivers

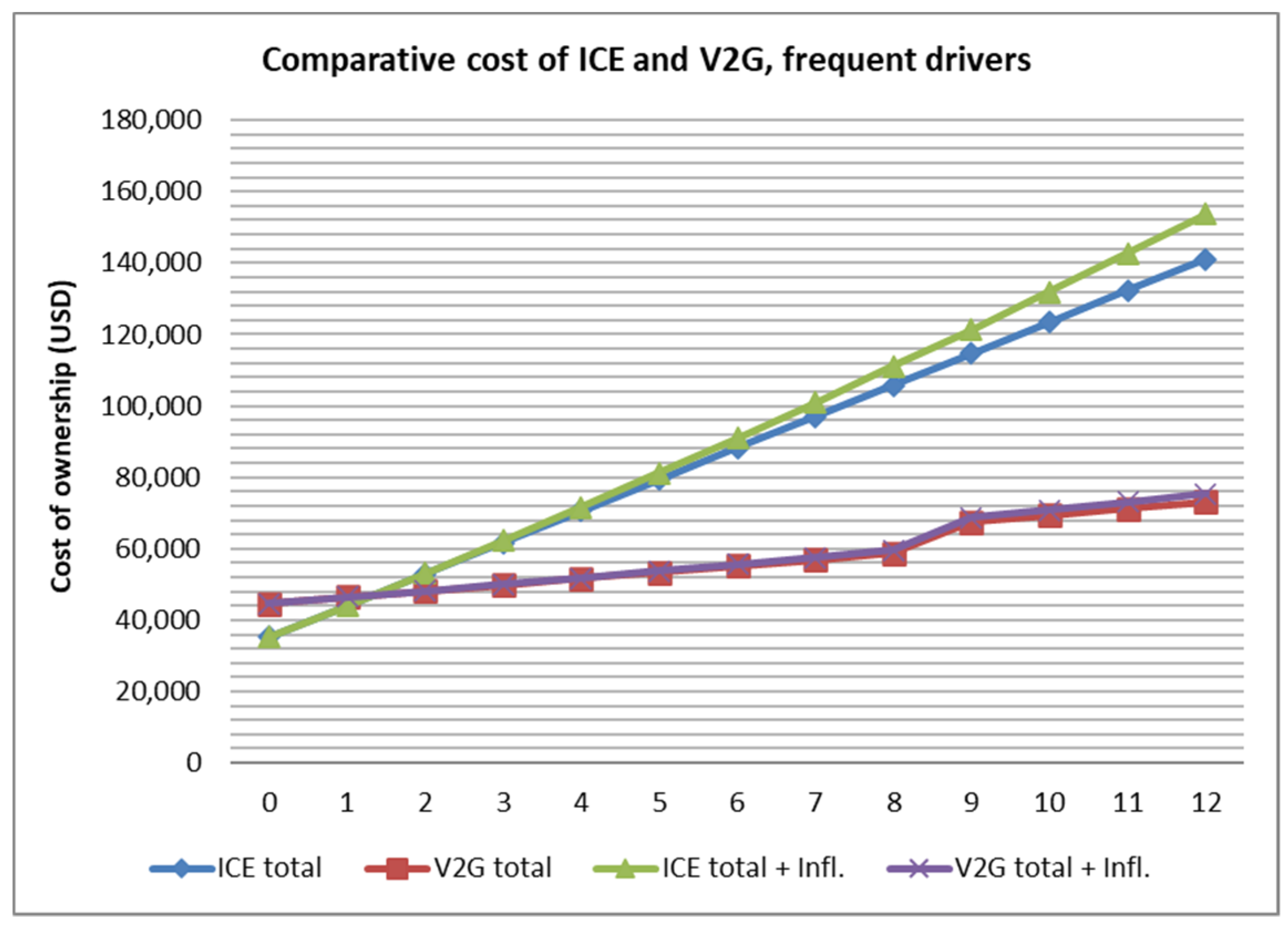

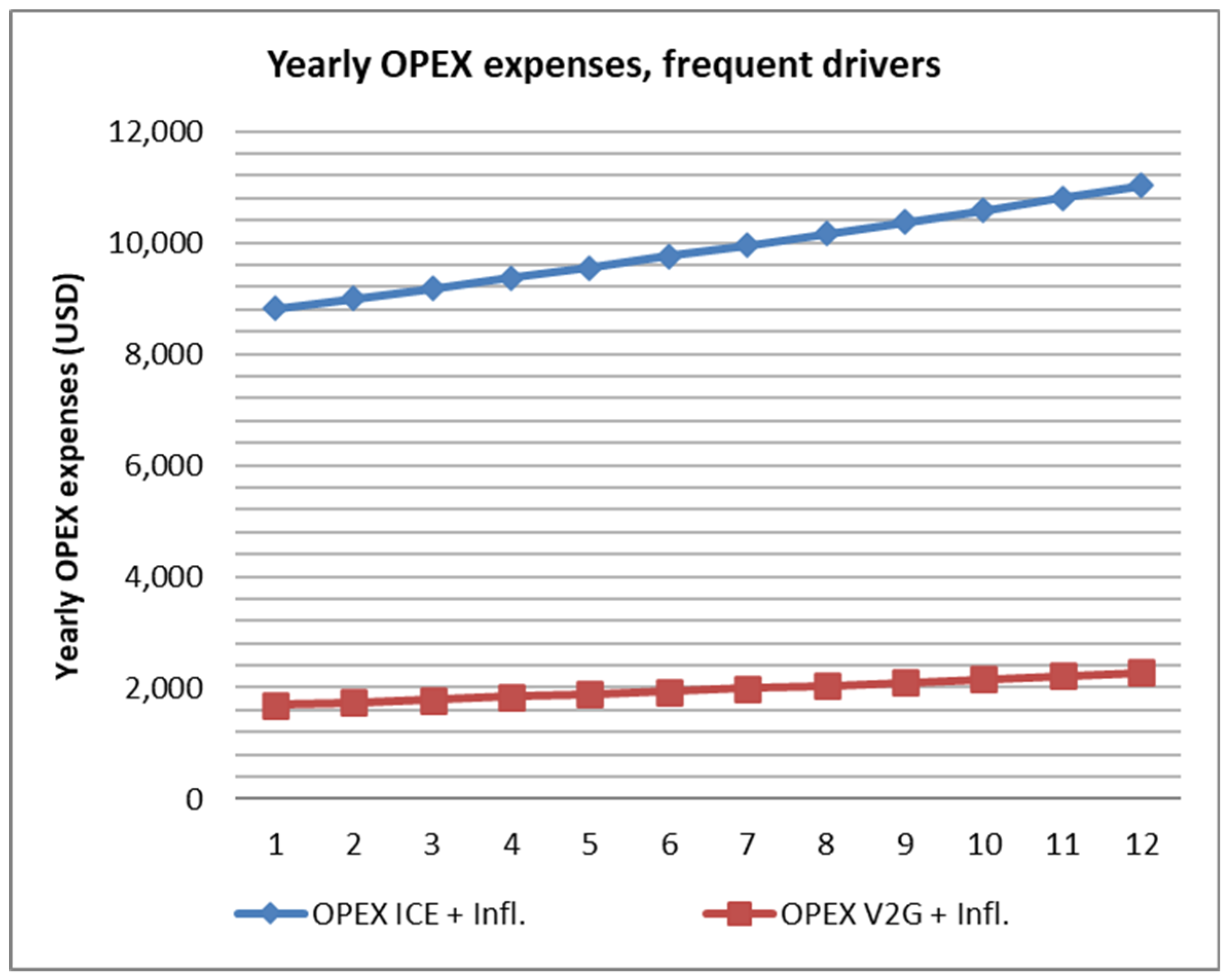

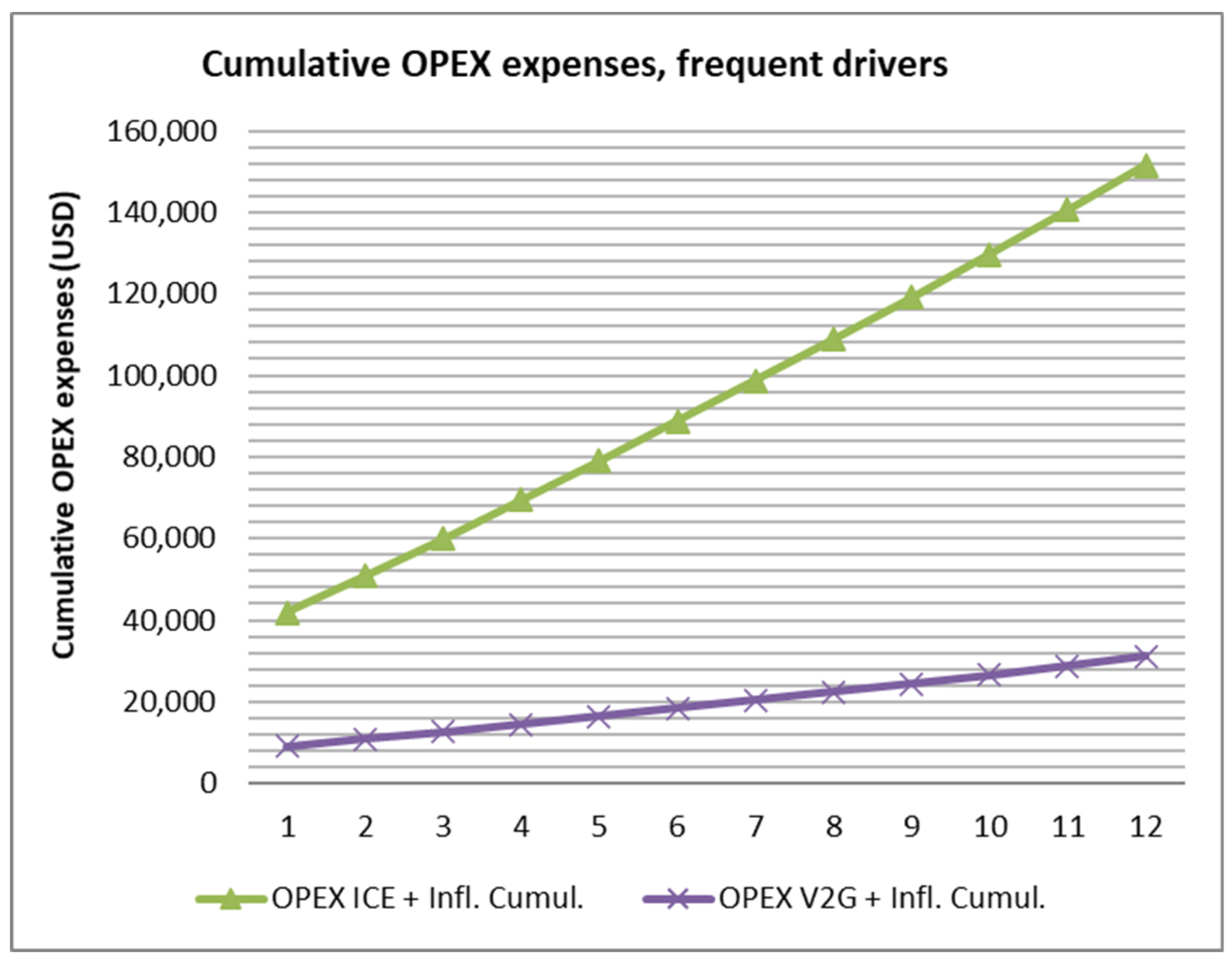

4.3. Case Study B: Frequent Drivers

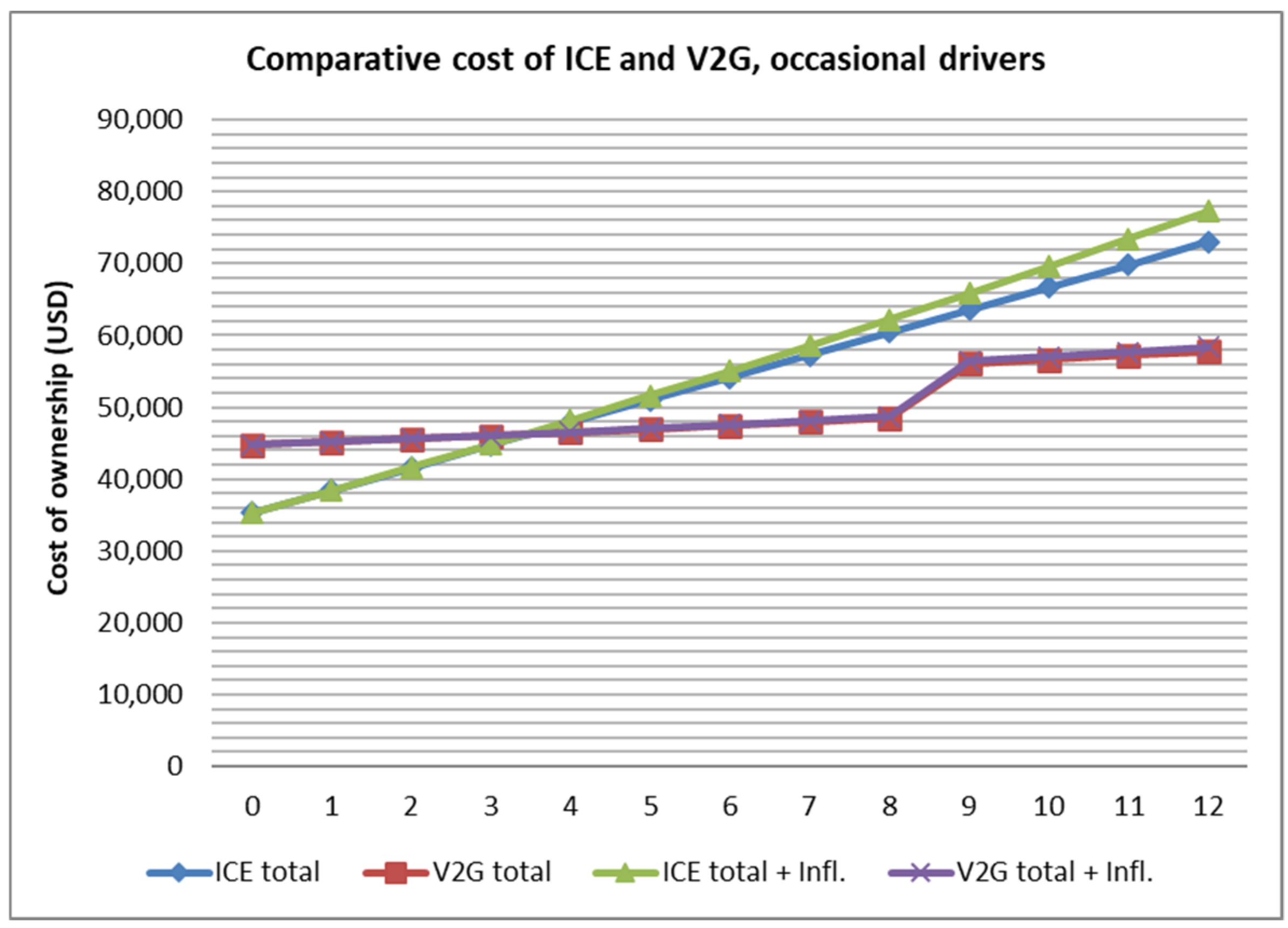

4.4. Case Study C: Occasional Drivers

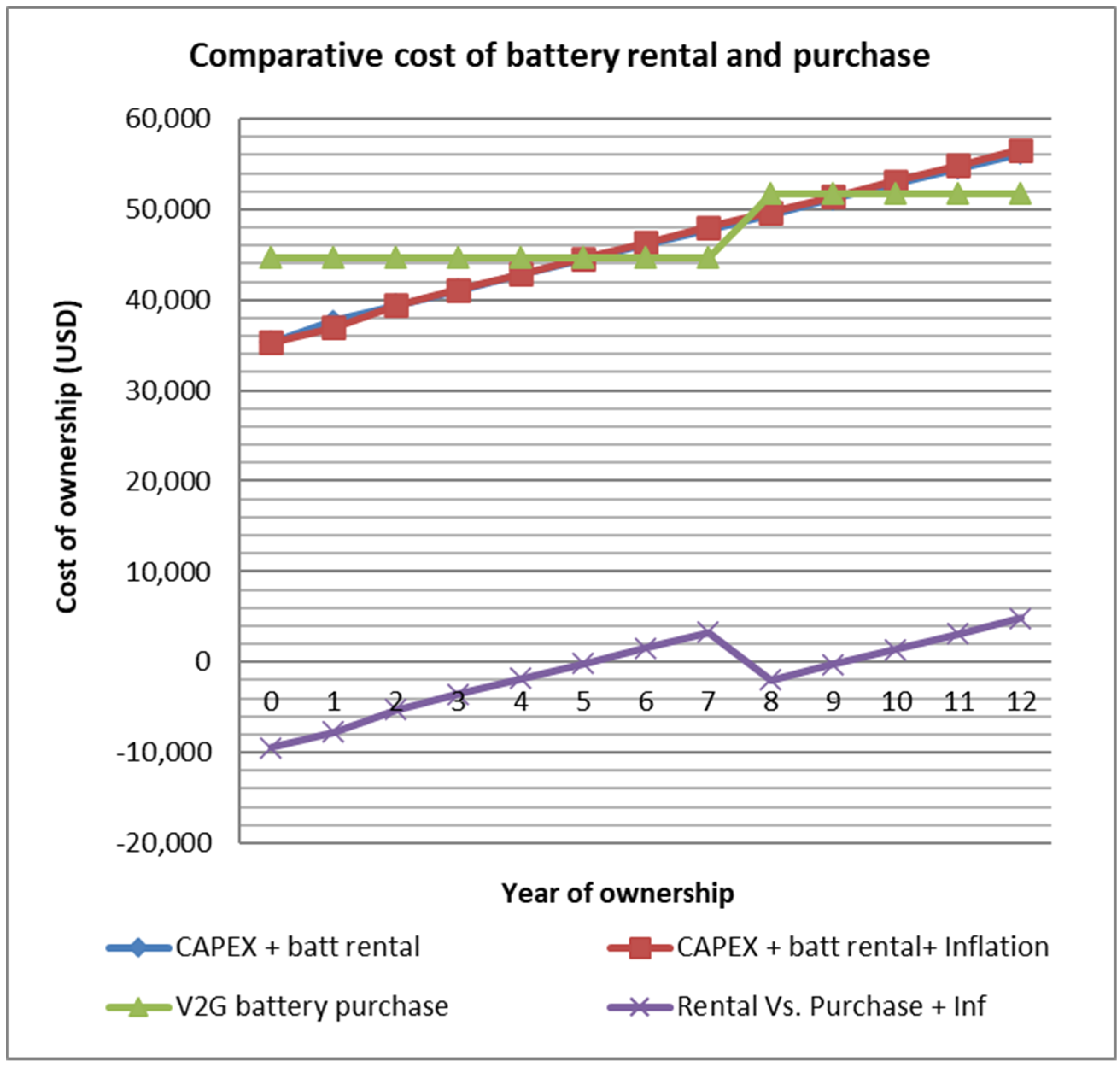

4.5. Comparison between Battery Rental and Battery Ownership

5. Impact on Grid Utilities

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Term | Meaning |

| Average distance rate | Used for maintenance and externalities measurement |

| Battery degradation | Used to calculate when the battery will have to be replaced |

| Battery leasing | Cost of leasing the battery |

| Battery replacement | Needed for continued energy storage |

| Capex | Cost of acquiring the vehicle |

| Carbon emissions | Quantity of carbon released by the vehicle |

| Cost of the Fuel | Evaluates difference between Internal Combustion Engine gas and electricity |

| Distance | Number of kilometres run by the vehicle |

| Energy consumption | Evaluates the consumed resources by the vehicle |

| Energy loses | Evaluates the loss of energy in the vehicle operation |

| Externalities | Impact in other areas related to the vehicle environment |

| Fuel consumption | Required to start and run the vehicle |

| Labour cost of battery change | Cost of a battery change |

| Labour cost of gas refilling | Cost of refilling gas |

| Maintenance | Costs used to keep the vehicle usable |

| Maximum real capacity | Actual capacity of the battery rather than the nominal one |

