Cost of Equity of Coal-Fired Power Generation Projects in Poland: Its Importance for the Management of Decision-Making Process

Abstract

1. Introduction

- −

- net present value (NPV)

- −

- internal rate of return (IRR)

- −

- discounted payback period (DPP)

2. Methods and Data

- −

- At this point, it is necessary to mention an important attribute of the capital asset valuation model. The cost of equity obtained in this algorithm is a discount rate for the whole company, not for the individual project. Therefore, concerning a given country, an industry (here: the power generation sector) in the literature, we can find different values depending on the company, its advancement, age of the technology used, the period, and the way it is expressed. For example, for companies using coal-fired power plants, the following figures can be recognized:

- −

- According to Organisation for Economic Co-operation and Development data (2010) [24], the real cost of equity calculated for years 2003–2004 after-tax is 8.7%;

- −

- According to World Energy Council (2013) [25], it is 10% with a comment that at present (i.e., in 2013), in case of construction of new coal-fired units, investors can expect as much as 18% and more (there is no information whether this is a pre- or post-tax rate and whether in nominal or real terms);

- −

- Surface Transportation Board (2015) [26] gave the cost of equity, real, after-tax for regulated electric companies (without specifying the fuel used) at 6.4%, while coal companies at 9.7%;

- −

- According to National Economic Research Associates (NERA) (2015) [27], hurdle rates for newly built modern coal-fired sources for 2015 (after-tax, real) are 7.75% (reference scenario; 6.18%—low scenario, and 9.31%—high scenario); and for 2030 (after-tax, real) are 8.57% (reference scenario, 7.48%—low scenario, 16.3%—high scenario);

- −

- Nine percent gives Nalbandian-Sugden (2016) [28], but without any other additional information;

- −

- −

- Saługa and Kamiński [31] reported, for the years 2013–2017, the cost of equity—nominal, after-tax, of the companies separated from the Damodaran Coal & Related Energy group at 9.7%, which after taking into account, the inflation is 9% in real terms;

- −

- Kozieł, Pawłowski, and Kustra [32], on the other hand, gave the cost of equity (2016–2017) of 5.52% for Tauron Polska Energia (TPE) (hard coal) and 5.33% for PGE (Polska Grupa Energetyczna) (lignite)—probably in nominal values; it is worth mentioning that both these companies have geological-mining assets in their portfolios, in addition to power generation assets;

- −

- Bachner, Mayer, and Steininger [33] estimated the cost of capital for investments in coal-fired units in Eastern Europe at just over 10% (approximately 10.3%), in nominal terms.

- (1)

