Do Energy Resource Curse and Heterogeneous Curse Exist in Provinces? Evidence from China

Abstract

1. Introduction

2. Literature Review

3. Data and Method

3.1. Model Setting

3.2. Sample Selection

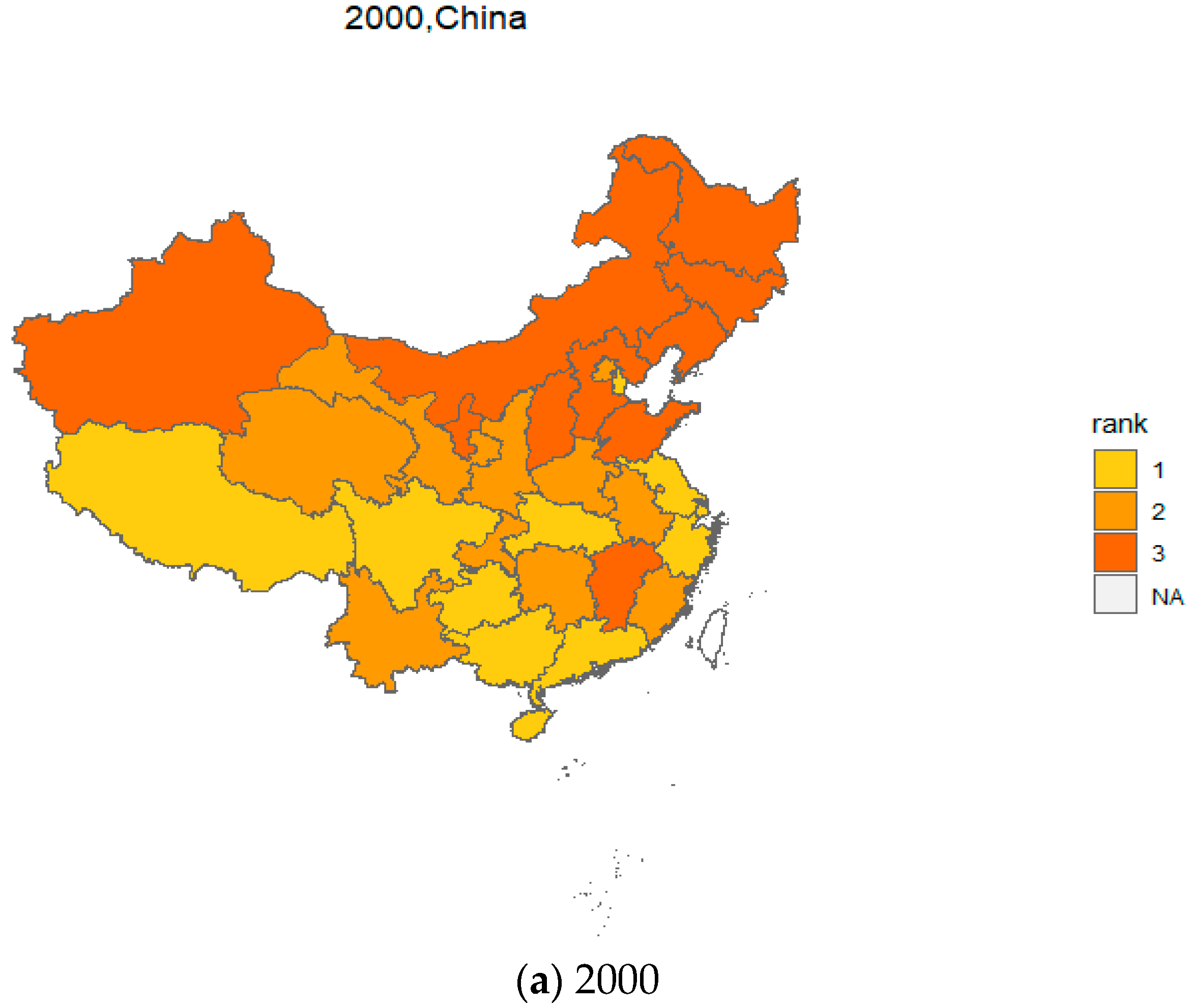

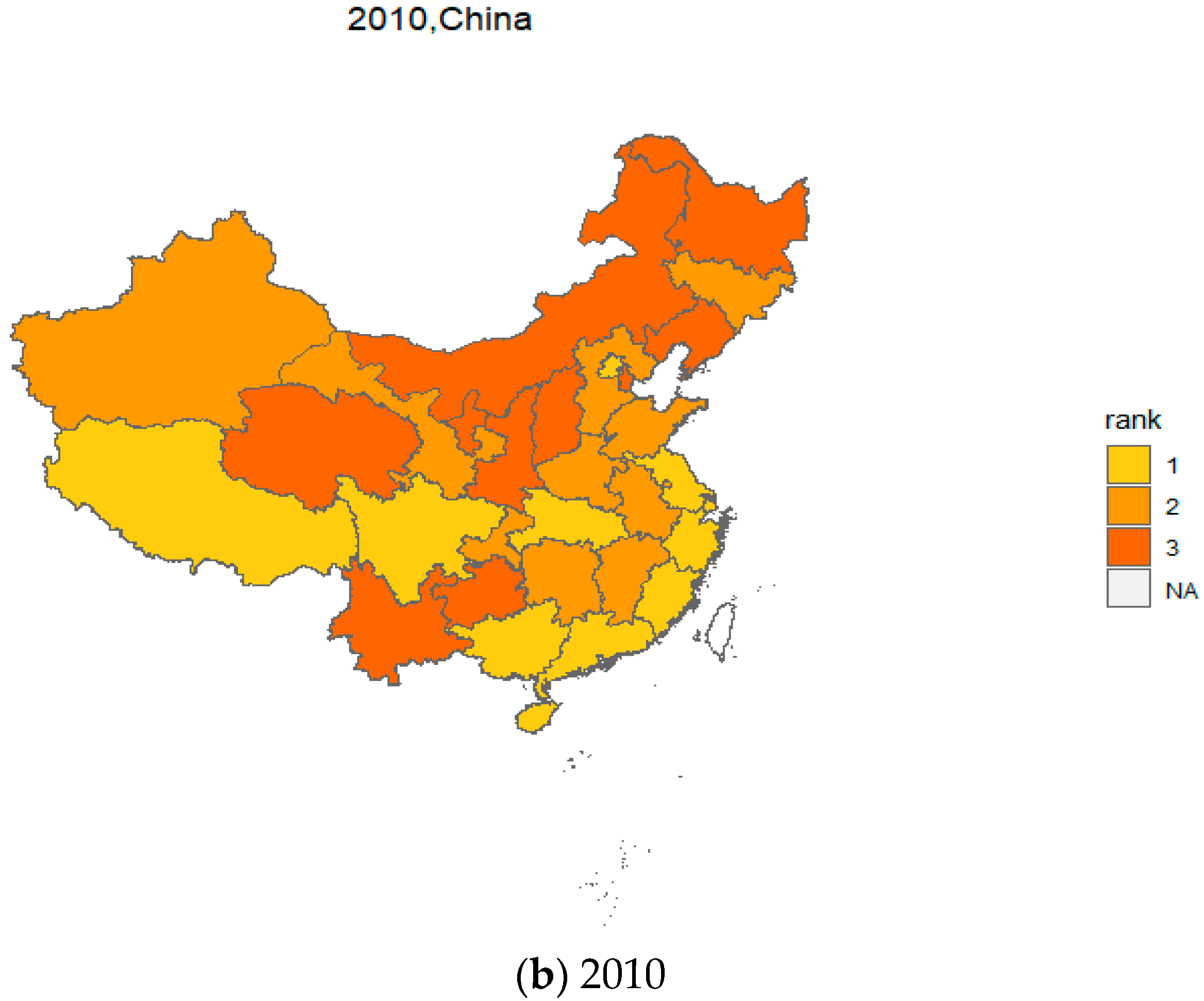

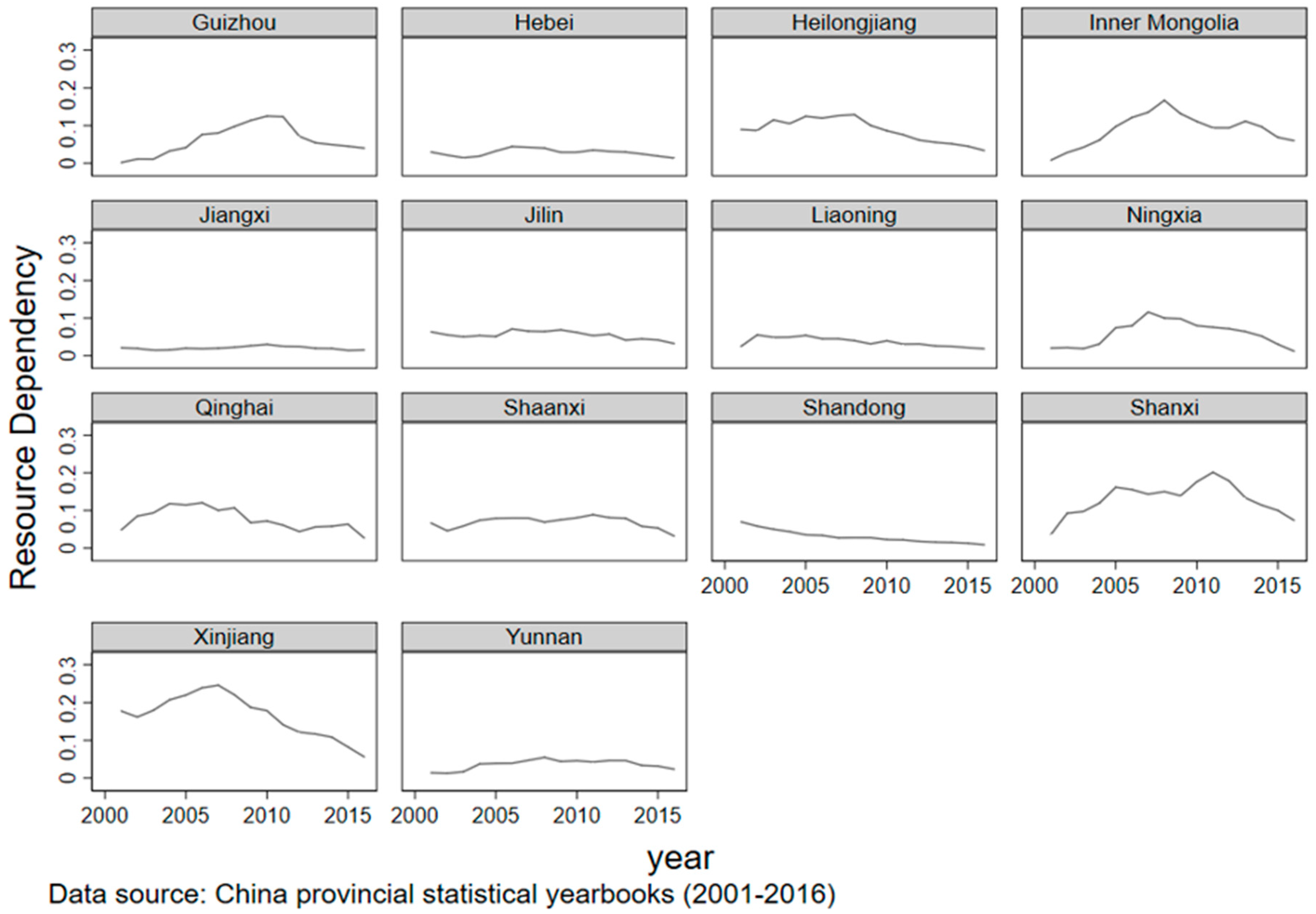

3.3. Data and Descriptive Statistics

4. Empirical Analyses and Results

4.1. Whether the Energy Resource Curse Exists

4.1.1. General panel—Data Regressions

4.1.2. Respective Regressions for Provinces

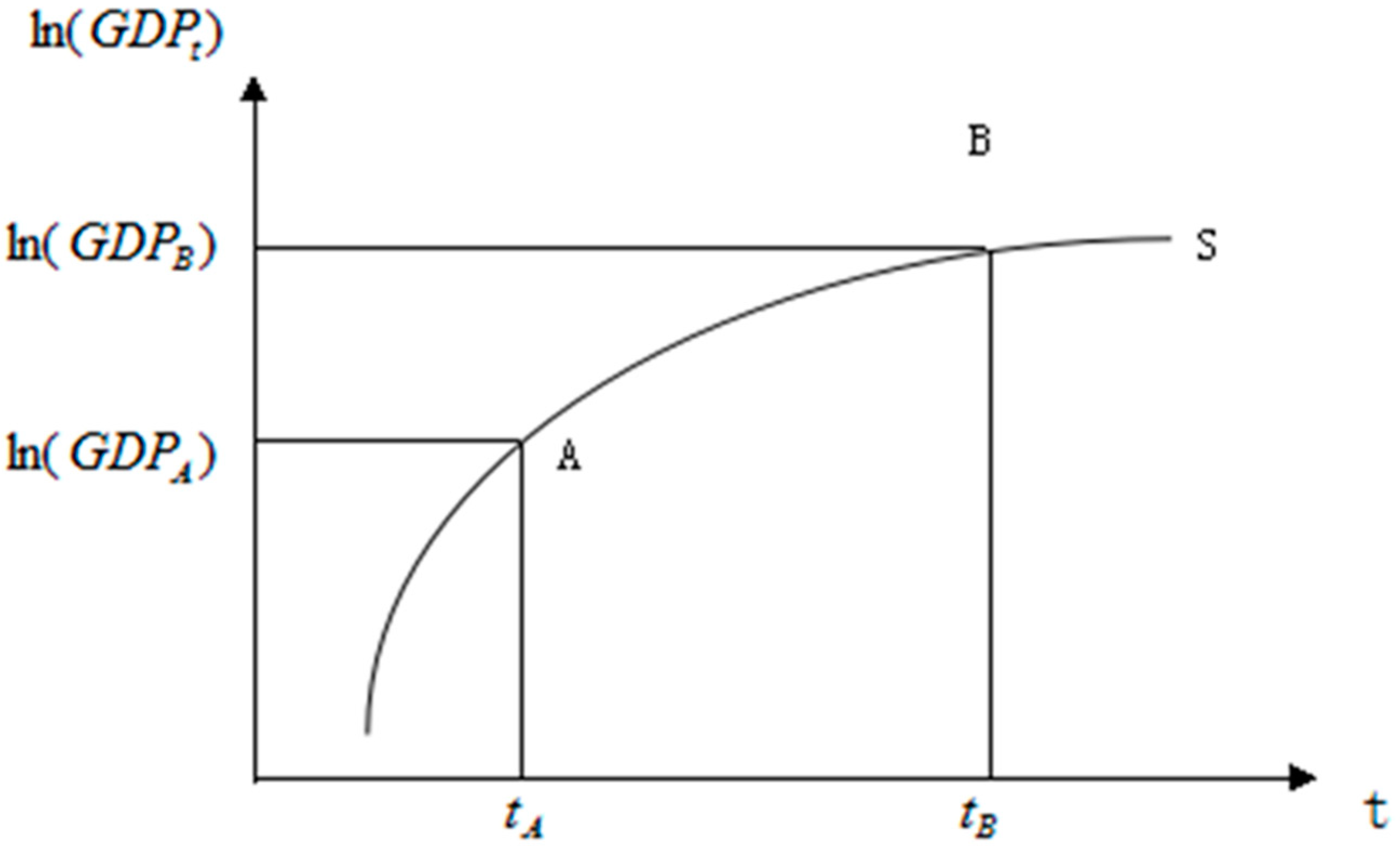

4.1.3. Time Prediction

4.2. Transmission Channels of the Energy Resource Curse

4.2.1. Regressions for Five Transmission Variables

4.2.2. Classification Analysis

4.2.3. Analysis of Invisible Energy Resource Curse

4.3. Energy Types and Resource Curse

5. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Shao, S.; Yang, L. Natural resource dependency, human capital accumulation, and economic growth: A combined explanation for the resource curse and the resource blessing. Energy Policy 2014, 74, 632–642. [Google Scholar] [CrossRef]

- Hajkowicz, S.A.; Heyenga, S.; Moffat, K. The relationship between mining and socio-economic wellbeing in Australia’s regions. Resour. Policy 2011, 36, 30–38. [Google Scholar] [CrossRef]

- James, A.; Aadland, D. The curse of natural resources: An empirical investigation of U.S. counties. Resour. Energy Econ. 2011, 33, 440–453. [Google Scholar] [CrossRef]

- James, A.G.; James, R.G. Do resource dependent regions grow slower than they should? Econ. Lett. 2011, 111, 194–196. [Google Scholar] [CrossRef]

- Frederick, V.D.P. Natural resources: Curse or blessing? J. Econ. Lit. 2011, 49, 366–420. [Google Scholar]