| Opex | Operational costs to keep the vehicle functional |

| Passive energy losses | Resulting from leaving the battery idle |

| Purchased energy | Electricity bought for the vehicle |

| Purchased power | Power bought during a certain amount of time |

| Revenues | Benefits from trading operations |

| Round-trip efficiency | Efficiency of energy usage in a full charge cycle |

| Social cost of carbon | Used to assess the impact on the environment by the vehicle |

| Sold energy | Electricity sold through the vehicle |

| Time | Amount of time for energy purchases |

| V2G conversion | Cost of turning an EV into a V2G |

Appendix A

| CAPEX ICE | Year | Externalities ICE | Ext. ICE w. Inflation | Maintenance | Maint. w. Inflation | Fuel | Fuel w. Inflation | OPEX ICE | OPEX ICE w. Inflation | CAPEX + OPEX ICE (Cumulative) | CAPEX + OPEX ICE w. Inflation (Cumulative) |

| 35,285 | |||||||||||

| 1 | 5202.59 | 5202.59 | 30,546.19 | 30,546.19 | 6121.09 | 6121.09 | 41,869.86 | 41,869.86 | 77,154.86 | 77,154.86 | |

| 2 | 5202.59 | 5294.16 | 30,546.19 | 31,083.80 | 6121.09 | 6353.69 | 41,869.86 | 42,731.64 | 119,024.73 | 119,886.51 | |

| 3 | 5202.59 | 5387.33 | 30,546.19 | 31,630.87 | 6121.09 | 6595.13 | 41,869.86 | 43,613.34 | 160,894.59 | 163,499.85 | |

| 4 | 5202.59 | 5482.15 | 30,546.19 | 32,187.58 | 6121.09 | 6845.74 | 41,869.86 | 44,515.47 | 202,764.46 | 208,015.32 | |

| 5 | 5202.59 | 5578.64 | 30,546.19 | 32,754.08 | 6121.09 | 7105.88 | 41,869.86 | 45,438.60 | 244,634.32 | 253,453.92 | |

| 6 | 5202.59 | 5676.82 | 30,546.19 | 33,330.55 | 6121.09 | 7375.91 | 41,869.86 | 46,383.28 | 286,504.19 | 299,837.19 | |

| 7 | 5202.59 | 5776.73 | 30,546.19 | 33,917.17 | 6121.09 | 7656.19 | 41,869.86 | 47,350.09 | 328,374.05 | 347,187.28 | |

| 8 | 5202.59 | 5878.40 | 30,546.19 | 34,514.11 | 6121.09 | 7947.13 | 41,869.86 | 48,339.64 | 370,243.92 | 395,526.92 | |

| 9 | 5202.59 | 5981.86 | 30,546.19 | 35,121.56 | 6121.09 | 8249.12 | 41,869.86 | 49,352.54 | 412,113.78 | 444,879.46 | |

| 10 | 5202.59 | 6087.14 | 30,546.19 | 35,739.70 | 6121.09 | 8562.58 | 41,869.86 | 50,389.42 | 453,983.65 | 495,268.88 | |

| 11 | 5202.59 | 6194.28 | 30,546.19 | 36,368.72 | 6121.09 | 8887.96 | 41,869.86 | 51,450.96 | 495,853.51 | 546,719.84 | |

| 12 | 5202.59 | 6303.30 | 30,546.19 | 37,008.81 | 6121.09 | 9225.70 | 41,869.86 | 52,537.81 | 537,723.38 | 599,257.65 | |

| Total | 62,431.08 | 68,843.39 | 366,554.24 | 404,203.13 | 73.453,06 | 90,926.12 | 502,438.38 | 563,972.65 | 537,723.38 | 599,257.65 | |

| CAPEX V2G | Year | Externalities V2G | Ext. V2G w. Inflation | Maintenance | Maint. w. Inflation | Electr. | Elec. w. Inflation | OPEX V2G | OPEX V2G w. Inflation | CAPEX + OPEX V2G + Battery (Cumulative) | CAPEX + OPEX V2G w. Inflation + Battery (Cumulative) |

| 44,721 | |||||||||||

| 1 | 927.88 | 927.88 | 6868.48 | 6868.48 | 1387.16 | 1387,16 | 9183.52 | 9183.52 | 53,904.52 | 53,904.52 | |

| 2 | 927.88 | 944.21 | 6868.48 | 6989.36 | 1403.26 | 1429,92 | 9199.62 | 9363.49 | 63,104.13 | 63,268.01 | |

| 3 | 927.88 | 960.83 | 6868.48 | 7112.38 | 1419.36 | 1473,29 | 9215.72 | 9546,50 | 72,319.85 | 72,814.51 | |

| 4 | 927.88 | 977.74 | 6868.48 | 7237.55 | 1435.46 | 1517,28 | 9231.81 | 9732.57 | 81,551.66 | 82,547.08 | |

| 5 | 927.88 | 994.95 | 6868.48 | 7364.93 | 1451.55 | 1561,87 | 9247.91 | 9921.75 | 90,799.58 | 92,468.83 | |

| 6 | 927.88 | 1012.46 | 6868.48 | 7494.56 | 1467.65 | 1607,08 | 9264.01 | 10,114.10 | 100,063.59 | 102,582.93 | |

| 7 | 927.88 | 1030.28 | 6868.48 | 7626.46 | 1483.75 | 1652,90 | 9280.11 | 10,309.64 | 109,343.70 | 112,892.57 | |

| 8 | 927.88 | 1048.41 | 6868.48 | 7760.69 | 1499.85 | 1699,33 | 9296.21 | 10,508.43 | 118,639.90 | 123,401.00 | |

| 9 | 927.88 | 1066.86 | 6868.48 | 7897.27 | 1515.95 | 1746,37 | 9312.31 | 10,710.51 | 134,957.81 | 141,117.11 | |

| 10 | 927.88 | 1085.64 | 6868.48 | 8036.27 | 1532.05 | 1794,03 | 9328.41 | 10,915.93 | 144,286.22 | 152,033.05 | |

| 11 | 927.88 | 1104.75 | 6868.48 | 8177.71 | 1548.15 | 1842,29 | 9344.50 | 11,124.75 | 153,630.72 | 163,157.79 | |

| 12 | 927.88 | 1124.19 | 6868.48 | 8321.63 | 1564.25 | 1891,17 | 9360.60 | 11,337.00 | 162,991.32 | 174,494.79 | |

| Total | 11,134.56 | 12,278.20 | 82,421.73 | 90,887.29 | 17,708.43 | 19,602.71 | 111,264.72 | 122,768.19 | 162,991.32 | 174,494.79 |

| CAPEX ICE | Year | Externalities ICE | Ext. ICE w. Inflation | Maintenance | Maint. w. Inflation | Fuel | Fuel w. Inflation | OPEX ICE | OPEX ICE w. Inflation | CAPEX + OPEX ICE | CAPEX + OPEX ICE w. Inflation |

| 35,285 | 1 | 969.19 | 969.19 | 6708.47 | 6708.47 | 1140.22 | 1140.22 | 8817.89 | 8817.89 | 44,102.89 | 44,102.89 |

| 2 | 969.19 | 986.25 | 6708.47 | 6826.54 | 1140.22 | 1183.55 | 8817.89 | 8996.34 | 52,920.78 | 53,099.23 | |

| 3 | 969.19 | 1003.61 | 6708.47 | 6946.69 | 1140.22 | 1228.53 | 8817.89 | 9178.82 | 61,738.66 | 62,278.05 | |

| 4 | 969.19 | 1021.27 | 6708.47 | 7068.95 | 1140.22 | 1275.21 | 8817.89 | 9365.43 | 70,556.55 | 71,643.49 | |

| 5 | 969.19 | 1039.24 | 6708.47 | 7193.37 | 1140.22 | 1323.67 | 8817.89 | 9556.28 | 79,374.44 | 81,199.77 | |

| 6 | 969.19 | 1057.53 | 6708.47 | 7319.97 | 1140.22 | 1373.97 | 8817.89 | 9751.47 | 88,192.33 | 90,951.24 | |

| 7 | 969.19 | 1076.15 | 6708.47 | 7448.80 | 1140.22 | 1426.18 | 8817.89 | 9951.13 | 97,010.22 | 100,902.37 | |

| 8 | 969.19 | 1095.09 | 6708.47 | 7579.90 | 1140.22 | 1480.37 | 8817.89 | 10,155.36 | 105,828.10 | 111,057.73 | |

| 9 | 969.19 | 1114.36 | 6708.47 | 7713.31 | 1140.22 | 1536.63 | 8817.89 | 10,364.29 | 114,645.99 | 121,422.02 | |

| 10 | 969.19 | 1133.97 | 6708.47 | 7849.06 | 1140.22 | 1595.02 | 8817.89 | 10,578.05 | 123,463.88 | 132,000.07 | |

| 11 | 969.19 | 1153.93 | 6708.47 | 7987.20 | 1140.22 | 1655.63 | 8817.89 | 10,796.77 | 132,281.77 | 142,796,84 | |

| 12 | 969.19 | 1174.24 | 6708.47 | 8127.78 | 1140.22 | 1718.55 | 8817.89 | 11,020.56 | 141,099.66 | 153,817.40 | |

| Total | 11,630.28 | 12,824.83 | 80,501.69 | 88,770.04 | 13,682.69 | 16,937.54 | 105,814.66 | 118,532.40 | 141,099.66 | 153,817.40 | |

| CAPEX V2G | Year | Externalities V2G | Ext. V2G w. Inflation | Maintenance | Maint. w. Inflation | Electr. | Elec. w. Inflation | OPEX V2G | OPEX V2G w. Inflation | CAPEX + OPEX V2G + Battery | CAPEX + OPEX V2G w. Inflation + Battery |

| 44,721 | 1 | 244.70 | 244.70 | 1559.96 | 1559.96 | −788.42 | −788.42 | 1016.24 | 1016.24 | 45,737.24 | 45,737.24 |

| 2 | 244.70 | 249.40 | 1559.96 | 1589.91 | −772.33 | −787.01 | 1032.33 | 1052.30 | 46,769.57 | 46,789.55 | |

| 3 | 244.70 | 254.19 | 1559.96 | 1620.44 | −756.25 | −784.99 | 1048.41 | 1089.64 | 47,817.98 | 47,879.18 | |

| 4 | 244.70 | 259.07 | 1559.96 | 1651.55 | −740.17 | −782.36 | 1064.49 | 1128.26 | 55,888.07 | 56,013.04 | |