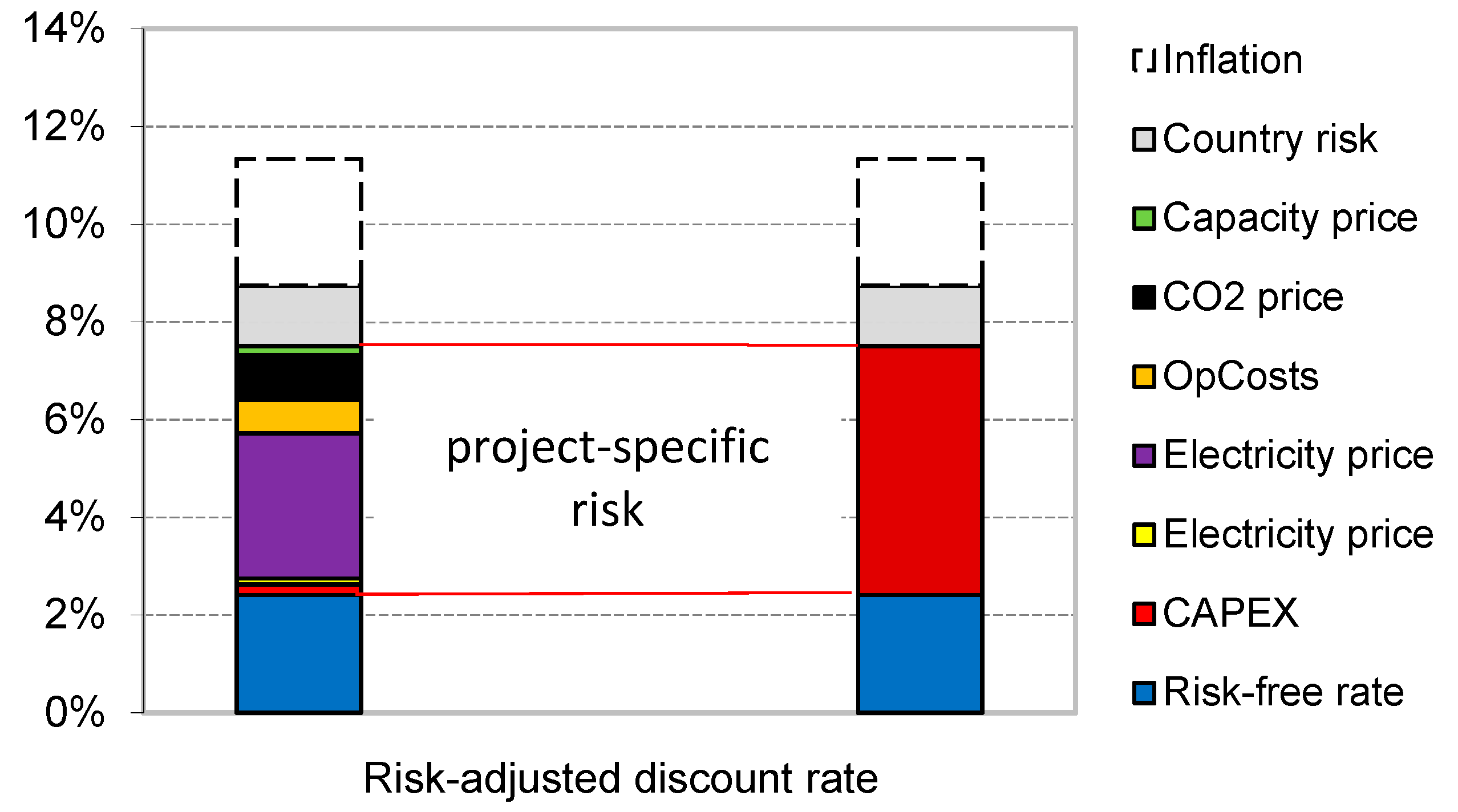

- risk-free rate

- (2)

- the rate related to the specific risk of the company/project

- (3)

- percentage of country risk

- (1)

