An Exploratory Economic Analysis of Underground Pumped-Storage Hydro Power Plants in Abandoned Deep Coal Mines

Abstract

:1. Introduction

2. On the History of Underground Pumped-Storage Hydro Power Plants

2.1. Rediscovery of an Old Idea

2.2. Caverns as Parts of Classical PSHP Plants

2.3. Expansion of the Intra-Day PSHP Plant Nassfeld, Austria

2.4. Abandoned UPSHP Power Plant Project Ritten, South Tyrol, Italy

2.5. Technical Feasibility Study for an UPSHP in the Abandoned Coal Mine of Prosper Haniel, Germany

3. Methodology for a Techno-Economic Analysis of the UPSHP Concept

3.1. Technical Considerations and Assumptions Made

3.1.1. Upper Reservoir

3.1.2. Lower Reservoir

3.1.3. Drift Advance and Costs

3.1.4. Conclusion for the Expansion Costs

3.1.5. Head height

3.1.6. Energy Quantity

3.1.7. Plant Design

3.1.8. Assembling and Structure

4. Economic Analysis

4.1. Cost-Determining Characteristics

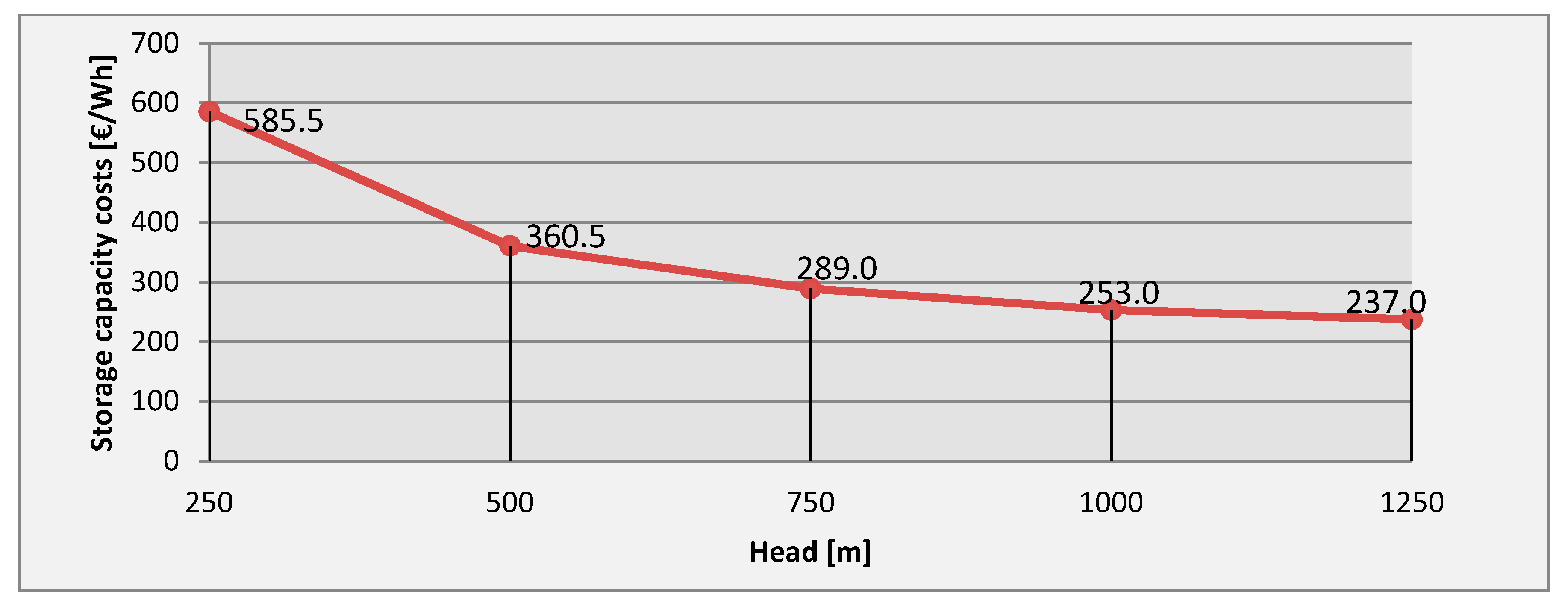

4.2. Head-Height-Dependent Costs

4.3. Other Costs

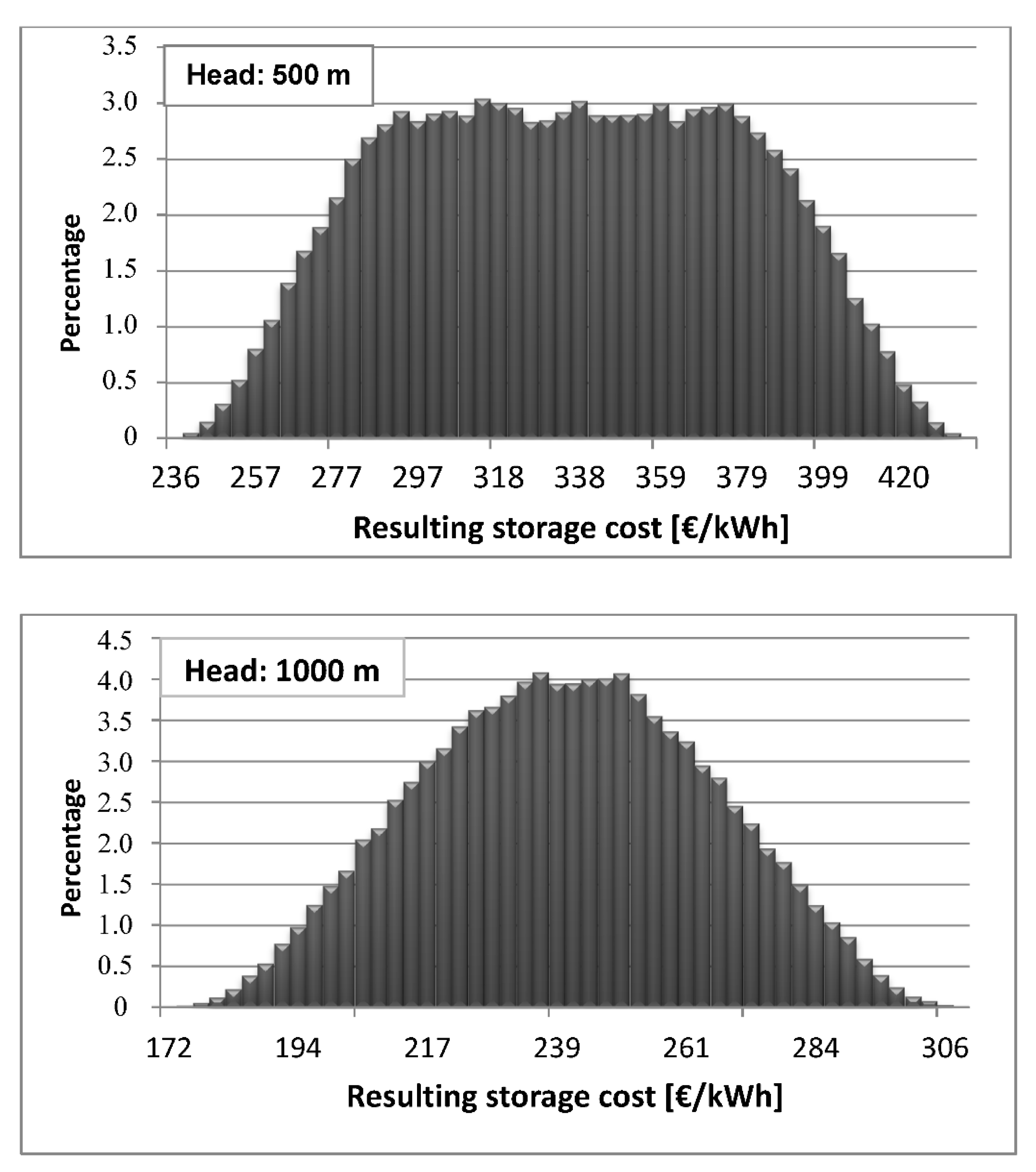

4.4. Cost Sensitivity Analysis (Monte Carlo Simulation)

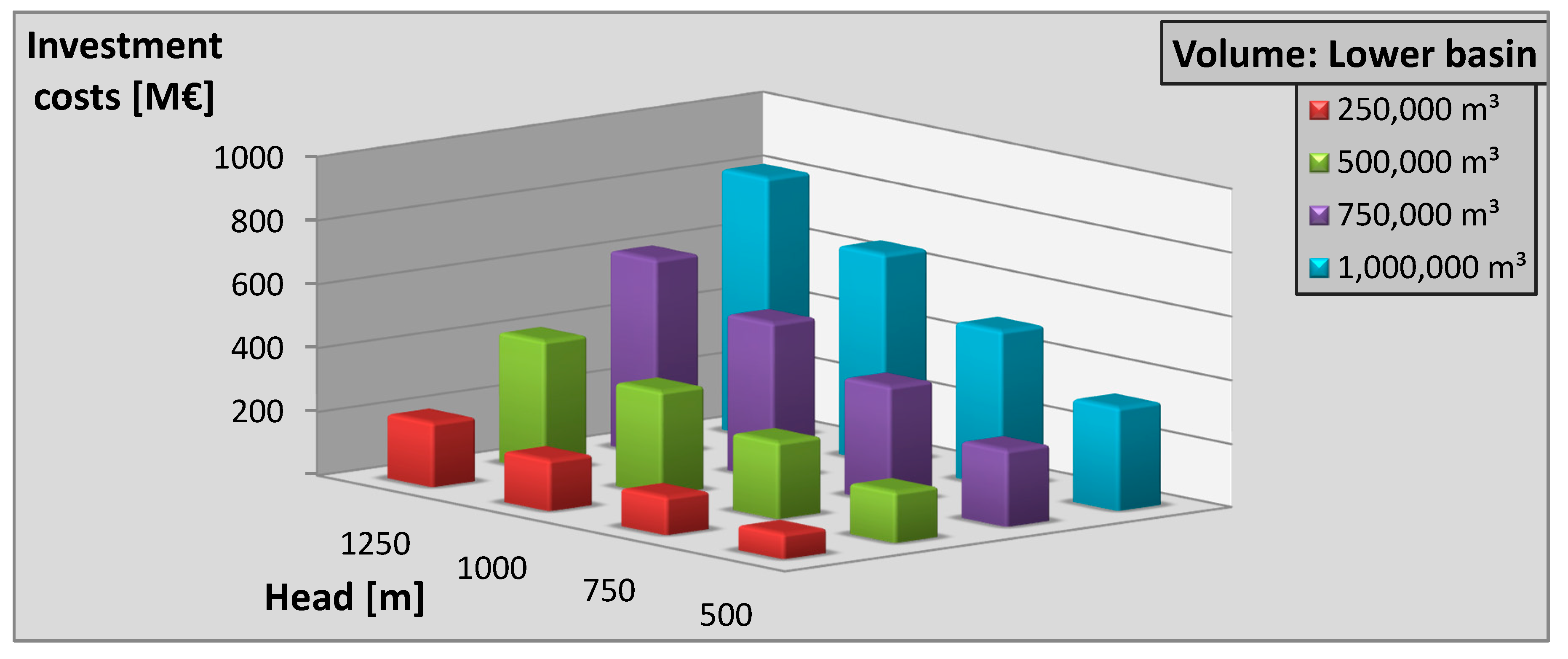

4.5. Investment Costs for UPSHP Plants with Different Head Heights and Lower Reservoir Volumes

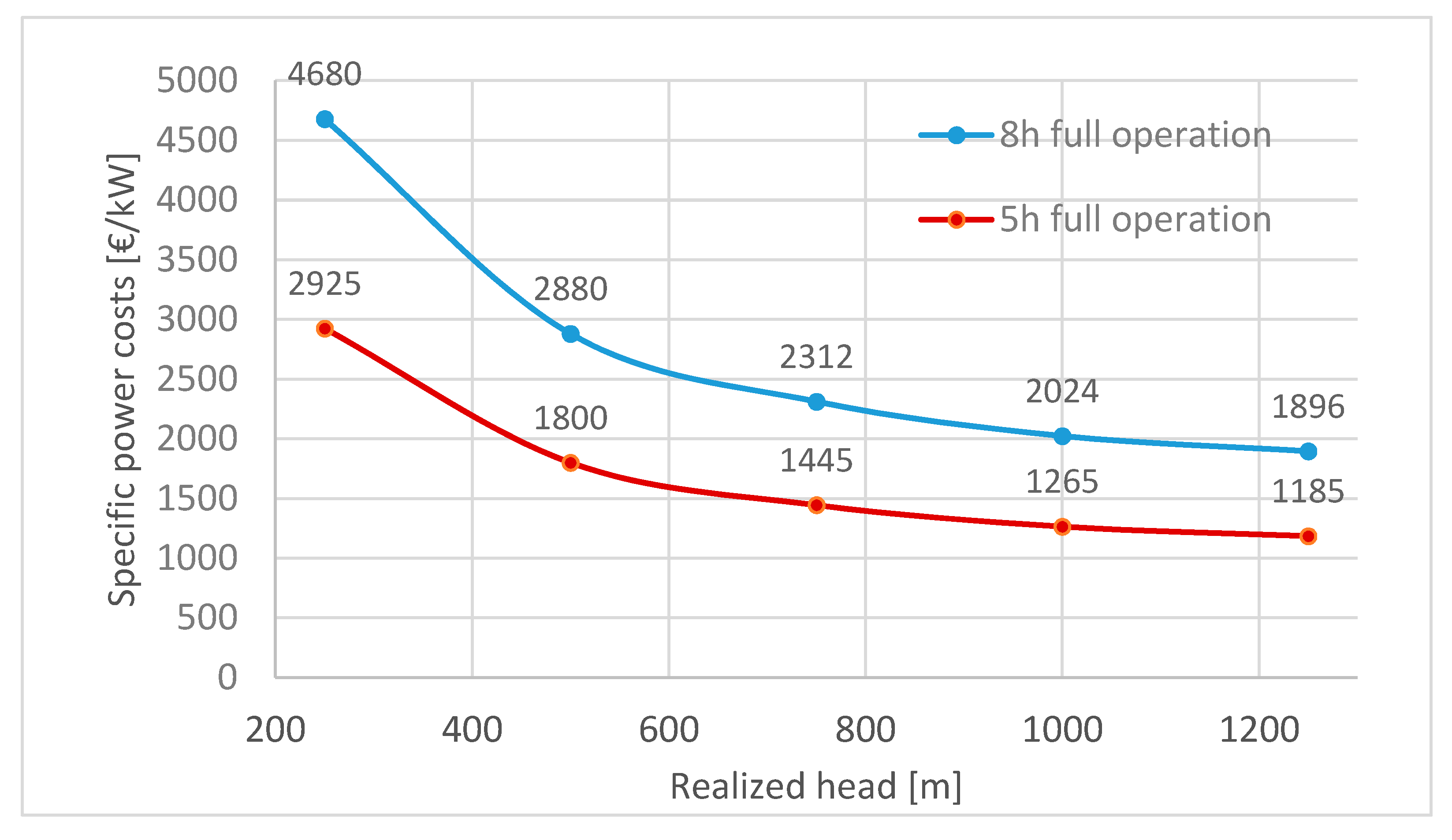

4.6. Characteristic Unit Capacity Costs

4.7. Revenue-Determining Characteristics

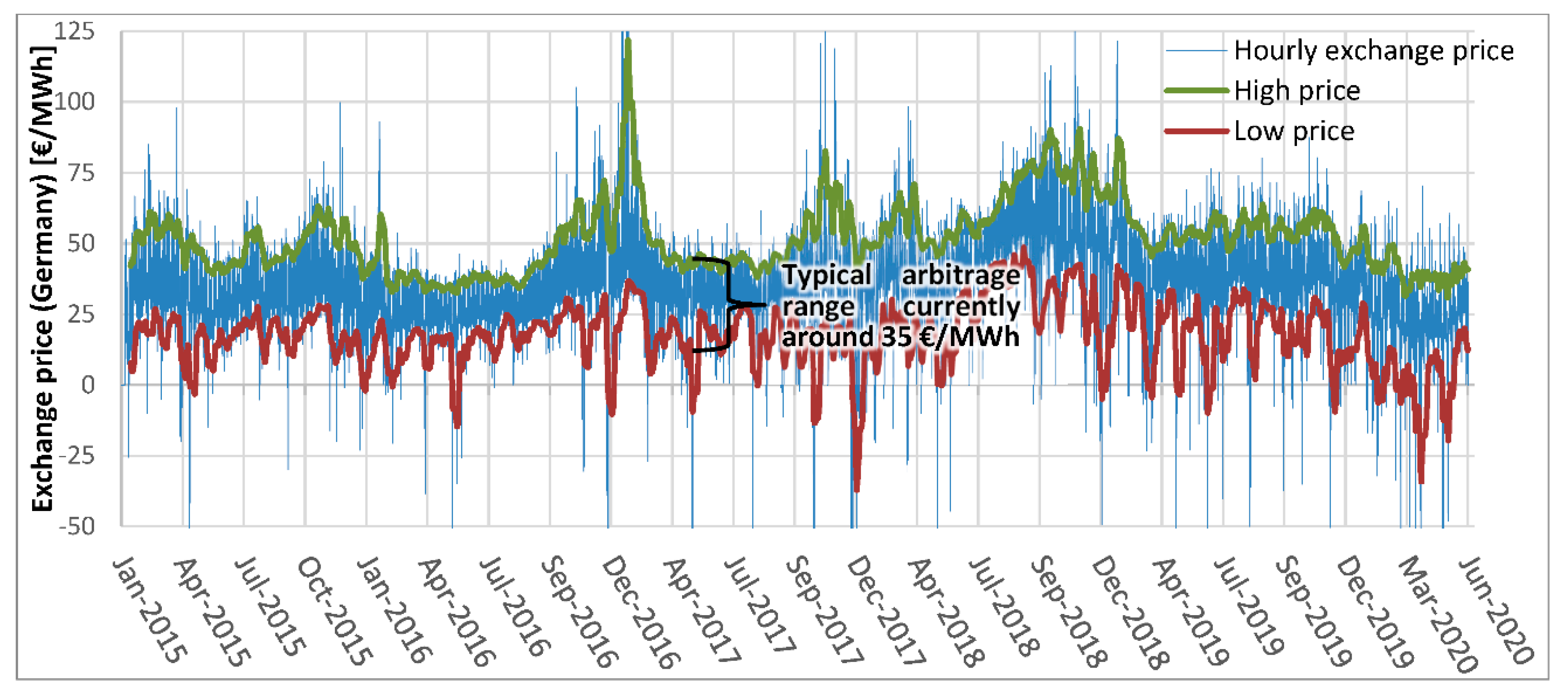