- Papyrakis, E.; Raveh, O. An empirical analysis of a regional Dutch disease: The case of Canada. Environ. Resour. Econ. 2014, 58, 179–198. [Google Scholar] [CrossRef]

- Cohen, P.J.; Lawless, S.; Dyer, M.; Morgan, M.; Saeni, E.; Teioli, H.; Kantor, P. Understanding adaptive capacity and capacity to innovate in social–ecological systems: Applying a gender lens. Ambio 2016, 45, 309–321. [Google Scholar] [CrossRef]

- Konte, M. A curse or a blessing? Natural resources in a multiple growth regimes analysis. Appl. Econ. 2013, 45, 3760–3769. [Google Scholar] [CrossRef]

- Chang, C.P.; Hao, Y. Environmental performance, corruption and economic growth: Global evidence using a new data set. Appl. Econ. 2017, 49, 498–514. [Google Scholar] [CrossRef]

- Measham, T.G.; Walton, A.; Graham, P.; Fleming-Muñoz, D.A. Living with resource booms and busts: Employment scenarios and resilience to unconventional gas cyclical effects in Australia. Energy Res. Soc. Sci. 2019, 56, 101221. [Google Scholar] [CrossRef]

- Liu, Y. Energy Production and Regional Economic Growth in China: A More Comprehensive Analysis Using a Panel Model. Energies 2013, 6, 1409–1420. [Google Scholar] [CrossRef]

- Stevens, P.; Dietsche, E. Resource curse: An analysis of causes, experiences and possible ways forward. Energy Policy 2008, 36, 56–65. [Google Scholar] [CrossRef]

- Fischer, A.P. Pathways of adaptation to external stressors in coastal natural-resource-dependent communities: Implications for climate change. World Dev. 2018, 108, 235–248. [Google Scholar] [CrossRef]