| 5 | 244.70 | 264.04 | 1559.96 | 1683.26 | −724.08 | −779.11 | 1080.58 | 1168.19 | 56,968.65 | 57,181.23 | |

| 6 | 244.70 | 269.11 | 1559.96 | 1715.58 | −708.00 | −775.26 | 1096.66 | 1209.43 | 58,065.31 | 58,390.66 | |

| 7 | 244.70 | 274.28 | 1559.96 | 1748.52 | −691.92 | −770.80 | 1112.74 | 1252.00 | 66,183.65 | 66,648.25 | |

| 8 | 244.70 | 279.54 | 1559.96 | 1782.09 | −675.84 | −765.72 | 1128.82 | 1295.91 | 67,312.47 | 67,944.17 | |

| 9 | 244.70 | 284.91 | 1559.96 | 1816.31 | −659.75 | −760.04 | 1144.91 | 1341.18 | 68,457.38 | 69,285.35 | |

| 10 | 244.70 | 290.38 | 1559.96 | 1851.18 | −643.67 | −753.74 | 1160.99 | 1387.82 | 76,623.97 | 77,678.77 | |

| 11 | 244.70 | 295.96 | 1559.96 | 1886.72 | −627.59 | −746.83 | 1177.07 | 1435.85 | 77,801.04 | 79,114.61 | |

| 12 | 244.70 | 301.64 | 1559.96 | 1922.95 | −611.51 | −739.31 | 1193.15 | 1485.27 | 78,994.20 | 80,599.89 | |

| Total | 2936.40 | 3267.21 | 18,719.52 | 20,828.45 | −8399.52 | −9233.58 | 13,256.40 | 14,862.09 | 78,994.20 | 80,599.89 |

| CAPEX ICE | Year | Externalities ICE | Ext. ICE w. Inflation | Maintenance | Maint. w. Inflation | Fuel | Fuel w. Inflation | OPEX ICE | OPEX ICE w. Inflation | CAPEX + OPEX ICE | CAPEX + OPEX ICE w. Inflation |

| 35,285 | 1 | 242,30 | 242,30 | 2615.37 | 2615.37 | 285.06 | 285.06 | 3142.72 | 3142.72 | 38,427.72 | 38,427.72 |

| 2 | 242,30 | 246,56 | 2615.37 | 2661.40 | 285.06 | 295.89 | 3142.72 | 3203.85 | 41,570.44 | 41,631.57 | |

| 3 | 242,30 | 250,90 | 2615.37 | 2708.24 | 285.06 | 307.13 | 3142.72 | 3266.27 | 44,713.17 | 44,897.84 | |

| 4 | 242,30 | 255,32 | 2615.37 | 2755.90 | 285.06 | 318.80 | 3142.72 | 3330.03 | 47,855.89 | 48,227.87 | |

| 5 | 242,30 | 259,81 | 2615.37 | 2804.41 | 285.06 | 330.92 | 3142.72 | 3395.14 | 50,998.61 | 51,623.01 | |

| 6 | 242,30 | 264,38 | 2615.37 | 2853.77 | 285.06 | 343.49 | 3142.72 | 3461.64 | 54,141.33 | 55,084.65 | |

| 7 | 242,30 | 269,04 | 2615.37 | 2903.99 | 285.06 | 356.54 | 3142.72 | 3529.57 | 57,284.06 | 58,614.22 | |

| 8 | 242,30 | 273,77 | 2615.37 | 2955.10 | 285.06 | 370.09 | 3142.72 | 3598.97 | 60,426.78 | 62,213.19 | |

| 9 | 242,30 | 278,59 | 2615.37 | 3007.11 | 285.06 | 384.16 | 3142.72 | 3669.86 | 63,569.50 | 65,883.05 | |

| 10 | 242,30 | 283,49 | 2615.37 | 3060.04 | 285.06 | 398.76 | 3142.72 | 3742.29 | 66,712.22 | 69,625.34 | |

| 11 | 242,30 | 288,48 | 2615.37 | 3113.89 | 285.06 | 413.91 | 3142.72 | 3816.29 | 69,854.94 | 73,441.62 | |

| 12 | 242,30 | 293,56 | 2615.37 | 3168.70 | 285.06 | 429.64 | 3142.72 | 3891.90 | 72,997.67 | 77,333.52 | |

| Total | 2907.57 | 3206.21 | 31,384.42 | 34,607.92 | 3420.67 | 4234.38 | 37,712.67 | 42,048.52 | 72,997.67 | 77,333.52 | |

| CAPEX V2G | Year | Externalities V2G | Ext. V2G w. Inflation | Maintenance | Maint. w. Inflation | Electr. | Elec. w. Inflation | OPEX V2G | OPEX V2G w. Inflation | CAPEX + OPEX V2G + Battery | CAPEX + OPEX V2G w. Inflation + Battery |

| 44,721 | 1 | 60.84 | 60.84 | 1512.62 | 1512.62 | −1157.36 | −1157.36 | 416.11 | 416.11 | 45,137.11 | 45,137.11 |

| 2 | 60.84 | 61.91 | 1512.62 | 1539.25 | −1141.33 | −1163.02 | 432.13 | 438.14 | 45,569.24 | 45,575.24 | |

| 3 | 60.84 | 63.00 | 1512.62 | 1566.34 | −1125.31 | −1168.07 | 448.15 | 461.26 | 46,017.39 | 46,036.51 | |

| 4 | 60.84 | 64.11 | 1512.62 | 1593.90 | −1109.29 | −1172.52 | 464.18 | 485.50 | 46,481.57 | 46,522.01 | |

| 5 | 60.84 | 65.24 | 1512.62 | 1621.96 | −1093.26 | −1176.35 | 480.20 | 510.84 | 46,961.77 | 47,032.85 | |

| 6 | 60.84 | 66.39 | 1512.62 | 1650.50 | −1077.24 | −1179.58 | 496.22 | 537.31 | 47,457.99 | 47,570.16 | |

| 7 | 60.84 | 67.55 | 1512.62 | 1679.55 | −1061.22 | −1182.20 | 512.25 | 564.91 | 47,970.24 | 48,135.07 | |

| 8 | 60.84 | 68.74 | 1512.62 | 1709.11 | −1045.19 | −1184.20 | 528.27 | 593.65 | 48,498.51 | 48,728.72 | |

| 9 | 60.84 | 69.95 | 1512.62 | 1739.19 | −1029.17 | −1185.60 | 544.29 | 623.54 | 56,048.40 | 56,357.86 | |

| 10 | 60.84 | 71.18 | 1512.62 | 1769.80 | −1013.15 | −1186.39 | 560.32 | 654.59 | 56,608.72 | 57,012.46 | |

| 11 | 60.84 | 72.44 | 1512.62 | 1800.95 | −997.12 | −1186.58 | 576.34 | 686.81 | 57,185.06 | 57,699.27 | |

| 12 | 60.84 | 73.71 | 1512.62 | 1832.65 | −981.10 | −1186.15 | 592.36 | 720.21 | 57,777.42 | 58,419.48 | |

| Total | 730.08 | 805.07 | 18,151.48 | 20,015.83 | −12,830.74 | −14,128.02 | 6050.82 | 6692.88 | 57,777.42 | 58,419.48 |

| Year | CAPEX + Battery Rental | CAPEX + Battery Rental+ Inflation | V2G Battery Purchase | Cost Difference Rental vs. Purchase | Cost Difference Rental vs. Purchase + Inflation |

|---|---|---|---|---|---|

| 1 | 35,285 | 35,285 | 44,721 | −9436.00 | −9436.00 |

| 2 | 37,715.40 | 36,994.57 | 44,721 | −7005.60 | −7726.43 |

| 3 | 39,395.40 | 39,455.06 | 44,721 | −5325.60 | −5265.94 |

| 4 | 41,075.40 | 41,165.67 | 44,721 | −3645.60 | −3555.33 |

| 5 | 42,755.40 | 42,876.83 | 44,721 | −1965.60 | −1844.17 |

| 6 | 44,435.40 | 44,588.54 | 44,721 | −285.60 | −132.46 |

| 7 | 46,115.40 | 46,300.80 | 44,721 | 1394.40 | 1579.80 |

| 8 | 47,795.40 | 48,013.63 | 44,721 | 3074.40 | 3292.63 |

| 9 | 49,475.40 | 49,727.04 | 51,726.60 | −2251.20 | −1999.56 |

| 10 | 51,155.40 | 51,441.04 | 51,726.60 | −571.20 | −285.56 |

| 11 | 52,835.40 | 53,155.63 | 51,726.60 | 1108.80 | 1429.03 |

| 12 | 54,515.40 | 54,870.84 | 51,726.60 | 2788.80 | 3144.24 |

| Year | Bought Energy | Cost per KWh Bought | Cost per KWh + Inflation | Sold Energy | Cost per KWh Sold | Cost per KWh Sold + Inflation | Energy V2G | Energy V2G + Inflation |

|---|---|---|---|---|---|---|---|---|

| 1 | 40,000 | 0.09956 | 0.09956 | 19,695.970 | 0.131765 | 0.131765 | 1387.16 | 1387,16 |

| 2 | 39,500 | 0.09956 | 0.10145164 | 19,196.000 | 0.131765 | 0.134268535 | 1403.26 | 1429,92 |

| 3 | 39,000 | 0.09956 | 0.10334328 | 18,696.029 | 0.131765 | 0.13677207 | 1419.36 | 1473,29 |

| 4 | 38,500 | 0.09956 | 0.10523492 | 18,196.059 | 0.131765 | 0139275605 | 1435.46 | 1517,28 |

| 5 | 38,000 | 0.09956 | 0.10712656 | 17,696.088 | 0.131765 | 0.14177914 | 1451.55 | 1561,87 |

| 6 | 37,500 | 0.09956 | 0.1090182 | 17,196.118 | 0.131765 | 0.144282675 | 1467.65 | 1607,08 |

| 7 | 37,000 | 0.09956 | 0.11090984 | 16,696.147 | 0.131765 | 0.14678621 | 1483.75 | 1652,90 |

| 8 | 36,500 | 0.09956 | 0.11280148 | 16,196.177 | 0.131765 | 0.149289745 | 1499.85 | 1699,33 |