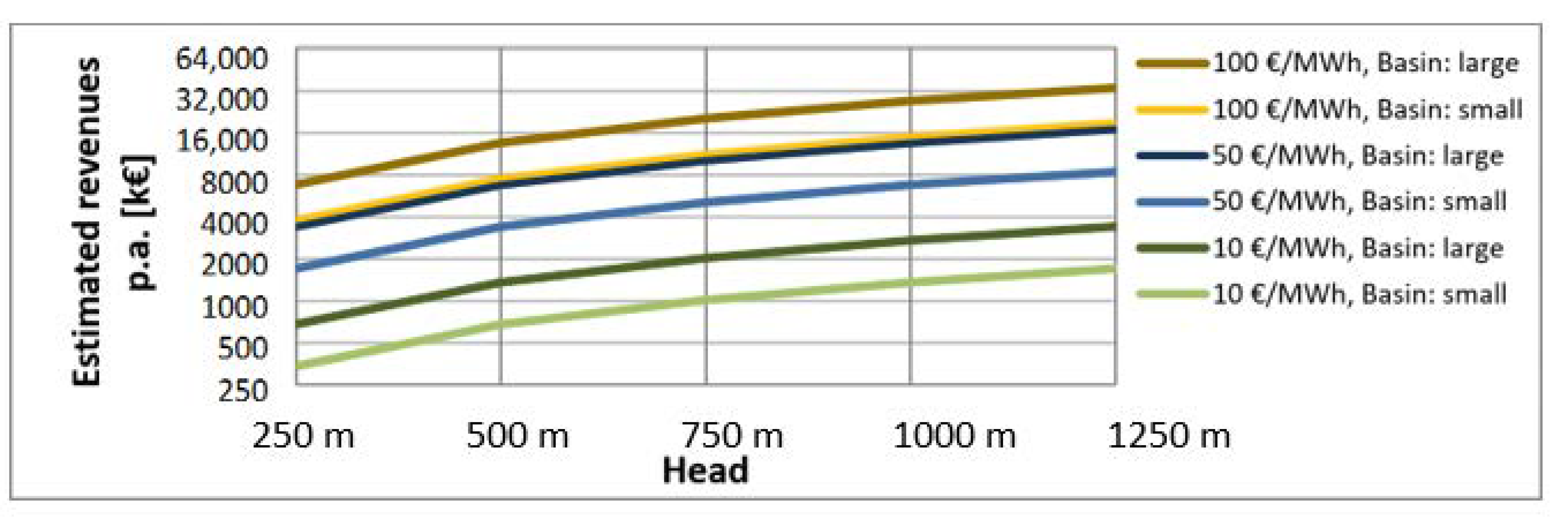

4.7.1. Revenues from Power Transfer

4.7.2. Revenues from a UPSHP Plant

5. Discussion of Results

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| CAES | Compressed Air Energy Storage |

| dena | Deutsche Energie-Agentur GmbH |

| EEG | Erneuerbare-Energien-Gesetz (German Act on Granting Priority to Renewable Energy Sources) |

| KELAG AG | Kärntner Elektrizitäts-Aktiengesellschaft |

| PSHP | Pumped-storage hydro power |

| RAG | RAG Aktiengesellschaft (est. 1968, formerly Ruhrkohle AG), Essen |

| UPSHP | Underground pumped-storage hydro power |

References

- Mautz, R.; Byzio, A.; Rosenbaum, W. Auf dem Weg zur Energiewende. In Die Entwicklung der Stromproduktion aus Erneuerbaren Energien in Deutschland; Universitätsverlag Göttingen: Göttingen, Germany, 2008. [Google Scholar]

- German Renewable Energies Act 2012. Gesetz für den Vorrang Erneuerbarer Energien—Erneuerbare-Energien-Gesetz, EEG. Bundesgesetzblatt 1998, 13, 305–308. [Google Scholar]

- Federal Ministry for Economic Affairs and Energy. Act on the Development of Renewable Energy Sources (Renewable Energy Sources Act 2014). EEG 2014/ RES Act 2014, Version as of 27 June 2014, released on 1 August 2014. Available online: http://www.bmwi.de/English/Redaktion/Pdf/renewable-energy-sources-act-eeg-2014,property=pdf,bereich=bmwi2012,sprache=en,rwb=true.pdf (accessed on 15 June 2020).