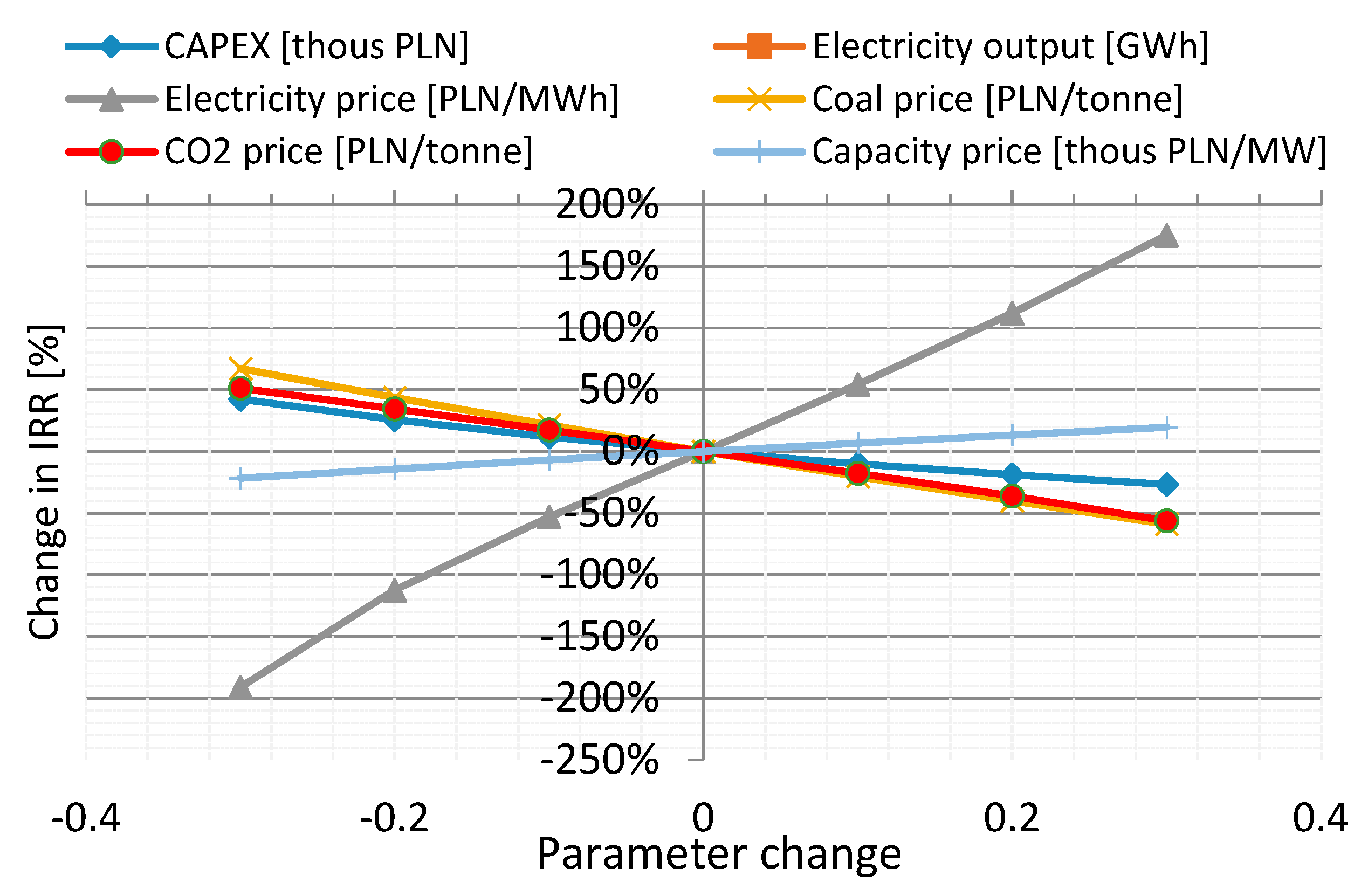

- capital expenditures

- (2)

- power generation

- (3)

- electricity price

- (4)

- operating costs—mainly fuel (coal) costs

- (5)

- costs of CO2 emission allowances

- (6)

- an auction price in the capacity market

3. Discussion of Results

- −

- formulating a long-term goal to be achieved through investment

- −

- determining the options of possible solutions

- −

- calculation of investment outlays and future cash-flows from investments

4. Summary and Final Conclusions

- −

- risk factor identification

- −

- scale estimation development

- −

- assessing the risk portion

- −

- calculation of the importance of individual risks

- −

- determining the risk value

Author Contributions

Funding

Conflicts of Interest

References

- World Bank. Guidelines for Economic Analysis of Power Sector Projects; Technical Notes; World Bank: Washington, DC, USA, 2015; Volume 2, p. 99506, Public Disclosure Authorized; Available online: http://documents1.worldbank.org/curated/en/267971468000014869/pdf/99506-WP-v2-PUBLIC-Box393204B-Guidelines-Economic-Analysis-Power-Projects-Volume-2-Final.pdf (accessed on 28 March 2020).

- Dranka, G.G.; Cunha, J.; de Lima, J.D.; Fereira, P. Economic Evaluation Methodologies for Renewable Energy Projects. Research article. AIMS Energy 2020, 8, 339–364. [Google Scholar] [CrossRef]

- Hermelink, A.H.; de Jager, D. Evaluating Our Future—The Crucial Role of Discount Rates in European Commission Energy System Modelling; European Council for an Energy Efficient Economy & Ecofys: Stockholm, Sweden, 2015; Available online: https://www.eceee.org/static/media/uploads/site-2/policy-areas/discount-rates/evaluating-our-future-report.pdf (accessed on 6 April 2020).

- Blinski, P. Do Analyst Disclose Cash Flow Forecast with Earnings Estimates when Earnings Quality is Low? J. Bus. Financ. Account. 2014, 41, 401–434. [Google Scholar] [CrossRef]

- Andrén, N.; Jankensgård, H. Disappearing investment-cash flow sensitivities: Earnings have not become a worse proxy for cash flow. J. Bus. Financ. Account. 2020, 47, 760–785. [Google Scholar] [CrossRef]

- Daroń, M.; Górska, M. Challenges and Problems of Transport. Management in the Mining Sector. In 33rd IBIMA Conference proceedings: Education Excellence and Innovation Management through Vision 2020; Soliman Khalid, S., Ed.; International Business Information Management (IBIMA): Granada, Spain, 2019; pp. 2357–2372. [Google Scholar]