- Arezki, R.; Sy, A.; Gylfason, T. Beyond the curse: Policies to harness the power of natural resources. Afr. Growth Agenda 2015, 10, 12–14. [Google Scholar]

- Satti, S.L.; Farooq, A.; Loganathan, N.; Shahbaz, M. Empirical evidence on the resource curse hypothesis in oil abundant economy. Econ. Model. 2014, 42, 421–429. [Google Scholar] [CrossRef]

- Papyrakis, E. A development curse: Formal vs informal activities in resource-dependent economies. Int. J. Soc. Econ. 2014, 41, 244–264. [Google Scholar] [CrossRef]

- Yuxiang, K.; Chen, Z. Resource abundance and financial development: Evidence from China. Resour. Policy 2011, 36, 72–79. [Google Scholar] [CrossRef]

- Doraisami, A. Has Malaysia really escaped the resources curse? A closer look at the political economy of oil revenue management and expenditures. Resour. Policy 2015, 45, 98–108. [Google Scholar] [CrossRef]

- Sachs, J.; Warner, A. Natural Resource Abundance and Economic Growth; NBER Working Paper No. 5398; National Bureau of Economic Research: Cambridge, MA, USA, 1995. [Google Scholar]

- Sachs, J.D.; Warner, A.M. The curse of natural resources. Eur. Econ. Rev. 2001, 45, 827–838. [Google Scholar] [CrossRef]

- Papyrakis, E.; Gerlagh, R. Resource abundance and economic growth in the United States. Eur. Econ. Rev. 2007, 51, 1011–1039. [Google Scholar] [CrossRef]

- Havranek, T.; Horvath, R.; Zeynalov, A. Natural Resources and Economic Growth: A Meta-Analysis. World Dev. 2016, 88, 134–151. [Google Scholar] [CrossRef]

- Fleming-Muñoz, D.A.; Measham, T.G.; Paredes, D. Understanding the resource curse (or blessing) across national and regional scales: Theory, empirical challenges and an application. Aust. J. Agric. Resour. Econ. 2015, 59, 624–639. [Google Scholar] [CrossRef]