- Tretter, H.; Pauritsch, G. Energiewirtschaftlicher Bedarf regelfähiger Kraftwerke mit Schwerpunkt auf Pumpspeicherkraftwerke. In Österreichische Energieagentur; Österreichische Energieagentur: Wien, Austria, 2010. [Google Scholar]

- Conconi, M.; Quesada, J. Strategic Research Agenda/Market Deployment Strategy. (SRA/MDS); European Wind Energy Association (EWEA): Brusseles, Belgium, 2014; Available online: www.ewea.org/report/tpwind-sra (accessed on 15 June 2020).

- Luo, X.; Wang, J.; Dooner, M.; Clarke, J. Overview of current development in electrical energy storage technologies and the application potential in power system operation. Appl. Energy 2015, 137, 511–536. [Google Scholar] [CrossRef]

- Borden, E. Expert Views on the Role of Energy Storage for the German Energiewende. In Final Report Alexander von Humboldt Foundation German Chancellor Fellowship “Energy Storage Technology and Large-Scale Integration of Renewable Energy”; German Institute for Economic Research (DIW): Berlin, Germany, 2014; Available online: http://www.diw.de/documents/dokumentenarchiv/17/diw_01.c.439628.de/borden2014_expert_views_storage.pdf (accessed on 15 June 2020).

- Van Hulle, F.; Gardner, P. Wind Energy—The Facts. Part II. Grid Integration; European Wind Energy Association (EWEA): Brussels, Belgium, 2009; Available online: http://www.wind-energy-the-facts.org/images/chapter2.pdf (accessed on 15 June 2020).

- Weibel, S.; Madlener, R. Cost-effective design of ringwall storage hybrid power plants: A real options analysis. Energy Convers. Manag. 2015, 103, 871–885. [Google Scholar] [CrossRef]

- Budny, C.; Madlener, R.; Hilgers, C. Economic feasibility of pipeline and underground reservoir storage options for power-to-gas load balancing. Energy Convers. Manag. 2015, 102, 258–266. [Google Scholar] [CrossRef]

- Rehman, S.; Al-Hadhrami, L.M.; Alam, M.M. Pumped hydro energy storage system: A technological review. Renew. Sustain. Energy Rev. 2015, 44, 586–598. [Google Scholar] [CrossRef]

- Brekke, H. Hydraulic Turbines: Design, Erection and Operation. Norwegian University of Science and Technology (NTNU). 2001. Available online: https://bit.ly/3ja4phP (accessed on 18 July 2020).

- Dohmen, F.; Jung, A.; Schwägerl, C. The Dirty Bridge to a Green Future: How Quickly Can Germany Abandon Nuclear Energy? Part 3: Too Little Storage, an Insufficient Grid and a Lack of Output Capacity. 2011. Available online: http://www.spiegel.de/international/germany/the-dirty-bridge-to-a-green-future-how-quickly-can-germany-abandon-nuclear-energy-a-752285-3.html (accessed on 15 June 2020).

- Steffen, B. Prospects for pumped-hydro storage in Germany. Energy Policy 2012, 45, 420–429. [Google Scholar] [CrossRef]

- Wessel, M.; Madlener, R.; Hilgers, C. Economic feasibility of semi-underground pumped storage hydropower plants in open-pit mines. Energies 2020, 13, 4178. [Google Scholar] [CrossRef]

- Grunow, D.; Liesenfeld, J.; Stachowiak, J. Empirische Befunde zur Energiewende und zu Unterirdischen Pumpspeicherwerken. Ergebnisse einer Repräsentativen Bevölkerungsbefragung im Ruhrgebiet. 2013. Available online: http://www.upsw.de/files/PDF-files/Liesenfeld_UPSW_Bericht_231013.pdf (accessed on 15 June 2020).

- Madlener, R.; Specht, J.M. An Exploratory Economic Analysis of Underground Pumped-Storage Hydro Power Plants in Abandoned Coal Mines; FCN Working Paper No. 2/2013; Institute for Future Energy Consumer Needs and Behavior: Aachen, Germany, 2013. [Google Scholar]

- Kitsikoudis, V.; Archambeau, P.; Dewals, B.; Pujades, E.; Orban, P.; Dassargues, A.; Pirotton, M.; Erpicum, S. Underground pumped-storage hydropower (UPSH) at the Martelange Mine (Belgium): Underground reservoir hydraulics. Energies 2020, 13, 3512. [Google Scholar] [CrossRef]

- Menéndez, J.; Fernández-Oro, J.M.; Galdo, M.; Loredo, J. Efficiency analysis of underground pumped storage hydropower plants. J. Energy Storage 2020, 28, 101234. [Google Scholar] [CrossRef]

- Pujades, E.; Orban, P.; Archambeau, P.; Kitsikoudis, V.; Erpicum, S.; Dassargues, A. Underground Pumped-Storage Hydropower (UPSH) at the Martelange Mine (Belgium): Interactions with Groundwater Flow. Energies 2020, 13, 2353. [Google Scholar] [CrossRef]

- Carneiro, J.F.; Matos, C.R.; van Gessel, S. Opportunities for large-scale energy storage in geological formations in mainland Portugal. Renew. Sustain. Energy Rev. 2019, 99, 201–211. [Google Scholar] [CrossRef]

- Matos, C.R.; Carneiro, J.F.; Silva, P.P. Overview of large-scale underground energy storage technologies for integration of renewable energies and criteria for reservoir identification. J. Energy Storage 2019, 21, 241–258. [Google Scholar] [CrossRef]