- Aliu, F.; Pavelkova, D.; Dehning, B. Portfolio risk-return analysis: The case of the automotive industry in the Czech Republic. J. Int. Stud. 2017, 10, 72–83. [Google Scholar] [CrossRef] [PubMed]

- Pietrzak, M.B.; Fałdziński, M.; Balcerzak, A.P.; Meluzín, T.; Zinecker, M. Short-term Shocks and Long-term Relationships of Interdependencies Among Central European Capital Markets. Econ. Sociol. 2017, 10, 61–77. [Google Scholar] [CrossRef] [PubMed]

- Jonek-Kowalska, I. Transformation of energy balances with dominant coal consumption in European economies and Turkey in the years 1990–2017. Oeconomia Copernic. 2019, 10, 627–647. [Google Scholar] [CrossRef]

- Jonek-Kowalska, I. Coal mining in Central-East Europe in perspective of industrial risk. Oeconomia Copernicana. 2017, 8, 131–143. [Google Scholar] [CrossRef]

- Amadi, C.W. Estimation of the Cost of Equity: A Chance of a Loss Approach; “Business Quest”; Richards College of Business; University of West Georgia: Carrollton, GA, USA, 2010. [Google Scholar]

- Mohutsiwa, M. Estimation of Capital Costs for Establishing Coal Mines in South Africa; a Research Report; Faculty of Engineering and the Built Environment, University of the Witwatersrand: Johannesburg, South Africa, 2015; Available online: http://wiredspace.wits.ac.za/jspui/bitstream/10539/18378/2/Moshe_Mohutsiwa_Estimation%20of%20Capital%20Costs%20for%20Establishing%20Coal%20Mines%20in%20South%20Africa.pdf (accessed on 26 July 2020).

- Oláh, J.; Kovács, S.; Virglerova, Z.; Lakner, Z.; Popp, J. Analysis and Comparison of Economic and Financial Risk Sources in SMEs of the Visegrad Group and Serbia. Sustainability 2019, 11, 1853. [Google Scholar] [CrossRef]

- Oláh, J.; Virglerova, Z.; Klieštiková, J.; Popp, J.; Kovács, S. The Assessment of Non-Financial Risk Sources of SMES in the V4 Countries and Serbia. Sustainability 2019, 11, 4806. [Google Scholar] [CrossRef]

- Rabe, M.; Streimikiene, D.; Bilan, Y. EU carbon emissions market development and its impact on penetration of renewables in the power sector. Energies 2019, 12, 2961. [Google Scholar] [CrossRef]

- Michalski, G. Relation Between Cash Levels and Debt in Small and Medium Wood and Furniture Industry Enterprises with Full Operating Cycle. Procedia Econ. Financ. 2015, 34, 469–476. [Google Scholar] [CrossRef]

- Hussain, H.I.; Slusarczyk, B.; Kamarudin, F.; Thaker, H.M.T.; Szczepańska-Woszczyna, K. An investigation of an adaptive neuro-fuzzy inference system to predict the relationship among energy intensity, globalization, and financial development in major ASEAN economies. Energies 2020, 13, 850. [Google Scholar] [CrossRef]

- Brealey, R.A.; Myers, S.C.; Allen, F. Principles of Corporate Finance; McGraw-Hill/Irwin: New York, NY, USA, 2008. [Google Scholar]

- Kolupaieva, I.; Pustovhar, S.; Suprun, O.; Shevchenko, O. Diagnostics of systemic risk impact on the enterprise capacity for financial risk neutralization: The case of Ukrainian metallurgical enterprises. Oeconomia Copernic. 2019, 10, 471–491. [Google Scholar] [CrossRef]

- Gollier, C.; Koundouri, P.; Pantelidis, T. Declining Discount Rates: Economic Justifications and Implications for Long-Run Policy. Econ. Policy 2008, 23, 757–795. [Google Scholar] [CrossRef]

- Lind, R.C. A Primer on the Major Issues Relating to the Discount Rate for Evaluating National Energy Options, Resources for the Future; Lind, R.C., Ed.; Discounting for Time and Risk in Energy Policy: Washington, DC, USA, 1982; pp. 21–94. [Google Scholar]

- García-Gusano, D.; Kari, E.; Lind, A.; Kirkengen, M. The Role of the Discount Rates in Energy Systems Optimisation Models. Renew. Sustain. Energy Rev. 2016, 59, 56–72. [Google Scholar] [CrossRef]

- Śliwiński, P.; Łobza, M. The impact of global risk on the performance of socially responsible and conventional stock indices. Equilibrium. Q. J. Econ. Econ. Policy 2017, 12, 657–674. [Google Scholar] [CrossRef]

- OECD. Projected Costs of Generation Electricity–2010, Edition, OECD Publications. 2010. Available online: https://www.oecd-nea.org/ndd/pubs/2010/6819-projected-costs.pdf (accessed on 28 August 2020).