- Huang, L.; Wu, J.; Yan, L. Defining and measuring urban sustainability: A review of indicators. Landsc. Ecol. 2015, 30, 1175–1193. [Google Scholar] [CrossRef]

- Kim, M.J.; Park, S.Y.; Sang, Y.J. An empirical test for Okun’s law using a smooth time-varying parameter approach: Evidence from East Asian countries. Appl. Econ. Lett. 2015, 22, 788–795. [Google Scholar] [CrossRef]

- Blanco, L.; Grier, R. Natural resource dependence and the accumulation of physical and human capital in Latin America. Resour. Policy 2012, 37, 281–295. [Google Scholar] [CrossRef]

- Oskenbayev, Y.; Yilmaz, M.; Abdulla, K. Resource concentration, institutional quality and the natural resource curse. Econ. Syst. 2013, 37, 254–270. [Google Scholar] [CrossRef]

- Idemudia, U. The resource curse and the decentralization of oil revenue: The case of Nigeria. J. Clean. Prod. 2012, 35, 183–193. [Google Scholar] [CrossRef]

- Hammond, J.L. The resource curse and oil revenues in Angola and Venezuela. Sci. Soc. 2011, 75, 348–378. [Google Scholar] [CrossRef]

- Auty, R.M. Sustaining Development in Resource Economies: The Resource Curse Thesis; Routledge: London, UK; New York, NY, USA, 1993. [Google Scholar]

- Xu, X.; Xu, X.; Chen, Q.; Che, Y. The research on generalized regional “resource curse” in China’s new normal stage. Resour. Policy 2016, 49, 12–19. [Google Scholar] [CrossRef]

- Shao, S.; Qi, Z. Energy exploitation and economic growth in western China: An empirical analysis based on the resource curse hypothesis. Front. Econ. China 2009, 4, 125–152. [Google Scholar] [CrossRef]

- Xu, Y.; Hu, Y. The relationship between economic development mode and natural resource advantages in Inner Mongolia: An empirical analysis based on the resource curse hypothesis. Resour. Sci. 2010, 32, 2391–2399. [Google Scholar]

- Sun, Y.; Ye, C. Resource dependency, locations and city economic growth. Mod. Econ. Sci. 2011, 33, 114–123. (In Chinese) [Google Scholar]

- Shao, S.; Fan, M.; Yang, L. How does resource-dependent industry effect economic development efficiency: Test and interpretation of conditional resource curse hypothesis. Manag. World 2013, 2, 32–63. (In Chinese) [Google Scholar]

- Ding, C.; Ma, P.; Liao, S. Resource curse and measurement of its micro mechanism. China Popul. Resour. Environ. 2018, 28, 138–147. [Google Scholar]

- Fang, Y.; Ji, K.; Zhao, Y. Whether there is a source curse in China? J. World Econ. 2011, 4, 144–160. (In Chinese) [Google Scholar]

- Deng, T.; Ma, M.; Cao, J. Tourism resource development and long-term economic growth: A resource curse hypothesis approach. Tour. Econ. 2014, 20, 923–938. [Google Scholar] [CrossRef]

- Sun, D.; Si, M. On resource abundance and China’s regional economic growth: A query on resource curse hypothesis. J. Zhongnan Univ. Econ. Law 2012, 1, 84–89. [Google Scholar]

- Cao, S.; Hu, D.; Zhao, W.; Mo, Y.; Chen, S. Monitoring Spatial Patterns and Changes of Ecology, Production, and Living Land in Chinese Urban Agglomerations: 35 Years after Reform and Opening Up, Where, How and Why? Sustainability 2017, 9, 766. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, F.; Wu, F. Intergroup neighboring in urban China: Implications for the social integration of migrants. Urban Stud. 2016, 53, 651–668. [Google Scholar] [CrossRef]

- Chen, T.; Kung, J.S. Do land revenue windfalls create a political resource curse? Evidence from China. J. Dev. Econ. 2016, 123, 86–106. [Google Scholar] [CrossRef]

- Guo, J.; Zheng, X.; Song, F. The Resource Curse and Its Transmission Channels: An Empirical Investigation of Chinese Cities’ Panel Data. Emerg. Mark. Financ. Trade 2016, 52, 1325–1334. [Google Scholar] [CrossRef]

- Li, T. Research on the Influence of Natural Resource Abundance on China’s Regional Economic Growth and Its Transmission Mechanism. Econ. Sci. 2007, 6, 66–76. (In Chinese) [Google Scholar]

- Wang, Z. Empirical study on resource curse transmission mechanism of resource-based cities. Urban Stud. 2011, 11, 85–89. [Google Scholar]

- Yang, L.; Shao, S. Human capital migration and resource curse effect: How to achieve the sustainable growth of resource-oriented regions. J. Financ. Econ. 2014, 11, 44–60. [Google Scholar]

- Zuo, N.; Schieffer, J. Are Resources a Curse? An Investigation of Chinese Provinces; Southern Agricultural Economics Association (SAEA): Dallas, TX, USA, 2014. [Google Scholar]

- He, Q. Quality-Adjusted Agricultural Land Abundance Curse in Economic Development: Evidence from Post-reform Chinese Panel Data. Emerg. Mark. Financ. Trade 2015, 51, S23–S39. [Google Scholar] [CrossRef]

- Uçak, H. The catch-up process of relative wages in European Union new member states. Ekon. Cas. 2012, 4, 360–370. [Google Scholar]

- Jalloh, M. Regional economic integration and incomes convergence: A case study of the economic community of West African states. J. Econ. Sustain. Dev. 2014, 5, 81–93. [Google Scholar]

- Berry, H.; Guillén, M.F.; Hendi, A.S. Is there convergence across countries? A spatial approach. J. Int. Bus. Stud. 2014, 45, 387–404. [Google Scholar] [CrossRef]

- Borsi, M.T.; Metiu, N. The evolution of economic convergence in the European Union. Empir. Econ. 2015, 48, 657–681. [Google Scholar] [CrossRef]

- Dong, B.; Zhang, Y.; Song, H. Corruption as a natural resource curse: Evidence from the Chinese coal mining. China Econ. Rev. 2019, 57, 101314. [Google Scholar] [CrossRef]

- Song, M.; Wang, J.; Zhao, J. Coal endowment, resource curse, and high coal-consuming industries location: Analysis based on large-scale data. Resour. Conserv. Recycl. 2018, 129, 333–344. [Google Scholar] [CrossRef]

- Liang, Y.; Zheng, Y.Q. The relationship between natural resources and economic growth: An inverted U curve hypothesis. Res. Financ. Econ. Issues 2015, 10, 9–14. [Google Scholar]

- Dreger, C.; Zhang, Y. On the relevance of exports for regional output growth in China. Appl. Econ. 2014, 46, 4302–4308. [Google Scholar] [CrossRef]

- Schuele, S.A.; Hilz, L.K.; Dreger, S.; Bolte, G. Social inequalities in environmental resources of green and blue spaces: A review of evidence in the WHO European Region. Int. J. Environ. Res. Public Health 2019, 16, 1216. [Google Scholar] [CrossRef] [PubMed]