- Menéndez, J.; Loredo, J.; Galdo, M.; Fernández-Oro, J.M. Energy storage in underground coal mines in NW Spain: Assessment of an underground lower water reservoir and preliminary energy balance. Renew. Energy 2019, 134, 1381–1391. [Google Scholar] [CrossRef]

- Schauer, R. Wirtschaftliche Bewertung eines Unterflur-Pumpspeicherwerk-Konzepts unter Berücksichtigung des geothermischen Potenzials; LIT Verlag Münster: Berlin, Germany, 2019. [Google Scholar]

- Niemann, A.; Balmes, J.P.; Schreiber, U.; Wagner, H.-J.; Friedrich, T. Proposed underground pumped hydro storage power plant at Prosper-Haniel colliery in Bottrop state of play and prospects. Min. Rep. Glückauf 2018, 154, 214–223. [Google Scholar]

- Kaiser, F.; Winde, F.; Erasmus, E. Storing energy in disused underground mine voids: Comparing pumped water- and compressed air-based technologies. Int. J. Min. Miner. Eng. 2018, 9, 177–197. [Google Scholar] [CrossRef]

- Alvarado Montero, R.; Wortberg, T.; Binias, J.; Niemann, A. Integrated assessment of underground pumped-storage facilities using existing coal mine infrastructure. Sustainable hydraulics in the era of global change. In Proceedings of the 4th IAHR Europe Congress, Liege, Belgium, 27–29 July 2016. [Google Scholar]

- Olsen, J.; Paasch, K.; Lassen, B.; Veye, C.T. A new principle for underground pumped hydroelectric storage. J. Energy Storage 2015, 2, 54–63. [Google Scholar] [CrossRef]

- Perau, E.; Zillmann, A.; Niemann, A. Realisierungskonzept für die Nutzung von Anlagen des Steinkohlebergbaus als unterirdische Pumpspeicherwerke—Übersicht und geotechnische Aspekte. Bergbau 2014, 11, 491–497. [Google Scholar]

- Luick, H. Konzeptionierung eines Unterflur-Pumpspeicherwerkes im Ruhrgebiet: Ein Vergleich der Bergwerke Prosper-Haniel in Bottrop und Auguste Victoria in Marl. Master′s Thesis, Universitätsbibliothek Duisburg-Essen, Essen, Germany, 2013. [Google Scholar]

- Pickard, W.F. The History, present state and future prospects of underground pumped hydro for massive energy storage. Proc. IEEE 2012, 100, 473–483. [Google Scholar] [CrossRef]

- Beck, H.-P.; Busch, W.; Erlei, M.; Langefeld, O.; Schmidt, M. Windenergiespeicherung durch Nachnutzung stillgelegter Bergwerke; Final Report; Bibliothek Clausthal: Clausthal, Germany, 2011; ISBN 978-3-942216-54-8. [Google Scholar]

- Min, A.P.N. Ondergrondse Pomp Accumulatie Centrale: Effectiviteitsverbetering d.m.v. Verschillende Pomp-Turbinevermogens. 1984. Available online: https://repository.tudelft.nl/islandora/object/uuid:a87a1047-fbed-4f39-9c86-7e829980a216 (accessed on 19 July 2020).

- Coates, M.S. Subsurface geologic considerations in siting an underground pumped-hydro project. J. Energy 1983, 7, 557–563. [Google Scholar] [CrossRef]

- Willett, D.C.; Warnock, J.G. The evolution of a technical opportunity: Underground pumped hydro storage. Undergr. Space 1983, 7, 347–352. [Google Scholar]

- Tam, S.W.; Blomquist, C.A.; Kartsounes, G.T. Underground Pumped Hydro Storage—An overview. Energy Sources 1979, 4, 329–351. [Google Scholar] [CrossRef]

- Sorensen, K.E. Underground reservoirs: Pumped storage of the future? Civil. Eng. 1969, 39, 66–70. [Google Scholar]

- Fessenden, R.A. System of Storing Power; Patent and Trademark Office: Washington, DC, USA, 1917.

- Eisenbrandt, D.-I.G.; Chromy, D.-I.U. Prävention und Migration am Beispiel des Baus des Pumpspeicherwerkes Goldisthal. Tiefbau 2005, 11, 650–653. [Google Scholar]

- Wall, J. Pumpspeicherkraftwerke. In Im Spannungsfeld zwischen der Europäischen Wasserrahmenrichtlinie und der Liberalisierung des Strommarktes; TU Graz: Graz, Austria, 2010. [Google Scholar]

- Seiwald, S.; Tschernutter, P. Erweiterung Tagesspeicher Naßfeld—Eine Unkonventionelle Technische Lösung im Einklang mit der Natur. In Proceedings of the Speicher- und Pumpspeicherkraftwerke-Planung, Bau und Betrieb, Graz, Austria, 23–24 September 2009. [Google Scholar]

- Cover-Presseagentur. Vorstellung Projekt Pumpspeicherkraftwerk Ritten. 2009. Available online: http://www.cover.pr.it/pressemitteilung/vorstellung-projekt-pumpspeicherkraftwerk-ritten (accessed on 15 June 2020).

- Rottensteiner, F. Pumpspeicherkraftwerk—Anfrage von Landtagsabgeordneter Ulli Mair. Available online: http://www2.landtag-bz.org/documenti_pdf/idap_223527.pdf (accessed on 15 June 2020).

- Krüger-Charlé, M.; Paul, H.; Becker, D. Ruhrbergbau und Strukturwandel: Probleme und Potentiale bei der Nutzung ehemaliger Bergbauflächen im Ruhrgebiet. Gelsenkirchen. 2013. Available online: http://hdl.handle.net/10419/77929 (accessed on 15 June 2020).