- WEC. World Energy Perspective: Cost of Energy Technologies; Project Partner: Bloomberg New Energy Finance; World Energy Council (WEC): London, UK, 2013; p. 48. Available online: https://www.worldenergy.org/assets/downloads/WEC_J1143_CostofTECHNOLOGIES_021013_WEB_Final.pdf (accessed on 5 March 2020).

- STB, Surface Transportation Board. Draft Environmental Impact Statement for the Tongue River Railroad. 2015, Appendix C, Coal Production and Markets, April 2015. Available online: https://www.stb.gov/decisions/readingroom.nsf/UNID/E7DE39D1F6FD4A9A85257E2A0049104D/$file/AppC_CoalProduction.pdf (accessed on 17 February 2020).

- NERA Economic Consulting. Electricity Generation Costs and Hurdle Rates–Lot 1: Hurdle Rates Update for Generation Technologies, Prepared for the Department of Energy and Climate Change (DECC). 2015. Available online: https://www.nera.com/content/dam/nera/publications/2016/,NERA_Hurdle_Rates_for_Electricity_Generation_Technologies.pdf (accessed on 8 March 2020).

- Nalbandian-Sugden, H. Operating Ratio and Cost of Coal Power Generation; IEA Clean Coal Centre: London, UK, 2016; p. 107. Available online: https://www.usea.org/sites/default/files/ (accessed on 19 February 2020).

- Zamasz, K. Discount Rates for the Evaluation of Energy Projects–Rules and Problems. Sci. J. Sil. Univ. Technol. Ser. Organ. Manag. (Zesz. Nauk. Politech. ŚląskiejSer. Organ. I Zarządzanie) 2017, 101, 571–584. [Google Scholar]

- Damodaran Online: Data. Costs of Capital by Industry (Europe). Website of Aswath Damodaran. Available online: http://pages.stern.nyu.edu/~adamodar (accessed on 15 March 2020).

- Saługa, P.W.; Kamiński, J. The Cost of Equity in the Energy Sector. Polityka Energetyczna-Energy Policy J. 2018, 21, 81–96. [Google Scholar] [CrossRef]

- Kozieł, D.; Pawłowski, S.; Kustra, A. Cost of Equity Estimation in Fuel and Energy Sector Companies Based on CAPM. Scientific-Research Cooperation between Vietnam and Poland POL-VIET 2017. In E3S Web of Conferences; EDP Sciences: Les Ulis, France, 2018; Volume 35, p. 1008. [Google Scholar] [CrossRef]

- Bachner, G.; Mayer, J.; Steininger, K.W. Costs or Benefits? Assessing the Economy-Wide Effects of the Electricity Sector’s Low Carbon Transition–The Role of Capital Costs, Divergent Risk Perceptions and Premiums. Energy Strategy Rev. 2019, 26, 100373. [Google Scholar] [CrossRef]

- Škare, M.; Tomić, D.; Stjepanović, S. Energy Consumption and Green GDP in Europe: A Panel Cointegration Analysis 2008–2016. Acta Montan. Slovaca 2020, 25, 46–56. [Google Scholar] [CrossRef]

- Energy Regulatory Office (URE). Methodology for Determining the Rate of Return on Capital Engaged, for Power System Operators for 2016–2020. 2015. Available online: www.ure.gov.pl (accessed on 16 March 2020).

- Energy Regulatory Office (URE). Risk-Free Rate for the Purpose of Determining the Cost of Capital Engaged, Used for the Calculation of Infrastructure Tariffs of Gas and District Heating Companies as well as Power System Operators, CIRE.pl. 2020. Available online: https://www.cire.pl/item,144479,5,0,0,0,0,0,stopa-wolna-od-ryzyka-.html (accessed on 16 March 2020).

- Statistics Poland (GUS). Annual Indices of Consumer Prices of Goods and Services Since 1950. 2020. Available online: https://stat.gov.pl/obszary-tematyczne/ceny-handel/wskazniki-cen/wskazniki-cen-towarow-i-uslug-konsumpcyjnych-pot-inflacja-/roczne-wskazniki-cen-towarow-i-uslug-konsumpcyjnych/ (accessed on 15 March 2020).