| 9 | 36,000 | 0.09956 | 0.11469312 | 15,696.206 | 0.131765 | 0.15179328 | 1515.95 | 1746,37 |

| 10 | 35,500 | 0.09956 | 0.11658476 | 15,196.236 | 0.131765 | 0.154296815 | 1532.05 | 1794,03 |

| 11 | 35,000 | 0.09956 | 0.1184764 | 14,696.265 | 0.131765 | 0.15680035 | 1548.15 | 1842,29 |

| 12 | 34,500 | 0.09956 | 0.12036804 | 14,196.295 | 0.131765 | 0.159303885 | 1564.25 | 1891,17 |

| 1 | 40,000 | 0.09956 | 0.09956 | 19,695.97 | 0.131765 | 0.131765 | 1387.16 | 1387.16 |

| 2 | 40,000 | 0.09956 | 0.10145164 | 19,695.97 | 0.131765 | 0.134268535 | 1387.16 | 1413.52 |

| 3 | 40,000 | 0.09956 | 0.10334328 | 19,695.97 | 0.131765 | 0.13677207 | 1387.16 | 1439.87 |

| 4 | 40,000 | 0.09956 | 0.10523492 | 19,695.97 | 0.131765 | 0.139275605 | 1387.16 | 1466.23 |

| 5 | 40,000 | 0.09956 | 0.10712656 | 19,695.97 | 0.131765 | 0.14177914 | 1387.16 | 1492.58 |

| 6 | 40,000 | 0.09956 | 0.1090182 | 19,695.97 | 0.131765 | 0.144282675 | 1387.16 | 1518.94 |

| 7 | 40,000 | 0.09956 | 0.11090984 | 19,695.97 | 0.131765 | 0.14678621 | 1387.16 | 1545.30 |

| 8 | 40,000 | 0.09956 | 0.11280148 | 19,695.97 | 0.131765 | 0.149289745 | 1387.16 | 1571.65 |

| 9 | 40,000 | 0.09956 | 0.11469312 | 19,695.97 | 0.131765 | 0.15179328 | 1387.16 | 1598.01 |

| 10 | 40,000 | 0.09956 | 0.11658476 | 19,695.97 | 0.131765 | 0.154296815 | 1387.16 | 1624.36 |

| 11 | 40,000 | 0.09956 | 0.1184764 | 19,695.97 | 0.131765 | 0.15680035 | 1387.16 | 1650.72 |

| 12 | 40,000 | 0.09956 | 0.12036804 | 19,695.97 | 0.131765 | 0.159303885 | 1387.16 | 1677.08 |

| Year | Bought Energy | Cost per KWh Bought | Cost per KWh + Inflation | Sold Energy | Cost per KWh Sold | Cost per KWh Sold + Inflation | Energy V2G | Energy V2G + Inflation |

|---|---|---|---|---|---|---|---|---|

| 1 | 40,000 | 0.09956 | 0.09956 | 36,207.000 | 0.131765 | 0.131765 | −788.42 | −788.42 |

| 2 | 39,500 | 0.09956 | 0.10145164 | 35,707.150 | 0.131765 | 0.134268535 | −772.33 | −787.01 |

| 3 | 39,000 | 0.09956 | 0.10334328 | 35,207.300 | 0.131765 | 0.13677207 | −756.25 | −784.99 |

| 4 | 38,500 | 0.09956 | 0.10523492 | 34,707.450 | 0.131765 | 0139275605 | −740.17 | −782.36 |

| 5 | 38,000 | 0.09956 | 0.10712656 | 34,207.600 | 0.131765 | 0.14177914 | −724.08 | −779.11 |

| 6 | 37,500 | 0.09956 | 0.1090182 | 33,707.750 | 0.131765 | 0.144282675 | −708.00 | −775.26 |

| 7 | 37,000 | 0.09956 | 0.11090984 | 33,207.900 | 0.131765 | 0.14678621 | −691.92 | −770.80 |

| 8 | 36,500 | 0.09956 | 0.11280148 | 32,708.050 | 0.131765 | 0.149289745 | −675.84 | −765.72 |

| 9 | 36,000 | 0.09956 | 0.11469312 | 32,208.200 | 0.131765 | 0.15179328 | −659.75 | −760.04 |

| 10 | 35,500 | 0.09956 | 0.11658476 | 31,708.350 | 0.131765 | 0.154296815 | −643.67 | −753.74 |

| 11 | 35,000 | 0.09956 | 0.1184764 | 31,208.500 | 0.131765 | 0.15680035 | −627.59 | −746.83 |

| 12 | 34,500 | 0.09956 | 0.12036804 | 30,708.650 | 0.131765 | 0.159303885 | −611.51 | −739.31 |

| 1 | 40,000 | 0.09956 | 0.09956 | 36,207.00 | 0.131765 | 0.131765 | −788.42 | −788.42 |

| 2 | 40,000 | 0.09956 | 0.10145164 | 36,207.00 | 0.131765 | 0.134268535 | −788.42 | −803.40 |

| 3 | 40,000 | 0.09956 | 0.10334328 | 36,207.00 | 0.131765 | 0.13677207 | −788.42 | −818.38 |

| 4 | 40,000 | 0.09956 | 0.10523492 | 36,207.00 | 0.131765 | 0.139275605 | −788.42 | −833.36 |

| 5 | 40,000 | 0.09956 | 0.10712656 | 36,207.00 | 0.131765 | 0.14177914 | −788.42 | −848.33 |

| 6 | 40,000 | 0.09956 | 0.1090182 | 36,207.00 | 0.131765 | 0.144282675 | −788.42 | −863.31 |

| 7 | 40,000 | 0.09956 | 0.11090984 | 36,207.00 | 0.131765 | 0.14678621 | −788.42 | −878.29 |

| 8 | 40,000 | 0.09956 | 0.11280148 | 36,207.00 | 0.131765 | 0.149289745 | −788.42 | −893.27 |

| 9 | 40,000 | 0.09956 | 0.11469312 | 36,207.00 | 0.131765 | 0.15179328 | −788.42 | −908.25 |

| 10 | 40,000 | 0.09956 | 0.11658476 | 36,207.00 | 0.131765 | 0.154296815 | −788.42 | −923.23 |

| 11 | 40,000 | 0.09956 | 0.1184764 | 36,207.00 | 0.131765 | 0.15680035 | −788.42 | −938.21 |

| 12 | 40,000 | 0.09956 | 0.12036804 | 36,207.00 | 0.131765 | 0.159303885 | −788.42 | −953.19 |

| Year | Bought Energy | Cost per KWh Bought | Cost per KWh + Inflation | Sold Energy | Cost per KWh Sold | Cost per KWh Sold + Inflation | Energy V2G | Energy V2G + Inflation |

|---|---|---|---|---|---|---|---|---|

| 1 | 40,000 | 0.09956 | 0.09956 | 39,007.000 | 0.131765 | 0.131765 | −1157.36 | −1157.36 |

| 2 | 39,500 | 0.09956 | 0.10145164 | 38,507.600 | 0.131765 | 0.134268535 | −1141.33 | −1163.02 |

| 3 | 39,000 | 0.09956 | 0.10334328 | 38,008.200 | 0.131765 | 0.13677207 | −1125.31 | −1168.07 |

| 4 | 38,500 | 0.09956 | 0.10523492 | 37,508.800 | 0.131765 | 0139275605 | −1109.29 | −1172.52 |

| 5 | 38,000 | 0.09956 | 0.10712656 | 37,009.400 | 0.131765 | 0.14177914 | −1093.26 | −1176.35 |

| 6 | 37,500 | 0.09956 | 0.1090182 | 36,510.000 | 0.131765 | 0.144282675 | −1077.24 | −1179.58 |

| 7 | 37,000 | 0.09956 | 0.11090984 | 36,010.600 | 0.131765 | 0.14678621 | −1061.22 | −1182.20 |

| 8 | 36,500 | 0.09956 | 0.11280148 | 35,511.200 | 0.131765 | 0.149289745 | −1045.19 | −1184.20 |

| 9 | 36,000 | 0.09956 | 0.11469312 | 35,011.800 | 0.131765 | 0.15179328 | −1029.17 | −1185.60 |

| 10 | 35,500 | 0.09956 | 0.11658476 | 34,512.400 | 0.131765 | 0.154296815 | −1013.15 | −1186.39 |

| 11 | 35,000 | 0.09956 | 0.1184764 | 34,013.000 | 0.131765 | 0.15680035 | −997.12 | −1186.58 |

| 12 | 34,500 | 0.09956 | 0.12036804 | 33,513.600 | 0.131765 | 0.159303885 | −981.10 | −1186.15 |

| 1 | 40,000 | 0.09956 | 0.09956 | 39,007.00 | 0.131765 | 0.131765 | −1157.36 | −1157.36 |

| 2 | 40,000 | 0.09956 | 0.10145164 | 39,007.00 | 0.131765 | 0.134268535 | −1157.36 | −1179.35 |

| 3 | 40,000 | 0.09956 | 0.10334328 | 39,007.00 | 0.131765 | 0.13677207 | −1157.36 | −1201.34 |

| 4 | 40,000 | 0.09956 | 0.10523492 | 39,007.00 | 0.131765 | 0.139275605 | −1157.36 | −1223.33 |

| 5 | 40,000 | 0.09956 | 0.10712656 | 39,007.00 | 0.131765 | 0.14177914 | −1157.36 | −1245.32 |

| 6 | 40,000 | 0.09956 | 0.1090182 | 39,007.00 | 0.131765 | 0.144282675 | −1157.36 | −1267.31 |

| 7 | 40,000 | 0.09956 | 0.11090984 | 39,007.00 | 0.131765 | 0.14678621 | −1157.36 | −1289.30 |

| 8 | 40,000 | 0.09956 | 0.11280148 | 39,007.00 | 0.131765 | 0.149289745 | −1157.36 | −1311.29 |

| 9 | 40,000 | 0.09956 | 0.11469312 | 39,007.00 | 0.131765 | 0.15179328 | −1157.36 | −1333.28 |

| 10 | 40,000 | 0.09956 | 0.11658476 | 39,007.00 | 0.131765 | 0.154296815 | −1157.36 | −1355.27 |

| 11 | 40,000 | 0.09956 | 0.1184764 | 39,007.00 | 0.131765 | 0.15680035 | −1157.36 | −1377.26 |

| 12 | 40,000 | 0.09956 | 0.12036804 | 39,007.00 | 0.131765 | 0.159303885 | −1157.36 | −1399.25 |

References

- Gungor, V.C.; Sahin, D.; Kocak, T.; Ergut, S.; Buccella, C.; Cecati, C.; Hancke, G.P. Smart Grid Technologies: Communication Technologies and Standards. IEEE Trans. Ind. Inform. 2011, 7, 529–539. [Google Scholar] [CrossRef]

- Chen, X.; Dinh, H.; Wang, B. Cascading Failures in Smart Grid—Benefits of Distributed Generation. In Proceedings of the First IEEE International Conference on Smart Grid Communications, Gaithersburg, MD, USA, 4–6 October 2010. [Google Scholar]

- Internal Revenue Service. Plug-In Electric Drive Vehicle Credit (IRC 30D). Available online: https://www.irs.gov/businesses/plug-in-electric-vehicle-credit-irc−30-and-irc−30d (accessed on 15 September 2020).