- Girmscheid, G. Baubetrieb und Bauverfahren im Tunnelbau; Ernst & Sohn: Berlin, Germany, 2008. [Google Scholar]

- CEC. Vortriebstechnik im Steinkohlenbergbau der Europäischen Gemeinschaft; Verlag Glückauf GmbH: Essen, Germany, 1983. [Google Scholar]

- Winkel, R.M. Analysis of Longwall Development Systems in Australian Underground Hard Coal Mines. Benchmarking and Optimisation. RWTH Aachen University. Aachen. 2003. Available online: https://bit.ly/3fLW6Xj (accessed on 15 June 2020).

- Wedig, M. German mining industry overview. Min. Rep. 2014, 150, 90–93. [Google Scholar] [CrossRef]

- Kahl, H.; Runkler, P. Tieferteufen Schacht 10 des Steinkohlenbergwerks Prosper-Haniel. Thyssen Min. Rep. 2010, 151, 44–48. [Google Scholar]

- Janssen, S.; Specht, J.M. Institute of Mining Engineering I, RWTH Aachen University. Personal interview, 26 June 2012. [Google Scholar]

- Giesecke, J.; Mosonyi, E. Wasserkraftanlagen; Planung Bau und Betrieb; Springer: Berlin/Heidelberg, Germany, 2009. [Google Scholar]

- Hayes, S.J. Technical Analysis of Pumped Storage and Integration with Wind Power in the Pacific Northwest. Final Report. Hg. v. MWH. Washington. 2009. Available online: https://bit.ly/2WDZZG3 (accessed on 15 June 2020).

- Ministry for Economic Affairs and Energy (BMWi). (Hg.) An Electricity Market for Germany’s Energy Transition. White Paper by the Federal Ministry for Economic Affairs and Energy (BMWi). 2015. Available online: https://www.bmwi.de/Redaktion/EN/Artikel/Energy/electricity-market-2-0.html (accessed on 21 July 2020).

- Deutsche Energie-Agentur GmbH (dena). Untersuchung der Elektrizitätswirtschaftlichen und energiepolitischen Auswirkungen der Erhebung von Netznutzungsentgelten für den Speicherstrombezug von Pumpspeicherwerken; Final Report; Dena: Berlin, Germany, 2008. [Google Scholar]

- Dierkes, S.; Bennewitz, F.; Maercks, M.; Verheggen, L.; Moser, A. Impact of distributed reactive power control of renewable energy sources in smart grids on voltage stability of the power system. In Proceedings of the 2014 Electric Power Quality and Supply Reliability Conference (PQ), Rakvere, Estonia, 11–13 June 2014; pp. 119–126. [Google Scholar]

- Tamimi, A.A.; Pahwa, A.; Starrett, S. Effective Wind Farm Sizing Method for Weak Power Systems Using Critical Modes of Voltage Instability. IEEE Trans. Power Syst. 2012, 27, 1610–1617. [Google Scholar] [CrossRef]

- Schleiss, A. Bemessung von Druckstollen; Eidg. Technische Hochschule: Zürich, Switzerland, 1985. [Google Scholar]

- Illwerke vkw. Kopswerk II. 2020. Available online: https://www.illwerkevkw.at/kopswerk-ii.htm (accessed on 15 June 2020).

- Black & Veatch (Ed.) Cost and Performance Data for Power Generation Technologies. Prepared for the National Renewable Energy Laboratory. 2012. Available online: https://refman.energytransitionmodel.com/publications/1921 (accessed on 15 June 2020).

- Auer, J.; Keil, J. Moderne Stromspeicher; DB Research; Unverzichtbare Bausteine der Energiewende: Frankfurt am Main, Germany, 2012. [Google Scholar]

- Pérez-Díaz, J.I.; Chazarra, M.; García-González, J.; Cavazzini, G.; Stoppato, A. Trends and challenges in the operation of pumped-storage hydropower plants. Renew. Sustain. Energy Rev. 2015, 44, 767–784. [Google Scholar] [CrossRef]

- Kondziella, H.; Bruckner, T. Economic analysis of electricity storage applications in the German spot market for 2020 and 2030. In Proceedings of the 7th Conference on Energy Economics and Technology “Infrastructure for the Energy Transformation” (Enerday 2012), Dresden, Germany, 27 April 2012; pp. 1–13. Available online: https://bit.ly/3dJABGp (accessed on 21 October 2020).

- Madlener, R.; Lohaus, M. Well Drainage Management in Abandoned Mines: Optimizing Energy Costs and Heat Use under Uncertainty; FCN Working Paper No. 12/2015; Institute for Future Energy Consumer Needs and Behavior, RWTH Aachen University: Aachen, Germany, 2015. [Google Scholar]

- Kondziella, H.; Bruckner, T. Konzept zur Bestimmung des Marktpotentials von Flexibilitätsoptionen im Strommarkt. In Proceedings of the 13th Symposium Energieinnovation, Graz, Austria, 12–14 February 2014; Available online: https://www.tugraz.at/fileadmin/user_upload/Events/Eninnov2014/files/lf/LF_Kondziella.pdf (accessed on 15 June 2020).