- Fan, R.; Fang, Y.; Park, S.Y. Resource abundance and economic growth in China. China Econ. Rev. 2012, 23, 704–719. [Google Scholar] [CrossRef]

- Davis, G.A. The resource drag. Int. Econ. Econ. Policy 2011, 8, 155–176. [Google Scholar] [CrossRef]

- Frederick, V.D.P.; Poelhekke, S. The pungent smell of ‘red herrings’: Subsoil assets, rents, volatility, and the resource curse. J. Environ. Econ. Manag. 2010, 60, 44–55. [Google Scholar]

- Wang, Q.; Su, M.; Li, R.; Ponce, P. The effects of energy prices, urbanization and economic growth on energy consumption per capita in 186 countries. J. Clean. Prod. 2019, 225, 1017–1032. [Google Scholar] [CrossRef]

- Arezki, R.; Lederman, D.; Zhao, H. The relative volatility of commodity prices: A reappraisal. Am. J. Agric. Econ. 2014, 96, 939–951. [Google Scholar] [CrossRef]

- Rahmati, M.H.; Karimirad, A. Subsidy and natural resource curse: Evidence from plant level observations in Iran. Resour. Policy 2017, 52, 90–99. [Google Scholar] [CrossRef]

- Hu, H.; Jin, Q.; Kavan, P. A study of heavy metal pollution in China: Current status, pollution-control policies and countermeasures. Sustainability 2014, 6, 5820–5838. [Google Scholar] [CrossRef]

- Stijns, J.P.C. Natural resource abundance and economic growth revisited. Resour. Policy 2005, 30, 107–130. [Google Scholar] [CrossRef]

- Gylfason, T.; Zoega, G. Natural resources and economic growth: The role of investment. World Econ. 2006, 29, 1091–1115. [Google Scholar] [CrossRef]

- Papyrakis, E.; Gerlagh, R. The resource curse hypothesis and its transmission channels. J. Comp. Econ. 2004, 32, 181–193. [Google Scholar] [CrossRef]

- Hoenderdaal, S.; Espinoza, L.T.; Marscheider-Weidenmann, F.; Graus, W. Can a dysprosium shortage threaten green energy technologies? Energy 2013, 49, 344–355. [Google Scholar] [CrossRef]

- Wang, Z.; Lu, H.; Han, Z. An analysis of the spatial and temporal differentiation and driving factors of the marine resource curse in China. Ocean Coast. Manag. 2018, 155, 60–67. [Google Scholar] [CrossRef]

- Zhong, T.; Zhang, X.; Huang, X.; Liu, F. Blessing or curse? Impact of land finance on rural public infrastructure development. Land Use Policy 2019, 85, 130–141. [Google Scholar] [CrossRef]

- Khan, M.A.; Khan, M.Z.; Zaman, K.; Arif, M. Global estimates of energy-growth nexus: Application of seemingly unrelated regressions. Renew. Sustain. Energy Rev. 2014, 29, 63–71. [Google Scholar] [CrossRef]

- Zellner, A. An efficient method of estimating seemingly unrelated regressions and tests for aggregation bias. Publ. Am. Stat. Assoc. 1962, 57, 348–368. [Google Scholar] [CrossRef]

- Huang, Y.; Fang, Y.; Zhang, Y.; Liu, J. A study of resource curse effect of Chinese provinces based on human developing index. Chin. Geogr. Sci. 2014, 24, 732–739. [Google Scholar] [CrossRef]

- Hu, H.; Xie, N.; Fang, D.; Zhang, X. The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: Evidence from 25 developing countries. Appl. Energy 2018, 211, 1229–1244. [Google Scholar] [CrossRef]

- Huang, Y.; Todd, D.; Zhang, L. Capitalizing on energy supply: Western China’s opportunity for development. Resour. Policy 2011, 36, 227–237. [Google Scholar] [CrossRef]

- Tang, L.; Ma, X.; Zhou, Y.; Shi, X.; Ma, J. Social relations, public interventions and land rent deviation: Evidence from Jiangsu Province in China. Land Use Policy 2019, 86, 406–420. [Google Scholar] [CrossRef]

- Ogwang, T.; Vanclay, F.; van den Assem, A. Rent-Seeking Practices, Local Resource Curse, and Social Conflict in Uganda’s Emerging Oil Economy. Land 2019, 8, 53. [Google Scholar] [CrossRef]

- Hoechle, D. Robust standard errors for panel regressions with cross-sectional dependence. Stata J. 2007, 7, 281–312. [Google Scholar] [CrossRef]

- Chai, S.; Zhang, Z.; Ge, J. Evolution of environmental policy for China’s rare earths: Comparing central and local government policies. Resour. Policy 2020, 68, 101786. [Google Scholar] [CrossRef]

- Zhang, Q.; Li, H.; Zhu, L.; Campana, P.E.; Lu, H.; Wallin, F.; Sun, Q. Factors influencing the economics of public charging infrastructures for EV–A review. Renew. Sustain. Energy Rev. 2018, 94, 500–509. [Google Scholar] [CrossRef]

- Sobel, R.S. Testing Baumol: Institutional quality and the productivity of entrepreneurship. J. Bus. Ventur. 2008, 23, 641–655. [Google Scholar] [CrossRef]

- Wang, F.; Guo, X. The Path of Transformation and Upgrading on Mineral Resource-based Enterprises Based on Sustainability Science: Derived from Empirical Data of Inner Mongolia. J. Ind. Technol. Econ. 2012, 10, 64–72. [Google Scholar]

- Bithas, K.; Kalimeris, P. Revisiting the Energy-Development Link: Evidence from the 20th Century for Knowledge-Based and Developing Economies; Springer: Heidelberg/Berlin, Germany, 2015. [Google Scholar]

- Zhou, X.; Zhang, J.; Li, J. Industrial structural transformation and carbon dioxide emissions in China. Energy Policy 2013, 57, 43–51. [Google Scholar] [CrossRef]

- Gruber, J. Revising the Resource Curse Using a Physical Resource Abundance Indicator. Ph.D. Thesis, University of Vienna, Wien, Austria, 2014. [Google Scholar]

- Gylfason, T.; Zoega, G. The Dutch Disease in Reverse: Iceland’s Natural Experiment; Research Paper No. 138; Oxford Centre for the Analysis of Resource Rich Economies, University of Oxford: Oxford, UK, 2014. [Google Scholar]

- James, A. The resource curse: A statistical mirage? J. Dev. Econ. 2015, 114, 55–63. [Google Scholar] [CrossRef]

- Leong, W.; Kamiar, M. Institutions and the Volatility Curse; Working Paper: SSRN 1885569; University of Cambridge: Cambridge, UK, 2011. [Google Scholar]

- Li, H.; Long, R.; Chen, H. Economic transition policies in Chinese resource-based cities: An overview of government efforts. Energy Policy 2013, 55, 251–260. [Google Scholar] [CrossRef]