- Sakurama, K.; Miura, M. Real-time pricing via distributed negotiations between prosumers in smart grids. In Proceedings of the IEEE Innovative Smart Grid Technologies—Asia (ISGT ASIA), Bangkok, Thailand, 3–6 November 2015. [Google Scholar]

- Palensky, P.; Dietrich, D. Demand Side Management: Demand Response, Intelligent Energy Systems, and Smart Loads. IEEE Trans. Ind. Inform. 2011, 7, 381–388. [Google Scholar] [CrossRef]

- United States Department of Energy. Emissions from Hybrid and Plug-In Electric Vehicles. Available online: http://www.afdc.energy.gov/vehicles/electric_emissions.php (accessed on 15 September 2020).

- Gungor, V.C.; Sahin, D.; Kocak, T.; Ergut, S.; Buccella, C.; Cecati, C.; Hancke, G.P. A Survey on Smart Grid Potential Applications and Communication Requirements. IEEE Trans. Ind. Inform. 2013, 9, 28–42. [Google Scholar] [CrossRef]

- Cai, H.; Hu, G. Distributed Control Scheme for Package-Level State-of-Charge Balancing of Grid-Connected Battery Energy Storage System. IEEE Trans. Ind. Inform. 2016, 12, 1919–1929. [Google Scholar] [CrossRef]

- Noel, L.; McCormack, R. A cost benefit analysis of a V2G-capable electric school bus compared to a traditional diesel school bus. Appl. Energy 2014, 126, 246–255. [Google Scholar] [CrossRef]

- Shirazi, Y.; Carr, E.D.; Knapp, L. A cost–benefit analysis of alternatively fueled buses with special considerations for V2G technology. Energy Policy 2015, 87, 591–603. [Google Scholar] [CrossRef]

- Park, D.; Seungwook, Y.; Euiseok, H. Cost benefit analysis of public service electric vehicles with vehicle-to-grid (V2G) capability. In Proceedings of the IEEE Transportation Electrification Conference and Expo, Asia-Pacific (ITEC Asia-Pacific), Busan, Korea, 1–4 June 2016. [Google Scholar]

- Nworgu, O.A.; Chukwu, U.C.; Okezie, C.G.; Chukwu, N.B. Economic prospects and market operations of V2G in electric distribution network. In Proceedings of the IEEE/PES Transmission and Distribution Conference and Exposition (T&D), Dallas, TX, USA, 3–5 May 2016. [Google Scholar]

- Hill, D.M.; Agarwal, A.S.; Ayello, F. Fleet operator risks for using fleets for V2G regulation. Energy Policy 2012, 41, 221–231. [Google Scholar] [CrossRef]

- Musio, M.; Lombardi, P.; Damiano, A. Vehicles to grid (V2G) concept applied to a Virtual Power Plant structure. In Proceedings of the XIX International Conference on Electrical Machines—ICEM, Rome, Italy, 6–8 September 2010. [Google Scholar]

- Jain, P.; Meena, D.; Jain, T. Revenue valuation of aggregated electric vehicles participating in V2G power service. In Proceedings of the IEEE Innovative Smart Grid Technologies—Asia (ISGT ASIA), Bangkok, Thailand, 3–6 November 2015. [Google Scholar]

- Lund, H.; Kempton, W. Integration of renewable energy into the transport and electricity sectors through V2G. Energy Policy 2008, 36, 3578–3587. [Google Scholar] [CrossRef]

- Qiang, H.; Gu, Y.; Zheng, J.; Zhou, X. Modeling and Simulating of Private EVs Charging Load. Open Electr. Electron. Eng. J. 2015, 9, 231–237. [Google Scholar] [CrossRef]

- Kumar, S.; Yaragatti, U.R.; Manasani, S. Modeling and Architectural Frame Work of Off-Board V2G Integrator for Smart Grid. Int. J. Renew. Energy Res. 2014, 4, 826–831. [Google Scholar]

- Du, C.; He, J. V2G charge-discharge strategy with EV mass application. In Proceedings of the 21st International Conference on Electricity Distribution, Franfurt, Germany, 6–9 June 2011. [Google Scholar]

- Wang, Z.; Tang, Y.; Chen, X.; Men, X.; Cao, J.; Wang, H. Optimized Daily Dispatching Strategy of Building—Integrated Energy Systems Considering Vehicle to Grid Technology and Room Temperature Control. Energies 2018, 11, 1287. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, P.; Wang, Y. The Location Privacy Protection of Electric Vehicles with Differential Privacy in V2G Networks. Energies 2018, 11, 2625. [Google Scholar] [CrossRef]

- Harighi, T.; Bayindir, R.; Padmanaban, S.; Mihet-Popa, L.; Hossain, E. An Overview of Energy Scenarios, Storage Systems and the Infrastructure for Vehicle-to-Grid Technology. Energies 2018, 11, 2174. [Google Scholar] [CrossRef]

- Child, M.; Nordling, A.; Breyer, C. The Impacts of High V2G Participation in a 100% Renewable Åland Energy System. Energies 2018, 11, 2206. [Google Scholar] [CrossRef]

- Weldon, P.; Morrissey, P.; O’Mahony, M. Long-term cost of ownership comparative analysis between electric vehicles and internal combustion engine vehicles. Sustain. Cities Soc. 2018, 39, 578–591. [Google Scholar] [CrossRef]

- Zhang, Y.; Lu, M.; Shen, S. On the Values of Vehicle-to-Grid Electricity Selling in Electric Vehicle Sharing. 2018. Available online: https://ssrn.com/abstract=3172116 (accessed on 18 September 2020).

- Maeng, K.; Ko, S.; Shin, J.; Cho, Y. How Much Electricity Sharing Will Electric Vehicle Owners Allow from Their Battery? Incorporating Vehicle-to-Grid Technology and Electricity Generation Mix. Energies 2020, 13, 4248. [Google Scholar] [CrossRef]

- Ercan, T.; Noori, M.; Zhao, Y.; Tatari, O. On the Front Lines of a Sustainable Transportation Fleet: Applications of Vehicle-to-Grid Technology for Transit and School Buses. Energies 2016, 9, 230. [Google Scholar] [CrossRef]

- Noel, L.; Brodie, J.F.; Kempton, W.; Archer, C.L.; Budischak, C. Cost minimization of generation, storage, and new loads, comparing costs with and without externalities. Appl. Energy 2017, 189, 110–121. [Google Scholar] [CrossRef]

- Erdinc, O.; Mendes, T.D.P.; Catalão, J.P.S. Impact of electric vehicle V2G operation and demand response strategies for smart households. In Proceedings of the IEEE PES T&D Conference and Exposition, Chicago, IL, USA, 14–17 April 2014; pp. 1–5. [Google Scholar] [CrossRef]

- Zeng, M.; Leng, S.; Maharjan, S.; Gjessing, S.; He, J. An Incentivized Auction-Based Group-Selling Approach for Demand Response Management in V2G Systems. IEEE Trans. Ind. Inform. 2015, 11, 1554–1563. [Google Scholar] [CrossRef]

- Kumar, K.N.; Sivaneasan, B.; Cheah, P.H.; So, P.L.; Wang, D.Z.W. V2G Capacity Estimation Using Dynamic EV Scheduling. IEEE Trans. Smart Grid 2014, 5, 1051–1060. [Google Scholar] [CrossRef]

- You, S.; Hu, J.; Pedersen, A.B.; Andersen, P.B.; Rasmussen, C.N.; Cha, S. Numerical comparison of optimal charging schemes for Electric Vehicles. In Proceedings of the IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012; pp. 1–6. [Google Scholar] [CrossRef]

- Kumar, S.; Kumar, R.Y.U. Performance analysis of LTE protocol for EV to EV communication in vehicle-to-grid (V2G). In Proceedings of the IEEE 28th Canadian Conference on Electrical and Computer Engineering (CCECE), Halifax, NS, Canada, 3–6 May 2015; pp. 1567–1571. [Google Scholar] [CrossRef]

- Parsons, G.R.; Hidrue, M.K.; Kempton, W.; Gardner, M.P. Willingness to Pay for Vehicle-to-Grid (V2G) Electric Vehicles and Their Contract Terms. Energy Econ. 2014, 42. [Google Scholar] [CrossRef]

- Red Eléctrica de España Web Site. Active Energy Invoicing Price. Available online: https://www.esios.ree.es/en/pvpc (accessed on 15 September 2020).

- Paevere, P.; Higgins, A.; Ren, Z.; Horn, M.; Grozev, G.; McNamara, C. Spatio-temporal modelling of electric vehicle charging demand and impacts on peak household electrical load. Sustain. Sci. 2014, 9, 10–1007. [Google Scholar] [CrossRef]

- Ashtari, A.; Bibeau, E.; Shahidinejad, S.; Molinski, T. PEV Charging Profile Prediction and Analysis Based on Vehicle Usage Data. IEEE Trans. Smart Grid 2012, 3, 341–350. [Google Scholar] [CrossRef]

- Red Eléctrica de España Web Site. Default Tariff of Active Energy Invoicing Price. Available online: https://www.esios.ree.es/en/analysis/1013 (accessed on 15 September 2020).