- Oxford University; The Oxford Institute for Energy Studies, Energy Transition. Uncertainty, and the Implications of Change in the Risk Preferences of Fossil Fuels Investors; University of Oxford: Oxford, UK, 2019; p. 13. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/01/Energy-Transition-Uncertainty-and-the-Implications-of-Change-in-the-Risk-Preferences-of-Fossil-Fuel-Investors-Insight-45.pdf (accessed on 18 February 2019).

- Smith, L.D. Discount Rates and Risk Assessment in Mineral Project Evaluations. Can. Inst. Min. Metall. Bull. 1995, 88, 34–43. [Google Scholar]

- Hudáková, M.; Dvorský, J. Assessing the risks and their sources in dependence on the rate of implementing the risk management process in the SMEs. Equilib. Q. J. Econ. Econ. Policy 2018, 13, 543–567. [Google Scholar] [CrossRef]

- Pöyry. Independent Market. Report for Poland (Q3 2019 Update). Available online: https://www.poyry.com/sites/default/files/pimrflyer_poland19_v100.pdf (accessed on 18 February 2019).

- Ministry of State Assets (MAP). Updated Draft Energy Policy of Poland Until 2040–Conclusions from Prognostic Analyses for the Fuel and Energy Sector. Available online: https://www.gov.pl/web/aktywa-panstwowe/zaktualizowany-projekt-polityki-energetyczna-polski-do-2040-r (accessed on 15 March 2019).

| Risk Component | UcRnty (Estimation Accuracy) | CnSqnce (Slope of the Sensitivity Curve) | Risk | Relative Risk | Risk Component |

|---|---|---|---|---|---|

| Risk-free rate (real) | 2.41% | ||||

| Capital expenditures (CAPEX) | 15% | 1.12 | 0.1680 | 0.043 | 0.22% |

| Power generation | 10% | 0.91 | 0.0907 | 0.023 | 0.12% |

| Electricity unit price | 40% | 5.69 | 2.2779 | 0.583 | 2.97% |

| Operational cost | 25% | 2.09 | 0.5234 | 0.134 | 0.68% |

| Price of CO2 emission allowances | 40% | 1.77 | 0.7082 | 0.181 | 0.92% |

| Capacity price | 20% | 0.69 | 0.1373 | 0.035 | 0.18% |

| Risk portion (SUM) | 3.8369 | 1.000 | 5.10% | ||

| Cost of equity—risk-adjusted discount rate, RADR (real) | 7.50% | ||||

| Country risk of Poland | 1.20% | ||||

| Cost of equity—risk-adjusted discount rate, RADR (real) taking into account the country risk of Poland | 8.70% | ||||

| Inflation rate | 2.60% | ||||

| Cost of equity—risk-adjusted discount rate, RADR (nominal) | 10.10% | ||||

| Cost of equity—risk-adjusted discount rate, RADR (nominal) taking into account the country risk of Poland | 11.30% | ||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saługa, P.W.; Szczepańska-Woszczyna, K.; Miśkiewicz, R.; Chłąd, M. Cost of Equity of Coal-Fired Power Generation Projects in Poland: Its Importance for the Management of Decision-Making Process. Energies 2020, 13, 4833. https://doi.org/10.3390/en13184833

Saługa PW, Szczepańska-Woszczyna K, Miśkiewicz R, Chłąd M. Cost of Equity of Coal-Fired Power Generation Projects in Poland: Its Importance for the Management of Decision-Making Process. Energies. 2020; 13(18):4833. https://doi.org/10.3390/en13184833

Chicago/Turabian StyleSaługa, Piotr W., Katarzyna Szczepańska-Woszczyna, Radosław Miśkiewicz, and Mateusz Chłąd. 2020. "Cost of Equity of Coal-Fired Power Generation Projects in Poland: Its Importance for the Management of Decision-Making Process" Energies 13, no. 18: 4833. https://doi.org/10.3390/en13184833

APA StyleSaługa, P. W., Szczepańska-Woszczyna, K., Miśkiewicz, R., & Chłąd, M. (2020). Cost of Equity of Coal-Fired Power Generation Projects in Poland: Its Importance for the Management of Decision-Making Process. Energies, 13(18), 4833. https://doi.org/10.3390/en13184833