| Author | Year | Country | Contribution | |

|---|---|---|---|---|

| Kitsikoudis et al. | 2020 | Belgium | UPSHP in an abandoned slate mine with focus on hydraulics and economic implications regarding volatile electricity prices | [18] |

| Menéndez et al. | 2020 | Spain | Impact of changes in air pressure in UPSHPs on global efficiency | [19] |

| Pujades et al. | 2020 | Belgium | Interaction between a UPSHP in an abandoned slate mine and ground water flow | [20] |

| Carneiro et al. | 2019 | Portugal | Screening of potential locations for different underground energy storage options in Portugal | [21] |

| Matos et al. | 2019 | Portugal | Development of geological screening criteria for various underground energy storage technologies, i.e., UPSHP | [22] |

| Menéndez et al. | 2019 | Spain | (I) Development of tunnel designs and (II) air pressure simulation | [23] |

| Schauer | 2019 | Germany | Techno-economic assessment for a UPSHP in the Ruhr area | [24] |

| Niemann et al. | 2018 | Germany | State of play and prospects for the pilot UPSHP plant Prosper-Haniel in the Ruhr area | [25] |

| Kaiser et al. | 2018 | Germany | Comparison of compressed air and UPSHP regarding technical and economic aspects | [26] |

| Alvarado Montero et al. | 2016 | Germany | Comprehensive case study for a pilot UPSHP plant in the mine “Prosper-Haniel” in the Ruhr area | [27] |

| Olsen et al. | 2015 | Denmark | Concept study of a pumped hydro storage in a water pocket only a few meters below the surface | [28] |

| Perau et al. | 2014 | Germany | Geological and technical aspects regarding a UPSHP | [29] |

| Luick | 2013 | Germany | Holistic comparison of different UPSHP sites in the Ruhr area | [30] |

| Pickard | 2012 | USA | Summary of the research on UPSHP | [31] |

| Beck et al. | 2011 | Germany | Comprehensive analysis of UPSHP in German hard rock formations in closed iron ore mines | [32] |

| Min et al. | 1984 | The Netherlands | Increasing turbine efficiency for UPSHP concepts | [33] |

| Coates | 1983 | USA | Suitability of rock formations in Illinois for a UPSHP | [34] |

| Willett et al. | 1983 | USA | Overview of the development of the UPSHP concept | [35] |

| Tam et al. | 1979 | USA | Exploratory techno-economic study of the UPSHP concept in the USA | [36] |

| Sorensen | 1969 | USA | One of the first general investigations of the UPSHP concept | [37] |

| Fessenden | 1917 | USA | Patent granted on the idea of underground pumped hydro storage | [38] |

| Drift Extension (m) | Storable Amount of Water * (t) | Extension Costs at 10 k€ m−1 (M€) | Extension Costs at 20 k€ m−1 (M€) |

|---|---|---|---|

| 2000 | 96,000 | 20 | 40 |

| 5000 | 240,000 | 50 | 100 |

| 10,000 | 480,000 | 100 | 200 |

| 15,000 | 720,000 | 150 | 300 |

| 20,000 | 960,000 | 200 | 400 |

| 30,000 | 1,440,000 | 300 | 600 |

| Head Height (m) | Water Mass (Mt) | |||||

|---|---|---|---|---|---|---|

| 0.1 | 0.25 | 0.5 | 0.75 | 1 | 1.5 | |

| 100 | 25.9 | 64.7 | 129.4 | 194.2 | 258.9 | 388.3 |

| 250 | 64.7 | 161.8 | 323.6 | 485.4 | 647.2 | 970.8 |

| 500 | 129.4 | 323.6 | 647.2 | 970.8 | 1294.4 | 1941.6 |

| 750 | 194.2 | 485.4 | 970.8 | 1456.2 | 1941.6 | 2912.3 |

| 1000 | 258.9 | 647.2 | 1294.4 | 1941.6 | 2588.8 | 3883.1 |

| 1250 | 323.6 | 809.0 | 1618.0 | 2427.0 | 3235.9 | 4853.9 |

| Cost Component | Cost Variation | Comments |

|---|---|---|

| Upper reservoir | −100%/+30% | − No costs might occur if an existing source of water can be used. + A more complex reservoir construction might increase costs. |

| Lower reservoir | −40%/+20% | − Several requirements that the tunneling for coal production had to meet can be neglected. + The necessary cladding of the tunnels could turn out to be a challenge. |

| Tunnels | +/−30% | + Extensive use of existing shafts can avoid costs. − If these tunnels cannot be used in the individual case, costs might turn out similar to conventional PSHP plant. |

| Powerhouse excavation | −20%/+50% | +/− The soft sediment in the Ruhr area poses a significant issue for excavating larger openings. For this reason, a cost mark-up factor of 2.5 (250%) compared to a conventional PSHP plant were already factored in. However, even these costs are probably more likely to increase than to fall. |

| Powerhouse | +/−30% | Powerhouse excavation is a huge task also in conventional PSHP plant. These costs were already increased by about 12% for the standard case. − These additional costs might be avoided in the case of good accessibility (compared to barely accessible mountainous terrain). + If, however, access turns out to be especially difficult, costs might increase by another 30%. |

| Engineering | −15%/+30% | +/− Since UPSHP is a novel concept, the engineering budget was increased by about 10% in the standard case. Due to the many uncertainties involved, this share is more likely to go up than down. |

| Owner’s costs | −100%/+10% | + In the best case, a sensible after use for the mine is also in the interest of RAG as the owner, so no costs might apply for the allowance to operate. − Since hardly any other serious competing after-use concept is foreseeable, only a moderate increase in the owner’s costs seems possible. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Madlener, R.; Specht, J.M. An Exploratory Economic Analysis of Underground Pumped-Storage Hydro Power Plants in Abandoned Deep Coal Mines. Energies 2020, 13, 5634. https://doi.org/10.3390/en13215634

Madlener R, Specht JM. An Exploratory Economic Analysis of Underground Pumped-Storage Hydro Power Plants in Abandoned Deep Coal Mines. Energies. 2020; 13(21):5634. https://doi.org/10.3390/en13215634

Chicago/Turabian StyleMadlener, Reinhard, and Jan Martin Specht. 2020. "An Exploratory Economic Analysis of Underground Pumped-Storage Hydro Power Plants in Abandoned Deep Coal Mines" Energies 13, no. 21: 5634. https://doi.org/10.3390/en13215634

APA StyleMadlener, R., & Specht, J. M. (2020). An Exploratory Economic Analysis of Underground Pumped-Storage Hydro Power Plants in Abandoned Deep Coal Mines. Energies, 13(21), 5634. https://doi.org/10.3390/en13215634