- Wang, D.; Saxena, S.; Coignard, J.; Iosifidou, E.A.; Guan, X. Quantifying electric vehicle battery degradation from driving vs. V2G services. In Proceedings of the IEEE Power and Energy Society General Meeting (PESGM), Boston, MA, USA, 17–21 July 2016. [Google Scholar]

- Ribberink, H.; Darcovich, K.; Pincet, F. Battery Life Impact of Vehicle-to-Grid Application of Electric Vehicles. In Proceedings of the 28th International Electric Vehicle Symposium and Exhibition, Goyang, Korea, 3–6 May 2015; p. 11. [Google Scholar]

- Tesla Battery Range Data. Available online: https://docs.google.com/spreadsheets/d/t024bMoRiDPIDialGnuKPsg/edit#gid=154312675 (accessed on 15 September 2020).

- Aditya, J.P.; Ferdowsi, M. Comparison of NiMH and Li-ion batteries in automotive applications. In Proceedings of the IEEE Vehicle Power and Propulsion Conference, Harbin, China, 3–5 September 2008; pp. 1–6. [Google Scholar] [CrossRef]

- Tesla, Inc. Vehicle Warranty, Model 3. Tesla Official Web Site. Available online: https://www.tesla.com/support/vehicle-warranty (accessed on 15 September 2020).

- Nissan Motor Company. Warranty Information Booklet from Nissan Leaf. 2018. Available online: https://owners.nissanusa.com/content/techpub/ManualsAndGuides/LEAF/2018/2018-LEAF-warranty-booklet.pdf (accessed on 15 September 2020).

- Palmer, K.; Tate, J.; Wadud, Z.; Nellthorp, J. Total cost of ownership and market share for hybrid and electric vehicles in the UK, US and Japan. Appl. Energy 2018, 209, 108–119. [Google Scholar] [CrossRef]

- eFile. Tax Credits for Buying Alternative, Electric Motor Vehicles. Available online: https://www.efile.com/tax-credit/hybrid-car-tax-credit/ (accessed on 4 November 2020).

- Hanley, S. Nissan LEAF Replacement Battery Cost = $5499. Available online: https://cleantechnica.com/2017/10/04/nissan-leaf-replacement-battery-will-cost−5499/ (accessed on 15 September 2020).

- Union of Concerned Scientists. Accelerating US Leadership in Electric Vehicles. Available online: https://www.ucsusa.org/sites/default/files/attach/2017/09/cv-factsheets-ev-incentives.pdf?_ga=2.108452610.1630188791.1517413160−1434713090.1436805699 (accessed on 15 September 2020).

- Berckmans, G.; Messagie, M.; Smekens, J.; Omar, N.; Vanhaverbeke, L.; Van Mierlo, J. Cost Projection of State of the Art Lithium-Ion Batteries for Electric Vehicles up to 2030. Energies 2017, 10, 1314. [Google Scholar] [CrossRef]

- Taxi and Limousine Commission. Taxi Cab Factbook. 2014. Available online: https://www1.nyc.gov/assets/tlc/downloads/pdf/2014_tlc_factbook.pdf (accessed on 15 September 2020).

- Suwannee Valley Electric Cooperative, Inc. Index of Rate Schedules. 2015. Available online: https://svec-coop.com/wp-content/uploads/SVEC−6_9_17-RATES.pdf (accessed on 15 September 2020).

- Wilson, J. Electric Car Battery Leasing: Should I Lease or Buy the Batteries? Available online: https://www.buyacar.co.uk/cars/1523/electric-car-battery-leasing-should-i-lease-or-buy-the-batteries (accessed on 15 September 2020).

- Kelley Blue Book. New-Car Transaction Prices up 2 Percent in March 2016, Along with Increases in Incentive Spend. Available online: https://mediaroom.kbb.com/average-new-car-prices-jump−2-percent-march−2018-suv-sales-strength-according-to-kelley-blue-book (accessed on 15 September 2020).

- US Energy Information Administration. Carbon Dioxide Emissions Coefficients. Available online: https://www.eia.gov/environment/emissions/co2_vol_mass.php (accessed on 15 September 2020).

- The International Council for Clean Transportation. Effects of Battery Manufacturing on Electric Vehicle Life-Cycle Greenhouse Gas Emissions. Available online: www.theicct.org (accessed on 15 September 2020).

- AAA Gas Prices. Available online: http://gasprices.aaa.com/news/ (accessed on 19 August 2020).

- Energy, U.D.O. Federal Tax Credits for All-Electric and Plug-in Hybrid Vehicles. Available online: https://www.fueleconomy.gov/feg/taxevb.shtml (accessed on 15 September 2020).

- US Department of Transportation. Annual Vehicle Distance Travelled in Miles and Related Data by Highway Category and Vehicle Type. 2016. Available online: https://www.fhwa.dot.gov/policyinformation/statistics/2016/pdf/vm1.pdf (accessed on 15 September 2020).

- AAA News Room. Your Driving Costs. How Much Are You Really Paying to Drive? Available online: https://newsroom.aaa.com/auto/your-driving-costs/ (accessed on 15 September 2020).

- Fixr. Home Electric Vehicle Charging Station Cost. Available online: https://www.fixr.com/costs/home-electric-vehicle-charging-station (accessed on 15 September 2020).

- US Department of Energy. Find a Car/Compare Side-by-Side. Available online: https://www.fueleconomy.gov/feg/Find.do?action=sbs&id=37066&id=37067&id=34918&id=34699 (accessed on 15 September 2020).

- Consumer Price Index All Urban Consumers (Current Series). 12-Month Percent Change Series. Available online: https://data.bls.gov/timeseries/CUUR0000SA0?output_view=pct_12mths (accessed on 15 September 2020).

- Marques, L.; Vasconcelos, V.; Pereirinha, P.G.; Trovão, J.P. Lithium Modular Battery Bank for Electric Vehicles. 2011. Available online: http://www.uc.pt/en/efs/research/EESEVS/f/XIICLEEE_1846_MarquesEtAl.pdf (accessed on 15 September 2020).

- Interagency Working Group on Social Cost of Greenhouse Gases, United States Government. Technical Support Document: Technical Update of the Social Cost of Carbon for Regulatory Impact Analysis Under Executive Order 12866. 2016. Available online: https://www.epa.gov/sites/production/files/2016−12/documents/sc_co2_tsd_august_2016.pdf (accessed on 15 September 2020).

- Ramsdale, J. How Much Will V2G Cost and When, Where and Who Will Make It Happen? Available online: http://www.yougen.co.uk/blog-entry/2688/How+much+will+V2G+cost+and+when’2C+where+and+who+will+make+it+happen’3F/ (accessed on 15 September 2020).

- Rue One. Investment Summary—American Gas & Technology. Available online: https://www.rueone.com/images/marketing/RueOne-AGT-Overview.pdf (accessed on 16 September 2020).

- Automotive News. Average U.S. Gasoline Usage Lowest in 3 Decades, Study Says. Available online: https://www.autonews.com/article/20150325/OEM06/150329911/average-u-s-gasoline-usage-lowest-in−3-decades-study-says (accessed on 16 September 2020).

- Annelena Lobb. Premium Prices for Teen-Age Drivers. 2002. Available online: http://money.cnn.com/2002/03/21/pf/insurance/q_teenagers/index.htm (accessed on 15 September 2020).

- Wright, P. Car Insurance for Occasional Drivers. Available online: http://surebuycarinsurance.com/occasional-driver-insurance/ (accessed on 15 September 2020).

- Chukwu, U.C.; Nworgu, O.A.; Dike, D.O. Impact of V2G penetration on distribution system components using diversity factor. In Proceedings of the IEEE Southeastcon, Lexington, KY, USA, 13–16 March 2014. [Google Scholar]

- Chukwu, U.C.; Mahajan, S.M. Impact of V2G on Distribution Feeder: An Energy Loss Reduction Approach. Sci. Educ. 2014, 2, 19–27. [Google Scholar]

- Mahmud, K.; Morsalin, S.; Kafle, Y.R.; Town, G.E. Improved peak shaving in grid-connected domestic power systems combining photovoltaic generation, battery storage, and V2G-capable electric vehicle. In Proceedings of the IEEE International Conference on Power System Technology (POWERCON), Wollongong, NSW, Australia, 28 September–1 October 2016. [Google Scholar]

- Wang, Z.; Wang, S. Grid Power Peak Shaving and Valley Filling Using Vehicle-to-Grid Systems. IEEE Trans. Power Deliv. 2013, 28, 1822–1829. [Google Scholar] [CrossRef]

- Wu, Q.; Cheng, L.; Pineau, U.; Nielsen, A.H.; Østergaard, J. Impact and cost evaluation of electric vehicle integration on medium voltage distribution networks. In Proceedings of the IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Kowloon, Hong Kong, China, 8–11 December 2013; pp. 1–5. [Google Scholar]

- Green, R.C.; Wang, L.; Alam, M. The impact of plug-in hybrid electric vehicles on distribution networks: A review and outlook. In Proceedings of the IEEE PES General Meeting, Minneapolis, MN, USA, 25–29 July 2010; pp. 1–8. [Google Scholar]

- Rodríguez-Molina, J.; Kammen, D. Middleware Architectures for the Smart Grid: A Survey on the State-of-the-Art, Taxonomy and Main Open Issues. IEEE Commun. Surv. Tutor. 2018, 20, 2992–3033. [Google Scholar] [CrossRef]

- Chamola, V.; Hassija, V.; Gupta, V.; Guizani, M. A Comprehensive Review of the COVID−19 Pandemic and the Role of IoT, Drones, AI, Blockchain, and 5G in Managing its Impact. IEEE Access 2020, 8, 90225–90265. [Google Scholar] [CrossRef]