- Liu, Q.; Reilly, B. Income transfers of Chinese rural migrants: Some empirical evidence from Jinan. Appl. Econ. 2004, 36, 1295–1313. [Google Scholar] [CrossRef]

| Category | Variable | Abbreviation or Acronym | Definition | Previous Studies Using the Variable |

|---|---|---|---|---|

| Dependent variable | Economic growth rate | [21] | ||

| Independent variable | Log of gross provincial product per capita in last term | The logarithm of the real per capita gross domestic product of province i in last year | [21] | |

| Independent variable | Energy resource dependency | The proportion of investment in energy resource exploitation industry in total fixed assets investment | [20,34] | |

| Independent variable | Fixed-asset investment | Total fixed assets investment | [21] | |

| Independent variable | Foreign direct investment | Foreign direct investment | [34] | |

| Independent variable | Educational level | The proportion of the population aged 6 and above who are junior college graduates or above accounts for the total population aged 6 and above | [21] | |

| Independent variable | Manufacturing output level | The proportion of the sales output value of the manufacturing industry above the scale in the total sales output value of the industry | [56,67] | |

| Independent variable | Level of nationalization | The proportion of the sales output value of state-holding industries above the scale in the total sales output value of the industry | [34] |

| Purpose | Method | Statistics | Result |

|---|---|---|---|

| Cross-sectional independence | Pesaran’s test | Pesaran’s statistics = 6.568 (p = 0.000) | Cross-sectionally dependent |

| Autocorrelation | Wooldridge test | F = 22.478 (p = 0.0004) | Autocorrelation |

| Heteroscedasticity | Wald test | χ2 = 191.76 (p = 0.000) | Heteroscedasticity |

| Fixed-effect or random-effect | Hausman test with auxiliary regression | F = 7.7 × 1014 (p = 0.000) | Fixed effect |

| Endogeneity | Hausman test | χ2 = 5.61 (p = 0.6914) | Exogenous |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| g | G | g | g | g | g | |

| Lngdp | −0.0421 *** | −0.0544 *** | −0.0392 *** | −0.0392 *** | −0.0467 *** | −0.0635 *** |

| (0.011) | (0.009) | (0.012) | (0.012) | (0.012) | (0.020) | |

| RD | 0.698 *** | 0.466 * | 0.352 ** | 0.364 ** | 0.340 ** | 0.362 ** |

| (0.229) | (0.256) | (0.144) | (0.137) | (0.133) | (0.143) | |

| MAN | −0.236 *** | −0.143 ** | −0.136 ** | −0.0985 * | −0.0892 | |

| (0.055) | (0.050) | (0.053) | (0.048) | (0.056) | ||

| EDU | −0.736 *** | −0.653 ** | −0.361 * | −0.448 * | ||

| (0.178) | (0.232) | (0.195) | (0.234) | |||

| NAT | 0.0273 | 0.0697 * | 0.100 *** | |||

| (0.044) | (0.038) | (0.033) | ||||

| FDI | 0.0210 *** | 0.0208 *** | ||||

| (0.006) | (0.006) | |||||

| INV | 0.00168 | |||||

| (0.001) | ||||||

| CONS | 0.0953 * | 0.320 *** | 0.268 *** | 0.243 *** | 0.176 ** | 0.198 ** |

| (0.045) | (0.045) | (0.045) | (0.057) | (0.063) | (0.072) | |

| N | 224 | 224 | 224 | 224 | 224 | 224 |

| R2 | 0.1257 | 0.1495 | 0.2144 | 0.2161 | 0.2693 | 0.2774 |

| Guizhou | Hebei | Heilongjiang | Inner Mongolia | Jiangxi | Jilin | Liaoning | |

| lngdp | −0.6032 *** | 0.1231 | −0.8851 *** | −0.4689 *** | −0.7984 *** | −0.105 | −1.3088 *** |

| (0.1658) | (0.0922) | (0.0567) | (0.1232) | (0.0814) | (0.1152) | (0.2768) | |

| RD | 1.1946 * | −0.1778 | −2.5627 *** | 0.4819 | 9.9568 *** | −0.6175 | 1.6168 ** |

| (0.66) | (0.7938) | (0.3372) | (0.398) | (3.0815) | (1.4708) | (0.7488) | |

| MAN | −0.2773 | 0.0670 * | −1.5791 *** | 0.3353 | −0.2658 | −1.0779 *** | 0.5017 *** |

| (0.4198) | (0.0396) | (0.2801) | (0.3675) | (0.4454) | (0.3707) | (0.134) | |

| EDU | 0.3981 | 0.5793 | −0.6885 ** | 0.0314 | 0.1441 | 2.9109 ** | −2.3315 *** |

| (0.5579) | (0.5552) | (0.2966) | (0.4823) | (1.0585) | (1.2058) | (0.3227) | |

| NAT | −0.3331 | 0.2948 ** | 1.3058 *** | 0.0003 | 0.9188 *** | 0.6607 *** | 0.0593 |

| (0.3679) | (0.1384) | (0.2236) | (0.2342) | (0.1515) | (0.1609) | (0.208) | |

| FDI | 0.001 | 0.0339 * | 0.0318 | 0.2695 *** | 0.3983 *** | 0.3763 | −0.0072 |

| (0.0185) | (0.0191) | (0.0302) | (0.0909) | (0.0876) | (0.3868) | (0.0063) | |

| INV | 0.0131 | −0.0013 | 0.0368 *** | 0.0082 ** | −0.0005 | 0.0353 *** | 0.0187 *** |

| (0.0119) | (0.0014) | (0.0052) | (0.0034) | (0.0215) | (0.0119) | (0.0023) | |

| CONS | 2.3398 *** | −0.6973 * | 3.2495 *** | 0.9181 | 1.8274 *** | 0.3677 | 5.2157 *** |

| (0.7705) | (0.359) | (0.313) | (0.6773) | (0.4848) | (0.58) | (1.2465) | |

| Ningxia | Qinghai | Shaanxi | Shandong | Shanxi | Xinjiang | Yunnan | |

| lngdp | −0.1244 *** | −0.1035 | −0.0113 | −0.3335 *** | −0.2538 | −1.2393 *** | −1.1953 *** |