- Zheng, N.; Du, S.; Wang, J.; Zhang, H.; Cui, W.; Kang, Z.; Yang, T.; Lou, B.; Chi, Y.C.; Long, H.; et al. Predicting COVID−19 in China Using Hybrid AI Model. IEEE Trans. Cybern. 2020, 50, 2891–2904. [Google Scholar] [CrossRef] [PubMed]

| Reviewed Work | Strengths | Weaknesses |

|---|---|---|

| L. Noel and R. McCormack [9] | Complete cost–benefit analysis for public transport | Focused on school buses rather than private transportation. This manuscript has been challenged by [10] |

| Y. Shirazi et al. [10] | Provides more parameters to consider (low temperatures, electrical losses) | Focused on school buses rather than private transportation |

| D. Park et al. [11] | Mobility patterns and mobility model velocities are taken into account | The study only covers municipal services |

| O. A. Nworgu et al. [12] | It is mentioned how to use V2G to flatten demand curve | The model does not take into account energy losses from using V2G |

| D. M. Hill et al. [13] | Battery degradation, replacement and risk acceptance are taken into account | The proposal deals with fleets of vehicles rather than private transport |

| M. Musio et al. [14] | The optimization problem resulting from having vehicles acting as a VPP is analyzed | The resulting VPP has no trade activities with the main grid |

| P. Jain et al. [15] | Perspective on SOC of the batteries is provided | Calculations are done based on external sources rather than by providing a new model |

| H. Lund and W. Kempton [16] | Model that integrates energy used for transport, heat and electricity at a national level | Less variables are taken into account than in the model presented in the manuscript |

| H. Qiang et al. [17] | Initial SOC, charging power and initial charging time are considered | Battery degradation, inflation or the battery costs are not considered |

| Santoshkumar et al. [18] | Varied loads have been taken into account in the model | economic feasibility of V2G integration is not present |

| Chenggang Du and Jinghan He [19] | Power and energy restrains are used for the daily load curve | The model does not take into account V2G owners |

| Zesen Wang et al. [20] | V2G solutions are modelled as movable energy storage devices | The model regards V2G as a support for Building-Integrated Energy Systems |

| Yuancheng Li et al. [21] | A thorough experimental analysis has been done regarding location privacy | The model focuses on differential privacy in V2G rather than doing a cost–benefit analysis |

| Tohid Harighi et al. [22] | V2G is acknowledged as a technology that can be used to meet goals in GHG reduction | Neither mathematical model nor cost–benefit analysis for V2G are offered |

| Michael Child et al. [23] | Impact of V2G in a system completely based on renewable energies is assessed | No cost benefit analysis has been performed in the manuscript |

| Peter Weldon et al. [24] | Model with three different kinds of EV users | No data about V2G solutions or battery degradation. Externalities not considered |

| Yiling Zhang et al. [25] | Study on the integration of V2G into the electricity grid | No data about battery degradation. No different profiles |

| Kyuho Maeng et al. [26] | Study of the most preferable kind of vehicle for a significant sample of users | No data about battery degradation. Profitability for end users is not considered |

| Vehicle | Battery Cost ($) per Kilowatt/Hour | Reference |

|---|---|---|

| Nissan Leaf best case scenario | $5499/40 = 137.45 $/kWh | [47] |

| Nissan Leaf worst case scenario | ($5499 + $1000 + 225)/40=168.1 $/kWh | [47] |

| Chevrolet Bolt EV | 205 $/kWh | [48] |

| Tesla Model 3 | 190 $/kWh | [48] |

| Average | 175.14 $/kWh | N/A |

| Variable | Description | Value (ICE) | Value (V2G) |

|---|---|---|---|

| Yearly average consumption of gas to move the ICE vehicle | 2813 */524 **/131 *** gallons [50] | -- | |

| Average cost of bought energy | -- | 9.35 cents/kWh (off-peak hours) [51] | |

| Average cost of sold energy | -- | 15 cents/kWh (peak hours) [51] | |

| Batr | Battery replacement | -- | $7005.60 [47,48], Table 2 |

| Bleas | Yearly battery leasing | -- | ca. $140 × 12 [52] |

| Total cost of battery leasing | -- | Bleas × 12 | |

| Cost of acquiring an Internal Combustion Engine-powered vehicle | $35,285 [53] | -- | |

| Cost of acquiring an Vehicle-to-Grid-powered vehicle | -- | (2) | |

| Yearly carbon dioxide emissions for an Internal Combustion Engine vehicle | 19.6 (8.89 kg) lbs/gallon [54] | -- | |

| Yearly carbon dioxide emissions for a Vehicle-to-Grid-powered vehicle | -- | 149.25 [55] × 40 = 5,97 MT/12 years = 497 kg/year | |

| Cost of the fuel for an Internal Combustion Engine-powered vehicle | $2.176/gallon [56] | -- | |

| Cost of acquiring the Electric Vehicle | -- | $42,785 [53,57] | |

| Real price of bought energy | -- | (12) | |

| Real price of sold energy | -- | (13) | |

| Total costs of purchase and usage of the Internal Combustion Engine vehicle | (1) | ||

| Total costs of purchase and usage of the Vehicle-to-Grid automobile | (2) | ||

| D | Yearly distance | 61,033 */11,370 **/ 2842.5 *** miles [58] | 61,033 */11,370 **/ 2842.5 *** miles [58] |

| Dg | Degradation factor of the battery (State of Health) | -- | (16) |

| Average maintenance rate per mile by an Internal Combustion Engine-powered vehicle (medium sedan) | $0.5762−$0.116 [59] = $0.4602 | -- | |

| Average maintenance rate per mile by a Vehicle-to-Grid-powered vehicle | -- | $0.09204 (1/5 of [9,59]) | |

| Yearly amount of energy bought | -- | 2304 kWh × 1000 battery cycles (from [60]) | |

| Yearly Amount of energy consumed | -- | 20,301.67 */3781 **/ 945 ***kWh [61] | |

| Efficiency factor for charging a vehicle via power cable | -- | 0.95 [17] | |

| Yearly amount of energy sold | -- | (13) | |

| Externalities for an Internal Combustion Engine-powered vehicle | (8) | -- | |

| Externalities for a Vehicle-to-Grid (V2G)-powered vehicle | -- | (9) | |

| Gas costs for an Internal Combustion Engine-powered vehicle | (12) | -- | |

| Energy costs for a Vehicle-to-Grid vehicle | -- | (13) | |

| Factor for energy purchase in optimal buying hours | -- | 0.8 ***** | |

| Factor for energy purchase in optimal selling hours | -- | 0.2 ***** | |

| Factor for energy sell in buying optimal hours | -- | 0.8 ***** | |

| Factor for energy sell in selling optimal hours | -- | 0.2 ***** | |

| Per-mile cost of the health impact caused by the electricity consumed by the ICE vehicle | $0.07 (estimated from [9,10]) | -- | |

| Per-Mile cost of the health impact caused by the electricity consumed by the V2G vehicle | -- | $0.0149 [9] | |

| Heq | Cost of the installation of the required equipment to charge the Electric Vehicle | -- | $1200 [61] |

| Inf | Average inflation 2008−2019 (US) | 1.76% [62] | 1.76% [62] |

| Inff | Inflation rate on fuel | 3.8% [57] | 1.9% [9] |

| Ins | Yearly cost of insurance | $1251 [58] | $1251 [58] |

| Lab | Yearly fuel refill labor | $1207.80 */225 **/56.25 *** [9] | -- |

| Maintenance costs of an Internal Combustion Engine-powered vehicle | (18) | -- | |

| Maintenance costs of a Vehicle-to-Grid vehicle | -- | (19) | |

| Operational costs to have the ICE vehicle in fully working condition | (4) | -- | |

| Operational costs to have the V2G vehicle in fully working condition | -- | (5) | |

| pdis | Passive discharge of the battery | -- | 5.59%/30% **/ 120% **** [63] |

| Pw | Amount of power purchased | -- | Ebuy/t |

| SCC | Social Cost of Carbon | $37.20/MTCO2e ([64], calculated for 2016 dollars) | $37.20/MTCO2e ([60], for 2016 dollars) |

| t | Period of time | -- | Variable; 12 years for Section 5 |

| Vcons | Cost of conversion to V2G technology | -- | $736 [65] |

| Professional Drivers | Frequent Drivers | Occasional Drivers | ||

|---|---|---|---|---|

| Externalities | ICE | $68,843.39 | $12,824.83 | $3206.21 |

| V2G | $12,278.20 | $2486.41 | $805.70 | |

| Maintenance | ICE | $404,203.13 | $88,770.04 | $34,607.92 |

| V2G | $90,887.29 | $30,401.65 | $20,015.83 | |

| Fuel | ICE | $90,926.412 | $16,937.54 | $4234.38 |

| V2G | $19,602.71 | −$9233.58 | −$14,128.02 | |

| CAPEX | ICE | $35,285 | $35,285 | $35,285 |

| V2G | $44,721 | $44,721 | $44,721 | |

| Total | ICE | $599,257.65 | $153,817.40 | $77,333.52 |

| V2G | $174,494.79 | $75,381.09 | $58,419.48 | |

| Year | Difference Degree/No Degree | Difference Purch./Rental No Deg. |

|---|---|---|

| 1 | 0.00 | −9436 |

| 2 | 16.40 | −7726.43 |

| 3 | 33.42 | −5282.34 |

| 4 | 51.05 | −3588.75 |

| 5 | 69.29 | −1895.22 |

| 6 | 88.14 | −201.75 |

| 7 | 107.60 | 1491.66 |

| 8 | 127.68 | 3185.03 |

| 9 | 148.36 | −2127.24 |

| 10 | 169.66 | −433.92 |

| 11 | 191.57 | 1259.37 |

| 12 | 214.10 | 2952.67 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rodríguez-Molina, J.; Castillejo, P.; Beltran, V.; Martínez-Núñez, M. A Model for Cost–Benefit Analysis of Privately Owned Vehicle-to-Grid Solutions. Energies 2020, 13, 5814. https://doi.org/10.3390/en13215814

Rodríguez-Molina J, Castillejo P, Beltran V, Martínez-Núñez M. A Model for Cost–Benefit Analysis of Privately Owned Vehicle-to-Grid Solutions. Energies. 2020; 13(21):5814. https://doi.org/10.3390/en13215814

Chicago/Turabian StyleRodríguez-Molina, Jesús, Pedro Castillejo, Victoria Beltran, and Margarita Martínez-Núñez. 2020. "A Model for Cost–Benefit Analysis of Privately Owned Vehicle-to-Grid Solutions" Energies 13, no. 21: 5814. https://doi.org/10.3390/en13215814

APA StyleRodríguez-Molina, J., Castillejo, P., Beltran, V., & Martínez-Núñez, M. (2020). A Model for Cost–Benefit Analysis of Privately Owned Vehicle-to-Grid Solutions. Energies, 13(21), 5814. https://doi.org/10.3390/en13215814