| (0.0398) | (0.0633) | (0.0546) | (0.0395) | (0.1584) | (0.08) | (0.0726) | |

| RD | 0.2971 | 1.5658 *** | −1.1960 *** | 0.6988 | 1.9737 *** | 2.6450 *** | 8.7009 *** |

| (0.4213) | (0.2263) | (0.3404) | (0.6543) | (0.3965) | (0.1947) | (1.1314) | |

| MAN | −2.2052 *** | −0.2765 *** | −1.5960 *** | −0.3371 *** | 2.0167 *** | 0.0142 | −3.6497 *** |

| (0.2469) | (0.0326) | (0.1757) | (0.0489) | (0.7251) | (0.163) | (0.3889) | |

| EDU | 4.6619 *** | 0.2714 | −0.005 | −0.2639 | 1.8149 *** | 1.4490 *** | −6.4311 *** |

| (0.8919) | (0.2055) | (0.1943) | (0.3403) | (0.6348) | (0.1562) | (0.8099) | |

| NAT | −0.0188 | −0.1303 | −0.3261 *** | 3.3748 *** | 0.6943 * | 0.6609 *** | 4.5236 *** |

| (0.2243) | (0.1497) | (0.0923) | (0.2859) | (0.3552) | (0.0969) | (0.4365) | |

| FDI | −0.3880 *** | −0.4756 *** | 0.0009 | −0.0091 ** | −0.001 | 0.014 | 0.9018 *** |

| (0.0666) | (0.1372) | (0.0025) | (0.0045) | (0.0078) | (0.0272) | (0.1755) | |

| INV | −0.0021 | −0.0219 * | −0.0047 ** | 0.0278 *** | 0.0115 * | 0.0405 *** | −0.0470 *** |

| (0.0032) | (0.0133) | (0.002) | (0.0029) | (0.0061) | (0.003) | (0.0171) | |

| CONS | 1.9152 *** | 0.3789 ** | 1.5202 *** | 0.7603 *** | −1.2683 | 3.6804 *** | 3.9790 *** |

| (0.3238) | (0.1707) | (0.2236) | (0.1506) | (1.0085) | (0.2805) | (0.2917) |

| ΔY/Y | Guizhou | Hebei | Heilongjiang | Inner Mongolia | Yunnan | Jilin | Liaoning |

| T = 1 | 0.0198 | 0.0525 | 0.4084 | 0.0326 | 0.9336 | 22.8355 | 2355.8774 |

| T = 2 | 0.0157 | 0.1140 | 0.0819 | 0.0346 | 1.8838 | 290.8977 | 0.9917 |

| T = 3 | 0.0167 | 0.2044 | 1.0421 | 0.0246 | 1.0000 | 925.5098 | 2.42 × 1022 |

| T = | + | + | − | + | + | + | − |

| ΔY/Y | Ningxia | Qinghai | Shaanxi | Shandong | Shanxi | Xinjiang | Jiangxi |

| T = 1 | 0.9687 | 0.1621 | 0.0270 | 0.0626 | 5.4949 | 0.9505 | 0.0423 |

| T = 2 | 0.9977 | 0.2718 | 0.0541 | 0.0826 | 15.3185 | 3.2149 | 0.0169 |

| T = 3 | 0.9991 | 0.3182 | 0.0803 | 0.0626 | 10.2904 | 1.0000 | 0.0664 |

| T = | − | − | − | + | + | − | + |

| Guizhou | Hebei | Heilongjiang | Inner Mongolia | Jiangxi | Jilin | Liaoning | |

| Coefficients of | |||||||

| MAN | −1.3333 *** | −1.581 | −2.5863 *** | −0.5561 *** | −2.5590 *** | −2.8196 *** | −2.8565 *** |

| (0.098) | (1.3577) | (0.1576) | (0.0966) | (0.7387) | (0.2693) | (0.4332) | |

| INV | 17.2957 *** | −5.9578 | −9.3884 *** | 81.8762 *** | 60.7413 *** | 31.5536 *** | −179.3170 *** |

| (2.5392) | (11.0408) | (2.4879) | (4.9927) | (5.0383) | (4.4188) | (31.5321) | |

| NAT | −0.5839 *** | −0.6205 *** | 3.9820 *** | −1.9672 *** | −10.9548 *** | 6.1432 *** | 5.9867 *** |

| (0.0741) | (0.1106) | (0.1314) | (0.1721) | (0.4127) | (0.3963) | (0.3462) | |

| FDI | 0.2982 | 1.4364 * | 2.5821 *** | 4.5964 *** | −16.0394 *** | −0.4227 * | 82.9098 *** |

| (1.0605) | (0.8262) | (0.4856) | (0.0857) | (1.9162) | (0.2233) | (7.9436) | |

| EDU | −0.0187 | −1.3897 *** | −0.9344 *** | 0.0373 | −0.1428 | −1.3246 *** | −2.7461 *** |

| (0.0317) | (0.0576) | (0.0432) | (0.0486) | (0.1681) | (0.1565) | (0.2313) | |

| Ningxia | Qinghai | Shaanxi | Shandong | Shanxi | Xinjiang | Yunnan | |

| Coefficients of | |||||||

| MAN | −0.4166 *** | −1.6240 *** | −1.4795 *** | −7.1750 *** | −0.6118 *** | −0.8643 *** | 1.0184 *** |

| (0.1152) | (0.5458) | (0.1523) | (0.3296) | (0.0675) | (0.0662) | (0.254) | |

| INV | −60.4498 *** | −26.3971 *** | −21.2090 *** | 49.8928 *** | 28.2422 *** | −39.4177 *** | 35.3213 *** |

| (6.8834) | (2.2788) | (6.7456) | (4.2262) | (1.3609) | (1.8962) | (5.4782) | |

| NAT | −0.6788 *** | 3.3701 *** | 1.4192 *** | 1.1068 *** | −0.6542 *** | 1.5628 *** | −1.3251 *** |

| (0.0614) | (0.1178) | (0.2634) | (0.0708) | (0.0361) | (0.0705) | (0.1522) | |

| FDI | −1.4520 *** | 1.8067 *** | 15.9627 ** | 61.7851 *** | 2.5709 | 5.4621 *** | −1.0416 * |

| (0.3967) | (0.0687) | (7.6268) | (4.2314) | (3.3508) | (0.3823) | (0.6083) | |

| EDU | −0.1347 *** | −0.4757 *** | −0.1379 * | −1.1306 *** | 0.0503 * | −0.2268 *** | 0.4678 *** |

| (0.022) | (0.0462) | (0.0788) | (0.0475) | (0.0265) | (0.0271) | (0.0544) | |

| Province | Transmission Channel | α1 | β3 | α1β3 + β2 | Relative Contribution |

| Guizhou | RD | 1.1946 | 100.00% | ||

| TOTAL | 1.1946 | 100.00% | |||

| Hebei ** | RD | −0.1778 | −34.50% | ||

| MAN | −1.5810 | 0.0670 | −0.1059 | −20.55% | |

| NAT | −0.6205 | 0.2948 | −0.1829 | −35.50% | |

| FDI | 1.4364 | 0.0339 | 0.0487 | 9.45% | |

| TOTAL | −0.4180 | 100.00% | |||

| Heilongjiang *** | RD | −2.5627 | −19.97% | ||

| MAN | −2.5863 | −1.5791 | 4.0840 | 31.82% | |

| EDU | −0.9344 | −0.6885 | 0.6433 | 5.01% | |

| NAT | 3.9820 | 1.3058 | 5.1997 | 40.51% | |

| INV | −9.3884 | 0.0368 | −0.3455 | −2.69% | |

| TOTAL | 7.0189 | 100.00% | |||

| Inner Mongolia | FDI | 4.5964 | 0.2695 | 1.2387 | 64.85% |

| INV | 81.8762 | 0.0082 | 0.6714 | 35.15% | |

| TOTAL | 1.9101 | 100.00% | |||

| Jiangxi * | RD | 9.9568 | 37.70% | ||

| NAT | −10.9548 | 0.9188 | −10.0653 | −38.11% | |

| FDI | −16.0394 | 0.3983 | −6.3885 | −24.19% | |

| TOTAL | −6.4970 | 100.00% | |||

| Jilin * | MAN | −2.8196 | −1.0779 | 3.0392 | 25.19% |

| EDU | −1.3246 | 2.9109 | −3.8558 | −31.95% | |

| NAT | 6.1432 | 0.6607 | 4.0588 | 33.63% | |

| INV | 31.5536 | 0.0353 | 1.1138 | 9.23% | |

| TOTAL | 4.3561 | 100.00% | |||

| Liaoning *** | RD | 1.6168 | 12.63% | ||

| MAN | −2.8565 | 0.5017 | −1.4331 | −11.19% | |

| EDU | −2.7461 | −2.3315 | 6.4025 | 50.00% | |

| INV | −179.3170 | 0.0187 | −3.3532 | −26.19% | |

| TOTAL | 3.2330 | 100.00% | |||

| Province | Transmission Channel | α1 | β3 | β2 + α1β3 | Relative Contribution |

| Ningxia *** | MAN | −0.4166 | −2.2052 | 0.9187 | 43.54% |

| EDU | −0.1347 | 4.6619 | −0.6280 | −29.76% | |

| FDI | −1.4520 | −0.3880 | 0.5634 | 26.70% | |

| TOTAL | 0.8541 | 100.00% | |||

| Qinghai *** | RD | 1.5658 | 45.36% | ||

| MAN | −1.6240 | −0.2765 | 0.4490 | 13.01% | |

| FDI | 1.8067 | −0.4756 | −0.8593 | −24.89% | |

| INV | −26.3971 | −0.0219 | 0.5781 | 16.75% | |

| TOTAL | 1.7337 | 100.00% | |||

| Shaanxi *** | RD | −1.1960 | −29.03% | ||

| MAN | −1.4795 | −1.5960 | 2.3613 | 57.32% | |

| NAT | 1.4192 | −0.3261 | −0.4628 | −11.23% | |

| INV | −21.2090 | −0.0047 | 0.0997 | 2.42% | |

| TOTAL | 0.8022 | 100.00% | |||

| Shandong * | MAN | −7.1750 | −0.3371 | 2.4187 | 29.85% |

| NAT | 1.1068 | 3.3748 | 3.7352 | 46.10% | |

| FDI | 61.7851 | −0.0091 | −0.5622 | −6.94% | |

| INV | 49.8928 | 0.0278 | 1.3870 | 17.12% | |

| TOTAL | 6.9787 | 100.00% | |||

| Shanxi * | RD | 1.9737 | 48.40% | ||

| MAN | −0.6118 | 2.0167 | −1.2338 | −30.26% | |

| EDU | 0.0503 | 1.8149 | 0.0913 | 2.24% | |

| NAT | −0.6542 | 0.6943 | −0.4542 | −11.14% | |

| INV | 28.2422 | 0.0115 | 0.3248 | 7.96% | |

| TOTAL | 0.7017 | 100.00% | |||

| Xinjiang *** | RD | 2.6450 | 62.56% | ||

| EDU | −0.2268 | 1.4490 | −0.3286 | −7.77% | |

| NAT | 1.5628 | 0.6609 | 1.0329 | 24.43% | |

| INV | 5.4621 | 0.0405 | 0.2212 | 5.23% | |

| TOTAL | 3.5704 | 100.00% | |||

| Yunnan * | RD | 8.7009 | 36.22% | ||

| MAN | 1.0184 | −3.6497 | −3.7169 | −15.47% | |

| EDU | 0.4678 | −6.4311 | −3.0085 | −12.52% | |

| NAT | −1.3251 | 4.5236 | −5.9942 | −24.96% | |

| FDI | −1.0416 | 0.9018 | −0.9393 | −3.91% | |

| INV | 35.3213 | −0.0470 | −1.6601 | −6.91% | |

| TOTAL | −6.6181 | 100.00% |

| Level of the Energy Resource Curse | Characteristics | Provinces |

|---|---|---|

| The level-three energy resource curse | Increasing RD by one standard deviation would lead to the declination of GDP in the long term | Heilongjiang, Liaoning, Ningxia, Qinghai, Shaanxi, and Xinjiang |

| The level-two energy resource curse | The effects of energy resources on the economy through transmission channels are negative, and values of TOTAL are negative | Hebei |

| The level-one energy resource curse | Energy resources directly promote but indirectly hinder economic growth | Jiangxi, Jilin, Shandong, Shanxi, and Yunnan |

| “Energy resource blessing” | Energy resources have a positive impact on economic growth | Guizhou and Inner Mongolia |

| Provinces | Resource Levels of Coal | Curse Transmission Channels of Coal | Resource Levels of Crude Oil and Natural Gas | Curse Transmission Channels of Oil and Natural Gas |

|---|---|---|---|---|

| Guizhou | “Blessing” | / | Level-three | Direct, MAN, NAT |

| Hebei ** | “Blessing” | / | “Blessing” | / |

| Heilongjiang *** | Level-two | direct | Level-three | INV |

| Inner Mongolia | “Blessing” | / | Level-one | MAN |

| Jiangxi * | Level-three | MAN, FDI, INV | Level-one | MAN, NAT |

| Jilin * | Level-one | NAT | Level-three | INV |

| Liaoning *** | Level-three | MAN, INV | Level-three | MAN, INV |

| Ningxia *** | Level-three | EDU | Level-three | MAN, FDI |

| Qinghai *** | Level-one | MAN, FDI | “Blessing” | / |

| Shaanxi *** | Level-two | direct, EDU | Level-three | NAT, INV |

| Shandong * | Level-one | FDI | “Blessing” | / |

| Shanxi * | Level-one | MAN, NAT | Level-one | MAN |

| Xinjiang *** | Level-one | MAN, NAT, FDI | Level-three | MAN, EDU, INV |

| Yunnan * | Level-one | MAN, EDU, NAT, FDI | Level-one | Direct, MAN |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, H.; Ran, W.; Wei, Y.; Li, X. Do Energy Resource Curse and Heterogeneous Curse Exist in Provinces? Evidence from China. Energies 2020, 13, 4383. https://doi.org/10.3390/en13174383

Hu H, Ran W, Wei Y, Li X. Do Energy Resource Curse and Heterogeneous Curse Exist in Provinces? Evidence from China. Energies. 2020; 13(17):4383. https://doi.org/10.3390/en13174383

Chicago/Turabian StyleHu, Hui, Weijun Ran, Yuchen Wei, and Xiang Li. 2020. "Do Energy Resource Curse and Heterogeneous Curse Exist in Provinces? Evidence from China" Energies 13, no. 17: 4383. https://doi.org/10.3390/en13174383

APA StyleHu, H., Ran, W., Wei, Y., & Li, X. (2020). Do Energy Resource Curse and Heterogeneous Curse Exist in Provinces? Evidence from China. Energies, 13(17), 4383. https://doi.org/10.3390/en13174383